|

|

市場調査レポート

商品コード

1732208

自動車内装材の世界市場:タイプ別、車両タイプ別、用途別、地域別 - 2030年までの予測Automotive Interior Materials Market by Type (Polymer, Genuine Leather, Fabric), Application (Seat, Dashboards, Safety Components), Vehicle Type (Passenger Cars, Buses & Coaches), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 自動車内装材の世界市場:タイプ別、車両タイプ別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月19日

発行: MarketsandMarkets

ページ情報: 英文 291 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の自動車内装材の市場規模は、2024年の530億9,000万米ドルから2030年には652億6,000万米ドルに達し、2025年からのCAGRは3.52%になると予測されています。

自動車内装材は、シート、ダッシュボード、ドアパネル、ヘッドライナーなどの部品を含む車両キャビンの製造に広く利用されています。これらの材料は、乗客の快適性、耐久性、安全性、車内全体の美観を高める上で重要な役割を果たしています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 対象ユニット | 金額(100万米ドル)および数量(キロトン) |

| セグメント | タイプ別、車両タイプ別、用途別、地域別 |

| 対象地域 | アジア太平洋、欧州、北米、中東・アフリカ、南米 |

頻繁な使用、紫外線への暴露、温度変化に耐えるよう設計されたこれらの素材は、長期間にわたって視覚的・触覚的品質を維持しながら、高性能基準を満たさなければならないです。乗員の安全性がますます重視されるようになり、環境および規制要件がますます厳しくなっていることも相まって、自動車業界全体で先端内装材の採用が加速しています。

材料科学と加工技術の絶え間ない進歩は、内装部品の持続可能性、機能性、弾力性を向上させ、それによって市場の幅広い成長を支えています。さらに、世界の工業化-特に新興市場-は、近代化された付加価値の高い車両設計への幅広い推進の一環として、高品質な自動車内装ソリューションへの需要増加に拍車をかけています。

2024年、ポリマーは、その卓越した汎用性、軽量特性、コスト効率に牽引され、自動車内装材市場で最大のシェアを占めました。ポリプロピレン、ポリウレタン、その他のエンジニアリング・ポリマーなどの素材は成形性に優れ、メーカーは複雑で人間工学に基づいた内装デザインを高い精度で作成することができます。

ポリマーは耐久性、耐摩耗性、熱安定性にも優れているため、ダッシュボード、ドアパネル、シートカバー、トリム部品など、使用頻度の高い部品に最適です。自動車業界では、燃費効率と車両の軽量化がますます重視されるようになっており、ポリマーベースのソリューションに対する需要がさらに高まっています。

さらに、業界の持続可能な製造へのシフトにより、リサイクル可能なポリマーやバイオベースポリマーの開発と採用が加速しています。これは、より広範な環境目標や法規制に合致するものであり、性能、設計の柔軟性、環境配慮型生産のバランスを求める自動車メーカーにとって、ポリマーは望ましい材料と位置づけられています。

大型商用車(HCV)セグメントは、予測期間中、自動車内装材市場において金額ベースで2番目に高いCAGRで成長すると予測されています。貨物、建設、鉱業用途に特有の過酷な運転環境に耐えうる耐久性と機能性を備えた内装部品への需要が高まることで、この成長が促進されます。長距離運行においてドライバーの快適性、安全性、人間工学がさらに重要視される中、メーカーはシート、ダッシュボード、キャビン断熱材の高性能素材に投資しています。さらに、燃費改善を求める規制当局の圧力が、内装材の軽量化を後押ししています。

金額ベースでは、欧州は堅調な自動車製造業と消費者による高級車需要の増加により、自動車内装材市場第2位となっています。同地域の自動車市場では、自動車内装材の革新性、持続可能性、高級感に重点を置くトップ企業が数多く存在します。EVの普及と環境政策の強化により、軽量で環境に優しい内装品の適用が引き続き推進されています。欧州の消費者もまた、デザインの美しさと快適性に高い関心を寄せているが、同時にメーカーにハイテク素材、ソフトタッチポリマー、天然タバコ、リサイクル生地などへの投資を促しています。さらに、政府による支援策と研究開発資金が、この地域全体の素材革新に拍車をかけています。これらすべての要因が総合的に、世界市場における欧州の大きなシェアにつながっています。

当レポートでは、世界の自動車内装材市場について調査し、タイプ別、車両タイプ別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 価格分析

- マクロ経済見通し

第6章 業界動向

- サプライチェーン分析

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- 貿易分析

- 技術分析

- ケーススタディ分析

- 規制状況

- 2025年~2026年の主な会議とイベント

- 投資と資金調達のシナリオ

- 特許分析

- AI/生成AIが自動車内装材市場に与える影響

- 2025年の米国関税が自動車内装材市場に与える影響

第7章 自動車内装材市場(タイプ別)

- イントロダクション

- ポリマー

- 本革

- ファブリック

- 合成皮革

- 熱可塑性オレフィン(TPO)

- その他

第8章 自動車内装材市場(車両タイプ別)

- イントロダクション

- 乗用車

- 小型商用車(LCVS)

- 大型商用車(HCVS)

- バスと長距離バス

第9章 自動車内装材市場(用途別)

- イントロダクション

- ダッシュボード

- 座席

- 室内照明

- ヘッドライナー

- 後部座席エンターテイメント

- フロアカーペット

- ドアパネル

- センターコンソール

- 接着剤とテープ

- ヘッドアップディスプレイ

- 安全部品

- その他

第10章 自動車内装材市場(地域別)

- イントロダクション

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- タイ

- 欧州

- ドイツ

- スペイン

- フランス

- 英国

- イタリア

- ロシア

- 北米

- 米国

- カナダ

- メキシコ

- 中東・アフリカ

- イラン

- 南アフリカ

- 南米

- ブラジル

- アルゼンチン

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 市場シェア分析

- 収益分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- LEAR CORPORATION

- ASAHI KASEI CORPORATION

- TOYOTA BOSHOKU CORPORATION

- FORVIA

- TOYODA GOSEI CO., LTD.

- GRUPO ANTOLIN-IRAUSA, S.A.U.(ANTOLIN)

- YANFENG AUTOMOTIVE INTERIORS

- SEIREN CO., LTD.

- DK LEATHER SEATS SDN. BHD.

- DRAXLMAIER GROUP

- その他の企業

- STAHL HOLDINGS B.V.

- GRAMMER AG

- MARELLI HOLDINGS CO., LTD.

- BENECKE-KALIKO AG

- KATZKIN LEATHER INC

- SMS AUTO FABRICS

- MACHINO PLASTICS LIMITED

- EISSMANN AUTOMOTIVE DEUTSCHLAND GMBH

- BOXMARK LEATHER GMBH & CO KG

- WOLLSDORF LEDER SCHMIDT & CO GES.M.B.H.

- CLASSIC SOFT TRIM

- NBHX TRIM GMBH

- GROCLIN GROUP S.A.(LESS S.A.)

- ELMO SWEDEN AB

- AGM AUTOMOTIVE, LLC

第13章 隣接市場と関連市場

第14章 付録

List of Tables

- TABLE 1 AUTOMOTIVE INTERIOR MATERIALS MARKET: DEFINITION AND INCLUSIONS, BY TYPE

- TABLE 2 AUTOMOTIVE INTERIOR MATERIALS MARKET: DEFINITION AND INCLUSIONS, BY VEHICLE TYPE

- TABLE 3 AUTOMOTIVE INTERIOR MATERIALS MARKET: DEFINITION AND INCLUSIONS, BY APPLICATION

- TABLE 4 AUTOMOTIVE INTERIOR MATERIALS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP VEHICLE TYPES (%)

- TABLE 6 KEY BUYING CRITERIA FOR TOP VEHICLE TYPES

- TABLE 7 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE INTERIOR MATERIALS OFFERED BY KEY PLAYERS, BY TYPE, 2024 (USD/KG)

- TABLE 8 GDP PERCENTAGE CHANGE, BY COUNTRY, 2021-2029

- TABLE 9 TRENDS IN GLOBAL AUTOMOTIVE INDUSTRY

- TABLE 10 ROLES OF COMPANIES IN AUTOMOTIVE INTERIOR MATERIALS ECOSYSTEM

- TABLE 11 IMPORT DATA RELATED TO HS CODE 3920-COMPLIANT PRODUCTS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 12 EXPORT DATA RELATED TO HS CODE 3920-COMPLIANT PRODUCTS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 13 BENEFITS OF POLYCARBONATE MATERIAL

- TABLE 14 GLOBAL: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 REGULATIONS FOR PASSENGER CAR SEATS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 AUTOMOTIVE INTERIOR MATERIAL: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 22 AUTOMOTIVE INTERIOR MATERIALS MARKET: FUNDING/INVESTMENT SCENARIO

- TABLE 23 AUTOMOTIVE INTERIOR MATERIALS MARKET: PATENT STATUS, 2014-2024

- TABLE 24 AUTOMOTIVE INTERIOR MATERIALS MARKET: LIST OF MAJOR PATENTS, 2014-2024

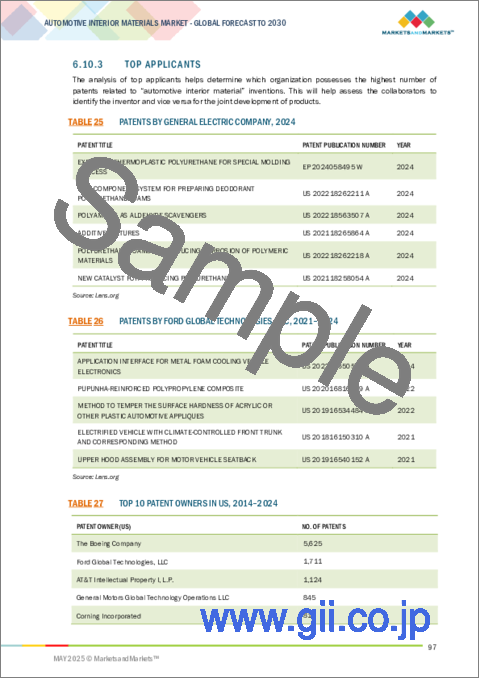

- TABLE 25 PATENTS BY GENERAL ELECTRIC COMPANY, 2024

- TABLE 26 PATENTS BY FORD GLOBAL TECHNOLOGIES, LLC, 2021-2024

- TABLE 27 TOP 10 PATENT OWNERS IN US, 2014-2024

- TABLE 28 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 29 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 30 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 31 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 32 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 33 POLYMER: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 34 POLYMER: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 35 POLYMER: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 36 POLYMER: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 GENUINE LEATHER: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 38 GENUINE LEATHER: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 39 GENUINE LEATHER: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 GENUINE LEATHER: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 FABRIC: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 42 FABRIC: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 43 FABRIC: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 44 FABRIC: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 SYNTHETIC LEATHER: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 46 SYNTHETIC LEATHER: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 47 SYNTHETIC LEATHER: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 48 SYNTHETIC LEATHER: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 THERMOPLASTIC OLEFIN (TPO): AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 50 THERMOPLASTIC OLEFIN (TPO): AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 51 THERMOPLASTIC OLEFIN (TPO): AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 THERMOPLASTIC OLEFIN (TPO): AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 OTHER TYPES: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 54 OTHER TYPES: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 55 OTHER TYPES: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 56 OTHER TYPES: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (KILOTON)

- TABLE 58 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (KILOTON)

- TABLE 59 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (USD MILLION)

- TABLE 60 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 61 PASSENGER CARS: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 62 PASSENGER CARS: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 63 PASSENGER CARS: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 64 PASSENGER CARS: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 LIGHT COMMERCIAL VEHICLES: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 66 LIGHT COMMERCIAL VEHICLES: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 67 LIGHT COMMERCIAL VEHICLES: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 68 LIGHT COMMERCIAL VEHICLES: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 HEAVY COMMERCIAL VEHICLES: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 70 HEAVY COMMERCIAL VEHICLES: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 71 HEAVY COMMERCIAL VEHICLES: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 72 HEAVY COMMERCIAL VEHICLES: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 BUSES & COACHES: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 74 BUSES & COACHES: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 75 BUSES & COACHES: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 76 BUSES & COACHES: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY APPLICATION, 2020-2024 (KILOTON)

- TABLE 78 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 79 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 80 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 81 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 82 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 83 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 84 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 ASIA PACIFIC: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 86 ASIA PACIFIC: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 87 ASIA PACIFIC: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 88 ASIA PACIFIC: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 89 ASIA PACIFIC: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (KILOTON)

- TABLE 90 ASIA PACIFIC: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (KILOTON)

- TABLE 91 ASIA PACIFIC: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (USD MILLION)

- TABLE 92 ASIA PACIFIC: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 93 ASIA PACIFIC: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 94 ASIA PACIFIC: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 95 ASIA PACIFIC: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 96 ASIA PACIFIC: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 97 CHINA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (KILOTON)

- TABLE 98 CHINA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (KILOTON)

- TABLE 99 CHINA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (USD MILLION)

- TABLE 100 CHINA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 101 JAPAN: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (KILOTON)

- TABLE 102 JAPAN: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (KILOTON)

- TABLE 103 JAPAN: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (USD MILLION)

- TABLE 104 JAPAN: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 105 INDIA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (KILOTON)

- TABLE 106 INDIA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (KILOTON)

- TABLE 107 INDIA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (USD MILLION)

- TABLE 108 INDIA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 109 SOUTH KOREA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (KILOTON)

- TABLE 110 SOUTH KOREA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (KILOTON)

- TABLE 111 SOUTH KOREA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (USD MILLION)

- TABLE 112 SOUTH KOREA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 113 THAILAND: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (KILOTON)

- TABLE 114 THAILAND: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (KILOTON)

- TABLE 115 THAILAND: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (USD MILLION)

- TABLE 116 THAILAND: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 117 EUROPE: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 118 EUROPE: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 119 EUROPE: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 120 EUROPE: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 121 EUROPE: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (KILOTON)

- TABLE 122 EUROPE: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (KILOTON)

- TABLE 123 EUROPE: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (USD MILLION)

- TABLE 124 EUROPE: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 125 EUROPE: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 126 EUROPE: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 127 EUROPE: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 128 EUROPE: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 129 GERMANY: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (KILOTON)

- TABLE 130 GERMANY: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (KILOTON)

- TABLE 131 GERMANY: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (USD MILLION)

- TABLE 132 GERMANY: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 133 SPAIN: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (KILOTON)

- TABLE 134 SPAIN: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (KILOTON)

- TABLE 135 SPAIN: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (USD MILLION)

- TABLE 136 SPAIN: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 137 FRANCE: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (KILOTON)

- TABLE 138 FRANCE: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (KILOTON)

- TABLE 139 FRANCE: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (USD MILLION)

- TABLE 140 FRANCE: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 141 UK: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (KILOTON)

- TABLE 142 UK: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (KILOTON)

- TABLE 143 UK: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (USD MILLION)

- TABLE 144 UK: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 145 ITALY: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (KILOTON)

- TABLE 146 ITALY: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (KILOTON)

- TABLE 147 ITALY: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (USD MILLION)

- TABLE 148 ITALY: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 149 RUSSIA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (KILOTON)

- TABLE 150 RUSSIA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (KILOTON)

- TABLE 151 RUSSIA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (USD MILLION)

- TABLE 152 RUSSIA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 153 NORTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 154 NORTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 155 NORTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 156 NORTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 157 NORTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (KILOTON)

- TABLE 158 NORTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (KILOTON)

- TABLE 159 NORTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (USD MILLION)

- TABLE 160 NORTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 161 NORTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 162 NORTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 163 NORTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 164 NORTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 165 US: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (KILOTON)

- TABLE 166 US: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (KILOTON)

- TABLE 167 US: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (USD MILLION)

- TABLE 168 US: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 169 CANADA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (KILOTON)

- TABLE 170 CANADA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (KILOTON)

- TABLE 171 CANADA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (USD MILLION)

- TABLE 172 CANADA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 173 MEXICO: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (KILOTON)

- TABLE 174 MEXICO: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (KILOTON)

- TABLE 175 MEXICO: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (USD MILLION)

- TABLE 176 MEXICO: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 178 MIDDLE EAST & AFRICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 179 MIDDLE EAST & AFRICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (KILOTON)

- TABLE 182 MIDDLE EAST & AFRICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (KILOTON)

- TABLE 183 MIDDLE EAST & AFRICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 186 MIDDLE EAST & AFRICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 187 MIDDLE EAST & AFRICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 189 IRAN: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (KILOTON)

- TABLE 190 IRAN: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (KILOTON)

- TABLE 191 IRAN: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (USD MILLION)

- TABLE 192 IRAN: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 193 SOUTH AFRICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (KILOTON)

- TABLE 194 SOUTH AFRICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (KILOTON)

- TABLE 195 SOUTH AFRICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (USD MILLION)

- TABLE 196 SOUTH AFRICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 197 SOUTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 198 SOUTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 199 SOUTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 200 SOUTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 201 SOUTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (KILOTON)

- TABLE 202 SOUTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (KILOTON)

- TABLE 203 SOUTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (USD MILLION)

- TABLE 204 SOUTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 205 SOUTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 206 SOUTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 207 SOUTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 208 SOUTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 209 BRAZIL: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (KILOTON)

- TABLE 210 BRAZIL: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (KILOTON)

- TABLE 211 BRAZIL: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (USD MILLION)

- TABLE 212 BRAZIL: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 213 ARGENTINA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (KILOTON)

- TABLE 214 ARGENTINA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (KILOTON)

- TABLE 215 ARGENTINA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2020-2024 (USD MILLION)

- TABLE 216 ARGENTINA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 217 OVERVIEW OF STRATEGIES ADOPTED BY KEY AUTOMOTIVE INTERIOR MATERIAL MANUFACTURERS

- TABLE 218 AUTOMOTIVE INTERIOR MATERIALS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 219 AUTOMOTIVE INTERIOR MATERIALS MARKET: REGION FOOTPRINT

- TABLE 220 AUTOMOTIVE INTERIOR MATERIALS MARKET: TYPE FOOTPRINT

- TABLE 221 AUTOMOTIVE INTERIOR MATERIALS MARKET: APPLICATION FOOTPRINT

- TABLE 222 AUTOMOTIVE INTERIOR MATERIALS MARKET: VEHICLE TYPE FOOTPRINT

- TABLE 223 AUTOMOTIVE INTERIOR MATERIALS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 224 AUTOMOTIVE INTERIOR MATERIALS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 225 AUTOMOTIVE INTERIOR MATERIALS MARKET: PRODUCT LAUNCHES, JANUARY 2019-APRIL 2025

- TABLE 226 AUTOMOTIVE INTERIOR MATERIALS MARKET: DEALS, JANUARY 2019-APRIL 2025

- TABLE 227 AUTOMOTIVE INTERIOR MATERIALS MARKET: EXPANSIONS, JANUARY 2019-APRIL 2025

- TABLE 228 AUTOMOTIVE INTERIOR MATERIALS MARKET: OTHER DEVELOPMENTS, JANUARY 2019-APRIL 2025

- TABLE 229 LEAR CORPORATION: COMPANY OVERVIEW

- TABLE 230 LEAR CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 LEAR CORPORATION: PRODUCT LAUNCHES

- TABLE 232 LEAR CORPORATION: DEALS

- TABLE 233 ASAHI KASEI CORPORATION: COMPANY OVERVIEW

- TABLE 234 ASAHI KASEI CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 ASAHI KASEI CORPORATION: DEALS

- TABLE 236 TOYOTA BOSHOKU CORPORATION: COMPANY OVERVIEW

- TABLE 237 TOYOTA BOSHOKU CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 TOYOTA BOSHOKU CORPORATION: EXPANSIONS

- TABLE 239 TOYOTA BOSHOKU CORPORATION: OTHER DEVELOPMENTS

- TABLE 240 FORVIA: COMPANY OVERVIEW

- TABLE 241 FORVIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 FORVIA: DEALS

- TABLE 243 FORVIA: EXPANSIONS

- TABLE 244 TOYODA GOSEI CO., LTD.: COMPANY OVERVIEW

- TABLE 245 TOYODA GOSEI CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 TOYODA GOSEI CO., LTD.: PRODUCT LAUNCHES

- TABLE 247 TOYODA GOSEI CO., LTD.: DEALS

- TABLE 248 TOYODA GOSEI CO., LTD.: EXPANSIONS

- TABLE 249 GRUPO ANTOLIN-IRAUSA, S.A.U.: COMPANY OVERVIEW

- TABLE 250 GRUPO ANTOLIN-IRAUSA, S.A.U.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 GRUPO ANTOLIN-IRAUSA, S.A.U.: PRODUCT LAUNCHES

- TABLE 252 GRUPO ANTOLIN-IRAUSA, S.A.U.: DEALS

- TABLE 253 GRUPO ANTOLIN-IRAUSA, S.A.U.: EXPANSIONS

- TABLE 254 YANFENG AUTOMOTIVE INTERIORS: COMPANY OVERVIEW

- TABLE 255 YANFENG AUTOMOTIVE INTERIORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 YANFENG AUTOMOTIVE INTERIORS: PRODUCT LAUNCHES

- TABLE 257 YANFENG AUTOMOTIVE INTERIORS: DEALS

- TABLE 258 YANFENG AUTOMOTIVE INTERIORS: EXPANSIONS

- TABLE 259 SEIREN CO., LTD.: COMPANY OVERVIEW

- TABLE 260 SEIREN CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 SEIREN CO., LTD.: DEALS

- TABLE 262 DK LEATHER SEATS SDN. BHD.: COMPANY OVERVIEW

- TABLE 263 DK LEATHER SEATS SDN. BHD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 DRAXLMAIER GROUP: COMPANY OVERVIEW

- TABLE 265 DRAXLMAIER GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 STAHL HOLDINGS B.V.: COMPANY OVERVIEW

- TABLE 267 GRAMMER AG: COMPANY OVERVIEW

- TABLE 268 MARELLI HOLDINGS CO., LTD.: COMPANY OVERVIEW

- TABLE 269 BENECKE-KALIKO AG: COMPANY OVERVIEW

- TABLE 270 KATZKIN LEATHER INC.: COMPANY OVERVIEW

- TABLE 271 SMS AUTO FABRICS: COMPANY OVERVIEW

- TABLE 272 MACHINO PLASTICS LIMITED: COMPANY OVERVIEW

- TABLE 273 EISSMANN AUTOMOTIVE DEUTSCHLAND GMBH: COMPANY OVERVIEW

- TABLE 274 BOXMARK LEATHER GMBH & CO KG: COMPANY OVERVIEW

- TABLE 275 WOLLSDORF LEDER SCHMIDT & CO GES.M.B.H.: COMPANY OVERVIEW

- TABLE 276 CLASSIC SOFT TRIM: COMPANY OVERVIEW

- TABLE 277 NBHX TRIM GMBH: COMPANY OVERVIEW

- TABLE 278 GROCLIN GROUP S.A. (LESS S.A.): COMPANY OVERVIEW

- TABLE 279 ELMO SWEDEN AB: COMPANY OVERVIEW

- TABLE 280 AGM AUTOMOTIVE, LLC: COMPANY OVERVIEW

- TABLE 281 VIBRATION DAMPING MATERIALS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 282 VIBRATION DAMPING MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 283 VIBRATION DAMPING MATERIALS MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 284 VIBRATION DAMPING MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 285 ASIA PACIFIC: VIBRATION DAMPING MATERIALS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 286 ASIA PACIFIC: VIBRATION DAMPING MATERIALS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 287 ASIA PACIFIC: VIBRATION DAMPING MATERIALS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 288 ASIA PACIFIC: VIBRATION DAMPING MATERIALS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 289 EUROPE: VIBRATION DAMPING MATERIALS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 290 EUROPE: VIBRATION DAMPING MATERIALS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 291 EUROPE: VIBRATION DAMPING MATERIALS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 292 EUROPE: VIBRATION DAMPING MATERIALS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 293 NORTH AMERICA: VIBRATION DAMPING MATERIALS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 294 NORTH AMERICA: VIBRATION DAMPING MATERIALS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 295 NORTH AMERICA: VIBRATION DAMPING MATERIALS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 296 NORTH AMERICA: VIBRATION DAMPING MATERIALS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 297 MIDDLE EAST & AFRICA: VIBRATION DAMPING MATERIALS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 298 MIDDLE EAST & AFRICA: VIBRATION DAMPING MATERIALS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 299 MIDDLE EAST & AFRICA: VIBRATION DAMPING MATERIALS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 300 MIDDLE EAST & AFRICA: VIBRATION DAMPING MATERIALS MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 301 SOUTH AMERICA: VIBRATION DAMPING MATERIALS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 302 SOUTH AMERICA: VIBRATION DAMPING MATERIALS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 303 SOUTH AMERICA: VIBRATION DAMPING MATERIALS MARKET, BY TYPE, 2020-2024 (KILOTON)

- TABLE 304 SOUTH AMERICA: VIBRATION DAMPING MATERIALS MARKET, BY TYPE, 2025-2030 (KILOTON)

List of Figures

- FIGURE 1 AUTOMOTIVE INTERIOR MATERIALS MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 AUTOMOTIVE INTERIOR MATERIALS MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): COMBINED REVENUE OF MAJOR PLAYERS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE AND SHARE OF MAJOR PLAYERS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3 - BOTTOM-UP (DEMAND SIDE): PRODUCTS SOLD

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4: TOP-DOWN

- FIGURE 7 AUTOMOTIVE INTERIOR MATERIALS MARKET: DATA TRIANGULATION

- FIGURE 8 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 9 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 10 SEATS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 11 POLYMER SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 12 PASSENGER CARS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 13 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 14 RAPID URBANIZATION AND GROWING DEMAND FOR AUTOMOBILES TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 15 ASIA PACIFIC TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 16 POLYMER SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES OF ASIA PACIFIC AUTOMOTIVE INTERIOR MATERIALS MARKET IN 2024

- FIGURE 17 POLYMER SEGMENT LED AUTOMOTIVE INTERIOR MATERIALS MARKET ACROSS ALL REGIONS IN 2024

- FIGURE 18 INDIA TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 AUTOMOTIVE INTERIOR MATERIALS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 AUTOMOTIVE INTERIOR MATERIALS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP VEHICLE TYPES

- FIGURE 22 KEY BUYING CRITERIA FOR TOP VEHICLE TYPES

- FIGURE 23 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE INTERIOR MATERIALS OFFERED BY KEY PLAYERS, BY TYPE, 2024 (USD/KG)

- FIGURE 24 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE INTERIOR MATERIALS, BY REGION, 2022-2030 (USD/KG)

- FIGURE 25 SALES OF NEW VEHICLES, BY REGION, 2019-2023 (MILLION UNITS)

- FIGURE 26 AUTOMOTIVE INTERIOR MATERIALS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 AUTOMOTIVE INTERIOR MARKET: KEY PLAYERS IN ECOSYSTEM

- FIGURE 29 IMPORT DATA FOR HS CODE 3920-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 30 EXPORT DATA FOR HS CODE 3920-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 31 PATENTS REGISTERED RELATED TO AUTOMOTIVE INTERIOR MATERIALS, 2014-2024

- FIGURE 32 TOP PATENT OWNERS, 2014-2024

- FIGURE 33 LEGAL STATUS OF PATENTS FILED FOR AUTOMOTIVE INTERIOR MATERIALS, 2014-2024

- FIGURE 34 MAJOR PATENTS FILED IN US JURISDICTION, 2014-2024

- FIGURE 35 AUTOMOTIVE INTERIOR MATERIALS MARKET: IMPACT OF AI/GEN AI

- FIGURE 36 POLYMER TYPE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 37 PASSENGER CARS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 38 SEATS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 39 ASIA PACIFIC TO BE FASTEST-GROWING AUTOMOTIVE INTERIOR MATERIALS MARKET BETWEEN 2025 AND 2030

- FIGURE 40 ASIA PACIFIC: AUTOMOTIVE INTERIOR MATERIALS MARKET SNAPSHOT

- FIGURE 41 EUROPE: AUTOMOTIVE INTERIOR MATERIALS MARKET SNAPSHOT

- FIGURE 42 NORTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET SNAPSHOT

- FIGURE 43 LEAR CORPORATION LED AUTOMOTIVE INTERIOR MATERIALS MARKET IN 2024

- FIGURE 44 AUTOMOTIVE INTERIOR MATERIALS MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 45 AUTOMOTIVE INTERIOR MATERIALS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 46 AUTOMOTIVE INTERIOR MATERIALS MARKET: COMPANY FOOTPRINT

- FIGURE 47 AUTOMOTIVE INTERIOR MATERIALS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 48 AUTOMOTIVE INTERIOR MATERIALS MARKET: ENTERPRISE VALUATION (EV) OF KEY PLAYERS

- FIGURE 49 AUTOMOTIVE INTERIOR MATERIALS MARKET: EV/EBITDA OF KEY MANUFACTURERS

- FIGURE 50 AUTOMOTIVE INTERIOR MATERIALS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 51 LEAR CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

- FIGURE 53 TOYOTA BOSHOKU CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 FORVIA: COMPANY SNAPSHOT

- FIGURE 55 TOYODA GOSEI CO., LTD.: COMPANY SNAPSHOT

- FIGURE 56 GRUPO ANTOLIN-IRAUSA, S.A.U.: COMPANY SNAPSHOT

- FIGURE 57 SEIREN CO., LTD.: COMPANY SNAPSHOT

The global automotive interior materials market size is projected to reach USD 65.26 billion by 2030 from USD 53.09 billion in 2024, at a CAGR of 3.52% from 2025. Automotive interior materials are extensively utilized in the manufacturing of vehicle cabins, including components such as seats, dashboards, door panels, and headliners. These materials play a critical role in enhancing passenger comfort, durability, safety, and the overall aesthetic appeal of the vehicle interior.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Type, Application, Vehicle Type, and Region |

| Regions covered | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

Designed to withstand frequent use, exposure to ultraviolet radiation, and temperature fluctuations, these materials must meet high-performance standards while maintaining their visual and tactile qualities over time. The growing emphasis on occupant safety, coupled with increasingly stringent environmental and regulatory requirements, is accelerating the adoption of advanced interior materials across the automotive industry.

Continuous advancements in material science and processing technologies are improving the sustainability, functionality, and resilience of interior components, thereby supporting broader market growth. Additionally, global industrialization-particularly in emerging markets-is fueling increased demand for high-quality automotive interior solutions as part of a broader push toward modernized, value-added vehicle design.

"Polymer type accounted for the largest share of the automotive interior materials market, in 2024."

In 2024, polymers accounted for the largest share of the automotive interior materials market, driven by their exceptional versatility, lightweight properties, and cost-efficiency. Materials such as polypropylene, polyurethane, and other engineered polymers offer superior moldability, enabling manufacturers to create complex and ergonomic interior designs with high precision.

Polymers are also favored for their durability, resistance to wear, and thermal stability, making them ideal for high-use components such as dashboards, door panels, seat covers, and trim parts. The automotive industry's increasing focus on fuel efficiency and vehicle lightweighting further amplifies demand for polymer-based solutions, as these materials contribute significantly to overall weight reduction without compromising structural integrity or esthetics.

Moreover, the industry's shift toward sustainable manufacturing has accelerated the development and adoption of recyclable and bio-based polymers. This aligns with broader environmental goals and regulatory mandates, positioning polymers as the preferred material for automakers seeking to balance performance, design flexibility, and eco-conscious production.

"Heavy commercial vehicles are projected to register the second-highest CAGR in the automotive interior materials market, in terms of value during the forecast period."

The heavy commercial vehicles (HCV) segment is expected to grow at the second highest CAGR in terms of value in the automotive interior materials market over the forecast period. By being subject to increasing demand for durable and functional interior components that can stand up to the harsh operation environment inherent to freight, construction, and mining applications, this growth is precipitated. While driver comfort, safety, and ergonomics gain further prominence in long-haul operations, manufacturers are investing in high-performance materials for seats, dashboard, and cabin insulation. Moreover, pressure by regulators for better fuel economy is driving lightweight interior materials.

"Europe was the second-largest automotive interior materials market, in terms of value."

In terms of value, Europe was the second-largest automotive interior materials market due to its robust automobile manufacturing industry and the increased demand for luxury vehicles by consumers. There are a number of top performers in the automobiles market in the region with a focus on innovation, sustainability and luxury in interior automobiles. Wider acceptance of EVs as well as tougher environmental policies have continued to promote the application of lightweight and environment-friendly interior fittings. European consumers, too, are highly concerned about design esthetics and comfort but at the same time push manufacturers to invest in high-tech materials, soft-touch polymers, natural tobacco and recycled fabrics, among others. What is more, supportive initiatives by governments and R&D funding are spurring material innovation throughout the region. All these factors cumulatively lead to Europe's large share in the global market.

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: Directors - 50%, Managers - 30%, and Others - 20%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, Rest of World - 5%

The key players profiled in the report include Lear Corporation (US), Asahi Kasei Corporation (Japan), Toyota Boshoku Corporation (Japan), Forvia (France), Toyoda Gosei Co., Ltd. (Japan), Grupo Antolin-Irausa, S.A.U. (Spain), Yanfeng Automotive Interiors (China), SEIREN CO., LTD. (Japan), DK Leather Seats Sdn. Bhd. (Malaysia), DRAXLMAIER Group (Germany), and among others.

Research Coverage

This report segments the market for automotive interior materials based on type, end-use industry, and region and provides estimations of value (USD million) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies, associated with the market for automotive interior materials.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the automotive interior materials market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on automotive interior materials offered by top players in the global market

- Analysis of Key Factors: Drivers (Increasing fuel efficiency by reducing weight, growing demand customization and comfort, rising demand for interior fabrics, and advancements in development of lightweight and advanced materials), restraints (fluctuations in raw material prices and improper disposal of used products), opportunities (rising production of automobile fabrics, use of sustainable technologies to manufacture automotive leather, and growing trend of styling in vehicles), and challenges (compliance with changing regulations) influencing the growth of automotive interior materials market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the automotive interior materials market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for automotive interior materials across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global automotive interior materials market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the automotive interior materials market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews - demand and supply sides

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE INTERIOR MATERIALS MARKET

- 4.2 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION

- 4.3 ASIA PACIFIC AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE AND COUNTRY

- 4.4 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE

- 4.5 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 High focus on optimization of fuel efficiency by reducing overall weight of vehicles

- 5.2.1.2 Rising demand for customization and comfort

- 5.2.1.3 Increased demand for interior fabrics

- 5.2.1.4 Emergence of various lightweight and advanced materials and innovative finishes

- 5.2.2 RESTRAINTS

- 5.2.2.1 Improper disposal of effluents by tanning industry

- 5.2.2.2 Volatility in raw material prices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Production of automobile fabrics incorporated with nanomaterials

- 5.2.3.2 Adoption of green technology in manufacturing of automobile leather

- 5.2.3.3 Rising trend of customization and styling in interiors of premium vehicles

- 5.2.4 CHALLENGES

- 5.2.4.1 Compliance with regulatory framework

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 BARGAINING POWER OF SUPPLIERS

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 THREAT OF NEW ENTRANTS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS AND BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE, 2024

- 5.5.2 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2030

- 5.6 MACROECONOMIC OUTLOOK

- 5.6.1 INTRODUCTION

- 5.6.2 GDP TRENDS AND FORECAST

- 5.6.3 GLOBAL VEHICLE PRODUCTION STATISTICS, 2022 AND 2023

- 5.6.3.1 Trends in automotive industry

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 ECOSYSTEM ANALYSIS

- 6.4 TRADE ANALYSIS

- 6.4.1 IMPORT SCENARIO (HS CODE 3920)

- 6.4.2 EXPORT SCENARIO (HS CODE 3920)

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Self-healing materials

- 6.5.1.2 Stiff and thin composite materials

- 6.5.1.3 Use of polycarbonate material

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Force-network-based granular damping technology

- 6.5.2.2 Anti-vibration polyamide technology

- 6.5.1 KEY TECHNOLOGIES

- 6.6 CASE STUDY ANALYSIS

- 6.6.1 LEAR CORPORATION - RENEWABLE AND LIGHTWEIGHT MATERIALS

- 6.6.2 FORVIA (FAURECIA) & VEOLIA - RECYCLED PLASTICS FOR INTERIOR MATERIALS

- 6.6.3 MAGNA INTERNATIONAL - MULTI-MATERIAL AND COMPOSITE INNOVATIONS

- 6.7 REGULATORY LANDSCAPE

- 6.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.7.2 REGULATIONS

- 6.7.2.1 REACH: Ensuring safe use of chemicals

- 6.7.2.2 ISO 26262 (Functional Safety)

- 6.7.2.3 Global Automotive Declarable Substance List (GADSL)

- 6.7.2.4 End-of-Life Vehicle (ELV) Directive

- 6.7.2.5 International Material Data System (IMDS)

- 6.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.9 INVESTMENT AND FUNDING SCENARIO

- 6.10 PATENT ANALYSIS

- 6.10.1 APPROACH

- 6.10.2 PATENT TYPES

- 6.10.3 TOP APPLICANTS

- 6.10.4 JURISDICTION ANALYSIS

- 6.11 IMPACT OF AI/GEN AI ON AUTOMOTIVE INTERIOR MATERIALS MARKET

- 6.12 IMPACT OF 2025 US TARIFF ON AUTOMOTIVE INTERIOR MATERIALS MARKET

- 6.12.1 INTRODUCTION

- 6.12.2 KEY TARIFF RATES

- 6.12.3 PRICE IMPACT ANALYSIS

- 6.12.4 IMPACT ON COUNTRY/REGION

- 6.12.4.1 US

- 6.12.4.2 Europe

- 6.12.4.3 Asia Pacific

- 6.12.5 IMPACT ON AUTOMOTIVE INDUSTRY

7 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 POLYMER

- 7.2.1 RISING DEMAND FOR LIGHTWEIGHT AND DURABLE POLYMERS IN AUTOMOBILE INTERIORS TO DRIVE MARKET

- 7.3 GENUINE LEATHER

- 7.3.1 RISING PREFERENCE FOR COMFORT AND LUXURY AND INNOVATIONS IN LEATHER PROCESSING TECHNOLOGIES TO DRIVE DEMAND

- 7.4 FABRIC

- 7.4.1 RISING DEMAND FOR SUSTAINABLE AND ECO-FRIENDLY MATERIALS AND VERSATILITY AND CUSTOMIZATION OPTIONS FEATURED BY FABRICS TO PROPEL MARKET

- 7.5 SYNTHETIC LEATHER

- 7.5.1 INCREASING DEMAND AS SUSTAINABLE ALTERNATIVE TO GENUINE LEATHER TO FUEL MARKET GROWTH

- 7.6 THERMOPLASTIC OLEFIN (TPO)

- 7.6.1 GROWING DEMAND FOR LIGHTWEIGHT AND DURABLE MATERIALS TO BOOST MARKET

- 7.7 OTHER TYPES

8 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY VEHICLE TYPE

- 8.1 INTRODUCTION

- 8.2 PASSENGER CARS

- 8.2.1 RISING PRODUCTION OF ELECTRIC AND HYBRID VEHICLES AND PERSONALIZATION TRENDS TO DRIVE MARKET

- 8.3 LIGHT COMMERCIAL VEHICLES (LCVS)

- 8.3.1 EXPANDING TRADE AND E-COMMERCE INDUSTRY TO PROPEL DEMAND

- 8.4 HEAVY COMMERCIAL VEHICLES (HCVS)

- 8.4.1 BOOMING CONSTRUCTION AND LOGISTICS INDUSTRIES TO FUEL MARKET GROWTH

- 8.5 BUSES & COACHES

- 8.5.1 URBAN MOBILITY AND PUBLIC TRANSPORT EXPANSION TO BOOST MARKET

9 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 DASHBOARDS

- 9.3 SEATS

- 9.4 INTERIOR LIGHTING

- 9.5 HEADLINERS

- 9.6 REAR SEAT ENTERTAINMENT

- 9.7 FLOOR CARPETS

- 9.8 DOOR PANELS

- 9.9 CENTER CONSOLES

- 9.10 ADHESIVE & TAPES

- 9.11 HEAD-UP DISPLAYS

- 9.12 SAFETY COMPONENTS

- 9.13 OTHER APPLICATIONS

10 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Increasing demand for aftermarket parts and services to drive market

- 10.2.2 JAPAN

- 10.2.2.1 Presence of prominent automotive interior component manufacturers supporting market growth

- 10.2.3 INDIA

- 10.2.3.1 Increasing population and improving economic conditions to support market growth

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Presence of technologically advanced vehicle manufacturers to support market growth

- 10.2.5 THAILAND

- 10.2.5.1 Increasing production of automotive parts to support market growth

- 10.2.1 CHINA

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 High technological advancements to meet customer requirements to favor market growth

- 10.3.2 SPAIN

- 10.3.2.1 Demand for lightweight materials in automotive industry to propel market

- 10.3.3 FRANCE

- 10.3.3.1 Domestic automotive industry players and demand for eco-friendly materials to drive market

- 10.3.4 UK

- 10.3.4.1 Growth in autonomous and connected technologies to drive market

- 10.3.5 ITALY

- 10.3.5.1 Presence of domestic car manufacturers to drive market

- 10.3.6 RUSSIA

- 10.3.6.1 Rising demand from infrastructure and refinery industries to drive market

- 10.3.1 GERMANY

- 10.4 NORTH AMERICA

- 10.4.1 US

- 10.4.1.1 Robust vehicle production and consumer demand to drive market

- 10.4.2 CANADA

- 10.4.2.1 Emission regulations and sustainability to drive market

- 10.4.3 MEXICO

- 10.4.3.1 Manufacturing strength and sustainability to drive market

- 10.4.1 US

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 IRAN

- 10.5.1.1 Domestic production and environmental policies to drive market

- 10.5.2 SOUTH AFRICA

- 10.5.2.1 Domestic manufacturing and export growth to drive market

- 10.5.1 IRAN

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Robust production and sustainability to drive market

- 10.6.2 ARGENTINA

- 10.6.2.1 Domestic demand and trade agreements to drive market

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE ANALYSIS

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Type footprint

- 11.5.5.4 Application footprint

- 11.5.5.5 Vehicle type footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startups/SMEs

- 11.6.5.2 Competitive benchmarking of key startups/SMEs

- 11.7 COMPANY VALUATION AND FINANCIAL METRICS

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.9.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 LEAR CORPORATION

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 ASAHI KASEI CORPORATION

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 TOYOTA BOSHOKU CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Expansions

- 12.1.3.3.2 Other developments

- 12.1.3.4 MnM View

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 FORVIA

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.3.2 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 TOYODA GOSEI CO., LTD.

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Expansions

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses/Competitive threats

- 12.1.6 GRUPO ANTOLIN-IRAUSA, S.A.U. (ANTOLIN)

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.3.2 Deals

- 12.1.6.3.3 Expansions

- 12.1.6.4 MnM view

- 12.1.6.4.1 Key strengths/Right to win

- 12.1.6.4.2 Strategic choices

- 12.1.6.4.3 Weaknesses/Competitive threats

- 12.1.7 YANFENG AUTOMOTIVE INTERIORS

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Deals

- 12.1.7.3.3 Expansions

- 12.1.8 SEIREN CO., LTD.

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent development

- 12.1.8.3.1 Deals

- 12.1.9 DK LEATHER SEATS SDN. BHD.

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.10 DRAXLMAIER GROUP

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.1 LEAR CORPORATION

- 12.2 OTHER PLAYERS

- 12.2.1 STAHL HOLDINGS B.V.

- 12.2.2 GRAMMER AG

- 12.2.3 MARELLI HOLDINGS CO., LTD.

- 12.2.4 BENECKE-KALIKO AG

- 12.2.5 KATZKIN LEATHER INC

- 12.2.6 SMS AUTO FABRICS

- 12.2.7 MACHINO PLASTICS LIMITED

- 12.2.8 EISSMANN AUTOMOTIVE DEUTSCHLAND GMBH

- 12.2.9 BOXMARK LEATHER GMBH & CO KG

- 12.2.10 WOLLSDORF LEDER SCHMIDT & CO GES.M.B.H.

- 12.2.11 CLASSIC SOFT TRIM

- 12.2.12 NBHX TRIM GMBH

- 12.2.13 GROCLIN GROUP S.A. (LESS S.A.)

- 12.2.14 ELMO SWEDEN AB

- 12.2.15 AGM AUTOMOTIVE, LLC

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 VIBRATION DAMPING MATERIALS MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.4 VIBRATION DAMPING MATERIALS MARKET, BY REGION

- 13.4.1 ASIA PACIFIC

- 13.4.2 EUROPE

- 13.4.3 NORTH AMERICA

- 13.4.4 MIDDLE EAST & AFRICA

- 13.4.5 SOUTH AMERICA

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS