|

|

市場調査レポート

商品コード

1735896

ネットワークスライシングの世界市場:オファリング別、エンドユーザー別、企業別、地域別 - 2030年までの予測Network Slicing Market by Offering (Solution, Service (Professional Services, Managed Services)), End User (Telecom Operators, Enterprises (Manufacturing, Automotive, Government & Public Sector, Healthcare & Life Sciences)) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ネットワークスライシングの世界市場:オファリング別、エンドユーザー別、企業別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月26日

発行: MarketsandMarkets

ページ情報: 英文 258 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

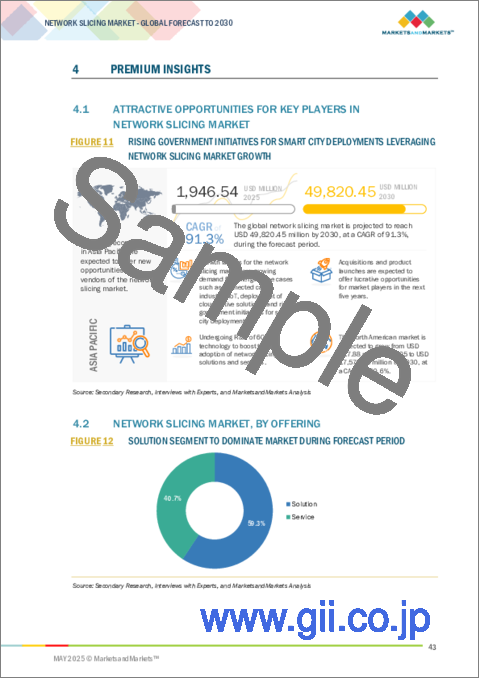

ネットワークスライシングの市場規模は、2025年には19億4,000万米ドル、2030年には498億2,000万米ドルに達すると推定され、2025年から2030年までのCAGRは91.3%と見込まれています。

現在の市場収益は、ネットワークスライシングソリューションに大きく影響されています。ネットワークスライシングソリューションは、クラウドネイティブなスタックにより、より迅速な展開と効率的なスライス管理を実現し、スタンドアロンサービスよりも高い価値をユーザーに提供します。その結果、スライスの展開と統合は急速にアウトソーシングされるようになり、主要参入企業は専門のシステムインテグレーターや電気通信会社と協力しています。アジア太平洋地域では、5Gスタンドアロンの導入が好調であり、政府からの支援、積極的な5G展開、製造業やスマートシティなどの分野におけるプライベートネットワークの効果的な利用により、急成長が予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 米ドル(10億米ドル) |

| セグメント別 | オファリング別、エンドユーザー別、企業別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

この分野が市場をリードしているのは、主要なネットワークゾーンすべてにおいてネットワークスライスの展開を簡素化する、完全ですぐに使えるプラットフォームを提供しているからです。オーケストレーションソフトウェア、ポリシーコントロール、ネットワークエクスポージャー機能、全管理サイクル用ツールなどがその特徴です。大手通信事業者は、バンドルされたソフトウェア・ソリューションを好んでいます。なぜなら、バンドルされたソフトウェア・ソリューションは、市場投入までの時間を短縮し、統合リスクを軽減し、厳しいSLAに沿った信頼性の高いパフォーマンスを可能にするからです。ソリューションは、利用可能なリソースの即時監視と分配をサポートします。これは、メディア放送、スマート物流、防衛など、高速で信頼性の高い接続に依存する業界にとって非常に重要です。5Gスタンドアロン市場が拡大するにつれ、通信事業者はネットワークスライシングのテストから課金へと移行しており、多くのサービスプロバイダーが「ネットワーク・アズ・ア・サービス」を企業に提供しています。AIを活用したオーケストレーション・システムと自動化されたスライシング・ツールにより、サービス・プロバイダーはハードウェアを大幅に変更することなく、さまざまなサービスを導入して先手を打つことができます。

事業者や企業がネットワークにネットワークスライシングを導入するにつれ、効果的な展開と統合サポートがこれまで以上に重要になっています。従来のネットワーク更新とは対照的に、スライシングはRANからエッジまでのすべてのネットワーク要素が協力し、企業固有のSLAを遵守しなければならないことを意味します。サービスプロバイダの統合は、スライステンプレートのパーソナライズ、APIの有効化、既存システムと5Gの新機能の通信を支援するために不可欠です。試験運用から実際の使用、そしてその後のアップデートまでの管理は、多くの通信事業者が専門のインテグレーターの支援を受けることで対応しています。これらのサービスには、ゼロタッチ・プロビジョニング、スライス分離のチェック、セキュリティへの特別な集中が含まれ、これらはすべて金融、公共安全、自律移動の分野で重要です。業界がテストから大規模な使用へとシフトするにつれ、企業は専門家によって管理される機敏な統合サービスを求めるようになっており、これがこのセグメントの足場固めに役立っています。

アジア太平洋地、積極的な5G SAの展開、効果的な政府の取り組み、強力な産業デジタル化の進展により、ネットワークスライシングにおいて最も大きな成長を遂げると予想されます。中国、日本、韓国、シンガポールなどの国々では、通信会社が港湾自動化、スマート製造、遠隔手術などのアプリケーション向けにスライスを実験・提供することが可能になっています。周波数利用における有利な変化と、民間と公共部門の両方が関与する協力プロジェクトが、民間の5Gと企業スライシングの成長を促しています。この分野の組織はいち早くスライシングを採用し、物流、公共事業、公共安全の分野で、主要なワークロードを共有システム間で分割することを可能にしました。さらに、通信事業者はクラウドやテクノロジー企業と協力し、迅速なリソースのプロビジョニングと柔軟なスケーリングのために、クラウドベースのソリューションを使用してスライシング機能を提供しています。このように、政策、ニーズ、テクノロジー受容のバランスが取れているため、アジア太平洋地域は世界的にスライシングの成長をリードしています。

当レポートでは、世界のネットワークスライシング市場について調査し、オファリング別、エンドユーザー別、企業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- ネットワークスライシングソリューションとサービスの進化

- ネットワークスライシング市場:エコシステム分析/市場マップ

- ケーススタディ分析

- バリューチェーン分析

- 規制状況

- 価格分析

- 技術分析

- 特許分析

- ポーターのファイブフォース分析

- 顧客のビジネスに影響を与える動向/混乱

- 主要な利害関係者と購入基準

- 主要な会議とイベント

- ネットワークスライシング市場の技術ロードマップ

- ネットワークスライシング市場におけるベストプラクティス

- 投資と資金調達のシナリオ

- 生成AIがネットワークスライシング市場に与える影響

- 2025年の米国関税の影響- 概要

第6章 ネットワークスライシング市場(オファリング容別)

- イントロダクション

- ソリューション

- サービス

第7章 ネットワークスライシング市場(エンドユーザー別)

- イントロダクション

- 通信事業者

- 企業

第8章 ネットワークスライシング市場(企業別)

- イントロダクション

- エンタープライズ:ネットワークスライシング市場促進要因

- 製造

- 自動車

- 政府・公共部門

- 運輸・物流

- エネルギー・公益事業

- ヘルスケア・ライフサイエンス

- メディア・エンターテインメント

- その他の企業

第9章 ネットワークスライシング市場(地域別)

- イントロダクション

- 北米

- 北米:マクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州:マクロ経済見通し

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- 北欧諸国

- その他

- アジア太平洋

- アジア太平洋:マクロ経済見通し

- 中国

- 日本

- インド

- オーストラリアとニュージーランド

- 韓国

- 東南アジア

- その他

- 中東・アフリカ

- 中東・アフリカ:マクロ経済見通し

- サウジアラビア王国(KSA)

- アラブ首長国連邦

- 南アフリカ

- その他

- ラテンアメリカ

- ラテンアメリカ:マクロ経済見通し

- ブラジル

- メキシコ

- その他

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2022年~2025年

- 市場シェア分析、2024年

- 収益分析、2020年~2024年

- ブランド/製品比較

- 企業評価と財務指標

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- ERICSSON

- HUAWEI

- NOKIA

- CISCO SYSTEMS, INC.

- ZTE

- CIENA CORPORATION

- AMDOCS

- TURK TELEKOM

- SAMSUNG

- HPE

- NTT

- BT GROUP

- BROADCOM

- JUNIPER NETWORKS

- T-MOBILE

- MAVENIR

- スタートアップ/中小企業

- PARALLEL WIRELESS

- AFFIRMED NETWORKS

- CELONA

- ARGELA TECHNOLOGIES

- TAMBORA SYSTEMS

- FIRECELL

- DRUID SOFTWARE

- NIRAL NETWORKS

- SLICEFINITY

第12章 隣接市場と関連市場

- イントロダクション

- ネットワーク自動化市場

- ネットワーク・アズ・ア・サービス市場

第13章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 NETWORK SLICING MARKET: ECOSYSTEM

- TABLE 3 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 INDICATIVE PRICING ANALYSIS OF NETWORK SLICING SOLUTIONS, BY KEY PLAYER, 2024

- TABLE 8 INDICATIVE PRICING ANALYSIS OF NETWORK SLICING SOLUTIONS, BY END USER, 2024

- TABLE 9 LIST OF KEY PATENTS

- TABLE 10 PORTER'S FIVE FORCES' IMPACT ON NETWORK SLICING MARKET

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- TABLE 12 KEY BUYING CRITERIA FOR END USERS

- TABLE 13 NETWORK SLICING MARKET: DETAILED LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 15 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKET DUE TO TARIFF IMPACT

- TABLE 16 NETWORK SLICING MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 17 NETWORK SLICING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 18 SOLUTION: NETWORK SLICING MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 19 SOLUTION: NETWORK SLICING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 20 SERVICE: NETWORK SLICING MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 21 SERVICE: NETWORK SLICING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 22 SERVICE: NETWORK SLICING MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 23 SERVICE: NETWORK SLICING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 24 PROFESSIONAL SERVICES: NETWORK SLICING MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 25 PROFESSIONAL SERVICES: NETWORK SLICING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 PROFESSIONAL SERVICES: NETWORK SLICING MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 27 PROFESSIONAL SERVICES: NETWORK SLICING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 28 NETWORK PLANNING & DESIGNING: NETWORK SLICING MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 29 NETWORK PLANNING & DESIGNING: NETWORK SLICING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 DEPLOYMENT & INTEGRATION: NETWORK SLICING MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 31 DEPLOYMENT & INTEGRATION: NETWORK SLICING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 SUPPORT & MAINTENANCE: NETWORK SLICING MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 33 SUPPORT & MAINTENANCE: NETWORK SLICING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 MANAGED SERVICES: NETWORK SLICING MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 35 MANAGED SERVICES: NETWORK SLICING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 NETWORK SLICING MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 37 NETWORK SLICING MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 38 TELECOM OPERATORS: NETWORK SLICING MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 39 TELECOM OPERATORS: NETWORK SLICING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 ENTERPRISE: NETWORK SLICING MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 41 ENTERPRISE: NETWORK SLICING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 NETWORK SLICING MARKET, BY ENTERPRISE, 2019-2024 (USD MILLION)

- TABLE 43 NETWORK SLICING MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 44 MANUFACTURING: NETWORK SLICING MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 45 MANUFACTURING: NETWORK SLICING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 AUTOMOTIVE: NETWORK SLICING MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 47 AUTOMOTIVE: NETWORK SLICING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 GOVERNMENT & PUBLIC SECTOR: NETWORK SLICING MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 49 GOVERNMENT & PUBLIC SECTOR: NETWORK SLICING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 TRANSPORTATION & LOGISTICS: NETWORK SLICING MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 51 TRANSPORTATION & LOGISTICS: NETWORK SLICING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 ENERGY & UTILITIES: NETWORK SLICING MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 53 ENERGY & UTILITIES: NETWORK SLICING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 HEALTHCARE & LIFE SCIENCES: NETWORK SLICING MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 55 HEALTHCARE & LIFE SCIENCES: NETWORK SLICING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 MEDIA & ENTERTAINMENT: NETWORK SLICING MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 57 MEDIA & ENTERTAINMENT: NETWORK SLICING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 OTHER ENTERPRISES: NETWORK SLICING MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 59 OTHER ENTERPRISES: NETWORK SLICING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 NETWORK SLICING MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 61 NETWORK SLICING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 NORTH AMERICA: NETWORK SLICING MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 63 NORTH AMERICA: NETWORK SLICING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: NETWORK SLICING MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 65 NORTH AMERICA: NETWORK SLICING MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: NETWORK SLICING MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 67 NORTH AMERICA: NETWORK SLICING MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 68 NORTH AMERICA: NETWORK SLICING MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 69 NORTH AMERICA: NETWORK SLICING MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: NETWORK SLICING MARKET, BY ENTERPRISE, 2019-2024 (USD MILLION)

- TABLE 71 NORTH AMERICA: NETWORK SLICING MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: NETWORK SLICING MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 73 NORTH AMERICA: NETWORK SLICING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 74 US: NETWORK SLICING MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 75 US: NETWORK SLICING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 76 US: NETWORK SLICING MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 77 US: NETWORK SLICING MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 78 US: NETWORK SLICING MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 79 US: NETWORK SLICING MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 80 US: NETWORK SLICING MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 81 US: NETWORK SLICING MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 82 US: NETWORK SLICING MARKET, BY ENTERPRISE, 2019-2024 (USD MILLION)

- TABLE 83 US: NETWORK SLICING MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 84 CANADA: NETWORK SLICING MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 85 CANADA: NETWORK SLICING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 86 CANADA: NETWORK SLICING MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 87 CANADA: NETWORK SLICING MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 88 CANADA: NETWORK SLICING MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 89 CANADA: NETWORK SLICING MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 90 CANADA: NETWORK SLICING MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 91 CANADA: NETWORK SLICING MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 92 CANADA: NETWORK SLICING MARKET, BY ENTERPRISE, 2019-2024 (USD MILLION)

- TABLE 93 CANADA: NETWORK SLICING MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 94 EUROPE: NETWORK SLICING MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 95 EUROPE: NETWORK SLICING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 96 EUROPE: NETWORK SLICING MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 97 EUROPE: NETWORK SLICING MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 98 EUROPE: NETWORK SLICING MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 99 EUROPE: NETWORK SLICING MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 100 EUROPE: NETWORK SLICING MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 101 EUROPE: NETWORK SLICING MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 102 EUROPE: NETWORK SLICING MARKET, BY ENTERPRISE, 2019-2024 (USD MILLION)

- TABLE 103 EUROPE: NETWORK SLICING MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 104 EUROPE: NETWORK SLICING MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 105 EUROPE: NETWORK SLICING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 106 GERMANY: NETWORK SLICING MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 107 GERMANY: NETWORK SLICING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 108 GERMANY: NETWORK SLICING MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 109 GERMANY: NETWORK SLICING MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 110 GERMANY: NETWORK SLICING MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 111 GERMANY: NETWORK SLICING MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 112 GERMANY: NETWORK SLICING MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 113 GERMANY: NETWORK SLICING MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 114 GERMANY: NETWORK SLICING MARKET, BY ENTERPRISE, 2019-2024 (USD MILLION)

- TABLE 115 GERMANY: NETWORK SLICING MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 116 ASIA PACIFIC: NETWORK SLICING MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 117 ASIA PACIFIC: NETWORK SLICING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 118 ASIA PACIFIC: NETWORK SLICING MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 119 ASIA PACIFIC: NETWORK SLICING MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 120 ASIA PACIFIC: NETWORK SLICING MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 121 ASIA PACIFIC: NETWORK SLICING MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 122 ASIA PACIFIC: NETWORK SLICING MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 123 ASIA PACIFIC: NETWORK SLICING MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 124 ASIA PACIFIC: NETWORK SLICING MARKET, BY ENTERPRISE, 2019-2024 (USD MILLION)

- TABLE 125 ASIA PACIFIC: NETWORK SLICING MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 126 ASIA PACIFIC: NETWORK SLICING MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 127 ASIA PACIFIC: NETWORK SLICING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 128 CHINA: NETWORK SLICING MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 129 CHINA: NETWORK SLICING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 130 CHINA: NETWORK SLICING MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 131 CHINA: NETWORK SLICING MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 132 CHINA: NETWORK SLICING MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 133 CHINA: NETWORK SLICING MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 134 CHINA: NETWORK SLICING MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 135 CHINA: NETWORK SLICING MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 136 CHINA: NETWORK SLICING MARKET, BY ENTERPRISE, 2019-2024 (USD MILLION)

- TABLE 137 CHINA: NETWORK SLICING MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: NETWORK SLICING MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: NETWORK SLICING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: NETWORK SLICING MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: NETWORK SLICING MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: NETWORK SLICING MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: NETWORK SLICING MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: NETWORK SLICING MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: NETWORK SLICING MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: NETWORK SLICING MARKET, BY ENTERPRISE, 2019-2024 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: NETWORK SLICING MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: NETWORK SLICING MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: NETWORK SLICING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 150 KSA: NETWORK SLICING MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 151 KSA: NETWORK SLICING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 152 KSA: NETWORK SLICING MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 153 KSA: NETWORK SLICING MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 154 KSA: NETWORK SLICING MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 155 KSA: NETWORK SLICING MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 156 KSA: NETWORK SLICING MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 157 KSA: NETWORK SLICING MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 158 KSA: NETWORK SLICING MARKET, BY ENTERPRISE, 2019-2024 (USD MILLION)

- TABLE 159 KSA: NETWORK SLICING MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 160 LATIN AMERICA: NETWORK SLICING MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 161 LATIN AMERICA: NETWORK SLICING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 162 LATIN AMERICA: NETWORK SLICING MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 163 LATIN AMERICA: NETWORK SLICING MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 164 LATIN AMERICA: NETWORK SLICING MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 165 LATIN AMERICA: NETWORK SLICING MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 166 LATIN AMERICA: NETWORK SLICING MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 167 LATIN AMERICA: NETWORK SLICING MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 168 LATIN AMERICA: NETWORK SLICING MARKET, BY ENTERPRISE, 2019-2024 (USD MILLION)

- TABLE 169 LATIN AMERICA: NETWORK SLICING MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 170 LATIN AMERICA: NETWORK SLICING MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 171 LATIN AMERICA: NETWORK SLICING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 172 BRAZIL: NETWORK SLICING MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 173 BRAZIL: NETWORK SLICING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 174 BRAZIL: NETWORK SLICING MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 175 BRAZIL: NETWORK SLICING MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 176 BRAZIL: NETWORK SLICING MARKET, BY PROFESSIONAL SERVICE, 2019-2024 (USD MILLION)

- TABLE 177 BRAZIL: NETWORK SLICING MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 178 BRAZIL: NETWORK SLICING MARKET, BY END USER, 2019-2024 (USD MILLION)

- TABLE 179 BRAZIL: NETWORK SLICING MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 180 BRAZIL: NETWORK SLICING MARKET, BY ENTERPRISE, 2019-2024 (USD MILLION)

- TABLE 181 BRAZIL: NETWORK SLICING MARKET, BY ENTERPRISE, 2025-2030 (USD MILLION)

- TABLE 182 OVERVIEW OF STRATEGIES ADOPTED BY KEY NETWORK SLICING MARKET PLAYERS, JANUARY 2022-APRIL 2025

- TABLE 183 NETWORK SLICING MARKET: DEGREE OF COMPETITION

- TABLE 184 NETWORK SLICING MARKET: REGION FOOTPRINT

- TABLE 185 NETWORK SLICING MARKET: OFFERING FOOTPRINT

- TABLE 186 NETWORK SLICING MARKET: END USER FOOTPRINT

- TABLE 187 NETWORK SLICING MARKET: ENTERPRISE FOOTPRINT

- TABLE 188 NETWORK SLICING MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 189 NETWORK SLICING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 190 NETWORK SLICING MARKET: PRODUCT LAUNCHES, JANUARY 2022-APRIL 2025

- TABLE 191 NETWORK SLICING MARKET: DEALS, JANUARY 2022-APRIL 2025

- TABLE 192 ERICSSON: COMPANY OVERVIEW

- TABLE 193 ERICSSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 ERICSSON: DEALS

- TABLE 195 HUAWEI: COMPANY OVERVIEW

- TABLE 196 HUAWEI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 HUAWEI: DEALS

- TABLE 198 NOKIA: COMPANY OVERVIEW

- TABLE 199 NOKIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 NOKIA: PRODUCT LAUNCHES

- TABLE 201 NOKIA: DEALS

- TABLE 202 CISCO SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 203 CISCO SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 CISCO SYSTEMS, INC.: DEALS

- TABLE 205 ZTE: COMPANY OVERVIEW

- TABLE 206 ZTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 ZTE: DEALS

- TABLE 208 CIENA CORPORATION: COMPANY OVERVIEW

- TABLE 209 CIENA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 CIENA CORPORATION: PRODUCT LAUNCHES

- TABLE 211 CIENA CORPORATION: DEALS

- TABLE 212 AMDOCS: COMPANY OVERVIEW

- TABLE 213 AMDOCS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 AMDOCS: DEALS

- TABLE 215 TURK TELEKOM: COMPANY OVERVIEW

- TABLE 216 TURK TELECOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 TURK TELEKOM: DEALS

- TABLE 218 SAMSUNG: COMPANY OVERVIEW

- TABLE 219 SAMSUNG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 SAMSUNG: DEALS

- TABLE 221 HPE: COMPANY OVERVIEW

- TABLE 222 HPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 HPE: DEALS

- TABLE 224 NETWORK AUTOMATION MARKET, BY COMPONENT, 2014-2019 (USD MILLION)

- TABLE 225 NETWORK AUTOMATION MARKET, BY COMPONENT, 2020-2025 (USD MILLION)

- TABLE 226 NETWORK AUTOMATION MARKET, BY SOLUTION, 2014-2019 (USD MILLION)

- TABLE 227 NETWORK AUTOMATION MARKET, BY SOLUTION, 2020-2025 (USD MILLION)

- TABLE 228 NETWORK AUTOMATION MARKET, BY PROFESSIONAL SERVICE, 2014-2019 (USD MILLION)

- TABLE 229 NETWORK AUTOMATION MARKET, BY PROFESSIONAL SERVICE, 2020-2025 (USD MILLION)

- TABLE 230 NETWORK AUTOMATION MARKET, BY NETWORK TYPE, 2014-2019 (USD MILLION)

- TABLE 231 NETWORK AUTOMATION MARKET, BY NETWORK TYPE, 2020-2025 (USD MILLION)

- TABLE 232 NETWORK AUTOMATION MARKET, BY DEPLOYMENT MODE, 2014-2019 (USD MILLION)

- TABLE 233 NETWORK AUTOMATION MARKET, BY DEPLOYMENT MODE, 2020-2025 (USD MILLION)

- TABLE 234 NETWORK AUTOMATION MARKET, BY END USER, 2014-2019 (USD MILLION)

- TABLE 235 NETWORK AUTOMATION MARKET, BY END USER, 2020-2025 (USD MILLION)

- TABLE 236 NETWORK AUTOMATION MARKET, BY ORGANIZATION SIZE, 2014-2019 (USD MILLION)

- TABLE 237 NETWORK AUTOMATION MARKET, BY ORGANIZATION SIZE, 2020-2025 (USD MILLION)

- TABLE 238 NETWORK AUTOMATION MARKET, BY ENTERPRISE VERTICAL, 2014-2019 (USD MILLION)

- TABLE 239 NETWORK AUTOMATION MARKET, BY ENTERPRISE VERTICAL, 2020-2025 (USD MILLION)

- TABLE 240 NETWORK AUTOMATION MARKET, BY REGION, 2014-2019 (USD MILLION)

- TABLE 241 NETWORK AUTOMATION MARKET, BY REGION, 2020-2025 (USD MILLION)

- TABLE 242 NETWORK AS A SERVICE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 243 NETWORK AS A SERVICE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 244 NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 245 NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 246 NETWORK AS A SERVICE MARKET, BY END USER, 2016-2021 (USD MILLION)

- TABLE 247 NETWORK AS A SERVICE MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 248 NETWORK AS A SERVICE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 249 NETWORK AS A SERVICE MARKET, BY REGION, 2022-2027 (USD MILLION)

List of Figures

- FIGURE 1 NETWORK SLICING MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 NETWORK SLICING MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE OF VENDORS IN NETWORK SLICING MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): NETWORK SLICING MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION USING BOTTOM-UP APPROACH

- FIGURE 8 NETWORK SLICING MARKET: DATA TRIANGULATION

- FIGURE 9 NETWORK SLICING MARKET, 2023-2030 (USD MILLION)

- FIGURE 10 NETWORK SLICING MARKET, BY REGION (2025)

- FIGURE 11 RISING GOVERNMENT INITIATIVES FOR SMART CITY DEPLOYMENTS LEVERAGING NETWORK SLICING MARKET GROWTH

- FIGURE 12 SOLUTION SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 DEPLOYMENT & INTEGRATION SERVICE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 TELECOM OPERATORS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 MANUFACTURING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 SOLUTION AND MANUFACTURING SEGMENTS TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN 2025

- FIGURE 17 NETWORK SLICING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 EVOLUTION: NETWORK SLICING SOLUTIONS AND SERVICES

- FIGURE 19 KEY PLAYERS IN NETWORK SLICING MARKET ECOSYSTEM

- FIGURE 20 NETWORK SLICING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 INDICATIVE PRICING ANALYSIS OF NETWORK SLICING SOLUTIONS, BY KEY PLAYER, 2024

- FIGURE 22 LIST OF KEY PATENTS FOR NETWORK SLICING, 2013-2024

- FIGURE 23 NETWORK SLICING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 NETWORK SLICING MARKET: DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- FIGURE 26 KEY BUYING CRITERIA FOR TOP END USERS

- FIGURE 27 INVESTMENT AND FUNDING SCENARIO, 2019-2024 (USD MILLION)

- FIGURE 28 MARKET POTENTIAL OF GENERATIVE AI IN ENHANCING NETWORK SLICING ACROSS VARIOUS TYPES OF SOLUTIONS

- FIGURE 29 GENERATIVE AI BEST PRACTICES ACROSS MAJOR INDUSTRIES

- FIGURE 30 SERVICE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 31 MANAGED SERVICES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 32 SUPPORT & MAINTENANCE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 TELECOM OPERATORS TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 34 HEALTHCARE & LIFE SCIENCES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 NORTH AMERICA: NETWORK SLICING MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: NETWORK SLICING MARKET SNAPSHOT

- FIGURE 37 SHARES OF LEADING COMPANIES IN NETWORK SLICING MARKET, 2024

- FIGURE 38 NETWORK SLICING MARKET: RANKING ANALYSIS OF TOP FIVE PLAYERS

- FIGURE 39 REVENUE ANALYSIS OF KEY PLAYERS IN NETWORK SLICING MARKET, 2020-2024 (USD MILLION)

- FIGURE 40 NETWORK SLICING MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 41 COMPANY VALUATION, 2025

- FIGURE 42 FINANCIAL METRICS OF KEY VENDORS, 2025

- FIGURE 43 NETWORK SLICING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 44 NETWORK SLICING MARKET: COMPANY FOOTPRINT

- FIGURE 45 NETWORK SLICING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 46 ERICSSON: COMPANY SNAPSHOT

- FIGURE 47 NOKIA: COMPANY SNAPSHOT

- FIGURE 48 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

- FIGURE 49 ZTE: COMPANY SNAPSHOT

- FIGURE 50 CIENA CORPORATION: COMPANY SNAPSHOT

- FIGURE 51 AMDOCS: COMPANY SNAPSHOT

- FIGURE 52 TURK TELEKOM: COMPANY SNAPSHOT

- FIGURE 53 SAMSUNG: COMPANY SNAPSHOT

- FIGURE 54 HPE: COMPANY SNAPSHOT

The network slicing market is estimated to be USD 1.94 billion in 2025 and reach USD 49.82 billion in 2030 at a CAGR of 91.3%, from 2025 to 2030. Current market revenues are greatly influenced by network slicing solutions, which display faster deployment and manage slices efficiently via their cloud-native stacks, providing more value to users than standalone services. As a result, deploying and merging slices is rapidly becoming outsourced, with key participants collaborating with specialist system integrators and telecom firms. The Asia Pacific region is seeing strong 5G standalone adoption and is predicted to grow fast due to support from governments, active 5G rollouts, and effective use of private networks in areas such as manufacturing and smart cities.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD (Billion) |

| Segments | By offering, end user, and region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

The solutions segment contributed to the largest market size of the network slicing market during the forecast period.

This area of the market leads because it provides complete, ready-to-use platforms that simplify the deployment of network slices in all main network zones. Features commonly found in these offerings are orchestration software, policy control, network exposure functionality, and tools for the entire management cycle. The leading telecom operators like bundled software solutions since they enable faster time-to-market, lessen integration risks, and allow for reliable performance in line with stringent SLAs. Solutions support instant supervision and distribution of available resources, which are very important for industries like media broadcasting, smart logistics, and defense that depend on fast, reliable connections. As the market for 5G Standalone increases, operators are moving from testing to charging for network slicing, and many service providers are now supplying "network-as-a-service" offerings to businesses. AI-powered orchestration systems and automated slicing tools allow service providers to stay ahead by introducing different services without the need for major hardware changes.

The deployment & integration services segment is projected to register the largest market share during the forecast period.

As operators and businesses introduce network slicing into their networks, it is more important than ever to have effective deployment and integration support. In contrast to traditional network updates, slicing means all network elements from RAN to the edge must cooperate and adhere to enterprise-specific SLAs. Integration of service providers is essential for personalizing slice templates, making APIs work, and helping existing systems communicate with new 5G features. Managing the progression from trials to actual use and later updates is often handled by accepting help from professional integrators by many telecom operators. These services come with zero-touch provisioning, checking slice isolation, and extra focus on security, all important in the finance, public safety, and autonomous mobility areas. As industry shifts from testing to wide-scale uses, businesses are looking for agile integration services managed by experts, which is helping this segment get a stronger foothold.

Asia Pacific is estimated to have the highest growth rate during the forecast period.

The Asia Pacific region is expected to achieve the most significant growth in network slicing thanks to active 5G SA deployment, effective government efforts, and strong industrial digitalization progress. Countries such as China, Japan, South Korea, and Singapore make it possible for telecom companies to experiment with and offer slices for applications like port automation, smart manufacturing, and remote surgery. Favorable changes in spectrum use and cooperative projects involving both private and public sectors are encouraging the growth of private 5G and enterprise slicing. Organizations in the area were quick to adapt slicing, making it possible to divide major workloads between shared systems in logistics, utilities, and public safety fields. Furthermore, operators are working with cloud and technology companies to provide slicing features using cloud-based solutions for quick resource provisioning and flexible scaling. Because of this balance of policy, need, and technology acceptance, Asia Pacific is leading the growth of slicing globally.

Breakdown of primary interviews

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The breakdown of the primary interviews is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 40%, and Tier 3 - 25%

- By Designation: C-level - 20%, Directors - 30%, and Others - 50%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, Rest of the World - 5%

The major players in the network slicing market are Ericsson (Sweden), Huawei (China), Nokia (Finland), Cisco (US), ZTE (China), Ciena Corporation (US), Amdocs (US), Turk Telekom (Turkey), Samsung (South Korea), HPE (US), NTT (Japan), BT Group (UK), and Broadcom (US), Juniper Networks (US), T-Mobile (US), and Mavenir (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, product launches, product enhancements, and acquisitions to expand their footprint in the network slicing market.

Research Coverage

The market study covers the network slicing market size across different segments. It aims to estimate the market size and the growth potential across different segments, including offering (solutions and services), end user (telecom operators and enterprises), and regions. The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the global network slicing market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Ultra-low latency slicing for real-time use cases, Rising enterprise demand for network customization, and Private 5G adoption fueling slicing deployment), restraints (Lack of unified standards across ecosystems, High cost of network transformation for smaller players, and Security risks in multi-tenant environments), opportunities (AI-powered orchestration for zero-touch slicing, Edge computing integration with slicing, and Cross-industry co-development of slicing use cases), and challenges (SLA enforcement remains difficult in live deployments, Shortage of slicing-skilled workforce, and Operational complexity in managing multiple slices) influencing the growth of the network slicing market. Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product & service launches in the network slicing market. Market Development: Comprehensive information about lucrative markets - the report analyzes the network slicing market across various regions. Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the network slicing market. Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players Ericsson (Sweden), Huawei (China), Nokia (Finland), Cisco (US), ZTE (China), Ciena Corporation (US), Amdocs (US), Turk Telekom (Turkey), Samsung (South Korea), HPE (US), NTT (Japan), BT Group (UK), Broadcom (US), Juniper Networks (US), T-Mobile (US), and Mavenir (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakdown of primary profiles

- 2.1.2.3 Key insights from industry experts

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.3 NETWORK SLICING MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- 2.4 RISK ASSESSMENT

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR KEY PLAYERS IN NETWORK SLICING MARKET

- 4.2 NETWORK SLICING MARKET, BY OFFERING

- 4.3 NETWORK SLICING MARKET, BY SERVICE

- 4.4 NETWORK SLICING MARKET, BY END USER

- 4.5 NETWORK SLICING MARKET, BY ENTERPRISE

- 4.6 NORTH AMERICA: NETWORK SLICING MARKET: OFFERINGS AND TOP THREE ENTERPRISES

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Ultra-low latency slicing for real-time use cases

- 5.2.1.2 Rising enterprise demand for network customization

- 5.2.1.3 Private 5G adoption fueling slicing deployment

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of unified standards across ecosystems

- 5.2.2.2 High cost of network transformation for smaller players

- 5.2.2.3 Security risks in multi-tenant environments

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 AI-powered orchestration for zero-touch slicing

- 5.2.3.2 Edge computing integration with slicing

- 5.2.3.3 Cross-industry co-development of slicing use cases

- 5.2.4 CHALLENGES

- 5.2.4.1 SLA enforcement remains difficult in live deployments

- 5.2.4.2 Shortage of slicing-skilled workforce

- 5.2.4.3 Operational complexity in managing multiple slices

- 5.2.1 DRIVERS

- 5.3 EVOLUTION OF NETWORK SLICING SOLUTIONS AND SERVICES

- 5.4 NETWORK SLICING MARKET: ECOSYSTEM ANALYSIS/MARKET MAP

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 FAR EASTONE AND ERICSSON DEMONSTRATED WORLD'S FIRST 5G END-TO-END MULTIPLE NETWORK SLICING USING ERICSSON DYNAMIC NETWORK SLICE SELECTION SOLUTION

- 5.5.2 TELENOR & NOKIA SHOWCASED ZERO-TOUCH 5G-VINNI DIGITAL ORCHESTRATION FOR NETWORK SLICING

- 5.5.3 A1 TELEKOM AUSTRIA GROUP AND AMDOCS SHOWCASED LIVE END-TO-END 5G NETWORK SLICING WITH AMDOCS' E2E SERVICE & NETWORK ORCHESTRATION AND 5G MONETIZATION SOLUTIONS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.1.1 International Telecommunication Union (ITU)

- 5.7.1.2 Federal Communications Commission (FCC) - United States

- 5.7.1.3 GSMA (Global System for Mobile Communications Association)

- 5.7.2 KEY REGULATIONS

- 5.7.2.1 North America

- 5.7.2.1.1 US

- 5.7.2.2 Europe

- 5.7.2.2.1 UK

- 5.7.2.3 Asia Pacific

- 5.7.2.3.1 India

- 5.7.2.3.2 Japan

- 5.7.2.4 Middle East & Africa

- 5.7.2.4.1 Saudi Arabia

- 5.7.2.5 Latin America

- 5.7.2.5.1 Brazil

- 5.7.2.1 North America

- 5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8 PRICING ANALYSIS

- 5.8.1 INDICATIVE PRICING ANALYSIS OF NETWORK SLICING SOLUTIONS, BY KEY PLAYER, 2024

- 5.8.2 INDICATIVE PRICING ANALYSIS OF NETWORK SLICING SOLUTIONS, BY END USER, 2024

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Software-defined Networking (SDN)

- 5.9.1.2 Network Function Virtualization (NFV)

- 5.9.1.3 5G Core

- 5.9.1.4 Orchestration & Automation Platforms

- 5.9.1.5 Multi-access Edge Computing (MEC)

- 5.9.2 ADJACENT TECHNOLOGIES

- 5.9.2.1 Intent-based Networking

- 5.9.2.2 Artificial Intelligence & Machine Learning (AI/ML)

- 5.9.2.3 Digital Twin

- 5.9.2.4 Open RAN

- 5.9.2.5 Segment Routing

- 5.9.3 COMPLEMENTARY TECHNOLOGIES

- 5.9.3.1 Internet of Things (IoT)

- 5.9.3.2 Blockchain

- 5.9.3.3 Cybersecurity

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS

- 5.15 TECHNOLOGY ROADMAP FOR NETWORK SLICING MARKET

- 5.15.1 SHORT-TERM ROADMAP (2025-2026)

- 5.15.2 MID-TERM ROADMAP (2027-2028)

- 5.15.3 LONG-TERM ROADMAP (2029-2030)

- 5.16 BEST PRACTICES IN NETWORK SLICING MARKET

- 5.16.1 CONTINUOUS SECURITY AND MONITORING

- 5.16.2 INTENT-BASED SLICE MANAGEMENT

- 5.16.3 LEVERAGE AI/ML-DRIVEN ORCHESTRATION

- 5.16.4 EMBRACE OPEN STANDARDS AND DISAGGREGATED RAN

- 5.16.5 AUTOMATE SLICE LIFECYCLE MANAGEMENT

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 IMPACT OF GENERATIVE AI ON NETWORK SLICING MARKET

- 5.18.1 TOP USE CASES AND MARKET POTENTIAL

- 5.18.1.1 Key use cases

- 5.18.2 BEST PRACTICES

- 5.18.2.1 Telecom Industry

- 5.18.2.2 Manufacturing Industry

- 5.18.2.3 Critical Infrastructure

- 5.18.3 CASE STUDIES OF GENERATIVE AI IMPLEMENTATION

- 5.18.3.1 AI-driven Virtual Expert for Slice Configuration

- 5.18.3.2 Hybrid Generative AI for Dynamic Resource Allocation

- 5.18.3.3 Digital Twin-powered Slice Simulation Framework

- 5.18.4 CLIENT READINESS AND IMPACT ASSESSMENT

- 5.18.4.1 Client A: Enterprise Wireless Provider

- 5.18.4.2 Client B: Global Communications Service Provider

- 5.18.4.3 Client C: Telecom R&D Consortium

- 5.18.1 TOP USE CASES AND MARKET POTENTIAL

- 5.19 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 IMPACT ON COUNTRY/REGION

- 5.19.4.1 North America

- 5.19.4.1.1 United States

- 5.19.4.1.2 Canada

- 5.19.4.1.3 Mexico

- 5.19.4.1.4 Market Challenges

- 5.19.4.1.5 Mitigation Measures

- 5.19.4.2 Europe

- 5.19.4.2.1 Germany

- 5.19.4.2.2 France

- 5.19.4.2.3 United Kingdom

- 5.19.4.2.4 Market Challenges

- 5.19.4.2.5 Mitigation Measures

- 5.19.4.3 APAC

- 5.19.4.3.1 China

- 5.19.4.3.2 India

- 5.19.4.3.3 Australia

- 5.19.4.3.4 Market Challenges

- 5.19.4.3.5 Mitigation Measures

- 5.19.4.1 North America

- 5.19.5 END-USE INDUSTRY IMPACT

6 NETWORK SLICING MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: NETWORK SLICING MARKET DRIVERS

- 6.2 SOLUTION

- 6.3 SERVICE

- 6.3.1 PROFESSIONAL SERVICES

- 6.3.1.1 Network planning & designing

- 6.3.1.1.1 Planning & designing crafts detailed slice blueprints covering capacity, placement, and isolation to guarantee that production deployments satisfy stringent SLA requirements

- 6.3.1.2 Deployment & integration

- 6.3.1.2.1 Deployment & integration implement and validate slice platforms bridging new orchestrators with existing networks to enable rapid, reliable slice provisioning

- 6.3.1.3 Support & maintenance

- 6.3.1.3.1 Support & maintenance ensure slice SLAs through real-time monitoring, AI-driven remediation, and proactive patch management

- 6.3.1.1 Network planning & designing

- 6.3.2 MANAGED SERVICES

- 6.3.1 PROFESSIONAL SERVICES

7 NETWORK SLICING MARKET, BY END USER

- 7.1 INTRODUCTION

- 7.1.1 END USER: NETWORK SLICING MARKET DRIVERS

- 7.2 TELECOM OPERATORS

- 7.3 ENTERPRISES

8 NETWORK SLICING MARKET, BY ENTERPRISE

- 8.1 INTRODUCTION

- 8.1.1 ENTERPRISE: NETWORK SLICING MARKET DRIVERS

- 8.2 MANUFACTURING

- 8.3 AUTOMOTIVE

- 8.4 GOVERNMENT & PUBLIC SECTOR

- 8.5 TRANSPORTATION & LOGISTICS

- 8.6 ENERGY & UTILITIES

- 8.7 HEALTHCARE & LIFE SCIENCES

- 8.8 MEDIA & ENTERTAINMENT

- 8.9 OTHER ENTERPRISES

9 NETWORK SLICING MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.2.1 Verizon and T-Mobile have commercialized network slicing for consumer and public safety, with AT&T expected to follow by 2025

- 9.2.3 CANADA

- 9.2.3.1 Canada progressing toward full-scale network slicing with nationwide trials

- 9.3 EUROPE

- 9.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.2 GERMANY

- 9.3.2.1 Germany leading slicing use in private 5G networks for industrial automation, using localized spectrum, telco-led campus networks, and edge integration

- 9.3.3 UK

- 9.3.3.1 UK advancing network slicing through operator trials, public sector-backed testbeds, and industry-specific slicing pilots in sectors like transport and logistics

- 9.3.4 FRANCE

- 9.3.4.1 France advancing network slicing through trials in railways and public services, operator-driven SA deployment, and sovereign tech collaborations

- 9.3.5 SPAIN

- 9.3.5.1 Spain leveraging slicing for connected mobility, urban services, and SME digitalization through public-private partnerships and 5G corridor pilots

- 9.3.6 ITALY

- 9.3.6.1 Italy pushing network slicing for critical communication in transport, healthcare, and rural digital services with support from telcos and defense entities

- 9.3.7 NORDIC COUNTRIES

- 9.3.7.1 Nordic countries are leading slicing innovation in transport, energy, and industrial automation

- 9.3.8 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.2 CHINA

- 9.4.2.1 China's network slicing ecosystem has evolved into extensive citywide pilots and advanced architecture rollouts

- 9.4.3 JAPAN

- 9.4.3.1 Japan's network slicing advances from dynamic PoCs with Ericsson to planned commercial SA rollouts targeting automotive, retail, and healthcare applications

- 9.4.4 INDIA

- 9.4.4.1 India's network slicing ecosystem driven by lab-based validations, carrier testbeds, and government initiatives that spur enterprise and rural connectivity trials

- 9.4.5 AUSTRALIA & NEW ZEALAND

- 9.4.5.1 Australia & New Zealand have moved from slicing trials to managed enterprise offerings, powered by Telstra's proof of value engine and Spark's edge-based SA deployments

- 9.4.6 SOUTH KOREA

- 9.4.6.1 South Korea leads in AI-enhanced network slicing, combining real-time analytics and SDN/NFV orchestration for adaptive SLAs in industrial and media applications

- 9.4.7 SOUTHEAST ASIA

- 9.4.7.1 Southeast Asia's network slicing pioneers include Singtel's app-based offerings and defense-grade slices, complemented by regional private network trials for manufacturing and emergency services

- 9.4.8 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.2 KINGDOM OF SAUDI ARABIA (KSA)

- 9.5.2.1 Saudi Arabia is aligning its network slicing strategy with Vision 2030, leveraging advanced spectrum, 5G standalone upgrades, and smart city initiatives to enable use cases in oil, logistics, and automation

- 9.5.3 UAE

- 9.5.3.1 UAE is positioning itself as a first-mover in network slicing commercialization through regulatory support, dense 5G coverage, and trials in smart mobility, public safety, and immersive digital services.

- 9.5.4 SOUTH AFRICA

- 9.5.4.1 South Africa preparing to scale network slicing through 5G edge trials, spectrum planning, and vertical-focused applications in mining, finance, and smart communities

- 9.5.5 REST OF MIDDLE EAST & AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.6.2 BRAZIL

- 9.6.2.1 Brazil leads Latin America in network slicing commercialization with TIM's public 5G slice for real-time video

- 9.6.3 MEXICO

- 9.6.3.1 Mexico preparing for network slicing commercialization through 5G standalone upgrades by Telcel and AT&T Mexico

- 9.6.4 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 10.3 MARKET SHARE ANALYSIS, 2024

- 10.3.1 MARKET RANKING ANALYSIS

- 10.4 REVENUE ANALYSIS, 2020-2024

- 10.5 BRAND/PRODUCT COMPARISON

- 10.6 COMPANY VALUATION AND FINANCIAL METRICS

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Offering footprint

- 10.7.5.4 End user footprint

- 10.7.5.5 Enterprise footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 ERICSSON

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 HUAWEI

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 NOKIA

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 CISCO SYSTEMS, INC.

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 ZTE

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 CIENA CORPORATION

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.3.2 Deals

- 11.1.7 AMDOCS

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.8 TURK TELEKOM

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.9 SAMSUNG

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.10 HPE

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.11 NTT

- 11.1.12 BT GROUP

- 11.1.13 BROADCOM

- 11.1.14 JUNIPER NETWORKS

- 11.1.15 T-MOBILE

- 11.1.16 MAVENIR

- 11.1.1 ERICSSON

- 11.2 STARTUPS/SMES

- 11.2.1 PARALLEL WIRELESS

- 11.2.2 AFFIRMED NETWORKS

- 11.2.3 CELONA

- 11.2.4 ARGELA TECHNOLOGIES

- 11.2.5 TAMBORA SYSTEMS

- 11.2.6 FIRECELL

- 11.2.7 DRUID SOFTWARE

- 11.2.8 NIRAL NETWORKS

- 11.2.9 SLICEFINITY

12 ADJACENT AND RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 NETWORK AUTOMATION MARKET

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.2.3 NETWORK AUTOMATION MARKET, BY SOLUTION

- 12.2.4 NETWORK AUTOMATION MARKET, BY PROFESSIONAL SERVICE

- 12.2.5 NETWORK AUTOMATION MARKET, BY NETWORK TYPE

- 12.2.6 NETWORK AUTOMATION MARKET, BY DEPLOYMENT TYPE

- 12.2.7 NETWORK AUTOMATION MARKET, BY END USER

- 12.2.8 NETWORK AUTOMATION MARKET, BY ORGANIZATION SIZE

- 12.2.9 NETWORK AUTOMATION MARKET, BY ENTERPRISE VERTICAL

- 12.2.10 NETWORK AUTOMATION MARKET, BY REGION

- 12.3 NETWORK AS A SERVICE MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 NETWORK AS A SERVICE MARKET, BY TYPE

- 12.3.3 NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE

- 12.3.4 NETWORK AS A SERVICE MARKET, BY END USER

- 12.3.5 NETWORK AS A SERVICE MARKET, BY REGION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS