|

|

市場調査レポート

商品コード

1728612

脂肪族アミンの世界市場:炭素鎖長別、タイプ別、機能別、最終用途別、地域別 - 2030年までの予測Fatty Amines Market by Type (Primary, Secondary, Tertiary), End Use (Agrochemicals, Oilfield Chemicals, Chemical Processing, Water Treatment, Asphalt Additives, Personal Care), Function, Carbon Chain Length, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 脂肪族アミンの世界市場:炭素鎖長別、タイプ別、機能別、最終用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月09日

発行: MarketsandMarkets

ページ情報: 英文 248 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の脂肪族アミンの市場規模は、2025年の36億米ドルから2030年には49億7,000万米ドルに成長し、予測期間中のCAGRは6.7%と予測されています。

脂肪族アミンは、主に天然油脂から得られる脂肪酸に由来する含窒素有機化合物です。窒素原子に結合しているアルキル基の数によって、第一級アミン、第二級アミン、第三級アミンに分類されます。これらの化合物は、乳化剤、分散剤、固結防止剤、浮遊剤、腐食防止剤、化学中間体など、多彩な機能を発揮します。そのため、農薬、油田化学薬品、パーソナルケア、水処理、アスファルト添加剤、化学処理など、さまざまな産業に不可欠です。農作物の生産性を向上させるための農薬需要の増加、産業インフラにおける腐食防止ニーズの高まり、環境規制の強化に対応した廃水処理への高い関心などです。さらに、パーソナルケア産業の拡大が、コンディショナーやローションなどの処方における脂肪族アミンの消費量増加に寄与しています。このような力学は、多様な産業用途における持続的な需要を強化し、脂肪族アミンを、セクターや産業全体の性能、効率、規制遵守を可能にする重要なコンポーネントとして位置づけています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル)、数量(キロトン) |

| セグメント | 炭素鎖長別、タイプ別、機能別、最終用途別、地域別 |

| 対象地域 | 北米、アジア太平洋、欧州、中東・アフリカ、南米 |

分散剤セグメントは、予測期間中、脂肪族アミン市場で金額ベースで第2位のシェアを占めると予測されます。その成長の原動力となっているのは、需要の高い複数の産業で幅広く使用され、拡大していることです。脂肪族アミン系分散剤は、液体製剤中の均一な粒子分布を維持し、凝集や沈殿を効果的に防止するために不可欠です。塗料・コーティング業界では、製品の安定性、流動性、総合的な性能の向上に貢献します。農業分野では、分散剤は有効成分の均一な分散を確保することで、農薬や肥料の供給と効力を向上させます。

また、油田用途では、課題となっている環境条件下での掘削および生産流体の安定化に役立ちます。工業用途や消費者用途では、塗料、コーティング剤、農薬の生産量が特に新興市場で増加していることに加え、高性能配合のニーズが高まっていることが、脂肪族アミン系分散剤の需要を押し上げています。さらに、環境意識の高まりがバイオベースのソリューションへのシフトを加速し、持続可能な分散剤としての脂肪族アミンの採用をさらに後押ししています。こうした多様な分野での重要な役割は、予測期間を通じて分散剤セグメントの力強い成長軌道を維持すると予想されます。

第二級脂肪族アミンセグメントは、その汎用性の高い化学的特性と主要産業分野にわたる幅広い適用性により、予測期間中、世界の脂肪族アミン市場において金額ベースで第二位のシェアを占めると予測されます。二級脂肪族アミンは、アミン基の水素原子1個がアルキル基またはアリール基で置換されているのが特徴で、一級アミンと比べて反応性と熱安定性が向上しています。これらの特性により、界面活性剤、乳化剤、腐食防止剤の合成中間体として非常に適しています。その用途は、農薬、パーソナルケア、油田用化学薬品、水処理など、過酷な条件下での化学的安定性と性能が重要な多業種に及ぶ。化学的劣化に対する強力な耐性と一貫した機能的効能が要求される製剤において、貴重な存在となっています。

産業界がますます高効率で性能重視の化学ソリューションを優先するようになるにつれ、第二級脂肪族アミンの需要は着実に高まっています。多様な製剤要件に適応し、優れた機能性を発揮する二級脂肪族アミンは、脂肪族アミン市場の持続的拡大に大きく貢献しています。

油田用化学品セグメントは、石油・ガス操業の効率と安全性を向上させる上で脂肪族アミンが果たす重要な役割に牽引され、予測期間中、世界の脂肪族アミン市場で金額ベースで2番目に大きなシェアを占めると予測されます。脂肪族アミンは、腐食防止剤、脱乳化剤、スケール防止剤として油田用途に広く利用されています。そのユニークな化学的特性により、金属表面に保護層を形成し、過酷な掘削・生産環境における腐食を効果的に防止します。さらに、エマルジョンの安定化、沈殿物の制御、石油の全体的な流れの促進を支援し、操業の信頼性と費用対効果を向上させる。世界のエネルギー需要が増加し、石油の上流と下流の活動が拡大するにつれて、効率的で特殊な化学ソリューションの必要性が高まっています。最適な生産、設備保護、規制遵守を確保するための高度な油田用化学薬品への依存度が高まるにつれ、石油・ガス産業における脂肪族アミンの採用が促進され、市場での地位がさらに強化されています。

北米は、同地域の多様な業界情勢と複数の最終用途産業にわたる持続的な需要に牽引され、予測期間中、世界の脂肪族アミン市場で金額ベースで第2位のシェアを占めると予測されます。農薬、油田化学薬品、水処理などの治療では、乳化、腐食抑制、分散などの主要な機能特性を持つ脂肪族アミンが広く利用されています。同地域の産業効率重視と厳格な環境規制遵守は、脂肪族アミンのような高性能化学ソリューションの採用をさらに後押ししています。

さらに、同地域の高度な製造能力と継続的な技術革新は、継続的な製品開発と脂肪族アミン用途の拡大のための強固な基盤となっています。こうした要因が、北米における脂肪族アミン市場の着実な成長と隆盛に寄与しています。

当レポートでは、世界の脂肪族アミン市場について調査し、炭素鎖長別、タイプ別、機能別、最終用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- 世界マクロ経済見通し

- バリューチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 価格分析

- 規制状況

- 2025年の主な会議とイベント

- 特許分析

- 技術分析

- 貿易分析

- 投資と資金調達のシナリオ

- 顧客ビジネスに影響を与える動向/混乱

- 生成AI/AIが脂肪酸アミン市場に与える影響

- トランプ関税が脂肪族アミン市場に与える影響

第7章 脂肪族アミン市場(炭素鎖長別)

- イントロダクション

- C8~C10

- C12~C14

- C16~C18

- C20以上

第8章 脂肪族アミン市場(タイプ別)

- イントロダクション

- 第一級

- 第二級

- 第三級

第9章 脂肪族アミン市場(機能別)

- イントロダクション

- 乳化剤

- 浮選剤

- 固結防止剤

- 分散剤

- 腐食防止剤

- 化学中間体

- その他

第10章 脂肪酸アミン市場(最終用途別)

- イントロダクション

- 農薬

- 油田化学品

- 化学処理

- 水処理

- アスファルト添加剤

- パーソナルケア

- その他

第11章 脂肪族アミン市場(地域別)

- イントロダクション

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- トルコ

- その他

- 北米

- 米国

- カナダ

- メキシコ

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- タイ

- マレーシア

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- エジプト

- その他

- 南米

- ブラジル

- コロンビア

- アルゼンチン

- その他

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

- 企業評価と財務指標

第13章 企業プロファイル

- 主要参入企業

- ARKEMA

- EVONIK INDUSTRIES AG

- KAO CORPORATION

- PROCTER & GAMBLE

- BASF

- PT. ECOGREEN OLEOCHEMICALS

- ERCA SPA

- GLOBAL AMINES COMPANY PTE. LTD.

- HUNTSMAN INTERNATIONAL LLC

- INDIA GLYCOLS LIMITED

- INDO AMINES LIMITED

- NOURYON

- QIDA CHEMICAL PTY LTD

- SYENSQO

- VOLANT-CHEM CORP.

- WUHAN OBAYER SCIENCE CO, LTD

- ALBEMARLE CORPORATION

- EASTMAN CHEMICAL COMPANY

- INDORAMA VENTURES PUBLIC COMPANY LIMITED

- その他の企業

- HARCROS CHEMICALS

- ISFAHAN COPOLYMER COMPANY

- KLK OLEO

- SABO S.P.A.

- SHANDONG FUSITE OIL TECHNOLOGY CO., LTD

- ZIBO TENGHUI OIL CHEMICAL CO., LTD.

- VENUS ETHOXYETHERS PVT.LTD.

第14章 隣接市場と関連市場

第15章 付録

List of Tables

- TABLE 1 FATTY AMINES MARKET SNAPSHOT: 2025 VS. 2030

- TABLE 2 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), BY KEY COUNTRY, 2022-2024 (%)

- TABLE 3 UNEMPLOYMENT RATE, BY KEY COUNTRY, 2022-2024 (%)

- TABLE 4 INFLATION RATE AVERAGE CONSUMER PRICES, BY KEY COUNTRY, 2022-2024 (%)

- TABLE 5 FOREIGN DIRECT INVESTMENT, BY REGION, 2022 AND 2023 (USD BILLION)

- TABLE 6 ROLES OF COMPANIES IN FATTY AMINES ECOSYSTEM

- TABLE 7 FATTY AMINES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR THREE END USES (%)

- TABLE 9 KEY BUYING CRITERIA FOR THREE END USES

- TABLE 10 AVERAGE SELLING PRICE TREND OF FATTY AMINES, BY KEY REGION, 2022-2024 (USD/TON)

- TABLE 11 AVERAGE SELLING PRICE TREND OF FATTY AMINES, BY TYPE, 2024 (USD/TON)

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 FATTY AMINES MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025

- TABLE 16 FATTY AMINES MARKET: LIST OF MAJOR PATENTS, 2014-2024

- TABLE 17 IMPORT DATA FOR HS CODE 3823-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 18 EXPORT DATA FOR HS CODE 3823-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 19 FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 20 FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 21 FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 22 FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 23 PRIMARY: FATTY AMINES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 24 PRIMARY: FATTY AMINES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 25 PRIMARY: FATTY AMINES MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 26 PRIMARY: FATTY AMINES MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 27 SECONDARY: FATTY AMINES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 28 SECONDARY: FATTY AMINES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 SECONDARY: FATTY AMINES MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 30 SECONDARY: FATTY AMINES MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 31 TERTIARY: FATTY AMINES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 TERTIARY: FATTY AMINES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 TERTIARY: FATTY AMINES MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 34 TERTIARY: FATTY AMINES MARKET, BY REGION, 2025-2030 (KILOTONS)

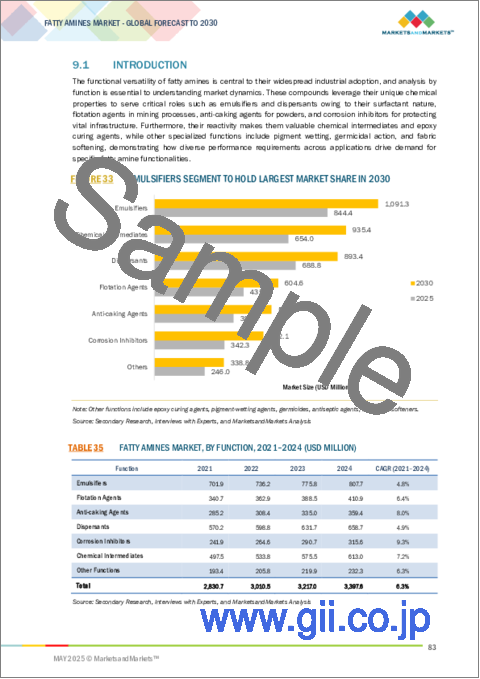

- TABLE 35 FATTY AMINES MARKET, BY FUNCTION, 2021-2024 (USD MILLION)

- TABLE 36 FATTY AMINES MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 37 FATTY AMINES MARKET, BY FUNCTION, 2021-2024 (KILOTONS)

- TABLE 38 FATTY AMINES MARKET, BY FUNCTION, 2025-2030 (KILOTONS)

- TABLE 39 EMULSIFIERS: FATTY AMINES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 EMULSIFIERS: FATTY AMINES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 EMULSIFIERS: FATTY AMINES MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 42 EMULSIFIERS: FATTY AMINES MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 43 FLOTATION AGENTS: FATTY AMINES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 FLOTATION AGENTS: FATTY AMINES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 FLOTATION AGENTS: FATTY AMINES MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 46 FLOTATION AGENTS: FATTY AMINES MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 47 ANTI-CAKING AGENTS: FATTY AMINES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 ANTI-CAKING AGENTS: FATTY AMINES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 ANTI-CAKING AGENTS: FATTY AMINES MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 50 ANTI-CAKING AGENTS: FATTY AMINES MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 51 DISPERSANTS: FATTY AMINES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 DISPERSANTS: FATTY AMINES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 DISPERSANTS: FATTY AMINES MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 54 DISPERSANTS: FATTY AMINES MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 55 CORROSION INHIBITORS: FATTY AMINES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 CORROSION INHIBITORS: FATTY AMINES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 CORROSION INHIBITORS: FATTY AMINES MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 58 CORROSION INHIBITORS: FATTY AMINES MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 59 CHEMICAL INTERMEDIATES: FATTY AMINES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 CHEMICAL INTERMEDIATES: FATTY AMINES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 CHEMICAL INTERMEDIATES: FATTY AMINES MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 62 CHEMICAL INTERMEDIATES: FATTY AMINES MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 63 OTHER FUNCTIONS: FATTY AMINES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 OTHER FUNCTIONS: FATTY AMINES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 OTHER FUNCTIONS: FATTY AMINES MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 66 OTHER FUNCTIONS: FATTY AMINES MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 67 FATTY AMINES MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 68 FATTY AMINES MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 69 FATTY AMINES MARKET, BY END USE, 2021-2024 (KILOTONS)

- TABLE 70 FATTY AMINES MARKET, BY END USE, 2025-2030 (KILOTONS)

- TABLE 71 AGROCHEMICALS: FATTY AMINES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 AGROCHEMICALS: FATTY AMINES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 AGROCHEMICALS: FATTY AMINES MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 74 AGROCHEMICALS: FATTY AMINES MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 75 OILFIELD CHEMICALS: FATTY AMINES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 OILFIELD CHEMICALS: FATTY AMINES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 OILFIELD CHEMICALS: FATTY AMINES MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 78 OILFIELD CHEMICALS: FATTY AMINES MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 79 CHEMICAL PROCESSING: FATTY AMINES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 CHEMICAL PROCESSING: FATTY AMINES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 CHEMICAL PROCESSING: FATTY AMINES MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 82 CHEMICAL PROCESSING: FATTY AMINES MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 83 WATER TREATMENT: FATTY AMINES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 WATER TREATMENT: FATTY AMINES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 WATER TREATMENT: FATTY AMINES MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 86 WATER TREATMENT: FATTY AMINES MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 87 ASPHALT ADDITIVES: FATTY AMINES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 ASPHALT ADDITIVES: FATTY AMINES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 ASPHALT ADDITIVES: FATTY AMINES MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 90 ASPHALT ADDITIVES: FATTY AMINES MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 91 PERSONAL CARE: FATTY AMINES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 PERSONAL CARE: FATTY AMINES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 PERSONAL CARE: FATTY AMINES MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 94 PERSONAL CARE: FATTY AMINES MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 95 OTHER END USES: FATTY AMINES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 OTHER END USES: FATTY AMINES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 OTHER END USES: FATTY AMINES MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 98 OTHER END USES: FATTY AMINES MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 99 FATTY AMINES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 100 FATTY AMINES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 FATTY AMINES MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 102 FATTY AMINES MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 103 EUROPE: FATTY AMINES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 104 EUROPE: FATTY AMINES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 105 EUROPE: FATTY AMINES MARKET, BY COUNTRY, 2021-2024 (KILOTONS)

- TABLE 106 EUROPE: FATTY AMINES MARKET, BY COUNTRY, 2025-2030 (KILOTONS)

- TABLE 107 EUROPE: FATTY AMINES MARKET, BY FUNCTION, 2021-2024 (USD MILLION)

- TABLE 108 EUROPE: FATTY AMINES MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 109 EUROPE: FATTY AMINES MARKET, BY FUNCTION, 2021-2024 (KILOTONS)

- TABLE 110 EUROPE: FATTY AMINES MARKET, BY FUNCTION, 2025-2030 (KILOTONS)

- TABLE 111 EUROPE: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 112 EUROPE: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 113 EUROPE: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 114 EUROPE: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 115 EUROPE: FATTY AMINES MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 116 EUROPE: FATTY AMINES MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 117 EUROPE: FATTY AMINES MARKET, BY END USE, 2021-2024 (KILOTONS)

- TABLE 118 EUROPE: FATTY AMINES MARKET, BY END USE, 2025-2030 (KILOTONS)

- TABLE 119 GERMANY: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 120 GERMANY: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 121 GERMANY: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 122 GERMANY: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 123 UK: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 124 UK: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 125 UK: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 126 UK: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 127 FRANCE: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 128 FRANCE: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 129 FRANCE: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 130 FRANCE: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 131 ITALY: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 132 ITALY: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 133 ITALY: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 134 ITALY: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 135 RUSSIA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 136 RUSSIA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 137 RUSSIA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 138 RUSSIA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 139 TURKEY: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 140 TURKEY: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 141 TURKEY: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 142 TURKEY: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 143 REST OF EUROPE: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 144 REST OF EUROPE: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 145 REST OF EUROPE: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 146 REST OF EUROPE: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 147 NORTH AMERICA: FATTY AMINES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 148 NORTH AMERICA: FATTY AMINES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 149 NORTH AMERICA: FATTY AMINES MARKET, BY COUNTRY, 2021-2024 (KILOTONS)

- TABLE 150 NORTH AMERICA: FATTY AMINES MARKET, BY COUNTRY, 2025-2030 (KILOTONS)

- TABLE 151 NORTH AMERICA: FATTY AMINES MARKET, BY FUNCTION, 2021-2024 (USD MILLION)

- TABLE 152 NORTH AMERICA: FATTY AMINES MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 153 NORTH AMERICA: FATTY AMINES MARKET, BY FUNCTION, 2021-2024 (KILOTONS)

- TABLE 154 NORTH AMERICA: FATTY AMINES MARKET, BY FUNCTION, 2025-2030 (KILOTONS)

- TABLE 155 NORTH AMERICA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 156 NORTH AMERICA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 157 NORTH AMERICA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 158 NORTH AMERICA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 159 NORTH AMERICA: FATTY AMINES MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 160 NORTH AMERICA: FATTY AMINES MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 161 NORTH AMERICA: FATTY AMINES MARKET, BY END USE, 2021-2024 (KILOTONS)

- TABLE 162 NORTH AMERICA: FATTY AMINES MARKET, BY END USE, 2025-2030 (KILOTONS)

- TABLE 163 US: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 164 US: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 165 US: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 166 US: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 167 CANADA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 168 CANADA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 169 CANADA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 170 CANADA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 171 MEXICO: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 172 MEXICO: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 173 MEXICO: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 174 MEXICO: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 175 ASIA PACIFIC: FATTY AMINES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 176 ASIA PACIFIC: FATTY AMINES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 177 ASIA PACIFIC: FATTY AMINES MARKET, BY COUNTRY, 2021-2024 (KILOTONS)

- TABLE 178 ASIA PACIFIC: FATTY AMINES MARKET, BY COUNTRY, 2025-2030 (KILOTONS)

- TABLE 179 ASIA PACIFIC: FATTY AMINES MARKET, BY FUNCTION, 2021-2024 (USD MILLION)

- TABLE 180 ASIA PACIFIC: FATTY AMINES MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 181 ASIA PACIFIC: FATTY AMINES MARKET, BY FUNCTION, 2021-2024 (KILOTONS)

- TABLE 182 ASIA PACIFIC: FATTY AMINES MARKET, BY FUNCTION, 2025-2030 (KILOTONS)

- TABLE 183 ASIA PACIFIC: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 184 ASIA PACIFIC: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 185 ASIA PACIFIC: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 186 ASIA PACIFIC: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 187 ASIA PACIFIC: FATTY AMINES MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 188 ASIA PACIFIC: FATTY AMINES MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 189 ASIA PACIFIC: FATTY AMINES MARKET, BY END USE, 2021-2024 (KILOTONS)

- TABLE 190 ASIA PACIFIC: FATTY AMINES MARKET, BY END USE, 2025-2030 (KILOTONS)

- TABLE 191 CHINA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 192 CHINA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 193 CHINA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 194 CHINA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 195 JAPAN: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 196 JAPAN: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 197 JAPAN: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 198 JAPAN: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 199 INDIA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 200 INDIA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 201 INDIA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 202 INDIA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 203 SOUTH KOREA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 204 SOUTH KOREA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 205 SOUTH KOREA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 206 SOUTH KOREA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 207 THAILAND: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 208 THAILAND: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 209 THAILAND: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 210 THAILAND: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 211 MALAYSIA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 212 MALAYSIA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 213 MALAYSIA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 214 MALAYSIA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 215 REST OF ASIA PACIFIC: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 216 REST OF ASIA PACIFIC: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 217 REST OF ASIA PACIFIC: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 218 REST OF ASIA PACIFIC: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 219 MIDDLE EAST & AFRICA: FATTY AMINES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: FATTY AMINES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: FATTY AMINES MARKET, BY COUNTRY, 2021-2024 (KILOTONS)

- TABLE 222 MIDDLE EAST & AFRICA: FATTY AMINES MARKET, BY COUNTRY, 2025-2030 (KILOTONS)

- TABLE 223 MIDDLE EAST & AFRICA: FATTY AMINES MARKET, BY FUNCTION, 2021-2024 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: FATTY AMINES MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: FATTY AMINES MARKET, BY FUNCTION, 2021-2024 (KILOTONS)

- TABLE 226 MIDDLE EAST & AFRICA: FATTY AMINES MARKET, BY FUNCTION, 2025-2030 (KILOTONS)

- TABLE 227 MIDDLE EAST & AFRICA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 230 MIDDLE EAST & AFRICA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 231 MIDDLE EAST & AFRICA: FATTY AMINES MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: FATTY AMINES MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: FATTY AMINES MARKET, BY END USE, 2021-2024 (KILOTONS)

- TABLE 234 MIDDLE EAST & AFRICA: FATTY AMINES MARKET, BY END USE, 2025-2030 (KILOTONS)

- TABLE 235 SAUDI ARABIA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 236 SAUDI ARABIA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 237 SAUDI ARABIA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 238 SAUDI ARABIA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 239 REST OF GCC COUNTRIES: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 240 REST OF GCC COUNTRIES: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 241 REST OF GCC COUNTRIES: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 242 REST OF GCC COUNTRIES: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 243 SOUTH AFRICA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 244 SOUTH AFRICA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 245 SOUTH AFRICA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 246 SOUTH AFRICA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 247 EGYPT: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 248 EGYPT: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 249 EGYPT: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 250 EGYPT: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 251 REST OF MIDDLE EAST & AFRICA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 252 REST OF MIDDLE EAST & AFRICA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 253 REST OF MIDDLE EAST & AFRICA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 254 REST OF MIDDLE EAST & AFRICA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 255 SOUTH AMERICA: FATTY AMINES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 256 SOUTH AMERICA: FATTY AMINES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 257 SOUTH AMERICA: FATTY AMINES MARKET, BY COUNTRY, 2021-2024 (KILOTONS)

- TABLE 258 SOUTH AMERICA: FATTY AMINES MARKET, BY COUNTRY, 2025-2030 (KILOTONS)

- TABLE 259 SOUTH AMERICA: FATTY AMINES MARKET, BY FUNCTION, 2021-2024 (USD MILLION)

- TABLE 260 SOUTH AMERICA: FATTY AMINES MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 261 SOUTH AMERICA: FATTY AMINES MARKET, BY FUNCTION, 2021-2024 (KILOTONS)

- TABLE 262 SOUTH AMERICA: FATTY AMINES MARKET, BY FUNCTION, 2025-2030 (KILOTONS)

- TABLE 263 SOUTH AMERICA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 264 SOUTH AMERICA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 265 SOUTH AMERICA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 266 SOUTH AMERICA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 267 SOUTH AMERICA: FATTY AMINES MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 268 SOUTH AMERICA: FATTY AMINES MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 269 SOUTH AMERICA: FATTY AMINES MARKET, BY END USE, 2021-2024 (KILOTONS)

- TABLE 270 SOUTH AMERICA: FATTY AMINES MARKET, BY END USE, 2025-2030 (KILOTONS)

- TABLE 271 BRAZIL: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 272 BRAZIL: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 273 BRAZIL: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 274 BRAZIL: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 275 COLOMBIA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 276 COLOMBIA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 277 COLOMBIA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 278 COLOMBIA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 279 ARGENTINA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 280 ARGENTINA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 281 ARGENTINA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 282 ARGENTINA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 283 REST OF SOUTH AMERICA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 284 REST OF SOUTH AMERICA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 285 REST OF SOUTH AMERICA: FATTY AMINES MARKET, BY TYPE, 2021-2024 (KILOTONS)

- TABLE 286 REST OF SOUTH AMERICA: FATTY AMINES MARKET, BY TYPE, 2025-2030 (KILOTONS)

- TABLE 287 FATTY AMINES MARKET: OVERVIEW OF MAJOR STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2025

- TABLE 288 FATTY AMINES MARKET: DEGREE OF COMPETITION, 2024

- TABLE 289 FATTY AMINES MARKET: REGION FOOTPRINT (19 COMPANIES)

- TABLE 290 FATTY AMINES MARKET: TYPE FOOTPRINT (19 COMPANIES)

- TABLE 291 FATTY AMINES MARKET: FUNCTION FOOTPRINT (19 COMPANIES)

- TABLE 292 FATTY AMINES MARKET: END-USE FOOTPRINT (18 COMPANIES)

- TABLE 293 FATTY AMINES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 294 FATTY AMINES MARKET: EXPANSIONS, FEBRUARY 2020-FEBRUARY 2025

- TABLE 295 ARKEMA: COMPANY OVERVIEW

- TABLE 296 ARKEMA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 297 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- TABLE 298 EVONIK INDUSTRIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 299 EVONIK INDUSTRIES AG: EXPANSIONS

- TABLE 300 KAO CORPORATION: COMPANY OVERVIEW

- TABLE 301 KAO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 302 PROCTER & GAMBLE: COMPANY OVERVIEW

- TABLE 303 PROCTER & GAMBLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 304 BASF: COMPANY OVERVIEW

- TABLE 305 BASF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 306 PT. ECOGREEN OLEOCHEMICALS: COMPANY OVERVIEW

- TABLE 307 PT. ECOGREEN OLEOCHEMICALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 308 ERCA SPA: COMPANY OVERVIEW

- TABLE 309 ERCA SPA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 310 GLOBAL AMINES COMPANY PTE. LTD.: COMPANY OVERVIEW

- TABLE 311 GLOBAL AMINES COMPANY PTE. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 312 GLOBAL AMINES COMPANY PTE. LTD.: EXPANSIONS

- TABLE 313 HUNTSMAN INTERNATIONAL LLC: COMPANY OVERVIEW

- TABLE 314 HUNTSMAN INTERNATIONAL LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 315 HUNTSMAN INTERNATIONAL LLC: EXPANSIONS

- TABLE 316 INDIA GLYCOLS LIMITED: COMPANY OVERVIEW

- TABLE 317 INDIA GLYCOLS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 318 INDO AMINES LIMITED: COMPANY OVERVIEW

- TABLE 319 INDO AMINES LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 320 NOURYON: COMPANY OVERVIEW

- TABLE 321 NOURYON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 322 QIDA CHEMICAL PTY LTD: COMPANY OVERVIEW

- TABLE 323 QIDA CHEMICAL PTY LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 324 SYENSQO: COMPANY OVERVIEW

- TABLE 325 SYENSQO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 326 VOLANT-CHEM CORP.: COMPANY OVERVIEW

- TABLE 327 VOLANT-CHEM CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 328 WUHAN OBAYER SCIENCE CO, LTD: COMPANY OVERVIEW

- TABLE 329 WUHAN OBAYER SCIENCE CO, LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 330 ALBEMARLE CORPORATION: COMPANY OVERVIEW

- TABLE 331 ALBEMARLE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 332 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 333 EASTMAN CHEMICAL COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 334 EASTMAN CHEMICAL COMPANY: EXPANSIONS

- TABLE 335 INDORAMA VENTURES PUBLIC COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 336 INDORAMA VENTURES PUBLIC COMPANY LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 337 HARCROS CHEMICALS: COMPANY OVERVIEW

- TABLE 338 ISFAHAN COPOLYMER COMPANY: COMPANY OVERVIEW

- TABLE 339 KLK OLEO: COMPANY OVERVIEW

- TABLE 340 SABO S.P.A.: COMPANY OVERVIEW

- TABLE 341 SHANDONG FUSITE OIL TECHNOLOGY CO., LTD: COMPANY OVERVIEW

- TABLE 342 ZIBO TENGHUI OIL CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 343 VENUS ETHOXYETHERS PVT.LTD.: COMPANY OVERVIEW

- TABLE 344 FATTY AMIDES MARKET, BY PRODUCT FORM, 2015-2022 (USD MILLION)

- TABLE 345 FATTY AMIDES MARKET, BY PRODUCT FORM, 2015-2022 (KILOTONS)

List of Figures

- FIGURE 1 FATTY AMINES MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 FATTY AMINES MARKET: RESEARCH DESIGN

- FIGURE 3 MAIN MATRIX CONSIDERED TO ASSESS DEMAND FOR FATTY AMINES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 METHODOLOGY USED FOR SUPPLY-SIDE SIZING OF FATTY AMINES

- FIGURE 7 FATTY AMINES MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 8 FATTY AMINES MARKET: DATA TRIANGULATION

- FIGURE 9 AGROCHEMICALS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 10 PRIMARY SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 11 EMULSIFIERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 12 SOUTH AMERICA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 INCREASING DEMAND IN AGROCHEMICALS, PERSONAL CARE, AND WATER TREATMENT INDUSTRIES TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 14 SOUTH AMERICA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 TERTIARY SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 AGROCHEMICALS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 EMULSIFIERS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 CHINA TO GROW AT HIGHEST RATE IN FATTY AMINES MARKET DURING FORECAST PERIOD

- FIGURE 19 FATTY AMINES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 FATTY AMINES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 FATTY AMINES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 22 FATTY AMINES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR THREE END USES

- FIGURE 24 KEY BUYING CRITERIA FOR THREE END USES

- FIGURE 25 AVERAGE SELLING PRICE TREND OF FATTY AMINES, BY KEY REGION, 2022-2024

- FIGURE 26 AVERAGE SELLING PRICE TREND OF FATTY AMINES, BY TYPE, 2024 (USD/TON)

- FIGURE 27 MAJOR PATENTS RELATED TO FATTY AMINES, 2014-2024

- FIGURE 28 IMPORT DATA RELATED TO HS CODE 3823-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 29 EXPORT DATA RELATED TO HS CODE 3823-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 30 FATTY AMINES MARKET: INVESTMENT AND FUNDING SCENARIO, 2020-2024 (USD MILLION)

- FIGURE 31 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 32 TERTIARY TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 33 EMULSIFIERS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 34 WATER TREATMENT TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 35 ASIA PACIFIC TO DOMINATE FATTY AMINES MARKET IN 2030

- FIGURE 36 EUROPE: FATTY AMINES MARKET SNAPSHOT

- FIGURE 37 NORTH AMERICA: FATTY AMINES MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: FATTY AMINES MARKET SNAPSHOT

- FIGURE 39 FATTY AMINES MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2019-2024 (USD BILLION)

- FIGURE 40 FATTY AMINES MARKET SHARE ANALYSIS, 2024

- FIGURE 41 FATTY AMINES MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 42 FATTY AMINES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 43 FATTY AMINES MARKET: COMPANY FOOTPRINT

- FIGURE 44 FATTY AMINES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 45 FATTY AMINES MARKET: EV/EBITDA, 2024

- FIGURE 46 FATTY AMINES MARKET: ENTERPRISE VALUE, 2024 (USD BILLION)

- FIGURE 47 FATTY AMINES MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS, 2024

- FIGURE 48 ARKEMA: COMPANY SNAPSHOT

- FIGURE 49 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

- FIGURE 50 KAO CORPORATION: COMPANY SNAPSHOT

- FIGURE 51 PROCTER & GAMBLE: COMPANY SNAPSHOT

- FIGURE 52 BASF: COMPANY SNAPSHOT

- FIGURE 53 HUNTSMAN INTERNATIONAL LLC: COMPANY SNAPSHOT

- FIGURE 54 INDIA GLYCOLS LIMITED: COMPANY SNAPSHOT

- FIGURE 55 INDO AMINES LIMITED: COMPANY SNAPSHOT

- FIGURE 56 SYENSQO: COMPANY SNAPSHOT

- FIGURE 57 ALBEMARLE CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 59 INDORAMA VENTURES PUBLIC COMPANY LIMITED: COMPANY SNAPSHOT

The global fatty amines market is projected to grow from USD 3.60 billion in 2025 to USD 4.97 billion by 2030, at a CAGR of 6.7% during the forecast period. Fatty amines are nitrogen-containing organic compounds derived primarily from fatty acids obtained from natural oils and fats. They are categorized into primary, secondary, and tertiary amines based on the number of alkyl groups bonded to the nitrogen atom. These compounds exhibit versatile functionality, serving as emulsifiers, dispersants, anti-caking agents, flotation agents, corrosion inhibitors, and chemical intermediates. As such, they are integral to various industries, including agrochemicals, oilfield chemicals, personal care, water treatment, asphalt additives, and chemical processing. The global fatty amines market is experiencing steady growth, driven by several key factors: rising demand for agrochemicals to improve crop productivity, increasing need for corrosion protection in industrial infrastructure, and high focus on wastewater treatment in response to stricter environmental regulations. Additionally, the expanding personal care industry is contributing to higher consumption of fatty amines in formulations such as conditioners and lotions. These dynamics are reinforcing sustained demand across diverse industrial applications, positioning fatty amines as critical components in enabling performance, efficiency, and regulatory compliance across sectors and industries.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kilotons) |

| Segments | Type, End Use, Function, Carbon Chain Length, and Region |

| Regions covered | North America, Asia Pacific, Europe, Middle East & Africa, and South America |

"Dispersants segment, by function, to account for second-largest market share during forecast period"

The dispersants segment is projected to hold the second-largest share of the fatty amines market by value during the forecast period. Its growth is driven by its extensive and expanding use across multiple high-demand industries. Fatty amine-based dispersants are essential in maintaining uniform particle distribution in liquid formulations, effectively preventing agglomeration and sedimentation. In the paints & coatings industry, they contribute to enhanced product stability, flow properties, and overall performance. In agriculture, these dispersants improve the delivery and efficacy of pesticides and fertilizers by ensuring even dispersion of active ingredients.

Additionally, in oilfield applications, they help stabilize drilling and production fluids under challenging environmental conditions. The increasing need for high-performance formulations in industrial and consumer applications-alongside growing production of paints, coatings, and agrochemicals, particularly in emerging markets-is driving demand for fatty amine-based dispersants. Moreover, rising environmental awareness is accelerating the shift toward bio-based solutions, further boosting the adoption of fatty amines as sustainable dispersants. These critical roles across diverse sectors are expected to sustain the strong growth trajectory of the dispersants segment throughout the forecast period.

"By type, secondary segment to account for second-largest market share during forecast period"

The secondary fatty amines segment is projected to hold the second-largest share of the global fatty amines market by value during the forecast period, driven by their versatile chemical properties and broad applicability across key industrial sectors. Secondary fatty amines are characterized by the substitution of one hydrogen atom in the amine group with an alkyl or aryl group, imparting them with enhanced reactivity and thermal stability compared to primary amines. These attributes make them highly suitable as intermediates in the synthesis of surfactants, emulsifiers, and corrosion inhibitors. Their utility spans multiple industries-including agrochemicals, personal care, oilfield chemicals, and water treatment-where their chemical stability and performance under harsh conditions are critical. They are valuable in formulations that demand strong resistance to chemical degradation and consistent functional efficacy.

As industries increasingly prioritize high-efficiency, performance-driven chemical solutions, the demand for secondary fatty amines is rising steadily. Their adaptability to diverse formulation requirements and ability to deliver superior functionality position them as a key contributor to the sustained expansion of the fatty amines market.

"By end use, oilfield chemicals segment to account for second-largest market share during forecast period"

The oilfield chemicals segment is projected to hold the second-largest share of the global fatty amines market by value during the forecast period, driven by the critical role fatty amines play in improving the efficiency and safety of oil and gas operations. Fatty amines are widely utilized in oilfield applications as corrosion inhibitors, demulsifiers, and scale inhibitors. Their unique chemical properties enable them to form protective layers on metal surfaces, effectively preventing corrosion in harsh drilling and production environments. Additionally, they assist in stabilizing emulsions, controlling deposits, and enhancing the overall flow of oil, improving operational reliability and cost-effectiveness. As global energy demand rises and upstream and downstream oil activities expand, the need for efficient and specialized chemical solutions grows. This increasing reliance on advanced oilfield chemicals to ensure optimal production, equipment protection, and regulatory compliance is driving the adoption of fatty amines in the oil & gas industry, further strengthening their market position.

"North America to account for second-largest market share during forecast period"

North America is projected to hold the second-largest share of the global fatty amines market by value during the forecast period, driven by the region's diverse industrial landscape and sustained demand across multiple end-use industries. Industries such as agrochemicals, oilfield chemicals, and water treatment extensively utilize fatty amines for their key functional properties, including emulsification, corrosion inhibition, and dispersion. The region's strong focus on industrial efficiency and adherence to stringent environmental regulations further supports the adoption of high-performance chemical solutions like fatty amines.

Moreover, the region's advanced manufacturing capabilities and continuous technological innovations provide a solid foundation for ongoing product development and the expansion of fatty amine applications. These factors contribute to the steady growth and prominence of the fatty amines market in North America.

Profile break-up of primary participants for report:

- By Company Type: Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation: Directors- 25%, Managers- 30%, and Others - 45%

- By Region: North America - 30%, Asia Pacific - 40%, Europe - 20%, Middle East & Africa - 7%, and South America - 3%

Arkema (France), Evonik Industries AG (Germany), Kao Corporation (Japan), Procter and Gamble (US), BASF (Germany), and Nouryon (Netherlands) are some of the major players operating in the fatty amines market. These players have adopted expansions to increase their market share and business revenue.

Research Coverage:

The report defines, segments, and projects the fatty amines market based on type, carbon chain length, function, end use, and region. It provides detailed information regarding the major factors influencing the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles fatty amine manufacturers, comprehensively analyzing their market shares and core competencies, and tracks and analyzes competitive developments, such as partnerships, agreements, product launches, and joint ventures.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the fatty amines market and its segments. This report is also expected to help stakeholders understand the market's competitive landscape better, gain insights to improve the position of their businesses, and make suitable go-to-market strategies. It also enables stakeholders to understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of critical drivers (Growing demand for fatty amines in various industries and sectors), restraints (Fluctuations in raw material prices), opportunities (Surge in demand for bio-based coating additives), and challenges (Environmental concerns regarding ammonia as byproduct) influencing the growth of the fatty amines market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities in the fatty amines market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the fatty amines market across varied regions.

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the fatty amines market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as Arkema (France), Evonik Industries AG (Germany), Kao Corporation (Japan), Procter and Gamble (US), BASF (Germany), and Nouryon (Netherlands), and others in the fatty amines market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants-demand and supply sides

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 DEMAND-SIDE ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 SUPPLY-SIDE ANALYSIS

- 2.4.1 CALCULATIONS FOR SUPPLY-SIDE ANALYSIS

- 2.5 GROWTH FORECAST

- 2.6 DATA TRIANGULATION

- 2.7 FACTOR ANALYSIS

- 2.8 RESEARCH ASSUMPTIONS

- 2.9 RESEARCH LIMITATIONS

- 2.10 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FATTY AMINES MARKET

- 4.2 FATTY AMINES MARKET, BY REGION

- 4.3 FATTY AMINES MARKET, BY TYPE

- 4.4 FATTY AMINES MARKET, BY END USE

- 4.5 FATTY AMINES MARKET, BY FUNCTION

- 4.6 FATTY AMINES MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand for fatty amines in various end-use industries

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fluctuations in raw material prices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Surging demand for bio-based coating additives

- 5.2.4 CHALLENGES

- 5.2.4.1 Environmental concerns regarding ammonia as by-product

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 GLOBAL MACROECONOMIC OUTLOOK

- 6.2 VALUE CHAIN ANALYSIS

- 6.3 ECOSYSTEM ANALYSIS

- 6.4 PORTER'S FIVE FORCES ANALYSIS

- 6.4.1 THREAT OF NEW ENTRANTS

- 6.4.2 THREAT OF SUBSTITUTES

- 6.4.3 BARGAINING POWER OF SUPPLIERS

- 6.4.4 BARGAINING POWER OF BUYERS

- 6.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.5 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.5.2 BUYING CRITERIA

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 6.6.2 AVERAGE SELLING PRICE TREND, BY TYPE, 2024

- 6.7 REGULATORY LANDSCAPE

- 6.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8 KEY CONFERENCES AND EVENTS, 2025

- 6.9 PATENT ANALYSIS

- 6.9.1 METHODOLOGY

- 6.10 TECHNOLOGY ANALYSIS

- 6.10.1 KEY TECHNOLOGIES

- 6.10.1.1 FLEXIZYME bio-catalysis technology

- 6.10.2 ADJCAENT TECHNOLOGIES

- 6.10.2.1 Ethoxylate

- 6.10.1 KEY TECHNOLOGIES

- 6.11 TRADE ANALYSIS

- 6.11.1 IMPORT SCENARIO (HS CODE 3823)

- 6.11.2 EXPORT SCENARIO (HS CODE 3823)

- 6.12 INVESTMENT AND FUNDING SCENARIO

- 6.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.14 IMPACT OF GENERATIVE AI/AI ON FATTY AMINES MARKET

- 6.14.1 INTRODUCTION

- 6.14.2 PROCESS OPTIMIZATION

- 6.14.3 QUALITY CONTROL

- 6.14.4 AI-DRIVEN INNOVATIONS

- 6.15 IMPACT OF TRUMP TARIFF ON FATTY AMINES MARKET

- 6.15.1 KEY TARIFF RATES IMPACTING MARKET

- 6.15.2 PRICE IMPACT ANALYSIS

- 6.15.3 IMPACT ON SEVERAL REGIONS/COUNTRIES

- 6.15.3.1 US

- 6.15.3.2 Europe

- 6.15.3.3 Asia Pacific

- 6.15.4 IMPACT OF TRUMP TARIFF RATES ON END-USE INDUSTRIES IN FATTY AMINES MARKET

- 6.15.4.1 Agrochemicals

- 6.15.4.2 Oilfield chemicals

- 6.15.4.3 Chemical processing

- 6.15.4.4 Water treatment

- 6.15.4.5 Asphalt additives

- 6.15.4.6 Personal care

7 FATTY AMINES MARKET, BY CARBON CHAIN LENGTH

- 7.1 INTRODUCTION

- 7.2 C8-C10

- 7.3 C12-C14

- 7.4 C16-C18

- 7.5 C20+

8 FATTY AMINES MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.2 PRIMARY

- 8.2.1 RISING DEMAND FOR CORROSION INHIBITORS AND SURFACTANTS TO DRIVE MARKET

- 8.3 SECONDARY

- 8.3.1 BOOMING TEXTILE AND OIL INDUSTRIES TO ACCELERATE MARKET GROWTH

- 8.4 TERTIARY

- 8.4.1 SURGING DEMAND FOR FABRIC SOFTENERS AND DISINFECTANTS TO FUEL MARKET GROWTH

9 FATTY AMINES MARKET, BY FUNCTION

- 9.1 INTRODUCTION

- 9.2 EMULSIFIERS

- 9.2.1 GROWING DEMAND FOR EMULSIFIERS IN INDUSTRIAL AND PERSONAL CARE SECTORS TO DRIVE MARKET

- 9.3 FLOTATION AGENTS

- 9.3.1 SURGING DEMAND FOR IRON ORE TO ACCELERATE ADOPTION

- 9.4 ANTI-CAKING AGENTS

- 9.4.1 EXPANDING AGRICULTURE AND CHEMICAL INDUSTRIES TO BOOST DEMAND

- 9.5 DISPERSANTS

- 9.5.1 RISING DEMAND FOR HIGH-PERFORMANCE DISPERSANTS TO PROPEL MARKET

- 9.6 CORROSION INHIBITORS

- 9.6.1 RISING NEED FOR CORROSION PROTECTION TO BOOST DEMAND

- 9.7 CHEMICAL INTERMEDIATES

- 9.7.1 GROWING DEMAND IN AGROCHEMICAL AND PHARMACEUTICAL INDUSTRIES TO DRIVE MARKET

- 9.8 OTHER FUNCTIONS

10 FATTY AMINE MARKET, BY END USE

- 10.1 INTRODUCTION

- 10.2 AGROCHEMICALS

- 10.2.1 RISING AGROCHEMICAL DEMAND AMID GLOBAL FOOD SECURITY CONCERNS TO BOOST MARKET GROWTH

- 10.3 OILFIELD CHEMICALS

- 10.3.1 INCREASED ENERGY SECURITY INITIATIVES AND DRILLING ACTIVITIES TO DRIVE MARKET

- 10.4 CHEMICAL PROCESSING

- 10.4.1 SURGE IN DEMAND FOR HIGH-PERFORMANCE INTERMEDIATES TO PROPEL MARKET

- 10.5 WATER TREATMENT

- 10.5.1 INCREASING DEMAND FOR ADVANCED WATER TREATMENT SOLUTIONS AND STRICT ENVIRONMENTAL NORMS TO FUEL MARKET GROWTH

- 10.6 ASPHALT ADDITIVES

- 10.6.1 INCREASE IN DEMAND FOR DURABLE ROAD INFRASTRUCTURE AND LOW-EMISSION PAVING MATERIALS TO ACCELERATE MARKET GROWTH

- 10.7 PERSONAL CARE

- 10.7.1 RISING DEMAND FOR SURFACTANTS AND EMULSIFIERS IN COSMETICS INDUSTRY TO DRIVE MARKET

- 10.8 OTHER END USES

11 FATTY AMINES MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 EUROPE

- 11.2.1 GERMANY

- 11.2.1.1 Presence of advanced wastewater treatment ecosystem to fuel demand

- 11.2.2 UK

- 11.2.2.1 Growing industrial water treatment sector to propel market

- 11.2.3 FRANCE

- 11.2.3.1 Rising use of bio-based ingredients in cosmetics and advanced water treatment solutions to boost market growth

- 11.2.4 ITALY

- 11.2.4.1 Expanding agrochemicals and cosmetics industries and wastewater treatment infrastructure to drive market

- 11.2.5 RUSSIA

- 11.2.5.1 Rise in agricultural and industrial growth to drive market

- 11.2.6 TURKEY

- 11.2.6.1 Growing use in agriculture, beauty, and infrastructure sectors to drive market

- 11.2.7 REST OF EUROPE

- 11.2.1 GERMANY

- 11.3 NORTH AMERICA

- 11.3.1 US

- 11.3.1.1 Emerging demand in energy, agriculture, and infrastructure sectors to drive market

- 11.3.2 CANADA

- 11.3.2.1 Growing demand from beauty and infrastructure sectors to propel market

- 11.3.3 MEXICO

- 11.3.3.1 Expanding agrochemical, water treatment, and construction industries to boost market growth

- 11.3.1 US

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Water management reforms and growth of agrochemical industry to fuel market growth

- 11.4.2 JAPAN

- 11.4.2.1 Rising demand in agrochemical industry to fuel market growth

- 11.4.3 INDIA

- 11.4.3.1 Agrochemical boom and rising number of wastewater treatment plants to fuel demand

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Booming personal care and agriculture industries to drive market

- 11.4.5 THAILAND

- 11.4.5.1 Rising investments in wastewater management, cosmetics, and agrochemical applications to drive market

- 11.4.6 MALAYSIA

- 11.4.6.1 Booming palm oil, personal care, and agrochemicals industries to boost market growth

- 11.4.7 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Sustained oil & gas activities and strategic economic diversification to fuel market growth

- 11.5.1.2 Rest of GCC Countries

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Growth of agrochemicals industry to drive market

- 11.5.3 EGYPT

- 11.5.3.1 Rising infrastructure development and major environmental projects to propel market

- 11.5.4 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Booming agribusiness and wastewater upgrades to drive market

- 11.6.2 COLOMBIA

- 11.6.2.1 Growing environmental regulations and rising focus on formulated chemical inputs to drive market

- 11.6.3 ARGENTINA

- 11.6.3.1 High agrochemical consumption and investments in wastewater infrastructure to propel market

- 11.6.4 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.3.1 REVENUE ANALYSIS OF TOP FIVE PLAYERS

- 12.4 MARKET SHARE ANALYSIS

- 12.4.1 ARKEMA (FRANCE)

- 12.4.2 KAO CORPORATION (JAPAN)

- 12.4.3 PROCTER & GAMBLE (US)

- 12.4.4 EVONIK INDUSTRIES AG (GERMANY)

- 12.4.5 BASF (GERMANY)

- 12.4.6 NOURYON (NETHERLANDS)

- 12.5 BRAND/PRODUCT COMPARISON

- 12.5.1 NORAMOX

- 12.5.2 ROFAMIN

- 12.5.3 ERCAMIN

- 12.5.4 ADOGEN

- 12.5.5 JEFFADD

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.6.5.1 Company footprint

- 12.6.5.2 Region footprint

- 12.6.5.3 Type footprint

- 12.6.5.4 Function footprint

- 12.6.5.5 End use footprint

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.7.5.1 Competitive benchmarking of key startups/SMEs

- 12.8 COMPETITIVE SCENARIO

- 12.8.1 EXPANSIONS

- 12.9 COMPANY VALUATION AND FINANCIAL METRICS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 ARKEMA

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 MnM view

- 13.1.1.3.1 Key strengths/Right to win

- 13.1.1.3.2 Strategic choices

- 13.1.1.3.3 Weaknesses/Competitive threats

- 13.1.2 EVONIK INDUSTRIES AG

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 KAO CORPORATION

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 MnM view

- 13.1.3.3.1 Key strengths/Right to win

- 13.1.3.3.2 Strategic choices

- 13.1.3.3.3 Weaknesses/Competitive threats

- 13.1.4 PROCTER & GAMBLE

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Key strengths/Right to win

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses/Competitive threats

- 13.1.5 BASF

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths/Right to win

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses/Competitive threats

- 13.1.6 PT. ECOGREEN OLEOCHEMICALS

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.7 ERCA SPA

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.8 GLOBAL AMINES COMPANY PTE. LTD.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Expansions

- 13.1.9 HUNTSMAN INTERNATIONAL LLC

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Expansions

- 13.1.10 INDIA GLYCOLS LIMITED

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.11 INDO AMINES LIMITED

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.12 NOURYON

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.13 QIDA CHEMICAL PTY LTD

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.14 SYENSQO

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.15 VOLANT-CHEM CORP.

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.16 WUHAN OBAYER SCIENCE CO, LTD

- 13.1.16.1 Business overview

- 13.1.16.2 Products/Solutions/Services offered

- 13.1.17 ALBEMARLE CORPORATION

- 13.1.17.1 Business overview

- 13.1.17.2 Products/Solutions/Services offered

- 13.1.18 EASTMAN CHEMICAL COMPANY

- 13.1.18.1 Business overview

- 13.1.18.2 Products/Solutions/Services offered

- 13.1.18.3 Recent developments

- 13.1.18.3.1 Expansions

- 13.1.19 INDORAMA VENTURES PUBLIC COMPANY LIMITED

- 13.1.19.1 Business overview

- 13.1.19.2 Products/Solutions/Services offered

- 13.1.1 ARKEMA

- 13.2 OTHER PLAYERS

- 13.2.1 HARCROS CHEMICALS

- 13.2.2 ISFAHAN COPOLYMER COMPANY

- 13.2.3 KLK OLEO

- 13.2.4 SABO S.P.A.

- 13.2.5 SHANDONG FUSITE OIL TECHNOLOGY CO., LTD

- 13.2.6 ZIBO TENGHUI OIL CHEMICAL CO., LTD.

- 13.2.7 VENUS ETHOXYETHERS PVT.LTD.

14 ADJACENT AND RELATED MARKET

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 INTERCONNECTED MARKET

- 14.4 FATTY AMIDES MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

- 14.4.3 FATTY AMIDES MARKET, BY PRODUCT FORM

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS