|

|

市場調査レポート

商品コード

1742433

紙・板紙包装の世界市場:グレード別、タイプ別、原料別、パルプ化別、用途別、地域別 - 予測(~2030年)Paper and Paperboard Packaging Market by Grade, Type, Source, Pulping, Application, & Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 紙・板紙包装の世界市場:グレード別、タイプ別、原料別、パルプ化別、用途別、地域別 - 予測(~2030年) |

|

出版日: 2025年06月02日

発行: MarketsandMarkets

ページ情報: 英文 316 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の紙・板紙包装の市場規模は、2024年に3,799億米ドルであり、2030年までに4,518億米ドルに達すると予測され、CAGRで2.9%の成長が見込まれます。

紙・板紙包装の需要は、プラスチックの使用を減らすための規制強化や環境意識の高まりにより着実に増加しています。現在、多くの政府が使い捨てプラスチックの使用を禁止または制限しているため、企業は紙製の包装など、より環境にやさしい代替品を使用するようになっています。eコマースの急速な拡大により、リサイクル可能かつ、印刷可能でブランディングをサポートするのに十分な堅牢性を備えた包装への需要が高まっています。食品・飲料産業では、環境に配慮した包装を求める消費者の選好を受けて、生分解性で食品に安全な材料の使用が急増しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 金額(100万米ドル)、数量(キロトン) |

| セグメント | グレード、タイプ、原料、パルプ化、用途、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、南米 |

グレード別では、グラシン・耐油セグメントが予測期間にもっとも高いCAGRとなる見込みです。

グレード別では、グラシン・グリースプルーフセグメントが予測期間に紙・板紙包装市場でもっとも高いCAGRで成長する見込みです。これは、持続可能で食品安全性が高く、耐油性のある包装ソリューションに対する需要が、特にフードサービスやベーカリーのセグメントで高まっていることによるものです。グラシンは滑らかで光沢があり、気密性が高いため、菓子類、ベーカリー製品、油脂に敏感な製品の包装に使用されています。生分解性とリサイクル性に優れているため、世界の環境目標に沿ったプラスチック由来のラップの代替品として好まれています。耐油紙は耐油性と耐湿性があるため、ファストフード、スナック菓子、軽食に最適です。プラスチック削減に対する規制圧力の高まりと、環境にやさしい包装に対する消費者の意識の高まりにより、メーカーはますますこれらの特殊紙を採用するようになっているため、市場シェアは拡大し、セグメント成長を促進しています。

タイプ別では、フレキシブルペーパーセグメントが予測期間にもっとも高いCAGRとなりました。

フレキシブルペーパーセグメントは、持続可能で高性能の交換可能な機能性が食品、パーソナルケア、小売部門で引き続き活況にあることから、予測期間紙に紙・板紙包装産業でもっとも高いCAGRで成長する見込みです。プラスチック消費からの脱却を求める法規制が続く中、メーカーは環境的な利点と機能的な性能を提供するパウチ、ラップ、小袋に代わる柔軟な紙を模索しています。外出先で消費するパターンが増え、スナック菓子や個包装された商品が好まれるようになったことで、軽量かつリサイクル可能で堆肥化可能な包装形式に対する需要が生まれています。フレキシブルペーパーは、ブランドをアピールする高級印刷仕様の需要に応え、リサイクル性を維持しながら耐湿性や耐油性を向上させるバリアコーティングを施すこともできます。消費者の間で持続可能な包装製品への需要が高まる中、コーティング技術の積極的な進歩もあり、フレキシブルペーパーは、特に持続可能性とシェルフアピールの要因が意思決定パラメーターに含まれる用途において、好ましい選択肢として優位に立つことができます。

当レポートでは、世界の紙・板紙包装市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- 紙・板紙包装市場における魅力的な機会

- 紙・板紙包装市場:タイプ別

- 紙・板紙包装市場:用途別

- 紙・板紙包装市場:グレード別

- アジア太平洋の紙・板紙包装市場:タイプ別、国別(2024年)

- 紙・板紙包装市場:主要国別

第5章 市場の概要

- イントロダクション

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 産業動向

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- 主要企業の平均販売価格の動向:タイプ別(2024年)

- 価格分析:地域別

- バリューチェーン分析

- エコシステム分析

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- イントロダクション

- アプローチ

- 主な出願者

- 貿易分析(HSコード48)

- HSコード48関連輸入データ

- HSコード48準拠製品の輸出データ

- 主な会議とイベント(2025年)

- 規制情勢

- 規制機関、政府機関、その他の組織

- 規制枠組み

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

- マクロ経済分析

- イントロダクション

- GDPの動向と予測

- 投資と資金調達のシナリオ

- 紙・板紙包装市場に対する2025年の米国関税の影響

- イントロダクション

- 主な関税率

- 価格の影響の分析

- さまざまな地域への主な影響

- 最終用途産業に対する影響

第7章 紙・板紙包装市場:グレード別

- イントロダクション

- SBS

- CUK/SUS

- FBB

- WLC

- グラシン・耐油

- ラベル用紙

- その他のグレード

第8章 紙・板紙包装市場:原料別

- イントロダクション

- 再生紙

第9章 紙・板紙包装市場:パルプ化別

- イントロダクション

- 化学パルプ化

- サーモメカニカルパルプ化

第10章 紙・板紙包装市場:タイプ別

- イントロダクション

- 段ボール箱

- ボール紙

- フレキシブルペーパー

第11章 紙・板紙包装市場:用途別

- イントロダクション

- 食品

- 飲料

- 医療

- パーソナルケア・ホームケア

- その他の用途

第12章 紙・板紙包装市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他のアジア太平洋

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他の欧州

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他の中東・アフリカ

第13章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業の評価と財務指標

- 財務指標

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合ベンチマーキング:スタートアップ/中小企業(2024年)

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- MONDI GROUP

- INTERNATIONAL PAPER

- SMURFIT KAPPA

- NIPPON PAPER INDUSTRIES CO., LTD.

- AMCOR

- OJI HOLDINGS CORPORATION

- ITC LIMITED

- METSA GROUP

- CLEARWATER PAPER CORPORATION

- PACKAGING CORPORATION OF AMERICA

- その他の企業

- KLABIN S.A.

- SAPPI LTD

- ORCON INDUSTRIES CORP.

- PROAMPAC

- TRIDENT PAPER BOX INDUSTRIES

- STORA ENSO

- TGI PACKAGING PVT. LTD.

- SAICA

- RELEAF PAPER

- ATHAR PACKAGING SOLUTIONS PVT. LTD.

- ECOENCLOSE INC.

- COVERIS

- EPAC HOLDINGS, LLC.

- EDPACK KARUNIA PERSADA, PT.

- ADEERA PACKAGING PVT. LTD.

第15章 隣接市場と関連市場

- イントロダクション

- 制限事項

- 紙袋市場

- 段ボール箱市場

第16章 付録

List of Tables

- TABLE 1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY TOP 3 TYPES, 2024 (USD/KG)

- TABLE 2 AVERAGE SELLING PRICE OF KEY PLAYERS, BY REGION, 2021-2030 (USD/KG)

- TABLE 3 ROLES OF COMPANIES IN PAPER & PAPERBOARD PACKAGING MARKET ECOSYSTEM

- TABLE 4 LIST OF PATENTS FOR PAPER & PAPERBOARD PACKAGING:

- TABLE 5 IMPORT DATA FOR HS CODE 48-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 6 EXPORT DATA FOR HS CODE 48-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 7 KEY CONFERENCES AND EVENTS, PAPER & PAPERBOARD PACKAGING MARKET, 2025

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 15 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 16 GLOBAL GDP GROWTH PROJECTION, 2021-2028 (USD TRILLION)

- TABLE 17 PAPER & PAPERBOARD PACKAGING MARKET, BY GRADE, 2021-2023 (USD MILLION)

- TABLE 18 PAPER & PAPERBOARD PACKAGING MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 19 PAPER & PAPERBOARD PACKAGING MARKET, BY GRADE, 2021-2023 (KILOTON)

- TABLE 20 PAPER & PAPERBOARD PACKAGING MARKET, BY GRADE, 2024-2030 (KILOTON)

- TABLE 21 SBS: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 22 SBS: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 23 CUK/SUS: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 24 CUK/SUS: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 25 FBB: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 26 FBB: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 27 WLC: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 28 WLC: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 29 GLASSINE & GREASEPROOF: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 30 GLASSINE & GREASEPROOF: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 31 LABEL PAPER: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 32 LABEL PAPER : PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 33 OTHER GRADES: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 OTHER GRADES: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 35 PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 36 PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 37 PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 38 PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 39 CORRUGATED BOX: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 CORRUGATED BOX: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 41 BOXBOARD: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 42 BOXBOARD: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 43 FLEXIBLE PAPER: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 FLEXIBLE PAPER: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 45 PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 46 PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 47 PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 48 PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 49 FOOD: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 50 FOOD: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 51 BEVERAGE: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 52 BEVERAGE: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 53 HEALTHCARE: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 54 HEALTHCARE: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 55 PERSONAL AND HOMECARE: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 56 PERSONAL AND HOMECARE: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 57 OTHER APPLICATIONS: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 58 OTHER APPLICATIONS: PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 59 PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 60 PAPER & PAPERBOARD PACKAGING MARKET, BY REGION 2024-2030 (USD MILLION)

- TABLE 61 PAPER & PAPERBOARD PACKAGING MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 62 PAPER & PAPERBOARD PACKAGING MARKET, BY REGION 2024-2030 (KILOTON)

- TABLE 63 NORTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 64 NORTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 66 NORTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 67 NORTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 68 NORTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 70 NORTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 71 NORTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 72 NORTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 73 NORTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 74 NORTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 75 NORTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY GRADE, 2021-2023 (USD MILLION)

- TABLE 76 NORTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY GRADE, 2021-2023 (KILOTON)

- TABLE 78 NORTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY GRADE, 2024-2030 (KILOTON)

- TABLE 79 US: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 80 US: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 81 US: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 82 US: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 83 CANADA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 84 CANADA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 85 CANADA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 86 CANADA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 87 MEXICO: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 88 MEXICO: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 89 MEXICO: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 90 MEXICO: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 91 ASIA PACIFIC: PAPER & PAPERBOARD PACKAGING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 92 ASIA PACIFIC: PAPER & PAPERBOARD PACKAGING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 93 ASIA PACIFIC: PAPER & PAPERBOARD PACKAGING MARKET, BY COUNTRY, 2021-2023 (USD KILOTON)

- TABLE 94 ASIA PACIFIC: PAPER & PAPERBOARD PACKAGING MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 95 ASIA PACIFIC: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 96 ASIA PACIFIC: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 97 ASIA PACIFIC: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 98 ASIA PACIFIC: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 99 ASIA PACIFIC: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 100 ASIA PACIFIC: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 101 ASIA PACIFIC: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 102 ASIA PACIFIC: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 103 ASIA PACIFIC: PAPER & PAPERBOARD PACKAGING MARKET, BY GRADE, 2021-2023 (USD MILLION)

- TABLE 104 ASIA PACIFIC: PAPER & PAPERBOARD PACKAGING MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 105 ASIA PACIFIC: PAPER & PAPERBOARD PACKAGING MARKET, BY GRADE, 2021-2023 (KILOTON)

- TABLE 106 ASIA PACIFIC: PAPER & PAPERBOARD PACKAGING MARKET, BY GRADE, 2024-2030 (KILOTON)

- TABLE 107 CHINA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 108 CHINA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 109 CHINA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 110 CHINA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 111 INDIA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 112 INDIA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 113 INDIA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 114 INDIA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 115 JAPAN: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 116 JAPAN: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 117 JAPAN: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 118 JAPAN: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 119 SOUTH KOREA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 120 SOUTH KOREA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 121 SOUTH KOREA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 122 SOUTH KOREA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 123 REST OF ASIA PACIFIC: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 124 REST OF ASIA PACIFIC: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 125 REST OF ASIA PACIFIC: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 126 REST OF ASIA PACIFIC: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 127 EUROPE: PAPER & PAPERBOARD PACKAGING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 128 EUROPE: PAPER & PAPERBOARD PACKAGING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 129 EUROPE: PAPER & PAPERBOARD PACKAGING MARKET, BY COUNTRY, 2021-2023 (USD KILOTON)

- TABLE 130 EUROPE: PAPER & PAPERBOARD PACKAGING MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 131 EUROPE: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 132 EUROPE: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 133 EUROPE: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 134 EUROPE: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 135 EUROPE: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 136 EUROPE: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 137 EUROPE: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 138 EUROPE: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 139 EUROPE: PAPER & PAPERBOARD PACKAGING MARKET, BY GRADE, 2021-2023 (USD MILLION)

- TABLE 140 EUROPE: PAPER & PAPERBOARD PACKAGING MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 141 EUROPE: PAPER & PAPERBOARD PACKAGING MARKET, BY GRADE, 2021-2023 (KILOTON)

- TABLE 142 EUROPE: PAPER & PAPERBOARD PACKAGING MARKET, BY GRADE, 2024-2030 (KILOTON)

- TABLE 143 GERMANY: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 144 GERMANY: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 145 GERMANY: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 146 GERMANY: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 147 UK: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 148 UK: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 149 UK: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 150 UK: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 151 FRANCE: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 152 FRANCE: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 153 FRANCE: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 154 FRANCE: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 155 ITALY: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 156 ITALY: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 157 ITALY: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 158 ITALY: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 159 REST OF EUROPE: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 160 REST OF EUROPE: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 161 REST OF EUROPE: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 162 REST OF EUROPE: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 163 SOUTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 164 SOUTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 165 SOUTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY COUNTRY, 2021-2023 (USD KILOTON)

- TABLE 166 SOUTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 167 SOUTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 168 SOUTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 169 SOUTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 170 SOUTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 171 SOUTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 172 SOUTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 173 SOUTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 174 SOUTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 175 SOUTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY GRADE, 2021-2023 (USD MILLION)

- TABLE 176 SOUTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 177 SOUTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY GRADE, 2021-2023 (KILOTON)

- TABLE 178 SOUTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY GRADE, 2024-2030 (KILOTON)

- TABLE 179 BRAZIL: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 180 BRAZIL: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 181 BRAZIL: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 182 BRAZIL: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 183 ARGENTINA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 184 ARGENTINA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 185 ARGENTINA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 186 ARGENTINA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 187 REST OF SOUTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 188 REST OF SOUTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 189 REST OF SOUTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 190 REST OF SOUTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 191 MIDDLE EAST & AFRICA: PAPER & PAPERBOARD PACKAGING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: PAPER & PAPERBOARD PACKAGING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: PAPER & PAPERBOARD PACKAGING MARKET, BY COUNTRY, 2021-2023 (USD KILOTON)

- TABLE 194 MIDDLE EAST & AFRICA: PAPER & PAPERBOARD PACKAGING MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 195 MIDDLE EAST & AFRICA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 198 MIDDLE EAST & AFRICA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 199 MIDDLE EAST & AFRICA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 202 MIDDLE EAST & AFRICA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 203 MIDDLE EAST & AFRICA: PAPER & PAPERBOARD PACKAGING MARKET, BY GRADE, 2021-2023 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: PAPER & PAPERBOARD PACKAGING MARKET, BY GRADE, 2024-2030 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: PAPER & PAPERBOARD PACKAGING MARKET, BY GRADE, 2021-2023 (KILOTON)

- TABLE 206 MIDDLE EAST & AFRICA: PAPER & PAPERBOARD PACKAGING MARKET, BY GRADE, 2024-2030 (KILOTON)

- TABLE 207 GCC COUNTRIES: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 208 GCC COUNTRIES: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 209 GCC COUNTRIES: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 210 GCC COUNTRIES: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 211 SAUDI ARABIA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 212 SAUDI ARABIA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 213 SAUDI ARABIA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 214 SAUDI ARABIA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 215 UAE: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 216 UAE: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 217 UAE: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 218 UAE: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 219 REST OF GCC COUNTRIES: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 220 REST OF GCC COUNTRIES: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 221 REST OF GCC COUNTRIES: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 222 REST OF GCC COUNTRIES: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 223 SOUTH AFRICA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 224 SOUTH AFRICA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 225 SOUTH AFRICA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 226 SOUTH AFRICA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 227 REST OF MIDDLE EAST & AFRICA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 228 REST OF MIDDLE EAST & AFRICA: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE, 2023-2030 (KILOTON)

- TABLE 229 REST OF MIDDLE EAST & AFRICA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 230 REST OF MIDDLE EAST & AFRICA: PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 231 PAPER & PAPERBOARD PACKAGING MARKET: OVERVIEW OF STRATEGIES ADOPTED BY MARKET PLAYERS BETWEEN JANUARY 2021 AND APRIL 2025

- TABLE 232 PAPER & PAPERBOARD PACKAGING MARKET: DEGREE OF COMPETITION

- TABLE 233 PAPER & PAPERBOARD PACKAGING MARKET: REGION FOOTPRINT

- TABLE 234 PAPER & PAPERBOARD PACKAGING MARKET: GRADE FOOTPRINT

- TABLE 235 PAPER & PAPERBOARD PACKAGING MARKET: TYPE FOOTPRINT

- TABLE 236 PAPER & PAPERBOARD PACKAGING MARKET: APPLICATION FOOTPRINT

- TABLE 237 PAPER & PAPERBOARD PACKAGING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 238 PAPER & PAPERBOARD PACKAGING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/1)

- TABLE 239 PAPER & PAPERBOARD PACKAGING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 240 PAPER & PAPERBOARD PACKAGING MARKET: PRODUCT LAUNCHES, JANUARY 2021-APRIL 2025

- TABLE 241 PAPER & PAPERBOARD PACKAGING MARKET: DEALS, JANUARY 2021-APRIL 2025

- TABLE 242 PAPER & PAPERBOARD PACKAGING MARKET: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 243 PAPER & PAPERBOARD PACKAGING MARKET: OTHER DEVELOPMENTS, JANUARY 2021-APRIL 2025

- TABLE 244 MONDI GROUP: COMPANY OVERVIEW

- TABLE 245 MONDI GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 MONDI GROUP: PRODUCT LAUNCHES, JANUARY 2021-APRIL 2025

- TABLE 247 MONDI GROUP: DEALS, JANUARY 2021-APRIL 2025

- TABLE 248 MONDI GROUP: EXPANSIONS, JANUARY 2021-APRIL 2025

- TABLE 249 INTERNATIONAL PAPER: COMPANY OVERVIEW

- TABLE 250 INTERNATIONAL PAPER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 INTERNATIONAL PAPER: DEALS, JANUARY 2021-APRIL 2025

- TABLE 252 INTERNATIONAL PAPER: EXPANSIONS, JANUARY 2021-APRIL 2025

- TABLE 253 INTERNATIONAL PAPER: OTHER DEVELOPMENTS, JANUARY 2021-APRIL 2025

- TABLE 254 SMURFIT KAPPA: COMPANY OVERVIEW

- TABLE 255 SMURFIT KAPPA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 SMURFIT KAPPA: DEALS, JANUARY 2021-APRIL 2025

- TABLE 257 SMURFIT KAPPA: EXPANSIONS, JANUARY 2021-APRIL 2025

- TABLE 258 NIPPON PAPER INDUSTRIES CO., LTD.: COMPANY OVERVIEW

- TABLE 259 NIPPON PAPER INDUSTRIES CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 260 NIPPON PAPER INDUSTRIES CO., LTD.: DEALS, JANUARY 2021-APRIL 2025

- TABLE 261 NIPPON PAPER INDUSTRIES CO., LTD.: EXPANSIONS, JANUARY 2021-APRIL 2025

- TABLE 262 AMCOR: COMPANY OVERVIEW

- TABLE 263 AMCOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 AMCOR: PRODUCT LAUNCHES, JANUARY 2021-APRIL 2025

- TABLE 265 AMCOR: DEALS, JANUARY 2021-APRIL 2025

- TABLE 266 AMCOR: EXPANSIONS, JANUARY 2021-APRIL 2025

- TABLE 267 OJI HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 268 OJI HOLDINGS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 OJI HOLDINGS CORPORATION: DEALS, JANUARY 2021-APRIL 2025

- TABLE 270 ITC LIMITED: COMPANY OVERVIEW

- TABLE 271 ITC LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 OJI HOLDINGS CORPORATION: DEALS, JANUARY 2021-APRIL 2025

- TABLE 273 METSA GROUP: COMPANY OVERVIEW

- TABLE 274 METSA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 275 METSA GROUP: EXPANSIONS, JANUARY 2021-APRIL 2025

- TABLE 276 CLEARWATER PAPER CORPORATION: COMPANY OVERVIEW

- TABLE 277 CLEARWATER PAPER CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 278 CLEARWATER PAPER CORPORATION: DEALS, JANUARY 2021-APRIL 2025

- TABLE 279 PACKAGING CORPORATION OF AMERICA: COMPANY OVERVIEW

- TABLE 280 PACKAGING CORPORATION OF AMERICA: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 281 KLABIN S.A.: COMPANY OVERVIEW

- TABLE 282 SAPPI LTD: COMPANY OVERVIEW

- TABLE 283 ORCON INDUSTRIES CORP.: COMPANY OVERVIEW

- TABLE 284 PROAMPAC: COMPANY OVERVIEW

- TABLE 285 TRIDENT PAPER BOX INDUSTRIES: COMPANY OVERVIEW

- TABLE 286 STORA ENSO: COMPANY OVERVIEW

- TABLE 287 TGI PACKAGING PVT. LTD.: COMPANY OVERVIEW

- TABLE 288 SAICA: COMPANY OVERVIEW

- TABLE 289 RELEAF PAPER: COMPANY OVERVIEW

- TABLE 290 ATHAR PACKAGING SOLUTIONS PVT. LTD.: COMPANY OVERVIEW

- TABLE 291 ECOENCLOSE INC.: COMPANY OVERVIEW

- TABLE 292 COVERIS: COMPANY OVERVIEW

- TABLE 293 EPAC HOLDINGS, LLC.: COMPANY OVERVIEW

- TABLE 294 EDPACK KARUNIA PERSADA, PT.: COMPANY OVERVIEW

- TABLE 295 ADEERA PACKAGING PVT.LTD.: COMPANY OVERVIEW

- TABLE 296 PAPER BAGS MARKET, BY PRODUCT TYPE, 2023-2029 (USD MILLION)

- TABLE 297 PAPER BAGS MARKET, BY PRODUCT TYPE, 2023-2029 (TON)

- TABLE 298 PAPER BAGS MARKET, BY THICKNESS, 2023-2029 (USD MILLION)

- TABLE 299 PAPER BAGS MARKET, BY THICKNESS, 2023-2029 (TON)

- TABLE 300 PAPER BAGS MARKET, BY MATERIAL, 2023-2029 (USD MILLION)

- TABLE 301 PAPER BAGS MARKET, BY MATERIAL, 2023-2029 (TON)

- TABLE 302 PAPER BAGS MARKET, BY END-USE, 2023-2029 (USD MILLION)

- TABLE 303 PAPER BAGS MARKET, BY END-USE, 2023-2029 (TON)

- TABLE 304 PAPER BAGS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 305 PAPER BAGS MARKET, BY REGION, 2023-2029 (KILOTON)

- TABLE 306 CORRUGATED BOXES MARKET, BY MATERIAL, 2019-2026 (USD MILLION)

- TABLE 307 CORRUGATED BOXES MARKET, BY MATERIAL, 2019-2026 (MILLION SQUARE METERS)

- TABLE 308 CORRUGATED BOXES MARKET, BY PRINTING INK, 2019-2026 (USD MILLION)

- TABLE 309 CORRUGATED BOXES MARKET, BY PRINTING INK, 2019-2026 (MILLION SQUARE METER)

- TABLE 310 CORRUGATED BOXES MARKET, BY PRINTING TECHNOLOGY, 2019-2026 (USD MILLION)

- TABLE 311 CORRUGATED BOXES MARKET, BY PRINTING TECHNOLOGY, 2019-2026 (MILLION SQUARE METER)

- TABLE 312 CORRUGATED BOXES MARKET, BY TYPE, 2019-2026 (USD MILLION)

- TABLE 313 CORRUGATED BOXES MARKET, BY TYPE, 2019-2026 (MILLION SQUARE METER)

- TABLE 314 CORRUGATED BOXES MARKET, BY END-USE INDUSTRY, 2019-2026 (USD MILLION)

- TABLE 315 CORRUGATED BOXES MARKET, BY END-USE INDUSTRY, 2019-2026 (MILLION SQUARE METER)

- TABLE 316 CORRUGATED BOXES MARKET, BY REGION, 2019-2026 (USD MILLION)

- TABLE 317 CORRUGATED BOXES MARKET, BY REGION, 2019-2026 (MILLION SQUARE METER)

List of Figures

- FIGURE 1 MARKET SEGMENTATION AND REGIONS COVERED

- FIGURE 2 PAPER & PAPERBOARD PACKAGING MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 PAPER & PAPERBOARD PACKAGING MARKET: APPROACH 1

- FIGURE 6 PAPER & PAPERBOARD PACKAGING MARKET: DATA TRIANGULATION

- FIGURE 7 CORRUGATED BOX SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 8 PERSONAL & HOMECARE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 9 FBB SEGMENT TO BE SECOND-FASTEST-GROWING DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING PAPER & PAPERBOARD PACKAGING MARKET DURING FORECAST PERIOD

- FIGURE 12 CORRUGATED BOX SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 FOOD SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 14 GLASSINE & GREASEPROOF SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 CHINA AND CORRUGATED BOX SEGMENT ACCOUNTED FOR THE LARGEST SHARES

- FIGURE 16 INDIA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN PAPER & PAPERBOARD PACKAGING MARKET

- FIGURE 18 GLOBAL GROWTH IN B2B E-COMMERCE SALES, 2017-2026

- FIGURE 19 GLOBAL B2C E-COMMERCE SALES GROWTH, 2023-2027

- FIGURE 20 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 21 PAPER & PAPERBOARD PACKAGING MARKET: AVERAGE SELLING PRICE, BY REGION, 2021-2030 (USD/KG)

- FIGURE 22 PAPER & PAPERBOARD PACKAGING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 PAPER & PAPERBOARD PACKAGING MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 LIST OF MAJOR PATENTS FOR PAPER & PAPERBOARD PACKAGING, 2014-2024

- FIGURE 25 REGIONAL ANALYSIS OF PATENTS GRANTED FOR PAPER & PAPERBOARD PACKAGING, 2014-2024

- FIGURE 26 IMPORT DATA FOR HS CODE 48-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 27 EXPORT DATA FOR HS CODE 48-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 28 PAPER & PAPERBOARD PACKAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 30 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 31 INVESTOR DEAL AND FUNDING TREND, 2020-2024 (USD MILLION)

- FIGURE 32 SOLID BLEACHED SULFATE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 33 CORRUGATED BOX SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 34 FOOD SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 35 INDIA TO WITNESS HIGHEST GROWTH BETWEEN 2025 AND 2030

- FIGURE 36 NORTH AMERICA: PAPER & PAPERBOARD PACKAGING MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: PAPER & PAPERBOARD PACKAGING MARKET SNAPSHOT

- FIGURE 38 PAPER & PAPERBOARD PACKAGING MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 39 PAPER & PAPERBOARD PACKAGING MARKET SHARE ANALYSIS, 2023

- FIGURE 40 COMPANY VALUATION (USD BILLION)

- FIGURE 41 FINANCIAL MATRIX: EV/EBITDA RATIO

- FIGURE 42 YEAR-TO-DATE PRICE AND FIVE-YEAR STOCK BETA

- FIGURE 43 PAPER & PAPERBOARD PACKAGING MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 44 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- FIGURE 45 PAPER & PAPERBOARD PACKAGING MARKET: COMPANY FOOTPRINT

- FIGURE 46 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- FIGURE 47 MONDI GROUP: COMPANY SNAPSHOT, 2024

- FIGURE 48 INTERNATIONAL PAPER: COMPANY SNAPSHOT,2024

- FIGURE 49 SMURFIT KAPPA: COMPANY SNAPSHOT, 2024

- FIGURE 50 NIPPON PAPER INDUSTRIES CO., LTD.: COMPANY SNAPSHOT, 2024

- FIGURE 51 AMCOR: COMPANY SNAPSHOT, 2024

- FIGURE 52 OJI HOLDINGS CORPORATION: COMPANY SNAPSHOT (2023)

- FIGURE 53 ITC LIMITED: COMPANY SNAPSHOT, 2024

- FIGURE 54 METSA GROUP: COMPANY SNAPSHOT, 2024

- FIGURE 55 CLEARWATER PAPER CORPORATION: COMPANY SNAPSHOT, 2024

- FIGURE 56 PACKAGING CORPORATION OF AMERICA: COMPANY SNAPSHOT, 2024

The market for paper and paperboard packaging was valued at USD 379.9 billion in 2024, and it is projected to reach USD 451.8 billion by 2030, at a CAGR of 2.9 %. The demand for paper & paperboard packaging is steadily rising due to stricter regulations to reduce the use of plastic and growing environmental consciousness. Many governments now forbid or restrict the use of single-use plastics, which is encouraging companies to use more ecologically friendly alternatives, such as packaging made of paper. The rapid expansion of e-commerce has increased demand for packaging that is both, recyclable and robust enough to support branding through printability. The food and beverage industry is witnessing a surge in the use of biodegradable, food-safe materials in response to consumer preferences for environmentally conscious packaging.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Grade, Type, Source, Pulping, Application, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, South America |

Based on Grade, the glassine & greaseproof segment is expected to account for the highest CAGR during the forecast period

Over the forecast period the glassine and greaseproof segment is expected to grow at the highest CAGR in the paper and paperboard packaging market by grade. This is driven by the increasing demand for sustainable, food-safe, and oil-resistant packaging solutions, especially in the foodservice and bakery segments. Glassine, with its smooth, glossy, and air-tight properties, is used for wrapping confectionery, bakery items, and grease-sensitive products. Its biodegradability and recyclability make it a preferred alternative to plastic-based wraps in line with global environmental goals. Greaseproof paper's oil and moisture resistance makes it ideal for fast food, snacks, and convenience meals. With increasing regulatory pressure to reduce plastic and growing consumer awareness of eco-friendly packaging, manufacturers are increasingly adopting these specialty papers, and hence, their market share is growing and driving segment growth.

Based on type, the flexible paper segment accounted for the highest CAGR during the forecast period

The flexible paper segment is expected to grow at the highest CAGR in the paper & paperboard packaging industry during the forecast period, with its sustainable and high-performance interchangeable functionality continuing to flourish in the food, personal care, and retail sectors. As regulations continue to push legislation to move away from the consumption of plastic, manufacturers are exploring flexible paper alternatives to pouches, wraps, and sachets that provide environmental benefits and functional performance. The increased on-the-go consumption patterns and preference for packaged snack and single-serve items create demand for lightweight, recyclable, and compostable forms of packaging. Flexible paper meets the demands for high-end printing specifications that showcase brand and can also have barrier coatings applied to improve moisture and grease resistance while retaining recyclability. As the demand for sustainable packaging products increases among consumers, combined with the positive advances taking place with coating technologies, flexible paper is positioned well to have an edge as a preferred choice, especially in applications where sustainability and shelf appeal factor into the decision-making parameters.

Based on application, the food segment to hold the largest market share during the forecast period

The food application category is expected to capture the largest market share in the paper and paperboard packaging market over the forecast period as a result of increased growth in demand for sustainable, safe, and functional packaging for a vast range of food applications. The use of paperboard cartons, trays, wraps, and containers is increasing for dry foods, frozen meals, baked goods, snacks, and ready-to-eat food, which all need protection but need good printing surfaces for quality printing and branding.

Also, advances in barrier coatings and moisture resistance have opened the doors to increasing paperboard applications that were previously occupied by plastic and foil without compromising food safety and shelf life. The increasing use of eco-friendly 'in a consumer's mind' packaging solutions, particularly in developed economies, and the rise in the consumption of packaged and convenience foods in emerging economies are supporting further growth in this segment. Included in the continued use of paper & paperboard packaging is that the food industry is a huge volume-based sector that requires consistency, cost savings, and packaging that meets regulations. It is clear that the food application category will remain the most significant contributor to the growth of paper & paperboard packaging globally.

Asia Pacific region to hold the largest market share during the forecast period

It is expected that the Asia Pacific will continue to account for a majority of the market share within the paper and paperboard packaging market during the forecast period as well due to many factors such as rapid industrialization, urbanization, and increased consumer demand in economic powerhouses, such as China, India, Indonesia, and Vietnam. The growing middle class and increasing populations lead to increased consumption in food, beverage, personal care, and e-commerce categories, and will become extraordinarily dependent on sustainable, efficient, and affordable packaging solutions for the delivery of products such as food and beverages. China and India are investing extensively in packaging infrastructure and adopting highly advanced technologies as the paper & paperboard industry is one of the highest performing sectors of their economies. Given its abundance of raw materials, low production costs, and strong export capabilities, the Asia Pacific is poised to manage and control worldwide growth and catch up with or stay ahead of developments in consumer markets, environmental policies, and economic engines.

- By Company Type: Tier 1: 55%, Tier 2: 30%, Tier 3: 15%

- By Designation: C Level: 30%, Director Level: 25%, Others: 45%

- By Region: North America: 27%, Europe: 20%, Asia Pacific: 33%, Middle East & Africa: 8%, and South America: 12%.

Companies Covered:

Mondi Group (UK), International Paper (US), Smurfit Kappa (Ireland), NIPPON PAPER INDUSTRIES CO., LTD. (Japan), Amcor (Switzerland), Oji Holdings Corporation (Japan), ITC Limited (India), Metsa Group (Finland)., Clearwater Paper Corporation (US), and Packaging Corporation of America (US) are some of the key players in the paper and paperboard packaging market.

Research Coverage

The market study covers the paper and paperboard packaging market across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on grade, type, source, pulping, application, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their positions in the paper and paperboard packaging market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall paper and paperboard packaging market and its segments and subsegments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the positions of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities.

The report provides insights on the following pointers:

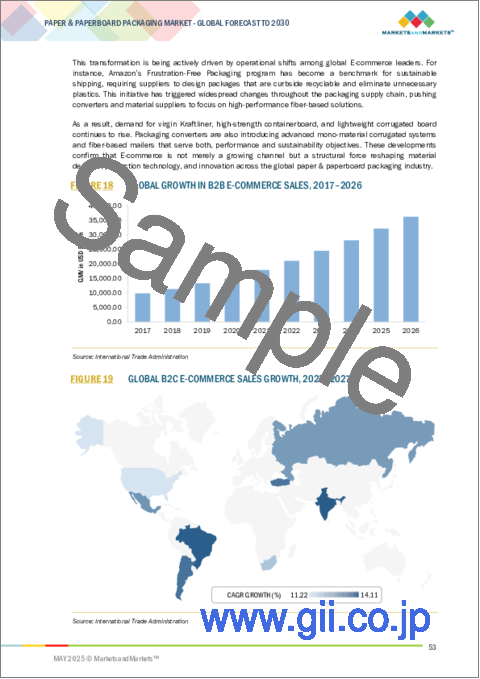

- Analysis of key drivers (growth in e-commerce packaging demand for recyclable mailers and corrugated inserts, and legislative ban on single-use plastic fuelling substitution with fiber-based formats), restraints (Balancing recyclability with barrier performance in food applications), opportunities (Integration of Smart Packaging Technologies with Paperboard Formats and Adoption of Agro-Residue and Alternative Fibers in Paperboard Production), and challenges (Limited barrier properties compared to plastics and metals) influencing the growth of the paper and paperboard packaging market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product & service launches in the paper and paperboard packaging market

- Market Development: Comprehensive information about profitable markets - the report analyzes the paper and paperboard packaging market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the paper and paperboard packaging market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Mondi Group (UK), International Paper (US), Smurfit Kappa (Ireland), NIPPON PAPER INDUSTRIES CO., LTD. (Japan), Amcor (Switzerland), Oji Holdings Corporation (Japan), ITC Limited (India), Metsa Group (Finland), Clearwater Paper Corporation (US), Packaging Corporation of America (US), and others in the paper and paperboard packaging market. The report also helps stakeholders understand the pulse of the paper and paperboard packaging market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 SUPPLY-SIDE APPROACH

- 2.4 GROWTH FORECAST

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 FACTOR ANALYSIS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PAPER & PAPERBOARD PACKAGING MARKET

- 4.2 PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE

- 4.3 PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION

- 4.4 PAPER & PAPERBOARD PACKAGING MARKET, BY GRADE

- 4.5 ASIA PACIFIC: PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE AND COUNTRY, 2024

- 4.6 PAPER & PAPERBOARD PACKAGING MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.1.1 DRIVERS

- 5.1.1.1 Rising consumer preference for sustainable paper-based packaging solutions

- 5.1.1.2 Recyclability of paper & paperboard key driver in adoption of sustainable packaging

- 5.1.1.3 Growth in demand for recyclable mailers and corrugated inserts in E-commerce packaging

- 5.1.1.4 Legislative bans on single-use plastics fueling substitution with fiber-based formats

- 5.1.2 RESTRAINTS

- 5.1.2.1 Limited barrier properties compared to plastics and metals

- 5.1.2.2 Price volatility of raw materials

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Integration of smart packaging technologies with paperboard formats

- 5.1.3.2 Adoption of agro-residue and alternative fibers in paperboard production

- 5.1.4 CHALLENGES

- 5.1.4.1 Balancing recyclability with barrier performance in food applications

- 5.1.4.2 Tightening deforestation regulations limiting virgin fiber sourcing

- 5.1.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE, 2024

- 6.2.2 PRICING ANALYSIS BASED ON REGION

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Calendering

- 6.5.1.2 Pulping technology

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Bio-based or synthetic barrier coating

- 6.5.2.2 Anti-microbial coating

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 Smart packaging

- 6.5.3.2 Packaging performance modeling

- 6.5.1 KEY TECHNOLOGIES

- 6.6 PATENT ANALYSIS

- 6.6.1 INTRODUCTION

- 6.6.2 APPROACH

- 6.6.3 TOP APPLICANTS

- 6.7 TRADE ANALYSIS (HS CODE 48)

- 6.7.1 IMPORT DATA RELATED TO HS CODE 48, BY COUNTRY, 2020-2024 (USD THOUSAND)

- 6.7.2 EXPORT DATA FOR HS CODE 48-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- 6.8 KEY CONFERENCES AND EVENTS, 2025

- 6.9 REGULATORY LANDSCAPE

- 6.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.9.2 REGULATORY FRAMEWORK

- 6.10 PORTER'S FIVE FORCES ANALYSIS

- 6.10.1 THREAT OF NEW ENTRANTS

- 6.10.2 THREAT OF SUBSTITUTES

- 6.10.3 BARGAINING POWER OF SUPPLIERS

- 6.10.4 BARGAINING POWER OF BUYERS

- 6.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.11.2 BUYING CRITERIA

- 6.12 CASE STUDY ANALYSIS

- 6.12.1 GREEN BAY PACKAGING'S DIGITAL TRANSFORMATION

- 6.12.2 SMURFIT KAPPA'S COLLABORATION WITH PRIWATT

- 6.12.3 METSA BOARD'S ADOPTION OF 3DEXPERIENCE PLATFORM

- 6.13 MACROECONOMIC ANALYSIS

- 6.13.1 INTRODUCTION

- 6.13.2 GDP TRENDS AND FORECASTS

- 6.14 INVESTMENT AND FUNDING SCENARIO

- 6.15 IMPACT OF 2025 US TARIFF ON PAPER & PAPERBOARD PACKAGING MARKET

- 6.15.1 INTRODUCTION

- 6.15.2 KEY TARIFF RATES

- 6.15.3 PRICE IMPACT ANALYSIS

- 6.15.4 KEY IMPACT ON VARIOUS REGIONS

- 6.15.4.1 US

- 6.15.4.2 Europe

- 6.15.4.3 Asia Pacific

- 6.15.5 END-USE INDUSTRY IMPACT

7 PAPER & PAPERBOARD PACKAGING MARKET, BY GRADE

- 7.1 INTRODUCTION

- 7.2 SOLID BLEACHED SULFATES (SBS)

- 7.2.1 RELIABLE PERFORMANCE IN COLD AND MOIST ENVIRONMENTS TO DRIVE MARKET

- 7.2.1.1 Properties

- 7.2.1.1.1 Surface coating with kaolin clay for enhanced printability

- 7.2.1.1 Properties

- 7.2.1 RELIABLE PERFORMANCE IN COLD AND MOIST ENVIRONMENTS TO DRIVE MARKET

- 7.3 COATED UNBLEACHED KRAFT PAPERBOARD (CUK/SUS)

- 7.3.1 DEMAND FOR FOOD AND BEVERAGE APPLICATIONS TO DRIVE MARKET GROWTH

- 7.3.1.1 Properties

- 7.3.1 DEMAND FOR FOOD AND BEVERAGE APPLICATIONS TO DRIVE MARKET GROWTH

- 7.4 FOLDING BOXBOARD (FBB)

- 7.4.1 PACKAGING APPLICATIONS IN HEALTHCARE AND PERSONAL CARE AND DIRECT FOOD CONTACT TO PROPEL DEMAND

- 7.4.1.1 Properties

- 7.4.1.1.1 Coatings and functional enhancements

- 7.4.1.1 Properties

- 7.4.1 PACKAGING APPLICATIONS IN HEALTHCARE AND PERSONAL CARE AND DIRECT FOOD CONTACT TO PROPEL DEMAND

- 7.5 WHITE LINED CHIPBOARD (WLC)

- 7.5.1 RISING DEMAND FOR PACKAGING FOR CONSUMER GOODS, PERSONAL AND HOMECARE, AND FROZEN FOOD TO PROPEL MARKET

- 7.5.1.1 Properties

- 7.5.1.1.1 Calcium carbonate coating to propel demand due to enhanced whiteness and print performance

- 7.5.1.1 Properties

- 7.5.1 RISING DEMAND FOR PACKAGING FOR CONSUMER GOODS, PERSONAL AND HOMECARE, AND FROZEN FOOD TO PROPEL MARKET

- 7.6 GLASSINE & GREASEPROOF

- 7.6.1 RISING ADOPTION IN FOOD-SAFE AND MOISTURE-RESISTANT PACKAGING TO FUEL DEMAND

- 7.6.1.1 Properties

- 7.6.1.1.1 Enhanced moisture barrier with wax-laminated glassine

- 7.6.1.1 Properties

- 7.6.1 RISING ADOPTION IN FOOD-SAFE AND MOISTURE-RESISTANT PACKAGING TO FUEL DEMAND

- 7.7 LABEL PAPER

- 7.7.1 GROWING DEMAND FOR VISUALLY APPEALING LABELS TO DRIVE MARKET GROWTH

- 7.7.1.1 Cast-coated and metallized label papers enhancing spirits packaging

- 7.7.1 GROWING DEMAND FOR VISUALLY APPEALING LABELS TO DRIVE MARKET GROWTH

- 7.8 OTHER GRADES

8 PAPER & PAPERBOARD PACKAGING MARKET, BY SOURCE

- 8.1 INTRODUCTION

- 8.1.1 HIGH MECHANICAL STRENGTH, HYGIENE, AND ESTHETIC UNIFORMITY TO PROPEL MARKET

- 8.2 RECYCLED WASTEPAPER

- 8.2.1 DEMAND FOR LOW-CARBON PACKAGING TO DRIVE MARKET

9 PAPER & PAPERBOARD PACKAGING MARKET, BY PULPING

- 9.1 INTRODUCTION

- 9.2 CHEMICAL PULPING

- 9.2.1 LEVERAGING SUPERIOR FIBER STRENGTH AND PURITY TO DRIVE DEMAND

- 9.3 THERMO MECHANICAL PULPING

- 9.3.1 UTILIZING HIGH PULP YIELD AND COST-EFFICIENCY TO PROPEL DEMAND

10 PAPER & PAPERBOARD PACKAGING MARKET, BY TYPE

- 10.1 INTRODUCTION

- 10.2 CORRUGATED BOX

- 10.2.1 ACCELERATING GROWTH IN E-COMMERCE AND EXPORT MOMENTUM TO DRIVE MARKET

- 10.3 BOXBOARD

- 10.3.1 EXPANDING BIODEGRADABLE CARTON APPLICATIONS ACROSS INDUSTRIES TO PROPEL DEMAND

- 10.3.1.1 Folding boxes

- 10.3.1.2 Trays

- 10.3.1 EXPANDING BIODEGRADABLE CARTON APPLICATIONS ACROSS INDUSTRIES TO PROPEL DEMAND

- 10.4 FLEXIBLE PAPER

- 10.4.1 HIGH RECYCLABILITY, LOW CARBON FOOTPRINT, AND COMPATIBILITY WITH CIRCULAR ECONOMY TO BOOST MARKET

- 10.4.2 PAPER BAGS

- 10.4.3 SHIPPING SACKS

- 10.4.4 SACHETS/POUCHES

11 PAPER & PAPERBOARD PACKAGING MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 FOOD

- 11.2.1 RISING DEMAND FOR CONVENIENCE FOODS TO BOOST MARKET

- 11.3 BEVERAGES

- 11.3.1 SURGE IN CONSUMPTION OF READY-TO-DRINK FORMATS TO PROPEL MARKET

- 11.4 HEALTHCARE

- 11.4.1 ADVANCING SUSTAINABLE AND SECURE PAPER-BASED HEALTHCARE PACKAGING TO DRIVE DEMAND

- 11.5 PERSONAL & HOMECARE

- 11.5.1 INNOVATIVE SUSTAINABLE PACKAGING SOLUTIONS ENHANCING PERSONAL CARE MARKETS TO DRIVE DEMAND

- 11.6 OTHER APPLICATIONS

12 PAPER & PAPERBOARD PACKAGING MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 US

- 12.2.1.1 Growth of food and beverage industry and sustainability trend to drive demand

- 12.2.2 CANADA

- 12.2.2.1 Structural growth and evolving consumer preferences across major end-use sectors to drive market

- 12.2.3 MEXICO

- 12.2.3.1 Rapid expansion of key end-use industries and growing emphasis on sustainability among manufacturers and consumers to boost market

- 12.2.1 US

- 12.3 ASIA PACIFIC

- 12.3.1 CHINA

- 12.3.1.1 Surging retail sales, expanding food delivery, and rising healthcare and cosmetics exports to drive demand

- 12.3.2 INDIA

- 12.3.2.1 Surge in consumption across sectors and sustainability trends to drive demand

- 12.3.3 JAPAN

- 12.3.3.1 Expanding sustainable packaging solutions in convenience, healthcare, and beauty markets to boost demand

- 12.3.4 SOUTH KOREA

- 12.3.4.1 Demand for sustainable and consumer-centric formats in food, pharma, and beauty sectors to boost market

- 12.3.5 REST OF ASIA PACIFIC

- 12.3.1 CHINA

- 12.4 EUROPE

- 12.4.1 GERMANY

- 12.4.1.1 Multiple industry shifts and consumer-driven transformations to propel demand

- 12.4.2 UK

- 12.4.2.1 Regulatory reforms, sector-specific transformations, and national shift toward sustainable consumption to fuel demand

- 12.4.3 FRANCE

- 12.4.3.1 Regulatory pressures, sustainability goals, and strategic transformation of key industrial sectors to support market growth

- 12.4.4 ITALY

- 12.4.4.1 Sustainability regulations, market growth, and export dynamics to boost market

- 12.4.5 REST OF EUROPE

- 12.4.1 GERMANY

- 12.5 SOUTH AMERICA

- 12.5.1 BRAZIL

- 12.5.1.1 Robust growth across food processing, pharmaceuticals, e-commerce, and personal care industries to fuel demand

- 12.5.2 ARGENTINA

- 12.5.2.1 Digital shopping boom and alignment with sustainability goals to drive market

- 12.5.3 REST OF SOUTH AMERICA

- 12.5.1 BRAZIL

- 12.6 MIDDLE EAST & AFRICA

- 12.6.1 GCC COUNTRIES

- 12.6.1.1 Saudi Arabia

- 12.6.1.1.1 Enhancement of sustainable packaging solutions in food, healthcare, and beauty sectors to propel market

- 12.6.1.2 UAE

- 12.6.1.2.1 Expanding consumer sector, booming E-commerce environment, and strategic policy shifts toward sustainable practices to fuel growth

- 12.6.1.3 Rest of GCC Countries

- 12.6.1.1 Saudi Arabia

- 12.6.2 SOUTH AFRICA

- 12.6.2.1 Rapid shifts in retail modernization, increased consumption of packaged goods, and evolving sustainability agenda to boost market

- 12.6.3 REST OF MIDDLE EAST & AFRICA

- 12.6.1 GCC COUNTRIES

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS

- 13.4 MARKET SHARE ANALYSIS

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.5.1 COMPANY VALUATION

- 13.6 FINANCIAL METRICS

- 13.7 BRAND/PRODUCT COMPARISON

- 13.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.8.1 STARS

- 13.8.2 EMERGING LEADERS

- 13.8.3 PERVASIVE PLAYERS

- 13.8.4 PARTICIPANTS

- 13.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.8.5.1 Company footprint

- 13.8.5.2 Region footprint

- 13.8.5.3 Grade footprint

- 13.8.5.4 Type footprint

- 13.8.5.5 Application footprint

- 13.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.9.1 PROGRESSIVE COMPANIES

- 13.9.2 RESPONSIVE COMPANIES

- 13.9.3 DYNAMIC COMPANIES

- 13.9.4 STARTING BLOCKS

- 13.10 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.10.1 DETAILED LIST OF KEY STARTUPS/SMES

- 13.10.2 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 13.11 COMPETITIVE SCENARIO

- 13.11.1 PRODUCT LAUNCHES

- 13.11.2 DEALS

- 13.11.3 EXPANSIONS

- 13.11.4 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 MONDI GROUP

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Expansions

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 INTERNATIONAL PAPER

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.3.2 Expansions

- 14.1.2.3.3 Other developments

- 14.1.2.4 MnM view

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 SMURFIT KAPPA

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Deals

- 14.1.3.3.2 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 NIPPON PAPER INDUSTRIES CO., LTD.

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Deals

- 14.1.4.3.2 Expansions

- 14.1.4.4 MnM view

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 AMCOR

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.3.3 Expansions

- 14.1.5.4 MnM view

- 14.1.5.4.1 Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 OJI HOLDINGS CORPORATION

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Deals

- 14.1.6.4 MnM view

- 14.1.6.4.1 Right to win

- 14.1.6.4.2 Strategic choices

- 14.1.6.4.3 Weaknesses and competitive threats

- 14.1.7 ITC LIMITED

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Deals

- 14.1.7.4 MnM view

- 14.1.8 METSA GROUP

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Expansions

- 14.1.8.4 MnM view

- 14.1.9 CLEARWATER PAPER CORPORATION

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Deals

- 14.1.9.4 MnM view

- 14.1.10 PACKAGING CORPORATION OF AMERICA

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 MnM view

- 14.1.1 MONDI GROUP

- 14.2 OTHER PLAYERS

- 14.2.1 KLABIN S.A.

- 14.2.2 SAPPI LTD

- 14.2.3 ORCON INDUSTRIES CORP.

- 14.2.4 PROAMPAC

- 14.2.5 TRIDENT PAPER BOX INDUSTRIES

- 14.2.6 STORA ENSO

- 14.2.7 TGI PACKAGING PVT. LTD.

- 14.2.8 SAICA

- 14.2.9 RELEAF PAPER

- 14.2.10 ATHAR PACKAGING SOLUTIONS PVT. LTD.

- 14.2.11 ECOENCLOSE INC.

- 14.2.12 COVERIS

- 14.2.13 EPAC HOLDINGS, LLC.

- 14.2.14 EDPACK KARUNIA PERSADA, PT.

- 14.2.15 ADEERA PACKAGING PVT. LTD.

15 ADJACENT & RELATED MARKET

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.2.1 PAPER BAGS MARKET

- 15.2.1.1 Market definition

- 15.2.1.2 Paper bags market, by product type

- 15.2.1.3 Paper bags market, by thickness

- 15.2.1.4 Paper bags market, by material

- 15.2.1.5 Paper bags market, by end-use

- 15.2.1.6 Paper bags market, by region

- 15.2.2 CORRUGATED BOXES MARKET

- 15.2.2.1 Market definition

- 15.2.2.2 Corrugated boxes market, by material

- 15.2.2.3 Corrugated boxes market, by printing ink

- 15.2.2.4 Corrugated boxes market, by printing technology

- 15.2.2.5 Corrugated boxes market, by type

- 15.2.2.6 Corrugated boxes market, by end-use industry

- 15.2.2.7 Corrugated boxes market, by region

- 15.2.1 PAPER BAGS MARKET

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS