|

|

市場調査レポート

商品コード

1711376

ギ酸カリウムの世界市場:形態別、用途別、最終用途産業別、地域別 - 2030年までの予測Potassium Formate Market by Form (Liquid/Brine, Powder). Application (Deicing Agent, Drilling & Completion Fluids, Fertilizer Additives, Heat Transfer Fluids, Preservatives), End-Use Industry - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ギ酸カリウムの世界市場:形態別、用途別、最終用途産業別、地域別 - 2030年までの予測 |

|

出版日: 2025年04月03日

発行: MarketsandMarkets

ページ情報: 英文 228 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

ギ酸カリウムの市場規模は、2024年に7億7,000万米ドルとなりました。

同市場は、2024年から2030年にかけて6.0%のCAGRで拡大し、2030年には10億7,000万米ドルに達すると予測されています。高い溶解性、環境に優しい性質、非腐食性化合物などの特性によるものです。液体・塩水状のギ酸カリウムが優位を占める主な要因の1つは、石油・ガス産業で、特に高圧高温(HPHT)坑井や海洋掘削において、低腐食性・高密度の掘削・補完流体として広く使用されていることです。北米、ノルウェー、ロシアの大手エネルギー企業は、環境規制の強化と効率的な坑井安定ソリューションの必要性から、ギ酸カリウム塩水を採用しています。持続可能な除氷製品への世界の移行により、主に欧州と北米で液体ギ酸カリウムベースの除氷剤の使用が推進されており、自治体や政府は塩化物ベースの除氷剤を廃止しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(100万米ドル)、数量(KG) |

| セグメント別 | 形態別、用途別、最終用途産業別、地域別 |

| 対象地域 | 欧州、北米、アジア太平洋、中東・アフリカ、南米 |

ギ酸カリウム市場において、肥料添加剤用途は第3位の市場シェアを占めると予測されています。農業における低塩化物肥料の代替品としての使用が増加しており、歴史的なカリウムベースの肥料、例えば塩化カリウム(KCl)は土壌の塩類化と長期的な劣化を引き起こすため、農家と規制機関はギ酸カリウムのような低塩化物代替品への移行を推進しています。欧州連合(EU)のFarm to Fork戦略と、北米やアジア太平洋の厳しい肥料規制が、環境に優しい土壌改良剤の需要を押し上げています。ギ酸カリウムは、土壌の圧縮や塩分の蓄積を引き起こすことなくカリウム栄養を供給するため、果物や野菜、高品質の穀物などのデリケートな作物に最適です。また、溶解性が高いため、液体肥料や葉面散布剤への配合が容易で、養分の取り込みと収量を高めることができます。世界中で有機農業や持続可能な農業への関心が高まるにつれ、ギ酸カリウムは放出制御型肥料や精密農業の選択肢になりつつあります。

2024年から2029年の予測期間中、農業最終用途産業はギ酸カリウム市場の最終用途産業において3番目に高い市場シェアを持つと予測されます。ギ酸カリウムの需要が農業最終用途産業で高まっているのは、土壌の塩分濃度と栄養分の溶出を引き起こす塩化カリウム(KCl)のような従来のカリウム肥料とは異なり、ギ酸カリウムは塩分濃度を高めることなく重要なカリウム栄養を提供するため、野菜、果物、豆類、穀物のような繊細な園芸作物に適しているからです。世界的に持続可能な農業が重視される中、「農場から食卓へ(Farm to Fork)戦略」に基づく欧州連合(EU)や米国農務省(USDA)といった組織が、持続可能な農業に取り組んでいます。農務省(USDA)は有機肥料の使用を推進しており、これも需要を刺激しています。

アジア太平洋は、石油・ガス、農業、飲食品などの最終用途産業からの旺盛な需要がギ酸カリウムの原動力となっているため、ギ酸カリウム市場が最も急成長しています。この地域は、IFFCO(Indian Farmers Fertiliser Cooperative Limited)、Sinofert Holdings Limited、UPL Limitedといった大手農業製品メーカーが独占しており、様々な用途でギ酸カリウムを包括的に使用しています。アジア太平洋地域には、世界で最も人口の多いインドや中国などの主要国があり、農業需要が増加する傾向にあります。第二に、アジア太平洋には、Hangzhou Focus Chemical、Krishna Chemicalsなど、様々なギ酸カリウムメーカーがあります。

当レポートでは、世界のギ酸カリウム市場について調査し、形態別、用途別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- マクロ経済指標

- AI/生成AIがギ酸カリウム市場に与える影響

- バリューチェーン分析

- エコシステム分析

- ケーススタディ分析

- 規制状況

- 技術分析

- 顧客ビジネスに影響を与える動向/混乱

- 貿易分析

- 2025年~2026年の主な会議とイベント

- 価格分析

- 投資と資金調達のシナリオ

- 特許分析

第6章 ギ酸カリウム市場、形態別

- イントロダクション

- 液体/塩水

- 粉末

第7章 ギ酸カリウム市場、用途別

- イントロダクション

- 除氷剤

- 掘削および仕上げ流体

- 肥料添加物

- 熱伝達流体

- 防腐剤

- その他

第8章 ギ酸カリウム市場、最終用途産業

- イントロダクション

- 建設

- 石油・ガス

- 農業

- 工業

- 食品・飲料

- その他

第9章 ギ酸カリウム市場、地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- スペイン

- 英国

- イタリア

- その他

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価と財務指標

- ブランド/製品比較分析

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- PERSTORP HOLDING AB(PETRONAS CHEMICALS GROUP)

- CLARIANT

- EASTMAN CHEMICAL COMPANY

- TETRA TECHNOLOGIES, INC.

- ADDCON GMBH

- SLB(SCHLUMBERGER)

- HAWKINS

- HANGZHOU FOCUS CHEMICAL CO., LTD.

- ESSECO UK

- DYNALENE, INC.

- その他の企業

- XINJIANG GUOLIN NEW MATERIALS CO., LTD

- ATAMAN KIMYA

- AMERICAN ELEMENTS

- NACHURS ALPINE SOLUTIONS

- SHOUGUANG HENGTONG CHEMICAL CO., LTD.

- GLOBAL DRILLING FLUIDS & CHEMICALS LIMITED

- CHONGQING CHUANDONG CHEMICAL(GROUP)CO., LTD.

- SHANDONG ACID TECHNOLOGY CO., LTD.

- PROVIRON

- TOMIYAMA PURE CHEMICAL INDUSTRIES, LTD.

- DONGYING SHUNTONG CHEMICAL(GROUP)CO., LTD.

- WEST BENGAL CHEMICAL INDUSTRIES LIMITED

- PROCHEM, INC.

- GEOCON PRODUCTS

- KRISHNA CHEMICALS

第12章 付録

List of Tables

- TABLE 1 POTASSIUM FORMATE MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 ADVANTAGES AND DISADVANTAGES ASSOCIATED WITH ALTERNATIVES TO POTASSIUM FORMATE

- TABLE 3 POTASSIUM FORMATE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY (%)

- TABLE 5 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 6 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2021-2029 (%)

- TABLE 7 ROLES OF COMPANIES IN POTASSIUM FORMATE ECOSYSTEM

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 POTASSIUM FORMATE MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 INDICATIVE PRICING ANALYSIS OF POTASSIUM FORMATE OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024 (USD/KG)

- TABLE 12 TOTAL PATENT COUNT, 2014-2024

- TABLE 13 TOP 10 PATENT OWNERS, 2014-2024

- TABLE 14 POTASSIUM FORMATE MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 15 POTASSIUM FORMATE MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 16 POTASSIUM FORMATE MARKET, BY FORM, 2021-2024 (KT)

- TABLE 17 POTASSIUM FORMATE MARKET, BY FORM, 2025-2030 (KT)

- TABLE 18 POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 19 POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 20 POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 21 POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 22 POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 23 POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 24 POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2021-2024 (KT)

- TABLE 25 POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KT)

- TABLE 26 POTASSIUM FORMATE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 27 POTASSIUM FORMATE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 POTASSIUM FORMATE MARKET, BY REGION, 2021-2024 (KT)

- TABLE 29 POTASSIUM FORMATE MARKET, BY REGION, 2025-2030 (KT)

- TABLE 30 POTASSIUM FORMATE MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 31 POTASSIUM FORMATE MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 32 POTASSIUM FORMATE MARKET, BY FORM, 2021-2024 (KT)

- TABLE 33 POTASSIUM FORMATE MARKET, BY FORM, 2025-2030 (KT)

- TABLE 34 POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 35 POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 36 POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 37 POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 38 POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 39 POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 40 POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2021-2024 (KT)

- TABLE 41 POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KT)

- TABLE 42 NORTH AMERICA: POTASSIUM FORMATE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 43 NORTH AMERICA: POTASSIUM FORMATE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 44 NORTH AMERICA: POTASSIUM FORMATE MARKET, BY COUNTRY, 2021-2024 (KT)

- TABLE 45 NORTH AMERICA: POTASSIUM FORMATE MARKET, BY COUNTRY, 2025-2030 (KT)

- TABLE 46 NORTH AMERICA: POTASSIUM FORMATE MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 47 NORTH AMERICA: POTASSIUM FORMATE MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 48 NORTH AMERICA: POTASSIUM FORMATE MARKET, BY FORM, 2021-2024 (KT)

- TABLE 49 NORTH AMERICA: POTASSIUM FORMATE MARKET, BY FORM, 2025-2030 (KT)

- TABLE 50 NORTH AMERICA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 51 NORTH AMERICA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 52 NORTH AMERICA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 53 NORTH AMERICA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 54 NORTH AMERICA: POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 55 NORTH AMERICA: POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 56 NORTH AMERICA: POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2021-2024 (KT)

- TABLE 57 NORTH AMERICA: POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KT)

- TABLE 58 US: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 59 US: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 60 US: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 61 US: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 62 CANADA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 63 CANADA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 64 CANADA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 65 CANADA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 66 MEXICO: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 67 MEXICO: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 68 MEXICO: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 69 MEXICO: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 70 EUROPE: POTASSIUM FORMATE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 71 EUROPE: POTASSIUM FORMATE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 72 EUROPE: POTASSIUM FORMATE MARKET, BY COUNTRY, 2021-2024 (KT)

- TABLE 73 EUROPE: POTASSIUM FORMATE MARKET, BY COUNTRY, 2025-2030 (KT)

- TABLE 74 EUROPE: POTASSIUM FORMATE MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 75 EUROPE: POTASSIUM FORMATE MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 76 EUROPE: POTASSIUM FORMATE MARKET, BY FORM, 2021-2024 (KT)

- TABLE 77 EUROPE: POTASSIUM FORMATE MARKET, BY FORM, 2025-2030 (KT)

- TABLE 78 EUROPE: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 79 EUROPE: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 80 EUROPE: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 81 EUROPE: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 82 EUROPE: POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 83 EUROPE: POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 84 EUROPE: POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2021-2024 (KT)

- TABLE 85 EUROPE: POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KT)

- TABLE 86 GERMANY: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 87 GERMANY: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 88 GERMANY: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 89 GERMANY: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 90 FRANCE: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 91 FRANCE: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 92 FRANCE: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 93 FRANCE: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 94 SPAIN: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 95 SPAIN: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 96 SPAIN: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 97 SPAIN: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 98 UK: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 99 UK: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 100 UK: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 101 UK: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 102 ITALY: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 103 ITALY: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 104 ITALY: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 105 ITALY: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 106 REST OF EUROPE: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 107 REST OF EUROPE: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 108 REST OF EUROPE: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 109 REST OF EUROPE: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 110 ASIA PACIFIC: POTASSIUM FORMATE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 111 ASIA PACIFIC: POTASSIUM FORMATE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 112 ASIA PACIFIC: POTASSIUM FORMATE MARKET, BY COUNTRY, 2021-2024 (KT)

- TABLE 113 ASIA PACIFIC: POTASSIUM FORMATE MARKET, BY COUNTRY, 2025-2030 (KT)

- TABLE 114 ASIA PACIFIC: POTASSIUM FORMATE MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 115 ASIA PACIFIC: POTASSIUM FORMATE MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 116 ASIA PACIFIC: POTASSIUM FORMATE MARKET, BY FORM, 2021-2024 (KT)

- TABLE 117 ASIA PACIFIC: POTASSIUM FORMATE MARKET, BY FORM, 2025-2030 (KT)

- TABLE 118 ASIA PACIFIC: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 119 ASIA PACIFIC: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 120 ASIA PACIFIC: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 121 ASIA PACIFIC: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 122 ASIA PACIFIC: POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 123 ASIA PACIFIC: POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 124 ASIA PACIFIC: POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2021-2024 (KT)

- TABLE 125 ASIA PACIFIC: POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KT)

- TABLE 126 CHINA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 127 CHINA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 128 CHINA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 129 CHINA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 130 JAPAN: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 131 JAPAN: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 132 JAPAN: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 133 JAPAN: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 134 INDIA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 135 INDIA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 136 INDIA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 137 INDIA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 138 SOUTH KOREA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 139 SOUTH KOREA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 140 SOUTH KOREA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 141 SOUTH KOREA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 142 REST OF ASIA PACIFIC: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 143 REST OF ASIA PACIFIC: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 144 REST OF ASIA PACIFIC: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 145 REST OF ASIA PACIFIC: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 146 MIDDLE EAST & AFRICA: POTASSIUM FORMATE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: POTASSIUM FORMATE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: POTASSIUM FORMATE MARKET, BY COUNTRY, 2021-2024 (KT)

- TABLE 149 MIDDLE EAST & AFRICA: POTASSIUM FORMATE MARKET, BY COUNTRY, 2025-2030 (KT)

- TABLE 150 MIDDLE EAST & AFRICA: POTASSIUM FORMATE MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: POTASSIUM FORMATE MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: POTASSIUM FORMATE MARKET, BY FORM, 2021-2024 (KT)

- TABLE 153 MIDDLE EAST & AFRICA: POTASSIUM FORMATE MARKET, BY FORM, 2025-2030 (KT)

- TABLE 154 MIDDLE EAST & AFRICA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 157 MIDDLE EAST & AFRICA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 158 MIDDLE EAST & AFRICA: POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2021-2024 (KT)

- TABLE 161 MIDDLE EAST & AFRICA: POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KT)

- TABLE 162 SAUDI ARABIA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 163 SAUDI ARABIA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 164 SAUDI ARABIA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 165 SAUDI ARABIA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 166 REST OF GCC COUNTRIES: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 167 REST OF GCC COUNTRIES: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 168 REST OF GCC COUNTRIES: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 169 REST OF GCC COUNTRIES: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 170 SOUTH AFRICA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 171 SOUTH AFRICA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 172 SOUTH AFRICA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 173 SOUTH AFRICA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 174 REST OF MIDDLE EAST & AFRICA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 175 REST OF MIDDLE EAST & AFRICA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 176 REST OF MIDDLE EAST & AFRICA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 177 REST OF MIDDLE EAST & AFRICA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 178 SOUTH AMERICA: POTASSIUM FORMATE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 179 SOUTH AMERICA: POTASSIUM FORMATE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 180 SOUTH AMERICA: POTASSIUM FORMATE MARKET, BY COUNTRY, 2021-2024 (KT)

- TABLE 181 SOUTH AMERICA: POTASSIUM FORMATE MARKET, BY COUNTRY, 2025-2030 (KT)

- TABLE 182 SOUTH AMERICA: POTASSIUM FORMATE MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 183 SOUTH AMERICA: POTASSIUM FORMATE MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 184 SOUTH AMERICA: POTASSIUM FORMATE MARKET, BY FORM, 2021-2024 (KT)

- TABLE 185 SOUTH AMERICA: POTASSIUM FORMATE MARKET, BY FORM, 2025-2030 (KT)

- TABLE 186 SOUTH AMERICA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 187 SOUTH AMERICA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 188 SOUTH AMERICA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 189 SOUTH AMERICA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 190 SOUTH AMERICA: POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 191 SOUTH AMERICA: POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 192 SOUTH AMERICA: POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2021-2024 (KT)

- TABLE 193 SOUTH AMERICA: POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY, 2025-2030 (KT)

- TABLE 194 BRAZIL: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 195 BRAZIL: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 196 BRAZIL: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 197 BRAZIL: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 198 ARGENTINA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 199 ARGENTINA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 200 ARGENTINA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 201 ARGENTINA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 202 REST OF SOUTH AMERICA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 203 REST OF SOUTH AMERICA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 204 REST OF SOUTH AMERICA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2021-2024 (KT)

- TABLE 205 REST OF SOUTH AMERICA: POTASSIUM FORMATE MARKET, BY APPLICATION, 2025-2030 (KT)

- TABLE 206 POTASSIUM FORMATE MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS BETWEEN 2020 AND 2024

- TABLE 207 POTASSIUM FORMATE MARKET: DEGREE OF COMPETITION, 2023

- TABLE 208 POTASSIUM FORMATE MARKET: REGION FOOTPRINT

- TABLE 209 POTASSIUM FORMATE MARKET: FORM FOOTPRINT

- TABLE 210 POTASSIUM FORMATE MARKET: APPLICATION FOOTPRINT

- TABLE 211 POTASSIUM FORMATE MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 212 POTASSIUM FORMATE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 213 POTASSIUM FORMATE MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 214 POTASSIUM FORMATE MARKET: EXPANSIONS, JANUARY 2020-APRIL 2024

- TABLE 215 POTASSIUM FORMATE MARKET: DEALS, JANUARY 2020-APRIL 2024

- TABLE 216 PERSTORP HOLDING AB: COMPANY OVERVIEW

- TABLE 217 PERSTORP HOLDING AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 PERSTORP HOLDING AB: DEALS

- TABLE 219 PERSTORP HOLDING AB: OTHERS

- TABLE 220 CLARIANT: COMPANY OVERVIEW

- TABLE 221 CLARIANT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 CLARIANT: DEALS

- TABLE 223 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 224 EASTMAN CHEMICAL COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 EASTMAN CHEMICAL COMPANY: EXPANSIONS

- TABLE 226 TETRA TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 227 TETRA TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 ADDCON GMBH: COMPANY OVERVIEW

- TABLE 229 ADDCON GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 SLB (SCHLUMBERGER): COMPANY OVERVIEW

- TABLE 231 SLB (SCHLUMBERGER): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 HAWKINS: COMPANY OVERVIEW

- TABLE 233 HAWKINS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 HAWKINS: DEALS

- TABLE 235 HANGZHOU FOCUS CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 236 HANGZHOU FOCUS CHEMICAL CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 237 ESSECO UK: COMPANY OVERVIEW

- TABLE 238 ESSECO UK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 DYNALENE, INC.: COMPANY OVERVIEW

- TABLE 240 DYNALENE, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 XINJIANG GUOLIN NEW MATERIALS CO., LTD: COMPANY OVERVIEW

- TABLE 242 ATAMAN KIMYA: COMPANY OVERVIEW

- TABLE 243 AMERICAN ELEMENTS: COMPANY OVERVIEW

- TABLE 244 NACHURS ALPINE SOLUTIONS: COMPANY OVERVIEW

- TABLE 245 SHOUGUANG HENGTONG CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 246 GLOBAL DRILLING FLUIDS & CHEMICALS LIMITED: COMPANY OVERVIEW

- TABLE 247 CHONGQING CHUANDONG CHEMICAL (GROUP) CO., LTD.: COMPANY OVERVIEW

- TABLE 248 SHANDONG ACID TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 249 PROVIRON: COMPANY OVERVIEW

- TABLE 250 TOMIYAMA PURE CHEMICAL INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 251 DONGYING SHUNTONG CHEMICAL (GROUP) CO., LTD.: COMPANY OVERVIEW

- TABLE 252 WEST BENGAL CHEMICAL INDUSTRIES LIMITED: COMPANY OVERVIEW

- TABLE 253 PROCHEM, INC.: COMPANY OVERVIEW

- TABLE 254 GEOCON PRODUCTS: COMPANY OVERVIEW

- TABLE 255 KRISHNA CHEMICALS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 POTASSIUM FORMATE MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 POTASSIUM FORMATE MARKET: RESEARCH DESIGN

- FIGURE 3 POTASSIUM FORMATE MARKET: BOTTOM-UP APPROACH

- FIGURE 4 POTASSIUM FORMATE MARKET: TOP-DOWN APPROACH

- FIGURE 5 POTASSIUM FORMATE MARKET: DATA TRIANGULATION

- FIGURE 6 LIQUID/BRINE SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 7 DRILLING & COMPLETION FLUIDS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 8 INDUSTRIAL SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 INCREASING GLOBAL EMPHASIS ON SUSTAINABLE AND ECO-FRIENDLY SOLUTIONS TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 11 LIQUID/BRINE SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 12 DRILLING & COMPLETION FLUIDS SEGMENT TO HOLD LARGEST SHARE OF POTASSIUM FORMATE MARKET IN 2030

- FIGURE 13 INDUSTRIAL SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 CHINA AND SAUDI ARABIA TO EXHIBIT HIGHEST CAGRS DURING FORECAST PERIOD

- FIGURE 15 POTASSIUM FORMATE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 POTASSIUM FORMATE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- FIGURE 18 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 19 POTASSIUM FORMATE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 POTASSIUM FORMATE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 21 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 22 EXPORT DATA RELATED TO HS CODE 283421-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 23 IMPORT DATA RELATED TO HS CODE 283421-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 24 AVERAGE SELLING PRICE TREND OF POTASSIUM FORMATE, BY REGION, 2021-2030 (USD/KG)

- FIGURE 25 AVERAGE SELLING PRICE TREND OF POTASSIUM FORMATE, BY END-USE INDUSTRY, 2022-2030 (USD/KG)

- FIGURE 26 AVERAGE SELLING PRICE TREND OF POTASSIUM FORMATE OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024 (USD/KG)

- FIGURE 27 POTASSIUM FORMATE MARKET: INVESTMENT AND FUNDING SCENARIO, 2019-2023 (USD MILLION)

- FIGURE 28 TOTAL NUMBER OF PATENTS, 2014-2024

- FIGURE 29 NUMBER OF PATENTS YEAR-WISE, 2014-2024

- FIGURE 30 PATENT ANALYSIS, BY LEGAL STATUS, 2014-2024

- FIGURE 31 TOP JURISDICTION, BY DOCUMENT, 2014-2024

- FIGURE 32 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS, 2014-2024

- FIGURE 33 LIQUID/BRINE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2025

- FIGURE 34 DRILLING & COMPLETION FLUIDS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 35 OIL & GAS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 36 CHINA AND SAUDI ARABIA TO REGISTER HIGHEST CAGRS DURING FORECAST PERIOD

- FIGURE 37 NORTH AMERICA: POTASSIUM FORMATE MARKET SNAPSHOT

- FIGURE 38 EUROPE: POTASSIUM FORMATE MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: POTASSIUM FORMATE MARKET SNAPSHOT

- FIGURE 40 POTASSIUM FORMATE MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2021-2023 (USD BILLION)

- FIGURE 41 POTASSIUM FORMATE MARKET SHARE ANALYSIS, 2023

- FIGURE 42 POTASSIUM FORMATE MARKET: COMPANY VALUATION OF KEY PLAYERS, 2024 (USD BILLION)

- FIGURE 43 POTASSIUM FORMATE MARKET: FINANCIAL METRICS OF KEY COMPANIES, 2024

- FIGURE 44 POTASSIUM FORMATE MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 45 POTASSIUM FORMATE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 46 POTASSIUM FORMATE MARKET: COMPANY FOOTPRINT

- FIGURE 47 POTASSIUM FORMATE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 48 CLARIANT: COMPANY SNAPSHOT

- FIGURE 49 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 50 TETRA TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 51 SLB (SCHLUMBERGER): COMPANY SNAPSHOT

- FIGURE 52 HAWKINS: COMPANY SNAPSHOT

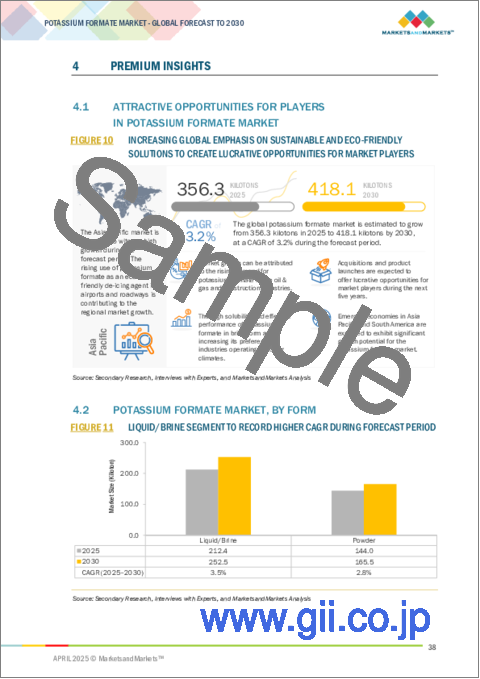

The potassium formate market is estimated at USD 0.77 billion in 2024 and is projected to reach USD 1.07 billion by 2030, at a CAGR of 6.0% from 2024 to 2030. Due to its properties such as high solubility, environmentally friendly nature, and non corrosive chemical compound. One of the key drivers for liquid/brine form potassium formate dominance is its extensive use in the oil & gas industry as a low-corrosive, high-density drilling and completion fluid, particularly in high-pressure, high-temperature (HPHT) wells and offshore drilling. Leading energy players in North America, Norway, and Russia are adopting potassium formate brines due to increasing environmental regulations and the need for efficient wellbore stability solutions. The worldwide move to sustainable deicing products has driven the use of liquid potassium formate-based deicers, predominantly in Europe and North America, where municipalities and governments are phasing out chloride-based deicers.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Million), Volume (KG) |

| Segments | By Form, By Application, By End-Use Industry, and By Region |

| Regions covered | Europe, North America, Asia Pacific, Middle East & Africa, and South America |

''In terms of value, fertilizer additives application accounted for the third largest share of the overall potassium formate market.''

Fertilizer additives application is projected to be the third largest market share holding application in the potassium formate market. The growing use as a alternative of low-chloride fertilizer in agriculture and historical potassium-based fertilizers, e.g., potassium chloride (KCl), cause soil salinization and long-term degradation, driving farmers and regulatory agencies toward low-salinity substitutes like potassium formate. The European Union Farm to Fork Strategy, together with stringent fertilizer regulations in North America and Asia Pacific region has driven the demand for environmentally friendly soil amendments. Potassium formate offers potassium nutrition without causing soil compaction and salt accumulation, thus being best suited for delicate crops like fruit, vegetables, and high-quality cereals. Its solubility is also high, which makes it easy to incorporate in liquid fertilizers and foliar sprays that enhance nutrient uptake and yields. As the world continues to develop interest in organic farming and sustainable agriculture, potassium formate is increasingly becoming the go-to option for controlled-release fertilizers and precision agriculture.

"During the forecast period, the potassium formate market in agriculture end use industry is projected to have third highest market share."

During the forecast period from 2024 to 2029, the agriculture end use industry is expected to have the third highest market share in end-use industry in the potassium formate market. The demand for potassium formate is rising in agriculture end use industry because unlike the conventional potassium fertilizers like potassium chloride (KCl) that cause soil salinity and nutrient leaching, potassium formate offers crucial potassium nutrition without building up salt levels, making it a suitable choice for sensitive horticultural crops like vegetables, fruits, pulses, and cereals. With the worldwide emphasis on sustainable agriculture, organizations like the European Union (EU) under the Farm to Fork Strategy and the United States. Department of Agriculture (USDA) are promoting the use of organic fertilizers, again stimulating demand.

"During the forecast period, the potassium formate market in Asia Pacific region is projected to be the third fastest growing region."

Asia Pacific is the fastest growing market for potassium formate because of its strong demand from oil & gas, agriculture & food & beverage end use industries, which is a driving factor for potassium formate. The region is dominated by large agricultural product manufacturers, IFFCO (Indian Farmers Fertiliser Cooperative Limited), Sinofert Holdings Limited, UPL Limited, which have comprehensive use of potassium formate in various applications. Asia Pacific region has major countries such as India, China which has highest population in the world, and which will tend to increase the demand for agricultural needs. Second, Asia Pacific region is home to various potassium formate manufacturers such as Hangzhou Focus Chemical Co., Ltd., Krishna Chemicals, and others.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type- Tier 1- 60%, Tier 2- 20%, and Tier 3- 20%

- By Designation- C Level- 33%, Director Level- 33%, and Managers- 34%

- By Region- North America- 20%, Europe- 25%, Asia Pacific- 25%, Middle East & Africa- 15%, and Latin America- 15%

The report provides a comprehensive analysis of company profiles:

Prominent companies Perstorp Holding AB (Sweden), Clariant (Switzerland), Thermo Fisher Scientific Inc (US), Eastman Chemical Company (US), Tetra Technologies Inc (US), ADDCON GmbH (Germany), Dynalene, Inc (US), Hawkins (US), American Elements (US), Hangzhou Focus Chemical Co., Ltd. (China), Xinjiang Guolin New Materials Co., Ltd (China), Esseco UK (UK), Nachurs Alpine Solutions (US), SLB (US), Shouguang Hengtong Chemical Co., Ltd., (China), Global Drilling Fluids And Chemicals Limited (India), Chongqing Chuandong Chemical (Group) Co., Ltd. (China), Shandong Acid Technology Co., Ltd (China), Proviron (Belgium), Tomiyama Pure Chemical Industries, Ltd. (Japan), Dongying Shuntong Chemical (Group) Co., Ltd. (China), West Bengal Chemical Industries Limited (India), ProChem, Inc. (US), Geocon Products (India), Krishna Chemicals (India).

Research Coverage

This research report categorizes the potassium formate market By Form (Liquid/Brine, Powder), By Application (Deicing Agent, Drilling & Completion Fluid, Heat Transfer Fluids, Fertilizer Additives, Preservatives, and Other Applications), End-Use Industry (Construction, Oil & Gas, Agriculture, Industrial, Food & Beverage, and Other End-use Industries), Region (North America, Europe, Asia Pacific, Middle East & Africa, and South America). The scope of the report includes detailed information about the major factors influencing the growth of the potassium formate market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted in order to provide insights into their business overview, solutions, and services, key strategies, contracts, partnerships, and agreements. Product launches, mergers and acquisitions, and recent developments in the potassium formate market are all covered. This report includes a competitive analysis of upcoming startups in the potassium formate market ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall potassium formate market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing demand for potassium formate in oil & gas end use industry, rising adoption in deicing application), restraints (High production cost, volatile raw material prices, competition from substitute products), opportunities (Agriculture sector growth, technological advancement in the potassium formate market), and challenges (limited awareness in emerging economies) influencing the growth of the potassium formate market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and service launches in the potassium formate market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the potassium formate market across varied regions.

- Market Diversification: Exhaustive information about services, untapped geographies, recent developments, and investments in the potassium formate market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Perstorp Holding AB (Sweden), Clariant (Switzerland), Thermo Fisher Scientific Inc (US), Eastman Chemical Company (US), Tetra Technologies Inc (US), ADDCON GmbH (Germany), Dynalene, Inc (US), Hawkins (US), American Elements (US), Hangzhou Focus Chemical Co., Ltd. (China), Xinjiang Guolin New Materials Co., Ltd (China), Esseco UK (UK), Nachurs Alpine Solutions (US), SLB (US), Shouguang Hengtong Chemical Co., Ltd., (China), Global Drilling Fluids And Chemicals Limited (India), Chongqing Chuandong Chemical (Group) Co., Ltd. (China), Shandong Acid Technology Co., Ltd (China), Proviron (Belgium), Tomiyama Pure Chemical Industries, Ltd. (Japan), Dongying Shuntong Chemical (Group) Co., Ltd. (China), West Bengal Chemical Industries Limited (India), ProChem, Inc. (US), Geocon Products (India), Krishna Chemicals (India), among others in the potassium formate market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 GROWTH RATE ASSUMPTIONS/FORECAST

- 2.5.1 SUPPLY SIDE

- 2.5.2 DEMAND SIDE

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN POTASSIUM FORMATE MARKET

- 4.2 POTASSIUM FORMATE MARKET, BY FORM

- 4.3 POTASSIUM FORMATE MARKET, BY APPLICATION

- 4.4 POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY

- 4.5 POTASSIUM FORMATE MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 High demand in oil & gas industry

- 5.2.1.2 Rising adoption for de-icing applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 High production cost

- 5.2.2.2 Volatile raw material prices

- 5.2.2.3 Competition from substitutes

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expanding agriculture industry

- 5.2.3.2 Technological advancements

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited awareness in emerging economies

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 BARGAINING POWER OF SUPPLIERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GLOBAL GDP TRENDS

- 5.6 IMPACT OF AI/GEN AI ON POTASSIUM FORMATE MARKET

- 5.7 VALUE CHAIN ANALYSIS

- 5.8 ECOSYSTEM ANALYSIS

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 ENSURING SEAL RESILIENCE: VISCOELASTIC EVALUATION OF ELASTOMERS IN POTASSIUM FORMATE ENVIRONMENTS

- 5.9.2 POTASSIUM FORMATE AS SUSTAINABLE INTERMEDIATE: OVERCOMING BARRIERS IN CO2 UTILIZATION FOR OXALATE PRODUCTION

- 5.9.3 ASSESSING POTASSIUM FORMATE'S IMPACT ON ALKALI-SILICA REACTION IN GRANITE AGGREGATE CONCRETE: STUDY ON DE-ICING EFFECTS AND MITIGATION

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATIONS

- 5.10.1.1 Europe

- 5.10.1.2 Asia Pacific

- 5.10.1.3 North America

- 5.10.2 STANDARDS

- 5.10.2.1 ISO 9001:2015

- 5.10.2.2 ISO 14001:2015

- 5.10.2.3 ISO 45001:2018

- 5.10.3 REGULATORY BODIES, GOVERNMENT BODIES, AND OTHER AGENCIES

- 5.10.1 REGULATIONS

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 Electrochemical CO2 reduction in potassium formate

- 5.11.1.2 Catalytic transfer hydrogenation

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 Dynamic mechanical analysis for material compatibility

- 5.11.2.2 Hybrid cooling systems

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 Cryo-electron microscopy for catalyst design

- 5.11.3.2 Nanozyme-assisted processing

- 5.11.1 KEY TECHNOLOGIES

- 5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.13 TRADE ANALYSIS

- 5.13.1 EXPORT SCENARIO (HS CODE 283421)

- 5.13.2 IMPORT SCENARIO (HS CODE 283421)

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 PRICING ANALYSIS

- 5.15.1 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2030

- 5.15.2 AVERAGE SELLING PRICE TREND, BY END-USE INDUSTRY, 2022-2030

- 5.15.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 5.16 INVESTMENT AND FUNDING SCENARIO

- 5.17 PATENT ANALYSIS

- 5.17.1 APPROACH

- 5.17.2 DOCUMENT TYPES

- 5.17.3 PUBLICATION TRENDS

- 5.17.4 INSIGHTS

- 5.17.5 LEGAL STATUS OF PATENTS

- 5.17.6 JURISDICTION ANALYSIS

- 5.17.7 TOP COMPANIES/APPLICANTS

- 5.17.8 TOP 10 PATENT OWNERS (US)

6 FORMATE MARKET, BY FORM

- 6.1 INTRODUCTION

- 6.2 LIQUID/BRINE

- 6.2.1 RISING PRODUCTION OF HIGHLY UNIFORM BRINES TO DRIVE DEMAND

- 6.3 POWDER

- 6.3.1 INCREASING DEMAND FOR ECO-FRIENDLY DE-ICING AGENTS, EFFICIENT DRILLING FLUIDS, AND SPECIALTY CHEMICALS TO FUEL DEMAND

7 POTASSIUM FORMATE MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 DE-ICING AGENTS

- 7.2.1 INCREASING DEMAND FOR DE-ICING APPLICATIONS DRIVEN BY UNIQUE PROPERTIES OF POTASSIUM FORMATE TO FUEL MARKET GROWTH

- 7.3 DRILLING & COMPLETION FLUIDS

- 7.3.1 RISING NEED FOR POTASSIUM FORMATE IN OIL & GAS INDUSTRY FOR DRILLING APPLICATIONS TO DRIVE MARKET

- 7.4 FERTILIZER ADDITIVES

- 7.4.1 GROWING REQUIREMENT FOR POTASSIUM FORMATE DUE TO HIGH POTASSIUM CONTENT TO DRIVE DEMAND

- 7.5 HEAT TRANSFER FLUIDS

- 7.5.1 HIGH THERMAL CONDUCTIVITY, LOW VISCOSITY, AND EXCELLENT FREEZE PROTECTION PROPERTIES TO PROPEL DEMAND

- 7.6 PRESERVATIVES

- 7.6.1 ANTIMICROBIAL PROPERTIES OF POTASSIUM FORMATE TO FUEL DEMAND

- 7.7 OTHER APPLICATIONS

8 POTASSIUM FORMATE MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 CONSTRUCTION

- 8.2.1 RISING DEMAND FOR POTASSIUM FORMATE-BASED CONCRETE ADMIXTURES AND DE-ICING SOLUTIONS TO DRIVE MARKET

- 8.3 OIL & GAS

- 8.3.1 HIGH-DENSITY AND LOW-VISCOSITY BRINE TO DRIVE DEMAND

- 8.4 AGRICULTURE

- 8.4.1 RISING USE AS FERTILIZER ADDITIVE AND SOIL AMENDMENT TO PROPEL MARKET

- 8.5 INDUSTRIAL

- 8.5.1 VERSATILE CHEMICAL PROPERTIES, HIGH SOLUBILITY, AND ECO-FRIENDLY NATURE TO FUEL DEMAND

- 8.6 FOOD & BEVERAGE

- 8.6.1 USE OF POTASSIUM FORMATE AS PRESERVATIVE AND PH REGULATOR TO DRIVE MARKET

- 8.7 OTHER END-USE INDUSTRIES

9 POTASSIUM FORMATE MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 US

- 9.2.1.1 Growing oil & gas industry to drive market

- 9.2.2 CANADA

- 9.2.2.1 Increasing demand for potassium formate as de-icing agent to propel market

- 9.2.3 MEXICO

- 9.2.3.1 Increased domestic energy production to drive demand

- 9.2.1 US

- 9.3 EUROPE

- 9.3.1 GERMANY

- 9.3.1.1 Rising municipal and aviation de-icing requirements to drive demand

- 9.3.2 FRANCE

- 9.3.2.1 Growing use of potassium formate in various industries to boost market

- 9.3.3 SPAIN

- 9.3.3.1 Rising demand in agriculture and industrial sectors to fuel market growth

- 9.3.4 UK

- 9.3.4.1 Increasing requirements from construction industry to propel market

- 9.3.5 ITALY

- 9.3.5.1 Ongoing government-led incentives to enhance building sustainability and digitalization to boost demand

- 9.3.6 REST OF EUROPE

- 9.3.1 GERMANY

- 9.4 ASIA PACIFIC

- 9.4.1 CHINA

- 9.4.1.1 High requirement for potassium formate in various end-use industries to drive demand

- 9.4.2 JAPAN

- 9.4.2.1 Rising use in construction industry to drive market

- 9.4.3 INDIA

- 9.4.3.1 High investments in agriculture and oil & gas industries to drive demand

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Strategic focus on agriculture and industrial sectors to drive market

- 9.4.5 REST OF ASIA PACIFIC

- 9.4.1 CHINA

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.5.1.1 Saudi Arabia

- 9.5.1.1.1 Growing commitment to sustainability and environmental management to fuel market growth

- 9.5.1.2 Rest of GCC countries

- 9.5.1.1 Saudi Arabia

- 9.5.2 SOUTH AFRICA

- 9.5.2.1 Increasing use in industrial and agriculture sectors to drive market

- 9.5.3 REST OF MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.6 SOUTH AMERICA

- 9.6.1 BRAZIL

- 9.6.1.1 Increased investments in oil & gas industry to drive market

- 9.6.2 ARGENTINA

- 9.6.2.1 Expanding oil & gas industry to propel market

- 9.6.3 REST OF SOUTH AMERICA

- 9.6.1 BRAZIL

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON ANALYSIS

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Form footprint

- 10.7.5.4 Application footprint

- 10.7.5.5 End-use industry footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2023

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 EXPANSIONS

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 PERSTORP HOLDING AB (PETRONAS CHEMICALS GROUP)

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Deals

- 11.1.1.3.2 Others

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths/Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses/Competitive threats

- 11.1.2 CLARIANT

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths/Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses/Competitive threats

- 11.1.3 EASTMAN CHEMICAL COMPANY

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths/Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses/Competitive threats

- 11.1.4 TETRA TECHNOLOGIES, INC.

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 MnM view

- 11.1.4.3.1 Key strengths/Right to win

- 11.1.4.3.2 Strategic choices

- 11.1.4.3.3 Weaknesses/Competitive threats

- 11.1.5 ADDCON GMBH

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Key strengths/Right to win

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses/Competitive threats

- 11.1.6 SLB (SCHLUMBERGER)

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 MnM view

- 11.1.7 HAWKINS

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.7.4 MnM view

- 11.1.8 HANGZHOU FOCUS CHEMICAL CO., LTD.

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 MnM view

- 11.1.9 ESSECO UK

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 MnM view

- 11.1.10 DYNALENE, INC.

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 MnM view

- 11.1.1 PERSTORP HOLDING AB (PETRONAS CHEMICALS GROUP)

- 11.2 OTHER PLAYERS

- 11.2.1 XINJIANG GUOLIN NEW MATERIALS CO., LTD

- 11.2.2 ATAMAN KIMYA

- 11.2.3 AMERICAN ELEMENTS

- 11.2.4 NACHURS ALPINE SOLUTIONS

- 11.2.5 SHOUGUANG HENGTONG CHEMICAL CO., LTD.

- 11.2.6 GLOBAL DRILLING FLUIDS & CHEMICALS LIMITED

- 11.2.7 CHONGQING CHUANDONG CHEMICAL (GROUP) CO., LTD.

- 11.2.8 SHANDONG ACID TECHNOLOGY CO., LTD.

- 11.2.9 PROVIRON

- 11.2.10 TOMIYAMA PURE CHEMICAL INDUSTRIES, LTD.

- 11.2.11 DONGYING SHUNTONG CHEMICAL (GROUP) CO., LTD.

- 11.2.12 WEST BENGAL CHEMICAL INDUSTRIES LIMITED

- 11.2.13 PROCHEM, INC.

- 11.2.14 GEOCON PRODUCTS

- 11.2.15 KRISHNA CHEMICALS

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS