|

|

市場調査レポート

商品コード

1724754

中空糸限外ろ過の世界市場:タイプ (ポリマー・セラミック・ハイブリッド)・用途 (都市・産業 (製薬・化学・石油&ガス))・地域別 (~2030年)Hollow Fiber Ultrafiltration Market by Type (Polymeric, Ceramic, Hybrid,), Application (Municipal, Industrial (Pharmaceutical, Chemicals, Oil & Gas)), Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 中空糸限外ろ過の世界市場:タイプ (ポリマー・セラミック・ハイブリッド)・用途 (都市・産業 (製薬・化学・石油&ガス))・地域別 (~2030年) |

|

出版日: 2025年05月07日

発行: MarketsandMarkets

ページ情報: 英文 254 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

中空糸限外ろ過の市場規模は、2025年の23億9,000万米ドルから、予測期間中はCAGR 15.2%で推移し、2030年には48億5,000万米ドルに成長すると予測されています。

中空糸限外ろ過は、水から真菌、ウイルス、細菌などの汚染物質を効果的に除去し、飲料用の安全な水を確保できるため、世界的に需要が増加しています。中空糸限外ろ過は、食品・飲料、製薬、石油・ガスなどさまざまな産業で活用されています。また、金属製造や処理水の浄化にも使用されており、浮遊物質、コロイド、微生物を効果的に除去することができます。このプロセスにより、企業は環境規制を順守するとともに、事業活動による環境への影響を低減することが可能になります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2030年 |

| 単位 | 金額 (米ドル)・数量 |

| セグメント | タイプ・用途・地域 |

| 対象地域 | アジア太平洋・北米・欧州・中東&アフリカ・南米 |

"ポリマー別では、PS&PESの部門が金額ベースで2番目に大きなサブセグメントタイプになる見通し”

PES (ポリエーテルスルホン) は、熱安定性、機械的強度、高い透水性 (フラックス) 、および耐薬品性といった優れた特性を備えており、高性能熱可塑性ポリマーとして知られています。中空糸限外ろ過システムでは、PESは支持層として使用され、膜に高い構造的安定性を提供するとともに、透過流の促進にも寄与します。この支持層は多孔質構造を持ち、溶媒が通過する一方で、分離を実際に行う活性層を保持する役割を担っています。一方、PS (ポリスルホン) は高い圧縮耐性を有しており、高圧条件下での使用により適した材料とされています。PSは水性の酸および塩基、ならびに多くの非極性溶媒に対して安定ですが、ジクロロメタンやメチルピロリドンには可溶であるという性質も持ちます。

"産業別では、食品・飲料の部門が金額ベースで第3位のシェアを占める"

食品・飲料業界は、非常に競争が激しく、変化の速い業界です。近年では健康への意識が高まっており、安全で栄養価の高い高品質な製品への需要が増加しています。このような背景から、目的に応じた適切な膜ろ過ソリューションの活用が不可欠となっています。この分野では、膜の利用が必須となっており、牛乳、チーズ、ホエイプロテインの加工などに広く使用されています。効率的な膜ろ過技術を活用することで、業界の製造業者はボトル入り飲料水、ジュース、ワインなどの濃縮、清澄化、精製を実現できます。さらに、酵素の回収や、チーズホエイの処理、牛乳中の病原菌除去などにも活用されています。

当レポートでは、世界の中空糸限外ろ過の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 生成AIの影響

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- マクロ経済指標

- 主要なステークホルダーと購入基準

- バリューチェーン分析

- エコシステム分析

- ケーススタディ分析

- 規制状況

- 技術分析

- 顧客ビジネスに影響を与える動向/ディスラプション

- 貿易分析

- 主な会議とイベント

- 価格分析

- 投資と資金調達のシナリオ

- 2025年の米国関税の影響

- 特許分析

第6章 中空糸限外ろ過市場:タイプ別

- ポリマー

- PS・PES

- PVDF

- その他

- セラミック限外濾過

- ジルコニア

- アルミナ

- タイタニア

- ハイブリッド

- その他

第7章 中空糸限外ろ過市場:用途別

- 自治体水処理

- 淡水化

- 公共事業用水処理

- 廃水の再利用

- 産業処理

- 食品・飲料

- 医薬品

- 石油・ガス

- その他

第8章 中空糸限外ろ過市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- スペイン

- 英国

- オランダ

- イタリア

- その他

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第9章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ

第10章 企業プロファイル

- 主要企業

- DUPONT

- VEOLIA

- TORAY INDUSTRIES, INC.

- ASAHI KASEI CORPORATION

- HYDRANAUTICS

- MANN+HUMMEL

- PENTAIR

- KOVALUS SEPARATION SOLUTIONS

- PALL CORPORATION

- HYFLUX

- VONTRON TECHNOLOGY CO., LTD.

- その他の企業

- APPLIED MEMBRANES, INC.

- MEMBRANE SOLUTIONS (NANTONG) CO., LTD.

- SCINOR WATER AMERICA, LLC

- ALPHA PLAN GMBH

- MEMFILL TECH PVT. LTD.

- QUA GROUP LLC

- POLYMEM

- HONGTEK FILTRATION CO., LTD.

- PCI MEMBRANES

- JIUWU HI-TECH MEMBRANE TECHNOLOGY

- AQUABRANE WATER TECHNOLOGIES PVT. LTD.

- HYDRAMEM

- THEWAY MEMBRANES

- HINADA WATER TREATMENT TECH CO., LTD.

第11章 付録

List of Tables

- TABLE 1 HOLLOW FIBER ULTRAFILTRATION MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 HOLLOW FIBER ULTRAFILTRATION MARKET: PORTER'S FIVE FORCES

- TABLE 3 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2021-2029

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS (%)

- TABLE 5 BUYING CRITERIA

- TABLE 6 HOLLOW FIBER ULTRAFILTRATION: ECOSYSTEM

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT BODIES, AND OTHER AGENCIES

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT BODIES, AND OTHER AGENCIES

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 10 EXPORT TRADE DATA OF HOLLOW FIBER ULTRAFILTRATION FOR TOP COUNTRIES, 2019-2023 (USD THOUSAND)

- TABLE 11 IMPORT TRADE DATA OF HOLLOW FIBER ULTRAFILTRATION FOR TOP COUNTRIES, 2019-2023 (USD THOUSAND)

- TABLE 12 HOLLOW FIBER ULTRAFILTRATION MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2025

- TABLE 13 INDICATIVE PRICING OF HOLLOW FIBER ULTRAFILTRATION, BY REGION (USD/UNIT)

- TABLE 14 INDICATIVE PRICING OF HOLLOW FIBER ULTRAFILTRATION BY KEY PLAYERS, BY TYPE (USD/UNIT)

- TABLE 15 INDICATIVE PRICING OF HOLLOW FIBER ULTRAFILTRATION BY KEY PLAYERS, BY APPLICATION (USD/UNIT)

- TABLE 16 KEY TARIFF MEASURES AND THEIR IMPACTS ON HOLLOW FIBER ULTRAFILTRATION

- TABLE 17 IMPACT ON KEY REGIONS

- TABLE 18 BREAKDOWN OF HOW DIFFERENT SECTORS HAVE BEEN AFFECTED

- TABLE 19 TOTAL NUMBER OF PATENTS

- TABLE 20 PATENTS BY GAMBRO LUNDIA AB (BAXTER)

- TABLE 21 PATENTS BY HANGZHOU AOKE FILTER TECH CO LTD

- TABLE 22 PATENTS BY BASF SE

- TABLE 23 TOP 10 PATENT OWNERS

- TABLE 24 HOLLOW FIBER ULTRAFILTRATION MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 25 HOLLOW FIBER ULTRAFILTRATION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 26 HOLLOW FIBER ULTRAFILTRATION MARKET, BY TYPE, 2022-2024 (QUANTITY)

- TABLE 27 HOLLOW FIBER ULTRAFILTRATION MARKET, BY TYPE, 2025-2030 (QUANTITY)

- TABLE 28 HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 29 HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 30 HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 31 HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 32 HOLLOW FIBER ULTRAFILTRATION MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 33 HOLLOW FIBER ULTRAFILTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 HOLLOW FIBER ULTRAFILTRATION MARKET, BY REGION, 2022-2024 (QUANTITY)

- TABLE 35 HOLLOW FIBER ULTRAFILTRATION MARKET, BY REGION, 2025-2030 (QUANTITY)

- TABLE 36 NORTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 37 NORTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 38 NORTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY COUNTRY, 2022-2024 (QUANTITY)

- TABLE 39 NORTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY COUNTRY, 2025-2030 (QUANTITY)

- TABLE 40 NORTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 41 NORTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 42 NORTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY TYPE, 2022-2024 (QUANTITY)

- TABLE 43 NORTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY TYPE, 2025-2030 (QUANTITY)

- TABLE 44 NORTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 45 NORTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 46 NORTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 47 NORTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 48 US: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 49 US: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 50 US: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 51 US: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 52 CANADA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 53 CANADA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 54 CANADA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 55 CANADA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 56 MEXICO: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 57 MEXICO: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 58 MEXICO: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 59 MEXICO: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 60 EUROPE: HOLLOW FIBER ULTRAFILTRATION MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 61 EUROPE: HOLLOW FIBER ULTRAFILTRATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 62 EUROPE: HOLLOW FIBER ULTRAFILTRATION MARKET, BY COUNTRY, 2022-2024 (QUANTITY)

- TABLE 63 EUROPE: HOLLOW FIBER ULTRAFILTRATION MARKET, BY COUNTRY, 2025-2030 (QUANTITY)

- TABLE 64 EUROPE: HOLLOW FIBER ULTRAFILTRATION MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 65 EUROPE: HOLLOW FIBER ULTRAFILTRATION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 66 EUROPE: HOLLOW FIBER ULTRAFILTRATION MARKET, BY TYPE, 2022-2024 (QUANTITY)

- TABLE 67 EUROPE: HOLLOW FIBER ULTRAFILTRATION MARKET, BY TYPE, 2025-2030 (QUANTITY)

- TABLE 68 EUROPE: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 69 EUROPE: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 70 EUROPE: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 71 EUROPE: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 72 GERMANY: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 73 GERMANY: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 74 GERMANY: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 75 GERMANY: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 76 FRANCE: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 77 FRANCE: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 78 FRANCE: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 79 FRANCE: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 80 SPAIN: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 81 SPAIN: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 82 SPAIN: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 83 SPAIN: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 84 UK: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 85 UK: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 86 UK: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 87 UK: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 88 NETHERLANDS: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 89 NETHERLANDS: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 90 NETHERLANDS: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 91 NETHERLANDS: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 92 ITALY: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 93 ITALY: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 94 ITALY: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 95 ITALY: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 96 REST OF EUROPE: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 97 REST OF EUROPE: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 98 REST OF EUROPE: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 99 REST OF EUROPE: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 100 ASIA PACIFIC: HOLLOW FIBER ULTRAFILTRATION MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 101 ASIA PACIFIC: HOLLOW FIBER ULTRAFILTRATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 102 ASIA PACIFIC: HOLLOW FIBER ULTRAFILTRATION MARKET, BY COUNTRY, 2022-2024 (QUANTITY)

- TABLE 103 ASIA PACIFIC: HOLLOW FIBER ULTRAFILTRATION MARKET, BY COUNTRY, 2025-2030 (QUANTITY)

- TABLE 104 ASIA PACIFIC: HOLLOW FIBER ULTRAFILTRATION MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 105 ASIA PACIFIC: HOLLOW FIBER ULTRAFILTRATION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 106 ASIA PACIFIC: HOLLOW FIBER ULTRAFILTRATION MARKET, BY TYPE, 2022-2024 (QUANTITY)

- TABLE 107 ASIA PACIFIC: HOLLOW FIBER ULTRAFILTRATION MARKET, BY TYPE, 2025-2030 (QUANTITY)

- TABLE 108 ASIA PACIFIC: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 109 ASIA PACIFIC: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 110 ASIA PACIFIC: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 111 ASIA PACIFIC: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 112 CHINA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 113 CHINA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 114 CHINA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 115 CHINA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 116 JAPAN: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 117 JAPAN: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 118 JAPAN: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 119 JAPAN: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 120 INDIA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 121 INDIA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 122 INDIA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 123 INDIA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 124 SOUTH KOREA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 125 SOUTH KOREA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 126 SOUTH KOREA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 127 SOUTH KOREA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 128 REST OF ASIA PACIFIC: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 129 REST OF ASIA PACIFIC: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 130 REST OF ASIA PACIFIC: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 131 REST OF ASIA PACIFIC: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 132 MIDDLE EAST & AFRICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY COUNTRY, 2022-2024 (QUANTITY)

- TABLE 135 MIDDLE EAST & AFRICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY COUNTRY, 2025-2030 (QUANTITY)

- TABLE 136 MIDDLE EAST & AFRICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY TYPE, 2022-2024 (QUANTITY)

- TABLE 139 MIDDLE EAST & AFRICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY TYPE, 2025-2030 (QUANTITY)

- TABLE 140 MIDDLE EAST & AFRICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 143 MIDDLE EAST & AFRICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 144 GCC COUNTRIES: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 145 GCC COUNTRIES: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 146 GCC COUNTRIES: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 147 GCC COUNTRIES: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 148 SAUDI ARABIA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 149 SAUDI ARABIA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 150 SAUDI ARABIA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 151 SAUDI ARABIA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 152 UAE: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 153 UAE: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 154 UAE: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 155 UAE: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 156 REST OF GCC COUNTRIES: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 157 REST OF GCC COUNTRIES: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 158 REST OF GCC COUNTRIES: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 159 REST OF GCC COUNTRIES: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 160 SOUTH AFRICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 161 SOUTH AFRICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 162 SOUTH AFRICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 163 SOUTH AFRICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 164 REST OF MIDDLE EAST & AFRICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 165 REST OF MIDDLE EAST & AFRICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 166 REST OF MIDDLE EAST & AFRICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 167 REST OF MIDDLE EAST & AFRICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 168 SOUTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 169 SOUTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 170 SOUTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY COUNTRY, 2022-2024 (QUANTITY)

- TABLE 171 SOUTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY COUNTRY, 2025-2030 (QUANTITY)

- TABLE 172 SOUTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 173 SOUTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 174 SOUTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY TYPE, 2022-2024 (QUANTITY)

- TABLE 175 SOUTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY TYPE, 2025-2030 (QUANTITY)

- TABLE 176 SOUTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 177 SOUTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 178 SOUTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 179 SOUTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 180 BRAZIL: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 181 BRAZIL: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 182 BRAZIL: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 183 BRAZIL: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 184 ARGENTINA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 185 ARGENTINA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 186 ARGENTINA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 187 ARGENTINA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 188 REST OF SOUTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 189 REST OF SOUTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 190 REST OF SOUTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2022-2024 (QUANTITY)

- TABLE 191 REST OF SOUTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION, 2025-2030 (QUANTITY)

- TABLE 192 HOLLOW FIBER ULTRAFILTRATION MARKET: DEGREE OF COMPETITION

- TABLE 193 HOLLOW FIBER ULTRAFILTRATION MARKET: REGION FOOTPRINT

- TABLE 194 HOLLOW FIBER ULTRAFILTRATION MARKET: TYPE FOOTPRINT

- TABLE 195 HOLLOW FIBER ULTRAFILTRATION MARKET: APPLICATION FOOTPRINT

- TABLE 196 HOLLOW FIBER ULTRAFILTRATION MARKET: KEY STARTUPS/SMES

- TABLE 197 HOLLOW FIBER ULTRAFILTRATION MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 198 HOLLOW FIBER ULTRAFILTRATION MARKET: PRODUCT LAUNCHES, JANUARY 2019-APRIL 2025

- TABLE 199 HOLLOW FIBER ULTRAFILTRATION MARKET: EXPANSIONS, JANUARY 2019-APRIL 2025

- TABLE 200 HOLLOW FIBER ULTRAFILTRATION MARKET: DEALS, JANUARY 2019-APRIL 2025

- TABLE 201 DUPONT: COMPANY OVERVIEW

- TABLE 202 DUPONT: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 203 DUPONT: DEALS, JANUARY 2019-APRIL 2025

- TABLE 204 VEOLIA: COMPANY OVERVIEW

- TABLE 205 VEOLIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 VEOLIA: DEALS, JANUARY 2019-APRIL 2025

- TABLE 207 VEOLIA: EXPANSIONS, JANUARY 2019-APRIL 2025

- TABLE 208 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 209 TORAY INDUSTRIES INC.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 210 TORAY INDUSTRIES INC.: DEALS, JANUARY 2019-APRIL 2025

- TABLE 211 ASAHI KASEI CORPORATION: COMPANY OVERVIEW

- TABLE 212 ASAHI KASEI CORPORATION: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 213 HYDRANAUTICS: COMPANY OVERVIEW

- TABLE 214 HYDRANAUTICS: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 215 HYDRANAUTICS: PRODUCT LAUNCHES, JANUARY 2019-APRIL 2025

- TABLE 216 HYDRANAUTICS: DEALS, JANUARY 2019-APRIL 2025

- TABLE 217 MANN+HUMMEL: COMPANY OVERVIEW

- TABLE 218 MANN+HUMMEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 PENTAIR: COMPANY OVERVIEW

- TABLE 220 PENTAIR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 PENTAIR: DEALS, JANUARY 2019-APRIL 2025

- TABLE 222 KOVALUS SEPARATION SOLUTIONS: COMPANY OVERVIEW

- TABLE 223 KOVALUS SEPARATION SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 KOVALUS SEPARATION SOLUTIONS: DEALS, JANUARY 2019-APRIL 2025

- TABLE 225 KOVALUS SEPARATION SOLUTIONS: EXPANSIONS, JANUARY 2019-APRIL 2025

- TABLE 226 PALL CORPORATION: COMPANY OVERVIEW

- TABLE 227 PALL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 PALL CORPORATION: DEALS, JANUARY 2019-APRIL 2025

- TABLE 229 HYFLUX: COMPANY OVERVIEW

- TABLE 230 HYFLUX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 VONTRON TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 232 VONTRON TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 APPLIED MEMBRANES, INC.: COMPANY OVERVIEW

- TABLE 234 MEMBRANE SOLUTIONS (NANTONG) CO., LTD.: COMPANY OVERVIEW

- TABLE 235 SCINOR WATER AMERICA, LLC: COMPANY OVERVIEW

- TABLE 236 ALPHA PLAN GMBH: COMPANY OVERVIEW

- TABLE 237 MEMFILL TECH PVT. LTD.: COMPANY OVERVIEW

- TABLE 238 QUA GROUP LLC: COMPANY OVERVIEW

- TABLE 239 POLYMEM: COMPANY OVERVIEW

- TABLE 240 HONGTEK FILTRATION CO., LTD.: COMPANY OVERVIEW

- TABLE 241 PCI MEMBRANES: COMPANY OVERVIEW

- TABLE 242 JIUWU HI-TECH MEMBRANE TECHNOLOGY: COMPANY OVERVIEW

- TABLE 243 AQUABRANE WATER TECHNOLOGIES PVT. LTD.: COMPANY OVERVIEW

- TABLE 244 HYDRAMEM: COMPANY OVERVIEW

- TABLE 245 THEWAY MEMBRANES: COMPANY OVERVIEW

- TABLE 246 HINADA WATER TREATMENT TECH CO., LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 HOLLOW FIBER ULTRAFILTRATION MARKET SEGMENTATION

- FIGURE 2 HOLLOW FIBER ULTRAFILTRATION MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 HOLLOW FIBER ULTRAFILTRATION MARKET: DATA TRIANGULATION

- FIGURE 6 POLYMERIC SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 7 INDUSTRIAL TO BE LARGER APPLICATION DURING FORECAST PERIOD

- FIGURE 8 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 9 INCREASING DEMAND FROM INDUSTRIAL SECTOR TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 10 POLYMERIC SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 INDUSTRIAL SEGMENT TO WITNESS HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 12 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN HOLLOW FIBER ULTRAFILTRATION MARKET

- FIGURE 14 HOLLOW FIBER ULTRAFILTRATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS

- FIGURE 16 KEY BUYING CRITERIA FOR TOP 4 APPLICATIONS

- FIGURE 17 HOLLOW FIBER ULTRAFILTRATION VALUE CHAIN

- FIGURE 18 HOLLOW FIBER ULTRAFILTRATION ECOSYSTEM

- FIGURE 19 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 20 COUNTRY-WISE EXPORT TRADE VALUE (USD THOUSAND)

- FIGURE 21 COUNTRY-WISE IMPORT TRADE VALUE (USD THOUSAND)

- FIGURE 22 AVERAGE SELLING PRICE TREND, BY REGION, 2023-2030

- FIGURE 23 INVESTMENT AND FUNDING SCENARIO

- FIGURE 24 TOTAL NUMBER OF PATENTS

- FIGURE 25 NUMBER OF PATENTS YEAR-WISE FROM 2013 TO 2023

- FIGURE 26 PATENT ANALYSIS, BY LEGAL STATUS

- FIGURE 27 TOP JURISDICTION, BY DOCUMENT

- FIGURE 28 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 29 POLYMERIC MEMBRANES TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 30 INDUSTRIAL TREATMENT TO BE LARGER APPLICATION OF HOLLOW FIBER ULTRAFILTRATION

- FIGURE 31 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 NORTH AMERICA: HOLLOW FIBER ULTRAFILTRATION MARKET SNAPSHOT

- FIGURE 33 INDUSTRIAL SEGMENT TO GROW AT HIGHER CAGR IN EUROPE

- FIGURE 34 ASIA PACIFIC: HOLLOW FIBER ULTRAFILTRATION MARKET SNAPSHOT

- FIGURE 35 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN HOLLOW FIBER ULTRAFILTRATION MARKET BETWEEN JANUARY 2019 AND APRIL 2025

- FIGURE 36 REVENUE ANALYSIS OF KEY COMPANIES IN HOLLOW FIBER ULTRAFILTRATION MARKET, 2022-2024

- FIGURE 37 SHARES OF LEADING COMPANIES IN HOLLOW FIBER ULTRAFILTRATION MARKET, 2024

- FIGURE 38 COMPANY VALUATION OF KEY COMPANIES IN HOLLOW FIBER ULTRAFILTRATION MARKET, 2024

- FIGURE 39 FINANCIAL METRICS OF KEY COMPANIES IN HOLLOW FIBER ULTRAFILTRATION MARKET, 2024

- FIGURE 40 HOLLOW FIBER ULTRAFILTRATION MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 41 HOLLOW FIBER ULTRAFILTRATION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 42 HOLLOW FIBER ULTRAFILTRATION MARKET: COMPANY FOOTPRINT

- FIGURE 43 HOLLOW FIBER ULTRAFILTRATION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 44 DUPONT: COMPANY SNAPSHOT

- FIGURE 45 VEOLIA: COMPANY SNAPSHOT

- FIGURE 46 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 47 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

- FIGURE 48 HYDRANAUTICS: COMPANY SNAPSHOT

- FIGURE 49 MANN+HUMMEL: COMPANY SNAPSHOT

- FIGURE 50 PENTAIR: COMPANY SNAPSHOT

The hollow fiber ultrafiltration market size is projected to grow from USD 2.39 billion in 2025 to USD 4.85 billion by 2030, at a CAGR of 15.2% during the forecast period. The global demand for hollow fiber ultrafiltration is on the rise as it effectively removes contaminants such as fungi, viruses, and bacteria from water, ensuring safe water for drinking. Hollow fiber ultrafiltration is applicable in various industries such as food & beverage, pharmaceutical, and oil & gas. Hollow fiber ultrafiltration is also used for metal manufacturing and treating processed water, as it effectively removes suspended solids, colloids, and microorganisms. This process ensures that companies comply with environmental regulations and reduces the environmental impact of their operations.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Quantity) |

| Segments | Type, Application, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

"PS & PES is projected to be the second-largest subsegment type, in terms of value, under the polymeric segment"

PES (Polyethersulfone) owns exceptional properties such as thermal stability, mechanical strength, high flux, and chemical resistance and thus is known to be a high-performance thermoplastic polymer. In hollow fiber ultrafiltration systems, PES is used as the support layer, which provides high structural stability to the membrane and facilitates permeate flow. This support layer ,which is porous in nature, allows solvents to pass through it and retains the active layer that performs the separation. The high compaction resistance property of PS (polysulfone) makes it a better material to use under high pressure conditions. It is stable in aqueous acids and bases and many non-polar solvents; however, it is soluble in dichloromethane and methyl pyrrolidone.

"Food & beverage accounted for the third-largest share of the application subsegment of the hollow fiber ultrafiltration market, in terms of value, under the industrial segment"

The food & beverage industry is highly competitive and dynamic in nature. In the past few years there has been an increase in awareness regarding health. Due to this, there is a demand for high-quality products which are safe and nutritious. Therefore, utilizing the right membrane filtration solution to accomplish the required goal is necessary. In this sector utilizing membranes has become a necessity as it helps in processing milk, cheese, and whey proteins. Utilizing the efficient membrane filtration technology helps this industry's manufacturers to concentrate, clarify, and purify products, including bottled water, juice, and wine. They can also be used for enzyme recovery, processing cheese whey, and removal of pathogens from milk.

"Middle East & Africa is the fourth-largest market for hollow fiber ultrafiltration"

Middle East & Africa holds the fourth-largest market share globally in the hollow fiber ultrafiltration market due to several key factors. The region has less than 1% of water resources for domestic and industrial consumption. Around 5% of the world's population resides in the region and has very scarce water resources, posing the major threat of water scarcity. Population growth and limited freshwater resources are some of the major reasons for the reuse and recycling of wastewater in the region. Increasing urbanization and improving the Middle East & Africa's business environment will further drive water & wastewater treatment activities. The region has multinational membrane manufacturing companies and innovation firms in water technology.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the hollow fiber ultrafiltration market, and information was gathered from secondary research to determine and verify the market sizes of several segments.

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C Level Executives- 20%, Directors - 10%, and Others - 70%

- By Region: North America - 22%, Europe - 22%, Asia Pacific - 45% and Rest of the World- 11%

The report provides a comprehensive company profile analysis:

The hollow fiber ultrafiltration market comprises major players such as Toray Industries, Inc. (Japan), DuPont (US), Veolia (France), Asahi Kasei Corporation (Japan), Hydranautics (US), Kovalus Separation Solutions (US), Pall Corporation (US), Pentair (US), and Mann+Hummel (Germany), among others. The study includes in-depth competitive analysis of these key players in the hollow fiber ultrafiltration market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the hollow fiber ultrafiltration market By Type (Polymeric, Ceramic, Hybrid), Application (Municipal, Industrial), Region (North America, Europe, Asia Pacific, Middle East & Africa, and South America). The scope of the report includes detailed information about the major factors influencing the growth of the hollow fiber ultrafiltration market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted in order to provide insights into their business overviews, solutions and services, key strategies, contracts, partnerships, and agreements. Product launches, mergers & acquisitions, and recent developments in the hollow fiber ultrafiltration market are all covered. This report includes a competitive analysis of the upcoming startups in the hollow fiber ultrafiltration market ecosystem.

Key benefits of buying this report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall hollow fiber ultrafiltration market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on the hollow fiber ultrafiltration market offered by top players in the global hollow fiber ultrafiltration market.

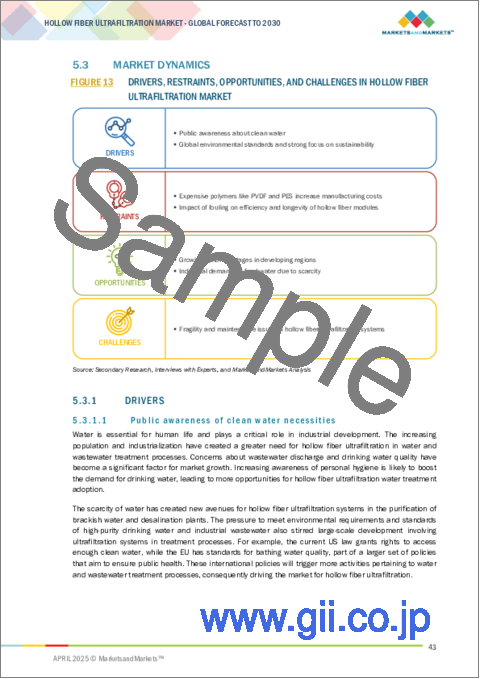

- Analysis of Drivers: (public awareness for clean water necessities, global environmental standards, strong focus on sustainability), restraints (expensive polymers, fouling impacts efficiency, longevity) opportunities (growing water shortages, industrial demand for freshwater), and challenges (fragile, maintenance issues) influencing the growth of the hollow fiber ultrafiltration market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product launches in the hollow fiber ultrafiltration market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for hollow fiber ultrafiltration across regions.

- Market Capacity: Production capacities of companies producing hollow fiber ultrafiltration are provided wherever available with upcoming capacities for the hollow fiber ultrafiltration market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the hollow fiber ultrafiltration market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 INCLUSIONS & EXCLUSIONS

- 1.3.2 YEARS CONSIDERED

- 1.3.3 CURRENCY CONSIDERED

- 1.3.4 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HOLLOW FIBER ULTRAFILTRATION MARKET

- 4.2 HOLLOW FIBER ULTRAFILTRATION MARKET, BY TYPE

- 4.3 HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION

- 4.4 HOLLOW FIBER ULTRAFILTRATION MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 IMPACT OF GEN AI

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Public awareness of clean water necessities

- 5.3.1.2 Increasing adoption of low-pressure, high-efficiency UF membranes

- 5.3.1.3 Global environmental standards and strong focus on sustainability

- 5.3.2 RESTRAINTS

- 5.3.2.1 High sensitivity to feed water quality and contaminants

- 5.3.2.2 Surge in manufacturing costs of PVDF and PES

- 5.3.2.3 Impact of fouling on efficiency and longevity of hollow fiber modules

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Growing water shortages in emerging economies

- 5.3.3.2 Industrial demand for freshwater due to scarcity

- 5.3.3.3 Integration of smart membrane technologies for real-time performance optimization

- 5.3.4 CHALLENGES

- 5.3.4.1 Fragility and maintenance issues in hollow fiber ultrafiltration systems

- 5.3.4.2 Scalability and performance limitations in high-solid environments

- 5.3.1 DRIVERS

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 THREAT OF SUBSTITUTES

- 5.4.2 BARGAINING POWER OF BUYERS

- 5.4.3 THREAT OF NEW ENTRANTS

- 5.4.4 BARGAINING POWER OF SUPPLIERS

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GLOBAL GDP TRENDS

- 5.6 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.6.2 BUYING CRITERIA

- 5.7 VALUE CHAIN ANALYSIS

- 5.7.1 RAW MATERIAL SUPPLIERS

- 5.7.2 MANUFACTURERS

- 5.7.3 SUPPLIERS/DISTRIBUTORS

- 5.7.4 END-USE INDUSTRIES

- 5.8 ECOSYSTEM ANALYSIS

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 INNOVATIVE ULTRAFILTRATION TECHNOLOGY TRANSFORMS WASTEWATER TREATMENT AT WUXI HIGH-TECH INDUSTRIAL PARK

- 5.9.2 ACHIEVING SUSTAINABLE WATER MANAGEMENT WITH APRICUS' HIGH-PERFORMANCE HOLLOW FIBER ULTRAFILTRATION MEMBRANES

- 5.9.3 ENHANCING ALUMINUM CASTING PROCESSES WITH SILICON NITRIDE

- 5.9.4 Q-SEP HOLLOW FIBER ULTRAFILTRATION (UF) MEMBRANES IN A TEXTILE PLANT'S EFFLUENT TREATMENT PROCESS

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATIONS

- 5.10.1.1 Europe

- 5.10.1.2 Asia Pacific

- 5.10.1.3 North America

- 5.10.2 STANDARDS

- 5.10.2.1 United States Pharmacopeia (USP) Class VI

- 5.10.3 REGULATORY BODIES, GOVERNMENT BODIES, AND OTHER AGENCIES

- 5.10.1 REGULATIONS

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 Large membrane area technology with high-packing-density

- 5.11.1.2 PVDF and PES for superior filtration performance

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 Innovative rotating hollow fiber membrane enhances MBR efficiency

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 Liquid separation using hollow fiber pervaporation modules

- 5.11.1 KEY TECHNOLOGIES

- 5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.13 TRADE ANALYSIS

- 5.13.1 EXPORT SCENARIO

- 5.13.2 IMPORT SCENARIO

- 5.14 KEY CONFERENCES & EVENTS IN 2025

- 5.15 PRICING ANALYSIS

- 5.15.1 AVERAGE SELLING PRICE TREND, BY REGION, 2023-2030

- 5.15.2 INDICATIVE PRICING OF HOLLOW FIBER ULTRAFILTRATION, BY REGION

- 5.15.3 INDICATIVE PRICING OF HOLLOW FIBER ULTRAFILTRATION BY KEY PLAYERS, BY TYPE

- 5.15.4 INDICATIVE PRICING OF HOLLOW FIBER ULTRAFILTRATION BY KEY PLAYERS, BY APPLICATION

- 5.16 INVESTMENT AND FUNDING SCENARIO

- 5.17 IMPACT OF 2025 US TARIFF - HOLLOW FIBER ULTRAFILTRATION MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.2.1 Tariffs on UF Raw Materials (Polymers, Membranes)

- 5.17.2.2 Tariffs on UF Systems and Parts

- 5.17.2.3 Broader Industrial Tariffs (Steel & Aluminum)

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.4.4 Latin America

- 5.17.4.5 Middle East & Africa

- 5.17.5 IMPACT ON END-USE INDUSTRIES

- 5.18 PATENT ANALYSIS

- 5.18.1 APPROACH

- 5.18.2 DOCUMENT TYPE

- 5.18.3 PUBLICATION TRENDS IN LAST 10 YEARS, 2013-2023

- 5.18.4 INSIGHTS

- 5.18.5 LEGAL STATUS OF PATENTS

- 5.18.6 JURISDICTION ANALYSIS

- 5.18.7 TOP APPLICANTS

- 5.18.8 TOP 10 PATENT OWNERS (US) LAST 10 YEARS

6 HOLLOW FIBER ULTRAFILTRATION MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 POLYMERIC

- 6.2.1 POROSITY AND PERMEABILITY OF POLYMERIC MEMBRANES TO DRIVE MARKET

- 6.2.2 PS & PES

- 6.2.3 PVDF

- 6.2.4 OTHER POLYMERIC TYPES

- 6.3 CERAMIC ULTRAFILTRATION

- 6.3.1 RESISTANCE TO CONCENTRATED ACIDS AND CAUSTIC SOLUTIONS TO DRIVE MARKET

- 6.3.2 ZIRCONIA

- 6.3.3 ALUMINA

- 6.3.4 TITANIA

- 6.4 HYBRID

- 6.4.1 HYDROPHILICITY AND CHEMICAL STABILITY TO DRIVE MARKET

- 6.5 OTHER TYPES

7 HOLLOW FIBER ULTRAFILTRATION MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 MUNICIPAL TREATMENT

- 7.2.1 DESALINATION

- 7.2.2 PUBLIC UTILITY WATER TREATMENT

- 7.2.3 WASTEWATER REUSE

- 7.3 INDUSTRIAL TREATMENT

- 7.3.1 FOOD & BEVERAGE

- 7.3.1.1 Dairy processing

- 7.3.1.2 Food processing

- 7.3.1.3 Beverage processing

- 7.3.2 PHARMACEUTICAL

- 7.3.3 OIL & GAS

- 7.3.4 OTHER INDUSTRIAL TREATMENT APPLICATIONS

- 7.3.1 FOOD & BEVERAGE

8 HOLLOW FIBER ULTRAFILTRATION MARKET, BY REGION

- 8.1 INTRODUCTION

- 8.2 NORTH AMERICA

- 8.2.1 US

- 8.2.1.1 Increasing adoption of safe water technologies to drive market

- 8.2.2 CANADA

- 8.2.2.1 Municipal regulations to support market growth

- 8.2.3 MEXICO

- 8.2.3.1 Growing population to drive demand

- 8.2.1 US

- 8.3 EUROPE

- 8.3.1 GERMANY

- 8.3.1.1 Advanced wastewater treatment to drive market

- 8.3.2 FRANCE

- 8.3.2.1 R&D for cost-effective water treatment technologies to drive market

- 8.3.3 SPAIN

- 8.3.3.1 EU directives to fuel water treatment innovations

- 8.3.4 UK

- 8.3.4.1 Food & beverage industry to drive demand

- 8.3.5 NETHERLANDS

- 8.3.5.1 Increase in municipal and industrial water treatment to drive demand

- 8.3.6 ITALY

- 8.3.6.1 Increasing role of ultrafiltration in chemical and food industries to drive demand

- 8.3.7 REST OF EUROPE

- 8.3.1 GERMANY

- 8.4 ASIA PACIFIC

- 8.4.1 CHINA

- 8.4.1.1 Industrialization and water challenges to propel filtration sector

- 8.4.2 JAPAN

- 8.4.2.1 Technological edge in water treatment to drive market

- 8.4.3 INDIA

- 8.4.3.1 Increase in government's focus on water treatment to drive market

- 8.4.4 SOUTH KOREA

- 8.4.4.1 Wastewater reuse initiatives to drive ultrafiltration demand

- 8.4.5 REST OF ASIA PACIFIC

- 8.4.1 CHINA

- 8.5 MIDDLE EAST & AFRICA

- 8.5.1 GCC COUNTRIES

- 8.5.1.1 Saudi Arabia

- 8.5.1.1.1 Plans to add plants with membrane technology to drive demand

- 8.5.1.2 UAE

- 8.5.1.2.1 Oil refinery industry to drive market

- 8.5.1.3 Rest of GCC countries

- 8.5.1.1 Saudi Arabia

- 8.5.2 SOUTH AFRICA

- 8.5.2.1 Huge population, severe drought, and water pollution to drive market

- 8.5.3 REST OF MIDDLE EAST & AFRICA

- 8.5.1 GCC COUNTRIES

- 8.6 SOUTH AMERICA

- 8.6.1 BRAZIL

- 8.6.1.1 High demand for potable and industrial processing water to drive market

- 8.6.2 ARGENTINA

- 8.6.2.1 Emphasis on wastewater treatment activities and foreign investments to boost market

- 8.6.3 REST OF SOUTH AMERICA

- 8.6.1 BRAZIL

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- 9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 9.3 REVENUE ANALYSIS, 2022-2024

- 9.4 MARKET SHARE ANALYSIS, 2024

- 9.5 COMPANY VALUATION AND FINANCIAL METRICS

- 9.6 BRAND/PRODUCT COMPARISON

- 9.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 9.7.1 STARS

- 9.7.2 EMERGING LEADERS

- 9.7.3 PERVASIVE PLAYERS

- 9.7.4 PARTICIPANTS

- 9.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 9.7.5.1 Company footprint

- 9.7.5.2 Region footprint

- 9.7.5.3 Type footprint

- 9.7.5.4 Application footprint

- 9.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 9.8.1 PROGRESSIVE COMPANIES

- 9.8.2 RESPONSIVE COMPANIES

- 9.8.3 DYNAMIC COMPANIES

- 9.8.4 STARTING BLOCKS

- 9.8.5 COMPETITIVE BENCHMARKING

- 9.8.5.1 Detailed list of key start-ups/SMEs

- 9.8.5.2 Competitive benchmarking of key startups/SMEs

- 9.9 COMPETITIVE SCENARIOS

- 9.9.1 PRODUCT LAUNCHES

- 9.9.2 EXPANSIONS

- 9.9.3 DEALS

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- 10.1.1 DUPONT

- 10.1.1.1 Business overview

- 10.1.1.2 Products/Solutions/Services offered

- 10.1.1.3 Recent developments

- 10.1.1.3.1 Deals

- 10.1.1.4 MnM view

- 10.1.1.4.1 Key strengths

- 10.1.1.4.2 Strategic choices

- 10.1.1.4.3 Weaknesses and competitive threats

- 10.1.2 VEOLIA

- 10.1.2.1 Business overview

- 10.1.2.2 Products/Solutions/Services offered

- 10.1.2.2.1 Deals

- 10.1.2.2.2 Expansions

- 10.1.2.3 MnM view

- 10.1.3 TORAY INDUSTRIES, INC.

- 10.1.3.1 Business overview

- 10.1.3.2 Products/Solutions/Services offered

- 10.1.3.3 Recent developments

- 10.1.3.3.1 Deals

- 10.1.3.4 MnM view

- 10.1.3.4.1 Key strengths

- 10.1.3.4.2 Strategic choices

- 10.1.3.4.3 Weaknesses and competitive threats

- 10.1.4 ASAHI KASEI CORPORATION

- 10.1.4.1 Business overview

- 10.1.4.2 Products/Solutions/Services offered

- 10.1.4.3 MnM view

- 10.1.5 HYDRANAUTICS

- 10.1.5.1 Business overview

- 10.1.5.2 Products/Solutions/Services offered

- 10.1.5.3 Recent developments

- 10.1.5.3.1 Product launches

- 10.1.5.3.2 Deals

- 10.1.5.4 MnM view

- 10.1.5.4.1 Key strengths

- 10.1.5.4.2 Strategic choices

- 10.1.5.4.3 Weaknesses and competitive threats

- 10.1.6 MANN+HUMMEL

- 10.1.6.1 Business overview

- 10.1.6.2 Products/Solutions/Services offered

- 10.1.6.3 MnM view

- 10.1.7 PENTAIR

- 10.1.7.1 Business overview

- 10.1.7.2 Products/Solutions/Services offered

- 10.1.7.3 Recent developments

- 10.1.7.3.1 Deals

- 10.1.7.4 MnM view

- 10.1.7.4.1 Key strengths

- 10.1.7.4.2 Strategic choices

- 10.1.7.4.3 Weaknesses and competitive threats

- 10.1.8 KOVALUS SEPARATION SOLUTIONS

- 10.1.8.1 Business overview

- 10.1.8.2 Products/Solutions/Services offered

- 10.1.8.3 Recent developments

- 10.1.8.3.1 Deals

- 10.1.8.3.2 Expansions

- 10.1.8.4 MnM view

- 10.1.9 PALL CORPORATION

- 10.1.9.1 Business overview

- 10.1.9.2 Products/Solutions/Services offered

- 10.1.9.3 Recent developments

- 10.1.9.3.1 Deals

- 10.1.9.4 MnM view

- 10.1.10 HYFLUX

- 10.1.10.1 Business overview

- 10.1.10.2 Products/Solutions/Services offered

- 10.1.10.3 MnM view

- 10.1.10.3.1 Key strengths

- 10.1.10.3.2 Strategic choices

- 10.1.10.3.3 Weaknesses and competitive threats

- 10.1.11 VONTRON TECHNOLOGY CO., LTD.

- 10.1.11.1 Business overview

- 10.1.11.2 Products/Solutions/Services offered

- 10.1.11.3 MnM view

- 10.1.1 DUPONT

- 10.2 OTHER PLAYERS

- 10.2.1 APPLIED MEMBRANES, INC.

- 10.2.2 MEMBRANE SOLUTIONS (NANTONG) CO., LTD.

- 10.2.3 SCINOR WATER AMERICA, LLC

- 10.2.4 ALPHA PLAN GMBH

- 10.2.5 MEMFILL TECH PVT. LTD.

- 10.2.6 QUA GROUP LLC

- 10.2.7 POLYMEM

- 10.2.8 HONGTEK FILTRATION CO., LTD.

- 10.2.9 PCI MEMBRANES

- 10.2.10 JIUWU HI-TECH MEMBRANE TECHNOLOGY

- 10.2.11 AQUABRANE WATER TECHNOLOGIES PVT. LTD.

- 10.2.12 HYDRAMEM

- 10.2.13 THEWAY MEMBRANES

- 10.2.14 HINADA WATER TREATMENT TECH CO., LTD.

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS