|

|

市場調査レポート

商品コード

1719527

画像誘導ナビゲーションの世界市場:製品別、治療領域別、ナビゲーションタイプ別、ケア環境別、リファレンスモダリティ別、エンドユーザー別 - 予測(~2030年)Image-guided Navigation Market by Product, Therapy Area, Type of Navigation, Care Setting, Reference Modality, End User - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 画像誘導ナビゲーションの世界市場:製品別、治療領域別、ナビゲーションタイプ別、ケア環境別、リファレンスモダリティ別、エンドユーザー別 - 予測(~2030年) |

|

出版日: 2025年05月01日

発行: MarketsandMarkets

ページ情報: 英文 342 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の画像誘導ナビゲーションの市場規模は、2025年の25億4,560万米ドルから2030年までに39億1,250万米ドルに達すると予測されており、予測期間にCAGRで9.0%の成長が見込まれます。

画像誘導ナビゲーションなどの先進医療システムは、CT、MRI、超音波などのモダリティを通じてリアルタイムの視覚的ガイダンスを統合することで手術の精度を高めます。これらの技術の市場は、MIS技術に対する需要の高まりと、手術室内での画像診断法の普及に後押しされて拡大しています。さらに、特に脳神経手術、整形外科、耳鼻咽喉科などでは、複雑な外科手術の精度を高める必要性があり、市場成長の促進要因となっています。医療機関が安全性と業務効率をますます重視するようになるにつれて、画像誘導手術システムは現代の外科手術に不可欠なものとなりつつあります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 100万米ドル |

| セグメント | 製品タイプ、ケア環境、治療領域、ナビゲーションタイプ、リファレンスモダリティタイプ、エンドユーザー、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ |

ケア環境別では、手術セグメントが予測期間にもっとも高いCAGRで成長すると見込みです。

2025年~2030年、画像誘導ナビゲーション市場の中で手術セグメントがもっとも大きく成長すると予測されます。この高い市場成長は、リアルタイム術中ワークフローへのナビゲーションシステムの統合の進行によるものと考えられます。ハイブリッド手術室の開発により、画像誘導プラットフォームと手術用顕微鏡、Cアーム、ロボットシステムとのシームレスな統合が容易になり、脳腫瘍切除術や脊椎固定術などの複雑な手技の効率が向上しています。さらに、特に脳神経手術や整形外科では、術中CTやMRIに対応したナビゲーションシステムの需要が顕著に増加しており、動的画像処理機能が手術精度を大幅に高めています。特に耳鼻咽喉科や頭蓋底手術では、手術時間を最短にし、重要な解剖学的構造を保護するために、病院はますますナビゲーション器具に注目するようになっています。このような手術需要の高まりは、ナビゲーション統合型手術ツールに対する近年の規制当局の承認もあり、術前や外来環境よりも、とりわけ手術室内での採用率を押し上げています。

ナビゲーションタイプ別では、光学ナビゲーションセグメントが2024年に最大の市場シェアを占めました。

2024年、光学ナビゲーションセグメントは、画像誘導ナビゲーションの中で市場シェアの大きな促進要因として浮上しました。その主な理由は、優れた視線精度と卓越した空間分解能であり、神経外科手術や脊椎手術においてもっとも重要なパラメーターです。電磁ナビゲーションシステムとは異なり、光学ナビゲーションは手術器具からの金属干渉を受けにくいため、複雑な手術環境でも一貫して正確な追跡が可能です。光学システムにアクティブ赤外線マーカーを組み込むことで、サブミリメートル精度のリアルタイムフィードバックが容易になり、低侵襲インターベンション中のナビゲーションに役立ちます。ハイブリッド手術室での天井取り付け型やポータブル光学式トラッキングシステムの採用が増加しており、術中機能が大幅に向上しています。さらに、これらの光学システムと先進の3Dイメージングソフトウェアとの互換性により、重要な手術領域におけるもっとも信頼できるナビゲーションモダリティとしての地位が確固たるものとなっています。この包括的な統合は、手術結果の最適化における光学ナビゲーションの極めて重要な役割を強調しています。

当レポートでは、世界の画像誘導ナビゲーション市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- 画像誘導ナビゲーション市場の概要

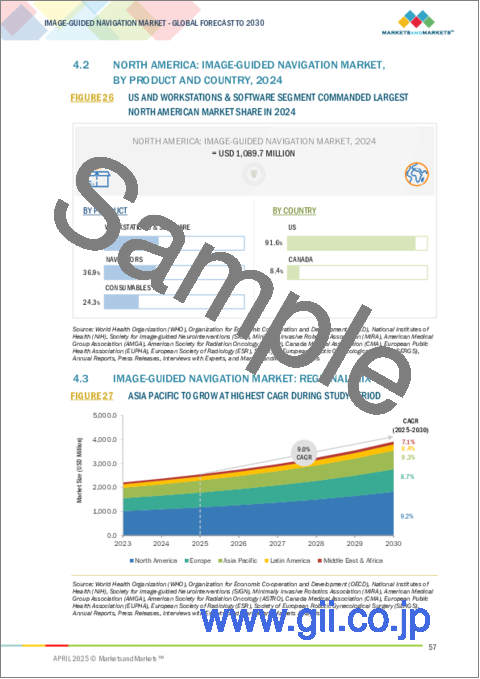

- 北米の画像誘導ナビゲーション市場:国別、製品別(2024年)

- 画像誘導ナビゲーション市場:地域構成

- 画像誘導ナビゲーション市場:地理的成長機会

- 画像誘導ナビゲーション市場:新興市場 vs. 先進市場

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 技術分析

- 主要技術

- 補完技術

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 規制分析

- 規制情勢

- 規制機関、政府機関、その他の組織

- 特許分析

- 特許公報の動向に関する考察(主な出願者/管轄)

- 主要特許リスト(2023年~2025年)

- 貿易分析

- HSコード901820の輸入データ(2020年~2024年)

- HSコード901820の輸出データ(2020年~2024年)

- 価格分析

- 画像誘導ナビゲーション製品の平均販売価格の動向:主要企業別(2022年~2024年)

- 画像誘導ナビゲーション製品の平均販売価格の動向:地域別(2022年~2024年)

- 主な会議とイベント(2025年~2026年)

- アンメットニーズ/エンドユーザーの期待

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- ケーススタディ分析

- 脳腫瘍手術を改善するBRAINLABのスマートナビゲーションシステム

- ZIMMER BIOMETのロボットナビゲーションが低侵襲関節置換術を支援する

- MEDTRONICの精密ナビゲーションシステムによる先進の脊椎手術

- 隣接市場の分析

- 顧客のビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- 画像誘導ナビゲーション市場に対するAI/生成AIの影響

- 画像誘導ナビゲーション市場に対する米国関税の影響(2025年)

- イントロダクション

- 主要関税率

- 価格の影響の分析

- 国/地域に対する影響

- 最終用途産業に対する影響

第6章 画像誘導ナビゲーション市場:製品別

- イントロダクション

- ワークステーション・ソフトウェア

- ナビゲーター

- 消耗品

第7章 画像誘導ナビゲーション市場:ケア環境別

- イントロダクション

- インターベンショナルラジオロジースイート

- 手術

- その他のケア環境

第8章 画像誘導ナビゲーション市場:治療領域別

- イントロダクション

- 腫瘍

- 神経

- 耳鼻咽喉科

- 肺

- 消化器内科

- 筋骨格

- 歯科

- 心血管

- その他の治療領域

第9章 画像誘導ナビゲーション市場:ナビゲーションタイプ別

- イントロダクション

- 光学ナビゲーション

- 電磁ナビゲーション

- ロボット支援追跡、AR・MRナビゲーション

第10章 画像誘導ナビゲーション市場:リファレンスモダリティタイプ別

- イントロダクション

- CTベースリファレンス

- 透視ベースリファレンス

- MRIベースリファレンス

- 超音波ベースリファレンス

- その他のリファレンスモダリティタイプ

第11章 画像誘導ナビゲーション市場:エンドユーザー別

- イントロダクション

- 病院

- 外来手術センター

- 画像診断センター

第12章 画像誘導ナビゲーション市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他のアジア太平洋

- ラテンアメリカ

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- アルゼンチン

- その他のラテンアメリカ

- 中東・アフリカ

- 中東・アフリカのマクロ経済の見通し

- GCC諸国

- その他の中東・アフリカ

第13章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析(2020年~2024年)

- 市場シェア分析(2024年)

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 企業の評価と財務指標

- 財務指標

- 企業の評価

- ブランド/製品の比較

- 主要企業のR&Dの評価

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- MEDTRONIC

- BRAINLAB AG

- STRYKER

- B. BRAUN SE

- KONINKLIJKE PHILIPS N.V.

- GE HEALTHCARE

- OLYMPUS CORPORATION

- SMITH+NEPHEW

- JOHNSON & JOHNSON SERVICES, INC.

- GLOBUS MEDICAL (NUVASIVE)

- STEREOTAXIS, INC.

- ORTHOFIX MEDICAL INC.

- INTEGRA LIFESCIENCES CORPORATION

- ZIMMER BIOMET

- INTUITIVE SURGICAL

- その他の企業

- KARL STORZ

- FIAGON GMBH

- ZETA SURGICAL INC.

- BRAIN NAVI BIOTECHNOLOGY CO., LTD.

- IMAGE NAVIGATION, LTD.

- HAPPY RELIABLE SURGERIES PVT. LTD.

- RXOOM HEALTHCARE PVT. LTD.

- CLARONAV

- SHANGHAI MICROPORT MEDICAL (GROUP) CO., LTD.

- ZIEHM IMAGING GMBH

第15章 付録

List of Tables

- TABLE 1 IMAGE-GUIDED NAVIGATION MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 STANDARD CURRENCY EXCHANGE RATES, 2021-2024 (USD)

- TABLE 3 IMAGE-GUIDED NAVIGATION MARKET: STUDY ASSUMPTIONS

- TABLE 4 IMAGE-GUIDED NAVIGATION MARKET: RISK ANALYSIS

- TABLE 5 MAJOR FUNDING BY GOVERNMENT BODIES, 2021-2024

- TABLE 6 PROJECTS FUNDED BY NATIONAL INSTITUTE OF BIOMEDICAL IMAGING AND BIOENGINEERING, 2024

- TABLE 7 IMAGE-GUIDED NAVIGATION MARKET: PORTER'S FIVE FORCES

- TABLE 8 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY PRODUCT

- TABLE 9 KEY BUYING CRITERIA FOR IMAGE-GUIDED NAVIGATION SYSTEMS, BY END USER

- TABLE 10 US FDA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 11 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 12 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PHARMACEUTICALS AND MEDICAL DEVICES AGENCY (PMDA)

- TABLE 13 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 IMAGE-GUIDED NAVIGATION MARKET: LIST OF MAJOR PATENTS, JANUARY 2023-MARCH 2025

- TABLE 18 IMPORT DATA FOR HS CODE 901820, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 19 EXPORT DATA FOR HS CODE 901820, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 20 AVERAGE SELLING PRICE TREND OF IMAGE-GUIDED NAVIGATION PRODUCTS, BY KEY PLAYER, 2022-2024 (USD)

- TABLE 21 AVERAGE SELLING PRICE TREND OF IMAGE-GUIDED NAVIGATION PRODUCTS, BY REGION, 2022-2024 (USD)

- TABLE 22 IMAGE-GUIDED NAVIGATION MARKET: DETAILED LIST OF KEY CONFERENCES & EVENTS, JANUARY 2025-DECEMBER 2026

- TABLE 23 IMAGE-GUIDED NAVIGATION MARKET: UNMET NEEDS/END-USER EXPECTATIONS

- TABLE 24 CASE STUDY 1: BRAINLAB'S SMART NAVIGATION SYSTEM TO IMPROVE BRAIN TUMOR SURGERY

- TABLE 25 CASE STUDY 2: ZIMMER BIOMET'S ROBOTIC NAVIGATION TO ASSIST MINIMALLY INVASIVE JOINT REPLACEMENT SURGERIES

- TABLE 26 CASE STUDY 3: MEDTRONIC'S PRECISION NAVIGATION SYSTEM TO CONDUCT ADVANCED SPINE SURGERIES

- TABLE 27 IMAGE-GUIDED NAVIGATION MARKET: IMPACT OF AI/GEN AI

- TABLE 28 US: ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 29 IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 30 KEY WORKSTATIONS & SOFTWARE AVAILABLE IN IMAGE-GUIDED NAVIGATION MARKET

- TABLE 31 IMAGE-GUIDED NAVIGATION MARKET FOR WORKSTATIONS & SOFTWARE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 KEY NAVIGATORS AVAILABLE IN IMAGE-GUIDED NAVIGATION MARKET

- TABLE 33 IMAGE-GUIDED NAVIGATION MARKET FOR NAVIGATORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 34 KEY CONSUMABLES AVAILABLE IN IMAGE-GUIDED NAVIGATION MARKET

- TABLE 35 IMAGE-GUIDED NAVIGATION MARKET FOR CONSUMABLES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 37 IMAGE-GUIDED NAVIGATION MARKET FOR INTERVENTIONAL RADIOLOGY SUITE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 IMAGE-GUIDED NAVIGATION MARKET FOR SURGICAL, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 39 IMAGE-GUIDED NAVIGATION MARKET FOR OTHER CARE SETTINGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 41 KEY ONCOLOGY PRODUCTS AVAILABLE IN IMAGE-GUIDED NAVIGATION MARKET

- TABLE 42 IMAGE-GUIDED NAVIGATION MARKET FOR ONCOLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 KEY NEUROLOGY PRODUCTS AVAILABLE IN IMAGE-GUIDED NAVIGATION MARKET

- TABLE 44 IMAGE-GUIDED NAVIGATION MARKET FOR NEUROLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 KEY ENT PRODUCTS AVAILABLE IN IMAGE-GUIDED NAVIGATION MARKET

- TABLE 46 IMAGE-GUIDED NAVIGATION MARKET FOR ENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 KEY PULMONARY PRODUCTS AVAILABLE IN IMAGE-GUIDED NAVIGATION MARKET

- TABLE 48 IMAGE-GUIDED NAVIGATION MARKET FOR PULMONARY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 KEY GASTROENTEROLOGY PRODUCTS AVAILABLE IN IMAGE-GUIDED NAVIGATION MARKET

- TABLE 50 IMAGE-GUIDED NAVIGATION MARKET FOR GASTROENTEROLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 KEY MUSCULOSKELETAL PRODUCTS AVAILABLE IN IMAGE-GUIDED NAVIGATION MARKET

- TABLE 52 IMAGE-GUIDED NAVIGATION MARKET FOR MUSCULOSKELETAL, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 KEY DENTAL PRODUCTS AVAILABLE IN IMAGE-GUIDED NAVIGATION MARKET

- TABLE 54 IMAGE-GUIDED NAVIGATION MARKET FOR DENTAL, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 KEY CARDIOVASCULAR PRODUCTS AVAILABLE IN IMAGE-GUIDED NAVIGATION MARKET

- TABLE 56 IMAGE-GUIDED NAVIGATION MARKET FOR CARDIOVASCULAR, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 57 KEY OTHER THERAPY PRODUCTS AVAILABLE IN IMAGE-GUIDED NAVIGATION MARKET

- TABLE 58 IMAGE-GUIDED NAVIGATION MARKET FOR OTHER THERAPY AREAS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2023-2030 (USD MILLION)

- TABLE 60 KEY OPTICAL NAVIGATION PRODUCTS AVAILABLE IN IMAGE-GUIDED NAVIGATION MARKET

- TABLE 61 IMAGE-GUIDED OPTICAL NAVIGATION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 62 KEY ELECTROMAGNETIC NAVIGATION PRODUCTS AVAILABLE IN IMAGE-GUIDED NAVIGATION MARKET

- TABLE 63 IMAGE-GUIDED ELECTROMAGNETIC NAVIGATION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 KEY ROBOTIC-ASSISTED TRACKING AND AUGMENTED REALITY & MIXED REALITY NAVIGATION PRODUCTS AVAILABLE IN IMAGE-GUIDED NAVIGATION MARKET

- TABLE 65 IMAGE-GUIDED ROBOTIC-ASSISTED TRACKING AND AUGMENTED REALITY & MIXED REALITY NAVIGATION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 66 IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2023-2030 (USD MILLION)

- TABLE 67 IMAGE-GUIDED NAVIGATION MARKET FOR CT-BASED REFERENCE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 68 IMAGE-GUIDED NAVIGATION MARKET FOR FLUOROSCOPY-BASED REFERENCE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 69 IMAGE-GUIDED NAVIGATION MARKET FOR MRI-BASED REFERENCE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 70 IMAGE-GUIDED NAVIGATION MARKET FOR ULTRASOUND-BASED REFERENCE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 71 IMAGE-GUIDED NAVIGATION MARKET FOR OTHER REFERENCE MODALITY TYPES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 72 IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 73 IMAGE-GUIDED NAVIGATION MARKET FOR HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 74 IMAGE-GUIDED NAVIGATION MARKET FOR AMBULATORY SURGERY CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 75 IMAGE-GUIDED NAVIGATION MARKET FOR DIAGNOSTIC IMAGING CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 76 IMAGE-GUIDED NAVIGATION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: IMAGE-GUIDED NAVIGATION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (UNITS SOLD)

- TABLE 80 NORTH AMERICA: IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 82 NORTH AMERICA: IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2023-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2023-2030 (USD MILLION)

- TABLE 84 NORTH AMERICA: IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 85 US: KEY MACROINDICATORS

- TABLE 86 US: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 87 US: IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 88 US: IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 89 US: IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2023-2030 (USD MILLION)

- TABLE 90 US: IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2023-2030 (USD MILLION)

- TABLE 91 US: IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 92 CANADA: KEY MACROINDICATORS

- TABLE 93 CANADA: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 94 CANADA: IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 95 CANADA: IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 96 CANADA: IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2023-2030 (USD MILLION)

- TABLE 97 CANADA: IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2023-2030 (USD MILLION)

- TABLE 98 CANADA: IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 99 EUROPE: IMAGE-GUIDED NAVIGATION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 100 EUROPE: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 101 EUROPE: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (UNITS SOLD)

- TABLE 102 EUROPE: IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 103 EUROPE: IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 104 EUROPE: IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2023-2030 (USD MILLION)

- TABLE 105 EUROPE: IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2023-2030 (USD MILLION)

- TABLE 106 EUROPE: IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 107 GERMANY: KEY MACROINDICATORS

- TABLE 108 GERMANY: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 109 GERMANY: IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 110 GERMANY: IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 111 GERMANY: IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2023-2030 (USD MILLION)

- TABLE 112 GERMANY: IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2023-2030 (USD MILLION)

- TABLE 113 GERMANY: IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 114 UK: KEY MACROINDICATORS

- TABLE 115 UK: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 116 UK: IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 117 UK: IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 118 UK: IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2023-2030 (USD MILLION)

- TABLE 119 UK: IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2023-2030 (USD MILLION)

- TABLE 120 UK: IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 121 FRANCE: KEY MACROINDICATORS

- TABLE 122 FRANCE: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 123 FRANCE: IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 124 FRANCE: IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 125 FRANCE: IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2023-2030 (USD MILLION)

- TABLE 126 FRANCE: IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2023-2030 (USD MILLION)

- TABLE 127 FRANCE: IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 128 ITALY: KEY MACROINDICATORS

- TABLE 129 ITALY: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 130 ITALY: IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 131 ITALY: IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 132 ITALY: IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2023-2030 (USD MILLION)

- TABLE 133 ITALY: IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2023-2030 (USD MILLION)

- TABLE 134 ITALY: IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 135 SPAIN: KEY MACROINDICATORS

- TABLE 136 SPAIN: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 137 SPAIN: IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 138 SPAIN: IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 139 SPAIN: IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2023-2030 (USD MILLION)

- TABLE 140 SPAIN: IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2023-2030 (USD MILLION)

- TABLE 141 SPAIN: IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 142 REST OF EUROPE: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 143 REST OF EUROPE: IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 144 REST OF EUROPE: IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 145 REST OF EUROPE: IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2023-2030 (USD MILLION)

- TABLE 146 REST OF EUROPE: IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2023-2030 (USD MILLION)

- TABLE 147 REST OF EUROPE: IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 148 ASIA PACIFIC: IMAGE-GUIDED NAVIGATION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 149 ASIA PACIFIC: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 150 ASIA PACIFIC: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (UNITS SOLD)

- TABLE 151 ASIA PACIFIC: IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 152 ASIA PACIFIC: IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 153 ASIA PACIFIC: IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2023-2030 (USD MILLION)

- TABLE 154 ASIA PACIFIC: IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2023-2030 (USD MILLION)

- TABLE 155 ASIA PACIFIC: IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 156 CHINA: KEY MACROINDICATORS

- TABLE 157 CHINA: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 158 CHINA: IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 159 CHINA: IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 160 CHINA: IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2023-2030 (USD MILLION)

- TABLE 161 CHINA: IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2023-2030 (USD MILLION)

- TABLE 162 CHINA: IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 163 JAPAN: KEY MACROINDICATORS

- TABLE 164 JAPAN: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 165 JAPAN: IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 166 JAPAN: IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 167 JAPAN: IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2023-2030 (USD MILLION)

- TABLE 168 JAPAN: IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 JAPAN: IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 170 INDIA: KEY MACROINDICATORS

- TABLE 171 INDIA: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 172 INDIA: IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 173 INDIA: IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 174 INDIA: IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2023-2030 (USD MILLION)

- TABLE 175 INDIA: IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2023-2030 (USD MILLION)

- TABLE 176 INDIA: IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 177 SOUTH KOREA: KEY MACROINDICATORS

- TABLE 178 SOUTH KOREA: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 179 SOUTH KOREA: IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 180 SOUTH KOREA: IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 181 SOUTH KOREA: IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2023-2030 (USD MILLION)

- TABLE 182 SOUTH KOREA: IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2023-2030 (USD MILLION)

- TABLE 183 SOUTH KOREA: IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 184 AUSTRALIA: KEY MACROINDICATORS

- TABLE 185 AUSTRALIA: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 186 AUSTRALIA: IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 187 AUSTRALIA: IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 188 AUSTRALIA: IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2023-2030 (USD MILLION)

- TABLE 189 AUSTRALIA: IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2023-2030 (USD MILLION)

- TABLE 190 AUSTRALIA: IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 191 REST OF ASIA PACIFIC: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 192 REST OF ASIA PACIFIC: IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 193 REST OF ASIA PACIFIC: IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 194 REST OF ASIA PACIFIC: IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2023-2030 (USD MILLION)

- TABLE 195 REST OF ASIA PACIFIC: IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2023-2030 (USD MILLION)

- TABLE 196 REST OF ASIA PACIFIC: IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 197 LATIN AMERICA: IMAGE-GUIDED NAVIGATION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 198 LATIN AMERICA: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 199 LATIN AMERICA: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (UNITS SOLD)

- TABLE 200 LATIN AMERICA: IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 201 LATIN AMERICA: IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 202 LATIN AMERICA: IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2023-2030 (USD MILLION)

- TABLE 203 LATIN AMERICA: IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2023-2030 (USD MILLION)

- TABLE 204 LATIN AMERICA: IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 205 BRAZIL: KEY MACROINDICATORS

- TABLE 206 BRAZIL: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 207 BRAZIL: IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 208 BRAZIL: IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 209 BRAZIL: IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2023-2030 (USD MILLION)

- TABLE 210 BRAZIL: IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2023-2030 (USD MILLION)

- TABLE 211 BRAZIL: IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 212 MEXICO: KEY MACROINDICATORS

- TABLE 213 MEXICO: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 214 MEXICO: IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 215 MEXICO: IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 216 MEXICO: IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2023-2030 (USD MILLION)

- TABLE 217 MEXICO: IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2023-2030 (USD MILLION)

- TABLE 218 MEXICO: IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 219 ARGENTINA: KEY MACROINDICATORS

- TABLE 220 ARGENTINA: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 221 ARGENTINA: IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 222 ARGENTINA: IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 223 ARGENTINA: IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2023-2030 (USD MILLION)

- TABLE 224 ARGENTINA: IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2023-2030 (USD MILLION)

- TABLE 225 ARGENTINA: IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 226 REST OF LATIN AMERICA: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 227 REST OF LATIN AMERICA: IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 228 REST OF LATIN AMERICA: IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 229 REST OF LATIN AMERICA: IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2023-2030 (USD MILLION)

- TABLE 230 REST OF LATIN AMERICA: IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2023-2030 (USD MILLION)

- TABLE 231 REST OF LATIN AMERICA: IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: IMAGE-GUIDED NAVIGATION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (UNITS SOLD)

- TABLE 235 MIDDLE EAST & AFRICA: IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2023-2030 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2023-2030 (USD MILLION)

- TABLE 239 MIDDLE EAST & AFRICA: IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 240 GCC COUNTRIES: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 241 GCC COUNTRIES: IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 242 GCC COUNTRIES: IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 243 GCC COUNTRIES: IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2023-2030 (USD MILLION)

- TABLE 244 GCC COUNTRIES: IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2023-2030 (USD MILLION)

- TABLE 245 GCC COUNTRIES: IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 246 REST OF MIDDLE EAST & AFRICA: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 247 REST OF MIDDLE EAST & AFRICA: IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2023-2030 (USD MILLION)

- TABLE 248 REST OF MIDDLE EAST & AFRICA: IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2023-2030 (USD MILLION)

- TABLE 249 REST OF MIDDLE EAST & AFRICA: IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2023-2030 (USD MILLION)

- TABLE 250 REST OF MIDDLE EAST & AFRICA: IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2023-2030 (USD MILLION)

- TABLE 251 REST OF MIDDLE EAST & AFRICA: IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 252 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN IMAGE-GUIDED NAVIGATION MARKET

- TABLE 253 IMAGE-GUIDED NAVIGATION MARKET: DEGREE OF COMPETITION

- TABLE 254 IMAGE-GUIDED NAVIGATION MARKET: REGION FOOTPRINT

- TABLE 255 IMAGE-GUIDED NAVIGATION MARKET: PRODUCT FOOTPRINT

- TABLE 256 IMAGE-GUIDED NAVIGATION MARKET: CARE SETTING FOOTPRINT

- TABLE 257 IMAGE-GUIDED NAVIGATION MARKET: THERAPY AREA FOOTPRINT

- TABLE 258 IMAGE-GUIDED NAVIGATION MARKET: TYPE OF NAVIGATION FOOTPRINT

- TABLE 259 IMAGE-GUIDED NAVIGATION MARKET: REFERENCE MODALITY TYPE FOOTPRINT

- TABLE 260 IMAGE-GUIDED NAVIGATION MARKET: DETAILED LIST OF KEY STARTUPS/SME PLAYERS

- TABLE 261 IMAGE-GUIDED NAVIGATION MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SME PLAYERS

- TABLE 262 IMAGE-GUIDED NAVIGATION MARKET: PRODUCT LAUNCHES/APPROVALS/ENHANCEMENTS, JANUARY 2022-MARCH 2025

- TABLE 263 IMAGE-GUIDED NAVIGATION MARKET: DEALS, JANUARY 2022-MARCH 2025

- TABLE 264 IMAGE-GUIDED NAVIGATION MARKET: EXPANSIONS, JANUARY 2022-MARCH 2025

- TABLE 265 MEDTRONIC: COMPANY OVERVIEW

- TABLE 266 MEDTRONIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 267 MEDTRONIC: PRODUCT LAUNCHES, JANUARY 2022-MARCH 2025

- TABLE 268 MEDTRONIC: DEALS, JANUARY 2022-MARCH 2025

- TABLE 269 MEDTRONIC: EXPANSIONS: JANUARY 2022-MARCH 2025

- TABLE 270 BRAINLAB AG: COMPANY OVERVIEW

- TABLE 271 BRAINLAB AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 272 BRAINLAB AG: PRODUCT APPROVALS, JANUARY 2022-MARCH 2025

- TABLE 273 BRAINLAB AG: DEALS, JANUARY 2022-MARCH 2025

- TABLE 274 STRYKER: COMPANY OVERVIEW

- TABLE 275 STRYKER: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 276 STRYKER: PRODUCT APPROVALS, JANUARY 2022-MARCH 2025

- TABLE 277 B. BRAUN SE: COMPANY OVERVIEW

- TABLE 278 B. BRAUN SE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 279 B. BRAUN SE.: DEALS, JANUARY 2022-MARCH 2025

- TABLE 280 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- TABLE 281 KONINKLIJKE PHILIPS N.V.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 282 KONINKLIJKE PHILIPS N.V.: PRODUCT LAUNCHES, JANUARY 2022-MARCH 2025

- TABLE 283 GE HEALTHCARE: COMPANY OVERVIEW

- TABLE 284 GE HEALTHCARE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 285 GE HEALTHCARE: PRODUCT APPROVALS, JANUARY 2022-MARCH 2025

- TABLE 286 GE HEALTHCARE: DEALS, JANUARY 2022-MARCH 2025

- TABLE 287 OLYMPUS CORPORATION: COMPANY OVERVIEW

- TABLE 288 OLYMPUS CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 289 OLYMPUS CORPORATION: DEALS, JANUARY 2022-MARCH 2025

- TABLE 290 SMITH+NEPHEW: COMPANY OVERVIEW

- TABLE 291 SMITH+NEPHEW: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 292 SMITH+NEPHEW: DEALS, JANUARY 2022-MARCH 2025

- TABLE 293 JOHNSON & JOHNSON SERVICES, INC.: COMPANY OVERVIEW

- TABLE 294 JOHNSON & JOHNSON SERVICES, INC.: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 295 JOHNSON & JOHNSON SERVICES, INC.: DEALS, JANUARY 2022-MARCH 2025

- TABLE 296 GLOBUS MEDICAL (NUVASIVE): COMPANY OVERVIEW

- TABLE 297 GLOBUS MEDICAL (NUVASIVE): PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 298 GLOBUS MEDICAL (NUVASIVE): DEALS, JANUARY 2022-MARCH 2025

- TABLE 299 STEREOTAXIS, INC.: COMPANY OVERVIEW

- TABLE 300 STEREOTAXIS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 301 STEREOTAXIS, INC.: PRODUCT APPROVALS, JANUARY 2022-MARCH 2025

- TABLE 302 STEREOTAXIS, INC.: DEALS, JANUARY 2022-MARCH 2025

- TABLE 303 ORTHOFIX MEDICAL INC.: COMPANY OVERVIEW

- TABLE 304 ORTHOFIX MEDICAL INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 305 ORTHOFIX MEDICAL INC.: DEALS, JANUARY 2022-MARCH 2025

- TABLE 306 INTEGRA LIFESCIENCES CORPORATION: COMPANY OVERVIEW

- TABLE 307 INTEGRA LIFESCIENCES CORPORATION: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 308 INTEGRA LIFESCIENCES CORPORATION: DEALS, JANUARY 2022-MARCH 2025

- TABLE 309 ZIMMER BIOMET: COMPANY OVERVIEW

- TABLE 310 ZIMMER BIOMET: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 311 ZIMMER BIOMET: DEALS, JANUARY 2022-MARCH 2025

- TABLE 312 INTUITIVE SURGICAL: COMPANY OVERVIEW

- TABLE 313 INTUITIVE SURGICAL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 314 INTUITIVE SURGICAL: OTHER DEVELOPMENTS, JANUARY 2022-MARCH 2025

- TABLE 315 KARL STORZ: COMPANY OVERVIEW

- TABLE 316 FIAGON GMBH: COMPANY OVERVIEW

- TABLE 317 ZETA SURGICAL INC.: COMPANY OVERVIEW

- TABLE 318 BRAIN NAVI BIOTECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 319 IMAGE NAVIGATION, LTD.: COMPANY OVERVIEW

- TABLE 320 HAPPY RELIABLE SURGERIES PVT. LTD.: COMPANY OVERVIEW

- TABLE 321 RXOOM HEALTHCARE PVT. LTD.: COMPANY OVERVIEW

- TABLE 322 CLARONAV: COMPANY OVERVIEW

- TABLE 323 SHANGHAI MICROPORT MEDICAL (GROUP) CO., LTD.: COMPANY OVERVIEW

- TABLE 324 ZIEHM IMAGING GMBH: COMPANY OVERVIEW

List of Figures

- FIGURE 1 IMAGE-GUIDED NAVIGATION MARKET: SEGMENTS CONSIDERED & GEOGRAPHICAL SCOPE

- FIGURE 2 IMAGE-GUIDED NAVIGATION MARKET: YEARS CONSIDERED

- FIGURE 3 IMAGE-GUIDED NAVIGATION MARKET: RESEARCH DESIGN

- FIGURE 4 IMAGE-GUIDED NAVIGATION MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 IMAGE-GUIDED NAVIGATION MARKET: KEY PRIMARY SOURCES

- FIGURE 6 IMAGE-GUIDED NAVIGATION MARKET: KEY DATA FROM PRIMARY SOURCES

- FIGURE 7 IMAGE-GUIDED NAVIGATION MARKET: KEY INSIGHTS FROM PRIMARIES

- FIGURE 8 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY SIDE AND OTHER PARTICIPANTS

- FIGURE 9 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 10 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- FIGURE 11 IMAGE-GUIDED NAVIGATION MARKET: SUPPLY-SIDE MARKET SIZE ESTIMATION (REVENUE SHARE ANALYSIS)

- FIGURE 12 IMAGE-GUIDED NAVIGATION MARKET: REVENUE SHARE ANALYSIS ILLUSTRATION FOR MEDTRONIC (2024)

- FIGURE 13 IMAGE-GUIDED NAVIGATION MARKET: TOP-DOWN APPROACH

- FIGURE 14 IMAGE-GUIDED NAVIGATION MARKET: SUPPLY-SIDE ANALYSIS (2024)

- FIGURE 15 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN IMAGE-GUIDED NAVIGATION MARKET

- FIGURE 16 IMAGE-GUIDED NAVIGATION MARKET: CAGR PROJECTIONS

- FIGURE 17 IMAGE-GUIDED NAVIGATION MARKET: DATA TRIANGULATION

- FIGURE 18 IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT, 2025 VS. 2030 (USD MILLION)

- FIGURE 19 IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING, 2025 VS. 2030 (USD MILLION)

- FIGURE 20 IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA, 2025 VS. 2030 (USD MILLION)

- FIGURE 21 IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 22 IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 23 IMAGE-GUIDED NAVIGATION MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 24 IMAGE-GUIDED NAVIGATION MARKET: REGIONAL SNAPSHOT

- FIGURE 25 INCREASING PREVALENCE OF CHRONIC DISEASES AND RISING ADOPTION OF MINIMALLY INVASIVE SURGICAL PROCEDURES TO DRIVE MARKET

- FIGURE 26 US AND WORKSTATIONS & SOFTWARE SEGMENT COMMANDED LARGEST NORTH AMERICAN MARKET SHARE IN 2024

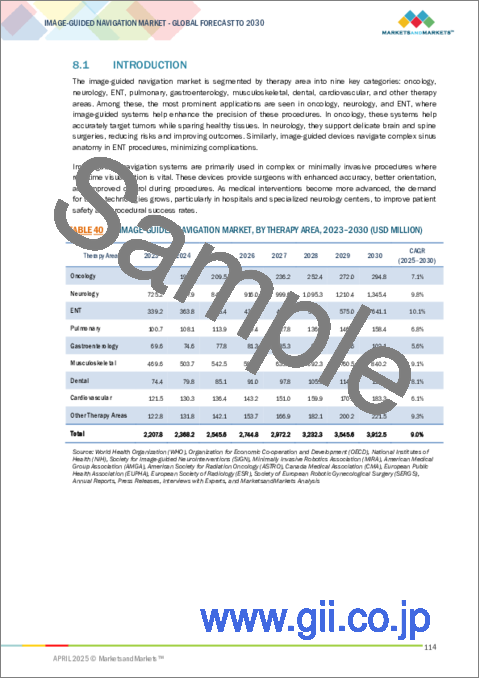

- FIGURE 27 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING STUDY PERIOD

- FIGURE 28 CHINA TO REGISTER HIGHEST GROWTH RATE FROM 2025 TO 2030

- FIGURE 29 EMERGING MARKETS TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 30 IMAGE-GUIDED NAVIGATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 31 NUMBER OF MINIMALLY INVASIVE SURGICAL PROCEDURES IN US (2018-2023)

- FIGURE 32 IMAGE-GUIDED NAVIGATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY PRODUCT

- FIGURE 34 KEY BUYING CRITERIA FOR IMAGE-GUIDED NAVIGATION SYSTEMS, BY END USER

- FIGURE 35 IMAGE-GUIDED NAVIGATION MARKET: PATENT PUBLICATION TRENDS, JURISDICTION, AND TOP APPLICANT ANALYSIS (JANUARY 2014-MARCH 2025)

- FIGURE 36 TOP APPLICANT COUNTRIES/REGIONS FOR IMAGE-GUIDED NAVIGATION PATENTS (JANUARY 2014-MARCH 2025)

- FIGURE 37 IMAGE-GUIDED NAVIGATION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 38 IMAGE-GUIDED NAVIGATION MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 39 IMAGE-GUIDED NAVIGATION MARKET: ECOSYSTEM ANALYSIS

- FIGURE 40 ADJACENT MARKETS FOR IMAGE-GUIDED NAVIGATION MARKET

- FIGURE 41 IMAGE-GUIDED NAVIGATION MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- FIGURE 42 IMAGE-GUIDED NAVIGATION MARKET: FUNDING AND NUMBER OF DEALS, 2020-2024

- FIGURE 43 IMAGE-GUIDED NAVIGATION MARKET: GEOGRAPHIC SNAPSHOT

- FIGURE 44 NORTH AMERICA: IMAGE-GUIDED NAVIGATION MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: IMAGE-GUIDED NAVIGATION MARKET SNAPSHOT

- FIGURE 46 REVENUE ANALYSIS OF KEY PLAYERS IN IMAGE-GUIDED NAVIGATION MARKET (2020-2024)

- FIGURE 47 MARKET SHARE ANALYSIS FOR KEY PLAYERS IN IMAGE-GUIDED NAVIGATION MARKET (2024)

- FIGURE 48 IMAGE-GUIDED NAVIGATION MARKET: COMPANY EVALUATION MATRIX: KEY PLAYERS (2024)

- FIGURE 49 IMAGE-GUIDED NAVIGATION MARKET: COMPANY FOOTPRINT

- FIGURE 50 IMAGE-GUIDED NAVIGATION MARKET: COMPANY EVALUATION MATRIX: STARTUPS/SMES (2024)

- FIGURE 51 EV/EBITDA OF KEY VENDORS

- FIGURE 52 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 53 IMAGE-GUIDED NAVIGATION MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 54 R&D ASSESSMENT OF KEY PLAYERS IN IMAGE-GUIDED NAVIGATION MARKET (2022-2024)

- FIGURE 55 MEDTRONIC: COMPANY SNAPSHOT

- FIGURE 56 STRYKER: COMPANY SNAPSHOT

- FIGURE 57 B. BRAUN SE: COMPANY SNAPSHOT

- FIGURE 58 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT

- FIGURE 59 GE HEALTHCARE: COMPANY SNAPSHOT

- FIGURE 60 OLYMPUS CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 SMITH+NEPHEW: COMPANY SNAPSHOT

- FIGURE 62 JOHNSON & JOHNSON SERVICES, INC.: COMPANY SNAPSHOT

- FIGURE 63 GLOBUS MEDICAL (NUVASIVE): COMPANY SNAPSHOT

- FIGURE 64 STEREOTAXIS, INC.: COMPANY SNAPSHOT

- FIGURE 65 ORTHOFIX MEDICAL INC.: COMPANY SNAPSHOT

- FIGURE 66 INTEGRA LIFESCIENCES CORPORATION: COMPANY SNAPSHOT

- FIGURE 67 ZIMMER BIOMET: COMPANY SNAPSHOT

- FIGURE 68 INTUITIVE SURGICAL: COMPANY SNAPSHOT

The global image-guided navigation market is projected to grow from USD 2,545.6 million in 2025 to USD 3,912.5 million by 2030, at a CAGR of 9.0%, during the forecast period. Advanced medical systems, such as image-guided navigation, enhance surgical precision by integrating real-time visual guidance through modalities such as CT, MRI, and ultrasound; this integration minimizes complication rates, accelerates recovery periods, and optimizes patient outcomes. The market for these technologies is expanding, propelled by the increasing demand for MIS techniques and the widespread adoption of imaging modalities within operating theaters. Furthermore, the necessity for heightened accuracy in complex surgical interventions, particularly in neurosurgery, orthopedics, and otolaryngology, drives market growth. As healthcare institutions increasingly emphasize safety and operational efficiency, image-guided surgical systems are becoming integral to contemporary surgical practices.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD million) |

| Segments | By Product Type, Care Setting, Therapy Area, Type of Navigation, Reference Modality Type, End User, Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America |

By care setting, the surgical segment is projected to grow at the highest CAGR during the forecast period.

Between 2025 and 2030, the surgical segment is anticipated to witness the most substantial growth within the image-guided navigation market. This high market growth can be attributed to the ongoing integration of navigation systems into real-time intraoperative workflows. The development of hybrid operating rooms has facilitated a seamless integration of image-guided platforms with surgical microscopes, C-arms, and robotic systems, thereby enhancing the efficiency of intricate procedures such as brain tumor resections and spinal fusions. Moreover, there is a notable increase in demand for intraoperative CT and MRI-compatible navigation systems, particularly in neurosurgery and orthopedics, where dynamic imaging capabilities significantly boost surgical accuracy. Hospitals are increasingly focusing on navigated instrumentation to minimize operative durations and protect critical anatomical structures, especially in ENT and skull base surgeries. This rising procedural demand, coupled with recent regulatory approvals for navigation-integrated surgical tools, has propelled adoption rates specifically within surgical suites rather than in pre-operative or outpatient environments.

By type of navigation, the optical navigation segment accounted for the largest market share in 2024.

In 2024, the optical navigation segment emerged as the predominant driver of market share within the image-guided navigation landscape, largely owing to its superior line-of-sight accuracy and exceptional spatial resolution, parameters of paramount importance in neurosurgical and spinal procedures. Unlike electromagnetic systems, optical navigation remains impervious to metallic interference from surgical instrumentation, thereby ensuring consistently precise tracking capabilities within intricate operative environments. The incorporation of active infrared markers in optical systems facilitates real-time feedback with sub-millimeter precision, which helps navigate during minimally invasive interventions. The increasing adoption of ceiling-mounted and portable optical tracking systems within hybrid operating suites has significantly enhanced their intraoperative functionality. Moreover, the compatibility of these optical systems with advanced 3D imaging software has solidified their status as the most dependable navigation modality in high-stakes surgical domains. This comprehensive integration underscores the pivotal role of optical navigation in optimizing surgical outcomes.

The Asia Pacific region is expected to witness the highest growth rate during the forecast period.

The Asia Pacific region is poised for significant growth in the image-guided navigation market from 2025 to 2030, driven by a surge in advanced surgical procedures in countries such as China, India, and South Korea. Strategic government initiatives aimed at enhancing hospital infrastructure, coupled with increased investments in robotic and image-guided surgical technologies, have propelled the demand for these navigation systems. Moreover, the proliferation of specialized neurosurgical and orthopedic centers, alongside the heightened awareness of the benefits of MIS techniques, is facilitating broader adoption of these systems. The local manufacturing and distribution efforts by regional companies have further enhanced the accessibility and affordability of image-guided navigation technologies in emerging markets. This convergence of factors is likely to establish the Asia Pacific as a key player in the advancement of image-guided surgical solutions.

Breakdown of supply-side primary interviews: * By Company Type: Tier 1-45%, Tier 2-20%, and Tier 3-35% * By Designation: C-level-35%, Director-level-25%, and Other designations-40% * By Region: North America-40%, Europe-25%, Asia Pacific-20%, Latin America-10%, Middle East & Africa-5%

Breakdown of demand-side primary interviews: * By Company Type: Hospitals-60%, Ambulatory Surgery Centers-25%, and Diagnostics Imaging Centers-15% * By Designation: Directors-35%, Vice Presidents-27%, Managers-22%, and Other Designations-16% * By Region: North America-40%, Europe-25%, Asia Pacific-20%, Latin America-10%, Middle East & Africa-5%

Research Coverage

This report studies the image-guided navigation market based on product type, care setting, therapy area, type of navigation, reference modality type, end user, and region. The report also studies factors (such as drivers, restraints, opportunities, and challenges) affecting market growth. It analyzes the opportunities and challenges in the market and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets with respect to their individual growth trends and forecasts the revenue of the market segments with respect to five main regions and respective countries.

Reasons to Buy the Report

The report serves as a valuable resource for both established enterprises and emerging or smaller firms to effectively assess market dynamics. This insight will enable them to capture a larger market share. Organizations that invest in the report can employ one or a combination of the following five strategic approaches.

This report provides insights into the following pointers:

- Analysis of key drivers (growing adoption of minimally invasive surgical procedures, rising uptake of robotics in surgeries, high government investments, funds, and grants for minimally invasive surgical procedures, increasing applications of image-guided navigation across medical specialties), restraints (High cost of image-guided navigation systems in surgical and interventional procedures, Lack of system accuracy and reliability), opportunities (Rising investments in healthcare AI and big data analytics, Increasing partnerships and collaborations among key players), and challenges (Rising number of product recalls, Limited adoption of image-guided navigation surgeries in emerging economies) influencing the growth of image-guided navigation market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the image-guided navigation market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for various types of image-guided navigation procedures across regions.

- Market Diversification: Exhaustive information about products, untapped regions, recent developments, and investments in the image-guided navigation market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, distribution networks, and manufacturing capabilities of the leading players in the image-guided navigation market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 SEGMENTS CONSIDERED & GEOGRAPHICAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key sources of secondary data

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key objectives of primary research

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Insights from primary experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 REVENUE SHARE ANALYSIS (SUPPLY SIDE)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 DEMAND-SIDE APPROACH

- 2.2.4 VOLUME DATA ANALYSIS

- 2.3 DATA TRIANGULATION

- 2.4 MARKET SHARE ANALYSIS

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 IMAGE-GUIDED NAVIGATION MARKET OVERVIEW

- 4.2 NORTH AMERICA: IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT AND COUNTRY, 2024

- 4.3 IMAGE-GUIDED NAVIGATION MARKET: REGIONAL MIX

- 4.4 IMAGE-GUIDED NAVIGATION MARKET: GEOGRAPHICAL GROWTH OPPORTUNITIES

- 4.5 IMAGE-GUIDED NAVIGATION MARKET: EMERGING VS. DEVELOPED MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing adoption of minimally invasive surgical procedures

- 5.2.1.2 Rising uptake of robotics in surgeries

- 5.2.1.3 High government investments, funds, and grants for minimally invasive surgeries

- 5.2.1.4 Increasing applications of image-guided navigation across medical specialties

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of image-guided navigation systems in surgical and interventional procedures

- 5.2.2.2 Lack of system accuracy and reliability

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising investments in healthcare AI and big data analytics

- 5.2.3.2 Increasing partnerships and collaborations among large industry players

- 5.2.4 CHALLENGES

- 5.2.4.1 Rising number of product recalls

- 5.2.4.2 Limited adoption of image-guided navigation surgeries in emerging economies

- 5.2.1 DRIVERS

- 5.3 TECHNOLOGY ANALYSIS

- 5.3.1 KEY TECHNOLOGIES

- 5.3.1.1 AI-based image analysis

- 5.3.1.2 Robot-assisted navigation

- 5.3.2 COMPLEMENTARY TECHNOLOGIES

- 5.3.2.1 Patient-specific 3D modelling

- 5.3.2.2 Cloud-based and remote navigation

- 5.3.1 KEY TECHNOLOGIES

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.4.2 BARGAINING POWER OF BUYERS

- 5.4.3 BARGAINING POWER OF SUPPLIERS

- 5.4.4 THREAT OF SUBSTITUTES

- 5.4.5 THREAT OF NEW ENTRANTS

- 5.5 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.5.2 KEY BUYING CRITERIA

- 5.6 REGULATORY ANALYSIS

- 5.6.1 REGULATORY LANDSCAPE

- 5.6.1.1 North America

- 5.6.1.1.1 US

- 5.6.1.2 Europe

- 5.6.1.3 Asia Pacific

- 5.6.1.3.1 Japan

- 5.6.1.3.2 China

- 5.6.1.3.3 India

- 5.6.1.4 Latin America

- 5.6.1.4.1 Brazil

- 5.6.1.5 Middle East & Africa

- 5.6.1.5.1 UAE

- 5.6.1.1 North America

- 5.6.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6.1 REGULATORY LANDSCAPE

- 5.7 PATENT ANALYSIS

- 5.7.1 INSIGHTS ON PATENT PUBLICATION TRENDS (TOP APPLICANTS/JURISDICTION)

- 5.7.2 LIST OF MAJOR PATENTS, 2023-2025

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT DATA FOR HS CODE 901820, 2020-2024

- 5.8.2 EXPORT DATA FOR HS CODE 901820, 2020-2024

- 5.9 PRICING ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE TREND OF IMAGE-GUIDED NAVIGATION PRODUCTS, BY KEY PLAYER, 2022-2024

- 5.9.2 AVERAGE SELLING PRICE TREND OF IMAGE-GUIDED NAVIGATION PRODUCTS, BY REGION, 2022-2024

- 5.10 KEY CONFERENCES & EVENTS, 2025-2026

- 5.11 UNMET NEEDS/END-USER EXPECTATIONS

- 5.12 VALUE CHAIN ANALYSIS

- 5.13 SUPPLY CHAIN ANALYSIS

- 5.14 ECOSYSTEM ANALYSIS

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 BRAINLAB'S SMART NAVIGATION SYSTEM TO IMPROVE BRAIN TUMOR SURGERY

- 5.15.2 ZIMMER BIOMET'S ROBOTIC NAVIGATION TO ASSIST MINIMALLY INVASIVE JOINT REPLACEMENT SURGERIES

- 5.15.3 MEDTRONIC'S PRECISION NAVIGATION SYSTEM TO CONDUCT ADVANCED SPINE SURGERIES

- 5.16 ADJACENT MARKET ANALYSIS

- 5.17 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 5.18 INVESTMENT & FUNDING SCENARIO

- 5.19 IMPACT OF AI/GEN AI ON IMAGE-GUIDED NAVIGATION MARKET

- 5.20 IMPACT OF 2025 US TARIFF ON IMAGE-GUIDED NAVIGATION MARKET

- 5.20.1 INTRODUCTION

- 5.20.2 KEY TARIFF RATES

- 5.20.3 PRICE IMPACT ANALYSIS

- 5.20.4 IMPACT ON COUNTRY/REGION

- 5.20.4.1 North America

- 5.20.4.1.1 US

- 5.20.4.2 Europe

- 5.20.4.3 Asia Pacific

- 5.20.4.1 North America

- 5.20.5 IMPACT ON END-USE INDUSTRIES

- 5.20.5.1 Hospitals

- 5.20.5.2 Ambulatory surgery centers

- 5.20.5.3 Diagnostic imaging centers

6 IMAGE-GUIDED NAVIGATION MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 WORKSTATIONS & SOFTWARE

- 6.2.1 DEMAND FOR ADVANCED SURGICAL PLANNING TOOLS AND REAL-TIME INTRAOPERATIVE NAVIGATION SYSTEMS TO DRIVE MARKET

- 6.3 NAVIGATORS

- 6.3.1 PREVALENCE OF COMPLEX MEDICAL CONDITIONS REQUIRING PRECISE SURGICAL INTERVENTIONS TO AUGMENT MARKET GROWTH

- 6.4 CONSUMABLES

- 6.4.1 INCREASING POPULARITY OF MINIMALLY INVASIVE SURGERIES TO BOOST DEMAND FOR CONSUMABLES

7 IMAGE-GUIDED NAVIGATION MARKET, BY CARE SETTING

- 7.1 INTRODUCTION

- 7.2 INTERVENTIONAL RADIOLOGY SUITE

- 7.2.1 GROWING INTEGRATION OF HYBRID OPERATING ROOMS WITH ADVANCED IMAGING CAPABILITIES TO SUPPORT MARKET GROWTH

- 7.3 SURGICAL

- 7.3.1 SURGICAL NAVIGATION SYSTEMS TO MINIMIZE TISSUE DAMAGE AND ENABLE MORE TARGETED INTERVENTIONS

- 7.4 OTHER CARE SETTINGS

8 IMAGE-GUIDED NAVIGATION MARKET, BY THERAPY AREA

- 8.1 INTRODUCTION

- 8.2 ONCOLOGY

- 8.2.1 INCREASING INCIDENCE OF CANCER TO DRIVE MARKET

- 8.3 NEUROLOGY

- 8.3.1 NEED FOR HIGH PRECISION IN BRAIN AND SPINAL SURGERIES TO SUPPORT MARKET GROWTH

- 8.4 ENT

- 8.4.1 INCREASING INCIDENCE OF COMPLEX ENT-RELATED INJURIES AND DISEASES TO FAVOR MARKET GROWTH

- 8.5 PULMONARY

- 8.5.1 HIGH BURDEN OF LUNG CANCER TO SPUR MARKET GROWTH

- 8.6 GASTROENTEROLOGY

- 8.6.1 INCREASED PREVALENCE OF COLORECTAL CANCER TO AUGMENT MARKET GROWTH

- 8.7 MUSCULOSKELETAL

- 8.7.1 RISING MUSCULOSKELETAL SURGICAL VOLUME TO FAVOR MARKET GROWTH

- 8.8 DENTAL

- 8.8.1 IMAGE-GUIDED DENTAL NAVIGATION SYSTEMS TO FACILITATE MINIMALLY-INVASIVE PROCEDURES AND ENHANCE PATIENT RECOVERY

- 8.9 CARDIOVASCULAR

- 8.9.1 HIGH PREVALENCE OF CARDIOVASCULAR DISEASES TO AID MARKET GROWTH

- 8.10 OTHER THERAPY AREAS

9 IMAGE-GUIDED NAVIGATION MARKET, BY TYPE OF NAVIGATION

- 9.1 INTRODUCTION

- 9.2 OPTICAL NAVIGATION

- 9.2.1 HIGH PRECISION AND SEAMLESS INTEGRATION WITH IMAGING MODALITIES TO AID ADOPTION IN SURGICAL APPLICATIONS

- 9.3 ELECTROMAGNETIC NAVIGATION

- 9.3.1 TECHNOLOGICAL ADVANCEMENTS AND AVAILABILITY OF HIGH-PRECISION GUIDANCE TO PROPEL MARKET GROWTH

- 9.4 ROBOTIC-ASSISTED TRACKING AND AUGMENTED REALITY & MIXED REALITY NAVIGATION

- 9.4.1 GROWING REQUIREMENT FOR ADVANCED VISUALIZATION AND PRECISION IN COMPLEX SURGERIES TO DRIVE MARKET

10 IMAGE-GUIDED NAVIGATION MARKET, BY REFERENCE MODALITY TYPE

- 10.1 INTRODUCTION

- 10.2 CT-BASED REFERENCE

- 10.2.1 WIDESPREAD CLINICAL USE AND DIAGNOSTIC ACCURACY OF CT SCANS TO PROPEL MARKET GROWTH

- 10.3 FLUOROSCOPY-BASED REFERENCE

- 10.3.1 ADVANCEMENTS IN FLUOROSCOPY TECHNOLOGY FOR COMPLEX SURGERIES TO AUGMENT MARKET GROWTH

- 10.4 MRI-BASED REFERENCE

- 10.4.1 SUPERIOR IMAGING CAPABILITIES TO ACCELERATE MARKET GROWTH

- 10.5 ULTRASOUND-BASED REFERENCE

- 10.5.1 TECHNOLOGICAL ADVANCEMENTS TO FUEL UPTAKE OF ULTRASOUND-BASED REFERENCE IN POINT-OF-CARE APPLICATIONS

- 10.6 OTHER REFERENCE MODALITY TYPES

11 IMAGE-GUIDED NAVIGATION MARKET, BY END USER

- 11.1 INTRODUCTION

- 11.2 HOSPITALS

- 11.2.1 BETTER RESOURCE AND COST MANAGEMENT TO FAVOR MARKET GROWTH

- 11.3 AMBULATORY SURGERY CENTERS

- 11.3.1 COST-EFFECTIVENESS AND IMPROVED PATIENT CONVENIENCE TO FAVOR MARKET GROWTH

- 11.4 DIAGNOSTIC IMAGING CENTERS

- 11.4.1 DIAGNOSTIC IMAGING CENTERS TO INTEGRATE IMAGE-GUIDED NAVIGATION SYSTEMS FOR IMPROVED PROCEDURAL OUTCOMES

12 IMAGE-GUIDED NAVIGATION MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.2.2 US

- 12.2.2.1 US to dominate North American image-guided navigation market during forecast period

- 12.2.3 CANADA

- 12.2.3.1 High government investments in digital research infrastructure to propel market growth

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.3.2 GERMANY

- 12.3.2.1 Strong healthcare infrastructure and demand for advanced surgical technologies to augment market growth

- 12.3.3 UK

- 12.3.3.1 High burden of complex diseases and well-developed public healthcare system to fuel market growth

- 12.3.4 FRANCE

- 12.3.4.1 Increased demand for minimally invasive surgeries and favorable government investments in digital health to aid market growth

- 12.3.5 ITALY

- 12.3.5.1 Strong network of public and private hospitals and high prevalence of complex diseases to propel market growth

- 12.3.6 SPAIN

- 12.3.6.1 Advancements in healthcare infrastructure to boost market growth

- 12.3.7 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.2 CHINA

- 12.4.2.1 Large patient population and favorable government initiatives to fuel adoption during surgeries

- 12.4.3 JAPAN

- 12.4.3.1 High geriatric population and universal reimbursement policy for standardized healthcare services to drive market

- 12.4.4 INDIA

- 12.4.4.1 Availability of skilled medical professionals to augment market growth

- 12.4.5 SOUTH KOREA

- 12.4.5.1 Advanced healthcare infrastructure and increased popularity of robot-assisted surgeries to fuel market growth

- 12.4.6 AUSTRALIA

- 12.4.6.1 Rising burden of neurological and spinal disorders to fuel uptake of image-guided navigation products

- 12.4.7 REST OF ASIA PACIFIC

- 12.5 LATIN AMERICA

- 12.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 12.5.2 BRAZIL

- 12.5.2.1 Increased government healthcare budget and favorable regulatory policies to support market growth

- 12.5.3 MEXICO

- 12.5.3.1 Nearshoring of medical device manufacturing to propel market growth

- 12.5.4 ARGENTINA

- 12.5.4.1 High government healthcare investments and increased prevalence of chronic diseases to drive market

- 12.5.5 REST OF LATIN AMERICA

- 12.6 MIDDLE EAST & AFRICA

- 12.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 12.6.2 GCC COUNTRIES

- 12.6.2.1 Increased government investments in medical sector to spur market growth

- 12.6.3 REST OF MIDDLE EAST & AFRICA

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN IMAGE-GUIDED NAVIGATION MARKET

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.5.5.1 Company footprint

- 13.5.5.2 Region footprint

- 13.5.5.3 Product footprint

- 13.5.5.4 Care setting footprint

- 13.5.5.5 Therapy area footprint

- 13.5.5.6 Type of navigation footprint

- 13.5.5.7 Reference modality type footprint

- 13.6 COMPANY EVALUATION MATRIX: STARTUPS/ SMES, 2024

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.6.5.1 Detailed list of key startups/SME players

- 13.6.5.2 Competitive benchmarking of startups/SME players

- 13.7 COMPANY VALUATION & FINANCIAL METRICS

- 13.7.1 FINANCIAL METRICS

- 13.7.2 COMPANY VALUATION

- 13.8 BRAND/PRODUCT COMPARISON

- 13.9 R&D ASSESSMENT OF KEY PLAYERS

- 13.10 COMPETITIVE SCENARIO

- 13.10.1 PRODUCT LAUNCHES/APPROVALS/ENHANCEMENTS

- 13.10.2 DEALS

- 13.10.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 MEDTRONIC

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Services/Solutions offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Expansions

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses & competitive threats

- 14.1.2 BRAINLAB AG

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Services/Solutions offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product approvals

- 14.1.2.3.2 Deals

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses & competitive threats

- 14.1.3 STRYKER

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Services/Solutions offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product approvals

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses & competitive threats

- 14.1.4 B. BRAUN SE

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Services/Solutions offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses & competitive threats

- 14.1.5 KONINKLIJKE PHILIPS N.V.

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Services/Solutions offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses & competitive threats

- 14.1.6 GE HEALTHCARE

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Services/Solutions offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product approvals

- 14.1.6.3.2 Deals

- 14.1.7 OLYMPUS CORPORATION

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Services/Solutions offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Deals

- 14.1.8 SMITH+NEPHEW

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Services/Solutions offered

- 14.1.8.3 Recent development

- 14.1.8.3.1 Deals

- 14.1.9 JOHNSON & JOHNSON SERVICES, INC.

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Services/Solutions offered

- 14.1.9.3 Recent development

- 14.1.9.3.1 Deals

- 14.1.10 GLOBUS MEDICAL (NUVASIVE)

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Services/Solutions offered

- 14.1.10.3 Recent development

- 14.1.10.3.1 Deals

- 14.1.11 STEREOTAXIS, INC.

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Services/Solutions offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Product approvals

- 14.1.11.3.2 Deals

- 14.1.12 ORTHOFIX MEDICAL INC.

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Services/Solutions offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Deals

- 14.1.13 INTEGRA LIFESCIENCES CORPORATION

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Services/Solutions offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Deals

- 14.1.14 ZIMMER BIOMET

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Services/Solutions offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Deals

- 14.1.15 INTUITIVE SURGICAL

- 14.1.15.1 Business overview

- 14.1.15.2 Products/Services/Solutions offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Other developments

- 14.1.1 MEDTRONIC

- 14.2 OTHER PLAYERS

- 14.2.1 KARL STORZ

- 14.2.2 FIAGON GMBH

- 14.2.3 ZETA SURGICAL INC.

- 14.2.4 BRAIN NAVI BIOTECHNOLOGY CO., LTD.

- 14.2.5 IMAGE NAVIGATION, LTD.

- 14.2.6 HAPPY RELIABLE SURGERIES PVT. LTD.

- 14.2.7 RXOOM HEALTHCARE PVT. LTD.

- 14.2.8 CLARONAV

- 14.2.9 SHANGHAI MICROPORT MEDICAL (GROUP) CO., LTD.

- 14.2.10 ZIEHM IMAGING GMBH

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS