|

|

市場調査レポート

商品コード

1712825

自動車用ヒートシールドの世界市場:製品タイプ別、用途別、機能別、材料タイプ別、車両タイプ別、EVタイプ別、地域別 - 2032年までの予測Automotive Heat Shield Market by Application, Product, Function, Material, Vehicle Type, EV Type, and Region - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用ヒートシールドの世界市場:製品タイプ別、用途別、機能別、材料タイプ別、車両タイプ別、EVタイプ別、地域別 - 2032年までの予測 |

|

出版日: 2025年04月21日

発行: MarketsandMarkets

ページ情報: 英文 259 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

自動車用ヒートシールドの市場規模は、2025年の121億4,000万米ドルから2032年には126億8,000万米ドルにCAGR 0.6%で成長すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 対象単位 | 数量(台)および金額(100万米ドル) |

| セグメント | 製品タイプ別、用途別、機能別、材料タイプ別、車両タイプ別、EVタイプ別、地域別 |

| 対象地域 | アジア、北米、欧州、その他の地域 |

遮熱材に対する需要は、軽量で密度が低く、高温に耐えるオプションへとシフトしています。内燃機関車ではターボチャージャーの使用が増加しているため、高温を効果的に管理しエンジン効率を向上させる遮熱材へのニーズが高まっています。さらに、プラグインハイブリッド電気自動車の増加により、エンジンと電気部品の両方を保護するために不可欠なヒートシールドの需要がさらに高まると予想されます。より優れた耐熱性と燃費基準を実現するためのヒートシールドの絶縁強化が、市場の成長を促進します。

非金属ヒートシールドは、予測期間中、自動車用ヒートシールド市場においてより高い成長率で成長すると予測されています。複合材料、セラミック繊維、その他の絶縁材料から作られるこれらのヒートシールドは、金属製の代替品よりも軽量でありながら、効果的な熱保護を提供します。これらのヒートシールドは、エンジン・コンパートメント、電子ボックス、ECU、バッテリー、ボンネット下の防火壁など、さまざまな用途で一般的に使用されています。また、トランスミッショントンネル、ギアボックス、インテークマニホールドやエアインテークエリアを含むターボチャージャーシステムなどのアンダーシャーシコンポーネントにも適用されます。軽量で低燃費の自動車に対する需要の高まりが、自動車用非金属遮熱板市場の成長を後押ししています。国産部品工業(日本)、Carcoustics(ドイツ)、Anhui Parker New Material(中国)、ElringKlinger AG(ドイツ)、Tenneco Inc.(米国)、Alkegen(米国)などの企業が、さまざまな自動車用途に合わせた非金属ヒートシールドを提供しています。

アコースティックヒートシールドは、断熱と騒音低減の二重機能により、自動車用ヒートシールド市場で最大の市場シェアを占めると推定されます。最近の自動車は、乗客の快適性と規制遵守にますます重点を置くようになっているため、メーカーは、放熱を効果的に管理しながら、エンジン音や排気音を最小限に抑えるために遮音ヒートシールドを組み込んでいます。内燃エンジン車、ハイブリッド車、電気自動車では、軽量で多層構造のヒートシールドの採用が増加しており、需要をさらに押し上げています。フォード・マスタング、ゼネラル・モーターズのシボレー・コルベット、ダイムラーのメルセデス・ベンツGクラスなどの車種には、熱音響保護シールド(TAPS)が組み込まれています。さらに、複合材料と製造技術の進歩により効率が向上し、世界中の自動車メーカーに好まれています。

欧州は予測期間中、自動車用ヒートシールド市場で大きな市場シェアを占めると予測されています。欧州の自動車用ヒートシールド市場は、主に、よりクリーンで持続可能な自動車を義務付ける厳しい環境規制によって牽引されています。このため、燃費向上と排出ガス削減を目的とした先進的な遮熱材料や軽量断熱ソリューションの需要が高まっています。また、燃料効率と熱管理が重視されるようになったことで、熱放散を効果的に管理することで車両システムのエネルギー損失を最小限に抑える高性能ヒートシールドの需要も高まっています。さらに、EVへの移行が進む地域では、バッテリーの温度調整、モーターの冷却、電気部品の過度の熱からの保護など、EVパワートレイン特有の熱課題に対応するよう設計された特殊なヒートシールドの需要が加速しています。ElringKlinger AG(ドイツ)、Autoneum(スイス)、Carcoustics(ドイツ)、Adler Pelzer Holding GmbH(ドイツ)、Zircotec(英国)などが、この地域の主要な自動車用ヒートシールドメーカーです。

当レポートでは、世界の自動車用ヒートシールド市場について調査し、製品タイプ別、用途別、機能別、材料タイプ別、車両タイプ別、EVタイプ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 主要な利害関係者と購入基準

- エコシステム分析

- バリューチェーン分析

- 価格分析

- 技術分析

- 特許分析

- 顧客のビジネスに影響を与える動向と混乱

- ケーススタディ分析

- 主要な会議とイベント

- 規制枠組み

- 乗用車におけるヒートシールドの平均重量に関する市場の考察

- 貿易データ

第6章 自動車用ヒートシールド市場(製品タイプ別)

- イントロダクション

- シングルシェル

- ダブルシェル

- サンドイッチ

- 主要な業界洞察

第7章 自動車用ヒートシールド市場(用途別)

- イントロダクション

- 排気システムヒートシールド

- エンジンルームヒートシールド

- ボンネット下ヒートシールド

- シャーシ下ヒートシールド

- ターボチャージャーヒートシールド

- 主要な業界洞察

第8章 自動車用ヒートシールド市場(機能別)

- イントロダクション

- 音響

- 非音響

- 主要な業界洞察

第9章 自動車用ヒートシールド市場(材料タイプ別)

- イントロダクション

- 軽量素材とスチールの比較

- 金属

- 非金属

- 主要な業界洞察

第10章 自動車用ヒートシールド市場(車両タイプ別)

- イントロダクション

- 乗用車

- 小型商用車

- 大型商用車

- 主要な業界洞察

第11章 自動車用ヒートシールド市場(EVタイプ別)

- イントロダクション

- バッテリー電気自動車(BEVS)

- プラグインハイブリッド電気自動車(PHEV)

- 燃料電池電気自動車(FCEV)

- ハイブリッド電気自動車(HEV)

- 主要な業界洞察

第12章 自動車用ヒートシールド市場(地域別)

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- タイ

- その他

- 欧州

- ドイツ

- フランス

- 英国

- スペイン

- ロシア

- トルコ

- イタリア

- その他

- 北米

- 米国

- カナダ

- メキシコ

- その他の地域

- ブラジル

- イラン

- 南アフリカ

第13章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 市場シェア分析

- 収益分析

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業

- 企業評価マトリックス:スタートアップ企業/中小企業

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- TENNECO INC.

- DANA LIMITED

- ELRINGKLINGER AG

- AUTONEUM

- ALKEGEN

- SANWA PACKING INDUSTRY CO., LTD.

- TECHNOL EIGHT GROUP

- THAI SUMMIT GROUP

- KOKUSAN PARTS INDUSTRY CO., LTD.

- CARCOUSTICS

- ASPEN AEROGELS, INC.

- FUTABA INDUSTRIAL CO., LTD.

- 主要な中国企業

- BSTFLEX NINGGUO BST THERMAL PRODUCTS CO., LTD.

- NINGBO RUIHANG AUTOPARTS CO., LTD.

- ANHUI PARKER NEW MATERIAL CO., LTD.

- NINGJIN ZHIYUAN NEW MATERIAL CO., LTD.

- CANGZHOU MOPAM AUTO PARTS CO., LTD.

- CHENGDU HONGCHENG AUTOMOTIVE PARTS MANUFACTURING CO., LTD.

- ANHUI ZHICHENG ELECTROMECHANICAL COMPONENTS CO., LTD.

- CHANGCHUN CITY FUFENG STAMPING PART CO., LTD.

- GONGZHULING DELI INTELLIGENT TECHNOLOGY CO., LTD.

- CHENGDU ZHENGHAI AUTOMOTIVE INTERIOR PARTS CO., LTD.

- その他の主要企業

- MURUGAPPA MORGAN THERMAL CERAMICS LTD

- DUPONT

- ADLER PELZER HOLDING GMBH

- ZIRCOTEC LTD

- UGN, INC.

- MORGAN ADVANCED MATERIALS

- NICHIAS CORPORATION

- HAPPICH GMBH

- HKO

- THE NARMCO GROUP

- DATSONS ENGINEERING WORKS PVT. LTD.

- TALBROS

第15章 市場における推奨事項

第16章 付録

List of Tables

- TABLE 1 MARKET DEFINITION, BY PRODUCT TYPE

- TABLE 2 MARKET DEFINITION, BY APPLICATION

- TABLE 3 MARKET DEFINITION, BY FUNCTION

- TABLE 4 MARKET DEFINITION, BY MATERIAL TYPE

- TABLE 5 MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 6 MARKET DEFINITION, BY ELECTRIC VEHICLE TYPE

- TABLE 7 INCLUSIONS AND EXCLUSIONS

- TABLE 8 USD EXCHANGE RATES

- TABLE 9 RESEARCH ASSUMPTIONS

- TABLE 10 RISK ASSESSMENT

- TABLE 11 US: FUEL EFFICIENCY STANDARDS

- TABLE 12 EUROPE: FUEL EFFICIENCY STANDARDS

- TABLE 13 CHINA: FUEL EFFICIENCY STANDARDS

- TABLE 14 IMPACT OF MARKET DYNAMICS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON THE BUYING PROCESS, BY VEHICLE TYPE

- TABLE 16 KEY BUYING CRITERIA, BY VEHICLE TYPE

- TABLE 17 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 18 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE HEAT SHIELDS, BY VEHICLE TYPE, 2022-2024 (USD)

- TABLE 19 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE HEAT SHIELDS, BY APPLICATION, 2022-2024 (USD)

- TABLE 20 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE HEAT SHIELDS, BY EV APPLICATION, 2022-2024 (USD)

- TABLE 21 ASIA PACIFIC: AVERAGE SELLING PRICE TREND OF AUTOMOTIVE HEAT SHIELDS, BY APPLICATION, 2022-2024 (USD)

- TABLE 22 EUROPE: AVERAGE SELLING PRICE TREND OF AUTOMOTIVE HEAT SHIELDS, BY APPLICATION, 2022-2024 (USD)

- TABLE 23 NORTH AMERICA: AVERAGE SELLING PRICE TREND OF AUTOMOTIVE HEAT SHIELDS, BY APPLICATION, 2022-2024 (USD)

- TABLE 24 ROW: AVERAGE SELLING PRICE TREND OF AUTOMOTIVE HEAT SHIELDS, BY APPLICATION, 2022-2024 (USD)

- TABLE 25 INDIA: AVERAGE SELLING PRICE TREND OF AUTOMOTIVE HEAT SHIELDS, BY APPLICATION, 2022-2024 (USD)

- TABLE 26 PATENT ANALYSIS, 2020-2024

- TABLE 27 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 28 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 29 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 30 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 31 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 32 IMPORT DATA FOR HS CODE 870899, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 33 EXPORT DATA FOR HS CODE 870899, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 34 IMPORT DATA FOR HS CODE 732690, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 35 EXPORT DATA FOR HS CODE 732690, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 36 IMPORT DATA FOR HS CODE 392690, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 37 EXPORT DATA FOR HS CODE 392690, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 38 APPLICATION OF AUTOMOTIVE HEAT SHIELD, BY PRODUCT TYPE

- TABLE 39 AUTOMOTIVE HEAT SHIELD MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 40 AUTOMOTIVE HEAT SHIELD MARKET, BY PRODUCT TYPE, 2025-2032 (USD MILLION)

- TABLE 41 SINGLE-SHELL AUTOMOTIVE HEAT SHIELD MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 SINGLE-SHELL AUTOMOTIVE HEAT SHIELD MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 43 DOUBLE-SHELL AUTOMOTIVE HEAT SHIELD MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 DOUBLE-SHELL AUTOMOTIVE HEAT SHIELD MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 45 SANDWICH AUTOMOTIVE HEAT SHIELD MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 SANDWICH AUTOMOTIVE HEAT SHIELD MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 47 AUTOMOTIVE HEAT SHIELD APPLICATION, BY COMPONENT

- TABLE 48 AUTOMOTIVE HEAT SHIELD MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 49 AUTOMOTIVE HEAT SHIELD MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 50 AUTOMOTIVE EXHAUST SYSTEM HEAT SHIELD MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 AUTOMOTIVE EXHAUST SYSTEM HEAT SHIELD MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 52 AUTOMOTIVE ENGINE COMPARTMENT HEAT SHIELD MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 AUTOMOTIVE ENGINE COMPARTMENT HEAT SHIELD MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 54 AUTOMOTIVE UNDER-BONNET HEAT SHIELD MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 AUTOMOTIVE UNDER-BONNET HEAT SHIELD MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 56 AUTOMOTIVE UNDER-CHASSIS HEAT SHIELD MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 AUTOMOTIVE UNDER-CHASSIS HEAT SHIELD MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 58 AUTOMOTIVE TURBOCHARGER HEAT SHIELD MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 AUTOMOTIVE TURBOCHARGER HEAT SHIELD MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 60 AUTOMOTIVE HEAT SHIELD APPLICATION, BY FUNCTION

- TABLE 61 AUTOMOTIVE HEAT SHIELD MARKET, BY FUNCTION, 2021-2024 (USD MILLION)

- TABLE 62 AUTOMOTIVE HEAT SHIELD MARKET, BY FUNCTION, 2025-2032 (USD MILLION)

- TABLE 63 ACOUSTIC AUTOMOTIVE HEAT SHIELD MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 ACOUSTIC AUTOMOTIVE HEAT SHIELD MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 65 NON-ACOUSTIC AUTOMOTIVE HEAT SHIELD MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 NON-ACOUSTIC AUTOMOTIVE HEAT SHIELD MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 67 LIGHTWEIGHT MATERIAL COMPARISON WITH STEEL

- TABLE 68 AUTOMOTIVE HEAT SHIELD APPLICATION, BY MATERIAL TYPE

- TABLE 69 AUTOMOTIVE HEAT SHIELD MARKET, BY MATERIAL TYPE, 2021-2024 (USD MILLION)

- TABLE 70 AUTOMOTIVE HEAT SHIELD MARKET, BY MATERIAL TYPE, 2025-2032 (USD MILLION)

- TABLE 71 METALLIC AUTOMOTIVE HEAT SHIELD MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 METALLIC AUTOMOTIVE HEAT SHIELD MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 73 NON-METALLIC AUTOMOTIVE HEAT SHIELD MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 NON-METALLIC AUTOMOTIVE HEAT SHIELD MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 75 AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 76 AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 77 AUTOMOTIVE HEAT SHIELD MARKET IN PASSENGER CARS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 AUTOMOTIVE HEAT SHIELD MARKET IN PASSENGER CARS, BY REGION, 2025-2032 (USD MILLION)

- TABLE 79 AUTOMOTIVE HEAT SHIELD MARKET IN LIGHT COMMERCIAL VEHICLES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 AUTOMOTIVE HEAT SHIELD MARKET IN LIGHT COMMERCIAL VEHICLES, BY REGION, 2025-2032 (USD MILLION)

- TABLE 81 AUTOMOTIVE HEAT SHIELD MARKET IN HEAVY COMMERCIAL VEHICLES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 AUTOMOTIVE HEAT SHIELD MARKET IN HEAVY COMMERCIAL VEHICLES, BY REGION, 2025-2032 (USD MILLION)

- TABLE 83 AUTOMOTIVE HEAT SHIELD MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 84 AUTOMOTIVE HEAT SHIELD MARKET, BY ELECTRIC VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 85 AUTOMOTIVE HEAT SHIELD MARKET IN BEVS, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 86 AUTOMOTIVE HEAT SHIELD MARKET IN BEVS, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 87 AUTOMOTIVE HEAT SHIELD MARKET IN PHEVS, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 88 AUTOMOTIVE HEAT SHIELD MARKET IN PHEVS, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 89 AUTOMOTIVE HEAT SHIELD MARKET IN FCEVS, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 90 AUTOMOTIVE HEAT SHIELD MARKET IN FCEVS, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 91 AUTOMOTIVE HEAT SHIELD MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 AUTOMOTIVE HEAT SHIELD MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 93 ASIA PACIFIC: AUTOMOTIVE HEAT SHIELD MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 94 ASIA PACIFIC: AUTOMOTIVE HEAT SHIELD MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 95 MANUFACTURERS PROVIDING AUTOMOTIVE HEAT SHIELDS TO OEMS IN CHINA

- TABLE 96 CHINA: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 97 CHINA: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 98 INDIA: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 99 INDIA: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 100 MANUFACTURERS PROVIDING AUTOMOTIVE HEAT SHIELDS TO OEMS IN JAPAN

- TABLE 101 JAPAN: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 102 JAPAN: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 103 SOUTH KOREA: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 104 SOUTH KOREA: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 105 MANUFACTURERS PROVIDING AUTOMOTIVE HEAT SHIELDS TO OEMS IN THAILAND

- TABLE 106 THAILAND: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 107 THAILAND: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 108 MANUFACTURERS PROVIDING AUTOMOTIVE HEAT SHIELDS TO OEMS IN INDONESIA

- TABLE 109 REST OF ASIA PACIFIC: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 110 REST OF ASIA PACIFIC: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 111 EUROPE: AUTOMOTIVE HEAT SHIELD MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 112 EUROPE: AUTOMOTIVE HEAT SHIELD MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 113 MANUFACTURERS PROVIDING AUTOMOTIVE HEAT SHIELDS TO OEMS IN GERMANY

- TABLE 114 GERMANY: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 115 GERMANY: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 116 FRANCE: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 117 FRANCE: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 118 MANUFACTURERS PROVIDING AUTOMOTIVE HEAT SHIELDS TO OEMS IN UK

- TABLE 119 UK: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 120 UK: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 121 MANUFACTURERS PROVIDING AUTOMOTIVE HEAT SHIELDS TO OEMS IN SPAIN

- TABLE 122 SPAIN: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 123 SPAIN: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 124 RUSSIA: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 125 RUSSIA: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 126 TURKEY: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 127 TURKEY: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 128 MANUFACTURERS PROVIDING AUTOMOTIVE HEAT SHIELDS TO OEMS IN ITALY

- TABLE 129 ITALY: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 130 ITALY: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 131 REST OF EUROPE: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 132 REST OF EUROPE: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 133 NORTH AMERICA: AUTOMOTIVE HEAT SHIELD MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 134 NORTH AMERICA: AUTOMOTIVE HEAT SHIELD MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 135 MANUFACTURERS PROVIDING AUTOMOTIVE HEAT SHIELDS TO OEMS IN US

- TABLE 136 US: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 137 US: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 138 CANADA: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 139 CANADA: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 140 MANUFACTURERS PROVIDING AUTOMOTIVE HEAT SHIELDS TO OEMS IN MEXICO

- TABLE 141 MEXICO: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 142 MEXICO: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 143 ROW: AUTOMOTIVE HEAT SHIELD MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 144 ROW: AUTOMOTIVE HEAT SHIELD MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 145 BRAZIL: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 146 BRAZIL: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 147 IRAN: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 148 IRAN: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 149 SOUTH AFRICA: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 150 SOUTH AFRICA: AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 151 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- TABLE 152 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2023

- TABLE 153 REGIONAL FOOTPRINT, 2023

- TABLE 154 APPLICATION FOOTPRINT, 2023

- TABLE 155 MATERIAL TYPE FOOTPRINT, 2023

- TABLE 156 VEHICLE TYPE FOOTPRINT, 2023

- TABLE 157 DETAILED LIST OF STARTUPS/SMES, 2023

- TABLE 158 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 159 AUTOMOTIVE HEAT SHIELD MARKET: DEALS, JANUARY 2021-FEBRUARY 2025

- TABLE 160 AUTOMOTIVE HEAT SHIELD MARKET: EXPANSIONS, JANUARY 2021-FEBRUARY 2025

- TABLE 161 AUTOMOTIVE HEAT SHIELD MARKET: OTHER DEVELOPMENTS, JANUARY 2021-FEBRUARY 2025

- TABLE 162 TENNECO INC.: COMPANY OVERVIEW

- TABLE 163 TENNECO INC.: SUPPLIER ANALYSIS

- TABLE 164 TENNECO INC.: SYSTEMS PROTECTION PRODUCT PORTFOLIO

- TABLE 165 TENNECO INC.: PRODUCTS OFFERED

- TABLE 166 DANA LIMITED: COMPANY OVERVIEW

- TABLE 167 DANA LIMITED: SUPPLIER ANALYSIS

- TABLE 168 DANA LIMITED: PRODUCTS OFFERED

- TABLE 169 DANA LIMITED: DEVELOPMENTS

- TABLE 170 ELRINGKLINGER AG: COMPANY OVERVIEW

- TABLE 171 ELRINGKLINGER AG: SUPPLIER ANALYSIS

- TABLE 172 ELRINGKLINGER AG: PRODUCTS OFFERED

- TABLE 173 ELRINGKLINGER AG: DEVELOPMENTS

- TABLE 174 AUTONEUM: COMPANY OVERVIEW

- TABLE 175 AUTONEUM: SUPPLIER ANALYSIS

- TABLE 176 AUTONEUM: PRODUCTS OFFERED

- TABLE 177 AUTONEUM: DEALS

- TABLE 178 AUTONEUM: EXPANSIONS

- TABLE 179 ALKEGEN: COMPANY OVERVIEW

- TABLE 180 ALKEGEN: PRODUCTS OFFERED

- TABLE 181 ALKEGEN: DEALS

- TABLE 182 ALKEGEN: OTHER DEVELOPMENTS

- TABLE 183 SANWA PACKING INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 184 SANWA PACKING INDUSTRY CO., LTD.: SUBSIDIARIES AND AFFILIATES

- TABLE 185 SANWA PACKING INDUSTRY CO., LTD.: SUPPLIER ANALYSIS

- TABLE 186 SANWA PACKING INDUSTRY CO., LTD.: PRODUCTS OFFERED

- TABLE 187 TECHNOL EIGHT GROUP: COMPANY OVERVIEW

- TABLE 188 TECHNOL EIGHT GROUP: SUBSIDIARIES AND AFFILIATES

- TABLE 189 TECHNOL EIGHT GROUP: SUPPLIER ANALYSIS

- TABLE 190 TECHNOL EIGHT GROUP: PRODUCTS OFFERED

- TABLE 191 THAI SUMMIT GROUP: COMPANY OVERVIEW

- TABLE 192 THAI SUMMIT GROUP: SUBSIDIARIES AND AFFILIATES

- TABLE 193 THAI SUMMIT GROUP: SUPPLIER ANALYSIS

- TABLE 194 THAI SUMMIT GROUP: PRODUCTS OFFERED

- TABLE 195 KOKUSAN PARTS INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 196 KOKUSAN PARTS INDUSTRY CO., LTD.: SUBSIDIARIES AND AFFILIATES

- TABLE 197 KOKUSAN PARTS INDUSTRY CO., LTD.: SUPPLIER ANALYSIS

- TABLE 198 KOKUSAN PARTS INDUSTRY CO., LTD.: PRODUCTS OFFERED

- TABLE 199 CARCOUSTICS: COMPANY OVERVIEW

- TABLE 200 CARCOUSTICS: SUBSIDIARIES AND AFFILIATES

- TABLE 201 CARCOUSTICS: SUPPLIER ANALYSIS

- TABLE 202 CARCOUSTICS: PRODUCTS OFFERED

- TABLE 203 ASPEN AEROGELS, INC.: COMPANY OVERVIEW

- TABLE 204 ASPEN AEROGELS, INC.: SUPPLIER ANALYSIS

- TABLE 205 ASPEN AEROGELS, INC.: PRODUCTS OFFERED

- TABLE 206 ASPEN AEROGELS, INC.: DEVELOPMENTS

- TABLE 207 FUTABA INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 208 FUTABA INDUSTRIAL CO., LTD.: SUPPLIER ANALYSIS

- TABLE 209 FUTABA INDUSTRIAL CO., LTD.: PRODUCTS OFFERED

- TABLE 210 FUTABA INDUSTRIAL CO., LTD.: DEALS

- TABLE 211 BSTFLEX NINGGUO BST THERMAL PRODUCTS CO., LTD.: COMPANY OVERVIEW

- TABLE 212 NINGBO RUIHANG AUTOPARTS CO., LTD.: COMPANY OVERVIEW

- TABLE 213 ANHUI PARKER NEW MATERIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 214 NINGJIN ZHIYUAN NEW MATERIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 215 CANGZHOU MOPAM AUTO PARTS CO., LTD.: COMPANY OVERVIEW

- TABLE 216 CHENGDU HONGCHENG AUTOMOTIVE PARTS MANUFACTURING CO., LTD.: COMPANY OVERVIEW

- TABLE 217 ANHUI ZHICHENG ELECTROMECHANICAL COMPONENTS CO., LTD.: COMPANY OVERVIEW

- TABLE 218 CHANGCHUN CITY FUFENG STAMPING PART CO., LTD.: COMPANY OVERVIEW

- TABLE 219 GONGZHULING DELI INTELLIGENT TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 220 CHENGDU ZHENGHAI AUTOMOTIVE INTERIOR PARTS CO., LTD.: COMPANY OVERVIEW

- TABLE 221 MURUGAPPA MORGAN THERMAL CERAMICS LTD: COMPANY OVERVIEW

- TABLE 222 DUPONT: COMPANY OVERVIEW

- TABLE 223 ADLER PELZER HOLDING GMBH: COMPANY OVERVIEW

- TABLE 224 ZIRCOTEC LTD: COMPANY OVERVIEW

- TABLE 225 UGN, INC.: COMPANY OVERVIEW

- TABLE 226 MORGAN ADVANCED MATERIALS: COMPANY OVERVIEW

- TABLE 227 NICHIAS CORPORATION: COMPANY OVERVIEW

- TABLE 228 HAPPICH GMBH: COMPANY OVERVIEW

- TABLE 229 HKO: COMPANY OVERVIEW

- TABLE 230 THE NARMCO GROUP: COMPANY OVERVIEW

- TABLE 231 DATSONS ENGINEERING WORKS PVT. LTD.: COMPANY OVERVIEW

- TABLE 232 TALBROS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 AUTOMOTIVE HEAT SHIELD MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- FIGURE 4 KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 8 BOTTOM-UP APPROACH

- FIGURE 9 TOP-DOWN APPROACH

- FIGURE 10 MARKET SIZE ESTIMATION NOTES

- FIGURE 11 DATA TRIANGULATION

- FIGURE 12 GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 13 DEMAND AND SUPPLY-SIDE FACTOR ANALYSIS

- FIGURE 14 AUTOMOTIVE HEAT SHIELD MARKET OVERVIEW

- FIGURE 15 ASIA PACIFIC TO LEAD MARKET AMONG REGIONS DURING FORECAST PERIOD

- FIGURE 16 PASSENGER CARS TO DOMINATE MARKET AMONG VEHICLE TYPES DURING FORECAST PERIOD

- FIGURE 17 TURBOCHARGER HEAT SHIELD SEGMENT TO LEAD MARKET AMONG APPLICATIONS DURING FORECAST PERIOD

- FIGURE 18 KEY PLAYERS IN AUTOMOTIVE HEAT SHIELD MARKET

- FIGURE 19 INCREASING DEMAND FOR FUEL-EFFICIENT VEHICLES TO DRIVE MARKET

- FIGURE 20 ASIA PACIFIC TO BE LARGEST MARKET IN 2025

- FIGURE 21 DOUBLE-SHELL HEAT SHIELDS TO LEAD MARKET BY 2032

- FIGURE 22 TURBOCHARGER HEAT SHIELDS TO ACHIEVE NOTABLE GROWTH COMPARED TO OTHER APPLICATIONS DURING FORECAST PERIOD

- FIGURE 23 ACOUSTIC HEAT SHIELDS TO ACCOUNT FOR LARGER SHARE BY 2032

- FIGURE 24 METALLIC HEAT SHIELDS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 25 PASSENGER CARS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 26 BEVS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 27 AUTOMOTIVE HEAT SHIELD MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 28 ELECTRIC CAR COMPONENTS

- FIGURE 29 GLOBAL PHEV SALES SHIFT, 2021-2024 (THOUSAND UNITS)

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VEHICLE TYPE

- FIGURE 31 KEY BUYING CRITERIA, BY VEHICLE TYPE

- FIGURE 32 ECOSYSTEM ANALYSIS

- FIGURE 33 VALUE CHAIN ANALYSIS

- FIGURE 34 PATENT ANALYSIS, 2015-2024

- FIGURE 35 LEGAL STATUS OF PATENTS, 2015-2024

- FIGURE 36 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 37 AVERAGE WEIGHT OF HEAT SHIELD IN PASSENGER CARS

- FIGURE 38 TOTAL EXHAUST SYSTEM HEAT SHIELD WEIGHT IN PASSENGER CARS

- FIGURE 39 AVERAGE WEIGHT OF UNDER-BONNET HEAT SHIELD IN PASSENGER CARS

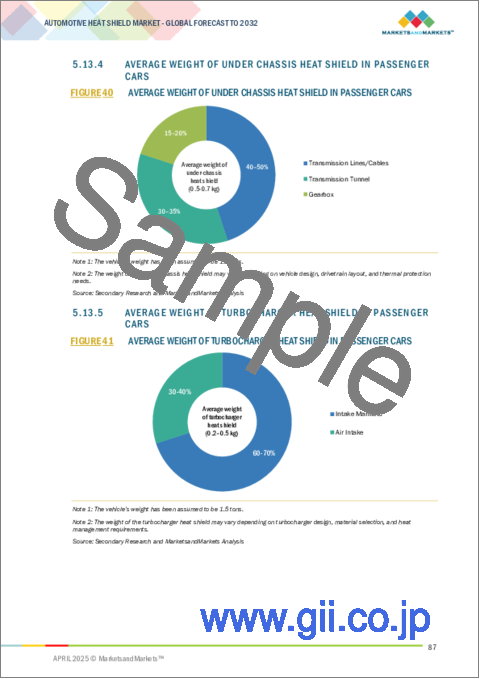

- FIGURE 40 AVERAGE WEIGHT OF UNDER CHASSIS HEAT SHIELD IN PASSENGER CARS

- FIGURE 41 AVERAGE WEIGHT OF TURBOCHARGER HEAT SHIELD IN PASSENGER CARS

- FIGURE 42 AUTOMOTIVE HEAT SHIELD MARKET, BY PRODUCT TYPE, 2025-2032 (USD MILLION)

- FIGURE 43 KEY INDUSTRY INSIGHTS, BY PRODUCT TYPE

- FIGURE 44 AUTOMOTIVE HEAT SHIELD MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- FIGURE 45 KEY INDUSTRY INSIGHTS, BY APPLICATION

- FIGURE 46 AUTOMOTIVE HEAT SHIELD MARKET, BY FUNCTION, 2025-2032 (USD MILLION)

- FIGURE 47 KEY INDUSTRY INSIGHTS, BY FUNCTION

- FIGURE 48 AUTOMOTIVE HEAT SHIELD MARKET, BY MATERIAL TYPE, 2025-2032 (USD MILLION)

- FIGURE 49 KEY INDUSTRY INSIGHTS, BY MATERIAL TYPE

- FIGURE 50 AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- FIGURE 51 KEY INDUSTRY INSIGHTS, BY VEHICLE TYPE

- FIGURE 52 AUTOMOTIVE HEAT SHIELD MARKET, BY ELECTRIC VEHICLE TYPE, 2025-2032 (USD MILLION)

- FIGURE 53 KEY INDUSTRY INSIGHTS, BY ELECTRIC VEHICLE TYPE

- FIGURE 54 AUTOMOTIVE HEAT SHIELD MARKET, BY REGION, 2025-2032 (USD MILLION)

- FIGURE 55 ASIA PACIFIC: AUTOMOTIVE HEAT SHIELD MARKET SNAPSHOT

- FIGURE 56 EUROPE: AUTOMOTIVE HEAT SHIELD MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- FIGURE 57 NORTH AMERICA: AUTOMOTIVE HEAT SHIELD MARKET SNAPSHOT

- FIGURE 58 ROW: AUTOMOTIVE HEAT SHIELD MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- FIGURE 59 MARKET SHARE ANALYSIS, 2023

- FIGURE 60 REVENUE ANALYSIS OF KEY PLAYERS, 2019-2023 (USD BILLION)

- FIGURE 61 COMPANY VALUATION OF KEY MANUFACTURERS, 2025 (USD BILLION)

- FIGURE 62 FINANCIAL METRICS OF MANUFACTURERS, 2025

- FIGURE 63 BRAND/PRODUCT COMPARISON

- FIGURE 64 AUTOMOTIVE HEAT SHIELD MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 65 COMPANY FOOTPRINT, 2023

- FIGURE 66 AUTOMOTIVE HEAT SHIELD MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 67 TENNECO INC.: COMPANY SNAPSHOT

- FIGURE 68 DANA LIMITED: COMPANY SNAPSHOT

- FIGURE 69 ELRINGKLINGER AG: COMPANY SNAPSHOT

- FIGURE 70 AUTONEUM: COMPANY SNAPSHOT

- FIGURE 71 TENNECO INC.: SHAREHOLDERS

- FIGURE 72 CARCOUSTICS: PRODUCT PORTFOLIO

- FIGURE 73 ASPEN AEROGELS, INC.: COMPANY SNAPSHOT

- FIGURE 74 FUTABA INDUSTRIAL CO., LTD.: COMPANY SNAPSHOT

The automotive heat shield market is projected to grow from USD 12.14 billion in 2025 to USD 12.68 billion by 2032 at a CAGR of 0.6%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Volume (Units) and Value (USD Million) |

| Segments | Type, Application, Function, Material Type, Vehicle Type, Electric Vehicle Type, and Region |

| Regions covered | Asia, North America, Europe, and Rest of the World |

The demand for heat shield materials is shifting toward options that are lightweight, low in density, and capable of withstanding high temperatures. The increasing use of turbochargers in ICE vehicles is driving the need for heat shields to effectively manage high temperatures and improve engine efficiency. Additionally, the rise in plug-in hybrid electric vehicles is expected to further increase the demand for heat shields, as they are essential for protecting both engine and electric components. Enhanced heat shield insulation for better thermal resistance and fuel efficiency standards propel market growth.

"Non-metallic heat shields are pegged to grow at a higher rate in the automotive heat shield market during the forecast period."

Non-metallic heat shields are projected to grow at a higher rate in the automotive heat shield market during the forecast period. Made from composite materials, ceramic fibers, and other insulating materials, these heat shields provide effective thermal protection while being lighter than metallic alternatives. These heat shields are commonly used in various applications, including engine compartments, electronic boxes, ECUs, batteries, and firewalls under the bonnet. They are also applied to under-chassis components like transmission tunnels, gearboxes, and turbocharger systems, including intake manifolds and air intake areas. The rising demand for lightweight and fuel-efficient vehicles drives the growth of the automotive non-metallic heat shield market. Companies such as Kokusan Parts Industry Co., Ltd. (Japan), Carcoustics (Germany), Anhui Parker New Material Co., Ltd. (China), ElringKlinger AG (Germany), Tenneco Inc. (US), and Alkegen (US), among others, provide non-metallic heat shields tailored for various automotive applications.

"The acoustic heat shield segment is projected to be the larger segment in the market during the forecast period."

Acoustic heat shields are estimated to account for the largest market share in the automotive heat shield market due to their dual functionality of thermal insulation and noise reduction. As modern vehicles increasingly focus on passenger comfort and regulatory compliance, manufacturers integrate acoustic heat shields to minimize engine and exhaust noise while effectively managing heat dissipation. The growing adoption of lightweight and multi-layered heat shields in internal combustion engine vehicles, hybrids, and electric vehicles further boosts demand. Vehicle models such as the Ford Mustang, General Motors' Chevrolet Corvette, and Daimler's Mercedes-Benz G-Class incorporate thermal acoustical protective shields (TAPS). Additionally, advancements in composite materials and manufacturing technologies enhance their efficiency, making them the preferred choice for automakers globally.

"Europe is projected to account for a significant market share in the automotive heat shield market during the forecast period."

Europe is expected to have a significant market share in the automotive heat shield market during the forecast period. The European automotive heat shield market is primarily driven by stringent environmental regulations that mandate cleaner and more sustainable automobiles. This has increased demand for advanced heat shield materials and lightweight thermal insulation solutions to improve fuel efficiency and reduce emissions. The increasing emphasis on fuel efficiency and thermal management has also raised the demand for high-performance heat shields, which help minimize energy losses in vehicle systems by effectively managing heat dissipation. Additionally, the region's transition toward EVs is accelerating demand for specialized heat shields designed to address the unique thermal challenges of EV powertrains, such as battery temperature regulation, motor cooling, and protection of electrical components from excessive heat. ElringKlinger AG (Germany), Autoneum (Switzerland), Carcoustics (Germany), Adler Pelzer Holding GmbH (Germany), and Zircotec (UK), among others, are some of the leading automotive heat shield manufacturers in the region.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: Tier I - 49%, Tier II - 29%, and OEM - 22%

- By Designation: C-level - 58%, D-level - 26%, and Others - 16%

- By Region: North America - 35%, Europe - 24%, and Asia Pacific - 41%

The automotive heat shield market is dominated by major players, including Tenneco Inc. (US), Dana Limited (US), ElringKlinger AG (Germany), Autoneum (Switzerland), Alkegen (US), Sanwa Packing Industry Co., Ltd. (Japan), Technol Eight Group (Japan), Thai Summit Group (Thailand), Kokusan Parts Industry Co., Ltd. (Japan), Carcoustics (Germany), Aspen Aerogels, Inc. (US), Futaba Industrial Co., Ltd. (Japan), DuPont (US), Zircotec (UK) and Morgan Advanced Materials (UK) These companies are developing products tailored to specific applications, incorporating new features, and using innovative materials.

Study Coverage

The report covers the automotive heat shield market in terms of Application (Exhaust system heat shield, Turbocharger heat shield, Under bonnet heat shield, Engine compartment heat shield, and Under chassis heat shield), Product (Single Shell, Double Shell, Sandwich), Function (Acoustic, Non-Acoustic), Material type (Metallic and non-metallic), Vehicle Type, Electrical Vehicle Type, and Region. It covers the competitive landscape and company profiles of the major automotive heat shield market ecosystem players.

The study also includes an in-depth competitive analysis of the key market players, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the overall automotive heat shield market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

- The report also helps stakeholders understand the current and future pricing trends of the automotive heat shield market.

The report provides insight on the following pointers:

- Analysis of key drivers (Innovation in heat shield insulation techniques for enhanced thermal resistance, growing focus on lightweight and fuel efficiency standards, and rise in electrical/electronic components in vehicles), restraints (restrictions on ICE vehicles by major countries, and customization requirements increasing production complexity and cost), opportunities (rising demand for PHEVs, and Recycling scrap automotive heat shield insulation material), and challenges (active cooling systems reducing reliance on passive heat shielding)

- Product Development/Innovation: Detailed insights on upcoming technologies and research & development activities in the automotive heat shield market

- Market Development: Comprehensive information about lucrative markets-the report analyses the automotive heat shield market across varied regions

- Market Diversification: Exhaustive information about untapped geographies, recent developments, and investments in the automotive heat shield market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and product offerings of leading players like Tenneco Inc. (US), Dana Limited (US), ElringKlinger AG (Germany), Autoneum (Switzerland), and Alkegen (US) in the automotive heat shield market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary Interview with Experts

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 List of primary participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

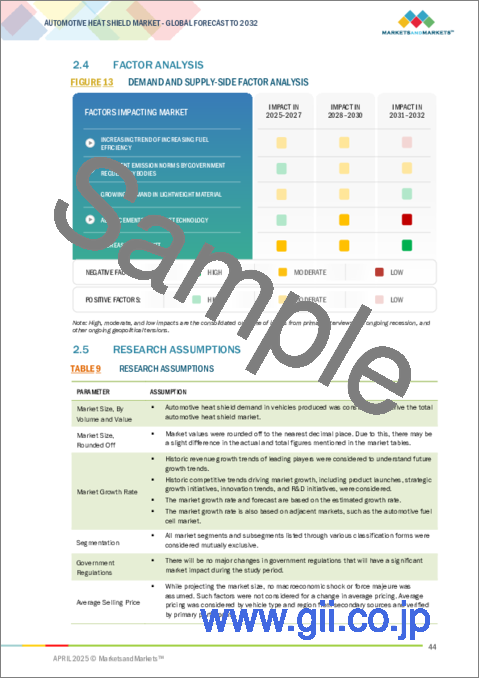

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE HEAT SHIELD MARKET

- 4.2 AUTOMOTIVE HEAT SHIELD MARKET, BY REGION

- 4.3 AUTOMOTIVE HEAT SHIELD MARKET, BY PRODUCT TYPE

- 4.4 AUTOMOTIVE HEAT SHIELD MARKET, BY APPLICATION

- 4.5 AUTOMOTIVE HEAT SHIELD MARKET, BY FUNCTION

- 4.6 AUTOMOTIVE HEAT SHIELD MARKET, BY MATERIAL TYPE

- 4.7 AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE

- 4.8 AUTOMOTIVE HEAT SHIELD MARKET, BY ELECTRIC VEHICLE TYPE

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Innovation in heat shield insulation techniques for enhanced thermal resistance

- 5.2.1.2 Growing focus on light-weighting and fuel efficiency standards

- 5.2.1.3 Rise in electrical/electronic components in vehicles

- 5.2.2 RESTRAINTS

- 5.2.2.1 Restrictions on ICE vehicles by key countries

- 5.2.2.2 Customization requirements increasing production complexity and cost

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for PHEVs

- 5.2.3.2 Recycling scrap automotive heat shield insulation material

- 5.2.4 CHALLENGES

- 5.2.4.1 Active cooling systems reducing reliance on passive heat shielding

- 5.2.1 DRIVERS

- 5.3 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.3.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.3.2 BUYING CRITERIA

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 RAW MATERIAL SUPPLIERS

- 5.4.2 AUTOMOTIVE HEAT SHIELD MANUFACTURERS

- 5.4.3 TIER 1 SUPPLIERS

- 5.4.4 OEMS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE HEAT SHIELDS BY VEHICLE TYPE

- 5.6.2 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE HEAT SHIELDS, BY APPLICATION

- 5.6.3 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE HEAT SHIELDS, BY EV APPLICATION

- 5.6.4 ASIA PACIFIC: AVERAGE SELLING PRICE TREND OF AUTOMOTIVE HEAT SHIELDS, BY APPLICATION

- 5.6.5 EUROPE: AVERAGE SELLING PRICE TREND OF AUTOMOTIVE HEAT SHIELDS, BY APPLICATION

- 5.6.6 NORTH AMERICA: AVERAGE SELLING PRICE TREND OF AUTOMOTIVE HEAT SHIELDS, BY APPLICATION

- 5.6.7 ROW: AVERAGE SELLING PRICE TREND OF AUTOMOTIVE HEAT SHIELDS, BY APPLICATION

- 5.6.8 INDIA: AVERAGE SELLING PRICE TREND OF AUTOMOTIVE HEAT SHIELDS BY APPLICATION

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Electrospun bioactive glass heat shielding

- 5.7.1.2 Thermal acoustic protective shielding (TAPS)

- 5.7.1.3 Advanced thermo-oxidative resistant textile composite heat shielding

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Advanced battery thermal management heat shielding

- 5.7.2.2 Embossed and formed aluminum heat shielding

- 5.7.2.3 Self-adhesive heat shielding

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Shell heat shield technology

- 5.7.3.2 Integrated technology heat shielding

- 5.7.3.3 Flexible technology heat shielding

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 ENHANCING MANUFACTURING EFFICIENCY OF AUTOMOTIVE HEAT SHIELDS

- 5.10.2 AUTOMATION IN AUTOMOTIVE HEAT SHIELD MANUFACTURING

- 5.10.3 OPTIMIZING HEAT SHIELD DESIGN FOR AUTOMOTIVE APPLICATIONS

- 5.10.4 ENHANCING HEAT SHIELD PERFORMANCE FOR COMPOSITE SPORTS CAR BODIES

- 5.11 KEY CONFERENCES AND EVENTS

- 5.12 REGULATORY FRAMEWORK

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 MARKETSANDMARKETS INSIGHT ON AVERAGE WEIGHT OF HEAT SHIELD IN PASSENGER CARS

- 5.13.1 AVERAGE WEIGHT OF HEAT SHIELD IN PASSENGER CARS

- 5.13.2 AVERAGE WEIGHT OF EXHAUST SYSTEM HEAT SHIELD IN PASSENGER CARS

- 5.13.3 AVERAGE WEIGHT OF UNDER-BONNET HEAT SHIELD IN PASSENGER CARS

- 5.13.4 AVERAGE WEIGHT OF UNDER CHASSIS HEAT SHIELD IN PASSENGER CARS

- 5.13.5 AVERAGE WEIGHT OF TURBOCHARGER HEAT SHIELD IN PASSENGER CARS

- 5.14 TRADE DATA

6 AUTOMOTIVE HEAT SHIELD MARKET, BY PRODUCT TYPE

- 6.1 INTRODUCTION

- 6.2 SINGLE SHELL

- 6.2.1 HIGH REFLECTIVITY AND LIGHTWEIGHT NATURE TO DRIVE DEMAND FOR SINGLE-SHELL ALUMINUM HEAT SHIELDS

- 6.3 DOUBLE SHELL

- 6.3.1 NEED FOR THERMAL COMFORT IN PASSENGER COMPARTMENTS AND ENGINE ENCAPSULATIONS TO BOOST DEMAND

- 6.4 SANDWICH

- 6.4.1 HIGH THERMAL AND ACOUSTIC PERFORMANCE OF SANDWICH HEAT SHIELDS TO DRIVE MARKET GROWTH

- 6.5 KEY INDUSTRY INSIGHTS

7 AUTOMOTIVE HEAT SHIELD MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 EXHAUST SYSTEM HEAT SHIELD

- 7.2.1 FOCUS ON INCREASING FUEL EFFICIENCY WOULD IMPACT DEMAND

- 7.3 ENGINE COMPARTMENT HEAT SHIELD

- 7.3.1 DEMAND FOR POWERFUL ENGINES WITH REDUCED NOISE TO DRIVE MARKET

- 7.4 UNDER-BONNET HEAT SHIELD

- 7.4.1 RISE IN ELECTRICAL/ELECTRONIC COMPONENTS IN VEHICLES TO DRIVE DEMAND FOR HEAT-SENSITIVE COMPONENTS

- 7.5 UNDER-CHASSIS HEAT SHIELD

- 7.5.1 TECHNOLOGICAL ADVANCEMENTS IN VEHICLE TRANSMISSION SYSTEMS TO DRIVE MARKET

- 7.6 TURBOCHARGER HEAT SHIELD

- 7.6.1 GROWTH IN TREND OF ENGINE DOWNSIZING TO FUEL MARKET

- 7.7 KEY INDUSTRY INSIGHTS

8 AUTOMOTIVE HEAT SHIELD MARKET, BY FUNCTION

- 8.1 INTRODUCTION

- 8.2 ACOUSTIC

- 8.2.1 NEED FOR THERMAL PROTECTION WITH OPTIMIZED NOISE ATTENUATION TO DRIVE DEMAND

- 8.3 NON-ACOUSTIC

- 8.3.1 INCREASE IN DEMAND FOR PRIORITIZED THERMAL PROTECTION AND DURABILITY TO DRIVE MARKET

- 8.4 KEY INDUSTRY INSIGHTS

9 AUTOMOTIVE HEAT SHIELD MARKET, BY MATERIAL TYPE

- 9.1 INTRODUCTION

- 9.2 LIGHTWEIGHT MATERIAL COMPARISON WITH STEEL

- 9.3 METALLIC

- 9.3.1 STRONG DEMAND FOR ICE VEHICLES IN EMERGING ECONOMIES TO DRIVE MARKET

- 9.4 NON-METALLIC

- 9.4.1 SHIFT TOWARD FUEL-EFFICIENT AND LIGHTWEIGHT VEHICLES TO DRIVE MARKET

- 9.5 KEY INDUSTRY INSIGHTS

10 AUTOMOTIVE HEAT SHIELD MARKET, BY VEHICLE TYPE

- 10.1 INTRODUCTION

- 10.2 PASSENGER CARS

- 10.2.1 RISE IN INTEGRATION OF TURBOCHARGED ENGINES TO DRIVE MARKET

- 10.3 LIGHT COMMERCIAL VEHICLES

- 10.3.1 DEMAND FOR HIGH FUEL EFFICIENCY IN LCVS TO FUEL MARKET

- 10.4 HEAVY COMMERCIAL VEHICLES

- 10.4.1 RISE IN LONG-HAUL FREIGHT TRANSPORTATION TO DRIVE MARKET

- 10.5 KEY INDUSTRY INSIGHTS

11 AUTOMOTIVE HEAT SHIELD MARKET, BY ELECTRIC VEHICLE TYPE

- 11.1 INTRODUCTION

- 11.2 BATTERY ELECTRIC VEHICLES (BEVS)

- 11.2.1 RISE IN DEMAND FOR HEAT MANAGEMENT APPLICATIONS IN BEVS TO PROPEL MARKET GROWTH

- 11.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS)

- 11.3.1 RISE IN CONCERNS OF PROTECTING BATTERIES AND ELECTRONICS FROM HEAT, ENSURING SAFETY AND EFFICIENCY, TO DRIVE SEGMENT

- 11.4 FUEL CELL ELECTRIC VEHICLES (FCEVS)

- 11.4.1 INCREASE IN NEED FOR THERMAL MANAGEMENT TO ENHANCE FUEL CELL EFFICIENCY AND PROTECTION OF HYDROGEN STORAGE TO FUEL SEGMENT

- 11.5 HYBRID ELECTRIC VEHICLES (HEVS)

- 11.6 KEY INDUSTRY INSIGHTS

12 AUTOMOTIVE HEAT SHIELD MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 CHINA

- 12.2.1.1 Growth in popularity of turbocharged engines to drive market

- 12.2.2 INDIA

- 12.2.2.1 Favorable government policies with significant potential for ICE and hybrid vehicles to drive market

- 12.2.3 JAPAN

- 12.2.3.1 OEMs' focus on developing ICE engine technologies to drive market

- 12.2.4 SOUTH KOREA

- 12.2.4.1 Increase in demand for premium vehicles with advanced safety features to propel market

- 12.2.5 THAILAND

- 12.2.5.1 Developments in ICE vehicle sector to drive market

- 12.2.6 REST OF ASIA PACIFIC

- 12.2.1 CHINA

- 12.3 EUROPE

- 12.3.1 GERMANY

- 12.3.1.1 Strategic adjustments and innovation by key OEMs to support long-term growth

- 12.3.2 FRANCE

- 12.3.2.1 Increase in preference for fuel-efficient vehicles to drive market

- 12.3.3 UK

- 12.3.3.1 Rise in demand for LCVs due to booming e-commerce and logistics industries to drive market

- 12.3.4 SPAIN

- 12.3.4.1 Higher investments from large industry players to fuel market

- 12.3.5 RUSSIA

- 12.3.5.1 Resurgence of domestic vehicle production to drive market

- 12.3.6 TURKEY

- 12.3.6.1 Government support for domestic production to drive market

- 12.3.7 ITALY

- 12.3.7.1 Industrial collaboration strategy to drive market

- 12.3.8 REST OF EUROPE

- 12.3.1 GERMANY

- 12.4 NORTH AMERICA

- 12.4.1 US

- 12.4.1.1 Rise in adoption of fuel-efficient vehicles to drive market

- 12.4.2 CANADA

- 12.4.2.1 Focus on energy-efficient and lightweight vehicles to fuel market

- 12.4.3 MEXICO

- 12.4.3.1 Growth of auto part manufacturing sector to drive market

- 12.4.1 US

- 12.5 REST OF THE WORLD (ROW)

- 12.5.1 BRAZIL

- 12.5.1.1 Rise in ICE and hybrid vehicle production, along with policy support to propel market

- 12.5.2 IRAN

- 12.5.2.1 Increase in contribution by domestic players in vehicle production to drive market

- 12.5.3 SOUTH AFRICA

- 12.5.3.1 Major contribution of ICE vehicles in country's automotive sector to drive market

- 12.5.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 MARKET SHARE ANALYSIS

- 13.4 REVENUE ANALYSIS

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.5.1 COMPANY VALUATION

- 13.5.2 FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS

- 13.7.5.1 Company footprint

- 13.7.5.2 Regional footprint

- 13.7.5.3 Application footprint

- 13.7.5.4 Material type footprint

- 13.7.5.5 Vehicle type footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUP/SMES

- 13.8.5.1 Detailed list of startups/SMEs

- 13.8.5.2 Competitive benchmarking of startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 DEALS

- 13.9.2 EXPANSIONS

- 13.9.3 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 TENNECO INC.

- 14.1.1.1 Business overview

- 14.1.1.2 Products offered

- 14.1.1.3 MnM view

- 14.1.1.3.1 Key strengths

- 14.1.1.3.2 Strategic choices

- 14.1.1.3.3 Weaknesses and competitive threats

- 14.1.2 DANA LIMITED

- 14.1.2.1 Business overview

- 14.1.2.2 Products offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Developments

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 ELRINGKLINGER AG

- 14.1.3.1 Business overview

- 14.1.3.2 Products offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Developments

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 AUTONEUM

- 14.1.4.1 Business overview

- 14.1.4.2 Products offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Deals

- 14.1.4.3.2 Expansions

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 ALKEGEN

- 14.1.5.1 Business overview

- 14.1.5.2 Products offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Deals

- 14.1.5.3.2 Other developments

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 SANWA PACKING INDUSTRY CO., LTD.

- 14.1.6.1 Business overview

- 14.1.6.2 Products offered

- 14.1.7 TECHNOL EIGHT GROUP

- 14.1.7.1 Business overview

- 14.1.7.2 Products offered

- 14.1.8 THAI SUMMIT GROUP

- 14.1.8.1 Business overview

- 14.1.8.2 Products offered

- 14.1.9 KOKUSAN PARTS INDUSTRY CO., LTD.

- 14.1.9.1 Business overview

- 14.1.9.2 Products offered

- 14.1.10 CARCOUSTICS

- 14.1.10.1 Business overview

- 14.1.10.2 Products offered

- 14.1.11 ASPEN AEROGELS, INC.

- 14.1.11.1 Business overview

- 14.1.11.2 Products offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Developments

- 14.1.12 FUTABA INDUSTRIAL CO., LTD.

- 14.1.12.1 Business overview

- 14.1.12.2 Products offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Deals

- 14.1.1 TENNECO INC.

- 14.2 MAJOR CHINESE PLAYERS

- 14.2.1 BSTFLEX NINGGUO BST THERMAL PRODUCTS CO., LTD.

- 14.2.2 NINGBO RUIHANG AUTOPARTS CO., LTD.

- 14.2.3 ANHUI PARKER NEW MATERIAL CO., LTD.

- 14.2.4 NINGJIN ZHIYUAN NEW MATERIAL CO., LTD.

- 14.2.5 CANGZHOU MOPAM AUTO PARTS CO., LTD.

- 14.2.6 CHENGDU HONGCHENG AUTOMOTIVE PARTS MANUFACTURING CO., LTD.

- 14.2.7 ANHUI ZHICHENG ELECTROMECHANICAL COMPONENTS CO., LTD.

- 14.2.8 CHANGCHUN CITY FUFENG STAMPING PART CO., LTD.

- 14.2.9 GONGZHULING DELI INTELLIGENT TECHNOLOGY CO., LTD.

- 14.2.10 CHENGDU ZHENGHAI AUTOMOTIVE INTERIOR PARTS CO., LTD.

- 14.3 OTHER KEY PLAYERS

- 14.3.1 MURUGAPPA MORGAN THERMAL CERAMICS LTD

- 14.3.2 DUPONT

- 14.3.3 ADLER PELZER HOLDING GMBH

- 14.3.4 ZIRCOTEC LTD

- 14.3.5 UGN, INC.

- 14.3.6 MORGAN ADVANCED MATERIALS

- 14.3.7 NICHIAS CORPORATION

- 14.3.8 HAPPICH GMBH

- 14.3.9 HKO

- 14.3.10 THE NARMCO GROUP

- 14.3.11 DATSONS ENGINEERING WORKS PVT. LTD.

- 14.3.12 TALBROS

15 RECOMMENDATIONS BY MARKETSANDMARKETS

- 15.1 SHIFTING MOBILITY TRENDS INFLUENCING AUTOMOTIVE HEAT SHIELD DEMAND IN KEY MARKETS

- 15.2 LIGHTWEIGHT MATERIALS AND TECHNOLOGIES FOR FUTURE DEMAND

- 15.3 REPURPOSING SCRAP AUTOMOTIVE HEAT SHIELD INSULATION

- 15.4 CONCLUSION

16 APPENDIX

- 16.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS