|

|

市場調査レポート

商品コード

1669771

EVAフィルムの世界市場:タイプ別、生産方法別、用途別、最終用途産業別 - 予測(~2029年)EVA Films Market by Type, Production Method, Application, End-Use Industry - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| EVAフィルムの世界市場:タイプ別、生産方法別、用途別、最終用途産業別 - 予測(~2029年) |

|

出版日: 2025年02月28日

発行: MarketsandMarkets

ページ情報: 英文 251 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のEVAフィルムの市場規模は、2024年の74億3,000万米ドルから2029年までに112億6,000万米ドルに達すると予測され、予測期間にCAGRで8.7%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 100万米ドル/10億米ドル |

| セグメント | タイプ、生産方法、用途、最終用途産業、地域 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

EVAフィルム市場は、その汎用性、耐久性、幅広い用途によって拡大しています。もっとも顕著な促進要因は太陽エネルギー産業の高い成長率であり、EVAフィルムは長期的な効率と保護を維持するために太陽光発電(PV)モジュールの封止に必要とされています。さらに、高性能包装材料、合わせガラス、建設・自動車部門の保護フィルムに対する需要の増加が、市場を牽引しています。ポリマー科学の進歩により、EVAフィルムの熱安定性、接着性、耐紫外線性が向上し、多くの用途に適したものとなっています。また、発展途上国における中間層の人口の増加、都市化、工業化により、消費者製品におけるEVAフィルムの消費が増加し、市場の需要がさらに高まっています。

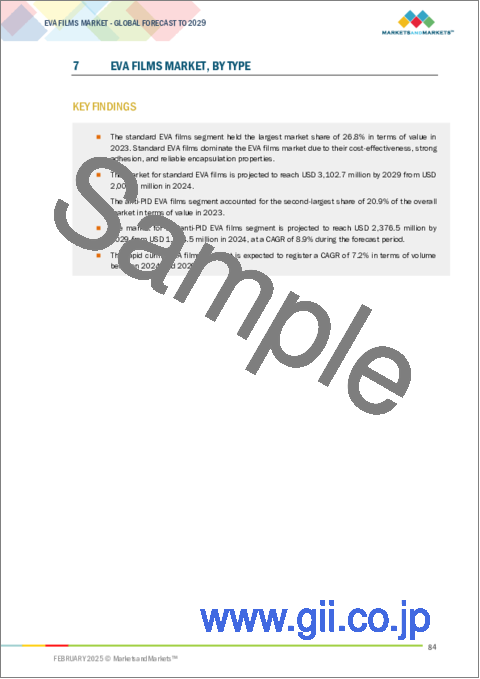

「タイプ別では、標準EVAフィルムがEVAフィルム市場でもっとも急成長しています。」

標準EVAフィルムセグメントは、その費用対効果、バランスのとれた性能特性、さまざまな産業にわたる幅広い適用性により、EVAフィルム市場でもっとも高い成長率を示しています。高成長の主な理由の1つは、その柔軟性、耐久性、粘着特性の最良のバランスであり、さまざまな用途で第一の選択肢となっています。標準EVAフィルムは熱安定性、耐薬品性、機械的強度に優れているため、頻繁に交換する必要がなく、さまざまな環境での使用に適しています。このフィルムはまた、高い透明性と優れた封止特性を持っているため、より人気が高まっています。その費用対効果の高さや、加工のしやすさと多くの製造工程への適合性により、これらは効果的でありながら費用対効果の高い選択肢を求める企業にとって第一の選択肢となっています。

「生産方法別では、押出がEVAフィルム市場で金額ベースでもっとも急成長しています。」

押出製造プロセスは、効率的でスケーラブルであり、均一な特性を持つ高品質なフィルムを作ることができるため、EVAフィルム市場でもっとも急成長しているセグメントです。押出成形は、均一な厚み、高い透明度、優れた機械的特性を持つEVAフィルムの生産を可能にする、合理的で連続的な製造工程を提供します。この技術は、フィルムの寸法、仕上がり、全体的な性能を非常に正確に制御できるため、メーカーに好まれています。押出工程が加速度的に成長している主な理由の1つは、その費用対効果にあります。その他の製造工程と比較して、押出成形は材料の無駄を減らし、人件費を最小化し、エネルギー効率を最大化します。高性能EVAフィルムのニーズが高まり続ける中、メーカーは多層共押出を含む革新的な押出技術に投資し、特性を調整したフィルムの生産を可能にしています。

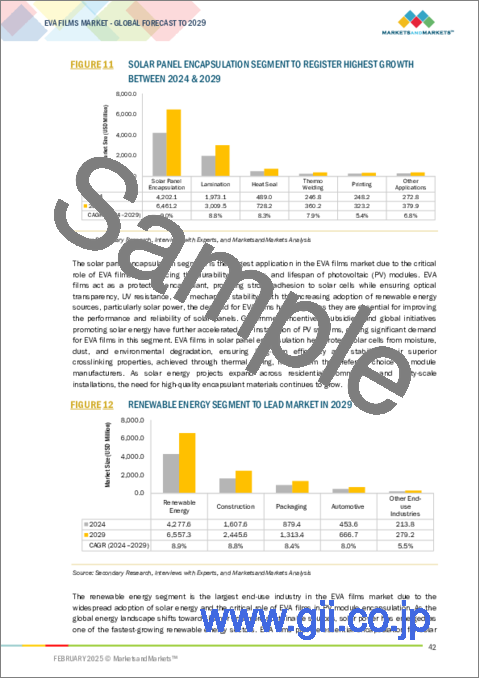

「ソーラーパネル封止は、EVAフィルム市場でもっとも急速に成長している用途セグメントです。」

世界中での再生可能エネルギーへの関心の高まりや、太陽光技術の発展、EVAフィルムの優れた保護機能により、ソーラーパネル封止用途はEVAフィルム市場でもっとも急成長しているセグメントとなっています。ソーラーパネル封止はEVAフィルムの重要な用途であり、その優れた保護機能(耐久性、UV安定性、太陽光発電(PV)モジュール材料との優れた接着性など)により、太陽光発電モジュールの性能と信頼性が長持ちします。このセグメントの主な成長促進要因の1つは、ソーラーパネル生産におけるEVAフィルムのコスト効率と加工上の利点です。EVA封止材はコストと高性能の兼ね合いをもたらすため、太陽電池モジュールメーカーの間でもっとも人気のある選択肢となっています。

当レポートでは、世界のEVAフィルム市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- EVAフィルム市場の企業にとって魅力的な機会

- EVAフィルム市場:タイプ別

- EVAフィルム市場:生産方法別

- EVAフィルム市場:用途別

- EVAフィルム市場:最終用途産業別

- EVAフィルム市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 生成AI

- EVAフィルム市場に対する生成AIの影響

第6章 産業の動向

- イントロダクション

- 顧客ビジネスに影響を与える動向/混乱

- サプライチェーン分析

- 投資と資金調達のシナリオ

- 価格分析

- 平均販売価格の動向:地域別

- 平均販売価格の動向:タイプ別

- 主要企業の平均販売価格の動向:タイプ別

- エコシステム分析

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 調査手法

- 特許取得

- 考察

- 法的地位

- 管轄分析

- 主な出願者

- 貿易分析

- 輸入シナリオ(HSコード390130)

- 輸出シナリオ(HSコード390130)

- 主な会議とイベント

- 関税と規制情勢

- 関税分析

- 規制機関、政府機関、その他の組織

- 基準と規制

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- マクロ経済の見通し

- ケーススタディ分析

第7章 EVAフィルム市場:タイプ別

- イントロダクション

- 標準EVAフィルム

- 急速硬化EVAフィルム

- 抗PID EVAフィルム

- 超透明EVAフィルム

- その他のタイプ

- 低温EVAフィルム

- カラーEVAフィルム

- 紫外線防止EVAフィルム

第8章 EVAフィルム市場:生産方法別

- イントロダクション

- 押出

- ブロー成形

- 一体成形

第9章 EVAフィルム市場:用途別

- イントロダクション

- ソーラーパネル封止

- ラミネーション

- ヒートシール

- 印刷

- 熱溶接

- その他の用途

- コーティング

- 超音波溶接

第10章 EVAフィルム市場:最終用途産業別

- イントロダクション

- 再生可能エネルギー

- 建設

- 自動車

- 包装

- その他の最終用途産業

- 農業

- 消費財

第11章 EVAフィルム市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他のアジア太平洋

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- イタリア

- フランス

- 英国

- スペイン

- ロシア

- その他の欧州

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他の中東・アフリカ

- 南米

- アルゼンチン

- ブラジル

- その他の南米

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 市場シェア分析

- H.B. FULLER COMPANY

- 3M

- HANWHA GROUP-

- HANGZHOU FIRST APPLIED MATERIAL CO., LTD.

- SHANGHAI HIUV NEW MATERIALS CO., LTD.

- 収益分析

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- ブランド/製品の比較分析

- PHOTOCAP 15580P

- 3M SOLAR ENCAPSULANT FILM EVA9100

- HEP SERIES

- F**RST

- HIUV S201MT

- 企業の評価と財務指標

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- H.B. FULLER COMPANY

- 3M

- JA SOLAR TECHNOLOGY CO., LTD.

- JIANGSU SVECK PHOTOVOLTAIC NEW MATERIAL CO., LTD.

- HANGZHOU FIRST APPLIED MATERIAL CO., LTD.

- SHANGHAI HIUV NEW MATERIALS CO., LTD.

- GUANGZHOU LUSHAN NEW MATERIALS CO., LTD.

- HANWHA GROUP

- CYBRID TECHNOLOGIES INC.

- BETTERIAL

- MATIV

- ZHEJIANG SINOPONT TECHNOLOGY CO., LTD.

- その他の企業

- SATINAL SPA

- FOLIENWERK WOLFEN GMBH

- SHENZHEN GAOREN ELECTRONIC NEW MATERIAL CO., LTD.

- HUIZHOU BAOJUN MATERIAL TECHNOLOGY CO., LTD.

- ZONPAK NEW MATERIALS CO., LTD.

- LUCENT CLEANENERGY

- DR. HANS WERNER CHEMIKALIEN

- HANGZHOU XINDONGKE ENERGY TECHNOLOGY CO., LTD.

- DANA POLY, INC.

- E&N FILM TECH CO. LTD.

- FANGDING TECHNOLOGY CO., LTD.

- HUICHI INDUSTRIAL DEVELOPMENT CO., LTD.

- RICH BIG ENTERPRISE CO., LTD.

- NOVOPOLYMERS

- ENERLITE SOLAR FILMS INDIA PRIVATE LIMITED

- CROWN ADVANCED MATERIAL CO., LTD.

- FUYIN GROUP

第14章 付録

List of Tables

- TABLE 1 AVERAGE SELLING PRICE TREND OF EVA FILMS, BY REGION, 2021-2023 (USD/KILOTON)

- TABLE 2 AVERAGE SELLING PRICE TREND OF EVA FILMS, BY TYPE, 2021-2023 (USD/KILOTON)

- TABLE 3 AVERAGE SELLING PRICE TREND OF EVA FILMS OFFERED BY KEY PLAYERS, 2023 (USD/KILOTON)

- TABLE 4 ROLE OF COMPANIES IN EVA FILMS ECOSYSTEM

- TABLE 5 EVA FILMS MARKET: KEY TECHNOLOGIES

- TABLE 6 EVA FILMS MARKET: COMPLEMENTARY TECHNOLOGIES

- TABLE 7 EVA FILMS MARKET: ADJACENT TECHNOLOGIES

- TABLE 8 TOTAL NUMBER OF PATENTS, 2014-2023

- TABLE 9 TOP OWNERS OF PATENTS RELATED TO EVA FILMS, 2014-2023

- TABLE 10 EVA FILMS MARKET: LIST OF KEY PATENTS, 2013-2023

- TABLE 11 EVA FILMS MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 12 TARIFF DATA RELATED TO HS CODE 350691-COMPLIANT PRODUCTS, BY COUNTRY, 2023

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EVA FILMS MARKET: STANDARDS AND REGULATIONS

- TABLE 19 EVA FILMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY (%)

- TABLE 21 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 22 GDP TRENDS AND FORECASTS, BY COUNTRY, 2023-2025 (USD MILLION)

- TABLE 23 EVA FILMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 24 EVA FILMS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 25 EVA FILMS MARKET, BY TYPE, 2020-2023 (KILOTON)

- TABLE 26 EVA FILMS MARKET, BY TYPE, 2024-2029 (KILOTON)

- TABLE 27 EVA FILMS MARKET, BY PRODUCTION METHOD, 2020-2023 (USD MILLION)

- TABLE 28 EVA FILMS MARKET, BY PRODUCTION METHOD, 2024-2029 (USD MILLION)

- TABLE 29 EVA FILMS MARKET, BY PRODUCTION METHOD, 2020-2023 (KILOTON)

- TABLE 30 EVA FILMS MARKET, BY PRODUCTION METHOD, 2024-2029 (KILOTON)

- TABLE 31 EVA FILMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 32 EVA FILMS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 33 EVA FILMS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 34 EVA FILMS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 35 EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 36 EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 37 EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 38 EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 39 EVA FILMS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 40 EVA FILMS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 41 EVA FILMS MARKET, BY REGION, 2020-2023 (KILOTON)

- TABLE 42 EVA FILMS MARKET, BY REGION, 2024-2029 (KILOTON)

- TABLE 43 ASIA PACIFIC: EVA FILMS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 44 ASIA PACIFIC: EVA FILMS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 45 ASIA PACIFIC: EVA FILMS MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 46 ASIA PACIFIC: EVA FILMS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 47 ASIA PACIFIC: EVA FILMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 48 ASIA PACIFIC: EVA FILMS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 49 ASIA PACIFIC: EVA FILMS MARKET, BY TYPE, 2020-2023 (KILOTON)

- TABLE 50 ASIA PACIFIC: EVA FILMS MARKET, BY TYPE, 2024-2029 (KILOTON)

- TABLE 51 ASIA PACIFIC: EVA FILMS MARKET, BY PRODUCTION METHOD, 2020-2023 (USD MILLION)

- TABLE 52 ASIA PACIFIC: EVA FILMS MARKET, BY PRODUCTION METHOD, 2024-2029 (USD MILLION)

- TABLE 53 ASIA PACIFIC: EVA FILMS MARKET, BY PRODUCTION METHOD, 2020-2023 (KILOTON)

- TABLE 54 ASIA PACIFIC: EVA FILMS MARKET, BY PRODUCTION METHOD, 2024-2029 (KILOTON)

- TABLE 55 ASIA PACIFIC: EVA FILMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 56 ASIA PACIFIC: EVA FILMS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 57 ASIA PACIFIC: EVA FILMS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 58 ASIA PACIFIC: EVA FILMS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 59 ASIA PACIFIC: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 60 ASIA PACIFIC: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 61 ASIA PACIFIC: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 62 ASIA PACIFIC: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 63 CHINA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 64 CHINA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 65 CHINA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 66 CHINA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 67 JAPAN: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 68 JAPAN: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 69 JAPAN: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 70 JAPAN: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 71 INDIA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 72 INDIA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 73 INDIA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 74 INDIA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 75 SOUTH KOREA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 76 SOUTH KOREA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 77 SOUTH KOREA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 78 SOUTH KOREA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 79 REST OF ASIA PACIFIC: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 80 REST OF ASIA PACIFIC: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 81 REST OF ASIA PACIFIC: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 82 REST OF ASIA PACIFIC: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 83 NORTH AMERICA: EVA FILMS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 84 NORTH AMERICA: EVA FILMS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 85 NORTH AMERICA: EVA FILMS MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 86 NORTH AMERICA: EVA FILMS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 87 NORTH AMERICA: EVA FILMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 88 NORTH AMERICA: EVA FILMS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 89 NORTH AMERICA: EVA FILMS MARKET, BY TYPE, 2020-2023 (KILOTON)

- TABLE 90 NORTH AMERICA: EVA FILMS MARKET, BY TYPE, 2024-2029 (KILOTON)

- TABLE 91 NORTH AMERICA: EVA FILMS MARKET, BY PRODUCTION METHOD, 2020-2023 (USD MILLION)

- TABLE 92 NORTH AMERICA: EVA FILMS MARKET, BY PRODUCTION METHOD, 2024-2029 (USD MILLION)

- TABLE 93 NORTH AMERICA: EVA FILMS MARKET, BY PRODUCTION METHOD, 2020-2023 (KILOTON)

- TABLE 94 NORTH AMERICA: EVA FILMS MARKET, BY PRODUCTION METHOD, 2024-2029 (KILOTON)

- TABLE 95 NORTH AMERICA: EVA FILMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 96 NORTH AMERICA: EVA FILMS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 97 NORTH AMERICA: EVA FILMS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 98 NORTH AMERICA: EVA FILMS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 99 NORTH AMERICA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 100 NORTH AMERICA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 101 NORTH AMERICA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 102 NORTH AMERICA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 103 US: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 104 US: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 105 US: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 106 US: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 107 CANADA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 108 CANADA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 109 CANADA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 110 CANADA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 111 MEXICO: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 112 MEXICO: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 113 MEXICO: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 114 MEXICO: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 115 EUROPE: EVA FILMS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 116 EUROPE: EVA FILMS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 117 EUROPE: EVA FILMS MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 119 EUROPE: EVA FILMS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 120 EUROPE: EVA FILMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 121 EUROPE: EVA FILMS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 123 EUROPE: EVA FILMS MARKET, BY TYPE, 2020-2023 (KILOTON)

- TABLE 124 EUROPE: EVA FILMS MARKET, BY TYPE, 2024-2029 (KILOTON)

- TABLE 125 EUROPE: EVA FILMS MARKET, BY PRODUCTION METHOD, 2020-2023 (USD MILLION)

- TABLE 126 EUROPE: EVA FILMS MARKET, BY PRODUCTION METHOD, 2024-2029 (USD MILLION)

- TABLE 127 EUROPE: EVA FILMS MARKET, BY PRODUCTION METHOD, 2020-2023 (KILOTON)

- TABLE 128 EUROPE: EVA FILMS MARKET, BY PRODUCTION METHOD, 2024-2029 (KILOTON)

- TABLE 129 EUROPE: EVA FILMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 130 EUROPE: EVA FILMS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 131 EUROPE: EVA FILMS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 132 EUROPE: EVA FILMS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 133 EUROPE: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 135 EUROPE: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 136 EUROPE: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 137 EUROPE: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 138 GERMANY: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 139 GERMANY: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 140 GERMANY: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 141 GERMANY: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 142 ITALY: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 143 ITALY: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 144 ITALY: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 145 ITALY: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 146 FRANCE: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 147 FRANCE: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 148 FRANCE: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 149 FRANCE: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 150 UK: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 151 UK: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 152 UK: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 153 UK: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 154 SPAIN: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 155 SPAIN: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 156 SPAIN: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 157 SPAIN: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 158 RUSSIA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 159 RUSSIA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 160 RUSSIA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 161 RUSSIA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 162 REST OF EUROPE: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 163 REST OF EUROPE: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 164 REST OF EUROPE: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 165 REST OF EUROPE: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 166 MIDDLE EAST & AFRICA: EVA FILMS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: EVA FILMS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: EVA FILMS MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 169 MIDDLE EAST & AFRICA: EVA FILMS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 170 MIDDLE EAST & AFRICA: EVA FILMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: EVA FILMS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: EVA FILMS MARKET, BY TYPE, 2020-2023 (KILOTON)

- TABLE 173 MIDDLE EAST & AFRICA: EVA FILMS MARKET, BY TYPE, 2024-2029 (KILOTON)

- TABLE 174 MIDDLE EAST & AFRICA: EVA FILMS MARKET, BY PRODUCTION METHOD, 2020-2023 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: EVA FILMS MARKET, BY PRODUCTION METHOD, 2024-2029 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: EVA FILMS MARKET, BY PRODUCTION METHOD, 2020-2023 (KILOTON)

- TABLE 177 MIDDLE EAST & AFRICA: EVA FILMS MARKET, BY PRODUCTION METHOD, 2024-2029 (KILOTON)

- TABLE 178 MIDDLE EAST & AFRICA: EVA FILMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: EVA FILMS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: EVA FILMS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 181 MIDDLE EAST & AFRICA: EVA FILMS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 182 MIDDLE EAST & AFRICA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 185 MIDDLE EAST & AFRICA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 186 SAUDI ARABIA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 187 SAUDI ARABIA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 188 SAUDI ARABIA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 189 SAUDI ARABIA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 190 UAE: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 191 UAE: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 192 UAE: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 193 UAE: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 194 REST OF GCC COUNTRIES: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 195 REST OF GCC COUNTRIES: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 196 REST OF GCC COUNTRIES: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 197 REST OF GCC COUNTRIES: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 198 SOUTH AFRICA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 199 SOUTH AFRICA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 200 SOUTH AFRICA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 201 SOUTH AFRICA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 202 REST OF MIDDLE EAST & AFRICA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 203 REST OF MIDDLE EAST & AFRICA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 204 REST OF MIDDLE EAST & AFRICA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 205 REST OF MIDDLE EAST & AFRICA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 206 SOUTH AMERICA: EVA FILMS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 207 SOUTH AMERICA: EVA FILMS MARKET, BY COUNTRY, 2024-2029(USD MILLION)

- TABLE 208 SOUTH AMERICA: EVA FILMS MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 209 SOUTH AMERICA: EVA FILMS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 210 SOUTH AMERICA: EVA FILMS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 211 SOUTH AMERICA: EVA FILMS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 212 SOUTH AMERICA: EVA FILMS MARKET, BY TYPE, 2020-2023 (KILOTON)

- TABLE 213 SOUTH AMERICA: EVA FILMS MARKET, BY TYPE, 2024-2029 (KILOTON)

- TABLE 214 SOUTH AMERICA: EVA FILMS MARKET, BY PRODUCTION METHOD, 2020-2023 (USD MILLION)

- TABLE 215 SOUTH AMERICA: EVA FILMS MARKET, BY PRODUCTION METHOD, 2024-2029 (USD MILLION)

- TABLE 216 SOUTH AMERICA: EVA FILMS MARKET, BY PRODUCTION METHOD, 2020-2023 (KILOTON)

- TABLE 217 SOUTH AMERICA: EVA FILMS MARKET, BY PRODUCTION METHOD, 2024-2029 (KILOTON)

- TABLE 218 SOUTH AMERICA: EVA FILMS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 219 SOUTH AMERICA: EVA FILMS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 220 SOUTH AMERICA: EVA FILMS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 221 SOUTH AMERICA: EVA FILMS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 222 SOUTH AMERICA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 223 SOUTH AMERICA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 224 SOUTH AMERICA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 225 SOUTH AMERICA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 226 ARGENTINA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 227 ARGENTINA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 228 ARGENTINA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 229 ARGENTINA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 230 BRAZIL: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 231 BRAZIL: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 232 BRAZIL: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 233 BRAZIL: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 234 REST OF SOUTH AMERICA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 235 REST OF SOUTH AMERICA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 236 REST OF SOUTH AMERICA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 237 REST OF SOUTH AMERICA: EVA FILMS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 238 OVERVIEW OF STRATEGIES ADOPTED BY KEY EVA FILM MANUFACTURERS

- TABLE 239 EVA FILMS MARKET: DEGREE OF COMPETITION

- TABLE 240 EVA FILMS MARKET: TYPE FOOTPRINT

- TABLE 241 EVA FILMS MARKET: PRODUCTION METHOD FOOTPRINT

- TABLE 242 EVA FILMS MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 243 EVA FILMS MARKET: REGION FOOTPRINT

- TABLE 244 EVA FILMS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 245 EVA FILMS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 246 EVA FILMS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2)

- TABLE 247 EVA FILMS MARKET: DEALS, JANUARY 2020-JANUARY 2025

- TABLE 248 EVA FILMS MARKET: EXPANSIONS, JANUARY 2020-JANUARY 2025

- TABLE 249 EVA FILMS MARKET: OTHER DEVELOPMENTS, JANUARY 2020-JANUARY 2025

- TABLE 250 H.B. FULLER COMPANY: COMPANY OVERVIEW

- TABLE 251 H.B. FULLER COMPANY: PRODUCTS OFFERED

- TABLE 252 H.B. FULLER COMPANY: DEALS, JANUARY 2020-JANUARY 2025

- TABLE 253 3M: COMPANY OVERVIEW

- TABLE 254 3M: PRODUCTS OFFERED

- TABLE 255 JA SOLAR TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 256 JA SOLAR TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 257 JIANGSU SVECK PHOTOVOLTAIC NEW MATERIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 258 JIANGSU SVECK PHOTOVOLTAIC NEW MATERIAL CO., LTD.: PRODUCTS OFFERED

- TABLE 259 JIANGSU SVECK PHOTOVOLTAIC NEW MATERIAL CO., LTD.: EXPANSIONS, JANUARY 2020-JANUARY 2025

- TABLE 260 HANGZHOU FIRST APPLIED MATERIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 261 HANGZHOU FIRST APPLIED MATERIAL CO., LTD.: PRODUCTS OFFERED

- TABLE 262 HANGZHOU FIRST APPLIED MATERIAL CO., LTD.: EXPANSIONS, JANUARY 2020-JANUARY 2025

- TABLE 263 HANGZHOU FIRST APPLIED MATERIAL CO., LTD.: OTHER DEVELOPMENTS, JANUARY 2020-JANUARY 2025

- TABLE 264 SHANGHAI HIUV NEW MATERIALS CO., LTD.: COMPANY OVERVIEW

- TABLE 265 SHANGHAI HIUV NEW MATERIALS CO., LTD.: PRODUCTS OFFERED

- TABLE 266 SHANGHAI HIUV NEW MATERIALS CO., LTD.: OTHER DEVELOPMENTS, JANUARY 2020-JANUARY 2025

- TABLE 267 GUANGZHOU LUSHAN NEW MATERIALS CO., LTD.: COMPANY OVERVIEW

- TABLE 268 GUANGZHOU LUSHAN NEW MATERIALS CO., LTD.: PRODUCTS OFFERED

- TABLE 269 HANWHA GROUP: COMPANY OVERVIEW

- TABLE 270 HANWHA GROUP: PRODUCTS OFFERED

- TABLE 271 HANWHA GROUP: DEALS, JANUARY 2020-JANUARY 2025

- TABLE 272 HANWHA GROUP: EXPANSIONS, JANUARY 2020-JANUARY 2025

- TABLE 273 CYBRID TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 274 CYBRID TECHNOLOGIES INC.: PRODUCTS OFFERED

- TABLE 275 CYBRID TECHNOLOGIES INC.: DEALS, JANUARY 2020-JANUARY 2025

- TABLE 276 BETTERIAL: COMPANY OVERVIEW

- TABLE 277 BETTERIAL: PRODUCTS OFFERED

- TABLE 278 BETTERIAL: OTHER DEVELOPMENTS, JANUARY 2020-JANUARY 2025

- TABLE 279 MATIV: COMPANY OVERVIEW

- TABLE 280 MATIV: PRODUCTS OFFERED

- TABLE 281 MATIV: DEALS, JANUARY 2020-JANUARY 2025

- TABLE 282 ZHEJIANG SINOPONT TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 283 ZHEJIANG SINOPONT TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 284 ZHEJIANG SINOPONT TECHNOLOGY CO., LTD.: EXPANSIONS, JANUARY 2020-JANUARY 2025

- TABLE 285 SATINAL SPA: COMPANY OVERVIEW

- TABLE 286 FOLIENWERK WOLFEN GMBH: COMPANY OVERVIEW

- TABLE 287 SHENZHEN GAOREN ELECTRONIC NEW MATERIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 288 HUIZHOU BAOJUN MATERIAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 289 ZONPAK NEW MATERIALS CO., LTD.: COMPANY OVERVIEW

- TABLE 290 LUCENT CLEANENERGY: COMPANY OVERVIEW

- TABLE 291 DR. HANS WERNER CHEMIKALIEN: COMPANY OVERVIEW

- TABLE 292 HANGZHOU XINDONGKE ENERGY TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 293 DANA POLY, INC.: COMPANY OVERVIEW

- TABLE 294 E&N FILM TECH CO. LTD.: COMPANY OVERVIEW

- TABLE 295 FANGDING TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 296 HUICHI INDUSTRIAL DEVELOPMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 297 RICH BIG ENTERPRISE CO., LTD.: COMPANY OVERVIEW

- TABLE 298 NOVOPOLYMERS: COMPANY OVERVIEW

- TABLE 299 ENERLITE SOLAR FILMS INDIA PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 300 CROWN ADVANCED MATERIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 301 FUYIN GROUP: COMPANY OVERVIEW

List of Figures

- FIGURE 1 EVA FILMS MARKET SEGMENTATION AND REGIONAL SNAPSHOT

- FIGURE 2 EVA FILMS MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS, 2023

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 EVA FILMS ADHESIVES MARKET: DATA TRIANGULATION

- FIGURE 9 STANDARD EVA FILMS SEGMENT TO DOMINATE MARKET IN 2029

- FIGURE 10 EXTRUSION SEGMENT DOMINATED MARKET IN 2024

- FIGURE 11 SOLAR PANEL ENCAPSULATION SEGMENT TO REGISTER HIGHEST GROWTH BETWEEN 2024 & 2029

- FIGURE 12 RENEWABLE ENERGY SEGMENT TO LEAD MARKET IN 2029

- FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 14 GROWING USE OF EVA FILMS IN CONSUMER GOODS INDUSTRY TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 15 STANDARD EVA FILMS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 EXTRUSION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 SOLAR PANEL ENCAPSULATION SEGMENT TO REGISTER HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 18 RENEWABLE ENERGY SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 19 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 20 EVA FILMS MARKE: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 USE OF GENERATIVE AI IN EVA FILMS MARKET

- FIGURE 22 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 23 EVA FILMS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 24 EVA FILMS MARKET: INVESTMENT AND FUNDING SCENARIO, 2020 VS. 2023 (USD MILLION)

- FIGURE 25 AVERAGE SELLING PRICE TREND OF EVA FILMS, BY REGION, 2021-2023 (USD/KILOTON)

- FIGURE 26 AVERAGE SELLING PRICE TREND OF EVA FILMS OFFERED BY KEY PLAYERS, BY TYPE, 2023 (USD/KILOTON)

- FIGURE 27 EVA FILMS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 28 PATENTS GRANTED OVER LAST 10 YEARS, 2014-2023

- FIGURE 29 PATENT ANALYSIS, BY LEGAL STATUS, 2014-2023

- FIGURE 30 REGIONAL ANALYSIS OF PATENTS GRANTED RELATED TO EVA FILMS, 2014-2023

- FIGURE 31 TOP COMPANIES WITH SUBSTANTIAL NUMBER OF PATENTS, 2014-2023

- FIGURE 32 IMPORT DATA RELATED TO HS CODE (390130)-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 33 EXPORT DATA RELATED TO HS CODE 390130-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 34 EVA FILMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- FIGURE 36 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 37 STANDARD EVA FILMS SEGMENT DOMINATED MARKET IN 2024

- FIGURE 38 EXTRUSION SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 39 SOLAR PANEL ENCAPSULATION SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 40 RENEWABLE ENERGY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 41 ASIA PACIFIC TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 42 ASIA PACIFIC: EVA FILMS MARKET SNAPSHOT

- FIGURE 43 NORTH AMERICA: EVA FILMS MARKET SNAPSHOT

- FIGURE 44 EUROPE: EVA FILMS MARKET SNAPSHOT

- FIGURE 45 EVA FILMS MARKET SHARE ANALYSIS, 2023

- FIGURE 46 EVA FILMS MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 47 EVA FILMS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 48 EVA FILMS MARKET: COMPANY FOOTPRINT

- FIGURE 49 EVA FILMS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 50 EVA FILMS MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 51 EV/EBITDA OF KEY MANUFACTURERS OF EVA FILMS

- FIGURE 52 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN

- FIGURE 53 H.B. FULLER COMPANY: COMPANY SNAPSHOT

- FIGURE 54 3M: COMPANY SNAPSHOT

- FIGURE 55 JA SOLAR TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 56 HANGZHOU FIRST APPLIED MATERIAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 57 GUANGZHOU LUSHAN NEW MATERIALS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 58 HANWHA GROUP: COMPANY SNAPSHOT

- FIGURE 59 MATIV: COMPANY SNAPSHOT

The EVA Films market size is projected to grow from USD 7.43 billion in 2024 to USD 11.26 billion by 2029, registering a CAGR of 8.7% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Type, Production Method, Application, End-Use Industry, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

The market for EVA films is increasing due to their versatility, durability, and wide-ranging applications. The most prominent driver is the solar energy industry's high growth rate, wherein EVA films are required for encapsulating photovoltaic (PV) modules to maintain long-term efficiency and protection. Moreover, increasing demand for high-performance packaging materials, laminated glass, and protective films in the construction and automotive sectors is driving the market forward. Advances in polymer science have increased the thermal stability, adhesion, and UV resistance of EVA films, making them suitable for a number of applications. In addition, the growing middle-class population, urbanization, and industrialization in developing countries have resulted in higher consumption of EVA films in consumer products, further enhancing market demand.

" Standrad EVA Films accounted for the fastest growing in type segment of EVA Films market in terms of value."

The standard EVA films segment is growing at the highest rate in the EVA films market because of its cost-effectiveness, balanced performance properties, and broad applicability across different industries. One of the major reasons for its high growth is its best balance of flexibility, durability, and adhesion properties, which makes it a first choice for different applications. Standard EVA films have good thermal stability, chemical resistance, and mechanical strength, which makes them a good choice for use in various environments without needing to be replaced often. The films also have high transparency and better encapsulation properties, which are making them more popular. Their cost-effectiveness, coupled with ease of processing and compatibility with most manufacturing processes, has made them a first preference for firms seeking effective yet cost-efficient options.

"Extrusion accounted for the fastest growing in production method segment of EVA Films market in terms of value."

The extrusion manufacturing process is the fastest-growing segment in the EVA films market because it is efficient, scalable, and can make high-quality films with uniform properties. Extrusion provides a streamlined, continuous process of manufacturing that allows for the production of EVA films with uniform thickness, high clarity, and improved mechanical properties. The technique provides a very accurate level of control over the dimensions, finish, and general performance of the film, making it a preferred choice among manufacturers. Among the main reasons for the accelerated growth of the extrusion process is its cost-effectiveness. In comparison to other manufacturing processes, extrusion reduces material wastage, minimizes labor expenses, and maximizes energy efficiency. As the need for high-performance EVA films continues to rise, producers are spending on innovative extrusion technology, including multi-layer co-extrusion, to enable the production of films with tailored properties.

"Solar panel encapsulation accounted for the for the fastest growing in application segment of EVA Films market in terms of value."

Solar panel encapsulation application is the fastest growing segment in the EVA films market because of growing worldwide attention to renewable power, solar technological developments, and the better protection features of EVA films. Solar panel encapsulation is an important application of EVA films due to its superior protective functions such as durability, UV stability, and great adhesion to photovoltaic (PV) module materials, providing long-lasting performance and dependability of photovoltaic modules. One of the major growth drivers in this segment is the cost efficiency and processing advantage of EVA films in solar panel production. EVA encapsulants provide a trade-off between cost and high performance, which makes them the most popular option among solar module manufacturers. The simplicity of lamination and compatibility with automated production lines enable manufacturers to simplify the encapsulation process, minimize production costs, and enhance throughput. In addition, ongoing developments in EVA formulations, including increased thermal stability and greater resistance to potential-induced degradation (PID), have further enhanced their use in solar applications. Such developments add to the long-term durability of solar panels, lessening maintenance and enhancing their economic feasibility..

"Renewable Energy accounted for the for the fastest growing in end-use industry segment of EVA Films market in terms of value."

The renewable energy end-use industry is the fastest growing segment in the EVA films market because of the worldwide transition towards clean energy solutions, rising investments in clean energy infrastructure, and the better properties of EVA films in renewable applications. Governments and institutions across the world are enforcing policies, subsidies, and incentives to promote the use of renewable energy sources, especially solar and wind power, where EVA films are of vital importance. The growing need for EVA films is, to a great extent, fueled by their widespread application in solar panel encapsulation, where they enable high optical transparency, UV resistance, and durability, guaranteeing the long-term performance and efficiency of photovoltaic (PV) modules. Among the key drivers propelling the rise of EVA films in the renewable energy space is that they can boost solar panel performance and longevity. As protective encapsulants, the EVA films keep out moisture, mechanical injury, and breakdown due to continuous exposure to stressful environmental conditions. This consistency has seen them be the first pick among solar module manufacturers, expanding the market even further.

"Asia pacific is the fastest growing market for EVA Films ."

The Asia Pacific is the fastest-growing market for EVA films because of fast-paced industrialization, growing infrastructure development, and expanding investments in renewable energy and advanced manufacturing. The region is dominated by nations such as China, India, Japan, and South Korea which have become leading centers for solar energy generation, electronics manufacturing, and construction. The extensive use of EVA films in numerous applications, especially for solar panel encapsulation, packaging, and industrial laminates, is driving growth in the market. China, being the world leader in solar panel manufacturing, has played a major role in the rising demand for EVA films by expanding the manufacturing of photovoltaic (PV) modules for domestic and global renewable energy needs. The presence of low-cost raw materials, high-tech production capabilities, and robust supply chain infrastructure has also further consolidated the market position of Asia Pacific.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the EVA Films market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, and Tier 3 - 20%

- By Designation: Managers- 15%, Directors - 20%, and Others - 65%

- By Region: North America - 30%, Europe - 25%, APAC - 35%, the Middle East & Africa -5%, and South America- 5%

The EVA Films market comprises major players H.B. Fuller (US), 3M (US), JA Solar Technology Co., Ltd. (China), Jiangsu Sveck Photovoltaic New Material Co., Ltd. (China), HANGZHOU FIRST APPLIED MATERIAL CO., LTD. (China), Shanghai HIUV New Materials Co., Ltd. (China), Guangzhou Lushan New Materials Co., Ltd. (China), Hanwha Group (South Korea), Cybrid Technologies Inc. (China), Betterial (China), Mativ (US) and Zhejiang Sinopont Technology Co., Ltd. (China). The study includes in-depth competitive analysis of these key players in the EVA Films market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the market for EVA Films market on the basis of type, form, end-use industry, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, and expansions associated with the market for EVA Films market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the EVA Films market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of drivers: (Improved bond strength in lamination, better impact resistance, and a wider service temperature range), restraints (Competition from other materials such as polyolefin), opportunities (Emerging application in agriculture, particularly in greenhouse coverings and agricultural mulch films), and challenges (Limited recyclability of EVA films poses environmental challenges) influencing the growth of EVA Films market.

- Market Penetration: Comprehensive information on the EVA Films market offered by top players in the global EVA Films market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, in the EVA Films market.

- Market Development: Comprehensive information about lucrative emerging markets the report analyzes the markets for EVA Films market across regions.

- Market Capacity: Production capacities of companies producing EVA Films are provided wherever available with upcoming capacities for the EVA Films market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the EVA Films market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SNAPSHOT

- 1.3.2 INCLUSIONS & EXCLUSIONS OF STUDY

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.1.2.3 Key participants for primary interviews

- 2.1.2.4 Breakdown of primary interviews

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE ANALYSIS

- 2.2.2 DEMAND-SIDE ANALYSIS

- 2.3 GROWTH FORECAST

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 GROWTH FORECAST

- 2.8 RISK ASSESSMENT

- 2.9 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EVA FILMS MARKET

- 4.2 EVA FILMS MARKET, BY TYPE

- 4.3 EVA FILMS MARKET, BY PRODUCTION METHOD

- 4.4 EVA FILMS MARKET, BY APPLICATION

- 4.5 EVA FILMS MARKET, BY END-USE INDUSTRY

- 4.6 EVA FILMS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increased use in various applications driven by superior durability, flexibility, and resilience

- 5.2.1.2 Growth of solar energy industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 Competition from other materials with similar properties

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of eco-friendly and biodegradable EVA film solutions

- 5.2.3.2 Emerging applications in agriculture, particularly in greenhouse coverings and agricultural mulch films

- 5.2.4 CHALLENGES

- 5.2.4.1 Discoloration of EVA films after extended exposure to sunlight

- 5.2.4.2 Limited recyclability of EVA films poses environmental challenges

- 5.2.1 DRIVERS

- 5.3 GENERATIVE AI

- 5.3.1 INTRODUCTION

- 5.4 IMPACT OF GENERATIVE AI ON EVA FILMS MARKET

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.4 INVESTMENT AND FUNDING SCENARIO

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE TREND, BY REGION

- 6.5.2 AVERAGE SELLING PRICE TREND, BY TYPE

- 6.5.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE

- 6.6 ECOSYSTEM ANALYSIS

- 6.7 TECHNOLOGY ANALYSIS

- 6.7.1 KEY TECHNOLOGIES

- 6.7.2 COMPLEMENTARY TECHNOLOGIES

- 6.7.3 ADJACENT TECHNOLOGIES

- 6.8 PATENT ANALYSIS

- 6.8.1 METHODOLOGY

- 6.8.2 GRANTED PATENTS

- 6.8.2.1 Patent publication trends

- 6.8.3 INSIGHTS

- 6.8.4 LEGAL STATUS

- 6.8.5 JURISDICTION ANALYSIS

- 6.8.6 TOP APPLICANTS

- 6.9 TRADE ANALYSIS

- 6.9.1 IMPORT SCENARIO (HS CODES 390130)

- 6.9.2 EXPORT SCENARIO (HS CODES 390130)

- 6.10 KEY CONFERENCES AND EVENTS

- 6.11 TARIFF AND REGULATORY LANDSCAPE

- 6.11.1 TARIFF ANALYSIS

- 6.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.3 STANDARDS AND REGULATIONS

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 MACROECONOMIC OUTLOOK

- 6.14.1 GDP TRENDS AND FORECASTS, BY COUNTRY

- 6.15 CASE STUDY ANALYSIS

- 6.15.1 CHARACTERIZATION OF EVA FILMS FOR PHOTOVOLTAIC MODULES

- 6.15.2 USING DEEP EUTECTIC SOLVENTS TO SEPARATE EVA FILMS FROM END-OF-LIFE PV MODULES

7 EVA FILMS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 STANDARD EVA FILMS

- 7.2.1 VERSATILE APPLICATIONS IN SOLAR, PACKAGING, AND AUTOMOTIVE INDUSTRIES TO DRIVE ADOPTION

- 7.3 RAPID CURING EVA FILMS

- 7.3.1 SHORTER PRODUCTION CYCLES AND REDUCED OVERALL PROCESSING TIME TO DRIVE MARKET

- 7.4 ANTI-PID EVA FILMS

- 7.4.1 IMPROVING EFFICIENCY AND LONGEVITY OF SOLAR MODULES BY REDUCING DEGRADATION TO DRIVE ADOPTION

- 7.5 ULTRA-TRANSPARENT EVA FILMS

- 7.5.1 ENHANCED LIGHT TRANSMISSION AND AESTHETIC QUALITY TO SUPPORT MARKET GROWTH

- 7.6 OTHER TYPES

- 7.6.1 LOW-TEMPERATURE EVA FILMS

- 7.6.2 COLOR EVA FILMS

- 7.6.3 ANTI-UV EVA FILMS

8 EVA FILMS MARKET, BY PRODUCTION METHOD

- 8.1 INTRODUCTION

- 8.2 EXTRUSION

- 8.2.1 EFFICIENCY, COST-EFFECTIVENESS, AND ABILITY TO PRODUCE FILMS WITH CONSISTENT PROPERTIES TO DRIVE MARKET GROWTH

- 8.3 BLOW MOLDING

- 8.3.1 ABILITY TO PRODUCE THIN FILMS WITH EXCELLENT MECHANICAL STRENGTH TO PROPEL ADOPTION

- 8.4 CASTING

- 8.4.1 ENABLES PRODUCTION OF MULTILAYER EVA FILMS WITH SPECIFIC FUNCTIONALITIES-KEY FACTOR DRIVING MARKET GROWTH

9 EVA FILMS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 SOLAR PANEL ENCAPSULATION

- 9.2.1 EXCELLENT ADHESIVE PROPERTIES AND ABILITY TO WITHSTAND EXTREME TEMPERATURES TO DRIVE ADOPTION

- 9.3 LAMINATION

- 9.3.1 DURABILITY AND TRANSPARENCY OF GLASS WHILE OFFERING SUPERIOR PROTECTION-KEY FACTOR DRIVING MARKET GROWTH

- 9.4 HEAT SEAL

- 9.4.1 DEMAND FOR CUSTOM SEALING SOLUTIONS TO ENSURE PRODUCT SAFETY AND FRESHNESS TO PROPEL MARKET

- 9.5 PRINTING

- 9.5.1 NEED TO ENHANCE PRODUCT PACKAGING WITH VIBRANT GRAPHICS AND CLEAR VISIBILITY TO DRIVE MARKET

- 9.6 THERMO WELDING

- 9.6.1 ROBUST AND RELIABLE BONDING IN AUTOMOTIVE AND CONSTRUCTION SECTORS TO DRIVE ADOPTION

- 9.7 OTHER APPLICATIONS

- 9.7.1 COATINGS

- 9.7.2 ULTRASONIC WELDING

10 EVA FILMS MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 RENEWABLE ENERGY

- 10.2.1 EXPANSION OF SOLAR ENERGY INSTALLATIONS WORLDWIDE TO DRIVE MARKET

- 10.3 CONSTRUCTION

- 10.3.1 INCREASING DEMAND FOR DURABLE, WEATHER-RESISTANT MATERIALS IN BUILDING AND INFRASTRUCTURE PROJECTS TO PROPEL MARKET

- 10.4 AUTOMOTIVE

- 10.4.1 INCREASING FOCUS ON ADVANCED AUTOMOTIVE GLASS FEATURES TO ENHANCE CONSUMER COMFORT AND VEHICLE PERFORMANCE TO DRIVE MARKET

- 10.5 PACKAGING

- 10.5.1 NEED TO MAINTAIN FRESHNESS AND SHELF LIFE OF PRODUCTS TO DRIVE ADOPTION

- 10.6 OTHER END-USE INDUSTRIES

- 10.6.1 AGRICULTURE

- 10.6.2 CONSUMER GOODS

11 EVA FILMS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Presence of leading EVA film manufacturers to support market growth

- 11.2.2 JAPAN

- 11.2.2.1 Growth in consumer electronics market to drive market

- 11.2.3 INDIA

- 11.2.3.1 Rapid urbanization and construction boom to drive demand for laminated glass and architectural applications

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Significant investments in R&D for high-quality materials to support market growth

- 11.2.5 REST OF ASIA PACIFIC

- 11.2.1 CHINA

- 11.3 NORTH AMERICA

- 11.3.1 US

- 11.3.1.1 Growing focus on sustainable and transparent packaging solutions to drive market

- 11.3.2 CANADA

- 11.3.2.1 Increasing focus on sustainable and energy-efficient building materials to drive demand

- 11.3.3 MEXICO

- 11.3.3.1 Growth in automotive sector to drive market

- 11.3.1 US

- 11.4 EUROPE

- 11.4.1 GERMANY

- 11.4.1.1 Strong automotive sector to boost demand

- 11.4.2 ITALY

- 11.4.2.1 Enhanced production capacity and strong international partnerships to support market growth

- 11.4.3 FRANCE

- 11.4.3.1 Presence of large industrial manufacturing and chemical sectors to boost market

- 11.4.4 UK

- 11.4.4.1 Growing focus on renewable energy and solar installations to propel market

- 11.4.5 SPAIN

- 11.4.5.1 Rapid growth in tourism sector to support market growth

- 11.4.6 RUSSIA

- 11.4.6.1 Infrastructural developments to fuel market growth

- 11.4.7 REST OF EUROPE

- 11.4.1 GERMANY

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Vision 2030 initiative to support market growth

- 11.5.1.2 UAE

- 11.5.1.2.1 Increased emphasis on high-quality interior aesthetics to support market growth

- 11.5.1.3 Rest of GCC countries

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Growth in automotive industry to propel market

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 ARGENTINA

- 11.6.1.1 Increased use in agriculture to drive market growth

- 11.6.2 BRAZIL

- 11.6.2.1 Expansion of solar power installations to drive market

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 ARGENTINA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 MARKET SHARE ANALYSIS

- 12.3.1 H.B. FULLER COMPANY

- 12.3.2 3M

- 12.3.3 HANWHA GROUP-

- 12.3.4 HANGZHOU FIRST APPLIED MATERIAL CO., LTD.

- 12.3.5 SHANGHAI HIUV NEW MATERIALS CO., LTD.

- 12.4 REVENUE ANALYSIS

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.5.5.1 Company footprint

- 12.5.5.2 Type footprint

- 12.5.5.3 Production method footprint

- 12.5.5.4 End-use industry footprint

- 12.5.5.5 Region footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2023

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 12.7.1 PHOTOCAP 15580P

- 12.7.2 3M SOLAR ENCAPSULANT FILM EVA9100

- 12.7.3 HEP SERIES

- 12.7.4 F**RST

- 12.7.5 HIUV S201MT

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 DEALS

- 12.9.2 EXPANSIONS

- 12.9.3 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 H.B. FULLER COMPANY

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 3M

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 MnM view

- 13.1.2.3.1 Key strengths

- 13.1.2.3.2 Strategic choices

- 13.1.2.3.3 Weaknesses and competitive threats

- 13.1.3 JA SOLAR TECHNOLOGY CO., LTD.

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 MnM view

- 13.1.3.3.1 Key strengths

- 13.1.3.3.2 Strategic choices

- 13.1.3.3.3 Weaknesses and competitive threats

- 13.1.4 JIANGSU SVECK PHOTOVOLTAIC NEW MATERIAL CO., LTD.

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Expansions

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 HANGZHOU FIRST APPLIED MATERIAL CO., LTD.

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Expansions

- 13.1.5.3.2 Other developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 SHANGHAI HIUV NEW MATERIALS CO., LTD.

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Other developments

- 13.1.6.4 MnM view

- 13.1.6.4.1 Key strengths

- 13.1.6.4.2 Strategic choices

- 13.1.6.4.3 Weaknesses and competitive threats

- 13.1.7 GUANGZHOU LUSHAN NEW MATERIALS CO., LTD.

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 MnM view

- 13.1.7.3.1 Key strengths

- 13.1.7.3.2 Strategic choices

- 13.1.7.3.3 Weaknesses and competitive threats

- 13.1.8 HANWHA GROUP

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.8.3.2 Expansions

- 13.1.8.4 MnM view

- 13.1.8.4.1 Key strengths

- 13.1.8.4.2 Strategic choices

- 13.1.8.4.3 Weaknesses and competitive threats

- 13.1.9 CYBRID TECHNOLOGIES INC.

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.9.4 MnM view

- 13.1.9.4.1 Key strengths

- 13.1.9.4.2 Strategic choices

- 13.1.9.4.3 Weaknesses and competitive threats

- 13.1.10 BETTERIAL

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Other developments

- 13.1.10.4 MnM view

- 13.1.10.4.1 Key strengths

- 13.1.10.4.2 Strategic choices

- 13.1.10.4.3 Weaknesses and competitive threats

- 13.1.11 MATIV

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.11.4 MnM view

- 13.1.11.4.1 Key strengths

- 13.1.11.4.2 Strategic choices

- 13.1.11.4.3 Weaknesses and competitive threats

- 13.1.12 ZHEJIANG SINOPONT TECHNOLOGY CO., LTD.

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Expansions

- 13.1.12.4 MnM view

- 13.1.12.4.1 Key strengths

- 13.1.12.4.2 Strategic choices

- 13.1.12.4.3 Weaknesses and competitive threats

- 13.1.1 H.B. FULLER COMPANY

- 13.2 OTHER PLAYERS

- 13.2.1 SATINAL SPA

- 13.2.2 FOLIENWERK WOLFEN GMBH

- 13.2.3 SHENZHEN GAOREN ELECTRONIC NEW MATERIAL CO., LTD.

- 13.2.4 HUIZHOU BAOJUN MATERIAL TECHNOLOGY CO., LTD.

- 13.2.5 ZONPAK NEW MATERIALS CO., LTD.

- 13.2.6 LUCENT CLEANENERGY

- 13.2.7 DR. HANS WERNER CHEMIKALIEN

- 13.2.8 HANGZHOU XINDONGKE ENERGY TECHNOLOGY CO., LTD.

- 13.2.9 DANA POLY, INC.

- 13.2.10 E&N FILM TECH CO. LTD.

- 13.2.11 FANGDING TECHNOLOGY CO., LTD.

- 13.2.12 HUICHI INDUSTRIAL DEVELOPMENT CO., LTD.

- 13.2.13 RICH BIG ENTERPRISE CO., LTD.

- 13.2.14 NOVOPOLYMERS

- 13.2.15 ENERLITE SOLAR FILMS INDIA PRIVATE LIMITED

- 13.2.16 CROWN ADVANCED MATERIAL CO., LTD.

- 13.2.17 FUYIN GROUP

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS