|

|

市場調査レポート

商品コード

1676640

精密ろ過膜の世界市場 (~2029年):タイプ (フッ素系ポリマー・セルロース系・ポリスルホン・セラミック)・孔径 (0.1ミクロン以上・0.4ミクロン以上・0.8ミクロン以上)・ろ過モード (クロスフロー・ダイレクトフロー)・用途別Microfiltration Membranes Market by Type (Fluorinated Polymers, Cellulosic, Polysulfones, Ceramic), pore size (>=0.1 micron, >=0.4 micron, >=0.8 micron), Filtration Mode (Cross flow, Direct flow), Applications - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 精密ろ過膜の世界市場 (~2029年):タイプ (フッ素系ポリマー・セルロース系・ポリスルホン・セラミック)・孔径 (0.1ミクロン以上・0.4ミクロン以上・0.8ミクロン以上)・ろ過モード (クロスフロー・ダイレクトフロー)・用途別 |

|

出版日: 2025年03月06日

発行: MarketsandMarkets

ページ情報: 英文 264 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

精密ろ過膜の市場規模は、2024年の13億8,000万米ドルから、CAGR 9.3%で推移し、2029年には21億6,000万米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 単位 | 金額 (米ドル)・数量 (平方メートル) |

| セグメント | タイプ・孔径・ろ過モード・用途・地域 |

| 対象地域 | 北米・欧州・アジア太平洋・中東&アフリカ・南米 |

水処理需要と廃水処理の増加などが精密ろ過膜市場の主要促進要因の1つです。工業化、都市化、人口拡大により淡水の供給に過度の負荷がかかっており、清潔で持続可能な水の供給を実現するための高度なろ過技術の導入につながっています。工業廃水、農業排水、未処理の都市廃水は、重金属、化学物質、バクテリア、マイクロプラスチックなどの有害物質による水質汚染の可能性があります。精密ろ過膜は、大きなエネルギーを消費することなく、懸濁物質、細菌、高分子を効果的に除去できるため、このような問題に対処するため、世界の政府や規制機関はこの技術に多額の投資を行っています。

精密ろ過は、飲料水の純度を高めるために地方自治体が水処理プラントに組み込んでいます。また、製薬、食品・飲料、化学などの産業によるプロセス水の浄化や廃水リサイクルにも利用されています。米国環境保護庁 (EPA) による規制やEU指令など、規制ニーズの高まりも精密ろ過膜の採用を促進しています。水の再利用効率を最大化し、運転コストを削減し、持続可能な水管理を可能にするこの技術は、世界の水危機に対する不可欠なソリューションとなっています。

"中空糸膜および高分子膜設計の進歩が市場最大の機会に"

中空糸膜と高性能ポリマー構造の開発は、ろ過効率、耐久性、経済性を最適化することで、精密ろ過膜業界を大きく変革しています。中空糸膜は表面積対体積比が高いため透過性が高く、より優れたろ過性能を発揮するため、バルク流体処理用途に理想的な選択となります。これらの膜は高い処理能力を提供するため、バイオ医薬品、水処理、食品加工などの業界では、分離品質を損なうことなく、より速いろ過速度を達成することができます。さらに、次世代フッ素化ポリマー、改質ポリエーテルスルホン (PES) 、ポリスルホン (PS) などの高分子膜材料の進歩により、膜の耐薬品性、機械的強度、耐ファウリング性が向上しています。これらの開発により、膜の長寿命化が可能となり、膜交換の頻度やメンテナンスコストの削減が可能となっています。さらに、セルフクリーニングや低ファウリング膜コーティングは、膜のファウリングや性能低下によるダウンタイムを最小限に抑え、運転効率を高めるのに役立っています。このようなコスト削減のメリットは、特に医薬品の無菌ろ過、乳製品加工、廃水処理など、連続的な高スループットろ過に依存する産業全体に広く適用される原動力となっています。継続的な研究と技術の進歩の結果、中空糸膜と高分子膜は、高性能精密ろ過システムにおいてますます重要な役割を果たすようになり、市場機会の拡大が期待されています。

当レポートでは、世界の精密ろ過膜の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 生成AIの影響

第6章 業界の動向

- 顧客の事業に影響を与える動向/ディスラプション

- バリューチェーン分析

- 価格分析

- 投資と資金調達のシナリオ

- エコシステム分析

- 技術分析

- 特許分析

- 貿易分析

- 主な会議とイベント

- 関税と規制状況

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- マクロ経済見通し

- ケーススタディ分析

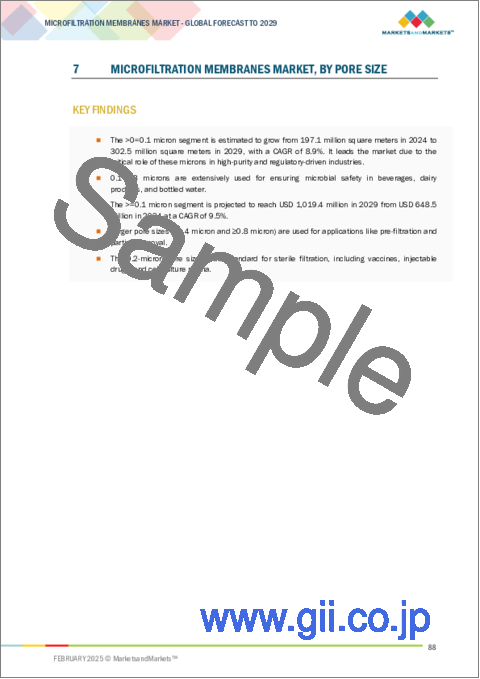

第7章 精密ろ過膜市場:孔径別

- 0.8ミクロン以上

- 0.4ミクロン以上

- 0.1ミクロン以上

第8章 精密ろ過膜市場:ろ過モード別

- ダイレクトフロー

- クロスフロー

第9章 精密ろ過膜市場:タイプ別

- フッ素ポリマー

- セルロース

- ポリスルホン

- セラミック

第10章 精密ろ過膜市場:用途別

- バイオ医薬品処理

- 水処理

- 食品・飲料

- 化学品

- その他

第11章 精密ろ過膜市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- イタリア

- フランス

- スペイン

- 英国

- ロシア

- その他

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第12章 競合情勢

- 主要参入企業の戦略/強み

- 市場シェア分析

- 収益分析

- ブランド比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオと動向

第13章 企業プロファイル

- 主要企業

- MERCK KGAA

- SARTORIUS AG

- KOVALUS SEPARATION SOLUTIONS

- HYDRANAUTICS (NITTO DENKO COMPANY)

- PALL CORPORATION

- 3M

- PENTAIR

- ASAHI KASEI CORPORATION

- TORAY INDUSTRIES INC.

- VEOLIA

- その他の企業

- ALFA LAVAL

- APPLIED MEMBRANES, INC.

- QUA GROUP LLC

- GEA GROUP AKTIENGESELLSCHAFT

- GRAVER TECHNOLOGIES

- IMEMFLO

- KUBOTA CORPORATION

- MANN+HUMMEL

- NX FILTRATION BV

- PARKER HANNIFIN CORP

- SYNDER FILTRATION, INC.

- TOSHIBA WATER SOLUTIONS PRIVATE LIMITED

- NILSAN NISHOTECH SYSTEMS PVT. LTD.

- LENNTECH B.V.

- LYDALL, INC.

第14章 付録

List of Tables

- TABLE 1 AVERAGE SELLING PRICE TREND OF MICROFILTRATION MEMBRANES, BY REGION, 2020-2024 (USD/SQUARE METER)

- TABLE 2 AVERAGE SELLING PRICE TREND, BY TYPE, 2020-2024 (USD/SQUARE METER)

- TABLE 3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE (USD/SQUARE METER)

- TABLE 4 MICROFILTRATION MEMBRANES MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 5 KEY TECHNOLOGIES IN MICROFILTRATION MEMBRANES MARKET

- TABLE 6 COMPLEMENTARY TECHNOLOGIES IN MICROFILTRATION MEMBRANES MARKET

- TABLE 7 ADJACENT TECHNOLOGIES IN MICROFILTRATION MEMBRANES MARKET

- TABLE 8 MICROFILTRATION MEMBRANES MARKET: TOTAL NUMBER OF PATENTS

- TABLE 9 MICROFILTRATION MEMBRANES MARKET: LIST OF MAJOR PATENT OWNERS

- TABLE 10 MICROFILTRATION MEMBRANES MARKET: LIST OF MAJOR PATENTS, 2018-2024

- TABLE 11 MICROFILTRATION MEMBRANES MARKET: LIST OF KEY CONFERENCES & EVENTS, 2025

- TABLE 12 TARIFF: RELATED MICROFILTRATION MEMBRANES MARKET

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 MIDDLE EAST AND AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 LIST OF REGULATIONS FOR MICROFILTRATION MEMBRANES MARKET

- TABLE 19 MICROFILTRATION MEMBRANES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS INDUSTRIES

- TABLE 21 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 22 GDP TRENDS AND FORECASTS, BY COUNTRY, 2023-2025 (USD MILLION)

- TABLE 23 MICROFILTRATION MEMBRANES MARKET, BY PORE SIZE, 2020-2023 (USD MILLION)

- TABLE 24 MICROFILTRATION MEMBRANES MARKET, BY PORE SIZE, 2024-2029 (USD MILLION)

- TABLE 25 MICROFILTRATION MEMBRANES MARKET, BY PORE SIZE, 2020-2023 (MILLION SQUARE METER)

- TABLE 26 MICROFILTRATION MEMBRANES MARKET, BY PORE SIZE, 2024-2029 (MILLION SQUARE METER)

- TABLE 27 MICROFILTRATION MEMBRANES MARKET, BY FILTRATION MODE, 2020-2023 (USD MILLION)

- TABLE 28 MICROFILTRATION MEMBRANES MARKET, BY FILTRATION MODE, 2024-2029 (USD MILLION)

- TABLE 29 MICROFILTRATION MEMBRANES MARKET, BY FILTRATION MODE, 2020-2023 (MILLION SQUARE METER)

- TABLE 30 MICROFILTRATION MEMBRANES MARKET, BY FILTRATION MODE, 2024-2029 (MILLION SQUARE METER)

- TABLE 31 MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 32 MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 33 MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 34 MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2024-2029 (MILLION SQUARE METER)

- TABLE 35 MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 36 MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 37 MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 38 MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 39 MICROFILTRATION MEMBRANES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 40 MICROFILTRATION MEMBRANES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 41 MICROFILTRATION MEMBRANES MARKET, BY REGION, 2020-2023 (MILLION SQUARE METER)

- TABLE 42 MICROFILTRATION MEMBRANES MARKET, BY REGION, 2024-2029 (MILLION SQUARE METER)

- TABLE 43 NORTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 44 NORTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 45 NORTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY COUNTRY, 2020-2023 (MILLION SQUARE METER)

- TABLE 46 NORTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY COUNTRY, 2024-2029 (MILLION SQUARE METER)

- TABLE 47 NORTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 48 NORTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 49 NORTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 50 NORTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2024-2029 (MILLION SQUARE METER)

- TABLE 51 NORTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY FILTRATION MODE, 2020-2023 (USD MILLION)

- TABLE 52 NORTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY FILTRATION MODE, 2024-2029 (USD MILLION)

- TABLE 53 NORTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY FILTRATION MODE, 2020-2023 (MILLION SQUARE METER)

- TABLE 54 NORTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY FILTRATION MODE, 2024-2029 (MILLION SQUARE METER)

- TABLE 55 NORTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 56 NORTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 57 NORTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 58 NORTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 59 US: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 60 US: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 61 US: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 62 US: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 63 CANADA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 64 CANADA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 65 CANADA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 66 CANADA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 67 MEXICO: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 68 MEXICO: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 69 MEXICO: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 70 MEXICO: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 71 EUROPE: MICROFILTRATION MEMBRANES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 72 EUROPE: MICROFILTRATION MEMBRANES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 73 EUROPE: MICROFILTRATION MEMBRANES MARKET, BY COUNTRY, 2020-2023 (MILLION SQUARE METER)

- TABLE 74 EUROPE: MICROFILTRATION MEMBRANES MARKET, BY COUNTRY, 2024-2029 (MILLION SQUARE METER)

- TABLE 75 EUROPE: MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 76 EUROPE: MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 77 EUROPE: MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 78 EUROPE: MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2024-2029 (MILLION SQUARE METER)

- TABLE 79 EUROPE: MICROFILTRATION MEMBRANES MARKET, BY FILTRATION MODE, 2020-2023 (USD MILLION)

- TABLE 80 EUROPE: MICROFILTRATION MEMBRANES MARKET, BY FILTRATION MODE, 2024-2029 (USD MILLION)

- TABLE 81 EUROPE: MICROFILTRATION MEMBRANES MARKET, BY FILTRATION MODE, 2020-2023 (MILLION SQUARE METER)

- TABLE 82 EUROPE: MICROFILTRATION MEMBRANES MARKET, BY FILTRATION MODE, 2024-2029 (MILLION SQUARE METER)

- TABLE 83 EUROPE: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 84 EUROPE: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 85 EUROPE: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 86 EUROPE: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 87 GERMANY: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 88 GERMANY: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 89 GERMANY: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 90 GERMANY: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 91 ITALY: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 92 ITALY: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 93 ITALY: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 94 ITALY: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 95 FRANCE: MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 96 FRANCE: MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 97 FRANCE: MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 98 FRANCE: MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2024-2029 (MILLION SQUARE METER)

- TABLE 99 SPAIN: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 100 SPAIN: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 101 SPAIN: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 102 SPAIN: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 103 UK: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 104 UK: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 105 UK: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 106 UK: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 107 RUSSIA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 108 RUSSIA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 109 RUSSIA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 110 RUSSIA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 111 REST OF EUROPE: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 112 REST OF EUROPE: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 113 REST OF EUROPE: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 114 REST OF EUROPE: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 115 ASIA PACIFIC: MICROFILTRATION MEMBRANES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 116 ASIA PACIFIC: MICROFILTRATION MEMBRANES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 117 ASIA PACIFIC: MICROFILTRATION MEMBRANES MARKET, BY COUNTRY, 2020-2023 (MILLION SQUARE METER)

- TABLE 118 ASIA PACIFIC: MICROFILTRATION MEMBRANES MARKET, BY COUNTRY, 2024-2029 (MILLION SQUARE METER)

- TABLE 119 ASIA PACIFIC: MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 120 ASIA PACIFIC: MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 121 ASIA PACIFIC: MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 122 ASIA PACIFIC: MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2024-2029 (MILLION SQUARE METER)

- TABLE 123 ASIA PACIFIC: MICROFILTRATION MEMBRANES MARKET, BY FILTRATION MODE, 2020-2023 (USD MILLION)

- TABLE 124 ASIA PACIFIC: MICROFILTRATION MEMBRANES MARKET, BY FILTRATION MODE, 2024-2029 (USD MILLION)

- TABLE 125 ASIA PACIFIC: MICROFILTRATION MEMBRANES MARKET, BY FILTRATION MODE, 2020-2023 (MILLION SQUARE METER)

- TABLE 126 ASIA PACIFIC: MICROFILTRATION MEMBRANES MARKET, BY FILTRATION MODE, 2024-2029 (MILLION SQUARE METER)

- TABLE 127 ASIA PACIFIC: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 128 ASIA PACIFIC: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 129 ASIA PACIFIC: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 130 ASIA PACIFIC: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 131 CHINA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 132 CHINA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 133 CHINA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 134 CHINA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 135 JAPAN: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 136 JAPAN: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 137 JAPAN: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 138 JAPAN: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 139 INDIA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 140 INDIA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 141 INDIA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 142 INDIA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 143 SOUTH KOREA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 144 SOUTH KOREA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 145 SOUTH KOREA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 146 SOUTH KOREA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 147 REST OF ASIA PACIFIC: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 150 REST OF ASIA PACIFIC: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 151 MIDDLE EAST & AFRICA: MICROFILTRATION MEMBRANES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: MICROFILTRATION MEMBRANES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: MICROFILTRATION MEMBRANES MARKET, BY COUNTRY, 2020-2023 (MILLION SQUARE METER)

- TABLE 154 MIDDLE EAST & AFRICA: MICROFILTRATION MEMBRANES MARKET, BY COUNTRY, 2024-2029 (MILLION SQUARE METER)

- TABLE 155 MIDDLE EAST & AFRICA: MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 158 MIDDLE EAST & AFRICA: MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2024-2029 (MILLION SQUARE METER)

- TABLE 159 MIDDLE EAST & AFRICA: MICROFILTRATION MEMBRANES MARKET, BY FILTRATION MODE, 2020-2023 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: MICROFILTRATION MEMBRANES MARKET, BY FILTRATION MODE, 2024-2029 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: MICROFILTRATION MEMBRANES MARKET, BY FILTRATION MODE, 2020-2023 (MILLION SQUARE METER)

- TABLE 162 MIDDLE EAST & AFRICA: MICROFILTRATION MEMBRANES MARKET, BY FILTRATION MODE, 2024-2029 (MILLION SQUARE METER)

- TABLE 163 MIDDLE EAST & AFRICA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 166 MIDDLE EAST & AFRICA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 167 UAE: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 168 UAE: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 169 UAE: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 170 UAE: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 171 SAUDI ARABIA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 172 SAUDI ARABIA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 173 SAUDI ARABIA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 174 SAUDI ARABIA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 175 REST OF GCC COUNTRIES: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 176 REST OF GCC COUNTRIES: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 177 REST OF GCC COUNTRIES: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 178 REST OF GCC COUNTRIES: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 179 SOUTH AFRICA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 180 SOUTH AFRICA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 181 SOUTH AFRICA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 182 SOUTH AFRICA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 183 REST OF MIDDLE EAST & AFRICA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 184 REST OF MIDDLE EAST & AFRICA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 185 REST OF MIDDLE EAST & AFRICA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 186 REST OF MIDDLE EAST & AFRICA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 187 SOUTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 188 SOUTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 189 SOUTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY COUNTRY, 2020-2023 (MILLION SQUARE METER)

- TABLE 190 SOUTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY COUNTRY, 2024-2029 (MILLION SQUARE METER)

- TABLE 191 SOUTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 192 SOUTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 193 SOUTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 194 SOUTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY TYPE, 2024-2029 (MILLION SQUARE METER)

- TABLE 195 SOUTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY FILTRATION MODE, 2020-2023 (USD MILLION)

- TABLE 196 SOUTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY FILTRATION MODE, 2024-2029 (USD MILLION)

- TABLE 197 SOUTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY FILTRATION MODE, 2020-2023 (MILLION SQUARE METER)

- TABLE 198 SOUTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY FILTRATION MODE, 2024-2029 (MILLION SQUARE METER)

- TABLE 199 SOUTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 200 SOUTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 201 SOUTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 202 SOUTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 203 BRAZIL: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 204 BRAZIL: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 205 BRAZIL: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 206 BRAZIL: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 207 ARGENTINA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 208 ARGENTINA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 209 ARGENTINA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 210 ARGENTINA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 211 REST OF SOUTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 212 REST OF SOUTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 213 REST OF SOUTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2020-2023 (MILLION SQUARE METER)

- TABLE 214 REST OF SOUTH AMERICA: MICROFILTRATION MEMBRANES MARKET, BY APPLICATION, 2024-2029 (MILLION SQUARE METER)

- TABLE 215 OVERVIEW OF STRATEGIES ADOPTED BY KEY MICROFILTRATION MEMBRANE MANUFACTURERS

- TABLE 216 MICROFILTRATION MEMBRANES MARKET: DEGREE OF COMPETITION

- TABLE 217 MICROFILTRATION MEMBRANES MARKET: REGION FOOTPRINT

- TABLE 218 MICROFILTRATION MEMBRANES MARKET: TYPE FOOTPRINT

- TABLE 219 MICROFILTRATION MEMBRANES MARKET: APPLICATION FOOTPRINT

- TABLE 220 MICROFILTRATION MEMBRANES MARKET: MODE FOOTPRINT

- TABLE 221 MICROFILTRATION MEMBRANES MARKET: KEY STARTUPS/SMES

- TABLE 222 MICROFILTRATION MEMBRANES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 223 MICROFILTRATION MEMBRANES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2)

- TABLE 224 MICROFILTRATION MEMBRANES MARKET: PRODUCT LAUNCHES, JANUARY 2021-JANUARY 2025

- TABLE 225 MICROFILTRATION MEMBRANES MARKET: DEALS, JANUARY 2021- JANUARY 2025

- TABLE 226 MICROFILTRATION MEMBRANES MARKET: EXPANSIONS, JANUARY 2021-JANUARY 2025

- TABLE 227 MERCK KGAA: COMPANY OVERVIEW

- TABLE 228 MERCK KGAA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 MERCK KGAA: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 230 MERCK KGAA: EXPANSIONS, JANUARY 2021-JANUARY 2025

- TABLE 231 SARTORIUS AG: COMPANY OVERVIEW

- TABLE 232 SARTORIUS AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 233 SARTORIUS AG: PRODUCT LAUNCHES, JANUARY 2021-JANUARY 2025

- TABLE 234 SARTORIUS AG: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 235 SARTORIUS AG: EXPANSIONS, JANUARY 2021-DECEMBER 2024

- TABLE 236 KOVALUS SEPARATION SOLUTIONS: COMPANY OVERVIEW

- TABLE 237 KOVALUS SEPARATION SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 KOVALUS SEPARATION SOLUTIONS: PRODUCT LAUNCHES, JANUARY 2021-JANUARY 2025

- TABLE 239 KOVALUS SEPARATION SOLUTIONS: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 240 KOVALUS SEPARATION SOLUTIONS: EXPANSIONS, JANUARY 2021-JANUARY 2025

- TABLE 241 HYDRANAUTICS: COMPANY OVERVIEW

- TABLE 242 HYDRANAUTICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 PALL CORPORATION: COMPANY OVERVIEW

- TABLE 244 PALL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 PALL CORPORATION: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 246 3M: COMPANY OVERVIEW

- TABLE 247 3M: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 PENTAIR: COMPANY OVERVIEW

- TABLE 249 PENTAIR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 PENTAIR: PRODUCT LAUNCHES, JANUARY 2021-JANUARY 2025

- TABLE 251 ASAHI KASEI CORPORATION: COMPANY OVERVIEW

- TABLE 252 ASAHI KASEI CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 254 TORAY INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 VEOLIA: COMPANY OVERVIEW

- TABLE 256 VEOLIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 VEOLIA: DEALS, JANUARY 2021-JANUARY 2025

- TABLE 258 ALFA LAVAL: COMPANY OVERVIEW

- TABLE 259 APPLIED MEMBRANES, INC.: COMPANY OVERVIEW

- TABLE 260 QUA GROUP LLC: COMPANY OVERVIEW

- TABLE 261 GEA GROUP AKTIENGESELLSCHAFT: COMPANY OVERVIEW

- TABLE 262 GRAVER TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 263 IMEMFLO: COMPANY OVERVIEW

- TABLE 264 KUBOTA CORPORATION: COMPANY OVERVIEW

- TABLE 265 MANN+HUMMEL: COMPANY OVERVIEW

- TABLE 266 NX FILTRATION BV: COMPANY OVERVIEW

- TABLE 267 PARKER HANNIFIN CORP: COMPANY OVERVIEW

- TABLE 268 SYNDER FILTRATION, INC.: COMPANY OVERVIEW

- TABLE 269 TOSHIBA WATER SOLUTIONS PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 270 NILSAN NISHOTECH SYSTEMS PVT. LTD.: COMPANY OVERVIEW

- TABLE 271 LENNTECH B.V.: COMPANY OVERVIEW

- TABLE 272 LYDALL, INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MICROFILTRATION MEMBRANES SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 MICROFILTRATION MEMBRANES MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 MICROFILTRATION MEMBRANES MARKET: DATA TRIANGULATION

- FIGURE 9 CROSS FLOW FILTRATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 FLUORINATED POLYMERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 WATER TREATMENT APPLICATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

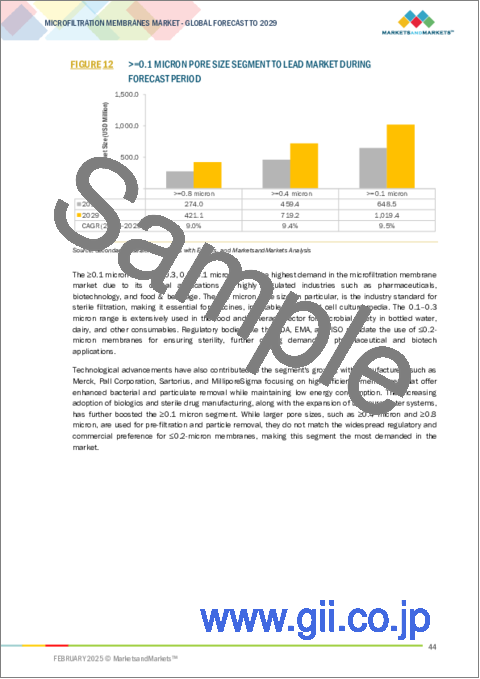

- FIGURE 12 >=0.1 MICRON PORE SIZE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO LEAD MICROFILTRATION MEMBRANES DURING FORECAST PERIOD

- FIGURE 14 INCREASING DEMAND FOR WATER PURIFICATION RESULTING IN SUBSTANTIAL INVESTMENTS IN WATER TREATMENT INFRASTRUCTURE

- FIGURE 15 CROSS-FLOW FILTRATION MODE TO BE FASTER-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 16 FLUORINATED POLYMERS TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 17 WATER TREATMENT TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 18 >=0.1 MICRON TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 19 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 20 MICROFILTRATION MEMBRANES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 USE OF GEN AI IN MICROFILTRATION MEMBRANES MARKET

- FIGURE 22 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 VALUE CHAIN OF MICROFILTRATION MEMBRANES MARKET

- FIGURE 24 AVERAGE SELLING PRICE TREND OF MICROFILTRATION MEMBRANES, BY REGION, 2020-2024 (USD/SQUARE METER)

- FIGURE 25 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE, 2020-2024

- FIGURE 26 MICROFILTRATION MEMBRANES MARKET: INVESTMENT AND FUNDING SCENARIO

- FIGURE 27 MICROFILTRATION MEMBRANES MARKET: ECOSYSTEM

- FIGURE 28 NUMBER OF PATENTS GRANTED (2014-2024)

- FIGURE 29 MICROFILTRATION MEMBRANES MARKET: LEGAL STATUS OF PATENTS

- FIGURE 30 PATENT ANALYSIS FOR MICROFILTRATION MEMBRANES, BY JURISDICTION, 2014-2023

- FIGURE 31 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENTS IN LAST 10 YEARS

- FIGURE 32 IMPORT OF HS CODE 84212900 -COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 33 EXPORT OF HS CODE 84212900-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 34 MICROFILTRATION MEMBRANES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 36 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 37 >=0.1 MICRON PORE SIZE TO LEAD MICROFILTRATION MEMBRANES MARKET DURING FORECAST PERIOD

- FIGURE 38 CROSS FLOW SEGMENT TO GROW AT FASTER RATE DURING FORECAST PERIOD

- FIGURE 39 FLUORINATED POLYMERS TYPE TO LEAD MICROFILTRATION MEMBRANES MARKET DURING FORECAST PERIOD

- FIGURE 40 WATER TREATMENT APPLICATION TO DRIVE MICROFILTRATION MEMBRANES MARKET BETWEEN 2024 AND 2029

- FIGURE 41 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 42 NORTH AMERICA: MICROFILTRATION MEMBRANES MARKET SNAPSHOT

- FIGURE 43 EUROPE: MICROFILTRATION MEMBRANES MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: MICROFILTRATION MEMBRANES MARKET SNAPSHOT

- FIGURE 45 MICROFILTRATION MEMBRANES MARKET: SHARE OF KEY PLAYERS (2023)

- FIGURE 46 MICROFILTRATION MEMBRANES MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 47 MICROFILTRATION MEMBRANES MARKET: BRAND COMPARISON, BY SEGMENT

- FIGURE 48 MICROFILTRATION MEMBRANES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 49 MICROFILTRATION MEMBRANES MARKET: COMPANY FOOTPRINT

- FIGURE 50 MICROFILTRATION MEMBRANES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 51 EV/EBITDA OF KEY VENDORS

- FIGURE 52 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN

- FIGURE 53 MERCK KGAA: COMPANY SNAPSHOT

- FIGURE 54 SARTORIUS AG: COMPANY SNAPSHOT

- FIGURE 55 HYDRANAUTICS: COMPANY SNAPSHOT

- FIGURE 56 PALL CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 3M: COMPANY SNAPSHOT

- FIGURE 58 PENTAIR: COMPANY SNAPSHOT

- FIGURE 59 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

- FIGURE 60 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 61 VEOLIA: COMPANY SNAPSHOT

The Microfiltration membranes market is projected to reach USD 2.16 billion by 2029, at a CAGR of 9.3% from USD 1.38 billion in 2024.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/USD Billion), Volume (Million square meter) |

| Segments | Type, pore size, filtration mode, Application and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, South America |

Increased water treatment demand and wastewater treatment is one of the key drivers for the microfiltration membranes market, driven by increased water scarcity, pollution, and more stringent regulatory standards. Industrialization, urbanization, and population expansion have placed undue stress on freshwater supplies, leading to the implementation of sophisticated filtration technology for delivering clean and sustainable water access. Industrial wastewaters, agricultural runoffs, and raw municipal wastewaters have led to gross water body pollution, which is a burden on harmful substances such as heavy metals, chemicals, bacteria, and microplastics. Governments and regulatory agencies across the globe are investing heavily in microfiltration membrane technologies to address such issues because they can effectively remove suspended solids, bacteria, and bulky macromolecules without the need for huge energy consumption. Microfiltration is being included in water treatment plants by local governments to enhance the purity of drinking water, whereas microfiltration membranes are utilized for purification of process water and wastewater recycling by industries such as pharmaceutical, food and beverages, and chemicals. Fueled by stringent wastewater discharge policies such as the U.S. Environmental Protection Agency (EPA) regulations and European Union Water Framework Directive, the increasing regulatory needs are compelling the adoption of microfiltration membranes. The ability of the technology to maximize water reuse efficiency, reduce operation costs, and enable sustainable water management makes it an essential solution to the water crisis in the world.

As cities grow, new challenges have to be met in terms of increasing water scarcity and the better treatment of sewage and waste. Therefore, installation of Microfiltration membranes becomes a necessity to ensure that there are efficient and sustainable water management systems that can fulfill the demands of the ever-increasing needs of a huge population in an urban area. Not to mention, with all these environmental concerns being brought into the limelight, recycling capabilities and energy conservation further give Microfiltration membranes an attraction to green infrastructure initiatives.

"The high initial investment & operational costs is the most prevalent restraining factor for the microfiltration membranes industry"

One of the significant hindrances to the widespread application of microfiltration membranes is the high cost of initial and operational installation and maintenance. While microfiltration affords greater filtration selectivity, the expense of membrane materials, equipment installation, and ancillary equipment-pressure vessels, pumps, and automation monitor systems, for instance-can prove to be economically disastrous, particularly to small-scale businesses and municipal water treatment authorities in developing economies. High-performance membranes like fluorinated polymers PTFE and PVDF or ceramic membranes have excellent chemical stability and mechanical strength but are very expensive to produce and hence system buying becomes a significant investment. Biofouling and organic contaminant fouling, bacteria, and mineral precipitate can reduce the filtration rate over time with more frequent cleaning and new membrane requirements, thereby increasing operating cost. Special cleaning agents, membrane regeneration, and rigorous maintenance routines are needed to ensure performance but add to overall cost. Continuous filtration also requires trained personnel to monitor system performance, troubleshoot malfunctions, and ensure regulatory compliance, further driving costs of operation. Where feedwater quality is fluctuating, such as in wastewater treatment, food and beverage manufacture, and pharmaceuticals, multiple levels of contaminants necessitate ongoing adjustments in system parameters, which drive energy usage and process complexity. Confronted by these cost restraints, companies opt more generally for more budget-friendly processes such as sand filtration, activated carbon filtration, or ultrafiltration, limiting microfiltration membranes' widescale application regardless of their excellent filter performance.

"Advancements in Hollow Fiber & Polymeric Membrane Designs proved to be the largest opportunity for the microfiltration membranes market"

Developments in hollow fiber membranes and high-performance polymeric structures are transforming the microfiltration membrane industry to a great extent by optimizing filtration efficiency, durability, and economics. Hollow fiber membranes are more permeable due to high surface area-to-volume ratio and provide better filtration performance, making them an ideal selection for bulk fluid processing applications. These membranes deliver higher throughput, enabling industries such as biopharmaceuticals, water treatment, and food processing to achieve faster filtration rates without compromising better separation quality. In addition, advancements in polymeric membrane materials such as next-generation fluorinated polymers, modified polyethersulfone (PES), and polysulfone (PS) have introduced higher membrane chemical resistance, mechanical strength, and fouling resistance. These developments allow longer membrane life, reducing the rate of replacements and maintenance costs. Moreover, self-cleaning and low-fouling membrane coatings have assisted in enhancing efficiency of operation through minimizing downtime because of membrane fouling and loss of performance. Such cost-saving benefits are driving wider application across industries that rely on continuous high-throughput filtration, particularly pharmaceutical sterile filtration, dairy processing, and wastewater treatment. As a result of continuous research and advances in technology, hollow fiber and polymeric membranes will be poised to play an increasingly important role in high-performance microfiltration systems, holding out for expanded market opportunities.

"Membrane Fouling and Biofouling is a Major Challenge for the Microfiltration Membranes Market"

One of the most common and serious issues in the microfiltration membrane industry is membrane fouling and biofouling, which profoundly decreases filtration effectiveness, raises working costs, and shortens membrane life. Fouling takes place when particles, organic contaminants, microorganisms, or mineral accumulations on the membrane surface or inside its pores cause clogging and decreased permeability. Such is particularly common in operations like water treatment, food and beverage, pharmaceuticals, and biotechnology, where sterilizing filtration, microbial contamination control, and the removal of suspended solids are normally done using microfiltration. Fouling of the membranes can result in up to 50% reduction in the filtration performance for the first months of plant operation, which will be based on the feedwater quality and type of membrane. Biofouling, being one form of fouling through the growth of microbes and the formation of biofilm, is a serious concern for high-purity applications including pharmaceutical manufacture and ultrapure water systems.

There has been an indication from research that biofilms on the surface of the membrane can raise energy consumption by 30-50% because of extra pressure needed to sustain flow rates. Biofouling has been confirmed as one of the most prevalent reasons for membrane failure in wastewater treatment and desalination facilities, necessitating regular shutdowns and replacements. As a fouling mitigation measure, industries have been using chemical cleaning, backflushing, and sophisticated pretreatment techniques like coagulation, filtration, and disinfection.

These mitigation measures, however, contribute to operating expense and sophistication, which makes microfiltration less appealing to cost-sensitive industries. The frequent replacement of the membrane due to irreversible fouling contributes even higher expenses, with the cost of the membrane comprising 30-50% of the overall filtration system cost over its life. As technologies come to be formulated in low-fouling materials for membranes, hydrophilic coatings, and self-cleaning mechanisms, these are not merely manufactured but normally at some additional cost, imposing a balance between functionality and price. The persistent fouling control issue highlights the necessity for ongoing innovations in membrane maintenance and design technologies. Until low-cost, durable anti-fouling technologies are universally available, membrane fouling and biofouling will continue to be a major disincentive for the widespread use of microfiltration technology, especially in cost-sensitive economies.

"Cross flow filtration mode continues to dominate the Microfiltration membranes market, further solidifying its role as the leading grade for a wide range of applications"

Cross-flow filtration is the market leader in the microfiltration membranes market over direct flow filtration due to its increased efficiency, increased membrane life, and reduced maintenance requirements. In cross-flow filtration, a portion of fluid continuously flows parallel to the membrane surface without permitting particles to settle and thus reducing membrane fouling. Direct flow filtration entails contaminants accumulating quickly with membrane clogging that necessitates frequent membrane replacement. Cross-flow filtration is widely favored by industries like water treatment, food & beverage, pharma, and biotechnology because of its requirement for continuous operation and high capacity. It offers improved filtration efficiency, improved recovery rates, and can handle higher solid loads, thereby being applicable for sterile filtration processes or particle separation. Cross-flow systems further reduce downtime during operations and limit the need for frequent cleaning, thereby saving money in the long run. As industries are increasingly process-optimizing and membrane-long-lasting, cross-flow filtration is the preference of choice, which accounts for its dominance in the microfiltration membranes market.

"Based on region, asia pacific was the largest market in 2023."

Asia Pacific is the global market leader in microfiltration membranes, driven by industrialization, increasing population, and the demand for food and water safety. The three top economies are China, India, and Japan, supported by growing pharmaceutical, biotechnology, food & beverage, and water treatment sectors. The area has a critical scarcity of water as well as pollution issues, compelling governments to invest heavily in new water treatment plants to provide pure drinking water as well as effective wastewater treatment. Besides, advanced biopharmaceutical and health care industries are driving demand for sterile filtration apparatus. The dairy processing, food and beverage business, beverage making, and the brewing industry predominantly depend on microfiltration membranes to ensure the quality and purity of the final product. Apart from that, reduced production expenses and domestic availability of prominent membrane producers fuel market acceptability and adoption. As stringent environmental regulations and increasing interest in sustainability necessitate microfiltration membranes to be used more and more in industrial wastewater treatment as well as air treatment, the market gets additional thrust in Asia Pacific.

.

In the process of determining and verifying the market size for several segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-Level Executives - 20%, Director Level - 10%, and Others - 70%

- By Region: North America - 30%, Europe -20%, Asia Pacific - 30%, Middle East & Africa - 10%, and South America-10%

The key players in this market are Merck KGaA (Germany), Sartorius AG (Germany), Kovalus Separation Solutions (US), Hydranautics (US), Pall Corporation (US), 3M (US), Pentair (UK), Asahi Kasei Corporation (Japan), TORAY INDUSTRIES, INC. (Japan), Veolia (France) etc.

Research Coverage

This report segments the market for the Microfiltration membranes on the basis of type, application and region. It provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, new product launches, expansions, and partnerships associated with the market for the Microfiltration membranes market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the Microfiltration membranes market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers: Microfiltration membranes being ideal for water and wastewater management, irrigation, and gas distribution systems thus and most suitable for the construction.

- Market Penetration: Comprehensive information on the Microfiltration membranes offered by top players in the global Microfiltration membranes market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the Microfiltration membranes market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for the Microfiltration membranes across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global Microfiltration membranes market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the Microfiltration membranes market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SPREAD

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.1.2.3 Key participants for primary interviews

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE ANALYSIS

- 2.2.2 DEMAND-SIDE ANALYSIS

- 2.3 GROWTH FORECAST

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 GROWTH FORECAST

- 2.8 RISK ASSESSMENT

- 2.9 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MICROFILTRATION MEMBRANES MARKET

- 4.2 MICROFILTRATION MEMBRANES MARKET, BY FILTRATION MODE

- 4.3 MICROFILTRATION MEMBRANES MARKET, BY MATERIAL TYPE

- 4.4 MICROFILTRATION MEMBRANES MARKET, BY APPLICATION

- 4.5 MICROFILTRATION MEMBRANES MARKET, BY PORE SIZE

- 4.6 MICROFILTRATION MEMBRANES MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing awareness of water & wastewater treatment

- 5.2.1.2 Stringent wastewater regulations

- 5.2.1.3 Selective separation technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Reduced membrane performance due to fouling

- 5.2.2.2 High capital cost

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand for water treatment in developing countries

- 5.2.3.2 Rising scarcity of freshwater

- 5.2.4 CHALLENGES

- 5.2.4.1 Lifespan and efficiency of membranes

- 5.2.1 DRIVERS

- 5.3 IMPACT OF GENERATIVE AI

- 5.3.1 INTRODUCTION

- 5.3.2 IMPACT OF GEN AI ON MICROFILTRATION MEMBRANES MARKET

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RAW MATERIAL SUPPLIERS

- 6.3.2 MANUFACTURERS

- 6.3.3 DISTRIBUTORS AND RETAILERS

- 6.3.4 END USERS

- 6.4 PRICING ANALYSIS

- 6.4.1 AVERAGE SELLING PRICE TREND, BY REGION, 2020-2024

- 6.4.2 AVERAGE SELLING PRICE TREND, BY TYPE, 2020-2024

- 6.4.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE (USD/SQUARE METER)

- 6.5 INVESTMENT AND FUNDING SCENARIO

- 6.6 ECOSYSTEM ANALYSIS

- 6.7 TECHNOLOGY ANALYSIS

- 6.7.1 KEY TECHNOLOGIES

- 6.7.2 COMPLEMENTARY TECHNOLOGIES

- 6.7.3 ADJACENT TECHNOLOGIES

- 6.8 PATENT ANALYSIS

- 6.8.1 METHODOLOGY

- 6.8.2 PATENTS GRANTED WORLDWIDE, 2014-2024

- 6.8.3 PATENT PUBLICATION TRENDS

- 6.8.4 INSIGHTS

- 6.8.5 LEGAL STATUS OF PATENTS

- 6.8.6 JURISDICTION ANALYSIS

- 6.8.7 TOP APPLICANTS

- 6.8.8 LIST OF MAJOR PATENTS

- 6.9 TRADE ANALYSIS

- 6.9.1 IMPORT SCENARIO (HS CODE 84212900)

- 6.9.2 EXPORT SCENARIO (HS CODE 84212900)

- 6.10 KEY CONFERENCES AND EVENTS, 2025

- 6.11 TARIFF AND REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 REGULATIONS RELATED TO MICROFILTRATION MEMBRANES MARKET

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 MACROECONOMIC OUTLOOK

- 6.14.1 GDP TRENDS AND FORECASTS, BY COUNTRY

- 6.15 CASE STUDY ANALYSIS

- 6.15.1 ADDRESSING MEMBRANE FOULING IN A DESALINATION PLANT

- 6.15.2 ONGOING ADVANCEMENTS IN MATERIALS, PRE-TREATMENT, AND CLEANING WILL BOOST CERAMIC MEMBRANE ADOPTION IN INDUSTRIAL WASTEWATER TREATMENT

- 6.15.3 DEVELOPMENT OF OLIVE SEED-BASED CERAMIC MICROFILTRATION MEMBRANE

7 MICROFILTRATION MEMBRANES MARKET, BY PORE SIZE

- 7.1 INTRODUCTION

- 7.2 >=0.8 MICRON

- 7.2.1 IDEAL FOR COARSE FILTRATION AND PROTECTING SENSITIVE MEMBRANE SYSTEMS FROM PREMATURE FOULING

- 7.3 >=0.4 MICRON

- 7.3.1 INCREASING DEMAND DUE TO HIGH THROUGHPUT AND EXTENDED LIFESPAN FOR EFFICIENT, MODERATE PRECISION FILTRATION

- 7.4 >=0.1 MICRONS

- 7.4.1 GROWING USE FOR NEAR-STERILE FILTRATION WITH EXCEPTIONAL RELIABILITY, PURITY, AND CONTAMINATION CONTROL.

8 MICROFILTRATION MEMBRANES MARKET, BY FILTRATION MODE

- 8.1 INTRODUCTION

- 8.2 DIRECT FLOW

- 8.2.1 EXTENSIVE USE IN ADSORPTIVE FILTRATION FOR COLOR ADJUSTMENT

- 8.3 CROSS FLOW

- 8.3.1 HIGH USE IN BEVERAGE CLARIFICATION

9 MICROFILTRATION MEMBRANES MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 FLUORINATED POLYMERS

- 9.2.1 INCREASING DEMAND DUE TO CHEMICAL RESISTANCE AND STRENGTH

- 9.3 CELLULOSIC

- 9.3.1 MATERIAL ENHANCEMENTS AND CROSS-LINKING TO BOOST DURABILITY AND ADOPTION

- 9.4 POLYSULFONES

- 9.4.1 HYDROPHILIC NATURE REDUCING FOULING AND EXTENDS LIFESPAN

- 9.5 CERAMIC

- 9.5.1 DEMAND GROWTH OF HYBRID CERAMIC-POLYMER MEMBRANES AND NANOCOATINGS

10 MICROFILTRATION MEMBRANES MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 BIOPHARMACEUTICAL PROCESSING

- 10.2.1 CRUCIAL ROLE IN SEPARATING CONTAMINANTS AND ENSURING PROCESS EFFICIENCY

- 10.3 WATER TREATMENT

- 10.3.1 INCREASING NEED FOR HIGH-QUALITY WATER

- 10.4 FOOD & BEVERAGE

- 10.4.1 STRICT SAFETY STANDARDS AND DEMAND FOR MINIMALLY PROCESSED PRODUCTS

- 10.5 CHEMICAL

- 10.5.1 RECOVERY OF VALUABLE BYPRODUCTS FROM WASTE STREAMS, SUPPORTING SUSTAINABLE MANUFACTURING

- 10.6 OTHER APPLICATIONS

11 MICROFILTRATION MEMBRANES MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Government regulations on wastewater treatment to drive market

- 11.2.2 CANADA

- 11.2.2.1 Increasing government support on wastewater treatment to accelerate market growth

- 11.2.3 MEXICO

- 11.2.3.1 Industrial sector to drive market

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Regulations and positive economic outlook to support market growth

- 11.3.2 ITALY

- 11.3.2.1 Rising need for clean water and positive economic outlook to drive market

- 11.3.3 FRANCE

- 11.3.3.1 Government regulations for wastewater treatment to support market growth

- 11.3.4 SPAIN

- 11.3.4.1 Government focus on water and wastewater treatment to drive market

- 11.3.5 UK

- 11.3.5.1 Growing end-use industries and government initiatives to support market growth

- 11.3.6 RUSSIA

- 11.3.6.1 Growing food & beverage and e-commerce industries to drive market

- 11.3.7 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Growing manufacturing sector to drive market in Asia Pacific

- 11.4.2 JAPAN

- 11.4.2.1 Development of advanced technologies and rapid industrialization to drive market

- 11.4.3 INDIA

- 11.4.3.1 Rising population, growing economy, and increasing adoption of wastewater technologies supporting market growth

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Food & beverage industry, skilled workforce, and laws & regulations to drive market

- 11.4.5 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 UAE

- 11.5.1.1.1 Growing end-use industries and government investment in wastewater treatment to drive market

- 11.5.1.2 Saudi Arabia

- 11.5.1.2.1 Immense growth of water filtration industry to drive market

- 11.5.1.3 Rest of GCC countries

- 11.5.1.1 UAE

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Stringent government regulations supporting market growth

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Stringent regulations, industrialization, and growing population to drive market

- 11.6.2 ARGENTINA

- 11.6.2.1 Recovering economy to boost market growth

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021- 2025

- 12.3 MARKET SHARE ANALYSIS, 2023

- 12.4 REVENUE ANALYSIS, 2020-2024

- 12.5 BRAND COMPARISON

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS (2023)

- 12.6.5.1 Company footprint

- 12.6.5.2 Region footprint

- 12.6.5.3 Type footprint

- 12.6.5.4 Application footprint

- 12.6.5.5 Mode footprint

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, (2023)

- 12.7.5.1 Detailed list of key startups/SMEs

- 12.7.5.2 Competitive benchmarking of key startups/SMEs

- 12.7.6 VALUATION AND FINANCIAL METRICS OF KEY MICROFILTRATION MEMBRANE VENDORS

- 12.8 COMPETITIVE SCENARIO AND TRENDS

- 12.8.1 PRODUCT LAUNCHES

- 12.8.2 DEALS

- 12.8.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 MERCK KGAA

- 13.1.1.1 Business overview

- 13.1.1.2 Products/solutions/services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.3.2 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 SARTORIUS AG

- 13.1.2.1 Business overview

- 13.1.2.2 Products/solutions/services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.3.3 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 KOVALUS SEPARATION SOLUTIONS

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 HYDRANAUTICS (NITTO DENKO COMPANY)

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Right to win

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses and competitive threats

- 13.1.5 PALL CORPORATION

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 3M

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 MnM view

- 13.1.6.3.1 Right to win

- 13.1.6.3.2 Strategic choices

- 13.1.6.3.3 Weaknesses and competitive threats

- 13.1.7 PENTAIR

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.7.4 MnM view

- 13.1.7.4.1 Right to win

- 13.1.7.4.2 Strategic choices

- 13.1.7.4.3 Weaknesses and competitive threats

- 13.1.8 ASAHI KASEI CORPORATION

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 MnM view

- 13.1.8.3.1 Right to win

- 13.1.8.3.2 Strategic choices

- 13.1.8.3.3 Weaknesses and competitive threats

- 13.1.9 TORAY INDUSTRIES INC.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 MnM view

- 13.1.9.3.1 Right to win

- 13.1.9.3.2 Strategic choices

- 13.1.9.3.3 Weaknesses and competitive threats

- 13.1.10 VEOLIA

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.10.4 MnM view

- 13.1.10.4.1 Right to win

- 13.1.10.4.2 Strategic choices

- 13.1.10.4.3 Weaknesses and competitive threats

- 13.1.1 MERCK KGAA

- 13.2 OTHER PLAYERS

- 13.2.1 ALFA LAVAL

- 13.2.2 APPLIED MEMBRANES, INC.

- 13.2.3 QUA GROUP LLC

- 13.2.4 GEA GROUP AKTIENGESELLSCHAFT

- 13.2.5 GRAVER TECHNOLOGIES

- 13.2.6 IMEMFLO

- 13.2.7 KUBOTA CORPORATION

- 13.2.8 MANN+HUMMEL

- 13.2.9 NX FILTRATION BV

- 13.2.10 PARKER HANNIFIN CORP

- 13.2.11 SYNDER FILTRATION, INC.

- 13.2.12 TOSHIBA WATER SOLUTIONS PRIVATE LIMITED

- 13.2.13 NILSAN NISHOTECH SYSTEMS PVT. LTD.

- 13.2.14 LENNTECH B.V.

- 13.2.15 LYDALL, INC.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS