|

|

市場調査レポート

商品コード

1745104

油圧機器の世界市場:タイプ別、コンポーネント別、センサー別、最終用途産業別、地域別 - 2030年までの予測Hydraulics Market by Type, Component, Sensor, End-use Industry and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 油圧機器の世界市場:タイプ別、コンポーネント別、センサー別、最終用途産業別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月23日

発行: MarketsandMarkets

ページ情報: 英文 208 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の油圧機器の市場規模は、2.4%のCAGRで拡大し、2025年の394億米ドルから2030年には442億6,000万米ドルに成長すると予測されています。

スマート油圧システムおよび電気油圧システムの発売は、油圧機器市場を牽引する重要な要因です。エレクトロニクスとデジタル制御を統合したこれらの技術は、監視の強化、応答時間の短縮、エネルギー効率の改善を可能にし、運転コストとダウンタイムを削減します。自動化およびインダストリー4.0構想との互換性により、最新の産業用途において非常に魅力的なものとなり、高度な油圧ソリューションの採用を加速しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント別 | タイプ別、コンポーネント別、センサー別、最終用途産業別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

モバイルセグメントは、主に建設、農業、マテリアルハンドリング、輸送、鉱業など、需要の高いいくつかの産業にわたる広範な用途により、予測期間を通じて油圧機器市場で最大のシェアを占めると予想されます。移動式油圧システムは、掘削機、トラクター、フォークリフト、オフハイウェイ車などの重機に不可欠な高い出力密度と柔軟性を提供します。現在進行中のインフラ開発、農業の機械化の進展、倉庫業や鉱業活動の成長が、移動式油圧機器の需要をさらに押し上げています。さらに、電動化やハイブリッドシステムの統合、リアルタイムデータ解析によるインテリジェント制御、エネルギー効率の高いポンプ技術、環境に優しい流体、安全機能の強化などの技術進歩により、移動油圧システムの性能、持続可能性、信頼性が大幅に向上しています。

ポジションセンサーは、シリンダやバルブなどの油圧コンポーネントに正確な位置フィードバックを提供するという重要な役割を担っているため、2024年の油圧機器市場で最大のシェアを占めました。この精度は、建設、自動車、航空宇宙、産業オートメーションなどの主要分野における油圧システムの効果的で安全な動作を保証するための基本です。自動化とインテリジェント油圧ソリューションの採用が加速しているため、システム性能、エネルギー効率、操作精度の向上を推進する信頼性の高い位置検出技術への需要がさらに高まっています。さらに、センサー技術、特に非接触で堅牢なセンサー設計の継続的な進歩は、その不可欠性を強化し、油圧機器市場におけるリーダー的地位を支えています。

アジア太平洋の油圧機器市場は、特に大規模なインフラ整備や工業生産における効率的な油圧機器への需要の高まりによって牽引されています。様々な産業における自動化の動向は、油圧システムが自動化された生産ラインの不可欠な構成要素となっていることから、この傾向をさらに後押ししています。都市化の進展に後押しされた建設・鉱業活動の急速な拡大は、これらのセクターにおける油圧機器のニーズを大幅に押し上げています。この地域全体のインフラプロジェクトへの投資は、油圧技術に依存した機械の使用の増加に寄与しています。さらに、農業分野では機械化が進んでおり、生産性向上のために近代的な農業機械の導入が着実に進んでいます。

当レポートでは、世界の油圧機器市場について調査し、タイプ別、コンポーネント別、センサー別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- サプライチェーン

- エコシステム

- 価格分析

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- AI/生成AIが油圧機器市場に与える影響

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ

- 貿易分析

- 特許分析

- 2025年~2026年の主な会議とイベント

- 規制機関、政府機関、その他の組織

- 油圧機器市場に関連する規格および規制

- 米国関税の影響:油圧機器市場

第6章 油圧分野における通信技術

- イントロダクション

- 無線周波数

- Bluetooth

- WI-FI

- 4G/5Gセルラー

第7章 油圧機器市場(タイプ別)

- イントロダクション

- 可動型

- 産業用

第8章 油圧機器市場(コンポーネント別)

- イントロダクション

- モーター

- ポンプ

- シリンダー

- バルブ

- トランスミッション

- アキュムレーター

- フィルター

- その他

第9章 油圧機器市場(センサー別)

- イントロダクション

- 傾斜センサー

- 位置センサー

- 圧力センサー

- 温度センサー

- レベルセンサー

- フローセンサー

第10章 油圧機器市場(最終用途産業別)

- イントロダクション

- 建設

- 航空宇宙

- マテリアルハンドリング

- 農業

- 鉱業

- 自動車

- 船舶

- 金属製造

- 石油・ガス

- その他

第11章 油圧機器市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- フランス

- 英国

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 日本

- 中国

- インド

- 韓国

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 南米

- GCC

- アフリカとその他

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2023年~2025年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- BOSCH REXROTH AG

- DANFOSS

- KAWASAKI HEAVY INDUSTRIES, LTD.

- KYB CORPORATION

- PARKER HANNIFIN CORP

- HYDAC INTERNATIONAL GMBH

- ENERPAC TOOL GROUP

- SMC CORPORATION

- WIPRO ENTERPRISES

- CATERPILLAR

- その他の企業

- ADVANCE HYDRAULICS, LLC

- AGGRESSIVE HYDRAULICS, INC.

- BAILEY INTERNATIONAL

- HOLMATRO

- PRINCE MANUFACTURING

- KAPPA ENGINEERING

- LEHIGH FLUID POWER, INC.

- LIGON HYDRAULIC CYLINDER GROUP

- MARREL

- PACOMA GMBH

- STANDEX INTERNATIONAL CORPORATION

- TEXAS HYDRAULICS

- VINTECCH HYDRAULICS

- WEBER-HYDRAULIK GMBH

- YUASA CO., LTD.

第14章 付録

List of Tables

- TABLE 1 RISK ASSESSMENT

- TABLE 2 HYDRAULICS MARKET ECOSYSTEM

- TABLE 3 INDICATIVE PRICING OF HYDRAULIC CYLINDERS, 2024

- TABLE 4 AVERAGE SELLING PRICE TREND OF HYDRAULIC CYLINDERS, BY KEY PLAYER, 2024

- TABLE 5 INDICATIVE PRICING OF HYDRAULIC CYLINDERS, BY REGION, 2024

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END-USE INDUSTRIES (%)

- TABLE 7 KEY BUYING CRITERIA FOR TOP END-USE INDUSTRIES

- TABLE 8 IMPORT DATA FOR HS CODE 841221-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 EXPORT DATA FOR HS CODE 841221-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 PATENTS PERTAINING TO HYDRAULICS MARKET, 2023-2025

- TABLE 11 CONFERENCES AND EVENTS

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

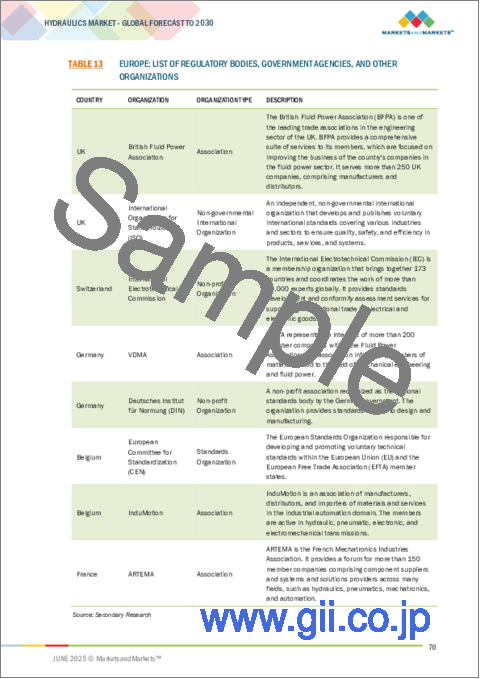

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 HYDRAULICS MARKET: STANDARDS AND REGULATIONS

- TABLE 17 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 18 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE INDUSTRIES DUE TO TARIFF IMPACT

- TABLE 19 HYDRAULICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 20 HYDRAULICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 21 MOBILE: HYDRAULICS MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 22 MOBILE: HYDRAULICS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 23 MOBILE: HYDRAULICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 24 MOBILE: HYDRAULICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 25 MOBILE: HYDRAULICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 26 MOBILE: HYDRAULICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 INDUSTRIAL: HYDRAULICS MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 28 INDUSTRIAL: HYDRAULICS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 29 INDUSTRIAL: HYDRAULICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 30 INDUSTRIAL: HYDRAULICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 31 INDUSTRIAL: HYDRAULICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 INDUSTRIAL: HYDRAULICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 HYDRAULICS MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 34 HYDRAULICS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 35 MOTORS: HYDRAULICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 36 MOTORS: HYDRAULICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 37 PUMPS: HYDRAULICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 38 PUMPS: HYDRAULICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 39 CYLINDERS: HYDRAULICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 40 CYLINDERS: HYDRAULICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 41 VALVES: HYDRAULICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 42 VALVES: HYDRAULICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 43 TRANSMISSIONS: HYDRAULICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 44 TRANSMISSIONS: HYDRAULICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 45 ACCUMULATORS: HYDRAULICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 46 ACCUMULATORS: HYDRAULICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 47 FILTERS: HYDRAULICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 48 FILTERS: HYDRAULICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 49 OTHER COMPONENTS: HYDRAULICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 50 OTHER COMPONENTS: HYDRAULICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 51 HYDRAULICS MARKET, BY SENSOR, 2021-2024 (USD MILLION)

- TABLE 52 HYDRAULICS MARKET, BY SENSOR, 2025-2030 (USD MILLION)

- TABLE 53 HYDRAULICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 54 HYDRAULICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 55 CONSTRUCTION: HYDRAULICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 56 CONSTRUCTION: HYDRAULICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 57 CONSTRUCTION: HYDRAULICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 CONSTRUCTION: HYDRAULICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 AEROSPACE: HYDRAULICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 60 AEROSPACE: HYDRAULICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 61 AEROSPACE: HYDRAULICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 AEROSPACE: HYDRAULICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 MATERIAL HANDLING: HYDRAULICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 64 MATERIAL HANDLING: HYDRAULICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 65 MATERIAL HANDLING: HYDRAULICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 MATERIAL HANDLING: HYDRAULICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 AGRICULTURE: HYDRAULICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 68 AGRICULTURE: HYDRAULICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 69 AGRICULTURE: HYDRAULICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 AGRICULTURE: HYDRAULICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 MINING: HYDRAULICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 72 MINING: HYDRAULICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 73 MINING: HYDRAULICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 MINING: HYDRAULICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 AUTOMOTIVE: HYDRAULICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 76 AUTOMOTIVE: HYDRAULICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 77 AUTOMOTIVE: HYDRAULICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 AUTOMOTIVE: HYDRAULICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 MARINE: HYDRAULICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 80 MARINE: HYDRAULICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 81 MARINE: HYDRAULICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 MARINE: HYDRAULICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 METALS MANUFACTURING: HYDRAULICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 84 METALS MANUFACTURING: HYDRAULICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 85 METALS MANUFACTURING: HYDRAULICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 METALS MANUFACTURING: HYDRAULICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 OIL & GAS: HYDRAULICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 88 OIL & GAS: HYDRAULICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 89 OIL & GAS: HYDRAULICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 OIL & GAS: HYDRAULICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 OTHER END-USE INDUSTRIES: HYDRAULICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 92 OTHER END-USE INDUSTRIES: HYDRAULICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 93 OTHER END-USE INDUSTRIES: HYDRAULICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 OTHER END-USE INDUSTRIES: HYDRAULICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 HYDRAULICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 HYDRAULICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: HYDRAULICS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 98 NORTH AMERICA: HYDRAULICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: HYDRAULICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 100 NORTH AMERICA: HYDRAULICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: HYDRAULICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 102 NORTH AMERICA: HYDRAULICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 103 EUROPE: HYDRAULICS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 104 EUROPE: HYDRAULICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 105 EUROPE: HYDRAULICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 106 EUROPE: HYDRAULICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 107 EUROPE: HYDRAULICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 108 EUROPE: HYDRAULICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 109 ASIA PACIFIC: HYDRAULICS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 110 ASIA PACIFIC: HYDRAULICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 111 ASIA PACIFIC: HYDRAULICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 112 ASIA PACIFIC: HYDRAULICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 113 ASIA PACIFIC: HYDRAULICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 114 ASIA PACIFIC: HYDRAULICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 115 ROW: HYDRAULICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 116 ROW: HYDRAULICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 117 ROW: HYDRAULICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 118 ROW: HYDRAULICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 119 ROW: HYDRAULICS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 120 ROW: HYDRAULICS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 121 HYDRAULICS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2023-2025

- TABLE 122 HYDRAULICS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 123 HYDRAULICS MARKET: COMPANY FOOTPRINT

- TABLE 124 HYDRAULICS MARKET: REGION FOOTPRINT

- TABLE 125 HYDRAULICS MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 126 HYDRAULICS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 127 HYDRAULICS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 128 HYDRAULICS MARKET: PRODUCT LAUNCHES, JANUARY 2023-MAY 2025

- TABLE 129 HYDRAULICS MARKET: DEALS, JANUARY 2023-MAY 2025

- TABLE 130 HYDRAULIC MARKET: EXPANSIONS

- TABLE 131 HYDRAULICS MARKET: OTHER DEVELOPMENTS, JANUARY 2023-MAY 2025

- TABLE 132 BOSCH REXROTH AG: COMPANY OVERVIEW

- TABLE 133 BOSCH REXROTH AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 134 BOSCH REXROTH AG: DEALS

- TABLE 135 BOSCH REXROTH AG: EXPANSIONS

- TABLE 136 DANFOSS: COMPANY OVERVIEW

- TABLE 137 DANFOSS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 138 DANFOSS: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 139 DANFOSS: OTHER DEVELOPMENTS

- TABLE 140 KAWASAKI HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 141 KAWASAKI HEAVY INDUSTRIES, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 142 KAWASAKI HEAVY INDUSTRIES, LTD.: EXPANSIONS

- TABLE 143 KYB CORPORATION: COMPANY OVERVIEW

- TABLE 144 KYB CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 145 PARKER HANNIFIN CORP: COMPANY OVERVIEW

- TABLE 146 PARKER HANNIFIN CORP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 HYDAC INTERNATIONAL GMBH: COMPANY OVERVIEW

- TABLE 148 HYDAC INTERNATIONAL GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 ENERPAC TOOL GROUP: COMPANY OVERVIEW

- TABLE 150 ENERPAC TOOL GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 SMC CORPORATION: COMPANY OVERVIEW

- TABLE 152 SMC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 153 WIPRO ENTERPRISES: COMPANY OVERVIEW

- TABLE 154 WIPRO ENTERPRISES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 CATERPILLAR: COMPANY OVERVIEW

- TABLE 156 CATERPILLAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 157 ADVANCE HYDRAULICS, LLC: COMPANY OVERVIEW

- TABLE 158 AGGRESSIVE HYDRAULICS, INC.: COMPANY OVERVIEW

- TABLE 159 BAILEY INTERNATIONAL: COMPANY OVERVIEW

- TABLE 160 HOLMATRO: COMPANY OVERVIEW

- TABLE 161 PRINCE MANUFACTURING: COMPANY OVERVIEW

- TABLE 162 KAPPA ENGINEERING: COMPANY OVERVIEW

- TABLE 163 LEHIGH FLUID POWER, INC.: COMPANY OVERVIEW

- TABLE 164 LIGON HYDRAULIC CYLINDER GROUP: COMPANY OVERVIEW

- TABLE 165 MARREL: COMPANY OVERVIEW

- TABLE 166 PACOMA GMBH: COMPANY OVERVIEW

- TABLE 167 STANDEX INTERNATIONAL CORPORATION: COMPANY OVERVIEW

- TABLE 168 TEXAS HYDRAULICS: COMPANY OVERVIEW

- TABLE 169 VINTECCH HYDRAULICS: COMPANY OVERVIEW

- TABLE 170 WEBER-HYDRAULIK GMBH: COMPANY OVERVIEW

- TABLE 171 YUASA CO., LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 HYDRAULICS MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 HYDRAULICS MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATION FROM HYDRAULIC COMPONENTS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 HYDRAULICS MARKET: DATA TRIANGULATION

- FIGURE 7 RESEARCH ASSUMPTIONS

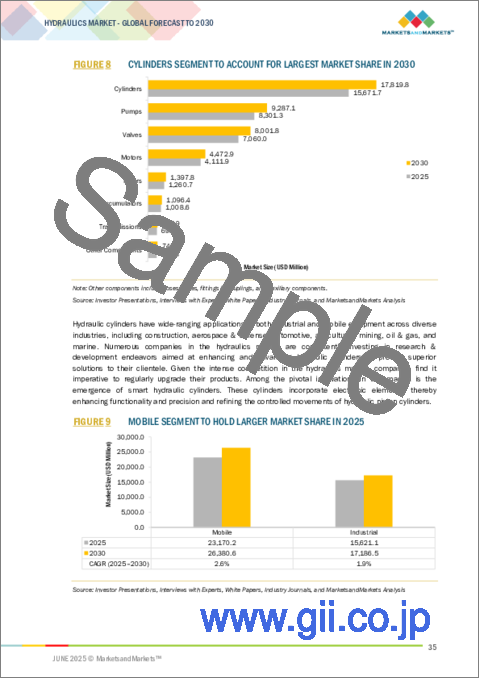

- FIGURE 8 CYLINDERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 9 MOBILE SEGMENT TO HOLD LARGER MARKET SHARE IN 2025

- FIGURE 10 AGRICULTURE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 RISING DEMAND FOR AGRICULTURAL, MATERIAL HANDLING, AND MINING EQUIPMENT TO FUEL MARKET GROWTH

- FIGURE 13 CYLINDERS SEGMENT TO LEAD MARKET IN 2025

- FIGURE 14 CONSTRUCTION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 15 MOBILE SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 16 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 HYDRAULICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 HYDRAULICS MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 19 HYDRAULICS MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 20 HYDRAULICS MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 21 HYDRAULICS MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 22 HYDRAULICS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 HYDRAULICS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 AVERAGE SELLING PRICE TREND OF HYDRAULIC CYLINDERS, BY KEY PLAYER, 2024

- FIGURE 25 AVERAGE SELLING PRICE TREND OF HYDRAULIC CYLINDERS, 2024-2029 (USD)

- FIGURE 26 IMPACT OF AI/GENERATIVE AI ON HYDRAULICS MARKET

- FIGURE 27 HYDRAULICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END-USE INDUSTRIES

- FIGURE 29 KEY BUYING CRITERIA FOR TOP END-USE INDUSTRIES

- FIGURE 30 IMPORT DATA FOR HS CODE 841221-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 31 EXPORT DATA FOR HS CODE 841221-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 32 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 33 HYDRAULICS MARKET, BY TYPE

- FIGURE 34 MOBILE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2030

- FIGURE 35 HYDRAULICS MARKET, BY COMPONENT

- FIGURE 36 CYLINDERS SEGMENT TO LEAD MARKET IN 2030

- FIGURE 37 HYDRAULICS MARKET, BY SENSOR

- FIGURE 38 POSITION SENSORS SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 39 HYDRAULICS MARKET, BY END-USE INDUSTRY

- FIGURE 40 CONSTRUCTION SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 41 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 ASIA PACIFIC TO LEAD MARKET IN 2030

- FIGURE 43 NORTH AMERICA: HYDRAULICS MARKET SNAPSHOT

- FIGURE 44 EUROPE: HYDRAULICS MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: HYDRAULICS MARKET SNAPSHOT

- FIGURE 46 HYDRAULICS MARKET: REVENUE ANALYSIS OF TOP PLAYERS, 2020-2024

- FIGURE 47 MARKET SHARE ANALYSIS OF COMPANIES OFFERING HYDRAULICS, 2024

- FIGURE 48 HYDRAULICS MARKET: COMPANY EVALUATION MATRIX, 2024

- FIGURE 49 HYDRAULICS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 50 BOSCH REXROTH AG: COMPANY SNAPSHOT

- FIGURE 51 DANFOSS: COMPANY SNAPSHOT

- FIGURE 52 KAWASAKI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 53 KYB CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 PARKER HANNIFIN CORP: COMPANY SNAPSHOT

- FIGURE 55 ENERPAC TOOL GROUP: COMPANY SNAPSHOT

- FIGURE 56 SMC CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 CATERPILLAR: COMPANY SNAPSHOT

The global hydraulics market is anticipated to grow from USD 39.40 billion in 2025 to USD 44.26 billion in 2030, at a CAGR of 2.4%. The launch of smart hydraulic and electro-hydraulic systems is a key factor driving the hydraulics market. By integrating electronics and digital controls, these technologies enable enhanced monitoring, faster response time, and improved energy efficiency, which reduces operational costs and downtime. Their compatibility with automation and Industry 4.0 initiatives makes them highly attractive for modern industrial applications, accelerating the adoption of advanced hydraulic solutions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | By type, component, sensor, end-use industry, and region |

| Regions covered | North America, Europe, APAC, RoW |

"Mobile segment to dominate hydraulics market, by type, throughout forecast period"

The mobile segment is expected to hold the largest share of the hydraulics market throughout the forecast period, primarily due to its extensive applications across several high-demand industries, such as construction, agriculture, material handling, transportation, and mining. Mobile hydraulic systems offer high power density and flexibility, essential for heavy machinery, including excavators, tractors, forklifts, and off-highway vehicles. The ongoing infrastructure development, increasing mechanization in agriculture, and growth in warehousing and mining activities further fuel the demand for mobile hydraulics. Additionally, technological advancements such as the integration of electrification and hybrid systems, intelligent control with real-time data analytics, energy-efficient pump technologies, environmentally friendly fluids, and enhanced safety features have significantly improved the performance, sustainability, and reliability of mobile hydraulic systems.

"Position sensors held largest share of hydraulics market in 2024"

Position sensors held the largest share of the hydraulics market in 2024 due to their critical role in delivering precise positional feedback for hydraulic components such as cylinders and valves. This precision is fundamental to ensuring the effective and safe operation of hydraulic systems across key sectors, including construction, automotive, aerospace, and industrial automation. The accelerating adoption of automation and intelligent hydraulic solutions further amplifies the demand for reliable position sensing technologies that drive enhanced system performance, energy efficiency, and operational accuracy. Moreover, continuous advancements in sensor technology, particularly non-contact and robust sensor designs, have reinforced their indispensability and underpin their leadership position within the hydraulics market landscape.

"Asia Pacific to hold largest market share throughout forecast period"

The hydraulics market in the Asia Pacific region is driven by the increasing demand for efficient hydraulic machinery, especially in large-scale infrastructure development and industrial manufacturing. Growing automation within various industries further propels this trend, as hydraulic systems become essential components of automated production lines. The rapid expansion of construction and mining activities, fueled by ongoing urbanization, significantly boosts the need for hydraulic equipment in these sectors. Investments in infrastructure projects across the region contribute to the rising use of machinery reliant on hydraulic technology. Additionally, the agricultural sector is witnessing increased mechanization, with modern farming equipment adoption growing steadily to improve productivity.

Breakdown of Primaries

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation - C-level Executives - 48%, Directors - 33%, and Others (Vice Presidents, Senior Managers, Project Managers, and Analysts) - 19%

- By Region - North America - 35%, Europe - 18%, Asia Pacific - 40%, and RoW - 7%

The hydraulics market is dominated by a few globally established players, such as Bosch Rexroth AG (Germany), Danfoss (Denmark), Kawasaki Heavy Industries, Ltd. (Japan), and KYB Corporation (Japan). The study includes an in-depth competitive analysis of these key players, including their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the hydraulics market and forecasts its size by type, component, sensor, end-use industry, and region. It also discusses the drivers, restraints, opportunities, and challenges pertaining to the market under study and gives a detailed view of the market across four main regions: North America, Europe, Asia Pacific, and RoW. The report includes a supply chain analysis, key players, and their competitive analysis in the hydraulics ecosystem.

Key Benefits of Buying the Report:

- Analysis of key drivers (rising need for more compact hydraulic components and systems, growing focus toward electrohydraulic systems); restraints (complexities associated with the maintenance of hydraulic systems); opportunities (increasing demand for smart hydraulic systems); and challenges (operational downtime and maintenance challenges)

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and latest product launches in the hydraulics market

- Market Development: Comprehensive information about lucrative markets-the report analyses the hydraulics market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the hydraulics market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the material informatics market, such as Bosch Rexroth AG (Germany), Danfoss (Denmark), HYDAC International GmbH (Germany), Kawasaki Heavy Industries, Ltd. (Japan), and KYB Corporation (Japan)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 INTRODUCTION

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Key data from primary sources

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach for arriving at market size using bottom-up approach

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach for arriving at market size using top-down approach

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN HYDRAULICS MARKET

- 4.2 HYDRAULICS MARKET, BY COMPONENT

- 4.3 HYDRAULICS MARKET, BY END-USE INDUSTRY

- 4.4 HYDRAULICS MARKET, BY TYPE

- 4.5 HYDRAULICS MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing focus toward electrohydraulic systems

- 5.2.1.2 Rising need for more compact hydraulic components and systems

- 5.2.1.3 Mounting demand for advanced agricultural equipment

- 5.2.1.4 Increasing demand for smart hydraulic systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 Complexities associated with maintenance of hydraulic equipment

- 5.2.2.2 High manufacturing and maintenance costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Surging adoption of lifting equipment in shipping industry

- 5.2.3.2 Continuous R&D and technological advancements in hydraulic cylinders

- 5.2.4 CHALLENGES

- 5.2.4.1 Availability of substitute products

- 5.2.1 DRIVERS

- 5.3 SUPPLY CHAIN

- 5.3.1 RAW MATERIAL SUPPLIERS

- 5.3.2 MANUFACTURERS

- 5.3.3 DISTRIBUTORS

- 5.3.4 END-USE INDUSTRIES

- 5.3.5 AFTER-SALES SERVICE PROVIDERS

- 5.4 ECOSYSTEM

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF HYDRAULIC CYLINDERS, BY KEY PLAYER, 2024

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Electrohydraulic

- 5.7.2 COMPLIMENTARY TECHNOLOGIES

- 5.7.2.1 IoT

- 5.7.2.2 Edge computing

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Mechatronics

- 5.7.3.2 Additive manufacturing

- 5.7.1 KEY TECHNOLOGIES

- 5.8 IMPACT OF AI/GENERATIVE AI ON HYDRAULICS MARKET

- 5.8.1 INTRODUCTION

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDIES

- 5.11.1 REXROTH'S HAGGLUNDS DIVISION HELPED STAHL IN COMPREHENSIVE MODERNIZATION THAT REDUCED OPERATIONAL COSTS AND SUPPORTED ITS SUSTAINABILITY GOALS

- 5.11.2 ROTEC DESIGNED AND MANUFACTURED FULLY SELF-CONTAINED HYDRAULIC SYSTEM THAT PROVIDED LONG-TERM AND RELIABLE SOLUTION TO SERVE PORT

- 5.11.3 ADVANCED HYDRAULICS DESIGNED AND BUILT COMPACT SKID-MOUNTED HYDRAULIC POWER UNIT THAT INCLUDED INTEGRATED LIFTING EYES AND ELECTRICAL BRACKETS AND MET STRUCTURAL, PERFORMANCE, AND SAFETY REQUIREMENTS

- 5.12 TRADE ANALYSIS

- 5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16 STANDARDS AND REGULATIONS RELATED TO HYDRAULICS MARKET

- 5.17 IMPACT OF US TARIFF: HYDRAULICS MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

6 COMMUNICATION TECHNOLOGIES DEPLOYED IN HYDRAULICS

- 6.1 INTRODUCTION

- 6.2 RADIOFREQUENCY

- 6.3 BLUETOOTH

- 6.4 WI-FI

- 6.5 4G/5G CELLULAR

7 HYDRAULICS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 MOBILE

- 7.2.1 RISING ADOPTION OF AUTOMATED HEAVY CONSTRUCTION AND MINING VEHICLES TO FUEL MARKET GROWTH

- 7.3 INDUSTRIAL

- 7.3.1 INCREASED CONVENIENCE OF OPERATORS AND REDUCED PHYSICAL EFFORTS OF WORKFORCE TO BOOST DEMAND

8 HYDRAULICS MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- 8.2 MOTORS

- 8.2.1 DESIGN UPGRADES AND TECHNICAL INNOVATIONS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 8.3 PUMPS

- 8.3.1 GROWING FOCUS ON PLANT AUTOMATION TO DRIVE MARKET

- 8.4 CYLINDERS

- 8.4.1 EASE OF USE AND DURABILITY TO FUEL MARKET GROWTH

- 8.5 VALVES

- 8.5.1 INTEGRATION OF IOT WITH HYDRAULIC VALVES TO FOSTER MARKET GROWTH

- 8.6 TRANSMISSIONS

- 8.6.1 INCREASING PRODUCTION OF OFF-ROAD EQUIPMENT TO DRIVE MARKET

- 8.7 ACCUMULATORS

- 8.7.1 DEVELOPMENT OF ENERGY-EFFICIENT HYDRAULIC ACCUMULATORS TO BOOST DEMAND

- 8.8 FILTERS

- 8.8.1 INCREASING DEPLOYMENT TO LIMIT CONTAMINANT-RELATED SYSTEM FAILURES TO SUPPORT MARKET GROWTH

- 8.9 OTHER COMPONENTS

9 HYDRAULICS MARKET, BY SENSOR

- 9.1 INTRODUCTION

- 9.2 TILT SENSORS

- 9.2.1 ESCALATING INDUSTRIALIZATION AND EXPANDING REAL ESTATE DOMAIN TO FUEL MARKET GROWTH

- 9.3 POSITION SENSORS

- 9.3.1 INCREASED MACHINE PRODUCTIVITY AND REDUCED DOWNTIME TO BOOST DEMAND

- 9.4 PRESSURE SENSORS

- 9.4.1 INTEGRATION OF PRESSURE SENSORS WITH CLOUD COMPUTING TO BOOST DEMAND

- 9.5 TEMPERATURE SENSORS

- 9.5.1 RISING NEED FOR REAL-TIME TEMPERATURE MONITORING TO DRIVE MARKET

- 9.6 LEVEL SENSORS

- 9.6.1 NEED TO MAINTAIN ADEQUATE FLUID LEVEL WITHIN HYDRAULIC RESERVOIR TANK TO FUEL MARKET GROWTH

- 9.7 FLOW SENSORS

- 9.7.1 INCREASED DEMAND FOR INTELLIGENT MONITORING AND CONTROLLING TOOLS & TECHNOLOGIES TO FUEL MARKET GROWTH

10 HYDRAULICS MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 CONSTRUCTION

- 10.2.1 INCREASING NEED FOR HOUSING TO DRIVE MARKET

- 10.3 AEROSPACE

- 10.3.1 RISING DEMAND FOR NEXT-GENERATION AND FUEL-EFFICIENT AIRCRAFT TO FUEL MARKET GROWTH

- 10.4 MATERIAL HANDLING

- 10.4.1 EXPANDING E-COMMERCE INDUSTRY AND WAREHOUSING REQUIREMENTS TO FOSTER MARKET GROWTH

- 10.5 AGRICULTURE

- 10.5.1 GROWING INVESTMENTS IN MACHINES FOR PRECISION AGRICULTURE TO SUPPORT MARKET GROWTH

- 10.6 MINING

- 10.6.1 ADOPTION OF ADVANCED TECHNOLOGIES IN MINING INDUSTRY TO DRIVE MARKET

- 10.7 AUTOMOTIVE

- 10.7.1 GROWING TREND FOR AUTONOMOUS, ELECTRIC, AND CONNECTED CARS TO DRIVE MARKET

- 10.8 MARINE

- 10.8.1 ABILITY TO WITHSTAND EXTREME CONDITIONS TO DRIVE MARKET

- 10.9 METALS MANUFACTURING

- 10.9.1 IMPLEMENTATION OF IOT-BASED HYDRAULICS IN MACHINE MANUFACTURING TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 10.10 OIL & GAS

- 10.10.1 INCREASED PRODUCTIVITY AND MINIMIZED OUTAGE TO FUEL MARKET GROWTH

- 10.11 OTHER END-USE INDUSTRIES

11 HYDRAULICS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Surging residential and commercial construction activities to fuel market growth

- 11.2.3 CANADA

- 11.2.3.1 Presence of established mining industry to boost demand

- 11.2.4 MEXICO

- 11.2.4.1 Thriving aerospace industry to support market growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Significant presence of leading hydraulics manufacturers to foster market growth

- 11.3.3 FRANCE

- 11.3.3.1 Growing application in automotive industry to boost demand

- 11.3.4 UK

- 11.3.4.1 Government-led initiatives to boost hydraulics manufacturing to foster market growth

- 11.3.5 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 JAPAN

- 11.4.2.1 Significant presence of key hydraulic equipment suppliers to boost demand

- 11.4.3 CHINA

- 11.4.3.1 Rapid growth in process manufacturing, public utilities, and general construction to support market growth

- 11.4.4 INDIA

- 11.4.4.1 Flourishing construction industry to offer lucrative growth opportunities

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Expanding shipbuilding industry to boost demand

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 11.5.2 SOUTH AMERICA

- 11.5.2.1 Rising middle-class population and growing crisis of affordable housing to fuel market growth

- 11.5.3 GCC

- 11.5.3.1 Rising investments in oil & gas industry to boost demand

- 11.5.4 AFRICA & REST OF MIDDLE EAST

- 11.5.4.1 Rising investments in infrastructure development and mining activities to drive market

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- 12.2.1 REVENUE ANALYSIS, 2020-2024

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.3.1 COMPANY FOOTPRINT

- 12.3.2 REGION FOOTPRINT

- 12.4 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.4.1 STARS

- 12.4.2 EMERGING LEADERS

- 12.4.3 PERVASIVE PLAYERS

- 12.4.4 PARTICIPANTS

- 12.4.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.4.6 DETAILED LIST OF KEY STARTUPS/SMES

- 12.4.7 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 12.5 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.5.1 PROGRESSIVE COMPANIES

- 12.5.2 RESPONSIVE COMPANIES

- 12.5.3 DYNAMIC COMPANIES

- 12.5.4 STARTING BLOCKS

- 12.6 COMPETITIVE SCENARIO

- 12.6.1 PRODUCT LAUNCHES

- 12.6.2 DEALS

- 12.6.3 EXPANSIONS

- 12.6.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 BOSCH REXROTH AG

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.3.2 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 DANFOSS

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 KAWASAKI HEAVY INDUSTRIES, LTD.

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.2.1 Expansions

- 13.1.3.3 MnM view

- 13.1.3.3.1 Right to win

- 13.1.3.3.2 Strategic choices

- 13.1.3.3.3 Weaknesses & competitive threats

- 13.1.4 KYB CORPORATION

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Right to win

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses & competitive threats

- 13.1.5 PARKER HANNIFIN CORP

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Right to win

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses & competitive threats

- 13.1.6 HYDAC INTERNATIONAL GMBH

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.7 ENERPAC TOOL GROUP

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.8 SMC CORPORATION

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.9 WIPRO ENTERPRISES

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.10 CATERPILLAR

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.1 BOSCH REXROTH AG

- 13.2 OTHER PLAYERS

- 13.2.1 ADVANCE HYDRAULICS, LLC

- 13.2.2 AGGRESSIVE HYDRAULICS, INC.

- 13.2.3 BAILEY INTERNATIONAL

- 13.2.4 HOLMATRO

- 13.2.5 PRINCE MANUFACTURING

- 13.2.6 KAPPA ENGINEERING

- 13.2.7 LEHIGH FLUID POWER, INC.

- 13.2.8 LIGON HYDRAULIC CYLINDER GROUP

- 13.2.9 MARREL

- 13.2.10 PACOMA GMBH

- 13.2.11 STANDEX INTERNATIONAL CORPORATION

- 13.2.12 TEXAS HYDRAULICS

- 13.2.13 VINTECCH HYDRAULICS

- 13.2.14 WEBER-HYDRAULIK GMBH

- 13.2.15 YUASA CO., LTD.

14 APPENDIX

- 14.1 INSIGHTS OF INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 AVAILABLE CUSTOMIZATIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS