|

|

市場調査レポート

商品コード

1718902

航空機用センサーの世界市場:センサータイプ別、用途別、接続性別、最終用途別、航空機タイプ別、地域別 - 予測(~2030年)Aircraft Sensors Market by Sensor Type (Pressure, Proximity, Optical, Force, Radar, Temperature, Motion), Application (Propulsion, Aerostructures & Flight Control, Flight Deck), Connectivity, End Use, Aircraft Type and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 航空機用センサーの世界市場:センサータイプ別、用途別、接続性別、最終用途別、航空機タイプ別、地域別 - 予測(~2030年) |

|

出版日: 2025年04月25日

発行: MarketsandMarkets

ページ情報: 英文 306 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の航空機用センサーの市場規模は、2025年に73億6,000万米ドルになると推定されます。

2030年までに93億3,000万米ドルに達すると予測され、CAGRで4.9%の成長が見込まれます。精巧なアビオニクスへの需要、世界中での航空交通量の拡大、民間/軍用フリートの規模が市場成長に影響を与えています。さらに、電気推進やハイブリッド推進の使用の拡大により、特定の熱、圧力、電力管理センサーが要求されます。さらに、無人航空機や次世代防衛システムへの投資の増加も、航空機用センサーの需要を押し上げています。規制によって強化された安全性と性能の基準により、メーカーは重要なシステムに多くのセンサーを取り付けることができます。航空産業では、データ主導の意思決定とデジタルトランスフォーメーションに対する需要が高く、市場成長の促進要因となっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 10億米ドル |

| セグメント | センサータイプ、用途、接続性、最終用途、航空機タイプ、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「客室・貨物環境制御セグメントが予測期間に第2位のシェアを占める見込みです。」

客室・貨物環境制御セグメントは、旅客の快適性、安全性、貨物の完全性の向上に対する需要の増加により、予測期間に第2位のシェアを占める見込みです。最新鋭の航空機には、客室や貨物エリア内の温度、湿度、気圧、空気質を制御する先進の環境制御システム(ECS)が搭載されるようになってきています。センサーは、これらのパラメーターのリアルタイムモニタリングと制御を可能にする重要な役割を果たし、規制遵守と最高の飛行状態を保証するために利用されています。長距離のフライト、プレミアム旅客サービス、医薬品や電子機器など温度に敏感な商品の輸送の増加は、高精度の温度、圧力、湿度、ガスセンサーに対する需要をさらに増加させます。加えて、特にパンデミック後の清浄度向上によるヘルスモニタリングと空気ろ過システムの需要の増加が、センサー統合を促進しています。航空機OEMと航空企業は、顧客体験の差別化と貨物の保護にますます投資しているため、このセグメントは、大型航空機用センサー市場の中でより強力な成長見通しの1つであり続けています。

「近接セグメントが2025年に最大のシェアを占めると推定されます。」

近接セグメントが2025年に最大のシェアを占めると推定されます。これは、航空機の安全性、自動化、飛行性能向上を提供する上で近接センサータイプが重要な役割を果たすことによるものと考えられます。これらのセンサーは、降着装置、動翼、アクセスドア、貨物室、スラストリバーサーのようなほとんどの航空機システムに一般的に展開され、非接触で物体や動きを感知します。その高い信頼性と、緊密な結合や過酷な条件下での性能は、現在の航空機システムにとって不可欠なものとなっています。より技術的に洗練された航空機や自動化されたコンポーネントでは、リアルタイムのシステムフィードバック、位置確認、故障検出を可能にするために近接センサーが追加されています。さらに、規制当局は安全基準や予知保全をますます重視するようになっており、市場はさらにその必要性を迫られています。将来の民間航空機や軍用航空機の生産台数の増加も、近接センサーの必要性を高めています。

「アジア太平洋が予測期間にもっとも急成長する市場になると予測されます。」

アジア太平洋が予測期間にもっとも急成長する市場になると予測されます。これは、中国、インド、東南アジアなどの新興経済国における民間航空部門の急成長によるものと考えられます。航空旅客の増加、格安航空企業の交通量の拡大、大規模な機体アップグレード計画が、新しい航空機の需要の主な促進要因となっており、先進のセンサー技術の採用に拍車をかけています。

当レポートでは、世界の航空機用センサー市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- 航空機用センサー市場の企業にとって魅力的な機会

- 航空機用センサー市場:最終用途別

- 航空機用センサー市場:タイプ別

- 航空機用センサー市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向と混乱

- バリューチェーン分析

- エコシステム分析

- OEM

- 民間企業、中小企業

- エンドユーザー

- 貿易分析

- 輸入シナリオ

- 輸出シナリオ

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 価格分析

- センサータイプの平均販売価格帯:主要企業別(2025年)

- 平均販売価格の動向:地域別(2021年~2025年)

- 運用データ

- 投資と資金調達のシナリオ

- AIの影響

- イントロダクション

- 民間航空におけるAIの採用

- ケーススタディ分析

- 主なステークホルダーと購入基準

- 主な会議とイベント(2025年~2026年)

- 関税と規制情勢

- 関税データ(HSコード:903180)- 物理量測定用電気機器

- 規制機関、政府機関、その他の組織

- 主な規制

- 米国の関税(2025年)

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 最終用途産業に対する影響

- 部品表(BOM)

- 総所有コスト(TCO)

- ビジネスモデル

- テクノロジーロードマップ

- マクロ経済の見通し

- 北米

- 欧州

- アジア太平洋

- 中東

- ラテンアメリカ

- アフリカ

第6章 産業動向

- イントロダクション

- 技術動向

- 無線センサーネットワーク、小型化

- 多機能、多パラメーターセンシング

- 電気先進光ファイバーセンシング

- マルチセンサーポッドシステム

- 先進センサー材料

- フライバイワイヤ、自律飛行システム

- メガトレンドの影響

- 3Dプリンティング

- AI

- 予知保全

- サプライチェーン分析

- イノベーションと特許の分析

第7章 航空機用センサー市場:タイプ別

- イントロダクション

- 圧力センサー

- 温度センサー

- 荷重センサー

- トルクセンサー

- スピードセンサー

- 位置、変位センサー

- レベルセンサー

- 近接センサー

- フローセンサー

- 光学センサー

- モーションセンサー

- レーダーセンサー

- 煙検知センサー

- GPSセンサー

- その他

第8章 航空機用センサー市場:用途別

- イントロダクション

- 燃料、油圧、空気圧システム

- エンジン/推進

- 客室・貨物環境制御

- 航空構造・飛行制御

- フライトデッキ

- 降着装置システム

- 兵器システム

- その他

第9章 航空機用センサー市場:航空機タイプ別

- イントロダクション

- 民間航空

- ビジネス・一般航空

- 軍用航空

- 無人航空機

- 次世代空モビリティ(AAM)

第10章 航空機用センサー市場:最終用途別

- イントロダクション

- OEM

- アフターマーケット

第11章 航空機用センサー市場:接続性別

- イントロダクション

- 有線

- 無線

第12章 航空機用センサー市場:地域別

- イントロダクション

- 北米

- PESTLE分析

- 米国

- カナダ

- 欧州

- PESTLE分析

- 英国

- フランス

- ドイツ

- イタリア

- ロシア

- その他の欧州

- アジア太平洋

- PESTLE分析

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- その他のアジア太平洋

- 中東

- PESTLE分析

- GCC

- イスラエル

- トルコ

- その他の中東

- ラテンアメリカ

- PESTLE分析

- ブラジル

- メキシコ

- その他のラテンアメリカ

- アフリカ

- PESTLE分析

- 南アフリカ

- ナイジェリア

- その他のアフリカ

第13章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み(2020年~2025年)

- 収益分析(2020年~2024年)

- 市場シェア分析(2024年)

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 企業の評価と財務指標

- ブランド/製品の比較

- 競合シナリオ

- 顧客分析:サプライヤーとOEMの調達行動

- エンジンOEM

- 航空機OEM

- Tier 1システムインテグレーター

第14章 企業プロファイル

- 主要企業

- HONEYWELL INTERNATIONAL INC.

- SAFRAN

- TE CONNECTIVITY LTD.

- MEGGITT PLC

- AMETEK INC.

- LOCKHEED MARTIN CORPORATION

- WOODWARD

- RTX

- THALES

- L3HARRIS TECHNOLOGIES, INC.

- THE BOSCH GROUP

- TRIMBLE INC.

- CURTISS-WRIGHT CORPORATION

- EATON CORPORATION

- CRANE AEROSPACE & ELECTRONICS

- STELLAR TECHNOLOGY

- AMPHENOL CORPORATION

- TDK CORPORATION

- ULTRA PRECISION CONTROL SYSTEMS

- VECTORNAV TECHNOLOGIES LLC

- EMCORE CORPORATION

- その他の企業

- AEROSONIC

- SENSOR SYSTEMS LLC

- CIRCOR AEROSPACE

- FUTEK ADVANCED SENSOR TECHNOLOGY, INC.

第15章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 NEW AIRCRAFT DELIVERIES, BY REGION, 2024-2043

- TABLE 3 AVERAGE NUMBER OF SENSORS INSTALLED ACROSS PLATFORMS, 2024

- TABLE 4 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 IMPORT DATA FOR SERVICE CODE 9, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 6 EXPORT DATA FOR SERVICE CODE 9, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 7 AVERAGE SELLING PRICE OF AIRCRAFT SENSORS, BY TYPE, 2025 (USD)

- TABLE 8 AVERAGE SELLING PRICE TREND OF AIRCRAFT SENSORS, BY REGION, 2021-2025 (USD THOUSAND)

- TABLE 9 GLOBAL COMMERCIAL AIRCRAFT FLEET, BY REGION, 2023

- TABLE 10 GLOBAL COMMERCIAL AIRCRAFT FLEET, 2043

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO AIRCRAFT TYPES (%)

- TABLE 12 KEY BUYING CRITERIA FOR TOP TWO AIRCRAFT TYPES

- TABLE 13 KEY CONFERENCES AND EVENTS IN 2025-2026

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 RECIPROCAL TARIFF RATES ADJUSTED BY US, BY COUNTRY

- TABLE 19 KEY COMPONENT-RELATED TARIFFS FOR AIRCRAFT SENSORS

- TABLE 20 AIRCRAFT SENSORS MARKET: RISK MATRIX (POST-2025 TARIFFS)

- TABLE 21 BILL OF MATERIALS (BOM) FOR MAJOR AIRCRAFT SENSOR TYPES: KEY COMPONENTS, MATERIAL USED, AND KEY SUPPLIERS (2024)

- TABLE 22 ESTIMATED TCO FOR MAJOR AIRCRAFT SENSORS, BY AIRCRAFT TYPE

- TABLE 23 AIRCRAFT SENSORS MARKET: BUSINESS MODELS

- TABLE 24 INNOVATIONS AND PATENT REGISTRATIONS, 2022-2023

- TABLE 25 AIRCRAFT SENSORS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 26 AIRCRAFT SENSORS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 27 AIRCRAFT SENSORS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 28 AIRCRAFT SENSORS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 29 AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2020-2024 (USD MILLION)

- TABLE 30 AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2025-2030 (USD MILLION)

- TABLE 31 COMMERCIAL AVIATION: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2020-2024 (USD MILLION)

- TABLE 32 COMMERCIAL AVIATION: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2025-2030 (USD MILLION)

- TABLE 33 COMMERCIAL AVIATION: AIRCRAFT SENSORS MARKET, BY FUEL, HYDRAULIC, AND PNEUMATIC SYSTEM, 2020-2024 (USD MILLION)

- TABLE 34 COMMERCIAL AVIATION: AIRCRAFT SENSORS MARKET, BY FUEL, HYDRAULIC, AND PNEUMATIC SYSTEM, 2025-2030 (USD MILLION)

- TABLE 35 COMMERCIAL AVIATION: AIRCRAFT SENSORS MARKET, BY ENGINE/PROPULSION, 2020-2024 (USD MILLION)

- TABLE 36 COMMERCIAL AVIATION: AIRCRAFT SENSORS MARKET, BY ENGINE/PROPULSION, 2025-2030 (USD MILLION)

- TABLE 37 COMMERCIAL AVIATION: AIRCRAFT SENSORS MARKET, BY CABIN & CARGO ENVIRONMENTAL CONTROL, 2020-2024 (USD MILLION)

- TABLE 38 COMMERCIAL AVIATION: AIRCRAFT SENSORS MARKET, BY CABIN & CARGO ENVIRONMENTAL CONTROL, 2025-2030 (USD MILLION)

- TABLE 39 COMMERCIAL AVIATION: AIRCRAFT SENSORS MARKET, BY AEROSTRUCTURE & FLIGHT CONTROL, 2020-2024 (USD MILLION)

- TABLE 40 COMMERCIAL AVIATION: AIRCRAFT SENSORS MARKET, BY AEROSTRUCTURE & FLIGHT CONTROL, 2025-2030 (USD MILLION)

- TABLE 41 COMMERCIAL AVIATION: AIRCRAFT SENSORS MARKET, BY FLIGHT DECK, 2020-2024 (USD MILLION)

- TABLE 42 COMMERCIAL AVIATION: AIRCRAFT SENSORS MARKET, BY FLIGHT DECK, 2025-2030 (USD MILLION)

- TABLE 43 COMMERCIAL AVIATION: AIRCRAFT SENSORS MARKET FOR OTHER TYPES, 2020-2024 (USD MILLION)

- TABLE 44 COMMERCIAL AVIATION: AIRCRAFT SENSORS MARKET FOR OTHER TYPES, 2025-2030 (USD MILLION)

- TABLE 45 BUSINESS & GENERAL AVIATION: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2020-2024 (USD MILLION)

- TABLE 46 BUSINESS & GENERAL AVIATION: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2025-2030 (USD MILLION)

- TABLE 47 BUSINESS & GENERAL AVIATION: AIRCRAFT SENSORS MARKET, BY FUEL, HYDRAULIC, AND PNEUMATIC SYSTEM, 2020-2024 (USD MILLION)

- TABLE 48 BUSINESS & GENERAL AVIATION: AIRCRAFT SENSORS MARKET, BY FUEL, HYDRAULIC, AND PNEUMATIC SYSTEM, 2025-2030 (USD MILLION)

- TABLE 49 BUSINESS & GENERAL AVIATION: AIRCRAFT SENSORS MARKET, BY ENGINE/PROPULSION, 2020-2024 (USD MILLION)

- TABLE 50 BUSINESS & GENERAL AVIATION: AIRCRAFT SENSORS MARKET, BY ENGINE/PROPULSION, 2025-2030 (USD MILLION)

- TABLE 51 BUSINESS & GENERAL AVIATION: AIRCRAFT SENSORS MARKET, BY CABIN & CARGO ENVIRONMENTAL CONTROL, 2020-2024 (USD MILLION)

- TABLE 52 BUSINESS & GENERAL AVIATION: AIRCRAFT SENSORS MARKET, BY CABIN & CARGO ENVIRONMENTAL CONTROL, 2025-2030 (USD MILLION)

- TABLE 53 BUSINESS & GENERAL AVIATION: AIRCRAFT SENSORS MARKET, BY AEROSTRUCTURE & FLIGHT CONTROL, 2020-2024 (USD MILLION)

- TABLE 54 BUSINESS & GENERAL AVIATION: AIRCRAFT SENSORS MARKET, BY AEROSTRUCTURE & FLIGHT CONTROL, 2025-2030 (USD MILLION)

- TABLE 55 BUSINESS & GENERAL AVIATION: AIRCRAFT SENSORS MARKET, BY FLIGHT DECK, 2020-2024 (USD MILLION)

- TABLE 56 BUSINESS & GENERAL AVIATION: AIRCRAFT SENSORS MARKET, BY FLIGHT DECK, 2025-2030 (USD MILLION)

- TABLE 57 BUSINESS & GENERAL AVIATION: AIRCRAFT SENSORS MARKET FOR OTHER TYPES, 2020-2024 (USD MILLION)

- TABLE 58 BUSINESS & GENERAL AVIATION: AIRCRAFT SENSORS MARKET FOR OTHER TYPES, 2025-2030 (USD MILLION)

- TABLE 59 MILITARY AVIATION: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2020-2024 (USD MILLION)

- TABLE 60 MILITARY AVIATION: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2025-2030 (USD MILLION)

- TABLE 61 UNMANNED AERIAL VEHICLES: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2020-2024 (USD MILLION)

- TABLE 62 UNMANNED AERIAL VEHICLES: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2025-2030 (USD MILLION)

- TABLE 63 ADVANCED AIR MOBILITY: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2025-2030 (USD MILLION)

- TABLE 64 AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 65 AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 66 AIRCRAFT SENSORS MARKET, BY CONNECTIVITY, 2020-2024 (USD MILLION)

- TABLE 67 AIRCRAFT SENSORS MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 68 AIRCRAFT SENSORS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 69 AIRCRAFT SENSORS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: AIRCRAFT SENSORS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 71 NORTH AMERICA: AIRCRAFT SENSORS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2020-2024 (USD MILLION)

- TABLE 73 NORTH AMERICA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2025-2030 (USD MILLION)

- TABLE 74 NORTH AMERICA: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 75 NORTH AMERICA: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: AIRCRAFT SENSORS MARKET, BY BUSINESS & GENERAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 77 NORTH AMERICA: AIRCRAFT SENSORS MARKET, BY BUSINESS & GENERAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 78 US: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 79 US: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 80 US: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 81 US: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 82 CANADA: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 83 CANADA: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 84 CANADA: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 85 CANADA: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 86 EUROPE: AIRCRAFT SENSORS MARKET, BY COUNTRY/REGION, 2020-2024 (USD MILLION)

- TABLE 87 EUROPE: AIRCRAFT SENSORS MARKET, BY COUNTRY/REGION, 2025-2030 (USD MILLION)

- TABLE 88 EUROPE: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2020-2024 (USD MILLION)

- TABLE 89 EUROPE: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2025-2030 (USD MILLION)

- TABLE 90 EUROPE: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 91 EUROPE: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 92 EUROPE: AIRCRAFT SENSORS MARKET, BY BUSINESS & GENERAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 93 EUROPE: AIRCRAFT SENSORS MARKET, BY BUSINESS & GENERAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 94 UK: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 95 UK: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 96 UK: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 97 UK: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 98 FRANCE: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 99 FRANCE: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 100 FRANCE: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 101 FRANCE: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 102 GERMANY: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 103 GERMANY: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 104 GERMANY: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 105 GERMANY: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 106 ITALY: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 107 ITALY: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 108 ITALY: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 109 ITALY: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 110 RUSSIA: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 111 RUSSIA: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 112 RUSSIA: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 113 RUSSIA: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 114 REST OF EUROPE: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 115 REST OF EUROPE: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 116 REST OF EUROPE: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 117 REST OF EUROPE: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 118 ASIA PACIFIC: AIRCRAFT SENSORS MARKET, BY COUNTRY/REGION, 2020-2024 (USD MILLION)

- TABLE 119 ASIA PACIFIC: AIRCRAFT SENSORS MARKET, BY COUNTRY/REGION, 2025-2030 (USD MILLION)

- TABLE 120 ASIA PACIFIC: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2020-2024 (USD MILLION)

- TABLE 121 ASIA PACIFIC: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2025-2030 (USD MILLION)

- TABLE 122 ASIA PACIFIC: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 123 ASIA PACIFIC: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 124 ASIA PACIFIC: AIRCRAFT SENSORS MARKET, BY BUSINESS & GENERAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 125 ASIA PACIFIC: AIRCRAFT SENSORS MARKET, BY BUSINESS & GENERAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 126 CHINA: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 127 CHINA: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 128 CHINA: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 129 CHINA: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 130 INDIA: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 131 INDIA: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 132 INDIA: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 133 INDIA: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 134 JAPAN: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 135 JAPAN: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 136 JAPAN: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 137 JAPAN: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 138 AUSTRALIA: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 139 AUSTRALIA: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 140 AUSTRALIA: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 141 AUSTRALIA: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 142 SOUTH KOREA: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 143 SOUTH KOREA: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 144 SOUTH KOREA: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 145 SOUTH KOREA: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 150 MIDDLE EAST: AIRCRAFT SENSORS MARKET, BY COUNTRY/REGION, 2020-2024 (USD MILLION)

- TABLE 151 MIDDLE EAST: AIRCRAFT SENSORS MARKET, BY COUNTRY/REGION, 2025-2030 (USD MILLION)

- TABLE 152 MIDDLE EAST: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2020-2024 (USD MILLION)

- TABLE 153 MIDDLE EAST: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2025-2030 (USD MILLION)

- TABLE 154 MIDDLE EAST: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 155 MIDDLE EAST: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 156 MIDDLE EAST: AIRCRAFT SENSORS MARKET, BY BUSINESS & GENERAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 157 MIDDLE EAST: AIRCRAFT SENSORS MARKET, BY BUSINESS & GENERAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 158 UAE: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 159 UAE: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 160 UAE: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 161 UAE: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 162 SAUDI ARABIA: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 163 SAUDI ARABIA: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 164 SAUDI ARABIA: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 165 SAUDI ARABIA: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 166 ISRAEL: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 167 ISRAEL: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 168 ISRAEL: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 169 ISRAEL: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 170 TURKEY: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 171 TURKEY: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 172 TURKEY: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 173 TURKEY: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 174 REST OF MIDDLE EAST: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 175 REST OF MIDDLE EAST: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 176 REST OF MIDDLE EAST: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 177 REST OF MIDDLE EAST: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 178 LATIN AMERICA: AIRCRAFT SENSORS MARKET, BY COUNTRY/REGION, 2020-2024 (USD MILLION)

- TABLE 179 LATIN AMERICA: AIRCRAFT SENSORS MARKET, BY COUNTRY/REGION, 2025-2030 (USD MILLION)

- TABLE 180 LATIN AMERICA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2020-2024 (USD MILLION)

- TABLE 181 LATIN AMERICA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2025-2030 (USD MILLION)

- TABLE 182 LATIN AMERICA: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 183 LATIN AMERICA: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 184 LATIN AMERICA: AIRCRAFT SENSORS MARKET, BY BUSINESS & GENERAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 185 LATIN AMERICA: AIRCRAFT SENSORS MARKET, BY BUSINESS & GENERAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 186 BRAZIL: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 187 BRAZIL: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 188 BRAZIL: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 189 BRAZIL: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 190 MEXICO: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 191 MEXICO: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 192 MEXICO: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 193 MEXICO: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 194 REST OF LATIN AMERICA: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 195 REST OF LATIN AMERICA: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 196 REST OF LATIN AMERICA: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 197 REST OF LATIN AMERICA: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 198 AFRICA: AIRCRAFT SENSORS MARKET, BY COUNTRY/REGION, 2020-2024 (USD MILLION)

- TABLE 199 AFRICA: AIRCRAFT SENSORS MARKET, BY COUNTRY/REGION, 2025-2030 (USD MILLION)

- TABLE 200 AFRICA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2020-2024 (USD MILLION)

- TABLE 201 AFRICA: AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE, 2025-2030 (USD MILLION)

- TABLE 202 AFRICA: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 203 AFRICA: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 204 AFRICA: AIRCRAFT SENSORS MARKET, BY BUSINESS & GENERAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 205 AFRICA: AIRCRAFT SENSORS MARKET, BY BUSINESS & GENERAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 206 SOUTH AFRICA: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 207 SOUTH AFRICA: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 208 SOUTH AFRICA: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 209 SOUTH AFRICA: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 210 NIGERIA: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 211 NIGERIA: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 212 NIGERIA: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 213 NIGERIA: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 214 REST OF AFRICA: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2020-2024 (USD MILLION)

- TABLE 215 REST OF AFRICA: AIRCRAFT SENSORS MARKET, BY COMMERCIAL AVIATION, 2025-2030 (USD MILLION)

- TABLE 216 REST OF AFRICA: AIRCRAFT SENSORS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 217 REST OF AFRICA: AIRCRAFT SENSORS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 218 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- TABLE 219 AIRCRAFT SENSORS MARKET: DEGREE OF COMPETITION

- TABLE 220 AIRCRAFT SENSORS MARKET: REGION FOOTPRINT

- TABLE 221 AIRCRAFT SENSORS MARKET: END USE FOOTPRINT

- TABLE 222 AIRCRAFT SENSORS MARKET: APPLICATION FOOTPRINT

- TABLE 223 AIRCRAFT SENSORS MARKET: LIST OF STARTUPS/SMES

- TABLE 224 AIRCRAFT SENSORS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 225 AIRCRAFT SENSORS MARKET: PRODUCT LAUNCHES, JANUARY 2020-MARCH 2025

- TABLE 226 AIRCRAFT SENSORS MARKET: DEALS, JANUARY 2020-MARCH 2025

- TABLE 227 AIRCRAFT SENSORS MARKET: OTHERS, JANUARY 2020-MARCH 2025

- TABLE 228 ENGINE OEMS: SUPPLIER & OEM PROCUREMENT BEHAVIOR

- TABLE 229 AIRFRAME OEMS: SUPPLIER & OEM PROCUREMENT BEHAVIOR

- TABLE 230 TIER-1 SYSTEM INTEGRATORS: SUPPLIER & OEM PROCUREMENT BEHAVIOR

- TABLE 231 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 232 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 234 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 235 HONEYWELL INTERNATIONAL INC.: OTHERS

- TABLE 236 SAFRAN: COMPANY OVERVIEW

- TABLE 237 SAFRAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 SAFRAN: DEALS

- TABLE 239 SAFRAN: OTHERS

- TABLE 240 TE CONNECTIVITY LTD.: COMPANY OVERVIEW

- TABLE 241 TE CONNECTIVITY LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 TE CONNECTIVITY LTD.: DEALS

- TABLE 243 MEGGITT PLC: COMPANY OVERVIEW

- TABLE 244 MEGGITT PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 MEGGITT PLC: OTHERS

- TABLE 246 AMETEK INC.: COMPANY OVERVIEW

- TABLE 247 AMETEK INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 AMETEK INC.: DEALS

- TABLE 249 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 250 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 LOCKHEED MARTIN CORPORATION: OTHERS

- TABLE 252 WOODWARD: COMPANY OVERVIEW

- TABLE 253 WOODWARD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 WOODWARD: DEALS

- TABLE 255 RTX: COMPANY OVERVIEW

- TABLE 256 RTX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 THALES: COMPANY OVERVIEW

- TABLE 258 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 THALES: DEALS

- TABLE 260 THALES: OTHERS

- TABLE 261 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 262 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 264 L3HARRIS TECHNOLOGIES, INC.: OTHERS

- TABLE 265 THE BOSCH GROUP: COMPANY OVERVIEW

- TABLE 266 THE BOSCH GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 267 TRIMBLE INC.: COMPANY OVERVIEW

- TABLE 268 TRIMBLE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 CURTISS-WRIGHT CORPORATION: COMPANY OVERVIEW

- TABLE 270 CURTISS-WRIGHT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 EATON CORPORATION: COMPANY OVERVIEW

- TABLE 272 EATON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 EATON CORPORATION: DEALS

- TABLE 274 CRANE AEROSPACE & ELECTRONICS: COMPANY OVERVIEW

- TABLE 275 CRANE AEROSPACE & ELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 276 STELLAR TECHNOLOGY: COMPANY OVERVIEW

- TABLE 277 STELLAR TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 278 AMPHENOL CORPORATION: COMPANY OVERVIEW

- TABLE 279 AMPHENOL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 AMPHENOL CORPORATION: DEALS

- TABLE 281 TDK CORPORATION: COMPANY OVERVIEW

- TABLE 282 TDK CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 ULTRA PRECISION CONTROL SYSTEMS: COMPANY OVERVIEW

- TABLE 284 ULTRA PRECISION CONTROL SYSTEMS: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 285 VECTORNAV TECHNOLOGIES LLC: COMPANY OVERVIEW

- TABLE 286 VECTORNAV TECHNOLOGIES LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 287 EMCORE CORPORATION: COMPANY OVERVIEW

- TABLE 288 EMCORE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 AEROSONIC: COMPANY OVERVIEW

- TABLE 290 SENSOR SYSTEMS LLC: COMPANY OVERVIEW

- TABLE 291 CIRCOR AEROSPACE: COMPANY OVERVIEW

- TABLE 292 FUTEK ADVANCED SENSOR TECHNOLOGY, INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 AIRCRAFT SENSORS MARKET: RESEARCH DESIGN

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 AIRCRAFT SENSORS MARKET, BY APPLICATION, 2025

- FIGURE 7 AIRCRAFT SENSORS MARKET, BY CONNECTIVITY, 2025

- FIGURE 8 AIRCRAFT SENSORS MARKET, BY REGION, 2025

- FIGURE 9 NEED FOR ADVANCED SENSING SOLUTIONS TO DRIVE MARKET

- FIGURE 10 OEM TO BE LARGER THAN AFTERMARKET SEGMENT DURING FORECAST PERIOD

- FIGURE 11 PRESSURE SENSORS TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 12 AUSTRALIA TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

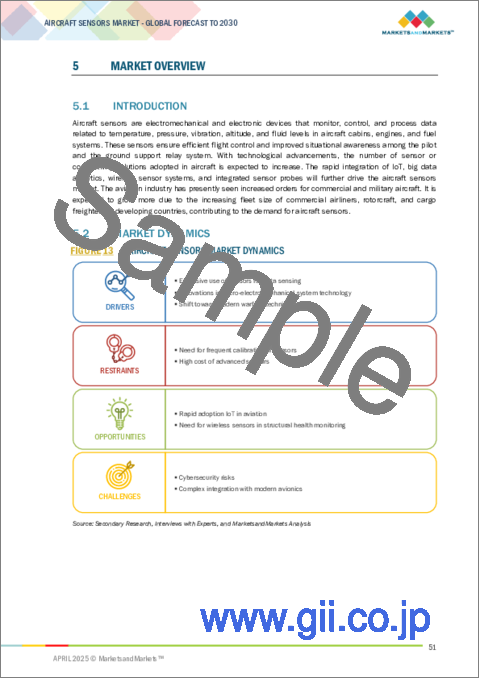

- FIGURE 13 AIRCRAFT SENSORS MARKET DYNAMICS

- FIGURE 14 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 15 VALUE CHAIN ANALYSIS

- FIGURE 16 ECOSYSTEM ANALYSIS

- FIGURE 17 IMPORT DATA FOR SERVICE CODE 9, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 18 EXPORT DATA FOR SERVICE CODE 9, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 19 AVERAGE SELLING PRICE OF AIRCRAFT SENSORS, BY TYPE, 2025 (USD)

- FIGURE 20 AVERAGE SELLING PRICE TREND OF AIRCRAFT SENSORS, BY REGION, 2021-2025 (USD)

- FIGURE 21 INVESTMENT & FUNDING SCENARIO, 2020-2024 (USD MILLION)

- FIGURE 22 AI LANDSCAPE

- FIGURE 23 AI ADOPTION IN COMMERCIAL AVIATION

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO AIRCRAFT TYPES

- FIGURE 25 KEY BUYING CRITERIA FOR TOP TWO AIRCRAFT TYPES

- FIGURE 26 AIRCRAFT SENSORS MARKET: TECHNOLOGY ROADMAP, 2024-2035

- FIGURE 27 TECHNOLOGY TRENDS

- FIGURE 28 SUPPLY CHAIN ANALYSIS

- FIGURE 29 LIST OF MAJOR PATENTS RELATED TO AIRCRAFT SENSORS MARKET

- FIGURE 30 PROXIMITY SENSORS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 31 FUEL, HYDRAULIC, AND PNEUMATIC SYSTEMS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 32 COMMERCIAL AVIATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 33 OEM SEGMENT TO CAPTURE SIGNIFICANT SHARE DURING FORECAST PERIOD

- FIGURE 34 WIRED SENSORS TO BE DOMINANT SEGMENT DURING FORECAST PERIOD

- FIGURE 35 AIRCRAFT SENSORS MARKET: REGIONAL SNAPSHOT

- FIGURE 36 NORTH AMERICA: AIRCRAFT SENSORS MARKET SNAPSHOT

- FIGURE 37 EUROPE: AIRCRAFT SENSORS MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: AIRCRAFT SENSORS MARKET SNAPSHOT

- FIGURE 39 MIDDLE EAST: AIRCRAFT SENSORS MARKET SNAPSHOT

- FIGURE 40 LATIN AMERICA: AIRCRAFT SENSORS MARKET SNAPSHOT

- FIGURE 41 AFRICA: AIRCRAFT SENSORS MARKET SNAPSHOT

- FIGURE 42 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- FIGURE 43 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 44 AIRCRAFT SENSORS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 45 AIRCRAFT SENSORS MARKET: COMPANY FOOTPRINT

- FIGURE 46 AIRCRAFT SENSORS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 47 VALUATION OF PROMINENT MARKET PLAYERS, 2025

- FIGURE 48 FINANCIAL METRICS OF PROMINENT MARKET PLAYERS, 2025

- FIGURE 49 BRAND/PRODUCT COMPARISON

- FIGURE 50 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 51 SAFRAN: COMPANY SNAPSHOT

- FIGURE 52 TE CONNECTIVITY LTD.: COMPANY SNAPSHOT

- FIGURE 53 AMETEK INC.: COMPANY SNAPSHOT

- FIGURE 54 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 WOODWARD: COMPANY SNAPSHOT

- FIGURE 56 RTX: COMPANY SNAPSHOT

- FIGURE 57 THALES: COMPANY SNAPSHOT

- FIGURE 58 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 59 THE BOSCH GROUP: COMPANY SNAPSHOT

- FIGURE 60 TRIMBLE INC.: COMPANY SNAPSHOT

- FIGURE 61 CURTISS-WRIGHT CORPORATION: COMPANY SNAPSHOT

- FIGURE 62 EATON CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 CRANE AEROSPACE & ELECTRONICS: COMPANY SNAPSHOT

- FIGURE 64 AMPHENOL CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 TDK CORPORATION: COMPANY SNAPSHOT

- FIGURE 66 ULTRA PRECISION CONTROL SYSTEMS: COMPANY SNAPSHOT

- FIGURE 67 EMCORE CORPORATION: COMPANY SNAPSHOT

The aircraft sensors market is estimated to be USD 7.36 billion in 2025. It is projected to reach USD 9.33 billion by 2030 at a CAGR of 4.9%. The demand for sophisticated avionics, expansion in air traffic worldwide, and commercial and military fleet size influence the market growth. Additionally, the expansion in the use of electric and hybrid propulsion demands specific thermal, pressure, and power management sensors. Moreover, increasing investments in unmanned aerial vehicles and future-generation defense systems are also driving the demand for aircraft sensors. Safety and performance standards enforced by regulations allow manufacturers to install more sensors in key systems. High demand for data-driven decision-making and digital transformation in aviation drives market growth.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Sensor Type, Application, Connectivity, End Use, Aircraft Type and Region |

| Regions covered | North America, Europe, APAC, RoW |

"The cabin & cargo environmental controls segment is projected to account for the second-largest share during the forecast period."

The cabin & cargo environmental controls segment is projected to account for the second-largest share during the forecast period due to the increasing demand for increased passenger comfort, safety, and cargo integrity. State-of-the-art aircraft are increasingly fitted with sophisticated environmental control systems (ECS) that control temperature, humidity, air pressure, and air quality inside cabin and cargo areas. Sensors are applied to play a key role in enabling real-time monitoring and control of these parameters, ensuring regulatory compliance and best-in-flight conditions. Growth in long-haul flights, premium passenger services, and transport of temperature-sensitive commodities, such as pharmaceuticals and electronics, further increase the demand for high-precision temperature, pressure, humidity, and gas sensors. Additionally, the increasing demand for health monitoring and air filtration systems, especially driven by increased post-pandemic cleanliness levels, is driving sensor integration. As aircraft OEMs and airlines invest increasingly in distinguishing customer experience and safeguarding cargo, this segment remains one of the stronger growth prospects within the larger aircraft sensors market.

"The proximity segment is estimated to account for the largest share in 2025."

The proximity segment is estimated to account for the largest share in 2025. This can be attributed to the critical role of proximity sensor types in providing aircraft safety, automation, and flight performance improvement. These sensors are commonly deployed in most aircraft systems, like landing gear, flight control surfaces, access doors, cargo bays, and thrust reversers, to sense objects or movement without contact. Their high reliability and performance under tightly coupled or hostile conditions make them essential to current aircraft systems. With more technologically sophisticated aircraft and automated components, proximity sensors are added to enable real-time system feedback, position confirmation, and fault detection. Furthermore, regulatory authorities are emphasizing safety standards and predictive maintenance more and more, compelling the market for the same even more. The rise in future commercial or military aircraft production also propels the requirement for proximity sensors.

"Asia Pacific is projected to be the fastest-growing market during the forecast period."

The Asia Pacific region is projected to be the fastest-growing market during the forecast period. This can be attributed to the swift growth of the commercial aviation sector in emerging economies like China, India, and Southeast Asia. Growing air passenger travel, expanding low-cost carrier traffic, and wide-scale fleet upgrade schemes are majorly driving the demand for new planes, spurring the adoption of sophisticated sensor technology.

Regional governments are investing heavily in modernizing defense, with nations such as China, India, South Korea, and Japan upgrading their military aviation fleet. This includes the procurement of new-generation fighter jets, surveillance jets, and UAVs, all of which require sophisticated sensor suites for performance tracking, navigation, and combat readiness.

The presence of new aerospace production hubs in the country and increasing collaboration with foreign OEMs fuel the expansion of sensor integration into domestic and export plane programs. Indigenous aircraft platform development and the introduction of sophisticated avionics systems also drive the demand for sensors in the region.

The Asia Pacific market is also gaining from the increasing focus on safety regulations, operation efficiency, and predictive maintenance, all of which are prime uses of aircraft sensors. With positive economic growth, favorable government policies, and rising adoption of technologies, Asia Pacific has good prospects to lead in the aircraft sensor market development during the forecast period.

Breakdown of Primaries

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1: 49%; Tier 2: 37%; and Tier 3: 14%

- By Designation: C-Level: 55%; Directors: 27%; and Others: 18%

- By Region: North America: 32%; Europe: 32%; Asia Pacific: 16%; Middle East & Africa: 10%; and Latin America: 10%

Honeywell International, Inc. (US); Safran (France); TE Connectivity Ltd. (Switzerland); Meggitt Plc (UK); and AMETEK, Inc. (US) are some of the leading players operating in the aircraft sensors market.

Research Coverage

The study covers the aircraft sensors market across various segments and subsegments. It aims to estimate this market's size and growth potential across different segments based on application, sensor type, aircraft type, end use, connectivity, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their solutions and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Key benefits of buying this report:

This report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall aircraft sensors market and its subsegments. The report covers the entire ecosystem of the aircraft sensors market. It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help them understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers and factors, such as extensive use of sensors for data sensing, innovations in microelectromechanical system technology, and shift toward modern warfare technique

- Product Development: In-depth analysis of product innovation/development by companies across various regions

- Comprehensive information about lucrative markets: Analysis of the aircraft sensors market across varied regions

- Market Diversification: Exhaustive information about new solutions, untapped geographies, recent developments, and investments in aircraft sensors market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and product offerings of leading players like market Honeywell International Inc. (US), Safran (France), Meggitt PLC (UK), TE Connectivity Ltd. (Switzerland), and AMETEK Inc. (US) among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND GEOGRAPHICAL SPREAD

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.2.1 Growing trend toward electric aircraft

- 2.2.2.2 Increasing demand for new commercial aircraft

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.2.3.1 Advancements in technologies to develop efficient, fault-tolerant aircraft

- 2.3 MARKET SIZE ESTIMATION

- 2.4 RESEARCH APPROACH & METHODOLOGY

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AIRCRAFT SENSORS MARKET

- 4.2 AIRCRAFT SENSORS MARKET, BY END USE

- 4.3 AIRCRAFT SENSORS MARKET, BY TYPE

- 4.4 AIRCRAFT SENSORS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Extensive use of sensors for data sensing

- 5.2.1.2 Innovations in micro-electromechanical system technology

- 5.2.1.3 Shift toward modern warfare techniques

- 5.2.1.4 Rising demand for geological surveys

- 5.2.1.5 Increase in demand for new aircraft worldwide

- 5.2.2 RESTRAINTS

- 5.2.2.1 Need for frequent calibration of sensors

- 5.2.2.2 High cost of advanced sensors

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rapid adoption of IoT in aviation

- 5.2.3.2 Need for wireless sensors in structural health monitoring

- 5.2.4 CHALLENGES

- 5.2.4.1 Cybersecurity risks

- 5.2.4.2 Complex integration with modern avionics

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 OEMS

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END USERS

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO

- 5.6.2 EXPORT SCENARIO

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Infrared sensors

- 5.7.1.2 Accelerometers

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Autonomous systems

- 5.7.2.2 Wireless communication systems

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Avionics systems

- 5.7.3.2 Aircraft maintenance management systems

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE RANGE OF SENSOR TYPE, BY KEY PLAYERS, 2025

- 5.8.2 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2025

- 5.9 OPERATIONAL DATA

- 5.10 INVESTMENT AND FUNDING SCENARIO

- 5.11 IMPACT OF AI

- 5.11.1 INTRODUCTION

- 5.11.2 AI ADOPTION IN COMMERCIAL AVIATION

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 AIRCRAFT TEMPERATURE SENSORS FOR ENGINE MONITORING

- 5.12.2 PRESSURE SENSOR-EQUIPPED AIR DATA SYSTEMS FOR FLIGHT CONTROL AND FUEL MANAGEMENT

- 5.12.3 FIBER OPTIC SENSORS FOR STRUCTURAL MONITORING

- 5.12.4 RADAR SENSORS FOR COLLISION AVOIDANCE

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS IN 2025-2026

- 5.15 TARIFF AND REGULATORY LANDSCAPE

- 5.15.1 TARIFF DATA (HS CODE: 903180) - ELECTRICAL INSTRUMENTS FOR MEASURING PHYSICAL QUANTITIES

- 5.15.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.3 KEY REGULATIONS

- 5.16 US TARIFF 2025

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT ON COUNTRY/REGION

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 Asia Pacific

- 5.16.5 IMPACT ON END-USE INDUSTRIES

- 5.17 BILL OF MATERIALS (BOM)

- 5.18 TOTAL COST OF OWNERSHIP (TCO)

- 5.19 BUSINESS MODELS

- 5.20 TECHNOLOGY ROADMAP

- 5.21 MACROECONOMIC OUTLOOK

- 5.21.1 NORTH AMERICA

- 5.21.2 EUROPE

- 5.21.3 ASIA PACIFIC

- 5.21.4 MIDDLE EAST

- 5.21.5 LATIN AMERICA

- 5.21.6 AFRICA

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 WIRELESS SENSOR NETWORKS AND MINIATURIZATION

- 6.2.2 MULTI-FUNCTION AND MULTI-PARAMETER SENSING

- 6.2.3 ELECTRIC ADVANCED FIBER OPTIC SENSING

- 6.2.4 MULTI-SENSOR POD SYSTEMS

- 6.2.5 ADVANCED SENSOR MATERIALS

- 6.2.6 FLY-BY-WIRE AND AUTONOMOUS FLIGHT SYSTEMS

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 3D PRINTING

- 6.3.2 ARTIFICIAL INTELLIGENCE

- 6.3.3 PREDICTIVE MAINTENANCE

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 INNOVATIONS AND PATENT ANALYSIS

7 AIRCRAFT SENSORS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 PRESSURE SENSORS

- 7.2.1 INCREASING NEED FOR ACCURATE PRESSURE MONITORING IN CRITICAL SYSTEMS TO DRIVE MARKET

- 7.2.2 USE CASE: ADOPTION OF AMETEK'S SOI-BASED PRESSURE TRANSDUCERS FOR HARSH AEROSPACE ENVIRONMENTS

- 7.3 TEMPERATURE SENSORS

- 7.3.1 RISING NEED FOR PRECISE THERMAL MANAGEMENT IN INCREASINGLY COMPLEX AND HIGH-PERFORMANCE AIRCRAFT SYSTEMS TO DRIVE MARKET

- 7.3.2 USE CASE: ADOPTION OF COLLINS AEROSPACE'S TOTAL AIR TEMPERATURE (TAT) SENSORS IN NEXT-GENERATION JET ENGINES

- 7.4 FORCE SENSORS

- 7.4.1 INCREASING DEMAND FOR ENHANCED STRUCTURAL HEALTH MONITORING TO DRIVE MARKET

- 7.4.2 USE CASE: INTEGRATION OF FORCE-SENSING COMPONENTS INTO AIRCRAFT FOR PRECISE PILOT INPUT MEASUREMENT AND OVERLOAD PROTECTION

- 7.5 TORQUE SENSORS

- 7.5.1 INCREASING NEED FOR ACCURATE TORQUE MONITORING TO OPTIMIZE PROPULSION SYSTEMS TO DRIVE MARKET

- 7.6 SPEED SENSORS

- 7.6.1 RISING DEMAND FOR REAL-TIME SPEED DATA TO SUPPORT SAFE AND EFFICIENT AIRCRAFT OPERATIONS TO DRIVE MARKET

- 7.7 POSITION AND DISPLACEMENT SENSORS

- 7.7.1 INCREASING RELIANCE ON ADVANCED FLIGHT CONTROL SYSTEMS TO DRIVE MARKET

- 7.8 LEVEL SENSORS

- 7.8.1 LEVEL SENSORS ARE INTEGRAL TO MONITORING FUEL AND OTHER FLUID LEVELS

- 7.9 PROXIMITY SENSORS

- 7.9.1 GROWING ADOPTION OF AUTOMATED AND FLY-BY-WIRE SYSTEMS IN MODERN AIRCRAFT TO DRIVE MARKET

- 7.10 FLOW SENSORS

- 7.10.1 NEED FOR EFFICIENT RESOURCE MANAGEMENT AND SYSTEM RELIABILITY TO DRIVE MARKET

- 7.11 OPTICAL SENSORS

- 7.11.1 HIGH DEMAND FOR ADVANCED SENSING TECHNOLOGIES THAT OFFER IMMUNITY TO ELECTROMAGNETIC INTERFERENCE TO DRIVE MARKET

- 7.12 MOTION SENSORS

- 7.12.1 INCREASING ADOPTION OF AUTOMATED FLIGHT CONTROL SYSTEMS TO DRIVE MARKET

- 7.13 RADAR SENSORS

- 7.13.1 FOCUS ON ADVANCED SURVEILLANCE AND DETECTION CAPABILITIES TO DRIVE MARKET

- 7.14 SMOKE DETECTION SENSORS

- 7.14.1 EMPHASIS ON ENHANCING PASSENGER AND CREW SAFETY TO DRIVE MARKET

- 7.15 GPS SENSORS

- 7.15.1 NEED FOR PRECISE POSITIONING DATA TO SUPPORT AUTOMATED FLIGHT CONTROL TO DRIVE MARKET

- 7.16 OTHERS

8 AIRCRAFT SENSORS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 FUEL, HYDRAULIC, AND PNEUMATIC SYSTEMS

- 8.2.1 NEED FOR SAFE AND EFFICIENT AIRCRAFT OPERATIONS TO DRIVE MARKET

- 8.3 ENGINE/PROPULSION

- 8.3.1 DEVELOPMENT OF NEXT-GEN PROPULSION TECHNOLOGIES TO DRIVE MARKET

- 8.4 CABIN & CARGO ENVIRONMENTAL CONTROLS

- 8.4.1 IMPROVED CABIN ERGONOMICS TO DRIVE DEMAND FOR ADVANCED SENSORS

- 8.5 AEROSTRUCTURE & FLIGHT CONTROLS

- 8.5.1 ABILITY TO DETECT EARLY SIGNS OF STRUCTURAL FATIGUE TO DRIVE GROWTH

- 8.6 FLIGHT DECKS

- 8.6.1 SENSORS AND CONTROLS PROVIDE PILOTS WITH REAL-TIME DATA ON HYDRAULIC AND FUEL SYSTEMS

- 8.7 LANDING GEAR SYSTEMS

- 8.7.1 INTEGRATION OF DIFFERENT SENSORS PROVIDES CRITICAL DATA ON DEPLOYMENT AND RETRACTION STATUS OF LANDING GEARS

- 8.8 WEAPON SYSTEMS

- 8.8.1 GROWING DEMAND FOR ADVANCED SENSOR SOLUTIONS TO DRIVE MARKET

- 8.9 OTHERS

9 AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE

- 9.1 INTRODUCTION

- 9.2 COMMERCIAL AVIATION

- 9.2.1 SHIFT TOWARD DIGITALIZATION AND SMART AVIONICS SYSTEMS IN COMMERCIAL FLEETS TO DRIVE MARKET

- 9.2.2 NARROW-BODY AIRCRAFT

- 9.2.3 WIDE-BODY AIRCRAFT

- 9.2.4 REGIONAL TRANSPORT AIRCRAFT

- 9.2.5 COMMERCIAL HELICOPTERS

- 9.3 BUSINESS & GENERAL AVIATION

- 9.3.1 RISING DEMAND FOR FUEL-EFFICIENT, QUIETER, AND ENVIRONMENTALLY SUSTAINABLE AIRCRAFT TO DRIVE MARKET

- 9.3.2 BUSINESS JETS

- 9.3.3 LIGHT AIRCRAFT

- 9.4 MILITARY AVIATION

- 9.4.1 CONTINUOUS MODERNIZATION OF MILITARY FLEETS TO DRIVE MARKET

- 9.4.2 FIGHTER AIRCRAFT

- 9.4.3 TRANSPORT AIRCRAFT

- 9.4.4 SPECIAL MISSION AIRCRAFT

- 9.4.5 MILITARY HELICOPTERS

- 9.5 UNMANNED AERIAL VEHICLES

- 9.5.1 RISING DEMAND FOR UNMANNED AERIAL VEHICLES ACROSS MILITARY, COMMERCIAL, AND CIVIL SECTORS TO DRIVE MARKET

- 9.5.2 FIXED-WING UAVS

- 9.5.3 FIXED-WING HYBRID VTOL UAVS

- 9.5.4 ROTARY-WING UAVS

- 9.6 ADVANCED AIR MOBILITY

- 9.6.1 SHIFT TOWARD ELECTRIFIED PROPULSION SYSTEMS AND LIGHTWEIGHT AIRFRAMES TO DRIVE MARKET

- 9.6.2 AIR TAXIS

- 9.6.2.1 Manned taxis

- 9.6.2.2 Drone taxis

- 9.6.3 AIR SHUTTLES & AIR METROS

- 9.6.4 PERSONAL AERIAL VEHICLES

- 9.6.5 CARGO AIR VEHICLES

- 9.6.6 LAST-MILE DELIVERY VEHICLES

- 9.6.7 AIR AMBULANCES & MEDICAL EMERGENCY VEHICLES

10 AIRCRAFT SENSORS MARKET, BY END USE

- 10.1 INTRODUCTION

- 10.2 OEM

- 10.2.1 INCREASE IN AIRCRAFT DELIVERIES TO DRIVE MARKET

- 10.3 AFTERMARKET

- 10.3.1 OEM EXPANSION INTO AFTERMARKET TO OFFER CERTIFIED COMPONENTS TO DRIVE GROWTH

11 AIRCRAFT SENSORS MARKET, BY CONNECTIVITY

- 11.1 INTRODUCTION

- 11.2 WIRED

- 11.2.1 ABILITY TO HANDLE LARGE VOLUMES OF DATA WITH MINIMAL LATENCY TO DRIVE MARKET

- 11.3 WIRELESS

- 11.3.1 NEED FOR IMPROVED FUEL EFFICIENCY AND LOW CARBON EMISSIONS TO DRIVE GROWTH

12 AIRCRAFT SENSORS MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 PESTLE ANALYSIS

- 12.2.2 US

- 12.2.2.1 Integration of sensors into hypersonic aircraft to drive market

- 12.2.3 CANADA

- 12.2.3.1 Focus on developing airborne monitoring technologies to fuel demand for aircraft sensors

- 12.3 EUROPE

- 12.3.1 PESTLE ANALYSIS

- 12.3.2 UK

- 12.3.2.1 Focus on hydrogen propulsion and defense modernization to drive market

- 12.3.3 FRANCE

- 12.3.3.1 Heavy investments in aerospace sector to drive demand for aircraft sensors

- 12.3.4 GERMANY

- 12.3.4.1 Commitment to enhancing military capabilities to drive market

- 12.3.5 ITALY

- 12.3.5.1 Active participation in Global Combat Air Programme to support market growth

- 12.3.6 RUSSIA

- 12.3.6.1 Investment in upgrading military aviation platforms to boost growth

- 12.3.7 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 PESTLE ANALYSIS

- 12.4.2 CHINA

- 12.4.2.1 Focus on establishing a vertically integrated aerospace supply chain to drive market

- 12.4.3 INDIA

- 12.4.3.1 Emphasis on developing ruggedized sensors for high altitude to drive market

- 12.4.4 JAPAN

- 12.4.4.1 Demand for multi-spectral and terrain-mapping sensors to boost growth

- 12.4.5 AUSTRALIA

- 12.4.5.1 Expansion of aerial surveillance and maritime patrol capabilities to fuel market growth

- 12.4.6 SOUTH KOREA

- 12.4.6.1 Expanding UAV development to drive demand for aircraft sensors

- 12.4.7 REST OF ASIA PACIFIC

- 12.5 MIDDLE EAST

- 12.5.1 PESTLE ANALYSIS

- 12.5.2 GCC

- 12.5.2.1 UAE

- 12.5.2.1.1 Growth of global aerospace hub to drive market growth

- 12.5.2.2 Saudi Arabia

- 12.5.2.2.1 Focus on building in-house capabilities to drive market

- 12.5.2.1 UAE

- 12.5.3 ISRAEL

- 12.5.3.1 Increased innovations in defense sector to contribute to market growth

- 12.5.4 TURKEY

- 12.5.4.1 Need for achieving self-reliant defense technologies to spur growth

- 12.5.5 REST OF MIDDLE EAST

- 12.6 LATIN AMERICA

- 12.6.1 PESTLE ANALYSIS

- 12.6.2 BRAZIL

- 12.6.2.1 Growth in military investments to drive market

- 12.6.3 MEXICO

- 12.6.3.1 Mexico's expanding MRO capabilities to drive market

- 12.6.4 REST OF LATIN AMERICA

- 12.7 AFRICA

- 12.7.1 PESTLE ANALYSIS

- 12.7.2 SOUTH AFRICA

- 12.7.2.1 Focus on defense modernization to drive market

- 12.7.3 NIGERIA

- 12.7.3.1 Emphasis on counterterrorism and border security to drive market

- 12.7.4 REST OF AFRICA

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT

- 13.5.5.1 Region Footprint

- 13.5.5.2 End use footprint

- 13.5.5.3 Application footprint

- 13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING

- 13.6.5.1 Detailed list of Start-ups/SMEs

- 13.6.5.2 Competitive benchmarking of key Start-ups/SMEs

- 13.7 COMPANY VALUATION AND FINANCIAL METRICS

- 13.8 BRAND/PRODUCT COMPARISON

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 OTHERS

- 13.10 CUSTOMER ANALYSIS: SUPPLIER & OEM PROCUREMENT BEHAVIOR

- 13.10.1 ENGINE OEMS

- 13.10.1.1 Key insights

- 13.10.2 AIRFRAME OEMS

- 13.10.2.1 Key insights

- 13.10.3 TIER-1 SYSTEM INTEGRATORS

- 13.10.3.1 Key insights

- 13.10.1 ENGINE OEMS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 HONEYWELL INTERNATIONAL INC.

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Others

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 SAFRAN

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.3.2 Others

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 TE CONNECTIVITY LTD.

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Deals

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 MEGGITT PLC

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Others

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 AMETEK INC.

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Deals

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 LOCKHEED MARTIN CORPORATION

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Others

- 14.1.7 WOODWARD

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Deals

- 14.1.8 RTX

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.9 THALES

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Deals

- 14.1.9.3.2 Others

- 14.1.10 L3HARRIS TECHNOLOGIES, INC.

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Deals

- 14.1.10.3.2 Others

- 14.1.11 THE BOSCH GROUP

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.12 TRIMBLE INC.

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.13 CURTISS-WRIGHT CORPORATION

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.14 EATON CORPORATION

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Solutions/Services offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Deals

- 14.1.15 CRANE AEROSPACE & ELECTRONICS

- 14.1.15.1 Business overview

- 14.1.15.2 Products/Solutions/Services offered

- 14.1.16 STELLAR TECHNOLOGY

- 14.1.16.1 Business overview

- 14.1.16.2 Products/Solutions/Services offered

- 14.1.17 AMPHENOL CORPORATION

- 14.1.17.1 Business overview

- 14.1.17.2 Products/Solutions/Services offered

- 14.1.17.3 Recent developments

- 14.1.17.3.1 Deals

- 14.1.18 TDK CORPORATION

- 14.1.18.1 Business overview

- 14.1.18.2 Products/Solutions/Services offered

- 14.1.19 ULTRA PRECISION CONTROL SYSTEMS

- 14.1.19.1 Business overview

- 14.1.19.2 Products/Solutions/Services offered

- 14.1.20 VECTORNAV TECHNOLOGIES LLC

- 14.1.20.1 Business overview

- 14.1.20.2 Products/Solutions/Services offered

- 14.1.21 EMCORE CORPORATION

- 14.1.21.1 Business overview

- 14.1.21.2 Products/Solutions/Services offered

- 14.1.1 HONEYWELL INTERNATIONAL INC.

- 14.2 OTHER PLAYERS

- 14.2.1 AEROSONIC

- 14.2.2 SENSOR SYSTEMS LLC

- 14.2.3 CIRCOR AEROSPACE

- 14.2.4 FUTEK ADVANCED SENSOR TECHNOLOGY, INC.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS