|

|

市場調査レポート

商品コード

1684187

空港システムの世界市場:技術別、ソリューション別、実装別、用途別、地域別 - 2030年までの予測Airport Systems Market by Technology, Solution (Passenger processing system, Airport Operation & Ground Handling System, Air Traffic Management System), Application (Airside, Terminal Side) Implementation and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 空港システムの世界市場:技術別、ソリューション別、実装別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年03月17日

発行: MarketsandMarkets

ページ情報: 英文 364 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

空港システムの市場規模は、2024年に322億8,000万米ドル、2030年には502億7,000万米ドルになると推定され、CAGRは7.7%と予測されています。

世界中の空港が効率、セキュリティ、旅客体験を強化するために最先端技術に投資しているため、空港システム市場は非常に急速に成長しています。空港業務の複雑化に伴い、相互接続されたデジタルプラットフォーム、自動化、リアルタイムデータ分析のニーズが拡大しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | 技術別、ソリューション別、実装別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

サイバーセキュリティ分野は、デジタル変革プロジェクトの高まりとサイバー脅威の高まりにより、空港システム市場で最大の成長率を記録します。空港は、クラウドコンピューティング、IoTベースの資産管理、AIを活用した分析など、相互依存のITインフラへの依存度を高めており、基幹システムへのサイバー攻撃の脅威は日々高まっています。ランサムウェア攻撃、データ漏洩、運用インシデントの増加により、より強固なサイバーセキュリティ対策の必要性が生じています。国際民間航空機関(ICAO)や米国運輸保安局(TSA)のような規制機関は、より強固なコンプライアンス体制を求めており、空港は高度な脅威検知、リアルタイム監視、ゼロトラスト・セキュリティ・モデルへの出費を余儀なくされています。さらに、生体認証による旅客処理、自動化された国境管理、非接触型決済の導入により、より強力な暗号化とID保護が必要な機密情報の量が増加しています。リスクを軽減するため、空港ではAIベースの脅威インテリジェンス、エンドポイントセキュリティ、インシデント対応ソリューションの導入が進んでいます。さらに、ハイブリッド運用モデルの拡大に伴い、サイバーセキュリティへの投資はITネットワークにとどまらず、重要な運用技術(OT)インフラを保護する方向に進んでいます。サイバー脆弱性によってもたらされる経済的、風評的、業務上の脅威により、サイバーセキュリティは現在、優先的な投資となっており、空港システム市場で最も急成長している分野となっています。

自律型旅客輸送セグメントは、旅客輸送量の増加、空港の拡張プロジェクト、非接触で摩擦のないモビリティソリューションへの要求により、空港システム市場で最も高い成長を遂げるとみられています。空港が無駄のない空港を目指す中で、自律走行シャトル、自動運転電気バス、ドライバーレス・ピープル・ムーバー(APM)への支出が膨らんでいます。これらのシステムは、あるターミナル、駐車場、または公共交通機関のノードから別のノードへの乗客の円滑な輸送を促進する経済的で柔軟なソリューションを提供し、従来の輸送形態への依存を軽減します。AI主導の車両管理、リアルタイムの交通センシング、および車両対インフラ(V2I)通信は、空港環境内でよりスマートで応答性の高い自律移動ネットワークを促進しています。また、電気自動車や自律走行型交通システムは、持続可能性の目標を通じて推進されており、排出量の削減や運行効率の向上が図られています。地上輸送サービスの労働力不足も、一貫した信頼性の高い旅客移動を維持するために、空港に自動運転車の導入を迫っています。

主要な国際空港ではすでに自律移動ソリューションのテストが行われており、規制機関も普及を可能にするためのルール作りを進めています。技術が向上し、自動化を可能にするインフラが進化するにつれて、自律型旅客輸送のニーズは増え続け、空港システム市場で最も急成長する分野となります。

アジア太平洋は、航空需要の急速な増加、大規模な空港開拓、洗練された技術への大規模な投資により、空港システム市場を独占する態勢を整えています。中国、インド、インドネシアは旅客輸送量が急増しており、政府や民間事業者は新空港の開発や既存空港の近代化を進めています。北京大興国際空港やインドのノイダ国際空港のような大規模開発では、よりスムーズな旅客の流れ、より迅速な手荷物処理、より高度なセキュリティを提供する最新システムが計画されています。

当レポートでは、世界の空港システム市場について調査し、技術別、ソリューション別、実装別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- 顧客ビジネスに影響を与える動向と混乱

- エコシステム分析

- 価格分析

- 運用データ

- 貿易分析

- 使用事例分析

- 2025年の主な会議とイベント

- 規制状況

- 主な利害関係者と購入基準

- 技術分析

- ビジネスモデル

- 投資と資金調達のシナリオ

- 総所有コスト(TCO)

- 部品表

- 技術ロードマップ

- マクロ経済見通し

第6章 業界の動向

- イントロダクション

- 技術動向

- メガトレンドの影響

- AI/生成AIの影響

- 特許分析

第7章 空港システム市場、技術別

- イントロダクション

- 自動旅客処理

- 乗客体験とデジタルエンゲージメント

- 手荷物および貨物の取扱い

- 航空交通とエプロン管理

- セキュリティと監視

- 航空機のハンドリングとターンアラウンド管理

- 空港と空港のモビリティ

- インテリジェントエネルギーと持続可能性

第8章 空港システム市場、ソリューション別

- イントロダクション

- 旅客処理システム

- 空港運営および地上ハンドリングシステム

- セキュリティシステム

- 情報通信システム

- ユーティリティシステム

- 環境システム

- 航空交通管理システム

- 空港駐車場と地上交通システム

第9章 空港システム市場、実装別

- イントロダクション

- アップグレードと近代化

- 新規インストール

第10章 空港システム市場、用途別

- イントロダクション

- エアサイド

- ターミナルサイド

- ランドサイド

第11章 空港システム市場、地域別

- イントロダクション

- 北米

- PESTLE分析

- 米国

- カナダ

- 欧州

- PESTLE分析

- 英国

- フランス

- ドイツ

- オランダ

- その他

- アジア太平洋

- PESTLE分析

- 中国

- インド

- 日本

- シンガポール

- オーストラリア

- その他

- 中東

- PESTLE分析

- 湾岸協力会議

- その他

- その他の地域

- ブラジル

- メキシコ

- 南アフリカ

- その他

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2020年~2025年

- 収益分析、2020年~2023年

- 市場シェア分析、2023年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業価値評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- SITA

- AMADEUS IT GROUP SA

- RTX

- THALES

- VANDERLANDE INDUSTRIES B.V.

- INDRA

- SIEMENS AG

- ADB SAFEGATE

- RESA

- TAV TECHNOLOGIES

- DAMAREL SYSTEMS INTERNATIONAL LTD

- NEC CORPORATION

- HONEYWELL INTERNATIONAL, INC.

- DEUTSCHE TELEKOM AG

- OSHKOSH AEROTECH

- TK ELEVATOR

- LEIDOS

- BEUMER GROUP

- DAIFUKU CO., LTD.

- その他の企業

- CURBIQ

- AUTOMOTUS, INC.

- SKIDATA

- MANTRA SOFTECH(INDIA)PVT. LTD.

- VEOVO

- A-ICE SRL

第14章 付録

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 MARKET SIZE ESTIMATION METHODOLOGY

- TABLE 4 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 INDICATIVE PRICING OF AIRPORT SOLUTIONS OFFERED BY KEY PLAYERS (USD)

- TABLE 6 AVERAGE SELLING PRICE OF AIRPORT SYSTEMS, BY REGION, 2021-2024 (USD BILLION)

- TABLE 7 NUMBER OF AIRPORTS, BY AIRPORT SIZE (UNITS)

- TABLE 8 AIRPORT INVESTMENTS, BY REGION

- TABLE 9 PASSENGER PROCESSING SYSTEM, BY AIRPORT SIZE (UNITS)

- TABLE 10 SECURITY SYSTEM, BY AIRPORT SIZE (UNITS)

- TABLE 11 AIRPORT OPERATIONS & GROUND HANDLING SYSTEM, BY AIRPORT SIZE (UNITS)

- TABLE 12 IMPORT DATA FOR SERVICE CODE 9, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 13 EXPORT DATA FOR SERVICE CODE 9, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 14 KEY CONFERENCES AND EVENTS, 2025

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP TWO SOLUTIONS

- TABLE 20 KEY BUYING CRITERIA FOR TOP TWO SOLUTIONS

- TABLE 21 BUSINESS MODELS IN AIRPORT SYSTEMS MARKET

- TABLE 22 COMPARISON OF TOTAL COST OF OWNERSHIP OF AIRPORT SYSTEMS

- TABLE 23 PATENT ANALYSIS

- TABLE 24 AIRPORT SYSTEMS MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 25 AIRPORT SYSTEMS MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 26 AIRPORT SYSTEMS MARKET, BY AUTOMATED PASSENGER PROCESSING, 2020-2023 (USD MILLION)

- TABLE 27 AIRPORT SYSTEMS MARKET, BY AUTOMATED PASSENGER PROCESSING, 2024-2030 (USD MILLION)

- TABLE 28 AIRPORT SYSTEMS MARKET, BY PASSENGER EXPERIENCE & DIGITAL ENGAGEMENT, 2020-2023 (USD MILLION)

- TABLE 29 AIRPORT SYSTEMS MARKET, BY PASSENGER EXPERIENCE & DIGITAL ENGAGEMENT, 2024-2030 (USD MILLION)

- TABLE 30 AIRPORT SYSTEMS MARKET, BY BAGGAGE & CARGO HANDLING, 2020-2023 (USD MILLION)

- TABLE 31 AIRPORT SYSTEMS MARKET, BY BAGGAGE & CARGO HANDLING, 2024-2030 (USD MILLION)

- TABLE 32 AIRPORT SYSTEMS MARKET, BY AIR TRAFFIC & APRON MANAGEMENT, 2020-2023 (USD MILLION)

- TABLE 33 AIRPORT SYSTEMS MARKET, BY AIR TRAFFIC & APRON MANAGEMENT, 2024-2030 (USD MILLION)

- TABLE 34 AIRPORT SYSTEMS MARKET, BY SECURITY & SURVEILLANCE, 2020-2023 (USD MILLION)

- TABLE 35 AIRPORT SYSTEMS MARKET, BY SECURITY & SURVEILLANCE, 2024-2030 (USD MILLION)

- TABLE 36 AIRPORT SYSTEMS MARKET, BY AIRCRAFT HANDLING & TURNAROUND MANAGEMENT, 2020-2023 (USD MILLION)

- TABLE 37 AIRPORT SYSTEMS MARKET, BY AIRCRAFT HANDLING & TURNAROUND MANAGEMENT, 2024-2030 (USD MILLION)

- TABLE 38 AIRPORT SYSTEMS MARKET, BY AIRSIDE & LANDSIDE MOBILITY, 2020-2023 (USD MILLION)

- TABLE 39 AIRPORT SYSTEMS MARKET, BY AIRSIDE & LANDSIDE MOBILITY, 2024-2030 (USD MILLION)

- TABLE 40 AIRPORT SYSTEMS MARKET, BY INTELLIGENT ENERGY & SUSTAINABILITY, 2020-2023 (USD MILLION)

- TABLE 41 AIRPORT SYSTEMS MARKET, BY INTELLIGENT ENERGY & SUSTAINABILITY, 2024-2030 (USD MILLION)

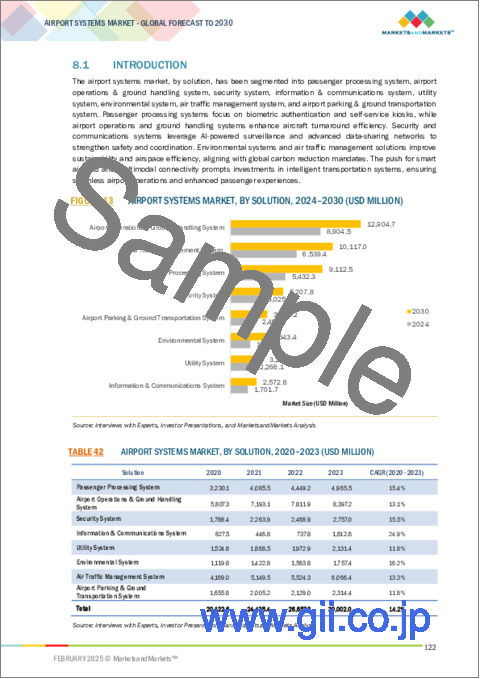

- TABLE 42 AIRPORT SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 43 AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- TABLE 44 AIRPORT SYSTEMS MARKET, BY PASSENGER PROCESSING SYSTEM, 2020-2023 (USD MILLION)

- TABLE 45 AIRPORT SYSTEMS MARKET, BY PASSENGER PROCESSING SYSTEM, 2024-2030 (USD MILLION)

- TABLE 46 AIRPORT SYSTEMS MARKET, BY AIRPORT OPERATIONS & GROUND HANDLING SYSTEM, 2020-2023 (USD MILLION)

- TABLE 47 AIRPORT SYSTEMS MARKET, BY AIRPORT OPERATIONS & GROUND HANDLING SYSTEM, 2024-2030 (USD MILLION)

- TABLE 48 AIRPORT SYSTEMS MARKET, BY SECURITY SYSTEM, 2020-2023 (USD MILLION)

- TABLE 49 AIRPORT SYSTEMS MARKET, BY SECURITY SYSTEM, 2024-2030 (USD MILLION)

- TABLE 50 AIRPORT SYSTEMS MARKET, BY INFORMATION & COMMUNICATIONS SYSTEM, 2020-2023 (USD MILLION)

- TABLE 51 AIRPORT SYSTEMS MARKET, BY INFORMATION & COMMUNICATIONS SYSTEM, 2024-2030 (USD MILLION)

- TABLE 52 AIRPORT SYSTEMS MARKET, BY UTILITY SYSTEM, 2020-2023 (USD MILLION)

- TABLE 53 AIRPORT SYSTEMS MARKET, BY UTILITY SYSTEM, 2024-2030 (USD MILLION)

- TABLE 54 AIRPORT SYSTEMS MARKET, BY ENVIRONMENTAL SYSTEM, 2020-2023 (USD MILLION)

- TABLE 55 AIRPORT SYSTEMS MARKET, BY ENVIRONMENTAL SYSTEM, 2024-2030 (USD MILLION)

- TABLE 56 AIRPORT SYSTEMS MARKET, BY AIR TRAFFIC MANAGEMENT SYSTEM, 2020-2023 (USD MILLION)

- TABLE 57 AIRPORT SYSTEMS MARKET, BY AIR TRAFFIC MANAGEMENT SYSTEM, 2024-2030 (USD MILLION)

- TABLE 58 AIRPORT SYSTEMS MARKET, BY AIRPORT PARKING & GROUND TRANSPORTATION SYSTEM, 2020-2023 (USD MILLION)

- TABLE 59 AIRPORT SYSTEMS MARKET, BY AIRPORT PARKING & GROUND TRANSPORTATION SYSTEM, 2024-2030 (USD MILLION)

- TABLE 60 AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 61 AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 62 AIRPORT SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 63 AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 64 AIRPORT SYSTEMS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 65 AIRPORT SYSTEMS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: AIRPORT PROJECTS AND CUSTOMER LANDSCAPE

- TABLE 67 NORTH AMERICA: AIRPORT SYSTEMS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 68 NORTH AMERICA: AIRPORT SYSTEMS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: AIRPORT SYSTEMS MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 70 NORTH AMERICA: AIRPORT SYSTEMS MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 72 NORTH AMERICA: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- TABLE 73 NORTH AMERICA: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 74 NORTH AMERICA: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 76 NORTH AMERICA: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 77 US: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 78 US: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- TABLE 79 US: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 80 US: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 81 US: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 82 US: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 83 CANADA: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 84 CANADA: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- TABLE 85 CANADA: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 86 CANADA: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 87 CANADA: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 88 CANADA: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 89 EUROPE: AIRPORT PROJECTS AND CUSTOMER LANDSCAPE

- TABLE 90 EUROPE: AIRPORT SYSTEMS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 91 EUROPE: AIRPORT SYSTEMS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 92 EUROPE: AIRPORT SYSTEMS MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 93 EUROPE: AIRPORT SYSTEMS MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 94 EUROPE: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 95 EUROPE: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- TABLE 96 EUROPE: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 97 EUROPE: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 98 EUROPE: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 99 EUROPE: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 100 UK: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 101 UK: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- TABLE 102 UK: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 103 UK: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 104 UK: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 105 UK: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 106 FRANCE: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 107 FRANCE: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- TABLE 108 FRANCE: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 109 FRANCE: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 110 FRANCE: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 111 FRANCE: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 112 GERMANY: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 113 GERMANY: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- TABLE 114 GERMANY: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 115 GERMANY: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 116 GERMANY: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 117 GERMANY: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 118 NETHERLANDS: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 119 NETHERLANDS: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- TABLE 120 NETHERLANDS: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 121 NETHERLANDS: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 122 NETHERLANDS: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 123 NETHERLANDS: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 124 REST OF EUROPE: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 125 REST OF EUROPE: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- TABLE 126 REST OF EUROPE: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 127 REST OF EUROPE: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 128 REST OF EUROPE: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 129 REST OF EUROPE: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 130 ASIA PACIFIC: AIRPORT PROJECTS AND CUSTOMER LANDSCAPE

- TABLE 131 ASIA PACIFIC: AIRPORT SYSTEMS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 132 ASIA PACIFIC: AIRPORT SYSTEMS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: AIRPORT SYSTEMS MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 134 ASIA PACIFIC: AIRPORT SYSTEMS MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 135 ASIA PACIFIC: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 136 ASIA PACIFIC: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 138 ASIA PACIFIC: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 139 ASIA PACIFIC: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 140 ASIA PACIFIC: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 141 CHINA: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 142 CHINA: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- TABLE 143 CHINA: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 144 CHINA: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 145 CHINA: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 146 CHINA: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 147 INDIA: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 148 INDIA: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- TABLE 149 INDIA: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 150 INDIA: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 151 INDIA: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 152 INDIA: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 153 JAPAN: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 154 JAPAN: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- TABLE 155 JAPAN: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 156 JAPAN: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 157 JAPAN: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 158 JAPAN: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 159 SINGAPORE: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 160 SINGAPORE: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- TABLE 161 SINGAPORE: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 162 SINGAPORE: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 163 SINGAPORE: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 164 SINGAPORE: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 165 AUSTRALIA: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 166 AUSTRALIA: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- TABLE 167 AUSTRALIA: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 168 AUSTRALIA: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 169 AUSTRALIA: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 170 AUSTRALIA: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- TABLE 173 REST OF ASIA PACIFIC: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 174 REST OF ASIA PACIFIC: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 175 REST OF ASIA PACIFIC: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 176 REST OF ASIA PACIFIC: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 177 MIDDLE EAST: AIRPORT PROJECTS AND CUSTOMER LANDSCAPE

- TABLE 178 MIDDLE EAST: AIRPORT SYSTEMS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 179 MIDDLE EAST: AIRPORT SYSTEMS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 180 MIDDLE EAST: AIRPORT SYSTEMS MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 181 MIDDLE EAST: AIRPORT SYSTEMS MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 182 MIDDLE EAST: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 183 MIDDLE EAST: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- TABLE 184 MIDDLE EAST: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 185 MIDDLE EAST: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 186 MIDDLE EAST: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 187 MIDDLE EAST: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 188 UAE: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 189 UAE: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- TABLE 190 UAE: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 191 UAE: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 192 UAE: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 193 UAE: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 194 SAUDI ARABIA: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 195 SAUDI ARABIA: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- TABLE 196 SAUDI ARABIA: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 197 SAUDI ARABIA: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 198 SAUDI ARABIA: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 199 SAUDI ARABIA: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 200 REST OF MIDDLE EAST: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 201 REST OF MIDDLE EAST: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- TABLE 202 REST OF MIDDLE EAST: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 203 REST OF MIDDLE EAST: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 204 REST OF MIDDLE EAST: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 205 REST OF MIDDLE EAST: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 206 REST OF THE WORLD: AIRPORT PROJECTS AND CUSTOMER LANDSCAPE

- TABLE 207 REST OF THE WORLD: AIRPORT SYSTEMS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 208 REST OF THE WORLD: AIRPORT SYSTEMS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 209 REST OF THE WORLD: AIRPORT SYSTEMS MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 210 REST OF THE WORLD: AIRPORT SYSTEMS MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 211 REST OF THE WORLD: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 212 REST OF THE WORLD: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- TABLE 213 REST OF THE WORLD: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 214 REST OF THE WORLD: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 215 REST OF THE WORLD: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 216 REST OF THE WORLD: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 217 BRAZIL: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 218 BRAZIL: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- TABLE 219 BRAZIL: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 220 BRAZIL: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 221 BRAZIL: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 222 BRAZIL: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 223 MEXICO: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 224 MEXICO: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- TABLE 225 MEXICO: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 226 MEXICO: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 227 MEXICO: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 228 MEXICO: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 229 SOUTH AFRICA: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 230 SOUTH AFRICA: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- TABLE 231 SOUTH AFRICA: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 232 SOUTH AFRICA: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 233 SOUTH AFRICA: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 234 SOUTH AFRICA: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 235 OTHERS: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD MILLION)

- TABLE 236 OTHERS: AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- TABLE 237 OTHERS: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2020-2023 (USD MILLION)

- TABLE 238 OTHERS: AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- TABLE 239 OTHERS: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 240 OTHERS: AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 241 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- TABLE 242 AIRPORT SYSTEMS MARKET: DEGREE OF COMPETITION

- TABLE 243 REGION FOOTPRINT

- TABLE 244 SOLUTION FOOTPRINT

- TABLE 245 APPLICATION FOOTPRINT

- TABLE 246 LIST OF START-UPS/SMES

- TABLE 247 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 248 AIRPORT SYSTEMS MARKET: PRODUCT LAUNCHES, 2020-2025

- TABLE 249 AIRPORT SYSTEMS MARKET: DEALS, 2020-2025

- TABLE 250 AIRPORT SYSTEMS MARKET: OTHERS, 2020-2025

- TABLE 251 SITA: COMPANY OVERVIEW

- TABLE 252 SITA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 SITA: DEALS

- TABLE 254 SITA: OTHERS

- TABLE 255 AMADEUS IT GROUP SA: COMPANY OVERVIEW

- TABLE 256 AMADEUS IT GROUP SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 AMADEUS IT GROUP SA: DEALS

- TABLE 258 AMADEUS IT GROUP SA: OTHERS

- TABLE 259 RTX: COMPANY OVERVIEW

- TABLE 260 RTX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 RTX: PRODUCT LAUNCHES

- TABLE 262 RTX: OTHERS

- TABLE 263 THALES: COMPANY OVERVIEW

- TABLE 264 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 THALES: PRODUCT LAUNCHES

- TABLE 266 THALES: DEALS

- TABLE 267 THALES: OTHERS

- TABLE 268 VANDERLANDE INDUSTRIES B.V.: COMPANY OVERVIEW

- TABLE 269 VANDERLANDE INDUSTRIES B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 VANDERLANDE INDUSTRIES B.V.: PRODUCT LAUNCHES

- TABLE 271 VANDERLANDE INDUSTRIES B.V.: DEALS

- TABLE 272 VANDERLANDE INDUSTRIES B.V.: OTHERS

- TABLE 273 INDRA: COMPANY OVERVIEW

- TABLE 274 INDRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 275 INDRA: DEALS

- TABLE 276 INDRA: OTHERS

- TABLE 277 SIEMENS AG: COMPANY OVERVIEW

- TABLE 278 SIEMENS AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 279 SIEMENS AG: PRODUCT LAUNCHES

- TABLE 280 SIEMENS AG: DEALS

- TABLE 281 SIEMENS AG: OTHERS

- TABLE 282 ADB SAFEGATE: COMPANY OVERVIEW

- TABLE 283 ADB SAFEGATE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 284 ADB SAFEGATE: PRODUCT LAUNCHES

- TABLE 285 ADB SAFEGATE: DEALS

- TABLE 286 ADB SAFEGATE: OTHERS

- TABLE 287 RESA: COMPANY OVERVIEW

- TABLE 288 RESA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 RESA: DEALS

- TABLE 290 RESA: OTHERS

- TABLE 291 TAV TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 292 TAV TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 293 TAV TECHNOLOGIES: DEALS

- TABLE 294 TAV TECHNOLOGIES: OTHERS

- TABLE 295 DAMAREL SYSTEMS INTERNATIONAL LTD: COMPANY OVERVIEW

- TABLE 296 DAMAREL SYSTEMS INTERNATIONAL LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 297 DAMAREL SYSTEMS INTERNATIONAL LTD: PRODUCT LAUNCHES

- TABLE 298 DAMAREL SYSTEMS INTERNATIONAL LTD: OTHERS

- TABLE 299 NEC CORPORATION: COMPANY OVERVIEW

- TABLE 300 NEC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 301 NEC CORPORATION: PRODUCT LAUNCHES

- TABLE 302 NEC CORPORATION: DEALS

- TABLE 303 NEC CORPORATION: OTHERS

- TABLE 304 HONEYWELL INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 305 HONEYWELL INTERNATIONAL, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 306 HONEYWELL INTERNATIONAL, INC.: OTHERS

- TABLE 307 DEUTSCHE TELEKOM AG: COMPANY OVERVIEW

- TABLE 308 DEUTSCHE TELEKOM AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 309 DEUTSCHE TELEKOM AG: DEALS

- TABLE 310 OSHKOSH AEROTECH: COMPANY OVERVIEW

- TABLE 311 OSHKOSH AEROTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 312 OSHKOSH AEROTECH: DEALS

- TABLE 313 TK ELEVATOR: COMPANY OVERVIEW

- TABLE 314 TK ELEVATOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 315 TK ELEVATOR: DEALS

- TABLE 316 TK ELEVATOR: OTHERS

- TABLE 317 LEIDOS: COMPANY OVERVIEW

- TABLE 318 LEIDOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 319 LEIDOS: PRODUCT LAUNCHES

- TABLE 320 LEIDOS: DEALS

- TABLE 321 LEIDOS: OTHERS

- TABLE 322 BEUMER GROUP: COMPANY OVERVIEW

- TABLE 323 BEUMER GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 324 BEUMER GROUP: OTHERS

- TABLE 325 DAIFUKU CO., LTD.: COMPANY OVERVIEW

- TABLE 326 DAIFUKU CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 327 DAIFUKU CO., LTD.: PRODUCT LAUNCHES

- TABLE 328 DAIFUKU CO., LTD.: OTHERS

- TABLE 329 CUBIC: COMPANY OVERVIEW

- TABLE 330 AUTOMOTUS, INC.: COMPANY OVERVIEW

- TABLE 331 SKIDATA: COMPANY OVERVIEW

- TABLE 332 MANTRA SOFTECH (INDIA) PVT. LTD.: COMPANY OVERVIEW

- TABLE 333 VEOVO: COMPANY OVERVIEW

- TABLE 334 A-ICE SRL: COMPANY OVERVIEW

List of Figures

- FIGURE 1 AIRPORT SYSTEMS MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN MODEL

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 UPGRADE & MODERNIZATION SEGMENT TO BE LARGER THAN NEW INSTALLATION SEGMENT DURING FORECAST PERIOD

- FIGURE 8 AIRPORT OPERATIONS & GROUND HANDLING SYSTEM TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 9 TERMINAL SIDE SEGMENT TO ACQUIRE MAXIMUM SHARE DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO BE LARGEST MARKET FOR AIRPORT SYSTEMS DURING FORECAST PERIOD

- FIGURE 11 RISE IN GLOBAL AIR TRAVEL TO DRIVE MARKET

- FIGURE 12 TERMINAL SIDE SEGMENT TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 13 UPGRADE & MODERNIZATION TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 14 BIOMETRIC CHECK-IN AND BOARDING SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 15 DIGITAL PASSENGER EXPERIENCE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 16 JAPAN TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 17 AIRPORT SYSTEMS MARKET DYNAMICS

- FIGURE 18 RISE IN PASSENGER TRAFFIC AT AIRPORTS

- FIGURE 19 INVESTMENT TRENDS IN AIRPORT APPLICATIONS

- FIGURE 20 EVOLUTION OF AIRPORT TECHNOLOGIES

- FIGURE 21 IMPLEMENTATION OF SELF-SERVICE SOLUTIONS BY AIRPORTS, 2015-2024

- FIGURE 22 TYPES OF AIRPORT ATTACKS, 2021-2023

- FIGURE 23 VALUE CHAIN ANALYSIS

- FIGURE 24 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 ECOSYSTEM ANALYSIS

- FIGURE 26 INDICATIVE PRICING OF AIRPORT SYSTEMS OFFERED BY KEY PLAYERS (USD)

- FIGURE 27 AVERAGE SELLING PRICE OF AIRPORT SYSTEMS, BY REGION, 2021-2024 (USD BILLION)

- FIGURE 28 IMPORT DATA FOR SERVICE CODE 9, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 29 EXPORT DATA FOR SERVICE CODE 9, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP TWO SOLUTIONS

- FIGURE 31 KEY BUYING CRITERIA FOR TOP TWO SOLUTIONS

- FIGURE 32 BUSINESS MODELS IN AIRPORT SYSTEMS MARKET

- FIGURE 33 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 34 TOTAL COST OF OWNERSHIP OF AIRPORT SYSTEMS

- FIGURE 35 BILL OF MATERIALS FOR SECURITY & SURVEILLANCE SYSTEMS

- FIGURE 36 BILL OF MATERIALS FOR CARGO & BAGGAGE MANAGEMENT SYSTEMS

- FIGURE 37 EVOLUTION OF AIRPORT SYSTEMS

- FIGURE 38 TECHNOLOGY ROADMAP

- FIGURE 39 GENERATIVE AI LANDSCAPE

- FIGURE 40 ADOPTION OF AI IN COMMERCIAL AVIATION BY TOP COUNTRIES

- FIGURE 41 PATENT ANALYSIS

- FIGURE 42 AIRPORT SYSTEMS MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- FIGURE 43 AIRPORT SYSTEMS MARKET, BY SOLUTION, 2024-2030 (USD MILLION)

- FIGURE 44 AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION, 2024-2030 (USD MILLION)

- FIGURE 45 AIRPORT SYSTEMS MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- FIGURE 46 AIRPORT SYSTEMS MARKET, BY REGION, 2024-2030

- FIGURE 47 NORTH AMERICA: AIRPORT SYSTEMS MARKET SNAPSHOT

- FIGURE 48 EUROPE: AIRPORT SYSTEMS MARKET SNAPSHOT

- FIGURE 49 ASIA PACIFIC: AIRPORT SYSTEMS MARKET SNAPSHOT

- FIGURE 50 MIDDLE EAST: AIRPORT SYSTEMS MARKET SNAPSHOT

- FIGURE 51 REST OF THE WORLD: AIRPORT SYSTEMS MARKET SNAPSHOT

- FIGURE 52 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2023

- FIGURE 53 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- FIGURE 54 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 55 COMPANY FOOTPRINT

- FIGURE 56 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 57 VALUATION OF PROMINENT MARKET PLAYERS, 2025

- FIGURE 58 FINANCIAL METRICS OF PROMINENT MARKET PLAYERS, 2025

- FIGURE 59 BRAND/PRODUCT COMPARISON

- FIGURE 60 AMADEUS IT GROUP SA: COMPANY SNAPSHOT

- FIGURE 61 RTX: COMPANY SNAPSHOT

- FIGURE 62 THALES: COMPANY SNAPSHOT

- FIGURE 63 INDRA: COMPANY SNAPSHOT

- FIGURE 64 SIEMENS AG: COMPANY SNAPSHOT

- FIGURE 65 TAV TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 66 NEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 67 HONEYWELL INTERNATIONAL, INC.: COMPANY SNAPSHOT

- FIGURE 68 DEUTSCHE TELEKOM AG: COMPANY SNAPSHOT

The Airport Systems market is estimated in terms of market size to be USD 32.28 billion in 2024 to USD 50.27 billion by 2030, at a CAGR of 7.7%. Airport systems market is growing extremely fast as airports across the globe are investing in cutting-edge technologies to enhance efficiency, security, and passenger experience. This report includes a detailed overview of market trends like the adoption of smart airport solutions, changing regulatory paradigms, and competition. With greater complexity in airport operations, there is an expanding need for interconnected digital platforms, automation, and real-time data analysis.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Solution, Application, Implementation, Technology |

| Regions covered | North America, Europe, APAC, RoW |

The study encompasses major growth impetuses such as increasing air traffic, modernization efforts, and requirement of smooth airport operations. The study encompasses how airports are leveraging recent technologies like machine learning, digital twins, and intelligent surveillance to streamline terminal operations and adhere to global aviation standards. The study also examines emerging trends in airport infrastructure, such as the use of blockchain for security, edge computing to process data, and improved real-time resource allocation. Geographically, the report offers insights into investment patterns, regional growth strategies, and market opportunities in major aviation centers. It also features leading industry participants, examining their strategies, products, and technology capabilities. Based on a fact-based analysis, this report is a must-have guide for stakeholders who want to navigate the evolving airport systems market landscape.

"The Cybersecurity segment will account for the largest market share in the Airport Systems market by security system during the forecast period."

The cybersecurity segment will experience the maximum growth rate in the airport systems market due to rising digital transformation projects and mounting cyber threats. With airports increasingly dependent on interdependent IT infrastructures, such as cloud computing, IoT-based asset management, and AI-powered analytics, the threat of cyberattacks on mission-critical systems is growing every day. Increased ransomware attacks, data breaches, and operational incidents have created the need for more robust cybersecurity measures. It has prompted regulatory agencies like the International Civil Aviation Organization (ICAO) and the U.S. Transportation Security Administration (TSA) to require stronger compliance regimes, forcing airports to spend money on sophisticated threat detection, real-time monitoring, and zero-trust security models. In addition, the implementation of biometric passenger processing, automated border control, and contactless payments is growing the amount of sensitive information that needs stronger encryption and identity protection. To reduce risks, airports are implementing AI-based threat intelligence, endpoint security, and incident response solutions. Furthermore, as hybrid operational models grow, cybersecurity investments are moving beyond IT networks to protect critical operational technology (OT) infrastructure. With the economic, reputational, and operational threats posed by cyber vulnerabilities, cybersecurity is now a priority investment, making it the fastest-growing segment in the airport systems market.

"The autonomous passenger segment will account for the highest CAGR in the airport systems market during the forecast period."

The autonomous passenger transportation segment will experience the highest growth in the airport systems market owing to rising passenger traffic, expansion projects of airports, and requirements for contactless, frictionless mobility solutions. As airports proceed towards becoming lean and unchoked, spending on autonomous shuttles, self-driving electric buses, and driverless people movers (APMs) is piling up. These systems provide an economic, flexible solution to facilitate smooth transportation of passengers from one terminal, parking, or public transport node to another, lessening reliance on conventional forms of transport.The application of AI-driven fleet management, real-time traffic sensing, and vehicle-to-infrastructure (V2I) communication is facilitating smarter, more responsive autonomous mobility networks within airport settings. Electric and autonomous transport systems are also being promoted through sustainability objectives, reducing emissions and enhancing operational efficiency. Ground transportation service labor shortages are also compelling airports to implement self-driving vehicles to maintain consistent and reliable passenger movement.

Key international airports are already testing autonomous mobility solutions, and regulatory agencies are creating rules to enable widespread use. As technology improves and infrastructure evolves to enable automation, the need for autonomous passenger transport will keep increasing, making it the fastest-growing sector in the airport systems market.

"The Asia Pacific market is estimated to lead the market."

The Asia-Pacific region is poised to dominate the airport systems market with increasing air travel demand at a fast rate, massive airport development, and extensive investments in sophisticated technology. China, India, and Indonesia are witnessing passenger traffic growing sharply, which is pushing governments and private operators to develop new airports and modernize existing ones. Massive developments such as Beijing Daxing International Airport and India's Noida International Airport are planned with the most up-to-date systems to offer smoother passenger flow, quicker baggage handling, and greater security.

Several airports in the region are adopting smart technologies such as facial recognition for check-in, AI-managed air traffic control, and automated baggage handling to improve efficiency. Besides, with the emphasis on sustainability, airports are increasingly adopting electrically propelled ground vehicles, energy-efficient lighting, and smart waste management systems. Governments are actively investing in upgrades to airport infrastructure, whereas private investor partnerships are fueling innovation and mass-scale upgrades.

The high concentration of technology suppliers and airport system manufacturers in the region is also driving market expansion. With air travel continuing to grow and airports going digital and automated, the Asia-Pacific region will be the largest and fastest-growing airport systems market during the next few years.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1-49%; Tier 2-37%; and Tier 3-14%

- By Designation: C Level-55%; Directors-27%; and Others-18%

- By Region: North America-32%; Europe-32%; Asia Pacific-16%; Middle East-10%; RoW-10%

Research Coverage

The study covers the airport systems market across various segments and subsegments. It aims to estimate the size and growth potential of this market across different segments based on technology, implementation, solution, application and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their solutions and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Key benefits of buying this report:

This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall airport systems market and its subsegments. The report covers the entire ecosystem of airport systems market. It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall Airport Systems market. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market Drivers (Rise in air passenger traffic, Emergence of smart airports, Extensive security challenges, Extensive use of self-service technologies at airports), Restraints ( High operating costs, Data and Privacy concerns) , Challenges (Expansion of air cargo infrastructure, Rapid adoption of electric and autonomous ground support equipment) , and opportunities (Complexity of large datasets, Prevalence of legacy infrastructure and slow technology adoption).

- Product Development: In-depth analysis of product innovation/development by companies across various region.

- Market Development: Comprehensive information about lucrative markets - the report analyses the airport systems market across varied regions.

- Market Diversification: Exhaustive information about new solutions, recent developments, and investments in Airport Systems market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like SITA (Switzerland), Amadeus IT Group SA (Spain), RTX (US), Thales (France), Vanderlande Industries B.V. (Netherlands), Honeywell International, Inc. (US) among others in the Airport Systems market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AIRPORT SYSTEMS MARKET

- 4.2 AIRPORT SYSTEMS MARKET, BY APPLICATION

- 4.3 AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION

- 4.4 AIRPORT SYSTEMS MARKET, BY AUTOMATED PASSENGER PROCESSING

- 4.5 AIRPORT SYSTEMS MARKET, BY PASSENGER PROCESSING SYSTEM

- 4.6 AIRPORT SYSTEMS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rise in air passenger traffic

- 5.2.1.2 Emergence of smart airports

- 5.2.1.3 Evolving security challenges

- 5.2.1.4 Extensive use of self-service technologies at airports

- 5.2.2 RESTRAINTS

- 5.2.2.1 High operating costs

- 5.2.2.2 Data and privacy concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of air cargo infrastructure

- 5.2.3.2 Rapid adoption of electric and autonomous ground support equipment

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexity of large datasets

- 5.2.4.2 Prevalence of legacy infrastructure and slow technology adoption

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 MANUFACTURERS

- 5.5.2 SYSTEM INTEGRATORS

- 5.6 PRICING ANALYSIS

- 5.6.1 INDICATIVE PRICING OF AIRPORT SYSTEMS OFFERED BY KEY PLAYERS

- 5.6.2 FACTOR ANALYSIS FOR PRICING STRATEGIES OF KEY PLAYERS

- 5.6.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.6.4 FACTOR ANALYSIS FOR REGIONAL PRICING TRENDS

- 5.7 OPERATIONAL DATA

- 5.7.1 TOTAL NUMBER OF AIRPORTS GLOBALLY

- 5.7.2 AIRPORT INVESTMENTS

- 5.7.3 AIRPORT SOLUTIONS REQUIRED

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO

- 5.8.2 EXPORT SCENARIO

- 5.9 USE CASE ANALYSIS

- 5.9.1 HEATHROW AIRPORT INTEGRATES BIOMETRIC TECHNOLOGY TO ENHANCE PASSENGER PROCESSING

- 5.9.2 DUBAI INTERNATIONAL AIRPORT INTRODUCES SELF-SERVICE KIOSKS TO HANDLE PASSENGER VOLUMES

- 5.9.3 CHANGI AIRPORT ADOPTS AI-DRIVEN ANALYTICS TO ADDRESS AIRPORT CONGESTION

- 5.9.4 SHENZHEN AIRPORT UNDERGOES DIGITALIZATION TO OPTIMIZE OPERATIONS

- 5.9.5 HONG KONG INTERNATIONAL AIRPORT DEPLOYS AI SOLUTIONS TO FACILITATE PASSENGER FLOW MANAGEMENT

- 5.9.6 PARIS CHARLES DE GAULLE AIRPORT ADOPTS BIG DATA TO ENSURE SEAMLESS OPERATIONS

- 5.10 KEY CONFERENCES AND EVENTS, 2025

- 5.11 REGULATORY LANDSCAPE

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 TECHNOLOGY ANALYSIS

- 5.13.1 KEY TECHNOLOGIES

- 5.13.1.1 Data integration platforms

- 5.13.1.2 Real-time analytics

- 5.13.2 COMPLEMENTARY TECHNOLOGIES

- 5.13.2.1 RFID and barcode technologies

- 5.13.2.2 Mobile applications

- 5.13.3 ADJACENT TECHNOLOGIES

- 5.13.3.1 AR/VR

- 5.13.1 KEY TECHNOLOGIES

- 5.14 BUSINESS MODELS

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 TOTAL COST OF OWNERSHIP (TCO)

- 5.17 BILL OF MATERIALS

- 5.18 TECHNOLOGY ROADMAP

- 5.19 MACROECONOMIC OUTLOOK

- 5.19.1 NORTH AMERICA

- 5.19.2 EUROPE

- 5.19.3 ASIA PACIFIC

- 5.19.4 MIDDLE EAST

- 5.19.5 LATIN AMERICA

- 5.19.6 AFRICA

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 AI-POWERED AIRPORT MANAGEMENT AND PREDICTIVE ANALYTICS

- 6.2.2 BIOMETRIC AND CONTACTLESS PASSENGER PROCESSING

- 6.2.3 AUTOMATION AND ROBOTICS

- 6.2.4 DOLPHIN AIRPORT INFORMATION

- 6.2.4.1 Dolphin flight information display system

- 6.2.4.2 Dolphin advertising content management system

- 6.2.4.3 Dolphin automatic flight announcement system

- 6.2.5 NEAR FIELD COMMUNICATION

- 6.2.6 RADIOFREQUENCY IDENTIFICATION

- 6.2.7 ARMADILLO INTEGRATED SECURITY

- 6.2.8 UNASSISTED BAG-DROP FACILITY

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 5G

- 6.3.2 EMERGING MOBILITY SOLUTIONS

- 6.4 IMPACT OF AI/GENERATIVE AI

- 6.4.1 INTRODUCTION

- 6.4.2 ADOPTION OF AI IN COMMERCIAL AVIATION BY TOP COUNTRIES

- 6.5 PATENT ANALYSIS

7 AIRPORT SYSTEMS MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 AUTOMATED PASSENGER PROCESSING

- 7.2.1 BIOMETRIC CHECK-IN & BOARDING

- 7.2.1.1 Focus on reducing dependency on manual checks to drive market

- 7.2.2 SELF-SERVICE KIOSK & CONTACTLESS PROCESSING

- 7.2.2.1 Need for automated solutions due to rising air traffic to drive

- 7.2.3 AUTOMATED BORDER CONTROL & PASSENGER SCREENING

- 7.2.3.1 Government emphasis on airport security to drive market

- 7.2.4 AI-DRIVEN PASSENGER FLOW OPTIMIZATION & QUEUE MANAGEMENT

- 7.2.4.1 Integration of AI with existing airport infrastructure to drive market

- 7.2.1 BIOMETRIC CHECK-IN & BOARDING

- 7.3 PASSENGER EXPERIENCE & DIGITAL ENGAGEMENT

- 7.3.1 PERSONALIZED PASSENGER ENGAGEMENT

- 7.3.1.1 Emphasis on passenger satisfaction to drive market

- 7.3.2 AUGMENTED & VIRTUAL REALITY FOR PASSENGER NAVIGATION

- 7.3.2.1 Consumer expectations for seamless travel experiences to drive market

- 7.3.3 AUTOMATED RETAIL & SMART DUTY-FREE SHOPPING

- 7.3.3.1 Lucrative opportunities for automated retail solutions to drive market

- 7.3.4 VOICE & GESTURE-BASED INTERACTIVE AIRPORT KIOSK

- 7.3.4.1 Growing need for efficient passenger services to drive market

- 7.3.1 PERSONALIZED PASSENGER ENGAGEMENT

- 7.4 BAGGAGE & CARGO HANDLING

- 7.4.1 AUTOMATED BAGGAGE HANDLING

- 7.4.1.1 Airport expansion projects to drive market

- 7.4.2 AUTOMATED STORAGE & RETRIEVAL

- 7.4.2.1 Elevated passenger baggage and cargo volumes to drive market

- 7.4.3 AI-POWERED BAGGAGE SCREENING & THREAT DETECTION

- 7.4.3.1 Evolving security threats to drive market

- 7.4.4 SMART CARGO HANDLING & AI-DRIVEN WAREHOUSE MANAGEMENT

- 7.4.4.1 Expansion of e-commerce and just-in-time logistics to drive market

- 7.4.5 BLOCKCHAIN-BASED CARGO TRACKING & COMPLIANCE

- 7.4.5.1 Growth of cross-border e-commerce to drive market

- 7.4.1 AUTOMATED BAGGAGE HANDLING

- 7.5 AIR TRAFFIC & APRON MANAGEMENT

- 7.5.1 AI-POWERED AIR TRAFFIC FLOW MANAGEMENT

- 7.5.1.1 Growing airspace congestion to drive market

- 7.5.2 DIGITAL TOWER & REMOTE AIR TRAFFIC CONTROL

- 7.5.2.1 Increasing demand for cost-effective airport operations to drive market

- 7.5.3 AIRBORNE SURVEILLANCE & AUTOMATED ADS-B

- 7.5.3.1 Regulatory requirements for enhanced airspace management to drive market

- 7.5.4 5G-ENABLED COMMUNICATION & DATA EXCHANGE

- 7.5.4.1 Ongoing modernization of airport operations to drive market

- 7.5.5 AUTOMATED GROUND MOVEMENT & APRON MANAGEMENT

- 7.5.5.1 Need to optimize aircraft parking to drive market

- 7.5.1 AI-POWERED AIR TRAFFIC FLOW MANAGEMENT

- 7.6 SECURITY & SURVEILLANCE

- 7.6.1 AI-BASED AUTOMATED THREAT DETECTION & PASSENGER PROFILING

- 7.6.1.1 Need to improve real-time risk assessment to drive market

- 7.6.2 MILLIMETER WAVE SCANNING FOR SECURITY SCREENING

- 7.6.2.1 Demand for AI-enhanced screening systems to drive market

- 7.6.3 AUTONOMOUS SECURITY ROBOT & AI-DRIVEN SURVEILLANCE SYSTEM

- 7.6.3.1 Rising demand for automated surveillance solutions to drive market

- 7.6.4 NEXT-GEN EXPLOSIVE & CHEMICAL DETECTION

- 7.6.4.1 Increasing complexity of concealed explosive materials to drive market

- 7.6.5 SMART PERIMETER SECURITY & INTRUSION DETECTION

- 7.6.5.1 Emerging threats to aviation infrastructure to drive market

- 7.6.1 AI-BASED AUTOMATED THREAT DETECTION & PASSENGER PROFILING

- 7.7 AIRCRAFT HANDLING & TURNAROUND MANAGEMENT

- 7.7.1 PREDICTIVE AI-DRIVEN AIRCRAFT STAND & GATE ALLOCATION

- 7.7.1.1 Increasing flight volumes and operational complexity to drive market

- 7.7.2 SMART TOWING & PUSHBACK SYSTEM

- 7.7.2.1 Growing emphasis on electrification and automation in ground handling to drive market

- 7.7.3 AUTONOMOUS AIRCRAFT DOCKING & PASSENGER BRIDGE MANAGEMENT

- 7.7.3.1 Focus on reducing manual errors to drive market

- 7.7.4 AI-POWERED FUELING & REFUELING OPTIMIZATION

- 7.7.4.1 Need for optimizing refueling processes to drive market

- 7.7.5 REAL-TIME FLIGHT STATUS & AUTOMATED DISPATCH COORDINATION

- 7.7.5.1 Focus on enhancing flight tracking accuracy to drive market

- 7.7.1 PREDICTIVE AI-DRIVEN AIRCRAFT STAND & GATE ALLOCATION

- 7.8 AIRSIDE & LANDSIDE MOBILITY

- 7.8.1 AUTONOMOUS PASSENGER TRANSPORT

- 7.8.1.1 Heightened demand for driverless shuttles to drive market

- 7.8.2 SMART PARKING & AI-BASED CURBSIDE MANAGEMENT

- 7.8.2.1 Escalating demand for seamless airport access to drive market

- 7.8.3 DIGITAL WAYFINDING & AR-ENABLED NAVIGATION

- 7.8.3.1 Interactive guidance using AR overlays to drive market

- 7.8.4 AI-POWERED TRAFFIC FLOW OPTIMIZATION

- 7.8.4.1 Integration of smart traffic control solutions to drive market

- 7.8.1 AUTONOMOUS PASSENGER TRANSPORT

- 7.9 INTELLIGENT ENERGY & SUSTAINABILITY

- 7.9.1 AI-POWERED ENERGY & CLIMATE CONTROL

- 7.9.1.1 Implementation of AI-driven automation in building management systems to drive market

- 7.9.2 ELECTRIC GROUND SUPPORT EQUIPMENT INFRASTRUCTURE

- 7.9.2.1 Funding for centralized electric charging stations to drive market

- 7.9.3 AUTOMATED WASTE SORTING & SMART RECYCLING

- 7.9.3.1 Circular economy goals to drive market

- 7.9.4 SUSTAINABLE AIRCRAFT TAXIING & POWER SYSTEM

- 7.9.4.1 Emphasis on reducing carbon footprints to drive market

- 7.9.1 AI-POWERED ENERGY & CLIMATE CONTROL

8 AIRPORT SYSTEMS MARKET, BY SOLUTION

- 8.1 INTRODUCTION

- 8.2 PASSENGER PROCESSING SYSTEM

- 8.2.1 DEPARTURE CONTROL SYSTEM

- 8.2.1.1 Shift toward cloud-based platforms to drive market

- 8.2.1.2 Use Case: Honolulu Airport implements SITA's Smart Path to enhance biometric boarding

- 8.2.1.3 Use Case: Japan Airlines employs Damarel Systems' B-DCS to maintain check-in and boarding operations

- 8.2.2 PASSENGER FLOW MANAGEMENT SYSTEM

- 8.2.2.1 Increased preference for contactless and biometric-enabled processing to drive market

- 8.2.2.2 Use Case: SITA's Passenger Flow Management enhances airport operations globally

- 8.2.2.3 Use Case: TAV Technologies' Passenger Flow Management Platform optimizes passenger experience

- 8.2.3 DIGITAL PASSENGER EXPERIENCE

- 8.2.3.1 Emphasis on self-service technologies such as mobile check-ins to drive market

- 8.2.3.2 Use Case: San Francisco International Airport implements SITA Flex Platform to enable mobile passenger processing

- 8.2.3.3 Use Case: Thales' Fly to Gate solution enhances touchless passenger processing

- 8.2.1 DEPARTURE CONTROL SYSTEM

- 8.3 AIRPORT OPERATIONS & GROUND HANDLING SYSTEM

- 8.3.1 PASSENGER HANDLING

- 8.3.1.1 Adoption of IoT-enabled telematics and predictive maintenance systems to drive market

- 8.3.1.2 Use Case: Kansas City International Airport selects Oshkosh AeroTech's Jetway to enhance passenger boarding

- 8.3.1.3 Use Case: TLD's ABS-580 Passenger Stairway facilitates safe boarding and disembarking at airports

- 8.3.2 AIRCRAFT HANDLING

- 8.3.2.1 Trend toward AI-powered fleet optimization to drive market

- 8.3.2.2 Use Case: Oshkosh AeroTech's AmpCart enhances charging infrastructure for electric ground support equipment

- 8.3.2.3 Use Case: Textron GSE's Premier MT35P75 Deicer enhances aircraft deicing operations

- 8.3.3 BAGGAGE & CARGO HANDLING

- 8.3.3.1 Growing adoption of automated baggage handling systems to drive market

- 8.3.3.2 Use Case: Vanderlande's BAGFLOW enhances baggage handling efficiency

- 8.3.3.3 Use Case: BEUMER Group's CrisBag System streamlines baggage handling at Singapore Changi Airport

- 8.3.4 NAVIGATION AIDS & LIGHTING

- 8.3.4.1 Increasing demand for advanced airfield lighting systems to drive market

- 8.3.4.2 Use Case: San Francisco International Airport installs ADB's AXON EQ LED Inset Lights to enhance runway safety

- 8.3.4.3 Use Case: Eaton's Crouse-Hinds Series EAL improves approach visibility at airports

- 8.3.5 AIRPORT OPERATION CENTER (APOC)

- 8.3.5.1 Need for predictive disruption management to drive market

- 8.3.5.2 Use Case: Heathrow Airport collaborates with Copenhagen Optimization to develop KPI framework for real-time performance evaluation

- 8.3.5.3 Use Case: WAISL and Amazon Web Services develop digital twin-powered APOC to optimize resource allocation

- 8.3.1 PASSENGER HANDLING

- 8.4 SECURITY SYSTEM

- 8.4.1 CCTV & VIDEO SURVEILLANCE

- 8.4.1.1 Rapid adoption of AI-powered video analytics and facial recognition to drive market

- 8.4.1.2 Use Case: Murtala Muhammed Airport Terminal 2 implements Pelco's VideoXpert to enhance safety

- 8.4.1.3 Use Case: Bosch's AI-driven analytics solution enhances security at Vancouver International Airport

- 8.4.2 INTRUSION DETECTION SYSTEM

- 8.4.2.1 Deployment of radar-based tracking and thermal imaging sensors to drive market

- 8.4.2.2 Use Case: Elbit Systems' C2π Critical Infrastructure Protection safeguards national seaport

- 8.4.2.3 Use Case: Thales offers smart security intrusion detection solutions to protect critical infrastructure

- 8.4.3 PASSENGER SECURITY SCREENING

- 8.4.3.1 Shift toward millimeter-wave scanners and advanced biometric authentication to drive market

- 8.4.3.2 Use Case: Leidos' Pro:Vision 3 enhances passenger security screening at US Airports

- 8.4.3.3 Use Case: Smiths Detection partners with Hong Kong International Airport to conduct trials of HI-SCAN 6040 CTiX for enhanced security

- 8.4.4 BAGGAGE & CARGO SECURITY SCREENING

- 8.4.4.1 Strict aviation security mandates to drive market

- 8.4.4.2 Use Case: Smiths Detection deploys CTX 9800 DSi at Milan's Linate and Malpensa Airports to enhance security

- 8.4.4.3 Use Case: S2 Global's CertScan improves cargo and vehicle inspection at Mexican borders

- 8.4.5 CYBERSECURITY

- 8.4.5.1 Need to prevent cyber threats targeting airport infrastructure to drive market

- 8.4.5.2 Use Case: SITA and Palo Alto Networks introduce Managed Secure Service Edge to ensure cybersecurity at airports

- 8.4.5.3 Use Case: Leidos' ProSight centralizes airport security management for enhanced cyber threat detection

- 8.4.6 ACCESS CONTROL

- 8.4.6.1 Integration of multi-factor identity verification to drive market

- 8.4.6.2 Use Case: Prague Airport deploys IDEMIA's MorphoWave Compact to enhance biometric access control

- 8.4.6.3 Use Case: Aratek's TruFace enables facial recognition access control at Dunhuang Mogao International Airport

- 8.4.1 CCTV & VIDEO SURVEILLANCE

- 8.5 INFORMATION & COMMUNICATIONS SYSTEM

- 8.5.1 FLIGHT INFORMATION SYSTEM

- 8.5.1.1 Surge in demand for cloud-based digital display systems to drive market

- 8.5.1.2 Use Case: Collins Aerospace's ARINC AirVue facilitates passenger communication at six Colombian airports

- 8.5.1.3 Use Case: ADB's AS-FIDS enhances passenger experience across multiple US airports

- 8.5.2 PUBLIC ADDRESS SYSTEM

- 8.5.2.1 Shift toward 5G-connected infrastructure to drive market

- 8.5.2.2 Use Case: Honeywell's PA/VA system enhances overall efficiency and response times at Pristina International Airport

- 8.5.2.3 Use Case: Indra's INSOUND enhances passenger communication at international airports

- 8.5.3 COMMUNICATION NETWORK

- 8.5.3.1 Growing adoption of 5G, private LTE, and fiber-optic infrastructure to drive market

- 8.5.3.2 Use Case: Amadeus' Smart Flows automates travel agency operations

- 8.5.3.3 Use Case: FAA collaborates with NASA to implement AeroMACS at Cleveland Hopkins International Airport for excellent ground coordination

- 8.5.4 AIRPORT MANAGEMENT SYSTEM

- 8.5.4.1 Real-time data integration to drive market

- 8.5.4.2 Use Case: Indra's InMOTION improves operational efficiency at Barcelona-El Prat Airport

- 8.5.4.3 Use Case: Amadeus Airport Operational Database (AODB) streamlines flight data management at Kansai Airports

- 8.5.1 FLIGHT INFORMATION SYSTEM

- 8.6 UTILITY SYSTEM

- 8.6.1 POWER SUPPLY & CHARGING SYSTEM

- 8.6.1.1 Focus on renewable energy integration to drive market

- 8.6.1.2 Use Case: Advanced Charging Technologies deploys cutting-edge charging infrastructure at Canada's airport to reduce emissions

- 8.6.1.3 Use Case: SilMan Industries designs electrical infrastructure for electric ground support equipment at Oakland International Airport

- 8.6.2 HVAC & CLIMATE CONTROL SYSTEM

- 8.6.2.1 Investments in AI-driven energy optimization to drive market

- 8.6.2.2 Use Case: Siemens' HVAC solutions ensure sustainability at Zurich Airport's The Circle

- 8.6.3 FUELING SYSTEM

- 8.6.3.1 Rising preference for automated fuel dispensing to drive market

- 8.6.3.2 Use Case: Varec's Tank Farm Automation optimizes fuel management at Chicago O'Hare International Airport

- 8.6.1 POWER SUPPLY & CHARGING SYSTEM

- 8.7 ENVIRONMENTAL SYSTEM

- 8.7.1 ENERGY MANAGEMENT

- 8.7.1.1 Advancements in battery storage systems to drive market

- 8.7.1.2 Use Case: Honeywell implements Enterprise Buildings Integrator at Pittsburgh International Airport to improve operational efficiency

- 8.7.2 WASTE MANAGEMENT

- 8.7.2.1 Regulatory pressure for zero waste to drive market

- 8.7.3 WATER MANAGEMENT

- 8.7.3.1 Strict water conservation policies to drive market

- 8.7.4 NOISE & AIR QUALITY MONITORING

- 8.7.4.1 Compliance with global environmental standards to drive market

- 8.7.4.2 Use Case: Oizom deploys Polludrone at airports for efficient environmental monitoring

- 8.7.1 ENERGY MANAGEMENT

- 8.8 AIR TRAFFIC MANAGEMENT SYSTEM

- 8.8.1 USE CASE: THALES' TOPSKY-ATC ENHANCES AIR TRAFFIC CONTROL IN ZAMBIA

- 8.8.2 USE CASE: INDRA IMPLEMENTS CONTROL CENTER WITH MANAGAIR FOR AIR TRAFFIC MANAGEMENT IN BAHRAIN

- 8.8.3 AIR TRAFFIC SERVICE

- 8.8.3.1 Shift from radar-based tracking to satellite-enabled automatic dependent surveillance-broadcast to drive market

- 8.8.4 AIR TRAFFIC FLOW MANAGEMENT

- 8.8.4.1 Evolving regulatory mandates for air traffic management to drive market

- 8.8.5 AIRSPACE MANAGEMENT

- 8.8.5.1 Need for flexible adjustments amid fluctuating demand to drive market

- 8.8.6 AERONAUTICAL INFORMATION MANAGEMENT

- 8.8.6.1 Demand for high-integrity aeronautical data to drive market

- 8.9 AIRPORT PARKING & GROUND TRANSPORTATION SYSTEM

- 8.9.1 INTERMODAL MOBILITY

- 8.9.1.1 Seamless integration between air travel and ground transportation networks to drive market

- 8.9.1.2 Use Case: Los Angeles International Airport constructs Automated People Mover to address congestion

- 8.9.1.3 Use Case: Orlando International Airport implements Automated People Mover to facilitate efficient passenger movement

- 8.9.2 PARKING & TICKETING SYSTEM

- 8.9.2.1 Rising passenger volumes to drive market

- 8.9.2.2 Use Case: SKIDATA's frictionless parking suite streamlines parking process at Mineta San Jose International Airport

- 8.9.2.3 Use Case: Isarsoft's Perception software enhances marking management at Jackson Hole Airport

- 8.9.3 CURBSIDE MOBILITY MANAGEMENT

- 8.9.3.1 Regulatory focus on traffic decongestion to drive market

- 8.9.3.2 Use Case: CurbIQ's Smart Curbside Management optimizes airport traffic flow

- 8.9.3.3 Use Case: Unleash Live's real-time analytics enhances Australian Airport's curbside efficiency

- 8.9.1 INTERMODAL MOBILITY

9 AIRPORT SYSTEMS MARKET, BY IMPLEMENTATION

- 9.1 INTRODUCTION

- 9.2 UPGRADE & MODERNIZATION

- 9.2.1 COMPLIANCE WITH STRINGENT REGULATIONS TO DRIVE MARKET

- 9.3 NEW INSTALLATION

- 9.3.1 GOVERNMENT FUNDING IN GREENFIELD AIRPORT DEVELOPMENTS TO DRIVE MARKET

10 AIRPORT SYSTEMS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 AIRSIDE

- 10.2.1 APRON SIDE

- 10.2.1.1 Focus on reducing operational delays to drive market

- 10.2.1.2 Use Case: Chhatrapati Shivaji Maharaj International Airport collaborates with Larsen & Toubro to expand Terminal 2 apron for enhanced aircraft parking

- 10.2.1.3 Use Case: Avalon Airport expands its apron capacity to facilitate simultaneous aircraft handling

- 10.2.1.4 Use Case: Airports Authority of India assists Tiruchirappalli International Airport in expanding its apron to optimize passenger processing

- 10.2.2 RUNWAY SIDE

- 10.2.2.1 Integration of advanced safety systems to drive market

- 10.2.2.2 Use Case: Los Angeles International Airport deploys FOD detection system to enhance runway safety

- 10.2.2.3 Use Case: London Heathrow Airport implements ADB's Airfield Ground Lighting with Honeywell's Automated Lighting Control to improve energy efficiency

- 10.2.2.4 Use Case: Hong Kong International Airport employs Dassault Systemes and Siemens' digital twin-based predictive maintenance solution to improve operational reliability

- 10.2.1 APRON SIDE

- 10.3 TERMINAL SIDE

- 10.3.1 ADOPTION OF SMART INFRASTRUCTURE SOLUTIONS TO DRIVE MARKET

- 10.3.2 USE CASE: CHANGI AIRPORT COLLABORATES WITH NEC CORPORATION AND SITA TO DEPLOY BIOMETRIC SYSTEM TO IMPROVE PASSENGER FLOW

- 10.3.3 USE CASE: BRISBANE AIRPORT PARTNERS WITH SMITHS DETECTION TO INSTALL AUTOMATED SCREENING LANES FOR ENHANCED PASSENGER EXPERIENCE

- 10.3.4 USE CASE: BRISTOL AIRPORT IMPLEMENTS COLLINS AEROSPACE'S SELF-SERVICE CHECK-IN KIOSKS AND BAG DROPS TO STREAMLINE OPERATIONS

- 10.4 LANDSIDE

- 10.4.1 INCREASED INVESTMENTS IN ACCESS ROADS, PARKING INFRASTRUCTURE, AND PASSENGER PROCESSING FACILITIES TO DRIVE MARKET

- 10.4.2 USE CASE: KOTA KINABALU INTERNATIONAL AIRPORT EXPANDS ITS CAPACITY TO ENHANCE LANDSIDE AND AIRSIDE FACILITIES

- 10.4.3 USE CASE: ADELAIDE AIRPORT'S INDUSTRIAL AND LOGISTICS DEVELOPMENT BOOSTS FREIGHT CAPABILITIES

- 10.4.4 USE CASE: HOLLYWOOD BURBANK AIRPORT'S ELEVATE BUR PROJECT ENHANCES LANDSIDE FACILITIES

11 AIRPORT SYSTEMS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 PESTLE ANALYSIS

- 11.2.2 US

- 11.2.2.1 Government-lead infrastructure investments to drive market

- 11.2.3 CANADA

- 11.2.3.1 Emphasis on modernizing airport infrastructure to drive market

- 11.3 EUROPE

- 11.3.1 PESTLE ANALYSIS

- 11.3.2 UK

- 11.3.2.1 Domestic airport expansion projects to drive market

- 11.3.3 FRANCE

- 11.3.3.1 Sustainability initiatives to drive market

- 11.3.4 GERMANY

- 11.3.4.1 Technological advancements in automation to drive market

- 11.3.5 NETHERLANDS

- 11.3.5.1 Focus on green airport initiatives to drive market

- 11.3.6 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 PESTLE ANALYSIS

- 11.4.2 CHINA

- 11.4.2.1 New airport constructions to drive market

- 11.4.3 INDIA

- 11.4.3.1 Implementation of UDAN scheme to drive market

- 11.4.4 JAPAN

- 11.4.4.1 Rise in international tourism to drive market

- 11.4.5 SINGAPORE

- 11.4.5.1 Substantial investments in smart airport infrastructure to drive market

- 11.4.6 AUSTRALIA

- 11.4.6.1 Rise in infrastructure projects to drive market

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST

- 11.5.1 PESTLE ANALYSIS

- 11.5.2 GCC

- 11.5.2.1 UAE

- 11.5.2.1.1 Ongoing airport expansion to drive market

- 11.5.2.2 Saudi Arabia

- 11.5.2.2.1 Vision 2030 strategy to drive market

- 11.5.2.1 UAE

- 11.5.3 REST OF MIDDLE EAST

- 11.6 REST OF THE WORLD

- 11.6.1 BRAZIL

- 11.6.1.1 Emphasis on airport privatization to drive market

- 11.6.2 MEXICO

- 11.6.2.1 Expanding trade and tourism sectors to drive market

- 11.6.3 SOUTH AFRICA

- 11.6.3.1 Need for improved operational efficiency to drive market

- 11.6.4 OTHERS

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 12.3 REVENUE ANALYSIS, 2020-2023

- 12.4 MARKET SHARE ANALYSIS, 2023

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Solution footprint

- 12.5.5.4 Application footprint

- 12.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING

- 12.6.5.1 List of start-ups/SMEs

- 12.6.5.2 Competitive benchmarking of start-ups/SMEs

- 12.7 COMPANY VALUATION AND FINANCIAL METRICS

- 12.8 BRAND/PRODUCT COMPARISON

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 OTHERS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 SITA

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.3.2 Others

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 AMADEUS IT GROUP SA

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Others

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 RTX

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Others

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 THALES

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.3.3 Others

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 VANDERLANDE INDUSTRIES B.V.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Deals

- 13.1.5.3.3 Others

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 INDRA

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.6.3.2 Others

- 13.1.7 SIEMENS AG

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product Launches

- 13.1.7.3.2 Deals

- 13.1.7.3.3 Others

- 13.1.8 ADB SAFEGATE

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.3.2 Deals

- 13.1.8.3.3 Others

- 13.1.9 RESA

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.9.3.2 Others

- 13.1.10 TAV TECHNOLOGIES

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.10.3.2 Others

- 13.1.11 DAMAREL SYSTEMS INTERNATIONAL LTD

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Product launches

- 13.1.11.3.2 Others

- 13.1.12 NEC CORPORATION

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Product launches

- 13.1.12.3.2 Deals

- 13.1.12.3.3 Others

- 13.1.13 HONEYWELL INTERNATIONAL, INC.

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Others

- 13.1.14 DEUTSCHE TELEKOM AG

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Deals

- 13.1.15 OSHKOSH AEROTECH

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Deals

- 13.1.16 TK ELEVATOR

- 13.1.16.1 Business overview

- 13.1.16.2 Products/Solutions/Services offered

- 13.1.16.3 Recent developments

- 13.1.16.3.1 Deals

- 13.1.16.3.2 Others

- 13.1.17 LEIDOS

- 13.1.17.1 Business overview

- 13.1.17.2 Products/Solutions/Services offered

- 13.1.17.3 Recent developments

- 13.1.17.3.1 Product launches

- 13.1.17.3.2 Deals

- 13.1.17.3.3 Others

- 13.1.18 BEUMER GROUP

- 13.1.18.1 Business overview

- 13.1.18.2 Products/Solutions/Services offered

- 13.1.18.3 Recent developments

- 13.1.18.3.1 Others

- 13.1.19 DAIFUKU CO., LTD.

- 13.1.19.1 Business overview

- 13.1.19.2 Products/Solutions/Services offered

- 13.1.19.3 Recent developments

- 13.1.19.3.1 Product Launches

- 13.1.19.3.2 Others

- 13.1.1 SITA

- 13.2 OTHER PLAYERS

- 13.2.1 CURBIQ

- 13.2.2 AUTOMOTUS, INC.

- 13.2.3 SKIDATA

- 13.2.4 MANTRA SOFTECH (INDIA) PVT. LTD.

- 13.2.5 VEOVO

- 13.2.6 A-ICE SRL

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS