|

|

市場調査レポート

商品コード

1734978

ヘルスケアにおけるコンピュータビジョンの世界市場:製品・サービス別、タイプ別、用途別、エンドユーザー別、地域別 - 2030年までの予測Computer Vision in Healthcare Market by Product, Type, Application (Imaging, Surgeries, Hospital Management ), End User & Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ヘルスケアにおけるコンピュータビジョンの世界市場:製品・サービス別、タイプ別、用途別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月16日

発行: MarketsandMarkets

ページ情報: 英文 278 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のヘルスケアにおけるコンピュータビジョンの市場規模は、2025年の48億6,000万米ドルから2030年には143億9,000万米ドルに成長し、予測期間中のCAGRは24.3%になると予測されています。

市場成長は、技術革新、ヘルスケア需要の高まり、規制支援、より効率的で効果的なヘルスケアソリューションの必要性の融合によって推進されます。データプライバシー、セキュリティ、規制遵守に関する懸念は、ヘルスケア環境におけるコンピュータビジョンソリューションの展開に大きな障壁となり、予測期間を通じて市場拡大の妨げとなります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 製品・サービス別、タイプ別、用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

最近の技術動向、特に、患者記録を共有することなく分散化されたヘルスケアデータ全体でモデル学習を可能にする連携学習は、プライバシーのハードルを克服し、アルゴリズム開発を加速させています。AI/ML対応医療機器に関するFDAの2024年5月のガイダンス草案は、規制の道筋を明確にし、ベンダーに継続的な学習と市販後の性能監視のための設計を促しています。これと並行して、エッジコンピューティングVPUと5G対応イメージングデバイスの台頭により、オンプレミスでの推論が容易になり、手術支援などタイムクリティカルなアプリケーションの待ち時間が短縮されます。

地域別では、北米がヘルスケアにおけるコンピュータビジョン市場を独占しており、これは先進的なヘルスケアインフラ、テクノロジーとデータ駆動型のヘルスケア組織の強い存在感、政府の大きな支援に後押しされています。FDAのAI/ML対応機器ソフトウェア機能に関する2025年1月のガイダンス草案や、米国国立衛生研究所(NIH)の人工知能プログラムなどのイニシアティブは、規制の道筋を明確にし、大規模な研究プロジェクトに資金を提供することで、AI搭載画像処理プラットフォームの採用を加速させています。また、米国の高額なヘルスケア支出、EHRインフラの普及、診断所要時間の短縮と患者の転帰改善の必要性も、採用を後押ししています。

NVIDIA Corporation(米国)、Intel Corporation(米国)、Microsoft Corporation(米国)、Advanced Micro Devices, Inc.(米国)、Google(米国)などの大手企業は、戦略的パートナーシップを活用しています。2023年4月、Microsoft(米国)とEpic Systems Corporation(米国)は、Azure OpenAI ServiceをEpicの電子カルテ(EHR)プラットフォームに統合することで、戦略的パートナーシップを拡大した。Mayo Clinic(米国)やCleveland Clinic(米国)などの大手医療機関は、専用のAIセンターや症例に特化した実装を通じて、放射線科ワークフローの自動化、脳卒中ケア、患者のリアルタイムモニタリングのために予測分析とコンピュータービジョンを活用しています。このように、北米市場のリーダーシップは、規制の進展、戦略的な業界連携、ヘルスケアにおける深いIT統合によって強化されており、この地域をヘルスケアにおけるコンピュータビジョンの世界のフロントランナーとして位置付けています。

製品・サービス別では、ヘルスケアにおけるコンピュータビジョン市場の支配的なセグメントはソフトウェアセグメントであると予想されます。これは、高度な分析とアルゴリズムを開発、展開、臨床に統合するための基盤として重要な役割を担っているためです。革新的なヘルスケアソリューションへの需要が拡大し続ける中、ソフトウェアベースのコンピュータビジョン技術は、患者ケアを変革し、医療提供とアウトカムの改善を推進する上で、ますます極めて重要な役割を果たすようになっています。

ヘルスケアにおけるコンピュータビジョン市場では、ヘルスケアプロバイダー分野が最も高い成長率を示すと予測されています。この成長は、ヘルスケアプロバイダーが患者ケアの強化と業務プロセスの合理化のためにAIと自動化技術を採用するようになっていることによる。その中で、コンピュータビジョンは、医療画像の解釈や患者のモニタリングに不可欠な画像解析やパターン認識などの一連の機能を提供します。

さらに、ヘルスケアにおけるコンピュータビジョン市場参入企業にとっては、中国やインドをはじめとするアジアの新興市場に有望な成長機会が見込まれています。アジア太平洋地域の拡大は、主に医療費の増加、慢性疾患負担の増加、ヘルスケアITの進歩、ヘルスケアサービスへのアクセスの改善、研究開発活動の増加、政府の支援イニシアティブなどの要因によって推進されています。このような動向が続く中、コンピュータビジョン技術の採用は加速し、アジア太平洋地域のヘルスケア分野における更なる成長とイノベーションを促進すると予想されます。

当レポートでは、世界のヘルスケアにおけるコンピュータビジョン市場について調査し、製品・サービス別、タイプ別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 業界動向

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 特許分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- アンメットニーズとエンドユーザーの期待

- ビジネスモデル分析

- 2025年の米国関税の影響

第6章 ヘルスケアにおけるコンピュータビジョン市場(製品・サービス別)

- イントロダクション

- ソフトウェア

- ハードウェア

- サービス

第7章 ヘルスケアにおけるコンピュータビジョン市場(タイプ別)

- イントロダクション

- PCベースのコンピュータビジョンシステム

- スマートカメラベースのコンピュータービジョンシステム

第8章 ヘルスケアにおけるコンピュータビジョン市場(用途別)

- イントロダクション

- 医療画像診断

- 病院経営

- 手術

- その他

第9章 ヘルスケアにおけるコンピュータビジョン市場(エンドユーザー別)

- イントロダクション

- ヘルスケアプロバイダー

- 診断センター

- その他

第10章 ヘルスケアにおけるコンピュータビジョン市場(地域別)

- イントロダクション

- 北米

- 北米:景気後退の影響分析

- 米国

- カナダ

- 欧州

- 欧州:景気後退の影響分析

- ドイツ

- 英国

- フランス

- イタリア

- その他

- アジア太平洋

- アジア太平洋:景気後退の影響分析

- 日本

- 中国

- インド

- その他

- ラテンアメリカ

- ラテンアメリカ:景気後退の影響分析

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 中東・アフリカ:景気後退の影響分析

- GCC諸国

- その他

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析、2019年~2023年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/ソフトウェア比較

- 企業評価マトリックス:主要参入企業:2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- NVIDIA CORPORATION

- INTEL CORPORATION

- MICROSOFT

- ADVANCED MICRO DEVICES, INC.

- BASLER AG

- AICURE

- ICAD, INC.

- THERMO FISHER SCIENTIFIC INC.

- SENSETIME

- KEYENCE CORPORATION

- ASSERT AI

- ARTISIGHT

- LOOKDEEP

- CARE.AI

- CAREVIEW COMMUNICATIONS

- VIRTUSENSE TECHNOLOGIES, INC.

- TETON

- その他の企業

- VISO.AI

- NANO-X IMAGING LTD.

- COMOFI MEDTECH PVT. LTD.

- AIVIDTECHVISION

- ROBOFLOW, INC.

- OPTOTUNE

- CUREMETRIX, INC.

第13章 付録

List of Tables

- TABLE 1 COMPUTER VISION IN HEALTHCARE MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 COMPUTER VISION IN HEALTHCARE MARKET: RISK ASSESSMENT

- TABLE 3 COMPUTER VISION IN HEALTHCARE MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS

- TABLE 4 AVERAGE SELLING PRICE OF PROCESSORS, BY KEY PLAYER, 2024 (USD)

- TABLE 5 AVERAGE SELLING PRICE OF PROCESSORS, BY REGION, 2024 (USD)

- TABLE 6 COMPUTER VISION IN HEALTHCARE MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 7 COMPUTER VISION IN HEALTHCARE MARKET: JURISDICTION ANALYSIS OF TOP APPLICANTS, BY COUNTRY, 2015-2025

- TABLE 8 COMPUTER VISION IN HEALTHCARE MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2020-2025

- TABLE 9 IMPORT DATA FOR HS CODE 854231, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 EXPORT DATA FOR HS CODE 854231, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 COMPUTER VISION IN HEALTHCARE MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 COMPUTER VISION IN HEALTHCARE MARKET: PORTER'S FIVE FORCES

- TABLE 17 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS (%)

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 19 UNMET NEEDS IN COMPUTER VISION IN HEALTHCARE MARKET

- TABLE 20 END-USER EXPECTATIONS IN COMPUTER VISION IN HEALTHCARE MARKET

- TABLE 21 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 22 COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 23 COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 24 COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 25 COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET FOR ON-PREMISE SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 26 COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET FOR CLOUD-BASED SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 27 COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 28 COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 30 COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET FOR CPUS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET FOR GPUS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET FOR FPGAS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 34 COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET FOR ASICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 35 COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET FOR VPUS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 COMPUTER VISION IN HEALTHCARE MEMORY DEVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 COMPUTER VISION IN HEALTHCARE NETWORKS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 COMPUTER VISION IN HEALTHCARE SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 39 COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 40 PC-BASED COMPUTER VISION SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 SMART CAMERA-BASED COMPUTER VISION SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 43 COMPUTER VISION IN HEALTHCARE MARKET FOR MEDICAL IMAGING & DIAGNOSTICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 45 COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 COMPUTER VISION IN HEALTHCARE MARKET FOR PATIENT ACTIVITY MONITORING/ FALL PREVENTION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 COMPUTER VISION IN HEALTHCARE MARKET FOR PATIENT/PROVIDER TRACKING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 48 COMPUTER VISION IN HEALTHCARE MARKET FOR SCHEDULING OPTIMIZATION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 COMPUTER VISION IN HEALTHCARE MARKET FOR INVENTORY MANAGEMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 50 COMPUTER VISION IN HEALTHCARE MARKET FOR SURGERIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 COMPUTER VISION IN HEALTHCARE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 53 COMPUTER VISION IN HEALTHCARE MARKET FOR HEALTHCARE PROVIDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 COMPUTER VISION IN HEALTHCARE MARKET FOR DIAGNOSTIC CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 COMPUTER VISION IN HEALTHCARE MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 56 COMPUTER VISION IN HEALTHCARE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 57 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 59 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 60 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 62 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 66 US: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 67 US: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 68 US: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 69 US: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 70 US: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 71 US: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 72 US: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 73 US: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 74 CANADA: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 75 CANADA: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 76 CANADA: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 77 CANADA: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 78 CANADA: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 79 CANADA: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 80 CANADA: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 81 CANADA: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 82 EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 83 EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 84 EUROPE: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 85 EUROPE: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 86 EUROPE: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 87 EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 88 EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 89 EUROPE: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 90 EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 91 GERMANY: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 92 GERMANY: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 93 GERMANY: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 94 GERMANY: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 95 GERMANY: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 96 GERMANY: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 97 GERMANY: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 98 GERMANY: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 99 UK: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 100 UK: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 101 UK: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 102 UK: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 103 UK: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 104 UK: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 105 UK: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 106 UK: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 107 FRANCE: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 108 FRANCE: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 109 FRANCE: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 110 FRANCE: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 111 FRANCE: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 112 FRANCE: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 113 FRANCE: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 114 FRANCE: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 115 ITALY: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 116 ITALY: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 117 ITALY: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 118 ITALY: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 ITALY: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 120 ITALY: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 121 ITALY: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 122 ITALY: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 123 REST OF EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 124 REST OF EUROPE: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 125 REST OF EUROPE: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 126 REST OF EUROPE: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 127 REST OF EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 128 REST OF EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 129 REST OF EUROPE: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 130 REST OF EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 132 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 134 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 135 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 136 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 138 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 140 JAPAN: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 141 JAPAN: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 142 JAPAN: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 143 JAPAN: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 144 JAPAN: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 145 JAPAN: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 146 JAPAN: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 147 JAPAN: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 148 CHINA: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 149 CHINA: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 150 CHINA: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 151 CHINA: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 152 CHINA: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 153 CHINA: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 154 CHINA: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 155 CHINA: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 156 INDIA: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 157 INDIA: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 INDIA: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 159 INDIA: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 160 INDIA: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 161 INDIA: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 162 INDIA: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 163 INDIA: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 164 REST OF ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 165 REST OF ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 166 REST OF ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 167 REST OF ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 168 REST OF ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 REST OF ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 170 REST OF ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 172 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 173 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 174 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 175 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 176 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 177 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 178 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 179 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 180 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 181 BRAZIL: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 182 BRAZIL: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 183 BRAZIL: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 184 BRAZIL: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 185 BRAZIL: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 186 BRAZIL: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 187 BRAZIL: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 188 BRAZIL: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 189 MEXICO: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 190 MEXICO: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 191 MEXICO: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 192 MEXICO: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 193 MEXICO: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 194 MEXICO: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 195 MEXICO: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 196 MEXICO: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 197 REST OF LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 198 REST OF LATIN AMERICA: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 199 REST OF LATIN AMERICA: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 200 REST OF LATIN AMERICA: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 201 REST OF LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 202 REST OF LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 203 REST OF LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 204 REST OF LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 214 GCC COUNTRIES: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 215 GCC COUNTRIES: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 216 GCC COUNTRIES: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 217 GCC COUNTRIES: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 218 GCC COUNTRIES: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 219 GCC COUNTRIES: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 220 GCC COUNTRIES: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 221 GCC COUNTRIES: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 222 REST OF MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 223 REST OF MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 224 REST OF MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 225 REST OF MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 226 REST OF MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 227 REST OF MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 228 REST OF MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 229 REST OF MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 230 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN COMPUTER VISION IN HEALTHCARE MARKET, JANUARY 2022-MAY 2025

- TABLE 231 COMPUTER VISION IN HEALTHCARE MARKET: DEGREE OF COMPETITION

- TABLE 232 COMPUTER VISION IN HEALTHCARE MARKET: REGION FOOTPRINT

- TABLE 233 COMPUTER VISION IN HEALTHCARE MARKET: PRODUCT & SERVICE FOOTPRINT

- TABLE 234 COMPUTER VISION IN HEALTHCARE MARKET: APPLICATION FOOTPRINT

- TABLE 235 COMPUTER VISION IN HEALTHCARE MARKET: END-USER FOOTPRINT

- TABLE 236 COMPUTER VISION IN HEALTHCARE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 237 COMPUTER VISION IN HEALTHCARE MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 238 COMPUTER VISION IN HEALTHCARE MARKET: PRODUCT/SOLUTION LAUNCHES AND APPROVALS, JANUARY 2022-MAY 2025

- TABLE 239 COMPUTER VISION IN HEALTHCARE MARKET: DEALS, JANUARY 2022-MAY 2025

- TABLE 240 COMPUTER VISION IN HEALTHCARE MARKET: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 241 NVIDIA CORPORATION: COMPANY OVERVIEW

- TABLE 242 NVIDIA CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 243 NVIDIA CORPORATION: PRODUCT/SOLUTION LAUNCHES AND APPROVALS, JANUARY 2022-MAY 2025

- TABLE 244 NVIDIA CORPORATION: DEALS, JANUARY 2022-MAY 2025

- TABLE 245 INTEL CORPORATION: COMPANY OVERVIEW

- TABLE 246 INTEL CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 247 INTEL CORPORATION: PRODUCT/SOLUTION LAUNCHES AND APPROVALS, JANUARY 2022-MAY 2025

- TABLE 248 INTEL CORPORATION: DEALS, JANUARY 2022-MAY 2025

- TABLE 249 MICROSOFT: COMPANY OVERVIEW

- TABLE 250 MICROSOFT: PRODUCTS/SOLUTIONS OFFERED

- TABLE 251 MICROSOFT: DEALS, JANUARY 2022-MAY 2025

- TABLE 252 ADVANCED MICRO DEVICES, INC.: COMPANY OVERVIEW

- TABLE 253 ADVANCED MICRO DEVICES, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 254 ADVANCED MICRO DEVICES, INC.: PRODUCT/SOLUTION LAUNCHES AND APPROVALS, JANUARY 2022-MAY 2025

- TABLE 255 ADVANCED MICRO DEVICES, INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 256 GOOGLE: COMPANY OVERVIEW

- TABLE 257 GOOGLE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 258 BASLER AG: COMPANY OVERVIEW

- TABLE 259 BASLER AG: PRODUCTS/SOLUTIONS OFFERED

- TABLE 260 BASLER AG: PRODUCT/SOLUTION LAUNCHES AND APPROVALS, JANUARY 2022-MAY 2025

- TABLE 261 AICURE: COMPANY OVERVIEW

- TABLE 262 AICURE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 263 AICURE: DEALS, JANUARY 2022-MAY 2025

- TABLE 264 AICURE: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 265 ICAD, INC.: COMPANY OVERVIEW

- TABLE 266 ICAD, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 267 ICAD, INC.: PRODUCT/SOLUTION LAUNCHES AND APPROVALS, JANUARY 2022-MAY 2025

- TABLE 268 ICAD, INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 269 ICAD, INC.: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 270 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 271 THERMO FISHER SCIENTIFIC INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 272 SENSETIME: COMPANY OVERVIEW

- TABLE 273 SENSETIME: PRODUCTS/SOLUTIONS OFFERED

- TABLE 274 SENSETIME: PRODUCT/SOLUTION LAUNCHES AND APPROVALS, JANUARY 2022-MAY 2025

- TABLE 275 KEYENCE CORPORATION: COMPANY OVERVIEW

- TABLE 276 KEYENCE CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 277 ASSERT AI: COMPANY OVERVIEW

- TABLE 278 ASSERT AI: PRODUCTS/SOLUTIONS OFFERED

- TABLE 279 ARTISIGHT: COMPANY OVERVIEW

- TABLE 280 ARTISIGHT: PRODUCTS/SOLUTIONS OFFERED

- TABLE 281 ARTISIGHT: DEALS, JANUARY 2022-MAY 2025

- TABLE 282 ARTISIGHT: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 283 LOOKDEEP: COMPANY OVERVIEW

- TABLE 284 LOOKDEEP: PRODUCTS/SOLUTIONS OFFERED

- TABLE 285 CARE.AI: COMPANY OVERVIEW

- TABLE 286 CARE.AI: PRODUCTS/SOLUTIONS OFFERED

- TABLE 287 CARE.AI: DEALS, JANUARY 2022-MAY 2025

- TABLE 288 CARE.AI: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 289 CAREVIEW COMMUNICATIONS: COMPANY OVERVIEW

- TABLE 290 CAREVIEW COMMUNICATIONS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 291 CAREVIEW COMMUNICATIONS: PRODUCT/SOLUTION LAUNCHES AND APPROVALS, JANUARY 2022-MAY 2025

- TABLE 292 CAREVIEW COMMUNICATIONS: DEALS, JANUARY 2022-MAY 2025

- TABLE 293 VIRTUSENSE TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 294 VIRTUSENSE TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 295 VIRTUSENSE TECHNOLOGIES, INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 296 TETON: COMPANY OVERVIEW

- TABLE 297 TETON: PRODUCTS/SOLUTIONS OFFERED

- TABLE 298 TETON: PRODUCT/SOLUTION LAUNCHES AND APPROVALS, JANUARY 2022-MAY 2025

- TABLE 299 TETON: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 300 VISO.AI: COMPANY OVERVIEW

- TABLE 301 NANO-X IMAGING LTD.: COMPANY OVERVIEW

- TABLE 302 COMOFI MEDTECH PVT. LTD.: COMPANY OVERVIEW

- TABLE 303 AIVIDTECHVISION: COMPANY OVERVIEW

- TABLE 304 ROBOFLOW, INC.: COMPANY OVERVIEW

- TABLE 305 OPTOTUNE: COMPANY OVERVIEW

- TABLE 306 CUREMETRIX, INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 COMPUTER VISION IN HEALTHCARE: MARKET SEGMENTATION AND REGIONS COVERED

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 CAGR PROJECTIONS FROM ANALYSIS OF MARKET DYNAMICS, 2025-2030

- FIGURE 8 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 RESEARCH ASSUMPTIONS

- FIGURE 11 COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2025 VS. 2030 (USD MILLION)

- FIGURE 12 COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

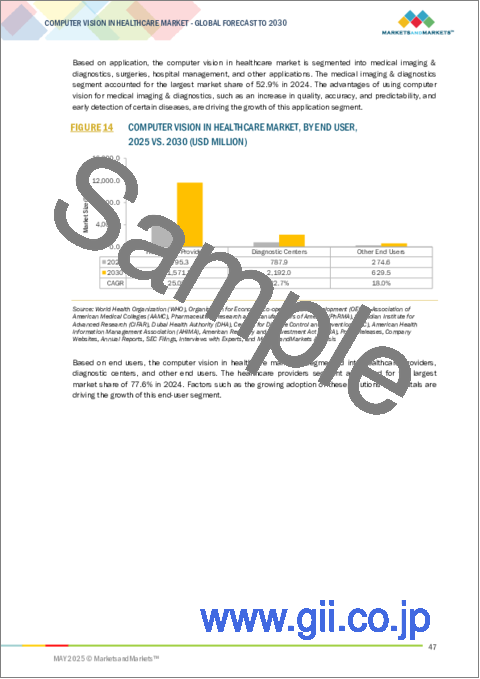

- FIGURE 14 COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 GEOGRAPHICAL SNAPSHOT OF COMPUTER VISION IN HEALTHCARE MARKET

- FIGURE 16 INCREASING DEMAND FOR COMPUTER VISION SYSTEMS IN HEALTHCARE INDUSTRY TO DRIVE MARKET

- FIGURE 17 SOFTWARE SEGMENT AND JAPAN LED ASIA PACIFIC MARKET IN 2024

- FIGURE 18 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 19 NORTH AMERICA TO DOMINATE COMPUTER VISION IN HEALTHCARE MARKET DURING FORECAST PERIOD

- FIGURE 20 EMERGING MARKETS TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 21 COMPUTER VISION IN HEALTHCARE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 COMPUTER VISION IN HEALTHCARE MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 AVERAGE SELLING PRICE OF PROCESSORS, BY KEY PLAYER, 2024 (USD)

- FIGURE 24 COMPUTER VISION IN HEALTHCARE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 COMPUTER VISION IN HEALTHCARE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 COMPUTER VISION IN HEALTHCARE MARKET: INVESTMENT AND FUNDING SCENARIO, 2021-2024

- FIGURE 27 COMPUTER VISION IN HEALTHCARE MARKET: PATENT ANALYSIS, JANUARY 2015-MAY 2025

- FIGURE 28 IMPORT DATA FOR HS CODE 854231, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 29 EXPORT DATA FOR HS CODE 854231, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 30 COMPUTER VISION IN HEALTHCARE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 33 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE MARKET SNAPSHOT

- FIGURE 34 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET SNAPSHOT

- FIGURE 35 REVENUE ANALYSIS OF KEY PLAYERS IN COMPUTER VISION IN HEALTHCARE MARKET, 2019-2023 (USD MILLION)

- FIGURE 36 MARKET SHARE ANALYSIS OF KEY PLAYERS IN COMPUTER VISION IN HEALTHCARE MARKET, 2024

- FIGURE 37 EV/EBITDA OF KEY VENDORS

- FIGURE 38 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF COMPUTER VISION SOLUTION VENDORS

- FIGURE 39 COMPUTER VISION IN HEALTHCARE MARKET: BRAND/SOFTWARE COMPARISON

- FIGURE 40 COMPUTER VISION IN HEALTHCARE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 41 COMPUTER VISION IN HEALTHCARE MARKET: COMPANY FOOTPRINT

- FIGURE 42 COMPUTER VISION IN HEALTHCARE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 43 NVIDIA CORPORATION: COMPANY SNAPSHOT (2023)

- FIGURE 44 INTEL CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 45 MICROSOFT: COMPANY SNAPSHOT (2024)

- FIGURE 46 ADVANCED MICRO DEVICES, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 47 GOOGLE: COMPANY SNAPSHOT (2024)

- FIGURE 48 BASLER AG: COMPANY SNAPSHOT (2024)

- FIGURE 49 ICAD, INC.: COMPANY SNAPSHOT (2023)

- FIGURE 50 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2024)

- FIGURE 51 SENSETIME: COMPANY SNAPSHOT (2024)

- FIGURE 52 KEYENCE CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 53 CAREVIEW COMMUNICATIONS: COMPANY SNAPSHOT (2023)

The global computer vision in healthcare market is projected to grow from USD 4.86 billion in 2025 to USD 14.39 billion by 2030, registering a 24.3% CAGR during the forecast period. Market growth is propelled by the convergence of technological innovation, growing healthcare demands, regulatory support, and the imperative for more efficient and effective healthcare solutions. Concerns regarding data privacy, security, and regulatory compliance pose significant barriers to the deployment of computer vision solutions in healthcare settings, which hinders market expansion throughout the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product & Service, Type, Application, End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Recent technological advancements, notably federated learning, which allows model training across decentralized healthcare data without sharing patient records, are overcoming privacy hurdles and accelerating algorithm development. The FDA's May 2024 draft guidance on AI/ML-enabled medical devices provides a clearer regulatory pathway, encouraging vendors to design for continuous learning and post-market performance monitoring. In parallel, the rise of edge-computing VPUs and 5G-enabled imaging devices is facilitating on-premises inference, reducing latency for time-critical applications such as surgical assistance.

Based on region, North America dominated the computer vision in healthcare market, driven by advanced healthcare infrastructure, a strong presence of technology and data-driven healthcare organizations, and significant government support. Initiatives such as the FDA's January 2025 Draft Guidance on AI/ML-Enabled Device Software Functions and the National Institutes of Health (NIH)'s Artificial Intelligence program have accelerated the adoption of AI-powered imaging platforms by clarifying regulatory pathways and funding large-scale research projects. Adoption is also propelled by high US healthcare spending, widespread EHR infrastructure, and the imperative to reduce diagnostic turnaround times and improve patient outcomes.

Major players such as NVIDIA Corporation (US), Intel Corporation (US), Microsoft Corporation (US), Advanced Micro Devices, Inc. (US), and Google (US) are leveraging strategic partnerships. In April 2023, Microsoft (US) and Epic Systems Corporation (US) expanded their strategic partnership by integrating Azure OpenAI Service into Epic's electronic health record (EHR) platform. Leading institutions such as Mayo Clinic (US) and Cleveland Clinic (US) harness predictive analytics and computer vision for automating radiology workflows, stroke care, and real-time patient monitoring through dedicated AI centers and case-specific implementations. The North American market's leadership is thus consolidated through regulatory advancements, strategic industry collaborations, and deep IT integration in healthcare, positioning the region as the global frontrunner in computer vision in healthcare.

The dominant segment in the computer vision in healthcare market, based on product & service, is expected to be the software segment. This can be attributed to its critical role as the foundation for developing, deploying, and integrating advanced analytics and algorithms into clinical practice. As the demand for innovative healthcare solutions continues to grow, software-based computer vision technologies are poised to play an increasingly pivotal role in transforming patient care and driving improvements in healthcare delivery and outcomes.

The healthcare providers segment is anticipated to exhibit the highest growth rate in the computer vision in healthcare market. This growth is due to healthcare providers increasingly embracing AI and automation technologies to enhance patient care and streamline operational processes. Within this context, computer vision offers a suite of capabilities, including image analysis and pattern recognition, which are crucial for medical imaging interpretation and patient monitoring.

Furthermore, prospective growth opportunities for participants in the computer vision in healthcare market are anticipated in emerging Asian markets, notably China and India. The expansion in the APAC region is primarily propelled by factors such as increasing healthcare expenditure, rising chronic disease burden, advancements in healthcare IT, improving access to healthcare services, growing research and development activities, and government support initiatives. As these trends continue, the adoption of computer vision technologies is expected to accelerate, driving further growth and innovation in the healthcare sector across the Asia Pacific region.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Insights from primary experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 COMPUTER VISION IN HEALTHCARE MARKET OVERVIEW

- 4.2 ASIA PACIFIC COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE AND COUNTRY, 2024

- 4.3 COMPUTER VISION IN HEALTHCARE MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 COMPUTER VISION IN HEALTHCARE MARKET: REGIONAL MIX, 2025-2030

- 4.5 COMPUTER VISION IN HEALTHCARE MARKET: DEVELOPED VS. EMERGING MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for computer vision systems in healthcare industry

- 5.2.1.2 Favorable government initiatives

- 5.2.1.3 Big data in healthcare

- 5.2.1.4 Use of computer vision in precision medicine

- 5.2.1.5 Advancements in deep learning and neural network technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Reluctance of medical practitioners to adopt AI-based technologies

- 5.2.2.2 Lack of awareness and technical knowledge

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Transition toward cloud-based computer vision systems

- 5.2.3.2 Unexplored applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Rising security concerns related to cloud-based image processing and analytics

- 5.2.4.2 Lack of curated data

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 EARLY DETECTION OF CANCER

- 5.3.2 INTERACTIVE MEDICAL IMAGING

- 5.3.3 PHYSICIAN TRAINING BY SURGERY SIMULATIONS

- 5.3.4 REAL-TIME SURGICAL ASSISTANCE

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE, BY KEY PLAYER

- 5.5.2 AVERAGE SELLING PRICE, BY REGION

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Deep learning and convolutional neural networks

- 5.9.1.2 Artificial intelligence

- 5.9.1.3 Machine learning

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Wearable technologies

- 5.9.2.2 Smartphone computer vision technologies

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Augmented reality

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA FOR HS CODE 854231

- 5.11.2 EXPORT DATA FOR HS CODE 854231

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 CASE 1: PUNKTUM AND MAYO CLINIC TO DEVELOP CUTTING-EDGE DEEP LEARNING-BASED MODEL FOR BETTER COMPUTER VISION

- 5.13.2 CASE 2: DEVELOPMENT OF AI-TAILORED CAMERAS FOR IMPROVED VISION

- 5.13.3 CASE 3: USE OF VIDEO ANALYTICS PLATFORM FOR IMMEDIATE NOTIFICATION TO MEDICAL STAFF

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 REGULATORY FRAMEWORK

- 5.14.2.1 North America

- 5.14.2.1.1 US

- 5.14.2.2 Europe

- 5.14.2.3 Asia Pacific

- 5.14.2.3.1 China

- 5.14.2.3.2 Japan

- 5.14.2.3.3 India

- 5.14.2.1 North America

- 5.15 PORTER'S FIVE FORCES ANALYSIS

- 5.15.1 BARGAINING POWER OF SUPPLIERS

- 5.15.2 BARGAINING POWER OF BUYERS

- 5.15.3 THREAT OF NEW ENTRANTS

- 5.15.4 THREAT OF SUBSTITUTES

- 5.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 KEY BUYING CRITERIA

- 5.17 UNMET NEEDS AND END-USER EXPECTATIONS

- 5.17.1 UNMET NEEDS

- 5.17.2 END-USER EXPECTATIONS

- 5.18 BUSINESS MODEL ANALYSIS

- 5.18.1 PLATFORM-AS-A-SERVICE MODEL

- 5.18.2 SOFTWARE-AS-A-SERVICE MODEL

- 5.18.3 PAY-PER-USE OR PAY-PER-TRANSACTION MODEL

- 5.18.4 ENTERPRISE LICENSING MODEL

- 5.18.5 HYBRID MODEL

- 5.19 IMPACT OF 2025 US TARIFF

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 IMPACT ON COUNTRY/REGION

- 5.19.4.1 US

- 5.19.4.2 Europe

- 5.19.4.3 Asia Pacific

- 5.19.5 IMPACT ON END-USE INDUSTRIES

6 COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE

- 6.1 INTRODUCTION

- 6.2 SOFTWARE

- 6.2.1 ON-PREMISE SOLUTIONS

- 6.2.1.1 Higher control and security to drive adoption

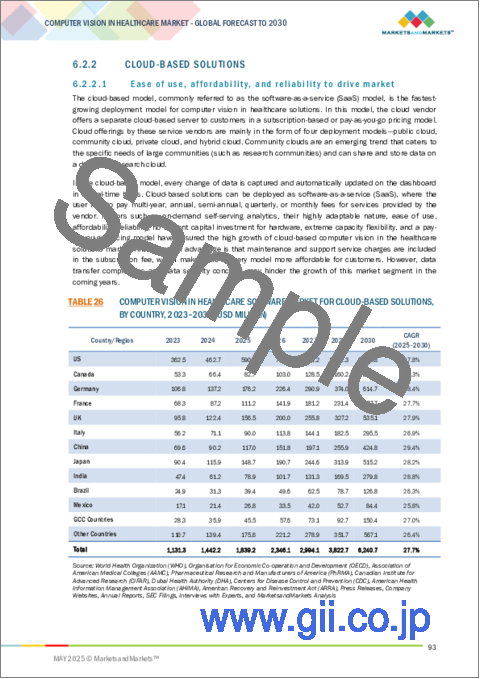

- 6.2.2 CLOUD-BASED SOLUTIONS

- 6.2.2.1 Ease of use, affordability, and reliability to drive market

- 6.2.1 ON-PREMISE SOLUTIONS

- 6.3 HARDWARE

- 6.3.1 PROCESSORS

- 6.3.1.1 CPUs

- 6.3.1.1.1 Escalating demand for advanced diagnostic imaging and real-time visual data analysis to drive market

- 6.3.1.2 GPUs

- 6.3.1.2.1 Higher graphics applications and display functions to promote growth

- 6.3.1.3 FPGAs

- 6.3.1.3.1 Rapid prototyping, shorter time-to-market, reprogramming ability, and longevity to aid growth

- 6.3.1.4 ASICs

- 6.3.1.4.1 High affordability and improved performance to augment growth

- 6.3.1.5 VPUs

- 6.3.1.5.1 Ability to accelerate computer vision tasks to bolster growth

- 6.3.1.1 CPUs

- 6.3.2 MEMORY DEVICES

- 6.3.2.1 High-bandwidth memory to spur growth

- 6.3.3 NETWORKS

- 6.3.3.1 High speed & bandwidth and energy-efficient interconnect products to fuel growth

- 6.3.1 PROCESSORS

- 6.4 SERVICES

- 6.4.1 RECURRING REQUIREMENT FOR TRAINING, SOFTWARE UPGRADES, AND SOFTWARE MAINTENANCE POST-INSTALLATION TO DRIVE MARKET

7 COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 PC-BASED COMPUTER VISION SYSTEMS

- 7.2.1 HIGH FLEXIBILITY AND SCALABILITY TO SUPPORT GROWTH

- 7.3 SMART CAMERA-BASED COMPUTER VISION SYSTEMS

- 7.3.1 ABILITY TO PERFORM MULTIPLE FUNCTIONS WITHOUT MANUAL INTERFERENCE TO BOOST MARKET

8 COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 MEDICAL IMAGING & DIAGNOSTICS

- 8.2.1 IMPROVED QUALITY, ACCURACY, AND PREDICTABILITY TO EXPEDITE GROWTH

- 8.3 HOSPITAL MANAGEMENT

- 8.3.1 PATIENT ACTIVITY MONITORING/FALL PREVENTION

- 8.3.1.1 Easy integration with wearable devices to foster growth

- 8.3.2 PATIENT/PROVIDER TRACKING

- 8.3.2.1 Real-time monitoring and efficient resource allocation to facilitate growth

- 8.3.3 SCHEDULING OPTIMIZATION

- 8.3.3.1 Growing demand for enhanced operational efficiency and resource utilization to drive market

- 8.3.4 INVENTORY MANAGEMENT

- 8.3.4.1 Need for inventory accuracy and waste reduction to contribute to growth

- 8.3.1 PATIENT ACTIVITY MONITORING/FALL PREVENTION

- 8.4 SURGERIES

- 8.4.1 NEED FOR PRECISION, EFFICIENCY, AND SAFETY DURING SURGERIES TO SUSTAIN GROWTH

- 8.5 OTHER APPLICATIONS

9 COMPUTER VISION IN HEALTHCARE MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 HEALTHCARE PROVIDERS

- 9.2.1 INCREASING AWARENESS OF EARLY DIAGNOSIS TO ENCOURAGE GROWTH

- 9.3 DIAGNOSTIC CENTERS

- 9.3.1 GROWING NEED FOR MEDICAL IMAGE INTERPRETATION TOOLS TO PROPEL MARKET

- 9.4 OTHER END USERS

10 COMPUTER VISION IN HEALTHCARE MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- 10.2.2 US

- 10.2.2.1 Rising volume of medical imaging data to drive market

- 10.2.3 CANADA

- 10.2.3.1 Increasing government funding for adoption of AI to fuel market

- 10.3 EUROPE

- 10.3.1 EUROPE: RECESSION IMPACT ANALYSIS

- 10.3.2 GERMANY

- 10.3.2.1 Growing adoption of computer vision systems in healthcare industry to boost market

- 10.3.3 UK

- 10.3.3.1 Rising investments in AI and computer vision technologies to support growth

- 10.3.4 FRANCE

- 10.3.4.1 Rising initiatives to promote adoption of healthcare IT solutions to propel market

- 10.3.5 ITALY

- 10.3.5.1 Increasing deployment of computer vision-based patient monitoring systems to foster growth

- 10.3.6 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- 10.4.2 JAPAN

- 10.4.2.1 Well-developed healthcare infrastructure and government initiatives to spur growth

- 10.4.3 CHINA

- 10.4.3.1 Favorable national strategies to facilitate growth

- 10.4.4 INDIA

- 10.4.4.1 Highly developed IT infrastructure and AI-friendly initiatives to stimulate growth

- 10.4.5 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 LATIN AMERICA: RECESSION IMPACT ANALYSIS

- 10.5.2 BRAZIL

- 10.5.2.1 Growing focus on improving healthcare accessibility and quality to fuel market

- 10.5.3 MEXICO

- 10.5.3.1 Increasing awareness about improved patient care to aid growth

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MIDDLE EAST & AFRICA: RECESSION IMPACT ANALYSIS

- 10.6.2 GCC COUNTRIES

- 10.6.2.1 Rising focus on technological advancements in healthcare to propel market

- 10.6.3 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN COMPUTER VISION IN HEALTHCARE MARKET

- 11.3 REVENUE ANALYSIS, 2019-2023

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/SOFTWARE COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS. 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Product & service footprint

- 11.7.5.4 Application footprint

- 11.7.5.5 End-user footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT/SOLUTION LAUNCHES AND APPROVALS

- 11.9.2 DEALS

- 11.9.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY COMPANIES

- 12.1.1 NVIDIA CORPORATION

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product/Solution launches and approvals

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 INTEL CORPORATION

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product/Solution launches and approvals

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 MICROSOFT

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 ADVANCED MICRO DEVICES, INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product/Solution launches and approvals

- 12.1.4.3.2 Deals

- 12.1.5 GOOGLE

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions offered

- 12.1.6 BASLER AG

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product/Solution launches and approvals

- 12.1.7 AICURE

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.7.3.2 Other developments

- 12.1.8 ICAD, INC.

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product/Solution launches and approvals

- 12.1.8.3.2 Deals

- 12.1.8.3.3 Other developments

- 12.1.9 THERMO FISHER SCIENTIFIC INC.

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions offered

- 12.1.10 SENSETIME

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product/Solution launches and approvals

- 12.1.11 KEYENCE CORPORATION

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions offered

- 12.1.12 ASSERT AI

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions offered

- 12.1.13 ARTISIGHT

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Deals

- 12.1.13.3.2 Other developments

- 12.1.14 LOOKDEEP

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions offered

- 12.1.15 CARE.AI

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Deals

- 12.1.15.3.2 Other developments

- 12.1.16 CAREVIEW COMMUNICATIONS

- 12.1.16.1 Business overview

- 12.1.16.2 Products/Solutions offered

- 12.1.16.3 Recent developments

- 12.1.16.3.1 Product/Solution launches and approvals

- 12.1.16.3.2 Deals

- 12.1.17 VIRTUSENSE TECHNOLOGIES, INC.

- 12.1.17.1 Business overview

- 12.1.17.2 Products/Solutions offered

- 12.1.17.3 Recent developments

- 12.1.17.3.1 Deals

- 12.1.18 TETON

- 12.1.18.1 Business overview

- 12.1.18.2 Products/Solutions offered

- 12.1.18.3 Recent developments

- 12.1.18.3.1 Product/Solution launches and approvals

- 12.1.18.3.2 Other developments

- 12.1.1 NVIDIA CORPORATION

- 12.2 OTHER PLAYERS

- 12.2.1 VISO.AI

- 12.2.2 NANO-X IMAGING LTD.

- 12.2.3 COMOFI MEDTECH PVT. LTD.

- 12.2.4 AIVIDTECHVISION

- 12.2.5 ROBOFLOW, INC.

- 12.2.6 OPTOTUNE

- 12.2.7 CUREMETRIX, INC.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS