|

|

市場調査レポート

商品コード

1720947

AI PCの世界市場:製品別、オペレーティングシステム別、コンピュートアーキテクチャ別、コンピュートタイプ別、価格別、エンドユーザー別、地域別 - 2031年までの予測AI PC Market by Product (Desktops & Notebooks, Workstations), Operating System (Windows, macOS, Chrome), Compute Type (GPU, NPU <40 TOPs, 40-60 TOPS), Compute Architecture (X86, ARM), Price (<USD 1,200, USD 1,200 and Above) - Global Forecast to 2031 |

||||||

カスタマイズ可能

|

|||||||

| AI PCの世界市場:製品別、オペレーティングシステム別、コンピュートアーキテクチャ別、コンピュートタイプ別、価格別、エンドユーザー別、地域別 - 2031年までの予測 |

|

出版日: 2025年04月25日

発行: MarketsandMarkets

ページ情報: 英文 235 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のAI PCの市場規模は、2025年の912億3,000万米ドルから2031年には2,604億3,000万米ドルに成長し、CAGRは19.1%になると予測されています。

高性能ゲーム機器への需要がAI PCの採用を後押ししています。最新のゲームでは、グラフィックスやよりスマートなNPCの動作に高度なAIが必要とされるためです。プロシージャルコンテンツ生成、リアルタイムレイトレーシング、適応型難易度などの機能には、強力なコンピューティングが必要です。GPUやNPUを搭載したAI PCは、シームレスなゲームプレイを実現し、ゲーム体験を向上させます。さらに、コンテンツ制作やゲームストリーミングの増加により、ゲーマーはAIベースのツールでマルチタスクをサポートするシステムを求めるようになり、AI搭載PCの魅力を高めています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023年~2031年 |

| 基準年 | 2023年 |

| 予測期間 | 2025年~2031年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | 製品別、オペレーティングシステム別、コンピュートアーキテクチャ別、コンピュートタイプ別、価格別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

x86コンピュートアーキテクチャは、長年パーソナルコンピューティングを支配してきたため、AI PC市場で最大のシェアを占めています。また、ソフトウェアの互換性が広く、性能も向上し続けています。IntelとAMDが開発したx86プロセッサーは、世界的にほとんどのデスクトップPCとノートPCに搭載されており、ほとんどのAI PCのデフォルト・アーキテクチャとなっています。これらの成熟したプラットフォームは、オペレーティングシステム、ソフトウェアパッケージ、開発者ツールをサポートしています。さらに、AIアクセラレータの統合、マルチコア性能の向上、電力効率の改善など、最近のx86アーキテクチャの動向により、これらのプロセッサは、増加するAIワークロードをホストできるようになっています。これにより、x86ベースのPCは、リアルタイムのコラボレーション、創造的なアプリケーション、ビジネスの生産性など、消費者や企業の使用シナリオに適合するようになります。主要PCメーカーは依然としてインテルとAMDのx86プロセッサに依存しており、これらの企業はAIに最適化されたCPUに多額の投資を行っているため、このアーキテクチャは引き続きAI PC市場をリードしていくと予想されます。

NPUはニューラルネットワークの処理に最適化されており、音声認識や顔認証などのAIタスクをより高速かつエネルギー効率よく実行できるため、NPUコンピュートタイプはAI PC市場で急成長するとみられています。低消費電力AIアクセラレータの需要が高まる中、Apple、Intel、Qualcomm、AMDなどの企業は、オンデバイスAI処理用にNPUをチップセットに統合し、応答時間、データプライバシー、ユーザーエクスペリエンスを強化しています。WindowsやmacOSなどのオペレーティング・システムは、スマート検索やシステム・パフォーマンスの向上などの機能のためにNPUを活用するよう最適化されており、NPUはAI PCの標準となっています。

米国は、技術革新におけるリーダーシップ、Apple、Intel、NVIDIAなどの大手ハイテク企業の存在、業界全体におけるAIソリューションの早期導入により、北米のAI PC市場で最大の市場シェアを獲得すると予想されます。強力なインフラと高度なコンピューティングに対する消費者の需要が、AIデバイスの採用を後押ししています。米国企業は、生産性向上とデータセキュリティ強化のためにAI PCに投資することで、デジタルトランスフォーメーションを優先しています。さらに、資金援助やパートナーシップを通じた政府の支援は、AI研究とイノベーションに対する同国のコミットメントをさらに強化し、AI PC市場における世界リーダーとしての地位を確固たるものにしています。

当レポートでは、世界のAI PC市場について調査し、製品別、オペレーティングシステム別、コンピュートアーキテクチャ別、コンピュートタイプ別、価格別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- サプライチェーン分析

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- 世界のPC出荷予測

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 投資と資金調達シナリオ、2022年~2024年

- 技術分析

- 2025年の米国関税の影響-AI PC市場

- 貿易分析

- 特許分析

- 関税と規制状況

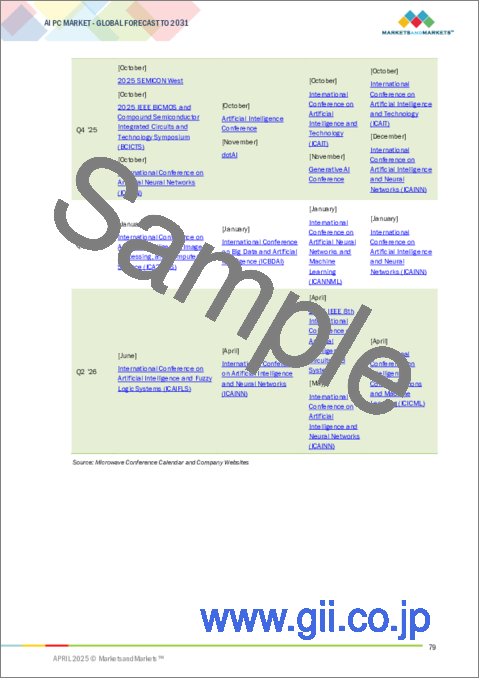

- 2025年~2026年の主な会議とイベント

- 価格分析

第6章 AI PC市場(製品別)

- イントロダクション

- デスクトップ/ノートブック

- ワークステーション

第7章 AI PC市場(オペレーティングシステム別)

- イントロダクション

- WINDOWS

- MACOS

- その他

第8章 AI PC市場(コンピュートアーキテクチャ別)

- イントロダクション

- X86

- ARM

第9章 AI PC市場(コンピュートタイプ別)

- イントロダクション

- グラフィックプロセッサ

- NPU

第10章 AI PC市場(価格別)

- イントロダクション

- 1,200米ドル未満

- 1,200米ドル以上

第11章 AI PC市場(エンドユーザー別)

- イントロダクション

- 消費者

- 企業

第12章 AI PC市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- 英国

- ドイツ

- イタリア

- フランス

- その他

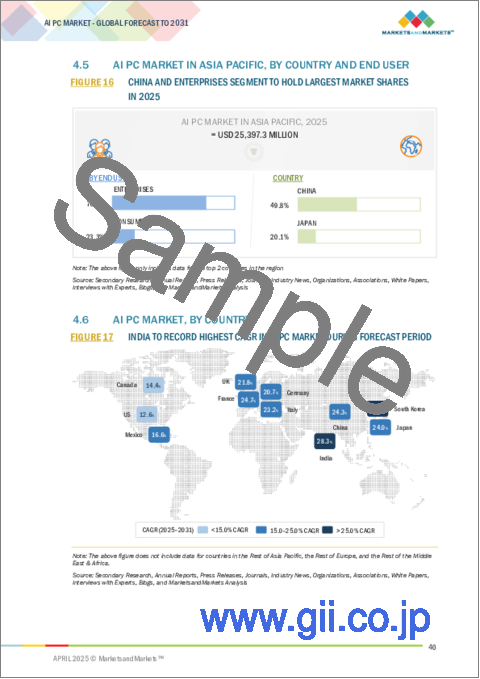

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- インド

- 韓国

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 中東・アフリカ

- 南米

第13章 競合情勢

- 概要

- 主な戦略/強み、2023年~2025年

- 主要参入企業の収益分析、2022年~2024年

- 主要参入企業の市場シェア分析、2024年

- 企業評価と財務指標、2025年

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競争シナリオ

第14章 企業プロファイル

- 主要参入企業

- APPLE INC.

- DELL INC.

- LENOVO

- HP DEVELOPMENT COMPANY, L.P.

- ASUSTEK COMPUTER INC.

- INTEL CORPORATION

- ADVANCED MICRO DEVICES, INC.

- NVIDIA CORPORATION

- MICROSOFT

- ACER INC.

- その他の企業

- FUJITSU

- HUAWEI TECHNOLOGIES CO., LTD.

- GIGA-BYTE TECHNOLOGY CO., LTD.

- MICRO-STAR INT'L CO., LTD.

- SUPER MICRO COMPUTER, INC.

- LAMBDA, INC.

- IBM CORPORATION

- BOXX

- CORSAIR

- PUGET SYSTEMS

- RAZER INC.

- SYSTEM76, INC.

- GROQ, INC.

- HAILO TECHNOLOGIES LTD

- BLAIZE

- KNERON, INC.

- CEREBRAS

第15章 付録

List of Tables

- TABLE 1 AI PC MARKET: RISK ANALYSIS

- TABLE 2 ROLES OF COMPANIES IN AI PC ECOSYSTEM

- TABLE 3 AI PC MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO END USERS (%)

- TABLE 5 KEY BUYING CRITERIA FOR TOP TWO END USERS

- TABLE 6 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024 (USD BILLION)

- TABLE 7 KEY PRODUCT-RELATED TARIFF EFFECTIVE

- TABLE 8 EXPECTED CHANGE IN PRICES AND IMPACT ON END-USE MARKET DUE TO TARIFF IMPACT

- TABLE 9 IMPORT DATA FOR HS CODE 847141-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 EXPORT DATA FOR HS CODE 847141-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 PATENT REGISTRATIONS, 2022-2024

- TABLE 12 TARIFF FOR HS CODE 847141-COMPLIANT PRODUCTS EXPORTED BY CHINA, 2023

- TABLE 13 TARIFF FOR HS CODE 847141-COMPLIANT PRODUCTS EXPORTED BY US, 2023

- TABLE 14 TARIFF FOR HS CODE 847141-COMPLIANT PRODUCTS EXPORTED BY GERMANY, 2023

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 REGULATORY STANDARDS RELATED TO AI PC MARKET

- TABLE 20 AI PC MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 21 INDICATIVE PRICING OF DESKTOPS/NOTEBOOKS OFFERED BY KEY PLAYERS, 2024

- TABLE 22 INDICATIVE PRICING OF WORKSTATIONS OFFERED BY KEY PLAYERS, 2024

- TABLE 23 INDICATIVE PRICING OF DESKTOPS/NOTEBOOKS AND WORKSTATIONS, BY REGION, 2024

- TABLE 24 AI PC MARKET, BY PRODUCT, 2024-2031 (USD MILLION)

- TABLE 25 AI PC MARKET, BY PRODUCT, 2024-2031 (MILLION UNITS)

- TABLE 26 DESKTOP/NOTEBOOK: AI PC MARKET, BY COMPUTE TYPE, 2024-2031 (USD MILLION)

- TABLE 27 DESKTOP/NOTEBOOK: AI PC MARKET, BY PRICE, 2024-2031 (USD MILLION)

- TABLE 28 DESKTOP/NOTEBOOK: AI PC MARKET, BY END USER, 2024-2031 (MILLION UNITS)

- TABLE 29 DESKTOP/NOTEBOOK: AI PC MARKET, BY END USER, 2024-2031 (USD MILLION)

- TABLE 30 WORKSTATION: AI PC MARKET, BY COMPUTE TYPE, 2024-2031 (USD MILLION)

- TABLE 31 WORKSTATION: AI PC MARKET, BY PRICE, 2024-2031 (USD MILLION)

- TABLE 32 WORKSTATION: AI PC MARKET, BY END USER, 2024-2031 (MILLION UNITS)

- TABLE 33 WORKSTATION: AI PC MARKET, BY END USER, 2024-2031 (USD MILLION)

- TABLE 34 AI PC MARKET, BY OPERATING SYSTEM, 2024-2031 (USD MILLION)

- TABLE 35 AI PC MARKET, BY COMPUTE ARCHITECTURE, 2024-2031 (USD MILLION)

- TABLE 36 AI PC MARKET, BY COMPUTE TYPE, 2024-2031 (USD MILLION)

- TABLE 37 AI PC MARKET, BY PRICE, 2024-2031 (USD MILLION)

- TABLE 38 LESS THAN USD 1,200: AI PC MARKET, BY REGION, 2024-2031 (USD MILLION)

- TABLE 39 USD 1,200 AND ABOVE: AI PC MARKET, BY REGION, 2024-2031 (USD MILLION)

- TABLE 40 AI PC MARKET, BY END USER, 2024-2031 (USD MILLION)

- TABLE 41 AI PC MARKET, BY END USER, 2024-2031 (MILLION UNITS)

- TABLE 42 CONSUMER: AI PC MARKET, BY REGION, 2024-2031 (USD MILLION)

- TABLE 43 CONSUMER: AI PC MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2031 (USD MILLION)

- TABLE 44 CONSUMER: AI PC MARKET IN EUROPE, BY COUNTRY, 2024-2031 (USD MILLION)

- TABLE 45 CONSUMER: AI PC MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2031 (USD MILLION)

- TABLE 46 CONSUMER: AI PC MARKET IN ROW, BY REGION, 2024-2031 (USD MILLION)

- TABLE 47 CONSUMER: AI PC MARKET IN MIDDLE EAST & AFRICA, BY REGION, 2024-2031 (USD MILLION)

- TABLE 48 CONSUMER: AI PC MARKET IN ROW, BY PRODUCT, 2024-2031 (USD MILLION)

- TABLE 49 ENTERPRISE: AI PC MARKET, BY REGION, 2024-2031 (USD MILLION)

- TABLE 50 ENTERPRISE: AI PC MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2031 (USD MILLION)

- TABLE 51 ENTERPRISE: AI PC MARKET IN EUROPE, BY COUNTRY, 2024-2031 (USD MILLION)

- TABLE 52 ENTERPRISE: AI PC MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2031 (USD MILLION)

- TABLE 53 ENTERPRISE: AI PC MARKET IN ROW, BY REGION, 2024-2031 (USD MILLION)

- TABLE 54 ENTERPRISE: AI PC MARKET IN MIDDLE EAST & AFRICA, BY REGION, 2024-2031 (USD MILLION)

- TABLE 55 ENTERPRISE: AI PC MARKET IN ROW, BY PRODUCT, 2024-2031 (USD MILLION)

- TABLE 56 AI PC MARKET, BY REGION, 2024-2031 (USD MILLION)

- TABLE 57 NORTH AMERICA: AI PC MARKET, BY END USER, 2024-2031 (USD MILLION)

- TABLE 58 NORTH AMERICA: AI PC MARKET, BY PRICE, 2024-2031 (USD MILLION)

- TABLE 59 NORTH AMERICA: AI PC MARKET, BY COUNTRY, 2024-2031 (USD MILLION)

- TABLE 60 US: AI PC MARKET, BY END USER, 2024-2031 (USD MILLION)

- TABLE 61 US: AI PC MARKET, BY PRICE, 2024-2031 (USD MILLION)

- TABLE 62 CANADA: AI PC MARKET, BY END USER, 2024-2031 (USD MILLION)

- TABLE 63 CANADA: AI PC MARKET, BY PRICE, 2024-2031 (USD MILLION)

- TABLE 64 MEXICO: AI PC MARKET, BY END USER, 2024-2031 (USD MILLION)

- TABLE 65 MEXICO: AI PC MARKET, BY PRICE, 2024-2031 (USD MILLION)

- TABLE 66 EUROPE: AI PC MARKET, BY END USER, 2024-2031 (USD MILLION)

- TABLE 67 EUROPE: AI PC MARKET, BY PRICE, 2024-2031 (USD MILLION)

- TABLE 68 EUROPE: AI PC MARKET, BY COUNTRY, 2024-2031 (USD MILLION)

- TABLE 69 UK: AI PC MARKET, BY END USER, 2024-2031 (USD MILLION)

- TABLE 70 UK: AI PC MARKET, BY PRICE, 2024-2031 (USD MILLION)

- TABLE 71 GERMANY: AI PC MARKET, BY END USER, 2024-2031 (USD MILLION)

- TABLE 72 GERMANY: AI PC MARKET, BY PRICE, 2024-2031 (USD MILLION)

- TABLE 73 ITALY: AI PC MARKET, BY END USER, 2024-2031 (USD MILLION)

- TABLE 74 ITALY: AI PC MARKET, BY PRICE, 2024-2031 (USD MILLION)

- TABLE 75 FRANCE: AI PC MARKET, BY END USER, 2024-2031 (USD MILLION)

- TABLE 76 FRANCE: AI PC MARKET, BY PRICE, 2024-2031 (USD MILLION)

- TABLE 77 REST OF EUROPE: AI PC MARKET, BY END USER, 2024-2031 (USD MILLION)

- TABLE 78 REST OF EUROPE: AI PC MARKET, BY PRICE, 2024-2031 (USD MILLION)

- TABLE 79 ASIA PACIFIC: AI PC MARKET, BY END USER, 2024-2031 (USD MILLION)

- TABLE 80 ASIA PACIFIC: AI PC MARKET, BY PRICE, 2024-2031 (USD MILLION))

- TABLE 81 ASIA PACIFIC: AI PC MARKET, BY COUNTRY, 2024-2031 (USD MILLION)

- TABLE 82 CHINA: AI PC MARKET, BY END USER, 2024-2031 (USD MILLION)

- TABLE 83 CHINA: AI PC MARKET, BY PRICE, 2024-2031 (USD MILLION)

- TABLE 84 JAPAN: AI PC MARKET, BY END USER, 2024-2031 (USD MILLION)

- TABLE 85 JAPAN: AI PC MARKET, BY PRICE, 2024-2031 (USD MILLION)

- TABLE 86 INDIA: AI PC MARKET, BY END USER, 2024-2031 (USD MILLION)

- TABLE 87 INDIA: AI PC MARKET, BY PRICE, 2024-2031 (USD MILLION)

- TABLE 88 SOUTH KOREA: AI PC MARKET, BY END USER, 2024-2031 (USD MILLION)

- TABLE 89 SOUTH KOREA: AI PC MARKET, BY PRICE, 2024-2031 (USD MILLION)

- TABLE 90 REST OF ASIA PACIFIC: AI PC MARKET, BY END USER, 2024-2031 (USD MILLION)

- TABLE 91 REST OF ASIA PACIFIC: AI PC MARKET, BY PRICE, 2024-2031 (USD MILLION)

- TABLE 92 ROW: AI PC MARKET, BY END USER, 2024-2031 (USD MILLION)

- TABLE 93 ROW: AI PC MARKET, BY PRICE, 2024-2031 (USD MILLION)

- TABLE 94 ROW: AI PC MARKET, BY REGION, 2024-2031 (USD MILLION)

- TABLE 95 MIDDLE EAST & AFRICA: AI PC MARKET, BY COUNTRY, 2024-2031 (USD MILLION)

- TABLE 96 MIDDLE EAST & AFRICA: AI PC MARKET, BY END USER, 2024-2031 (USD MILLION)

- TABLE 97 MIDDLE EAST & AFRICA: AI PC MARKET, BY PRICE, 2024-2031 (USD MILLION)

- TABLE 98 GCC COUNTRIES: AI PC MARKET, BY END USER, 2024-2031 (USD MILLION)

- TABLE 99 REST OF MIDDLE EAST & AFRICA: AI PC MARKET, BY END USER, 2024-2031 (USD MILLION)

- TABLE 100 SOUTH AMERICA: AI PC MARKET, BY END USER, 2024-2031 (USD MILLION)

- TABLE 101 SOUTH AMERICA: AI PC MARKET, BY PRICE, 2024-2031 (USD MILLION)

- TABLE 102 AI PC MARKET: OVERVIEW OF MAJOR STRATEGIES ADOPTED BY KEY PLAYERS, 2023-2025

- TABLE 103 AI PC MARKET: DEGREE OF COMPETITION

- TABLE 104 AI PC MARKET: REGION FOOTPRINT

- TABLE 105 AI PC MARKET: PRODUCT FOOTPRINT

- TABLE 106 AI PC MARKET: END USER FOOTPRINT

- TABLE 107 AI PC MARKET: OPERATING SYSTEM FOOTPRINT

- TABLE 108 AI PC MARKET: COMPUTE TYPE FOOTPRINT

- TABLE 109 AI PC MARKET: PRICE FOOTPRINT

- TABLE 110 AI PC MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 111 AI PC MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 112 AI PC MARKET: PRODUCT LAUNCHES, JANUARY 2023-APRIL 2025

- TABLE 113 AI PC MARKET: DEALS, JANUARY 2023-APRIL 2025

- TABLE 114 AI PC MARKET: EXPANSIONS, JANUARY 2023-APRIL 2025

- TABLE 115 AI PC MARKET: OTHER DEVELOPMENTS, JANUARY 2023-APRIL 2025

- TABLE 116 APPLE INC.: COMPANY OVERVIEW

- TABLE 117 APPLE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 118 APPLE INC.: PRODUCT LAUNCHES

- TABLE 119 APPLE INC.: DEALS

- TABLE 120 DELL INC.: COMPANY OVERVIEW

- TABLE 121 DELL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 122 DELL INC.: PRODUCT LAUNCHES

- TABLE 123 DELL INC.: DEALS

- TABLE 124 DELL INC.: EXPANSIONS

- TABLE 125 LENOVO: COMPANY OVERVIEW

- TABLE 126 LENOVO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 127 LENOVO: PRODUCT LAUNCHES

- TABLE 128 LENOVO: DEALS

- TABLE 129 LENOVO: EXPANSIONS

- TABLE 130 HP DEVELOPMENT COMPANY, L.P.: COMPANY OVERVIEW

- TABLE 131 HP DEVELOPMENT COMPANY, L.P.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 132 HP DEVELOPMENT COMPANY, L.P.: PRODUCT LAUNCHES

- TABLE 133 HP DEVELOPMENT COMPANY, L.P.: DEALS

- TABLE 134 ASUSTEK COMPUTER INC.: COMPANY OVERVIEW

- TABLE 135 ASUSTEK COMPUTER INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 136 ASUSTEK COMPUTER INC.: PRODUCT LAUNCHES

- TABLE 137 INTEL CORPORATION: COMPANY OVERVIEW

- TABLE 138 INTEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 139 INTEL CORPORATION: PRODUCT LAUNCHES

- TABLE 140 INTEL CORPORATION: DEALS

- TABLE 141 INTEL CORPORATION: OTHER DEVELOPMENTS

- TABLE 142 ADVANCED MICRO DEVICES, INC.: COMPANY OVERVIEW

- TABLE 143 ADVANCED MICRO DEVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 144 ADVANCED MICRO DEVICES, INC.: PRODUCT LAUNCHES

- TABLE 145 ADVANCED MICRO DEVICES, INC.: DEALS

- TABLE 146 ADVANCED MICRO DEVICES, INC.: EXPANSIONS

- TABLE 147 NVIDIA CORPORATION: COMPANY OVERVIEW

- TABLE 148 NVIDIA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 NVIDIA CORPORATION: PRODUCT LAUNCHES

- TABLE 150 NVIDIA CORPORATION: DEALS

- TABLE 151 MICROSOFT: COMPANY OVERVIEW

- TABLE 152 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 153 MICROSOFT: DEALS

- TABLE 154 MICROSOFT: OTHER DEVELOPMENTS

- TABLE 155 ACER INC.: COMPANY OVERVIEW

- TABLE 156 ACER INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 157 ACER INC.: PRODUCT LAUNCHES

List of Figures

- FIGURE 1 AI PC MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 AI PC MARKET: RESEARCH DESIGN

- FIGURE 3 AI PC MARKET: RESEARCH FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 AI PC MARKET: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY-SIDE): REVENUE GENERATED BY AI PC MANUFACTURERS

- FIGURE 6 AI PC MARKET: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 WORKSTATION SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 9 WINDOWS SEGMENT TO LEAD MARKET IN 2031

- FIGURE 10 CONSUMER SEGMENT TO DISPLAY HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 11 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 12 ONGOING DEVELOPMENTS IN AI AND ML TO DRIVE MARKET

- FIGURE 13 DESKTOP/NOTEBOOK SEGMENT TO HOLD LARGER MARKET SHARE IN 2025

- FIGURE 14 NPU SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2031

- FIGURE 15 LESS THAN USD 1,200 SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 16 CHINA AND ENTERPRISES SEGMENT TO HOLD LARGEST MARKET SHARES IN 2025

- FIGURE 17 INDIA TO RECORD HIGHEST CAGR IN AI PC MARKET DURING FORECAST PERIOD

- FIGURE 18 AI PC MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 AI PC MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 20 AI PC MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 21 AI PC MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 22 AI PC MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 23 AI PC MARKET: SUPPLY CHAIN

- FIGURE 24 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 AI PC MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 GLOBAL PC SHIPMENT FORECAST, 2020-2030

- FIGURE 27 AI PC MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO END USERS

- FIGURE 29 KEY BUYING CRITERIA FOR TOP TWO END USERS

- FIGURE 30 INVESTMENT AND FUNDING SCENARIO, 2022-2024 (USD MILLION)

- FIGURE 31 IMPORT DATA FOR HS CODE 847141-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 32 EXPORT DATA FOR HS CODE 847141-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 33 NUMBER OF PATENTS APPLIED AND GRANTED, 2014-2024

- FIGURE 34 INDICATIVE PRICING OF PRODUCTS OF KEY PLAYERS, 2024

- FIGURE 35 WORKSTATION SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 36 WINDOWS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 37 X86 SEGMENT TO HOLD LARGER MARKET SHARE IN 2031

- FIGURE 38 NPU SEGMENT TO HOLD LARGEST MARKET SHARE IN 2031

- FIGURE 39 USD 1,200 AND ABOVE PRICE RANGE HELD LARGEST MARKET SHARE IN 2024

- FIGURE 40 ENTERPRISE SEGMENT HELD LARGEST MARKET SHARE IN 2024

- FIGURE 41 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 NORTH AMERICA: AI PC MARKET SNAPSHOT

- FIGURE 43 EUROPE: AI PC MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: AI PC MARKET SNAPSHOT

- FIGURE 45 AI PC MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2022-2024

- FIGURE 46 AI PC MARKET: SHARE OF KEY PLAYER, 2024

- FIGURE 47 AI PC MARKET: COMPANY VALUATION, 2025

- FIGURE 48 AI PC MARKET: FINANCIAL METRICS, 2025

- FIGURE 49 BRAND/PRODUCT COMPARISON OF MAJOR COMPANIES

- FIGURE 50 AI PC MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 51 AI PC MARKET: COMPANY FOOTPRINT

- FIGURE 52 AI PC MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 53 APPLE INC.: COMPANY SNAPSHOT

- FIGURE 54 DELL INC.: COMPANY SNAPSHOT

- FIGURE 55 LENOVO: COMPANY SNAPSHOT

- FIGURE 56 HP DEVELOPMENT COMPANY, L.P.: COMPANY SNAPSHOT

- FIGURE 57 ASUSTEK COMPUTER INC.: COMPANY SNAPSHOT

- FIGURE 58 INTEL CORPORATION: COMPANY SNAPSHOT

- FIGURE 59 ADVANCED MICRO DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 60 NVIDIA CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 62 ACER INC.: COMPANY SNAPSHOT

The global AI PC market is expected to grow from USD 91.23 billion in 2025 to USD 260.43 billion by 2031, at a CAGR of 19.1%. The demand for high-performance gaming devices drives the adoption of AI PCs, as modern games require advanced AI for graphics and smarter NPC behavior. Features including procedural content generation, real-time ray tracing, and adaptive difficulty necessitate powerful computing. AI PCs with GPUs and NPUs deliver seamless gameplay and enhance the gaming experience. Additionally, the rise in content creation and game streaming has led gamers to seek systems that support multitasking with AI-based tools, boosting the appeal of AI-powered PCs.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2031 |

| Base Year | 2023 |

| Forecast Period | 2025-2031 |

| Units Considered | Value (USD Billion) |

| Segments | By Product, Operating System, Compute Type, Compute Architecture and Region |

| Regions covered | North America, Europe, APAC, RoW |

"X86 compute architecture to account for significant share of AI PC market"

The x86 compute architecture contributes the largest share of the AI PC market as it has dominated personal computing for many years. In addition, it has widespread software compatibility and continues to improve performance. Intel and AMD developed x86 processors that power most desktop and notebook PCs globally, making them the default architecture for most AI PC deployments. Their mature platform supports operating systems, software packages, and developer tools. Moreover, recent developments in x86 architecture, such as integrating AI accelerators, improved multi-core performance, and upgraded power efficiency, enable these processors to host increasing AI workloads. This makes x86-based PCs compatible with consumer and enterprise usage scenarios, including real-time collaboration, creative applications, and business productivity. With leading PC makers still depending on x86 processors from Intel and AMD, and with these companies heavily investing in AI-optimized CPUs, the architecture is expected to continue leading the AI PC market.

"NPU compute type to grow fastest in AI PC market during forecast period"

The NPU compute type is set to grow rapidly in the AI PC market, as NPUs are optimized for processing neural networks, enabling faster and more energy-efficient execution of AI tasks such as speech recognition and face authentication. With the rising demand for low-power AI accelerators, companies such as Apple, Intel, Qualcomm, and AMD are integrating NPUs into their chipsets for on-device AI processing, enhancing response times, data privacy, and user experiences. Operating systems such as Windows and macOS are being optimized to leverage NPUs for features such as smart search and system performance improvements, making NPUs the standard in AI PCs.

"US to hold largest share of North American AI PC market"

The US is expected to capture the largest market share of the AI PC market in North America due to its leadership in technological innovation, presence of major tech firms such as Apple, Intel, and NVIDIA, and early adoption of AI solutions across industries. The strong infrastructure and consumer demand for advanced computing have driven the adoption of AI devices. US enterprises prioritize digital transformation by investing in AI PCs to boost productivity and enhance data security. Additionally, government support through funding and partnerships further strengthens the country's commitment to AI research and innovation, solidifying its position as a global leader in the AI PC market.

In-depth interviews have been conducted with C-level executives, directors, and other executives from various key organizations operating in the AI PC marketplace.

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C-level Executives - 35%, Directors - 45%, and Others - 20%

- By Region: North America- 45%, Europe - 25%, Asia Pacific - 20%, and RoW - 10%

The study includes an in-depth competitive analysis of these key players in the AI PC market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the AI PC market by product, operating system, compute architecture, compute type, price, end user, and region (North America, Europe, Asia Pacific). The report scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the AI PC market. A thorough analysis of the key industry players has provided insights into their business overview, solutions and services, key strategies, Contracts, partnerships, agreements, new product and service launches, acquisitions, and recent developments associated with the AI PC market. This report covers a competitive analysis of the upcoming AI PC market ecosystem startups.

Reasons to Buy This Report

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the AI PC market and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (rise of generative AI & productivity tools, increasing adoption of digital platforms, booming gaming industry, and advancements in AI and ML, enterprise adoption of intelligent productivity tools), restraints (reliance on cloud-based services, shortage of qualified professionals, and requirement for specialized hardware components), opportunities (requirement for hardware upgrades due to software optimization, advancements in AI hardware, increasing adoption in commercial sector, and integration into IoT ecosystems), and challenges (rapid technological evolution and upgrade cycles, high costs of AI-optimized hardware) influencing the growth of the AI PC market.

- Product Development/Innovation: The report includes detailed insights on upcoming technologies, research & development activities, and product launches in the AI PC market.

- Market Development: The report provides comprehensive information about lucrative markets and analyzes the AI PC market across varied regions.

- Market Diversification: It includes exhaustive information about new products, untapped geographies, recent developments, and investments in the AI PC market.

- Competitive Assessment: The AI PC market report includes information about In-depth assessments of market shares, growth strategies, and service offerings of leading players, such as Apple Inc. (US), Dell Inc. (US), HP Development Company, L.P. (US), Lenovo (China), and ASUSTeK Computer Inc. (Taiwan).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (supply side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (demand side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ANALYSIS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AI PC MARKET

- 4.2 AI PC MARKET, BY PRODUCT

- 4.3 AI PC MARKET, BY COMPUTE TYPE

- 4.4 AI PC MARKET, BY PRICE

- 4.5 AI PC MARKET IN ASIA PACIFIC, BY COUNTRY AND END USER

- 4.6 AI PC MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Adoption of digital platforms

- 5.2.1.2 Advancements in GenAI and ML

- 5.2.1.3 Expanding gaming industry

- 5.2.1.4 Rise of Generative AI & productivity tools

- 5.2.2 RESTRAINTS

- 5.2.2.1 Shortage of qualified professionals

- 5.2.2.2 Requirement of specialized hardware components

- 5.2.2.3 Reliance on cloud-based services

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing adoption in commercial sector

- 5.2.3.2 Integration into IoT ecosystem

- 5.2.3.3 Increasing optimization of software for AI workloads

- 5.2.4 CHALLENGES

- 5.2.4.1 High costs of AI-optimized hardware

- 5.2.4.2 Rapid shifting landscape of technology in AI industry

- 5.2.1 DRIVERS

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 GLOBAL PC SHIPMENT FORECAST

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF SUPPLIERS

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.5 INTENSITY OF COMPETITION RIVALRY

- 5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.8.2 BUYING CRITERIA

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 DELOITTE ACCELERATED DIGITAL TRANSFORMATION WITH DELL AI PCS POWERED BY INTEL

- 5.9.2 INTEL INTEGRATED AI INTO NEW GENERATION OF PCS THAT ENHANCED SPEED AND SECURITY

- 5.9.3 DELL WORKSTATIONS DEPLOYED NVIDIA GPUS THAT BOOSTED AI PERFORMANCE AND COMPUTATIONAL POWER

- 5.9.4 ACER DELIVERED TRAVELMATE SPIN B3 LAPTOPS TO VARIETAS THAT ENHANCED LEARNING EXPERIENCE

- 5.10 INVESTMENT AND FUNDING SCENARIO, 2022-2024

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 Edge AI

- 5.11.1.2 Processors used in AI PC

- 5.11.1.2.1 AMD Ryzen AI processors

- 5.11.1.2.2 Apple's neural engine

- 5.11.1.2.3 Intel deep learning boost

- 5.11.1.2.4 Qualcomm's hexagon

- 5.11.1.2.5 NVIDIA GeForce and RTX GPUs

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 High bandwidth memory

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 Integration of AI accelerators

- 5.11.1 KEY TECHNOLOGIES

- 5.12 IMPACT OF 2025 US TARIFF- AI PC MARKET

- 5.12.1 INTRODUCTION

- 5.12.2 KEY TARIFF RATES

- 5.12.3 PRICE IMPACT ANALYSIS

- 5.12.4 IMPACT ON COUNTRY/REGION

- 5.12.4.1 The US

- 5.12.4.2 Europe

- 5.12.4.3 APAC

- 5.12.5 IMPACT ON END-USE INDUSTRIES

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT SCENARIO (HS CODE 847141)

- 5.13.2 EXPORT SCENARIO (HS CODE 847141)

- 5.14 PATENT ANALYSIS

- 5.15 TARIFF AND REGULATORY LANDSCAPE

- 5.15.1 TARIFF ANALYSIS

- 5.15.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.3 REGULATORY STANDARDS

- 5.16 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.17 PRICING ANALYSIS

- 5.17.1 INDICATIVE PRICING OF KEY PLAYERS, BY PRODUCT, 2024

- 5.17.2 INDICATIVE PRICING OF DESKTOPS/NOTEBOOKS AND WORKSTATIONS, BY REGION, 2024

6 AI PC MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 DESKTOP/NOTEBOOK

- 6.2.1 ENHANCED USER EXPERIENCES THROUGH AI-DRIVEN AUTOMATION TO FUEL MARKET GROWTH

- 6.3 WORKSTATION

- 6.3.1 RISING AI APPLICATION IN FINANCE, HEALTHCARE, AND CREATIVE SECTORS TO FUEL MARKET GROWTH

7 AI PC MARKET, BY OPERATING SYSTEM

- 7.1 INTRODUCTION

- 7.2 WINDOWS

- 7.2.1 INTEGRATION OF GEN AI INTO OPERATING SYSTEMS TO DRIVE MARKET

- 7.3 MACOS

- 7.3.1 EASE OF INTEGRATION OF ML MODELS INTO APPS TO BOOST DEMAND

- 7.4 OTHERS

8 AI PC MARKET, BY COMPUTE ARCHITECTURE

- 8.1 INTRODUCTION

- 8.2 X86

- 8.2.1 ABILITY TO SUPPORT LARGE AMOUNT OF RAM TO BOOST DEMAND

- 8.3 ARM

- 8.3.1 RISING NEED TO MAINTAIN BALANCE BETWEEN POWER EFFICIENCY AND PROCESSING CAPABILITIES TO FUEL MARKET GROWTH

9 AI PC MARKET, BY COMPUTE TYPE

- 9.1 INTRODUCTION

- 9.2 GPU

- 9.2.1 ABILITY TO PROCESS LARGE MATRICES AND COMPLEX COMPUTATIONS IN AI ALGORITHMS TO FUEL MARKET GROWTH

- 9.3 NPU

- 9.3.1 GROWING NEED TO HANDLE ML AND DEEP LEARNING WORKLOADS TO BOOST DEMAND

- 9.3.1.1 <40 tops

- 9.3.1.2 40-60 tops

- 9.3.1 GROWING NEED TO HANDLE ML AND DEEP LEARNING WORKLOADS TO BOOST DEMAND

10 AI PC MARKET, BY PRICE

- 10.1 INTRODUCTION

- 10.2 LESS THAN USD 1,200

- 10.2.1 INCREASING ADOPTION OF LESS COMPLEX MODELS TO DRIVE MARKET

- 10.3 USD 1,200 AND ABOVE

- 10.3.1 GROWING ADOPTION AMONG RESEARCHERS TO FOSTER MARKET GROWTH

11 AI PC MARKET, BY END USER

- 11.1 INTRODUCTION

- 11.2 CONSUMER

- 11.2.1 GROWING DEMAND FOR AI-DRIVEN GAMING, SMART ASSISTANTS, PERSONALIZED RECOMMENDATIONS TO FUEL MARKET GROWTH

- 11.3 ENTERPRISE

- 11.3.1 IMPROVED PRODUCTIVITY THROUGH WORKFLOW AUTOMATION AND INTELLIGENT DECISION-MAKING TO DRIVE MARKET

12 AI PC MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.2.2 US

- 12.2.2.1 Government-led initiatives to boost AI development to foster market growth

- 12.2.3 CANADA

- 12.2.3.1 Growing emphasis on developing digital economy to fuel market growth

- 12.2.4 MEXICO

- 12.2.4.1 Increasing shift toward digital platforms to accelerate demand

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.3.2 UK

- 12.3.2.1 Development of data centers to boost demand

- 12.3.3 GERMANY

- 12.3.3.1 Surging adoption of AI in automotive, manufacturing, and healthcare sectors to drive market

- 12.3.4 ITALY

- 12.3.4.1 Growing need for advanced data processing methods to offer lucrative growth opportunities

- 12.3.5 FRANCE

- 12.3.5.1 Increasing collaborations between academia, industry, and government to foster market growth

- 12.3.6 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.2 CHINA

- 12.4.2.1 Rising initiatives to develop and deploy AI PCs to accelerate demand

- 12.4.3 JAPAN

- 12.4.3.1 Expanding data center infrastructure to offer lucrative growth opportunities

- 12.4.4 INDIA

- 12.4.4.1 Rising e-governance to offer lucrative growth opportunities

- 12.4.5 SOUTH KOREA

- 12.4.5.1 Government-led initiatives to boost AI infrastructure to drive market

- 12.4.6 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 12.5.2 MIDDLE EAST & AFRICA

- 12.5.2.1 Increasing demand for AI infrastructure to drive market

- 12.5.2.2 GCC countries

- 12.5.2.3 Rest of Middle East & Africa

- 12.5.3 SOUTH AMERICA

- 12.5.3.1 Rapid technological advancements to foster market growth

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY STRATEGIES/RIGHT TO WIN, 2023-2025

- 13.3 REVENUE ANALYSIS OF KEY PLAYERS, 2022-2024

- 13.4 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS, 2025

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Product footprint

- 13.7.5.4 End user footprint

- 13.7.5.5 Operating system footprint

- 13.7.5.6 Compute type footprint

- 13.7.5.7 Price footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIOS

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

- 13.9.4 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 APPLE INC.

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths/Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses/Competitive threats

- 14.1.2 DELL INC.

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Deals

- 14.1.2.3.3 Expansion

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths/Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses/Competitive threats

- 14.1.3 LENOVO

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.3.3 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths/Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses/Competitive threats

- 14.1.4 HP DEVELOPMENT COMPANY, L.P.

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths/Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses/Competitive threats

- 14.1.5 ASUSTEK COMPUTER INC.

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths/Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses/Competitive threats

- 14.1.6 INTEL CORPORATION

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Deals

- 14.1.6.3.3 Other developments

- 14.1.7 ADVANCED MICRO DEVICES, INC.

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.7.3.2 Deals

- 14.1.7.3.3 Expansions

- 14.1.8 NVIDIA CORPORATION

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.8.3.2 Deals

- 14.1.9 MICROSOFT

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Deals

- 14.1.9.3.2 Other developments

- 14.1.10 ACER INC.

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches

- 14.1.1 APPLE INC.

- 14.2 OTHER PLAYERS

- 14.2.1 FUJITSU

- 14.2.2 HUAWEI TECHNOLOGIES CO., LTD.

- 14.2.3 GIGA-BYTE TECHNOLOGY CO., LTD.

- 14.2.4 MICRO-STAR INT'L CO., LTD.

- 14.2.5 SUPER MICRO COMPUTER, INC.

- 14.2.6 LAMBDA, INC.

- 14.2.7 IBM CORPORATION

- 14.2.8 BOXX

- 14.2.9 CORSAIR

- 14.2.10 PUGET SYSTEMS

- 14.2.11 RAZER INC.

- 14.2.12 SYSTEM76, INC.

- 14.2.13 GROQ, INC.

- 14.2.14 HAILO TECHNOLOGIES LTD

- 14.2.15 BLAIZE

- 14.2.16 KNERON, INC.

- 14.2.17 CEREBRAS

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS