|

|

市場調査レポート

商品コード

1740261

乳房生検装置の世界市場:製品別、処置別、用途別、エンドユーザー別 - 予測(~2030年)Breast Biopsy Devices Market by Product, Procedure, Application, End User - Global Forecasts to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 乳房生検装置の世界市場:製品別、処置別、用途別、エンドユーザー別 - 予測(~2030年) |

|

出版日: 2025年05月23日

発行: MarketsandMarkets

ページ情報: 英文 290 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の乳房生検装置の市場規模は、2025年の23億8,410万米ドルから2030年までに32億6,170万米ドルに達すると予測され、予測期間にCAGRで6.5%の成長が見込まれます。

市場は、乳がん罹患率の上昇、早期発見の重要性に対する意識の高まり、低侵襲診断処置への選好の高まりなどの複合的な要因から恩恵を受けています。さらに、州や地方の検診プログラムが、潜在的な乳がんに対する女性の検診率を大幅に向上させています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 100万米ドル |

| セグメント | 製品、処置、用途、エンドユーザー、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

生検針セグメントが2024年に市場で最大のシェアを占めました。

生検針は、高い精度と最小限の侵襲で病理組織学的分析に用いる組織サンプルを採取することから、乳がん診断に不可欠なツールとなっています。生検針は、コアニードル生検(CNB)、細針吸引生検(FNAB)、吸引式組織生検(VAB)に利用することができ、それぞれ特定の臨床シナリオや病変のさまざまな特徴に合わせて設計されています。針生検は外科的生検と比較して、患者にとって不快感が少なく診断結果が得られ、処置と回復に要する時間が短いため好まれています。

針乳房生検処置セグメントが2024年に最大の市場シェアを占めました。

針式乳房生検セグメントの成長は、複数の要因によって促進されています。これらの要因には、乳がん罹患率の上昇、早期の正確な診断の重視、低侵襲手術に対する患者の選好の高まりなどがあります。特に画像誘導と針設計における技術の進歩は、不快感や不便さを最小化しながら針乳房生検の精度を高めています。これにより、患者にとってより受け入れやすく、実行可能な処置となっています。さらに、乳がん検診プログラムの確立、有利な償還政策、女性の健康問題に対する意識の高まりも市場の成長に寄与しています。加えて、外来治療への選好や費用対効果の高い診断オプションへの関心の高まりが、さまざまな医療環境における針乳房生検の幅広い受け入れにつながっています。

リキッドバイオプシーセグメントが予測期間にもっとも高いCAGRを記録する見込みです。

リキッドバイオプシーセグメントは、非侵襲的で正確なリアルタイムのがん診断ソリューションに対する需要の増加によって成長を示しています。リキッドバイオプシープロセスは、血液中の循環腫瘍細胞(CTC)と循環腫瘍DNA(ctDNA)を検出するもので、従来の組織生検よりも侵襲性が低いです。これにより、早期診断、治療効果の追跡、疾患の再発や進行の効果的なモニタリングが可能になります。リキッドバイオプシー市場の成長には、乳がん罹患率の上昇、精密(個別化)医療の進歩、次世代シーケンシング(NGS)やデジタルPCRを中心とした分子診断技術の向上など、複数の要因があります。リキッドバイオプシーの臨床的有用性の増大と日常的な利用は、その利点に対する認識の高まりと支持的な規制政策もあり、これらの技術の世界的な採用をさらに促進しています。

早期がん検診セグメントが2024年に市場を独占しました。

早期がん検診は、がんをもっとも早い治療可能な段階で発見することによって死亡率を低下させ、治療成績を向上させる上で重要な役割を果たすため、最大の市場シェアを占めています。世界のがん罹患率の上昇、特に脆弱な高齢者の間での罹患率の上昇により、効果的な疾病モニタリングの必要性が高まっています。その結果、技術の進歩が早期の予防的なヘルスモニタリングと健康診断の重大な促進要因となります。

当レポートでは、世界の乳房生検装置市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- 乳房生検装置市場の概要

- 乳房生検装置市場:地域別(2025年・2030年)

- 欧州の乳房生検装置市場:地域別、用途別(2024年)

- 乳房生検装置市場の地理的スナップショット

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 規制分析

- 規制機関、政府機関、その他の組織

- 規制情勢

- バリューチェーン分析

- サプライチェーン分析

- 著名企業

- 中小企業

- エンドユーザー

- エコシステム分析

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 貿易分析

- 輸入データ

- 輸出データ

- 特許分析

- ポーターのファイブフォース分析

- 価格分析

- 乳房生検装置の平均販売価格の動向:地域別

- 乳房生検装置の平均販売価格:用途別

- ケーススタディ分析

- 主な会議とイベント(2025年~2026年)

- 主なステークホルダーと購入基準

- 乳房生検装置市場に対する2025年の米国関税の影響

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 最終用途産業に対する影響

- 乳房生検装置市場に対する生成AI/AIの影響

- 投資と資金調達のシナリオ

第6章 乳房生検装置市場:処置別

- イントロダクション

- 針乳房生検

- コアニードル生検

- 吸引式組織生検(VAB)

- 細針吸引生検(FNAB)

- 外科的乳房生検

- 切除生検

- 切開生検

- 液体乳房生検

- 循環腫瘍細胞

- 循環腫瘍DNA(ctDNA)

- その他のバイオマーカー

第7章 乳房生検装置市場:製品別

- イントロダクション

- 生検針

- コアニードル

- 細吸引針

- 吸引式組織生検針

- 生検装置

- コア生検装置

- 吸引式組織生検装置

- 誘導システム

- マンモグラフィ誘導定位生検

- 超音波誘導生検

- MRI誘導生検

- 生検テーブル

- アッセイキット

- リキッドバイオプシー装置

- ローカリゼーションワイヤー

- その他の製品

第8章 乳房生検市場:用途別

- イントロダクション

- 早期がん検診

- 治療選択

- 治療モニタリング

- 再発モニタリング

第9章 乳房生検装置市場:エンドユーザー別

- イントロダクション

- 病院・診療所

- 画像診断クリニック・診断センター

- 乳房ケアセンター

第10章 乳房生検装置市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋

- ラテンアメリカ

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析(2020年~2024年)

- 市場シェア分析(2024年)

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 企業の評価と財務指標

- 財務指標

- 企業の評価

- ブランド/製品の比較

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- HOLOGIC, INC.

- DANAHER CORPORATION

- BECTON, DICKINSON AND COMPANY

- ARGON MEDICAL

- QIAGEN

- MERIT MEDICAL SYSTEMS

- MENARINI SILICON BIOSYSTEMS SPA

- GUARDANT HEALTH, INC.

- NEOGENOMICS LABORATORIES, INC.

- STERYLAB S.R.L

- BIOCEPT, INC.

- BIO-RAD LABORATORIES, INC.

- F. HOFFMANN-LA ROCHE LTD.

- EXACT SCIENCES CORPORATION

- SYSMEX INOSTICS (A SUBSIDIARY OF SYSMEX CORPORATION)

- THERMO FISHER SCIENTIFIC

- FUJIFILM HOLDINGS CORPORATION

- その他の企業

- CARDIFF ONCOLOGY INC.

- MYRIAD GENETICS, INC.

- ILLUMINA, INC.

- FLUXION BIOSCIENCES, INC.

- INRAD, INC.

- IZI MEDICAL PRODUCTS

- REMINGTON MEDICAL INC.

- CP MEDICAL

第13章 付録

List of Tables

- TABLE 1 BREAST BIOPSY DEVICES MARKET: STUDY ASSUMPTIONS

- TABLE 2 BREAST BIOPSY DEVICES MARKET: RISK ANALYSIS

- TABLE 3 MEDICARE REIMBURSEMENT FOR BREAST BIOPSY

- TABLE 4 COST AND UTILITY MODEL INPUTS (2022)

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 11 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 12 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 13 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

- TABLE 14 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 15 BREAST BIOPSY DEVICES MARKET: ROLE IN ECOSYSTEM

- TABLE 16 IMPORT DATA FOR NEEDLES, CATHETERS, AND CANNULAE (HS CODE 901839), BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 17 EXPORT DATA FOR BREAST BIOPSY DEVICES (HS CODE 901839), BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 18 BREAST BIOPSY DEVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 19 INDICATIVE SELLING PRICE TREND OF BREAST BIOPSY DEVICES, BY REGION, 2022-2024 (USD)

- TABLE 20 AVERAGE SELLING PRICE OF BREAST BIOPSY DEVICES, BY KEY PLAYER, 2024 (USD)

- TABLE 21 BREAST BIOPSY DEVICES MARKET: LIST OF MAJOR CONFERENCES & EVENTS

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF BREAST BIOPSY DEVICES, BY TOP THREE END USERS

- TABLE 23 KEY BUYING CRITERIA FOR TOP THREE END USERS OF BREAST BIOPSY DEVICES

- TABLE 24 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 25 BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 26 NEEDLE BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 27 CORE NEEDLE BIOPSY DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 28 VACUUM-ASSISTED BIOPSY DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 29 FINE NEEDLE ASPIRATION BIOPSY DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 30 OPEN SURGICAL BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 31 EXCISIONAL BIOPSY DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 32 INCISIONAL BIOPSY DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 33 LIQUID BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 34 LIQUID BREAST BIOPSY DEVICES MARKET FOR CIRCULATING TUMOR CELLS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 35 LIQUID BREAST BIOPSY DEVICES MARKET FOR CIRCULATING TUMOR DNA, BY REGION, 2023-2030 (USD MILLION)

- TABLE 36 LIQUID BREAST BIOPSY DEVICES MARKET FOR OTHER BIOMARKERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 37 BREAST BIOPSY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 38 BREAST BIOPSY DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 39 BREAST BIOPSY DEVICES MARKET FOR BIOPSY NEEDLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 BREAST BIOPSY DEVICES MARKET FOR BIOPSY NEEDLES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 41 BREAST BIOPSY DEVICES MARKET FOR CORE NEEDLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 42 BREAST BIOPSY DEVICES MARKET FOR FINE ASPIRATION NEEDLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 43 BREAST BIOPSY DEVICES MARKET FOR VACUUM-ASSISTED NEEDLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 BREAST BIOPSY DEVICES MARKET FOR BIOPSY EQUIPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 45 BREAST BIOPSY DEVICES MARKET FOR BIOPSY EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 46 BREAST BIOPSY DEVICES MARKET FOR CORE BIOPSY EQUIPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 47 BREAST BIOPSY DEVICES MARKET FOR VACUUM-ASSISTED BIOPSY EQUIPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 48 BREAST BIOPSY DEVICES MARKET FOR GUIDANCE SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 49 BREAST BIOPSY DEVICES MARKET FOR GUIDANCE SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 50 BREAST BIOPSY DEVICES MARKET FOR MAMMOGRAPHY-GUIDED STEREOTACTIC BIOPSY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 51 BREAST BIOPSY DEVICES MARKET FOR ULTRASOUND-GUIDED BIOPSY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 52 BREAST BIOPSY DEVICES MARKET FOR MRI-GUIDED BIOPSY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 53 BREAST BIOPSY DEVICES MARKET FOR BIOPSY TABLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 54 BREAST BIOPSY DEVICES MARKET FOR ASSAY KITS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 55 BREAST BIOPSY DEVICES MARKET FOR LIQUID BIOPSY INSTRUMENTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 56 BREAST BIOPSY DEVICES MARKET FOR LOCALIZATION WIRES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 57 BREAST BIOPSY DEVICES MARKET FOR OTHER PRODUCTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 58 BREAST BIOPSY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 59 BREAST BIOPSY DEVICES MARKET FOR EARLY CANCER SCREENING, BY REGION, 2023-2030 (USD MILLION)

- TABLE 60 BREAST BIOPSY DEVICES MARKET FOR THERAPY SELECTION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 61 BREAST BIOPSY DEVICES MARKET FOR TREATMENT MONITORING, BY REGION, 2023-2030 (USD MILLION)

- TABLE 62 BREAST BIOPSY DEVICES MARKET FOR RECURRENCE MONITORING, BY REGION, 2023-2030 (USD MILLION)

- TABLE 63 BREAST BIOPSY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 64 BREAST BIOPSY DEVICES MARKET FOR HOSPITALS & CLINICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 65 BREAST BIOPSY DEVICES MARKET FOR IMAGING CLINICS & DIAGNOSTIC CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 66 BREAST BIOPSY DEVICES MARKET FOR BREAST CARE CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 67 BREAST BIOPSY DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 68 TOTAL NUMBER OF BREAST BIOPSY PROCEDURES BY REGION, 2024

- TABLE 69 VACUUM ASSISTED BIOPSY NEEDLES MARKET, REGION, 2023-2030 (USD MILLION)

- TABLE 70 NA BREAST BIOPSY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: MACROINDICATORS

- TABLE 72 NORTH AMERICA: BREAST BIOPSY DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 73 NORTH AMERICA: BREAST BIOPSY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 74 NORTH AMERICA: BREAST BIOPSY DEVICES MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA: NEEDLE BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: BREAST BIOPSY DEVICES MARKET FOR BIOPSY EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: BREAST BIOPSY DEVICES MARKET FOR GUIDANCE SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: BREAST BIOPSY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: BREAST BIOPSY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 80 US: BREAST BIOPSY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 81 US: NEEDLE BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 82 US: BREAST BIOPSY DEVICES MARKET FOR BIOPSY EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 83 US: BREAST BIOPSY DEVICES MARKET FOR GUIDANCE SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 84 CANADA: BREAST BIOPSY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 85 CANADA: NEEDLE BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 86 CANADA: BREAST BIOPSY DEVICES MARKET FOR BIOPSY EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 87 CANADA: BREAST BIOPSY DEVICES MARKET FOR GUIDANCE SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 88 EUROPE: MACROINDICATORS

- TABLE 89 EUROPE: BREAST BIOPSY DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 90 EUROPE: BREAST BIOPSY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 91 EUROPE: BREAST BIOPSY DEVICES MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 92 EUROPE: NEEDLE BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 93 EUROPE: BREAST BIOPSY DEVICES MARKET FOR BIOPSY EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 94 EUROPE: BREAST BIOPSY DEVICES MARKET FOR GUIDANCE SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 95 EUROPE: BREAST BIOPSY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 96 EUROPE: BREAST BIOPSY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 97 GERMANY: BREAST BIOPSY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 98 GERMANY: NEEDLE BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 99 GERMANY: BREAST BIOPSY DEVICES MARKET FOR BIOPSY EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 100 GERMANY: BREAST BIOPSY DEVICES MARKET FOR GUIDANCE SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 101 UK: BREAST BIOPSY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 102 UK: NEEDLE BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 103 UK: BREAST BIOPSY DEVICES MARKET FOR BIOPSY EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 104 UK: BREAST BIOPSY DEVICES MARKET FOR GUIDANCE SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 105 FRANCE: BREAST BIOPSY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 106 FRANCE: NEEDLE BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 107 FRANCE: BREAST BIOPSY DEVICES MARKET FOR BIOPSY EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 108 FRANCE: BREAST BIOPSY DEVICES MARKET FOR GUIDANCE SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 109 ITALY: BREAST BIOPSY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 110 ITALY: NEEDLE BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 111 ITALY BREAST BIOPSY DEVICES MARKET FOR BIOPSY EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 112 ITALY: BREAST BIOPSY DEVICES MARKET FOR GUIDANCE SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 113 SPAIN: BREAST BIOPSY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 114 SPAIN: NEEDLE BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 115 SPAIN: BREAST BIOPSY DEVICES MARKET FOR BIOPSY EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 116 SPAIN: BREAST BIOPSY DEVICES MARKET FOR GUIDANCE SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 117 REST OF EUROPE: BREAST BIOPSY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 118 REST OF EUROPE: NEEDLE BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 REST OF EUROPE: BREAST BIOPSY DEVICES MARKET FOR BIOPSY EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 120 REST OF EUROPE: BREAST BIOPSY DEVICES MARKET FOR GUIDANCE SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 121 ASIA PACIFIC: MACROINDICATORS

- TABLE 122 ASIA PACIFIC: BREAST BIOPSY DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 123 ASIA PACIFIC: BREAST BIOPSY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 124 ASIA PACIFIC: BREAST BIOPSY DEVICES MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 125 ASIA PACIFIC: NEEDLE BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 126 ASIA PACIFIC: BREAST BIOPSY DEVICES MARKET FOR BIOPSY EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 127 ASIA PACIFIC: BREAST BIOPSY DEVICES MARKET FOR GUIDANCE SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 128 ASIA PACIFIC: BREAST BIOPSY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: BREAST BIOPSY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 130 CHINA: BREAST BIOPSY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 131 CHINA: NEEDLE BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 CHINA: BREAST BIOPSY DEVICES MARKET FOR BIOPSY EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 133 CHINA: BREAST BIOPSY DEVICES MARKET FOR GUIDANCE SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 134 JAPAN: BREAST BIOPSY DEVICES MARKET, BY PRODUCT, 2023-2030

- TABLE 135 JAPAN: NEEDLE BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 136 JAPAN: BREAST BIOPSY DEVICES MARKET FOR BIOPSY EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 137 JAPAN: BREAST BIOPSY DEVICES MARKET FOR GUIDANCE SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 138 INDIA: BREAST BIOPSY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 139 INDIA: NEEDLE BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 INDIA: BREAST BIOPSY DEVICES MARKET FOR BIOPSY EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 141 INDIA: BREAST BIOPSY DEVICES MARKET FOR GUIDANCE SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 142 AUSTRALIA: BREAST BIOPSY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 143 AUSTRALIA: NEEDLE BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 144 AUSTRALIA: BREAST BIOPSY DEVICES MARKET FOR BIOPSY EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 145 AUSTRALIA: BREAST BIOPSY DEVICES MARKET FOR GUIDANCE SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 146 SOUTH KOREA: BREAST BIOPSY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 147 SOUTH KOREA: NEEDLE BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 148 SOUTH KOREA: BREAST BIOPSY DEVICES MARKET FOR BIOPSY EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 149 SOUTH KOREA: BREAST BIOPSY DEVICES MARKET FOR GUIDANCE SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: BREAST BIOPSY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: NEEDLE BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: BREAST BIOPSY DEVICES MARKET FOR BIOPSY EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: BREAST BIOPSY DEVICES MARKET FOR GUIDANCE SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 154 LATIN AMERICA: MACROINDICATORS

- TABLE 155 LATIN AMERICA: BREAST BIOPSY DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 156 LATIN AMERICA: BREAST BIOPSY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 157 LATIN AMERICA: BREAST BIOPSY DEVICES MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 158 LATIN AMERICA: NEEDLE BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 159 LATIN AMERICA: BREAST BIOPSY DEVICES MARKET FOR BIOPSY EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 160 LATIN AMERICA: BREAST BIOPSY DEVICES MARKET FOR GUIDANCE SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 161 LATIN AMERICA: BREAST BIOPSY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 162 LATIN AMERICA: BREAST BIOPSY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 163 BRAZIL: BREAST BIOPSY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 164 BRAZIL: NEEDLE BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 165 BRAZIL: BREAST BIOPSY DEVICES MARKET FOR BIOPSY EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 166 BRAZIL: BREAST BIOPSY DEVICES MARKET FOR GUIDANCE SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 167 MEXICO: BREAST BIOPSY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 168 MEXICO: NEEDLE BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 MEXICO: BREAST BIOPSY DEVICES MARKET FOR BIOPSY EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 170 MEXICO: BREAST BIOPSY DEVICES MARKET FOR GUIDANCE SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 171 REST OF LATIN AMERICA: BREAST BIOPSY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 172 REST OF LATIN AMERICA: NEEDLE BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 173 REST OF LATIN AMERICA: BREAST BIOPSY DEVICES MARKET FOR BIOPSY EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 174 REST OF LATIN AMERICA: BREAST BIOPSY DEVICES MARKET FOR GUIDANCE SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: KEY MACROINDICATORS

- TABLE 176 MIDDLE EAST & AFRICA: BREAST BIOPSY DEVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: BREAST BIOPSY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: BREAST BIOPSY DEVICES MARKET, BY PROCEDURE, 2023-2030 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: NEEDLE BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: BREAST BIOPSY DEVICES MARKET FOR BIOPSY EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: BREAST BIOPSY DEVICES MARKET FOR GUIDANCE SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: BREAST BIOPSY DEVICES MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: BREAST BIOPSY DEVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 184 GCC COUNTRIES: BREAST BIOPSY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 185 GCC COUNTRIES: NEEDLE BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 186 GCC COUNTRIES: BREAST BIOPSY DEVICES MARKET FOR BIOPSY EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 187 GCC COUNTRIES: BREAST BIOPSY DEVICES MARKET FOR GUIDANCE SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 188 REST OF MIDDLE EAST & AFRICA: BREAST BIOPSY DEVICES MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 189 REST OF MIDDLE EAST & AFRICA: NEEDLE BREAST BIOPSY DEVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 190 REST OF MIDDLE EAST & AFRICA: BREAST BIOPSY DEVICES MARKET FOR BIOPSY EQUIPMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 191 REST OF MIDDLE EAST & AFRICA: BREAST BIOPSY DEVICES MARKET FOR GUIDANCE SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 192 OVERVIEW OF STRATEGIES DEPLOYED BY KEY BREAST BIOPSY DEVICE MANUFACTURING COMPANIES

- TABLE 193 BREAST BIOPSY DEVICES MARKET: DEGREE OF COMPETITION

- TABLE 194 BREAST BIOPSY DEVICES MARKET: REGION FOOTPRINT

- TABLE 195 BREAST BIOPSY DEVICES MARKET: PRODUCT FOOTPRINT

- TABLE 196 BREAST BIOPSY DEVICES MARKET: PROCEDURE FOOTPRINT

- TABLE 197 BREAST BIOPSY DEVICES MARKET: APPLICATION FOOTPRINT

- TABLE 198 BREAST BIOPSY DEVICES MARKET: END USER FOOTPRINT

- TABLE 199 BREAST BIOPSY DEVICES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 200 BREAST BIOPSY DEVICES MARKET: COMPETITIVE BENCHMARKING OF STARTUP/SME PLAYERS, BY REGION

- TABLE 201 BREAST BIOPSY DEVICES MARKET: COMPETITIVE BENCHMARKING OF STARTUP/SME PLAYERS, BY PRODUCT

- TABLE 202 BREAST BIOPSY DEVICES MARKET: PRODUCT LAUNCHES & APPROVALS, JANUARY 2021-MAY 2025

- TABLE 203 BREAST BIOPSY DEVICES MARKET: DEALS, JANUARY 2021-MAY 2025

- TABLE 204 HOLOGIC, INC. BUSINESS OVERVIEW

- TABLE 205 HOLOGIC, INC.: PRODUCTS OFFERED

- TABLE 206 HOLOGIC, INC.: DEALS, JANUARY 2021-MAY 2025

- TABLE 207 DANAHER CORPORATION: COMPANY OVERVIEW

- TABLE 208 DANAHER CORPORATION: PRODUCTS OFFERED

- TABLE 209 DANAHER CORPORATION: PRODUCT LAUNCHES & APPROVALS, JANUARY 2021-MAY 2025

- TABLE 210 DANAHER CORPORATION: DEALS, JANUARY 2021-MAY 2025

- TABLE 211 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

- TABLE 212 BECTON, DICKINSON AND COMPANY: PRODUCTS OFFERED

- TABLE 213 ARGON MEDICAL: COMPANY OVERVIEW

- TABLE 214 ARGON MEDICAL: PRODUCTS OFFERED

- TABLE 215 ARGON MEDICAL: PRODUCT LAUNCHES & APPROVALS, JANUARY 2021-MAY 2025

- TABLE 216 ARGON MEDICAL: DEALS, JANUARY 2021-MAY 2025

- TABLE 217 QIAGEN: COMPANY OVERVIEW

- TABLE 218 QIAGEN: PRODUCTS OFFERED

- TABLE 219 QIAGEN: DEALS, JANUARY 2021-MAY 2025

- TABLE 220 MERIT MEDICAL SYSTEMS: COMPANY OVERVIEW

- TABLE 221 MERIT MEDICAL SYSTEMS: PRODUCTS OFFERED

- TABLE 222 MERIT MEDICAL SYSTEMS: PRODUCT LAUNCHES & APPROVALS, JANUARY 2021-MAY 2025

- TABLE 223 MERIT MEDICAL SYSTEMS: DEALS, JANUARY 2021-MAY 2025

- TABLE 224 MENARINI SILICON BIOSYSTEMS SPA: COMPANY OVERVIEW

- TABLE 225 MENARINI SILICON BIOSYSTEMS SPA: PRODUCTS OFFERED

- TABLE 226 MENARINI SILICON BIOSYSTEMS SPA: PRODUCT LAUNCHES & APPROVALS, JANUARY 2021-MAY 2025

- TABLE 227 MENARINI SILICON BIOSYSTEMS SPA: DEALS, JANUARY 2021-MAY 2025

- TABLE 228 GUARDANT HEALTH, INC.: COMPANY OVERVIEW

- TABLE 229 GUARDANT HEALTH, INC.: PRODUCTS OFFERED

- TABLE 230 GUARDANT HEALTH, INC.: PRODUCT LAUNCHES & APPROVALS, JANUARY 2021-MAY 2025

- TABLE 231 GUARDANT HEALTH, INC.: DEALS, JANUARY 2021-MAY 2025

- TABLE 232 GUARDANT HEALTH, INC.: OTHER DEVELOPMENTS, JANUARY 2021-MAY 2025

- TABLE 233 NEOGENOMICS LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 234 NEOGENOMICS LABORATORIES, INC.: PRODUCTS OFFERED

- TABLE 235 NEOGENOMICS LABORATORIES, INC.: PRODUCT LAUNCHES & APPROVALS, JANUARY 2021-MAY 2025

- TABLE 236 NEOGENOMICS LABORATORIES, INC.: DEALS, JANUARY 2021-MAY 2025

- TABLE 237 STERYLAB S.R.L: COMPANY OVERVIEW

- TABLE 238 STERYLAB S.R.L: PRODUCTS OFFERED

- TABLE 239 BIOCEPT, INC.: COMPANY OVERVIEW

- TABLE 240 BIOCEPT, INC.: PRODUCTS OFFERED

- TABLE 241 BIO-RAD LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 242 BIO-RAD LABORATORIES, INC.: PRODUCTS OFFERED

- TABLE 243 BIO-RAD LABORATORIES, INC.: PRODUCT LAUNCHES & APPROVALS, JANUARY 2021-MAY 2025

- TABLE 244 F. HOFFMANN-LA ROCHE LTD.: COMPANY OVERVIEW

- TABLE 245 F. HOFFMANN-LA ROCHE LTD.: PRODUCTS OFFERED

- TABLE 246 EXACT SCIENCES CORPORATION: COMPANY OVERVIEW

- TABLE 247 EXACT SCIENCES CORPORATION: PRODUCTS OFFERED

- TABLE 248 EXACT SCIENCES CORPORATION: DEALS, JANUARY 2021-MAY 2025

- TABLE 249 SYSMEX INOSTICS: COMPANY OVERVIEW

- TABLE 250 SYSMEX INOSTICS: PRODUCTS OFFERED

- TABLE 251 SYSMEX INOSTICS: DEALS, JANUARY 2021-MAY 2025

- TABLE 252 THERMO FISHER SCIENTIFIC: COMPANY OVERVIEW

- TABLE 253 THERMO FISHER SCIENTIFIC: PRODUCTS OFFERED

- TABLE 254 THERMO FISHER SCIENTIFIC: DEALS, JANUARY 2021-MARCH 2024

- TABLE 255 FUJIFILM HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 256 FUJIFILM HOLDINGS CORPORATION: PRODUCTS OFFERED

- TABLE 257 CARDIFF ONCOLOGY INC.: COMPANY OVERVIEW

- TABLE 258 MYRIAD GENETICS, INC.: COMPANY OVERVIEW

- TABLE 259 ILLUMINA, INC.: COMPANY OVERVIEW

- TABLE 260 FLUXION BIOSCIENCES, INC.: COMPANY OVERVIEW

- TABLE 261 INRAD, INC.: COMPANY OVERVIEW

- TABLE 262 IZI MEDICAL PRODUCTS: COMPANY OVERVIEW

- TABLE 263 REMINGTON MEDICAL INC.: COMPANY OVERVIEW

- TABLE 264 CP MEDICAL: COMPANY OVERVIEW

List of Figures

- FIGURE 1 BREAST BIOPSY DEVICES MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 BREAST BIOPSY DEVICES MARKET: RESEARCH DATA

- FIGURE 3 BREAST BIOPSY DEVICES MARKET: RESEARCH DESIGN

- FIGURE 4 BREAST BIOPSY DEVICES MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 BREAST BIOPSY DEVICES MARKET: PRIMARY SOURCES

- FIGURE 6 BREAST BIOPSY DEVICES MARKET: KEY INDUSTRY INSIGHTS

- FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 8 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY- AND DEMAND-SIDE PARTICIPANTS

- FIGURE 9 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 10 BREAST BIOPSY DEVICES MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (REVENUE SHARE ANALYSIS)

- FIGURE 11 BREAST BIOPSY DEVICES MARKET SIZE ESTIMATION: COMPANY REVENUE ESTIMATION

- FIGURE 12 BREAST BIOPSY DEVICES MARKET: TOP-DOWN APPROACH

- FIGURE 13 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 14 BREAST BIOPSY DEVICES MARKET: DATA TRIANGULATION

- FIGURE 15 BREAST BIOPSY DEVICES MARKET, BY PRODUCT, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 BREAST BIOPSY DEVICES MARKET, BY PROCEDURE, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 BREAST BIOPSY PROCEDURE GROWTH [ BIOPSY PROCEDURES IN '000S VS FEMALES AGED 40 - 69 YEARS IN MILLIONS (2023) ]

- FIGURE 18 BREAST BIOPSY DEVICES MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 19 BREAST BIOPSY DEVICES MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

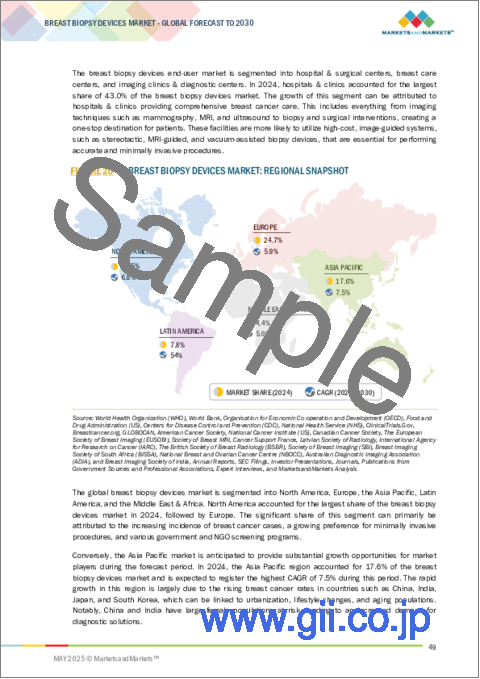

- FIGURE 20 BREAST BIOPSY DEVICES MARKET: REGIONAL SNAPSHOT

- FIGURE 21 GROWING INCIDENCE OF BREAST CANCER TO DRIVE MARKET

- FIGURE 22 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF MARKET DURING FORECAST PERIOD

- FIGURE 23 EARLY CANCER SCREENING SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 24 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 25 BREAST BIOPSY DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 26 VALUE CHAIN ANALYSIS-MAXIMUM VALUE ADDED DURING MANUFACTURING PHASE

- FIGURE 27 BREAST BIOPSY DEVICES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 28 BREAST BIOPSY DEVICES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 29 PATENT DETAILS FOR BREAST BIOPSY DEVICES (JANUARY 2013-MAY 2025)

- FIGURE 30 BREAST BIOPSY DEVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 AVERAGE SELLING PRICE TREND OF BREAST BIOPSY DEVICES, BY REGION, 2022-2024 (USD)

- FIGURE 32 AVERAGE SELLING PRICE OF BREAST BIOPSY DEVICES, BY KEY PLAYER, 2024 (USD)

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF BREAST BIOPSY DEVICES, BY TOP THREE END USERS

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE END USERS OF BREAST BIOPSY DEVICES

- FIGURE 35 BREAST BIOPSY DEVICES: INVESTMENT & FUNDING SCENARIO

- FIGURE 36 NUMBER OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023

- FIGURE 37 VALUE OF INVESTOR DEALS, BY KEY PLAYER, 2018-2022 (USD MILLION)

- FIGURE 38 NORTH AMERICA: BREAST BIOPSY DEVICES MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: BREAST BIOPSY DEVICES MARKET SNAPSHOT

- FIGURE 40 REVENUE ANALYSIS OF TOP 5 PLAYERS IN BREAST BIOPSY DEVICES MARKET, 2020-2024

- FIGURE 41 MARKET SHARE ANALYSIS OF KEY PLAYERS IN BREAST BIOPSY DEVICES MARKET (2024)

- FIGURE 42 BREAST BIOPSY DEVICES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 43 BREAST BIOPSY DEVICES MARKET: COMPANY FOOTPRINT

- FIGURE 44 BREAST BIOPSY DEVICES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 45 EV/EBITDA OF KEY VENDORS

- FIGURE 46 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 47 BREAST BIOPSY DEVICES MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 48 HOLOGIC, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 49 DANAHER CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 50 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2024)

- FIGURE 51 QIAGEN: COMPANY SNAPSHOT (2024)

- FIGURE 52 MERIT MEDICAL SYSTEMS: COMPANY SNAPSHOT (2024)

- FIGURE 53 GUARDANT HEALTH, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 54 NEOGENOMICS LABORATORIES, INC.: COMPANY SNAPSHOT (2023)

- FIGURE 55 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 56 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2024)

- FIGURE 57 EXACT SCIENCES CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 58 SYSMEX INOSTICS: COMPANY SNAPSHOT (2024)

- FIGURE 59 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT (2024)

- FIGURE 60 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT (2024)

The global market for breast biopsy devices is expected to reach USD 3,261.7 million by 2030 from USD 2,384.1 million in 2025, representing a CAGR of 6.5% during the forecast period. The market is benefiting from a combination of factors, including rising breast cancer rates, increased awareness of the importance of early detection, and the growing preference for minimally invasive diagnostic procedures. Additionally, state and provincial screening programs are significantly improving the rate of screenings among women for potential breast cancer.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD million) |

| Segments | Product, Procedure, Application, End User and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

The biopsy needles segment held the largest share of the market in 2024.

Based on type, the breast biopsy devices market is divided into several segments: biopsy needles, guidance systems, biopsy tables, localization wires, assay kits, liquid biopsy instruments, and other devices. Among these, the biopsy needles segment holds a significant share of the market. Biopsy needles are essential tools for diagnosing breast cancer, as they collect tissue samples for histopathological analysis with high accuracy and minimal invasiveness. They can be utilized in core-needle biopsy (CNB), fine-needle aspiration biopsy (FNAB), and vacuum-assisted biopsy (VAB), each designed for specific clinical scenarios and the varying characteristics of the lesions. Biopsy needles are preferred because they provide diagnostic results with less discomfort for the patient and require less time for both the procedure and recovery compared to surgical biopsies.

The needle breast biopsy procedure segment accounted for the largest market share in 2024.

Based on procedures, the breast biopsy devices market can be broadly categorized into three types: needle breast biopsy, open surgical breast biopsy, and liquid breast biopsy. The growth of the needle breast biopsy segment is driven by several key factors. These include rising breast cancer rates, a greater emphasis on early and accurate diagnosis, and an increasing preference among patients for minimally invasive procedures. Advancements in technology, particularly in image guidance and needle design, have enhanced the accuracy of needle breast biopsies while minimizing discomfort and inconvenience. This has made the procedure more acceptable and feasible for patients. Furthermore, the establishment of breast cancer screening programs, more favorable reimbursement policies, and heightened awareness of women's health issues are also contributing to market growth. Additionally, the preference for outpatient care and the growing interest in cost-effective diagnostic options have led to broader acceptance of needle breast biopsies across various healthcare settings.

The liquid biopsy segment is projected to register the highest CAGR during the forecast period.

The breast biopsy devices market is primarily categorized into three main techniques: image-guided biopsy, liquid biopsy, and other methods. The liquid biopsy segment is experiencing growth due to the increasing demand for non-invasive, accurate, and real-time cancer diagnostic solutions. Liquid biopsy processes detect circulating tumor cells (CTCs) and circulating tumor DNA (ctDNA) in the blood, making them less invasive than traditional tissue biopsies. This allows for earlier diagnoses, better tracking of treatment responses, and effective monitoring for recurrence or progression of the disease. Several factors are driving the growth of the liquid biopsy market, including the rising incidence of breast cancer, the advancement of precision (or personalized) medicine, and improvements in molecular diagnostic technologies, particularly through next-generation sequencing (NGS) and digital PCR. The increasing clinical utility and routine application of liquid biopsies, along with a growing awareness of their benefits and supportive regulatory policies, are further promoting the global adoption of these technologies.

The early cancer screening segment dominated the market in 2024.

The breast biopsy market can be broadly categorized based on its applications into four main areas: early cancer screening, therapy selection, treatment monitoring, and recurrence monitoring. Early cancer screening holds the largest market share as it plays a crucial role in reducing mortality rates and improving treatment outcomes by detecting cancer at the earliest and most treatable stage. The rising incidence of cancer globally, particularly among vulnerable and aging populations, has increased the need for effective illness monitoring. Consequently, advancements in technology will serve as a significant driver for early and proactive health monitoring and diagnosis.

Asia Pacific is expected to register a significant growth rate in the market during the forecast period.

The breast biopsy market is experiencing the highest growth in the Asia Pacific region due to several converging factors. These include an increasing incidence of breast cancer, the development of healthcare infrastructure, and greater awareness of the importance of early cancer detection. Countries such as China, India, and Japan are making significant investments in interventional and diagnostic imaging, which is creating a demand for advanced biopsy technologies. Additionally, government support, improved access to medical care in rural areas, and the expansion of global medical device companies promoting their products in emerging markets are driving this adoption. Furthermore, the region's large population and rising healthcare spending are key drivers of its double-digit market growth.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1 (40%), Tier 2 (30%), and Tier 3 (30%)

- By Designation: C-level Executives (27%), Director-level Executives (18%), and Other Designations (55%)

- By Region: North America (50%), Europe (20%), Asia Pacific (15%), Latin America (10%), and the Middle East & Africa (5%)

Prominent players in this market are Hologic Inc. (US), Danaher Corporation (US), Argon Medical Devices (US), Merit Medical Systems (US), Menarini-Silicon Biosystems (Italy), Varian Medical Systems, Inc. (Germany), Planmed Oy (Finland), Sterylab S.R.L (Italy), Biocept, Inc. (US), Bio-Rad Laboratories, Inc. (US), F. Hoffmann-La Roche Ltd. (Switzerland), QIAGEN (Germany), and Exact Sciences Corporation (US).

Research Coverage

- The report studies the breast biopsy devices market by product, procedure, application, end user, and region.

- The report analyzes factors affecting market growth (drivers, restraints, opportunities, and challenges).

- The report evaluates the market opportunities and challenges for stakeholders and details the competitive landscape for market leaders.

- The report studies micromarkets with respect to their growth trends, prospects, and contributions to the global breast biopsy devices market.

- The report forecasts the revenue of market segments with respect to five major regions.

Key Benefits of Buying the Report:

The report is designed to assist both new entrants and established market leaders, as well as smaller companies in the breast biopsy devices sector, in making informed investment decisions. It provides comprehensive data that supports risk evaluation and validated investment strategies. The report features detailed market segmentation based on end users and regional aspects, enabling you to focus on specific segments. Additionally, it offers thorough coverage and analysis of trends, challenges, growth opportunities, and future prospects, ensuring that your decisions are well-informed and considerate of all relevant factors.

The report provides insights into the following pointers:

- Analysis of key drivers (ongoing innovations in biopsy needle designs and liquid biopsy technologies), restraints (high costs associated with advanced biopsy equipment and imaging technologies and stringent regulatory approval procedures), opportunities (technological advancements in imaging technology), and challenges (accuracy and reliability of certain biopsy procedures), influencing the growth of the breast biopsy devices market.

- Product Development/Innovation: Detailed insights into upcoming technologies, R&D activities, and new product & service launches in the breast biopsy devices market.

- Market Diversification: Exhaustive information about untapped geographies, new products, recent developments, and investments in the breast biopsy devices market.

- Market Development: Comprehensive information about lucrative markets-the report analyzes the breast biopsy devices market across varied regions.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Hologic Inc. (US), Danaher Corporation (US), Argon Medical Devices (US), Merit Medical Systems (US), Menarini-Silicon Biosystems (Italy), Varian Medical Systems, Inc. (Germany), Planmed Oy (Finland), Sterylab S.R.L (Italy), QIAGEN (Germany), and Biocept, Inc. (US), among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STUDY LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key sources of secondary data

- 2.1.1.2 Objectives of secondary research

- 2.1.1.3 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key objectives of primary research

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH (REVENUE SHARE ANALYSIS)

- 2.2.1.1 Company revenue estimation approach

- 2.2.1.2 Customer-based market estimation

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH (REVENUE SHARE ANALYSIS)

- 2.3 DATA TRIANGULATION

- 2.4 MARKET SHARE ASSESSMENT

- 2.5 STUDY ASSUMPTIONS

- 2.5.1 MARKET ASSUMPTIONS

- 2.5.2 GROWTH RATE ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 BREAST BIOPSY DEVICES MARKET OVERVIEW

- 4.2 BREAST BIOPSY DEVICES MARKET, BY REGION, 2025 VS. 2030 (USD MILLION)

- 4.3 EUROPE: BREAST BIOPSY DEVICES MARKET, BY REGION AND APPLICATION, 2024

- 4.4 GEOGRAPHIC SNAPSHOT OF BREAST BIOPSY DEVICES MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing incidence of breast cancer

- 5.2.1.2 Expansion of private diagnostic chains and imaging centers

- 5.2.1.3 Increasing demand for minimally invasive and non-invasive procedures

- 5.2.1.4 Growing awareness regarding early detection of breast cancer

- 5.2.1.5 Improved reimbursement scenario

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of liquid biopsy tests

- 5.2.2.2 Stringent regulatory approval procedures

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Technological advancements

- 5.2.3.2 Growing collaboration and financial support from public and private sectors

- 5.2.4 CHALLENGES

- 5.2.4.1 Shortage of skilled professionals

- 5.2.1 DRIVERS

- 5.3 REGULATORY ANALYSIS

- 5.3.1 REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

- 5.3.2 REGULATORY LANDSCAPE

- 5.3.2.1 North America

- 5.3.2.1.1 US

- 5.3.2.1.2 Canada

- 5.3.2.2 Europe

- 5.3.2.3 Asia Pacific

- 5.3.2.3.1 Japan

- 5.3.2.3.2 China

- 5.3.2.3.3 India

- 5.3.2.1 North America

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 5.5.3 END USERS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Ultrasound

- 5.7.1.2 Mammography-guided stereotactic biopsy

- 5.7.1.3 MRI

- 5.7.1.4 Contrast-enhanced mammography (CEM) guidance

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Gamma-guided biopsy systems

- 5.7.2.2 Molecular breast imaging (MBI)-guided biopsy

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Surgical oncology technologies

- 5.7.3.2 Cryoablation and other minimally invasive ablation technologies

- 5.7.1 KEY TECHNOLOGIES

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT DATA

- 5.8.2 EXPORT DATA

- 5.9 PATENT ANALYSIS

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE TREND OF BREAST BIOPSY DEVICES, BY REGION

- 5.11.2 AVERAGE SELLING PRICE OF BREAST BIOPSY DEVICES, BY APPLICATION

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 CASE STUDY 1: PET-GUIDED BREAST BIOPSY

- 5.12.2 CASE STUDY 2: EARLY-STAGE BREAST CANCER AMID COVID PANDEMIC

- 5.12.3 CASE STUDY 3: SAMPLING MULTIPLE SMALL LESIONS IN DENSE BREAST TISSUE

- 5.13 KEY CONFERENCES & EVENTS, 2025-2026

- 5.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS

- 5.14.2 BUYING CRITERIA

- 5.15 IMPACT OF 2025 US TARIFF ON BREAST BIOPSY DEVICES MARKET

- 5.15.1 INTRODUCTION

- 5.15.2 KEY TARIFF RATES

- 5.15.3 PRICE IMPACT ANALYSIS

- 5.15.4 IMPACT ON COUNTRY/REGION

- 5.15.4.1 US

- 5.15.4.2 Europe

- 5.15.4.3 Asia Pacific

- 5.15.5 IMPACT ON END-USE INDUSTRIES

- 5.16 IMPACT OF GENERATIVE AI/AI ON BREAST BIOPSY DEVICES MARKET

- 5.17 INVESTMENT & FUNDING SCENARIO

6 BREAST BIOPSY DEVICES MARKET, BY PROCEDURE

- 6.1 INTRODUCTION

- 6.2 NEEDLE BREAST BIOPSY

- 6.2.1 CORE NEEDLE BIOPSY

- 6.2.1.1 Procedural advantages of guidance system-based biopsy to drive revenue growth

- 6.2.2 VACUUM-ASSISTED BIOPSY (VAB)

- 6.2.2.1 High diagnostic specificity and accuracy of technique to boost demand

- 6.2.3 FINE NEEDLE ASPIRATION BIOPSY (FNAB)

- 6.2.3.1 Drawbacks associated with procedure to limit market growth

- 6.2.1 CORE NEEDLE BIOPSY

- 6.3 OPEN SURGICAL BREAST BIOPSY

- 6.3.1 EXCISIONAL BIOPSY

- 6.3.1.1 Risk of post-operative complications to hinder market growth

- 6.3.2 INCISIONAL BIOPSY

- 6.3.2.1 Longer recovery period associated with incisional biopsy to restrict growth

- 6.3.1 EXCISIONAL BIOPSY

- 6.4 LIQUID BREAST BIOPSY

- 6.4.1 CIRCULATING TUMOR CELLS

- 6.4.1.1 Ability to provide important information on molecular properties of breast tumors to boost market

- 6.4.2 CIRCULATING TUMOR DNA (CTDNA)

- 6.4.2.1 Low concentrations of ctDNA to make screening for clinically relevant mutations challenging

- 6.4.3 OTHER BIOMARKERS

- 6.4.1 CIRCULATING TUMOR CELLS

7 BREAST BIOPSY DEVICES MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- 7.2 BIOPSY NEEDLES

- 7.2.1 CORE NEEDLES

- 7.2.1.1 Early detection through core needle biopsy to boost growth

- 7.2.2 FINE ASPIRATION NEEDLES

- 7.2.2.1 Accurate clinical decisions for early cancer diagnosis to drive demand for fine aspiration needles

- 7.2.3 VACUUM-ASSISTED BIOPSY NEEDLES

- 7.2.3.1 Enhanced accuracy with vacuum-assisted tissue sampling to drive adoption

- 7.2.1 CORE NEEDLES

- 7.3 BIOPSY EQUIPMENT

- 7.3.1 CORE BIOPSY EQUIPMENT

- 7.3.1.1 Ability to streamline breast diagnosis with core biopsy technology to boost demand

- 7.3.2 VACUUM-ASSISTED BIOPSY EQUIPMENT

- 7.3.2.1 Advantages of VAB in breast biopsy to drive market growth

- 7.3.1 CORE BIOPSY EQUIPMENT

- 7.4 GUIDANCE SYSTEMS

- 7.4.1 MAMMOGRAPHY-GUIDED STEREOTACTIC BIOPSY

- 7.4.1.1 Advantages of technique to boost adoption in coming years

- 7.4.2 ULTRASOUND-GUIDED BIOPSY

- 7.4.2.1 Ability to create fine-grained pictures of breasts to drive growth

- 7.4.3 MRI-GUIDED BIOPSY

- 7.4.3.1 High cost and low specificity to affect demand

- 7.4.1 MAMMOGRAPHY-GUIDED STEREOTACTIC BIOPSY

- 7.5 BIOPSY TABLES

- 7.5.1 GROWING USE OF BIOPSY TABLES TO PERFORM STEREOTACTIC BIOPSY PROCEDURES TO FAVOR MARKET GROWTH

- 7.6 ASSAY KITS

- 7.6.1 PRODUCT APPROVALS AND LAUNCHES TO DRIVE SEGMENTAL GROWTH

- 7.7 LIQUID BIOPSY INSTRUMENTS

- 7.7.1 ONGOING RESEARCH AND CLINICAL TRIALS TO DELIVER NOVEL SOLUTIONS IN MARKET

- 7.8 LOCALIZATION WIRES

- 7.8.1 WIDE USAGE OF LOCALIZATION WIRES TO LOCATE BREAST ABNORMALITIES AND LUMPS TO BOOST MARKET

- 7.9 OTHER PRODUCTS

8 BREAST BIOPSY MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 EARLY CANCER SCREENING

- 8.2.1 GROWING AWARENESS ABOUT EARLY CANCER DETECTION TO DRIVE SEGMENT GROWTH

- 8.3 THERAPY SELECTION

- 8.3.1 ABILITY OF PERSONALIZED THERAPY SELECTION TO ENHANCE TREATMENT EFFICACY TO DRIVE DEMAND

- 8.4 TREATMENT MONITORING

- 8.4.1 GROWING POPULARITY OF REAL-TIME TREATMENT MONITORING TO BOOST MARKET

- 8.5 RECURRENCE MONITORING

- 8.5.1 UNMET CLINICAL NEEDS TO CREATE OPPORTUNITIES FOR PLAYERS IN MARKET

9 BREAST BIOPSY DEVICES MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 HOSPITALS & CLINICS

- 9.2.1 RISING DEMAND FOR QUICK AND ACCURATE DIAGNOSIS TO BOOST MARKET

- 9.3 IMAGING CLINICS & DIAGNOSTIC CENTERS

- 9.3.1 RISING NUMBER OF PRIVATE IMAGING CENTERS TO CONTRIBUTE TO MARKET GROWTH

- 9.4 BREAST CARE CENTERS

- 9.4.1 INCREASING POPULARITY OF BREAST CARE CENTERS IN DEVELOPED COUNTRIES TO BOOST MARKET

10 BREAST BIOPSY DEVICES MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 US to dominate North America breast biopsy devices market during forecast period

- 10.2.3 CANADA

- 10.2.3.1 Surge in incidence of breast cancer and favorable government guidelines to support market growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Favorable changes in reimbursement scenario to fuel adoption of technologically advanced products in Germany

- 10.3.3 UK

- 10.3.3.1 Initiatives by public & private organizations to increase awareness about breast cancer to drive growth

- 10.3.4 FRANCE

- 10.3.4.1 Rising geriatric population to support market growth

- 10.3.5 ITALY

- 10.3.5.1 Evolving regulatory scenario for breast biopsy to boost market

- 10.3.6 SPAIN

- 10.3.6.1 Increased funding scenario to propel market growth

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Increasing patient pool and government initiatives for healthcare development to fuel market growth

- 10.4.3 JAPAN

- 10.4.3.1 Presence of universal healthcare reimbursement scenario and rising breast cancer cases

- 10.4.4 INDIA

- 10.4.4.1 Government initiatives to improve female health to drive market growth in India

- 10.4.5 AUSTRALIA

- 10.4.5.1 Rising research investments and awareness campaigns to support market growth

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Rising R&D and promising clinical trials in country to positively impact market growth

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 Key market in Latin America owing to modernization of healthcare facilities

- 10.5.3 MEXICO

- 10.5.3.1 Availability of advanced care and increasing awareness programs to fuel market growth

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 IMPROVING HEALTHCARE INFRASTRUCTURE AND INCREASING PUBLIC-PRIVATE INVESTMENTS TO DRIVE MARKET GROWTH IN MEA REGION

- 10.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.6.3 GCC COUNTRIES

- 10.6.3.1 Growing healthcare infrastructure to fuel market growth

- 10.6.4 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS (2024)

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Product footprint

- 11.5.5.4 Procedure footprint

- 11.5.5.5 Application footprint

- 11.5.5.6 End-user footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES (2024)

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startups/SMEs

- 11.6.5.2 Competitive benchmarking of startup/SME players, by region

- 11.6.5.3 Competitive benchmarking of startup/SME players, product

- 11.7 COMPANY VALUATION & FINANCIAL METRICS

- 11.7.1 FINANCIAL METRICS

- 11.7.2 COMPANY VALUATION

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 THIS SEGMENT INCLUDES THE GROWTH STRATEGIES ADOPTED BY MAJOR PLAYERS IN THE BREAST BIOPSY DEVICES MARKET BETWEEN JANUARY 2020 AND MAY 2025.

- 11.9.2 PRODUCT LAUNCHES & APPROVALS

- 11.9.3 DEALS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 HOLOGIC, INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.2.1 Deals

- 12.1.1.3 MnM view

- 12.1.1.3.1 Key strengths

- 12.1.1.3.2 Strategic choices

- 12.1.1.3.3 Weaknesses & competitive threats

- 12.1.2 DANAHER CORPORATION

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches & approvals

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 BECTON, DICKINSON AND COMPANY

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 MnM View

- 12.1.3.3.1 Key strengths

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses & competitive threats

- 12.1.4 ARGON MEDICAL

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches & approvals

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses & competitive threats

- 12.1.5 QIAGEN

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses & competitive threats

- 12.1.6 MERIT MEDICAL SYSTEMS

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches & approvals

- 12.1.6.3.2 Deals

- 12.1.7 MENARINI SILICON BIOSYSTEMS SPA

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches & approvals

- 12.1.7.3.2 Deals

- 12.1.8 GUARDANT HEALTH, INC.

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches & approvals

- 12.1.8.3.2 Deals

- 12.1.8.3.3 Other developments

- 12.1.9 NEOGENOMICS LABORATORIES, INC.

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches & approvals

- 12.1.9.3.2 Deals

- 12.1.10 STERYLAB S.R.L

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.11 BIOCEPT, INC.

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.12 BIO-RAD LABORATORIES, INC.

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product launches & approvals

- 12.1.13 F. HOFFMANN-LA ROCHE LTD.

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.14 EXACT SCIENCES CORPORATION

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Deals

- 12.1.15 SYSMEX INOSTICS (A SUBSIDIARY OF SYSMEX CORPORATION)

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Deals

- 12.1.16 THERMO FISHER SCIENTIFIC

- 12.1.16.1 Business overview

- 12.1.16.2 Products offered

- 12.1.16.3 Recent developments

- 12.1.16.3.1 Deals

- 12.1.17 FUJIFILM HOLDINGS CORPORATION

- 12.1.17.1 Business overview

- 12.1.17.2 Products offered

- 12.1.1 HOLOGIC, INC.

- 12.2 OTHER PLAYERS

- 12.2.1 CARDIFF ONCOLOGY INC.

- 12.2.2 MYRIAD GENETICS, INC.

- 12.2.3 ILLUMINA, INC.

- 12.2.4 FLUXION BIOSCIENCES, INC.

- 12.2.5 INRAD, INC.

- 12.2.6 IZI MEDICAL PRODUCTS

- 12.2.7 REMINGTON MEDICAL INC.

- 12.2.8 CP MEDICAL

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS