|

|

市場調査レポート

商品コード

1732206

無人水上車両の世界市場:用途別、タイプ別、巡航速度別、耐久性別、船体タイプ別、サイズ別、システム別、地域別 - 2030年までの予測Unmanned Surface Vehicles Market by Application (Mine Countermeasure, Anti-Submarine Warfare, Hydrographic Survey, Security), Type (Autonomous, Remotely Operated), System, Cruising Speed, Hull Type, Endurance, Size and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

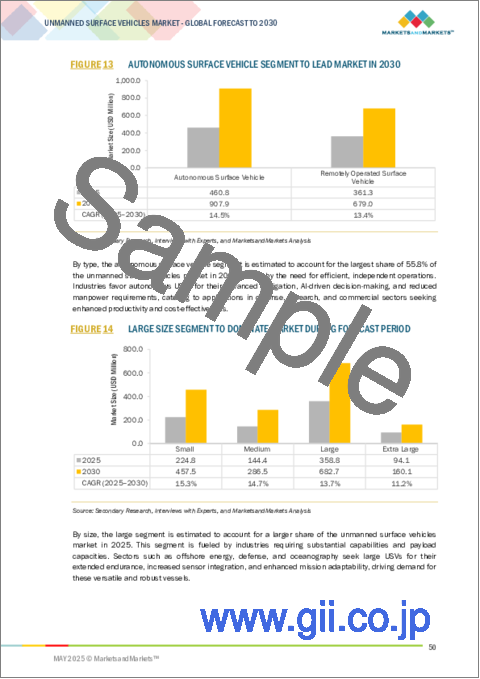

|||||||

| 無人水上車両の世界市場:用途別、タイプ別、巡航速度別、耐久性別、船体タイプ別、サイズ別、システム別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月19日

発行: MarketsandMarkets

ページ情報: 英文 296 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

無人水上車両の市場規模は、2025年に8億2,000万米ドルと推定され、2030年には14.1%のCAGR で拡大すると予測されており、15億9,000万米ドルに達する見込みです。

無人水上車両市場は、水質モニタリング、海洋データマッピングの需要増加、非対称的脅威の高まりによる海上セキュリティ強化の必要性などを背景に、着実に成長しています。さらに、海洋石油・ガス事業への投資が増加していることも、検査や支援作業へのUSVの使用を後押ししています。しかし、市場は、より安価な代替品の入手可能性や、高度なUSVシステムの開発と維持にかかる高コストなどの抑制要因に直面しており、コストに敏感な分野での採用が制限される可能性があります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント別 | 用途別、タイプ別、巡航速度別、耐久性別、船体タイプ別、サイズ別、システム別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

1,000時間超セグメントが無人水上車両市場で最大であるのは、今日の多くのミッションが停止することなく長時間作業できるビークルを必要としているからです。1,000時間以上の耐久性を持つUSVは、燃料や修理を必要とせずに何週間も水中にとどまることができます。これは、海の監視、国境のチェック、環境調査、はるか沖合の物体の検査といった仕事に役立ちます。防衛分野では、人々を危険にさらすことなく、スパイ活動や危険区域のパトロールに役立ちます。これらの長寿命のUSVは、コストを節約し、人間の助けを必要とせず、より簡単に厳しい任務を終えることができます。そのため、需要が高く、耐久性セグメントをリードしています。

小型(3メートル未満)セグメントは無人水上車両市場で最も急成長していますが、その理由はこれらのビークルが低コストで使いやすく、短時間のミッションに最適だからです。小型であるため、持ち運びが容易で、岸壁や小型ボートから打ち上げられ、河川、湖沼、港湾などの場所で使用できます。水質のチェックや調査、港湾の安全維持といった仕事に最適です。小型とはいえ、新技術によりスマートセンサーを搭載し、単独で動作するようになっています。手頃な価格で扱いやすく、さまざまな作業に役立つため、ビジネス、研究、政府で小型USVを選ぶ人が増えています。

アジア太平洋は造船業が盛んで、海上貿易が伸びているため、無人水上車両(USV)市場で最も急成長している地域です。中国、日本、韓国、インドなどの国々は、USVの製造や使用に役立つ船舶や船舶用エンジンを数多く製造しています。この地域の経済が成長するにつれ、より多くの物資が海上輸送されるようになり、港湾管理、海岸線の監視、海洋調査など、よりスマートで安全な方法が必要とされています。USVはこれらすべての仕事を支援します。このため、アジア太平洋地域の企業も政府もUSVの利用を増やしており、市場で最も活発な成長地域となっています。

当レポートでは、世界の無人水上車両市場について調査し、用途別、タイプ別、巡航速度別、耐久性別、船体タイプ別、サイズ別、システム別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- エコシステム分析

- 顧客のビジネスに影響を与える動向と混乱

- 価格分析

- 主要な利害関係者と購入基準

- ケーススタディ

- 技術分析

- 貿易分析

- 規制状況

- 規制枠組み

- 2025年~2026年の主な会議とイベント

- ボリュームデータ

- 投資と資金調達のシナリオ

- マクロ経済見通し

- 技術ロードマップ

第6章 業界動向

- イントロダクション

- 技術動向

- メガトレンドの影響

- 特許分析

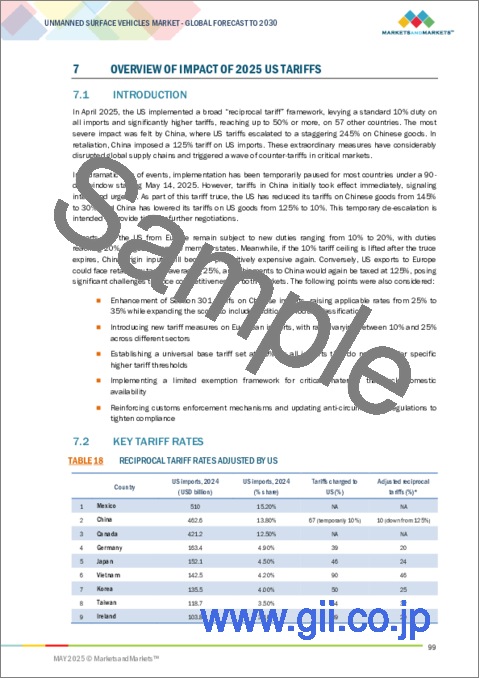

第7章 2025年の米国関税の影響の概要

- イントロダクション

- 主要関税率

- 価格影響分析

- 国/地域への影響

- 米国

- 欧州

- アジア太平洋

- 応用セグメントへの影響

第8章 無人水上車両市場(用途別)

- イントロダクション

- 防衛

- 商業

第9章 無人水上車両市場(タイプ別)

- イントロダクション

- 遠隔操作水上車両

- 自律走行水上車両

第10章 無人水上車両市場(巡航速度別)

- イントロダクション

- 10ノット未満

- 10~30ノット

- 30ノット超

第11章 無人水上車両市場(耐久性別)

- イントロダクション

- 100時間未満

- 100~500時間

- 501~1,000時間

- 1,000時間以上

第12章 無人水上車両市場(船体タイプ別)

- イントロダクション

- シングル

- ツイン

- トリプル

- 硬質インフレータブル

第13章 無人水上車両市場(サイズ別)

- イントロダクション

- 小

- 中

- 大

- 特大

第14章 無人水上車両市場(システム別)

- イントロダクション

- 推進

- コミュニケーション

- ペイロード

- シャーシ

第15章 無人水上車両市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- ノルウェー

- その他

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- その他

- 中東

- GCC

- イスラエル

- その他中東

- その他の地域

- ラテンアメリカ

- アフリカ

第16章 競合情勢

- イントロダクション

- 主要参入企業が採用する戦略の概要(2021年~2024年)

- 収益分析、2021年~2024年

- 市場シェア分析、2024年

- ブランド/製品比較

- 企業評価と財務指標

- 企業評価マトリックス:主要参入企業

- 企業評価マトリックス:スタートアップ企業/中小企業

- 競合シナリオ

- 製品の発売

- 取引

- その他の展開

第17章 企業プロファイル

- 主要参入企業

- L3HARRIS TECHNOLOGIES, INC.

- THALES

- EXAIL TECHNOLOGIES

- TEXTRON INC.

- TELEDYNE TECHNOLOGIES INCORPORATED

- ELBIT SYSTEMS LTD.

- KONGSBERG

- ISRAEL AEROSPACE INDUSTRIES LTD.

- QINETIQ

- LIG NEX1

- BAE SYSTEMS

- ATLAS ELEKTRONIK GMBH

- SEAROBOTICS CORP.

- LIQUID ROBOTICS, INC.

- MARTAC

- EDGE PJSC GROUP

- OCEAN AERO

- DEEP OCEAN ENGINEERING, INC.

- CLEARPATH ROBOTICS, INC.

- SAILDRONE, INC.

- SEAFLOOR SYSTEMS, INC.

- SEA-KIT INTERNATIONAL

- ST ENGINEERING

- その他の企業

- ZHUHAI YUNZHOU INTELLIGENCE TECHNOLOGY LTD.

- MARITIME ROBOTICS

- OCIUS TECHNOLOGIES

- OCEANALPHA

- SEA MACHINES ROBOTICS, INC.

第18章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2021-2024

- TABLE 2 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 3 AVERAGE SELLING PRICE OF UNMANNED SURFACE VEHICLES OFFERED BY KEY PLAYERS, BY APPLICATION (USD MILLION)

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY ENDURANCE (%)

- TABLE 5 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 6 IMPORT DATA FOR HS CODE 8906-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 7 EXPORT DATA FOR HS CODE 8906-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REGULATORY FRAMEWORK, BY COUNTRY

- TABLE 14 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 UNMANNED SURFACE VEHICLE VOLUME (NEW DELIVERIES), 2021-2030

- TABLE 16 IMPACT OF AI ON MARINE APPLICATIONS

- TABLE 17 PATENTS GRANTED, 2018-2024

- TABLE 18 RECIPROCAL TARIFF RATES ADJUSTED BY US

- TABLE 19 KEY PRODUCT-RELATED TARIFF FOR UNMANNED SURFACE VEHICLES

- TABLE 20 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKET DUE TO TARIFF CHANGE

- TABLE 21 UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 22 UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 23 DEFENSE: UNMANNED SURFACE VEHICLES MARKET, BY SUBAPPLICATION, 2021-2024 (USD MILLION)

- TABLE 24 DEFENSE: UNMANNED SURFACE VEHICLES MARKET, BY SUBAPPLICATION, 2025-2030 (USD MILLION)

- TABLE 25 COMMERCIAL: UNMANNED SURFACE VEHICLES MARKET, BY SUBAPPLICATION, 2021-2024 (USD MILLION)

- TABLE 26 COMMERCIAL: UNMANNED SURFACE VEHICLES MARKET, BY SUBAPPLICATION, 2025-2030 (USD MILLION)

- TABLE 27 UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 28 UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 29 UNMANNED SURFACE VEHICLES MARKET, BY CRUISING SPEED, 2021-2024 (USD MILLION)

- TABLE 30 UNMANNED SURFACE VEHICLES MARKET, BY CRUISING SPEED, 2025-2030 (USD MILLION)

- TABLE 31 UNMANNED SURFACE VEHICLES MARKET, BY ENDURANCE, 2021-2024 (USD MILLION)

- TABLE 32 UNMANNED SURFACE VEHICLES MARKET, BY ENDURANCE, 2025-2030 (USD MILLION)

- TABLE 33 UNMANNED SURFACE VEHICLES MARKET, BY HULL TYPE, 2021-2024 (USD MILLION)

- TABLE 34 UNMANNED SURFACE VEHICLES MARKET, BY HULL TYPE, 2025-2030 (USD MILLION)

- TABLE 35 UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 36 UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 37 UNMANNED SURFACE VEHICLES MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 38 UNMANNED SURFACE VEHICLES MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 39 PROPULSION: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 40 PROPULSION: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 41 COMMUNICATION: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 42 COMMUNICATION: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 43 RADIO FREQUENCY: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 44 RADIO FREQUENCY: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 45 PAYLOAD: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 46 PAYLOAD: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 47 CHASSIS: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 48 CHASSIS: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 49 UNMANNED SURFACE VEHICLES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 UNMANNED SURFACE VEHICLES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 NORTH AMERICA: UNMANNED SURFACE VEHICLES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 52 NORTH AMERICA: UNMANNED SURFACE VEHICLES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 53 NORTH AMERICA: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 54 NORTH AMERICA: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 55 NORTH AMERICA: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 56 NORTH AMERICA: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 57 NORTH AMERICA: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 58 NORTH AMERICA: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 59 US: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 60 US: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 61 US: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 62 US: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 63 US: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 64 US: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 65 CANADA: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 66 CANADA: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 67 CANADA: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 68 CANADA: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 69 CANADA: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 70 CANADA: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 71 EUROPE: UNMANNED SURFACE VEHICLES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 72 EUROPE: UNMANNED SURFACE VEHICLES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 73 EUROPE: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 74 EUROPE: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 75 EUROPE: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 76 EUROPE: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 77 EUROPE: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 78 EUROPE: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 79 UK: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 80 UK: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 81 UK: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 82 UK: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 83 UK: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 84 UK: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 85 GERMANY: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 86 GERMANY: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 87 GERMANY: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 88 GERMANY: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 89 GERMANY: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 90 GERMANY: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 91 FRANCE: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 92 FRANCE: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 93 FRANCE: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 94 FRANCE: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 95 FRANCE: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 96 FRANCE: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 97 ITALY: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 98 ITALY: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 99 ITALY: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 100 ITALY: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 101 ITALY: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 102 ITALY: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 103 NORWAY: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 104 NORWAY: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 105 NORWAY: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 106 NORWAY: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 107 NORWAY: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 108 NORWAY: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 109 REST OF EUROPE: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 110 REST OF EUROPE: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 111 REST OF EUROPE: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 112 REST OF EUROPE: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 113 REST OF EUROPE: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 114 REST OF EUROPE: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 115 ASIA PACIFIC: UNMANNED SURFACE VEHICLES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 116 ASIA PACIFIC: UNMANNED SURFACE VEHICLES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 117 ASIA PACIFIC: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 118 ASIA PACIFIC: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 119 ASIA PACIFIC: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 120 ASIA PACIFIC: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 121 ASIA PACIFIC: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 122 ASIA PACIFIC: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 123 CHINA: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 124 CHINA: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 125 CHINA: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 126 CHINA: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 127 CHINA: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 128 CHINA: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 129 INDIA: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 130 INDIA: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 131 INDIA: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 132 INDIA: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 133 INDIA: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 134 INDIA: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 135 JAPAN: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 136 JAPAN: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 137 JAPAN: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 138 JAPAN: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 139 JAPAN: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 140 JAPAN: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 141 AUSTRALIA: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 142 AUSTRALIA: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 143 AUSTRALIA: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 144 AUSTRALIA: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 145 AUSTRALIA: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 146 AUSTRALIA: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 147 SOUTH KOREA: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 148 SOUTH KOREA: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 149 SOUTH KOREA: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 150 SOUTH KOREA: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 151 SOUTH KOREA: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 152 SOUTH KOREA: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 155 REST OF ASIA PACIFIC: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 156 REST OF ASIA PACIFIC: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 158 REST OF ASIA PACIFIC: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 159 MIDDLE EAST: UNMANNED SURFACE VEHICLES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 160 MIDDLE EAST: UNMANNED SURFACE VEHICLES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 161 MIDDLE EAST: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 162 MIDDLE EAST: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 163 MIDDLE EAST: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 164 MIDDLE EAST: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 165 MIDDLE EAST: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 166 MIDDLE EAST: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 167 UAE: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 168 UAE: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 169 UAE: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 170 UAE: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 171 UAE: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 172 UAE: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 173 SAUDI ARABIA: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 174 SAUDI ARABIA: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 175 SAUDI ARABIA: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 176 SAUDI ARABIA: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 177 SAUDI ARABIA: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 178 SAUDI ARABIA: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 179 ISRAEL: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 180 ISRAEL: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 181 ISRAEL: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 182 ISRAEL: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 183 ISRAEL: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 184 ISRAEL: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 185 REST OF MIDDLE EAST: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 186 REST OF MIDDLE EAST: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 187 REST OF MIDDLE EAST: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 188 REST OF MIDDLE EAST: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 189 REST OF MIDDLE EAST: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 190 REST OF MIDDLE EAST: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 191 REST OF THE WORLD: UNMANNED SURFACE VEHICLES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 192 REST OF THE WORLD: UNMANNED SURFACE VEHICLES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 193 REST OF THE WORLD: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 194 REST OF THE WORLD: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 195 REST OF THE WORLD: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 196 REST OF THE WORLD: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 197 REST OF THE WORLD: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 198 REST OF THE WORLD: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 199 LATIN AMERICA: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 200 LATIN AMERICA: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 201 LATIN AMERICA: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 202 LATIN AMERICA: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 203 LATIN AMERICA: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 204 LATIN AMERICA: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 205 AFRICA: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 206 AFRICA: UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 207 AFRICA: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2021-2024 (USD MILLION)

- TABLE 208 AFRICA: UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 209 AFRICA: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 210 AFRICA: UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 211 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2024

- TABLE 212 UNMANNED SURFACE VEHICLES MARKET: DEGREE OF COMPETITION

- TABLE 213 REGION FOOTPRINT

- TABLE 214 APPLICATION FOOTPRINT

- TABLE 215 TYPE FOOTPRINT

- TABLE 216 LIST OF KEY STARTUPS/SMES

- TABLE 217 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 218 UNMANNED SURFACE VEHICLES MARKET: PRODUCT LAUNCHES, JANUARY 2020-MAY 2025

- TABLE 219 UNMANNED SURFACE VEHICLES MARKET: DEALS, JANUARY 2020-MAY 2025

- TABLE 220 UNMANNED SURFACE VEHICLES MARKET: OTHER DEVELOPMENTS, JANUARY 2020-MAY 2025

- TABLE 221 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 222 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 L3HARRIS TECHNOLOGIES, INC.: PRODUCT DEVELOPMENTS

- TABLE 224 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 225 L3HARRIS TECHNOLOGIES, INC.: OTHER DEVELOPMENTS

- TABLE 226 THALES: COMPANY OVERVIEW

- TABLE 227 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 THALES: DEALS

- TABLE 229 THALES: OTHER DEVELOPMENTS

- TABLE 230 EXAIL TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 231 EXAIL TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 EXAIL TECHNOLOGIES: DEALS

- TABLE 233 EXAIL TECHNOLOGIES: OTHER DEVELOPMENTS

- TABLE 234 TEXTRON INC.: COMPANY OVERVIEW

- TABLE 235 TEXTRON INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 TEXTRON INC.: PRODUCT DEVELOPMENTS

- TABLE 237 TEXTRON INC.: OTHER DEVELOPMENTS

- TABLE 238 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

- TABLE 239 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCT DEVELOPMENTS

- TABLE 241 TELEDYNE TECHNOLOGIES INCORPORATED: OTHER DEVELOPMENTS

- TABLE 242 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 243 ELBIT SYSTEMS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 ELBIT SYSTEMS LTD.: PRODUCT DEVELOPMENTS

- TABLE 245 ELBIT SYSTEMS LTD.: OTHER DEVELOPMENTS

- TABLE 246 KONGSBERG: COMPANY OVERVIEW

- TABLE 247 KONGSBERG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 KONGSBERG: OTHER DEVELOPMENTS

- TABLE 249 ISRAEL AEROSPACE INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 250 ISRAEL AEROSPACE INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 ISRAEL AEROSPACE INDUSTRIES LTD.: DEALS

- TABLE 252 QINETIQ: COMPANY OVERVIEW

- TABLE 253 QINETIQ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 LIG NEX1: COMPANY OVERVIEW

- TABLE 255 LIG NEX1: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 BAE SYSTEMS: COMPANY OVERVIEW

- TABLE 257 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 ATLAS ELEKTRONIK GMBH: COMPANY OVERVIEW

- TABLE 259 ATLAS ELEKTRONIK GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 ATLAS ELEKTRONIK GMBH: OTHER DEVELOPMENTS

- TABLE 261 SEAROBOTICS CORP.: COMPANY OVERVIEW

- TABLE 262 SEAROBOTICS CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 SEAROBOTICS CORP.: PRODUCT DEVELOPMENTS

- TABLE 264 SEAROBOTICS CORP.: OTHER DEVELOPMENTS

- TABLE 265 LIQUID ROBOTICS, INC.: COMPANY OVERVIEW

- TABLE 266 LIQUID ROBOTICS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 267 LIQUID ROBOTICS, INC.: DEALS

- TABLE 268 MARTAC: COMPANY OVERVIEW

- TABLE 269 MARTAC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 MARTAC: PRODUCT DEVELOPMENTS

- TABLE 271 EDGE PJSC GROUP: COMPANY OVERVIEW

- TABLE 272 EDGE PJSC GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 OCEAN AERO: COMPANY OVERVIEW

- TABLE 274 OCEAN AERO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 275 OCEAN AERO: DEALS

- TABLE 276 DEEP OCEAN ENGINEERING, INC.: COMPANY OVERVIEW

- TABLE 277 DEEP OCEAN ENGINEERING, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 278 CLEARPATH ROBOTICS, INC.: COMPANY OVERVIEW

- TABLE 279 CLEARPATH ROBOTICS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 SAILDRONE, INC.: COMPANY OVERVIEW

- TABLE 281 SAILDRONE, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 282 SAILDRONE, INC.: PRODUCT DEVELOPMENTS

- TABLE 283 SAILDRONE, INC.: DEALS

- TABLE 284 SAILDRONE, INC.: OTHER DEVELOPMENTS

- TABLE 285 SEAFLOOR SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 286 SEAFLOOR SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 287 SEAFLOOR SYSTEMS, INC.: DEALS

- TABLE 288 SEAFLOOR SYSTEMS, INC.: OTHER DEVELOPMENTS

- TABLE 289 SEA-KIT INTERNATIONAL: COMPANY OVERVIEW

- TABLE 290 SEA-KIT INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 291 SEA-KIT INTERNATIONAL: OTHER DEVELOPMENTS

- TABLE 292 ST ENGINEERING: COMPANY OVERVIEW

- TABLE 293 ST ENGINEERING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 294 ST ENGINEERING: OTHER DEVELOPMENTS

- TABLE 295 ZHUHAI YUNZHOU INTELLIGENCE TECHNOLOGY LTD.: COMPANY OVERVIEW

- TABLE 296 MARITIME ROBOTICS: COMPANY OVERVIEW

- TABLE 297 OCIUS TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 298 OCEANALPHA: COMPANY OVERVIEW

- TABLE 299 SEA MACHINES ROBOTICS, INC.: COMPANY OVERVIEW

- TABLE 300 ANNEXTURE: LONG LIST OF COMPANIES IN THE UNMANNED SURFACE VEHICLES MARKET

List of Figures

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 4 KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 DEFENSE SEGMENT TO ACCOUNT FOR LARGER SHARE THAN COMMERCIAL SEGMENT IN 2025

- FIGURE 9 501-1,000 HOURS ENDURANCE SEGMENT TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 10 PAYLOAD TO BE LARGEST SYSTEM SEGMENT DURING FORECAST PERIOD

- FIGURE 11 SINGLE HULL SEGMENT TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 12 > 30 KNOTS TO SURPASS OTHER CRUISING SPEED SEGMENTS IN MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 AUTONOMOUS SURFACE VEHICLE SEGMENT TO LEAD MARKET IN 2030

- FIGURE 14 LARGE SIZE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 16 INCREASE IN DEMAND FOR EFFECTIVE SURVEILLANCE TO DRIVE GROWTH

- FIGURE 17 501-1,000 HOURS ENDURANCE SEGMENT TO LEAD MARKET IN 2025

- FIGURE 18 DEFENSE SEGMENT TO ACHIEVE SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 19 SINGLE HULL TYPE TO ACHIEVE LARGEST SHARE IN 2025

- FIGURE 20 LARGE SIZE SEGMENT TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 21 PAYLOAD TO BE LEADING SYSTEM SEGMENT DURING FORECAST PERIOD

- FIGURE 22 ISRAEL TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 23 UNMANNED SURFACE VEHICLES MARKET DYNAMICS

- FIGURE 24 NUMBER OF PIRATE ATTACKS AGAINST SHIPS WORLDWIDE, 2021 VS. 2022

- FIGURE 25 UPSTREAM OIL & GAS CAPEX, 2018-2025 (USD BILLION)

- FIGURE 26 VALUE CHAIN ANALYSIS

- FIGURE 27 ECOSYSTEM MAPPING

- FIGURE 28 COMPANIES IN ECOSYSTEM

- FIGURE 29 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 30 AVERAGE SELLING PRICE OF UNMANNED SURFACE VEHICLES OFFERED BY KEY PLAYERS, BY APPLICATION (USD MILLION)

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY ENDURANCE

- FIGURE 32 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 33 CROSS-PLATFORM OPERATION

- FIGURE 34 IMPORT DATA FOR HS CODE 8906-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 35 EXPORT DATA FOR HS CODE 8906-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 36 INVESTMENT AND FUNDING SCENARIO, 2018-2024 (USD MILLION)

- FIGURE 37 IMPACT OF AI ON MARINE VESSELS

- FIGURE 38 TECHNOLOGY ROADMAP OF UNMANNED SURFACE VEHICLES

- FIGURE 39 PATENTS GRANTED, 2014-2026

- FIGURE 40 UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 41 MINE COUNTERMEASURES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 42 HYDROGRAPHIC SURVEY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 43 UNMANNED SURFACE VEHICLES MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 44 UNMANNED SURFACE VEHICLES MARKET, BY CRUISING SPEED, 2025 VS. 2030 (USD MILLION)

- FIGURE 45 UNMANNED SURFACE VEHICLES MARKET, BY ENDURANCE, 2025 VS. 2030 (USD MILLION)

- FIGURE 46 UNMANNED SURFACE VEHICLES MARKET, BY HULL TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 47 UNMANNED SURFACE VEHICLES MARKET, BY SIZE, 2025 VS. 2030 (USD MILLION)

- FIGURE 48 UNMANNED SURFACE VEHICLES MARKET, BY SYSTEM, 2025 VS. 2030 (USD MILLION)

- FIGURE 49 ELECTRIC TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 50 SATELLITE COMMUNICATION TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 51 OPTICAL SYSTEM TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 52 THERMOPLASTIC TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 53 UNMANNED SURFACE VEHICLES MARKET, BY REGION, 2025-2030

- FIGURE 54 NORTH AMERICA: UNMANNED SURFACE VEHICLES MARKET SNAPSHOT

- FIGURE 55 EUROPE: UNMANNED SURFACE VEHICLES MARKET SNAPSHOT

- FIGURE 56 ASIA PACIFIC: UNMANNED SURFACE VEHICLES MARKET SNAPSHOT

- FIGURE 57 MIDDLE EAST: UNMANNED SURFACE VEHICLES MARKET SNAPSHOT

- FIGURE 58 REST OF THE WORLD: UNMANNED SURFACE VEHICLES MARKET SNAPSHOT

- FIGURE 59 REVENUE ANALYSIS OF KEY PLAYERS, 2021-2024 (USD MILLION)

- FIGURE 60 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 61 BRAND/PRODUCT COMPARISON

- FIGURE 62 FINANCIAL METRICS OF PROMINENT PLAYERS, 2025

- FIGURE 63 VALUATION OF PROMINENT MARKET PLAYERS, 2025

- FIGURE 64 UNMANNED SURFACE VEHICLES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 65 COMPANY FOOTPRINT

- FIGURE 66 UNMANNED SURFACE VEHICLES MARKET: COMPANY EVALUATION MARKET (STARTUPS/SMES), 2024

- FIGURE 67 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 68 THALES: COMPANY SNAPSHOT

- FIGURE 69 EXAIL TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 70 TEXTRON INC.: COMPANY SNAPSHOT

- FIGURE 71 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

- FIGURE 72 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 73 KONGSBERG: COMPANY SNAPSHOT

- FIGURE 74 ISRAEL AEROSPACE INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 75 QINETIQ: COMPANY SNAPSHOT

- FIGURE 76 LIG NEX1: COMPANY SNAPSHOT

- FIGURE 77 BAE SYSTEMS: COMPANY SNAPSHOT

- FIGURE 78 ST ENGINEERING: COMPANY SNAPSHOT

The market size of unmanned surface vehicles is estimated to be USD 0.82 billion in 2025 and is projected to reach USD 1.59 billion by 2030, at a CAGR of 14.1%. The unmanned surface vehicles market is growing steadily, driven by increasing demand for water quality monitoring, ocean data mapping, and the need for enhanced maritime security due to rising asymmetric threats. Additionally, higher investments in offshore oil & gas operations are boosting the use of USVs for inspection and support tasks. However, the market faces restraints such as the availability of cheaper alternatives and the high costs involved in developing and maintaining advanced USV systems, which may limit adoption in cost-sensitive sectors.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | By Application, Type, System, Cruising Speed, Hull Type, Endurance, Size and Region |

| Regions covered | North America, Europe, APAC, RoW |

"The >1,000 hours segment will account for the largest market share in the unmanned surface vehicles market during the forecast period."

The >1,000 hours segment is the largest in the unmanned surface vehicles market because many missions today need vehicles that can work for a long time without stopping. USVs with more than 1,000 hours of endurance can stay in the water for weeks without needing fuel or repairs. This is useful for jobs like watching the ocean, checking borders, studying the environment, or inspecting things far offshore. In defense, they help with spying and patrolling dangerous areas without putting people at risk. These long-lasting USVs save money, need less human help, and finish tough missions more easily. That is why they are in high demand and lead the endurance segment.

"The small segment will be the fastest-growing segment in the unmanned surface vehicles market during the forecast period."

The small (<3 meter) segment is growing the fastest in the unmanned surface vehicles market because these vehicles are low-cost, simple to use, and perfect for short missions. Their small size makes them easy to carry, launch from the shore or small boats, and use in places like rivers, lakes, and ports. They are great for jobs like checking water quality, doing research, or keeping ports safe. Even though they are small, new technology lets them carry smart sensors and work on their own. Because they are affordable, easy to handle, and useful for many tasks, more people in business, research, and government are choosing small USVs.

"Asia Pacific is estimated to be the fastest-growing market in the unmanned surface vehicles market."

Asia Pacific is the fastest-growing region in the unmanned surface vehicles (USV) market because it has strong shipbuilding industries and growing sea trade. Countries like China, Japan, South Korea, and India build many ships and marine engines, which help in making and using USVs. As the region's economy grows, more goods are moved by sea, so there is a bigger need for smart and safe ways to manage ports, watch coastlines, and study the ocean. USVs help with all these jobs. Because of this, both businesses and governments in Asia Pacific are using more USVs, making it the most active and growing region in the market.

Break-up of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1-45%; Tier 2-35%; and Tier 3-20%

- By Designation: C Level-50%; Directors-25%; and Others-25%

- By Region: North America-52%; Europe-25%; Asia Pacific-14%; Rest of the World-9%.

L3Harris Technologies, Inc. (US), Teledyne Technologies Incorporated (US), Textron Inc. (US), Exail Technologies (France), Elbit Systems Ltd (Israel), MARTAC (US), and Thales (France) are some of the leading players operating in the unmanned surface vehicles market.

Research Coverage

The study covers the unmanned surface vehicles market across various segments and subsegments. It aims to estimate the size and growth potential of this market across different segments based on type, cruising speed, size, application, system, hull type, endurance, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their solutions and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Key benefits of buying this report:

This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall unmanned surface vehicles market and its subsegments. The report covers the entire ecosystem of the unmanned surface vehicles market. It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers and factors, such as high demand for water quality monitoring and ocean data mapping, surge in asymmetric threats and need for maritime security, and growing capital expenditure in offshore oil & gas industries in the unmanned surface vehicles market.

- Product Development: In-depth analysis of product innovation/development by companies across various regions.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the unmanned surface vehicles market across varied regions.

- Market Diversification: Exhaustive information about new solutions, untapped geographies, recent developments, and investments in the unmanned surface vehicles market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like market L3Harris Technologies, Inc. (US), Teledyne Technologies Incorporated (US), Textron Inc. (US), Exail Technologies (France), Elbit Systems Ltd (Israel), MARTAC (US), and Thales (France), among others in the unmanned surface vehicles market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.4 YEARS CONSIDERED

- 1.5 INCLUSIONS & EXCLUSIONS

- 1.6 CURRENCY CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Bottom-up estimation methodology

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN UNMANNED SURFACE VEHICLES MARKET

- 4.2 UNMANNED SURFACE VEHICLES MARKET, BY ENDURANCE

- 4.3 UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION

- 4.4 UNMANNED SURFACE VEHICLES MARKET, BY HULL TYPE

- 4.5 UNMANNED SURFACE VEHICLES MARKET, BY SIZE

- 4.6 UNMANNED SURFACE VEHICLES MARKET, BY SYSTEM

- 4.7 UNMANNED SURFACE VEHICLES MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 High demand for water quality monitoring and ocean data mapping

- 5.2.1.2 Surge in asymmetric threats and need for maritime security

- 5.2.1.3 Growing capital expenditure in offshore oil and gas industries

- 5.2.2 RESTRAINTS

- 5.2.2.1 Availability of low-cost substitutes

- 5.2.2.2 High development and maintenance costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advancements in naval technologies

- 5.2.3.2 Rapid adoption of unmanned surface vehicles in defense operations

- 5.2.3.3 Rise in defense budgets

- 5.2.4 CHALLENGES

- 5.2.4.1 Unclear navigation rules and need for human intervention

- 5.2.4.2 Absence of robust collision avoidance systems in USVs

- 5.2.4.3 Cybersecurity threats to autonomous systems

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 PROMINENT COMPANIES

- 5.4.2 PRIVATE AND SMALL ENTERPRISES

- 5.4.3 END USERS

- 5.5 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF UNMANNED SURFACE VEHICLES OFFERED BY KEY PLAYERS, BY APPLICATION

- 5.6.2 INDICATIVE PRICING ANALYSIS OF UNMANNED SURFACE VEHICLES, BY SIZE

- 5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.7.1 STAKEHOLDERS IN BUYING PROCESS

- 5.7.2 BUYING CRITERIA

- 5.8 CASE STUDIES

- 5.8.1 FUGRO DEPLOYED 12-METER UNCREWED SURFACE VESSEL EQUIPPED WITH ELECTRIC-POWERED REMOTELY OPERATED VEHICLE

- 5.8.2 USE OF NORBIT'S SONAR DEVICES FOR MAPPING BEAVER BURROWS

- 5.8.3 USE OF OCEANALPHA SL40 USV FOR HYDROGRAPHIC SURVEYING OF HAMBURG PORT

- 5.8.4 USE OF OCEANAPLHA M80 USV FOR OFFSHORE WIND FARM SCOURING AND CABLE SURVEY

- 5.8.5 USE OF UNI-PACT USV FOR NEAR-SHORE TOPOGRAPHIC AND BATHYMETRY DATA

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Cross-platform operation

- 5.9.1.2 Autonomy & navigation systems

- 5.9.1.3 Sensor suites

- 5.9.1.4 Propulsion & energy systems

- 5.9.1.5 Command, control, and communications

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Data analytics & cloud platforms

- 5.9.2.2 Cybersecurity solutions

- 5.9.2.3 Digital twin & simulation

- 5.9.2.4 Internet of Things (IoT) integration

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Unmanned aerial vehicles (UAVs)

- 5.9.3.2 Unmanned underwater vehicles (UUVs)

- 5.9.3.3 Port automation and smart ports

- 5.9.1 KEY TECHNOLOGIES

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO

- 5.10.2 EXPORT SCENARIO

- 5.11 REGULATORY LANDSCAPE

- 5.12 REGULATORY FRAMEWORK

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 VOLUME DATA

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 MACROECONOMIC OUTLOOK

- 5.16.1 INTRODUCTION

- 5.16.2 NORTH AMERICA

- 5.16.3 EUROPE

- 5.16.4 ASIA PACIFIC

- 5.16.5 MIDDLE EAST

- 5.16.6 LATIN AMERICA & AFRICA

- 5.16.7 IMPACT OF AI ON MARINE INDUSTRY

- 5.16.8 IMPACT OF AI ON UNMANNED SURFACE VEHICLES MARKET

- 5.17 TECHNOLOGY ROADMAP

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 AUTONOMOUS REFUELING

- 6.2.2 COLLABORATIVE UNMANNED SYSTEM

- 6.2.3 SPECIAL MONITORING OF APPLIED RESPONSE TECHNOLOGY

- 6.2.4 LAUNCH AND RECOVERY SYSTEM

- 6.2.5 NIMH BATTERY

- 6.2.6 MARITIME SWARMING TECHNOLOGY

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 UNMANNED SURFACE VEHICLES AS WEAPONS OF WAR

- 6.3.2 DATA DISSEMINATION

- 6.3.3 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

- 6.3.4 ADVANCED MATERIALS AND MANUFACTURING

- 6.3.5 MARITIME AUTONOMY SURFACE TEST BED

- 6.3.6 CYBERSECURITY

- 6.4 PATENT ANALYSIS

7 OVERVIEW OF IMPACT OF 2025 US TARIFFS

- 7.1 INTRODUCTION

- 7.2 KEY TARIFF RATES

- 7.3 PRICE IMPACT ANALYSIS

- 7.4 IMPACT ON COUNTRY/REGION

- 7.4.1 US

- 7.4.2 EUROPE

- 7.4.3 ASIA PACIFIC

- 7.5 IMPACT ON APPLICATION SEGMENTS

- 7.5.1 COMMERCIAL

- 7.5.2 DEFENSE

8 UNMANNED SURFACE VEHICLES MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 DEFENSE

- 8.2.1 NEED FOR VEHICLES OFFERING LONG ENDURANCE AND HIGH PAYLOAD-CARRYING CAPACITY TO DRIVE GROWTH

- 8.2.1.1 Use case: MAST-13, developed by L3Harris Technologies, demonstrated great potential for defense applications

- 8.2.1.2 ISR

- 8.2.1.3 Mine countermeasure

- 8.2.1.4 Hydrographic survey

- 8.2.1.5 Anti-submarine warfare

- 8.2.1.6 Electronic warfare

- 8.2.1.7 Communication gateway

- 8.2.1.8 Naval warfare

- 8.2.1.9 Firefighting

- 8.2.1.10 Logistic support

- 8.2.1 NEED FOR VEHICLES OFFERING LONG ENDURANCE AND HIGH PAYLOAD-CARRYING CAPACITY TO DRIVE GROWTH

- 8.3 COMMERCIAL

- 8.3.1 FOCUS ON REDUCING DEVELOPMENT AND OPERATIONAL COSTS TO DRIVE GROWTH

- 8.3.1.1 Use case: Sounder USV, by Kongsberg, supports advanced communication tools and mission control systems

- 8.3.1.2 Weather monitoring

- 8.3.1.3 Search and rescue

- 8.3.1.4 Environment monitoring

- 8.3.1.5 Infrastructure inspection

- 8.3.1.5.1 Offshore inspection

- 8.3.1.5.2 Oil and gas inspection

- 8.3.1.6 Hydrographic survey

- 8.3.1.7 Security

- 8.3.1.8 Firefighting

- 8.3.1.9 Marine aquaculture

- 8.3.1 FOCUS ON REDUCING DEVELOPMENT AND OPERATIONAL COSTS TO DRIVE GROWTH

9 UNMANNED SURFACE VEHICLES MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 REMOTELY OPERATED SURFACE VEHICLE

- 9.2.1 RISING DEMAND FOR REAL-TIME CONTROL IN HAZARDOUS MARITIME OPERATIONS TO DRIVE GROWTH

- 9.2.2 USE CASE: BHARAT ELECTRONICS DEVELOPED REMOTELY OPERATED UNMANNED SURFACE VEHICLE FOR HYDROGRAPHIC SURVEYING AND COASTAL SURVEILLANCE

- 9.3 AUTONOMOUS SURFACE VEHICLE

- 9.3.1 RAPID DEVELOPMENT BY PROMINENT COMPANIES TO DRIVE GROWTH

- 9.3.2 USE CASE: EXAIL TECHNOLOGIES DEVELOPED INSPECTOR 90 FOR VARIOUS MARITIME OPERATIONS

10 UNMANNED SURFACE VEHICLES MARKET, BY CRUISING SPEED

- 10.1 INTRODUCTION

- 10.2 < 10 KNOTS

- 10.2.1 FOCUS ON ENHANCED PRECISION AND STABILITY TO DRIVE GROWTH

- 10.3 10-30 KNOTS

- 10.3.1 HIGH DEMAND FROM MILITARY SURVEILLANCE OPERATIONS TO DRIVE GROWTH

- 10.4 > 30 KNOTS

- 10.4.1 NEED FOR RAPID RESPONSE AND INTERCEPTION TO DRIVE GROWTH

11 UNMANNED SURFACE VEHICLES MARKET, BY ENDURANCE

- 11.1 INTRODUCTION

- 11.2 <100 HOURS

- 11.2.1 ADVANCEMENTS IN BATTERY TECHNOLOGY TO DRIVE GROWTH

- 11.3 100-500 HOURS

- 11.3.1 OCEANOGRAPHY SURVEYS AND RIVER MAPPING APPLICATIONS TO DRIVE GROWTH

- 11.4 501-1,000 HOURS

- 11.4.1 INCREASING ADOPTION BY ENVIRONMENTAL AGENCIES TO DRIVE GROWTH

- 11.5 > 1,000 HOURS

- 11.5.1 FOCUS ON ANTI-SUBMARINE WARFARE MISSIONS TO DRIVE GROWTH

12 UNMANNED SURFACE VEHICLES MARKET, BY HULL TYPE

- 12.1 INTRODUCTION

- 12.2 SINGLE

- 12.2.1 SINGLE-HULL USVS FEATURE STREAMLINED AND COST-EFFECTIVE DESIGN

- 12.3 TWIN

- 12.3.1 NEED FOR USVS FOR PRECISION APPLICATIONS TO DRIVE GROWTH

- 12.4 TRIPLE

- 12.4.1 NEED FOR USVS WITH ENHANCED PAYLOAD CAPACITY TO DRIVE GROWTH

- 12.5 RIGID INFLATABLE 127 12.5.1 IDEAL FOR MILITARY AND MARITIME APPLICATIONS

13 UNMANNED SURFACE VEHICLES MARKET, BY SIZE

- 13.1 INTRODUCTION

- 13.2 SMALL

- 13.2.1 RISE IN R&D INVESTMENTS TO DRIVE GROWTH

- 13.3 MEDIUM

- 13.3.1 PRE-WAR AND POST-WAR MAINTENANCE AND SUPPORT SERVICES TO DRIVE GROWTH

- 13.4 LARGE

- 13.4.1 FOCUS ON IMPROVED SAFETY AND PERFORMANCE TO DRIVE GROWTH

- 13.5 EXTRA LARGE

- 13.5.1 NEED FOR USVS FOR MISSIONS REQUIRING LARGE PAYLOADS AND HIGH AUTONOMY TO BOOST DEMAND

14 UNMANNED SURFACE VEHICLES MARKET, BY SYSTEM

- 14.1 INTRODUCTION

- 14.2 PROPULSION

- 14.2.1 INCREASING DEMAND FOR SUSTAINABLE TECHNOLOGIES TO DRIVE GROWTH

- 14.2.1.1 Diesel/Gasoline

- 14.2.1.2 Renewable

- 14.2.1.3 Hybrid

- 14.2.1.4 Electric

- 14.2.1 INCREASING DEMAND FOR SUSTAINABLE TECHNOLOGIES TO DRIVE GROWTH

- 14.3 COMMUNICATION

- 14.3.1 NEED FOR REAL-TIME INFORMATION TO DRIVE GROWTH

- 14.3.1.1 Radio frequency

- 14.3.1.1.1 Radio

- 14.3.1.1.2 Wi-Fi

- 14.3.1.1.3 UHF/VHF

- 14.3.1.2 Satellite Communication

- 14.3.1.3 Other communication systems

- 14.3.1.1 Radio frequency

- 14.3.1 NEED FOR REAL-TIME INFORMATION TO DRIVE GROWTH

- 14.4 PAYLOAD

- 14.4.1 RISING DEMAND FOR OPERATIONAL EFFICIENCY TO DRIVE GROWTH

- 14.4.1.1 Optical system

- 14.4.1.2 Sonar

- 14.4.1.3 Radar

- 14.4.1.4 LiDAR

- 14.4.1.5 Other payload systems

- 14.4.1 RISING DEMAND FOR OPERATIONAL EFFICIENCY TO DRIVE GROWTH

- 14.5 CHASSIS

- 14.5.1 NEED FOR HIGH STRENGTH AND DURABILITY TO DRIVE GROWTH

- 14.5.1.1 Aluminum

- 14.5.1.2 Carbon fiber

- 14.5.1.3 Thermoplastic

- 14.5.1.4 Fiberglass

- 14.5.2 NAVIGATION, GUIDANCE, AND CONTROL SYSTEM

- 14.5.2.1 Demand for robust NGCS in expanding unmanned surface vehicles market to drive growth

- 14.5.3 ELECTRONIC COMPONENTS

- 14.5.3.1 Electronic components act as central enablers of control and communication

- 14.5.1 NEED FOR HIGH STRENGTH AND DURABILITY TO DRIVE GROWTH

15 UNMANNED SURFACE VEHICLES MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 US

- 15.2.1.1 Increasing demand for advanced unmanned systems for defense security to drive growth

- 15.2.2 CANADA

- 15.2.2.1 Dynamic regulatory environment governing maritime activities to drive growth

- 15.2.1 US

- 15.3 EUROPE

- 15.3.1 UK

- 15.3.1.1 Focus on advanced marine technologies to drive growth

- 15.3.2 GERMANY

- 15.3.2.1 Innovations in USV technologies to drive growth

- 15.3.3 FRANCE

- 15.3.3.1 Presence of significant players to drive growth

- 15.3.4 ITALY

- 15.3.4.1 Increasing demand for efficient maritime surveillance and data collection solutions to drive growth

- 15.3.5 NORWAY

- 15.3.5.1 Need for combatting illegal offshore activities to drive growth

- 15.3.6 REST OF EUROPE

- 15.3.1 UK

- 15.4 ASIA PACIFIC

- 15.4.1 CHINA

- 15.4.1.1 Emphasis on domestic USV programs to drive growth

- 15.4.2 INDIA

- 15.4.2.1 Potential avenues for USV integration to drive growth

- 15.4.3 JAPAN

- 15.4.3.1 Need for effective maritime solutions to drive growth

- 15.4.4 AUSTRALIA

- 15.4.4.1 Domestic maritime interests to drive growth

- 15.4.5 SOUTH KOREA

- 15.4.5.1 Government investments toward technological advancements to drive growth

- 15.4.6 REST OF ASIA PACIFIC

- 15.4.1 CHINA

- 15.5 MIDDLE EAST

- 15.5.1 GCC

- 15.5.1.1 UAE

- 15.5.1.1.1 Focus on enhancing maritime security and adopting advanced defense and surveillance technologies to drive growth

- 15.5.1.2 SAUDI ARABIA

- 15.5.1.2.1 Focus on unmanned systems for defense purposes to drive growth

- 15.5.1.1 UAE

- 15.5.2 ISRAEL

- 15.5.2.1 Military modernization programs to drive growth

- 15.5.3 REST OF MIDDLE EAST

- 15.5.1 GCC

- 15.6 REST OF THE WORLD

- 15.6.1 LATIN AMERICA

- 15.6.1.1 Rising investments in offshore oil and gas drilling activities to drive growth

- 15.6.2 AFRICA

- 15.6.2.1 Extensive offshore inspection activities to drive growth

- 15.6.1 LATIN AMERICA

16 COMPETITIVE LANDSCAPE

- 16.1 INTRODUCTION

- 16.2 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2024

- 16.3 REVENUE ANALYSIS, 2021-2024

- 16.4 MARKET SHARE ANALYSIS, 2024

- 16.5 BRAND/PRODUCT COMPARISON

- 16.6 COMPANY VALUATION AND FINANCIAL METRICS

- 16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS

- 16.7.1 STARS

- 16.7.2 EMERGING LEADERS

- 16.7.3 PERVASIVE PLAYERS

- 16.7.4 PARTICIPANTS

- 16.7.5 COMPANY FOOTPRINT

- 16.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES

- 16.8.1 PROGRESSIVE COMPANIES

- 16.8.2 RESPONSIVE COMPANIES

- 16.8.3 DYNAMIC COMPANIES

- 16.8.4 STARTING BLOCKS

- 16.8.5 COMPETITIVE BENCHMARKING

- 16.9 COMPETITIVE SCENARIO

- 16.10 PRODUCT LAUNCHES

- 16.11 DEALS

- 16.12 OTHER DEVELOPMENTS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 L3HARRIS TECHNOLOGIES, INC.

- 17.1.1.1 Business overview

- 17.1.1.2 Products/Solutions/Services offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Product developments

- 17.1.1.3.2 Deals

- 17.1.1.3.3 Other developments

- 17.1.1.4 MnM view

- 17.1.1.4.1 Right to win

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses and competitive threats

- 17.1.2 THALES

- 17.1.2.1 Business overview

- 17.1.2.2 Products/Solutions/Services offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Deals

- 17.1.2.3.2 Other developments

- 17.1.2.4 MnM view

- 17.1.2.4.1 Right to win

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses and competitive threats

- 17.1.3 EXAIL TECHNOLOGIES

- 17.1.3.1 Business overview

- 17.1.3.2 Products/Solutions/Services offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Deals

- 17.1.3.3.2 Other developments

- 17.1.3.4 MnM view

- 17.1.3.4.1 Right to win

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses and competitive threats

- 17.1.4 TEXTRON INC.

- 17.1.4.1 Business overview

- 17.1.4.2 Products/Solutions/Services offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Product developments

- 17.1.4.3.2 Other developments

- 17.1.4.4 MnM view

- 17.1.4.4.1 Right to Win

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses and competitive threats

- 17.1.5 TELEDYNE TECHNOLOGIES INCORPORATED

- 17.1.5.1 Business overview

- 17.1.5.2 Products/Solutions/Services offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Product developments

- 17.1.5.3.2 Other developments

- 17.1.5.4 MnM view

- 17.1.5.4.1 Right to win

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses and competitive threats

- 17.1.6 ELBIT SYSTEMS LTD.

- 17.1.6.1 Business overview

- 17.1.6.2 Products/Solutions/Services offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Product developments

- 17.1.6.3.2 Other developments

- 17.1.7 KONGSBERG

- 17.1.7.1 Business overview

- 17.1.7.2 Products/Solutions/Services offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Other developments

- 17.1.8 ISRAEL AEROSPACE INDUSTRIES LTD.

- 17.1.8.1 Business overview

- 17.1.8.2 Products/Solutions/Services offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Deals

- 17.1.9 QINETIQ

- 17.1.9.1 Business overview

- 17.1.9.2 Products/Solutions/Services offered

- 17.1.10 LIG NEX1

- 17.1.10.1 Business overview

- 17.1.10.2 Products/Solutions/Services offered

- 17.1.11 BAE SYSTEMS

- 17.1.11.1 Business overview

- 17.1.11.2 Products/Solutions/Services offered

- 17.1.12 ATLAS ELEKTRONIK GMBH

- 17.1.12.1 Business overview

- 17.1.12.2 Products/Solutions/Services offered

- 17.1.12.3 Recent developments

- 17.1.12.3.1 Other developments

- 17.1.13 SEAROBOTICS CORP.

- 17.1.13.1 Business overview

- 17.1.13.2 Products/Solutions/Services offered

- 17.1.13.3 Recent developments

- 17.1.13.3.1 Product developments

- 17.1.13.3.2 Other developments

- 17.1.14 LIQUID ROBOTICS, INC.

- 17.1.14.1 Business overview

- 17.1.14.2 Products/Solutions/Services offered

- 17.1.14.3 Recent developments

- 17.1.14.3.1 Deals

- 17.1.15 MARTAC

- 17.1.15.1 Business overview

- 17.1.15.2 Products/Solutions/Services offered

- 17.1.15.3 Recent developments

- 17.1.15.3.1 Product developments

- 17.1.16 EDGE PJSC GROUP

- 17.1.16.1 Business overview

- 17.1.16.2 Products/Solutions/Services offered

- 17.1.17 OCEAN AERO

- 17.1.17.1 Business overview

- 17.1.17.2 Products/Solutions/Services offered

- 17.1.17.3 Recent developments

- 17.1.17.3.1 Deals

- 17.1.18 DEEP OCEAN ENGINEERING, INC.

- 17.1.18.1 Business overview

- 17.1.18.2 Products/Solutions/Services offered

- 17.1.19 CLEARPATH ROBOTICS, INC.

- 17.1.19.1 Business overview

- 17.1.19.2 Products/Solutions/Services offered

- 17.1.20 SAILDRONE, INC.

- 17.1.20.1 Business overview

- 17.1.20.2 Products/Solutions/Services offered

- 17.1.20.3 Recent developments

- 17.1.20.3.1 Product developments

- 17.1.20.3.2 Deals

- 17.1.20.3.3 Other developments

- 17.1.21 SEAFLOOR SYSTEMS, INC.

- 17.1.21.1 Business overview

- 17.1.21.2 Products/Solutions/Services offered

- 17.1.21.3 Recent developments

- 17.1.21.3.1 Deals

- 17.1.21.3.2 Other developments

- 17.1.22 SEA-KIT INTERNATIONAL

- 17.1.22.1 Business overview

- 17.1.22.2 Products/Solutions/Services offered

- 17.1.22.3 Recent developments

- 17.1.22.3.1 Other developments

- 17.1.23 ST ENGINEERING

- 17.1.23.1 Business overview

- 17.1.23.2 Products/Solutions/Services offered

- 17.1.23.3 Recent developments

- 17.1.23.3.1 Other developments

- 17.1.1 L3HARRIS TECHNOLOGIES, INC.

- 17.2 OTHER PLAYERS

- 17.2.1 ZHUHAI YUNZHOU INTELLIGENCE TECHNOLOGY LTD.

- 17.2.2 MARITIME ROBOTICS

- 17.2.3 OCIUS TECHNOLOGIES

- 17.2.4 OCEANALPHA

- 17.2.5 SEA MACHINES ROBOTICS, INC.

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 RELATED REPORTS

- 18.4 AUTHOR DETAILS