|

|

市場調査レポート

商品コード

1724750

自動車内装の世界市場:コンポーネントタイプ別、電気自動車タイプ別、エンジン車タイプ別、自動運転レベル別、素材タイプ別、乗用車クラス別、地域別 - 2032年までの予測Automotive Interior Market by Component, Material Type, Level of Autonomy, Electric Vehicle, Passenger Car Class, ICE Vehicle Type and Region - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| 自動車内装の世界市場:コンポーネントタイプ別、電気自動車タイプ別、エンジン車タイプ別、自動運転レベル別、素材タイプ別、乗用車クラス別、地域別 - 2032年までの予測 |

|

出版日: 2025年05月06日

発行: MarketsandMarkets

ページ情報: 英文 472 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の自動車内装の市場規模は、2025年の1,764億4,000万米ドルから2032年には2,057億7,000万米ドルに成長すると予測され、CAGRは2.2%になるとみられています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018年~2032 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 検討単位 | 金額(100万米ドル/1,000米ドル) |

| セグメント | コンポーネントタイプ別、電気自動車タイプ別、エンジン車タイプ別、自律性レベル別、素材タイプ別、乗用車クラス別、地域別 |

| 対象地域 | 北米、アジア太平洋、欧州、その他の地域 |

自動車内装市場は、様々な要因によって成長が見込まれています。自動車産業は現在、技術の進歩やエンドユーザーの嗜好による新たな変化への適応を常に迫られています。自動車内装は、安全性と快適性に対する消費者の要求、燃費効率に対する嗜好、業界内の競争の激化など、様々な要因によって急速な変化を目の当たりにしている主要分野です。OEMは、先進的な機能と高級なデザイン要素を統合することを優先しており、同時に、軽量でコスト効率に優れ、耐久性のある素材を活用することで、車両全体の性能と持続可能性を向上させています。最近の動向としては、ヘッドアップディスプレイ、高度なジェスチャー・ボイスコントロール、ステアリング・ホイール・ヒーター、触覚フィードバック、スマート・シーティング・システム、アンビエント・ライティング、イルミネーション・ヘッドライナー、統合型空気清浄システムなどの採用が挙げられます。消費者は、パーソナライズされたハイテクを駆使した運転体験をますます求めるようになっており、業界各社は市場での地位を強化するため、革新的で高性能なインテリア・ソリューションの開発に投資しています。

自動車内装市場における金属セグメントは、予測期間中に最も高いCAGRを記録すると予測されます。この成長の背景には、シートフレーム、インストルメントパネル、ペダル、ステアリングシステムといった主要な内装部品の強度、耐久性、構造的完全性に対する需要の増加があります。自動車が高度化し、安全規制が強化されるにつれて、車内機能を支える堅牢な金属要素の役割はさらに重要になります。

金属材料、特に高強度鋼とアルミニウム合金は、安全性や性能を損なうことなく重量を最適化するために、徐々に利用されるようになっています。自動車メーカーは、燃費目標を達成し、車両全体のダイナミクスを改善するために、軽量金属ソリューションを優先しています。電気自動車やハイブリッド車では、金属内装はより優れた熱管理とバッテリー統合をサポートし、次世代車両設計におけるその重要性をさらに高めています。

高級車セグメントもこの動向に貢献しており、視覚的な魅力と高級感を高めるため、高級インテリアではブラッシュドメタルのトリムやアクセントの使用が一般的になっています。消費者の期待が進化し、メーカーが機能性と美観の両面で進歩を推し進めるなか、金属セグメントは、すべての自動車カテゴリーで新たな機会を生かす好位置につけています。

乗用車セグメントは、予測期間中に自動車内装市場で力強い成長を記録すると予想されます。この動向は、車内の快適性、先進機能、美観の向上に対する消費者の期待の高まりに大きく後押しされています。都市化が加速し、特に新興市場で可処分所得水準が上昇するにつれて、乗用車の販売は勢いを増しています。その結果、インフォテインメント・システム、スマート・シート、アンビエント照明、空調制御技術など、アップグレードされたインテリア・コンポーネントへの需要が高まっています。

OEMは、自社の製品を差別化し、ユーザー体験を向上させるために、乗用車インテリアのカスタマイズと技術的進歩に多額の投資を行っています。AI対応の音声アシスタンス、デジタルメータークラスター、アンビエント照明などの機能は、以前はプレミアムカーにのみ使用されていましたが、現在ではコンパクトカーやミッドレンジカーに統合されつつあります。さらに、電気自動車やハイブリッド車へのシフトが、新しいインテリア・レイアウトやスペース最適化戦略の開発を後押ししています。日産自動車(日本)、本田技研工業(日本)、Audi AG(ドイツ)、BMW(ドイツ)、Mercedes-Benz (ドイツ)などの相手先商標製品メーカー(OEM)は、レベル2およびレベル3の半自律走行車を積極的に導入しており、ドライバーの快適性と安全性を向上させるために高度なインテリア機能が必要とされています。こうした進歩は消費者の期待を再構築し、革新的なインテリア・ソリューションへの需要を促進しています。

2025年、Renault Groupは、インドの合弁会社ルRenault Nissan Automotive India Private Ltd (RNAIPL)の日産自動車の株式51%を取得し、チェンナイにある製造施設の完全所有権を取得する計画を発表しました。この戦略的な動きは、インド市場におけるプレゼンスを拡大するというルノーのコミットメントに沿ったものであり、自動車技術革新と生産の拠点としてのインドの重要性を強調するものです。この買収により、進歩した独立型ハイライトを搭載したモデルを含む新型車の開発と生産が促進されることが期待されます。

こうした開発は、自動車業界が消費者の進化する需要に応えるため、自動車の内装に最先端技術を統合する方向にシフトしていることを浮き彫りにしています。OEMが自律走行車技術への投資を続け、インドなどの主要市場で事業を拡大していることから、自動車内装市場は予測期間中に力強い成長を遂げると予想されます。

アジア太平洋地域は、主に中国市場の急速な拡大に牽引され、世界の自動車産業にとって潜在力の高い地域として浮上し続けています。中国と並んで、インド、日本、韓国といった国々が、この地域の自動車情勢を形成する上で重要な役割を果たしています。日本と韓国は強力なOEMの足跡を持つ成熟市場である一方、インドは製造と技術革新の重要な拠点へと着実に進化しています。OICAによると、中国とインドは合わせて年間3,000万台以上の自動車を生産しており、世界市場の減速にもかかわらず、この地域の戦略的重要性を強めています。

さらに、同地域は小型乗用車の最大市場であり、自動車内装部品サプライヤーにとって有力な市場となっています。自律走行車の動向の高まりに伴い、自動車内装部品は車種選択においてますます重要性を増すと思われます。その結果、メーカーは先進エンターテインメント・システム、コネクテッド・アプリケーション、高級内装材などのハイテク内装を提供するようになっています。

アジア太平洋の市場成長は、日本、韓国、中国における自動車生産台数の多さと先進エレクトロニクスの使用の増加に起因しています。これらの国の政府は、自動車セクターの成長の可能性を認識し、その結果、大手OEMの国内市場への参入を奨励するためのさまざまな取り組みを行ってきました。Volkswagen(ドイツ)、Mercedes Benz(ドイツ)、General Motors(米国)など、世界の自動車メーカー数社は、生産工場をこの地域の新興経済国に移しています。

当レポートでは、世界の自動車内装市場について調査し、コンポーネントタイプ別、電気自動車タイプ別、エンジン車タイプ別、自動運転レベル別、素材タイプ別、乗用車クラス別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- AI/生成AIが自動車内装市場に与える影響

- 顧客ビジネスに影響を与える動向/混乱

- 市場力学

- 価格分析

- エコシステム分析

- サプライチェーン分析

- ケーススタディ分析

- 特許分析

- 技術分析

- 規制状況

- 投資シナリオ

- 貿易分析

- 2025年~2026年の主な会議とイベント

- 主要な利害関係者と購入基準

- サプライヤー分析

第6章 自動車内装市場(コンポーネントタイプ別)

- イントロダクション

- センタースタック

- ヘッドアップディスプレイ(HUD)

- 計器クラスター

- 後部座席エンターテイメント

- ドームモジュール

- ヘッドライナー

- シート

- 室内照明

- ドアパネル

- センターコンソール

- その他

- 接着剤とテープ

- 室内装飾

- 主要な業界洞察

第7章 自動車内装市場(電気自動車タイプ別)

- イントロダクション

- バッテリー電気自動車(BEV)

- 燃料電池電気自動車(FCEV)

- ハイブリッド電気自動車(HEV)

- プラグインハイブリッド電気自動車(PHEV)

- 主要な業界洞察

第8章 自動車内装市場(エンジン車タイプ別)

- イントロダクション

- 乗用車(PC)

- 軽商用車(LCV)

- 大型商用車(HCV)

- 主要な業界洞察

第9章 自動車内装市場(自動運転レベル別)

- イントロダクション

- 非自動運転車

- 半自動運転車

- 自動運転車

- 主要な業界洞察

第10章 自動車内装市場(素材タイプ別)

- イントロダクション

- レザー

- ファブリック

- ビニール

- 木材

- ガラス繊維複合材

- カーボンファイバー複合材

- 金属

- 主要な業界洞察

第11章 自動車内装市場(乗用車クラス別)

- イントロダクション

- エコカー

- ミッドセグメントカー

- 高級車

- 主要な業界洞察

第12章 自動車内装市場(地域別)

- イントロダクション

- アジア太平洋

- マクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- タイ

- その他

- 欧州

- ミクロ経済見通し

- ドイツ

- フランス

- 英国

- スペイン

- イタリア

- ロシア

- トルコ

- その他

- 北米

- マクロ経済見通し

- 米国

- カナダ

- メキシコ

- その他の地域

- マクロ経済見通し

- ブラジル

- イラン

- 南アフリカ

第13章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2021年~2025年

- 市場シェア分析、2024年

- 収益分析、2020年~2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- ADIENT PLC.

- FORVIA FAURECIA

- YANFENG

- LEAR CORPORATION

- CONTINENTAL AG

- ANTOLIN

- SAMVARDHANA MOTHERSON GROUP(SMP DEUTSCHLAND GMBH)

- TOYOTA BOSHOKU CORPORATION

- ROBERT BOSCH GMBH

- HYUNDAI MOBIS

- DENSO CORPORATION

- ZF FRIEDRICHSHAFEN AG

- PANASONIC HOLDINGS CORPORATION

- VALEO

- DRAXLMAIER GROUP

- その他の企業

- NIPPON SEIKI CO., LTD.

- YAZAKI CORPORATION

- RENESAS ELECTRONICS CORPORATION

- JAPAN DISPLAY, INC.

- MAGNA INTERNATIONAL INC.

- HARMAN INTERNATIONAL

- SAINT-GOBAIN

- PIONEER CORPORATION

- VISTEON CORPORATION

- FUJITSU LIMITED

第15章 提言

第16章 付録

List of Tables

- TABLE 1 AUTOMOTIVE INTERIOR MARKET DEFINITION, BY COMPONENT TYPE

- TABLE 2 AUTOMOTIVE INTERIOR MARKET DEFINITION, BY ICE VEHICLE TYPE

- TABLE 3 AUTOMOTIVE INTERIOR MARKET DEFINITION, BY MATERIAL TYPE

- TABLE 4 AUTOMOTIVE INTERIOR MARKET DEFINITION, BY ELECTRIC VEHICLE TYPE

- TABLE 5 AUTOMOTIVE INTERIOR MARKET DEFINITION, BY LEVEL OF AUTONOMY

- TABLE 6 AUTOMOTIVE INTERIOR MARKET DEFINITION, BY PASSENGER CAR CLASS

- TABLE 7 AUTOMOTIVE INTERIOR MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 8 CURRENCY EXCHANGE RATES

- TABLE 9 PROPERTIES OF SOME COMMON MATERIALS USED IN AUTOMOTIVE INTERIORS

- TABLE 10 MODULAR/FUNCTIONAL TRENDS IN AUTOMOTIVE INTERIOR COMPONENTS

- TABLE 11 ELECTRIC/AUTONOMOUS VEHICLE MODELS, BY LAUNCH YEAR

- TABLE 12 ROADMAP FOR TECHNOLOGY LEVEL AND IMPLEMENTATION OF SEMI-AUTONOMOUS AND AUTONOMOUS DRIVING SYSTEMS

- TABLE 13 PRODUCTION VOLUME OF LUXURY CAR MODELS, 2023 VS. 2024

- TABLE 14 RECYCLABILITY OF COMPONENTS, BY MATERIAL

- TABLE 15 OEM AMBIENT LIGHTING COST

- TABLE 16 AFTERMARKET AMBIENT LIGHTING COST

- TABLE 17 PASSENGER CAR SEAT COST

- TABLE 18 PASSENGER CAR SEAT MATERIAL COST

- TABLE 19 AVERAGE PRICING ANALYSIS, OF COMPONENT, BY VEHICLE TYPE, 2024 (USD)

- TABLE 20 AVERAGE PRICING ANALYSIS, OF COMPONENT, BY REGION, 2024 (USD)

- TABLE 21 AUTOMOTIVE INTERIOR MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 22 AUTOMOTIVE INTERIOR: PATENT REGISTRATIONS, 2022-2024

- TABLE 23 REGULATIONS FOR DISPLAY SYSTEMS

- TABLE 24 AUTONOMOUS VEHICLE REGULATION ACTIVITIES

- TABLE 25 SAFETY REGULATIONS RELATED TO AUTOMOTIVE SEATS, BY COUNTRY/REGION

- TABLE 26 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 27 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 28 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 29 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 30 US: IMPORT DATA FOR AUTOMOTIVE SEAT, BY EXPORTING COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 31 GERMANY: IMPORT DATA FOR AUTOMOTIVE SEAT, BY EXPORTING COUNTRY, 2020-2024(USD THOUSAND)

- TABLE 32 FRANCE: IMPORT DATA FOR AUTOMOTIVE SEAT, BY EXPORTING COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 33 UK: IMPORT DATA FOR AUTOMOTIVE SEAT, BY EXPORTING COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 34 CHINA: IMPORT DATA FOR AUTOMOTIVE SEAT, BY EXPORTING COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 35 JAPAN: IMPORT DATA FOR AUTOMOTIVE SEAT, BY EXPORTING COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 36 SOUTH KOREA: IMPORT DATA FOR AUTOMOTIVE SEAT, BY EXPORTING COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 37 CANADA: IMPORT DATA FOR AUTOMOTIVE SEAT, BY EXPORTING COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 38 INDIA: IMPORT DATA FOR AUTOMOTIVE SEAT, BY EXPORTING COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 39 BRAZIL: IMPORT DATA FOR AUTOMOTIVE SEAT, BY EXPORTING COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 40 US: EXPORT DATA FOR AUTOMOTIVE SEAT, BY IMPORTING COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 41 GERMANY: EXPORT DATA FOR AUTOMOTIVE SEAT, BY IMPORTING COUNTRY, 2020-2024(USD THOUSAND)

- TABLE 42 FRANCE: IMPORT DATA FOR AUTOMOTIVE SEAT, BY IMPORTING COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 43 UK: EXPORT DATA FOR AUTOMOTIVE SEAT, BY IMPORTING COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 44 CHINA: EXPORT DATA FOR AUTOMOTIVE SEAT, BY IMPORTING COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 45 JAPAN: EXPORT DATA FOR AUTOMOTIVE SEAT, BY IMPORTING COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 46 SOUTH KOREA: EXPORT DATA FOR AUTOMOTIVE SEAT, BY IMPORTING COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 47 CANADA: EXPORT DATA FOR AUTOMOTIVE SEAT, BY IMPORTING COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 48 INDIA: EXPORT DATA FOR AUTOMOTIVE SEAT, BY IMPORTING COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 49 BRAZIL: EXPORT DATA FOR AUTOMOTIVE SEAT, BY IMPORTING COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 50 AUTOMOTIVE INTERIOR MARKET: KEY CONFERENCES AND EVENTS

- TABLE 51 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR COMPONENTS

- TABLE 52 KEY BUYING CRITERIA FOR AUTOMOTIVE INTERIOR COMPONENTS

- TABLE 53 SEAT: OEM MODELS AND SUPPLIER DATA

- TABLE 54 HEAD-UP DISPLAY (HUD): OEM MODELS AND SUPPLIER DATA

- TABLE 55 INSTRUMENT CLUSTER: OEM MODELS AND SUPPLIER DATA

- TABLE 56 DOME MODULE: OEM MODELS AND SUPPLIER DATA

- TABLE 57 HEADLINER: OEM MODELS AND SUPPLIER DATA

- TABLE 58 INTERIOR LIGHTING: OEM MODELS AND SUPPLIER DATA

- TABLE 59 DOOR PANEL: OEM MODELS AND SUPPLIER DATA

- TABLE 60 CENTER CONSOLE: OEM MODELS AND SUPPLIER DATA

- TABLE 61 UPHOLSTERY: OEM MODELS AND SUPPLIER DATA

- TABLE 62 OTHERS: OEM MODELS AND SUPPLIER DATA

- TABLE 63 AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 64 AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 65 AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 66 AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD MILLION)

- TABLE 67 CENTER STACK: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 68 CENTER STACK: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 69 CENTER STACK: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 CENTER STACK: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 71 HEAD-UP DISPLAY: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 72 HEAD-UP DISPLAY: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 73 HEAD-UP DISPLAY: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 HEAD-UP DISPLAY: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 75 INSTRUMENT CLUSTER: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 76 INSTRUMENT CLUSTER: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 77 INSTRUMENT CLUSTER: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 INSTRUMENT CLUSTER: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 79 REAR-SEAT ENTERTAINMENT: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 80 REAR-SEAT ENTERTAINMENT: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

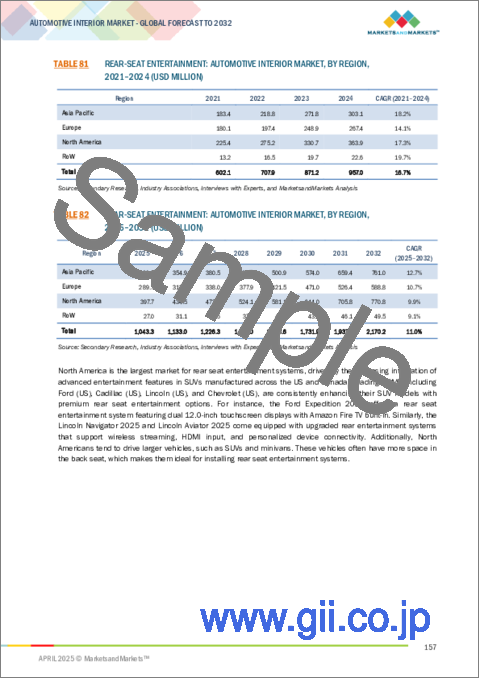

- TABLE 81 REAR-SEAT ENTERTAINMENT: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 REAR-SEAT ENTERTAINMENT: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 83 DOME MODULE: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 84 DOME MODULE: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 85 DOME MODULE: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 DOME MODULE: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 87 HEADLINER: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 88 HEADLINER: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 89 HEADLINER: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 HEADLINER: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 91 SEAT: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 92 SEAT: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 93 SEAT: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 SEAT: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 95 CHINA: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2024-2025

- TABLE 96 INDIA: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2024-2025

- TABLE 97 JAPAN: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2024-2025

- TABLE 98 SELECT MODELS WITH POWERED SEATS, 2022-2025

- TABLE 99 SELECT MODELS WITH HEATED AND POWERED SEATS, 2022-2025

- TABLE 100 SELECT MODELS WITH HEATED SEATS, 2022-2025

- TABLE 101 INTERIOR LIGHTING: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 102 INTERIOR LIGHTING: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 103 INTERIOR LIGHTING: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 104 INTERIOR LIGHTING: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 105 DOOR PANEL: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 106 DOOR PANEL: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 107 DOOR PANEL: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 108 DOOR PANEL: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 109 CENTER CONSOLE: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 110 CENTER CONSOLE: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 111 CENTER CONSOLE: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 112 CENTER CONSOLE: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 113 OTHERS: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 114 OTHERS: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 115 OTHERS: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 116 OTHERS: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 117 LIST OF TOP OEM ELECTRIC VEHICLES MODEL SALES 2024

- TABLE 118 AUTOMOTIVE INTERIOR MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2024 (UNITS)

- TABLE 119 AUTOMOTIVE INTERIOR MARKET, BY ELECTRIC VEHICLE TYPE, 2025-2032 (UNITS)

- TABLE 120 AUTOMOTIVE INTERIOR MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2024 (USD THOUSAND MILLION)

- TABLE 121 AUTOMOTIVE INTERIOR MARKET, BY ELECTRIC VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 122 BATTERY ELECTRIC VEHICLE: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (UNITS)

- TABLE 123 BATTERY ELECTRIC VEHICLE: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (UITS)

- TABLE 124 BATTERY ELECTRIC VEHICLE: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 125 BATTERY ELECTRIC VEHICLE: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD MILLION)

- TABLE 126 FUEL CELL ELECTRIC VEHICLE: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE 2021-2024 (UNITS)

- TABLE 127 FUEL CELL ELECTRIC VEHICLE: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (UNITS)

- TABLE 128 FUEL CELL ELECTRIC VEHICLE: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (THOUSAND USD MILLION)

- TABLE 129 FUEL CELL ELECTRIC VEHICLE: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD THOUSAND MILLION)

- TABLE 130 HYBRID ELECTRIC VEHICLE: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (UNITS)

- TABLE 131 HYBRID ELECTRIC VEHICLE: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 132 HYBRID ELECTRIC VEHICLE: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD THOUSAND MILLION)

- TABLE 133 HYBRID ELECTRIC VEHICLE: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD THOUSAND MILLION)

- TABLE 134 PLUG-IN HYBRID ELECTRIC VEHICLE: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (UNITS)

- TABLE 135 PLUG-IN HYBRID ELECTRIC VEHICLE: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (UNITS)

- TABLE 136 PLUG-IN HYBRID ELECTRIC VEHICLE: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD THOUSAND MILLION)

- TABLE 137 PLUG-IN HYBRID ELECTRIC VEHICLE: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD THOUSAND MILLION)

- TABLE 138 AUTOMOTIVE INTERIOR MARKET, BY ICE VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 139 AUTOMOTIVE INTERIOR MARKET, BY ICE VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 140 AUTOMOTIVE INTERIOR MARKET, BY ICE VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 141 AUTOMOTIVE INTERIOR MARKET, BY ICE VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 142 PASSENGER CAR: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 143 PASSENGER CAR: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 144 PASSENGER CAR: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 145 PASSENGER CAR: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 146 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 147 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 148 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 149 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 150 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 151 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 152 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 153 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 154 AUTOMOTIVE INTERIOR MARKET, BY LEVEL OF AUTONOMY, 2021-2024 (USD MILLION)

- TABLE 155 AUTOMOTIVE INTERIOR MARKET, BY LEVEL OF AUTONOMY, 2025-2032 (USD MILLION)

- TABLE 156 AUTONOMOUS VEHICLE LAUNCHES, 2025

- TABLE 157 AUTONOMOUS VEHICLE LAUNCHES, 2024

- TABLE 158 EXPECTED TECHNOLOGY VS. CURRENT TECHNOLOGY READINESS LEVEL OF AUTONOMOUS VEHICLES

- TABLE 159 NON-AUTONOMOUS CAR: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 160 NON-AUTONOMOUS CAR: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 161 SEMI-AUTONOMOUS CAR: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 162 SEMI-AUTONOMOUS CAR: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 163 AUTONOMOUS CAR: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 164 AUTONOMOUS CAR: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 165 AUTOMOTIVE INTERIOR MARKET, BY MATERIAL TYPE, 2021-2024 (USD MILLION)

- TABLE 166 AUTOMOTIVE INTERIOR MARKET, BY MATERIAL TYPE, 2025-2032 (USD MILLION)

- TABLE 167 LEATHER: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 168 LEATHER: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 169 FABRIC: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 170 FABRIC: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 171 VINYL: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 172 VINYL: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 173 WOOD: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 174 WOOD: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 175 GLASS FIBER COMPOSITE: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 176 GLASS FIBER COMPOSITE: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 177 CARBON FIBER COMPOSITE: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 178 CARBON FIBER COMPOSITE: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 179 METAL: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 180 METAL: AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 181 AUTOMOTIVE INTERIOR MARKET, BY PASSENGER CAR CLASS, 2021-2024 (THOUSAND UNITS)

- TABLE 182 AUTOMOTIVE INTERIOR MARKET, BY PASSENGER CAR CLASS, 2025-2032 (THOUSAND UNITS)

- TABLE 183 AUTOMOTIVE INTERIOR MARKET, BY PASSENGER CAR CLASS, 2021-2024 (USD MILLION)

- TABLE 184 AUTOMOTIVE INTERIOR MARKET, BY PASSENGER CAR CLASS, 2025-2032 (USD MILLION)

- TABLE 185 ECONOMIC CAR: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 186 ECONOMIC CAR: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 187 ECONOMIC CAR: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 188 ECONOMIC CAR: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD MILLION)

- TABLE 189 MID-SEGMENT CAR: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 190 MID-SEGMENT CAR: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 191 MID-SEGMENT CAR: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 192 MID-SEGMENT CARS: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD MILLION)

- TABLE 193 LUXURY CAR: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 194 LUXURY CAR: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 195 LUXURY CAR: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 196 LUXURY CAR: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD MILLION)

- TABLE 197 AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 198 AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 199 AUTOMOTIVE INTERIOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 200 AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 201 ASIA PACIFIC: AUTOMOTIVE INTERIOR MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 202 ASIA PACIFIC: AUTOMOTIVE INTERIOR MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 203 ASIA PACIFIC: AUTOMOTIVE INTERIOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 204 ASIA PACIFIC: AUTOMOTIVE INTERIOR MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 205 CHINA: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 206 CHINA: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 207 CHINA: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 208 CHINA: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD MILLION)

- TABLE 209 JAPAN: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 210 JAPAN: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 211 JAPAN: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 212 JAPAN: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD MILLION)

- TABLE 213 SOUTH KOREA: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 214 SOUTH KOREA: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 215 SOUTH KOREA: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 216 SOUTH KOREA: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD MILLION)

- TABLE 217 INDIA: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 218 INDIA: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 219 INDIA: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 220 INDIA: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD MILLION)

- TABLE 221 THAILAND: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 222 THAILAND: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 223 THAILAND: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 224 THAILAND: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD MILLION)

- TABLE 225 REST OF ASIA PACIFIC: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 226 REST OF ASIA PACIFIC: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 227 REST OF ASIA PACIFIC: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 228 REST OF ASIA PACIFIC: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD MILLION)

- TABLE 229 EUROPE: AUTOMOTIVE INTERIOR MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 230 EUROPE: AUTOMOTIVE INTERIOR MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 231 EUROPE: AUTOMOTIVE INTERIOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 232 EUROPE: AUTOMOTIVE INTERIOR MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 233 GERMANY: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 234 GERMANY: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 235 GERMANY: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 236 GERMANY: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD MILLION)

- TABLE 237 FRANCE: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 238 FRANCE: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 239 FRANCE: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 240 FRANCE: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD MILLION)

- TABLE 241 UK: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 242 UK: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 243 UK: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 244 UK: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD MILLION)

- TABLE 245 SPAIN: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 246 SPAIN: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 247 SPAIN: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 248 SPAIN: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD MILLION)

- TABLE 249 ITALY: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 250 ITALY: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 251 ITALY: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 252 ITALY: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD MILLION)

- TABLE 253 RUSSIA: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 254 RUSSIA: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 255 RUSSIA: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 256 RUSSIA: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD MILLION)

- TABLE 257 TURKEY: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 258 TURKEY: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 259 TURKEY: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 260 TURKEY: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD MILLION)

- TABLE 261 REST OF EUROPE: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 262 REST OF EUROPE: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 263 REST OF EUROPE: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 264 REST OF EUROPE: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD MILLION)

- TABLE 265 NORTH AMERICA: AUTOMOTIVE INTERIOR MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 266 NORTH AMERICA: AUTOMOTIVE INTERIOR MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 267 NORTH AMERICA: AUTOMOTIVE INTERIOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 268 NORTH AMERICA: AUTOMOTIVE INTERIOR MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 269 US: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 270 US: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 271 US: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 272 US: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD MILLION)

- TABLE 273 CANADA: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 274 CANADA: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 275 CANADA: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 276 CANADA: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD MILLION)

- TABLE 277 MEXICO: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 278 MEXICO: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 279 MEXICO: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 280 MEXICO: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD MILLION)

- TABLE 281 REST OF THE WORLD: AUTOMOTIVE INTERIOR MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 282 REST OF THE WORLD: AUTOMOTIVE INTERIOR MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 283 REST OF THE WORLD: AUTOMOTIVE INTERIOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 284 REST OF THE WORLD: AUTOMOTIVE INTERIOR MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 285 BRAZIL: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 286 BRAZIL: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 287 BRAZIL: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 288 BRAZIL: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD MILLION)

- TABLE 289 IRAN: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 290 IRAN: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 291 IRAN: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 292 IRAN: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD MILLION)

- TABLE 293 SOUTH AFRICA: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 294 SOUTH AFRICA: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 295 SOUTH AFRICA: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 296 SOUTH AFRICA: AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE, 2025-2032 (USD MILLION)

- TABLE 297 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- TABLE 298 AUTOMOTIVE INTERIOR MANUFACTURER, MARKET SHARE ANALYSIS, 2024

- TABLE 299 AUTOMOTIVE INTERIOR MARKET: EV TYPE FOOTPRINT

- TABLE 300 AUTOMOTIVE INTERIOR MARKET: COMPONENT TYPE FOOTPRINT

- TABLE 301 AUTOMOTIVE INTERIOR MARKET: VEHICLE TYPE FOOTPRINT

- TABLE 302 AUTOMOTIVE INTERIOR MARKET: MATERIAL TYPE FOOTPRINT

- TABLE 303 AUTOMOTIVE INTERIOR MARKET: REGION FOOTPRINT

- TABLE 304 AUTOMOTIVE INTERIOR MARKET: KEY STARTUPS/SMES

- TABLE 305 AUTOMOTIVE INTERIOR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 306 PRODUCT LAUNCHES, 2020-2025

- TABLE 307 AUTOMOTIVE INTERIOR MARKET: DEALS, JANUARY 2020-JANUARY 2025

- TABLE 308 AUTOMOTIVE INTERIOR MARKET: EXPANSIONS, JANUARY 2020-JANUARY 2025

- TABLE 309 AUTOMOTIVE INTERIOR MARKET: OTHER DEVELOPMENTS, JANUARY 2020-JANUARY 2025

- TABLE 310 ADIENT PLC.: KEY CUSTOMERS

- TABLE 311 ADIENT PLC.: COMPANY OVERVIEW

- TABLE 312 ADIENT PLC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 313 ADIENT PLC.: PRODUCT LAUNCHES

- TABLE 314 ADIENT PLC.: DEALS

- TABLE 315 ADIENT PLC: EXPANSIONS

- TABLE 316 ADIENT PLC: OTHERS

- TABLE 317 FORVIA FAURECIA: KEY CUSTOMERS

- TABLE 318 FORVIA FAURECIA: COMPANY OVERVIEW

- TABLE 319 FORVIA FAURECIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 320 FORVIA FAURECIA: PRODUCT LAUNCHES

- TABLE 321 FORVIA FAURECIA: DEALS

- TABLE 322 FORVIA FAURECIA: EXPANSIONS

- TABLE 323 FORVIA FAURECIA: OTHERS

- TABLE 324 YANFENG: KEY CUSTOMERS

- TABLE 325 YANFENG: COMPANY OVERVIEW

- TABLE 326 YANFENG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 327 YANFENG: PRODUCT LAUNCHES

- TABLE 328 YANFENG: DEALS

- TABLE 329 YANFENG: EXPANSIONS

- TABLE 330 LEAR CORPORATION: KEY CUSTOMERS

- TABLE 331 LEAR CORPORATION: COMPANY OVERVIEW

- TABLE 332 LEAR CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 333 LEAR CORPORATION: PRODUCT LAUNCHES

- TABLE 334 LEAR CORPORATION: DEALS

- TABLE 335 LEAR CORPORATION: EXPANSIONS

- TABLE 336 LEAR CORPORATION: OTHERS

- TABLE 337 CONTINENTAL AG: KEY CUSTOMERS

- TABLE 338 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 339 CONTINENTAL AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 340 CONTINENTAL AG: PRODUCT LAUNCHES

- TABLE 341 CONTINENTAL AG: DEALS

- TABLE 342 CONTINENTAL AG: EXPANSIONS

- TABLE 343 ANTOLIN: KEY CUSTOMERS

- TABLE 344 ANTOLIN: COMPANY OVERVIEW

- TABLE 345 ANTOLIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 346 ANTOLIN: PRODUCT LAUNCHES

- TABLE 347 ANTOLIN: DEALS

- TABLE 348 ANTOLIN: EXPANSIONS

- TABLE 349 SAMVARDHANA MOTHERSON GROUP (SMP DEUTSCHLAND GMBH): KEY CUSTOMERS

- TABLE 350 SAMVARDHANA MOTHERSON GROUP (SMP DEUTSCHLAND GMBH): COMPANY OVERVIEW

- TABLE 351 SAMVARDHANA MOTHERSON GROUP (DEUTSCHLAND GMBH): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 352 SAMVARDHANA MOTHERSON GROUP (SMP DEUTSCHLAND GMBH): DEALS

- TABLE 353 SAMVARDHANA MOTHERSON GROUP (SMP DEUTSCHLAND GMBH): EXPANSIONS

- TABLE 354 MOTHERSON: OTHERS

- TABLE 355 TOYOTA BOSHOKU CORPORATION: KEY CUSTOMERS

- TABLE 356 TOYOTA BOSHOKU CORPORATION: COMPANY OVERVIEW

- TABLE 357 TOYOTA BOSHOKU CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 358 TOYOTA BOSHOKU CORPORATION: PRODUCT LAUNCHES

- TABLE 359 TOYOTA BOSHOKU CORPORATION: DEALS

- TABLE 360 TOYOTA BOSHOKU CORPORATION: EXPANSIONS

- TABLE 361 TOYOTA BOSHOKU CORPORATION: OTHERS

- TABLE 362 ROBERT BOSCH GMBH: KEY CUSTOMERS

- TABLE 363 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 364 ROBERT BOSCH GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 365 ROBERT BOSCH GMBH: PRODUCT LAUNCHES

- TABLE 366 ROBERT BOSCH GMBH: DEALS

- TABLE 367 ROBERT BOSCH GMBH: EXPANSIONS

- TABLE 368 HYUNDAI MOBIS: KEY CUSTOMERS

- TABLE 369 HYUNDAI MOBIS: COMPANY OVERVIEW

- TABLE 370 HYUNDAI MOBIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 371 HYUNDAI MOBIS: PRODUCT LAUNCHES

- TABLE 372 HYUNDAI MOBIS: DEALS

- TABLE 373 HYUNDAI MOBIS: EXPANSIONS

- TABLE 374 HYUNDAI MOBIS: OTHERS

- TABLE 375 DENSO CORPORATION: KEY CUSTOMERS

- TABLE 376 DENSO CORPORATION: COMPANY OVERVIEW

- TABLE 377 DENSO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 378 DENSO CORPORATION: DEALS

- TABLE 379 DENSO CORPORATION: EXPANSIONS

- TABLE 380 ZF FRIEDRICHSHAFEN AG: KEY CUSTOMERS

- TABLE 381 ZF FRIEDRICHSHAFEN AG: COMPANY OVERVIEW

- TABLE 382 ZF FRIEDRICHSHAFEN AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 383 ZF FRIEDRICHSHAFEN AG: PRODUCT LAUNCHES

- TABLE 384 ZF FRIEDRICHSHAFEN AG: DEALS

- TABLE 385 ZF FRIEDRICHSHAFEN AG: EXPANSIONS

- TABLE 386 PANASONIC HOLDINGS CORPORATION: KEY CUSTOMERS

- TABLE 387 PANASONIC HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 388 PANASONIC HOLDINGS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 389 PANASONIC HOLDINGS CORPORATION: PRODUCT LAUNCHES

- TABLE 390 PANASONIC HOLDINGS CORPORATION: DEALS

- TABLE 391 VALEO: KEY CUSTOMERS

- TABLE 392 VALEO: COMPANY OVERVIEW

- TABLE 393 VALEO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 394 VALEO: PRODUCT LAUNCHES

- TABLE 395 VALEO: DEALS

- TABLE 396 VALEO: OTHERS

- TABLE 397 DRAXLMAIER GROUP: COMPANY OVERVIEW

- TABLE 398 DRAXLMAIER GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 399 DRAXLMAIER GROUP: PRODUCT LAUNCHES

- TABLE 400 DRAXLMAIER GROUP: DEALS

- TABLE 401 DRAXLMAIER GROUP: EXPANSIONS

- TABLE 402 NIPPON SEIKI CO., LTD.: COMPANY OVERVIEW

- TABLE 403 YAZAKI CORPORATION: COMPANY OVERVIEW

- TABLE 404 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 405 JAPAN DISPLAY, INC.: COMPANY OVERVIEW

- TABLE 406 MAGNA INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 407 HARMAN INTERNATIONAL: COMPANY OVERVIEW

- TABLE 408 SAINT-GOBAIN: COMPANY OVERVIEW

- TABLE 409 PIONEER CORPORATION: COMPANY OVERVIEW

- TABLE 410 VISTEON CORPORATION: COMPANY OVERVIEW

- TABLE 411 FUJITSU LIMITED: COMPANY OVERVIEW

List of Figures

- FIGURE 1 AUTOMOTIVE INTERIOR MARKET SEGMENTATION

- FIGURE 2 AUTOMOTIVE INTERIOR MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH METHODOLOGY MODEL

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 6 DETAILED ILLUSTRATION OF BOTTOM-UP APPROACH

- FIGURE 7 AUTOMOTIVE INTERIOR MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 8 AUTOMOTIVE INTERIOR MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 9 AUTOMOTIVE INTERIOR MARKET ESTIMATION NOTES

- FIGURE 10 AUTOMOTIVE INTERIOR MARKET: DATA TRIANGULATION

- FIGURE 11 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- FIGURE 12 AUTOMOTIVE INTERIOR MARKET OUTLOOK

- FIGURE 13 AUTOMOTIVE INTERIOR MARKET, BY REGION, 2025-2032

- FIGURE 14 PASSENGER CARS SEGMENT TO LEAD AUTOMOTIVE INTERIOR MARKET IN 2025

- FIGURE 15 GROWING DEMAND FOR ENHANCED INTERIOR COMPONENTS, SAFETY, AND CONVENIENCE FEATURES TO DRIVE AUTOMOTIVE INTERIOR MARKET GROWTH

- FIGURE 16 ASIA PACIFIC TO HOLD LARGEST MARKET SHARE IN AUTOMOTIVE INTERIOR MARKET IN 2025

- FIGURE 17 HEAD-UP DISPLAY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 FABRIC SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 19 SEMI-AUTONOMOUS CARS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 20 MID-SEGMENT PASSENGER CARS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 21 BATTERY ELECTRIC VEHICLE SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 22 PASSENGER CARS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 AUTOMOTIVE INTERIOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 LUXURY CAR BRANDS: GLOBAL SALES IN FY 2024

- FIGURE 26 POWER CONSUMPTION BY AUTOMOTIVE INTERIOR APPLICATIONS

- FIGURE 27 AUTOMOTIVE INTERIOR MARKET: ECOSYSTEM ANALYSIS

- FIGURE 28 AUTOMOTIVE INTERIOR MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 29 PATENT ANALYSIS, 2014-2024

- FIGURE 30 INVESTMENT SCENARIO, 2021-2024

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR COMPONENTS

- FIGURE 32 KEY BUYING CRITERIA FOR AUTOMOTIVE INTERIOR COMPONENTS

- FIGURE 33 SEAT SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 34 BATTERY ELECTRIC VEHICLE SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 35 PASSENGER CAR TO HOLD LARGEST SHARE IN ICE VEHICLE TYPE SEGMENT OF AUTOMOTIVE INTERIOR MARKET

- FIGURE 36 ADAS MARKET GROWTH PROJECTIONS

- FIGURE 37 SEMI-AUTONOMOUS CAR SEGMENT TO CAPTURE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 38 FABRIC SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 39 MID-SEGMENT CAR TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC TO HOLD LARGEST SHARE IN AUTOMOTIVE INTERIOR MARKET DURING FORECAST PERIOD

- FIGURE 41 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 42 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 43 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 44 ASIA PACIFIC: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2024

- FIGURE 45 ASIA PACIFIC: AUTOMOTIVE INTERIOR MARKET SNAPSHOT

- FIGURE 46 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 47 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 48 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 49 EUROPE: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2024

- FIGURE 50 EUROPE: AUTOMOTIVE INTERIOR MARKET SNAPSHOT

- FIGURE 51 NORTH AMERICA: AUTOMOTIVE INTERIOR MARKET SNAPSHOT

- FIGURE 52 NORTH AMERICA REAL GDP GROWTH RATE, BY COUNTRY, 2023-2026

- FIGURE 53 NORTH AMERICA GDP PER CAPITA, BY COUNTRY, 2023-2026

- FIGURE 54 NORTH AMERICA CPI INFLATION RATE, BY COUNTRY, 2023-2026

- FIGURE 55 NORTH AMERICA MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2024

- FIGURE 56 BRAZIL TO HOLD LARGEST MARKET SHARE IN REST OF THE WORLD

- FIGURE 57 ROW: REAL GDP ANNUAL PERCENTAGE CHANGE, 2024-2026

- FIGURE 58 ROW: GDP PER CAPITA, 2024-2026

- FIGURE 59 ROW: AVERAGE CPI INFLATION RATE, 2024-2026

- FIGURE 60 ROW: MANUFACTURING INDUSTRY VALUE (AS PART OF GDP), 2024

- FIGURE 61 AUTOMOTIVE INTERIOR MANUFACTURER, MARKET SHARE ANALYSIS, 2024

- FIGURE 62 AUTOMOTIVE SEAT MANUFACTURER, MARKET SHARE ANALYSIS, 2024

- FIGURE 63 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2020-2024

- FIGURE 64 COMPANY VALUATION OF KEY PLAYERS, 2024

- FIGURE 65 FINANCIAL METRICS OF KEY PLAYERS, 2024

- FIGURE 66 BRAND/PRODUCT COMPARISON

- FIGURE 67 AUTOMOTIVE INTERIOR MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 68 AUTOMOTIVE INTERIOR MARKET: COMPANY FOOTPRINT

- FIGURE 69 AUTOMOTIVE INTERIOR MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 70 ADIENT PLC.: COMPANY SNAPSHOT

- FIGURE 71 FORVIA FAURECIA: COMPANY SNAPSHOT

- FIGURE 72 YANFENG: COMPANY SNAPSHOT

- FIGURE 73 LEAR CORPORATION: COMPANY SNAPSHOT

- FIGURE 74 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 75 ANTOLIN: COMPANY SNAPSHOT

- FIGURE 76 SAMVARDHANA MOTHERSON GROUP (SMP DEUTSCHLAND GMBH): COMPANY SNAPSHOT

- FIGURE 77 TOYOTA BOSHOKU CORPORATION: COMPANY SNAPSHOT

- FIGURE 78 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 79 HYUNDAI MOBIS: COMPANY SNAPSHOT

- FIGURE 80 DENSO CORPORATION: COMPANY SNAPSHOT

- FIGURE 81 ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT

- FIGURE 82 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 83 VALEO: COMPANY SNAPSHOT

The global automotive interior market size is projected to grow from USD 176.44 billion in 2025 to USD 205.77 billion by 2032, at a CAGR of 2.2%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/USD Thousand) |

| Segments | Component, Material, Level of Autonomy, Electric Vehicle Type, ICE Vehicle Type, Passenger Car Class, and Region |

| Regions covered | North America, Asia Pacific, Europe, and Rest of the World |

The automotive interior market is expected to experience growth driven by various factors. The automotive industry is currently under constant pressure to adapt to new changes due to technological advancements and end-user preferences. Vehicle interiors are key areas that have witnessed a rapid change due to various factors, such as consumer demand for safety and comfort, preference for fuel efficiency, and increasing competition within the industry. OEMs are prioritizing the integration of advanced features and premium design elements, while simultaneously leveraging lightweight, cost-effective, and durable materials to improve overall vehicle performance and sustainability. Recent developments include the adoption of head-up displays, advanced gesture and voice controls, heated steering wheels, haptic feedback, smart seating systems, ambient lighting, illuminated headliners, and integrated air purification systems. As consumers increasingly seek personalized and tech-enabled driving experiences, industry players are investing in the development of innovative, high-performance interior solutions to strengthen their market position.

Metal segment to have highest CAGR during forecast period

The metal segment in the automotive interior market is anticipated to register the highest CAGR during the forecast period. This growth is driven by increasing demand for strength, durability, and structural integrity in key interior components such as seat frames, instrument panels, pedals, and steering systems. As vehicles become more advanced and safety regulations tighten, the role of robust metal elements in supporting in-cabin features becomes even more critical.

Metal materials, especially high-strength steel and aluminum alloys, are progressively utilized to optimize weight without compromising safety or performance. Automakers are prioritizing lightweight metal solutions to meet fuel efficiency targets and improve overall vehicle dynamics. In electric and hybrid vehicles, metal interiors also support better thermal management and battery integration, further boosting their significance in next-generation vehicle design.

The premium vehicle segment is also contributing to this trend, with the use of brushed metal trims and accents becoming more common in high-end interiors to elevate visual appeal and luxury perception. As consumer expectations evolve and manufacturers push for advancement in both functionality and aesthetics, the metal segment is well-positioned to capitalize on emerging openings across all vehicle categories.

Passenger cars segment to witness significant growth during forecast period

The passenger cars segment is anticipated to register strong growth in the automotive interior market during the forecast period. This trend is largely driven by rising consumer expectations for enhanced in-vehicle comfort, advanced features, and aesthetic appeal. As urbanization accelerates and disposable income levels rise-particularly in emerging markets-passenger vehicle sales are gaining momentum. This has resulted in increasing demand for upgraded interior components such as infotainment systems, smart seating, ambient lighting, and climate control technologies.

OEMs are heavily investing in the customization and technological advancement of passenger car interiors to distinguish their offerings and enhance the user experience. Features such as AI-enabled voice assistance, digital instrument clusters, and ambient lighting, which were previously used only in premium cars, are presently being integrated into compact and mid-range passenger cars. Moreover, the shift toward electric and hybrid vehicles is driving the development of new interior layouts and space-optimization strategies. Original equipment manufacturers (OEMs) such as Nissan (Japan), Honda Motor Co., Ltd. (Japan), Audi AG (Germany), BMW (Germany), and Mercedes-Benz (Germany) are actively introducing Level 2 and Level 3 semi-autonomous vehicles, which necessitate advanced interior features to improve driver comfort and safety. These advancements are reshaping consumer expectations and driving demand for innovative interior solutions.

In 2025, Renault Group announced plans to acquire Nissan's 51% stake in their Indian joint venture, Renault Nissan Automotive India Private Ltd (RNAIPL), subsequently taking full ownership of the manufacturing facility in Chennai. This strategic move aligns with Renault's commitment to extend its presence in the Indian market and underscores the importance of India as a hub for automotive innovation and production. The acquisition is anticipated to facilitate the development and production of new models, including those equipped with progressed independent highlights.

These developments highlight the automotive industry's shift towards integrating cutting-edge technologies within vehicle interiors to meet evolving consumer demands. As OEMs continue to invest in autonomous vehicle technologies and expand their operations in key markets like India, the automotive interior market is anticipated to experience robust growth during the forecast period.

Asia Pacific to hold the largest market share during the forecast period

Asia Pacific continues to emerge as a high-potential region for the global automotive industry, led primarily by the rapid expansion of the Chinese market. Alongside China, countries such as India, Japan, and South Korea play significant roles in shaping the regional automotive landscape. While Japan and South Korea are mature markets with strong OEM footprints, India is steadily evolving into a key manufacturing and innovation hub. According to OICA, China and India together produce over 30 million vehicles annually, reinforcing the region's strategic importance despite global market slowdowns.

Furthermore, the region is the largest market for small passenger cars, making it a viable market for automotive interior component suppliers. With the rise of autonomous vehicle trends, automotive interior components will become increasingly important in the selection of car models; as a result, manufacturers are delivering high-tech interiors such as advanced entertainment systems, connected applications, and premium interior materials.

The market growth in Asia Pacific can be attributed to the high vehicle production and increased use of advanced electronics in Japan, South Korea, and China. The governments of these countries have recognized the growth potential of the automotive sector and have consequently undertaken various initiatives to encourage major OEMs to enter their domestic markets. Several global automobile manufacturers, such as Volkswagen (Germany), Mercedes Benz (Germany), and General Motors (US), have shifted their production plants to emerging economies in the region.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEMs - 24%, Tier I - 44%, Tier II - 32%

- By Designation: CXOs - 24%, Directors - 37%, and Others - 39%

- By Region: North America - 24%, Europe - 32%, Asia Pacific- 36%, and RoW- 8%

The automotive interior market is dominated by global players such as FORVIA Faurecia (France), Adient plc. (Ireland), Robert Bosch GmbH (Germany), Lear Corporation (US), and Antolin (Spain). These companies adopted product launches, deals, and other strategies to gain traction in the automotive interior market.

Research Coverage:

The market study covers the Automotive Interior Market by Component (Center Stack, Head-Up Display, Instrument Cluster, Rear Seat Entertainment, Dome Module, Headliner, Seat, Interior Lighting, Door Panel, Center Console, Adhesives & Tapes, Upholstery), Material Type (Leather, Fabric, Vinyl, Wood, Glass Fiber Composite, Carbon Fiber Composite, Metal), Level of Autonomy (Semi-Autonomous, Autonomous, Non-autonomous), Electric Vehicle (BEV, FCEV, HEV, PHEV), Passenger Car Class (Economic Cars, Mid Segment Cars, Luxury Segment Cars), ICE Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), and Region (Asia Pacific, Europe, North America, RoW). It also covers the competitive landscape and company profiles of the major players in the automotive interior market ecosystem.

The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall automotive interior market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of Key Drivers (Growing consumer preference for high-end features, convenience, and advanced safety, lightweight & sustainable material innovations, enhanced functionalities in lighting, and increasing demand for modular & multi-functional interior designs), Restraints (High development cost and volatility in raw material prices, significant power consumption in automotive interior electronics, increasing competition from local companies offering counterfeit/retrofit solutions), Opportunities (Rising trend of semi-autonomous and autonomous vehicles, growing trend of interior customization in premium vehicles, new entertainment and smart mirror applications, recycling and refurbishment of automotive interior materials), and Challenges (Cybersecurity risks in connected interiors, presence of unorganized aftermarket) influencing the growth of the automotive interior market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the automotive interior market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the automotive interior market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the automotive interior market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like FORVIA Faurecia (France), Adient plc. (Ireland), Robert Bosch GmbH (Germany), Lear Corporation (US), and Antolin (Spain), among others in the automotive interior market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of participating companies for primary research

- 2.1.2.3 Major objectives of primary research

- 2.1.2.4 List of primary participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE INTERIOR MARKET

- 4.2 AUTOMOTIVE INTERIOR MARKET, BY REGION

- 4.3 AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE

- 4.4 AUTOMOTIVE INTERIOR MARKET, BY MATERIAL TYPE

- 4.5 AUTOMOTIVE INTERIOR MARKET, BY LEVEL OF AUTONOMY

- 4.6 AUTOMOTIVE INTERIOR MARKET, BY PASSENGER CAR CLASS

- 4.7 AUTOMOTIVE INTERIOR MARKET, BY ELECTRIC VEHICLE TYPE

- 4.8 AUTOMOTIVE INTERIOR MARKET, BY ICE VEHICLE TYPE

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 IMPACT OF AI/GEN AI ON AUTOMOTIVE INTERIOR MARKET

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 MARKET DYNAMICS

- 5.4.1 DRIVERS

- 5.4.1.1 Growing consumer preference for high-end features, convenience, and advanced safety

- 5.4.1.2 Lightweight & sustainable material innovations

- 5.4.1.3 Enhanced functionalities in interior lighting

- 5.4.1.4 Increasing demand for modular & multi-functional interior designs

- 5.4.2 RESTRAINTS

- 5.4.2.1 High development cost and volatility in raw material prices

- 5.4.2.2 Increasing competition from local companies offering counterfeit/retrofit solutions

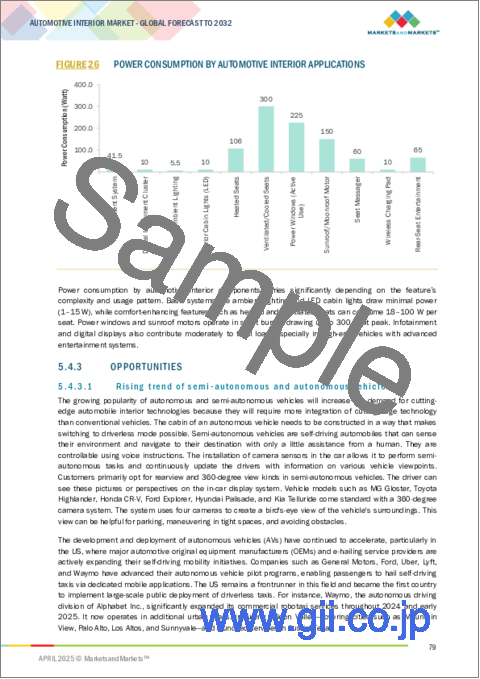

- 5.4.2.3 Significant power consumption in automotive interior electronics

- 5.4.3 OPPORTUNITIES

- 5.4.3.1 Rising trend of semi-autonomous and autonomous vehicles

- 5.4.3.2 Growing trend of interior customization in premium vehicles

- 5.4.3.3 New entertainment and smart mirror applications

- 5.4.3.4 Recycling of automotive interior materials

- 5.4.4 CHALLENGES

- 5.4.4.1 Cybersecurity risks in connected interiors

- 5.4.4.2 Presence of unorganized aftermarket

- 5.4.1 DRIVERS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TRENDS OF COMPONENTS, BY VEHICLE TYPE, 2024

- 5.5.2 AVERAGE SELLING PRICE TRENDS OF COMPONENTS, BY REGION, 2024

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 CONCEPT AND SERIAL DEVELOPMENT OF HIGH-END AUTOMOTIVE DOOR PANELS

- 5.8.2 INCORPORATION OF HIDDEN LIGHTING WITHIN TRIM PIECES AND GLOVEBOX

- 5.8.3 DINETTE SEATING FOR WINNEBAGO MPV MODELS

- 5.8.4 ACCENTURE LEVERAGED AI TO DESIGN CAR SEATS WITH INTELLIGENCE-DRIVEN FEATURES

- 5.8.5 DESIGNING REAR INTERIOR COMPARTMENT TRI WITH AESTHETICS AND REDUCED NVH IN CABINS

- 5.8.6 DESIGN AND DEVELOPMENT OF MODULAR CAR INTERIOR SYSTEM TO REDUCE CYCLE TIME

- 5.9 PATENT ANALYSIS

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Wireless lighting using integrated sensors and controllers with luminaires

- 5.10.1.2 Active motion seating

- 5.10.1.3 AR HUDs

- 5.10.1.4 Curved and flexible displays

- 5.10.1.5 Multi-display systems

- 5.10.1.6 Transparent and headliner displays

- 5.10.1.7 High-resolution and high-dynamic-range (HDR) displays

- 5.10.1.8 3D printing materials for vehicle interior parts

- 5.10.1.9 Adaptive lighting

- 5.10.2 ADJACENT TECHNOLOGIES

- 5.10.2.1 Networked lighting controllers

- 5.10.2.2 Lighting control system network with AI

- 5.10.2.3 Connected lighting

- 5.10.3 COMPLEMENTARY TECHNOLOGIES

- 5.10.3.1 Human-centric lighting

- 5.10.3.2 Integrated wellness features

- 5.10.3.3 Multi-material smart surfaces in car interiors

- 5.10.1 KEY TECHNOLOGIES

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANISATION

- 5.12 INVESTMENT SCENARIO

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT SCENARIO OF AUTOMOTIVE SEAT

- 5.13.2 EXPORT SCENARIO OF AUTOMOTIVE SEAT

- 5.14 KEY CONFERENCES AND EVENTS IN 2025-2026

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 SUPPLIER ANALYSIS

- 5.16.1 SEAT

- 5.16.2 HEAD-UP DISPLAY (HUD)

- 5.16.3 INSTRUMENT CLUSTER

- 5.16.4 DOME MODULE

- 5.16.5 HEADLINER

- 5.16.6 INTERIOR LIGHTING

- 5.16.7 DOOR PANEL

- 5.16.8 CENTER CONSOLE

- 5.16.9 UPHOLSTERY

- 5.16.10 OTHERS

6 AUTOMOTIVE INTERIOR MARKET, BY COMPONENT TYPE

- 6.1 INTRODUCTION

- 6.2 CENTER STACK

- 6.2.1 INCREASING DEMAND FOR CONNECTIVITY AND INFOTAINMENT TO DRIVE MARKET

- 6.3 HEAD-UP DISPLAY (HUD)

- 6.3.1 DEMAND FOR COMFORT AND SAFETY FUNCTIONS TO DRIVE MARKET

- 6.4 INSTRUMENT CLUSTER

- 6.4.1 RISING DEMAND FOR DIGITAL INSTRUMENT CLUSTERS TO DRIVE MARKET

- 6.5 REAR SEAT ENTERTAINMENT

- 6.5.1 GROWTH IN SALES OF LUXURY VEHICLES TO DRIVE MARKET

- 6.6 DOME MODULE

- 6.6.1 GROWING POPULARITY OF CONNECTED CARS TO DRIVE MARKET

- 6.7 HEADLINER

- 6.7.1 INCREASING DEMAND FOR SAFETY FEATURES TO DRIVE MARKET

- 6.8 SEAT

- 6.8.1 INCREASING DEMAND FOR PREMIUM PASSENGER CARS TO DRIVE MARKET

- 6.8.1.1 Standard seat

- 6.8.1.2 Powered seat

- 6.8.1.3 Heated and powered seat

- 6.8.1.4 Heated seat

- 6.8.1.5 Powered, heated, and memory seat

- 6.8.1.6 Powered, heated, and ventilated seat

- 6.8.1.7 Powered, heated, ventilated, and memory seat

- 6.8.1.8 Powered, heated, ventilated, memory, and massage seat

- 6.8.1 INCREASING DEMAND FOR PREMIUM PASSENGER CARS TO DRIVE MARKET

- 6.9 INTERIOR LIGHTING

- 6.9.1 RISING DEMAND FOR AMBIENT LIGHTING TO DRIVE MARKET

- 6.9.2 AUTOMOTIVE INTERIOR LIGHTING APPLICATIONS

- 6.9.2.1 Dashboard lights

- 6.9.2.2 Glovebox lights

- 6.9.2.3 Reading lights

- 6.9.2.4 Dome lights

- 6.9.2.5 Rear-view mirror interior lights

- 6.9.2.6 Engine compartment lights

- 6.9.2.7 Passenger area lights

- 6.9.2.8 Driver area lights

- 6.9.2.9 Footwell lights

- 6.10 DOOR PANEL

- 6.10.1 RISING AUTOMOBILE PRODUCTION TO DRIVE MARKET

- 6.11 CENTER CONSOLE

- 6.11.1 GROWING DEMAND FOR ADVANCED INFOTAINMENT, CONNECTIVITY, AND ERGONOMIC DESIGN TO DRIVE MARKET

- 6.12 OTHERS

- 6.13 ADHESIVES & TAPES

- 6.14 UPHOLSTERY

- 6.15 KEY INDUSTRY INSIGHTS

7 AUTOMOTIVE INTERIOR MARKET, BY ELECTRIC VEHICLE TYPE

- 7.1 INTRODUCTION

- 7.2 BATTERY ELECTRIC VEHICLE (BEV)

- 7.2.1 RISING INTEGRATION OF ADVANCED TECHNOLOGIES AND SAFETY NORMS TO DRIVE MARKET

- 7.3 FUEL CELL ELECTRIC VEHICLE (FCEV)

- 7.3.1 RAPID ADVANCEMENT IN INTERIOR COMPONENTS TO DRIVE MARKET

- 7.4 HYBRID ELECTRIC VEHICLE (HEV)

- 7.4.1 FOCUS ON COMFORT AND LUXURY TO DRIVE MARKET

- 7.5 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

- 7.5.1 FOCUS ON SUSTAINABILITY AND DIGITALIZATION TO DRIVE PHEV INTERIOR INNOVATIONS

- 7.6 KEY INDUSTRY INSIGHTS

8 AUTOMOTIVE INTERIOR MARKET, BY ICE VEHICLE TYPE

- 8.1 INTRODUCTION

- 8.2 PASSENGER CAR (PC)

- 8.2.1 RISING DEMAND FOR MID-SEGMENT AND LUXURY CARS TO DRIVE MARKET

- 8.3 LIGHT COMMERCIAL VEHICLE (LCV)

- 8.3.1 GROWTH IN POINT-TO-POINT TRANSPORTATION OWING TO INCREASING E-COMMERCE ACTIVITIES TO DRIVE MARKET

- 8.4 HEAVY COMMERCIAL VEHICLE (HCV)

- 8.4.1 HIGH DEMAND FOR FREIGHT TRANSPORTATION BY ROAD TO DRIVE MARKET

- 8.5 KEY INDUSTRY INSIGHTS

9 AUTOMOTIVE INTERIOR MARKET, BY LEVEL OF AUTONOMY

- 9.1 INTRODUCTION

- 9.2 NON-AUTONOMOUS CAR

- 9.2.1 RISING DEMAND FOR COMFORT DRIVING TO DRIVE MARKET

- 9.3 SEMI-AUTONOMOUS CAR

- 9.3.1 INCREASING DEMAND FOR SAFETY FEATURES TO DRIVE MARKET

- 9.4 AUTONOMOUS CAR

- 9.4.1 ADVANCEMENTS IN ROBO-TAXIS AND AUTOMATED RIDE-HAILING SERVICES TO DRIVE MARKET

- 9.5 KEY INDUSTRY INSIGHTS

10 AUTOMOTIVE INTERIOR MARKET, BY MATERIAL TYPE

- 10.1 INTRODUCTION

- 10.2 LEATHER

- 10.2.1 HIGH DEMAND FOR LEATHER SEATS AND FINISHES IN ASIA PACIFIC TO DRIVE MARKET

- 10.3 FABRIC

- 10.3.1 RISING PRODUCTION OF ECONOMIC CARS TO DRIVE MARKET

- 10.4 VINYL

- 10.4.1 DURABILITY, AFFORDABILITY, AND VERSATILITY OF VINYL TO DRIVE MARKET

- 10.5 WOOD

- 10.5.1 RISING DEMAND FOR LUXURY VEHICLES TO DRIVE MARKET

- 10.6 GLASS FIBER COMPOSITE

- 10.6.1 WIDE USE IN INSTRUMENT AND DOOR PANELS TO DRIVE MARKET

- 10.7 CARBON FIBER COMPOSITE

- 10.7.1 INCREASING DEMAND FOR LIGHTWEIGHT AND FUEL-EFFICIENT VEHICLES TO DRIVE MARKET

- 10.8 METAL

- 10.8.1 INCREASING USE OF CHROME FINISH IN VEHICLE INTERIORS TO DRIVE MARKET

- 10.9 KEY INDUSTRY INSIGHTS

11 AUTOMOTIVE INTERIOR MARKET, BY PASSENGER CAR CLASS

- 11.1 INTRODUCTION

- 11.2 ECONOMIC CAR

- 11.2.1 INCREASING DEMAND FOR CONNECTIVITY AND INFOTAINMENT TO DRIVE MARKET

- 11.3 MID-SEGMENT CAR

- 11.3.1 ADVANCEMENT IN AUTOMOTIVE TECHNOLOGY TO DRIVE MARKET

- 11.4 LUXURY CAR

- 11.4.1 INCREASING DEMAND FOR ADVANCED FEATURES TO DRIVE MARKET

- 11.5 KEY INDUSTRY INSIGHTS

12 AUTOMOTIVE INTERIOR MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 MACROECONOMIC OUTLOOK

- 12.2.2 CHINA

- 12.2.2.1 Introduction of new technologies to drive market

- 12.2.3 JAPAN

- 12.2.3.1 Rising demand for comfort features in passenger cars to drive market

- 12.2.4 SOUTH KOREA

- 12.2.4.1 Rising demand for luxurious interiors to drive market

- 12.2.5 INDIA

- 12.2.5.1 Increase in demand for compact SUVs to drive market

- 12.2.6 THAILAND

- 12.2.6.1 Rise in digitalization and connectivity in vehicles to drive market

- 12.2.7 REST OF ASIA PACIFIC

- 12.3 EUROPE

- 12.3.1 MICROECONOMIC OUTLOOK

- 12.3.2 GERMANY

- 12.3.2.1 Increase in demand for autonomous vehicles to drive market

- 12.3.3 FRANCE

- 12.3.3.1 Rise in demand for SUVs to drive market

- 12.3.4 UK

- 12.3.4.1 Increase in demand for comfort and convenience in vehicles to drive market

- 12.3.5 SPAIN

- 12.3.5.1 Increase in adoption of semi-autonomous vehicles to drive market

- 12.3.6 ITALY

- 12.3.6.1 Government policies to support higher vehicle production to drive market

- 12.3.7 RUSSIA

- 12.3.7.1 Development of automotive component manufacturing facilities and investments to drive market

- 12.3.8 TURKEY

- 12.3.8.1 Growing popularity of personalization of vehicles to drive market

- 12.3.9 REST OF EUROPE

- 12.4 NORTH AMERICA

- 12.4.1 MACROECONOMIC OUTLOOK

- 12.4.2 US

- 12.4.2.1 Increasing demand for modular features in SUVs to drive market

- 12.4.3 CANADA

- 12.4.3.1 Collaborations between OEMs and domestic automotive interior suppliers to drive market

- 12.4.4 MEXICO

- 12.4.4.1 OEM expansion and cost-efficient manufacturing to drive market

- 12.5 REST OF THE WORLD (ROW)

- 12.5.1 MACROECONOMIC OUTLOOK

- 12.5.2 BRAZIL

- 12.5.2.1 Rising focus on comfort and convenience to drive market

- 12.5.3 IRAN

- 12.5.3.1 Technology transfer from foreign partners to drive market

- 12.5.4 SOUTH AFRICA

- 12.5.4.1 Interior upgrades in entry-level cars to drive market

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.3.1 AUTOMOTIVE INTERIOR MANUFACTURER, MARKET SHARE ANALYSIS, 2024

- 13.3.2 AUTOMOTIVE SEAT MANUFACTURER, MARKET SHARE ANALYSIS, 2024

- 13.4 REVENUE ANALYSIS, 2020-2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT

- 13.7.5.1 Company footprint

- 13.7.5.2 EV type footprint

- 13.7.5.3 Component type footprint

- 13.7.5.4 Vehicle type footprint

- 13.7.5.5 Material type footprint

- 13.7.5.6 Region footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING

- 13.8.5.1 List of startups/SMEs

- 13.8.5.2 Competitive benchmarking of startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

- 13.9.4 OTHERS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 ADIENT PLC.

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Expansions

- 14.1.1.3.4 Others

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 FORVIA FAURECIA

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Deals

- 14.1.2.3.3 Expansions

- 14.1.2.3.4 Others

- 14.1.2.4 MnM view

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 YANFENG

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.3.3 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 LEAR CORPORATION

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.3.3 Expansions

- 14.1.4.3.4 Others

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 CONTINENTAL AG

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.3.3 Expansions

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 ANTOLIN

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Deals

- 14.1.6.3.3 Expansions

- 14.1.7 SAMVARDHANA MOTHERSON GROUP (SMP DEUTSCHLAND GMBH)

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Deals

- 14.1.7.3.2 Expansions

- 14.1.7.3.3 Others

- 14.1.8 TOYOTA BOSHOKU CORPORATION

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.8.3.2 Deals

- 14.1.8.3.3 Expansions

- 14.1.8.3.4 Others

- 14.1.9 ROBERT BOSCH GMBH

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.9.3.2 Deals

- 14.1.9.3.3 Expansions

- 14.1.10 HYUNDAI MOBIS

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches

- 14.1.10.3.2 Deals

- 14.1.10.3.3 Expansions

- 14.1.10.3.4 Others

- 14.1.11 DENSO CORPORATION

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Deals

- 14.1.11.3.2 Expansions

- 14.1.12 ZF FRIEDRICHSHAFEN AG

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Product launches

- 14.1.12.3.2 Deals

- 14.1.12.3.3 Expansions

- 14.1.13 PANASONIC HOLDINGS CORPORATION

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Product launches

- 14.1.13.3.2 Deals

- 14.1.14 VALEO

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Solutions/Services offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Product launches

- 14.1.14.3.2 Deals

- 14.1.14.3.3 Others

- 14.1.15 DRAXLMAIER GROUP

- 14.1.15.1 Business overview

- 14.1.15.2 Products/Solutions/Services offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Product launches

- 14.1.15.3.2 Deals

- 14.1.15.3.3 Expansions

- 14.1.1 ADIENT PLC.

- 14.2 OTHER KEY PLAYERS

- 14.2.1 NIPPON SEIKI CO., LTD.

- 14.2.2 YAZAKI CORPORATION

- 14.2.3 RENESAS ELECTRONICS CORPORATION

- 14.2.4 JAPAN DISPLAY, INC.

- 14.2.5 MAGNA INTERNATIONAL INC.

- 14.2.6 HARMAN INTERNATIONAL

- 14.2.7 SAINT-GOBAIN

- 14.2.8 PIONEER CORPORATION

- 14.2.9 VISTEON CORPORATION

- 14.2.10 FUJITSU LIMITED

15 RECOMMENDATIONS

- 15.1 ASIA PACIFIC TO BE KEY AUTOMOTIVE INTERIOR MARKET

- 15.2 INTEGRATION OF NEW TECHNOLOGIES AS KEY FOCUS AREA

- 15.3 CONCLUSION

16 APPENDIX

- 16.1 KEY INSIGHTS OF INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS