|

|

市場調査レポート

商品コード

1734979

マシンビジョンの世界市場:コンポーネント別、ビジョンタイプ別、展開別、システムタイプ別、業界別、地域別 - 2030年までの予測Machine Vision Market by Component (Camera, Frame Grabbers, Optics, LED Lighting, Processors, AI-based Machine Vision Software), Type (PC based, Smart Camera-based), Deployment (General, Robotic Cell), Vision Type (1D, 2D, 3D) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| マシンビジョンの世界市場:コンポーネント別、ビジョンタイプ別、展開別、システムタイプ別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月20日

発行: MarketsandMarkets

ページ情報: 英文 310 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のマシンビジョンの市場規模は、8.3%のCAGRで拡大し、2025年の158億3,000万米ドルから2030年には236億3,000万米ドルに上昇すると予想されています。

製造業は技術革新の新しい波を目の当たりにしており、製造業および非製造業アプリケーションにおける人工知能(AI)の採用を後押ししています。AIベースのソリューションは、資産活用の最大化、ダウンタイムの最小化、機械効率の改善によって生産性を向上させるために製造施設で採用されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント別 | コンポーネント別、ビジョンタイプ別、展開別、システムタイプ別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

カメラレンズは、光学レンズ、またはカメラ本体と組み合わせて使用されるレンズの集合体であり、物体の画像を取り込む機構を持っています。画像は、写真フィルムや、画像を化学的または電子的に保存できるその他の媒体に取り込むことができます。レンズは、撮影した画像をカメラ内のイメージセンサーを通してエンドユーザーに提供します。マシンビジョンシステムで使用されるレンズには、主に固定レンズと交換レンズの2種類があります。スタンドアローンのビジョンシステムの一部として、固定レンズは機械的または液体レンズであり、自動的に焦点を合わせることができます。通常、オートフォーカスレンズは固定視野を持っています。レンズの詳細な設計と構造を除けば、スチルカメラ、ビデオカメラ、望遠鏡、顕微鏡、その他の装置に使用されるレンズの間に大きな違いはありません。

自動車産業は製造業において重要な役割を果たしています。マシンビジョン技術は、自動車産業において、シーラントビードの測定・検査、ネジ山の存在エラー防止、ピストン組立の検証、リベットのステーキング高さの検査、ダッシュボードグラフィックの検査、エアバッグ組立の検証、ドアハンドルの色選別、タイヤとホイールの識別、部品組立のエラー防止、2Dマトリックスコードの読み取り、ロボットガイダンスと組立など、さまざまな用途に使用されています。マシンビジョンシステムは、欠陥の検出、部品の位置合わせや組み立てに使用されます。これらのシステムは、塗装やロボットガイダンスにも使用されます。これらのシステムは、ビンのピッキングや、ドアやパネルなどの部品を組み立てるための位置決めなど、重要な作業の精度を向上させます。熟練労働者不足のため、自動車会社は生産工程の自動化に力を入れています。自動車産業は、生産工程でマシンビジョン技術をいち早く導入しています。

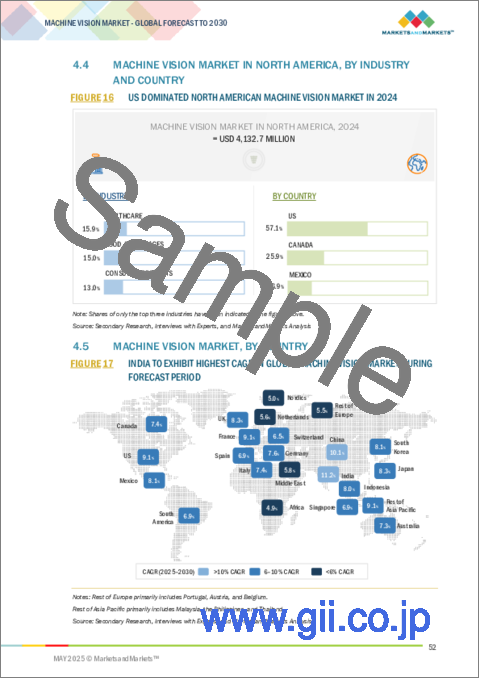

北米は、マシンビジョンシステムが広く採用されているヘルスケア分野の存在感が大きいことから、世界のマシンビジョン市場で2番目のシェアを占めると推定されています。同地域のヘルスケア分野は、厳しい規制、標準プロトコル、包括的な品質管理が特徴です。同地域では、マシンビジョンと人工知能(AI)およびエッジコンピューティングの統合が進んでおり、生産現場でのリアルタイムの意思決定が可能になっています。この開発は、品質管理を簡素化することで、メーカーが労働力不足に対処するのに役立っています。

当レポートでは、世界のマシンビジョン市場について調査し、コンポーネント別、ビジョンタイプ別、展開別、システムタイプ別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 特許分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- ケーススタディ

- 規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- AI/生成AIがマシンビジョン市場に与える影響

- 2025年の米国関税がマシンビジョン市場に与える影響

第6章 マシンビジョンの応用

- イントロダクション

- 品質保証と検査

- ポジショニングとガイダンス

- 測定

- 識別

- 予測保守

第7章 マシンビジョン市場(コンポーネント別)

- イントロダクション

- カメラ

- フレームグラバー

- LED照明

- 光学

- プロセッサー

- その他のハードウェアコンポーネント

- ソフトウェア

第8章 マシンビジョン市場(ビジョンタイプ別)

- イントロダクション

- 1Dビジョンシステム

- 2Dビジョンシステム

- 3Dビジョンシステム

第9章 マシンビジョン市場(展開別)

- イントロダクション

- 一般的転回

- ロボットセル

第10章 マシンビジョン市場(システムタイプ別)

- イントロダクション

- PCベース

- スマートカメラベース

第11章 マシンビジョン市場(業界別)

- イントロダクション

- 自動車

- エレクトロニクス・半導体

- 消費財

- 金属

- ヘルスケア

- 食品・飲料

- ゴム・プラスチック

- 印刷

- 機械

- 太陽光パネル製造

- ロジスティクス

- その他

第12章 マシンビジョン市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- オランダ

- スイス

- 北欧

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- インドネシア

- シンガポール

- オーストラリア

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 中東

- 南米

- アフリカ

第13章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2021年1月~2025年3月

- 収益分析、2020年~2024年

- 2024年におけるトップ5社の市場シェア分析

- 製品比較

- 企業評価と財務指標

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- COGNEX CORPORATION

- BASLER AG

- KEYENCE CORPORATION

- TELEDYNE TECHNOLOGIES INC.

- OMRON CORPORATION

- TKH

- SICK AG

- SONY GROUP CORPORATION

- TEXAS INSTRUMENTS INCORPORATED

- ATLAS COPCO AB

- AMETEK.INC.

- EMERSON ELECTRIC CO.

- CANON INC.

- ZEBRA TECHNOLOGIES CORP.

- その他の企業

- QUALITAS TECHNOLOGIES

- BAUMER

- TORDIVEL AS

- MVTEC SOFTWARE GMBH

- JAI A/S

- INDUSTRIAL VISION SYSTEMS

- IVISYS

- USS VISION LLC

- OPTOTUNE

- IDS IMAGING DEVELOPMENT SYSTEMS GMBH

- INTELGIC INC.

第15章 付録

List of Tables

- TABLE 1 MACHINE VISION MARKET: RESEARCH ASSUMPTIONS

- TABLE 2 MACHINE VISION MARKET: RISK ANALYSIS

- TABLE 3 INDICATING PRICING OF MACHINE VISION KEY COMPONENT (CAMERA), BY KEY PLAYERS, 2024

- TABLE 4 AVERAGE SELLING PRICE TREND OF MACHINE VISION HARDWARE COMPONENT, 2021-2024 (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND OF MACHINE VISION HARDWARE COMPONENT, BY REGION, 2021-2024 (USD)

- TABLE 6 MACHINE VISION MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 7 LIST OF MAJOR PATENTS, 2021-2024

- TABLE 8 IMPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 9 EXPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 10 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 STANDARDS

- TABLE 16 MACHINE VISION MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES (%)

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- TABLE 19 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 20 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR MACHINE VISION

- TABLE 21 MACHINE VISION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

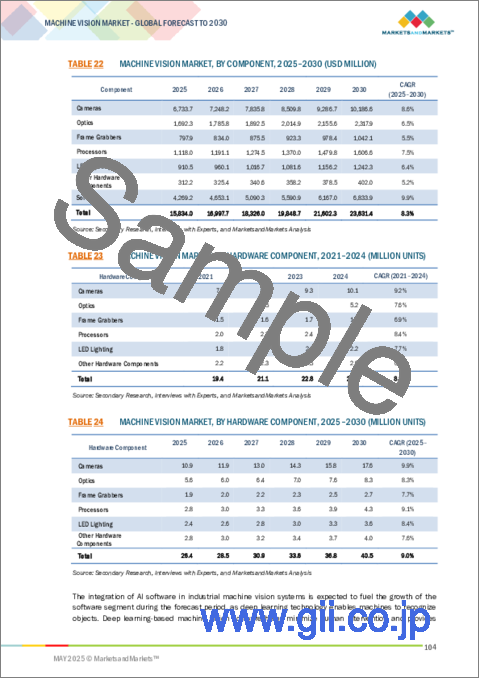

- TABLE 22 MACHINE VISION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 23 MACHINE VISION MARKET, BY HARDWARE COMPONENT, 2021-2024 (MILLION UNITS)

- TABLE 24 MACHINE VISION MARKET, BY HARDWARE COMPONENT, 2025-2030 (MILLION UNITS)

- TABLE 25 CAMERAS: MACHINE VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 26 CAMERAS: MACHINE VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 CAMERAS: MACHINE VISION HARDWARE MARKET, BY IMAGING SPECTRUM, 2021-2024 (USD MILLION)

- TABLE 28 CAMERAS: MACHINE VISION HARDWARE MARKET, BY IMAGING SPECTRUM, 2025-2030 (USD MILLION)

- TABLE 29 CAMERAS: MACHINE VISION HARDWARE MARKET, BY FRAME RATE, 2021-2024 (USD MILLION)

- TABLE 30 CAMERAS: MACHINE VISION HARDWARE MARKET, BY FRAME RATE, 2025-2030 (USD MILLION)

- TABLE 31 CAMERAS: MACHINE VISION HARDWARE MARKET, BY FORMAT, 2021-2024 (USD MILLION)

- TABLE 32 CAMERAS: MACHINE VISION HARDWARE MARKET, BY FORMAT, 2025-2030 (USD MILLION)

- TABLE 33 FRAME GRABBERS: MACHINE VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 FRAME GRABBERS: MACHINE VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 LED LIGHTING: MACHINE VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 LED LIGHTING: MACHINE VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 OPTICS: MACHINE VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 OPTICS: MACHINE VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 PROCESSORS: MACHINE VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 PROCESSORS: MACHINE VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 OTHER HARDWARE COMPONENTS: MACHINE VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 OTHER HARDWARE COMPONENTS: MACHINE VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 SOFTWARE: MACHINE VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 SOFTWARE: MACHINE VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 MACHINE VISION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 46 MACHINE VISION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 47 PC-BASED: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 48 PC-BASED: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 49 SMART CAMERA-BASED: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 50 SMART CAMERA-BASED: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 51 MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 52 MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 53 AUTOMOTIVE: MACHINE VISION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 54 AUTOMOTIVE: MACHINE VISION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 55 AUTOMOTIVE: MACHINE VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 AUTOMOTIVE: MACHINE VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 ELECTRONICS & SEMICONDUCTORS: MACHINE VISION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 58 ELECTRONICS & SEMICONDUCTORS: MACHINE VISION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 59 ELECTRONICS & SEMICONDUCTORS: MACHINE VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 ELECTRONICS & SEMICONDUCTORS: MACHINE VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 CONSUMER PRODUCTS: MACHINE VISION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 62 CONSUMER PRODUCTS: MACHINE VISION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 63 CONSUMER PRODUCTS: MACHINE VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 CONSUMER PRODUCTS: MACHINE VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 METALS: MACHINE VISION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 66 METALS: MACHINE VISION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 67 METALS: MACHINE VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 METALS: MACHINE VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 HEALTHCARE: MACHINE VISION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 70 HEALTHCARE: MACHINE VISION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 71 HEALTHCARE: MACHINE VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 HEALTHCARE: MACHINE VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 FOOD & BEVERAGE: MACHINE VISION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 74 FOOD & BEVERAGE: MACHINE VISION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 75 FOOD & BEVERAGE: MACHINE VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 FOOD & BEVERAGE: MACHINE VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 RUBBER & PLASTICS: MACHINE VISION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 78 RUBBER & PLASTICS: MACHINE VISION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 79 RUBBER & PLASTICS: MACHINE VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 RUBBER & PLASTICS: MACHINE VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 PRINTING: MACHINE VISION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 82 PRINTING: MACHINE VISION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 83 PRINTING: MACHINE VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 PRINTING: MACHINE VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 MACHINERY: MACHINE VISION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 86 MACHINERY: MACHINE VISION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 87 MACHINERY: MACHINE VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 MACHINERY: MACHINE VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 SOLAR PANEL MANUFACTURING: MACHINE VISION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 90 SOLAR PANEL MANUFACTURING: MACHINE VISION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 91 SOLAR PANEL MANUFACTURING: MACHINE VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 SOLAR PANEL MANUFACTURING: MACHINE VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 LOGISTICS: MACHINE VISION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 94 LOGISTICS: MACHINE VISION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 95 LOGISTICS: MACHINE VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 LOGISTICS: MACHINE VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 OTHER INDUSTRIES: MACHINE VISION MARKET, BY SYSTEM TYPE, 2021-2024 (USD MILLION)

- TABLE 98 OTHER INDUSTRIES: MACHINE VISION MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 99 OTHER INDUSTRIES: MACHINE VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 100 OTHER INDUSTRIES: MACHINE VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 MACHINE VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 102 MACHINE VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 NORTH AMERICA: MACHINE VISION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 104 NORTH AMERICA: MACHINE VISION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: MACHINE VISION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 106 NORTH AMERICA: MACHINE VISION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 107 NORTH AMERICA: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 108 NORTH AMERICA: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 109 US: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 110 US: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 111 CANADA: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 112 CANADA: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 113 MEXICO: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 114 MEXICO: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 115 EUROPE: MACHINE VISION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 116 EUROPE: MACHINE VISION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 117 EUROPE: MACHINE VISION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 118 EUROPE: MACHINE VISION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 119 EUROPE: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 120 EUROPE: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 121 GERMANY: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 122 GERMANY: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 123 UK: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 124 UK: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 125 FRANCE: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 126 FRANCE: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 127 ITALY: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 128 ITALY: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 129 SPAIN: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 130 SPAIN: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 131 NETHERLANDS: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 132 NETHERLANDS: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 133 SWITZERLAND: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 134 SWITZERLAND: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 135 NORDICS: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 136 NORDICS: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 137 REST OF EUROPE: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 138 REST OF EUROPE: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 139 ASIA PACIFIC: MACHINE VISION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 140 ASIA PACIFIC: MACHINE VISION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 141 ASIA PACIFIC: MACHINE VISION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 142 ASIA PACIFIC: MACHINE VISION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 143 ASIA PACIFIC: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 144 ASIA PACIFIC: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 145 CHINA: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 146 CHINA: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 147 JAPAN: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 148 JAPAN: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 149 SOUTH KOREA: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 150 SOUTH KOREA: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 151 INDIA: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 152 INDIA: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 153 INDONESIA: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 154 INDONESIA: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 155 SINGAPORE: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 156 SINGAPORE: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 157 AUSTRALIA: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 158 AUSTRALIA: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 159 REST OF ASIA PACIFIC: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 160 REST OF ASIA PACIFIC: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 161 ROW: MACHINE VISION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 162 ROW: MACHINE VISION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 163 ROW: MACHINE VISION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 164 ROW: MACHINE VISION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 165 ROW: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 166 ROW: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 167 MIDDLE EAST: MACHINE VISION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 168 MIDDLE EAST: MACHINE VISION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 169 MIDDLE EAST: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 170 MIDDLE EAST: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 171 SOUTH AMERICA: MACHINE VISION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 172 SOUTH AMERICA: MACHINE VISION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 173 SOUTH AMERICA: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 174 SOUTH AMERICA: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 175 AFRICA: MACHINE VISION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 176 AFRICA: MACHINE VISION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 177 AFRICA: MACHINE VISION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 178 AFRICA: MACHINE VISION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 179 MACHINE VISION MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-MARCH 2025

- TABLE 180 MACHINE VISION MARKET: DEGREE OF COMPETITION

- TABLE 181 MACHINE VISION MARKET: REGION FOOTPRINT

- TABLE 182 MACHINE VISION MARKET: SYSTEM TYPE FOOTPRINT

- TABLE 183 MACHINE VISION MARKET: COMPONENT FOOTPRINT

- TABLE 184 MACHINE VISION MARKET: INDUSTRY FOOTPRINT

- TABLE 185 MACHINE VISION MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 186 MACHINE VISION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 187 MACHINE VISION MARKET: PRODUCT LAUNCHES, JANUARY 2021-MARCH 2025

- TABLE 188 MACHINE VISION MARKET: DEALS, JANUARY 2021-MARCH 2025

- TABLE 189 COGNEX CORPORATION: COMPANY OVERVIEW

- TABLE 190 COGNEX CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 COGNEX CORPORATION: PRODUCT LAUNCHES

- TABLE 192 BASLER AG: COMPANY OVERVIEW

- TABLE 193 BASLER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 BASLER AG: PRODUCT LAUNCHES

- TABLE 195 BASLER AG: DEALS

- TABLE 196 KEYENCE CORPORATION: COMPANY OVERVIEW

- TABLE 197 KEYENCE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 KEYENCE CORPORATION: PRODUCT LAUNCHES

- TABLE 199 TELEDYNE TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 200 TELEDYNE TECHNOLOGIES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 TELEDYNE TECHNOLOGIES INC.: PRODUCT LAUNCHES

- TABLE 202 OMRON CORPORATION: COMPANY OVERVIEW

- TABLE 203 OMRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 OMRON CORPORATION: PRODUCT LAUNCHES

- TABLE 205 OMRON CORPORATION: DEALS

- TABLE 206 TKH: COMPANY OVERVIEW

- TABLE 207 TKH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 TKH: PRODUCT LAUNCHES

- TABLE 209 TKH: DEALS

- TABLE 210 SICK AG: COMPANY OVERVIEW

- TABLE 211 SICK AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 SICK AG: PRODUCT LAUNCHES

- TABLE 213 SICK AG: DEALS

- TABLE 214 SONY GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 215 SONY GROUP CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 SONY GROUP CORPORATION: PRODUCT LAUNCHES

- TABLE 217 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 218 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 219 TEXAS INSTRUMENTS INCORPORATED: PRODUCT LAUNCHES

- TABLE 220 ATLAS COPCO AB: COMPANY OVERVIEW

- TABLE 221 ATLAS COPCO AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 AMETEK.INC.: COMPANY OVERVIEW

- TABLE 223 AMETEK.INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 225 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 EMERSON ELECTRIC CO.: DEALS

- TABLE 227 CANON INC.: COMPANY OVERVIEW

- TABLE 228 CANON INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 ZEBRA TECHNOLOGIES CORP.: COMPANY OVERVIEW

- TABLE 230 ZEBRA TECHNOLOGIES CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 ZEBRA TECHNOLOGIES CORP.: PRODUCT LAUNCHES

- TABLE 232 ZEBRA TECHNOLOGIES CORP.: DEALS

List of Figures

- FIGURE 1 MACHINE VISION MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 MACHINE VISION MARKET: RESEARCH DESIGN

- FIGURE 3 MACHINE VISION MARKET: RESEARCH APPROACH

- FIGURE 4 MACHINE VISION MARKET: BOTTOM-UP APPROACH

- FIGURE 5 MACHINE VISION MARKET: TOP-DOWN APPROACH

- FIGURE 6 MACHINE VISION MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 7 MACHINE VISION MARKET: DATA TRIANGULATION

- FIGURE 8 MACHINE VISION MARKET SIZE, 2021-2030

- FIGURE 9 CAMERAS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MACHINE VISION MARKET FROM 2025 TO 2030

- FIGURE 10 SMART CAMERA-BASED SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 FOOD & BEVERAGES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF MACHINE VISION MARKET IN 2024

- FIGURE 13 GROWING AUTOMATION OF INDUSTRIAL PROCESSES TO DRIVE ADOPTION OF MACHINE VISION SOLUTIONS

- FIGURE 14 CAMERAS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MACHINE VISION MARKET DURING FORECAST PERIOD

- FIGURE 15 FOOD & BEVERAGES SEGMENT TO BE LARGEST END USER DURING FORECAST PERIOD

- FIGURE 16 US DOMINATED NORTH AMERICAN MACHINE VISION MARKET IN 2024

- FIGURE 17 INDIA TO EXHIBIT HIGHEST CAGR IN GLOBAL MACHINE VISION MARKET DURING FORECAST PERIOD

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 ANNUAL INSTALLATION OF INDUSTRIAL ROBOTICS, 2019-2023

- FIGURE 20 IMPACT ANALYSIS: DRIVERS

- FIGURE 21 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 22 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 23 IMPACT ANALYSIS: CHALLENGES

- FIGURE 24 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 AVERAGE SELLING PRICE TREND OF MACHINE VISION HARDWARE COMPONENT, 2021-2024

- FIGURE 26 AVERAGE SELLING PRICE TREND OF MACHINE VISION HARDWARE COMPONENT, BY REGION, 2020-2024

- FIGURE 27 MACHINE VISION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 MACHINE VISION MARKET: ECOSYSTEM ANALYSIS

- FIGURE 29 INVESTMENT AND FUNDING SCENARIO, 2021-2024

- FIGURE 30 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 31 IMPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2019-2023

- FIGURE 32 EXPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2019-2023

- FIGURE 33 MACHINE VISION MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- FIGURE 35 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- FIGURE 36 AI USE CASES IN MACHINE VISION

- FIGURE 37 MACHINE VISION MARKET, BY APPLICATION

- FIGURE 38 MACHINE VISION MARKET, BY COMPONENT

- FIGURE 39 SOFTWARE SEGMENT TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 40 MACHINE VISION MARKET, BY VISION TYPE

- FIGURE 41 MACHINE VISION MARKET, BY DEPLOYMENT

- FIGURE 42 MACHINE VISION MARKET, BY SYSTEM TYPE

- FIGURE 43 SMART CAMERA-BASED SEGMENT TO REGISTER HIGHER CAGR FROM 2025 TO 2030

- FIGURE 44 MACHINE VISION MARKET, BY INDUSTRY

- FIGURE 45 FOOD & BEVERAGES SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MACHINE VISION MARKET

- FIGURE 46 MACHINE VISION MARKET, BY REGION

- FIGURE 47 INDIA TO EXHIBIT HIGHEST CAGR IN GLOBAL MACHINE VISION MARKET DURING FORECAST PERIOD

- FIGURE 48 NORTH AMERICA: MACHINE VISION MARKET SNAPSHOT

- FIGURE 49 US TO DOMINATE NORTH AMERICAN MACHINE VISION MARKET FROM 2025 TO 2030

- FIGURE 50 EUROPE: MACHINE VISION MARKET SNAPSHOT

- FIGURE 51 GERMANY TO ACCOUNT FOR LARGEST SHARE OF EUROPEAN MACHINE VISION MARKET DURING FORECAST PERIOD

- FIGURE 52 ASIA PACIFIC: MACHINE VISION MARKET SNAPSHOT

- FIGURE 53 CHINA TO BE LARGEST MACHINE VISION MARKET IN ASIA PACIFIC BETWEEN 2025 AND 2030

- FIGURE 54 SOUTH AMERICA TO DOMINATE MACHINE VISION MARKET IN ROW MARKET DURING FORECAST PERIOD

- FIGURE 55 MACHINE VISION MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2020-2024

- FIGURE 56 MACHINE VISION MARKET SHARE ANALYSIS, 2024

- FIGURE 57 PRODUCT COMPARISON

- FIGURE 58 COMPANY VALUATION

- FIGURE 59 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 60 MACHINE VISION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 61 MACHINE VISION MARKET: COMPANY FOOTPRINT

- FIGURE 62 MACHINE VISION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 63 COGNEX CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 BASLER AG: COMPANY SNAPSHOT

- FIGURE 65 KEYENCE CORPORATION: COMPANY SNAPSHOT

- FIGURE 66 TELEDYNE TECHNOLOGIES INC.: COMPANY SNAPSHOT

- FIGURE 67 OMRON CORPORATION: COMPANY SNAPSHOT

- FIGURE 68 TKH: COMPANY SNAPSHOT

- FIGURE 69 SICK AG: COMPANY SNAPSHOT

- FIGURE 70 SONY GROUP CORPORATION: COMPANY SNAPSHOT

- FIGURE 71 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- FIGURE 72 ATLAS COPCO AB: COMPANY SNAPSHOT

- FIGURE 73 AMETEK.INC.: COMPANY SNAPSHOT

- FIGURE 74 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- FIGURE 75 CANON INC.: COMPANY SNAPSHOT

- FIGURE 76 ZEBRA TECHNOLOGIES CORP.: COMPANY SNAPSHOT

With a CAGR of 8.3%, the worldwide machine vision market is expected to rise from USD 15.83 billion in 2025 to USD 23.63 billion by 2030. The manufacturing sector is witnessing a new wave of technological revolution, boosting the adoption of artificial intelligence (AI) in manufacturing and non-manufacturing applications. AI-based solutions are being adopted in manufacturing facilities to improve productivity by maximizing asset utilization, minimizing downtime, and improving machine efficiency.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | By Component, Type, Deployment, Vision Type and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Optics segment to secure significant market share during forecast period"

A camera lens is an optical lens, or an assembly of lenses used in conjunction with a camera body, with a mechanism to capture images of objects. The images can be captured on a photographic film or other media capable of storing an image chemically or electronically. The lens delivers the captured image through the image sensor present in the camera to the end user. The two main types of lenses used in machine vision systems are fixed and interchangeable lenses. As part of a standalone vision system, the fixed lens could be a mechanical or liquid lens, which can focus automatically. Typically, autofocus lenses have a fixed field of view. Except for the detailed design and construction of lenses, there are no major differences between a lens used for a still camera, a video camera, a telescope, a microscope, or other apparatus.

"Automotive segment to account for third-largest market share during forecast period"

The automotive industry plays a vital role in the manufacturing sector. Machine vision technology has a range of applications in the automotive industry, such as gauging and inspecting sealant beads, error-proofing thread presence, verifying piston assembly, inspecting rivet staking heights, inspecting dashboard graphics, verifying airbag assembly, color sorting door handles, identifying tires and wheels, error-proofing component assembly, reading 2D matrix codes, as well as for robotic guidance and assembly. Machine vision systems are used to detect defects and align and assemble parts. These systems are also used for painting and robotics guidance. They improve accuracy in critical activities, including bin picking and positioning parts, such as doors and panels, for assembly. Due to the shortage of skilled laborers, automobile companies focus more on automation in their production processes. The automotive industry is an early adopter of machine vision technology in production.

"North America to account for second-largest market share during forecast period"

North America is estimated to account for the second-largest share of the global machine vision market, primarily due to its strong presence of the healthcare sector, where machine vision systems are widely adopted. The healthcare sector in the region is characterized by stringent regulatory mandates, standard protocols, and comprehensive quality controls. There is an increasing integration of machine vision with artificial intelligence (AI) and edge computing in the region, which enables real-time decision-making in production floors. This development helps manufacturers to cope with labor shortages by simplifying quality control.

Breakdown of primaries

A variety of executives from key organizations operating in the machine vision market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1 -40%, Tier 2 - 25%, and Tier 3 - 35%

- By Designation: C-level Executives - 48%, Directors - 33%, and Others - 19%

- By Region: North America - 35%, Europe - 18%, Asia Pacific - 40%, and RoW - 7%

Major players profiled in this report include Cognex Corporation (US), KEYENCE CORPORATION (Japan), Teledyne Technologies Inc. (US), Basler AG (Germany), Omron Corporation (Japan), and others. These leading companies possess a wide portfolio of products, ensuring a prominent presence in established as well as emerging markets.

The study provides a detailed competitive analysis of these key players in the machine vision market, presenting their company profiles, most recent developments, and key market strategies.

Key Market Players

Key players operating in the machine vision market are as follows:

1. Cognex Corporation (US)

2. Basler AG (Germany)

3. KEYENCE CORPORATION (Japan)

4. Teledyne Technologies Inc. (US)

5. TKH (Netherlands)

6. Omron Corporation (Japan)

7. SICK AG (Germany)

8. Sony Group Corporation (Japan)

9. Texas Instruments Incorporated (US)

10. Atlas Copco AB (Sweden)

11. AMETEK.Inc. (US)

12. Emerson Electric Co. (US)

13. Canon Inc. (Japan)

14. Zebra Technologies Corp. (US)

15. Qualitas Technologies (India)

16. Baumer (Switzerland)

17. Tordivel AS (Norway)

18. MVTec Software GmbH (Germany)

19. JAI A/S (Denmark)

20. Industrial Vision Systems (UK)

21. IVISYS (Sweden)

22. USS Vision LLC (US)

23. Optotune (Switzerland)

24. IDS Imaging Development Systems GmbH (Germany)

25. Intelgic Inc. (India)

Study Coverage

In this report, the machine vision market has been segmented based on application, vision type, deployment, component, system type, industry, and region. Application segments include quality assurance and inspection, positioning and guidance, measurement, identification, and predictive maintenance. Vision type segments include 1D vision system, 2D vision system, and 3D vision system. Deployment segments include general and robotic cell. Component segments include cameras, optics, frame grabbers, LED lighting, processors, other hardware components, and software. System type segments include PC based and smart camera-based machine vision systems. Industry segments include automotive, consumer products, electronics & semiconductors, printing, metals, food & beverages, logistics, healthcare, rubber & plastics, machinery, solar panel manufacturing, and other industries. The market has been segmented into four regions: North America, Asia Pacific, Europe, and RoW.

Key Benefits of Buying the Report

- Analysis of key drivers (Increasing demand for quality assurance and automated inspection in the manufacturing industry, rising adoption of vision-guided robotic systems across multiple industries, growing emphasis on safety and improved product quality in the industrial sector), restraints (Cyber vulnerabilities in industrial robotic systems, lack of skilled workforce to operate machine vision systems in the manufacturing industry), opportunities (Rising implementation of machine vision systems in the food and beverage industry, government-backed initiatives aimed to support industrial automation, growing adoption of AI-powered systems across manufacturing and non-manufacturing sectors, emergence of compact smart cameras and processors, surging market demand for hybrid and EVs), and challenges (Complexities in integrating diverse machine vision components across application sites, lack of awareness and high cost associated with machine vision systems) influencing the growth of the machine vision market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the machine vision market.

- Market Development: Comprehensive information about lucrative markets-the report analyses the machine vision market across various regions.

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in the machine vision market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Cognex Corporation (US), KEYENCE CORPORATION (Japan), Teledyne Technologies Inc. (US), Basler AG (Germany), Omron Corporation (Japan), and others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to derive market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MACHINE VISION MARKET

- 4.2 MACHINE VISION MARKET, BY COMPONENT

- 4.3 MACHINE VISION MARKET, BY INDUSTRY

- 4.4 MACHINE VISION MARKET IN NORTH AMERICA, BY INDUSTRY AND COUNTRY

- 4.5 MACHINE VISION MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for quality assurance and automated inspection in manufacturing industry

- 5.2.1.2 Rising adoption of vision-guided robotic systems across multiple industries

- 5.2.1.3 Growing emphasis on safety and improved product quality

- 5.2.1.4 Growing adoption of AI-powered systems across industries

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of awareness and high cost associated with machine vision systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising adoption in food & beverage industry

- 5.2.3.2 Government-backed initiatives to support industrial automation

- 5.2.3.3 Emergence of compact smart cameras and processors

- 5.2.3.4 Surging demand for hybrid and EVs

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexities in integrating diverse machine vision components with traditional systems

- 5.2.4.2 Cyber vulnerabilities in industrial robotic systems

- 5.2.4.3 Lack of skilled workforce to operate machine vision systems

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 INDICATIVE PRICING OF MACHINE VISION KEY COMPONENT (CAMERA), BY KEY PLAYERS, 2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF MACHINE VISION HARDWARE COMPONENT, 2021-2024

- 5.4.3 AVERAGE SELLING PRICE TREND OF MACHINE VISION HARDWARE COMPONENT, BY REGION, 2021-2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Robotic vision

- 5.8.1.2 AI in machine vision

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 5G

- 5.8.2.2 Edge computing

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Cloud computing

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 852580)

- 5.10.2 EXPORT SCENARIO (HS CODE 852580)

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 CASE STUDY

- 5.12.1 PANPASS TECHNOLOGY CO., LTD. AND COGNEX CORPORATION TRANSFORM YUNMEN WINE GROUP'S TRACEABILITY THROUGH MACHINE VISION AND AI-BASED OCR

- 5.12.2 PRESCRIPTIVE DATA USES TELEDYNE FLIR'S MACHINE VISION SENSORS TO DELIVER ACCURATE OCCUPANCY DATA FOR SMART BUILDINGS

- 5.12.3 LEADING AUTOMOTIVE SUPPLIER IMPROVES INSPECTION EFFICIENCY WITH FUJIFILM'S 4D HIGH RESOLUTION MACHINE VISION LENSES

- 5.12.4 ADVANCED DIMENSIONAL AND QUALITY CONTROL WITH 3D MACHINE VISION AT SIDENOR STEEL MILL

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 STANDARDS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON MACHINE VISION MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 IMPACT OF AI/GEN AI ON KEY END-USE INDUSTRIES

- 5.16.2.1 Electronics & semiconductors

- 5.16.2.2 Food & beverages

- 5.16.3 AI USE CASES

- 5.16.4 FUTURE OF AI/GEN AI IN MACHINE VISION ECOSYSTEM

- 5.17 IMPACT OF 2025 US TARIFF ON MACHINE VISION MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

6 APPLICATIONS OF MACHINE VISION

- 6.1 INTRODUCTION

- 6.2 QUALITY ASSURANCE AND INSPECTION

- 6.3 POSITIONING AND GUIDANCE

- 6.4 MEASUREMENT

- 6.5 IDENTIFICATION

- 6.6 PREDICTIVE MAINTENANCE

7 MACHINE VISION MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- 7.2 CAMERAS

- 7.2.1 EMERGENCE OF 3D CAMERAS WITH HIGH-PRECISION VISION TO DRIVE MARKET

- 7.2.2 INTERFACE STANDARDS

- 7.2.2.1 USB 2.0

- 7.2.2.2 USB 3.0

- 7.2.2.3 Camera Link

- 7.2.2.4 Camera Link HS

- 7.2.2.5 GigE

- 7.2.2.6 10 GigE & 25 GigE bandwidth over GigE Vision

- 7.2.2.7 Others

- 7.2.3 IMAGING SPECTRUM

- 7.2.3.1 Visible light

- 7.2.3.2 Visible + IR/IR

- 7.2.4 FRAME RATE

- 7.2.4.1 Less than 25 frames per second

- 7.2.4.2 25-125 frames per second

- 7.2.4.3 More than 125 frames per second

- 7.2.5 FORMAT

- 7.2.5.1 Line scan

- 7.2.5.2 Area scan

- 7.2.6 SENSOR

- 7.2.6.1 Complementary Metal Oxide Semiconductor (CMOS)

- 7.2.6.2 Charged-Coupled Device (CCD)

- 7.3 FRAME GRABBERS

- 7.3.1 INCREASING ADOPTION IN HIGH-SPEED AND LARGE-SCALE MACHINE VISION SYSTEMS TO DRIVE MARKET

- 7.4 LED LIGHTING

- 7.4.1 INCREASING ADOPTION OF STRUCTURED LIGHTING SOLUTIONS TO FUEL DEMAND

- 7.5 OPTICS

- 7.5.1 GROWING INTEGRATION WITH CAMERA BODIES FOR OBJECT IMAGE CAPTURE TO FUEL DEMAND

- 7.6 PROCESSORS

- 7.6.1 ADOPTION OF ADVANCED VISION SYSTEMS FUELING DEMAND FOR HIGH-PERFORMANCE PROCESSORS

- 7.6.2 FIELD-PROGRAMMABLE GATE ARRAY (FPGA)

- 7.6.3 DIGITAL SIGNAL PROCESSOR (DSP)

- 7.6.4 MICROCONTROLLER AND MICROPROCESSOR

- 7.6.5 VISION PROCESSING UNIT

- 7.7 OTHER HARDWARE COMPONENTS

- 7.7.1 NEED TO ENHANCE SYSTEM RELIABILITY AND PERFORMANCE TO FUEL SEGMENTAL GROWTH

- 7.8 SOFTWARE

- 7.8.1 AI-BASED MACHINE VISION SOFTWARE

8 MACHINE VISION MARKET, BY VISION TYPE

- 8.1 INTRODUCTION

- 8.2 1D VISION SYSTEMS

- 8.2.1 APPLICATION IN PRECISE LINEAR INSPECTION IN MANUFACTURING TO DRIVE DEMAND

- 8.3 2D VISION SYSTEMS

- 8.3.1 ADVANCEMENTS IN EMBEDDED VISION AND SMART CAMERA TECHNOLOGIES TO SUPPORT MARKET GROWTH

- 8.4 3D VISION SYSTEMS

- 8.4.1 RISING ADOPTION IN DEPTH ANALYSIS AND SURFACE INSPECTION TO FUEL DEMAND

9 MACHINE VISION MARKET, BY DEPLOYMENT

- 9.1 INTRODUCTION

- 9.2 GENERAL

- 9.2.1 RISING DEMAND FOR AUTOMATED INSPECTIONS TO DRIVE MARKET GROWTH

- 9.3 ROBOTIC CELL

- 9.3.1 RISING AUTOMATION AND TECHNOLOGICAL ADVANCEMENTS TO PROPEL MACHINE VISION ADOPTION

10 MACHINE VISION MARKET, BY SYSTEM TYPE

- 10.1 INTRODUCTION

- 10.2 PC-BASED

- 10.2.1 ADVANCED PROCESSING WITH MULTI-CAMERA SUPPORT TO DRIVE ADOPTION OF PC-BASED VISION SYSTEMS

- 10.3 SMART CAMERA-BASED

- 10.3.1 RISING ADOPTION OF SMART CAMERA IN IMAGING AND SECURITY APPLICATIONS TO DRIVE MARKET

11 MACHINE VISION MARKET, BY INDUSTRY

- 11.1 INTRODUCTION

- 11.2 AUTOMOTIVE

- 11.2.1 NEED FOR ENHANCING ACCURACY AND PRODUCTIVITY TO INCREASE ADOPTION

- 11.3 ELECTRONICS & SEMICONDUCTORS

- 11.3.1 RISING NEED TO IMPROVE ELECTRONIC MANUFACTURING BY IDENTIFYING DEFECTS AND ENHANCING SEMICONDUCTOR PRODUCTION

- 11.4 CONSUMER PRODUCTS

- 11.4.1 GROWING DEMAND FOR AUTOMATED INSPECTION TO IMPROVE ELECTRONIC ASSEMBLY TO DRIVE MARKET

- 11.5 METALS

- 11.5.1 SHORTAGE OF SKILLED LABOR FUELING ADOPTION OF MACHINE VISION SYSTEMS TO BOOST PRODUCT QUALITY

- 11.6 HEALTHCARE

- 11.6.1 STRINGENT GOVERNMENT REGULATION AND GROWING NEED TO COMBAT COUNTERFEIT PRODUCTS TO DRIVE MARKET

- 11.7 FOOD & BEVERAGES

- 11.7.1 FOOD

- 11.7.1.1 Need to reduce labor cost and enhance food processing fueling adoption

- 11.7.2 BEVERAGES

- 11.7.2.1 Need to ensure quality and hygiene in beverage production to fuel market growth

- 11.7.1 FOOD

- 11.8 RUBBER & PLASTICS

- 11.8.1 INCREASING CONSUMPTION OF PLASTICS IN VARIOUS INDUSTRIAL SECTORS TO SUPPORT MARKET GROWTH

- 11.9 PRINTING

- 11.9.1 MACHINE VISION SYSTEMS INCREASINGLY USED TO MAINTAIN QUALITY IN PRINTING OPERATIONS

- 11.10 MACHINERY

- 11.10.1 GROWING NEED TO ENHANCE MACHINERY PERFORMANCE AND SAFETY TO FUEL DEMAND

- 11.11 SOLAR PANEL MANUFACTURING

- 11.11.1 NEED FOR INCREASED PRODUCTION AND QUALITY OF SOLAR PANELS TO BOOST MARKET GROWTH

- 11.12 LOGISTICS

- 11.12.1 GROWING DEMAND FOR AUTOMATED SORTING AND TRACKING TO DRIVE MARKET

- 11.13 OTHER INDUSTRIES

- 11.13.1 INCREASING ADOPTION OF MACHINE VISION FOR DEFECT DETECTION AND QUALITY CONTROL TO SUPPORT MARKET GROWTH

12 MACHINE VISION MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.2.2 US

- 12.2.2.1 Expanding role of machine vision in healthcare and automotive applications to drive market

- 12.2.3 CANADA

- 12.2.3.1 Increasing adoption in automotive, electronics, and healthcare industries to boost demand

- 12.2.4 MEXICO

- 12.2.4.1 Growing emphasis on high-quality standards and operational efficiency to fuel adoption

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.3.2 GERMANY

- 12.3.2.1 Increasing adoption to enhance operational efficiency and precision in industrial applications to drive market

- 12.3.3 UK

- 12.3.3.1 Rising adoption in automotive and manufacturing sectors to fuel market growth

- 12.3.4 FRANCE

- 12.3.4.1 Growth in electric vehicle market and portable electronics driving machine vision adoption

- 12.3.5 ITALY

- 12.3.5.1 Government initiatives driving adoption of advanced manufacturing technologies

- 12.3.6 SPAIN

- 12.3.6.1 Growth of consumer electronics and pharmaceutical industries fueling machine vision adoption

- 12.3.7 NETHERLANDS

- 12.3.7.1 Rising adoption in logistics, food processing, and electronics sectors to drive market

- 12.3.8 SWITZERLAND

- 12.3.8.1 Increased integration of machine vision in precision manufacturing and pharmaceutical automation to boost market

- 12.3.9 NORDICS

- 12.3.9.1 Strong push for industrial automation fueling demand across manufacturing and energy sectors

- 12.3.10 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.2 CHINA

- 12.4.2.1 Expanding deployment of machine vision systems for higher productivity and quality enhancement

- 12.4.3 JAPAN

- 12.4.3.1 Increasing adoption in consumer electronics sector to boost market growth

- 12.4.4 SOUTH KOREA

- 12.4.4.1 Adoption of machine vision systems expanding in key sectors to ensure quality compliance

- 12.4.5 INDIA

- 12.4.5.1 Government initiatives driving factory automation growth

- 12.4.6 INDONESIA

- 12.4.6.1 Emerging industrial base and rising automation needs driving machine vision adoption

- 12.4.7 SINGAPORE

- 12.4.7.1 Technological leadership and advanced infrastructure supporting market growth

- 12.4.8 AUSTRALIA

- 12.4.8.1 Expanding applications in food & beverages and electronics industries to drive demand

- 12.4.9 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 12.5.2 MIDDLE EAST

- 12.5.2.1 Saudi Arabia

- 12.5.2.1.1 Vision 2030 reforms fueling demand for industrial automation and machine vision systems

- 12.5.2.2 UAE

- 12.5.2.2.1 Rapid digital transformation and smart factory initiatives to fuel market growth

- 12.5.2.3 Bahrain

- 12.5.2.3.1 Increasing investment in smart manufacturing technologies to drive machine vision adoption

- 12.5.2.4 Kuwait

- 12.5.2.4.1 Rising implementation of smart factories accelerating demand for machine vision technologies

- 12.5.2.5 Oman

- 12.5.2.5.1 Strategic focus on industrial modernization fostering machine vision system adoption

- 12.5.2.6 Qatar

- 12.5.2.6.1 Strategic focus on automation and vision technologies to enhance industrial capabilities

- 12.5.2.7 Rest of Middle East

- 12.5.2.1 Saudi Arabia

- 12.5.3 SOUTH AMERICA

- 12.5.3.1 Brazil

- 12.5.3.1.1 Booming automotive, food & beverages, and manufacturing industries driving machine vision adoption

- 12.5.3.2 Argentina

- 12.5.3.2.1 Growing focus on modernizing manufacturing facilities to boost machine vision market

- 12.5.3.3 Other South American countries

- 12.5.3.1 Brazil

- 12.5.4 AFRICA

- 12.5.4.1 South Africa

- 12.5.4.1.1 Increasing focus on automated visual inspection and quality assurance to drive adoption

- 12.5.4.2 Other African countries

- 12.5.4.1 South Africa

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2021-MARCH 2025

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2024

- 13.5 PRODUCT COMPARISON

- 13.6 COMPANY VALUATION AND FINANCIAL METRICS

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 System type footprint

- 13.7.5.4 Component footprint

- 13.7.5.5 Industry footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 COGNEX CORPORATION

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 BASLER AG

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Deals

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 KEYENCE CORPORATION

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 TELEDYNE TECHNOLOGIES INC.

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 OMRON CORPORATION

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 TKH

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Deals

- 14.1.6.4 MnM view

- 14.1.6.4.1 Key strengths

- 14.1.6.4.2 Strategic choices

- 14.1.6.4.3 Weaknesses and competitive threats

- 14.1.7 SICK AG

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.7.3.2 Deals

- 14.1.8 SONY GROUP CORPORATION

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.9 TEXAS INSTRUMENTS INCORPORATED

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.10 ATLAS COPCO AB

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.11 AMETEK.INC.

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.12 EMERSON ELECTRIC CO.

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Deals

- 14.1.13 CANON INC.

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.14 ZEBRA TECHNOLOGIES CORP.

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Solutions/Services offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Product launches

- 14.1.14.3.2 Deals

- 14.1.1 COGNEX CORPORATION

- 14.2 OTHER PLAYERS

- 14.2.1 QUALITAS TECHNOLOGIES

- 14.2.2 BAUMER

- 14.2.3 TORDIVEL AS

- 14.2.4 MVTEC SOFTWARE GMBH

- 14.2.5 JAI A/S

- 14.2.6 INDUSTRIAL VISION SYSTEMS

- 14.2.7 IVISYS

- 14.2.8 USS VISION LLC

- 14.2.9 OPTOTUNE

- 14.2.10 IDS IMAGING DEVELOPMENT SYSTEMS GMBH

- 14.2.11 INTELGIC INC.

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS