|

|

市場調査レポート

商品コード

1652616

eVTOL航空機市場:揚力技術別、推進タイプ別、システム別、運航モード別、用途別、最大離陸重量別、航続距離別、地域別 - 2035年までの予測eVTOL Aircraft Market by Lift Technology (Vectored Thrust, Multirotor, Lift Plus Cruise), Propulsion Type (Fully Electric, Hybrid, Hydrogen), Application (Air Taxi, Air Metro), System, Mode of Operation, MTOW, Range and Region - Global Forecast to 2035 |

||||||

カスタマイズ可能

|

|||||||

| eVTOL航空機市場:揚力技術別、推進タイプ別、システム別、運航モード別、用途別、最大離陸重量別、航続距離別、地域別 - 2035年までの予測 |

|

出版日: 2025年02月06日

発行: MarketsandMarkets

ページ情報: 英文 398 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

eVTOL航空機の市場規模は、2024年に7億6,000万米ドルとなりました。

同市場は、2024年から2030年に35.3%のCAGRで拡大し、2030年には46億7,000万米ドルに達すると予測されています。また、2031年から2035年までのCAGRは27.6%と見込まれ、2031年には65億3,000万米ドル、2035年には173億4,000万米ドルに成長すると予測されています。eVTOL航空機は、より速く、よりクリーンで、より効率的な移動手段を約束し、輸送のあり方を変えようとしています。この革新的な航空機は、電気推進力と高度な空気力学を組み合わせ、垂直離着陸能力を確保しています。この航空機は、UAM(アーバン・エアモビリティ)、貨物ロジスティクスから救急サービスまで、あらゆる用途に対応します。混雑と公害の増加に伴い、世界は持続可能なeVTOLによる代替輸送源を必要としています。電気動力および/またはハイブリッド電気推進、完全または部分的な電気式eVTOLシステムは、低デシベルの音響出力でエミッションフリーの飛行を実現し、このような航空機を使用する都市部や郊外での機会を提供します。このような柔軟性は、旅客の輸送、貨物の輸送、災害時の救助・救命任務、病院や病院の死傷者の避難に役立ちます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2035年 |

| 基準年 | 2023年 |

| 予測期間 | 2025年~2035年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | 揚力技術別、推進タイプ別、システム別、運航モード別、用途別、最大離陸重量別、航続距離別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

アビオニクスセグメントは、eVTOL航空機の安全性、効率性、自律飛行、都市および地域の航空モビリティにおけるeVTOLの成功に不可欠な要素に照らして、eVTOL航空機の市場全体を支配すると予想されます。アビオニクス・システムには、ナビゲーション、通信、飛行制御、衝突回避技術が含まれ、これらすべてが複雑な都市環境におけるeVTOLの成功に重要な役割を果たします。

eVTOL航空機は電気推進力に依存し、低高度の交通量の多い空域で運用するように設計されているため、高度なアビオニクス技術によって、正確で安定した飛行制御と、時間的に重要な判断が保証されます。例えば、自律飛行システムや探知・回避技術は、UAMを拡大するための中心的な要素であり、これによってeVTOLは混雑した空を安全に航行し、既存の航空交通管理システムと相互作用することができます。アビオニクスは、都市交通管理(UTM)フレームワークとともに、運用効率の点でその使い勝手をさらに拡大します。

アジア太平洋は、eVTOL航空機の中で2番目に大きな市場シェアを占めると予想されています。東京、上海、ソウル、ムンバイ、シンガポールのような国々は、陸上で大きな混雑を経験しているため、都市人口拡大の持続可能なレベルを達成することはできないが、同時に、eVTOLを使用してメガシティや密集した郊外地域の人口、商業/オフィス、関連する建物密度の期待に応える大きな可能性に直面しています。

この地域の大規模な人口基盤は、可処分所得の増加や中間層の拡大と相まって、革新的な移動手段の必要性を煽っています。アジア太平洋全域でのeコマースの急成長は、特に中国やインドなどの国々で、ラストワンマイルや地域配送サービス用の貨物eVTOLの需要に拍車をかけています。

同地域の政府は、スマート・シティ、持続可能なモビリティ・プロジェクト、都市空域でのeVTOLの運用を可能にする規制枠組みへの資金提供を通じて、eVTOL開発に積極的に参加し続けています。その一例が、EHangを通じた自律的配備という点では中国であり、日本は2025年の大阪万博でエアタクシーの本格的なデモンストレーションを行うための準備を進めており、韓国ではK-UAMイニシアチブが2030年までにUAMのインフラと運用能力を目標としています。

当レポートでは、世界のeVTOL航空機市場について調査し、揚力技術別、推進タイプ別、システム別、運航モード別、用途別、最大離陸重量別、航続距離別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- エコシステム分析

- 顧客ビジネスに影響を与える動向と混乱

- 運用データ

- 投資と資金調達のシナリオ

- 技術分析

- ケーススタディ分析

- 貿易分析

- 規制状況

- 主な利害関係者と購入基準

- 主な会議とイベント

- eVTOL市場:ビジネスモデル

- 総所有コスト(TCO)分析

- 価格分析

- 部品表(BOM)分析

- マクロ経済見通し

- 技術ロードマップ

第6章 業界の動向

- イントロダクション

- 新たな動向

- サプライチェーン分析

- メガトレンドの影響

- 特許分析

- 生成AIの影響

第7章 eVTOL航空機のハイブリッドリフト技術

第8章 eVTOL航空機インフラ市場

- イントロダクション

- Vポート

- 充電ステーション

- 航空交通管理施設

- メンテナンス施設

第9章 eVTOL航空機市場、揚力技術別

- イントロダクション

- 推力偏向

- マルチローター

- リフトプラスクルーズ

第10章 eVTOL航空機市場、推進タイプ別

- イントロダクション

- 完全電動

- ハイブリッド・電気

- 水素・電気

第11章 eVTOL航空機市場、システム別

- イントロダクション

- バッテリーとセル

- 電動モーター/エンジン

- 航空機構造とキャビンインテリア

- 航空電子工学

- ソフトウェア

- その他

第12章 eVTOL航空機市場、運航モード別

- イントロダクション

- パイロット

- 自律型

第13章 eVTOL航空機市場、用途別

- イントロダクション

- エアタクシー

- エアシャトルとエアメトロ

- プライベート輸送

- 貨物輸送

- 救急航空と医療緊急

- ラストマイル配送

- 特別ミッション

- その他

第14章 eVTOL航空機市場、最大離陸重量別

- イントロダクション

- 100~1,000キログラム

- 1,001~2,000キログラム

- 2,000キログラム超

第15章 eVTOL航空機市場、航続距離別

- イントロダクション

- 200キロメートル以下

- 200キロ以上

第16章 eVTOL航空機市場、地域別

- イントロダクション

- 北米

- PESTLE分析

- 米国

- カナダ

- 欧州

- PESTLE分析

- 英国

- ドイツ

- フランス

- アイルランド

- スペイン

- その他

- アジア太平洋

- PESTLE分析

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- その他

- ラテンアメリカ

- PESTLE分析

- ブラジル

- メキシコ

- アルゼンチン

- 中東・アフリカ

- PESTLE分析

- 湾岸協力会議

- 南アフリカ

- その他

第17章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2020年~2024年

- 収益分析

- 市場シェア分析

- 取引に基づく上位5社の市場ランキング、2021年~2024年

- 2024年の受注残シェア分析

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第18章 企業プロファイル

- 主要参入企業

- ARCHER AVIATION INC.

- VERTICAL AEROSPACE

- EVE HOLDINGS, INC.

- EHANG

- JOBY AVIATION

- AIRBUS

- TEXTRON INC.

- WISK AERO LLC

- JAUNT AIR MOBILITY LLC

- BETA TECHNOLOGIES

- VOLOCOPTER GMBH

- XTI AEROSPACE

- LILIUM GMBH

- LIFT AIRCRAFT INC.

- AUTOFLIGHT

- VOLANT AEROTECH

- その他の企業

- ARC AERO SYSTEMS

- SKYDRIVE INC.

- ELECTRA.AERO

- OVERAIR, INC.

- MANTA AIRCRAFT

- AIR VEV LTD

- URBAN AERONAUTICS

- SKYRYSE, INC.

- ASCENDANCE FLIGHT TECHNOLOGIES S.A.S

第19章 付録

List of Tables

- TABLE 1 EVTOL AIRCRAFT MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES, 2020-2023

- TABLE 3 EVTOL AIRCRAFT MARKET ECOSYSTEM

- TABLE 4 EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (UNITS)

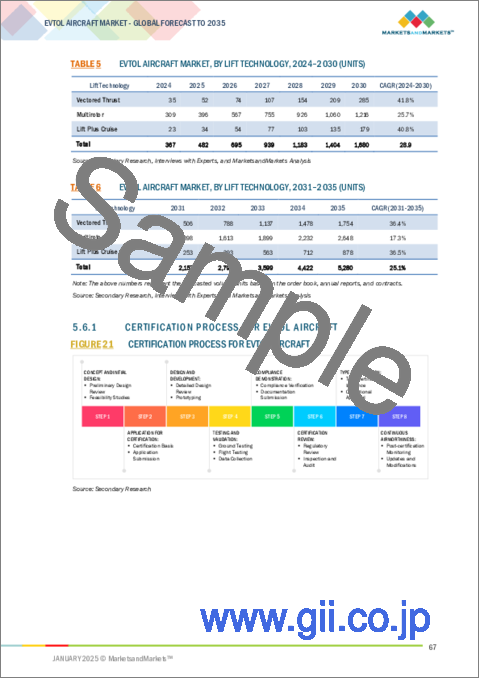

- TABLE 5 EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (UNITS)

- TABLE 6 EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (UNITS)

- TABLE 7 IMPORT DATA FOR HS CODE 880610-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 8 EXPORT DATA FOR HS CODE 880610-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY MODE OF OPERATION (%)

- TABLE 14 KEY BUYING CRITERIA FOR EVTOL AIRCRAFT, BY MODE OF OPERATION

- TABLE 15 DETAILED LIST OF CONFERENCES AND EVENTS, 2025

- TABLE 16 EVTOL AIRCRAFT MARKET: BUSINESS MODELS

- TABLE 17 INDICATIVE PRICING ANALYSIS OF EVTOL AIRCRAFT, BY AIRCRAFT MODEL, 2024 (USD MILLION)

- TABLE 18 INDICATIVE PRICING ANALYSIS, BY REGION, 2024 (USD MILLION)

- TABLE 19 INNOVATIONS AND PATENT REGISTRATIONS, 2020-2024

- TABLE 20 EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 21 EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 22 EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 23 JOBY AVIATION'S EVTOL AIRCRAFT SPECIFICATIONS

- TABLE 24 EHANG'S EH216-S AIRCRAFT SPECIFICATIONS

- TABLE 25 BETA TECHNOLOGIES' ALIA-250 AIRCRAFT SPECIFICATIONS

- TABLE 26 EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 27 EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 28 EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 29 EVE HOLDING'S EVE AIRCRAFT SPECIFICATIONS

- TABLE 30 VERTICAL AEROSPACE'S VX4 AIRCRAFT SPECIFICATIONS

- TABLE 31 TEXTRON'S BELL NEXUS 4EX (HYDROGEN VARIANT) AIRCRAFT SPECIFICATIONS

- TABLE 32 EVTOL AIRCRAFT MARKET, BY SYSTEM, 2020-2023 (USD MILLION)

- TABLE 33 EVTOL AIRCRAFT MARKET, BY SYSTEM, 2024-2030 (USD MILLION)

- TABLE 34 EVTOL AIRCRAFT MARKET, BY SYSTEM, 2031-2035 (USD MILLION)

- TABLE 35 EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 36 EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 37 EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

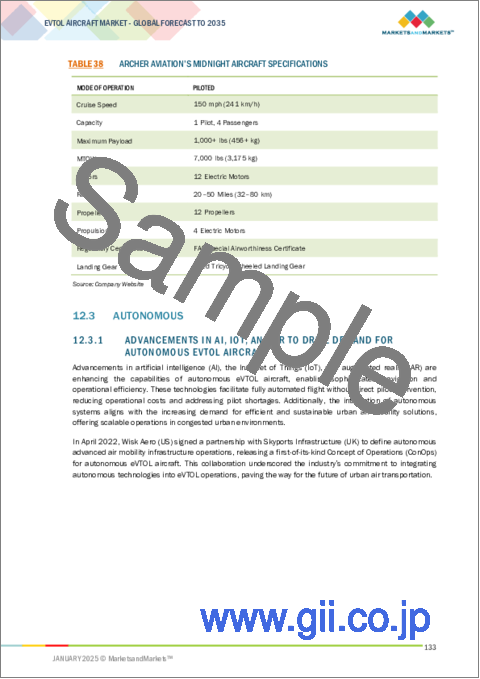

- TABLE 38 ARCHER AVIATION'S MIDNIGHT AIRCRAFT SPECIFICATIONS

- TABLE 39 EHANG'S EH216-L AIRCRAFT SPECIFICATIONS

- TABLE 40 EVTOL AIRCRAFT MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 41 EVTOL AIRCRAFT MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 42 EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031-2035 (USD MILLION)

- TABLE 43 EVTOL AIRCRAFT MARKET, BY MTOW, 2020-2023 (USD MILLION)

- TABLE 44 EVTOL AIRCRAFT MARKET, BY MTOW, 2024-2030 (USD MILLION)

- TABLE 45 EVTOL AIRCRAFT MARKET, BY MTOW, 2031-2035 (USD MILLION)

- TABLE 46 LIFT AIRCRAFT'S HEXA AIRCRAFT SPECIFICATIONS

- TABLE 47 SKYDRIVE'S SD-05 AIRCRAFT SPECIFICATIONS

- TABLE 48 SUPERNAL'S S-A2 AIRCRAFT SPECIFICATIONS

- TABLE 49 EVTOL AIRCRAFT MARKET, BY RANGE, 2020-2023 (USD MILLION)

- TABLE 50 EVTOL AIRCRAFT MARKET, BY RANGE, 2024-2030 (USD MILLION)

- TABLE 51 EVTOL AIRCRAFT MARKET, BY RANGE, 2031-2035 (USD MILLION)

- TABLE 52 AIRBUS'S CITYAIRBUS NEXTGEN AIRCRAFT SPECIFICATIONS

- TABLE 53 AUTOFLIGHT'S ALBATROSS AIRCRAFT SPECIFICATIONS

- TABLE 54 EVTOL AIRCRAFT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 55 EVTOL AIRCRAFT MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 56 EVTOL AIRCRAFT MARKET, BY REGION, 2031-2035 (USD MILLION)

- TABLE 57 NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 58 NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 59 NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2031-2035 (USD MILLION)

- TABLE 60 NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 61 NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 62 NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 63 NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 64 NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 66 NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 67 NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 68 NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

- TABLE 69 NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 70 NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031-2035 (USD MILLION)

- TABLE 72 US: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 73 US: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 74 US: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 75 US: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 76 US: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 77 US: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 78 US: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 79 US: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 80 US: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

- TABLE 81 CANADA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 82 CANADA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 83 CANADA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 84 CANADA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 85 CANADA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 86 CANADA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 87 CANADA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 88 CANADA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 89 CANADA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

- TABLE 90 EUROPE: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 91 EUROPE: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 92 EUROPE: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2031-2035 (USD MILLION)

- TABLE 93 EUROPE: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 94 EUROPE: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 95 EUROPE: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 96 EUROPE: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 97 EUROPE: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 98 EUROPE: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 99 EUROPE: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 100 EUROPE: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 101 EUROPE: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

- TABLE 102 EUROPE: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 103 EUROPE: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 104 EUROPE: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031-2035 (USD MILLION)

- TABLE 105 UK: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 106 UK: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 107 UK: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 108 UK: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 109 UK: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 110 UK: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 111 UK: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 112 UK: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 113 UK: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

- TABLE 114 GERMANY: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 115 GERMANY: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 116 GERMANY: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 117 GERMANY: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 118 GERMANY: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 119 GERMANY: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 120 GERMANY: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 121 GERMANY: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 122 GERMANY: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

- TABLE 123 FRANCE: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 124 FRANCE: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 125 FRANCE: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 126 FRANCE: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 127 FRANCE: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 128 FRANCE: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 129 FRANCE: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 130 FRANCE: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 131 FRANCE: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

- TABLE 132 IRELAND: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 133 IRELAND: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 134 IRELAND: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 135 IRELAND: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 136 IRELAND: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 137 IRELAND: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 138 IRELAND: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 139 IRELAND: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 140 IRELAND: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

- TABLE 141 SPAIN: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 142 SPAIN: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 143 SPAIN: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 144 SPAIN: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 145 SPAIN: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 146 SPAIN: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 147 SPAIN: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 148 SPAIN: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 149 SPAIN: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

- TABLE 150 REST OF EUROPE: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 151 REST OF EUROPE: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 152 REST OF EUROPE: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 153 REST OF EUROPE: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 154 REST OF EUROPE: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 155 REST OF EUROPE: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 156 REST OF EUROPE: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 157 REST OF EUROPE: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 158 REST OF EUROPE: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

- TABLE 159 ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 160 ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 161 ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2031-2035 (USD MILLION)

- TABLE 162 ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 163 ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 164 ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 165 ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 166 ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 167 ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 168 ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 169 ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 170 ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

- TABLE 171 ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 172 ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 173 ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031-2035 (USD MILLION)

- TABLE 174 CHINA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 175 CHINA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 176 CHINA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 177 CHINA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 178 CHINA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 179 CHINA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 180 CHINA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 181 CHINA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 182 CHINA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

- TABLE 183 INDIA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 184 INDIA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 185 INDIA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 186 INDIA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 187 INDIA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 188 INDIA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 189 INDIA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 190 INDIA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 191 INDIA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

- TABLE 192 JAPAN: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 193 JAPAN: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 194 JAPAN: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 195 JAPAN: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 196 JAPAN: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 197 JAPAN: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 198 JAPAN: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 199 JAPAN: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 200 JAPAN: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

- TABLE 201 SOUTH KOREA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 202 SOUTH KOREA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 203 SOUTH KOREA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 204 SOUTH KOREA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 205 SOUTH KOREA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 206 SOUTH KOREA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 207 SOUTH KOREA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 208 SOUTH KOREA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 209 SOUTH KOREA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

- TABLE 210 AUSTRALIA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 211 AUSTRALIA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 212 AUSTRALIA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 213 AUSTRALIA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 214 AUSTRALIA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 215 AUSTRALIA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 216 AUSTRALIA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 217 AUSTRALIA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 218 AUSTRALIA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

- TABLE 219 REST OF ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 220 REST OF ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 221 REST OF ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 222 REST OF ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 223 REST OF ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 224 REST OF ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 225 REST OF ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 226 REST OF ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 227 REST OF ASIA PACIFIC: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

- TABLE 228 LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 229 LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 230 LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2031-2035 (USD MILLION)

- TABLE 231 LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 232 LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 233 LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 234 LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 235 LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 236 LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 237 LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 238 LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 239 LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

- TABLE 240 LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 241 LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 242 LATIN AMERICA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031-2035 (USD MILLION)

- TABLE 243 BRAZIL: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 244 BRAZIL: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 245 BRAZIL: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 246 BRAZIL: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 247 BRAZIL: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 248 BRAZIL: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 249 BRAZIL: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 250 BRAZIL: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 251 BRAZIL: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

- TABLE 252 MEXICO: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 253 MEXICO: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 254 MEXICO: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 255 MEXICO: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 256 MEXICO: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 257 MEXICO: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 258 MEXICO: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 259 MEXICO: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 260 MEXICO: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

- TABLE 261 ARGENTINA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 262 ARGENTINA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 263 ARGENTINA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 264 ARGENTINA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 265 ARGENTINA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 266 ARGENTINA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 267 ARGENTINA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 268 ARGENTINA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 269 ARGENTINA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

- TABLE 270 MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 271 MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 272 MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY COUNTRY, 2031-2035 (USD MILLION)

- TABLE 273 MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 274 MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 275 MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 276 MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 277 MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 278 MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 279 MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 280 MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 281 MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

- TABLE 282 MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 283 MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 284 MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY APPLICATION, 2031-2035 (USD MILLION)

- TABLE 285 UAE: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 286 UAE: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 287 UAE: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 288 UAE: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 289 UAE: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 290 UAE: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 291 UAE: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 292 UAE: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 293 UAE: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

- TABLE 294 SAUDI ARABIA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 295 SAUDI ARABIA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 296 SAUDI ARABIA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 297 SAUDI ARABIA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 298 SAUDI ARABIA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 299 SAUDI ARABIA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 300 SAUDI ARABIA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 301 SAUDI ARABIA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 302 SAUDI ARABIA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

- TABLE 303 SOUTH AFRICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 304 SOUTH AFRICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 305 SOUTH AFRICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 306 SOUTH AFRICA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 307 SOUTH AFRICA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 308 SOUTH AFRICA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 309 SOUTH AFRICA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 310 SOUTH AFRICA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 311 SOUTH AFRICA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

- TABLE 312 REST OF MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 313 REST OF MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 314 REST OF MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2031-2035 (USD MILLION)

- TABLE 315 REST OF MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 316 REST OF MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- TABLE 317 REST OF MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2031-2035 (USD MILLION)

- TABLE 318 REST OF MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020-2023 (USD MILLION)

- TABLE 319 REST OF MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2030 (USD MILLION)

- TABLE 320 REST OF MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2031-2035 (USD MILLION)

- TABLE 321 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 322 EVTOL AIRCRAFT MARKET: DEGREE OF COMPETITION

- TABLE 323 EVTOL AIRCRAFT MARKET: DEGREE OF COMPETITION (KEY PLAYERS)

- TABLE 324 REGION FOOTPRINT

- TABLE 325 LIFT TECHNOLOGY FOOTPRINT

- TABLE 326 APPLICATION FOOTPRINT

- TABLE 327 LIST OF STARTUPS/SMES

- TABLE 328 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 329 EVTOL AIRCRAFT MARKET: PRODUCT LAUNCHES, JANUARY 2020-JANUARY 2025

- TABLE 330 EVTOL AIRCRAFT MARKET: DEALS, JANUARY 2020-JANUARY 2025

- TABLE 331 EVTOL AIRCRAFT MARKET: OTHER DEVELOPMENTS, JANUARY 2020-JANUARY 2025

- TABLE 332 ARCHER AVIATION INC.: COMPANY OVERVIEW

- TABLE 333 ARCHER AVIATION INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 334 ARCHER AVIATION INC.: DEALS

- TABLE 335 ARCHER AVIATION INC.: OTHER DEVELOPMENTS

- TABLE 336 VERTICAL AEROSPACE: COMPANY OVERVIEW

- TABLE 337 VERTICAL AEROSPACE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 338 VERTICAL AEROSPACE: DEALS

- TABLE 339 VERTICAL AEROSPACE: OTHER DEVELOPMENTS

- TABLE 340 EVE HOLDINGS, INC: COMPANY OVERVIEW

- TABLE 341 EVE HOLDINGS, INC: PRODUCTS/SOLUTIONS OFFERED

- TABLE 342 EVE HOLDINGS, INC: DEALS

- TABLE 343 EHANG: COMPANY OVERVIEW

- TABLE 344 EHANG: PRODUCTS/SOLUTIONS OFFERED

- TABLE 345 EHANG: DEALS

- TABLE 346 EHANG: OTHER DEVELOPMENTS

- TABLE 347 JOBY AVIATION: COMPANY OVERVIEW

- TABLE 348 JOBY AVIATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 349 JOBY AVIATION: DEALS

- TABLE 350 JOBY AVIATION: OTHER DEVELOPMENTS

- TABLE 351 AIRBUS: COMPANY OVERVIEW

- TABLE 352 AIRBUS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 353 AIRBUS: PRODUCT LAUNCHES

- TABLE 354 AIRBUS: DEALS

- TABLE 355 TEXTRON INC.: COMPANY OVERVIEW

- TABLE 356 TEXTRON INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 357 TEXTRON INC.: DEALS

- TABLE 358 TEXTRON INC.: OTHER DEVELOPMENTS

- TABLE 359 WISK AERO LLC: COMPANY OVERVIEW

- TABLE 360 WISK AERO LLC: PRODUCTS/SERVICES OFFERED

- TABLE 361 WISK AERO LLC: PRODUCT LAUNCHES

- TABLE 362 WISK AERO LLC: OTHER DEVELOPMENTS

- TABLE 363 JAUNT AIR MOBILITY LLC: COMPANY OVERVIEW

- TABLE 364 JAUNT AIR MOBILITY LLC: PRODUCTS/SOLUTIONS OFFERED

- TABLE 365 JAUNT AIR MOBILITY LLC: DEALS

- TABLE 366 BETA TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 367 BETA TECHNOLOGIES: PRODUCTS/SOLUTIONS OFFERED

- TABLE 368 BETA TECHNOLOGIES: DEALS

- TABLE 369 BETA TECHNOLOGIES: OTHER DEVELOPMENTS

- TABLE 370 VOLOCOPTER GMBH: COMPANY OVERVIEW

- TABLE 371 VOLOCOPTER GMBH: PRODUCTS/SOLUTIONS OFFERED

- TABLE 372 VOLOCOPTER GMBH: DEALS

- TABLE 373 VOLOCOPTER GMBH: OTHER DEVELOPMENTS

- TABLE 374 XTI AEROSPACE: COMPANY OVERVIEW

- TABLE 375 XTI AEROSPACE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 376 XTI AEROSPACE: DEALS

- TABLE 377 LILIUM GMBH: COMPANY OVERVIEW

- TABLE 378 LILIUM GMBH: PRODUCTS/SOLUTIONS OFFERED

- TABLE 379 LILIUM GMBH: DEALS

- TABLE 380 LILIUM GMBH: OTHER DEVELOPMENTS

- TABLE 381 LIFT AIRCRAFT INC.: COMPANY OVERVIEW

- TABLE 382 LIFT AIRCRAFT INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 383 LIFT AIRCRAFT INC.: PRODUCT LAUNCHES

- TABLE 384 LIFT AIRCRAFT INC.: DEALS

- TABLE 385 LIFT AIRCRAFT INC.: OTHER DEVELOPMENTS

- TABLE 386 AUTOFLIGHT: COMPANY OVERVIEW

- TABLE 387 AUTOFLIGHT: PRODUCTS/SOLUTIONS OFFERED

- TABLE 388 AUTOFLIGHT: PRODUCT LAUNCHES

- TABLE 389 AUTOFLIGHT: DEALS

- TABLE 390 AUTOFLIGHT: OTHER DEVELOPMENTS

- TABLE 391 VOLANT AEROTECH: COMPANY OVERVIEW

- TABLE 392 VOLANT AEROTECH: PRODUCTS/SOLUTIONS OFFERED

- TABLE 393 VOLANT AEROTECH: DEALS

- TABLE 394 VOLANT AEROTECH: OTHER DEVELOPMENTS

- TABLE 395 ARC AERO SYSTEMS: COMPANY OVERVIEW

- TABLE 396 SKYDRIVE INC.: COMPANY OVERVIEW

- TABLE 397 ELECTRA.AERO: COMPANY OVERVIEW

- TABLE 398 OVERAIR, INC.: COMPANY OVERVIEW

- TABLE 399 MANTA AIRCRAFT: COMPANY OVERVIEW

- TABLE 400 AIR VEV LTD: COMPANY OVERVIEW

- TABLE 401 URBAN AERONAUTICS: COMPANY OVERVIEW

- TABLE 402 SKYRYSE, INC.: COMPANY OVERVIEW

- TABLE 403 ASCENDANCE FLIGHT TECHNOLOGIES S.A.S: COMPANY OVERVIEW

List of Figures

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARIES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (DEMAND SIDE)

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 VECTORED THRUST TO BE LEADING LIFT TECHNOLOGY SEGMENT DURING FORECAST PERIOD

- FIGURE 8 FULLY ELECTRIC TO BE LEADING PROPULSION TYPE SEGMENT DURING FORECAST PERIOD

- FIGURE 9 PILOTED TO BE LEADING MODE OF OPERATION SEGMENT DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA TO BE LEADING MARKET FOR EVTOL AIRCRAFT DURING FORECAST PERIOD

- FIGURE 11 ADVANCES IN HYDROGEN-ELECTRIC PROPULSION TECHNOLOGY TO DRIVE MARKET

- FIGURE 12 <= 200 KM SEGMENT TO ACQUIRE LARGER SHARE THAN > 200 KM SEGMENT DURING FORECAST PERIOD

- FIGURE 13 PILOTED SEGMENT TO ACQUIRE LARGER SHARE THAN AUTONOMOUS SEGMENT DURING FORECAST PERIOD

- FIGURE 14 100-1,000 KG SEGMENT TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 15 VECTORED THRUST TO SURPASS OTHER SEGMENTS IN TERMS OF MARKET SIZE DURING FORECAST PERIOD

- FIGURE 16 IRELAND TO BE FASTEST-GROWING MARKET FOR EVTOL AIRCRAFT DURING FORECAST PERIOD

- FIGURE 17 EVTOL AIRCRAFT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 EVTOL AIRCRAFT MARKET: VALUE CHAIN ANALYSIS

- FIGURE 19 EVTOL AIRCRAFT MARKET ECOSYSTEM

- FIGURE 20 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 21 CERTIFICATION PROCESS FOR EVTOL AIRCRAFT

- FIGURE 22 NOISE LEVELS IN KEY EVTOL AIRCRAFT MODELS (DB)

- FIGURE 23 READINESS LEVELS IN KEY EVTOL AIRCRAFT MODELS

- FIGURE 24 SUPPLIER LANDSCAPE FOR KEY EVTOL SYSTEMS

- FIGURE 25 INVESTMENT AND FUNDING SCENARIO, 2020-2024 (USD MILLION)

- FIGURE 26 IMPORT DATA FOR HS CODE 880610-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 27 EXPORT DATA FOR HS CODE 880610-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY MODE OF OPERATION

- FIGURE 29 KEY BUYING CRITERIA FOR EVTOL AIRCRAFT, BY MODE OF OPERATION

- FIGURE 30 EVTOL MARKET: BUSINESS MODELS

- FIGURE 31 TOTAL COST OF OWNERSHIP (TCO) ANALYSIS FOR EVTOL AIRCRAFT

- FIGURE 32 INDICATIVE PRICING ANALYSIS OF EVTOL AIRCRAFT, BY AIRCRAFT MODEL, 2024 (USD MILLION)

- FIGURE 33 COMPARATIVE STUDY OF PRICE AND RANGE OF EVTOL AIRCRAFT MODELS

- FIGURE 34 COMPARATIVE STUDY OF PRICE AND MTOW OF EVTOL AIRCRAFT MODELS

- FIGURE 35 COMPARATIVE STUDY OF PRICE AND PASSENGER CAPACITY OF EVTOL AIRCRAFT MANUFACTURERS

- FIGURE 36 BILL OF MATERIALS (BOM) ANALYSIS FOR EVTOL AIRCRAFT

- FIGURE 37 MACROECONOMIC OUTLOOK FOR NORTH AMERICA, EUROPE, ASIA PACIFIC, AND MIDDLE EAST

- FIGURE 38 MACROECONOMIC OUTLOOK FOR LATIN AMERICA AND AFRICA

- FIGURE 39 TECHNOLOGICAL EVOLUTION OF EVTOL AIRCRAFT

- FIGURE 40 TECHNOLOGY ROADMAP OF EVTOL AIRCRAFT

- FIGURE 41 SUPPLY CHAIN ANALYSIS

- FIGURE 42 PATENT REGISTERED, 2018-2024

- FIGURE 43 GENERATIVE AI LANDSCAPE

- FIGURE 44 ADOPTION OF GENERATIVE AI IN COMMERCIAL AVIATION, BY KEY COUNTRY

- FIGURE 45 EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY, 2024-2035 (USD MILLION)

- FIGURE 46 EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE, 2024-2035 (USD MILLION)

- FIGURE 47 EVTOL AIRCRAFT MARKET, BY SYSTEM, 2024-2035 (USD MILLION)

- FIGURE 48 EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION, 2024-2035 (USD MILLION)

- FIGURE 49 EVTOL AIRCRAFT MARKET, BY APPLICATION, 2024-2035 (USD MILLION)

- FIGURE 50 EVTOL AIRCRAFT MARKET, BY MTOW, 2024-2035 (USD MILLION)

- FIGURE 51 EVTOL AIRCRAFT MARKET, BY RANGE, 2024-2035 (USD MILLION)

- FIGURE 52 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 53 NORTH AMERICA: EVTOL AIRCRAFT MARKET SNAPSHOT

- FIGURE 54 EUROPE: EVTOL AIRCRAFT MARKET SNAPSHOT

- FIGURE 55 ASIA PACIFIC: EVTOL AIRCRAFT MARKET SNAPSHOT

- FIGURE 56 LATIN AMERICA: EVTOL AIRCRAFT MARKET SNAPSHOT

- FIGURE 57 MIDDLE EAST & AFRICA: EVTOL AIRCRAFT MARKET SNAPSHOT

- FIGURE 58 REVENUE ANALYSIS, 2020-2023 (USD MILLION)

- FIGURE 59 MARKET SHARE ANALYSIS, 2023

- FIGURE 60 TOTAL VALUE OF DEALS UNDERTAKEN BY TOP FIVE PLAYERS, 2021-2024 (USD MILLION)

- FIGURE 61 ORDER BOOK SHARE ANALYSIS, 2024

- FIGURE 62 EVTOL AIRCRAFT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 63 COMPANY FOOTPRINT

- FIGURE 64 EVTOL AIRCRAFT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 65 VALUATION OF PROMINENT MARKET PLAYERS

- FIGURE 66 FINANCIAL METRICS OF PROMINENT MARKET PLAYERS

- FIGURE 67 BRAND/PRODUCT COMPARISON

- FIGURE 68 AIRBUS: COMPANY SNAPSHOT

- FIGURE 69 TEXTRON INC.: COMPANY SNAPSHOT

- FIGURE 70 WISK AERO: COMPANY SNAPSHOT

- FIGURE 71 XTI AEROSPACE: COMPANY SNAPSHOT

The eVTOL Aircraft market is valued at USD 0.76 billion in 2024 and is projected to reach USD 4.67 billion by 2030, at a CAGR of 35.3 % from 2024 to 2030 and is projected to grow from USD 6.53 billion in 2031 to 17.34 billion by 2035 at a CAGR of 27.6 % from 2031 to 2035. The eVTOL aircraft is changing the face of transportation with a promise of a faster, cleaner, and more efficient method of mobility. The innovative aircraft combine electric propulsion with advanced aerodynamics to ensure vertical take-off and landing abilities. They address a whole range of applications from UAM (urban air mobility), cargo logistics, to emergency services. With increasing congestion and pollution, the world needs an alternative source of transportation through sustainable eVTOLs. Electrically powered and/or hybrid electric propulsion, fully or partially electric eVTOL systems will give rise to emission-free flights with low decibel sound output, providing urban and sub-urban opportunities to use such craft. Such flexibility will help the aircraft in ferrying passengers, transporting cargo, or rescue and life-saving missions during disasters or evacuation from hospitals or hospitals' casualties.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2035 |

| Base Year | 2023 |

| Forecast Period | 2025-2035 |

| Units Considered | Value (USD Billion) |

| Segments | By Lift technology, Application, Propulsion type, Range, Mode of Operation, MTOW, System and region |

| Regions covered | North America, Europe, APAC, RoW |

Based on System, the avionics segment is projected to grow at the highest rate during the forecast period.

The avionics segment is expected to dominate the overall market for eVTOL aircraft in light of its criticality to safe, efficient, and autonomous flight, critical elements of eVTOL success in urban and regional air mobility. Avionics systems include navigation, communication, flight control, and collision-avoidance technologies, all of which play a significant role in the successful performance of eVTOLs in complex urban environments

Because eVTOL aircraft depend on electric propulsion and are designed to operate in low-altitude high-traffic airspaces, advanced avionics technology ensures accurate and stable flight control as well as time-critical decisions. Autonomous flight systems and detect-and-avoid technologies, for example, are central components for scaling UAM, by which eVTOLs can safely navigate the crowded skies and interact with the existing air traffic management systems. Avionics, along with Urban Traffic Management (UTM) frameworks, further expand its usability in terms of operational efficiency.

Based on Mode of Operation, Piloted segment is expected to grow at the fastest rate during the forecast period

The avionics segment is expected to dominate the overall market for eVTOL aircraft in light of its criticality to safe, efficient, and autonomous flight, critical elements of eVTOL success in urban and regional air mobility. Avionics systems include navigation, communication, flight control, and collision-avoidance technologies, all of which play a significant role in the successful performance of eVTOLs in complex urban environments.

Because eVTOL aircraft depend on electric propulsion and are designed to operate in low-altitude high-traffic airspaces, advanced avionics technology ensures accurate and stable flight control as well as time-critical decisions. Autonomous flight systems and detect-and-avoid technologies, for example, are central components for scaling UAM, by which eVTOLs can safely navigate the crowded skies and interact with the existing air traffic management systems. Avionics, along with Urban Traffic Management (UTM) frameworks, further expand its usability in terms of operational efficiency.

The Asia Pacific market is projected to contribute the 2nd most significant share from 2024 to 2035 in the eVTOL Aircraft market.

The Asia-Pacific is expected to account for the second largest market share within eVTOL aircraft. Due to high and continued dense urbanization and strong investment in mega-city transport solution plans, a country such as Tokyo, Shanghai, Seoul, Mumbai, or Singapore with major congestions experiences on land cannot achieve sustainable levels for urban population expansion, yet at the same time faces great potential to meet megacity and dense suburban area population and commercial/office and related building density expectations using eVTOL.

Large population base in the region, combined with rising disposable income and expanding middle class, fuels the need for innovative mobility options. The rapid growth of e-commerce across Asia-Pacific has spurred demand for cargo eVTOLs for last-mile and regional delivery services, especially in countries like China and India.

The governments within the region continue to actively participate in eVTOL development through funding smart cities, sustainable mobility projects, and regulatory frameworks within which to host eVTOLs within an urban air operating environment. A case in point is China in terms of autonomous deployment through EHang, Japan setting up for a full-scale demonstration of air taxis at the Osaka Expo 2025, and in South Korea the K-UAM initiative targets an infrastructure and operating capability for UAM by 2030.

The break-up of the profile of primary participants in the eVTOL Aircraft market:

- By Company Type: Tier 1 - 49%, Tier 2 - 37%, and Tier 3 - 14%

- By Designation: C Level - 55%, Managers - 27%, and Others - 18%

- By Region: North America - 32%, Europe - 32%, Asia Pacific - 16%, Middle East & Africa - 10%, Latin America - 10%

Major companies profiled in the report include Archer Aviation (US), Eve Holdings (Brazil), ehang (China), Joby Aviation (US), Textron Inc (US), Airbus (Netherlands), Vertical Aerospace (UK), Wisk Aero LLC (US), Beta Technologies(US), Volocopter Gmbh (Germany), XTI Aerospace ( US), Lilium Gmbh (Germany), Lift Aircraft Inc.(US), Autoflight (China), Volant Aerotech (China), among others.

Research Coverage:

This market study covers the eVTOL Aircraft market across various segments and subsegments. It aims to estimate this market's size and growth potential across different parts based on Application (Air Taxi, Air Shuttles and Air Metros, Private Transport, Cargo Trasport, Air Ambulance and Medical Emergency, Last-Mile Delivery, Special Mission, Other Application), Lift technology (Vectored Thrust, Multirotor, Lift plus Cruise), MTOW (100-1000 Kg, 1001 - 2000 Kg, >2000 Kg), Range, ( <=200 Km, >200 Km), Mode of Operation ( Piloted, Autonomous), Propulsion Type (Fully Electric, Hybrid Electric, Hydrogen-Electric), By System ( Batteries And Cells, Electric Motors/Engines, Aerostructures and Cabin Interiors, Avionic, Software, Other Solutions) and Region (North America, Europe, Asia Pacific, Middle East & Africa, Latin America).

This study also includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to their product and business offerings, recent developments, and key market strategies they adopted.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall eVTOL Aircraft market. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market Drivers (Growing need for green energy and noise free aircraft, Increasing demands for alternative mode of transport, Demand for faster commuting in metropolitan cities, Improving technologies in batteries, motors and power electronics) , Restraints ( Regulatory Hurdles, High Development and Infrastructure Costs, Urban Airspace Congestion) Opportunities (Autonomous Operation, Regional Air Mobility Expansion) and Challenges (Lack of Regulatory Standards, Short Range due to battery limitations). The growth of the market can be attributed to the push for zero-emission transportation with governments and organizations aim to reduce carbon footprints.

The report provides insights on the following pointers:

Advancements in battery technology, including higher energy densities and faster charging systems, are drive the market.

- Market Penetration: Comprehensive information on eVTOL Aircraft offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the eVTOL Aircraft market

- Market Development: Comprehensive information about lucrative markets - the report analyses the eVTOL Aircraft market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the eVTOL Aircraft market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and manufacturing capabilities of leading players in the eVTOL Aircraft market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 RESEARCH LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 RESEARCH APPROACH AND METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation: Bottom-up approach

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION AND VALIDATION

- 2.4.1 STEPS INVOLVED IN DATA TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

- 2.5 GROWTH FORECAST

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH ASSUMPTIONS & CONSIDERATIONS

- 2.8 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EVTOL AIRCRAFT MARKET

- 4.2 EVTOL AIRCRAFT MARKET, BY RANGE

- 4.3 EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION

- 4.4 EVTOL AIRCRAFT MARKET, BY MTOW

- 4.5 EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY

- 4.6 EVTOL AIRCRAFT MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Need for green energy and noise-free aircraft

- 5.2.1.2 Increasing need for alternative modes of transport

- 5.2.1.3 Demand for fast commuting in metropolitan cities

- 5.2.1.4 Technological advancements in batteries, motors, and power electronics

- 5.2.2 RESTRAINTS

- 5.2.2.1 Regulatory hurdles

- 5.2.2.2 High development and infrastructure costs

- 5.2.2.3 Urban airspace congestion

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Autonomous operations

- 5.2.3.2 Regional air mobility expansion

- 5.2.4 CHALLENGES

- 5.2.4.1 Cybersecurity concerns

- 5.2.4.2 Short range due to battery limitations

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.3.1 RAW MATERIALS

- 5.3.2 R&D

- 5.3.3 COMPONENT MANUFACTURING

- 5.3.4 OEMS

- 5.3.5 END USERS

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 OEMS

- 5.4.2 INFRASTRUCTURE PROVIDERS

- 5.4.3 SUPPLIERS OF PARTS

- 5.4.4 END USERS

- 5.5 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 OPERATIONAL DATA

- 5.6.1 CERTIFICATION PROCESS FOR EVTOL AIRCRAFT

- 5.6.2 NOISE LEVELS IN KEY EVTOL AIRCRAFT MODELS

- 5.6.3 READINESS LEVELS IN EVTOL AIRCRAFT MODELS

- 5.6.4 SUPPLIER LANDSCAPE FOR KEY EVTOL SYSTEMS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Lithium-sulfur batteries

- 5.8.1.2 Hydrogen fuel cells

- 5.8.2 ADJACENT TECHNOLOGIES

- 5.8.2.1 Charging and refueling infrastructure

- 5.8.2.2 Simulation and training

- 5.8.1 KEY TECHNOLOGIES

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 ARCHER AVIATION EXPANDS ITS CAPABILITIES BEYOND URBAN AIR MOBILITY INTO MILITARY AND DEFENSE APPLICATIONS

- 5.9.2 EHANG COLLABORATES WITH AIRPORT AUTHORITIES AND CITY PLANNERS TO DEPLOY VERTIPORTS AND AUTOMATED CHARGING HUBS

- 5.9.3 VOLOCOPTER CONDUCTS SEVERAL TEST FLIGHTS AND DEMONSTRATIONS GLOBALLY

- 5.9.4 AIRBUS'S VAHANA PROJECT FOCUSES ON SINGLE-PASSENGER, SELF-PILOTED EVTOL AIRCRAFT

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO

- 5.10.2 EXPORT SCENARIO

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 KEY CONFERENCES & EVENTS

- 5.14 EVTOL MARKET: BUSINESS MODELS

- 5.15 TOTAL COST OF OWNERSHIP (TCO) ANALYSIS

- 5.16 PRICING ANALYSIS

- 5.16.1 INDICATIVE PRICING ANALYSIS OF EVTOL AIRCRAFT

- 5.16.2 INDICATIVE PRICING ANALYSIS, BY REGION

- 5.16.3 COMPARATIVE STUDY OF EVTOL AIRCRAFT MODELS

- 5.17 BILL OF MATERIALS (BOM) ANALYSIS

- 5.18 MACROECONOMIC OUTLOOK

- 5.18.1 INTRODUCTION

- 5.18.2 NORTH AMERICA

- 5.18.3 EUROPE

- 5.18.4 ASIA PACIFIC

- 5.18.5 MIDDLE EAST

- 5.18.6 LATIN AMERICA

- 5.18.7 AFRICA

- 5.19 TECHNOLOGY ROADMAP

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 EMERGING TRENDS

- 6.2.1 ARTIFICIAL INTELLIGENCE (AI)

- 6.2.2 BIG DATA ANALYTICS

- 6.2.3 INTERNET OF THINGS (IOT)

- 6.2.4 CYCLOROTOR EVTOL

- 6.2.5 URBAN AIR MOBILITY

- 6.2.6 ENERGY HARVESTING

- 6.2.7 NOISE REDUCTION TECHNOLOGIES

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.4 IMPACT OF MEGATRENDS

- 6.5 PATENT ANALYSIS

- 6.6 IMPACT OF GENERATIVE AI

- 6.6.1 INTRODUCTION

- 6.6.2 ADOPTION OF GENERATIVE AI IN COMMERCIAL AVIATION

7 EVTOL AIRCRAFT HYBRID LIFT TECHNOLOGIES

- 7.1 INTRODUCTION

- 7.2 VECTORED THRUST WITH INTEGRATED WING LIFT

- 7.3 LIFT PLUS CRUISE WITH PARTIAL PROPELLOR VECTORING

- 7.4 CYCLOIDAL ROTOR AND WINGS HYBRID

- 7.5 BLADELESS PROPULSION FOR HYBRID LIFT

8 EVTOL AIRCRAFT INFRASTRUCTURE MARKET

- 8.1 INTRODUCTION

- 8.2 VERTIPORTS

- 8.2.1 RAPID ADOPTION OF ADVANCED AIR MOBILITY TO DRIVE MARKET

- 8.3 CHARGING STATIONS

- 8.3.1 NEED FOR RAPID TURNAROUND TIME IN URBAN AIR MOBILITY OPERATIONS TO BOOST MARKET

- 8.4 AIR TRAFFIC MANAGEMENT FACILITIES

- 8.4.1 INCREASE IN EVTOL AIRCRAFT OPERATIONS TO NECESSITATE NEED FOR ADVANCED AIR TRAFFIC MANAGEMENT FACILITIES

- 8.5 MAINTENANCE FACILITIES

- 8.5.1 RAPID SCALING OF EVTOL AIRCRAFT OPERATIONS TO BOOST DEMAND FOR SPECIALIZED MAINTENANCE SERVICES

9 EVTOL AIRCRAFT MARKET, BY LIFT TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 VECTORED THRUST

- 9.2.1 DEMAND FOR EVTOL AIRCRAFT WITH ENHANCED TAKE-OFF EFFICIENCY AND SUPERIOR SPEED TO DRIVE MARKET

- 9.3 MULTIROTOR

- 9.3.1 NEED FOR AIRCRAFT WITH EXCEPTIONAL NAVIGATING CAPABILITIES TO DRIVE GROWTH

- 9.4 LIFT PLUS CRUISE

- 9.4.1 NEED TO MINIMIZE MECHANICAL STRESS AND ENHANCE SAFETY OF AIRCRAFT TO DRIVE MARKET

10 EVTOL AIRCRAFT MARKET, BY PROPULSION TYPE

- 10.1 INTRODUCTION

- 10.2 FULLY ELECTRIC

- 10.2.1 ADVANCEMENTS IN ENERGY STORAGE TO BOOST USE OF FULLY ELECTRIC PROPULSION SYSTEMS

- 10.3 HYBRID-ELECTRIC

- 10.3.1 NEED FOR EXTENDED RANGE AND OPERATIONAL VERSATILITY TO BOOST GROWTH

- 10.4 HYDROGEN-ELECTRIC

- 10.4.1 DEMAND FOR EXTENDED FLIGHT RANGE TO DRIVE NEED FOR HYDROGEN-ELECTRIC PROPULSION SYSTEMS

11 EVTOL AIRCRAFT MARKET, BY SYSTEM

- 11.1 INTRODUCTION

- 11.2 BATTERIES & CELLS

- 11.2.1 ADVANCEMENTS IN BATTERY CHEMISTRY TO BOOST PERFORMANCE OF EVTOL AIRCRAFT

- 11.3 ELECTRIC MOTOR/ENGINES

- 11.3.1 ADVANCEMENTS IN MOTOR EFFICIENCY, POWER DENSITY, AND THERMAL MANAGEMENT TO DRIVE MARKET

- 11.4 AEROSTRUCTURE & CABIN INTERIORS

- 11.4.1 DEMAND FOR SUSTAINABLE AND EFFICIENT MATERIALS FOR AEROSTRUCTURE AND CABIN INTERIORS TO BOOST DEMAND

- 11.5 AVIONICS

- 11.5.1 NEED FOR CUTTING-EDGE FLIGHT CONTROL TECHNOLOGIES TO BOOST GROWTH

- 11.6 SOFTWARE

- 11.6.1 RISING DEMAND FOR SEAMLESS URBAN AIR MOBILITY SOLUTIONS TO DRIVE MARKET

- 11.7 OTHER SYSTEMS

12 EVTOL AIRCRAFT MARKET, BY MODE OF OPERATION

- 12.1 INTRODUCTION

- 12.2 PILOTED

- 12.2.1 REGULATORY PREFERENCES FOR TRADITIONALLY OPERATED SYSTEMS TO BOOST GROWTH

- 12.3 AUTONOMOUS

- 12.3.1 ADVANCEMENTS IN AI, IOT, AND AR TO DRIVE DEMAND FOR AUTONOMOUS EVTOL AIRCRAFT

13 EVTOL AIRCRAFT MARKET, BY APPLICATION

- 13.1 INTRODUCTION

- 13.2 AIR TAXIS

- 13.2.1 ADVANCEMENTS IN BATTERY AND PROPULSION TECHNOLOGIES TO DRIVE MARKET

- 13.2.2 USE CASE: ADOPTION OF JOBY AVIATION'S EVTOL AIRCRAFT FOR AIR TAXI SERVICES

- 13.3 AIR SHUTTLES & AIR METROS

- 13.3.1 INCREASING URBANIZATION AND WORSENING TRAFFIC CONGESTION TO DRIVE MARKET

- 13.3.2 USE CASE: ADOPTION OF LILIUM JETS FOR AIR SHUTTLES AND AIR METROS

- 13.4 PRIVATE TRANSPORT

- 13.4.1 NEED FOR FLEXIBLE AND PREMIUM AIR MOBILITY SOLUTIONS TO DRIVE GROWTH

- 13.4.2 USE CASE: ADOPTION OF EHANG 216 AIRCRAFT FOR PRIVATE TRANSPORT

- 13.5 CARGO TRANSPORT

- 13.5.1 RAPID EXPANSION OF E-COMMERCE TO DRIVE USE OF EVTOL AIRCRAFT

- 13.5.2 USE CASE: ROLE OF ELROY AIR'S CHAPARRAL IN ACHIEVING EFFICIENT AND SUSTAINABLE LOGISTICS

- 13.6 AIR AMBULANCE & MEDICAL EMERGENCY

- 13.6.1 NEED FOR IMMEDIATE ACCESS TO REMOTE LOCATIONS TO BOOST DEMAND

- 13.6.2 USE CASE: ADOPTION OF BETA TECHNOLOGIES' ALIA-250 IN EMERGENCY MEDICAL SERVICES

- 13.7 LAST MILE DELIVERY

- 13.7.1 DEMAND FOR RAPID AND EFFICIENT DELIVERY SERVICES TO SPUR GROWTH

- 13.7.2 USE CASE: ADOPTION OF EHANG'S FALCON IN LAST MILE DELIVERY OPERATIONS

- 13.8 SPECIAL MISSION

- 13.8.1 NEED FOR ASSISTANCE IN SPECIAL MISSIONS TO DRIVE DEMAND FOR SPECIALIZED EVTOL AIRCRAFT

- 13.8.2 USE CASE: DEPLOYMENT OF SABREWING'S RHAEGAL IN SPECIAL MISSION OPERATIONS

- 13.9 OTHER APPLICATIONS

14 EVTOL AIRCRAFT MARKET, BY MTOW

- 14.1 INTRODUCTION

- 14.2 100-1,000 KG

- 14.2.1 EVTOL AIRCRAFT WITH MTOW OF 100-1,000 KG ARE WELL-SUITED FOR URBAN AIR MOBILITY APPLICATIONS

- 14.3 1,001-2,000 KG

- 14.3.1 INCREASED URBAN AIR MOBILITY TO DEMAND AIRCRAFT WITH MAXIMUM MTOW

- 14.4 > 2,000 KG

- 14.4.1 DEMAND FOR EVTOL AIRCRAFT WITH INCREASED PASSENGER CAPACITY TO BOOST DEMAND

15 EVTOL AIRCRAFT MARKET, BY RANGE

- 15.1 INTRODUCTION

- 15.2 <= 200 KM

- 15.2.1 INCREASED REGIONAL COMMUTES AND INTERCITY TRAVEL TO BOOST GROWTH

- 15.3 > 200 KM

- 15.3.1 INCREASE IN REGIONAL TRANSPORTATION NEEDS TO BOOST MARKET

16 EVTOL AIRCRAFT, BY REGION

- 16.1 INTRODUCTION

- 16.2 NORTH AMERICA

- 16.2.1 PESTLE ANALYSIS

- 16.2.2 US

- 16.2.2.1 Significant private and public investments to drive market

- 16.2.3 CANADA

- 16.2.3.1 Need for enhanced connectivity to drive adoption of eVTOL aircraft

- 16.3 EUROPE

- 16.3.1 PESTLE ANALYSIS

- 16.3.2 UK

- 16.3.2.1 Strategic initiatives by government to drive market

- 16.3.3 GERMANY

- 16.3.3.1 Commitment to environmental sustainability to drive market

- 16.3.4 FRANCE

- 16.3.4.1 Partnerships between domestic aerospace companies and international eVTOL developers to drive market

- 16.3.5 IRELAND

- 16.3.5.1 Increasing investments in aviation infrastructure to drive market

- 16.3.6 SPAIN

- 16.3.6.1 Well-developed tourism industry to drive market

- 16.3.7 REST OF EUROPE

- 16.4 ASIA PACIFIC

- 16.4.1 PESTLE ANALYSIS

- 16.4.2 CHINA

- 16.4.2.1 Government subsidies for electric aviation development to drive market

- 16.4.3 INDIA

- 16.4.3.1 Rapidly increasing traffic congestion to drive market

- 16.4.4 JAPAN

- 16.4.4.1 Government-backed initiatives for eVTOL adoption to drive market

- 16.4.5 SOUTH KOREA

- 16.4.5.1 Push for smart city development to drive market

- 16.4.6 AUSTRALIA

- 16.4.6.1 High demand for sustainable transportation to drive market

- 16.4.7 REST OF ASIA PACIFIC

- 16.5 LATIN AMERICA

- 16.5.1 PESTLE ANALYSIS

- 16.5.2 BRAZIL

- 16.5.2.1 Growing commitment to sustainable transportation to drive market

- 16.5.3 MEXICO

- 16.5.3.1 Severe traffic congestion to drive demand

- 16.5.4 ARGENTINA

- 16.5.4.1 Vast geographical expanse and commitment to sustainability to drive market

- 16.6 MIDDLE EAST & AFRICA

- 16.6.1 PESTLE ANALYSIS

- 16.6.2 GCC

- 16.6.2.1 UAE

- 16.6.2.1.1 Economic Vision 2030 and Smart City programs to drive growth

- 16.6.2.2 Saudi Arabia

- 16.6.2.2.1 Strategic focus on integrating advanced mobility solutions to drive market

- 16.6.2.1 UAE

- 16.6.3 SOUTH AFRICA

- 16.6.3.1 Development of electric mobility technologies to drive market

- 16.6.4 REST OF MIDDLE EAST & AFRICA

17 COMPETITIVE LANDSCAPE

- 17.1 INTRODUCTION

- 17.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 17.3 REVENUE ANALYSIS

- 17.4 MARKET SHARE ANALYSIS

- 17.5 MARKET RANKING OF TOP FIVE PLAYERS BASED ON DEALS, 2021-2024

- 17.6 ORDER BOOK SHARE ANALYSIS, 2024

- 17.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 17.7.1 STARS

- 17.7.2 EMERGING LEADERS

- 17.7.3 PERVASIVE PLAYERS

- 17.7.4 PARTICIPANTS

- 17.7.5 COMPANY FOOTPRINT

- 17.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 17.8.1 PROGRESSIVE COMPANIES

- 17.8.2 RESPONSIVE COMPANIES

- 17.8.3 DYNAMIC COMPANIES

- 17.8.4 STARTING BLOCKS

- 17.8.5 COMPETITIVE BENCHMARKING

- 17.9 COMPANY VALUATION AND FINANCIAL METRICS

- 17.10 BRAND/PRODUCT COMPARISON

- 17.11 COMPETITIVE SCENARIO

- 17.11.1 PRODUCT LAUNCHES

- 17.11.2 DEALS

- 17.11.3 OTHER DEVELOPMENTS

18 COMPANY PROFILES

- 18.1 KEY PLAYERS

- 18.1.1 ARCHER AVIATION INC.

- 18.1.1.1 Business overview

- 18.1.1.2 Products/Solutions offered

- 18.1.1.3 Recent developments

- 18.1.1.4 MnM view

- 18.1.1.4.1 Key strengths

- 18.1.1.4.2 Strategic choices

- 18.1.1.4.3 Weaknesses and competitive threats

- 18.1.2 VERTICAL AEROSPACE

- 18.1.2.1 Business overview

- 18.1.2.2 Products/Solutions offered

- 18.1.2.3 Recent developments

- 18.1.2.4 MnM view

- 18.1.2.4.1 Key strengths

- 18.1.2.4.2 Strategic choices

- 18.1.2.4.3 Weaknesses and competitive threats

- 18.1.3 EVE HOLDINGS, INC.

- 18.1.3.1 Business overview

- 18.1.3.2 Products/Solutions offered

- 18.1.3.3 Recent developments

- 18.1.3.4 MnM view

- 18.1.3.4.1 Key strengths

- 18.1.3.4.2 Strategic choices

- 18.1.3.4.3 Weaknesses and competitive threats

- 18.1.4 EHANG

- 18.1.4.1 Business overview

- 18.1.4.2 Products/Solutions offered

- 18.1.4.3 Recent developments

- 18.1.4.4 MnM view

- 18.1.4.4.1 Key strengths

- 18.1.4.4.2 Strategic choices

- 18.1.4.4.3 Weaknesses and competitive threats

- 18.1.5 JOBY AVIATION

- 18.1.5.1 Business overview

- 18.1.5.2 Products/Solutions offered

- 18.1.5.3 Recent developments

- 18.1.5.4 MnM view

- 18.1.5.4.1 Key strengths

- 18.1.5.4.2 Strategic choices

- 18.1.5.4.3 Weaknesses and competitive threats

- 18.1.6 AIRBUS

- 18.1.6.1 Business overview

- 18.1.6.2 Products/Solutions offered

- 18.1.6.3 Recent developments

- 18.1.7 TEXTRON INC.

- 18.1.7.1 Business overview

- 18.1.7.2 Products/Solutions offered

- 18.1.7.3 Recent developments

- 18.1.8 WISK AERO LLC

- 18.1.8.1 Business overview

- 18.1.8.2 Products/Services offered

- 18.1.8.3 Recent developments

- 18.1.9 JAUNT AIR MOBILITY LLC

- 18.1.9.1 Business overview

- 18.1.9.2 Products/Solutions offered

- 18.1.9.3 Recent developments

- 18.1.10 BETA TECHNOLOGIES

- 18.1.10.1 Business overview

- 18.1.10.2 Products/Solutions offered

- 18.1.10.3 Recent developments

- 18.1.11 VOLOCOPTER GMBH

- 18.1.11.1 Business overview

- 18.1.11.2 Products/Solutions offered

- 18.1.11.3 Recent developments

- 18.1.12 XTI AEROSPACE

- 18.1.12.1 Business overview

- 18.1.12.2 Products/Solutions offered

- 18.1.12.3 Recent developments

- 18.1.13 LILIUM GMBH

- 18.1.13.1 Business overview

- 18.1.13.2 Products/Solutions offered

- 18.1.13.3 Recent developments

- 18.1.14 LIFT AIRCRAFT INC.

- 18.1.14.1 Business overview

- 18.1.14.2 Products/Solutions offered

- 18.1.14.3 Recent developments

- 18.1.15 AUTOFLIGHT

- 18.1.15.1 Business overview

- 18.1.15.2 Products/Solutions offered

- 18.1.15.3 Recent developments

- 18.1.16 VOLANT AEROTECH

- 18.1.16.1 Business overview

- 18.1.16.2 Products/Solutions offered

- 18.1.16.3 Recent developments

- 18.1.1 ARCHER AVIATION INC.

- 18.2 OTHER PLAYERS

- 18.2.1 ARC AERO SYSTEMS

- 18.2.2 SKYDRIVE INC.

- 18.2.3 ELECTRA.AERO

- 18.2.4 OVERAIR, INC.

- 18.2.5 MANTA AIRCRAFT

- 18.2.6 AIR VEV LTD

- 18.2.7 URBAN AERONAUTICS

- 18.2.8 SKYRYSE, INC.

- 18.2.9 ASCENDANCE FLIGHT TECHNOLOGIES S.A.S

19 APPENDIX

- 19.1 DISCUSSION GUIDE

- 19.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.3 CUSTOMIZATION OPTIONS

- 19.4 RELATED REPORTS

- 19.5 AUTHOR DETAILS