|

|

市場調査レポート

商品コード

1698625

高機能添加剤の世界市場 (~2029年):製品タイプ (安定剤・充填剤・加硫剤・軟化剤・樹脂)・機能 (機能添加剤・加工添加剤)・エンドユーザー産業 (自動車・医療) 別High-performance Additives Market by Product Type (Stabilizers, Fillers, Vulcanization Agents, Softeners, Resin), Function(Performance Additives, Processing Additives) End-Use Industry (Automotive, Medical) - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 高機能添加剤の世界市場 (~2029年):製品タイプ (安定剤・充填剤・加硫剤・軟化剤・樹脂)・機能 (機能添加剤・加工添加剤)・エンドユーザー産業 (自動車・医療) 別 |

|

出版日: 2025年04月02日

発行: MarketsandMarkets

ページ情報: 英文 280 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

高機能添加剤の市場規模は、2024年の140億2,000万米ドルから、予測期間中はCAGR 7.5%で推移し、2029年には201億1,000万米ドルに成長すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 単位 | 金額 (米ドル) |

| セグメント | 製品タイプ・機能・エンドユーザー産業・地域 |

| 対象地域 | アジア太平洋・北米・欧州・中東&アフリカ・南米 |

製品の性能、寿命、持続可能性の向上に対する産業界のニーズが高まっているため、機能添加剤の需要が拡大しています。高機能添加剤は、自動車、医療、建築、エレクトロニクスの各産業でよく利用されており、強度、熱安定性、耐薬品性、加工性といった材料の特性を高めるために使用されています。製造業者が廃棄物の最小化を目指す中、高機能添加剤は、より軽く、より強く、より耐久性のある製品の製造を促進し、エネルギー効率の向上につながります。また、分散性の向上、粘度の低下、さまざまな基材との相溶性の改善など、加工能力の向上も需要の原動力となっています。

"製品タイプ別では、安定剤がもっとも急成長しています"

耐熱性、耐紫外線性、耐酸化性、耐環境劣化性を備えた材料への要求が高まっているため、安定剤がもっとも急成長しています。安定剤は、時間の経過を経ても構造的完全性、色彩安定性、機械的強度を維持するため、材料の寿命を延ばすために重要です。これらの安定剤は、熱分解、酸化ストレス、光劣化を阻止する上で極めて重要であり、これらはすべて材料の強度と効果の低下につながります。もっとも頻繁に使用される安定剤は、熱安定剤、紫外線安定剤、酸化防止剤で、それぞれ特定のタイプの劣化から素材を保護する役割を担っています。高性能ポリマー、高度なコーティング、特殊複合材料に対する要求がますます高まる中、製品の品質と長寿命性能を維持するために安定性に対するニーズが高まっています。材料がより洗練され多機能になるにつれ、熱、湿度、紫外線などの環境条件によるダメージに対する脆弱性も増しています。安定剤は、こうしたリスクを最小限に抑え、素材が本来の特性、色、強度を維持できるようにします。

"機能別では、もっとも急成長しているのは機能添加剤です"

産業界では製品効率の向上、持続可能性、法規制への適合に対する要求が高まっているため、機能添加剤がもっとも急成長しています。同添加剤は自動車や医療などの産業において、耐久性、熱安定性、耐食性、機械的特性を向上させます。

軽量素材、高性能ポリマー、高度なコーティングへと産業が変化する中、酸化防止剤、紫外線安定剤、レオロジー調整剤などの機能添加剤は、製品の機能性と寿命を向上させるために必須となってきています。研究開発への投資の拡大により、企業は持続可能性への取り組みを支援しながら、特定の機能要求をターゲットとする次世代機能添加剤の創出に向けて取り組んでいます。優れた、長持ちする、持続可能な素材へのニーズの高まりは、今後も機能添加剤の成長を促進すると思われます。

”エンドユーザー産業別では、自動車部門がもっとも急成長しています"

自動車の性能、耐久性、効率を向上させる先端材料へのニーズが高まっていることから、自動車部門はもっとも急成長しています。高機能添加剤は、特にタイヤ、潤滑剤、コーティング剤、プラスチックなど、自動車製品の品質向上に不可欠です。シリカ、オゾン防止剤、酸化防止剤などのタイヤ製造用添加剤は、グリップ力、燃費効率、耐摩耗性を向上させ、環境に優しく高性能なタイヤに対する需要の高まりに対応しています。EVの需要は、専用添加剤の需要の伸びをさらに加速させています。EVは、より大きなトルクの結果として、転がり抵抗の低減とタイヤの耐久性の向上を要求するからです。さらに、排出ガスの削減と燃費の向上を求める厳しい環境法も、高機能添加剤でアップグレードされた軽量素材の使用をメーカーに促しています。

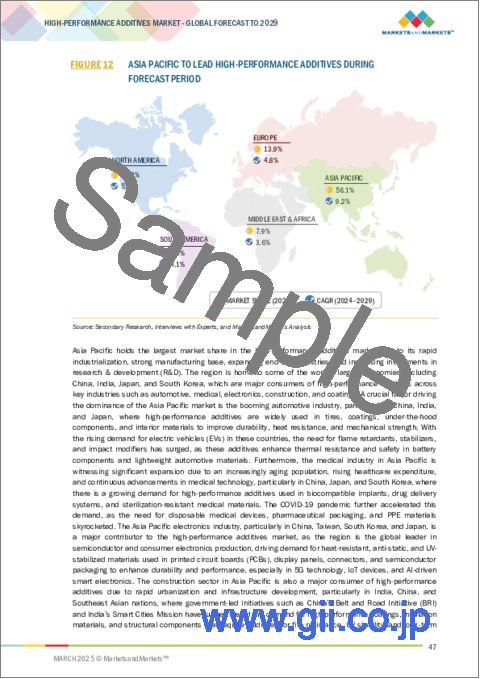

”アジア太平洋地域が最速成長の市場です"

アジア太平洋地域は、産業基盤の急成長、製造業からの高い需要、大規模なインフラ成長により、高機能添加剤のもっとも急成長している市場です。中国、インド、日本、韓国は、材料の強度、耐久性、効率を向上させる高機能添加剤を必要とする自動車や医療などの分野で世界のリーダーとして台頭しています。特に自動車産業は主要な促進要因であり、アジア太平洋地域には世界最大級の自動車メーカーやタイヤメーカーがあります。高性能タイヤの製造が伸びているため、タイヤの耐久性、耐熱性、転がり効率を高める加工助剤、オゾン防止剤、強化充填剤などの添加剤製品に対する需要が高まっています。自動車以外では、医療への投資の増加や、手術用・医療用手袋の需要増加など、医療業界も市場成長を牽引しています。

当レポートでは、世界の高機能添加剤の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 生成AIの影響

- 高機能添加剤市場へのAIの影響

第6章 業界動向

- 顧客ビジネスに影響を与える動向/ディスラプション

- バリューチェーン分析

- 価格分析

- 投資と資金調達のシナリオ

- エコシステム分析

- バイヤーサプライヤー分析

- 技術分析

- プラスチック添加剤の顧客分析

- 特許分析

- 貿易分析

- 主な会議とイベント

- 関税と規制状況

- ポーターのファイブフォース分析

- 主要なステークホルダーと購入基準

- マクロ経済見通し

- ケーススタディ分析

第7章 高機能添加剤市場:製品タイプ別

- ソフナー

- 安定剤

- 加硫剤

- 樹脂

- フィラー

- その他

第8章 高機能添加剤市場:機能別

- 機能添加剤

- 加工添加剤

第9章 高機能添加剤市場:エンドユーザー産業別

- 医療

- 自動車

- タイヤ

- その他

- その他

- 塗料・コーティング

- 電子機器および電気部品

- プラスチック

- 建設

第10章 高機能添加剤市場:地域別

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- イタリア

- フランス

- 英国

- スペイン

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他

- 南米

- アルゼンチン

- ブラジル

- その他

第11章 競合情勢

- 主要参入企業の戦略/強み

- 市場シェア分析

- 上位5社の収益分析

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- ブランド比較

- 企業評価と財務指標

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- BASF

- CLARIANT

- EVONIK INDUSTRIES AG

- LANXESS

- ARKEMA

- AVIENT CORPORATION

- SOLVAY

- SABIC

- SYNTHOMER PLC

- CABOT CORPORATION

- SI GROUP, INC.

- その他の企業

- KEMIPEX

- FLEXSYS

- OTSUKA CHEMICAL CO., LTD.

- KRATON CORPORATION

- CHINA SUNSINE CHEMICAL HOLDINGS

- SONGWON

- TAIZHOU LIANCHENG NEW MATERIAL CO., LTD.

- BEHN MEYER

- AVANZARE INNOVACION TECNOLOGICA S.L.

- SHENYANG SUNNYJOINT CHEMICALS CO., LTD

- ALLNEX GMBH

- SHANDONG STAIR CHEMICAL & TECHNOLOGY CO., LTD.

- KEMAI CHEMICAL CO., LTD.

- NINGBO ACTMIX RUBBER CHEMICALS CO., LTD.

- VENNOK

第13章 付録

List of Tables

- TABLE 1 AVERAGE SELLING PRICE TREND OF HIGH-PERFORMANCE ADDITIVES, BY REGION, 2021-2024 (USD/KILOTON)

- TABLE 2 AVERAGE SELLING PRICE TREND, BY PRODUCT TYPE, 2021-2024 (USD/KILOTON)

- TABLE 3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PRODUCT TYPE, 2021-2024 (USD/KILOTON)

- TABLE 4 HIGH-PERFORMANCE ADDITIVES MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 5 KEY TECHNOLOGIES IN HIGH-PERFORMANCE ADDITIVES MARKET

- TABLE 6 COMPLEMENTARY TECHNOLOGIES IN HIGH-PERFORMANCE ADDITIVES MARKET

- TABLE 7 ADJACENT TECHNOLOGIES IN HIGH-PERFORMANCE ADDITIVES MARKET

- TABLE 8 CUSTOMER ANALYSIS IN PLASTIC ADDITIVES MARKET

- TABLE 9 HIGH-PERFORMANCE ADDITIVES MARKET: TOTAL NUMBER OF PATENTS

- TABLE 10 HIGH-PERFORMANCE ADDITIVES MARKET: LIST OF MAJOR PATENT OWNERS

- TABLE 11 HIGH-PERFORMANCE ADDITIVES MARKET: LIST OF MAJOR PATENTS, 2018-2024

- TABLE 12 HIGH-PERFORMANCE ADDITIVES MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 13 TARIFF-RELATED TO HIGH-PERFORMANCE ADDITIVES

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 REGULATIONS FOR PLAYERS IN HIGH-PERFORMANCE ADDITIVES MARKET

- TABLE 20 HIGH-PERFORMANCE ADDITIVES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- TABLE 22 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 23 GDP TRENDS AND FORECASTS, BY COUNTRY, 2023-2025 (USD MILLION)

- TABLE 24 HIGH-PERFORMANCE ADDITIVES MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

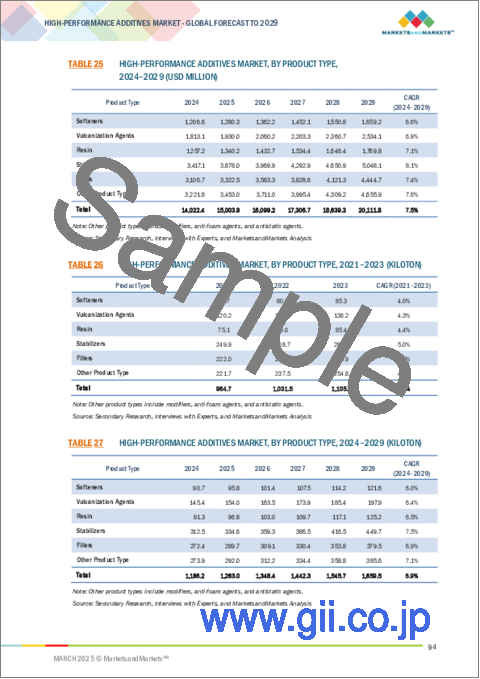

- TABLE 25 HIGH-PERFORMANCE ADDITIVES MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 26 HIGH-PERFORMANCE ADDITIVES MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 27 HIGH-PERFORMANCE ADDITIVES MARKET, BY PRODUCT TYPE, 2024-2029 (KILOTON)

- TABLE 28 HIGH-PERFORMANCE ADDITIVES MARKET, BY, 2021-2023 (USD MILLION)

- TABLE 29 HIGH-PERFORMANCE ADDITIVES MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 30 HIGH-PERFORMANCE ADDITIVES MARKET, BY FUNCTION, 2021-2023 (KILOTON)

- TABLE 31 HIGH-PERFORMANCE ADDITIVES MARKET, BY FUNCTION, 2024-2029 (KILOTON)

- TABLE 32 HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 33 HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 34 HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 35 HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 36 HIGH-PERFORMANCE ADDITIVES MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 37 HIGH-PERFORMANCE ADDITIVES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 38 HIGH-PERFORMANCE ADDITIVES MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 39 HIGH-PERFORMANCE ADDITIVES MARKET, BY REGION, 2024-2029 (KILOTON)

- TABLE 40 ASIA PACIFIC: HIGH-PERFORMANCE ADDITIVES MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 41 ASIA PACIFIC: HIGH-PERFORMANCE ADDITIVES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 42 ASIA PACIFIC: HIGH-PERFORMANCE ADDITIVES MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 43 ASIA PACIFIC: HIGH-PERFORMANCE ADDITIVES MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 44 ASIA PACIFIC: HIGH-PERFORMANCE ADDITIVES MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 45 ASIA PACIFIC: HIGH-PERFORMANCE ADDITIVES MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 46 ASIA PACIFIC: HIGH-PERFORMANCE ADDITIVES MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 47 ASIA PACIFIC: HIGH-PERFORMANCE ADDITIVES MARKET, BY PRODUCT TYPE, 2024-2029 (KILOTON)

- TABLE 48 ASIA PACIFIC: HIGH-PERFORMANCE ADDITIVES MARKET, FUNCTION, 2021-2023 (USD MILLION)

- TABLE 49 ASIA PACIFIC: HIGH-PERFORMANCE ADDITIVES MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 50 ASIA PACIFIC: HIGH-PERFORMANCE ADDITIVES MARKET, FUNCTION, 2021-2023 (KILOTON)

- TABLE 51 ASIA PACIFIC: HIGH-PERFORMANCE ADDITIVES MARKET, BY FUNCTION, 2024-2029 (KILOTON)

- TABLE 52 ASIA PACIFIC: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 53 ASIA PACIFIC: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 54 ASIA PACIFIC: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 55 ASIA PACIFIC: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 56 CHINA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 57 CHINA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 58 CHINA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 59 CHINA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 60 JAPAN: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 61 JAPAN: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 62 JAPAN: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 63 JAPAN: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 64 INDIA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 65 INDIA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 66 INDIA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 67 INDIA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 68 SOUTH KOREA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 69 SOUTH KOREA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 70 SOUTH KOREA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 71 SOUTH KOREA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 72 REST OF ASIA PACIFIC: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 73 REST OF ASIA PACIFIC: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 74 REST OF ASIA PACIFIC: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 75 REST OF ASIA PACIFIC: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 76 NORTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 77 NORTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 78 NORTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 79 NORTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 80 NORTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 81 NORTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 82 NORTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 83 NORTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY PRODUCT TYPE, 2024-2029 (KILOTON)

- TABLE 84 NORTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, FUNCTION, 2021-2023 (USD MILLION)

- TABLE 85 NORTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 86 NORTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, FUNCTION, 2021-2023 (KILOTON)

- TABLE 87 NORTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY FUNCTION, 2024-2029 (KILOTON)

- TABLE 88 NORTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 89 NORTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 90 NORTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 91 NORTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 92 US: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 93 US: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 94 US: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 95 US: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 96 CANADA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 97 CANADA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 98 CANADA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 99 CANADA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 100 MEXICO: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 101 MEXICO: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 102 MEXICO: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 103 MEXICO: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 104 EUROPE: HIGH-PERFORMANCE ADDITIVES MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 105 EUROPE: HIGH-PERFORMANCE ADDITIVES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 106 EUROPE: HIGH-PERFORMANCE ADDITIVES MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 107 EUROPE: HIGH-PERFORMANCE ADDITIVES MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 108 EUROPE: HIGH-PERFORMANCE ADDITIVES MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 109 EUROPE: HIGH-PERFORMANCE ADDITIVES MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 110 EUROPE: HIGH-PERFORMANCE ADDITIVES MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 111 EUROPE: HIGH-PERFORMANCE ADDITIVES MARKET, BY PRODUCT TYPE, 2024-2029 (KILOTON)

- TABLE 112 EUROPE: HIGH-PERFORMANCE ADDITIVES MARKET, FUNCTION, 2021-2023 (USD MILLION)

- TABLE 113 EUROPE: HIGH-PERFORMANCE ADDITIVES MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 114 EUROPE: HIGH-PERFORMANCE ADDITIVES MARKET, FUNCTION, 2021-2023 (KILOTON)

- TABLE 115 EUROPE: HIGH-PERFORMANCE ADDITIVES MARKET, BY FUNCTION, 2024-2029 (KILOTON)

- TABLE 116 EUROPE: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 117 EUROPE: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 118 EUROPE: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 119 EUROPE: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 120 GERMANY: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 121 GERMANY: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 122 GERMANY: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 123 GERMANY: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 124 ITALY: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 125 ITALY: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 126 ITALY: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 127 ITALY: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 128 FRANCE: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 129 FRANCE: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 130 FRANCE: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 131 FRANCE: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 132 UK: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 133 UK: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 134 UK: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 135 UK: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 136 SPAIN: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 137 SPAIN: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 138 SPAIN: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 139 SPAIN: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 140 REST OF EUROPE: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 141 REST OF EUROPE: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 142 REST OF EUROPE: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 143 REST OF EUROPE: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 144 MIDDLE EAST & AFRICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 147 MIDDLE EAST & AFRICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 148 MIDDLE EAST & AFRICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 151 MIDDLE EAST & AFRICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY PRODUCT TYPE, 2024-2029 (KILOTON)

- TABLE 152 MIDDLE EAST & AFRICA: HIGH-PERFORMANCE ADDITIVES MARKET, FUNCTION, 2021-2023 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: HIGH-PERFORMANCE ADDITIVES MARKET, FUNCTION, 2021-2023 (KILOTON)

- TABLE 155 MIDDLE EAST & AFRICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY FUNCTION, 2024-2029 (KILOTON)

- TABLE 156 MIDDLE EAST & AFRICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 159 MIDDLE EAST & AFRICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 160 SAUDI ARABIA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 161 SAUDI ARABIA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 162 SAUDI ARABIA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 163 SAUDI ARABIA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 164 UAE: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 165 UAE: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 166 UAE: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 167 UAE: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 168 REST OF GCC COUNTRIES: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 169 REST OF GCC COUNTRIES: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 170 REST OF GCC COUNTRIES: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 171 REST OF GCC COUNTRIES: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 172 SOUTH AFRICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 173 SOUTH AFRICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 174 SOUTH AFRICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 175 SOUTH AFRICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 176 REST OF MIDDLE EAST & AFRICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 177 REST OF MIDDLE EAST & AFRICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 178 REST OF MIDDLE EAST & AFRICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 179 REST OF MIDDLE EAST & AFRICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 180 SOUTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 181 SOUTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 182 SOUTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 183 SOUTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 184 SOUTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 185 SOUTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 186 SOUTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 187 SOUTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY PRODUCT TYPE, 2024-2029 (KILOTON)

- TABLE 188 SOUTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, FUNCTION, 2021-2023 (USD MILLION)

- TABLE 189 SOUTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 190 SOUTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, FUNCTION, 2021-2023 (KILOTON)

- TABLE 191 SOUTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY FUNCTION, 2024-2029 (KILOTON)

- TABLE 192 SOUTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 193 SOUTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 194 SOUTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 195 SOUTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 196 ARGENTINA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 197 ARGENTINA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 198 ARGENTINA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 199 ARGENTINA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 200 BRAZIL: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 201 BRAZIL: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 202 BRAZIL: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 203 BRAZIL: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 204 REST OF SOUTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 205 REST OF SOUTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 206 REST OF SOUTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 207 REST OF SOUTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 208 OVERVIEW OF STRATEGIES ADOPTED BY KEY HIGH-PERFORMANCE ADDITIVE MANUFACTURERS

- TABLE 209 HIGH-PERFORMANCE ADDITIVES MARKET: DEGREE OF COMPETITION

- TABLE 210 HIGH-PERFORMANCE ADDITIVES MARKET: REGION FOOTPRINT

- TABLE 211 HIGH-PERFORMANCE ADDITIVES MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 212 HIGH-PERFORMANCE ADDITIVES: FUNCTION FOOTPRINT

- TABLE 213 HIGH-PERFORMANCE ADDITIVES MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 214 HIGH-PERFORMANCE ADDITIVES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 215 HIGH-PERFORMANCE ADDITIVES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 216 HIGH-PERFORMANCE ADDITIVES MARKET: PRODUCT LAUNCHES, JANUARY 2020-FEBRUARY 2025

- TABLE 217 HIGH-PERFORMANCE ADDITIVES MARKET: DEALS, JANUARY 2020-FEBRUARY 2025

- TABLE 218 HIGH-PERFORMANCE ADDITIVES MARKET: EXPANSIONS, JANUARY 2020-FEBRUARY 2025

- TABLE 219 HIGH-PERFORMANCE ADDITIVES MARKET: OTHER DEVELOPMENTS, JANUARY 2020-FEBRUARY 2025

- TABLE 220 BASF: COMPANY OVERVIEW

- TABLE 221 BASF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 BASF: PRODUCT LAUNCHES, JANUARY 2020-FEBRUARY 2025

- TABLE 223 BASF: EXPANSIONS, JANUARY 2020-FEBRUARY 2025

- TABLE 224 BASF: OTHERS, JANUARY 2020-FEBRUARY 2025

- TABLE 225 CLARIANT: COMPANY OVERVIEW

- TABLE 226 CLARIANT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 CLARIANT: PRODUCT LAUNCHES, JANUARY 2020-FEBRUARY 2025

- TABLE 228 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- TABLE 229 EVONIK INDUSTRIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 EVONIK INDUSTRIES AG: DEALS, JANUARY 2020-FEBRUARY 2025

- TABLE 231 EVONIK INDUSTRIES AG: EXPANSIONS, JANUARY 2020-FEBRUARY 2025

- TABLE 232 LANXESS: COMPANY OVERVIEW

- TABLE 233 LANXESS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 LANXESS: PRODUCT LAUNCHES, JANUARY 2020-FEBRUARY 2025

- TABLE 235 ARKEMA: COMPANY OVERVIEW

- TABLE 236 ARKEMA: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 237 ARKEMA: OTHERS, JANUARY 2020-FEBRUARY 2025

- TABLE 238 AVIENT CORPORATION: COMPANY OVERVIEW

- TABLE 239 AVIENT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 AVIENT CORPORATION: OTHERS, JANUARY 2020-FEBRUARY 2025

- TABLE 241 SOLVAY: COMPANY OVERVIEW

- TABLE 242 SOLVAY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 SOLVAY: DEALS, JANUARY 2020-FEBRUARY 2025

- TABLE 244 SOLVAY: EXPANSIONS, JANUARY 2020-FEBRUARY 2025

- TABLE 245 SABIC: COMPANY OVERVIEW

- TABLE 246 SABIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 SYNTHOMER PLC: COMPANY OVERVIEW

- TABLE 248 SYNTHOMER PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 SYNTHOMER PLC: DEALS, JANUARY 2020-FEBRUARY 2025

- TABLE 250 CABOT CORPORATION: COMPANY OVERVIEW

- TABLE 251 CABOT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 CABOT CORPORATION: PRODUCT LAUNCHES, JANUARY 2020-FEBRUARY 2025

- TABLE 253 CABOT CORPORATION: EXPANSIONS, JANUARY 2020-FEBRUARY 2025

- TABLE 254 SI GROUP, INC.: COMPANY OVERVIEW

- TABLE 255 SI GROUP, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 SI GROUP, INC.: PRODUCT LAUNCHES, JANUARY 2020- FEBRUARY 2025

- TABLE 257 SI GROUP, INC.: EXPANSIONS, JANUARY 2020- FEBRUARY 2025

- TABLE 258 SI GROUP, INC.: OTHERS, JANUARY 2020- FEBRUARY 2025

- TABLE 259 KEMIPEX: COMPANY OVERVIEW

- TABLE 260 FLEXSYS: COMPANY OVERVIEW

- TABLE 261 OTSUKA CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 262 KRATON CORPORATION: COMPANY OVERVIEW

- TABLE 263 CHINA SUNSINE CHEMICAL HOLDINGS: COMPANY OVERVIEW

- TABLE 264 SONGWON: COMPANY OVERVIEW

- TABLE 265 TAIZHOU LIANCHENG NEW MATERIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 266 BEHN MEYER: COMPANY OVERVIEW

- TABLE 267 AVANZARE INNOVACION TECNOLOGICA S.L.: COMPANY OVERVIEW

- TABLE 268 SHENYANG SUNNYJOINT CHEMICALS CO., LTD: COMPANY OVERVIEW

- TABLE 269 ALLNEX GMBH: COMPANY OVERVIEW

- TABLE 270 SHANDONG STAIR CHEMICAL & TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 271 KEMAI CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 272 NINGBO ACTMIX RUBBER CHEMICALS CO., LTD.: COMPANY OVERVIEW

- TABLE 273 VENNOK: COMPANY OVERVIEW

List of Figures

- FIGURE 1 HIGH-PERFORMANCE ADDITIVES MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 HIGH-PERFORMANCE ADDITIVES MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 HIGH-PERFORMANCE ADDITIVES MARKET: DATA TRIANGULATION

- FIGURE 9 PERFORMANCE ADDITIVES FUNCTION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 STABILIZERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 AUTOMOTIVE END-USE INDUSTRY SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO LEAD HIGH-PERFORMANCE ADDITIVES DURING FORECAST PERIOD

- FIGURE 13 MARKET GROWTH DUE TO ADVANCED MATERIALS ACROSS HIGH-GROWTH INDUSTRIES SUCH AS AUTOMOTIVE AND MEDICAL

- FIGURE 14 PERFORMANCE ADDITIVES TO GROW FASTER DURING FORECAST PERIOD

- FIGURE 15 STABILIZERS TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 16 AUTOMOTIVE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 17 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 18 HIGH-PERFORMANCE ADDITIVES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 USE OF GENERATIVE AI IN HIGH-PERFORMANCE ADDITIVES MARKET

- FIGURE 20 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 21 VALUE CHAIN OF HIGH-PERFORMANCE ADDITIVES MARKET

- FIGURE 22 AVERAGE SELLING PRICE TREND OF HIGH-PERFORMANCE ADDITIVES, BY REGION, 2021-2024 (USD/KILOTON)

- FIGURE 23 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PRODUCT TYPE, 2021-2024

- FIGURE 24 HIGH-PERFORMANCE ADDITIVES MARKET: INVESTMENT AND FUNDING SCENARIO

- FIGURE 25 HIGH-PERFORMANCE ADDITIVES MARKET: ECOSYSTEM

- FIGURE 26 NUMBER OF PATENTS GRANTED (2014-2024)

- FIGURE 27 HIGH-PERFORMANCE ADDITIVES MARKET: LEGAL STATUS OF PATENTS

- FIGURE 28 PATENT ANALYSIS FOR HIGH-PERFORMANCE ADDITIVES, BY JURISDICTION, 2015-2025

- FIGURE 29 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENTS IN LAST 10 YEARS

- FIGURE 30 IMPORT OF HS CODE 381220 -COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 31 EXPORT OF HS CODE 381220-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 32 HIGH-PERFORMANCE ADDITIVES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 35 STABILIZERS WAS LARGEST PRODUCT TYPE SEGMENT OF HIGH-PERFORMANCE ADDITIVES MARKET IN 2024

- FIGURE 36 PERFORMANCE ADDITIVES WAS LARGER SEGMENT OF HIGH-PERFORMANCE ADDITIVES MARKET IN 2024

- FIGURE 37 AUTOMOTIVE SEGMENT WAS THE LARGEST END-USE INDUSTRY OF HIGH-PERFORMANCE ADDITIVES MARKET IN 2024

- FIGURE 38 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 39 ASIA PACIFIC: HIGH-PERFORMANCE ADDITIVES MARKET SNAPSHOT

- FIGURE 40 NORTH AMERICA: HIGH-PERFORMANCE ADDITIVES MARKET SNAPSHOT

- FIGURE 41 EUROPE: HIGH-PERFORMANCE ADDITIVES MARKET SNAPSHOT

- FIGURE 42 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2023

- FIGURE 43 REVENUE ANALYSIS OF KEY COMPANIES IN LAST FIVE YEARS

- FIGURE 44 HIGH-PERFORMANCE ADDITIVES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 45 HIGH-PERFORMANCE ADDITIVES MARKET: COMPANY FOOTPRINT

- FIGURE 46 HIGH-PERFORMANCE ADDITIVES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 47 BRAND COMPARATIVE ANALYSIS, BY HIGH-PERFORMANCE ADDITIVE PRODUCTS

- FIGURE 48 EV/EBITDA OF KEY MANUFACTURERS OF HIGH-PERFORMANCE ADDITIVES

- FIGURE 49 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN

- FIGURE 50 BASF: COMPANY SNAPSHOT

- FIGURE 51 CLARIANT: COMPANY SNAPSHOT

- FIGURE 52 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

- FIGURE 53 LANXESS: COMPANY SNAPSHOT

- FIGURE 54 ARKEMA: COMPANY SNAPSHOT

- FIGURE 55 AVIENT CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 SOLVAY: COMPANY SNAPSHOT

- FIGURE 57 SABIC: COMPANY SNAPSHOT

- FIGURE 58 SYNTHOMER PLC: COMPANY SNAPSHOT

- FIGURE 59 CABOT CORPORATION: COMPANY SNAPSHOT

The High-performance additives market size is projected to grow from USD 14.02 billion in 2024 to USD 20.11 billion by 2029, registering a CAGR of 7.5% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Product Type, Function, End-Use Industry, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

Demand for performance additives is expanding because of enhanced industry needs for increased product performance, lifespan, and sustainability. High-performance additives are found universally across the industries of automobile, medical, building and electronics used to enhance properties of material like strength, heat stability, resistance against chemicals, and processibility. As producers aim to minimize waste, high-performance additives facilitate the creation of lighter, stronger, and more durable products, leading to enhanced energy efficiency. The demand for improved process ability, including improved dispersion, reduced viscosities, and improved compatibility with a variety of base materials, also drives the demand.

" Stabilizers accounted for the fastest growing in product type segment of High-performance additives market in terms of value."

The stabilizers is the fastest-growing segment in the high-performance additives market because of the growing requirement for materials with heat, UV radiation, oxidation, and environmental degradation resistance. Stabilizers are important to increase the life of materials by preserving their structural integrity, color stability, and mechanical strength with time. These stabilizers are crucial in thwarting thermal breakdown, oxidative stress, and light degradation, all of which lead to material loss of strength and effectiveness. The most frequently used stabilizers are heat stabilizers, UV stabilizers, and antioxidants, each responsible for protecting material against a particular type of degradation. With the ever-increasing demands for high-performance polymers, advanced coatings, and specialty composites, there has been increased need for stability in order to maintain product quality and long-life performance. As materials become more sophisticated and multifunctional, so do their vulnerabilities to damage by environmental conditions like heat, humidity, and UV light. Stabilizers ensure that these risks are minimized, and materials remain with their original properties, color, and strength.

"Performance additives accounted for the fastest growing in function segment of High-performance additives market in terms of value."

The performance additives is the fastest growing segment in the high-performance additives market because of the increased demand for improved product efficiency, sustainability, and regulatory conformity by industries. The additives enhance durability, thermal stability, corrosion resistance, and mechanical properties in industries such as automotive and medical.

With the changing industries towards light-weight materials, high-performance polymers, and advanced coatings, performance additives such as antioxidants, UV stabilizers, and rheology modifiers are becoming a must to enhance product functionality and lifespan. With more investments in research and development, businesses are all set to work towards creating the next-generation performance additives that target specific functional demands while supporting sustainability efforts. The growing need for superior, long-lasting, and sustainable materials will continue to drive the growth of the performance additives.

"Automotive accounted for the for the fastest growing in end-use industry segment of High-performance additives market in terms of value."

The automotive sector is the fastest growing end-use industry in the high-performance additives market because of the increasing need for advanced materials that improve the performance, durability, and efficiency of vehicles. High-performance additives are essential to enhance the quality of automotive products, especially in tires, lubricants, coatings, and plastics. Additives in the manufacturing of tires, such as silica, anti-ozonants, and antioxidants, enhance grip, fuel efficiency, and wear resistance to meet growing demands for environmentally friendly and high-performance tires. The demand for EVs has further accelerated the growth in demand for dedicated additives because EVs demand lower rolling resistance and increased durability from the tires as a result of more torque. In addition, tough environmental laws demanding reduced emissions and increased fuel economy have prompted manufacturers to use light weight material upgraded with high-performance additives.

"Asia pacific is the fastest growing market for High-performance additives ."

The Asia-Pacific region is the fastest-growing market for high-performance additives on account of its fast-growing industrial base, excellent demand from manufacturing industries, and large-scale infrastructure growth. China, India, Japan, and South Korea have emerged as world leaders in sectors such as automotive and medical all of which demand high-performance additives to improve material strength, durability, and efficiency. The automotive industry, in particular, is a major growth driver, with the Asia-Pacific region hosting some of the world's biggest vehicle and tire makers. The growth in the manufacture of high-performance tires has resulted in a strong demand for additive products like processing aids, anti-ozonants, and reinforcing fillers, which enhance tire durability, heat resistance, and rolling efficiency. Outside of automotive, the medical industry is also driving market growth, with increasing investments in healthcare and increased demand for surgical and medical gloves.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the High-performance additives market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, and Tier 3 - 20%

- By Designation: Managers- 15%, Directors - 20%, and Others - 65%

- By Region: North America - 30%, Europe - 25%, APAC - 35%, the Middle East & Africa -5%, and South America- 5%

The High-performance additives market comprises major BASF (Germany), CLARIANT (Switzerland), Evonik Industries AG (Germany), LANXESS (Germany), Arkema (France), Avient Corporation (US), Solvay (Belgium), SI Group, Inc. (US), SABIC (Saudi Arabia), Synthomer plc (UK), and Cabot Corporation (US). The study includes in-depth competitive analysis of these key players in the High-performance additives market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the market for High-performance additives market on the basis of product type, function, end-use industry, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, and expansions associated with the market for High-performance additives market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the High-performance additives market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of drivers: (High Optimizing rolling resistance for EVs to improve battery performance, enabler for the next generation healthcare innovations), restraints (faces development and application complexities), opportunities (Bio-Based and Sustainable Additives are driving Environmental Sustainability), and challenges (Ensuring High-performance while adopting sustainable and eco-friendly additive solutions) influencing the growth of High-performance additives market.

- Market Penetration: Comprehensive information on the High-performance additives market offered by top players in the global High-performance additives market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, new product launches, expansions, and partnerships in the High-performance additives market.

- Market Development: Comprehensive information about lucrative emerging markets the report analyzes the markets for High-performance additives market across regions.

- Market Capacity: Production capacities of companies producing High-performance additives are provided wherever available with upcoming capacities for the High-performance additives market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the High-performance additives market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SPREAD

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.1.2.3 Key participants for primary interviews

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE ANALYSIS

- 2.2.2 DEMAND-SIDE ANALYSIS

- 2.3 GROWTH FORECAST

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 GROWTH FORECAST

- 2.8 RISK ASSESSMENT

- 2.9 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HIGH-PERFORMANCE ADDITIVES

- 4.2 HIGH-PERFORMANCE ADDITIVES, BY FUNCTION

- 4.3 HIGH-PERFORMANCE ADDITIVES, BY PRODUCT TYPE

- 4.4 HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY

- 4.5 HIGH-PERFORMANCE ADDITIVES, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Improved mechanical strength, wear resistance, thermal stability, and chemical resilience

- 5.2.1.2 Lightweighting and material efficiency in aircraft and heavy vehicles

- 5.2.1.3 High demand as enabler for next-generation healthcare innovations

- 5.2.1.4 High optimizing rolling resistance for EVs to improve battery performance

- 5.2.2 RESTRAINTS

- 5.2.2.1 Development and application complexities

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Bio-based and sustainable additives driving environmental sustainability without compromising performance efficacy

- 5.2.3.2 AI-optimized additives enabling custom high-performance material formulations

- 5.2.4 CHALLENGES

- 5.2.4.1 Ensuring high performance while adopting sustainable and eco-friendly additive solutions

- 5.2.1 DRIVERS

- 5.3 IMPACT OF GENERATIVE AI

- 5.3.1 INTRODUCTION

- 5.4 IMPACT OF AI ON HIGH-PERFORMANCE ADDITIVES MARKET

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RAW MATERIAL SUPPLIERS

- 6.3.2 MANUFACTURERS

- 6.3.3 COMPOUNDERS AND MASTERBATCH PRODUCERS

- 6.3.4 DISTRIBUTORS AND SUPPLIERS

- 6.3.5 END-USE INDUSTRIES

- 6.4 PRICING ANALYSIS

- 6.4.1 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024

- 6.4.2 AVERAGE SELLING PRICE TREND, BY PRODUCT TYPE, 2021-2024

- 6.4.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PRODUCT TYPE, 2021-2024

- 6.5 INVESTMENT AND FUNDING SCENARIO

- 6.6 ECOSYSTEM ANALYSIS

- 6.7 BUYER SUPPLIER ANALYSIS

- 6.7.1 PROCUREMENT PRICE

- 6.7.2 EXISTING SUPPLIER

- 6.7.3 ESTIMATED CUSTOMER CONSUMPTION (VALUE & VOLUME), 2023

- 6.8 TECHNOLOGY ANALYSIS

- 6.8.1 KEY TECHNOLOGIES

- 6.8.2 COMPLEMENTARY TECHNOLOGIES

- 6.8.3 ADJACENT TECHNOLOGIES

- 6.9 CUSTOMER ANALYSIS IN PLASTIC ADDITIVES

- 6.9.1 CUSTOMER ANALYSIS IN PLASTIC ADDITIVES MARKET AT REGIONAL LEVEL

- 6.10 PATENT ANALYSIS

- 6.10.1 METHODOLOGY

- 6.10.2 PATENTS GRANTED WORLDWIDE, 2014-2023

- 6.10.3 PATENT PUBLICATION TRENDS

- 6.10.4 INSIGHTS

- 6.10.5 LEGAL STATUS OF PATENTS

- 6.10.6 JURISDICTION ANALYSIS

- 6.10.7 TOP APPLICANTS

- 6.10.8 LIST OF MAJOR PATENTS

- 6.11 TRADE ANALYSIS

- 6.11.1 IMPORT SCENARIO (HS CODE 381220)

- 6.11.2 EXPORT SCENARIO (HS CODE 381220)

- 6.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.13 TARIFF AND REGULATORY LANDSCAPE

- 6.13.1 TARIFF AND REGULATORY REGULATIONS RELATED TO HIGH-PERFORMANCE ADDITIVES

- 6.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.13.3 REGULATIONS RELATED TO HIGH-PERFORMANCE ADDITIVES MARKET

- 6.14 PORTER'S FIVE FORCES ANALYSIS

- 6.14.1 THREAT OF NEW ENTRANTS

- 6.14.2 THREAT OF SUBSTITUTES

- 6.14.3 BARGAINING POWER OF SUPPLIERS

- 6.14.4 BARGAINING POWER OF BUYERS

- 6.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.15.2 BUYING CRITERIA

- 6.16 MACROECONOMIC OUTLOOK

- 6.16.1 GDP TRENDS AND FORECASTS, BY COUNTRY

- 6.17 CASE STUDY ANALYSIS

- 6.17.1 REDUCING SCRATCH WHITENESS IN AUTOMOTIVE PLASTICS WITH INCROMOLD K

- 6.17.2 ENHANCING AUTOMOTIVE PLASTICS: OVERCOMING KEY CHALLENGES IN MOLD RELEASE, STATIC CONTROL, SURFACE PROTECTION, AND COMPOSITE PROCESSING

- 6.17.3 CRITICAL ROLE OF UV PROTECTION IN PLASTICS AND INNOVATIVE SOLUTIONS

7 HIGH-PERFORMANCE ADDITIVES MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- 7.2 SOFTENERS

- 7.2.1 ENHANCE FLEXIBILITY AND PERFORMANCE IN POLYMERS AND RUBBER

- 7.2.1.1 Plasticizers

- 7.2.1 ENHANCE FLEXIBILITY AND PERFORMANCE IN POLYMERS AND RUBBER

- 7.3 STABILIZERS

- 7.3.1 PREVENT THERMAL UV AND LIGHT DEGRADATION IN VARIOUS MATERIALS

- 7.3.1.1 Antioxidants

- 7.3.1 PREVENT THERMAL UV AND LIGHT DEGRADATION IN VARIOUS MATERIALS

- 7.4 VULCANIZATION AGENTS

- 7.4.1 CROSS-LINKING POLYMERS FOR STRONGER, MORE RESILIENT RUBBER MATERIALS

- 7.5 RESINS

- 7.5.1 OPTIMIZING MATERIAL PERFORMANCE BY IMPROVING ADHESION ELASTICITY AND WEAR RESISTANCE

- 7.6 FILLERS

- 7.6.1 ENHANCE ROLLING RESISTANCE GRIP AND DURABILITY IN ELASTOMER-BASED PRODUCTS FOR SUPERIOR PERFORMANCE

- 7.7 OTHER PRODUCT TYPES

- 7.7.1 MODIFIERS

- 7.7.2 ANTIFOAM-AGENTS

- 7.7.3 ANTISTATIC AGENTS

8 HIGH-PERFORMANCE ADDITIVES MARKET, BY FUNCTION

- 8.1 INTRODUCTION

- 8.2 PERFORMANCE ADDITIVES

- 8.2.1 ENHANCING PRODUCT SAFETY AND EFFICIENCY WITH SPECIALIZED PERFORMANCE ADDITIVES

- 8.3 PROCESSING ADDITIVES

- 8.3.1 OPTIMIZING MANUFACTURING PROCESSES ENSURING BETTER MATERIAL FLOW, DISPERSION, AND PROCESS CONSISTENCY

9 HIGH-PERFORMANCE ADDITIVES MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 MEDICAL

- 9.2.1 ENHANCING SAFETY AND LONGEVITY IN HEALTHCARE GLOVES AND PROTECTIVE WEAR

- 9.2.2 MEDICAL GLOVES

- 9.2.3 SURGICAL GLOVES

- 9.2.4 OTHER PROTECTIVE WEARS

- 9.3 AUTOMOTIVE

- 9.3.1 ENHANCING DURABILITY AND SAFETY OF AUTOMOTIVE COMPONENTS UNDER EXTREME CONDITIONS

- 9.3.2 TIRES

- 9.3.2.1 Passenger

- 9.3.2.2 Commercial

- 9.3.2.3 Specialty/Off the Road

- 9.3.3 OTHER AUTOMOTIVE COMPONENTS

- 9.4 OTHER END-USE INDUSTRIES

- 9.4.1 PAINTS & COATINGS

- 9.4.2 ELECTRONICS & ELECTRICAL COMPONENTS

- 9.4.3 PLASTICS

- 9.4.4 CONSTRUCTION

10 HIGH-PERFORMANCE ADDITIVES MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Dominance in automotive production

- 10.2.2 JAPAN

- 10.2.2.1 Highly advanced automotive and electronics sectors requiring specialized additives

- 10.2.3 INDIA

- 10.2.3.1 Increasing population driving demand for passenger and commercial vehicles

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Significant investment in R&D for high-quality materials

- 10.2.5 REST OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 NORTH AMERICA

- 10.3.1 US

- 10.3.1.1 High use in surgical and medical gloves to drive market

- 10.3.2 CANADA

- 10.3.2.1 Focus on technological progress accelerating market growth

- 10.3.3 MEXICO

- 10.3.3.1 Emergence as manufacturing hub to drive demand

- 10.3.1 US

- 10.4 EUROPE

- 10.4.1 GERMANY

- 10.4.1.1 Strong base of additive manufacturers

- 10.4.2 ITALY

- 10.4.2.1 Increasing use in luxury goods in materials like plastics and coatings

- 10.4.3 FRANCE

- 10.4.3.1 Presence of large automotive, industrial manufacturing, and chemical sectors to boost market

- 10.4.4 UK

- 10.4.4.1 Growth in private healthcare facilities and advancements in medical research

- 10.4.5 SPAIN

- 10.4.5.1 Rising adoption of low-carbon footprint tires necessitating high-performance

- 10.4.6 REST OF EUROPE

- 10.4.1 GERMANY

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.5.1.1 Saudi Arabia

- 10.5.1.1.1 Saudi Arabia's vision 2030 spurs investment in healthcare

- 10.5.1.2 UAE

- 10.5.1.2.1 Strategic location and economic diversification

- 10.5.1.3 Rest of GCC countries

- 10.5.1.1 Saudi Arabia

- 10.5.2 SOUTH AFRICA

- 10.5.2.1 Growing use of high-performance additives in automotive industry

- 10.5.3 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.6 SOUTH AMERICA

- 10.6.1 ARGENTINA

- 10.6.1.1 Rising healthcare expenditure boosts demand for durable, safe medical and surgical gloves

- 10.6.2 BRAZIL

- 10.6.2.1 Expanding commercial transportation drives need for durable additives

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 ARGENTINA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE ANALYSIS OF TOP FIVE PLAYERS (2020-2024)

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Product type footprint

- 11.5.5.4 Function footprint

- 11.5.5.5 End-use industry footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING

- 11.6.5.1 Detailed list of key startups/SMEs

- 11.6.5.2 Competitive benchmarking of key startups/SMEs

- 11.7 BRAND COMPARISON

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.9.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 BASF

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Expansions

- 12.1.1.3.3 Others

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 CLARIANT

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 EVONIK INDUSTRIES AG

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 LANXESS

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 ARKEMA

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Others

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 AVIENT CORPORATION

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Others

- 12.1.6.4 MnM view

- 12.1.6.4.1 Right to win

- 12.1.6.4.2 Strategic choices

- 12.1.6.4.3 Weaknesses and competitive threats

- 12.1.7 SOLVAY

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.7.3.2 Expansions

- 12.1.7.4 MnM view

- 12.1.7.4.1 Key strengths/Right to win

- 12.1.7.4.2 Strategic choices

- 12.1.7.4.3 Weaknesses/Competitive threats

- 12.1.8 SABIC

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 MnM view

- 12.1.8.3.1 Key strengths

- 12.1.8.3.2 Strategic choices

- 12.1.8.3.3 Weaknesses and competitive threats

- 12.1.9 SYNTHOMER PLC

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.9.4 MnM view

- 12.1.9.4.1 Key strengths

- 12.1.9.4.2 Strategic choices

- 12.1.9.4.3 Weaknesses and competitive threats

- 12.1.10 CABOT CORPORATION

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.10.3.2 Expansions

- 12.1.10.4 MnM view

- 12.1.10.4.1 Key strengths/Right to win

- 12.1.10.4.2 Strategic choices

- 12.1.10.4.3 Weaknesses/Competitive threats

- 12.1.11 SI GROUP, INC.

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product launches

- 12.1.11.3.2 Expansions

- 12.1.11.3.3 Others

- 12.1.11.4 MnM view

- 12.1.11.4.1 Key strengths/Right to win

- 12.1.11.4.2 Strategic choices

- 12.1.11.4.3 Weaknesses/Competitive threats

- 12.1.1 BASF

- 12.2 OTHER PLAYERS

- 12.2.1 KEMIPEX

- 12.2.2 FLEXSYS

- 12.2.3 OTSUKA CHEMICAL CO., LTD.

- 12.2.4 KRATON CORPORATION

- 12.2.5 CHINA SUNSINE CHEMICAL HOLDINGS

- 12.2.6 SONGWON

- 12.2.7 TAIZHOU LIANCHENG NEW MATERIAL CO., LTD.

- 12.2.8 BEHN MEYER

- 12.2.9 AVANZARE INNOVACION TECNOLOGICA S.L.

- 12.2.10 SHENYANG SUNNYJOINT CHEMICALS CO., LTD

- 12.2.11 ALLNEX GMBH

- 12.2.12 SHANDONG STAIR CHEMICAL & TECHNOLOGY CO., LTD.

- 12.2.13 KEMAI CHEMICAL CO., LTD.

- 12.2.14 NINGBO ACTMIX RUBBER CHEMICALS CO., LTD.

- 12.2.15 VENNOK

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS