|

|

市場調査レポート

商品コード

1734006

医薬品・医療機器組み合わせ製品の世界市場:製品タイプ別、用途別、エンドユーザー別、地域別 - 2030年までの予測Drug Device Combination Products Market by Type (Injectable, Transdermal Patch, Infusion Pump, Drug-eluting Stent, Inhaler), Application (Diabetes, Oncology, Pain, Opthamology), End User (Hospital, Home Care), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 医薬品・医療機器組み合わせ製品の世界市場:製品タイプ別、用途別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月13日

発行: MarketsandMarkets

ページ情報: 英文 346 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の医薬品・医療機器組み合わせ製品の市場規模は、2025年の2,430億2,000万米ドルから2030年には3,791億7,000万米ドルに達すると予測され、予測期間中のCAGRは9.3%になるとみられています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント | 製品タイプ別、用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

糖尿病や心血管疾患などの慢性疾患を患う患者の顕著な増加と相まって、高齢者人口層の急速な拡大が医薬品・医療機器組み合わせ製品の市場を大きく牽引すると予測されます。さらに、自己投与の着実な増加、患者中心の設計と治療レジメンの遵守の重視の高まりが、市場の成長をさらに促進すると予想されます。医薬品・医療機器組み合わせ製品における技術的進歩、革新的な製品の導入、有利な償還の枠組み、政府の支援政策などはすべて、市場のダイナミクスを高めると予想されます。さらに、ヘルスケア・インフラへの戦略的投資や、これらの組み合わせ製品の入手しやすさと購入しやすさを向上させる取り組みが、市場拡大に大きく貢献すると思われます。

ドラッグデリバリーデバイスの組み合わせ製品の領域では、注射用ドラッグデリバリーシステムが最大の市場シェアを占め、成長が加速しています。この動向は、経口投与には適さない複雑な生物製剤やその他の治療薬を、迅速かつ標的を絞って投与できることが主な理由です。糖尿病やがんなどの慢性疾患の蔓延が拡大していることが、この分野の需要を牽引しています。さらに、この業界では、自動注射器やペン型注射器など、ユーザー中心の設計によって促進される自己投与へのパラダイムシフトが見られます。デバイス技術の絶え間ない革新は、患者の快適性、安全性、アドヒアランスを向上させ、市場成長をさらに後押ししています。

注射式ドラッグデリバリーデバイスは、プレフィルドシリンジ、ペン型注射器、自動注射器、無針注射器、ウェアラブル注射器に細分化できます。このうち、自動注射器は、ユーザーフレンドリーなデザイン、利便性、正確な投薬量を投与する機能により、市場で顕著な成長軌道を経験しています。これらの特徴により、自己注射器は糖尿病や多発性硬化症などの慢性疾患を持つ患者に特に適しています。自動注射器のアーキテクチャは自己投与を容易にし、患者の治療レジメンへのアドヒアランスを高め、医療施設への頻繁な訪問の必要性を最小限に抑えます。在宅医療や患者中心の治療ソリューションが重視されるようになっていることから、自己注射器市場は大きく拡大する見込みです。

世界の医薬品・医療機器組み合わせ製品市場は、5つの主要地域(北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ)に分類されます。現在、北米がこの市場を独占しているのは、慢性疾患、特に糖尿病の負担が大きいためであり、こうした併用療法に依存する患者層が拡大しています。同地域の市場成長は、複数の大手業界参入企業の存在と、革新的な治療法へのアクセスを容易にする支援的な償還政策によってさらに後押しされています。一方、アジア太平洋地域は予測期間中にCAGRが最も高くなると予測されており、これはこの分野における需要の急増と拡大の可能性を示しています。

当レポートでは、世界の医薬品・医療機器組み合わせ製品市場について調査し、製品タイプ別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 業界動向

- 技術分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 規制分析

- 特許分析

- 貿易分析

- 価格分析

- バリューチェーン分析

- 2025年~2026年の主な会議とイベント

- アンメットニーズ/エンドユーザーの期待

- 隣接市場分析

- エコシステム分析

- ケーススタディ分析

- サプライチェーン分析

- 顧客のビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- 償還シナリオ分析

- 臨床パイプライン分析

- AI/生成AIが医薬品・医療機器組み合わせ製品市場に与える影響

- 2025年の米国関税が医薬品・医療機器組み合わせ製品市場に与える影響

第6章 医薬品・医療機器組み合わせ製品市場(製品タイプ別)

- イントロダクション

- 注射ドラッグデリバリーデバイス

- 薬剤溶出ステント

- 吸入器

- 輸液ポンプ

- 経皮パッチ

- 薬剤コーティングされた風船

- その他

第7章 医薬品・医療機器組み合わせ製品市場(用途別)

- イントロダクション

- 糖尿病管理

- 呼吸器疾患

- 眼科

- 自己免疫疾患

- 腫瘍学

- 感染症

- 心血管疾患

- 肥満管理

- 疼痛管理

- その他

第8章 医薬品・医療機器組み合わせ製品市場(エンドユーザー別)

- イントロダクション

- 病院とクリニック

- 外来手術センター

- 長期ケア施設

- 在宅ケア

- その他

第9章 医薬品・医療機器組み合わせ製品市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他ラテンアメリカ

- 中東・アフリカ

- 中東・アフリカのマクロ経済見通し

- GCC諸国

- その他

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- ABBOTT

- ELI LILLY AND COMPANY

- MEDTRONIC

- NOVO NORDISK A/S

- NOVARTIS AG

- SANOFI

- BOSTON SCIENTIFIC CORPORATION

- BECTON, DICKINSON AND COMPANY

- MERCK KGAA

- ABBVIE INC.

- TEVA PHARMACEUTICAL INDUSTRIES LTD.

- STRYKER

- B. BRAUN SE

- TERUMO CORPORATION

- その他の企業

- TANDEM DIABETES CARE, INC.

- CEQUR SIMPLICITY

- INTARCIA THERAPEUTICS, INC.

- HALOZYME, INC.

- KALEO, INC.

- LEAD CHEMICAL CO., LTD.

- PURDUE PHARMA L.P.

- ALVOGEN

- EVOLUTIS

- MUNDIPHARMA INTERNATIONAL LIMITED

- SPARSHA PHARMA INTERNATIONAL PVT. LTD.

- SUPERNUS PHARMACEUTICALS, INC.

- ALCON INC.

第12章 付録

List of Tables

- TABLE 1 DRUG DEVICE COMBINATION PRODUCTS MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- TABLE 3 DRUG DEVICE COMBINATION PRODUCTS MARKET: STUDY ASSUMPTIONS

- TABLE 4 DRUG DEVICE COMBINATION PRODUCTS MARKET: RISK ANALYSIS

- TABLE 5 DIABETES POPULATION WORLDWIDE, 2024 VS. 2050 (MILLION)

- TABLE 6 DRUG DEVICE COMBINATION PRODUCTS MARKET: PORTER'S FIVE FORCES

- TABLE 7 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS OF DRUG DEVICE COMBINATION PRODUCTS

- TABLE 8 KEY BUYING CRITERIA FOR DRUG DEVICE COMBINATION PRODUCTS

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 US: CLASSIFICATION AND APPROVAL PATHWAYS

- TABLE 15 US: CLASSIFICATION OF MEDICAL EQUIPMENT

- TABLE 16 US: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 17 CANADA: CLASSIFICATION OF DRUG DEVICE COMBINATION PRODUCTS

- TABLE 18 CANADA: RISK, TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 19 EUROPE: EUROPEAN REGULATORY FRAMEWORK FOR DRUG DEVICE COMBINATION PRODUCTS

- TABLE 20 EUROPE: RISK, TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 21 CHINA: RISK, TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 22 JAPAN: RISK, TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 23 DRUG DEVICE COMBINATION PRODUCTS MARKET: KEY PATENTS GRANTED, JANUARY 2022-APRIL 2025

- TABLE 24 IMPORT DATA FOR PREFILLED SYRINGES (HS CODE 300431), BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 25 EXPORT DATA FOR PREFILLED SYRINGES (HS CODE 300431), BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 26 IMPORTS DATA FOR TRANSDERMAL PATCHES (HS CODE 300431), BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 27 EXPORT DATA FOR TRANSDERMAL PATCHES (HS CODE 300431), BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 28 INDICATIVE PRICING OF DRUG DEVICE COMBINATION PRODUCTS, BY KEY PLAYER, 2024

- TABLE 29 AVERAGE SELLING PRICE TREND OF INJECTABLE DRUG DEVICE DELIVERY DEVICES, BY KEY PLAYER, 2022-2024

- TABLE 30 AVERAGE SELLING PRICE TREND FOR PEN INJECTORS, BY REGION, 2022-2024

- TABLE 31 AVERAGE SELLING PRICE TREND FOR INHALERS, BY REGION, 2022-2024

- TABLE 32 AVERAGE SELLING PRICE TREND FOR DRUG-ELUTING STENTS, BY REGION, 2022-2024

- TABLE 33 DRUG DEVICE COMBINATION PRODUCTS MARKET: LIST OF KEY CONFERENCES & EVENTS, JANUARY 2025-DECEMBER 2026

- TABLE 34 DRUG DEVICE COMBINATION PRODUCTS MARKET: ROLE IN ECOSYSTEM

- TABLE 35 CASE STUDY 1: MINIMED 780G DIABETES MANAGEMENT SYSTEM TO COMBINE CONTINUOUS GLUCOSE MONITORING WITH AUTOMATED INSULIN DELIVERY

- TABLE 36 CASE STUDY 2: DIGIINHALER-SMART INHALER FOR ASTHMA/COPD TO TRACK LUNG FUNCTION

- TABLE 37 CASE STUDY 3: ADOPTION OF PEN INJECTORS BY NEMERA FRANCE TO IMPROVE THERAPEUTIC OUTCOMES

- TABLE 38 DRUG DEVICE COMBINATION PRODUCTS MARKET: REIMBURSEMENT SCENARIO ANALYSIS

- TABLE 39 DRUG DEVICE COMBINATION PRODUCTS MARKET: CLINICAL PIPELINE ANALYSIS (AS OF MARCH 2025)

- TABLE 40 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 41 KEY PRODUCT-RELATED TARIFF FOR DRUG DEVICE PRODUCTS

- TABLE 42 DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 43 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 44 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 45 LIST OF KEY PREFILLED SYRINGES AVAILABLE IN MARKET

- TABLE 46 PREFILLED SYRINGES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 47 LAUNCH OF KEY GLP-1-RELATED INJECTABLES BY MAJOR PHARMACEUTICAL COMPANIES, 2010-2024

- TABLE 48 LIST OF KEY PEN INJECTORS AVAILABLE IN MARKET

- TABLE 49 PEN INJECTORS MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

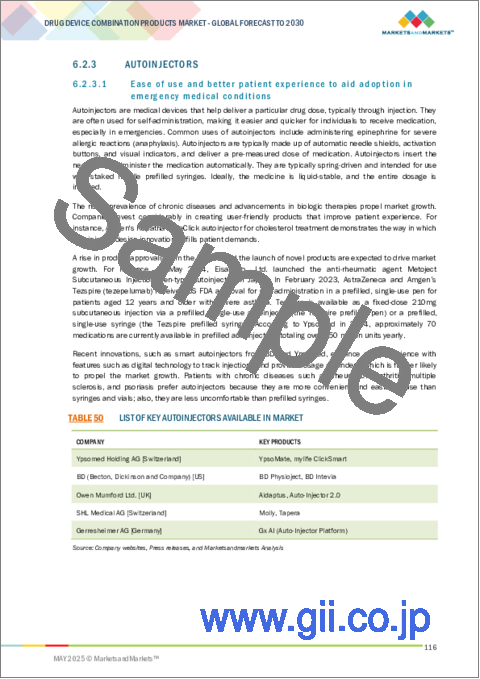

- TABLE 50 LIST OF KEY AUTOINJECTORS AVAILABLE IN MARKET

- TABLE 51 AUTOINJECTORS MARKET, BY COUNTRY 2023-2030 (USD BILLION)

- TABLE 52 TOP FIVE COUNTRIES WITH HIGHEST NUMBER OF DIABETES PATIENTS (20-79 YEARS), 2021 VS. 2045 (MILLION)

- TABLE 53 LIST OF KEY WEREABLE INJECTORS AVAILABLE IN MARKET

- TABLE 54 WEARABLE INJECTORS MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 55 LIST OF KEY NEEDLE-FREE INJECTORS AVAILABLE IN MARKET

- TABLE 56 NEEDLE-FREE INJECTORS MARKET, BY COUNTRY 2023-2030 (USD BILLION)

- TABLE 57 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR DRUG-ELUTING STENTS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 58 LIST OF KEY INHALERS AVAILABLE IN MARKET

- TABLE 59 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INHALERS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 60 LIST OF KEY INFUSION PUMPS AVAILABLE IN MARKET

- TABLE 61 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INFUSION PUMPS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 62 LIST OF KEY TRANSDERMAL PATCHES AVAILABLE IN MARKET

- TABLE 63 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR TRANSDERMAL PATCHES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 64 LIST OF KEY DRUG-COATED BALLOONS AVAILABLE IN MARKET

- TABLE 65 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR DRUG-COATED BALLOONS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 66 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR OTHER PRODUCT TYPES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 67 DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 68 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR DIABETES MANAGEMENT, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 69 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR RESPIRATORY DISEASES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 70 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR OPHTHALMOLOGY, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 71 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR AUTOIMMUNE DISEASES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 72 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR ONCOLOGY, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 73 KEY DRUG DEVICE COMBINATION PRODUCTS AVAILABLE FOR INFECTIOUS DISEASES

- TABLE 74 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 75 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR CARDIOVASCULAR DISEASES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 76 KEY DRUG DEVICE COMBINATION PRODUCTS AVAILABLE FOR OBESITY MANAGEMENT

- TABLE 77 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR OBESITY MANAGEMENT, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 78 KEY TRANSDERMAL PATCHES AVAILABLE FOR PAIN MANAGEMENT

- TABLE 79 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR PAIN MANAGEMENT, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 80 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 81 DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 82 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 83 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR AMBULATORY SURGERY CENTERS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 84 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR LONG-TERM CARE FACILITIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 85 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR HOME CARE SETTINGS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 86 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 87 DRUG DEVICE COMBINATION PRODUCTS MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 88 TRANSDERMAL PATCHES MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 89 DRUG-ELUTING STENTS MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 90 NORTH AMERICA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 91 NORTH AMERICA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 92 NORTH AMERICA: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 93 NORTH AMERICA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 94 NORTH AMERICA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 95 US: KEY MACROINDICATORS

- TABLE 96 US: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 97 US: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 98 US: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 99 US: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 100 CANADA: KEY MACROINDICATORS

- TABLE 101 CANADA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 102 CANADA: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 103 CANADA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 104 CANADA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 105 EUROPE: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 106 EUROPE: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 107 EUROPE: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 108 EUROPE: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 109 EUROPE: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 110 GERMANY: KEY MACROINDICATORS

- TABLE 111 GERMANY: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 112 GERMANY: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 113 GERMANY: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 114 GERMANY: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 115 UK: KEY MACROINDICATORS

- TABLE 116 UK: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 117 UK: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 118 UK: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 119 UK: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 120 FRANCE: KEY MACROINDICATORS

- TABLE 121 FRANCE: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 122 FRANCE: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 123 FRANCE: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 124 FRANCE: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 125 ITALY: KEY MACROINDICATORS

- TABLE 126 ITALY: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 127 ITALY: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 128 ITALY: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 129 ITALY: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 130 SPAIN: KEY MACROINDICATORS

- TABLE 131 SPAIN: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 132 SPAIN: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 133 SPAIN: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 134 SPAIN: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 135 REST OF EUROPE: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 136 REST OF EUROPE: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 137 REST OF EUROPE: DRUG DEVICE COMBINATION PRODUCTS MARKET, APPLICATION, 2023-2030 (USD BILLION)

- TABLE 138 REST OF EUROPE: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 139 ASIA PACIFIC: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 140 ASIA PACIFIC: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 141 ASIA PACIFIC: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 142 ASIA PACIFIC: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 143 ASIA PACIFIC: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 144 CHINA: KEY MACROINDICATORS

- TABLE 145 CHINA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 146 CHINA: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 147 CHINA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 148 CHINA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 149 JAPAN: KEY MACROINDICATORS

- TABLE 150 JAPAN: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 151 JAPAN: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 152 JAPAN: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 153 JAPAN: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 154 INDIA: KEY MACROINDICATORS

- TABLE 155 INDIA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 156 INDIA: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 157 INDIA: DRUG DEVICE COMBINATION PRODUCTS MARKET, APPLICATION, 2023-2030 (USD BILLION)

- TABLE 158 INDIA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 159 SOUTH KOREA: KEY MACROINDICATORS

- TABLE 160 SOUTH KOREA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 161 SOUTH KOREA: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 162 SOUTH KOREA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 163 SOUTH KOREA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 164 AUSTRALIA: KEY MACROINDICATORS

- TABLE 165 AUSTRALIA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 166 AUSTRALIA: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 167 AUSTRALIA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 168 AUSTRALIA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 169 REST OF ASIA PACIFIC: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 170 REST OF ASIA PACIFIC: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 171 REST OF ASIA PACIFIC: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 172 REST OF ASIA PACIFIC: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 173 LATIN AMERICA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 174 LATIN AMERICA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 175 LATIN AMERICA: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 176 LATIN AMERICA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 177 LATIN AMERICA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 178 BRAZIL: KEY MACROINDICATORS

- TABLE 179 BRAZIL: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 180 BRAZIL: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 181 BRAZIL: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 182 BRAZIL: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 183 MEXICO: KEY MACROINDICATORS

- TABLE 184 MEXICO: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 185 MEXICO: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 186 MEXICO: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 187 MEXICO: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 188 REST OF LATIN AMERICA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 189 REST OF LATIN AMERICA: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 190 REST OF LATIN AMERICA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 191 REST OF LATIN AMERICA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 192 MIDDLE EAST & AFRICA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 193 MIDDLE EAST & AFRICA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 194 MIDDLE EAST & AFRICA: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 195 MIDDLE EAST & AFRICA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 196 MIDDLE EAST & AFRICA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 197 GCC COUNTRIES: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 198 GCC COUNTRIES: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 199 GCC COUNTRIES: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 200 GCC COUNTRIES: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 201 GCC COUNTRIES: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 202 KINGDOM OF SAUDI ARABIA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 203 KINGDOM OF SAUDI ARABIA: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 204 KINGDOM OF SAUDI ARABIA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 205 KINGDOM OF SAUDI ARABIA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 206 UAE: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 207 UAE: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 208 UAE: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 209 UAE: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 210 REST OF GCC COUNTRIES: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 211 REST OF GCC COUNTRIES: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 212 REST OF GCC COUNTRIES: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 213 REST OF GCC COUNTRIES: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 214 REST OF MIDDLE EAST & AFRICA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2023-2030 (USD BILLION)

- TABLE 215 REST OF MIDDLE EAST & AFRICA: DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 216 REST OF MIDDLE EAST & AFRICA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2023-2030 (USD BILLION)

- TABLE 217 REST OF MIDDLE EAST & AFRICA: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 218 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN DRUG DEVICE COMBINATION PRODUCTS MARKET

- TABLE 219 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR AUTOINJECTORS: DEGREE OF COMPETITION

- TABLE 220 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR PEN INJECTORS: DEGREE OF COMPETITION

- TABLE 221 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR TRANSDERMAL PATCHES: DEGREE OF COMPETITION

- TABLE 222 DRUG DEVICE COMBINATION PRODUCTS MARKET: REGION FOOTPRINT

- TABLE 223 DRUG DEVICE COMBINATION PRODUCTS MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 224 DRUG DEVICE COMBINATION PRODUCTS MARKET: APPLICATION FOOTPRINT

- TABLE 225 DRUG DEVICE COMBINATION PRODUCTS MARKET: DETAILED LIST OF KEY STARTUPS/SME PLAYERS

- TABLE 226 DRUG DEVICE COMBINATION PRODUCTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SME PLAYERS

- TABLE 227 DRUG DEVICE COMBINATION PRODUCTS MARKET: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-MARCH 2025

- TABLE 228 DRUG DEVICE COMBINATION PRODUCTS MARKET: DEALS, JANUARY 2022-MARCH 2025

- TABLE 229 DRUG DEVICE COMBINATION PRODUCTS MARKET: EXPANSIONS, JANUARY 2022-MARCH 2025

- TABLE 230 DRUG DEVICE COMBINATION PRODUCTS MARKET: OTHER DEVELOPMENTS, JANUARY 2022-MARCH 2025

- TABLE 231 ABBOTT: COMPANY OVERVIEW

- TABLE 232 ABBOTT: PRODUCTS OFFERED

- TABLE 233 ABBOTT: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-MARCH 2025

- TABLE 234 ABBOTT: DEALS, JANUARY 2022-MARCH 2025

- TABLE 235 ELI LILLY AND COMPANY: COMPANY OVERVIEW

- TABLE 236 ELI LILLY AND COMPANY: PRODUCTS OFFERED

- TABLE 237 ELI LILLY AND COMPANY: PRODUCT APPROVALS, JANUARY 2022-MARCH 2025

- TABLE 238 ELI LILLY AND COMPANY: DEALS, JANUARY 2022-MARCH 2025

- TABLE 239 ELI LILLY AND COMPANY: EXPANSIONS, JANUARY 2022-MARCH 2025

- TABLE 240 ELI LILLY AND COMPANY: OTHER DEVELOPMENTS, JANUARY 2022-MARCH 2025

- TABLE 241 MEDTRONIC: COMPANY OVERVIEW

- TABLE 242 MEDTRONIC: PRODUCTS OFFERED

- TABLE 243 MEDTRONIC: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-MARCH 2025

- TABLE 244 MEDTRONIC: DEALS, JANUARY 2022-MARCH 2025

- TABLE 245 NOVO NORDISK A/S: COMPANY OVERVIEW

- TABLE 246 NOVO NORDISK A/S: PRODUCTS OFFERED

- TABLE 247 NOVO NORDISK A/S: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-MARCH 2025

- TABLE 248 NOVO NORDISK A/S: DEALS, JANUARY 2022-MARCH 2025

- TABLE 249 NOVO NORDISK A/S: EXPANSIONS, JANUARY 2022-MARCH 2025

- TABLE 250 NOVARTIS AG: COMPANY OVERVIEW

- TABLE 251 NOVARTIS AG: PRODUCTS OFFERED

- TABLE 252 NOVARTIS AG: PRODUCT APPROVALS, JANUARY 2022-MARCH 2025

- TABLE 253 NOVARTIS AG: DEALS, JANUARY 2022-MARCH 2025

- TABLE 254 NOVARTIS AG: EXPANSIONS, JANUARY 2022-MARCH 2025

- TABLE 255 SANOFI: COMPANY OVERVIEW

- TABLE 256 SANOFI: PRODUCTS OFFERED

- TABLE 257 SANOFI: PRODUCT APPROVALS, JANUARY 2022-MARCH 2025

- TABLE 258 SANOFI: DEALS, JANUARY 2022-MARCH 2025

- TABLE 259 SANOFI: OTHER DEVELOPMENTS, JANUARY 2022-MARCH 2025

- TABLE 260 BOSTON SCIENTIFIC CORPORATION: COMPANY OVERVIEW

- TABLE 261 BOSTON SCIENTIFIC CORPORATION: PRODUCTS OFFERED

- TABLE 262 BOSTON SCIENTIFIC CORPORATION: PRODUCT APPROVALS, JANUARY 2022-MARCH 2025

- TABLE 263 BOSTON SCIENTIFIC CORPORATION: DEALS, JANUARY 2022-MARCH 2025

- TABLE 264 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

- TABLE 265 BECTON, DICKINSON AND COMPANY: PRODUCTS OFFERED

- TABLE 266 BECTON, DICKINSON AND COMPANY: DEALS, JANUARY 2022-MARCH 2025

- TABLE 267 BECTON, DICKINSON AND COMPANY: OTHER DEVELOPMENTS, JANUARY 2022-MARCH 2025

- TABLE 268 MERCK KGAA: COMPANY OVERVIEW

- TABLE 269 MERCK KGAA: PRODUCTS OFFERED

- TABLE 270 MERCK KGGA: DEALS, JANUARY 2022-MARCH 2025

- TABLE 271 ABBVIE INC.: COMPANY OVERVIEW

- TABLE 272 ABBVIE INC.: PRODUCTS OFFERED

- TABLE 273 ABBVIE INC: PRODUCT APPROVALS, JANUARY 2022-MARCH 2025

- TABLE 274 ABBVIE INC.: DEALS, JANUARY 2022-MARCH 2025

- TABLE 275 ABBVIE INC.: EXPANSIONS, JANUARY 2022-MARCH 2025

- TABLE 276 TEVA PHARMACEUTICAL INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 277 TEVA PHARMACEUTICAL INDUSTRIES LTD.: PRODUCTS OFFERED

- TABLE 278 TEVA PHARMACEUTICAL INDUSTRIES LTD.: PRODUCT APPROVALS, JANUARY 2022-MARCH 2025

- TABLE 279 TEVA PHARMACEUTICAL INDUSTRIES LTD.: OTHER DEVELOPMENTS, JANUARY 2022-MARCH 2025

- TABLE 280 STRYKER: COMPANY OVERVIEW

- TABLE 281 STRYKER: PRODUCTS OFFERED

- TABLE 282 B. BRAUN SE: COMPANY OVERVIEW

- TABLE 283 B. BRAUN SE: PRODUCTS OFFERED

- TABLE 284 TERUMO CORPORATION: COMPANY OVERVIEW

- TABLE 285 TERUMO CORPORATION: PRODUCTS OFFERED

- TABLE 286 TERUMO CORPORATION: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-MARCH 2025

- TABLE 287 TANDEM DIABETES CARE, INC.: COMPANY OVERVIEW

- TABLE 288 CEQUR SIMPLICITY: COMPANY OVERVIEW

- TABLE 289 INTARCIA THERAPEUTICS, INC.: COMPANY OVERVIEW

- TABLE 290 HALOZYME, INC.: COMPANY OVERVIEW

- TABLE 291 KALEO, INC.: COMPANY OVERVIEW

- TABLE 292 LEAD CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 293 PURDUE PHARMA L.P.: COMPANY OVERVIEW

- TABLE 294 ALVOGEN: COMPANY OVERVIEW

- TABLE 295 EVOLUTIS: COMPANY OVERVIEW

- TABLE 296 MUNDIPHARMA INTERNATIONAL LIMITED: COMPANY OVERVIEW

- TABLE 297 SPARSHA PHARMA INTERNATIONAL PVT. LTD.: COMPANY OVERVIEW

- TABLE 298 SUPERNUS PHARMACEUTICALS, INC.: COMPANY OVERVIEW

- TABLE 299 ALCON INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 DRUG DEVICE COMBINATION PRODUCTS MARKET: SEGMENTS CONSIDERED & GEOGRAPHICAL SCOPE

- FIGURE 2 DRUG DEVICE COMBINATION PRODUCTS MARKET: YEARS CONSIDERED

- FIGURE 3 DRUG DEVICE COMBINATION PRODUCTS MARKET: RESEARCH DESIGN

- FIGURE 4 DRUG DEVICE COMBINATION PRODUCTS MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 DRUG DEVICE COMBINATION PRODUCTS MARKET: KEY PRIMARY SOURCES

- FIGURE 6 DRUG DEVICE COMBINATION PRODUCTS MARKET: INSIGHTS FROM PRIMARIES

- FIGURE 7 DRUG DEVICE COMBINATION PRODUCTS MARKET: BREAKDOWN OF PRIMARIES (BY COMPANY TYPE, DESIGNATION, AND REGION)

- FIGURE 8 DRUG DEVICE COMBINATION PRODUCTS MARKET: BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY- AND DEMAND-SIDE PARTICIPANTS)

- FIGURE 9 DRUG DEVICE COMBINATION PRODUCTS MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS (2024)

- FIGURE 10 PEN INJECTORS MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS (BOTTOM-UP APPROACH)

- FIGURE 11 AUTOINJECTORS MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS (BOTTOM-UP APPROACH)

- FIGURE 12 DRUG DEVICE COMBINATION PRODUCTS MARKET: TOP-DOWN APPROACH

- FIGURE 13 DRUG DEVICE COMBINATION PRODUCTS MARKET: CAGR PROJECTIONS (SUPPLY SIDE)

- FIGURE 14 DRUG DEVICE COMBINATION PRODUCTS MARKET: DATA TRIANGULATION

- FIGURE 15 DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE, 2025 VS. 2030 (USD BILLION)

- FIGURE 16 DRUG DEVICE COMBINATION PRODUCTS MARKET FOR INJECTABLE DRUG DELIVERY DEVICES, BY TYPE, 2025 VS. 2030 (USD BILLION)

- FIGURE 17 DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION, 2025 VS. 2030 (USD BILLION)

- FIGURE 18 DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER, 2025 VS. 2030 (USD BILLION)

- FIGURE 19 REGIONAL SNAPSHOT OF DRUG DEVICE COMBINATION PRODUCTS MARKET

- FIGURE 20 INCREASING NUMBER OF REGULATORY APPROVALS AND RISING INCIDENCE OF CHRONIC DISEASES TO DRIVE MARKET

- FIGURE 21 CHINA AND DIABETES MANAGEMENT SEGMENT COMMANDED LARGEST MARKET SHARE IN 2024

- FIGURE 22 CHINA TO REGISTER HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 23 DRUG DEVICE COMBINATION PRODUCTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 DISABILITY-ADJUSTED LIFE YEARS FOR INDIVIDUALS WITH CHRONIC OBSTRUCTIVE PULMONARY DISEASE (COPD) IN AUSTRALIA, BY AGE (2023)

- FIGURE 25 SHARE OF GLOBAL GERIATRIC POPULATION (ABOVE 60 YEARS), BY REGION, 2010 VS. 2015 VS. 2030 (PROJECTED)

- FIGURE 26 DRUG DEVICE COMBINATION PRODUCTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS OF DRUG DEVICE COMBINATION PRODUCTS

- FIGURE 28 KEY BUYING CRITERIA FOR DRUG DEVICE COMBINATION PRODUCTS

- FIGURE 29 DRUG DEVICE COMBINATION PRODUCTS MARKET: PATENT PUBLICATION TRENDS AND TOP APPLICANT ANALYSIS (JANUARY 2014-APRIL 2025)

- FIGURE 30 TOP PATENT APPLICANTS FOR DRUG DEVICE COMBINATION PRODUCTS, BY JURISDICTION (JANUARY 2014-APRIL 2025)

- FIGURE 31 DRUG DEVICE COMBINATION PRODUCTS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 32 DRUG DEVICE COMBINATION PRODUCTS MARKET: ADJACENT MARKETS

- FIGURE 33 DRUG DEVICE COMBINATION PRODUCTS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 34 DRUG DEVICE COMBINATION PRODUCTS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 35 DRUG DEVICE COMBINATION PRODUCTS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 36 DRUG DEVICE COMBINATION PRODUCTS MARKET: FUNDING AND NUMBER OF DEALS, 2019-2023

- FIGURE 37 DRUG DEVICE COMBINATION PRODUCTS MARKET: IMPACT OF AI/GEN AI

- FIGURE 38 NORTH AMERICA: DRUG DEVICE COMBINATION PRODUCTS MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: DRUG DEVICE COMBINATION PRODUCTS MARKET SNAPSHOT

- FIGURE 40 REVENUE ANALYSIS OF KEY PLAYERS IN DRUG DEVICE COMBINATION PRODUCTS MARKET (2020-2024)

- FIGURE 41 MARKET SHARE ANALYSIS OF KEY PLAYERS IN AUTOINJECTORS MARKET (2024)

- FIGURE 42 MARKET SHARE ANALYSIS OF KEY PLAYERS IN PEN INJECTORS MARKET (2024)

- FIGURE 43 MARKET SHARE ANALYSIS OF KEY PLAYERS IN TRANSDERMAL PATCHES MARKET (2024)

- FIGURE 44 RANKING OF KEY PLAYERS IN DRUG DEVICE COMBINATION PRODUCTS MARKET (2024)

- FIGURE 45 DRUG DEVICE COMBINATION PRODUCTS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 46 DRUG DEVICE COMBINATION PRODUCTS MARKET: COMPANY FOOTPRINT

- FIGURE 47 DRUG DEVICE COMBINATION PRODUCTS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 48 EV/EBITDA OF KEY VENDORS

- FIGURE 49 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 50 DRUG DEVICE COMBINATION PRODUCTS MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 51 ABBOTT: COMPANY SNAPSHOT

- FIGURE 52 ELI LILLY AND COMPANY: COMPANY SNAPSHOT

- FIGURE 53 MEDTRONIC: COMPANY SNAPSHOT

- FIGURE 54 NOVO NORDISK A/S: COMPANY SNAPSHOT

- FIGURE 55 NOVARTIS AG: COMPANY SNAPSHOT

- FIGURE 56 SANOFI: COMPANY SNAPSHOT

- FIGURE 57 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT

- FIGURE 59 MERCK KGAA: COMPANY SNAPSHOT

- FIGURE 60 ABBVIE INC.: COMPANY SNAPSHOT

- FIGURE 61 TEVA PHARMACEUTICAL INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 62 STRYKER: COMPANY SNAPSHOT

- FIGURE 63 B. BRAUN SE: COMPANY SNAPSHOT

- FIGURE 64 TERUMO CORPORATION: COMPANY SNAPSHOT

The global drug device combination products market is projected to reach USD 379.17 billion by 2030 from USD 243.02 billion in 2025, at a CAGR of 9.3% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD million) |

| Segments | Product Type, Application, End User |

| Regions covered | North America, Europe, APAC, LATAM, MEA |

The rapid expansion of the geriatric demographic, coupled with a notable increase in patients suffering from chronic conditions such as diabetes and cardiovascular diseases, is projected to drive the market for drug-device combination products significantly. Additionally, the steady rise in self-administration practices and a heightened emphasis on patient-centric design and adherence to treatment regimens are expected to further propel market growth. Technological advancements in drug-device combination products, the introduction of innovative products, and favorable reimbursement frameworks, along with supportive government policies, are all anticipated to enhance market dynamics. Furthermore, strategic investments in healthcare infrastructure and initiatives to improve the accessibility and affordability of these combination products will likely contribute significantly to market expansion.

The injectable drug delivery devices segment is expected to grow at the highest CAGR during the forecast period.

In the realm of drug-device combination products, injectable drug delivery systems command the largest market share and are experiencing accelerated growth. This trend is predominantly due to their capacity for rapid, targeted administration of complex biologics and other therapies that are unsuitable for oral delivery routes. The escalating prevalence of chronic diseases, such as diabetes and cancer, is a primary driver of demand in this sector. Additionally, the industry is witnessing a paradigm shift towards self-administration facilitated by user-centered designs, including autoinjectors and pen injectors. Continuous innovation in device technology is enhancing patient comfort, safety, and adherence, further propelling market growth.

The autoinjectors subsegment of the injectable drug delivery devices segment captured the largest market share in 2024.

The injectable drug delivery devices can be subcategorized into prefilled syringes, pen injectors, autoinjectors, needle-free injectors, and wearable injectors. Among these, autoinjectors have experienced a pronounced growth trajectory in the market due to their user-friendly design, convenience, and capability to administer accurate doses of medication. These features make autoinjectors particularly suitable for patients with chronic conditions such as diabetes and multiple sclerosis. The architecture of autoinjectors facilitates self-administration, which enhances patient adherence to treatment regimens and minimizes the necessity for frequent visits to healthcare facilities. Given the rising emphasis on home-based care and patient-centric therapeutic solutions, the market for autoinjectors is poised for significant expansion.

North America accounted for the largest market share in 2024.

The global market for drug-device combination products is categorized into five key regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. Currently, North America dominates this market due to its substantial burden of chronic diseases, particularly diabetes, which enlarges the patient demographic that relies on these combination products. The region's market growth is further bolstered by the presence of several major industry players and supportive reimbursement policies that facilitate access to innovative therapies. Meanwhile, the Asia Pacific region is projected to experience the highest CAGR during the forecast period, indicating a burgeoning demand and potential for expansion in this sector.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1-35%, Tier 2-40%, and Tier 3- 25%

- By Designation: C-level-30%, Director-level-23%, and Other Designations-47%

- By Region: North America-35%, Europe-20%, Asia Pacific-25%, Latin America-13%, and Middle East & Africa-7%

The major players operating in the drug device combination products market are Abbott (US), Boston Scientific Corporation (US), Medtronic (Ireland), Becton, Dickinson and Company (US), Novartis AG (Switzerland), Novo Nordisk A/S (Denmark), Sanofi (France), Eli Lilly and Company (US), Merck KGaA (Germany), AbbVie Inc. (US), Teva Pharmaceutical Industries Ltd. (Israel), Stryker (US), B. Braun SE (Germany), Terumo Corporation (Japan) and Kaleo, Inc.(US).

Research Coverage

This report studies the drug device combination products market based on product type, application, and region. The report also studies factors (such as drivers, restraints, opportunities, and challenges) affecting market growth and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets with respect to their individual growth trends and forecasts the revenue of the market segments with respect to five major regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will allow both established companies and new or smaller firms to understand market trends, helping them to increase their market share. Firms that purchase the report can use one or a combination of the strategies mentioned below to enhance their market presence.

This report provides insights on the following pointers:

- Analysis of Key divers (increasing prevalence of chronic disease, technological advancements in drug device combination products, new product launches & high R&D investment), restraints (stringent regulatory requirement), opportunities (growth in emerging economies, growing adoption of drug device combination products), challenge (lack of training and awareness, and product malfunction & wastage)

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the drug device combination products market

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the drug device combination products market

- Market Development: Comprehensive information on lucrative emerging regions

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the drug device combination products market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 SEGMENTS CONSIDERED & GEOGRAPHICAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key sources of secondary data

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key objectives of primary research

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 REVENUE SHARE ANALYSIS (BOTTOM-UP APPROACH)

- 2.2.2 MNM REPOSITORY ANALYSIS

- 2.2.3 COMPANY INVESTOR PRESENTATIONS AND PRIMARY INTERVIEWS

- 2.2.4 TOP-DOWN APPROACH

- 2.3 MARKET GROWTH RATE PROJECTION

- 2.4 DATA TRIANGULATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 DRUG DEVICE COMBINATION PRODUCTS MARKET OVERVIEW

- 4.2 ASIA PACIFIC: DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION AND COUNTRY

- 4.3 DRUG DEVICE COMBINATION PRODUCTS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising prevalence of chronic diseases

- 5.2.1.2 Growing adoption of biologics and vaccines

- 5.2.1.3 High R&D investments from government organizations and private bodies

- 5.2.1.4 Shift toward personalized medicines and patient-centric care

- 5.2.1.5 Rising popularity of self-administered medicines

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent regulatory policies and compliance hurdles

- 5.2.2.2 Focus on alternative drug delivery methods

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increased preference for minimally invasive products

- 5.2.3.2 High growth potential in emerging economies

- 5.2.3.3 Growing adoption of drug device combination products and expanding biologics market

- 5.2.4 CHALLENGES

- 5.2.4.1 Heavy financial impact of drug wastage and device malfunction

- 5.2.4.2 Lack of standardized reimbursement policies

- 5.2.4.3 Limited training and education for healthcare professionals

- 5.2.4.4 Lack of medical specialists and surgeons

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 RISING POPULARITY OF SELF-ADMINISTERED MEDICINES AND HOME CARE SETTINGS

- 5.3.2 INTEGRATION OF DRUG DEVICE COMBINATION PRODUCTS WITH SMART CONNECTED DEVICES

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 Wearable technologies

- 5.4.1.2 Drug-eluting technologies

- 5.4.2 COMPLEMENTARY TECHNOLOGIES

- 5.4.2.1 Connected health and digital technologies

- 5.4.3 ADJACENT TECHNOLOGIES

- 5.4.3.1 Advanced materials and biopolymers

- 5.4.1 KEY TECHNOLOGIES

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 THREAT OF NEW ENTRANTS

- 5.5.2 THREAT OF SUBSTITUTES

- 5.5.3 BARGAINING POWER OF SUPPLIERS

- 5.5.4 BARGAINING POWER OF BUYERS

- 5.5.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.6 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.6.2 KEY BUYING CRITERIA

- 5.7 REGULATORY ANALYSIS

- 5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.2 REGULATORY FRAMEWORK

- 5.7.2.1 North America

- 5.7.2.1.1 US

- 5.7.2.1.2 Canada

- 5.7.2.2 Europe

- 5.7.2.3 Asia Pacific

- 5.7.2.3.1 India

- 5.7.2.3.2 China

- 5.7.2.3.3 Japan

- 5.7.2.4 Latin America

- 5.7.2.5 Middle East & Africa

- 5.7.2.1 North America

- 5.8 PATENT ANALYSIS

- 5.8.1 KEY PATENTS GRANTED

- 5.9 TRADE ANALYSIS

- 5.9.1 TRADE ANALYSIS FOR PREFILLED SYRINGES (HS CODE 300431), 2019-2023

- 5.9.1.1 Import data for HS Code 300431

- 5.9.1.2 Export data for HS Code 300431

- 5.9.2 TRADE DATA FOR TRANSDERMAL PATCHES (HS CODE 300431), 2019-2023

- 5.9.2.1 Import data for HS Code 300431

- 5.9.2.2 Export data for HS Code 300431

- 5.9.1 TRADE ANALYSIS FOR PREFILLED SYRINGES (HS CODE 300431), 2019-2023

- 5.10 PRICING ANALYSIS

- 5.10.1 INDICATIVE PRICING OF DRUG DEVICE COMBINATION PRODUCTS, BY KEY PLAYER, 2024

- 5.10.2 AVERAGE SELLING PRICE TREND OF INJECTABLE DRUG DELIVERY DEVICES, BY KEY PLAYER, 2022-2024

- 5.10.3 AVERAGE SELLING PRICE TREND OF DRUG DELIVERY COMBINATION PRODUCTS, BY REGION, 2022-2024

- 5.10.3.1 Average selling price trend for pen injectors, 2022-2024

- 5.10.3.2 Average selling price trend for inhalers, 2022-2024

- 5.10.3.3 Average selling price trend for drug-eluting stents, 2022-2024

- 5.11 VALUE CHAIN ANALYSIS

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 UNMET NEEDS/END-USER EXPECTATIONS

- 5.14 ADJACENT MARKET ANALYSIS

- 5.15 ECOSYSTEM ANALYSIS

- 5.15.1 ROLE IN ECOSYSTEM

- 5.16 CASE STUDY ANALYSIS

- 5.16.1 MINIMED 780G DIABETES MANAGEMENT SYSTEM TO COMBINE CONTINUOUS GLUCOSE MONITORING WITH AUTOMATED INSULIN DELIVERY

- 5.16.2 DIGIINHALER-SMART INHALER FOR ASTHMA/COPD TO TRACK LUNG FUNCTION

- 5.16.3 ADOPTION OF PEN INJECTORS BY NEMERA FRANCE TO IMPROVE THERAPEUTIC OUTCOMES

- 5.17 SUPPLY CHAIN ANALYSIS

- 5.18 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.19 INVESTMENT & FUNDING SCENARIO

- 5.20 REIMBURSEMENT SCENARIO ANALYSIS

- 5.21 CLINICAL PIPELINE ANALYSIS

- 5.22 IMPACT OF AI/GEN AI ON DRUG DEVICE COMBINATION PRODUCTS MARKET

- 5.23 IMPACT OF 2025 US TARIFF ON DRUG DEVICE COMBINATION PRODUCTS MARKET

- 5.23.1 KEY TARIFF RATES

- 5.23.2 PRICE IMPACT ANALYSIS

- 5.23.3 IMPACT ON COUNTRY/REGION

- 5.23.3.1 North America

- 5.23.3.1.1 US

- 5.23.3.2 Europe

- 5.23.3.3 Asia Pacific

- 5.23.3.1 North America

- 5.23.4 IMPACT ON END-USE INDUSTRIES

- 5.23.4.1 Hospitals & clinics

- 5.23.4.2 Ambulatory surgery centers

- 5.23.4.3 Long-term care facilities

- 5.23.4.4 Home care settings

6 DRUG DEVICE COMBINATION PRODUCTS MARKET, BY PRODUCT TYPE

- 6.1 INTRODUCTION

- 6.2 INJECTABLE DRUG DELIVERY DEVICES

- 6.2.1 PREFILLED SYRINGES

- 6.2.1.1 Need to eliminate dosing mistakes and improve patient compliance to drive segment

- 6.2.2 PEN INJECTORS

- 6.2.2.1 Ease of self-administration and improved dosage accuracy to fuel adoption

- 6.2.3 AUTOINJECTORS

- 6.2.3.1 Ease of use and better patient experience to aid adoption in emergency medical conditions

- 6.2.4 WEARABLE INJECTORS

- 6.2.4.1 Rising popularity of embedded wireless devices to propel market growth

- 6.2.5 NEEDLE-FREE INJECTORS

- 6.2.5.1 Reduced risk of needlestick injury to fuel market adoption

- 6.2.1 PREFILLED SYRINGES

- 6.3 DRUG-ELUTING STENTS

- 6.3.1 LOW RATE OF RESTENOSIS TO PROPEL MARKET GROWTH

- 6.4 INHALERS

- 6.4.1 INCREASING PREVALENCE OF RESPIRATORY DISEASES TO FUEL UPTAKE

- 6.5 INFUSION PUMPS

- 6.5.1 RISING NUMBER OF SURGICAL PROCEDURES TO FUEL DEMAND FOR AMBULATORY INFUSION PUMPS

- 6.6 TRANSDERMAL PATCHES

- 6.6.1 RISING INCIDENCE OF CHRONIC DISEASES REQUIRING LONG-TERM MEDICATION TO AID MARKET GROWTH

- 6.7 DRUG-COATED BALLOONS

- 6.7.1 ABILITY TO DELIVER LOCALIZED DRUG THERAPY WITH MINIMAL SYSTEMIC EXPOSURE TO DRIVE MARKET

- 6.8 OTHER PRODUCT TYPES

7 DRUG DEVICE COMBINATION PRODUCTS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 DIABETES MANAGEMENT

- 7.2.1 HIGH GERIATRIC POPULATION AND INCREASED SEDENTARY LIFESTYLE TO PROPEL MARKET GROWTH

- 7.3 RESPIRATORY DISEASES

- 7.3.1 RISE IN URBANIZATION, AIR POLLUTION, AND SMOKING TO FUEL RESPIRATORY AILMENTS

- 7.4 OPTHALMOLOGY

- 7.4.1 RISE OF DIABETIC EYE DISEASES AND FAVORABLE REGULATORY SCENARIO TO AUGMENT MARKET GROWTH

- 7.5 AUTOIMMUNE DISEASES

- 7.5.1 NEED FOR PROLONGED TREATMENT IN CHRONIC PATIENTS TO SPUR MARKET GROWTH

- 7.6 ONCOLOGY

- 7.6.1 DRUG DEVICE COMBINATION PRODUCTS TO AID THERAPEUTIC PRECISION AND OPTIMIZE PATIENT OUTCOMES DURING CANCER TREATMENT

- 7.7 INFECTIOUS DISEASES

- 7.7.1 IRREGULARIZED URBANIZATION AND POOR SANITATION IN EMERGING ECONOMIES TO PROPEL MARKET GROWTH

- 7.8 CARDIOVASCULAR DISEASES

- 7.8.1 INCREASE IN SEDENTARY LIFESTYLE AND CHANGES IN EATING HABITS TO FUEL MARKET GROWTH

- 7.9 OBESITY MANAGEMENT

- 7.9.1 INCREASING PREVALENCE OF OBESITY TO SUPPORT MARKET GROWTH

- 7.10 PAIN MANAGEMENT

- 7.10.1 BETTER PATIENT ADHERENCE AND MINIMAL SIDE EFFECTS TO DRIVE ADOPTION OF TRANSDERMAL PATCHES

- 7.11 OTHER APPLICATIONS

8 DRUG DEVICE COMBINATION PRODUCTS MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS & CLINICS

- 8.2.1 ACCESS TO MULTI-DISCIPLINARY EXPERTISE AND PROCEDURE-BASED CARE TO AID MARKET GROWTH

- 8.3 AMBULATORY SURGERY CENTERS

- 8.3.1 NEED FOR COST-EFFECTIVE AND HIGH-QUALITY MINIMALLY INVASIVE TREATMENT TO SUPPORT MARKET GROWTH

- 8.4 LONG-TERM CARE FACILITIES

- 8.4.1 INCREASING INCIDENCE OF CHRONIC DISEASES AMONG ELDERLY AND DISABLED POPULATION TO DRIVE MARKET

- 8.5 HOME CARE SETTINGS

- 8.5.1 INCREASING DEMAND FOR PATIENT-CENTRIC AND COST-EFFECTIVE HEALTHCARE TO PROPEL MARKET GROWTH

- 8.6 OTHER END USERS

9 DRUG DEVICE COMBINATION PRODUCTS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 US to dominate North American drug device combination products market during forecast period

- 9.2.3 CANADA

- 9.2.3.1 Regulatory modernization and strategic government investments to augment market growth

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Technological advancements and strong R&D infrastructure to propel market growth

- 9.3.3 UK

- 9.3.3.1 Strong emphasis on personalized and value-based healthcare to aid market growth

- 9.3.4 FRANCE

- 9.3.4.1 Strong healthcare infrastructure and high investments in biopharmaceutical innovation to boost market growth

- 9.3.5 ITALY

- 9.3.5.1 Focus on pharmaceutical-meditech convergence and healthcare modernization to drive market

- 9.3.6 SPAIN

- 9.3.6.1 Increasing geriatric population and growing focus on home-based treatment to propel market growth

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Favorable government policies and increased healthcare spending to support market growth

- 9.4.3 JAPAN

- 9.4.3.1 Advanced healthcare systems and universal reimbursement policies to spur market growth

- 9.4.4 INDIA

- 9.4.4.1 Growing focus on digital health integration and booming biosimilars sector to drive market

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Robust R&D infrastructure and enhanced focus on government-industry collaborations to aid market growth

- 9.4.6 AUSTRALIA

- 9.4.6.1 Rising healthcare investments by government and private organizations to boost market growth

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Presence of universal healthcare system and high geriatric population to drive market

- 9.5.3 MEXICO

- 9.5.3.1 Focus on nearshoring and improvement in healthcare sector to drive market

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.6.2 GCC COUNTRIES

- 9.6.2.1 Kingdom of Saudi Arabia

- 9.6.2.1.1 Developed medical tourism and favorable government initiatives to support market growth

- 9.6.2.2 UAE

- 9.6.2.2.1 Increased prevalence of diabetes and focus on innovative patient-centric care to drive market

- 9.6.2.3 Rest of GCC countries

- 9.6.2.1 Kingdom of Saudi Arabia

- 9.6.3 REST OF MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN DRUG DEVICE COMBINATION PRODUCTS MARKET

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.4.1 RANKING OF KEY MARKET PLAYERS

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Product type footprint

- 10.5.5.4 Application footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SME players

- 10.6.5.2 Competitive benchmarking of key startups/SME players

- 10.7 COMPANY VALUATION & FINANCIAL METRICS

- 10.7.1 FINANCIAL METRICS

- 10.7.2 COMPANY VALUATION

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES AND APPROVALS

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

- 10.9.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 ABBOTT

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches and approvals

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 ELI LILLY AND COMPANY

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product approvals

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Expansions

- 11.1.2.3.4 Other developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 MEDTRONIC

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches and approvals

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 NOVO NORDISK A/S

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches and approvals

- 11.1.4.3.2 Deals

- 11.1.4.3.3 Expansions

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 NOVARTIS AG

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product approvals

- 11.1.5.3.2 Deals

- 11.1.5.3.3 Expansions

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses & competitive threats

- 11.1.6 SANOFI

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product approvals

- 11.1.6.3.2 Deals

- 11.1.6.3.3 Other developments

- 11.1.7 BOSTON SCIENTIFIC CORPORATION

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product approvals

- 11.1.7.3.2 Deals

- 11.1.8 BECTON, DICKINSON AND COMPANY

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.8.3.2 Other developments

- 11.1.9 MERCK KGAA

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.10 ABBVIE INC.

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product approvals

- 11.1.10.3.2 Deals

- 11.1.10.3.3 Expansions

- 11.1.11 TEVA PHARMACEUTICAL INDUSTRIES LTD.

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product approvals

- 11.1.11.3.2 Other developments

- 11.1.12 STRYKER

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.13 B. BRAUN SE

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.14 TERUMO CORPORATION

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Product launches and approvals

- 11.1.1 ABBOTT

- 11.2 OTHER PLAYERS

- 11.2.1 TANDEM DIABETES CARE, INC.

- 11.2.2 CEQUR SIMPLICITY

- 11.2.3 INTARCIA THERAPEUTICS, INC.

- 11.2.4 HALOZYME, INC.

- 11.2.5 KALEO, INC.

- 11.2.6 LEAD CHEMICAL CO., LTD.

- 11.2.7 PURDUE PHARMA L.P.

- 11.2.8 ALVOGEN

- 11.2.9 EVOLUTIS

- 11.2.10 MUNDIPHARMA INTERNATIONAL LIMITED

- 11.2.11 SPARSHA PHARMA INTERNATIONAL PVT. LTD.

- 11.2.12 SUPERNUS PHARMACEUTICALS, INC.

- 11.2.13 ALCON INC.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS