|

|

市場調査レポート

商品コード

1697826

植物育種およびCRISPR植物の世界市場:タイプ別、形質別、技術別、用途別、地域別 - 2030年までの予測Plant Breeding and CRISPR Plants Market by Type, Trait, Technology, Application, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 植物育種およびCRISPR植物の世界市場:タイプ別、形質別、技術別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年03月31日

発行: MarketsandMarkets

ページ情報: 英文 427 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の植物育種およびCRISPR植物の市場規模は、2025年には89億1,000万米ドルと推定され、2025年から2030年までのCAGRは9.2%と見込まれており、2030年には138億6,000万米ドルに達すると予測されています。

この産業は、政府の法律や規制によって大きく左右されます。2021年9月にISAAA(International Service for the Acquisition of Agri-biotech Applications)が発表した記事によると、日本ではゲノム編集高GABAトマトが2021年に商業販売を開始しました。市場は、特に食料安全保障と持続可能性のためにバイオテクノロジーを推進する地域において、合理化された承認手続きと明確な規制によって支えられています。しかし、CRISPRの導入は、欧州連合(EU)などの厳しい規制によって遅れています。さらに、遺伝子編集作物に関する社会的な懸念や倫理的な議論がハードルとなっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2025年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(米ドル)および数量(ヘクタール) |

| セグメント別 | タイプ別、形質別、技術別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、その他の地域 |

植物育種およびCRISPR植物市場に影響を与える破壊:植物育種およびCRISPR植物の市場は、規制の変化、サプライチェーンの問題、技術のブレークスルーによって混乱しています。特に欧州連合(EU)における規制の不確実性は、ゲノム編集作物の導入の遅れにつながり、市場の勢いに影響を与えています。その一方で、CRISPR-Cas9のようなゲノム編集の改良は、形質開発のスピードアップによって育種期間を短縮しています。しかし、中小企業や研究機関は、遺伝子編集技術をめぐる知的財産権紛争による課題に直面しています。さらに、育種資材の入手可能性や国際的な技術協力は、地政学的緊張や貿易制限の影響を受ける。さらに、大手アグリビジネス企業の統合が進んでいるため、小規模な育種業者が競争することが難しくなっています。こうした障害にもかかわらず、研究への継続的な投資と政府の強力な支援が、先端育種技術の採用を後押ししています。

除草剤耐性セグメントは、農業における効果的な雑草管理の需要の高まりにより、植物育種およびCRISPR植物市場で最大のシェアを占めています。農家は、労働コストを削減し、収量を向上させるために、除草剤耐性作物を使用するようになってきています。ゲノム編集と遺伝子工学の進歩により、キャノーラ、トウモロコシ、大豆などの重要な作物に除草剤耐性形質を作り出すことが容易になっています。これらの作物はまた、耕起の必要性を減らすことで土壌浸食を防ぎ、持続可能な農業を支えています。これらの作物の商業的拡大は、米国など数カ国の規制当局の承認によってさらに後押しされており、除草剤耐性分野の市場支配力を確固たるものにしています。

分子育種は、植物育種において最も広く使用されているバイオテクノロジー手法です。正確な形質選択を可能にすることで、遺伝的改良を加速させる。従来の育種に比べ、この方法は所望の形質を正確に選択できるため、作物開発に要する時間が短縮されます。マーカー支援選抜(MAS)やゲノム選抜のような技術は、育種家が高収量品種や耐病性品種を開発するのに役立ちます。シークエンシング技術が手頃な価格で入手できるようになったことで、分子育種の導入はさらに強化され、より幅広い育種プログラムで利用できるようになっています。さらに、分子育種は小麦、トウモロコシ、コメのような主食作物で頻繁に採用されており、そこでは遺伝形質の強化が食糧安全保障の確保に不可欠です。ゲノム研究への継続的な投資により、この分野は主導的地位を維持すると予想されます。

植物育種およびCRISPR植物市場は、政府のイニシアチブと研究資金の増加により、インドで大きく成長すると予測されています。International Service for the Acquisition of Agri-biotech Applications(ISAAA)が2023年2月に発表した記事によると、インドのバイオテクノロジー省(DBT)は、科学者のゲノム編集能力を高めるための研究助成金を開始しました。このプログラムは、作物改良におけるイノベーションを奨励し、持続可能な農業のための国家ミッションに沿ったものです。インドの人口増加と農業課題は、気候変動に強く高収量の作物への需要を高めています。さらに、政府が種子生産とバイオテクノロジーの進歩における自立を推進していることも、市場の見通しを強めています。研究機関の存在感の高まりや、学界と産業界の協力関係は、この分野におけるインドの急速な市場拡大にさらに貢献しています。

当レポートでは、世界の植物育種およびCRISPR植物市場について調査し、タイプ別、形質別、技術別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

- AI/生成AIが植物育種およびCRISPR植物市場に与える影響

第6章 業界動向

- イントロダクション

- 顧客ビジネスに影響を与える動向/混乱

- サプライチェーン分析

- バリューチェーン分析

- 貿易分析

- 技術分析

- エコシステム分析

- 特許分析

- 2025年~2026年の主な会議とイベント

- 規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 投資と資金調達のシナリオ

第7章 植物育種およびCRISPR植物市場(用途別)

- イントロダクション

- 穀物

- 油糧種子と豆類

- 果物と野菜

- その他

第8章 植物育種およびCRISPR植物市場(形質別)

- イントロダクション

- 除草剤耐性

- 耐病性

- 収量と粒度の改善

- 温度とストレス耐性

- 干ばつ耐性

- その他

第9章 植物育種およびCRISPR植物市場(タイプ別)

- イントロダクション

- バイオテクノロジー的方法

- 従来の育種

第10章 植物育種およびCRISPR植物市場(技術別)

- イントロダクション

- 従来の育種

- バイオテクノロジー的方法

第11章 植物育種およびCRISPR植物市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- オランダ

- 英国

- イタリア

- スペイン

- その他

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- その他の地域

- 中東

- アフリカ

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2021年~2024年

- 収益分析、2021年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオと動向

第13章 企業プロファイル

- 種子メーカー(社内育種)

- BAYER AG

- SYNGENTA GROUP

- KWS SAAT SE & CO. KGAA

- CORTEVA

- BASF

- LIMAGRAIN

- UPL(ADVANTA SEEDS)

- BEIJING DABEINONG BIOTECHNOLOGY CO., LTD.

- SAKATA SEED CORPORATION

- RIJK ZWAAN ZAADTEELT EN ZAADHANDEL B.V.

- サービスプロバイダー

- EUROFINS SCIENTIFIC

- SGS SOCIETE GENERALE DE SURVEILLANCE SA.

- PACBIO

- EVOGENE LTD.

- BGI GROUP

- 植物ゲノム編集企業

- SANATECH SEED CO.,LTD.

- PAIRWISE

- CIBUS INC.

- BENSON HILL INC.

- PHYTOFORM

- HUDSON RIVER BIOTECHNOLOGY

- INARI AGRICULTURE, INC.

- TROPIC

- PLANTAE BY HUMINN

- KEYGENE

第14章 隣接市場と関連市場

第15章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES CONSIDERED FOR STUDY, 2020-2024

- TABLE 2 PLANT BREEDING & CRISPR PLANTS MARKET SHARE SNAPSHOT, 2025 VS. 2030 (USD MILLION)

- TABLE 3 EXPORT VALUE OF HS CODE 1209, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 4 IMPORT VALUE OF HS CODE 1209, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 5 PLANT BREEDING AND CRISPR PLANTS MARKET: ECOSYSTEM

- TABLE 6 KEY PATENTS PERTAINING TO PLANT BREEDING AND CRISPR PLANTS MARKET, 2016-2025

- TABLE 7 CONFERENCES & EVENTS, 2025-2026

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TYPE

- TABLE 15 KEY BUYING CRITERIA FOR PLANT BREEDING AND CRISPR PLANTS

- TABLE 16 PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 17 PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 18 CEREALS & GRAINS: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 19 CEREALS & GRAINS: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 20 PLANT BREEDING AND CRISPR PLANTS MARKET, BY CEREAL & GRAIN, 2020-2024 (USD MILLION)

- TABLE 21 PLANT BREEDING AND CRISPR PLANTS MARKET, BY CEREAL & GRAIN, 2025-2030 (USD MILLION)

- TABLE 22 CORN: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 23 CORN: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 24 WHEAT: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 25 WHEAT: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 RICE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 27 RICE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 OTHER CEREALS & GRAINS: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 29 OTHER CEREALS & GRAINS: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 OILSEEDS & PULSES: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 31 OILSEEDS & PULSES: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 PLANT BREEDING AND CRISPR PLANTS MARKET, BY OILSEED & PULSE, 2020-2024 (USD MILLION)

- TABLE 33 PLANT BREEDING AND CRISPR PLANTS MARKET, BY OILSEED & PULSE, 2025-2030 (USD MILLION)

- TABLE 34 SOYBEAN: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 35 SOYBEAN: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 COTTON: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 37 COTTON: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 CANOLA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 39 CANOLA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 OTHER OILSEEDS & PULSES: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 41 OTHER OILSEEDS & PULSES: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

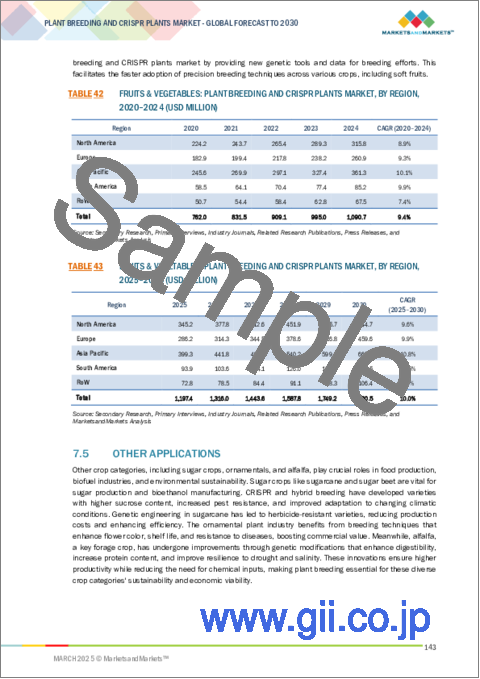

- TABLE 42 FRUITS & VEGETABLES: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 43 FRUITS & VEGETABLES: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 OTHER APPLICATIONS: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 45 OTHER APPLICATIONS: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT, 2020-2024 (USD MILLION)

- TABLE 47 PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT, 2025-2030 (USD MILLION)

- TABLE 48 PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT, 2020-2024 (MILLION HA)

- TABLE 49 PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT, 2025-2030 (MILLION HA)

- TABLE 50 HERBICIDE TOLERANCE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 51 HERBICIDE TOLERANCE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 HERBICIDE TOLERANCE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (MILLION HA)

- TABLE 53 HERBICIDE TOLERANCE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (MILLION HA)

- TABLE 54 DISEASE RESISTANCE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 55 DISEASE RESISTANCE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 DISEASE RESISTANCE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (MILLION HA)

- TABLE 57 DISEASE RESISTANCE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (MILLION HA)

- TABLE 58 YIELD & GRAIN SIZE IMPROVEMENT: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 59 YIELD & GRAIN SIZE IMPROVEMENT: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 YIELD & GRAIN SIZE IMPROVEMENT: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (MILLION HA)

- TABLE 61 YIELD & GRAIN SIZE IMPROVEMENT: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (MILLION HA)

- TABLE 62 TEMPERATURE & STRESS TOLERANCE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 63 TEMPERATURE & STRESS TOLERANCE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 TEMPERATURE & STRESS TOLERANCE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (MILLION HA)

- TABLE 65 TEMPERATURE & STRESS TOLERANCE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (MILLION HA)

- TABLE 66 DROUGHT RESISTANCE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 67 DROUGHT RESISTANCE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 DROUGHT RESISTANCE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (MILLION HA)

- TABLE 69 DROUGHT RESISTANCE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (MILLION HA)

- TABLE 70 OTHER TRAITS: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 71 OTHER TRAITS: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 OTHER TRAITS: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (MILLION HA)

- TABLE 73 OTHER TRAITS: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (MILLION HA)

- TABLE 74 PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 75 PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 76 BIOTECHNOLOGICAL METHOD: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 77 BIOTECHNOLOGICAL METHOD: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 PLANT BREEDING AND CRISPR PLANTS MARKET, BY BIOTECHNOLOGICAL METHOD, 2020-2024 (USD MILLION)

- TABLE 79 PLANT BREEDING AND CRISPR PLANTS MARKET, BY BIOTECHNOLOGICAL METHOD, 2025-2030 (USD MILLION)

- TABLE 80 MOLECULAR BREEDING: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 81 MOLECULAR BREEDING: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 HYBRID BREEDING: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 83 HYBRID BREEDING: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 GENETIC ENGINEERING: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 85 GENETIC ENGINEERING: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 GENOME EDITING: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 87 GENOME EDITING: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 CONVENTIONAL BREEDING: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 89 CONVENTIONAL BREEDING: PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 91 PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 92 PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2020-2024 (MILLION HA)

- TABLE 93 PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION, 2025-2030 (MILLION HA)

- TABLE 94 NORTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 95 NORTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 97 NORTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY BIOTECHNOLOGICAL METHOD, 2020-2024 (USD MILLION)

- TABLE 99 NORTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY BIOTECHNOLOGICAL METHOD, 2025-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT, 2020-2024 (USD MILLION)

- TABLE 101 NORTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT, 2025-2030 (USD MILLION)

- TABLE 102 NORTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT, 2020-2024 (MILLION HA)

- TABLE 103 NORTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT, 2025-2030 (MILLION HA)

- TABLE 104 NORTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 105 NORTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 106 NORTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY CEREAL & GRAIN, 2020-2024 (USD MILLION)

- TABLE 107 NORTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY CEREAL & GRAIN, 2025-2030 (USD MILLION)

- TABLE 108 NORTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY OILSEED & PULSE, 2020-2024 (USD MILLION)

- TABLE 109 NORTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY OILSEED & PULSE, 2025-2030 (USD MILLION)

- TABLE 110 US: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 111 US: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 112 US: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 113 US: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 114 CANADA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 115 CANADA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 116 CANADA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 117 CANADA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 118 MEXICO: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 119 MEXICO: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 120 MEXICO: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 121 MEXICO: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 122 EUROPE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 123 EUROPE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 124 EUROPE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 125 EUROPE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 126 EUROPE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY BIOTECHNOLOGICAL METHOD, 2020-2024 (USD MILLION)

- TABLE 127 EUROPE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY BIOTECHNOLOGICAL METHOD, 2025-2030 (USD MILLION)

- TABLE 128 EUROPE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT, 2020-2024 (USD MILLION)

- TABLE 129 EUROPE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT, 2025-2030 (USD MILLION)

- TABLE 130 EUROPE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT, 2020-2024 (MILLION HA)

- TABLE 131 EUROPE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT, 2025-2030 (MILLION HA)

- TABLE 132 EUROPE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 133 EUROPE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 134 EUROPE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY CEREAL & GRAIN, 2020-2024 (USD MILLION)

- TABLE 135 EUROPE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY CEREAL & GRAIN, 2025-2030 (USD MILLION)

- TABLE 136 EUROPE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY OILSEED & PULSE, 2020-2024 (USD MILLION)

- TABLE 137 EUROPE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY OILSEED & PULSE, 2025-2030 (USD MILLION)

- TABLE 138 GERMANY: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 139 GERMANY: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 140 GERMANY: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 141 GERMANY: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 142 FRANCE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 143 FRANCE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 144 FRANCE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 145 FRANCE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 146 NETHERLANDS: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 147 NETHERLANDS: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 148 NETHERLANDS: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 149 NETHERLANDS: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 150 UK: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 151 UK: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 152 UK: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 153 UK: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 154 ITALY: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 155 ITALY: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 156 ITALY: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 157 ITALY: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 158 SPAIN: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 159 SPAIN: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 160 SPAIN: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 161 SPAIN: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 162 REST OF EUROPE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 163 REST OF EUROPE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 164 REST OF EUROPE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 165 REST OF EUROPE: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 166 ASIA PACIFIC: PLANT BREEDING AND CRISPR PLANTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 167 ASIA PACIFIC: PLANT BREEDING AND CRISPR PLANTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 168 ASIA PACIFIC: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 169 ASIA PACIFIC: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 170 ASIA PACIFIC: PLANT BREEDING AND CRISPR PLANTS MARKET, BY BIOTECHNOLOGICAL METHOD, 2020-2024 (USD MILLION)

- TABLE 171 ASIA PACIFIC: PLANT BREEDING AND CRISPR PLANTS MARKET, BY BIOTECHNOLOGICAL METHOD, 2025-2030 (USD MILLION)

- TABLE 172 ASIA PACIFIC: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT, 2020-2024 (USD MILLION)

- TABLE 173 ASIA PACIFIC: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT, 2025-2030 (USD MILLION)

- TABLE 174 ASIA PACIFIC: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT, 2020-2024 (MILLION HA)

- TABLE 175 ASIA PACIFIC: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT, 2025-2030 (MILLION HA)

- TABLE 176 ASIA PACIFIC: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 177 ASIA PACIFIC: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 178 ASIA PACIFIC: PLANT BREEDING AND CRISPR PLANTS MARKET, BY CEREAL & GRAIN, 2020-2024 (USD MILLION)

- TABLE 179 ASIA PACIFIC: PLANT BREEDING AND CRISPR PLANTS MARKET, BY CEREAL & GRAIN, 2025-2030 (USD MILLION)

- TABLE 180 ASIA PACIFIC: PLANT BREEDING AND CRISPR PLANTS MARKET, BY OILSEED & PULSE, 2020-2024 (USD MILLION)

- TABLE 181 ASIA PACIFIC: PLANT BREEDING AND CRISPR PLANTS MARKET, BY OILSEED & PULSE, 2025-2030 (USD MILLION)

- TABLE 182 CHINA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 183 CHINA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 184 CHINA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 185 CHINA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 186 INDIA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 187 INDIA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 188 INDIA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 189 INDIA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 190 JAPAN: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 191 JAPAN: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 192 JAPAN: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 193 JAPAN: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 194 AUSTRALIA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 195 AUSTRALIA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 196 AUSTRALIA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 197 AUSTRALIA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 198 REST OF ASIA PACIFIC: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 199 REST OF ASIA PACIFIC: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 200 REST OF ASIA PACIFIC: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 201 REST OF ASIA PACIFIC: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 202 SOUTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 203 SOUTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 204 SOUTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 205 SOUTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 206 SOUTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY BIOTECHNOLOGICAL METHOD, 2020-2024 (USD MILLION)

- TABLE 207 SOUTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY BIOTECHNOLOGICAL METHOD, 2025-2030 (USD MILLION)

- TABLE 208 SOUTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT, 2020-2024 (USD MILLION)

- TABLE 209 SOUTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT, 2025-2030 (USD MILLION)

- TABLE 210 SOUTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT, 2020-2024 (MILLION HA)

- TABLE 211 SOUTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT, 2025-2030 (MILLION HA)

- TABLE 212 SOUTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 213 SOUTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 214 SOUTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY CEREAL & GRAIN, 2020-2024 (USD MILLION)

- TABLE 215 SOUTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY CEREAL & GRAIN, 2025-2030 (USD MILLION)

- TABLE 216 SOUTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY OILSEED & PULSE, 2020-2024 (USD MILLION)

- TABLE 217 SOUTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY OILSEED & PULSE, 2025-2030 (USD MILLION)

- TABLE 218 BRAZIL: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 219 BRAZIL: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 220 BRAZIL: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 221 BRAZIL: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 222 ARGENTINA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 223 ARGENTINA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 224 ARGENTINA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 225 ARGENTINA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 226 REST OF SOUTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 227 REST OF SOUTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 228 REST OF SOUTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 229 REST OF SOUTH AMERICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 230 REST OF THE WORLD: PLANT BREEDING AND CRISPR PLANTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 231 REST OF THE WORLD: PLANT BREEDING AND CRISPR PLANTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 232 REST OF THE WORLD: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 233 REST OF THE WORLD: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 234 REST OF THE WORLD: PLANT BREEDING AND CRISPR PLANTS MARKET, BY BIOTECHNOLOGICAL METHOD, 2020-2024 (USD MILLION)

- TABLE 235 REST OF THE WORLD: PLANT BREEDING AND CRISPR PLANTS MARKET, BY BIOTECHNOLOGICAL METHOD, 2025-2030 (USD MILLION)

- TABLE 236 REST OF THE WORLD: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT, 2020-2024 (USD MILLION)

- TABLE 237 REST OF THE WORLD: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT, 2025-2030 (USD MILLION)

- TABLE 238 REST OF THE WORLD: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT, 2020-2024 (MILLION HA)

- TABLE 239 REST OF THE WORLD: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT, 2025-2030 (MILLION HA)

- TABLE 240 REST OF THE WORLD: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 241 REST OF THE WORLD: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 242 REST OF THE WORLD: PLANT BREEDING AND CRISPR PLANTS MARKET, BY CEREAL & GRAIN, 2020-2024 (USD MILLION)

- TABLE 243 REST OF THE WORLD: PLANT BREEDING AND CRISPR PLANTS MARKET, BY CEREAL & GRAIN, 2025-2030 (USD MILLION)

- TABLE 244 REST OF THE WORLD: PLANT BREEDING AND CRISPR PLANTS MARKET, BY OILSEED & PULSE, 2020-2024 (USD MILLION)

- TABLE 245 REST OF THE WORLD: PLANT BREEDING AND CRISPR PLANTS MARKET, BY OILSEED & PULSE, 2025-2030 (USD MILLION)

- TABLE 246 MIDDLE EAST: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 247 MIDDLE EAST: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 248 MIDDLE EAST: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 249 MIDDLE EAST: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 250 AFRICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 251 AFRICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 252 AFRICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 253 AFRICA: PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 254 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MARKET PLAYERS

- TABLE 255 PLANT BREEDING AND CRISPR PLANTS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 256 PLANT BREEDING AND CRISPR PLANTS MARKET: TYPE FOOTPRINT

- TABLE 257 PLANT BREEDING AND CRISPR PLANTS MARKET: TRAIT FOOTPRINT

- TABLE 258 PLANT BREEDING AND CRISPR PLANTS MARKET: APPLICATION FOOTPRINT

- TABLE 259 PLANT BREEDING AND CRISPR PLANTS MARKET: REGIONAL FOOTPRINT

- TABLE 260 PLANT BREEDING AND CRISPR PLANTS MARKET: KEY START-UPS/SMES

- TABLE 261 PLANT BREEDING AND CRISPR PLANTS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES, 2024

- TABLE 262 PLANT BREEDING AND CRISPR PLANTS MARKET: PRODUCT LAUNCHES, JANUARY 2020-MARCH 2025

- TABLE 263 PLANT BREEDING AND CRISPR PLANTS MARKET: DEALS, JANUARY 2020-MARCH 2025

- TABLE 264 PLANT BREEDING AND CRISPR PLANTS MARKET: EXPANSIONS, JANUARY 2020-MARCH 2025

- TABLE 265 PLANT BREEDING AND CRISPR PLANTS MARKET: OTHER DEVELOPMENTS, JANUARY 2020-MARCH 2025

- TABLE 266 BAYER AG: COMPANY OVERVIEW

- TABLE 267 BAYER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 268 BAYER AG: PRODUCT LAUNCHES

- TABLE 269 BAYER AG: DEALS

- TABLE 270 BAYER AG: EXPANSIONS

- TABLE 271 BAYER AG: OTHER DEVELOPMENTS

- TABLE 272 SYNGENTA GROUP: COMPANY OVERVIEW

- TABLE 273 SYNGENTA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 SYNGENTA GROUP: PRODUCT LAUNCHES

- TABLE 275 SYNGENTA GROUP: DEALS

- TABLE 276 SYNGENTA GROUP: EXPANSIONS

- TABLE 277 SYNGENTA GROUP: OTHER DEVELOPMENTS

- TABLE 278 KWS SAAT SE & CO. KGAA: COMPANY OVERVIEW

- TABLE 279 KWS SAAT SE & CO. KGAA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 KWS SAAT SE & CO. KGAA: PRODUCT LAUNCHES

- TABLE 281 KWS SAAT SE & CO. KGAA: DEALS

- TABLE 282 KWS SAAT SE & CO. KGAA: EXPANSIONS

- TABLE 283 CORTEVA: COMPANY OVERVIEW

- TABLE 284 CORTEVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 CORTEVA: PRODUCT LAUNCHES

- TABLE 286 CORTEVA: DEALS

- TABLE 287 CORTEVA: EXPANSIONS

- TABLE 288 CORTEVA: OTHER DEVELOPMENTS

- TABLE 289 BASF: COMPANY OVERVIEW

- TABLE 290 BASF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 291 BASF: PRODUCT LAUNCHES

- TABLE 292 BASF: DEALS

- TABLE 293 LIMAGRAIN: COMPANY OVERVIEW

- TABLE 294 LIMAGRAIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 295 LIMAGRAIN: DEALS

- TABLE 296 LIMAGRAIN: EXPANSIONS

- TABLE 297 LIMAGRAIN: OTHER DEVELOPMENTS

- TABLE 298 UPL: COMPANY OVERVIEW

- TABLE 299 UPL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 300 UPL: PRODUCT LAUNCHES

- TABLE 301 UPL: DEALS

- TABLE 302 UPL: EXPANSIONS

- TABLE 303 BEIJING DABEINONG BIOTECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 304 BEIJING DABEINONG BIOTECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 305 BEIJING DABEINONG BIOTECHNOLOGY CO., LTD.: DEALS

- TABLE 306 SAKATA SEED CORPORATION: COMPANY OVERVIEW

- TABLE 307 SAKATA SEED CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 308 SAKATA SEED CORPORATION: PRODUCT LAUNCHES

- TABLE 309 SAKATA SEED CORPORATION: DEALS

- TABLE 310 SAKATA SEED CORPORATION: EXPANSIONS

- TABLE 311 RIJK ZWAAN ZAADTEELT EN ZAADHANDEL B.V.: COMPANY OVERVIEW

- TABLE 312 RIJK ZWAAN ZAADTEELT EN ZAADHANDEL B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 313 RIJK ZWAAN ZAADTEELT EN ZAADHANDEL B.V.: PRODUCT LAUNCHES

- TABLE 314 RIJK ZWAAN ZAADTEELT EN ZAADHANDEL B.V.: EXPANSIONS

- TABLE 315 EUROFINS SCIENTIFIC: COMPANY OVERVIEW

- TABLE 316 EUROFINS SCIENTIFIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 317 EUROFINS SCIENTIFIC: PRODUCT LAUNCHES

- TABLE 318 EUROFINS SCIENTIFIC: DEALS

- TABLE 319 SGS SOCIETE GENERALE DE SURVEILLANCE SA.: COMPANY OVERVIEW

- TABLE 320 SGS SOCIETE GENERALE DE SURVEILLANCE SA.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 321 SGS SOCIETE GENERALE DE SURVEILLANCE SA.: EXPANSIONS

- TABLE 322 PACBIO: COMPANY OVERVIEW

- TABLE 323 PACBIO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 324 PACBIO: DEALS

- TABLE 325 EVOGENE LTD.: COMPANY OVERVIEW

- TABLE 326 EVOGENE LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 327 EVOGENE LTD.: DEALS

- TABLE 328 BGI GROUP: COMPANY OVERVIEW

- TABLE 329 BGI GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 330 BGI GROUP: DEALS

- TABLE 331 SANATECH SEED CO.,LTD.: COMPANY OVERVIEW

- TABLE 332 SANATECH SEED CO.,LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 333 SANATECH SEED CO.,LTD.: PRODUCT LAUNCHES

- TABLE 334 SANATECH SEED CO.,LTD.: DEALS

- TABLE 335 PAIRWISE: COMPANY OVERVIEW

- TABLE 336 PAIRWISE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 337 PAIRWISE: PRODUCT LAUNCHES

- TABLE 338 PAIRWISE: DEALS

- TABLE 339 CIBUS INC.: COMPANY OVERVIEW

- TABLE 340 CIBUS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 341 CIBUS INC.: DEALS

- TABLE 342 BENSON HILL INC.: COMPANY OVERVIEW

- TABLE 343 BENSON HILL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 344 BENSON HILL INC.: PRODUCT LAUNCHES

- TABLE 345 BENSON HILL INC.: DEALS

- TABLE 346 PHYTOFORM: COMPANY OVERVIEW

- TABLE 347 PHYTOFORM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 348 HUDSON RIVER BIOTECHNOLOGY: COMPANY OVERVIEW

- TABLE 349 INARI AGRICULTURE, INC.: COMPANY OVERVIEW

- TABLE 350 TROPIC: COMPANY OVERVIEW

- TABLE 351 PLANTAE BY HUMINN: COMPANY OVERVIEW

- TABLE 352 KEYGENE: COMPANY OVERVIEW

- TABLE 353 GENE EDITING MARKET, BY OFFERING, 2022-2029 (USD MILLION)

- TABLE 354 GENE EDITING PRODUCTS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 355 GENE EDITING SERVICES MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 356 GENOMICS MARKET, BY OFFERING, 2022-2029 (USD MILLION)

- TABLE 357 GENOMICS MARKET, BY REGION, 2022-2029 (USD MILLION)

List of Figures

- FIGURE 1 MARKET SEGMENTATION: PLANT BREEDING AND CRISPR PLANTS MARKET

- FIGURE 2 PLANT BREEDING AND CRISPR PLANTS MARKET: RESEARCH DESIGN

- FIGURE 3 PLANT BREEDING AND CRISPR PLANTS MARKET: BOTTOM-UP APPROACH

- FIGURE 4 PLANT BREEDING AND CRISPR PLANTS MARKET: TOP-DOWN APPROACH

- FIGURE 5 DATA TRIANGULATION: SUPPLY SIDE

- FIGURE 6 DATA TRIANGULATION: DEMAND SIDE

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 PLANT BREEDING & CRISPR PLANTS MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 9 PLANT BREEDING & CRISPR PLANTS MARKET, BY TRAIT, 2025 VS. 2030 (USD MILLION)

- FIGURE 10 PLANT BREEDING & CRISPR PLANTS MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 11 PLANT BREEDING & CRISPR PLANTS MARKET SHARE AND GROWTH RATE, BY REGION

- FIGURE 12 INCREASING DEMAND FOR CLIMATE-RESILIENT, HIGH-YIELD, AND PEST-RESISTANT CROPS TO DRIVE MARKET

- FIGURE 13 BIOTECHNOLOGICAL METHOD SEGMENT AND CHINA TO ACCOUNT FOR SIGNIFICANT SHARES IN 2025

- FIGURE 14 US TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 15 BIOTECHNOLOGY METHOD SEGMENT AND NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 16 HERBICIDE TOLERANCE SEGMENT AND NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 17 CEREALS & GRAINS SEGMENT AND NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 18 WORLD POPULATION BY YEAR, 2000-2025

- FIGURE 19 PLANT BREEDING AND CRISPR PLANTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 ADOPTION OF GENETICALLY ENGINEERED CROPS IN UNITED STATES, 2000-2024 (%)

- FIGURE 21 EVOGENE LTD.'S (ISRAEL) SALES AND R&D EXPENDITURE, 2021-2023 (USD THOUSAND)

- FIGURE 22 ADOPTION OF GEN AI IN PLANT BREEDING AND CRISPR PLANTS PRODUCTION PROCESS

- FIGURE 23 PLANT BREEDING AND CRISPR PLANTS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 PLANT BREEDING AND CRISPR PLANTS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 25 VALUE CHAIN ANALYSIS

- FIGURE 26 EXPORT VALUE OF HS CODE 1209, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 27 IMPORT VALUE OF HS CODE 1209, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 28 KEY PLAYERS IN PLANT BREEDING AND CRISPR PLANTS MARKET ECOSYSTEM

- FIGURE 29 PATENTS GRANTED FOR PLANT BREEDING AND CRISPR PLANTS MARKET, 2015-2025

- FIGURE 30 JURISDICTIONS WITH HIGHEST PATENT APPROVALS, 2015-2025

- FIGURE 31 PLANT BREEDING AND CRISPR PLANTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TYPE

- FIGURE 33 KEY BUYING CRITERIA FOR PLANT BREEDING AND CRISPR PLANTS

- FIGURE 34 INVESTMENT & FUNDING SCENARIO OF START-UP/SMES, 2017-2024 (USD MILLION)

- FIGURE 35 PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 36 PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT, 2025 VS. 2030 (USD MILLION)

- FIGURE 37 PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 38 PLANT BREEDING AND CRISPR PLANTS MARKET: REGIONAL SNAPSHOT

- FIGURE 39 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 41 REVENUE ANALYSIS FOR KEY COMPANIES IN LAST 5 YEARS, 2021-2024 (USD BILLION)

- FIGURE 42 SHARE OF LEADING PLAYERS IN PLANT BREEDING AND CRISPR PLANTS MARKET, 2024

- FIGURE 43 RANKING OF TOP FIVE PLAYERS IN PLANT BREEDING AND CRISPR PLANTS MARKET, 2024

- FIGURE 44 COMPANY VALUATION FOR FEW PLAYERS IN PLANT BREEDING AND CRISPR PLANTS MARKET (USD BILLION)

- FIGURE 45 EV/EBITDA OF FEW PLAYERS

- FIGURE 46 PLANT BREEDING AND CRISPR PLANTS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 47 PLANT BREEDING AND CRISPR PLANTS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 48 PLANT BREEDING AND CRISPR PLANTS MARKET: COMPANY FOOTPRINT

- FIGURE 49 PLANT BREEDING AND CRISPR PLANTS MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 50 BAYER AG: COMPANY SNAPSHOT

- FIGURE 51 SYNGENTA GROUP: COMPANY SNAPSHOT

- FIGURE 52 KWS SAAT SE & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 53 CORTEVA: COMPANY SNAPSHOT

- FIGURE 54 BASF: COMPANY SNAPSHOT

- FIGURE 55 LIMAGRAIN: COMPANY SNAPSHOT

- FIGURE 56 UPL: COMPANY SNAPSHOT

- FIGURE 57 BEIJING DABEINONG BIOTECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 58 SAKATA SEED CORPORATION: COMPANY SNAPSHOT

- FIGURE 59 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

- FIGURE 60 SGS SOCIETE GENERALE DE SURVEILLANCE SA.: COMPANY SNAPSHOT

- FIGURE 61 PACBIO: COMPANY SNAPSHOT

- FIGURE 62 EVOGENE LTD.: COMPANY SNAPSHOT

- FIGURE 63 BGI GROUP: COMPANY SNAPSHOT

- FIGURE 64 CIBUS INC.: COMPANY SNAPSHOT

- FIGURE 65 BENSON HILL INC.: COMPANY SNAPSHOT

The global plant breeding and CRISPR plants market is estimated at USD 8.91 billion in 2025 and is anticipated to reach USD 13.86 billion by 2030, at a CAGR of 9.2% from 2025 to 2030. This industry is significantly shaped by government laws and regulations. Many countries are developing supportive policies to encourage genome editing innovations, as seen in Japan, where genome-edited high-GABA tomatoes entered commercial sales in 2021, as per an article published by International Service for the Acquisition of Agri-biotech Applications (ISAAA) in September 2021. The market is aided by streamlined approval procedures and clear regulations, especially in regions promoting biotechnology for food security and sustainability. However, the adoption of CRISPR is slowed down by stringent regulations in places like the European Union. Additionally, public concerns and ethical debates about gene-edited crops create hurdles, as regulatory approval alone does not ensure widespread acceptance.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) and Volume (Hectares) |

| Segments | By Type, Trait, Application, and By Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

Disruptions Impacting the Market for plant breeding and CRISPR plants: The market for plant breeding and CRISPR plants is being disrupted by changing regulations, supply chain issues, and technology breakthroughs. Regulatory uncertainties, especially in the European Union, have led to delays in the adoption of genome-edited crops, impacting market momentum. Meanwhile, improvements in genome editing, like CRISPR-Cas9, have shortened breeding times by speeding up trait development. However, smaller companies and research institutions face challenges due to intellectual property disputes surrounding gene-editing technologies. Furthermore, the availability of breeding materials and international technological collaborations are impacted by geopolitical tensions and trade restrictions. Additionally, the growing consolidation of major agribusiness firms is making it harder for smaller breeders to compete. Despite these hurdles, continuous investments in research and strong government support are pushing the adoption of advanced breeding techniques.

"The herbicide tolerance segment held the largest share in the plant breeding and CRISPR plants market in 2024."

The herbicide tolerance segment holds the largest share in the plant breeding and CRISPR plants market due to the rising demand for effective weed management in agriculture. Farmers are increasingly using herbicide-tolerant crops to reduce labor costs and improve yields. Advancements in genome editing and genetic engineering have made it easier to create herbicide-resistant traits in important crops like canola, corn and soybeans. These crops also support sustainable farming by reducing the need for tillage, which helps prevent soil erosion. The commercial expansion of these crops is further supported by regulatory approvals in several countries such as US, which solidifies the herbicide tolerance segment's market dominance.

"Molecular breeding held the largest share within the biotechnological method segment in the plant breeding and CRISPR plants market in 2024"

Molecular breeding is the most widely used biotechnological method in plant breeding. It accelerates genetic improvements by allowing precise trait selection. Compared to conventional breeding, this method shortens the time needed for crop development by enabling precise selection of desired traits. Techniques like marker-assisted selection (MAS) and genomic selection help breeders develop high-yielding and disease-resistant varieties. The increasing affordability of sequencing technologies has further strengthened molecular breeding adoption, making it accessible to a broader range of breeding programs. Furthermore, molecular breeding is frequently employed in staple crops like wheat, maize, and rice, where enhancing genetic traits is crucial for ensuring food security. With continued investments in genomics research, this segment is expected to maintain its leading position.

India is expected to witness fastest growth in the Asia Pacific plant breeding and CRISPR plants market during the forecast period.

The market for plant breeding and CRISPR plants is anticipated to grow significantly in India due to government initiatives and rising research funding. As per an article published by International Service for the Acquisition of Agri-biotech Applications (ISAAA) in February 2023, India's Department of Biotechnology (DBT) has launched research grants to enhance genome editing capacity among scientists. This program encourages innovation in crop improvement and is in line with the nation's National Mission for Sustainable Agriculture. India's growing population and agricultural challenges are driving up demand for climate-resilient and high-yield crops. Furthermore, the government's push for self-reliance in seed production and biotechnology advancements strengthens market prospects. The growing presence of research institutions and collaborations between academia and industry further contribute to India's rapid market expansion in this sector.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the plant breeding and CRISPR plants market:

- By Value Chain: Supply Side - 65% and Demand Side - 35%

- By Designation: CXOs- 25%, Managers - 40%, Executives- 35%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 25%, South America - 15% and Rest of the World -5%

Prominent companies in the market include Bayer AG (Germany), Syngenta Group (Switzerland), KWS SAAT SE & Co. KGaA (Germany), Corteva (US), BASF (Germany), Limagrain (France), UPL (India), Beijing Dabeinong Biotechnology Co., Ltd. (China), SAKATA SEED CORPORATION (Japan), Rijk Zwaan Zaadteelt en Zaadhandel B.V. (Netherlands), Eurofins Scientific (Luxembourg), SGS Societe Generale de Surveillance SA. (Switzerland), PacBio (US), Evogene Ltd. (Israel), BGI Group (China), Sanatech Seed Co.,Ltd. (Japan), Pairwise (US), Cibus Inc. (US), Benson Hill Inc. (US), and KeyGene (Netherlands).

Other players include Phytoform (UK), Hudson River Biotechnology (Netherlands), Inari Agriculture, Inc. (US), TROPIC (UK), and Plantae by Huminn (Israel).

Research Coverage:

This research report categorizes the plant breeding and CRISPR plants market by type (conventional breeding and biotechnological method), by trait (herbicide tolerance, disease resistance, yield & grain size improvement, temperature & stress tolerance, drought resistance, and other traits), by application (cereals & grains, oilseeds & pulses , fruits & vegetables, and other applications) by technology (conventional breeding (cross breeding and selection methods, hybridization methods, and back-cross breeding) and and biotechnological method (genetic transformation, marker-assisted breeding, gene editing technologies, and tissue culture methods)), and region (North America, Europe, Asia Pacific, South America, and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of plant breeding and CRISPR plants market. A detailed analysis of the key industry players has been done to provide insights into their business overview, services, key strategies, contracts, partnerships, agreements, new service launches, mergers and acquisitions, and recent developments associated with the plant breeding and CRISPR plants market. Competitive analysis of upcoming startups in the plant breeding and CRISPR plants market ecosystem is covered in this report. Furthermore, industry-specific trends such as technology analysis, ecosystem and market mapping, patent, regulatory landscape, among others, are also covered in the study.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall plant breeding and CRISPR plants and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (government initiatives and regulatory support), restraints (stringent and lack of harmonized global regulatory frameworks for gene-edited crop), opportunities (development of crops with enhanced nutritional profiles), and challenges (limited public awareness and consumer skepticism about gene-edited foods) influencing the growth of the plant breeding and CRISPR plants market.

- New product launch/Innovation: Detailed insights on research & development activities and new product/service launches in the plant breeding and CRISPR plants market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the plant breeding and CRISPR plants market across varied regions.

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in the plant breeding and CRISPR plants market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product foot prints of leading players such as Bayer AG (Germany), Syngenta Group (Switzerland), KWS SAAT SE & Co. KGaA (Germany), Corteva (US), BASF (Germany), Limagrain (France), Beijing Dabeinong Biotechnology Co., Ltd. (China), SAKATA SEED CORPORATION (Japan), Eurofins Scientific (Luxembourg), SGS Societe Generale de Surveillance SA. (Switzerland), and other players in the plant breeding and CRISPR plants market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 UNIT CONSIDERED

- 1.4.1 CURRENCY CONSIDERED

- 1.4.2 VOLUME UNIT CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key insights from primary experts

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 SUPPLY SIDE

- 2.2.4 DEMAND SIDE

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS & RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PLANT BREEDING AND CRISPR PLANTS MARKET

- 4.2 ASIA PACIFIC: PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE AND KEY COUNTRY

- 4.3 PLANT BREEDING AND CRISPR PLANTS MARKET: REGIONAL SNAPSHOT

- 4.4 PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE AND REGION

- 4.5 PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT AND REGION

- 4.6 PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION AND REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 GLOBAL POPULATION GROWTH & FOOD SECURITY CONCERNS

- 5.2.2 GLOBAL GDP & ECONOMIC GROWTH

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Government initiatives and regulatory support

- 5.3.1.2 Growing adoption of hybrid and genetically engineered/edited seeds

- 5.3.1.3 Technological advancements in plant breeding & CRISPR

- 5.3.2 RESTRAINTS

- 5.3.2.1 High costs associated with CRISPR and modern breeding techniques

- 5.3.2.2 Stringent and lack of harmonized global regulatory frameworks for gene-edited crops

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Development of crops with enhanced nutritional profiles

- 5.3.3.2 Rising demand for non-GMO yet genetically enhanced crops

- 5.3.4 CHALLENGES

- 5.3.4.1 Limited public awareness and consumer skepticism about gene-edited foods

- 5.3.1 DRIVERS

- 5.4 IMPACT OF AI/GEN AI ON PLANT BREEDING AND CRISPR PLANTS MARKET

- 5.4.1 INTRODUCTION

- 5.4.2 USE OF GEN AI IN PLANT BREEDING AND CRISPR PLANTS MARKET

- 5.4.3 CASE STUDY ANALYSIS

- 5.4.3.1 Limagrain partnered with Alteia to accelerate digital phenotyping in plant breeding and field seeds & partnership

- 5.4.3.2 Syngenta Group & InstaDeep collaborated to implement AI-powered trait discovery in plant breeding

- 5.4.3.3 Bayer AG's CRISPR revolutionized plant breeding with AI and precision breeding innovations

- 5.4.4 IMPACT ON PLANT BREEDING AND CRISPR PLANTS MARKET

- 5.4.5 ADJACENT ECOSYSTEM WORKING ON GENERATIVE AI

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.4 VALUE CHAIN ANALYSIS

- 6.4.1 RESEARCH AND INNOVATION

- 6.4.2 GERMPLASM DEVELOPMENT

- 6.4.3 SEED PRODUCTION & MULTIPLICATION

- 6.4.4 REGULATORY APPROVALS & COMPLIANCE

- 6.4.5 DISTRIBUTION & COMMERCIALIZATION

- 6.4.6 END-USE APPLICATIONS

- 6.5 TRADE ANALYSIS

- 6.5.1 EXPORT SCENARIO OF HS CODE 1209, 2020-2024

- 6.5.2 IMPORT SCENARIO OF HS CODE 1209, 2020-2024

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 KEY TECHNOLOGIES

- 6.6.1.1 Genome editing (CRISPR, TALENs, ZFNs)

- 6.6.1.2 Genetic engineering (GM Crops)

- 6.6.2 COMPLEMENTARY TECHNOLOGIES

- 6.6.2.1 Bioinformatics & computational genomics

- 6.6.2.2 Phenotyping technologies (High-throughput & automated systems)

- 6.6.3 ADJACENT TECHNOLOGIES

- 6.6.3.1 Artificial intelligence & machine learning in agriculture

- 6.6.3.2 Vertical farming & Controlled Environment Agriculture (CEA)

- 6.6.1 KEY TECHNOLOGIES

- 6.7 ECOSYSTEM ANALYSIS

- 6.7.1 DEMAND SIDE

- 6.7.2 SUPPLY SIDE

- 6.8 PATENT ANALYSIS

- 6.9 KEY CONFERENCES & EVENTS, 2025-2026

- 6.10 REGULATORY LANDSCAPE

- 6.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10.2 REGULATORY FRAMEWORK

- 6.10.2.1 North America

- 6.10.2.1.1 US

- 6.10.2.1.2 Canada

- 6.10.2.1.3 Mexico

- 6.10.2.2 Europe

- 6.10.2.2.1 European Union (EU)

- 6.10.2.2.2 UK

- 6.10.2.3 Asia Pacific

- 6.10.2.3.1 India

- 6.10.2.3.2 Japan

- 6.10.2.3.3 China

- 6.10.2.4 South America

- 6.10.2.4.1 Brazil

- 6.10.2.5 Rest of the World

- 6.10.2.5.1 South Africa

- 6.10.2.1 North America

- 6.11 PORTER'S FIVE FORCES ANALYSIS

- 6.11.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.11.2 THREAT OF NEW ENTRANTS

- 6.11.3 THREAT OF SUBSTITUTES

- 6.11.4 BARGAINING POWER OF SUPPLIERS

- 6.11.5 BARGAINING POWER OF BUYERS

- 6.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.12.2 BUYING CRITERIA

- 6.13 CASE STUDY ANALYSIS

- 6.13.1 OHIO STATE UNIVERSITY & UNIVERSITY OF NEBRASKA-LINCOLN UTILIZED MARKER-ASSISTED SELECTION FOR BACTERIAL SPOT RESISTANCE IN TOMATO

- 6.13.2 MICHIGAN STATE UNIVERSITY IMPLEMENTED MARKER-ASSISTED SELECTION FOR GOLDEN NEMATODE RESISTANCE IN POTATO

- 6.13.3 BASF IMPLEMENTED VISION AI FOR SEED BREEDING AND PRODUCTION MONITORING

- 6.14 INVESTMENT AND FUNDING SCENARIO

7 PLANT BREEDING AND CRISPR PLANTS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 CEREALS & GRAINS

- 7.2.1 RISING GLOBAL POPULATION AND INCREASING FOOD SECURITY CONCERNS TO DRIVE DEMAND FOR PLANT BREEDING IN CEREALS & GRAINS

- 7.2.2 CORN

- 7.2.3 WHEAT

- 7.2.4 RICE

- 7.2.5 OTHER CEREALS & GRAINS

- 7.3 OILSEEDS & PULSES

- 7.3.1 GROWING DEMAND FOR PLANT-BASED PROTEINS AND SUSTAINABLE EDIBLE OILS TO FUEL DEMAND FOR PLANT BREEDING IN OILSEEDS & PULSES

- 7.3.2 SOYBEAN

- 7.3.3 COTTON

- 7.3.4 CANOLA

- 7.3.5 OTHER OILSEEDS & PULSES

- 7.4 FRUITS & VEGETABLES

- 7.4.1 CLIMATE VARIABILITY AFFECTING FRUIT AND VEGETABLE YIELDS AND QUALITY TO BOOST DEMAND FOR PLANT BREEDING IN FRUITS & VEGETABLES

- 7.5 OTHER APPLICATIONS

8 PLANT BREEDING AND CRISPR PLANTS MARKET, BY TRAIT

- 8.1 INTRODUCTION

- 8.2 HERBICIDE TOLERANCE

- 8.2.1 RISING PREVALENCE OF HERBICIDE-RESISTANT WEEDS TO BOLSTER NEED FOR HERBICIDE-TOLERANT CROP VARIETIES

- 8.3 DISEASE RESISTANCE

- 8.3.1 INCREASING REGULATORY RESTRICTIONS ON CHEMICAL FUNGICIDES AND BACTERICIDES TO FOSTER DEMAND FOR DISEASE RESISTANCE CROPS

- 8.4 YIELD & GRAIN SIZE IMPROVEMENT

- 8.4.1 INCREASING GLOBAL FOOD DEMAND DUE TO POPULATION GROWTH AND URBANIZATION TO ACCELERATE ITS DEMAND

- 8.5 TEMPERATURE & STRESS TOLERANCE

- 8.5.1 INCREASING FREQUENCY OF EXTREME WEATHER EVENTS DUE TO CLIMATE CHANGE TO PROPEL ITS DEMAND

- 8.6 DROUGHT RESISTANCE

- 8.6.1 RISING WATER SCARCITY AND DECLINING GROUNDWATER LEVELS IMPACTING CROP CULTIVATION TO DRIVE ITS DEMAND

- 8.7 OTHER TRAITS

9 PLANT BREEDING AND CRISPR PLANTS MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 BIOTECHNOLOGICAL METHOD

- 9.2.1 GROWING NEED FOR HIGHER YIELD AND STRESS-RESILIENT CROPS TO FUEL DEMAND FOR BIOTECHNOLOGICAL METHOD

- 9.2.2 MOLECULAR BREEDING

- 9.2.3 HYBRID BREEDING

- 9.2.4 GENETIC ENGINEERING

- 9.2.5 GENOME EDITING

- 9.3 CONVENTIONAL BREEDING

- 9.3.1 COMPLIANCE WITH STRICT GMO REGULATIONS AND RISING CONSUMER PREFERENCE FOR ORGANIC FOOD PRODUCTS TO DRIVE DEMAND FOR CONVENTIONAL BREEDING

10 PLANT BREEDING AND CRISPR PLANTS MARKET, BY TECHNOLOGY

- 10.1 INTRODUCTION

- 10.2 CONVENTIONAL BREEDING

- 10.2.1 FEWER REGULATORY HURDLES COMPARED TO GENETICALLY MODIFIED AND GENE-EDITED CROPS TO BOOST DEMAND FOR CONVENTIONAL BREEDING TECHNOLOGIES

- 10.2.2 CROSS-BREEDING AND SELECTION METHODS

- 10.2.2.1 Pedigree breeding

- 10.2.2.2 Mass selection

- 10.2.2.3 Bulk breeding

- 10.2.2.4 Pure line selection

- 10.2.3 HYBRIDIZATION METHODS

- 10.2.3.1 Single cross hybrids

- 10.2.3.2 Three-way cross hybrids

- 10.2.3.3 Double cross hybrids

- 10.2.4 BACK-CROSS BREEDING

- 10.3 BIOTECHNOLOGICAL METHOD

- 10.3.1 REDUCED BREEDING TIME AND ENHANCED TRAIT DEVELOPMENT TO BOLSTER DEMAND FOR BIOTECHNOLOGICAL METHOD TECHNOLOGIES

- 10.3.2 GENETIC TRANSFORMATION

- 10.3.2.1 Agrobacterium-mediated transformation

- 10.3.2.2 Particle bombardment/gene gun

- 10.3.2.3 PEG-mediated transformation

- 10.3.2.4 Electroporation

- 10.3.3 MARKER-ASSISTED BREEDING

- 10.3.3.1 SNP markers

- 10.3.3.2 SSR markers

- 10.3.3.3 Others

- 10.3.4 GENE EDITING TECHNOLOGIES

- 10.3.4.1 CRISPR-Cas9

- 10.3.4.2 TALENs

- 10.3.4.3 Zinc Finger Nucleases (ZFNs)

- 10.3.5 TISSUE CULTURE METHODS

- 10.3.5.1 Micropropagation

- 10.3.5.2 Embryo rescue

- 10.3.5.3 Anther/pollen culture

- 10.3.5.4 Protoplast fusion

11 PLANT BREEDING AND CRISPR PLANTS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 High adoption of genetically engineered and gene-edited crops coupled with favorable regulatory framework for genome editing to drive market

- 11.2.2 CANADA

- 11.2.2.1 Growing export potential and demand for high-yield, input-efficient crops to propel market

- 11.2.3 MEXICO

- 11.2.3.1 Rising demand for improved vegetable and staple crop seeds to enhance food security to accelerate market

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Government funding and research initiatives to fuel market growth

- 11.3.2 FRANCE

- 11.3.2.1 Shift in European regulatory stance toward easing restrictions on gene-edited crops to foster market

- 11.3.3 NETHERLANDS

- 11.3.3.1 Government funding and academic collaboration for climate-resilient crops to enhance market

- 11.3.4 UK

- 11.3.4.1 Regulatory relaxation post-Brexit enabling gene editing in plant breeding to propel market

- 11.3.5 ITALY

- 11.3.5.1 High susceptibility of Italian crops, such as grapes, wheat, and tomatoes, to diseases to drive market

- 11.3.6 SPAIN

- 11.3.6.1 Increasing investments in R&D and breeding facilities by global seed companies to fuel market growth

- 11.3.7 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Government initiatives to boost domestic crop production and reduce reliance on imported soybean and corn to propel market

- 11.4.2 INDIA

- 11.4.2.1 Government regulatory reforms and policy support for genome-edited crops to accelerate market

- 11.4.3 JAPAN

- 11.4.3.1 High dependence on imported agricultural commodities to foster market

- 11.4.4 AUSTRALIA

- 11.4.4.1 Need for higher crop yields and sustainability in agriculture to boost market

- 11.4.5 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.5.1.1 Favorable regulatory policies classifying gene-edited crops under non-GMO classification to drive market

- 11.5.2 ARGENTINA

- 11.5.2.1 Increasing need for drought-resistant and climate-resilient crops coupled with streamlined regulatory framework for new breeding techniques to foster market

- 11.5.3 REST OF SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.6 REST OF THE WORLD

- 11.6.1 MIDDLE EAST

- 11.6.1.1 Water scarcity and soil salinity challenges coupled with government initiatives supporting agricultural biotechnology to fuel market growth

- 11.6.2 AFRICA

- 11.6.2.1 Rising food insecurity and the need for increased crop yields to propel market

- 11.6.1 MIDDLE EAST

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 12.3 REVENUE ANALYSIS, 2021-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.4.1 MARKET RANKING ANALYSIS

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Type footprint

- 12.7.5.3 Trait footprint

- 12.7.5.4 Application footprint

- 12.7.5.5 Regional footprint

- 12.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING, START-UPS/SMES, 2024

- 12.8.5.1 Detailed list of key start-ups/SMEs

- 12.8.5.2 Competitive benchmarking of key start-ups/SMEs

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 SEED COMPANIES (IN-HOUSE BREEDING)

- 13.1.1 BAYER AG

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Expansions

- 13.1.1.3.4 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 SYNGENTA GROUP

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.3.3 Expansions

- 13.1.2.3.4 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 KWS SAAT SE & CO. KGAA

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 CORTEVA

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.3.3 Expansions

- 13.1.4.3.4 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 BASF

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 LIMAGRAIN

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.6.3.2 Expansions

- 13.1.6.3.3 Other developments

- 13.1.6.4 MnM view

- 13.1.7 UPL (ADVANTA SEEDS)

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.7.3.2 Deals

- 13.1.7.3.3 Expansions

- 13.1.7.4 MnM view

- 13.1.8 BEIJING DABEINONG BIOTECHNOLOGY CO., LTD.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.8.4 MnM view

- 13.1.9 SAKATA SEED CORPORATION

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.9.3.2 Deals

- 13.1.9.3.3 Expansions

- 13.1.9.4 MnM view

- 13.1.10 RIJK ZWAAN ZAADTEELT EN ZAADHANDEL B.V.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.10.3.2 Expansions

- 13.1.10.4 MnM view

- 13.1.1 BAYER AG

- 13.2 SERVICE PROVIDERS

- 13.2.1 EUROFINS SCIENTIFIC

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Product launches

- 13.2.1.3.2 Deals

- 13.2.1.4 MnM view

- 13.2.2 SGS SOCIETE GENERALE DE SURVEILLANCE SA.

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.3.1 Expansions

- 13.2.2.4 MnM view

- 13.2.3 PACBIO

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Deals

- 13.2.3.4 MnM view

- 13.2.4 EVOGENE LTD.

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Deals

- 13.2.4.4 MnM view

- 13.2.5 BGI GROUP

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Deals

- 13.2.5.4 MnM view

- 13.2.1 EUROFINS SCIENTIFIC

- 13.3 PLANT GENOME EDITING COMPANIES

- 13.3.1 SANATECH SEED CO.,LTD.

- 13.3.1.1 Business overview

- 13.3.1.2 Products/Solutions/Services offered

- 13.3.1.3 Recent developments

- 13.3.1.3.1 Product launches

- 13.3.1.3.2 Deals

- 13.3.1.4 MnM view

- 13.3.2 PAIRWISE

- 13.3.2.1 Business overview

- 13.3.2.2 Products/Solutions/Services offered

- 13.3.2.3 Recent developments

- 13.3.2.3.1 Product launches

- 13.3.2.3.2 Deals

- 13.3.2.4 MnM view

- 13.3.3 CIBUS INC.

- 13.3.3.1 Business overview

- 13.3.3.2 Products/Solutions/Services offered

- 13.3.3.3 Recent developments

- 13.3.3.3.1 Deals

- 13.3.3.4 MnM view

- 13.3.4 BENSON HILL INC.

- 13.3.4.1 Business overview

- 13.3.4.2 Products/Solutions/Services offered

- 13.3.4.3 Recent developments

- 13.3.4.3.1 Product launches

- 13.3.4.3.2 Deals

- 13.3.4.4 MnM view

- 13.3.5 PHYTOFORM

- 13.3.5.1 Business overview

- 13.3.5.2 Products/Solutions/Services offered

- 13.3.5.3 Recent developments

- 13.3.5.4 MnM view

- 13.3.6 HUDSON RIVER BIOTECHNOLOGY

- 13.3.7 INARI AGRICULTURE, INC.

- 13.3.8 TROPIC

- 13.3.9 PLANTAE BY HUMINN

- 13.3.10 KEYGENE

- 13.3.1 SANATECH SEED CO.,LTD.

14 ADJACENT & RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 GENE EDITING MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.3 GENE EDITING MARKET, BY OFFERING

- 14.3.3.1 Introduction

- 14.3.4 GENE EDITING MARKET, BY REGION

- 14.3.4.1 Introduction

- 14.4 GENOMICS MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

- 14.4.3 GENOMICS MARKET, BY OFFERING

- 14.4.3.1 Introduction

- 14.4.4 GENOMICS MARKET, BY REGION

- 14.4.4.1 Introduction

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS