|

|

市場調査レポート

商品コード

1718870

自動車用ピストンの世界市場 (~2035年):形状 (フラットトップ・ボウル・ドーム)・材質 (スチール・アルミニウム)・コーティング (遮熱・ドライフィルム・オイルシェディング)・部品 (ピン・リング・ヘッド)・燃料タイプ・車両タイプ・アフターマーケット部品別・地域別Automotive Piston Market by Shape (Flat-top, Bowl, Dome), Material (Steel, Aluminum), Coating (Thermal Barrier, Dry Film, Oil Shedding), Component (Pin, Ring, Head), Fuel Type, Vehicle Type, Aftermarket by Component, & Region - Global Forecast to 2035 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用ピストンの世界市場 (~2035年):形状 (フラットトップ・ボウル・ドーム)・材質 (スチール・アルミニウム)・コーティング (遮熱・ドライフィルム・オイルシェディング)・部品 (ピン・リング・ヘッド)・燃料タイプ・車両タイプ・アフターマーケット部品別・地域別 |

|

出版日: 2025年04月29日

発行: MarketsandMarkets

ページ情報: 英文 264 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

自動車用ピストンの市場規模は、2025年の24億6,000万米ドルから、予測期間中はCAGR 1.3%で推移し、2035年には27億9,000万米ドルに成長すると予測されています。

乗用車セグメントは、今後数年間で最も高いピストン需要が見込まれています。近年、GDIエンジンの需要が大幅に増加しており、特に3気筒構成のエンジンが注目されています。これらは少ないシリンダー数でも同等の性能を発揮できるため、需要が高まっています。このGDIエンジンの需要増は、ボウル形状のピストンの必要性を高めると予想されています。ボウル形状ピストンは、乱流を強化し、燃料の霧化を改善し、点火時にスパークプラグ周辺の気筒内での気流を最適化することで、燃焼効率を高めます。さらに、中国、日本、インド、米国などの国々で中型および大型SUVの販売が増加していることも、自動車用ピストンの需要をさらに押し上げる要因となっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2035年 |

| 基準年 | 2023年 |

| 予測期間 | 2025-2035年 |

| 単位 | 金額 (米ドル) |

| セグメント別 | コンポーネント・燃料タイプ・材質・車両タイプ・形状・コーティング・アフターマーケット部品・地域別 |

| 対象地域 | アジア太平洋・北米・欧州:その他の地域 |

欧州のVolkswagen、Renault、BMW Group、Land RoverなどいくつかのOEMは、は、3気筒または4気筒構成のGDIエンジンを搭載した乗用車を提供しています。OEM各社が3気筒および4気筒構成のGDI技術に注力する中、自動車用ピストンの需要は予測期間中に安定的に成長すると見込まれています。

"スチールピストンの需要は予測期間中、世界的に高い成長率が見込まれる"

スチールピストンは主に合金鋼から作られ、鍛造や精密鋳造などの高度な方法で製造され、高い耐久性と性能を保証します。耐久性に優れ、高温や高圧に耐えられるため、ヘビーデューティ用途や高性能エンジンに使用されます。炭素鋼ピストン、合金鋼ピストン、軽量鋼ピストンがスチールピストンの主な構成材質です。

大型商用車には主にスチールピストンが使用されています。熱伝導率が低く、アルミよりも燃料消費を抑えることができるため、エンジンの高温化が実現し、車両の効率向上に貢献します。また、スチールピストンは圧縮高さが低いため、長いコネクティングロッドを使用することができ、摩擦性能をさらに高めることができます。Mercedes-BenzEクラスが現在のV6ディーゼルエンジンにスチールピストンを採用しているように、いくつかのOEMが高性能車にスチールピストンを組み込んでいます。インフラ開発、eコマース、ロジスティクス産業の成長により、アジア太平洋地域が大型商用車の最大の生産量を占めています。アジア太平洋のような地域で大型商用車の需要が増加しているため、スチールピストンの需要は今後数年間で増加すると予想されます。スチールピストンは、耐久性、燃費効率、エンジン性能の向上により、大型商用車にも好まれています。したがって、スチールピストンの需要は予測期間中に伸びるでしょう。

"アジア太平洋地域が予測期間中に最大の市場になる見通し"

アジア太平洋地域は、ハッチバック車、コンパクトSUV、中型SUV、台数の少ないコンパクトセダンといった経済性重視の乗用車が多数存在しており、そのうち約80~85%がガソリン車です。特に中国、インド、日本、韓国ではガソリン車の需要が非常に高い状況にあります。過去3~4年の間に電気自動車への関心は高まっているものの、中国を除く多くの国々では依然としてガソリンエンジンが主流であり続けると予測されています。アジア地域は経済車の一大生産拠点であるため、3気筒・4気筒エンジンの需要も高く、GDIエンジンを搭載したコンパクトSUVや中型SUVの急成長が、自動車用ピストンの需要を押し上げています。

さらに、いくつかの地域では、燃料費の安さと低いメンテナンスコストから、CNG車両の需要も高まっています。2024年には、中国とインドが軽・重量商用車の生産で全体の約82%を占めました。現在、ほぼすべての大型トラックやバスはディーゼルエンジンで稼働しており、この傾向は2035年まで安定的に継続すると見られています。排出ガス規制への対応として、軽量化戦略が進められており、今後もこの流れは続くと予想されます。

これらの要因を総合すると、アジア太平洋地域では今後、乗用車セグメントにおいて最も高いピストン需要が見込まれています。また、中国、日本、韓国ではハイブリッド車の普及も進んでおり、これらの車両タイプにおいてもピストンの需要は根強いです。さらに、インドやタイなどの途上国では、厳格な排出規制やガソリン価格の高騰が、代替燃料車への移行を促進しています。

当レポートでは、世界の自動車用ピストンの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客の事業に影響を与える動向/ディスラプション

- エコシステム分析

- サプライチェーン分析

- 主要なステークホルダーと購入基準

- 主な会議とイベント

- サプライヤー分析

- 技術分析

- 特許分析

- 貿易分析

- ケーススタディ分析

- 規制状況

- 価格分析

第6章 自動車用ピストン市場:車両タイプ別

- 乗用車

- 小型商用車

- 大型商用車

- 業界の考察

第7章 自動車用ピストン市場:燃料別

- ガソリン

- ディーゼル

- 代替燃料

- 業界の考察

第8章 自動車用ピストン市場:材質別

- 鋼鉄

- アルミニウム

- 業界の考察

第9章 自動車用ピストン市場:形状別

- フラットトップ

- ボウル

- ドーム

- 業界の考察

第10章 自動車用ピストン市場:コーティング別

- 遮熱コーティング

- ドライフィルム潤滑コーティング

- オイル剥離コーティング

- 業界の考察

第11章 自動車用ピストン市場:部品別

- ピストンヘッド

- ピストンリング

- ピストンピン

- 業界の考察

第12章 アフターマーケット自動車用ピストン市場:部品別

- ピストンヘッド

- ピストンリング

- ピストンピン

- 業界の考察

第13章 自動車用ピストン市場:地域別

- アジア太平洋

- マクロ経済見通し

- 中国

- インド

- 日本

- 韓国

- その他

- 欧州

- マクロ経済見通し

- ドイツ

- 英国

- フランス

- スペイン

- その他

- 北米

- マクロ経済見通し

- 米国

- メキシコ

- カナダ

- その他の地域

- ブラジル

- 南アフリカ

- その他

第14章 競合情勢

- 主要参入企業の戦略/強み

- 市場シェア分析

- 収益分析

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第15章 企業プロファイル

- 主要企業

- MAHLE GMBH

- TENNECO INC.

- AISIN CORPORATION

- KOLBENSCHMIDT PISTONS

- SHRIRAM PISTONS

- DONGSUHFEDERAL-MOGUL CO., LTD.

- NPR-RIKEN CORPORATION

- INDIA PISTONS LTD.

- HITACHI ASTEMO, LTD.

- HIRSCHVOGEL GROUP

- C.S. PISTON (THAILAND) CO., LTD.

- 他の企業

- PT ASTRA OTOPARTS TBK.

- HONDA FOUNDRY CO., LTD.

- MENON GROUP

- ROSS RACING PISTONS

- CP CARRILLO

- CAPRICORN GROUP

- COSWORTH

- BOHAI AUTOMOTIVE SYSTEMS CO., LTD.

- TOMEI POWERED INCORPORATED

- LALLSONS PISTON & RINGS PVT. LTD.

- ATRAC ENGINEERING CO.

- WISECO

- JEPISTONS

- GIBTEC PISTONS

- DONG YANG PISTON

第16章 バイオ燃料とE-燃料の使用に関するMNMの洞察

- 米国

- ブラジル

- インド

- 欧州

- インドネシア

第17章 提言

- 日本、インド、韓国:自動車用ピストンの安定した需要を示す中国に代わる有望な選択肢

- ピストン製造においてフラットトップが重要な形状に

- 代替燃料セグメントが最も急速に成長

- 総論

第18章 付録

List of Tables

- TABLE 1 CURRENCY EXCHANGE RATES

- TABLE 2 COMPARISON OF STEEL VS. ALUMINUM AS MATERIAL IN PISTON

- TABLE 3 ADOPTION OF ENGINE DOWNSIZING BY OEMS AND MANUFACTURERS

- TABLE 4 AUTOMOTIVE PISTON MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR AUTOMOTIVE PISTON

- TABLE 6 KEY BUYING CRITERIA FOR AUTOMOTIVE PISTON MARKET, BY MATERIAL TYPE

- TABLE 7 AUTOMOTIVE PISTON MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 8 AUTOMOTIVE PISTON: SUPPLIER ANALYSIS, 2019-2025

- TABLE 9 IMPORTANT PATENT REGISTRATIONS RELATED TO AUTOMOTIVE PISTON MARKET

- TABLE 10 US: IMPORT DATA FOR AUTOMOTIVE PISTONS, BY EXPORTING COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 11 MEXICO: IMPORT DATA FOR AUTOMOTIVE PISTONS, BY EXPORTING COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 GERMANY: IMPORT DATA FOR AUTOMOTIVE PISTONS, BY EXPORTING COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 13 CANADA: IMPORT DATA FOR AUTOMOTIVE PISTONS, BY EXPORTING COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 14 CHINA: IMPORT DATA FOR AUTOMOTIVE PISTONS, BY EXPORTING COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 15 GERMANY: EXPORT DATA FOR AUTOMOTIVE PISTONS, BY IMPORTING COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 16 CHINA: EXPORT DATA FOR AUTOMOTIVE PISTONS, BY IMPORTING COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 17 JAPAN: EXPORT DATA FOR AUTOMOTIVE PISTONS, BY IMPORTING COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 18 MEXICO: EXPORT DATA FOR AUTOMOTIVE PISTONS, BY IMPORTING COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 19 US: EXPORT DATA FOR AUTOMOTIVE PISTONS, BY IMPORTING COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 20 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 INDICATIVE AVERAGE SELLING OE PRICE TREND OF AUTOMOTIVE PISTONS, BY SHAPE, 2021-2025 (USD)

- TABLE 24 INDICATIVE AVERAGE SELLING OE PRICE TREND OF AUTOMOTIVE PISTONS, BY VEHICLE TYPE, 2021-2025 (USD)

- TABLE 25 INDICATIVE AVERAGE SELLING OE PRICE TREND OF AUTOMOTIVE PISTONS, BY REGION, 2021-2025 (USD)

- TABLE 26 AUTOMOTIVE PISTON MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 27 AUTOMOTIVE PISTON MARKET, BY VEHICLE TYPE, 2025-2035 (THOUSAND UNITS)

- TABLE 28 AUTOMOTIVE PISTON MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 29 AUTOMOTIVE PISTON MARKET, BY VEHICLE TYPE, 2025-2035 (USD MILLION)

- TABLE 30 PASSENGER CARS: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 31 PASSENGER CARS: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 32 PASSENGER CARS: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 33 PASSENGER CARS: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (USD MILLION)

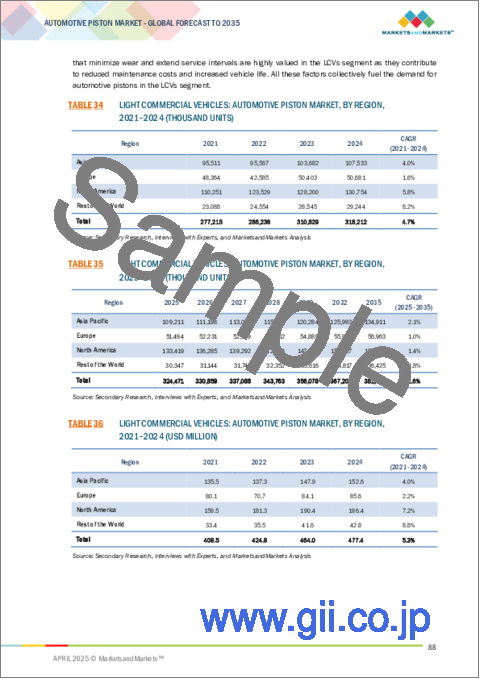

- TABLE 34 LIGHT COMMERCIAL VEHICLES: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 35 LIGHT COMMERCIAL VEHICLES: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 36 LIGHT COMMERCIAL VEHICLES: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 LIGHT COMMERCIAL VEHICLES: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (USD MILLION)

- TABLE 38 HEAVY COMMERCIAL VEHICLES: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 39 HEAVY COMMERCIAL VEHICLES: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 40 HEAVY COMMERCIAL VEHICLES: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 HEAVY COMMERCIAL VEHICLES: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (USD MILLION)

- TABLE 42 AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 43 AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (THOUSAND UNITS)

- TABLE 44 AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 45 AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (USD MILLION)

- TABLE 46 GASOLINE: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 47 GASOLINE: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 48 GASOLINE: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 GASOLINE: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (USD MILLION)

- TABLE 50 DIESEL: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 51 DIESEL: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 52 DIESEL: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 DIESEL: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (USD MILLION)

- TABLE 54 ALTERNATE FUELS: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 55 ALTERNATE FUELS: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 56 ALTERNATE FUELS: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 ALTERNATE FUELS: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (USD MILLION)

- TABLE 58 AUTOMOTIVE PISTON MARKET, BY MATERIAL TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 59 AUTOMOTIVE PISTON MARKET, BY MATERIAL TYPE, 2025-2035 (THOUSAND UNITS)

- TABLE 60 AUTOMOTIVE PISTON MARKET, BY MATERIAL TYPE, 2021-2024 (USD MILLION)

- TABLE 61 AUTOMOTIVE PISTON MARKET, BY MATERIAL TYPE, 2025-2035 (USD MILLION)

- TABLE 62 STEEL: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 63 STEEL: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 64 STEEL: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 65 STEEL: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (USD MILLION)

- TABLE 66 ALUMINUM: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 67 ALUMINUM: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 68 ALUMINUM: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 ALUMINUM: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (USD MILLION)

- TABLE 70 AUTOMOTIVE PISTON MARKET, BY SHAPE, 2021-2024 (THOUSAND UNITS)

- TABLE 71 AUTOMOTIVE PISTON MARKET, BY SHAPE, 2025-2035 (THOUSAND UNITS)

- TABLE 72 AUTOMOTIVE PISTON MARKET, BY SHAPE, 2021-2024 (USD MILLION)

- TABLE 73 AUTOMOTIVE PISTON MARKET, BY SHAPE, 2025-2035 (USD MILLION)

- TABLE 74 FLAT-TOPS: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 75 FLAT-TOPS: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 76 FLAT-TOPS: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 FLAT-TOPS: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (USD MILLION)

- TABLE 78 BOWL: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 79 BOWL: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 80 BOWL: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 81 BOWL: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (USD MILLION)

- TABLE 82 DOME: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 83 DOME: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 84 DOME: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 85 DOME: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (USD MILLION)

- TABLE 86 AUTOMOTIVE PISTON MARKET, BY COATING, 2021-2024 (METRIC TONS)

- TABLE 87 AUTOMOTIVE PISTON MARKET, BY COATING, 2025-2035 (METRIC TONS)

- TABLE 88 THERMAL BARRIER COATING: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (METRIC TONS)

- TABLE 89 THERMAL BARRIER COATING: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (METRIC TONS)

- TABLE 90 DRY FILM LUBRICANT COATING: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (METRIC TONS)

- TABLE 91 DRY FILM LUBRICANT COATING: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (METRIC TONS)

- TABLE 92 OIL SHEDDING COATING: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (METRIC TONS)

- TABLE 93 OIL SHEDDING COATING: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (METRIC TONS)

- TABLE 94 AUTOMOTIVE PISTON MARKET, BY COMPONENT, 2021-2024 (THOUSAND UNITS)

- TABLE 95 AUTOMOTIVE PISTON MARKET, BY COMPONENT, 2025-2035 (THOUSAND UNITS)

- TABLE 96 AUTOMOTIVE PISTON MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 97 AUTOMOTIVE PISTON MARKET, BY COMPONENT, 2025-2035 (USD MILLION)

- TABLE 98 PISTON HEADS: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 99 PISTON HEADS: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 100 PISTON HEADS: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 101 PISTON HEADS: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (USD MILLION)

- TABLE 102 PISTON RINGS: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 103 PISTON RINGS: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 104 PISTON RINGS: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 105 PISTON RINGS: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (USD MILLION)

- TABLE 106 PISTON PINS: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 107 PISTON PINS: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 108 PISTON PINS: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 109 PISTON PINS: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (USD MILLION)

- TABLE 110 AUTOMOTIVE PISTON AFTERMARKET, BY COMPONENT, 2021-2024 (THOUSAND UNITS)

- TABLE 111 AUTOMOTIVE PISTON AFTERMARKET, BY COMPONENT, 2025-2035 (THOUSAND UNITS)

- TABLE 112 AUTOMOTIVE PISTON AFTERMARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 113 AUTOMOTIVE PISTON AFTERMARKET, BY COMPONENT, 2025-2035 (USD MILLION)

- TABLE 114 PISTON HEADS: AUTOMOTIVE PISTON AFTERMARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 115 PISTON HEADS: AUTOMOTIVE PISTON AFTERMARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 116 PISTON HEADS: AUTOMOTIVE PISTON AFTERMARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 117 PISTON HEADS: AUTOMOTIVE PISTON AFTERMARKET, BY REGION, 2025-2035 (USD MILLION)

- TABLE 118 PISTON RINGS: AUTOMOTIVE PISTON AFTERMARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 119 PISTON RINGS: AUTOMOTIVE PISTON AFTERMARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 120 PISTON RINGS: AUTOMOTIVE PISTON AFTERMARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 121 PISTON RINGS: AUTOMOTIVE PISTON AFTERMARKET, BY REGION, 2025-2035 (USD MILLION)

- TABLE 122 PISTON PINS: AUTOMOTIVE PISTON AFTERMARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 123 PISTON PINS: AUTOMOTIVE PISTON AFTERMARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 124 PISTON PINS: AUTOMOTIVE PISTON AFTERMARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 125 PISTON PINS: AUTOMOTIVE PISTON AFTERMARKET, BY REGION, 2025-2035 (USD MILLION)

- TABLE 126 AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 127 AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 128 AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 129 AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (USD MILLION)

- TABLE 130 ASIA PACIFIC: AUTOMOTIVE PISTON MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 131 ASIA PACIFIC: AUTOMOTIVE PISTON MARKET, BY COUNTRY, 2025-2035 (THOUSAND UNITS)

- TABLE 132 ASIA PACIFIC: AUTOMOTIVE PISTON MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 133 ASIA PACIFIC: AUTOMOTIVE PISTON MARKET, BY COUNTRY, 2025-2035 (USD MILLION)

- TABLE 134 CHINA: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 135 CHINA: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (THOUSAND UNITS)

- TABLE 136 CHINA: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 137 CHINA: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (USD MILLION)

- TABLE 138 INDIA: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 139 INDIA: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (THOUSAND UNITS)

- TABLE 140 INDIA: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 141 INDIA: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (USD MILLION)

- TABLE 142 JAPAN: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 143 JAPAN: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (THOUSAND UNITS)

- TABLE 144 JAPAN: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 145 JAPAN: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (USD MILLION)

- TABLE 146 SOUTH KOREA: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 147 SOUTH KOREA: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (THOUSAND UNITS)

- TABLE 148 SOUTH KOREA: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 149 SOUTH KOREA: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 151 REST OF ASIA PACIFIC: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (THOUSAND UNITS)

- TABLE 152 REST OF ASIA PACIFIC: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (USD MILLION)

- TABLE 154 EUROPE: AUTOMOTIVE PISTON MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 155 EUROPE: AUTOMOTIVE PISTON MARKET, BY COUNTRY, 2025-2035 (THOUSAND UNITS)

- TABLE 156 EUROPE: AUTOMOTIVE PISTON MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 157 EUROPE: AUTOMOTIVE PISTON MARKET, BY COUNTRY, 2025-2035 (USD MILLION)

- TABLE 158 GERMANY: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 159 GERMANY: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (THOUSAND UNITS)

- TABLE 160 GERMANY: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 161 GERMANY: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (USD MILLION)

- TABLE 162 UK: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 163 UK: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (THOUSAND UNITS)

- TABLE 164 UK: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 165 UK: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (USD MILLION)

- TABLE 166 FRANCE: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 167 FRANCE: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (THOUSAND UNITS)

- TABLE 168 FRANCE: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 169 FRANCE: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (USD MILLION)

- TABLE 170 SPAIN: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 171 SPAIN: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (THOUSAND UNITS)

- TABLE 172 SPAIN: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 173 SPAIN: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (USD MILLION)

- TABLE 174 REST OF EUROPE: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 175 REST OF EUROPE: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (THOUSAND UNITS)

- TABLE 176 REST OF EUROPE: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 177 REST OF EUROPE: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (USD MILLION)

- TABLE 178 NORTH AMERICA: AUTOMOTIVE PISTON MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 179 NORTH AMERICA: AUTOMOTIVE PISTON MARKET, BY COUNTRY, 2025-2035 (THOUSAND UNITS)

- TABLE 180 NORTH AMERICA: AUTOMOTIVE PISTON MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 181 NORTH AMERICA: AUTOMOTIVE PISTON MARKET, BY COUNTRY, 2025-2035 (USD MILLION)

- TABLE 182 US: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 183 US: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (THOUSAND UNITS)

- TABLE 184 US: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 185 US: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (USD MILLION)

- TABLE 186 MEXICO: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 187 MEXICO: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (THOUSAND UNITS)

- TABLE 188 MEXICO: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 189 MEXICO: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (USD MILLION)

- TABLE 190 CANADA: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 191 CANADA: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (THOUSAND UNITS)

- TABLE 192 CANADA: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 193 CANADA: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (USD MILLION)

- TABLE 194 REST OF THE WORLD: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 195 REST OF THE WORLD: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (THOUSAND UNITS)

- TABLE 196 REST OF THE WORLD: AUTOMOTIVE PISTON MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 197 REST OF THE WORLD: AUTOMOTIVE PISTON MARKET, BY REGION, 2025-2035 (USD MILLION)

- TABLE 198 BRAZIL: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 199 BRAZIL: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (THOUSAND UNITS)

- TABLE 200 BRAZIL: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 201 BRAZIL: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (USD MILLION)

- TABLE 202 SOUTH AFRICA: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 203 SOUTH AFRICA: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (THOUSAND UNITS)

- TABLE 204 SOUTH AFRICA: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 205 SOUTH AFRICA: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (USD MILLION)

- TABLE 206 OTHERS: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 207 OTHERS: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (THOUSAND UNITS)

- TABLE 208 OTHERS: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 209 OTHERS: AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025-2035 (USD MILLION)

- TABLE 210 AUTOMOTIVE PISTON MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2024

- TABLE 211 AUTOMOTIVE PISTON MARKET: DEGREE OF COMPETITION

- TABLE 212 AUTOMOTIVE PISTON MARKET: REGION FOOTPRINT

- TABLE 213 AUTOMOTIVE PISTON MARKET: VEHICLE TYPE FOOTPRINT

- TABLE 214 AUTOMOTIVE PISTON MARKET: SHAPE FOOTPRINT

- TABLE 215 AUTOMOTIVE PISTON MARKET: LIST OF STARTUPS/SMES

- TABLE 216 AUTOMOTIVE PISTON MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 217 AUTOMOTIVE PISTON MARKET: PRODUCT LAUNCHES, JANUARY 2020-DECEMBER 2024

- TABLE 218 AUTOMOTIVE PISTON MARKET: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 219 AUTOMOTIVE PISTON MARKET: EXPANSIONS, JANUARY 2020-DECEMBER 2024

- TABLE 220 AUTOMOTIVE PISTON MARKET: OTHER DEVELOPMENTS, JANUARY 2020-DECEMBER 2024

- TABLE 221 MAHLE GMBH: COMPANY OVERVIEW

- TABLE 222 MAHLE GMBH: PRODUCTS/SOLUTIONS OFFERED

- TABLE 223 MAHLE GMBH: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 224 MAHLE GMBH: OTHER DEVELOPMENTS

- TABLE 225 TENNECO INC.: COMPANY OVERVIEW

- TABLE 226 TENNECO INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 227 TENNECO INC.: DEVELOPMENTS

- TABLE 228 AISIN CORPORATION: COMPANY OVERVIEW

- TABLE 229 AISIN CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 230 KOLBENSCHMIDT PISTONS: COMPANY OVERVIEW

- TABLE 231 KOLBENSCHMIDT PISTONS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 232 KOLBENSCHMIDT PISTONS: EXPANSIONS

- TABLE 233 KOLBENSCHMIDT PISTONS: OTHER DEVELOPMENTS

- TABLE 234 SHRIRAM PISTONS: COMPANY OVERVIEW

- TABLE 235 SHRIRAM PISTONS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 236 DONGSUHFEDERAL-MOGUL CO., LTD.: COMPANY OVERVIEW

- TABLE 237 DONGSUHFEDERAL-MOGUL CO., LTD.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 238 DONGSUHFEDERAL-MOGUL CO., LTD.: DEVELOPMENTS

- TABLE 239 NPR-RIKEN CORPORATION: COMPANY OVERVIEW

- TABLE 240 NPR-RIKEN CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 241 INDIA PISTONS LTD.: COMPANY OVERVIEW

- TABLE 242 INDIA PISTONS LTD.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 243 HITACHI ASTEMO, LTD.: COMPANY OVERVIEW

- TABLE 244 HITACHI ASTEMO, LTD.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 245 HIRSCHVOGEL GROUP: COMPANY OVERVIEW

- TABLE 246 HIRSCHVOGEL GROUP: PRODUCTS/SOLUTIONS OFFERED

- TABLE 247 C.S. PISTON (THAILAND) CO., LTD.: COMPANY OVERVIEW

- TABLE 248 C.S. PISTON (THAILAND) CO., LTD.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 249 PT ASTRA OTOPARTS TBK.: COMPANY OVERVIEW

- TABLE 250 HONDA FOUNDRY CO., LTD.: COMPANY OVERVIEW

- TABLE 251 MENON GROUP: COMPANY OVERVIEW

- TABLE 252 ROSS RACING PISTONS: COMPANY OVERVIEW

- TABLE 253 CP CARRILLO: COMPANY OVERVIEW

- TABLE 254 CAPRICORN GROUP: COMPANY OVERVIEW

- TABLE 255 COSWORTH: COMPANY OVERVIEW

- TABLE 256 BOHAI AUTOMOTIVE SYSTEMS CO., LTD.: COMPANY OVERVIEW

- TABLE 257 TOMEI POWERED INCORPORATED: COMPANY OVERVIEW

- TABLE 258 LALLSONS PISTON & RINGS PVT. LTD.: COMPANY OVERVIEW

- TABLE 259 ATRAC ENGINEERING CO.: COMPANY OVERVIEW

- TABLE 260 WISECO: COMPANY OVERVIEW

- TABLE 261 JEPISTONS: COMPANY OVERVIEW

- TABLE 262 GIBTEC PISTONS: COMPANY OVERVIEW

- TABLE 263 DONG YANG PISTON: COMPANY OVERVIEW

- TABLE 264 US: BIOFUEL & E-FUEL MARKET, BY FUEL TYPE, 2023-2035 (USD MILLION)

- TABLE 265 INSIGHTS ON INCENTIVE/POLICIES

- TABLE 266 INSIGHTS ON REGULATIONS

- TABLE 267 KEY PLAYERS IN BIOFUELS & E-FUELS

- TABLE 268 US: PRODUCTION CAPACITY, 2024

- TABLE 269 BRAZIL: BIOFUEL & E-FUEL MARKET, BY FUEL TYPE, 2023-2035 (USD MILLION)

- TABLE 270 INSIGHTS ON INCENTIVES/POLICIES

- TABLE 271 BRAZIL: KEY PLAYERS IN BIOFUELS & E-FUELS

- TABLE 272 BRAZIL: PRODUCTION CAPACITY, 2024 VS. 2030

- TABLE 273 INDIA: BIOFUEL MARKET, BY FUEL TYPE, 2023-2035 (USD MILLION)

- TABLE 274 INSIGHTS ON POLICIES & REGULATIONS

- TABLE 275 INDIA: KEY PLAYERS IN BIOFUELS & E-FUELS

- TABLE 276 INDIA: PRODUCTION CAPACITY. 2024 VS. 2030

- TABLE 277 EUROPE: BIOFUEL MARKET, BY FUEL TYPE, 2023-2035 (USD MILLION)

- TABLE 278 INSIGHTS ON POLICIES & REGULATIONS

- TABLE 279 EUROPE: KEY PLAYERS IN BIOFUELS & E-FUELS

- TABLE 280 EUROPE: PRODUCTION CAPACITY, 2024 VS. 2030

- TABLE 281 INDONESIA: BIOFUEL & E-FUEL MARKET, BY FUEL TYPE, 2023-2035 (USD MILLION)

- TABLE 282 INSIGHTS ON POLICIES & REGULATIONS

- TABLE 283 INDONESIA: KEY PLAYERS IN BIOFUELS & E-FUELS

- TABLE 284 PRODUCTION CAPACITY, 2024 VS. 2030

List of Figures

- FIGURE 1 AUTOMOTIVE PISTON MARKET SEGMENTATION

- FIGURE 2 AUTOMOTIVE PISTON MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH METHODOLOGY MODEL

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 6 BOTTOM-UP APPROACH FOR OE PISTON MARKET, BY FUEL TYPE AND VEHICLE TYPE

- FIGURE 7 TOP-DOWN APPROACH FOR OE AUTOMOTIVE PISTON MARKET, BY SHAPE, BY MATERIAL, AND BY COATING

- FIGURE 8 BOTTOM-UP APPROACH FOR AFTERMARKET PISTON, BY COMPONENT

- FIGURE 9 AUTOMOTIVE PISTON MARKET: DATA TRIANGULATION

- FIGURE 10 AUTOMOTIVE PISTON MARKET OVERVIEW

- FIGURE 11 AUTOMOTIVE PISTON MARKET SIZE BY REGION, 2025 VS. 2035

- FIGURE 12 ASIA PACIFIC VEHICLE PRODUCTION (VEHICLE PRODUCTION VS. FUEL TYPE) 2024 VS. 2030 (THOUSAND UNITS)

- FIGURE 13 EUROPE VEHICLE PRODUCTION (VEHICLE PRODUCTION VS. FUEL TYPE) 2024 VS. 2030 (THOUSAND UNITS)

- FIGURE 14 NORTH AMERICA VEHICLE PRODUCTION (VEHICLE PRODUCTION VS. FUEL TYPE) 2024 VS. 2030 (THOUSAND UNITS)

- FIGURE 15 RISING PASSENGER AND HYBRID CAR SALES AND PRODUCTION TO DRIVE MARKET GROWTH

- FIGURE 16 PISTON HEAD SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 FLAT-TOP PISTONS TO SECURE LEADING MARKET POSITION DURING FORECAST PERIOD

- FIGURE 18 CNG SEGMENT TO GROW AT FASTEST CAGR DURING FORECAST PERIOD

- FIGURE 19 DRY FILM LUBRICANT COATING SEGMENT TO HAVE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 20 ALUMINUM SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 21 PASSENGER CAR SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 22 PISTON RING SEGMENT TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 23 ASIA PACIFIC TO BE LARGEST MARKET FOR AUTOMOTIVE PISTON DURING FORECAST PERIOD

- FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN AUTOMOTIVE PISTON MARKET

- FIGURE 25 GLOBAL PASSENGER CAR SALES, 2020-2024 (MILLION UNITS)

- FIGURE 26 GLOBAL EV SALES, 2020-2024 (MILLION UNITS)

- FIGURE 27 GLOBAL ESTIMATED BEV VS. ICE LIGHT VEHICLE SALES SHARE BY 2030

- FIGURE 28 AUTOMOTIVE PISTON MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 29 AUTOMOTIVE PISTON MARKET ECOSYSTEM

- FIGURE 30 AUTOMOTIVE PISTON MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR AUTOMOTIVE PISTON

- FIGURE 32 KEY BUYING CRITERIA FOR AUTOMOTIVE PISTONS, BY MATERIAL TYPE

- FIGURE 33 PATENT ANALYSIS OF AUTOMOTIVE PISTON MARKET, 2013-2025

- FIGURE 34 AUTOMOTIVE PISTON MARKET, BY VEHICLE TYPE, 2025 VS. 2035 (USD MILLION)

- FIGURE 35 AUTOMOTIVE PISTON MARKET, BY FUEL TYPE, 2025 VS. 2035 (USD MILLION)

- FIGURE 36 AUTOMOTIVE PISTON MARKET, BY MATERIAL TYPE, 2025 VS. 2035 (USD MILLION)

- FIGURE 37 AUTOMOTIVE PISTON MARKET, BY SHAPE, 2025-2035 (USD MILLION)

- FIGURE 38 AUTOMOTIVE PISTON MARKET, BY COATING, 2025 VS. 2035 (METRIC TONS)

- FIGURE 39 AUTOMOTIVE PISTON MARKET, BY COMPONENT, 2025 VS. 2035 (USD MILLION)

- FIGURE 40 AUTOMOTIVE PISTON AFTERMARKET, BY COMPONENT, 2025-2035 (USD MILLION)

- FIGURE 41 AUTOMOTIVE PISTON MARKET, BY REGION, 2025 VS. 2035 (USD MILLION)

- FIGURE 42 ASIA PACIFIC: AUTOMOTIVE PISTON MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 44 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 45 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 46 ASIA PACIFIC: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2024

- FIGURE 47 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 48 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 49 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 50 EUROPE: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2024

- FIGURE 51 EUROPE: AUTOMOTIVE PISTON MARKET SNAPSHOT

- FIGURE 52 NORTH AMERICA: AUTOMOTIVE PISTON MARKET SNAPSHOT

- FIGURE 53 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 54 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 55 NORTH AMERICA: CPI INFLATION RATE, BY COUNTRY, 2024-2026

- FIGURE 56 NORTH AMERICA: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2024

- FIGURE 57 REST OF THE WORLD: AUTOMOTIVE PISTON MARKET, 2025 VS. 2035 (USD MILLION)

- FIGURE 58 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 59 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2019-2023 (USD BILLION)

- FIGURE 60 AUTOMOTIVE PISTON MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 61 AUTOMOTIVE PISTON MARKET: COMPANY FOOTPRINT

- FIGURE 62 AUTOMOTIVE PISTON MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 63 COMPANY VALUATION OF MAJOR PLAYERS, 2025

- FIGURE 64 EV/EBITDA OF MAJOR PLAYERS, 2025

- FIGURE 65 BRAND/PRODUCT COMPARISON

- FIGURE 66 MAHLE GMBH: COMPANY SNAPSHOT

- FIGURE 67 AISIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 68 KOLBENSCHMIDT PISTONS: COMPANY SNAPSHOT

- FIGURE 69 SHRIRAM PISTONS: COMPANY SNAPSHOT

- FIGURE 70 HITACHI ASTEMO, LTD.: COMPANY SNAPSHOT

The automotive piston market is projected to grow from USD 2.46 billion in 2025 to USD 2.79 billion by 2035, at a CAGR of 1.3% during the forecast period. The passenger car segment is estimated to witness the highest piston demand in the coming years. In recent years, the demand for GDI engines has significantly increased, particularly for those using 3-cylinder configurations that can deliver comparable performance. This rising demand for GDI engines is expected to boost the need for bowl-shaped pistons. These pistons enhance turbulence, improve fuel atomization, and promote better airflow in line with the cylinder near the spark plug during ignition. Additionally, the growing sales of mid-size and full-size SUVs in countries such as China, Japan, India, and the US are further driving the demand for automotive pistons.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2035 |

| Base Year | 2023 |

| Forecast Period | 2025-2035 |

| Units Considered | Value (USD Million) |

| Segments | By Component, Fuel Type, Material Type, Vehicle Type, Shape, Coating, Aftermarket Component, and Region. |

| Regions covered | Asia Pacific, North America, Europe, and the Rest of the World |

Several OEMs, such as Volkswagen, Renault, BMW Group, and Land Rover from Europe, offer GDI passenger cars with 3 or 4-cylinder configurations. As OEMs increasingly focus on GDI technology with 3 and 4-cylinder configurations, the demand for automotive pistons is projected to grow at a steady rate during the forecast period.

"The demand for steel pistons is expected to grow at a high rate globally during the forecast period"

Steel pistons are primarily made from alloy steel and are produced through advanced methods such as forging and precision casting, ensuring high durability and performance. They are highly durable and are usually used in heavy-duty applications and high-performance engines due to their ability to withstand heavy temperatures and pressure. Carbon steel pistons, alloy steel pistons, and lightweight steel pistons are the primary construction materials in steel pistons.

Heavy commercial vehicles use steel pistons predominantly. Their low thermal conductivity and capacity to reduce fuel consumption more than aluminum help the engine achieve a high temperature and improve the vehicle's efficiency. Steel pistons also have a lower compression height, which allows the use of longer connecting rods for a further frictional performance advantage. Several OEMs are incorporating steel pistons in their high-performance vehicles, such as the Mercedes-Benz E-class, which uses steel pistons on the present V6 diesel engine. Asia Pacific accounted for the largest production of heavy commercial vehicles due to growth in infrastructure development, e-commerce, and logistics industries. With the rising demand for heavy commercial vehicles in regions like Asia Pacific, the demand for steel pistons is expected to grow in the coming years. Steel pistons are also preferred for heavy commercial vehicles due to their durability, fuel efficiency benefits, and improved engine performance. Hence, the demand for steel pistons will grow during the forecast period.

"Piston rings are projected to be the largest aftermarket component over the forecast period"

Piston rings accounted for the highest aftermarket demand for automotive pistons in 2024, owing to a maximum number of counts and a reasonably frequent replacement compared to other components. In commercial vehicles and high-performance passenger cars, engine overhauls are common. Piston rings get replaced during a major engine rebuild or overhauling, making them a necessary aftermarket replacement component in the piston aftermarket industry. Heavy-duty trucks have a higher demand for piston ring replacement due to the higher average running miles per year across the world. According to the US Department of Energy, semi-trucks typically travel nearly 62,000 miles per year, while long-haul trucks cover an average distance of 100,000 to 130,000 miles annually in the US. With such long-distance travel per year, the engine components, including piston heads, piston rings, and piston pins, go through greater mechanical stress, requiring major overhauling of engines after a certain period. During the overhauling of engines, the piston ring gets replaced. Thus, with increasing average distance traveled, specifically by heavy commercial vehicles globally, the demand for automotive piston rings will increase in the coming years.

"Asia Pacific is expected to be the largest market for automotive pistons during the forecast period"

The Asia Pacific region is primarily characterized by a strong presence of economic passenger vehicles, which include hatchbacks, compact and mid-size SUVs, and a limited number of compact sedans. Approximately 80-85% of the demand in this region is for gasoline-powered passenger cars. Major markets such as China, India, Japan, and South Korea show a particularly high demand for gasoline-based vehicles. While there has been a growing interest in electric vehicles over the past 3-4 years, most countries, with the exception of China, are expected to continue relying on gasoline-dominant engines. The demand for 3-cylinder and 4-cylinder engines is high in Asia as it is a significant hub for economy car production. The rapid growth in gasoline-powered compact & mid-size SUVs with GDI engines fuels the demand for automotive pistons.

Additionally, several regional countries are experiencing demand for CNG-based vehicles due to lower fuel costs and minimal maintenance expenses. In 2024, China and India led the production of both light and heavy commercial vehicles, accounting for approximately 82% of the market. Currently, almost all heavy trucks and buses are powered by diesel, and this trend is expected to continue with steady growth through 2035. To comply with emissions regulations, manufacturers are adopting strategies such as lightweighting. Engine downsizing and the use of aluminum alloy-based pistons are examples of this trend, which is anticipated to persist in the coming years.

Considering these factors, the passenger car segment is estimated to witness the highest piston demand in the coming years in the Asia Pacific region. Hybrid vehicles have also been adopted considerably in China, Japan, and South Korea, demonstrating a strong demand for automotive pistons in this car segment. Stringent emission regulations and rising gasoline prices drive the adoption of alternative fuel vehicles in developing nations such as India and Thailand. Vehicles powered by CNG are gaining traction as consumers seek cleaner alternatives to traditional fuels at a lower cost. Diesel engines drive heavy commercial vehicles with mostly 6 and 8-cylinder in-line configurations across all countries in the regional market.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: Piston Manufacturers - 70% and OEM - 30%

- By Designation: C-Level - 40%, Director Level - 40%, and Others - 20%

- By Region: North America - 20%, Europe - 25%, Asia Pacific - 45%, and Rest of the World - 10%

Key players in the automotive piston market include MAHLE GmbH (Germany), Tenneco Inc. (US), AISIN CORPORATION (Japan), Kolbenschmidt (Germany), and Shriram Pistons & Rings Limited (India). These companies engaged in expansions, product launches, partnerships, and mergers & acquisitions to gain traction in the automotive piston market.

Research Coverage:

The report covers the automotive piston market in terms of component (piston heads, piston rings, and piston pins), coating (dry film lubricant, thermal barrier, and oil shedding), shape (flat-top pistons, bowl pistons, and dome pistons), fuel type (gasoline, diesel, and alternate fuels), material (steel and aluminum), vehicle type (passenger cars, light commercial vehicles, and heavy commercial vehicles), aftermarket component (piston heads, piston rings, and piston pins), and region. It covers the competitive landscape and company profiles of the significant automotive piston market ecosystem players.

The study also includes an in-depth competitive analysis of the key market players with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the overall automotive piston market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

- The report also helps stakeholders understand the automotive piston market's current and future pricing trends.

The report provides insight into the following pointers:

- Analysis of key drivers (Increased demand for gasoline vehicles and rising demand for lightweight pistons), restraints (Increase in adoption of electric vehicles and growing trend of engine downsizing), opportunities (Manufacturing of pistons using alternative materials and advanced manufacturing processes), and challenges (Manufacturing high-quality, cost-effective pistons).

- Product Development/Innovation: Detailed insights on upcoming technologies and research & development activities in the automotive piston market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the automotive piston market across varied regions.

- Market Diversification: Exhaustive information about untapped geographies, recent developments, trends & disruptions impacting customer business, trade analysis, case study analysis, buying criteria, key stakeholders, pricing analysis, key conferences & events, patent analysis, and investments in the automotive piston market.

- Competitive Assessment: In-depth assessment of market share, growth strategies, and product offerings of leading players in the automotive piston market, such as MAHLE GmbH (Germany), Tenneco Inc. (US), AISIN CORPORATION (Japan), Kolbenschmidt (Germany), and Shriram Pistons & Rings Limited (India).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 MARKETS COVERED

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources for vehicle production and market sizing

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary participants

- 2.1.3 SAMPLING TECHNIQUES AND DATA COLLECTION METHODS

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 AUTOMOTIVE PISTON OE MARKET: BOTTOM-UP APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.3 AUTOMOTIVE PISTON OE MARKET: TOP-DOWN APPROACH

- 2.2.4 AUTOMOTIVE PISTON AFTERMARKET: BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS AND RISK ASSESSMENT

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE PISTON MARKET

- 4.2 AUTOMOTIVE PISTON MARKET, BY COMPONENT

- 4.3 AUTOMOTIVE PISTON MARKET, BY SHAPE

- 4.4 AUTOMOTIVE PISTON MARKET, BY FUEL TYPE

- 4.5 AUTOMOTIVE PISTON MARKET, BY COATING

- 4.6 AUTOMOTIVE PISTON MARKET, BY MATERIAL TYPE

- 4.7 AUTOMOTIVE PISTON MARKET, BY VEHICLE TYPE

- 4.8 AUTOMOTIVE PISTON MARKET, BY AFTERMARKET COMPONENT

- 4.9 AUTOMOTIVE PISTON MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increased demand for gasoline vehicles

- 5.2.1.2 Rise in demand for lightweight pistons

- 5.2.2 RESTRAINTS

- 5.2.2.1 Increase in adoption of electric vehicles

- 5.2.2.2 Growing trend of smaller 3-cylinder engine

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Manufacturing of pistons using alternative materials and advanced manufacturing processes

- 5.2.3.2 Implementation of H2-ICE in Heavy commercial vehicles

- 5.2.4 CHALLENGES

- 5.2.4.1 Manufacturing high-quality, cost-effective pistons

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL SUPPLIERS

- 5.5.2 COMPONENT SUPPLIERS

- 5.5.3 ENGINE MANUFACTURERS

- 5.5.4 OEMS

- 5.6 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.6.2 KEY BUYING CRITERIA

- 5.7 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.8 SUPPLIER ANALYSIS

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Material innovation in automotive pistons

- 5.9.1.2 3D printing of automotive pistons

- 5.9.2 ADJACENT TECHNOLOGIES

- 5.9.2.1 Developments in cylinder liners

- 5.9.3 COMPLEMENTARY TECHNOLOGIES

- 5.9.3.1 Digital twin technology

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO OF AUTOMOTIVE PISTONS

- 5.11.2 EXPORT SCENARIO OF AUTOMOTIVE PISTONS

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 IMPACT OF PISTON NODE MASS ON DIESEL ENGINE PERFORMANCE

- 5.12.2 DESIGN AND ANALYSIS OF AUTOMOTIVE BIMETALLIC PISTON

- 5.12.3 OPTIMIZATION OF PISTON COOLING OIL JET USING PARTICLEWORKS

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 PRICING ANALYSIS

- 5.14.1 BY SHAPE

- 5.14.2 BY VEHICLE TYPE

- 5.14.3 BY REGION

6 AUTOMOTIVE PISTON MARKET, BY VEHICLE TYPE

- 6.1 INTRODUCTION

- 6.2 PASSENGER CARS

- 6.2.1 SHIFT TOWARD SUVS AND HYBRID VEHICLES TO DRIVE MARKET

- 6.3 LIGHT COMMERCIAL VEHICLES

- 6.3.1 INCREASING DEMAND FOR LAST-MILE DELIVERY AND INFRASTRUCTURAL DEVELOPMENTS TO DRIVE MARKET

- 6.4 HEAVY COMMERCIAL VEHICLES

- 6.4.1 GROWING TRANSPORTATION, MANUFACTURING, MINING, AND CONSTRUCTION ACTIVITIES TO DRIVE MARKET

- 6.5 INDUSTRY INSIGHTS

7 AUTOMOTIVE PISTON MARKET, BY FUEL TYPE

- 7.1 INTRODUCTION

- 7.2 GASOLINE

- 7.2.1 HIGHER ADOPTION IN PASSENGER CARS AND LCVS TO DRIVE MARKET

- 7.3 DIESEL

- 7.3.1 DEMAND FOR HIGH POWER AND TORQUE IN HCVS TO DRIVE MARKET

- 7.4 ALTERNATE FUELS

- 7.4.1 EMISSION REGULATIONS AND DIESEL BANS TO DRIVE MARKET

- 7.5 INDUSTRY INSIGHTS

8 AUTOMOTIVE PISTON MARKET, BY MATERIAL TYPE

- 8.1 INTRODUCTION

- 8.2 STEEL

- 8.2.1 HIGH STRENGTH WITH HIGHER TEMPERATURE RESISTANCE TO DRIVE DEMAND

- 8.3 ALUMINUM

- 8.3.1 LIGHTWEIGHT AND LOWER MANUFACTURING COSTS TO DRIVE MARKET

- 8.4 INDUSTRY INSIGHTS

9 AUTOMOTIVE PISTON MARKET, BY SHAPE

- 9.1 INTRODUCTION

- 9.2 FLAT -TOP

- 9.2.1 SIMPLE DESIGN AND HIGHER EFFICIENCY DRIVE MARKET GROWTH

- 9.3 BOWL

- 9.3.1 INCREASED DEMAND FOR LAST-MILE DELIVERY AND INFRASTRUCTURAL DEVELOPMENTS DRIVES MARKET

- 9.4 DOME

- 9.4.1 INCREASE IN SPORTS CARS MARKET DRIVES DEMAND

- 9.5 INDUSTRY INSIGHTS

10 AUTOMOTIVE PISTON MARKET, BY COATING

- 10.1 INTRODUCTION

- 10.2 THERMAL BARRIER COATING

- 10.2.1 NEED FOR HEAT TRANSFER REDUCTION FROM COMBUSTION CHAMBER TO DRIVE DEMAND

- 10.3 DRY FILM LUBRICANT COATING

- 10.3.1 NEED TO MINIMIZE PISTON WEAR AND TEAR TO DRIVE DEMAND

- 10.4 OIL SHEDDING COATING

- 10.4.1 NEED TO CURTAIL OIL ACCUMULATION IN PISTONS TO DRIVE DEMAND

- 10.5 INDUSTRY INSIGHTS

11 AUTOMOTIVE PISTON MARKET, BY COMPONENT

- 11.1 INTRODUCTION

- 11.2 PISTON HEADS

- 11.2.1 DEMAND FOR ENHANCED ENGINE EFFICIENCY TO DRIVE MARKET

- 11.3 PISTON RINGS

- 11.3.1 DEVELOPMENT OF EFFICIENT AND RELIABLE ENGINES TO DRIVE MARKET

- 11.4 PISTON PINS

- 11.4.1 NEED FOR REPLACEMENT PARTS TO DRIVE DEMAND FOR PISTON PINS

- 11.5 INDUSTRY INSIGHTS

12 AUTOMOTIVE PISTON AFTERMARKET, BY COMPONENT

- 12.1 INTRODUCTION

- 12.2 PISTON HEADS

- 12.2.1 HIGH DEMAND FROM ENGINE OVERHAULS AND REBUILDING DRIVES MARKET

- 12.3 PISTON RINGS

- 12.3.1 HIGH WEAR RATE REQUIRING FREQUENT REPLACEMENTS SUPPORTS MARKET GROWTH

- 12.4 PISTON PINS

- 12.4.1 HIGH WEAR & TEAR DRIVES DEMAND

- 12.5 INDUSTRY INSIGHTS

13 AUTOMOTIVE PISTON MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 ASIA PACIFIC

- 13.2.1 MACROECONOMIC OUTLOOK

- 13.2.2 CHINA

- 13.2.2.1 Strong demand for GDI and SUVs vehicles to drive market growth

- 13.2.3 INDIA

- 13.2.3.1 Rapid adoption of CNG vehicles to propel market

- 13.2.4 JAPAN

- 13.2.4.1 Growing HEVs industry with higher cylinder numbers to fuel market growth

- 13.2.5 SOUTH KOREA

- 13.2.5.1 Presence of local piston manufacturers to accelerate market growth

- 13.2.6 REST OF ASIA PACIFIC

- 13.2.6.1 Strong demand for alternate fuel to foster engines in emerging economies

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK

- 13.3.2 GERMANY

- 13.3.2.1 Presence of key players and automotive manufacturing hub to bolster market growth

- 13.3.3 UK

- 13.3.3.1 Growth of light commercial vehicles to fuel market growth

- 13.3.4 FRANCE

- 13.3.4.1 Strong government incentives for hybrid vehicles to support market growth

- 13.3.5 SPAIN

- 13.3.5.1 Strong automotive manufacturing industry to foster market growth

- 13.3.6 REST OF EUROPE

- 13.4 NORTH AMERICA

- 13.4.1 MACROECONOMIC OUTLOOK

- 13.4.2 US

- 13.4.2.1 Inclination toward full-size performance oriented SUVs and light trucks to support market growth

- 13.4.3 MEXICO

- 13.4.3.1 Competitive manufacturing costs, strategic location, and participation in trade agreements fleets to boost market growth

- 13.4.4 CANADA

- 13.4.4.1 Rise in larger vehicle models to enhance market growth

- 13.5 REST OF THE WORLD (ROW)

- 13.5.1 BRAZIL

- 13.5.1.1 Rising passenger cars with alternate to boost market growth

- 13.5.2 SOUTH AFRICA

- 13.5.2.1 Rising vehicle production to drive market

- 13.5.3 OTHERS

- 13.5.1 BRAZIL

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 14.3 MARKET SHARE ANALYSIS, 2024

- 14.4 REVENUE ANALYSIS, 2019-2023

- 14.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- 14.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.5.5.1 Company footprint

- 14.5.5.2 Region footprint

- 14.5.5.3 Vehicle type footprint

- 14.5.5.4 Shape footprint

- 14.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.6.1 PROGRESSIVE COMPANIES

- 14.6.2 RESPONSIVE COMPANIES

- 14.6.3 DYNAMIC COMPANIES

- 14.6.4 STARTING BLOCKS

- 14.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.6.5.1 Detailed list of key startups/SMEs

- 14.6.5.2 Competitive benchmarking of key startups/SMEs

- 14.7 COMPANY VALUATION AND FINANCIAL METRICS

- 14.8 BRAND/PRODUCT COMPARISON

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

- 14.9.4 OTHER DEVELOPMENTS

15 COMPANY PROFILE

- 15.1 KEY PLAYERS

- 15.1.1 MAHLE GMBH

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches/developments

- 15.1.1.3.2 Other developments

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 TENNECO INC.

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Developments

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 AISIN CORPORATION

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions offered

- 15.1.3.3 MnM view

- 15.1.3.3.1 Key strengths

- 15.1.3.3.2 Strategic choices

- 15.1.3.3.3 Weaknesses and competitive threats

- 15.1.4 KOLBENSCHMIDT PISTONS

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Expansions

- 15.1.4.3.2 Other developments

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 SHRIRAM PISTONS

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions offered

- 15.1.5.3 MnM view

- 15.1.5.3.1 Key strengths

- 15.1.5.3.2 Strategic choices

- 15.1.5.3.3 Weaknesses and competitive threats

- 15.1.6 DONGSUHFEDERAL-MOGUL CO., LTD.

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Developments

- 15.1.7 NPR-RIKEN CORPORATION

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions offered

- 15.1.8 INDIA PISTONS LTD.

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions offered

- 15.1.9 HITACHI ASTEMO, LTD.

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions offered

- 15.1.10 HIRSCHVOGEL GROUP

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions offered

- 15.1.11 C.S. PISTON (THAILAND) CO., LTD.

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions offered

- 15.1.1 MAHLE GMBH

- 15.2 OTHER PLAYERS

- 15.2.1 PT ASTRA OTOPARTS TBK.

- 15.2.2 HONDA FOUNDRY CO., LTD.

- 15.2.3 MENON GROUP

- 15.2.4 ROSS RACING PISTONS

- 15.2.5 CP CARRILLO

- 15.2.6 CAPRICORN GROUP

- 15.2.7 COSWORTH

- 15.2.8 BOHAI AUTOMOTIVE SYSTEMS CO., LTD.

- 15.2.9 TOMEI POWERED INCORPORATED

- 15.2.10 LALLSONS PISTON & RINGS PVT. LTD.

- 15.2.11 ATRAC ENGINEERING CO.

- 15.2.12 WISECO

- 15.2.13 JEPISTONS

- 15.2.14 GIBTEC PISTONS

- 15.2.15 DONG YANG PISTON

16 MNM INSIGHTS ON BIO-FUEL AND E-FUEL USAGE

- 16.1 US

- 16.1.1 MNM INSIGHTS ON BIO-FUEL AND E-FUEL USAGE IN US LIGHT & HEAVY-DUTY VEHICLE CATEGORY

- 16.1.1.1 Light-duty vehicles

- 16.1.1.2 Heavy-duty vehicles

- 16.1.2 INSIGHTS ON POLICIES & REGULATIONS

- 16.1.3 FUEL PRODUCTION: FUTURE TECHNOLOGY ROADMAP

- 16.1.1 MNM INSIGHTS ON BIO-FUEL AND E-FUEL USAGE IN US LIGHT & HEAVY-DUTY VEHICLE CATEGORY

- 16.2 BRAZIL

- 16.2.1 MNM INSIGHTS ON BIO-FUEL AND E-FUEL USAGE IN BRAZILIAN LIGHT & HEAVY-DUTY VEHICLE CATEGORY

- 16.2.1.1 Light-duty vehicles

- 16.2.1.2 Heavy-duty vehicles

- 16.2.2 INSIGHTS ON POLICIES & REGULATIONS

- 16.2.3 FUEL PRODUCTION: BRAZIL'S FUTURE TECHNOLOGY ROADMAP

- 16.2.1 MNM INSIGHTS ON BIO-FUEL AND E-FUEL USAGE IN BRAZILIAN LIGHT & HEAVY-DUTY VEHICLE CATEGORY

- 16.3 INDIA

- 16.3.1 MNM INSIGHTS ON BIO-FUEL AND E-FUEL USAGE IN INDIAN LIGHT & HEAVY-DUTY VEHICLE CATEGORY

- 16.3.1.1 Light-duty vehicles

- 16.3.1.2 Heavy-duty vehicles

- 16.3.2 FUEL PRODUCTION: INDIA'S FUTURE TECHNOLOGY ROADMAP

- 16.3.1 MNM INSIGHTS ON BIO-FUEL AND E-FUEL USAGE IN INDIAN LIGHT & HEAVY-DUTY VEHICLE CATEGORY

- 16.4 EUROPE

- 16.4.1 MNM INSIGHTS ON BIO-FUEL AND E-FUEL USAGE IN EUROPEAN LIGHT & HEAVY-DUTY VEHICLE CATEGORY

- 16.4.1.1 Light-duty vehicles

- 16.4.1.2 Heavy-duty vehicles

- 16.4.2 FUEL PRODUCTION: EUROPE'S FUTURE TECHNOLOGY ROADMAP

- 16.4.1 MNM INSIGHTS ON BIO-FUEL AND E-FUEL USAGE IN EUROPEAN LIGHT & HEAVY-DUTY VEHICLE CATEGORY

- 16.5 INDONESIA

- 16.5.1 MNM INSIGHTS ON BIO-FUEL AND E-FUEL USAGE IN INDONESIA LIGHT & HEAVY-DUTY VEHICLE CATEGORY

- 16.5.1.1 Light-duty vehicles

- 16.5.1.2 Heavy-duty vehicles

- 16.5.2 FUEL PRODUCTION: INDONESIA'S FUTURE TECHNOLOGY ROADMAP

- 16.5.1 MNM INSIGHTS ON BIO-FUEL AND E-FUEL USAGE IN INDONESIA LIGHT & HEAVY-DUTY VEHICLE CATEGORY

17 RECOMMENDATIONS

- 17.1 JAPAN, INDIA, AND SOUTH KOREA: PROMISING ALTERNATIVES TO CHINA AS THEY DEMONSTRATE STABLE DEMAND FOR AUTOMOTIVE PISTONS

- 17.2 FLAT-TOP TO BE KEY SHAPE IN PISTON MANUFACTURING

- 17.3 ALTERNATE FUEL SEGMENT TO GROW AT FASTEST RATE

- 17.4 CONCLUSION

18 APPENDIX

- 18.1 INSIGHTS FROM INDUSTRY EXPERTS

- 18.2 DISCUSSION GUIDE

- 18.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.4 CUSTOMIZATION OPTIONS

- 18.4.1 AUTOMOTIVE PISTON MARKET, BY COUNTRY, BY VEHICLE TYPE

- 18.4.1.1 Passenger cars

- 18.4.1.2 LCVs

- 18.4.1.3 HCVs

- 18.4.2 AUTOMOTIVE PISTON MARKET, BY COUNTRY, BY COMPONENT

- 18.4.2.1 Piston heads

- 18.4.2.2 Piston rings

- 18.4.2.3 Piston pins

- 18.4.3 AUTOMOTIVE PISTON AFTERMARKET, BY COUNTRY, BY COMPONENT

- 18.4.3.1 Piston heads

- 18.4.3.2 Piston rings

- 18.4.3.3 Piston pins

- 18.4.1 AUTOMOTIVE PISTON MARKET, BY COUNTRY, BY VEHICLE TYPE

- 18.5 RELATED REPORTS

- 18.6 AUTHOR DETAILS