|

|

市場調査レポート

商品コード

1633536

世界の自動車市場の見通し(2025年):自動車タイプ別、推進力タイプ別、地域別Global Automotive Outlook- 2025 by Vehicle Type (Hatchback, Sedan, SUV, MPV, Vans, Pick-Ups/Light Trucks), Propulsion Type (ICE, Hybrid & Electric), and Region (China, India, North America, Europe, Rest of Asia, Rest of the World) |

||||||

カスタマイズ可能

|

|||||||

| 世界の自動車市場の見通し(2025年):自動車タイプ別、推進力タイプ別、地域別 |

|

出版日: 2025年01月09日

発行: MarketsandMarkets

ページ情報: 英文 65 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

2024年の世界の軽自動車販売台数は8,400万台であり、2025年には8,510万台に達すると予測され、2024年から2025年にかけて前年比1.3%の成長が見られます。

自動車市場は、さまざまな要因によって成長が見込まれています。自動車産業は、顧客の要求や5G、AI、自律走行などの進化し続ける技術の最前線に適応するために急速に進化しています。電気自動車の採用は、自動車業界の急速な変化を目の当たりにした重要な要因です。EV分野では、長距離バッテリーの開発と製造、顧客向けの高速・超高速充電ポイントの設置が、OEMやEVソリューション提供企業の最重要課題となっています。

さらに、安全機能の強化や高度な自動化を伴う自律走行や5Gによるコネクティビティ強化が、自動車市場の動向を変えつつあります。さらに、OEM各社は、ギガキャスティング技術の利用やEVスケートボード・プラットフォームの開発により、自動車の市場投入までの時間を短縮することに注力しており、これにより自動車の設計・製造が迅速化され、コストと時間の効率が向上し、品質管理が強化されています。

また、中古車のネット販売市場も世界的に大きな市場価値を持っています。2024年には世界で1,846万台近くの中古車が販売されました。しかし、自動車部品のオンライン販売は、2025年には非常に大きな成長が見込まれています。

予測期間中、BEVの販売台数は伸び悩み、PHEVセグメントが両市場間の販売台数の伸びをリードすると予想されます。EVに対する政府補助金の削減動向は、成長率鈍化の大きな要因となっています。また、米国のトランプ新政権はEVに対する様々な補助金を見直すと予想されており、世界のBEVサプライチェーンと市場にも同様の影響を及ぼすと予想されます。しかし、ハイブリッド車は、バッテリーに完全に依存せず、ICエンジンの存在により顧客に航続距離の不安を与えないこと、また、BEVと比較して満タンやバッテリー充電での航続距離が長いことから、ポジティブな成長が期待されます。これがハイブリッド車の売上増に貢献している主な要因です。

自律走行車は、安全性、快適性、運転の利便性に対する需要の高まりから、2025年に大きく成長すると予測されています。テスラはi.RobotaxiやRobovansといった自律走行車を発表しています。中国は、路上での自律走行車の商業化のリーダーとしての地位を確立しています。公共交通機関に自律走行車を導入する様々な段階にある中国の都市は19以上あります。

中国のEV企業はここ数年、小型商用車の輸出を着実に増やしています。中国のOEMは、欧州と南米への進出を着実に増やしています。これらの地域は商用車の需要が大きく、特に欧州ではE-Commercial Vehicleの需要が大きいです。欧州のOEMは部分的にこの市場に対応できているが、価格は比較的高いです。中国のOEMは、より競争力のある価格帯で、航続距離、機能、排出ガスの面で大きな価値を提供することができます。

高級車セグメントは、特にアジア太平洋地域の富裕層(HNI)の急成長により、それなりに販売台数を伸ばしています。このセグメントでは、ロールス・ロイス、メルセデス、ジャガーなどのEVが登場し、より高度な高級機能を提供し始めています。EVには多数のセンサーが搭載され、ソフトウェアによって操作されるため、OEMは多数の機能などを通じて、ユーザーによりプレミアムでパーソナライズされたラグジュアリーな体験を提供できます。

アジア太平洋地域は、世界の自動車産業にとって有望な市場として浮上しています。この傾向の主な原動力となっているのは中国市場です。中国市場は世界最大の自動車生産・購入国に成長し、電気自動車とバッテリーに関する主要なEV技術開発の主要な要因として台頭してきました。インド、日本、韓国もこの地域の重要な国別市場です。インドは自動車分野で徐々に主要な貢献者になりつつあるが、日本と韓国はすでに定着しています。OICAによると、中国とインドは毎年3,000万台以上の自動車を生産しています。自動車販売に関して比較的厳しいシナリオにもかかわらず、アジア地域では2023年と2024年に自動車生産台数が増加しています。この動向を継続すると、2025年にはアジア地域が市場を独占することになります。

さらに、中国は、原材料の供給、製造、販売に関して自動車産業を最も支配している国です。中国は、EV用バッテリーの最も強力なサプライチェーンを持っています。EVバッテリーの50%以上が中国で製造され、EVバッテリーの部品の約75%も中国で製造されています。これらの中国メーカーは、サービスを拡大し、世界中でさらなる市場シェアを獲得しようとしています。

当レポートでは、世界の自動車市場について調査し、2024年の自動車産業の動向、2025年の自動車産業に影響を及ぼす要因、内燃機関車(ICE)と電気自動車(EV)、自律走行車、自動車における5Gコネクティビティ、スマート製造、中古車市場の概要など、幅広い範囲を網羅しています。地域的には、北米、欧州、アジア太平洋地域、その他地域をカバーしています。

目次

- 2024年の主な開発

- 2025年のトップ予測

- 調査範囲

- 調査目的と調査手法

- 世界および地域の経済分析

- 自動車産業の業績:2023年と2024年

- 2024年の主な発展

- 自動車産業の業績:2024年と2025年

- 2025年の主な動向

List of Tables

_

List of Figures

_

The global light vehicle sales were 84.0 million units in 2024 and are projected to reach 85.1 million units in 2025, witnessing a YoY growth of 1.3% from 2024 to 2025. The automotive market is expected to experience growth driven by various factors. The automotive industry is rapidly evolving to adapt to customer demands and ever-evolving frontiers of technologies like 5G, AI, and Autonomous Driving. The adoption of electric vehicles is the key factor that has witnessed a rapid change in the automotive industry. In line with the EV sector, the development and manufacturing of long-range batteries and the installation of fast and ultra-fast charging points for customers is the foremost agenda of the OEMs and EV solution-providing companies.

Further, the introduction of autonomous driving and enhanced connectivity via 5G with enhanced safety features and higher level of automation is shifting the trends in the automotive market. Moreover, OEMs are focused on reducing the time to markets of the vehicle by using gigacasting technology and developing EV skateboard platforms, which makes designing and manufacturing of cars faster, cost and time-efficient, and enhances quality control.

In addition, the online sales of used cars market also has a large market value around the world. Close to 18.46 million units of used cars were sold in 2024 globally. However, the online sales of auto components is expected to have a very significant growth in 2025.

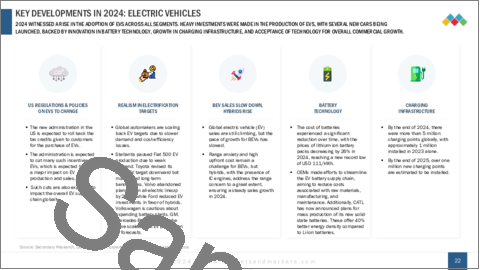

"EV sales grows at a slower pace while hybrids race ahead."

The BEV sales are expected to have slower growth and PHEV segments is expected to lead the sales growth between the two market during the forecast period. There has been a trend of methodical reduction in government subsidies of EVs which is considered to be a major or driving the sluggish growth rate. Also, the new incoming trump administration in US is expected reconsider various subsidies on EVs which is further expected to create similar effects in global BEV supply chains and market. However, the hybrid cars are expected to see positive growth as they are not completely dependent on battery and the presence of IC engine ensures no range anxiety to the customer, and also they provide larger range on full tank and battery charge compared to BEVs. This is the major factor contributing to the growth sales of hybrid.

"Autonomous vehicles are anticipated to witness significant growth in 2025."

Autonomous vehicles are projected to grow significantly in 2025 due to the rising demand for safety, comfort, and driving convenience features. Tesla has showcased it's autonomous vehicles i.e. Robotaxi and Robovans. China has established itself to be the leader in commercialising autonomous vehicles on it's streets. There are more than 19 chinese cities that are in various stages of implementing autonomous vehicles for public transportation.

"Chinese EV firms are increasing their focus on E-LCV segments for global market ."

Chinese EV firms have seen a steady increase in export of Electric Light commercial vehicles over past years. Chinese OEMs have steadily increased there present in Europe and South America. These regions have significant demand for commercial vehicles and especially in Europe there is a large demand for E-Commercial vehicles. European OEMs have been partially able to cater to this market but at a relatively higher price point. Chinese OEMs are able to provide large value in terms of Range, features and emissiona at a more competitive price point.

"Luxury segment is being re-defined by Electric Vehicles"

The luxury car segment has seen a decent rise in sales, especially in the Asia-Pacific region, due to the fast-growing High Net worth Individuals (HNI) in the region. With the advent of EVs in this segment likes of Rolls-Royce, Mercedes, Jaguar etc have started to offer a higher degree of luxury features as EVs due to presence of large number of sensors and being operated by softwares to a large degree provides OEMs a large scope for more premium, personalised luxurious experience to the user via a large number of features etc.

"Asia Pacific holds the largest market share in the forecast period"

Asia Pacific has emerged as a promising market for the global automobile industry. The principal driver of this trend is the Chinese market, which has grown to become the world's largest producer and buyer of automobiles and emerged as a key player in the development of key EV technologies vis-a-vis Electric Vehicles and Batteries. India, Japan, and South Korea are also important country-level markets in the region. While India is gradually becoming a major contributor in the automotive sector, Japan and South Korea are already well-established. According to OICA, China and India produce over 30 million vehicles each year. Despite a relatively challenging scenario vis-a-vis vehicle sales, the Asia region has seen growth in automobile production in 2023 and 2024. Continuing this trend, the Asia region will dominate the market in 2025.

Further, China is the most dominant nation in the automotive industry with respect to supplying raw materials, manufacturing, and sales. China has the most powerful supply chain of EV batteries. Over 50% of the EV batteries are manufactured in China, and around 75% of the components of EV batteries are also manufactured in China. These Chinese manufacturers are looking to expand their services and acquire additional market share around the world.

Furthermore, the market growth in Asia Pacific can be attributed to the high vehicle production and increased use of advanced electronics in Japan, South Korea, and China. The governments of these countries have recognized the growth potential of the automotive sector and have consequently undertaken various initiatives to encourage major OEMs to enter their domestic markets. Several global automobile manufacturers, such as Volkswagen (Germany), Mercedes Benz (Germany), and General Motors (US), have shifted their production plants to emerging economies in the region.

In addition, being the most populous region, Asia-Pacific also holds the largest share of the used cars market. The per capita GDP of the people here is favorable for the growth of the used cars market. The spending capacity of the people in this region has grown gradually with the rise in foreign investments and setup in manufacturing plants in this region.

Research Coverage:

The market analysis encompasses the Global Automotive Market Outlook, focusing on the sales volume of light vehicles. Additionally, it examines the developments in the automotive industry in 2024. The report delves into the trends propelling the automotive sector, analyzing factors influencing the industry in 2025. The study encompasses a broad range, including Internal Combustion Engine (ICE) vehicles and Electric Vehicles (EVs), autonomous vehicles, 5G connectivity in cars, smart manufacturing, and an overview of the used cars market. Geographically, the report covers North America, Europe, Asia Pacific, and the Rest of the World.

Report Scope

The report will help market leaders and new entrants in this market with information on the closest approximations of the sales numbers for the automotive market in 2024 and their subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key Trends in 2024 and 2025 (Rise in Hybrid Vehicle Sales, Stability in vehicles sales in 2025, Online component sales expected to boom, Luxury vehicle sales rise and emergence integrated powertrains ).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the automotive market

- Market Development: Comprehensive information about lucrative markets - the report analyses the automotive market across varied regions

- Market Diversification: Exhaustive information about diversification of supply chains, untapped geographies, recent developments, and investments in the automotive market

- Competitive Assessment: Assessment of market shares, growth strategies and service offerings of leading players like across light vehicle segments which are then dirther divided into ICE and electric among others in the automotive market strategies. The report also helps stakeholders understand the pulse of the autonomous vehicle market and provides them information on key market drivers, challenges, and opportunities.

TABLE OF CONTENTS

1. EXECUTIVE SUMMARY

- 1.1 TOP DEVELOPMENTS IN 2024

- 1.2 TOP PREDICTIONS FOR 2025

2. RESEARCH SCOPE, OBJECTIVES, AND METHODOLOGY

- 2.1 STUDY SCOPE

- 2.2 STUDY OBJECTIVES AND METHODOLOGY

3. GLOBAL MACROECONOMIC ANALYSIS

- 3.1 GLOBAL AND REGIONAL ECONOMIC ANALYSIS

4. GLOBAL AUTOMOTIVE INDUSTRY IN 2024

- 4.1 AUTOMOTIVE INDUSTRY PERFORMANCE: 2023 VS. 2024

- 4.2 KEY DEVELOPMENTS IN 2024

5. GLOBAL AUTOMOTIVE INDUSTRY OUTLOOK IN 2025

- 5.1 AUTOMOTIVE INDUSTRY PERFORMANCE: 2024 VS. 2025

- 5.2 KEY TRENDS IN 2025

6. KEY GROWTH OPPORTUNITIES AND RECOMMENDATIONS

7. CONCLUSION AND KEY TAKEAWAYS

8. APPENDIX

9. ABOUT MARKETSANDMARKETS

10. LEGAL DISCLAIMER