|

|

市場調査レポート

商品コード

1711380

コンクリートシーラーの世界市場:タイプ別、機能別、用途別、地域別 - 2030年までの予測Concrete Sealers Market by Type (Water-Based, Solvent-Based), Function (Topical Sealers, Penetrating Sealers, Other Functions), Application (Residential, Non-residential), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| コンクリートシーラーの世界市場:タイプ別、機能別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年04月21日

発行: MarketsandMarkets

ページ情報: 英文 244 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

コンクリートシーラーの市場規模は、2024年に20億3,000万米ドルとなりました。

同市場は、2030年には29億5,000万米ドルに達すると予測され、予測期間中のCAGRは6.4%と見込まれています。厳しい環境規制により、VOC排出量の削減と持続可能な建設手法の採用が重視されています。その結果、コンクリートシーラーメーカーは技術革新を進め、低VOCや水性配合にシフトしています。これらの環境に優しい処方は、有害な化学物質のオフガスを削減し、室内空気の質を高め、シーラーの全体的な環境への影響を軽減し、LEEDのようなグリーンビルディングの評価に含めるのに適しています。高性能で環境に配慮したソリューションへの需要の高まりが市場の成長を促進する一方で、メーカーは新しい化学物質に投資し、耐久性や付着特性と美観や環境問題のバランスを取っています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(100万米ドル)および数量(キロトン) |

| セグメント | タイプ別、機能別、用途別、地域別 |

| 対象地域 | アジア太平洋、欧州、北米、中東・アフリカ、南米 |

溶剤系シーラーは、予測期間中、コンクリートシーラー市場で2番目に急成長するセグメントと推定されます。溶剤型シーラーの主な利点は、硬化が早いことです。ダウンタイムはしばしば大きな懸念事項であるため、顧客はより短時間で硬化するソリューションを好みます。溶剤はすぐに蒸発し、活動可能な硬い保護表面を残します。この利点は、一刻を争うプロジェクトや、天候が予測できない地域で有益です。苛酷な天候は、新しい塗布を遅らせたり、塗布が硬化している間に雨や破片による流出で台無しにしたりする可能性があります。

その他の機能セグメントは、2024年から2030年の間にコンクリートシーラー市場で3番目に高いCAGRを記録すると予測されています。ハイブリッド、フッ素系、ポリアスパラギン系シーラーは、紫外線、化学物質、摩耗に対して並外れた耐性を発揮するために、いくつかの化学物質の最高の特性を示します。過酷な産業環境、沿岸条件、交通量の多い場所にさらされた場合、従来のシーラーを凌駕し、長期にわたる保護を提供します。さらに、極端な温度、腐食剤、機械的な力にも耐えるため、高い耐久性を必要とするインフラ、製造工場、屋外設備には欠かせないものとなっています。

2023年のコンクリートシーラー市場では、住宅分野が第2位のシェアを占めました。地下室や屋内のコンクリート床は、水分の浸入、カビの繁殖、悪臭を防ぐシーラーを使用できます。湿気や洪水の可能性がある地域では、シーラーは水害に対する最初の防衛線であり、コンクリートと家の構造的完全性を保護します。シーラーはまた、湿気やアレルゲンを除去することで、より健康的な室内空気の質を促進するために、ランドリールームやクロールスペースにも使用されます。

2023年のコンクリートシーラーの地域別市場規模は欧州が第2位でした。REACHやEUグリーンディールのような厳しい環境政策により、欧州ではグリーンなコンクリートシーラーへの移行が加速しています。ほとんどのシーラーは現在、水性、低VOC、無溶剤の処方で構成されており、メーカーは性能と排出基準を満たすために製品を改良しています。建材に含まれる有害な化学物質に対する規制は、バイオベースや持続可能なシーラー技術の革新に影響を与えています。

当レポートでは、世界のコンクリートシーラー市場について調査し、タイプ別、機能別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- マクロ経済指標

第6章 業界動向

- サプライチェーン分析

- 価格分析

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- 技術分析

- ケーススタディ分析

- 貿易分析

- 規制状況

- 2025年の主な会議とイベント

- 投資と資金調達のシナリオ

- 特許分析

- AI/生成AIがコンクリートシーラー市場に与える影響

第7章 コンクリートシーラー市場、タイプ別

- イントロダクション

- 水性

- 溶剤ベース

第8章 コンクリートシーラー市場、機能別

- イントロダクション

- 局所シーラー

- 浸透性シーラー

- その他

第9章 コンクリートシーラー市場、用途別

- イントロダクション

- 住宅用

- 非住宅用

第10章 コンクリートシーラー市場、地域別

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- スペイン

- ロシア

- トルコ

- 中東・アフリカ

- GCC諸国

- イラン

- 南アフリカ

- 南米

- ブラジル

- アルゼンチン

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 市場シェア分析

- 収益分析

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- ブランド/製品比較分析

- 企業評価と財務指標

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- SIKA AG

- RPM INTERNATIONAL INC.

- ARKEMA(BOSTIK)

- MAPEI S.P.A.

- PPG INDUSTRIES, INC.

- BASF SE

- PROSOCO

- WACKER CHEMIE AG

- SHERWIN-WILLIAMS COMPANY(VALSPAR CORPORATION)

- EVONIK INDUSTRIES AG

- その他の企業

- VEXCON CHEMICALS, INC.(CHEMMASTER)

- CURECRETE DISTRIBUTION INC.

- LATICRETE INTERNATIONAL, INC.

- SAINT-GOBAIN S.A.

- AKZONOBEL

- DOW, INC.

- HENKEL AG & CO. KGAA

- DUPONT DE NEMOURS, INC.

- H.B. FULLER

- ARDEX

- JOTUN

- W. R. MEADOWS, INC.

- FOSROC

- CONCRETE SEALERS USA

- SEALSOURCE INC.

第13章 隣接市場と関連市場

第14章 付録

List of Tables

- TABLE 1 CONCRETE SEALERS MARKET: DEFINITION AND INCLUSIONS, BY TYPE

- TABLE 2 CONCRETE SEALERS MARKET: DEFINITION AND INCLUSIONS, BY FUNCTION

- TABLE 3 CONCRETE SEALERS MARKET: DEFINITION AND INCLUSIONS, BY APPLICATION

- TABLE 4 CONCRETE SEALERS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 6 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 7 GDP TRENDS AND FORECAST, BY KEY COUNTRY, 2021-2029 (USD BILLION)

- TABLE 8 INDICATIVE PRICING ANALYSIS OF CONCRETE SEALERS OFFERED BY KEY PLAYERS, BY APPLICATION, 2023 (USD/KG)

- TABLE 9 AVERAGE SELLING PRICE TREND OF CONCRETE SEALERS, BY REGION, 2021-2030 (USD/KG)

- TABLE 10 ROLE OF COMPANIES IN CONCRETE SEALERS ECOSYSTEM

- TABLE 11 IMPORT DATA FOR HS CODE 321490-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 12 EXPORT DATA FOR HS CODE 321490-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 13 GLOBAL: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 CONCRETE SEALERS MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025

- TABLE 20 CONCRETE SEALERS MARKET: FUNDING/INVESTMENT SCENARIO, 2023-2024

- TABLE 21 PATENT STATUS: PATENT APPLICATIONS, LIMITED PATENTS, AND GRANTED PATENTS, 2014-2024

- TABLE 22 LIST OF MAJOR PATENTS RELATED TO CONCRETE SEALERS, 2014-2024

- TABLE 23 PATENTS BY SIKA AG, 2020-2024

- TABLE 24 CONCRETE SEALERS MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 25 CONCRETE SEALERS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 26 CONCRETE SEALERS MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 27 CONCRETE SEALERS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 28 WATER-BASED CONCRETE SEALERS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 29 WATER-BASED CONCRETE SEALERS MARKET, BY REGION, 2024-2030 (USD MILLION)

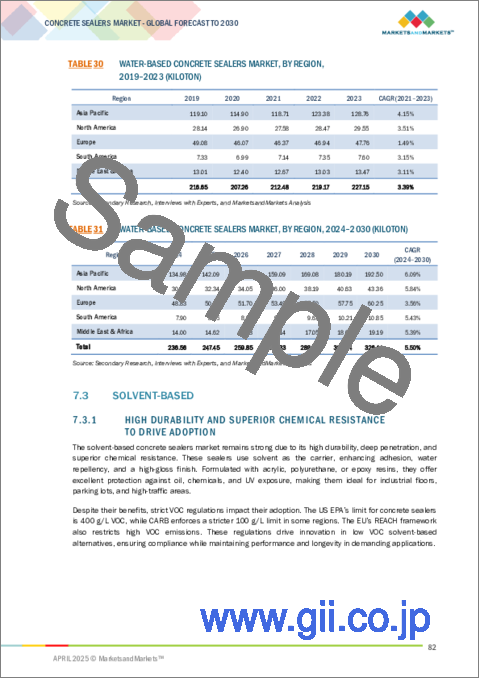

- TABLE 30 WATER-BASED CONCRETE SEALERS MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 31 WATER-BASED CONCRETE SEALERS MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 32 SOLVENT-BASED CONCRETE SEALERS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 33 SOLVENT-BASED CONCRETE SEALERS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 34 SOLVENT-BASED CONCRETE SEALERS MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 35 SOLVENT-BASED CONCRETE SEALERS MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 36 CONCRETE SEALERS MARKET, BY FUNCTION, 2019-2023 (USD MILLION)

- TABLE 37 CONCRETE SEALERS MARKET, BY FUNCTION, 2024-2030 (USD MILLION)

- TABLE 38 CONCRETE SEALERS MARKET, BY FUNCTION, 2019-2023 (KILOTON)

- TABLE 39 CONCRETE SEALERS MARKET, BY FUNCTION, 2024-2030 (KILOTON)

- TABLE 40 TOPICAL SEALERS: CONCRETE SEALERS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 41 TOPICAL SEALERS: CONCRETE SEALERS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 42 TOPICAL SEALERS: CONCRETE SEALERS MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 43 TOPICAL SEALERS: CONCRETE SEALERS MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 44 ACRYLIC SEALERS: CONCRETE SEALERS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 45 ACRYLIC SEALERS: CONCRETE SEALERS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 46 ACRYLIC SEALERS: CONCRETE SEALERS MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 47 ACRYLIC SEALERS: CONCRETE SEALERS MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 48 POLYURETHANE SEALERS: CONCRETE SEALERS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 49 POLYURETHANE SEALERS: CONCRETE SEALERS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 50 POLYURETHANE SEALERS: CONCRETE SEALERS MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 51 POLYURETHANE SEALERS: CONCRETE SEALERS MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 52 EPOXY SEALERS: CONCRETE SEALERS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 53 EPOXY SEALERS: CONCRETE SEALERS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 54 EPOXY SEALERS: CONCRETE SEALERS MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 55 EPOXY SEALERS: CONCRETE SEALERS MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 56 PENETRATING SEALERS: CONCRETE SEALERS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 57 PENETRATING SEALERS: CONCRETE SEALERS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 58 PENETRATING SEALERS: CONCRETE SEALERS MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 59 PENETRATING SEALERS: CONCRETE SEALERS MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 60 OTHER FUNCTIONS: CONCRETE SEALERS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 61 OTHER FUNCTIONS: CONCRETE SEALERS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 62 OTHER FUNCTIONS: CONCRETE SEALERS MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 63 OTHER FUNCTIONS: CONCRETE SEALERS MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 64 CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 65 CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 66 CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 67 CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 68 RESIDENTIAL: CONCRETE SEALERS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 69 RESIDENTIAL: CONCRETE SEALERS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 70 RESIDENTIAL: CONCRETE SEALERS MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 71 RESIDENTIAL: CONCRETE SEALERS MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 72 NON-RESIDENTIAL: CONCRETE SEALERS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 73 NON-RESIDENTIAL: CONCRETE SEALERS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 74 NON-RESIDENTIAL: CONCRETE SEALERS MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 75 NON-RESIDENTIAL: CONCRETE SEALERS MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 76 CONCRETE SEALERS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 77 CONCRETE SEALERS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 78 CONCRETE SEALERS MARKET, BY REGION, 2019-2023 (KILOTON)

- TABLE 79 CONCRETE SEALERS MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 80 ASIA PACIFIC: CONCRETE SEALERS MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 81 ASIA PACIFIC: CONCRETE SEALERS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 82 ASIA PACIFIC: CONCRETE SEALERS MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 83 ASIA PACIFIC: CONCRETE SEALERS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 84 ASIA PACIFIC: CONCRETE SEALERS MARKET, BY FUNCTION, 2019-2023 (USD MILLION)

- TABLE 85 ASIA PACIFIC: CONCRETE SEALERS MARKET, BY FUNCTION, 2024-2030 (USD MILLION)

- TABLE 86 ASIA PACIFIC: CONCRETE SEALERS MARKET, BY FUNCTION, 2019-2023 (KILOTON)

- TABLE 87 ASIA PACIFIC: CONCRETE SEALERS MARKET, BY FUNCTION, 2024-2030 (KILOTON)

- TABLE 88 ASIA PACIFIC: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 89 ASIA PACIFIC: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 90 ASIA PACIFIC: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 91 ASIA PACIFIC: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 92 ASIA PACIFIC: CONCRETE SEALERS MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 93 ASIA PACIFIC: CONCRETE SEALERS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 94 ASIA PACIFIC: CONCRETE SEALERS MARKET, BY COUNTRY, 2019-2023 (KILOTON)

- TABLE 95 ASIA PACIFIC: CONCRETE SEALERS MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 96 CHINA: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 97 CHINA: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 98 CHINA: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 99 CHINA: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 100 INDIA: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 101 INDIA: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 102 INDIA: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 103 INDIA: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 104 JAPAN: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 105 JAPAN: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 106 JAPAN: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 107 JAPAN: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 108 SOUTH KOREA: CONCRETE SEALERS MARKET, APPLICATION, 2019-2023 (USD MILLION)

- TABLE 109 SOUTH KOREA: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 110 SOUTH KOREA: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 111 SOUTH KOREA: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 112 NORTH AMERICA: CONCRETE SEALERS MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 113 NORTH AMERICA: CONCRETE SEALERS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 114 NORTH AMERICA: CONCRETE SEALERS MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 115 NORTH AMERICA: CONCRETE SEALERS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 116 NORTH AMERICA: CONCRETE SEALERS MARKET, BY FUNCTION, 2019-2023 (USD MILLION)

- TABLE 117 NORTH AMERICA: CONCRETE SEALERS MARKET, BY FUNCTION, 2024-2030 (USD MILLION)

- TABLE 118 NORTH AMERICA: CONCRETE SEALERS MARKET, FUNCTION, 2019-2023 (KILOTON)

- TABLE 119 NORTH AMERICA: CONCRETE SEALERS MARKET, BY FUNCTION, 2024-2030 (KILOTON)

- TABLE 120 NORTH AMERICA: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 121 NORTH AMERICA: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 122 NORTH AMERICA: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 123 NORTH AMERICA: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 124 NORTH AMERICA: CONCRETE SEALERS MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 125 NORTH AMERICA: CONCRETE SEALERS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 126 NORTH AMERICA: CONCRETE SEALERS MARKET, BY COUNTRY, 2019-2023 (KILOTON)

- TABLE 127 NORTH AMERICA: CONCRETE SEALERS MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 128 US: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 129 US: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 130 US: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 131 US: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 132 CANADA: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 133 CANADA: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 134 CANADA: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 135 CANADA: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 136 MEXICO: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 137 MEXICO: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 138 MEXICO: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 139 MEXICO: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 140 EUROPE: CONCRETE SEALERS MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 141 EUROPE: CONCRETE SEALERS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 142 EUROPE: CONCRETE SEALERS MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 143 EUROPE: CONCRETE SEALERS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 144 EUROPE: CONCRETE SEALERS MARKET, BY FUNCTION, 2019-2023 (USD MILLION)

- TABLE 145 EUROPE: CONCRETE SEALERS MARKET, BY FUNCTION, 2024-2030 (USD MILLION)

- TABLE 146 EUROPE: CONCRETE SEALERS MARKET, BY FUNCTION, 2019-2023 (KILOTON)

- TABLE 147 EUROPE: CONCRETE SEALERS MARKET, BY FUNCTION, 2024-2030 (KILOTON)

- TABLE 148 EUROPE: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 149 EUROPE: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 150 EUROPE: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 151 EUROPE: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 152 EUROPE: CONCRETE SEALERS MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 153 EUROPE: CONCRETE SEALERS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 154 EUROPE: CONCRETE SEALERS MARKET, BY COUNTRY, 2019-2023 (KILOTON)

- TABLE 155 EUROPE: CONCRETE SEALERS MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 156 GERMANY: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 157 GERMANY: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 158 GERMANY: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 159 GERMANY: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 160 FRANCE: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 161 FRANCE: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 162 FRANCE: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 163 FRANCE: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 164 ITALY: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 165 ITALY: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 166 ITALY: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 167 ITALY: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 168 UK: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 169 UK: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 170 UK: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 171 UK: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 172 SPAIN: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 173 SPAIN: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 174 SPAIN: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 175 SPAIN: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 176 RUSSIA: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 177 RUSSIA: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 178 RUSSIA: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 179 RUSSIA: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 180 TURKEY: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 181 TURKEY: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 182 TURKEY: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 183 TURKEY: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 184 MIDDLE EAST & AFRICA: CONCRETE SEALERS MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: CONCRETE SEALERS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: CONCRETE SEALERS MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 187 MIDDLE EAST & AFRICA: CONCRETE SEALERS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 188 MIDDLE EAST & AFRICA: CONCRETE SEALERS MARKET, BY FUNCTION, 2019-2023 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: CONCRETE SEALERS MARKET, BY FUNCTION, 2024-2030 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: CONCRETE SEALERS MARKET, BY FUNCTION, 2019-2023 (KILOTON)

- TABLE 191 MIDDLE EAST & AFRICA: CONCRETE SEALERS MARKET, BY FUNCTION, 2024-2030 (KILOTON)

- TABLE 192 MIDDLE EAST & AFRICA: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 195 MIDDLE EAST & AFRICA: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 196 MIDDLE EAST & AFRICA: CONCRETE SEALERS MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: CONCRETE SEALERS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: CONCRETE SEALERS MARKET, BY COUNTRY, 2019-2023 (KILOTON)

- TABLE 199 MIDDLE EAST & AFRICA: CONCRETE SEALERS MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 200 UAE: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 201 UAE: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 202 UAE: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 203 UAE: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 204 SAUDI ARABIA: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 205 SAUDI ARABIA: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 206 SAUDI ARABIA: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 207 SAUDI ARABIA: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 208 QATAR: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 209 QATAR: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 210 QATAR: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 211 QATAR: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 212 IRAN: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 213 IRAN: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 214 IRAN: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 215 IRAN: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 216 SOUTH AFRICA: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 217 SOUTH AFRICA: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 218 SOUTH AFRICA: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 219 SOUTH AFRICA: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 220 SOUTH AMERICA: CONCRETE SEALERS MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 221 SOUTH AMERICA: CONCRETE SEALERS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 222 SOUTH AMERICA: CONCRETE SEALERS MARKET, BY TYPE, 2019-2023 (KILOTON)

- TABLE 223 SOUTH AMERICA: CONCRETE SEALERS MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 224 SOUTH AMERICA: CONCRETE SEALERS MARKET, BY FUNCTION, 2019-2023 (USD MILLION)

- TABLE 225 SOUTH AMERICA: CONCRETE SEALERS MARKET, BY FUNCTION, 2024-2030 (USD MILLION)

- TABLE 226 SOUTH AMERICA: CONCRETE SEALERS MARKET, BY FUNCTION, 2019-2023 (KILOTON)

- TABLE 227 SOUTH AMERICA: CONCRETE SEALERS MARKET, BY FUNCTION, 2024-2030 (KILOTON)

- TABLE 228 SOUTH AMERICA: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 229 SOUTH AMERICA: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 230 SOUTH AMERICA: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 231 SOUTH AMERICA: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 232 SOUTH AMERICA: CONCRETE SEALERS MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 233 SOUTH AMERICA: CONCRETE SEALERS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 234 SOUTH AMERICA: CONCRETE SEALERS MARKET, BY COUNTRY, 2019-2023 (KILOTON)

- TABLE 235 SOUTH AMERICA: CONCRETE SEALERS MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 236 BRAZIL: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 237 BRAZIL: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 238 BRAZIL: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 239 BRAZIL: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 240 ARGENTINA: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 241 ARGENTINA: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 242 ARGENTINA: CONCRETE SEALERS MARKET, BY APPLICATION, 2019-2023 (KILOTON)

- TABLE 243 ARGENTINA: CONCRETE SEALERS MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 244 CONCRETE SEALERS MARKET: OVERVIEW OF KEY STRATEGIES ADOPTED BY MAJOR COMPANIES

- TABLE 245 CONCRETE SEALERS MARKET: DEGREE OF COMPETITION, 2023

- TABLE 246 CONCRETE SEALERS MARKET: REGION FOOTPRINT

- TABLE 247 CONCRETE SEALERS MARKET: FUNCTION FOOTPRINT

- TABLE 248 CONCRETE SEALERS MARKET: TYPE FOOTPRINT

- TABLE 249 CONCRETE SEALERS MARKET: APPLICATION FOOTPRINT

- TABLE 250 CONCRETE SEALERS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 251 CONCRETE SEALERS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 252 CONCRETE SEALERS MARKET: DEALS, JANUARY 2019-JANUARY 2025

- TABLE 253 CONCRETE SEALERS MARKET: EXPANSIONS, JANUARY 2019-JANUARY 2025

- TABLE 254 SIKA AG: BUSINESS OVERVIEW

- TABLE 255 SIKA AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 256 SIKA AG: DEALS

- TABLE 257 SIKA AG: EXPANSIONS

- TABLE 258 RPM INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 259 RPM INTERNATIONAL INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 260 RPM INTERNATIONAL INC.: DEALS

- TABLE 261 ARKEMA (BOSTIK): COMPANY OVERVIEW

- TABLE 262 ARKEMA (BOSTIK): PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 263 ARKEMA (BOSTIK): DEALS

- TABLE 264 ARKEMA (BOSTIK): EXPANSIONS

- TABLE 265 MAPEI S.P.A.: COMPANY OVERVIEW

- TABLE 266 MAPEI S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 267 MAPEI S.P.A.: DEALS

- TABLE 268 MAPEI S.P.A.: EXPANSIONS

- TABLE 269 PPG INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 270 PPG INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 PPG INDUSTRIES, INC.: DEALS

- TABLE 272 BASF SE: COMPANY OVERVIEW

- TABLE 273 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 PROSOCO: COMPANY OVERVIEW

- TABLE 275 PROSOCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 276 PROSOCO: DEALS

- TABLE 277 WACKER CHEMIE AG: COMPANY OVERVIEW

- TABLE 278 WACKER CHEMIE AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 279 WACKER CHEMIE AG: EXPANSIONS

- TABLE 280 SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

- TABLE 281 SHERWIN-WILLIAMS COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 282 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- TABLE 283 EVONIK INDUSTRIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 284 EVONIK INDUSTRIES AG: EXPANSIONS

- TABLE 285 VEXCON CHEMICALS, INC.: COMPANY OVERVIEW

- TABLE 286 CURECRETE DISTRIBUTION INC.: COMPANY OVERVIEW

- TABLE 287 LATICRETE INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 288 SAINT-GOBAIN S.A.: COMPANY OVERVIEW

- TABLE 289 AKZONOBEL: COMPANY OVERVIEW

- TABLE 290 DOW, INC.: COMPANY OVERVIEW

- TABLE 291 HENKEL AG & CO. KGAA: COMPANY OVERVIEW

- TABLE 292 DUPONT DE NEMOURS, INC.: COMPANY OVERVIEW

- TABLE 293 H.B. FULLER: COMPANY OVERVIEW

- TABLE 294 ARDEX: COMPANY OVERVIEW

- TABLE 295 JOTUN: COMPANY OVERVIEW

- TABLE 296 W. R. MEADOWS, INC.: COMPANY OVERVIEW

- TABLE 297 FOSROC: COMPANY OVERVIEW

- TABLE 298 CONCRETE SEALERS USA: COMPANY OVERVIEW

- TABLE 299 SEALSOURCE INC.: COMPANY OVERVIEW

- TABLE 300 EUROPE: POLISHED CONCRETE MARKET, BY COUNTRY, 2018-2025 (USD THOUSAND)

- TABLE 301 NORTH AMERICA: POLISHED CONCRETE MARKET, BY COUNTRY, 2018-2025 (USD THOUSAND)

- TABLE 302 ASIA PACIFIC: POLISHED CONCRETE MARKET, BY COUNTRY, 2018-2025 (USD THOUSAND)

- TABLE 303 SOUTH AMERICA: POLISHED CONCRETE MARKET, BY COUNTRY, 2018-2025 (USD THOUSAND)

- TABLE 304 MIDDLE EAST & AFRICA: POLISHED CONCRETE MARKET, BY COUNTRY, 2018-2025 (USD THOUSAND)

List of Figures

- FIGURE 1 CONCRETE SEALERS MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 CONCRETE SEALERS MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE MARKET SHARE OF KEY PLAYERS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 - BOTTOM-UP (DEMAND SIDE)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 4 - TOP-DOWN

- FIGURE 7 CONCRETE SEALERS MARKET: DATA TRIANGULATION

- FIGURE 8 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 9 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 10 WATER-BASED SEGMENT TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 11 TOPICAL SEALERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 NON-RESIDENTIAL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- FIGURE 14 RAPID URBANIZATION TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 15 NORTH AMERICA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 16 NON-RESIDENTIAL SEGMENT ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2023

- FIGURE 17 WATER-BASED SEGMENT DOMINATED MARKET ACROSS ALL REGIONS IN 2023

- FIGURE 18 INDIA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 19 CONCRETE SEALERS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 CONCRETE SEALERS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 22 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 23 CONCRETE SEALERS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 24 AVERAGE SELLING PRICE TREND OF CONCRETE SEALERS OFFERED BY KEY PLAYERS, BY APPLICATION, 2023 (USD/KG)

- FIGURE 25 AVERAGE SELLING PRICE TREND OF CONCRETE SEALERS, BY REGION, 2021-2030 (USD/KG)

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 CONCRETE SEALERS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 28 IMPORT DATA RELATED TO HS CODE 321490-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD THOUSAND)

- FIGURE 29 EXPORT DATA RELATED TO HS CODE 321490-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD THOUSAND)

- FIGURE 30 PATENTS REGISTERED FOR CONCRETE SEALERS, 2014-2024

- FIGURE 31 MAJOR PATENTS RELATED TO CONCRETE SEALERS, 2014-2024

- FIGURE 32 LEGAL STATUS OF PATENTS FILED RELATED TO CONCRETE SEALERS, 2014-2024

- FIGURE 33 MAXIMUM PATENTS FILED IN JURISDICTION OF CHINA DURING 2014-2024

- FIGURE 34 WATER-BASED CONCRETE SEALERS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 35 TOPICAL SEALERS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 36 NON-RESIDENTIAL SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 ASIA PACIFIC TO BE LARGEST MARKET FOR CONCRETE SEALERS DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC: CONCRETE SEALERS MARKET SNAPSHOT

- FIGURE 39 NORTH AMERICA: CONCRETE SEALERS MARKET SNAPSHOT

- FIGURE 40 EUROPE: CONCRETE SEALERS MARKET SNAPSHOT

- FIGURE 41 CONCRETE SEALERS MARKET SHARE ANALYSIS, 2023

- FIGURE 42 REVENUE ANALYSIS OF KEY COMPANIES, 2019-2023 (USD MILLION)

- FIGURE 43 CONCRETE SEALERS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 44 CONCRETE SEALERS MARKET: COMPANY FOOTPRINT

- FIGURE 45 CONCRETE SEALERS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 46 CONCRETE SEALERS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 47 CONCRETE SEALERS MARKET: EV/EBITDA OF KEY MANUFACTURERS

- FIGURE 48 CONCRETE SEALERS MARKET: ENTERPRISE VALUATION (EV) OF KEY PLAYERS

- FIGURE 49 SIKA AG: COMPANY SNAPSHOT

- FIGURE 50 RPM INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 51 ARKEMA (BOSTIK): COMPANY SNAPSHOT

- FIGURE 52 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 53 BASF SE: COMPANY SNAPSHOT

- FIGURE 54 WACKER CHEMIE AG: COMPANY SNAPSHOT

- FIGURE 55 SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

- FIGURE 56 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

The concrete sealers market is expected to be valued at USD 2.03 billion in 2024 and reach USD 2.95 billion by 2030, registering a CAGR of 6.4% during the forecast period. Strict environmental regulations have led to a high focus on lowering VOC emissions and adopting sustainable construction practices. As a result, concrete sealer manufacturers are innovating and shifting to low-VOC and water-based formulations. These environmentally friendly formulations reduce off-gassing of detrimental chemicals, enhance indoor air quality, and lessen the overall environmental impact of sealers, making them suitable for inclusion in green building ratings such as LEED. The increasing demand for high-performing and environmentally conscious solutions is driving market growth while manufacturers invest in new chemistries, balancing durability and adherent properties with aesthetics and environmental issues.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Type, Function, Application, and Region |

| Regions covered | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

"Solvent-based sealers to be second-fastest growing segment of concrete sealers market during forecast period"

The solvent-based sealers segment is estimated to be the second-fastest growing segment of the concrete sealers market during the forecast period. A major benefit of solvent-based sealers is that they cure quickly. Since downtime is often a major concern, clients prefer solutions that are cured in less time. The solvents evaporate quickly, leaving a hard protective surface ready for activity. This benefit is beneficial on time-sensitive projects or in regions where the weather is unpredictable. Harsh weather could cause a new application to be delayed or be ruined by a runoff due to rain or debris while the application is curing.

"Other functions segment to register third-highest CAGR in concrete sealers market during forecast period"

The other functions segment is projected to record the third-highest CAGR in the concrete sealers market between 2024 and 2030. Hybrid, fluorinated, and polyaspartic sealers exhibit the best characteristics of several chemistries to deliver extraordinary resistance to UV, chemicals, and abrasion. They outperform traditional sealers when subjected to harsh industrial environments, coastal conditions, and heavy traffic areas, providing long-lasting protection. Besides, they withstand extreme temperatures, corrosives, and mechanical forces, making them vital for any infrastructure, manufacturing plant, and outdoor installations that require high durability.

"Residential was second-largest application segment of concrete sealers market in terms of value in 2023"

The residential segment held the second-largest share of the concrete sealers market in 2023. Basements and indoor concrete floors can use sealers that prevent moisture infiltration, mold growth, and odors. In areas with humidity and flood potential, sealers are the first line of defense against water damage, protecting the concrete and the home's structural integrity. Sealers are also used in laundry rooms and crawl spaces to promote healthier indoor air quality by eliminating moisture and allergens.

"Europe accounted for second-largest share of concrete sealers market in 2023"

Europe was the second-largest regional market for concrete sealers in 2023. Strict environmental policies like REACH and the EU Green Deal are speeding the transition to green concrete sealers in Europe. Most sealers are now composed of water-based, low-VOC, and solvent-free formulas as manufacturers have reformulated products to meet the performance and emission standards. The restrictions on harmful chemicals in construction materials influence the innovation of bio-based and sustainable sealer technologies.

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: Directors - 50%, Managers - 30%, and Others - 20%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, RoW - 5%

Key players profiled in the report include Sika AG (Switzerland), RPM International Inc. (US), Arkema (France), Mapei S.P.A. (Italy), PPG Industries Inc. (US), Prosoco (US), BASF SE (Germany), Wacker Chemie AG (Germany), Sherwin-Williams Company (US), and Evonik Industries AG (Germany).

Research Coverage

This report segments the concrete sealers market based on type, function, application, and region and provides estimations of value (USD Million) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies associated with the concrete sealers market.

Reasons to Buy Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles - which together provide an overall view of the competitive landscape, emerging and high-growth segments of the concrete sealers market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights into the following points:

- Market Penetration: Comprehensive information on concrete sealers offered by top players in the global market

- Analysis of key drivers (Rising global construction activities, increasing demand for durable concrete solutions, and growing preference for decorative concrete surfaces), restraints (High initial costs and environmental concerns), opportunities (Rising demand for eco-friendly sealers and growing market potential in emerging economies), and challenges (Fluctuating raw material prices and competition from alternative flooring solutions) influencing the growth of the concrete sealers market.

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and new product launches in the concrete sealers market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for concrete sealers across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global concrete sealers market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the concrete sealers market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY-SIDE ANALYSIS

- 2.4.2 DEMAND-SIDE ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CONCRETE SEALERS MARKET

- 4.2 CONCRETE SEALERS MARKET, BY REGION

- 4.3 ASIA PACIFIC: CONCRETE SEALERS MARKET, BY APPLICATION AND COUNTRY

- 4.4 REGIONAL ANALYSIS: CONCRETE SEALERS MARKET, BY TYPE

- 4.5 CONCRETE SEALERS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising global construction activities

- 5.2.1.2 Increasing demand for durable concrete solutions

- 5.2.1.3 Growing preference for decorative concrete surfaces

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial costs

- 5.2.2.2 Environmental concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for eco-friendly sealers

- 5.2.3.2 Growing market potential in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Fluctuating raw material prices

- 5.2.4.2 Competition from alternative flooring solutions

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GDP TRENDS AND FORECAST OF PROMINENT ECONOMIES

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION, 2023

- 6.2.2 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2030

- 6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Nanotechnology in concrete sealers

- 6.5.1.2 Silane & siloxane technology

- 6.5.2 COMPLIMENTARY TECHNOLOGIES

- 6.5.2.1 Self-healing coating

- 6.5.1 KEY TECHNOLOGIES

- 6.6 CASE STUDY ANALYSIS

- 6.6.1 ENHANCEMENT OF CONCRETE DURABILITY THROUGH SELF-HEALING TECHNOLOGY

- 6.6.2 ENHANCEMENT OF SUSTAINABILITY AND DURABILITY OF CEMENTITIOUS CONSTRUCTION MATERIALS THROUGH SURFACE COATINGS

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO (HS CODE 321490)

- 6.7.2 EXPORT SCENARIO (HS CODE 321490)

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8.2 REGULATORY FRAMEWORK

- 6.8.2.1 European Chemicals Agency (ECHA) Standards for Concrete Sealers

- 6.8.2.2 International Organization for Standardization (ISO) Standards for Concrete Sealers

- 6.8.2.3 EPA and Clean Air Act Standards for Concrete Sealers

- 6.9 KEY CONFERENCES AND EVENTS, 2025

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 DOCUMENT TYPES

- 6.11.3 TOP APPLICANTS

- 6.11.4 JURISDICTION ANALYSIS

- 6.12 IMPACT OF AI/GEN AI ON CONCRETE SEALERS MARKET

7 CONCRETE SEALERS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 WATER-BASED

- 7.2.1 INCREASING DEMAND FOR ECO-FRIENDLY, LOW-VOC CONSTRUCTION MATERIALS TO DRIVE MARKET

- 7.3 SOLVENT-BASED

- 7.3.1 HIGH DURABILITY AND SUPERIOR CHEMICAL RESISTANCE TO DRIVE ADOPTION

8 CONCRETE SEALERS MARKET, BY FUNCTION

- 8.1 INTRODUCTION

- 8.2 TOPICAL SEALERS

- 8.2.1 ACRYLIC SEALERS

- 8.2.1.1 Low VOC emissions and eco-friendliness to support adoption

- 8.2.2 POLYURETHANE SEALERS

- 8.2.2.1 Increased demand for chemical-resistant polyurethane sealers to drive market

- 8.2.3 EPOXY SEALERS

- 8.2.3.1 Exceptional strength and durability to propel adoption

- 8.2.1 ACRYLIC SEALERS

- 8.3 PENETRATING SEALERS

- 8.3.1 RISING DEMAND FOR LONG-LASTING PROTECTION IN CONSTRUCTION AND RENOVATION PROJECTS TO BOOST DEMAND

- 8.4 OTHER FUNCTIONS

9 CONCRETE SEALERS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 RESIDENTIAL

- 9.2.1 RISING RESIDENTIAL CONSTRUCTION TO DRIVE GROWTH

- 9.3 NON-RESIDENTIAL

- 9.3.1 INCREASED INVESTMENTS IN COMMERCIAL, INDUSTRIAL, AND PUBLIC INFRASTRUCTURE PROJECTS TO PROPEL MARKET

10 CONCRETE SEALERS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Accelerating industrial growth to drive market

- 10.2.2 INDIA

- 10.2.2.1 Expanding commercial construction sector to fuel market growth

- 10.2.3 JAPAN

- 10.2.3.1 Growing popularity of aesthetic concrete finishes to drive market

- 10.2.4 SOUTH KOREA

- 10.2.4.1 High-tech infrastructure growth to boost market

- 10.2.1 CHINA

- 10.3 NORTH AMERICA

- 10.3.1 US

- 10.3.1.1 Rising demand for decorative concrete to drive market

- 10.3.2 CANADA

- 10.3.2.1 Industrial expansion to support market growth

- 10.3.3 MEXICO

- 10.3.3.1 Infrastructure development & government investments to drive market

- 10.3.1 US

- 10.4 EUROPE

- 10.4.1 GERMANY

- 10.4.1.1 High demand for industrial flooring to boost demand

- 10.4.2 FRANCE

- 10.4.2.1 Eco-friendly building mandates to drive market

- 10.4.3 ITALY

- 10.4.3.1 Boom in luxury construction to boost market

- 10.4.4 UK

- 10.4.4.1 Growing investment in R&D to boost market growth

- 10.4.5 SPAIN

- 10.4.5.1 Revival of infrastructure projects to present immense opportunities

- 10.4.6 RUSSIA

- 10.4.6.1 Growing industrial sector to drive market

- 10.4.7 TURKEY

- 10.4.7.1 Growing tourism industry to drive market

- 10.4.1 GERMANY

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.5.1.1 UAE

- 10.5.1.1.1 Government policies and R&D investments to drive market

- 10.5.1.2 Saudi Arabia

- 10.5.1.2.1 Increasing government investments in construction and chemical manufacturing to drive market

- 10.5.1.3 Qatar

- 10.5.1.3.1 Increasing investments in smart cities, transport networks, and tourism-related infrastructure to propel market

- 10.5.1.1 UAE

- 10.5.2 IRAN

- 10.5.2.1 Significant increase in construction activity to drive market

- 10.5.3 SOUTH AFRICA

- 10.5.3.1 Significant demand for concrete sealers in building projects to boost market

- 10.5.1 GCC COUNTRIES

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Rising infrastructure projects to drive demand

- 10.6.2 ARGENTINA

- 10.6.2.1 Government infrastructure investments, urbanization, and foreign direct investments to drive market

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE ANALYSIS

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Function footprint

- 11.5.5.4 Type footprint

- 11.5.5.5 Application footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 11.6.5.1 Detailed list of key startups/SMES

- 11.6.5.2 Competitive benchmarking of key startups/SMEs

- 11.7 BRAND/PRODUCT COMPARISON ANALYSIS

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 DEALS

- 11.9.2 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 SIKA AG

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Services/Solutions offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 RPM INTERNATIONAL INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Services/Solutions offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 ARKEMA (BOSTIK)

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Services/Solutions offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 MAPEI S.P.A.

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.3.2 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 PPG INDUSTRIES, INC.

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses/Competitive threats

- 12.1.6 BASF SE

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 MnM view

- 12.1.6.3.1 Key strengths/Right to win

- 12.1.6.3.2 Strategic choices

- 12.1.6.3.3 Weaknesses/Competitive threats

- 12.1.7 PROSOCO

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.7.4 MnM view

- 12.1.7.4.1 Key strengths/Right to win

- 12.1.7.4.2 Strategic choices

- 12.1.7.4.3 Weaknesses/Competitive threats

- 12.1.8 WACKER CHEMIE AG

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Expansions

- 12.1.9 SHERWIN-WILLIAMS COMPANY (VALSPAR CORPORATION)

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.10 EVONIK INDUSTRIES AG

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Expansions

- 12.1.1 SIKA AG

- 12.2 OTHER PLAYERS

- 12.2.1 VEXCON CHEMICALS, INC. (CHEMMASTER)

- 12.2.2 CURECRETE DISTRIBUTION INC.

- 12.2.3 LATICRETE INTERNATIONAL, INC.

- 12.2.4 SAINT-GOBAIN S.A.

- 12.2.5 AKZONOBEL

- 12.2.6 DOW, INC.

- 12.2.7 HENKEL AG & CO. KGAA

- 12.2.8 DUPONT DE NEMOURS, INC.

- 12.2.9 H.B. FULLER

- 12.2.10 ARDEX

- 12.2.11 JOTUN

- 12.2.12 W. R. MEADOWS, INC.

- 12.2.13 FOSROC

- 12.2.14 CONCRETE SEALERS USA

- 12.2.15 SEALSOURCE INC.

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 POLISHED CONCRETE MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.3 POLISHED CONCRETE MARKET, BY REGION

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS