|

|

市場調査レポート

商品コード

1688892

冷凍機の世界市場:製品別、可動性別、冷媒タイプ別 - 予測(~2029年)Refrigeration Coolers Market by Offering (Condensers, Compressors, Evaporators, Air Cooler), Mobility (Stationary, Portable), Refrigerant Type (Ammonia, Carbon Dioxide, HFC/HFO, Propane, Glycol, Brine, Hydrocarbon Blends) - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 冷凍機の世界市場:製品別、可動性別、冷媒タイプ別 - 予測(~2029年) |

|

出版日: 2025年03月01日

発行: MarketsandMarkets

ページ情報: 英文 308 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の冷凍機の市場規模は、2024年に41億9,000万米ドルであり、2029年までに57億4,000万米ドルに達すると推定され、予測期間にCAGRで6.5%の成長が見込まれます。

都市化の進行、冷媒に対する規制要件、オンライン食料品ショッピングの成長、効率的な冷蔵・輸送ソリューション、冷蔵技術の成長、より環境にやさしい冷媒への移行などが市場成長をもたらしています。これらのことやその他の戦略が、冷凍機市場のリーズナブルなセッティングを促進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 10億米ドル |

| セグメント | 提供、可動性、冷媒タイプ、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「アンモニアが冷凍機市場で大きなシェアを占めます。」

アンモニア冷媒は、その優れた熱力学的特性、エネルギー効率、環境上の利点から、冷凍機市場で力強い成長が予測されます。気候変動やオゾン層の破壊など、環境問題をめぐる国際的な規制強化の動向が強まっているため、産業はカーボンフットプリントを削減しなければなりません。高い効率と低いエネルギー消費、産業用冷蔵倉庫への大規模な利用も、大規模成長の有望な見通しです。さらに、アンモニア冷蔵技術の安全性と性能の向上は、より広範な受け入れを促進します。このように、持続可能性の要件を満たすことで、冷媒としてのアンモニアは市場で健全な成長を示す可能性があります。

「ポータブルが冷凍機市場で大きく成長します。」

ポータブルセグメントが2023年に大きな市場シェアを占め、予測期間にもロジスティクス・倉庫などの新しく登場した用途で冷凍機システムの使用が増加していることから、同様の動向がみられる可能性が高いです。ポータブル冷凍機はどこにでも持ち運びができ、さまざまな用途で利便性と高まる需要を満たすためにどこでも使用できるため、大きな可能性を秘めています。屋台やフードトラックの増加により、持ち運びが可能で、さまざまな場所に簡単に設置できる効率的でコンパクトな冷蔵ソリューションへの需要が高まっています。同様に、この分野の技術動向は、エネルギー効率に優れた軽量なポータブル冷凍機を誕生させ、消費者や企業の間での需要の高まりにも寄与しています。ライフスタイルや消費者の選好の変化に伴い、ポータブル冷凍機市場は大きく成長します。

「アジア太平洋が冷凍機市場の成長率に大きく寄与します。」

アジア太平洋は、環境規制や持続可能な活動に対する意識の高まりにより、アジア太平洋諸国におけるエネルギー効率の高い冷凍技術の採用が増加することで、複数の説得力のある理由から、冷凍機市場の大きなシェアに寄与すると考えられています。第一に、政府はアンモニアやCO2のような冷媒を支援しており、これらは環境にやさしいだけでなく、冷凍機システムが環境に与える影響を緩和するという、現在の世界的な動向に寄与しています。一方、この地域の医薬品製造施設では、常に冷凍機の需要が高いです。効率的なコールドチェーンを必要とするeコマースやオンライン食料品プラットフォームの成長も、アジア太平洋の冷凍機市場の成長を後押ししています。

当レポートでは、世界の冷凍機市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 冷凍機市場の企業にとって魅力的な機会

- 冷凍機市場:提供別

- 冷凍機市場:可動性別

- 冷凍機市場:冷媒別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 冷凍機市場に対するAIの影響

- バリューチェーン分析

- 研究開発(R&D)

- 部品メーカー

- 販売業者/再販業者

- 組立業者/設置業者/インテグレーター

- エンドユーザー

- アフターサービス

- エコシステム分析

- 投資と資金調達のシナリオ

- 価格分析

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

- 貿易分析

- 輸入シナリオ(HSコード841869)

- 輸出シナリオ(HSコード841869)

- 特許分析

- 主な会議とイベント(2025年)

- 規制情勢

- 規制機関、政府機関、その他の組織

- 標準

第6章 冷凍機市場:提供別

- イントロダクション

- 凝縮器

- 圧縮機

- 蒸発器・空気冷却器

第7章 冷凍機市場:冷媒別

- イントロダクション

- HFC/HFO

- CO2

- NH3

- プロパン

- その他

第8章 冷凍機市場:可動性別

- イントロダクション

- 固定式

- 可動式

第9章 冷凍機市場:用途別

- イントロダクション

- 小売

- 食品・飲料

- ロジスティクス・倉庫

- 医療・医薬品

- その他の用途

第10章 冷凍機市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- 英国

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インド

- 韓国

- その他のアジア太平洋

- その他の地域

- その他の地域のマクロ経済の見通し

- 中東

- アフリカ

- 南米

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み(2020年~2024年)

- 収益分析(2019年~2023年)

- 市場シェア分析(2023年)

- 企業の評価と財務指標

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- JOHNSON CONTROLS

- LU-VE

- KELVION HOLDING GMBH

- RIVACOLD SRL

- LENNOX INTERNATIONAL INC.

- GUNTNER GMBH & CO. KG

- COPELAND LP

- DANFOSS

- MODINE MANUFACTURING COMPANY

- EVAPCO

- THERMOFIN

- その他の企業

- STEFANI

- ONDA S.P.A.

- ROEN EST

- KFL

- WALTER ROLLER

- CABERO

- THERMOKEY

- KOXKA

- CENTAURO INTERNACIONAL

- BALTIMORE AIRCOIL COMPANY, INC.

- FRITERM

- DAIKIN

- PROFROID

- ROCKWELL INDUSTRIES LIMITED

- MUKUNDA FOODS PRIVATE LIMITED

- BLUE STAR LIMITED

- WSL REFRIGERATION D.O.O.

第13章 付録

List of Tables

- TABLE 1 REFRIGERATION COOLERS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 2 AVERAGE SELLING PRICE TREND OF REFRIGERATION COOLER COMPONENTS PROVIDED BY MAJOR PLAYERS (USD)

- TABLE 3 INDICATIVE SELLING PRICE OF REFRIGERATION COOLER SYSTEM, BY COMPONENT, 2020-2023 (USD)

- TABLE 4 INDICATIVE PRICING OF REFRIGERATION COOLERS, BY REGION

- TABLE 5 REFRIGERATION COOLERS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 8 IMPORT SCENARIO (HS CODE 841869)

- TABLE 9 EXPORT SCENARIO (HS CODE 841869)

- TABLE 10 REFRIGERATION COOLERS MARKET: CONFERENCES AND EVENTS, 2025

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REFRIGERATION COOLERS MARKET: KEY STANDARDS

- TABLE 16 REFRIGERATION COOLERS MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 17 REFRIGERATION COOLERS MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 18 CONDENSERS: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 19 CONDENSERS: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION))

- TABLE 20 COMPRESSORS: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 21 COMPRESSORS: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION))

- TABLE 22 EVAPORATORS & AIR COOLERS: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 23 EVAPORATORS & AIR COOLERS: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 24 REFRIGERATION COOLERS MARKET, BY REFRIGERANT, 2020-2023 (USD MILLION)

- TABLE 25 REFRIGERATION COOLERS MARKET, BY REFRIGERANT, 2024-2029 (USD MILLION)

- TABLE 26 HFC/HFO: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 27 HFC/HFO: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 28 CO2: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 29 CO2: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 30 NH3: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 31 NH3: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 32 PROPANE: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 33 PROPANE: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 34 OTHERS: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 35 OTHERS: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 36 REFRIGERATION COOLERS MARKET, BY MOBILITY, 2020-2023 (USD MILLION)

- TABLE 37 REFRIGERATION COOLERS MARKET, BY MOBILITY, 2024-2029 (USD MILLION)

- TABLE 38 STATIONARY: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 39 STATIONARY: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 40 PORTABLE: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 41 PORTABLE: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 42 REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 43 REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 44 REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (THOUSAND UNITS)

- TABLE 45 REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 ( THOUSAND UNITS)

- TABLE 46 RETAIL: REFRIGERATION COOLERS MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 47 RETAIL: REFRIGERATION COOLERS MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 48 RETAIL: REFRIGERATION COOLERS MARKET, BY REFRIGERANT, 2020-2023 (USD MILLION)

- TABLE 49 RETAIL: REFRIGERATION COOLERS MARKET, BY REFRIGERANT, 2024-2029 (USD MILLION)

- TABLE 50 RETAIL: REFRIGERATION COOLERS MARKET, BY MOBILITY, 2020-2023 (USD MILLION)

- TABLE 51 RETAIL: REFRIGERATION COOLERS MARKET, BY MOBILITY, 2024-2029 (USD MILLION)

- TABLE 52 RETAIL: REFRIGERATION COOLERS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 53 RETAIL: REFRIGERATION COOLERS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 54 FOOD & BEVERAGE: REFRIGERATION COOLERS MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 55 FOOD & BEVERAGE: REFRIGERATION COOLERS MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 56 FOOD & BEVERAGE: REFRIGERATION COOLERS MARKET, BY REFRIGERANT, 2020-2023 (USD MILLION)

- TABLE 57 FOOD & BEVERAGE: REFRIGERATION COOLERS MARKET, BY REFRIGERANT, 2024-2029 (USD MILLION)

- TABLE 58 FOOD & BEVERAGE: REFRIGERATION COOLERS MARKET, BY MOBILITY, 2020-2023 (USD MILLION)

- TABLE 59 FOOD & BEVERAGE: REFRIGERATION COOLERS MARKET, BY MOBILITY, 2024-2029 (USD MILLION)

- TABLE 60 FOOD & BEVERAGE: REFRIGERATION COOLERS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 61 FOOD & BEVERAGE: REFRIGERATION COOLERS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 62 LOGISTICS & WAREHOUSING: REFRIGERATION COOLERS MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 63 LOGISTICS & WAREHOUSING: REFRIGERATION COOLERS MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 64 LOGISTICS & WAREHOUSING: REFRIGERATION COOLERS MARKET, BY REFRIGERANT, 2020-2023 (USD MILLION)

- TABLE 65 LOGISTICS & WAREHOUSING: REFRIGERATION COOLERS MARKET, BY REFRIGERANT, 2024-2029 (USD MILLION)

- TABLE 66 LOGISTICS & WAREHOUSING: REFRIGERATION COOLERS MARKET, BY MOBILITY, 2020-2023 (USD MILLION)

- TABLE 67 LOGISTICS & WAREHOUSING: REFRIGERATION COOLERS MARKET, BY MOBILITY, 2024-2029 (USD MILLION)

- TABLE 68 LOGISTICS & WAREHOUSING: REFRIGERATION COOLERS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 69 LOGISTICS & WAREHOUSING: REFRIGERATION COOLERS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 70 HEALTHCARE & PHARMACEUTICALS: REFRIGERATION COOLERS MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 71 HEALTHCARE & PHARMACEUTICALS: REFRIGERATION COOLERS MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 72 HEALTHCARE & PHARMACEUTICALS: REFRIGERATION COOLERS MARKET, BY REFRIGERANT, 2020-2023 (USD MILLION)

- TABLE 73 HEALTHCARE & PHARMACEUTICALS: REFRIGERATION COOLERS MARKET, BY REFRIGERANT, 2024-2029 (USD MILLION)

- TABLE 74 HEALTHCARE & PHARMACEUTICALS: REFRIGERATION COOLERS MARKET, BY MOBILITY, 2020-2023 (USD MILLION)

- TABLE 75 HEALTHCARE & PHARMACEUTICALS: REFRIGERATION COOLERS MARKET, BY MOBILITY, 2024-2029 (USD MILLION)

- TABLE 76 HEALTHCARE & PHARMACEUTICALS: REFRIGERATION COOLERS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 77 HEALTHCARE & PHARMACEUTICALS: REFRIGERATION COOLERS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 78 OTHER APPLICATIONS: REFRIGERATION COOLERS MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 79 OTHER APPLICATIONS: REFRIGERATION COOLERS MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 80 OTHER APPLICATIONS: REFRIGERATION COOLERS MARKET, BY REFRIGERANT, 2020-2023 (USD MILLION)

- TABLE 81 OTHER APPLICATIONS: REFRIGERATION COOLERS MARKET, BY REFRIGERANT, 2024-2029 (USD MILLION)

- TABLE 82 OTHER APPLICATIONS: REFRIGERATION COOLERS MARKET, BY MOBILITY, 2020-2023 (USD MILLION)

- TABLE 83 OTHER APPLICATIONS: REFRIGERATION COOLERS MARKET, BY MOBILITY, 2024-2029 (USD MILLION)

- TABLE 84 OTHER APPLICATIONS: REFRIGERATION COOLERS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 85 OTHER APPLICATIONS: REFRIGERATION COOLERS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 86 REFRIGERATION COOLERS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 87 REFRIGERATION COOLERS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 88 NORTH AMERICA: REFRIGERATION COOLERS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 89 NORTH AMERICA: REFRIGERATION COOLERS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 90 NORTH AMERICA: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 91 NORTH AMERICA: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 92 NORTH AMERICA: REFRIGERATION COOLERS MARKET IN FOOD & BEVERAGE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 93 NORTH AMERICA: REFRIGERATION COOLERS MARKET IN FOOD & BEVERAGE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 94 NORTH AMERICA: REFRIGERATION COOLERS MARKET IN RETAIL, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 95 NORTH AMERICA: REFRIGERATION COOLERS MARKET IN RETAIL, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 96 NORTH AMERICA: REFRIGERATION COOLERS MARKET IN LOGISTICS & WAREHOUSING, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 97 NORTH AMERICA: REFRIGERATION COOLERS MARKET IN LOGISTICS & WAREHOUSING, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 98 NORTH AMERICA: REFRIGERATION COOLERS MARKET IN HEALTHCARE & PHARMACEUTICALS, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 99 NORTH AMERICA: REFRIGERATION COOLERS MARKET IN HEALTHCARE & PHARMACEUTICALS, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 100 NORTH AMERICA: REFRIGERATION COOLERS MARKET IN OTHER APPLICATIONS, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 101 NORTH AMERICA: REFRIGERATION COOLERS MARKET IN OTHER APPLICATIONS, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 102 US: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 103 US: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 104 CANADA: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 105 CANADA: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 106 MEXICO: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 107 MEXICO: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 108 EUROPE: REFRIGERATION COOLERS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 109 EUROPE: REFRIGERATION COOLERS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 110 EUROPE: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 111 EUROPE: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 112 EUROPE: REFRIGERATION COOLERS MARKET IN FOOD & BEVERAGE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 113 EUROPE: REFRIGERATION COOLERS MARKET IN FOOD & BEVERAGE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 114 EUROPE: REFRIGERATION COOLERS MARKET IN RETAIL, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 115 EUROPE: REFRIGERATION COOLERS MARKET IN RETAIL, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 116 EUROPE: REFRIGERATION COOLERS MARKET IN LOGISTICS & WAREHOUSING, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 117 EUROPE: REFRIGERATION COOLERS MARKET IN LOGISTICS & WAREHOUSING, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 118 EUROPE: REFRIGERATION COOLERS MARKET IN HEALTHCARE & PHARMACEUTICALS, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 119 EUROPE: REFRIGERATION COOLERS MARKET IN HEALTHCARE & PHARMACEUTICALS, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 120 EUROPE: REFRIGERATION COOLERS MARKET IN OTHER APPLICATIONS, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 121 EUROPE: REFRIGERATION COOLERS MARKET IN OTHER APPLICATIONS, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 122 GERMANY: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 123 GERMANY: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 124 UK: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 125 UK: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 126 FRANCE: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 127 FRANCE: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 128 ITALY: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 129 ITALY: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 130 REST OF EUROPE: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 131 REST OF EUROPE: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 132 ASIA PACIFIC: REFRIGERATION COOLERS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 133 ASIA PACIFIC: REFRIGERATION COOLERS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 134 ASIA PACIFIC: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 135 ASIA PACIFIC: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 136 ASIA PACIFIC: REFRIGERATION COOLERS MARKET IN FOOD & BEVERAGE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 137 ASIA PACIFIC: REFRIGERATION COOLERS MARKET IN FOOD & BEVERAGE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 138 ASIA PACIFIC: REFRIGERATION COOLERS MARKET IN RETAIL, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 139 ASIA PACIFIC: REFRIGERATION COOLERS MARKET IN RETAIL, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 140 ASIA PACIFIC: REFRIGERATION COOLERS MARKET IN LOGISTICS & WAREHOUSING, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 141 ASIA PACIFIC: REFRIGERATION COOLERS MARKET IN LOGISTICS & WAREHOUSING, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 142 ASIA PACIFIC: REFRIGERATION COOLERS MARKET IN HEALTHCARE & PHARMACEUTICALS, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 143 ASIA PACIFIC: REFRIGERATION COOLERS MARKET IN HEALTHCARE & PHARMACEUTICALS, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 144 ASIA PACIFIC: REFRIGERATION COOLERS MARKET IN OTHER APPLICATIONS, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 145 ASIA PACIFIC: REFRIGERATION COOLERS MARKET IN OTHER APPLICATIONS, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 146 CHINA: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 147 CHINA: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 148 JAPAN: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 149 JAPAN: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 150 INDIA: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 151 INDIA: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 152 SOUTH KOREA: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 153 SOUTH KOREA: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 155 REST OF ASIA PACIFIC: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 156 ROW: REFRIGERATION COOLERS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 157 ROW: REFRIGERATION COOLERS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 158 ROW: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 159 ROW: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 160 ROW: REFRIGERATION COOLERS MARKET IN FOOD & BEVERAGE, BY REGION, 2020-2023 (USD MILLION)

- TABLE 161 ROW: REFRIGERATION COOLERS MARKET IN FOOD & BEVERAGE, BY REGION, 2024-2029 (USD MILLION)

- TABLE 162 ROW: REFRIGERATION COOLERS MARKET IN RETAIL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 163 ROW: REFRIGERATION COOLERS MARKET IN RETAIL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 164 ROW: REFRIGERATION COOLERS MARKET IN LOGISTICS & WAREHOUSING, BY REGION, 2020-2023 (USD MILLION)

- TABLE 165 ROW: REFRIGERATION COOLERS MARKET IN LOGISTICS & WAREHOUSING, BY REGION, 2024-2029 (USD MILLION)

- TABLE 166 ROW: REFRIGERATION COOLERS MARKET IN HEALTHCARE & PHARMACEUTICALS, BY REGION, 2020-2023 (USD MILLION)

- TABLE 167 ROW: REFRIGERATION COOLERS MARKET IN HEALTHCARE & PHARMACEUTICALS, BY REGION, 2024-2029 (USD MILLION)

- TABLE 168 ROW: REFRIGERATION COOLERS MARKET IN OTHER APPLICATIONS, BY REGION, 2020-2023 (USD MILLION)

- TABLE 169 ROW: REFRIGERATION COOLERS MARKET IN OTHER APPLICATIONS, BY REGION, 2024-2029 (USD MILLION)

- TABLE 170 MIDDLE EAST: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 171 MIDDLE EAST: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 172 AFRICA: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 173 AFRICA: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 174 SOUTH AMERICA: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 175 SOUTH AMERICA: REFRIGERATION COOLERS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 176 STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2024

- TABLE 177 REFRIGERATION COOLERS MARKET: DEGREE OF COMPETITION, 2023

- TABLE 178 REFRIGERATION COOLERS MARKET: REGION FOOTPRINT

- TABLE 179 REFRIGERATION COOLERS MARKET: OFFERING FOOTPRINT

- TABLE 180 REFRIGERATION COOLERS MARKET: MOBILITY FOOTPRINT

- TABLE 181 REFRIGERATION COOLERS MARKET: APPLICATION FOOTPRINT

- TABLE 182 REFRIGERATION COOLERS MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 183 REFRIGERATION COOLERS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 184 REFRIGERATION COOLERS MARKET: PRODUCT LAUNCHES, JANUARY 2020-DECEMBER 2024

- TABLE 185 REFRIGERATION COOLERS MARKET: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 186 REFRIGERATION COOLERS MARKET: EXPANSIONS, JANUARY 2020- DECEMBER 2024

- TABLE 187 REFRIGERATION COOLERS MARKET: OTHER DEVELOPMENTS, JANUARY 2020-DECEMBER 2024

- TABLE 188 JOHNSON CONTROLS: COMPANY OVERVIEW

- TABLE 189 JOHNSON CONTROLS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 JOHNSON CONTROLS: PRODUCT LAUNCHES

- TABLE 191 JOHNSON CONTROLS: DEALS

- TABLE 192 LU-VE: COMPANY OVERVIEW

- TABLE 193 LU-VE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 LU-VE: DEALS

- TABLE 195 LU-VE GROUP: EXPANSIONS

- TABLE 196 LU-VE GROUP: OTHER DEVELOPMENTS

- TABLE 197 KELVION HOLDING GMBH: COMPANY OVERVIEW

- TABLE 198 KELVION HOLDING GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 KELVION HOLDING GMBH: PRODUCT LAUNCHES

- TABLE 200 KELVION HOLDING GMBH: DEALS

- TABLE 201 KELVION HOLDING GMBH: EXPANSIONS

- TABLE 202 RIVACOLD SRL: COMPANY OVERVIEW

- TABLE 203 RIVACOLD SRL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 LENNOX INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 205 LENNOX INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 LENNOX INTERNATIONAL: PRODUCT LAUNCHES

- TABLE 207 GUNTNER GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 208 GUNTNER GMBH & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 COPELAND LP: COMPANY OVERVIEW

- TABLE 210 COPELAND LP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 COPELAND LP: PRODUCT LAUNCHES

- TABLE 212 COPELAND LP: DEALS

- TABLE 213 COPELAND LP: EXPANSIONS

- TABLE 214 DANFOSS: COMPANY OVERVIEW

- TABLE 215 DANFOSS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 DANFOSS: PRODUCT LAUNCHES

- TABLE 217 DANFOSS: DEALS

- TABLE 218 DANFOSS: OTHER DEVELOPMENTS

- TABLE 219 MODINE MANUFACTURING COMPANY: COMPANY OVERVIEW

- TABLE 220 MODINE MANUFACTURING COMPANY: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 221 MODINE MANUFACTURING COMPANY: DEALS

- TABLE 222 MODINE MANUFACTURING COMPANY: EXPANSIONS

- TABLE 223 MODINE MANUFACTURING COMPANY: OTHER DEVELOPMENTS

- TABLE 224 EVAPCO: COMPANY OVERVIEW

- TABLE 225 EVAPCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 THERMOFIN: COMPANY OVERVIEW

- TABLE 227 THERMOFIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 STEFANI: COMPANY OVERVIEW

- TABLE 229 ONDA S.P.A.: COMPANY OVERVIEW

- TABLE 230 ROEN EST: COMPANY OVERVIEW

- TABLE 231 KFL: COMPANY OVERVIEW

- TABLE 232 WALTER ROLLER: COMPANY OVERVIEW

- TABLE 233 CABERO: COMPANY OVERVIEW

- TABLE 234 THERMOKEY: COMPANY OVERVIEW

- TABLE 235 KOXKA: COMPANY OVERVIEW

- TABLE 236 CENTAURO INTERNACIONAL: COMPANY OVERVIEW

- TABLE 237 BALTIMORE AIRCOIL COMPANY, INC.: COMPANY OVERVIEW

- TABLE 238 FRITERM: COMPANY OVERVIEW

- TABLE 239 DAIKIN: COMPANY OVERVIEW

- TABLE 240 PROFROID: COMPANY OVERVIEW

- TABLE 241 ROCKWELL INDUSTRIES LIMITED: COMPANY OVERVIEW

- TABLE 242 MUKUNDA FOODS PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 243 BLUE STAR LIMITED: COMPANY OVERVIEW

- TABLE 244 WSL REFRIGERATION D.O.O.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 REFRIGERATION COOLERS MARKET SEGMENTATION

- FIGURE 2 REFRIGERATION COOLERS MARKET: PROCESS FLOW OF MARKET SIZE ESTIMATION

- FIGURE 3 REFRIGERATION COOLERS MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED BY KEY PLAYERS FROM REFRIGERATION COOLING SYSTEMS

- FIGURE 7 DATA TRIANGULATION: REFRIGERATION COOLERS MARKET

- FIGURE 8 EVAPORATORS & AIR COOLERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 9 NH3 SEGMENT TO ACCOUNT FOR LARGEST SHARE OF REFRIGERATION COOLERS MARKET IN 2029

- FIGURE 10 RETAIL TO BE LARGEST APPLICATION OF REFRIGERATION COOLERS DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO RECORD HIGHEST CAGR IN REFRIGERATION COOLERS MARKET DURING FORECAST PERIOD

- FIGURE 12 INCREASING DEMAND FOR FRESH AND FROZEN FOOD DRIVING REFRIGERATION COOLERS MARKET

- FIGURE 13 EVAPORATORS & AIR COOLERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 14 STATIONARY REFRIGERATION COOLERS SEGMENT TO DOMINATE MARKET IN 2024

- FIGURE 15 NH3 REFRIGERANT TO LEAD REFRIGERATION COOLERS MARKET IN 2029

- FIGURE 16 REFRIGERATION COOLERS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 REFRIGERATION COOLERS MARKET: DRIVERS AND THEIR IMPACT

- FIGURE 18 REFRIGERATION COOLERS MARKET: RESTRAINTS AND THEIR IMPACT

- FIGURE 19 REFRIGERATION COOLERS MARKET: OPPORTUNITIES AND THEIR IMPACT

- FIGURE 20 REFRIGERATION COOLERS MARKET: CHALLENGES AND THEIR IMPACT

- FIGURE 21 REFRIGERATION COOLERS MARKET: AI IMPACT ANALYSIS

- FIGURE 22 REFRIGERATION COOLERS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 REFRIGERATION COOLERS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 REFRIGERATION COOLERS MARKET PLAYERS' ECOSYSTEM

- FIGURE 25 INVESTMENT AND FUNDING SCENARIO: COLD STORAGE INVESTMENT IN ASIA PACIFIC

- FIGURE 26 AVERAGE SELLING PRICE TREND OF REFRIGERATION COOLER SYSTEM COMPONENTS OFFERED BY MAJOR PLAYERS

- FIGURE 27 INDICATIVE PRICING OF REFRIGERATION COOLERS, BY REGION, 2020-2023

- FIGURE 28 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 29 REFRIGERATION COOLERS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 31 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 32 IMPORT DATA FOR HS CODE 841869-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 33 EXPORT DATA FOR HS CODE 841869-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 34 TOP PATENT APPLICANTS AND OWNERS, 2014-2023

- FIGURE 35 REFRIGERATION COOLERS MARKET, BY OFFERING

- FIGURE 36 EVAPORATORS & AIR COOLERS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 RETAIL APPLICATION TO REGISTER HIGHEST CAGR IN EVAPORATORS & AIR COOLERS SEGMENT DURING FORECAST PERIOD

- FIGURE 38 REFRIGERATION COOLERS MARKET, BY REFRIGERANT

- FIGURE 39 CO2 REFRIGERANT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 RETAIL TO BE LARGEST APPLICATION FOR CO2 REFRIGERANT SEGMENT DURING FORECAST PERIOD

- FIGURE 41 RETAIL APPLICATION TO REGISTER HIGHEST CAGR FOR NH3 REFRIGERANT SEGMENT DURING FORECAST PERIOD

- FIGURE 42 PORTABLE REFRIGERATION COOLERS SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 43 REFRIGERATION COOLERS MARKET, BY APPLICATION

- FIGURE 44 RETAIL TO BE FASTEST-GROWING APPLICATION OF REFRIGERATION COOLERS DURING FORECAST PERIOD

- FIGURE 45 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR REFRIGERATION COOLERS IN RETAIL SEGMENT DURING FORECAST PERIOD

- FIGURE 46 EVAPORATORS & COOLERS SEGMENT TO REGISTER HIGHEST CAGR IN FOOD & BEVERAGE APPLICATION DURING FORECAST PERIOD

- FIGURE 47 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN REFRIGERATION COOLERS MARKET DURING FORECAST PERIOD

- FIGURE 48 NORTH AMERICA: REFRIGERATION COOLERS MARKET SNAPSHOT

- FIGURE 49 EUROPE: REFRIGERATION COOLERS MARKET SNAPSHOT

- FIGURE 50 ASIA PACIFIC: REFRIGERATION COOLERS MARKET SNAPSHOT

- FIGURE 51 REFRIGERATION COOLERS MARKET: REVENUE ANALYSIS, 2019-2023

- FIGURE 52 REFRIGERATION COOLERS MARKET SHARE ANALYSIS, 2023

- FIGURE 53 COMPANY VALUATION, 2023

- FIGURE 54 FINANCIAL METRICS (EV/EBITDA), 2023

- FIGURE 55 BRAND/PRODUCT COMPARISON

- FIGURE 56 REFRIGERATION COOLERS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 57 REFRIGERATION COOLERS MARKET: COMPANY FOOTPRINT

- FIGURE 58 REFRIGERATION COOLERS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 59 JOHNSON CONTROLS: COMPANY SNAPSHOT

- FIGURE 60 LU-VE: COMPANY SNAPSHOT

- FIGURE 61 LENNOX INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 62 DANFOSS: COMPANY SNAPSHOT

- FIGURE 63 MODINE MANUFACTURING COMPANY: COMPANY SNAPSHOT

"The global refrigeration coolers market was valued at USD 4.19 billion in 2024 and is estimated to reach USD 5.74 billion by 2029, registering a CAGR of 6.5% during the forecast period. Rising urbanization, regulatory requirements for cooling refrigerants, growth in online grocery shopping, efficient cold storage and transportation solutions, growth in refrigeration technology, and transition to more environmentally friendly refrigerants are leading to market growth. These and other strategies foster a reasonable setting for the refrigeration coolers market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Mobility, Refrigerant Type and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Ammonia to contribute significant share in refrigeration coolers market."

Ammonia refrigerant, therefore, is expected to grow strongly in the refrigeration coolers market because of its excellent thermodynamic properties, energy efficiency, and environmental benefits. Industries will have to reduce their carbon footprints because there is an increasing international tendency to oblige with sterner regulations on environmental issues that border on climate change, depleting the ozone layer, and others. High efficiency, lower energy consumption, and high-scale application in industrial refrigeration and cold storage also has promising prospects for large-scale growth. Moreover, the safety and performance improvements of ammonia refrigeration technologies promote more extensive acceptance. Thus, by meeting sustainability requirements, ammonia as a refrigerant is posed for healthy growth in the market.

"Portable mobility to grow significantly in the refrigeration coolers market."

In 2023, the portable mobility segment accounted for a larger market share, and a similar trend is likely to be observed during the forecast period, as the use of refrigeration coolers systems is on the rise in newly emerging applications such as logistics & warehousing. There is great potential for portable refrigeration coolers, as they can be carried everywhere and used anywhere to satisfy convenience and growing demand in a variety of applications. The growth of more street food vendors and food trucks has increased the demand for efficient and compact refrigeration solutions that are portable and can be easily transported and set up in different locations. Similarly, the technology trends in this area have given birth to energy-efficient, lighter, portable coolers, which further contribute to the growing demands among consumers and firms as well. With changing lifestyle and consumer preferences, the market for portable refrigeration coolers will rise significantly.

"Asia Pacific will contribute significantly to the growth rate in refrigeration coolers market."

Asia Pacific is poised to contribute a significant share to the refrigeration coolers market for several compelling reasons, by increasing adoption of energy-efficient refrigeration technologies in Asia Pacific countries due to environmental regulations and more awareness towards sustainable practices. First, the government supports refrigerants like ammonia and CO2 that are not only environmentally friendly but also contribute to the trend that is currently worldwide in helping alleviate the impact of refrigerator systems on the environment. On the other hand, the region's pharmaceutical-based manufacturing facilities have always had a high demand for refrigeration coolers. With growth in e-commerce and online grocery platforms requiring efficient cold chains, these factors are also driving Asia Pacific's growth in the refrigeration coolers market.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the refrigeration coolers market place.

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C-level Executives - 48%, Directors - 33%, and Others - 19%

- By Region: North America- 35%, Europe - 18%, Asia Pacific- 40% and RoW- 7%

The study includes an in-depth competitive analysis of these key players in the refrigeration coolers market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the refrigeration coolers market by offering, refrigerant, industry, mobility and region (North America, Europe, Asia Pacific). The report scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the refrigeration coolers market. A detailed analysis of the key industry players has provided insights into their business overview, solutions and services, key strategies, Contracts, partnerships, and agreements. New product and service launches, acquisitions, and recent developments associated with the refrigeration coolers market. This report covers competitive analysis of upcoming startups in the refrigeration coolers market ecosystem.

Reasons to buy this report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the refrigeration coolers market, and subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (growing investments in refrigerated warehouses/cold storage, rising demand for frozen and processed foods worldwide, rising demand for innovative and compact refrigeration coolers, and growing adoption of natural refrigerant-based systems due to stringent regulatory policies), restraints (High Installation cost ), opportunities (growing popularity of CO2-based cascade refrigeration systems and rising demand for frozen and processed food worldwide), and challenges (the lack of skilled personnel and growing safety concerns pose, setup issues associated with refrigeration coolers systems) influencing the growth of the refrigeration coolers market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the refrigeration coolers market

- Market Development: Comprehensive information about lucrative markets - the report analyses the refrigeration coolers market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the refrigeration coolers market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like as Johnson Controls International plc (Ireland), LU-VE SPA (Italy), Lennox International (US), Kelvion Holding GmbH (Germany), Rivacold srl (Italy) among others in the refrigeration coolers market."

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Intended participants in primary interviews

- 2.1.2.2 Key primary interview participants

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key industry insights

- 2.1.2.5 Key data from primary sources

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Bottom-up approach for estimating market size

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Top-down approach for estimating market size

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN REFRIGERATION COOLERS MARKET

- 4.2 REFRIGERATION COOLERS MARKET, BY OFFERING

- 4.3 REFRIGERATION COOLERS MARKET, BY MOBILITY

- 4.4 REFRIGERATION COOLERS MARKET, BY REFRIGERANT

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing investments in refrigerated warehouses/cold storage facilities

- 5.2.1.2 Growing demand for frozen and processed foods

- 5.2.1.3 Shift towards low GWP refrigerants

- 5.2.1.4 Changes in global weather patterns

- 5.2.2 RESTRAINTS

- 5.2.2.1 High installation and operational costs

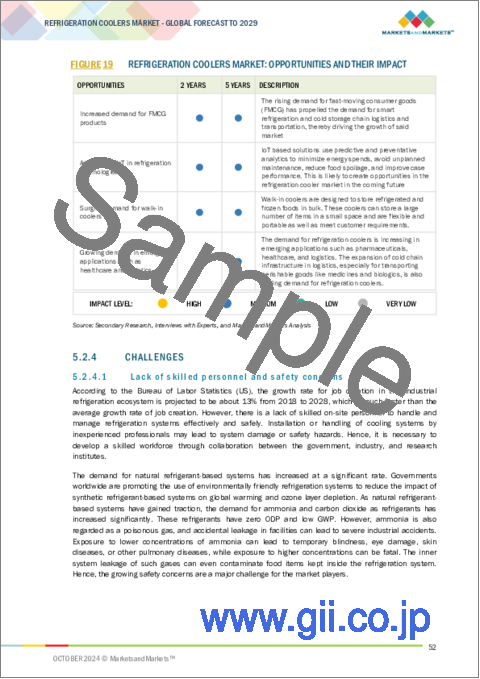

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand for FMCG products

- 5.2.3.2 Adoption of IoT in refrigeration technologies

- 5.2.3.3 Surging demand for walk-in coolers

- 5.2.3.4 Growing demand in emerging applications such as healthcare and logistics

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of skilled personnel and safety concerns

- 5.2.4.2 Complexity associated with installation of refrigeration cooling systems

- 5.2.1 DRIVERS

- 5.3 AI IMPACT ON REFRIGERATION COOLERS MARKET

- 5.4 VALUE CHAIN ANALYSIS

- 5.4.1 RESEARCH AND DEVELOPMENT (R&D)

- 5.4.2 COMPONENT MANUFACTURERS

- 5.4.3 DISTRIBUTORS/RESELLERS

- 5.4.4 ASSEMBLERS/INSTALLERS/INTEGRATORS

- 5.4.5 END USERS

- 5.4.6 AFTER-SALES SERVICES

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY COMPONENT

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Artificial Intelligence (AI)

- 5.9.1.2 Internet of Things (IoT)

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Automation

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Shell and tube heat exchanger

- 5.9.3.2 Spiral heat exchanger

- 5.9.3.3 Plate heat exchanger

- 5.9.3.4 Plate-fin heat exchanger

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 DANFOSS INSTALLS COMPRESSOR SYSTEM AT ANANDA FOODS (INDIA)

- 5.12.2 LU-VE GROUP OFFERS COLD STORAGE SOLUTIONS FOR CARREFOUR SUPERMARKET IN ITALY

- 5.12.3 CARREFOUR'S NORTH-WEST LOGISTICS CENTER IN RIVALTA, TURIN, ADOPTS RIVACOLD'S REFRIGERATION SOLUTIONS

- 5.12.4 INDOSPACE AND KOOL-EX PARTNERSHIP FOR TEMPERATURE-CONTROLLED WAREHOUSING

- 5.12.5 INNOVATE UK, IMS EVOLVE, AND TESCO STORES INVESTIGATE DEMAND-SIDE RESPONSE IN REFRIGERATION SYSTEMS

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT SCENARIO (HS CODE 841869)

- 5.13.2 EXPORT SCENARIO (HS CODE 841869)

- 5.14 PATENT ANALYSIS

- 5.14.1 REFRIGERATION COOLERS MARKET: LIST OF MAJOR PATENTS

- 5.15 KEY CONFERENCES AND EVENTS, 2025

- 5.16 REGULATORY LANDSCAPE

- 5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16.2 STANDARDS

6 REFRIGERATION COOLERS MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 CONDENSERS

- 6.2.1 AIR-COOLED

- 6.2.1.1 Air-cooled condensers suitable for use in water-scarce areas

- 6.2.2 WATER-COOLED

- 6.2.2.1 Demand for compact condensers fueling growth of water-cooled condensers

- 6.2.3 EVAPORATIVE

- 6.2.3.1 Regulations limiting physical size of cooling systems restricting use of evaporative condensers

- 6.2.1 AIR-COOLED

- 6.3 COMPRESSORS

- 6.3.1 POSITIVE DISPLACEMENT COMPRESSORS

- 6.3.1.1 Increasing demand for efficient gas compression driving positive displacement compressors

- 6.3.2 DYNAMIC COMPRESSORS

- 6.3.2.1 Need for low compression with high volume flows refrigerant fueling demand for dynamic compressors

- 6.3.1 POSITIVE DISPLACEMENT COMPRESSORS

- 6.4 EVAPORATORS & AIR COOLERS

- 6.4.1 RISING DEMAND IN LARGE REFRIGERATION PLANTS AND CENTRAL AIR CONDITIONING PLANTS FUELING GROWTH

- 6.4.2 AIR UNITS

- 6.4.2.1 By design type

- 6.4.2.1.1 Horizontal

- 6.4.2.1.1.1 Rising demand for refrigeration in attics or crawl spaces fueling growth of horizontal air coolers

- 6.4.2.1.2 Vertical

- 6.4.2.1.2.1 Inclination toward compact design of air coolers increasing adoption of vertical air coolers

- 6.4.2.1.3 V-shaped and angled designs

- 6.4.2.1.3.1 Demand for coolers with reduced plan dimensions driving growth of V-shaped air coolers

- 6.4.2.1.1 Horizontal

- 6.4.2.2 By implementation type

- 6.4.2.2.1 Ceiling/Wall

- 6.4.2.2.1.1 Increasing space crunch in buildings propelling adoption of ceiling/wall-mounted air coolers

- 6.4.2.2.2 Floor

- 6.4.2.2.2.1 Demand for air cooling in large rooms driving growth of floor air coolers

- 6.4.2.2.3 Counter/Cabinets

- 6.4.2.2.3.1 Rising need for air coolers in harsh environments fueling growth of counter/cabinet coolers

- 6.4.2.2.1 Ceiling/Wall

- 6.4.2.1 By design type

- 6.4.3 DRY COOLERS

- 6.4.3.1 Demand for efficient heat transfer contributing to growth of dry coolers

- 6.4.4 BRINE COOLERS

- 6.4.4.1 Rising installation of air coolers in commercial and industrial refrigeration fueling growth of brine coolers

- 6.4.5 BLAST/TUNNEL UNIT COOLERS

- 6.4.5.1 Demand for cold storage fueling adoption of blast unit coolers

7 REFRIGERATION COOLERS MARKET, BY REFRIGERANT

- 7.1 INTRODUCTION

- 7.2 HFC/HFO

- 7.2.1 MOST WIDELY USED REFRIGERANT TYPE FOR REFRIGERATION COOLERS

- 7.3 CO2

- 7.3.1 INCREASED DEMAND FOR HEAT RECOVERY FUELING ADOPTION OF CO2 REFRIGERANTS

- 7.4 NH3

- 7.4.1 NEED FOR EFFICIENT COOLING IN INDUSTRIAL APPLICATIONS CONTRIBUTING TO GROWTH OF NH3 REFRIGERANTS

- 7.5 PROPANE

- 7.5.1 DEMAND FOR ENVIRONMENTALLY FRIENDLY, AFFORDABLE OPTION PROPELLING ADOPTION OF PROPANE

- 7.6 OTHERS

- 7.6.1 DEMAND FOR A2L REFRIGERANTS INCREASING TO ENSURE SAFE OPERATIONS

8 REFRIGERATION COOLERS MARKET, BY MOBILITY

- 8.1 INTRODUCTION

- 8.2 STATIONARY

- 8.2.1 STATIONARY REFRIGERATION COOLERS WIDELY USED FOR RELIABLE, LARGE-SCALE, AND LONG-TERM COOLING SOLUTIONS

- 8.3 PORTABLE 106 8.3.1 INCREASED FOOD TRANSPORTATION DEMAND FUELING ADOPTION OF MOBILE/PORTABLE COOLING SYSTEMS

9 REFRIGERATION COOLERS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 RETAIL

- 9.2.1 SUPERMARKETS

- 9.2.1.1 Need for continuous refrigeration propelling demand for refrigeration units in supermarkets

- 9.2.2 HYPERMARKETS

- 9.2.2.1 Demand for better visibility of food on racks increasing adoption of refrigeration coolers in hypermarkets

- 9.2.3 CONVENIENCE STORES & MINI MARKETS

- 9.2.3.1 Need for walk-in freezers in convenience stores accelerating demand for refrigeration coolers

- 9.2.4 HOSPITALITY

- 9.2.4.1 Demand for cold storage of food & beverages in hotels driving adoption of refrigeration coolers

- 9.2.1 SUPERMARKETS

- 9.3 FOOD & BEVERAGE

- 9.3.1 FRUIT & VEGETABLE PROCESSING

- 9.3.1.1 Need for preservation of fruits & vegetables for longer periods fueling growth

- 9.3.2 BEVERAGE PROCESSING

- 9.3.2.1 Demand for fresh beverages fueling market for refrigeration coolers

- 9.3.3 DAIRY & ICE-CREAM PROCESSING

- 9.3.3.1 Need to reduce spoilage of dairy products increasing use of refrigeration coolers

- 9.3.4 MEAT, POULTRY & FISH PROCESSING

- 9.3.4.1 Demand for refrigeration coolers high in meat, poultry, and fish processing due to their limited shelf life

- 9.3.1 FRUIT & VEGETABLE PROCESSING

- 9.4 LOGISTICS & WAREHOUSING

- 9.4.1 REFRIGERATED WAREHOUSES

- 9.4.1.1 Need for extra surveillance and maintenance of perishable items fueling demand

- 9.4.2 LOGISTICS & STORAGE ROOMS

- 9.4.2.1 Demand for timely ripening of fruits and vegetables accelerating adoption of small storage rooms

- 9.4.1 REFRIGERATED WAREHOUSES

- 9.5 HEALTHCARE & PHARMACEUTICALS

- 9.5.1 VACCINE STORAGE

- 9.5.1.1 Need to ensure safety, longevity, and efficacy of medical products and vaccines to drive market

- 9.5.2 MEDICAL DEVICES

- 9.5.2.1 Refrigeration coolers used to minimize material degradation of certain critical medical devices

- 9.5.1 VACCINE STORAGE

- 9.6 OTHER APPLICATIONS

- 9.6.1 VERTICAL FARMING

- 9.6.2 SCIENTIFIC RESEARCH

- 9.6.3 SPECIAL APPLICATIONS

10 REFRIGERATION COOLERS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Strict guidelines regarding storage of food to prevent spoilage and bacterial growth driving demand

- 10.2.3 CANADA

- 10.2.3.1 Rising demand for CO2 refrigerant due to increased environmental concerns

- 10.2.4 MEXICO

- 10.2.4.1 Focus on using refrigeration units with low GWP values to drive market

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Rising need for natural refrigerants to drive market in Germany

- 10.3.3 UK

- 10.3.3.1 Rising demand for cold storage driving market in UK

- 10.3.4 FRANCE

- 10.3.4.1 Increasing adoption of refrigeration coolers in artificial ice-skating rinks to fuel market

- 10.3.5 ITALY

- 10.3.5.1 Adoption of greener refrigeration technologies using eco-friendly refrigerants to accelerate market growth

- 10.3.6 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Significant increase in demand for food, drugs, cosmetics, and cold chain logistics to drive market

- 10.4.3 JAPAN

- 10.4.3.1 Market characterized by shifting focus toward implementation of natural refrigerant-based systems

- 10.4.4 INDIA

- 10.4.4.1 Government initiatives for setting up cold chain networks across country to augment market growth

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Presence of large refrigerated warehousing capacity to propel market growth

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 REST OF THE WORLD (ROW)

- 10.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 10.5.2 MIDDLE EAST

- 10.5.2.1 Increasing investments in warehouses and cold storage facilities to fuel demand

- 10.5.3 AFRICA

- 10.5.3.1 Food security, healthcare, pharmaceuticals, and export-driven agribusiness to drive market

- 10.5.4 SOUTH AMERICA

- 10.5.4.1 Increasing demand in commercial applications, especially supermarkets, to fuel market growth

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 11.3 REVENUE ANALYSIS, 2019-2023

- 11.4 MARKET SHARE ANALYSIS, 2023

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Offering footprint

- 11.7.5.4 Mobility footprint

- 11.7.5.5 Application footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING, STARTUPS/SMES, 2023

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.9.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 JOHNSON CONTROLS

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 LU-VE

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Expansions

- 12.1.2.3.3 Other developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 KELVION HOLDING GMBH

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.3.3 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 RIVACOLD SRL

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 MnM view

- 12.1.4.3.1 Key strengths/Right to win

- 12.1.4.3.2 Strategic choices

- 12.1.4.3.3 Weaknesses and competitive threats

- 12.1.5 LENNOX INTERNATIONAL INC.

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 GUNTNER GMBH & CO. KG

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.7 COPELAND LP

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Deals

- 12.1.7.3.3 Expansions

- 12.1.8 DANFOSS

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.8.3.2 Deals

- 12.1.8.3.3 Other developments

- 12.1.9 MODINE MANUFACTURING COMPANY

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.9.3.2 Expansions

- 12.1.9.3.3 Other developments

- 12.1.10 EVAPCO

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.11 THERMOFIN

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.1 JOHNSON CONTROLS

- 12.2 OTHER PLAYERS

- 12.2.1 STEFANI

- 12.2.2 ONDA S.P.A.

- 12.2.3 ROEN EST

- 12.2.4 KFL

- 12.2.5 WALTER ROLLER

- 12.2.6 CABERO

- 12.2.7 THERMOKEY

- 12.2.8 KOXKA

- 12.2.9 CENTAURO INTERNACIONAL

- 12.2.10 BALTIMORE AIRCOIL COMPANY, INC.

- 12.2.11 FRITERM

- 12.2.12 DAIKIN

- 12.2.13 PROFROID

- 12.2.14 ROCKWELL INDUSTRIES LIMITED

- 12.2.15 MUKUNDA FOODS PRIVATE LIMITED

- 12.2.16 BLUE STAR LIMITED

- 12.2.17 WSL REFRIGERATION D.O.O.

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS