|

|

市場調査レポート

商品コード

1725766

ハードウェアインザループ (HIL) 市場:オファリング別、タイプ別、業界別、地域別 - 2030年までの予測Hardware in the Loop Market by Offering (Hardware, Software and Consulting and System Design, System Integration, Maintenance and Support), Type (Open Loop, Closed Loop), Vertical and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ハードウェアインザループ (HIL) 市場:オファリング別、タイプ別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年04月29日

発行: MarketsandMarkets

ページ情報: 英文 243 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

ハードウェアインザループ (HIL) の市場規模は、2024年に10億170万米ドルとなりました。

同市場は、2025年から2030年にかけて10.1%のCAGRで拡大し、2030年には17億8,440万米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | オファリング別、タイプ別、業界別、地域別 |

| 対象地域 | 北米、欧州、APAC、RoW |

ハードウェアインザループ (HIL) 業界は、組込みシステムの複雑化、電気自動車や自律走行車の普及、製品の検証をより迅速かつ安価に行う必要性などの要因により成長しています。さらに、リアルタイム・シミュレーションとデジタル・ツインの進歩、安全性とコンプライアンスを満たすための規制圧力の高まりも、市場の成長を後押ししています。セットアップのための初期投資が高く、専門の人材も必要です。レガシー業務システムとの統合に関する問題も大きな抑制要因であり、小規模組織や新興市場での普及が制限される可能性があります。

ソフトウェア分野は、リアルタイムシミュレーションシステムにおける柔軟性、拡張性、インテリジェンスを実現する役割が高まっているため、予測期間中、ハードウェアインザループ (HIL) 市場で最も高いCAGRで成長すると予想されます。特に電気自動車、自律走行、航空宇宙システム、再生可能エネルギーなど、組込みシステムが複雑化するにつれて、実世界の状況やシステム動作を正確にモデル化できる高度なシミュレーション、自動化、制御ソフトウェアに対する需要が高まっています。また、ソフトウェアエコシステムは、デジタルツインやアルゴリズムの統合、機械学習ベースの自動化をテスト作業に利用することを可能にし、テスト効率を向上させ、市場投入までの時間を大幅に短縮します。

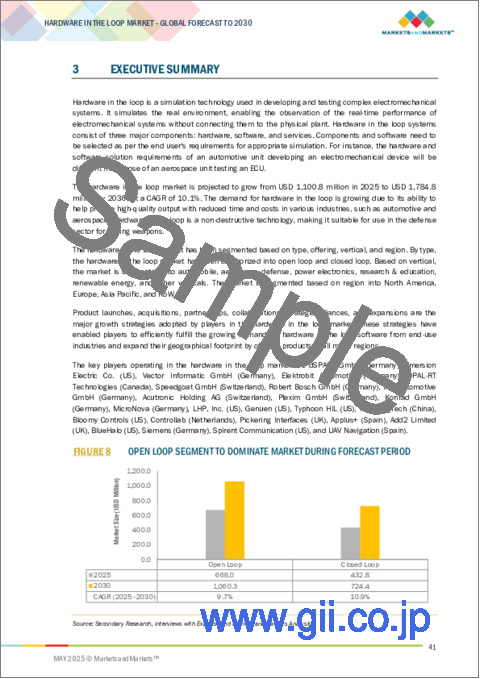

オープンループセグメントは、予測期間中、ハードウェアインザループ (HIL) 市場で最大のシェアを占めると予測されています。これらのシステムは、初期段階の開発とコスト重視のシナリオの両方で一般的に使用されています。オープンループHILシステムは、クローズドループシステムよりもセットアップがシンプルでコストがかからないため、応答時間が即時フィードバックを必要としないアプリケーションで大きな魅力を発揮します。

アジア太平洋のハードウェアインザループ (HIL) 市場は、急速な産業成長、電気自動車(EV)への投資の増加、自動化と技術革新に対する政府の強力な支援により、予測期間中に最も高いCAGRを達成すると予測されています。中国、インド、日本、韓国などの国々は、自動車、航空宇宙、エネルギーの各分野で先端技術に多額の投資を行っており、これらはすべてHILシステムのリアルタイム・シミュレーションとテスト機能によって支えられています。

当レポートでは、世界のハードウェアインザループ (HIL) 市場について調査し、オファリング別、タイプ別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- エコシステム分析

- 顧客に影響を与える動向/混乱

- ケーススタディ

- 技術分析

- 価格分析

- 貿易分析

- 関税と規制状況

- 特許分析

- 2025年~2026年の主な会議とイベント

- AI/生成AIがハードウェア・イン・ザ・ループ市場に与える影響

- 投資と資金調達のシナリオ

- 2025年の米国関税がループ市場におけるハードウェアに与える影響

第6章 ハードウェアインザループ (HIL) 市場、オファリング別

- イントロダクション

- ハードウェア

- ソフトウェア

- サービス

第7章 ハードウェアインザループ (HIL) 市場、タイプ別

- イントロダクション

- オープンループ

- クローズドループ

第8章 ハードウェアインザループ (HIL) 市場、業界別

- イントロダクション

- 自動車

- 航空宇宙

- 防衛

- パワーエレクトロニクス

- 研究と教育

- 再生可能エネルギー

- その他の

第9章 ハードウェアインザループ (HIL) 市場、地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 北米のマクロ経済見通し

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- ポーランド

- 北欧

- その他

- 欧州のマクロ経済見通し

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- インドネシア

- オーストラリア

- マレーシア

- タイ

- ベトナム

- その他

- アジア太平洋のマクロ経済見通し

- その他の地域

- 南米

- 中東

- アフリカ

- その他の地域のマクロ経済見通し

第10章 競合情勢

- 概要

- 主な戦略/強み、2021年~2025年

- 収益分析、2022年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標、2025年

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- DSPACE

- EMERSON ELECTRIC CO.

- VECTOR INFORMATIK

- ELEKTROBIT AUTOMOTIVE

- OPAL-RT TECHNOLOGIES

- SPEEDGOAT

- BOSCH SOFTWARE PRIVATE LIMITED

- TYPHOON HIL

- IPG AUTOMOTIVE

- ACUTRONIC

- PLEXIM

- その他の企業

- GENUEN

- LHP, INC.

- MICRONOVA

- KONRAD TECHNOLOGIES

- MODELINGTECH

- BLOOMY CONTROLS

- CONTROLLAB

- PICKERING INTERFACES

- APPLUS+

- ADD2 LIMITED

- BLUEHALO

- SIEMENS

- SPIRENT COMMUNICATIONS

- UAV NAVIGATION

第12章 付録

List of Tables

- TABLE 1 RESEARCH ASSUMPTIONS: HARDWARE IN THE LOOP MARKET

- TABLE 2 LIMITATIONS AND ASSOCIATED RISKS

- TABLE 3 HARDWARE IN THE LOOP MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 4 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE VERTICALS (%)

- TABLE 5 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 6 HARDWARE IN THE LOOP MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 7 AVERAGE SELLING PRICE OF HARDWARE IN THE LOOP TEST SYSTEM PROVIDED BY KEY PLAYERS, 2024 (USD)

- TABLE 8 AVERAGE SELLING PRICE TREND OF HARDWARE IN THE LOOP TEST SYSTEM, BY REGION, 2021 TO 2024

- TABLE 9 IMPORT DATA FOR HS CODE 9031-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024, (USD THOUSAND)

- TABLE 10 EXPORT DATA FOR HS CODE 9031-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 11 MFN TARIFFS FOR MEASURING OR CHECKING INSTRUMENTS, APPLIANCES, AND MACHINES IMPORTED BY CHINA

- TABLE 12 MFN TARIFFS FOR MEASURING OR CHECKING INSTRUMENTS, APPLIANCES, AND MACHINES IMPORTED BY US

- TABLE 13 MFN TARIFF FOR MEASURING OR CHECKING INSTRUMENTS, APPLIANCES, AND MACHINES IMPORTED BY GERMANY

- TABLE 14 MFN TARIFF FOR MEASURING OR CHECKING INSTRUMENTS, APPLIANCES, AND MACHINES IMPORTED BY INDIA

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 MAJOR PATENTS IN HARDWARE IN THE LOOP MARKET, 2015-2025

- TABLE 19 HARDWARE IN THE LOOP MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 20 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 21 HARDWARE IN THE LOOP MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 22 HARDWARE IN THE LOOP MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 23 HARDWARE IN THE LOOP MARKET, BY OFFERING, 2021-2024 (THOUSAND UNITS)

- TABLE 24 HARDWARE IN THE LOOP MARKET, BY OFFERING, 2025-2030 (THOUSAND UNITS)

- TABLE 25 SERVICES: HARDWARE IN THE LOOP MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 26 SERVICES: HARDWARE IN THE LOOP MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 27 HARDWARE IN THE LOOP MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 28 HARDWARE IN THE LOOP MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 29 OPEN LOOP: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 30 OPEN LOOP: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 31 CLOSED LOOP: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 32 CLOSED LOOP: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 33 HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 34 HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 35 AUTOMOBILE: HARDWARE IN THE LOOP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 AUTOMOBILE: HARDWARE IN THE LOOP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 AUTOMOBILE: HARDWARE IN THE LOOP MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 38 AUTOMOBILE: HARDWARE IN THE LOOP MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 39 AUTOMOBILE: HARDWARE IN THE LOOP MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 40 AUTOMOBILE: HARDWARE IN THE LOOP MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 41 AUTOMOBILE: HARDWARE IN THE LOOP MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 42 AUTOMOBILE: HARDWARE IN THE LOOP MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 43 AUTOMOBILE: HARDWARE IN THE LOOP MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 44 AUTOMOBILE: HARDWARE IN THE LOOP MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 45 AUTOMOBILE: HARDWARE IN THE LOOP MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 AUTOMOBILE: HARDWARE IN THE LOOP MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 AUTOMOBILE: HARDWARE IN THE LOOP MARKET IN MIDDLE EAST, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 48 AUTOMOBILE: HARDWARE IN THE LOOP MARKET IN MIDDLE EAST, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 49 AUTOMOBILE: HARDWARE IN THE LOOP MARKET IN AFRICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 50 AUTOMOBILE: HARDWARE IN THE LOOP MARKET IN AFRICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 51 AEROSPACE: HARDWARE IN THE LOOP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 AEROSPACE: HARDWARE IN THE LOOP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 AEROSPACE: HARDWARE IN THE LOOP MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 54 AEROSPACE: HARDWARE IN THE LOOP MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 55 AEROSPACE: HARDWARE IN THE LOOP MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 56 AEROSPACE: HARDWARE IN THE LOOP MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 57 AEROSPACE: HARDWARE IN THE LOOP MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 58 AEROSPACE: HARDWARE IN THE LOOP MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 59 AEROSPACE: HARDWARE IN THE LOOP MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 60 AEROSPACE: HARDWARE IN THE LOOP MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 61 AEROSPACE: HARDWARE IN THE LOOP MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 AEROSPACE: HARDWARE IN THE LOOP MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 AEROSPACE: HARDWARE IN THE LOOP MARKET IN MIDDLE EAST, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 64 AEROSPACE: HARDWARE IN THE LOOP MARKET IN MIDDLE EAST, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 65 AEROSPACE: HARDWARE IN THE LOOP MARKET IN AFRICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 66 AEROSPACE: HARDWARE IN THE LOOP MARKET IN AFRICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 67 DEFENSE: HARDWARE IN THE LOOP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 DEFENSE: HARDWARE IN THE LOOP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 DEFENSE: HARDWARE IN THE LOOP MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 70 DEFENSE: HARDWARE IN THE LOOP MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 71 DEFENSE: HARDWARE IN THE LOOP MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 72 DEFENSE: HARDWARE IN THE LOOP MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 73 DEFENSE: HARDWARE IN THE LOOP MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 74 DEFENSE: HARDWARE IN THE LOOP MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 75 DEFENSE: HARDWARE IN THE LOOP MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 76 DEFENSE: HARDWARE IN THE LOOP MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 77 DEFENSE: HARDWARE IN THE LOOP MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 DEFENSE: HARDWARE IN THE LOOP MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 DEFENSE: HARDWARE IN THE LOOP MARKET IN MIDDLE EAST, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 80 DEFENSE: HARDWARE IN THE LOOP MARKET IN MIDDLE EAST, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 81 DEFENSE: HARDWARE IN THE LOOP MARKET IN AFRICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 82 DEFENSE: HARDWARE IN THE LOOP MARKET IN AFRICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 83 POWER ELECTRONICS: HARDWARE IN THE LOOP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 POWER ELECTRONICS: HARDWARE IN THE LOOP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 POWER ELECTRONICS: HARDWARE IN THE LOOP MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 86 POWER ELECTRONICS: HARDWARE IN THE LOOP MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 87 POWER ELECTRONICS: HARDWARE IN THE LOOP MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 88 POWER ELECTRONICS: HARDWARE IN THE LOOP MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 89 POWER ELECTRONICS: HARDWARE IN THE LOOP MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 90 POWER ELECTRONICS: HARDWARE IN THE LOOP MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 91 POWER ELECTRONICS: HARDWARE IN THE LOOP MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 92 POWER ELECTRONICS: HARDWARE IN THE LOOP MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 93 POWER ELECTRONICS: HARDWARE IN THE LOOP MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 POWER ELECTRONICS: HARDWARE IN THE LOOP MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 POWER ELECTRONICS: HARDWARE IN THE LOOP MARKET IN MIDDLE EAST, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 96 POWER ELECTRONICS: HARDWARE IN THE LOOP MARKET IN MIDDLE EAST, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 97 POWER ELECTRONICS: HARDWARE IN THE LOOP MARKET IN AFRICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 98 POWER ELECTRONICS: HARDWARE IN THE LOOP MARKET IN AFRICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 99 RESEARCH & EDUCATION: HARDWARE IN THE LOOP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 100 RESEARCH & EDUCATION: HARDWARE IN THE LOOP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 RESEARCH & EDUCATION: HARDWARE IN THE LOOP MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 102 RESEARCH & EDUCATION: HARDWARE IN THE LOOP MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 103 RESEARCH & EDUCATION: HARDWARE IN THE LOOP MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 104 RESEARCH & EDUCATION: HARDWARE IN THE LOOP MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 105 RESEARCH & EDUCATION: HARDWARE IN THE LOOP MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 106 RESEARCH & EDUCATION: HARDWARE IN THE LOOP MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 107 RESEARCH & EDUCATION: HARDWARE IN THE LOOP MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 108 RESEARCH & EDUCATION: HARDWARE IN THE LOOP MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 109 RESEARCH & EDUCATION: HARDWARE IN THE LOOP MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 110 RESEARCH & EDUCATION: HARDWARE IN THE LOOP MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111 RESEARCH & EDUCATION: HARDWARE IN THE LOOP MARKET IN MIDDLE EAST, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 112 RESEARCH & EDUCATION: HARDWARE IN THE LOOP MARKET IN MIDDLE EAST, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 113 RESEARCH & EDUCATION: HARDWARE IN THE LOOP MARKET IN AFRICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 114 RESEARCH & EDUCATION: HARDWARE IN THE LOOP MARKET IN AFRICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 115 RENEWABLE ENERGY: HARDWARE IN THE LOOP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 116 RENEWABLE ENERGY: HARDWARE IN THE LOOP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 117 RENEWABLE ENERGY: HARDWARE IN THE LOOP MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 118 RENEWABLE ENERGY: HARDWARE IN THE LOOP MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 119 RENEWABLE ENERGY: HARDWARE IN THE LOOP MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 120 RENEWABLE ENERGY: HARDWARE IN THE LOOP MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 121 RENEWABLE ENERGY: HARDWARE IN THE LOOP MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 122 RENEWABLE ENERGY: HARDWARE IN THE LOOP MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 123 RENEWABLE ENERGY: HARDWARE IN THE LOOP MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 124 RENEWABLE ENERGY: HARDWARE IN THE LOOP MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 125 RENEWABLE ENERGY: HARDWARE IN THE LOOP MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 126 RENEWABLE ENERGY: HARDWARE IN THE LOOP MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 127 RENEWABLE ENERGY: HARDWARE IN THE LOOP MARKET IN MIDDLE EAST, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 128 RENEWABLE ENERGY: HARDWARE IN THE LOOP MARKET IN MIDDLE EAST, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 129 RENEWABLE ENERGY: HARDWARE IN THE LOOP MARKET IN AFRICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 130 RENEWABLE ENERGY: HARDWARE IN THE LOOP MARKET IN AFRICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 131 OTHER VERTICALS: HARDWARE IN THE LOOP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 132 OTHER VERTICALS: HARDWARE IN THE LOOP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 133 OTHER VERTICALS: HARDWARE IN THE LOOP MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 134 OTHER VERTICALS: HARDWARE IN THE LOOP MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 135 OTHER VERTICALS: HARDWARE IN THE LOOP MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 136 OTHER VERTICALS: HARDWARE IN THE LOOP MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 137 OTHER VERTICALS: HARDWARE IN THE LOOP MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 138 OTHER VERTICALS: HARDWARE IN THE LOOP MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 139 OTHER VERTICALS: HARDWARE IN THE LOOP MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 140 OTHER VERTICALS: HARDWARE IN THE LOOP MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 141 OTHER VERTICALS: HARDWARE IN THE LOOP MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 142 OTHER VERTICALS: HARDWARE IN THE LOOP MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 143 OTHER VERTICALS: HARDWARE IN THE LOOP MARKET IN MIDDLE EAST, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 144 OTHER VERTICALS: HARDWARE IN THE LOOP MARKET IN MIDDLE EAST, BY REGION, 2025-2030 (USD MILLION)

- TABLE 145 OTHER VERTICALS: HARDWARE IN THE LOOP MARKET IN AFRICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 146 OTHER VERTICALS: HARDWARE IN THE LOOP MARKET IN AFRICA, BY REGION, 2025-2030 (USD MILLION)

- TABLE 147 HARDWARE IN THE LOOP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 148 HARDWARE IN THE LOOP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 149 NORTH AMERICA: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 150 NORTH AMERICA: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 151 NORTH AMERICA: HARDWARE IN THE LOOP MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 152 NORTH AMERICA: HARDWARE IN THE LOOP MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 153 US: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 154 US: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 155 CANADA: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 156 CANADA: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 157 MEXICO: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 158 MEXICO: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 159 EUROPE: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 160 EUROPE: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 161 EUROPE: HARDWARE IN THE LOOP MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 162 EUROPE: HARDWARE IN THE LOOP MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 163 UK: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 164 UK: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 165 GERMANY: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 166 GERMANY: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 167 FRANCE: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 168 FRANCE: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 169 ITALY: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 170 ITALY: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 171 SPAIN: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 172 SPAIN: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 173 POLAND: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 174 POLAND: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 175 NORDICS: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 176 NORDICS: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 177 REST OF EUROPE: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 178 REST OF EUROPE: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 179 ASIA PACIFIC: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 180 ASIA PACIFIC: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 181 ASIA PACIFIC: HARDWARE IN THE LOOP MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 182 ASIA PACIFIC: HARDWARE IN THE LOOP MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 183 CHINA: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 184 CHINA: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 185 INDIA: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 186 INDIA: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 187 JAPAN: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 188 JAPAN: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 189 SOUTH KOREA: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 190 SOUTH KOREA: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 191 INDONESIA: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 192 INDONESIA: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 193 AUSTRALIA: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 194 AUSTRALIA: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 195 MALAYSIA: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 196 MALAYSIA: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 197 THAILAND: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 198 THAILAND: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 199 VIETNAM: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 200 VIETNAM: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 201 REST OF ASIA PACIFIC: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 202 REST OF ASIA PACIFIC: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 203 ROW: HARDWARE IN THE LOOP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 204 ROW: HARDWARE IN THE LOOP MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 205 ROW: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 206 ROW: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 207 SOUTH AMERICA: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 208 SOUTH AMERICA: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 209 MIDDLE EAST: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 210 MIDDLE EAST: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 211 AFRICA: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 212 AFRICA: HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 213 HARDWARE IN THE LOOP MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2025

- TABLE 214 HARDWARE IN THE LOOP MARKET: DEGREE OF COMPETITION

- TABLE 215 HARDWARE IN THE LOOP MARKET: REGION FOOTPRINT

- TABLE 216 HARDWARE IN THE LOOP MARKET: TYPE FOOTPRINT

- TABLE 217 HARDWARE IN THE LOOP MARKET: VERTICAL FOOTPRINT

- TABLE 218 HARDWARE IN THE LOOP MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 219 HARDWARE IN THE LOOP MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 220 HARDWARE IN THE LOOP MARKET: PRODUCT LAUNCHES, NOVEMBER 2019-FEBRUARY 2025

- TABLE 221 HARDWARE IN THE LOOP MARKET: DEALS, NOVEMBER 2019-FEBRUARY 2025

- TABLE 222 HARDWARE IN THE LOOP MARKET: OTHER DEVELOPMENTS, NOVEMBER 2019-FEBRUARY 2025

- TABLE 223 DSPACE: COMPANY OVERVIEW

- TABLE 224 DSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 DSPACE: DEALS

- TABLE 226 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 227 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES

- TABLE 229 EMERSON ELECTRIC CO.: DEALS

- TABLE 230 VECTOR INFORMATIK: COMPANY OVERVIEW

- TABLE 231 VECTOR INFORMATIK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 VECTOR INFORMATIK: PRODUCT LAUNCHES

- TABLE 233 VECTOR INFORMATIK: DEALS

- TABLE 234 ELEKTROBIT AUTOMOTIVE: COMPANY OVERVIEW

- TABLE 235 ELEKTROBIT AUTOMOTIVE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 ELEKTROBIT AUTOMOTIVE: DEALS

- TABLE 237 ELEKTROBIT AUTOMOTIVE: OTHER DEVELOPMENTS

- TABLE 238 OPAL-RT TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 239 OPAL-RT TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 OPAL-RT TECHNOLOGIES: DEALS

- TABLE 241 OPAL-RT TECHNOLOGIES: EXPANSIONS

- TABLE 242 SPEEDGOAT: COMPANY OVERVIEW

- TABLE 243 SPEEDGOAT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 SPEEDGOAT: PRODUCT LAUNCHES

- TABLE 245 SPEEDGOAT: DEALS

- TABLE 246 BOSCH SOFTWARE PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 247 BOSCH SOFTWARE PRIVATE LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 TYPHOON HIL: COMPANY OVERVIEW

- TABLE 249 TYPHOON HIL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 TYPHOON HIL: PRODUCT LAUNCHES

- TABLE 251 IPG AUTOMOTIVE: COMPANY OVERVIEW

- TABLE 252 IPG AUTOMOTIVE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 IPG AUTOMOTIVE: PRODUCT LAUNCHES

- TABLE 254 IPG AUTOMOTIVE: OTHER DEVELOPMENTS

- TABLE 255 ACUTRONIC: COMPANY OVERVIEW

- TABLE 256 ACUTRONIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 PLEXIM: COMPANY OVERVIEW

- TABLE 258 PLEXIM: PRODUCT OFFERINGS

- TABLE 259 GENUEN: COMPANY OVERVIEW

- TABLE 260 LHP, INC.: COMPANY OVERVIEW

- TABLE 261 MICRONOVA: COMPANY OVERVIEW

- TABLE 262 KONRAD TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 263 MODELINGTECH: COMPANY OVERVIEW

- TABLE 264 BLOOMY CONTROLS: COMPANY OVERVIEW

- TABLE 265 CONTROLLAB: COMPANY OVERVIEW

- TABLE 266 PICKERING INTERFACES: COMPANY OVERVIEW

- TABLE 267 APPLUS+: COMPANY OVERVIEW

- TABLE 268 ADD2 LIMITED: COMPANY OVERVIEW

- TABLE 269 BLUEHALO: COMPANY OVERVIEW

- TABLE 270 SIEMENS: COMPANY OVERVIEW

- TABLE 271 SPIRENT COMMUNICATIONS: COMPANY OVERVIEW

- TABLE 272 UAV NAVIGATION: COMPANY OVERVIEW

List of Figures

- FIGURE 1 HARDWARE IN THE LOOP MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 HARDWARE IN THE LOOP MARKET: RESEARCH FLOW

- FIGURE 3 HARDWARE IN THE LOOP MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION: HARDWARE IN THE LOOP MARKET

- FIGURE 8 OPEN LOOP SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 9 AUTOMOBILE TO BE LARGEST VERTICAL IN HARDWARE IN THE LOOP MARKET DURING FORECAST PERIOD

- FIGURE 10 SOFTWARE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR HARDWARE IN THE LOOP DURING FORECAST PERIOD

- FIGURE 12 GROWING DEMAND FOR HARDWARE IN THE LOOP TECHNIQUE IN ELECTRIC VEHICLE TESTING AND AUTONOMOUS DRIVING TO DRIVE MARKET

- FIGURE 13 US ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN HARDWARE IN THE LOOP MARKET IN 2024

- FIGURE 14 POWER ELECTRONICS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 SOUTH KOREA TO REGISTER HIGHEST CAGR IN HARDWARE IN THE LOOP MARKET FROM 2025 TO 2030

- FIGURE 16 HARDWARE IN THE LOOP MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 HARDWARE IN THE LOOP MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 18 HARDWARE IN THE LOOP MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 19 HARDWARE IN THE LOOP MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 20 HARDWARE IN THE LOOP MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 21 HARDWARE IN THE LOOP MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 HARDWARE IN THE LOOP MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 24 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 25 HARDWARE IN THE LOOP MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 HARDWARE IN THE LOOP MARKET: TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 27 AVERAGE SELLING PRICE OF HARDWARE IN THE LOOP TEST SYSTEM, BY KEY PLAYERS, 2024

- FIGURE 28 AVERAGE SELLING PRICE TREND OF HARDWARE IN THE LOOP TEST SYSTEM, BY REGION, 2021 TO 2024

- FIGURE 29 IMPORT SCENARIO FOR HS CODE 9031-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 30 EXPORT SCENARIO FOR HS CODE 9031-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 31 PATENTS APPLIED AND GRANTED 2015-2025

- FIGURE 32 HARDWARE IN THE LOOP MARKET: IMPACT OF AI/GEN AI

- FIGURE 33 INVESTMENT AND FUNDING SCENARIO, 2021-2024

- FIGURE 34 HARDWARE IN THE LOOP MARKET, BY OFFERING

- FIGURE 35 HARDWARE IN THE LOOP MARKET, BY OFFERING, 2025-2030

- FIGURE 36 HARDWARE IN THE LOOP MARKET, BY TYPE

- FIGURE 37 HARDWARE IN THE LOOP MARKET, BY TYPE, 2025-2030

- FIGURE 38 HARDWARE IN THE LOOP MARKET, BY VERTICAL

- FIGURE 39 HARDWARE IN THE LOOP MARKET, BY VERTICAL, 2025-2030

- FIGURE 40 HARDWARE IN THE LOOP MARKET, BY REGION, 2025-2030

- FIGURE 41 NORTH AMERICA: HARDWARE IN THE LOOP MARKET SNAPSHOT

- FIGURE 42 EUROPE: HARDWARE IN THE LOOP MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: HARDWARE IN THE LOOP MARKET SNAPSHOT

- FIGURE 44 HARDWARE IN THE LOOP MARKET: REVENUE ANALYSIS FOR TOP PLAYER, 2022-2024

- FIGURE 45 HARDWARE IN THE LOOP MARKET SHARE ANALYSIS, 2024

- FIGURE 46 COMPANY VALUATION, 2025

- FIGURE 47 EV/EBITDA OF KEY VENDORS, 2025

- FIGURE 48 HARDWARE IN THE LOOP MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 49 HARDWARE IN THE LOOP MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 50 HARDWARE IN THE LOOP MARKET: COMPANY FOOTPRINT

- FIGURE 51 HARDWARE IN THE LOOP MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 52 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

The hardware in the loop market is estimated to be valued at USD 1,001.7 million in 2024 and is projected to reach USD 1,784.4 million by 2030, growing at a CAGR of 10.1% from 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Type, Vertical and Region |

| Regions covered | North America, Europe, APAC, RoW |

The hardware-in-the-loop (HIL) industry is growing due to several factors, such as the increasing complexity of embedded systems, the growing adoption of electric and autonomous vehicles, and the need for faster and cheaper ways to validate products. Furthermore, advances in real-time simulation and digital twin, as well as increasing regulatory pressure to meet safety and compliance, are also driving the market growth. The initial investment for the setup is high, and there is also a need for specialized personnel. Issues with integration into legacy business systems are also a major restraint and may limit widespread adoption among smaller organizations or in emerging markets.

"Software offering segment to register highest growth during forecast period"

The software segment is expected to grow at the highest CAGR in the hardware-in-the-loop (HIL) market during the forecast period due to its increasing role in enabling flexibility, scalability, and intelligence in real-time simulation systems. As embedded systems become more complex, particularly in electric vehicles, autonomous driving, aerospace systems, and renewable energy, there is a rising demand for advanced simulation, automation, and control software that can accurately model real-world conditions and system behavior. Software ecosystems also enable the integration of digital twins, algorithms, and the use of machine learning-based automation for testing efforts, improving testing efficiency and reducing time-to-market significantly.

"Open Loop: The largest type in hardware in the loop market"

The open loop segment is projected to account for the largest share of hardware-in-the-loop (HIL) market during the forecast period. These systems are commonly used in both early-stage development and cost-conscious scenarios. Open-loop HIL systems have a simpler and less expensive setup than closed-loop systems, which creates significant appeal within applications where response time does not require immediate feedback.

"Asia Pacific to be fastest-growing market during forecast period"

It is anticipated that the hardware-in-the-loop (HIL) market in the Asia Pacific region will achieve the highest CAGR during the forecast period due to rapid industrial growth, rising investments in electric vehicles (EVs), and strong government support for automation and innovation. Countries such as China, India, Japan, and South Korea are all investing significantly in advanced technologies in the automotive, aerospace, and energy domains that are all supported by real-time simulation and testing capabilities of HIL systems.

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 25%, and Tier 3 - 35%

- By Designation: C-level Executives - 35%, Directors - 28%, and Others - 37%

- By Region: Europe - 45%, North America - 30%, APAC - 20%, RoW - 5%

dSPACE GmbH (Germany), Emerson Electric Co. (US), Vector Informatik GmbH (Germany), Elektrobit (Germany), OPAL-RT Technologies (Canada), Speedgoat GmbH (Switzerland), Robert Bosch GmbH (Germany), IPG Automotive GmbH (Germany), Acutronic Holding AG (Switzerland), and Konrad GmbH (Germany) are among the many players in the hardware in the loop market.

Research Coverage:

The report segments the hardware in the loop market and forecasts its size, by value, based on offering, type, vertical, and region. The report also provides a comprehensive review of market drivers, restraints, opportunities, and challenges in the hardware in the loop market. The report also covers qualitative aspects in addition to the quantitative aspects of these markets.

Reason to buy this Report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the hardware in the loop market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Technological advancement in electric and autonomous vehicles), restraints (High cost of ownership and technical complexity in implementation), opportunities (Adoption in new application area such as power electronics and industrial robotics), and challenges (Complexity in creating real time simulation) influencing the growth of the hardware in the loop market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the hardware in the loop market

- Market Development: Comprehensive information about lucrative markets - the report analyses the hardware in the loop market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the hardware in the loop market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and offerings of leading players, such as dSPACE GmbH (Germany), Emerson Electric Co. (US), Vector Informatic GmbH (Germany), Elektrobit (Germany), and OPAL-RT Technologies (Canada), in the hardware in the loop market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 INTRODUCTION

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of major secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Key data from primary sources

- 2.1.3.2 List of key primary interview participants

- 2.1.3.3 Breakdown of primaries

- 2.1.3.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach for arriving at market size using bottom-up analysis

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach for arriving at market size using top-down analysis

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN HARDWARE IN THE LOOP MARKET

- 4.2 HARDWARE IN THE LOOP MARKET IN NORTH AMERICA, BY COUNTRY AND BY VERTICAL

- 4.3 HARDWARE IN THE LOOP MARKET, BY VERTICAL

- 4.4 HARDWARE IN THE LOOP MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Technological advancements in electric and autonomous vehicles

- 5.2.1.2 Increasing adoption in early product development phase

- 5.2.1.3 Growing demand in developing countries

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of ownership and technical complexity in implementation

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption in power electronics and industrial robotics

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexity in creating real-time simulation

- 5.2.4.2 Limited investments due to lack of awareness

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.4.2 BARGAINING POWER OF SUPPLIERS

- 5.4.3 BARGAINING POWER OF BUYERS

- 5.4.4 THREAT OF NEW ENTRANTS

- 5.4.5 THREAT OF SUBSTITUTES

- 5.5 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.5.2 BUYING CRITERIA

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS

- 5.8 CASE STUDIES

- 5.8.1 MODULAR HARDWARE IN THE LOOP TEST SYSTEM FOR AUTOMOBILE ECU TESTING

- 5.8.2 HARDWARE IN THE LOOP AND DURABILITY TESTING FOR ELECTRIC PARKING BRAKES

- 5.8.3 HARDWARE IN THE LOOP-POWERED DIGITAL TWIN MODEL FOR SMART ELECTRIC GRID RESEARCH

- 5.8.4 AUTOMATED VALIDATION OF RADAR SENSORS IN AUTOMOBILES

- 5.8.5 DEVELOPING HARDWARE IN THE LOOP SYSTEM FOR TESTING HYDROGEN VEHICLES

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Cloud hardware-in-the-loop

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Digital twin

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Software-in-the-loop

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PRICING ANALYSIS

- 5.10.1 AVERAGE SELLING PRICE OF HARDWARE IN THE LOOP TEST SYSTEM, 2024

- 5.10.2 AVERAGE SELLING PRICE TREND OF HARDWARE IN THE LOOP TEST SYSTEM, BY REGION, 2021 TO 2024

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 9031)

- 5.11.2 EXPORT SCENARIO (HS CODE 9031)

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 TARIFF ANALYSIS

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 IMPACT OF AI/GEN AI ON HARDWARE IN THE LOOP MARKET

- 5.16 INVESTMENT AND FUNDING SCENARIO

- 5.17 2025 US TARIFF IMPACT ON HARDWARE IN THE LOOP MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

6 HARDWARE IN THE LOOP MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 HARDWARE

- 6.2.1 DEMAND FOR SYSTEM PERFORMANCE WITH SCALABLE HARDWARE TO DRIVE MARKET

- 6.3 SOFTWARE

- 6.3.1 INCREASING DEMAND FOR ENABLING SCALABLE AND INTELLIGENT HIL SIMULATIONS TO DRIVE SEGMENT GROWTH

- 6.4 SERVICES

- 6.4.1 INCREASING DEMAND FOR SYSTEM INTEGRATION TO DRIVE MARKET GROWTH

- 6.4.1.1 Consulting and system design

- 6.4.1.2 System integration

- 6.4.1.3 Maintenance and support

- 6.4.1 INCREASING DEMAND FOR SYSTEM INTEGRATION TO DRIVE MARKET GROWTH

7 HARDWARE IN THE LOOP MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 OPEN LOOP

- 7.2.1 APPLICATIONS IN SIMPLE OPEN-LOOP CONTROLLERS TESTING TO DRIVE MARKET GROWTH

- 7.3 CLOSED LOOP

- 7.3.1 ADOPTION IN COMPLEX CONTROLLERS & CONTROL SYSTEMS IN DYNAMIC TEST PLATFORM TO DRIVE DEMAND

8 HARDWARE IN THE LOOP MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- 8.2 AUTOMOBILE

- 8.2.1 TECHNOLOGICAL ADVANCES IN AUTOMOTIVE SECTOR FUELING DEMAND FOR FAST AND RESPONSIVE TESTING

- 8.3 AEROSPACE

- 8.3.1 NEED FOR RAPID DEVELOPMENT OF ECU SOFTWARE AND SIMULTANEOUS VERIFICATION OF CONTROL SYSTEMS TO DRIVE MARKET

- 8.4 DEFENSE

- 8.4.1 OFFERS COST-EFFECTIVE AND RELIABLE TESTING OF DEFENSE TECHNOLOGIES

- 8.5 POWER ELECTRONICS

- 8.5.1 NEED FOR ONGOING TESTING AND SIMULATION OF DIFFERENT SCENARIOS WITHIN ELECTRIC GRIDS TO DRIVE MARKET

- 8.6 RESEARCH & EDUCATION

- 8.6.1 OFFERS RELIABLE VIRTUAL TESTING OF ECU FOR RESEARCH AND ACADEMIC STUDIES

- 8.7 RENEWABLE ENERGY

- 8.7.1 OFFERS RELIABLE VIRTUAL TESTING OF SOLAR POWER PLANTS FOR RENEWABLE ENERGY

- 8.8 OTHER VERTICALS

9 HARDWARE IN THE LOOP MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 US

- 9.2.1.1 Presence of strong aerospace sector fueling market growth

- 9.2.2 CANADA

- 9.2.2.1 Growth of electric vehicles industry to boost demand for hardware in the loop testing of equipment and control systems

- 9.2.3 MEXICO

- 9.2.3.1 Growing investments from automobile manufacturers to propel demand

- 9.2.4 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.1 US

- 9.3 EUROPE

- 9.3.1 UK

- 9.3.1.1 Development of power infrastructure and integration of renewable energy sources to boost demand

- 9.3.2 GERMANY

- 9.3.2.1 Presence of leading automobile companies to drive market

- 9.3.3 FRANCE

- 9.3.3.1 Increasing adoption of robotics to fuel demand for testing and simulation

- 9.3.4 ITALY

- 9.3.4.1 Increasing technology adoption in automotive sector to support market growth

- 9.3.5 SPAIN

- 9.3.5.1 Increasing adoption of renewable energy to drive market growth

- 9.3.6 POLAND

- 9.3.6.1 Adoption of Industry 4.0 platform to drive demand

- 9.3.7 NORDICS

- 9.3.7.1 Increasing trend of green technology adoption to drive market

- 9.3.8 REST OF EUROPE

- 9.3.9 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.1 UK

- 9.4 ASIA PACIFIC

- 9.4.1 CHINA

- 9.4.1.1 Strong presence of manufacturing industry to fuel market growth

- 9.4.2 INDIA

- 9.4.2.1 Expansion of electric vehicle industry to create demand for testing and simulation

- 9.4.3 JAPAN

- 9.4.3.1 Growth of power electronics sector to support market growth

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Growth of automotive sector to drive demand

- 9.4.5 INDONESIA

- 9.4.5.1 Growing demand for advanced testing in automotive sector to drive market

- 9.4.6 AUSTRALIA

- 9.4.6.1 Expansion of electric vehicle industry to fuel market growth

- 9.4.7 MALAYSIA

- 9.4.7.1 Government initiatives to support smart manufacturing to drive market

- 9.4.8 THAILAND

- 9.4.8.1 Government initiatives to strengthen digital infrastructure and promote technological innovation to fuel market growth

- 9.4.9 VIETNAM

- 9.4.9.1 Government initiatives to enhance simulation and testing techniques to support market growth

- 9.4.10 REST OF ASIA PACIFIC

- 9.4.11 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.1 CHINA

- 9.5 ROW

- 9.5.1 SOUTH AMERICA

- 9.5.1.1 Development of EV industry to increase demand for hardware in the loop solutions

- 9.5.2 MIDDLE EAST

- 9.5.2.1 Growing adoption of EVs to support market growth

- 9.5.2.2 Bahrain

- 9.5.2.2.1 Growing automotive and industrial automation sectors to drive market

- 9.5.2.3 Kuwait

- 9.5.2.3.1 Investments in smart infrastructure and digitalization to support market growth

- 9.5.2.4 Qatar

- 9.5.2.4.1 Smart city and IoT infrastructure projects fueling HIL testing

- 9.5.2.5 Oman

- 9.5.2.5.1 Growing infrastructure and manufacturing activities to fuel adoption of hardware in the loop test systems

- 9.5.2.6 Saudi Arabia

- 9.5.2.6.1 Push for development of autonomous and electric vehicles sector fueling demand

- 9.5.2.7 UAE

- 9.5.2.7.1 Digitalization in manufacturing sector propelling market growth

- 9.5.3 AFRICA

- 9.5.3.1 Industrial modernization and need for efficient, cost-effective testing to support market growth

- 9.5.3.2 South Africa

- 9.5.3.2.1 Government support for technological advancement to support market growth

- 9.5.3.3 Other African countries

- 9.5.3.3.1 Expansion of automotive testing facilities and push for safer, locally produced vehicles fueling demand

- 9.5.4 MACROECONOMIC OUTLOOK FOR ROW

- 9.5.1 SOUTH AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY STRENGTHS/RIGHT TO WIN, 2021-2025

- 10.3 REVENUE ANALYSIS, 2022-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS, 2025

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE COMPANIES

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Type footprint

- 10.7.5.4 Vertical footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 DSPACE

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 EMERSON ELECTRIC CO.

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 VECTOR INFORMATIK

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 ELEKTROBIT AUTOMOTIVE

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.3.2 Other developments

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 OPAL-RT TECHNOLOGIES

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Deals

- 11.1.5.3.2 Expansions

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 SPEEDGOAT

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.3.2 Deals

- 11.1.7 BOSCH SOFTWARE PRIVATE LIMITED

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.8 TYPHOON HIL

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches

- 11.1.9 IPG AUTOMOTIVE

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches

- 11.1.9.3.2 Other developments

- 11.1.10 ACUTRONIC

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Expansions

- 11.1.11 PLEXIM

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.1 DSPACE

- 11.2 OTHER PLAYERS

- 11.2.1 GENUEN

- 11.2.2 LHP, INC.

- 11.2.3 MICRONOVA

- 11.2.4 KONRAD TECHNOLOGIES

- 11.2.5 MODELINGTECH

- 11.2.6 BLOOMY CONTROLS

- 11.2.7 CONTROLLAB

- 11.2.8 PICKERING INTERFACES

- 11.2.9 APPLUS+

- 11.2.10 ADD2 LIMITED

- 11.2.11 BLUEHALO

- 11.2.12 SIEMENS

- 11.2.13 SPIRENT COMMUNICATIONS

- 11.2.14 UAV NAVIGATION

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS