|

|

市場調査レポート

商品コード

1740260

ブレーキ摩擦製品の世界市場(OEM、アフターマーケット):タイプ別、ディスクタイプ別、ライナータイプ別、車両タイプ別、地域別 - 予測(~2032年)Brake Friction Products Market (OEM, Aftermarket), by Type (Brake Disc, Pad, Drum, Shoe, Liner, Shim), Disc Type (Metallic, Composite, Ceramic), Liner Type (Molded, Woven), Vehicle Type (ICE, Electric, PHEV, OHV), and Region - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| ブレーキ摩擦製品の世界市場(OEM、アフターマーケット):タイプ別、ディスクタイプ別、ライナータイプ別、車両タイプ別、地域別 - 予測(~2032年) |

|

出版日: 2025年05月22日

発行: MarketsandMarkets

ページ情報: 英文 331 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のブレーキ摩擦製品の市場規模は、2025年の133億2,000万米ドルから2032年までに155億2,000万米ドルに達すると予測され、2025年~2032年にCAGRで2.2%の成長が見込まれます。

中国、米国、インド、欧州におけるEVの普及が、今後数年間のブレーキ摩擦製品市場を牽引します。また、トラック・バスセグメントでは、走行距離の増加により高品質なブレーキ摩擦製品へのニーズが高まるため、市場需要に大きく寄与します。また、アフターマーケットセグメントもブレーキ摩擦製品の需要を促進する上で重要な役割を果たすと予測されます。自動車生産の増加と乗用車のディスクブレーキ需要により、ブレーキ摩擦製品の需要は増加すると予測されます。さらに、軽量部品の使用が増加しているため、高品質なブレーキ摩擦ソリューションと材料に対する需要が高まっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 単位 | 数量、金額(100万米ドル/10億米ドル) |

| セグメント | 製品タイプ、車両タイプ、ライナータイプ、材料タイプ、オフハイウェイ市場、用途とディスクタイプ、電気自動車用ブレーキ摩擦OE市場、車両タイプ、アフターマーケット(製品、車両タイプ、地域) |

| 対象地域 | アジア太平洋、欧州、北米、その他のアジア太平洋 |

「総自動車数と走行距離の増加がアフターマーケットを後押し」

ブレーキ摩擦市場は、定期的な交換を必要とする製品の摩耗や破損によるアフターマーケット売上に依存しています。成長は、世界の自動車数の増加と平均走行距離の増加に関連しており、特に欧州では2015年の1万マイルから2020年に1万4,000マイル近くまで増加しています。その結果、ブレーキシステムにはより大きなストレスがかかるようになり、理想的には3万~7万マイルごとに交換が必要になります。EUでは厳しい規制により、新車の乗用車と大型商用車にはディスクブレーキが標準装備されており、この動向はアジアでも同様です。eコマースの急増も、トラックのブレーキ性能向上を要求しています。OICAによると、世界の自動車売上は2022年の8,290万台から2024年に9,530万台に増加しており、世界の乗用車数を押し上げ、ブレーキ製品の需要を促進しています。

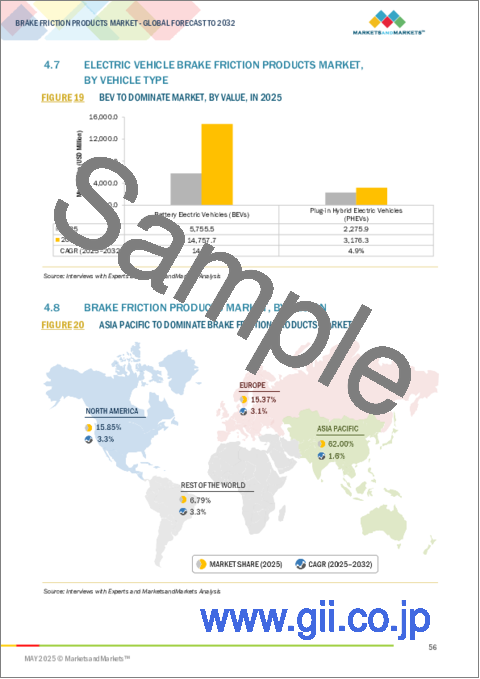

「バッテリー電気自動車(BEV)が予測期間にブレーキ摩擦製品の最大かつ最速の成長市場になる見込みです。」

BEVは過去5年間で著しい成長を示しており、売上は2023年の950万台から2024年に1,080万台近くに達しました。中国が市場をリードし、世界のBEV売上の60%を占め、欧州、北米がこれに続きます。中国とインドでは環境にやさしいモデルが一般的で、2ディスクや2ドラムのブレーキシステムを採用することが多いです。しかし、SUVや高級車への需要の高まりから、中級セグメントでは全ディスクシステムへのシフトが進んでいます。回生ブレーキ技術は、制動時に運動エネルギーを蓄積エネルギーに変換することでエネルギー効率を向上させるため、極めて重要です。これは従来のブレーキ部品の摩耗を減らし、需要に影響を与えます。主な動向は、セラミック材料や複合材料の使用、予知保全に向けたセンサーの統合、より静かで長持ちするブレーキソリューションの開発などです。

「欧州が予測期間にブレーキ摩擦製品市場で大きな市場シェアを占める見込みです。」

欧州にはドイツ、英国、スペイン、フランスなどの先進諸国があり、自動車の安全基準や技術でリードしています。乗用車の95%超に全4ディスクブレーキが装備され、小型商用車(LCV)も約65~70%が装備されています。EUのGeneral Safety Regulationでは、大型車にアンチロックブレーキシステム(ABS)やエレクトロニックスタビリティコントロール(ESC)といった先進のブレーキシステムを義務付けています。また、近年のEuro 7規制では、ブレーキダストの排出に厳しい制限を課しており、PM10の排出を2026年までに7mg/km、2035年までに3mg/kmに削減するために、先進の摩擦材やコーティングローターを開発することをメーカーに求めています。

当レポートでは、世界のブレーキ摩擦製品市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- EVブレーキ摩擦製品市場における魅力的な機会

- ブレーキ摩擦製品市場:タイプ別

- ブレーキ摩擦製品アフターマーケット:車両タイプ別

- ブレーキライナー市場:タイプ別

- ブレーキディスク市場:材料別

- オフハイウェイ機械用ブレーキ摩擦製品市場:用途別

- 電気自動車用ブレーキ摩擦製品市場:車両タイプ別

- ブレーキ摩擦製品市場:地域別

- ブレーキ摩擦製品アフターマーケット:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- 乗用車、平均販売価格の動向:ブレーキ摩擦製品タイプ別

- 小型商用車、平均販売価格の動向:ブレーキ摩擦製品タイプ別

- 大型商用車、平均販売価格の動向:ブレーキ摩擦製品タイプ別

- ブレーキシムの平均販売価格推移:車両タイプ別

- バリューチェーン分析

- ブレーキ摩擦製品市場のエコシステム

- 投資シナリオ

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 貿易分析

- 輸入シナリオ(2020年~2024年)

- 輸出データ(2020年~2024年)

- 主な会議とイベント(2025年~2026年)

- ケーススタディ分析

- 規制情勢

- ブレーキ摩擦基準

- 車両安全基準

- 規制機関、政府機関、その他の組織

- 主なステークホルダーと購入基準

第6章 ブレーキ摩擦製品市場:タイプ別

- イントロダクション

- ブレーキディスク

- ブレーキパッド

- ブレーキドラム

- ブレーキシュー

- ブレーキライナー

- ブレーキシム

- 産業考察

第7章 ブレーキライナー市場:タイプ別

- イントロダクション

- 成形ブレーキライナー

- 織布ブレーキライナー

- 産業考察

第8章 ブレーキディスク市場:材料別

- イントロダクション

- 金属ディスク

- 複合材料ディスク

- セラミックディスク

- 産業考察

第9章 ブレーキ摩擦製品市場:車両タイプ別

- イントロダクション

- 乗用車

- 小型商用車(LCV)

- トラック

- バス

- 産業考察

第10章 オフハイウェイ機械用ブレーキ摩擦製品市場:用途別

- イントロダクション

- 農業用トラクター

- 乾式ブレーキディスク

- 湿式ブレーキディスク

- 建設機械

- 乾式ブレーキディスク

- 湿式ブレーキディスク

- 産業考察

第11章 電気自動車用ブレーキ摩擦製品市場:車両タイプ別

- イントロダクション

- バッテリー電気自動車(BEV)

- プラグインハイブリッド電気自動車(PHEV)

- 産業考察

第12章 ブレーキ摩擦製品アフターマーケット:車両タイプ別、製品タイプ別

- イントロダクション

- 乗用車

- 小型商用車(LCVS)

- 大型商用車(HCVS)

- 産業考察

第13章 ブレーキ摩擦製品アフターマーケット:地域別

- イントロダクション

- アジア太平洋

- マクロ経済の見通し

- 中国

- 日本

- 韓国

- インド

- 欧州

- マクロ経済の見通し

- ドイツ

- フランス

- 英国

- スペイン

- 北米

- マクロ経済の見通し

- 米国

- メキシコ

- カナダ

- その他の地域

- マクロ経済の見通し

- ロシア

- ブラジル

- 産業考察

第14章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析(2021年~2024年)

- 市場シェア分析(2024年)

- 企業の評価

- 財務指標(2025年)

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:アフターマーケット企業(2024年)

- サプライヤー分析

- 自動車メーカー向けブレーキパッドサプライヤー

- 自動車メーカー向けブレーキローターサプライヤー

- 自動車メーカー向けブレーキドラムサプライヤー

- 競合シナリオ

第15章 企業プロファイル

- 主要企業

- AISIN CORPORATION

- ZF FRIEDRICHSHAFEN AG

- BREMBO S.P.A

- TENNECO INC.

- NISSHINBO HOLDINGS INC.

- ROBERT BOSCH GMBH

- AKEBONO BRAKE INDUSTRY CO., LTD.

- CONTINENTAL AG

- ITT INC.

- MIBA AG

- SGL CARBON

- CUMMINS INC.

- 追加の企業

- HELLA GMBH & CO. KGAA

- FTE AUTOMOTIVE

- WUHAN YOUFIN AUTO PARTS CO., LTD.

- EBC BRAKES

- HITACHI ASTEMO LTD.

- HALDEX

- CARDONE INDUSTRIES

- GMP FRICTION PRODUCTS

- DELPHI TECHNOLOGIES

- DURAGO

- アフターマーケットブレーキシムメーカー

- RAYBESTOS

- POWERSTOP LLC

- CARLISLE BRAKE & FRICTION

- MAT HOLDING, INC.

- POWERTECH AUTO PARTS CO. LTD.

第16章 MARKETSANDMARKETSの提言

- アジア太平洋のブレーキ摩擦製品の成長可能性

- ディスクブレーキへの注目の高まり

- 農業用トラクターにおける油圧式湿式ブレーキの需要の増加

- 高級車における複合材料ディスクブレーキの需要の増加

- 結論

第17章 付録

List of Tables

- TABLE 1 BRAKE FRICTION PRODUCTS MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 CURRENCY EXCHANGE RATES

- TABLE 3 ANNUAL TIME SPENT IN TRAFFIC CONGESTION (HOURS), 2023

- TABLE 4 VEHICLE WEIGHT REDUCTION TARGETS FOR LIGHT-DUTY ICE VEHICLES (2020-2050)

- TABLE 5 PASSENGER CARS: AVERAGE SELLING PRICE TREND OF BRAKE FRICTION PRODUCTS, BY PRODUCT TYPE, 2020-2024 (USD)

- TABLE 6 LIGHT COMMERCIAL VEHICLES: AVERAGE SELLING PRICE TREND OF BRAKE FRICTION PRODUCTS, BY PRODUCT TYPE, 2020-2024 (USD)

- TABLE 7 HEAVY COMMERCIAL VEHICLES: AVERAGE SELLING PRICE OF BRAKE FRICTION PRODUCTS, BY PRODUCT TYPE, 2022-2024 (USD)

- TABLE 8 AVERAGE SELLING PRICE TREND OF BRAKE SHIMS, BY VEHICLE TYPE, 2020-2024 (USD)

- TABLE 9 APPLICATIONS AND PATENTS, 2021-2025

- TABLE 10 US: IMPORT DATA FOR HS CODE 870830, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 11 GERMANY: IMPORT DATA FOR HS CODE 870830, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 MEXICO: IMPORT DATA FOR HS CODE 870830, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 13 CANADA: IMPORT DATA FOR HS CODE 870830, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 14 FRANCE: IMPORT DATA FOR HS CODE 870830, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 15 CHINA: EXPORT DATA FOR HS CODE 870830, 2020-2024 (USD THOUSAND)

- TABLE 16 GERMANY: EXPORT DATA FOR HS CODE 870830, 2020-2024 (USD THOUSAND)

- TABLE 17 MEXICO: EXPORT DATA FOR HS CODE 870830, 2020-2024 (USD THOUSAND)

- TABLE 18 US: EXPORT DATA FOR HS CODE 870830, 2020-2024 (USD THOUSAND)

- TABLE 19 ITALY: EXPORT DATA FOR HS CODE 870830, 2020-2024 (USD THOUSAND)

- TABLE 20 BRAKE FRICTION PRODUCTS MARKET: UPCOMING CONFERENCES AND EVENTS

- TABLE 21 BRAKE FRICTION STANDARDS, BY COUNTRY/REGION

- TABLE 22 VEHICLE SAFETY STANDARDS, BY COUNTRY/REGION

- TABLE 23 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR BRAKE FRICTION PRODUCTS MARKET, BY PRODUCT TYPE (%)

- TABLE 27 KEY BUYING CRITERIA FOR BRAKE FRICTION PRODUCTS MARKET

- TABLE 28 BRAKE FRICTION PRODUCTS MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 29 BRAKE FRICTION PRODUCTS MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 30 BRAKE FRICTION PRODUCTS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 31 BRAKE FRICTION PRODUCTS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 32 RECENT TECHNOLOGIES USED IN VEHICLES

- TABLE 33 BRAKE DISCS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 34 BRAKE DISCS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 35 BRAKE DISCS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 BRAKE DISCS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 37 EURO 7 NORMS FOR DIFFERENT VEHICLE TYPES

- TABLE 38 BRAKE PADS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 39 BRAKE PADS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 40 BRAKE PADS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 BRAKE PADS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 42 BRAKE DRUMS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 43 BRAKE DRUMS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 44 BRAKE DRUMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 45 BRAKE DRUMS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 46 BRAKE SHOES MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 47 BRAKE SHOES MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 48 BRAKE SHOES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 BRAKE SHOES MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 50 BRAKE LINERS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 51 BRAKE LINERS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 52 BRAKE LINERS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 BRAKE LINERS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 54 VEHICLES OFFERING SHIM PADS

- TABLE 55 BRAKE SHIMS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 56 BRAKE SHIMS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 57 BRAKE SHIMS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 BRAKE SHIMS MARKET, BY REGION, 2025-2032 (USD MILLION)

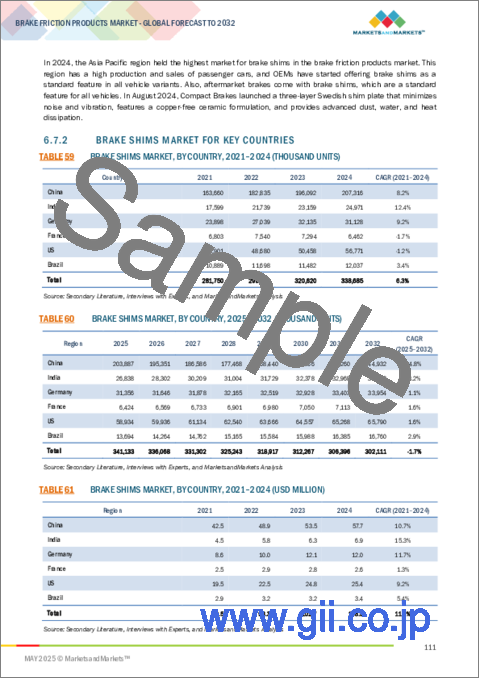

- TABLE 59 BRAKE SHIMS MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 60 BRAKE SHIMS MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 61 BRAKE SHIMS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 62 BRAKE SHIMS MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 63 BRAKE LINERS MARKET, BY TYPE, 2021-2024 (MILLION UNITS)

- TABLE 64 BRAKE LINERS MARKET, BY TYPE, 2025-2032 (MILLION UNITS)

- TABLE 65 BRAKE LINERS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 66 BRAKE LINERS MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 67 MOLDED BRAKE LINERS MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 68 MOLDED BRAKE LINERS MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 69 MOLDED BRAKE LINERS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 MOLDED BRAKE LINERS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 71 WOVEN BRAKE LINERS MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 72 WOVEN BRAKE LINERS MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 73 WOVEN BRAKE LINERS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 WOVEN BRAKE LINERS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 75 BRAKE DISCS MARKET, BY MATERIAL TYPE, 2021-2024 (MILLION UNITS)

- TABLE 76 BRAKE DISCS MARKET, BY MATERIAL TYPE, 2025-2032 (MILLION UNITS)

- TABLE 77 BRAKE DISCS MARKET, BY MATERIAL TYPE, 2021-2024 (USD MILLION)

- TABLE 78 BRAKE DISCS MARKET, BY MATERIAL TYPE, 2025-2032 (USD MILLION)

- TABLE 79 METALLIC DISCS MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 80 METALLIC DISCS MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 81 METALLIC DISCS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 METALLIC DISCS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 83 COMPOSITE DISCS MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 84 COMPOSITE DISCS MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 85 COMPOSITE DISCS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 COMPOSITE DISCS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 87 CERAMIC DISCS MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 88 CERAMIC DISCS MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 89 CERAMIC DISCS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 CERAMIC DISCS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 91 BRAKE FRICTION PRODUCTS MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 92 BRAKE FRICTION PRODUCTS MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 93 BRAKE FRICTION PRODUCTS MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 94 BRAKE FRICTION PRODUCTS MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 95 PASSENGER CARS: BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 96 PASSENGER CARS: BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 97 PASSENGER CARS: BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 PASSENGER CARS: BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 99 LIGHT COMMERCIAL VEHICLES: BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 100 LIGHT COMMERCIAL VEHICLES: BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 101 LIGHT COMMERCIAL VEHICLES: BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 102 LIGHT COMMERCIAL VEHICLES: BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 103 TRUCKS: BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 104 TRUCKS: BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 105 TRUCKS: BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 106 TRUCKS: BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 107 BUSES: BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 108 BUSES: BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 109 BUSES: BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 110 BUSES: BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 111 OFF-HIGHWAY EQUIPMENT BRAKE FRICTION PRODUCTS MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 112 OFF-HIGHWAY EQUIPMENT BRAKE FRICTION PRODUCTS MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 113 OFF-HIGHWAY EQUIPMENT BRAKE FRICTION PRODUCTS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 114 OFF-HIGHWAY EQUIPMENT BRAKE FRICTION PRODUCTS MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 115 AGRICULTURAL TRACTORS: OFF-HIGHWAY EQUIPMENT BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 116 AGRICULTURAL TRACTORS: OFF-HIGHWAY EQUIPMENT BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 117 AGRICULTURAL TRACTORS: OFF-HIGHWAY EQUIPMENT BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 118 AGRICULTURAL TRACTORS: OFF-HIGHWAY EQUIPMENT BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 119 AGRICULTURAL TRACTORS: OFF-HIGHWAY EQUIPMENT BRAKE FRICTION PRODUCTS MARKET, BY TYPE, 2021-2024 (MILLION UNITS)

- TABLE 120 AGRICULTURAL TRACTORS: OFF-HIGHWAY EQUIPMENT BRAKE FRICTION PRODUCTS MARKET, BY TYPE, 2025-2032 (MILLION UNITS)

- TABLE 121 AGRICULTURAL TRACTORS: DRY BRAKE DISCS MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 122 AGRICULTURAL TRACTORS: DRY BRAKE DISCS MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 123 AGRICULTURAL TRACTORS: WET BRAKE DISCS MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 124 AGRICULTURAL TRACTORS: WET BRAKE DISCS MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 125 CONSTRUCTION EQUIPMENT: OFF-HIGHWAY EQUIPMENT BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 126 CONSTRUCTION EQUIPMENT: OFF-HIGHWAY EQUIPMENT BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 127 CONSTRUCTION EQUIPMENT: OFF-HIGHWAY EQUIPMENT BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 128 CONSTRUCTION EQUIPMENT: OFF-HIGHWAY EQUIPMENT BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 129 CONSTRUCTION EQUIPMENT: BRAKE DISCS MARKET, BY TYPE, 2021-2024 (MILLION UNITS)

- TABLE 130 CONSTRUCTION EQUIPMENT: BRAKE DISCS MARKET, BY TYPE, 2025-2032 (MILLION UNITS)

- TABLE 131 CONSTRUCTION EQUIPMENT: DRY BRAKE DISCS MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 132 CONSTRUCTION EQUIPMENT: DRY BRAKE DISCS MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 133 CONSTRUCTION EQUIPMENT: WET BRAKE DISCS MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 134 CONSTRUCTION EQUIPMENT: WET BRAKE DISCS MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 135 ELECTRIC VEHICLE BRAKE FRICTION PRODUCTS MARKET, BY PRODUCT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 136 ELECTRIC VEHICLE BRAKE FRICTION PRODUCTS MARKET, BY PRODUCT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 137 ELECTRIC VEHICLE BRAKE FRICTION PRODUCTS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 138 ELECTRIC VEHICLE BRAKE FRICTION PRODUCTS MARKET, BY PRODUCT TYPE, 2025-2032 (USD MILLION)

- TABLE 139 ELECTRIC VEHICLE BRAKE FRICTION PRODUCTS MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 140 ELECTRIC VEHICLE BRAKE FRICTION PRODUCTS MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 141 ELECTRIC VEHICLE BRAKE FRICTION PRODUCTS MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 142 ELECTRIC VEHICLE BRAKE FRICTION PRODUCTS MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 143 BATTERY ELECTRIC VEHICLES (BEVS): BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 144 BATTERY ELECTRIC VEHICLES (BEVS): BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 145 BATTERY ELECTRIC VEHICLES (BEVS): BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 146 BATTERY ELECTRIC VEHICLES (BEVS): BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 147 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS): BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 148 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS): BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 149 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS): BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 150 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS): BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 151 BRAKE FRICTION PRODUCTS AFTERMARKET, BY VEHICLE TYPE, 2021-2024 (MILLION UNITS)

- TABLE 152 BRAKE FRICTION PRODUCTS AFTERMARKET, BY VEHICLE TYPE, 2025-2032 (MILLION UNITS)

- TABLE 153 BRAKE FRICTION PRODUCTS AFTERMARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 154 BRAKE FRICTION PRODUCTS AFTERMARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 155 PASSENGER CARS: BRAKE FRICTION PRODUCTS AFTERMARKET, BY TYPE, 2021-2024 (MILLION UNITS)

- TABLE 156 PASSENGER CARS: BRAKE FRICTION PRODUCTS AFTERMARKET, BY TYPE, 2025-2032 (MILLION UNITS)

- TABLE 157 PASSENGER CARS: BRAKE FRICTION PRODUCTS AFTERMARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 158 PASSENGER CARS: BRAKE FRICTION PRODUCTS AFTERMARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 159 LIGHT COMMERCIAL VEHICLES (LCVS): BRAKE FRICTION PRODUCTS AFTERMARKET, BY TYPE, 2021-2024 (MILLION UNITS)

- TABLE 160 LIGHT COMMERCIAL VEHICLES (LCVS): BRAKE FRICTION PRODUCTS AFTERMARKET, BY TYPE, 2025-2032 (MILLION UNITS)

- TABLE 161 LIGHT COMMERCIAL VEHICLES (LCVS): BRAKE FRICTION PRODUCTS AFTERMARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 162 LIGHT COMMERCIAL VEHICLES (LCVS): BRAKE FRICTION PRODUCTS AFTERMARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 163 HEAVY COMMERCIAL VEHICLES (HCVS): BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (MILLION UNITS)

- TABLE 164 HEAVY COMMERCIAL VEHICLES (HCVS): BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (MILLION UNITS)

- TABLE 165 HEAVY COMMERCIAL VEHICLES (HCVS): BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 166 HEAVY COMMERCIAL VEHICLES (HCVS): BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 167 BRAKE FRICTION PRODUCTS AFTERMARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 168 BRAKE FRICTION PRODUCTS AFTERMARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 169 BRAKE FRICTION PRODUCTS AFTERMARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 170 BRAKE FRICTION PRODUCTS AFTERMARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 171 ASIA PACIFIC: BRAKE FRICTION PRODUCTS AFTERMARKET, BY COUNTRY, 2021-2024 (MILLION UNITS)

- TABLE 172 ASIA PACIFIC: BRAKE FRICTION PRODUCTS AFTERMARKET, BY COUNTRY, 2025-2032 (MILLION UNITS)

- TABLE 173 ASIA PACIFIC: BRAKE FRICTION PRODUCTS AFTERMARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 174 ASIA PACIFIC: BRAKE FRICTION PRODUCTS AFTERMARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 175 MANUFACTURERS PROVIDING BRAKE PADS TO OEMS IN CHINA

- TABLE 176 MANUFACTURERS PROVIDING BRAKE LINERS TO OEMS IN CHINA

- TABLE 177 CHINA: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (MILLION UNITS)

- TABLE 178 CHINA: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (MILLION UNITS)

- TABLE 179 CHINA: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 180 CHINA: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 181 MANUFACTURERS PROVIDING DISC PADS TO OEMS IN JAPAN

- TABLE 182 MANUFACTURERS PROVIDING DISC BRAKE CALIPERS TO OEMS IN JAPAN

- TABLE 183 JAPAN: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (MILLION UNITS)

- TABLE 184 JAPAN: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (MILLION UNITS)

- TABLE 185 JAPAN: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 186 JAPAN: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 187 SOUTH KOREA: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (MILLION UNITS)

- TABLE 188 SOUTH KOREA: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (MILLION UNITS)

- TABLE 189 SOUTH KOREA: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 190 SOUTH KOREA: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 191 INDIA: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (MILLION UNITS)

- TABLE 192 INDIA: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (MILLION UNITS)

- TABLE 193 INDIA: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 194 INDIA: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 195 MANUFACTURERS PROVIDING DISC PADS TO OEMS IN EUROPE

- TABLE 196 MANUFACTURERS PROVIDING BRAKE LINERS TO OEMS IN EUROPE

- TABLE 197 EUROPE: BRAKE FRICTION PRODUCTS AFTERMARKET, BY COUNTRY, 2021-2024 (MILLION UNITS)

- TABLE 198 EUROPE: BRAKE FRICTION PRODUCTS AFTERMARKET, BY COUNTRY, 2025-2032 (MILLION UNITS)

- TABLE 199 EUROPE: BRAKE FRICTION PRODUCTS AFTERMARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 200 EUROPE: BRAKE FRICTION PRODUCTS AFTERMARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 201 GERMANY: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (MILLION UNITS)

- TABLE 202 GERMANY: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (MILLION UNITS)

- TABLE 203 GERMANY: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 204 GERMANY: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 205 FRANCE: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (MILLION UNITS)

- TABLE 206 FRANCE: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (MILLION UNITS)

- TABLE 207 FRANCE: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 208 FRANCE: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 209 UK: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (MILLION UNITS)

- TABLE 210 UK: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (MILLION UNITS)

- TABLE 211 UK: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 212 UK: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 213 SPAIN: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (MILLION UNITS)

- TABLE 214 SPAIN: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (MILLION UNITS)

- TABLE 215 SPAIN: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 216 SPAIN: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 217 MANUFACTURERS PROVIDING BRAKE PADS TO OEMS IN AMERICA

- TABLE 218 MANUFACTURERS PROVIDING BRAKE LINERS TO OEMS IN AMERICA

- TABLE 219 NORTH AMERICA: BRAKE FRICTION PRODUCTS AFTERMARKET, BY COUNTRY, 2021-2024 (MILLION UNITS)

- TABLE 220 NORTH AMERICA: BRAKE FRICTION PRODUCTS AFTERMARKET, BY COUNTRY, 2025-2032 (MILLION UNITS)

- TABLE 221 NORTH AMERICA: BRAKE FRICTION PRODUCTS AFTERMARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 222 NORTH AMERICA: BRAKE FRICTION PRODUCTS AFTERMARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 223 US: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (MILLION UNITS)

- TABLE 224 US: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (MILLION UNITS)

- TABLE 225 US: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 226 US: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 227 MEXICO: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (MILLION UNITS)

- TABLE 228 MEXICO: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (MILLION UNITS)

- TABLE 229 MEXICO: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 230 MEXICO: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 231 CANADA: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (MILLION UNITS)

- TABLE 232 CANADA: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (MILLION UNITS)

- TABLE 233 CANADA: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 234 CANADA: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 235 REST OF THE WORLD: BRAKE FRICTION PRODUCTS AFTERMARKET, BY COUNTRY, 2021-2024 (MILLION UNITS)

- TABLE 236 REST OF THE WORLD: BRAKE FRICTION PRODUCTS AFTERMARKET, BY COUNTRY, 2025-2032 (MILLION UNITS)

- TABLE 237 REST OF THE WORLD: BRAKE FRICTION PRODUCTS AFTERMARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 238 REST OF THE WORLD: BRAKE FRICTION PRODUCTS AFTERMARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 239 RUSSIA: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (MILLION UNITS)

- TABLE 240 RUSSIA: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (MILLION UNITS)

- TABLE 241 RUSSIA: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 242 RUSSIA: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 243 BRAZIL: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (MILLION UNITS)

- TABLE 244 BRAZIL: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (MILLION UNITS)

- TABLE 245 BRAZIL: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 246 BRAZIL: BRAKE FRICTION PRODUCTS AFTERMARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 247 OVERVIEW OF STRATEGIES DEPLOYED BY KEY COMPANIES

- TABLE 248 BRAKE FRICTION PRODUCTS MARKET SHARE ANALYSIS, 2024

- TABLE 249 BRAKE FRICTION PRODUCTS MARKET: REGION FOOTPRINT, 2024

- TABLE 250 BRAKE FRICTION PRODUCTS MARKET: PRODUCT FOOTPRINT, 2024

- TABLE 251 BRAKE FRICTION PRODUCTS MARKET: MATERIAL FOOTPRINT, 2024

- TABLE 252 BRAKE FRICTION PRODUCTS MARKET: VEHICLE TYPE FOOTPRINT, 2024

- TABLE 253 AFTERMARKET BRAKE FRICTION PRODUCTS MARKET: ELECTRIC VEHICLE TYPE FOOTPRINT, 2024

- TABLE 254 AFTERMARKET BRAKE FRICTION PRODUCTS MARKET: ICE VEHICLE TYPE FOOTPRINT, 2024

- TABLE 255 AFTERMARKET BRAKE FRICTION PRODUCTS MARKET: BRAKE FRICTION PRODUCTS TYPE FOOTPRINT, 2024

- TABLE 256 SUPPLIER ANALYSIS: BRAKE PAD MANUFACTURERS TO OEMS, 2022-2025

- TABLE 257 SUPPLIER ANALYSIS: BRAKE ROTOR MANUFACTURERS TO OEMS, 2022-2025

- TABLE 258 SUPPLIER ANALYSIS: BRAKE DRUM MANUFACTURERS TO OEMS, 2022-2025

- TABLE 259 BRAKE FRICTION PRODUCTS MARKET: PRODUCT LAUNCHES, JUNE 2021-APRIL 2025

- TABLE 260 BRAKE FRICTION PRODUCTS MARKET: DEALS, JUNE 2021-APRIL 2025

- TABLE 261 BRAKE FRICTION PRODUCTS MARKET: EXPANSIONS, JUNE 2021-APRIL 2025

- TABLE 262 BRAKE FRICTION PRODUCTS MARKET: OTHER DEVELOPMENTS, JUNE 2021-APRIL 2025

- TABLE 263 AISIN CORPORATION: COMPANY OVERVIEW

- TABLE 264 AISIN CORPORATION: PRODUCTS OFFERED

- TABLE 265 AISIN CORPORATION: PRODUCT LAUNCHES

- TABLE 266 ASINI CORPORATION: DEALS

- TABLE 267 AISIN CORPORATION: OTHER DEVELOPMENTS

- TABLE 268 ZF FRIEDRICHSHAFEN AG: COMPANY OVERVIEW

- TABLE 269 ZF FRIEDRICHSHAFEN AG: PRODUCTS OFFERED

- TABLE 270 ZF FRIEDRICHSHAFEN AG: PRODUCT LAUNCHES

- TABLE 271 ZF FRIEDRICHSHAFEN AG: DEALS

- TABLE 272 ZF FRIEDRICHSHAFEN AG: OTHER DEVELOPMENTS

- TABLE 273 BREMBO S.P.A: COMPANY OVERVIEW

- TABLE 274 BREMBO S.P.A: PRODUCTS OFFERED

- TABLE 275 BREMBO S.P.A: PRODUCT LAUNCHES

- TABLE 276 BREMBO S.P.A: DEALS

- TABLE 277 BREMBO S.P.A.: EXPANSIONS

- TABLE 278 BREMBO S.P.A.: OTHER DEVELOPMENTS

- TABLE 279 TENNECO INC.: COMPANY OVERVIEW

- TABLE 280 TENNECO INC.: PRODUCTS OFFERED

- TABLE 281 TENNECO INC.: PRODUCT LAUNCHES

- TABLE 282 TENNECO INC.: DEALS

- TABLE 283 NISSHINBO HOLDINGS INC.: COMPANY OVERVIEW

- TABLE 284 NISSHINBO HOLDINGS INC.: PRODUCTS OFFERED

- TABLE 285 NISSHINBO HOLDINGS INC.: PRODUCT LAUNCHES

- TABLE 286 NISSHINBO HOLDINGS INC.: DEALS

- TABLE 287 NISSHINBO HOLDINGS INC.: OTHER DEVELOPMENTS

- TABLE 288 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 289 ROBERT BOSCH GMBH: PRODUCTS OFFERED

- TABLE 290 ROBERT BOSCH GMBH: PRODUCT LAUNCHES

- TABLE 291 ROBERT BOSCH GMBH: DEALS

- TABLE 292 ROBERT BOSCH GMBH: EXPANSIONS

- TABLE 293 AKEBONO BRAKE INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 294 AKEBONO BRAKE INDUSTRY CO., LTD.: PRODUCTS OFFERED

- TABLE 295 AKEBONO BRAKE INDUSTRY CO., LTD.: PRODUCT LAUNCHES

- TABLE 296 AKEBONO BRAKE INDUSTRY CO., LTD.: DEALS

- TABLE 297 AKEBONO BRAKE INDUSTRY CO., LTD.: OTHER DEVELOPMENTS

- TABLE 298 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 299 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 300 CONTINENTAL AG: PRODUCT LAUNCHES

- TABLE 301 CONTINENTAL AG: DEALS

- TABLE 302 CONTINENTAL AG: EXPANSIONS

- TABLE 303 ITT INC.: COMPANY OVERVIEW

- TABLE 304 ITT INC.: PRODUCTS OFFERED

- TABLE 305 ITT INC.: PRODUCT LAUNCHES

- TABLE 306 ITT INC.: DEALS

- TABLE 307 ITT INC.: EXPANSIONS

- TABLE 308 ITT INC.: OTHER DEVELOPMENTS

- TABLE 309 MIBA AG: COMPANY OVERVIEW

- TABLE 310 MIBA AG: PRODUCTS OFFERED

- TABLE 311 MIBA AG: EXPANSIONS

- TABLE 312 SGL CARBON: BUSINESS OVERVIEW

- TABLE 313 SGL CARBON: PRODUCTS OFFERED

- TABLE 314 SGL CARBON: EXPANSIONS

- TABLE 315 CUMMINS INC.: COMPANY OVERVIEW

- TABLE 316 CUMMINS INC.: PRODUCTS OFFERED

- TABLE 317 CUMMINS INC.: PRODUCT LAUNCHES

- TABLE 318 CUMMINS INC.: DEALS

- TABLE 319 CUMMINS INC.: OTHER DEVELOPMENTS

- TABLE 320 HELLA GMBH & CO. KGAA: COMPANY OVERVIEW

- TABLE 321 FTE AUTOMOTIVE: COMPANY OVERVIEW

- TABLE 322 WUHAN YOUFIN AUTO PARTS CO., LTD.: COMPANY OVERVIEW

- TABLE 323 EBC BRAKES: COMPANY OVERVIEW

- TABLE 324 HITACHI ASTEMO LTD.: COMPANY OVERVIEW

- TABLE 325 HALDEX: COMPANY OVERVIEW

- TABLE 326 CARDONE INDUSTRIES: COMPANY OVERVIEW

- TABLE 327 GMP FRICTION PRODUCTS: COMPANY OVERVIEW

- TABLE 328 DELPHI TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 329 DURAGO: COMPANY OVERVIEW

- TABLE 330 RAYBESTOS: COMPANY OVERVIEW

- TABLE 331 POWERSTOP LLC: COMPANY OVERVIEW

- TABLE 332 CARLISLE BRAKE & FRICTION: COMPANY OVERVIEW

- TABLE 333 MAT HOLDING, INC.: COMPANY OVERVIEW

- TABLE 334 POWERTECH AUTO PARTS CO. LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 BRAKE FRICTION PRODUCTS MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 BRAKE FRICTION PRODUCTS MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH METHODOLOGY MODEL

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 6 BOTTOM-UP APPROACH: BRAKE FRICTION PRODUCTS OE MARKET

- FIGURE 7 BOTTOM-UP APPROACH: BRAKE FRICTION PRODUCTS AFTERMARKET

- FIGURE 8 BOTTOM-UP APPROACH: OFF-HIGHWAY BRAKE FRICTION PRODUCTS MARKET

- FIGURE 9 TOP-DOWN APPROACH: BRAKE DISCS OE MARKET, BY MATERIAL TYPE

- FIGURE 10 DATA TRIANGULATION

- FIGURE 11 BRAKE FRICTION PRODUCTS: MARKET OUTLOOK

- FIGURE 12 BRAKE FRICTION PRODUCTS MARKET, BY REGION, 2025-2032 (USD MILLION)

- FIGURE 13 RISING AVERAGE MILES DRIVEN AND STOPPING DISTANCE REGULATIONS TO DRIVE MARKET

- FIGURE 14 BRAKE DISCS SEGMENT TO LEAD MARKET, BY VALUE, IN 2025

- FIGURE 15 PASSENGER CARS TO HOLD DOMINANT POSITION, BY VALUE, IN 2025

- FIGURE 16 MOLDED BRAKE LINERS TO BE MAJOR SEGMENT BY 2032

- FIGURE 17 COMPOSITE BRAKE DISCS TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 18 CONSTRUCTION EQUIPMENT TO COMMAND MARKET, BY VALUE, IN 2025

- FIGURE 19 BEV TO DOMINATE MARKET, BY VALUE, IN 2025

- FIGURE 20 ASIA PACIFIC TO DOMINATE BRAKE FRICTION PRODUCTS MARKET

- FIGURE 21 NORTH AMERICA TO BE LARGEST AFTERMARKET FOR BRAKE FRICTION PRODUCTS, BY VALUE, IN 2025

- FIGURE 22 BRAKE FRICTION PRODUCTS MARKET: MARKET DYNAMICS

- FIGURE 23 TOTAL VEHICLE PARC, BY KEY COUNTRY, 2019 VS. 2023 VS. 2028 (THOUSAND UNITS)

- FIGURE 24 PASSENGER CAR PRODUCTION, BY COUNTRY, 2021-2032 (THOUSAND UNITS)

- FIGURE 25 US: COMPARISON OF STOPPING DISTANCES AT 65 MPH FOR PASSENGER CARS AND TRUCKS

- FIGURE 26 TOTAL STOPPING DISTANCES FOR PASSENGER CARS AND TRUCKS

- FIGURE 27 EFFECT OF EBD

- FIGURE 28 OFF-HIGHWAY VEHICLE SALES, BY COUNTRY, 2021 VS. 2025 VS 2032 (000 UNITS)

- FIGURE 29 REPLACEMENT LIFE OF BRAKE DISCS, BY MATERIAL, 2024 (KILOMETERS)

- FIGURE 30 WEIGHT OF BRAKE DISCS, BY MATERIAL (LBS.)

- FIGURE 31 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 32 PASSENGER CARS: AVERAGE SELLING PRICE TREND, BY TYPE OF BRAKE FRICTION PRODUCT, 2020-2024

- FIGURE 33 LIGHT COMMERCIAL VEHICLES: AVERAGE SELLING PRICE TREND, BY TYPE OF BRAKE FRICTION PRODUCT, 2020-2024

- FIGURE 34 HEAVY COMMERCIAL VEHICLES: AVERAGE SELLING PRICE TREND, BY TYPE OF BRAKE FRICTION PRODUCT, 2020-2024

- FIGURE 35 AVERAGE SELLING PRICE TREND OF BRAKE SHIMS, BY VEHICLE TYPE, 2020-2024

- FIGURE 36 VALUE CHAIN ANALYSIS: BRAKE FRICTION PRODUCTS MARKET

- FIGURE 37 BRAKE FRICTION PRODUCTS MARKET ECOSYSTEM

- FIGURE 38 INVESTMENT SCENARIO

- FIGURE 39 PATENT ANALYSIS, 2015-2025

- FIGURE 40 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR BRAKE FRICTION PRODUCTS, BY PRODUCT TYPE

- FIGURE 41 KEY BUYING CRITERIA OF BRAKE FRICTION PRODUCTS FOR DISC BRAKES AND DRUM BRAKES

- FIGURE 42 BRAKE FRICTION PRODUCTS MARKET, BY TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 43 BRAKE LINERS MARKET, BY TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 44 BRAKE DISCS MARKET, BY MATERIAL TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 45 BRAKE FRICTION PRODUCTS MARKET, BY VEHICLE TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 46 OFF-HIGHWAY EQUIPMENT BRAKE FRICTION PRODUCTS MARKET, BY APPLICATION, 2025 VS. 2032 (USD MILLION)

- FIGURE 47 ELECTRIC VEHICLE BRAKE FRICTION PRODUCTS MARKET, BY VEHICLE TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 48 BRAKE FRICTION PRODUCTS AFTERMARKET, BY VEHICLE TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 49 BRAKE FRICTION PRODUCTS AFTERMARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 50 ASIA PACIFIC: BRAKE FRICTION PRODUCTS AFTERMARKET SNAPSHOT

- FIGURE 51 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 52 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 53 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 54 ASIA PACIFIC: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2024

- FIGURE 55 EUROPE: BRAKE FRICTION PRODUCTS AFTERMARKET, BY COUNTRY (USD MILLION)

- FIGURE 56 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 57 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 58 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 59 EUROPE: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2024

- FIGURE 60 NORTH AMERICA: BRAKE FRICTION PRODUCTS AFTERMARKET SNAPSHOT

- FIGURE 61 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 62 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 63 NORTH AMERICA: CPI INFLATION RATE, BY COUNTRY, 2024-2026

- FIGURE 64 NORTH AMERICA: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2024

- FIGURE 65 REST OF THE WORLD: BRAKE FRICTION PRODUCTS AFTERMARKET, BY COUNTRY, 2025 VS. 2032 (USD MILLION)

- FIGURE 66 ROW: REAL GDP ANNUAL PERCENTAGE CHANGE, 2024-2026

- FIGURE 67 ROW: GDP PER CAPITA, 2024-2026

- FIGURE 68 ROW: AVERAGE CPI INFLATION RATE, 2024-2026

- FIGURE 69 ROW: MANUFACTURING INDUSTRY VALUE (AS PART OF GDP 2024)

- FIGURE 70 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2021-2024

- FIGURE 71 BRAKE FRICTION PRODUCTS MARKET SHARE ANALYSIS, 2024

- FIGURE 72 COMPANY VALUATION, 2025 (USD BILLION)

- FIGURE 73 COMPANY FINANCIAL METRICS, 2025 (USD BILLION)

- FIGURE 74 BRAKE FRICTION PRODUCTS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 75 BRAKE FRICTION PRODUCTS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 76 BRAKE FRICTION PRODUCTS MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 77 BRAKE FRICTION PRODUCTS MARKET: COMPANY EVALUATION MATRIX (AFTERMARKET PLAYERS), 2024

- FIGURE 78 BRAKE FRICTION PRODUCTS MARKET, AFTERMARKET KEY PLAYERS, 2024

- FIGURE 79 AISIN CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 80 ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT (2024)

- FIGURE 81 BREMBO S.P.A.: COMPANY SNAPSHOT (2024)

- FIGURE 82 NISSHINBO HOLDINGS INC.: COMPANY SNAPSHOT (2023)

- FIGURE 83 ROBERT BOSCH GMBH: COMPANY SNAPSHOT (2024)

- FIGURE 84 AKEBONO BRAKE INDUSTRY CO., LTD.: COMPANY SNAPSHOT (2023)

- FIGURE 85 CONTINENTAL AG: COMPANY SNAPSHOT (2024)

- FIGURE 86 ITT INC.: COMPANY SNAPSHOT (2024)

- FIGURE 87 MIBA AG: COMPANY SNAPSHOT (2024)

- FIGURE 88 SGL CARBON: COMPANY SNAPSHOT (2024)

- FIGURE 89 CUMMINS INC.: COMPANY SNAPSHOT (2024)

The global brake friction products market is projected to reach USD 15.52 billion in 2032 from USD 13.32 billion in 2025, at a CAGR of 2.2% from 2025 to 2032. The growing penetration of EVs in China, the US, India, and Europe will drive the brake friction products market in the coming years. Additionally, the trucks and bus segment will contribute significantly to market demand, as an increase in miles driven by these vehicles increases the need for high-quality brake friction products. The aftermarket segment is also anticipated to be vital in driving demand for brake friction products. Demand for brake friction materials is predicted to rise due to increased vehicle production and demand for disc brakes in passenger automobiles. Furthermore, the rising usage of lightweight components has raised the demand for high-quality brake friction solutions and materials.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Volume, Value (USD Million/Billion) |

| Segments | Product Type, Vehicle Type, Liner Type, Material Type, Off-Highway Market, Application and Disc Type, Electric Vehicle Brake Friction OE Market, Vehicle Type, Aftermarket By-Products, Vehicle Type, and Region. |

| Regions covered | Asia Pacific, Europe, North America, and the Rest of the World |

"Increasing vehicle parc & vehicle miles traveled to boost the aftermarket."

The brake friction market relies on aftermarket sales due to the wear and tear of products that require periodic replacement. Growth is linked to the rising global vehicle population and increased average mileage, particularly in Europe, which rose from 10,000 miles in 2015 to nearly 14,000 in 2020. As a result, brake systems are under more stress, necessitating replacements, ideally every 30,000 to 70,000 miles. In the EU, disc brakes are standard in new passenger cars and heavy commercial vehicles due to strict regulations, a trend echoed in Asia. The surge in e-commerce also demands better braking for trucks. According to the OICA, global vehicle sales increased from 82.9 million in 2022 to 95.3 million in 2024, boosting the global passenger car population and driving demand for brake products.

"Battery Electric Vehicles (BEV) are expected to be the largest & fastest-growing market for brake friction products during the forecast period."

BEVs have seen remarkable growth over the past five years, with sales reaching nearly 10.8 million units in 2024, up from 9.5 million in 2023. China leads the market, accounting for 60% of global BEV sales, followed by Europe and North America. Eco-friendly models are common in China and India, often featuring two-disc and two-drum braking systems. However, there is a shift toward all-disc systems in the mid-range segment due to rising demand for SUVs and premium vehicles. Regenerative braking technology is crucial, as it improves energy efficiency by converting kinetic energy into stored energy when braking. This reduces wear on traditional brake components and influences demand. Key trends include using ceramic and composite materials, sensor integration for predictive maintenance, and creating quieter, longer-lasting braking solutions.

"Europe is expected to have a significant market share in the brake friction products market during the forecast period."

Europe is home to developed countries like Germany, the UK, Spain, and France, which lead in automotive safety standards and technology. Over 95% of passenger cars are equipped with all four-disc brakes, while light commercial vehicles (LCVs) have about 65-70% of the same. The EU's General Safety Regulation mandates advanced braking systems, such as Anti-lock Braking System (ABS) and Electronic Stability Control (ESC), for heavy-duty vehicles. The recent Euro 7 regulations also impose strict limits on brake dust emissions, requiring manufacturers to create advanced friction materials and coated rotors to reduce PM10 emissions to 7 mg/km by 2026 and 3 mg/km by 2035.

Countries like Germany, the UK, and France dominate the European automotive industry, led by major OEMs such as BMW, Daimler, and Volkswagen. With the rising focus on safety, there's an increasing demand for high-performance brake friction products. This shift and the move toward electric vehicles (EVs) drive the need for lightweight and energy-efficient braking solutions.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: Brake friction products manufacturers - 100%

- By Designation: Directors - 30%, Managers - 50%, and Others - 20%

- By Region: Asia Pacific - 70%, North America - 20%, Europe - 10%

The brake friction products market is dominated by major players, including Aisin Corporation (Japan), Brembo (Italy), Nisshinbo Holdings Inc. (Japan), and Tenneco (US). These companies are expanding their operations to strengthen their market positions.

Research Coverage:

The report covers the brake friction products market in terms of product type (brake disc, brake pads, drum brake, brake shoe, brake liner), liner type (molded, woven), material (metallic disc, composite disc, ceramic brake disc), vehicle type (passenger car, light commercial vehicle, trucks, buses), off-highway brake friction products (agriculture tractors, construction equipment), electric vehicle brake friction products (BEV & PHEV), brake friction products aftermarket (passenger cars, LCVs, and HCVs) and region. It covers the competitive landscape and company profiles of the significant brake friction products market ecosystem players.

The study also includes an in-depth competitive analysis of the key market players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders and new entrants with information on the closest approximations of revenue numbers for the overall brake friction products market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights, enabling them to position their businesses better and plan suitable go-to-market strategies.

- The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

- The report also helps stakeholders understand the product market's current and future pricing trends.

The report provides insight into the following pointers:

- Analysis of critical drivers (Increasing vehicle parc & vehicle miles traveled to boost the aftermarket, increase in vehicle production will fuel the demand for brake friction OE market, growing use of brakes due to traffic congestion to increase the demand for replacement units), restraints (improving the life of brake friction products to influence the demand for replacement units), opportunities (use of lightweight materials in brake friction products, eco-friendly, and non-toxic brake friction products to be new avenues of growth for brake manufacturers), and challenges (government regulations related to alloy composition of brake friction products, counterfeit brake friction products in the aftermarket).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the brake friction products market.

- Market Development: Comprehensive information about lucrative markets-the report analyzes the brake friction products market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the brake friction products market.

- Competitive Assessment: In-depth assessment of market share, growth strategies, and service offerings of leading players in the brake friction products market, such as Robert Bosch GmbH (Germany), Aisin Corporation (Japan), Brembo (Italy), and Tenneco (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 SUMMARY OF CHANGES

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Sampling techniques & data collection methods

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FACTOR ANALYSIS

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK & IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN EV BRAKE FRICTION PRODUCTS MARKET

- 4.2 BRAKE FRICTION PRODUCTS MARKET, BY TYPE

- 4.3 BRAKE FRICTION PRODUCTS AFTERMARKET, BY VEHICLE TYPE

- 4.4 BRAKE LINERS MARKET, BY TYPE

- 4.5 BRAKE DISCS MARKET, BY MATERIAL

- 4.6 OFF-HIGHWAY EQUIPMENT BRAKE FRICTION PRODUCTS MARKET, BY APPLICATION

- 4.7 ELECTRIC VEHICLE BRAKE FRICTION PRODUCTS MARKET, BY VEHICLE TYPE

- 4.8 BRAKE FRICTION PRODUCTS MARKET, BY REGION

- 4.9 BRAKE FRICTION PRODUCTS AFTERMARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing vehicle parc & vehicle miles traveled to boost aftermarket sales

- 5.2.1.2 Rising vehicle production to fuel demand for OE brake friction products

- 5.2.1.2.1 Growing demand for passenger cars and commercial vehicles

- 5.2.1.2.2 Stopping distance for light and heavy-duty vehicles

- 5.2.1.2.3 Enhanced vehicle safety with ABS and EBD

- 5.2.1.3 Increasing demand for construction equipment and off-highway vehicles

- 5.2.1.4 Brake wear and tears due to traffic congestion to increase demand for replacements

- 5.2.2 RESTRAINTS

- 5.2.2.1 Increased life of brake friction products to affect demand for replacements

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Use of lightweight materials in brake friction products

- 5.2.3.1.1 Composite brake disc provides weight reduction by 20%

- 5.2.3.2 Eco-friendly and non-toxic brake friction products

- 5.2.3.3 Development of products to meet Euro 7 regulations

- 5.2.3.1 Use of lightweight materials in brake friction products

- 5.2.4 CHALLENGES

- 5.2.4.1 Government regulations related to alloy composition of brake friction products

- 5.2.4.2 Counterfeit brake friction products in aftermarket

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 PASSENGER CARS: AVERAGE SELLING PRICE TREND, BY TYPE OF BRAKE FRICTION PRODUCT

- 5.4.2 LIGHT COMMERCIAL VEHICLES: AVERAGE SELLING PRICE TREND, BY TYPE OF BRAKE FRICTION PRODUCT

- 5.4.3 HEAVY COMMERCIAL VEHICLES: AVERAGE SELLING PRICE TREND, BY TYPE OF BRAKE FRICTION PRODUCT

- 5.4.4 AVERAGE SELLING PRICE TREND OF BRAKE SHIMS, BY VEHICLE TYPE

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 BRAKE FRICTION PRODUCTS MARKET ECOSYSTEM

- 5.7 INVESTMENT SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Front electric park brake (EPB)

- 5.8.1.2 Lightweight rotor brakes

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Brake-by-wire technology

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Copper-free XTRA brake pads

- 5.8.3.2 WECODUR

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO, 2020-2024

- 5.10.2 EXPORT DATA, 2020-2024

- 5.11 KEY CONFERENCES AND EVENTS IN 2025-2026

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 CASE STUDY 1: BREMBO ADOPTS MODEL-BASED SYSTEMS ENGINEERING TO DESIGN ACTUATORS

- 5.12.2 CASE STUDY 2: HYUNDAI I30 IMPLEMENTS HIGH-PERFORMANCE BRAKING

- 5.12.3 CASE STUDY 3: APEC AUTOMOTIVE DIAGNOSES PREMATURE WEAR OF OUTER BRAKE PADS

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 BRAKE FRICTION STANDARDS

- 5.13.2 VEHICLE SAFETY STANDARDS

- 5.13.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3.1 North America

- 5.13.3.2 Europe

- 5.13.3.3 Asia Pacific

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 CRITICAL STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

6 BRAKE FRICTION PRODUCTS MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 BRAKE DISCS

- 6.2.1 INCREASINGLY STRINGENT SAFETY NORMS TO DRIVE MARKET

- 6.3 BRAKE PADS

- 6.3.1 INCREASING DEMAND FOR SAFETY, PERFORMANCE, AND CONTROL TO DRIVE MARKET

- 6.4 BRAKE DRUMS

- 6.4.1 RISING SALES OF COMMERCIAL VEHICLES TO DRIVE MARKET

- 6.5 BRAKE SHOES

- 6.5.1 RISING SALES OF HCVS TO PROPEL MARKET

- 6.6 BRAKE LINERS

- 6.6.1 ADVANCEMENTS IN BRAKE LINER MATERIAL TO PROPEL MARKET

- 6.7 BRAKE SHIMS

- 6.7.1 NEED FOR REDUCING NVH LEVELS IN VEHICLES WHILE BRAKING TO DRIVE MARKET

- 6.7.2 BRAKE SHIMS MARKET FOR KEY COUNTRIES

- 6.8 INDUSTRY INSIGHTS

7 BRAKE LINERS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 MOLDED BRAKE LINERS

- 7.2.1 RISING USE OF NATURAL ASBESTOS FIBERS IN MOLDED BRAKE LINERS TO DRIVE MARKET

- 7.3 WOVEN BRAKE LINERS

- 7.3.1 RISING PRODUCTION OF HCVS TO PROPEL MARKET GROWTH

- 7.4 INDUSTRY INSIGHTS

8 BRAKE DISCS MARKET, BY MATERIAL

- 8.1 INTRODUCTION

- 8.2 METALLIC DISCS

- 8.2.1 LOW COST AND THERMAL STABILITY TO DRIVE MARKET

- 8.3 COMPOSITE DISCS

- 8.3.1 INCREASING DEMAND FOR MID-SEGMENT CARS TO DRIVE MARKET

- 8.4 CERAMIC DISCS

- 8.4.1 GROWING USE OF CERAMIC DISCS IN SPORTS CARS AND SUPERCARS TO DRIVE MARKET

- 8.5 INDUSTRY INSIGHTS

9 BRAKE FRICTION PRODUCTS MARKET, BY VEHICLE TYPE

- 9.1 INTRODUCTION

- 9.2 PASSENGER CARS

- 9.2.1 INCREASING SHIFT TOWARD SAFETY STANDARDS TO DRIVE MARKET

- 9.3 LIGHT COMMERCIAL VEHICLES (LCVS)

- 9.3.1 GROWING E-COMMERCE AND LOGISTICS INDUSTRIES TO DRIVE MARKET

- 9.4 TRUCKS

- 9.4.1 INCREASING REGULATIONS AND MANDATES TO DRIVE MARKET

- 9.5 BUSES

- 9.5.1 GROWING FOCUS ON ADVANCED EMERGENCY BRAKING SYSTEMS TO DRIVE MARKET

- 9.6 INDUSTRY INSIGHTS

10 OFF-HIGHWAY EQUIPMENT BRAKE FRICTION PRODUCTS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 AGRICULTURE TRACTORS

- 10.2.1 DRY BRAKE DISCS

- 10.2.1.1 Higher preference for lower HP tractors to drive market

- 10.2.2 WET BRAKE DISCS

- 10.2.2.1 Stringent safety regulations to drive market

- 10.2.1 DRY BRAKE DISCS

- 10.3 CONSTRUCTION EQUIPMENT

- 10.3.1 DRY BRAKE DISCS

- 10.3.1.1 Low cost and maintenance to drive market

- 10.3.2 WET BRAKE DISCS

- 10.3.2.1 Higher durability and non-exposure to contaminators to drive market

- 10.3.1 DRY BRAKE DISCS

- 10.4 INDUSTRY INSIGHTS

11 ELECTRIC VEHICLE BRAKE FRICTION PRODUCTS MARKET, BY VEHICLE TYPE

- 11.1 INTRODUCTION

- 11.2 BATTERY ELECTRIC VEHICLES (BEVS)

- 11.2.1 NEED TO ADHERE TO EMISSION STANDARDS TO DRIVE MARKET

- 11.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

- 11.3.1 GOVERNMENT SUBSIDIES AND TAX EXEMPTIONS TO DRIVE MARKET

- 11.4 INDUSTRY INSIGHTS

12 BRAKE FRICTION PRODUCTS AFTERMARKET, BY VEHICLE TYPE & PRODUCT TYPE

- 12.1 INTRODUCTION

- 12.2 PASSENGER CARS

- 12.2.1 INCREASING BRAKE PAD REPLACEMENTS TO DRIVE MARKET

- 12.3 LIGHT COMMERCIAL VEHICLES (LCVS)

- 12.3.1 RISE IN SALES OF PICKUP TRUCKS AND FAVORABLE INFRASTRUCTURE PROJECTS TO DRIVE MARKET

- 12.4 HEAVY COMMERCIAL VEHICLES (HCVS)

- 12.4.1 GROWING PUBLIC AND URBAN TRANSPORTATION TO DRIVE MARKET

- 12.5 INDUSTRY INSIGHTS

13 BRAKE FRICTION PRODUCTS AFTERMARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 ASIA PACIFIC

- 13.2.1 MACROECONOMIC OUTLOOK

- 13.2.2 CHINA

- 13.2.2.1 Emission norms and regulations regarding stopping distance to drive market

- 13.2.3 JAPAN

- 13.2.3.1 Increase in sales of passenger cars and LCVs to support market growth

- 13.2.4 SOUTH KOREA

- 13.2.4.1 Increasing average miles driven owing to improved life span of vehicles to drive market

- 13.2.5 INDIA

- 13.2.5.1 Increase in vehicle parc and average miles driven to drive market

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK

- 13.3.2 GERMANY

- 13.3.2.1 Increasing penetration of disc brakes in HCVs to boost market

- 13.3.3 FRANCE

- 13.3.3.1 Increasing penetration of disc brakes to drive market

- 13.3.4 UK

- 13.3.4.1 Increasing adoption of disc brakes in LCVs and HCVs to drive market

- 13.3.5 SPAIN

- 13.3.5.1 Advancements in brake systems to contribute to market growth

- 13.4 NORTH AMERICA

- 13.4.1 MACROECONOMIC OUTLOOK

- 13.4.2 US

- 13.4.2.1 Regulations to reduce stopping distance in commercial vehicles to propel market

- 13.4.3 MEXICO

- 13.4.3.1 Demand for asbestos-free brake pads to spur market growth

- 13.4.4 CANADA

- 13.4.4.1 OE-recommended replacement miles for friction products to drive the market

- 13.5 REST OF THE WORLD

- 13.5.1 MACROECONOMIC OUTLOOK

- 13.5.2 RUSSIA

- 13.5.2.1 Increasing adoption of disc brakes in LCVs to drive market

- 13.5.3 BRAZIL

- 13.5.3.1 Numerous OES and IAM players to drive market

- 13.6 INDUSTRY INSIGHTS

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 14.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN BRAKE FRICTION PRODUCTS MARKET

- 14.3 REVENUE ANALYSIS, 2021-2024

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 COMPANY VALUATION

- 14.6 FINANCIAL METRICS, 2025

- 14.7 BRAND/PRODUCT COMPARISON

- 14.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.8.1 STARS

- 14.8.2 EMERGING LEADERS

- 14.8.3 PERVASIVE PLAYERS

- 14.8.4 PARTICIPANTS

- 14.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.8.5.1 Company footprint

- 14.8.5.2 Region footprint

- 14.8.5.3 Product footprint

- 14.8.5.4 Material footprint

- 14.8.5.5 Vehicle type footprint

- 14.9 COMPANY EVALUATION MATRIX: AFTERMARKET PLAYERS, 2024

- 14.9.1 STARS

- 14.9.2 EMERGING LEADERS

- 14.9.3 PERVASIVE PLAYERS

- 14.9.4 PARTICIPANTS

- 14.9.5 COMPANY FOOTPRINT: AFTERMARKET PLAYERS, 2024

- 14.9.5.1 Company footprint

- 14.9.5.2 Electric vehicle type footprint

- 14.9.5.3 ICE vehicle type footprint

- 14.9.5.4 Brake friction product type footprint

- 14.10 SUPPLIER ANALYSIS

- 14.10.1 BRAKE PAD SUPPLIERS TO AUTOMAKERS

- 14.10.2 BRAKE ROTOR SUPPLIERS TO AUTOMAKERS

- 14.10.3 BRAKE DRUM SUPPLIERS TO AUTOMAKERS

- 14.11 COMPETITIVE SCENARIO

- 14.11.1 PRODUCT LAUNCHES

- 14.11.2 DEALS

- 14.11.3 EXPANSIONS

- 14.11.4 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 AISIN CORPORATION

- 15.1.1.1 Business overview

- 15.1.1.2 Products offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches

- 15.1.1.3.2 Deals

- 15.1.1.3.3 Other developments

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses & competitive threats

- 15.1.2 ZF FRIEDRICHSHAFEN AG

- 15.1.2.1 Business overview

- 15.1.2.2 Products offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.3.2 Deals

- 15.1.2.3.3 Other developments

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses & competitive threats

- 15.1.3 BREMBO S.P.A

- 15.1.3.1 Business overview

- 15.1.3.2 Products offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product launches

- 15.1.3.3.2 Deals

- 15.1.3.3.3 Expansions

- 15.1.3.3.4 Other developments

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses & competitive threats

- 15.1.4 TENNECO INC.

- 15.1.4.1 Business overview

- 15.1.4.2 Products offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product launches

- 15.1.4.3.2 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses & competitive threats

- 15.1.5 NISSHINBO HOLDINGS INC.

- 15.1.5.1 Business overview

- 15.1.5.2 Products offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product launches

- 15.1.5.3.2 Deals

- 15.1.5.3.3 Other developments

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses & competitive threats

- 15.1.6 ROBERT BOSCH GMBH

- 15.1.6.1 Business overview

- 15.1.6.2 Products offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Product launches

- 15.1.6.3.2 Deals

- 15.1.6.3.3 Expansions

- 15.1.6.4 MnM view

- 15.1.6.4.1 Key strengths

- 15.1.6.4.2 Strategic choices

- 15.1.6.4.3 Weaknesses & competitive threats

- 15.1.7 AKEBONO BRAKE INDUSTRY CO., LTD.

- 15.1.7.1 Business overview

- 15.1.7.2 Products offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches

- 15.1.7.3.2 Deals

- 15.1.7.3.3 Other developments

- 15.1.8 CONTINENTAL AG

- 15.1.8.1 Business overview

- 15.1.8.2 Products offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Product launches

- 15.1.8.3.2 Deals

- 15.1.8.3.3 Expansions

- 15.1.9 ITT INC.

- 15.1.9.1 Business overview

- 15.1.9.2 Products offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Product launches

- 15.1.9.3.2 Deals

- 15.1.9.3.3 Expansions

- 15.1.9.3.4 Other developments

- 15.1.10 MIBA AG

- 15.1.10.1 Business overview

- 15.1.10.2 Products offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Expansions

- 15.1.11 SGL CARBON

- 15.1.11.1 Business overview

- 15.1.11.2 Products offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Expansions

- 15.1.12 CUMMINS INC.

- 15.1.12.1 Business overview

- 15.1.12.2 Products offered

- 15.1.12.3 Recent developments

- 15.1.12.3.1 Product launches

- 15.1.12.3.2 Deals

- 15.1.12.3.3 Other developments

- 15.1.1 AISIN CORPORATION

- 15.2 ADDITIONAL PLAYERS

- 15.2.1 HELLA GMBH & CO. KGAA

- 15.2.2 FTE AUTOMOTIVE

- 15.2.3 WUHAN YOUFIN AUTO PARTS CO., LTD.

- 15.2.4 EBC BRAKES

- 15.2.5 HITACHI ASTEMO LTD.

- 15.2.6 HALDEX

- 15.2.7 CARDONE INDUSTRIES

- 15.2.8 GMP FRICTION PRODUCTS

- 15.2.9 DELPHI TECHNOLOGIES

- 15.2.10 DURAGO

- 15.3 AFTERMARKET BRAKE SHIM MANUFACTURERS

- 15.3.1 RAYBESTOS

- 15.3.2 POWERSTOP LLC

- 15.3.3 CARLISLE BRAKE & FRICTION

- 15.3.4 MAT HOLDING, INC.

- 15.3.5 POWERTECH AUTO PARTS CO. LTD.

16 MARKETSANDMARKETS' RECOMMENDATIONS

- 16.1 GROWTH POTENTIAL IN ASIA PACIFIC FOR BRAKE FRICTION PRODUCTS

- 16.2 GROWING FOCUSING ON DISC BRAKES

- 16.3 GROWING DEMAND FOR HYDRAULIC WET BRAKES IN AGRICULTURAL TRACTORS

- 16.4 GROWING DEMAND FOR COMPOSITE DISC BRAKES IN PREMIUM CARS

- 16.5 CONCLUSION

17 APPENDIX

- 17.1 INSIGHTS FROM INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.4 CUSTOMIZATION OPTIONS

- 17.4.1 OFF-HIGHWAY BRAKE FRICTION PRODUCTS MARKET, BY PRODUCT TYPE (COUNTRY LEVEL)

- 17.4.1.1 Construction equipment: Brake friction products market

- 17.4.1.1.1 Brake discs

- 17.4.1.1.2 Brake pads

- 17.4.1.1.3 Brake drums

- 17.4.1.1.4 Brake shoes

- 17.4.1.1.5 Brake liners

- 17.4.1.2 Agricultural tractors: Brake friction products market

- 17.4.1.2.1 Brake discs

- 17.4.1.2.2 Brake pads

- 17.4.1.2.3 Brake drums

- 17.4.1.2.4 Brake shoes

- 17.4.1.2.5 Brake liners

- 17.4.1.1 Construction equipment: Brake friction products market

- 17.4.2 BRAKE FRICTION PRODUCTS OE MARKET, BY VEHICLE TYPE (COUNTRY LEVEL)

- 17.4.2.1 Passenger cars: Brake friction products market

- 17.4.2.1.1 Brake discs

- 17.4.2.1.2 Brake pads

- 17.4.2.1.3 Brake drums

- 17.4.2.1.4 Brake shoes

- 17.4.2.1.5 Brake liners

- 17.4.2.1.6 Brake shims

- 17.4.2.2 LCVs: Brake friction products market

- 17.4.2.2.1 Brake discs

- 17.4.2.2.2 Brake pads

- 17.4.2.2.3 Brake drums

- 17.4.2.2.4 Brake shoes

- 17.4.2.2.5 Brake liners

- 17.4.2.3 Buses: Brake friction products market

- 17.4.2.3.1 Brake discs

- 17.4.2.3.2 Brake pads

- 17.4.2.3.3 Brake drums

- 17.4.2.3.4 Brake shoes

- 17.4.2.3.5 Brake liners

- 17.4.2.4 Trucks: Brake friction products market

- 17.4.2.4.1 Brake discs

- 17.4.2.4.2 Brake pads

- 17.4.2.4.3 Brake drums

- 17.4.2.4.4 Brake shoes

- 17.4.2.4.5 Brake liners

- 17.4.2.1 Passenger cars: Brake friction products market

- 17.4.3 DETAILED ANALYSIS AND PROFILING OF ADDITIONAL MARKET PLAYERS

- 17.4.1 OFF-HIGHWAY BRAKE FRICTION PRODUCTS MARKET, BY PRODUCT TYPE (COUNTRY LEVEL)

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS