|

|

市場調査レポート

商品コード

1593549

逆浸透膜(RO膜)の世界市場:タイプ別、最終用途産業別、フィルターモジュール別、用途別、地域別 - 予測(~2029年)Reverse Osmosis (RO) Membrane Market by Type (Thin Film Composite Membranes; Cellulose Based Membranes), End-Use Industry (Water & Wastewater Treatment; Industrial Processing), Filter Module, Application, & Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 逆浸透膜(RO膜)の世界市場:タイプ別、最終用途産業別、フィルターモジュール別、用途別、地域別 - 予測(~2029年) |

|

出版日: 2024年11月11日

発行: MarketsandMarkets

ページ情報: 英文 327 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の逆浸透膜(RO膜)の市場規模は、2024年の37億3,000万米ドルから2029年までに51億1,000万米ドルに達すると予測され、CAGRで6.5%の成長が見込まれます。

急速な産業化、人口増加、水不足の深刻化により、RO膜の需要が世界中で高まっています。さらに、新興国における食品・飲料、製薬、化学などの産業の拡大が、産業廃水を処理するRO膜の需要を生み出しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | キロトン、100万米ドル |

| セグメント | フィルターモジュール、用途、タイプ、最終用途産業、地域 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

「用途別では、淡水化が予測期間に金額ベースで最大の市場規模を占めます。」

世界の水不足の課題解決に重要な役割を果たすため、用途別では淡水化がRO膜市場で最大のシェアを占めています。中東やアフリカなど淡水資源が限られている地域では、安全で清潔な飲料水に対するニーズの高まりに対応するため、淡水化に大きく依存しています。RO膜はコスト効率とエネルギー効率が高いため、淡水化プラントで多用され、海水や汽水から塩分や汚染物質を除去し、高品質な水を生産しています。さらに、厳しい環境規制に加え、地方自治体や産業部門からの需要の高まりが、淡水化プラントにおけるRO膜の採用を増加させています。世界の水不足の高まりにより、淡水化用途でのRO膜の利用は拡大すると予測されます。

「最終用途産業別では、産業処理が金額ベースで予測期間にもっとも急成長する市場となります。」

厳しい政府規制の実施や世界の水不足の深刻化により、食品・飲料、医療、石油化学、エネルギーなどのさまざまな産業で浄水ニーズが高まっています。これらの産業では、製造プロセスに高品質な浄水が必要とされ、その効率的な浄水により、これらの用途へのRO膜の採用が増加しています。さらに、都市化の進行に伴う産業化の進行は、石油精製や発電などの産業における水の使用の増加につながり、RO膜の需要をさらに高めています。これらの要因が重なり、産業処理がRO膜の最速の成長市場となっています。

「地域別では、アジア太平洋が金額ベースでRO膜の最大かつ最速の成長市場です。」

人口の急速な拡大、産業化の進行、水不足の深刻化により、安全で清潔な飲料水へのニーズが高まっています。このため、水処理と廃水処理に多額の投資が行われ、その有効性からこれらの用途でRO膜の需要が高まっています。水処理と水質に関する政府の厳しい規制と、純水へのアクセスを改善するための取り組みは、この地域におけるRO膜の需要をさらに促進しています。中国やインドのような新興経済国は、人口増加による純水需要を満たすために大規模な淡水化プラントを導入しており、これらの用途へのRO膜の採用につながっています。これらの要因により、アジア太平洋はRO膜の最大かつ最速の成長市場として浮上しています。

当レポートでは、世界の逆浸透膜(RO膜)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 逆浸透膜(RO膜)市場の企業にとって魅力的な機会

- 逆浸透膜(RO膜)市場:タイプ別

- 逆浸透膜(RO膜)市場:フィルターモジュール別

- 逆浸透膜(RO膜)市場:用途別

- 逆浸透膜(RO膜)市場:最終用途産業別

- 逆浸透膜(RO膜)市場:主要国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 購入プロセスにおける主なステークホルダー

- 品質

- サービス

- マクロ経済の見通し

- GDPの動向と予測

- 処理された都市廃水

- AI/生成AIの影響

- バリューチェーン分析

- エコシステム分析

- ケーススタディ分析

- 関税と規制情勢

- 環境規制

- 北米

- アジア太平洋

- 欧州

- 標準

- 規制機関、政府機関、その他の組織

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 顧客ビジネスに影響を与える動向/混乱

- 貿易分析

- 輸入シナリオ(HSコード842121)

- 輸出シナリオ(HSコード842121)

- 主な会議とイベント(2024年~2025年)

- 価格分析

- 平均販売価格の動向:地域別

- 平均販売価格の動向:フィルターモジュール別

- 平均販売価格の動向:最終用途産業別

- 投資と資金調達のシナリオ

- 特許分析

- イントロダクション

- 文献の種類

- 過去10年間の公報の動向

- 考察

- 特許の法的地位

- 管轄分析

- 主な出願者

第6章 逆浸透膜(RO膜)市場:タイプ別

- イントロダクション

- セルロース系膜

- 薄膜複合膜

- その他のタイプ

第7章 逆浸透膜(RO膜)市場:フィルターモジュール別

- イントロダクション

- プレート・フレーム

- チューブラー

- スパイラルワウンド

- 中空糸

第8章 逆浸透膜(RO膜)市場:用途別

- イントロダクション

- 淡水化

- ユーティリティ水処理

- 廃水処理・再使用

- プロセス用水

- 飲料水

- その他の用途

第9章 逆浸透膜(RO膜)市場:最終用途産業別

- イントロダクション

- 水処理・廃水処理

- 住宅・商業

- 地方自治体

- 産業処理

- エネルギー・電力

- 食品・飲料

- 医療

- 化学・石油化学

- その他

第10章 逆浸透膜(RO膜)市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他のアジア太平洋

- 欧州

- ドイツ

- スペイン

- イタリア

- 英国

- フランス

- ロシア

- トルコ

- その他の欧州

- 北米

- 米国

- カナダ

- メキシコ

- 中東・アフリカ

- GCC

- エジプト

- 南アフリカ

- その他の中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

第11章 競合情勢

- 概要

- 主要企業戦略/有力企業

- 収益分析(2021年~2023年)

- 市場シェア分析

- 企業の評価と財務指標

- ブランド/製品の比較

- FILMTEC

- TM700D

- NANOH2O

- PRO SERIES

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオと動向

第12章 企業プロファイル

- 主要企業

- DUPONT

- TORAY INDUSTRIES, INC.

- LG CHEM

- HYDRANAUTICS (A NITTO DENKO GROUP COMPANY)

- VEOLIA

- TOYOBO, CO. LTD.

- ALFA LAVAL

- MANN+HUMMEL

- MERCK KGAA

- KOVALUS SEPARATION SOLUTIONS

- MEMBRANIUM

- PENTAIR

- THERMO FISHER SCIENTIFIC

- PALL CORPORATION

- BEST WATER TECHNOLOGY GROUP

- その他の企業

- SYNDER FILTRATION, INC.

- LENNTECH

- AQUAPORIN A/S

- KURITA WATER INDUSTRIES

- APPLIED MEMBRANES, INC.

- MEMBRACON

- EUROWATER

- AXEON WATER

- PERMIONICS MEMBRANES PRIVATE LIMITED

- VONTRON TECHNOLOGY

- NEWATER

第13章 付録

List of Tables

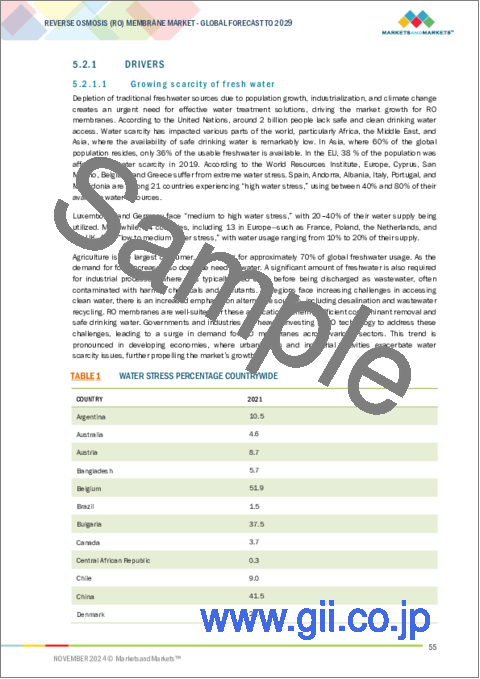

- TABLE 1 WATER STRESS PERCENTAGE COUNTRYWIDE

- TABLE 2 REVERSE OSMOSIS MEMBRANE MARKET: LIST OF REGULATIONS

- TABLE 3 REVERSE OSMOSIS MEMBRANE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO END-USE INDUSTRIES

- TABLE 5 KEY BUYING CRITERIA FOR TOP TWO END-USE INDUSTRIES

- TABLE 6 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2019-2023

- TABLE 7 GDP ANNUAL PERCENT CHANGE AND PROJECTION OF KEY COUNTRIES, 2024-2029

- TABLE 8 TREATED MUNICIPAL WASTEWATER (10**9 M3/YEAR) AND NUMBER OF MUNICIPAL WASTEWATER TREATMENT FACILITIES

- TABLE 9 REVERSE OSMOSIS MEMBRANE MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 10 REVERSE OSMOSIS MEMBRANE MARKET: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 REVERSE OSMOSIS MEMBRANE MARKET: KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 12 LIST OF PATENTS BY TORAY INDUSTRIES, INC.

- TABLE 13 LIST OF PATENTS BY KURITA WATER IND. LTD.

- TABLE 14 LIST OF PATENTS BY DOW GLOBAL TECHNOLOGIES

- TABLE 15 TOP 10 PATENT OWNERS IN LAST 10 YEARS

- TABLE 16 REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2020-2023 (UNITS)

- TABLE 17 REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2024-2029 (UNITS)

- TABLE 18 REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2020-2023 (METER SQUARE)

- TABLE 19 REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2024-2029 (METER SQUARE)

- TABLE 20 REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 21 REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 22 REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2020-2023 (UNITS)

- TABLE 23 REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2024-2029 (UNITS)

- TABLE 24 REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2020-2023 (METER SQUARE)

- TABLE 25 REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2024-2029 (METER SQUARE)

- TABLE 26 REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2020-2023 (USD MILLION)

- TABLE 27 REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2024-2029 (USD MILLION)

- TABLE 28 REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 29 REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 30 REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2020-2023 (METER SQUARE)

- TABLE 31 REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2024-2029 (METER SQUARE)

- TABLE 32 REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 33 REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 34 REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNIT)

- TABLE 35 REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNIT)

- TABLE 36 REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 37 REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 38 REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 39 REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 40 REVERSE OSMOSIS MEMBRANE MARKET, BY REGION, 2020-2023 (UNITS)

- TABLE 41 REVERSE OSMOSIS MEMBRANE MARKET, BY REGION, 2024-2029 (UNITS)

- TABLE 42 REVERSE OSMOSIS MEMBRANE MARKET, BY REGION, 2020-2023 (METER SQUARE)

- TABLE 43 REVERSE OSMOSIS MEMBRANE MARKET, BY REGION, 2024-2029 (METER SQUARE)

- TABLE 44 REVERSE OSMOSIS MEMBRANE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 45 REVERSE OSMOSIS MEMBRANE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 46 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2020-2023 (UNITS)

- TABLE 47 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2024-2029 (UNITS)

- TABLE 48 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2020-2023 (METER SQUARE)

- TABLE 49 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2024-2029 (METER SQUARE)

- TABLE 50 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 51 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 52 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2020-2023 (UNITS)

- TABLE 53 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2024-2029 (UNITS)

- TABLE 54 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2020-2023 (METER SQUARE)

- TABLE 55 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2024-2029 (METER SQUARE)

- TABLE 56 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2020-2023 (USD MILLION)

- TABLE 57 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2024-2029 (USD MILLION)

- TABLE 58 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 59 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 60 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2020-2023 (METER SQUARE)

- TABLE 61 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2024-2029 (METER SQUARE)

- TABLE 62 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 63 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 64 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2020-2023 (UNITS)

- TABLE 65 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2024-2029 (UNITS)

- TABLE 66 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2020-2023 (METER SQUARE)

- TABLE 67 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2024-2029 (METER SQUARE)

- TABLE 68 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 69 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 70 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 71 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 72 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 73 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 74 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 75 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 76 CHINA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 77 CHINA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 78 CHINA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 79 CHINA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 80 CHINA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 81 CHINA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 82 JAPAN: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 83 JAPAN: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 84 JAPAN: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 85 JAPAN: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 86 JAPAN: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 87 JAPAN: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 88 INDIA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 89 INDIA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 90 INDIA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 91 INDIA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 92 INDIA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 93 INDIA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 94 SOUTH KOREA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 95 SOUTH KOREA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 96 SOUTH KOREA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 97 SOUTH KOREA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 98 SOUTH KOREA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 99 SOUTH KOREA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 100 AUSTRALIA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 101 AUSTRALIA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 102 AUSTRALIA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 103 AUSTRALIA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 104 AUSTRALIA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 105 AUSTRALIA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 106 REST OF ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 107 REST OF ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 108 REST OF ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 109 REST OF ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 110 REST OF ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 111 REST OF ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 112 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2020-2023 (UNITS)

- TABLE 113 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2024-2029 (UNITS)

- TABLE 114 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2020-2023 (METER SQUARE)

- TABLE 115 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2024-2029 (METER SQUARE)

- TABLE 116 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 117 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 118 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2020-2023 (UNITS)

- TABLE 119 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2024-2029 (UNITS)

- TABLE 120 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2020-2023 (METER SQUARE)

- TABLE 121 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2024-2029 (METER SQUARE)

- TABLE 122 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2020-2023 (USD MILLION)

- TABLE 123 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2024-2029 (USD MILLION)

- TABLE 124 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 125 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 126 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2020-2023 (METER SQUARE)

- TABLE 127 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2024-2029 (METER SQUARE)

- TABLE 128 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 129 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 130 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2020-2023 (UNITS)

- TABLE 131 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2024-2029 (UNITS)

- TABLE 132 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2020-2023 (METER SQUARE)

- TABLE 133 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2024-2029 (METER SQUARE)

- TABLE 134 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 135 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 136 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 137 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 138 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 139 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 140 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 141 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 142 GERMANY: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 143 GERMANY: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 144 GERMANY: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 145 GERMANY: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 146 GERMANY: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 147 GERMANY: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 148 SPAIN: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 149 SPAIN: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 150 SPAIN: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 151 SPAIN: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 152 SPAIN: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 153 SPAIN: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 154 ITALY: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 155 ITALY: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 156 ITALY: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 157 ITALY: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 158 ITALY: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 159 ITALY: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 160 UK: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 161 UK: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 162 UK: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 163 UK: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 164 UK: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 165 UK: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 166 FRANCE: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 167 FRANCE: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 168 FRANCE: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 169 FRANCE: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 170 FRANCE: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 171 FRANCE: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 172 RUSSIA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 173 RUSSIA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 174 RUSSIA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 175 RUSSIA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 176 RUSSIA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 177 RUSSIA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 178 TURKEY: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 179 TURKEY: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 180 TURKEY: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 181 TURKEY: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 182 TURKEY: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 183 TURKEY: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 184 REST OF EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 185 REST OF EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 186 REST OF EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 187 REST OF EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 188 REST OF EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 189 REST OF EUROPE: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 190 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2020-2023 (UNITS)

- TABLE 191 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2024-2029 (UNITS)

- TABLE 192 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2020-2023 (METER SQUARE)

- TABLE 193 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2024-2029 (METER SQUARE)

- TABLE 194 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 195 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 196 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2020-2023 (UNITS)

- TABLE 197 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2024-2029 (UNITS)

- TABLE 198 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2020-2023 (METER SQUARE)

- TABLE 199 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2024-2029 (METER SQUARE)

- TABLE 200 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2020-2023 (USD MILLION)

- TABLE 201 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2024-2029 (USD MILLION)

- TABLE 202 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 203 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 204 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2020-2023 (METER SQUARE)

- TABLE 205 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2024-2029 (METER SQUARE)

- TABLE 206 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 207 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 208 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2020-2023 (UNITS)

- TABLE 209 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2024-2029 (UNITS)

- TABLE 210 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2020-2023 (METER SQUARE)

- TABLE 211 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2024-2029 (METER SQUARE)

- TABLE 212 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 213 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 214 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 215 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 216 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 217 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 218 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 219 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 220 US: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 221 US: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 222 US: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 223 US: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 224 US: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 225 US: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 226 CANADA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 227 CANADA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 228 CANADA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 229 CANADA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 230 CANADA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 231 CANADA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 232 MEXICO: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 233 MEXICO: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 234 MEXICO: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 235 MEXICO: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 236 MEXICO: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 237 MEXICO: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2020-2023 (UNITS)

- TABLE 239 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2024-2029 (UNITS)

- TABLE 240 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2020-2023 (METER SQUARE)

- TABLE 241 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2024-2029 (METER SQUARE)

- TABLE 242 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 244 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2020-2023 (UNITS)

- TABLE 245 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2024-2029 (UNITS)

- TABLE 246 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2020-2023 (METER SQUARE)

- TABLE 247 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2024-2029 (METER SQUARE)

- TABLE 248 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2020-2023 (USD MILLION)

- TABLE 249 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2024-2029 (USD MILLION)

- TABLE 250 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 251 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 252 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2020-2023 (METER SQUARE)

- TABLE 253 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2024-2029 (METER SQUARE)

- TABLE 254 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 255 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 256 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2020-2023 (UNITS)

- TABLE 257 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2024-2029 (UNITS)

- TABLE 258 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2020-2023 (METER SQUARE)

- TABLE 259 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2024-2029 (METER SQUARE)

- TABLE 260 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 261 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 262 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 263 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 264 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 265 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 266 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 267 MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 268 SAUDI ARABIA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 269 SAUDI ARABIA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 270 SAUDI ARABIA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 271 SAUDI ARABIA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 272 SAUDI ARABIA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 273 SAUDI ARABIA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 274 REST OF GCC: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 275 REST OF GCC: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 276 REST OF GCC: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 277 REST OF GCC: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 278 REST OF GCC: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 279 REST OF GCC: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 280 EGYPT: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 281 EGYPT: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 282 EGYPT: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 283 EGYPT: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 284 EGYPT: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 285 EGYPT: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 286 SOUTH AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 287 SOUTH AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 288 SOUTH AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 289 SOUTH AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 290 SOUTH AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 291 SOUTH AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 292 REST OF MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 293 REST OF MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 294 REST OF MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 295 REST OF MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 296 REST OF MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 297 REST OF MIDDLE EAST & AFRICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 298 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2020-2023 (UNITS)

- TABLE 299 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2024-2029 (UNITS)

- TABLE 300 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2020-2023 (METER SQUARE)

- TABLE 301 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2024-2029 (METER SQUARE)

- TABLE 302 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 303 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 304 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2020-2023 (UNITS)

- TABLE 305 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2024-2029 (UNITS)

- TABLE 306 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2020-2023 (METER SQUARE)

- TABLE 307 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2024-2029 (METER SQUARE)

- TABLE 308 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2020-2023 (USD MILLION)

- TABLE 309 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE, 2024-2029 (USD MILLION)

- TABLE 310 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 311 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 312 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2020-2023 (METER SQUARE)

- TABLE 313 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2024-2029 (METER SQUARE)

- TABLE 314 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 315 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 316 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2020-2023 (UNITS)

- TABLE 317 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2024-2029 (UNITS)

- TABLE 318 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2020-2023 (METER SQUARE)

- TABLE 319 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2024-2029 (METER SQUARE)

- TABLE 320 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 321 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 322 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 323 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 324 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 325 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 326 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 327 SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 328 BRAZIL: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 329 BRAZIL: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 330 BRAZIL: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 331 BRAZIL: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 332 BRAZIL: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 333 BRAZIL: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 334 ARGENTINA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 335 ARGENTINA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 336 ARGENTINA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 337 ARGENTINA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 338 ARGENTINA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 339 ARGENTINA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 340 REST OF SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (UNITS)

- TABLE 341 REST OF SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (UNITS)

- TABLE 342 REST OF SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (METER SQUARE)

- TABLE 343 REST OF SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (METER SQUARE)

- TABLE 344 REST OF SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 345 REST OF SOUTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 346 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN REVERSE OSMOSIS MEMBRANE MARKET BETWEEN 2019 AND 2024

- TABLE 347 REVERSE OSMOSIS MEMBRANE MARKET: DEGREE OF COMPETITION

- TABLE 348 REVERSE OSMOSIS MEMBRANE MARKET: FILTER MODULE FOOTPRINT

- TABLE 349 REVERSE OSMOSIS MEMBRANE MARKET: APPLICATION FOOTPRINT

- TABLE 350 REVERSE OSMOSIS MEMBRANE MARKET: TYPE FOOTPRINT

- TABLE 351 REVERSE OSMOSIS MEMBRANE MARKET: INDUSTRY FOOTPRINT

- TABLE 352 REVERSE OSMOSIS MEMBRANE MARKET: REGION FOOTPRINT

- TABLE 353 REVERSE OSMOSIS MEMBRANE MARKET: KEY STARTUPS/SMES

- TABLE 354 REVERSE OSMOSIS MEMBRANE MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 355 REVERSE OSMOSIS MEMBRANE MARKET: PRODUCT LAUNCHES, JANUARY 2019- SEPTEMBER 2024

- TABLE 356 REVERSE OSMOSIS MEMBRANE MARKET: DEALS, JANUARY 2019- SEPTEMBER 2024

- TABLE 357 REVERSE OSMOSIS MEMBRANE MARKET: EXPANSIONS, JANUARY 2019-SEPTEMBER 2024

- TABLE 358 REVERSE OSMOSIS MEMBRANE MARKET: OTHER DEVELOPMENTS, JANUARY 2019- SEPTEMBER 2024

- TABLE 359 DUPONT: COMPANY OVERVIEW

- TABLE 360 DUPONT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 361 DUPONT: DEALS, JANUARY 2019-SEPTEMBER 2024

- TABLE 362 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 363 TORAY INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 364 TORAY INDUSTRIES, INC.: PRODUCT LAUNCHES, JANUARY 2019-SEPTEMBER 2024

- TABLE 365 TORAY INDUSTRIES, INC.: DEALS, JANUARY 2019-SEPTEMBER 2024

- TABLE 366 LG CHEM: COMPANY OVERVIEW

- TABLE 367 LG CHEM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 368 LG CHEM: EXPANSIONS, JANUARY 2019-SEPTEMBER 2024

- TABLE 369 LG CHEM: OTHER DEVELOPMENTS, JANUARY 2019-SEPTEMBER 2024

- TABLE 370 HYDRANAUTICS: COMPANY OVERVIEW

- TABLE 371 HYDRANAUTICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 372 HYDRANAUTICS: PRODUCT LAUNCHES, JANUARY 2019-SEPTEMBER 2024

- TABLE 373 VEOLIA: COMPANY OVERVIEW

- TABLE 374 VEOLIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 375 VEOLIA: DEALS, JANUARY 2019-SEPTEMBER 2024

- TABLE 376 TOYOBO, CO. LTD: COMPANY OVERVIEW

- TABLE 377 TOYOBO, CO. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 378 ALFA LAVAL: COMPANY OVERVIEW

- TABLE 379 ALFA LAVAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 380 MANN + HUMMEL: COMPANY OVERVIEW

- TABLE 381 MANN + HUMMEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 382 MANN + HUMMEL: DEALS, JANUARY 2019-SEPTEMBER 2024

- TABLE 383 MANN + HUMMEL: EXPANSIONS, JANUARY 2019-SEPTEMBER 2024

- TABLE 384 MERCK KGAA: COMPANY OVERVIEW

- TABLE 385 MERCK KGAA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 386 KOVALUS SEPARATION SOLUTIONS: COMPANY OVERVIEW

- TABLE 387 KOVALUS SEPARATION SOLUTIONS: PRODUCT OFFERINGS

- TABLE 388 KOVALUS SEPARATION SOLUTIONS: PRODUCT LAUNCHES, JANUARY 2019-SEPTEMBER 2024

- TABLE 389 KOVALUS SEPARATION SOLUTIONS: DEALS, JANUARY 2019-SEPTEMBER 2024

- TABLE 390 MEMBRANIUM: COMPANY OVERVIEW

- TABLE 391 MEMBRANIUM: PRODUCT OFFERINGS

- TABLE 392 PENTAIR: COMPANY OVERVIEW

- TABLE 393 PENTAIR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 394 THERMO FISHER SCIENTIFIC: COMPANY OVERVIEW

- TABLE 395 THERMO FISHER SCIENTIFIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 396 PALL CORPORATION: COMPANY OVERVIEW

- TABLE 397 PALL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 398 BEST WATER TECHNOLOGY GROUP: COMPANY OVERVIEW

- TABLE 399 BEST WATER TECHNOLOGY GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 400 SYNDER FILTRATION, INC.: COMPANY OVERVIEW

- TABLE 401 LENNTECH: COMPANY OVERVIEW

- TABLE 402 AQUAPORIN A/S: COMPANY OVERVIEW

- TABLE 403 KURITA WATER INDUSTRIES: COMPANY OVERVIEW

- TABLE 404 APPLIED MEMBRANES, INC.: COMPANY OVERVIEW

- TABLE 405 MEMBRACON: COMPANY OVERVIEW

- TABLE 406 EUROWATER: COMPANY OVERVIEW

- TABLE 407 AXEON WATER: COMPANY OVERVIEW

- TABLE 408 PERMIONICS MEMBRANES PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 409 VONTRON TECHNOLOGY: COMPANY OVERVIEW

- TABLE 410 NEWATER: COMPANY OVERVIEW

List of Figures

- FIGURE 1 REVERSE OSMOSIS MEMBRANE MARKET: RESEARCH DESIGN

- FIGURE 2 REVERSE OSMOSIS MEMBRANE MARKET: BOTTOM-UP APPROACH

- FIGURE 3 REVERSE OSMOSIS MEMBRANE MARKET: TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: REVERSE OSMOSIS MEMBRANE MARKET

- FIGURE 5 DEMAND-SIDE FORECAST PROJECTIONS

- FIGURE 6 REVERSE OSMOSIS MEMBRANE MARKET: DATA TRIANGULATION

- FIGURE 7 THIN FILM COMPOSITE MEMBRANES TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 8 SPIRAL WOUND FILTER MODULE TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 9 DESALINATION TO BE LARGEST APPLICATION OF REVERSE OSMOSIS MEMBRANES

- FIGURE 10 WATER & WASTEWATER TREATMENT INDUSTRY TO HOLD LARGER SHARE DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 THIN FILM COMPOSITE MEMBRANE TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 SPIRAL WOUND FILTER MODULE TO CAPTURE LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 15 DESALINATION APPLICATION TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 WATER & WASTEWATER TREATMENT INDUSTRY TO LEAD OVERALL MARKET DURING FORECAST PERIOD

- FIGURE 17 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN REVERSE OSMOSIS MEMBRANE MARKET

- FIGURE 19 PORTER'S FIVE FORCES ANALYSIS OF REVERSE OSMOSIS MEMBRANE MARKET

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO END-USE INDUSTRIES

- FIGURE 21 SUPPLIER SELECTION CRITERION

- FIGURE 22 REVERSE OSMOSIS MEMBRANE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 REVERSE OSMOSIS MEMBRANE MARKET: ECOSYSTEM

- FIGURE 24 TRENDS AND DISRUPTIONS IN REVERSE OSMOSIS MEMBRANE MARKET

- FIGURE 25 COUNTRY-WISE IMPORT TRADE DATA FOR HS-CODE 842121-COMPLIANT PRODUCTS (USD THOUSAND)

- FIGURE 26 COUNTRY-WISE EXPORT TRADE DATA FOR HS-CODE 842121-COMPLIANT PRODUCTS (USD THOUSAND)

- FIGURE 27 AVERAGE SELLING PRICE TREND, BY REGION (USD/METER SQUARE)

- FIGURE 28 AVERAGE SELLING PRICE TREND, BY APPLICATION (USD/METER SQUARE)

- FIGURE 29 AVERAGE SELLING PRICE TREND, BY END-USE INDUSTRY (USD/METER SQUARE)

- FIGURE 30 INVESTMENT AND FUNDING SCENARIO, 2021-2023 (USD MILLION)

- FIGURE 31 PATENTS REGISTERED (2013-2023)

- FIGURE 32 NUMBER OF PATENTS IN LAST 10 YEARS

- FIGURE 33 LEGAL STATUS OF PATENTS (2013-2024)

- FIGURE 34 TOP JURISDICTIONS

- FIGURE 35 TOP APPLICANTS' ANALYSIS

- FIGURE 36 THIN FILM COMPOSITE MEMBRANES TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 37 SPIRAL WOUND TO BE LARGEST FILTER MODULE DURING FORECAST PERIOD

- FIGURE 38 DESALINATION TO BE LARGEST APPLICATION DURING FORECAST PERIOD

- FIGURE 39 WATER & WASTEWATER TREATMENT INDUSTRY TO BE LARGEST END-USE INDUSTRY DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 41 ASIA PACIFIC: REVERSE OSMOSIS MEMBRANE MARKET SNAPSHOT

- FIGURE 42 EUROPE: REVERSE OSMOSIS MEMBRANE MARKET SNAPSHOT

- FIGURE 43 NORTH AMERICA: REVERSE OSMOSIS MEMBRANE MARKET SNAPSHOT

- FIGURE 44 REVENUE ANALYSIS OF TOP FOUR PLAYERS IN REVERSE OSMOSIS MEMBRANE MARKET, 2021-2023

- FIGURE 45 MARKET SHARE OF KEY COMPANIES IN REVERSE OSMOSIS MEMBRANE MARKET, 2023

- FIGURE 46 VALUATION OF LEADING COMPANIES IN REVERSE OSMOSIS MEMBRANE MARKET, 2023

- FIGURE 47 FINANCIAL METRICS OF LEADING COMPANIES IN REVERSE OSMOSIS MEMBRANE MARKET, 2023

- FIGURE 48 REVERSE OSMOSIS MEMBRANE MARKET: BRAND/PRODUCT COMPARISON ANALYSIS

- FIGURE 49 REVERSE OSMOSIS MEMBRANE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 50 REVERSE OSMOSIS MEMBRANE MARKET: OVERALL COMPANY FOOTPRINT

- FIGURE 51 REVERSE OSMOSIS MEMBRANE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 52 DUPONT: COMPANY SNAPSHOT

- FIGURE 53 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 54 LG CHEM: COMPANY SNAPSHOT

- FIGURE 55 VEOLIA: COMPANY SNAPSHOT

- FIGURE 56 TOYOBO, CO. LTD.: COMPANY SNAPSHOT

- FIGURE 57 ALFA LAVAL: COMPANY SNAPSHOT

- FIGURE 58 MANN + HUMMEL: COMPANY SNAPSHOT

- FIGURE 59 MERCK KGAA: COMPANY SNAPSHOT

- FIGURE 60 PENTAIR: COMPANY SNAPSHOT

- FIGURE 61 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT

The RO membrane market is projected to reach USD 5.11 Billion By 2029, At A CAGR Of 6.5% From USD 3.73 Billion In 2024. RO membrane Rapid industrialization, expanding population and increasing water scarcity is fueling the demand for RO membrane worldwide. Additionally, the expanding industries in emerging economies such as food & beverage, pharmaceuticals and chemicals is creating a demand for RO membranes to process industrial wastewater.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Kiloton; Value (USD Million) |

| Segments | Filter module, Application, Type, End-use industry, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

"Based on application, desalination accounts the largest market during the forecast period, in terms of value."

Desalination accounts for the largest share of RO membrane market by application due to its vital role in addressing the water scarcity challenges globally. Regions with limited freshwater resources such as Middle Wast & Africa are highly dependent on desalination to meet the growing needs for safe and clean drinking water. Due to the cost effectiveness and energy efficient properties RO membranes are heavily used in desalination plants for removing salts and contaminants from sweater and brackish water for producing high quality water. Moreover, the rising demand from municipal and industrial sectors along with stringent environmental regulations, is increasing the adoption of RO membranes in desalination plants. The rising global water scarcity, the application of RO membranes for desalination applications is anticipated to grow.

"Based on end-use industry, industrial processing is the fastest growing market during the forecast period, in terms of value."

The implementation of stringent government regulations and increasing water scarcity globally has created a need for water purification across various industries such as food & beverage, healthcare, petrochemicals & energy. These industries require higher quality water purification for manufacturing processes which increases the adoption of RO membranes for these applications due to their efficiency water purification. Moreover, the rising industrialization along with growing urbanization is leading to increased usage of water in industries such as oil refining and power generation, further fueling the demand for RO membranes. Collectively, these factors have been leading to industrial processing to be the fastest growing market for RO membranes.

"Based on region, Asia Pacific is the largest and fastest growing market for RO membrane, in terms of value."

The rapidly expanding population, rising industrialization and growing water scarcity has created need for safe and clean drinking water. This has encouraged significant investments in water and wastewater treatments propelling a demand for RO membranes in these applications due to their effectiveness. The stringent government regulations for water treatment and water quality along with initiatives for improving accessibility of pure water is further fueling the demand for RO membranes in the region. The developing economies like China and India are implementing large scale desalination plants for meeting the pure water needs due to rising population resulting into adoption of RO membranes for these applications. These factors collectively have positioned Asia Pacific to emerge as largest and fastest growing market for RO membranes.

In the process of determining and verifying the market size for several segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees are as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-Level - 35%, Director Level - 25%, and Others - 40%

- By Region: North America - 22%, Europe - 22%, Asia Pacific - 45%, Middle East & Africa-5%, and Latin America-6%

The key players in this market are DuPont (US), Toray Industries Inc (Japan), LG Chem (South Korea), Hydranautics (US), Veolia (France), Toyobo Co., Ltd (Japan), Kovalus Separation Solutions (US) Alfa Laval (Sweden), Mann+Hummel Water and Fluid Solutions (Germany), Membranium (Russia), Pentair (US), Thermo Fisher Scientific (US), Lanxess (Germany), Merck KGaA (Germany), Pall Corporation (US), and Best Water Technology Group (Austria)

Research Coverage

This report segments the RO membrane market based on filter module, application, type, end-use industry, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products and services, key strategies, new product launches, expansions, and mergers and acquisitions associated with the RO membrane market.

Key benefits of buying this report

This research report focuses on various levels of analysis, including industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the RO membrane market, high-growth regions, and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing water scarcity, Stringent government regulations, Industrialization and Technological advancements), restraints (Membrane fouling & scaling and Complex Pretreatment Requirements), opportunities (Increasing demand for water treatment in developing countries and growing industrial applications) and challenges (Discharge of brine as waste and high energy consumption).

- Market Penetration: Comprehensive information on the RO membrane market offered by top players in the global RO membrane market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the RO membrane market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for RO membrane market across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global RO membrane market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the RO membrane market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of key primary interview participants

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS AND RISKS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN REVERSE OSMOSIS MEMBRANE MARKET

- 4.2 REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE

- 4.3 REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE

- 4.4 REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION

- 4.5 REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY

- 4.6 REVERSE OSMOSIS MEMBRANE MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing scarcity of fresh water

- 5.2.1.2 Implementation of stringent standards for water quality and wastewater treatment

- 5.2.1.3 Technological advancements in reverse osmosis membranes

- 5.2.2 RESTRAINTS

- 5.2.2.1 Membrane fouling & scaling

- 5.2.2.2 Complex pretreatment requirements for filtration

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand for water treatment from emerging economies

- 5.2.3.2 Need for eliminating contaminants in industrial applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Discharge of brine as waste

- 5.2.4.2 High energy consumption and operational costs

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT FROM NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 QUALITY

- 5.4.3 SERVICE

- 5.5 MACROECONOMIC OUTLOOK

- 5.5.1 GDP TRENDS AND FORECASTS

- 5.5.2 TREATED MUNICIPAL WASTEWATER

- 5.6 IMPACT OF AI/GENAI

- 5.7 VALUE CHAIN ANALYSIS

- 5.8 ECOSYSTEM ANALYSIS

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 DUPONT ENSURED WATER SECURITY FOR GUJARAT'S INDUSTRIAL HUB USING DESALINATION SOLUTIONS

- 5.9.2 TORAY'S LOW-FOULING RO MEMBRANE TECHNOLOGY DRIVES COST-EFFICIENCY AT THAI WASTEWATER REUSE PLANTS

- 5.9.3 HYDRANAUTICS' RO SOLUTION LOWERS TREATMENT COSTS AND ENHANCES GLYCERIN RECOVERY IN JOHOR BAHRU'S BIODIESEL INDUSTRY

- 5.10 TARIFF AND REGULATORY LANDSCAPE

- 5.10.1 ENVIRONMENTAL REGULATIONS

- 5.10.2 NORTH AMERICA

- 5.10.3 ASIA PACIFIC

- 5.10.4 EUROPE

- 5.10.5 STANDARDS

- 5.10.6 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 Graphene oxide membranes

- 5.11.1.2 Pulse flow reverse osmosis

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 Nanocomposite RO membranes

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 Predictive maintenance

- 5.11.1 KEY TECHNOLOGIES

- 5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT SCENARIO (HS CODE 842121)

- 5.13.2 EXPORT SCENARIO (HS CODE 842121)

- 5.14 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.15 PRICING ANALYSIS

- 5.15.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.15.2 AVERAGE SELLING PRICE TREND, BY FILTER MODULE

- 5.15.3 AVERAGE SELLING PRICE TREND, BY END-USE INDUSTRY

- 5.16 INVESTMENT AND FUNDING SCENARIO

- 5.17 PATENT ANALYSIS

- 5.17.1 INTRODUCTION

- 5.17.2 DOCUMENT TYPES

- 5.17.3 PUBLICATION TRENDS IN LAST 10 YEARS

- 5.17.4 INSIGHTS

- 5.17.5 LEGAL STATUS OF PATENTS

- 5.17.6 JURISDICTION ANALYSIS

- 5.17.7 TOP APPLICANTS

6 REVERSE OSMOSIS MEMBRANE MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 CELLULOSE-BASED MEMBRANE

- 6.2.1 ADVANCEMENTS IN NANOCELLULOSE TECHNOLOGY TO ENHANCE ION SELECTIVITY AND STABILITY

- 6.2.2 CELLULOSE ACETATE MEMBRANES

- 6.2.3 OTHERS

- 6.3 THIN FILM COMPOSITE MEMBRANE

- 6.3.1 IDEAL FOR PURIFICATION OF FEED STREAMS CONTAINING DISSOLVED CONTAMINANTS

- 6.3.2 POLYAMIDE COMPOSITE MEMBRANES

- 6.3.3 OTHERS

- 6.4 OTHER TYPES

7 REVERSE OSMOSIS MEMBRANE MARKET, BY FILTER MODULE

- 7.1 INTRODUCTION

- 7.2 PLATE & FRAME

- 7.2.1 LOW COST AND EASE OF CLEANING

- 7.3 TUBULAR

- 7.3.1 ROBUST DESIGN AND ABILITY TO HANDLE LARGE WATER FEED STREAMS

- 7.4 SPIRAL WOUND

- 7.4.1 HIGH EFFICIENCY AND OPTIMAL SPACE UTILIZATION

- 7.5 HOLLOW FIBER

- 7.5.1 HIGH FILTRATION EFFICIENCY AND LOW ENERGY CONSUMPTION

8 REVERSE OSMOSIS MEMBRANE MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 DESALINATION

- 8.2.1 RAPID POPULATION GROWTH AND DEPLETING WATER RESOURCES TO BOOST DEMAND

- 8.3 UTILITY WATER TREATMENT

- 8.3.1 STRINGENT WATER QUALITY STANDARDS AND FLUCTUATING DEMAND TO DRIVE MARKET

- 8.4 WASTEWATER TREATMENT & REUSE

- 8.4.1 WATER REUSE INITIATIVES AND SUSTAINABLE PRACTICES TO BOOST DEMAND

- 8.5 PROCESS WATER

- 8.5.1 INCREASING FOCUS OF INDUSTRIES ON SUSTAINABLE WATER MANAGEMENT PRACTICES TO DRIVE MARKET

- 8.6 POTABLE WATER

- 8.6.1 RISING DEMAND FOR SAFE AND CLEAN DRINKING WATER TO DRIVE MARKET

- 8.7 OTHER APPLICATIONS

9 REVERSE OSMOSIS MEMBRANE MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 WATER & WASTEWATER TREATMENT

- 9.2.1 RESIDENTIAL & COMMERCIAL

- 9.2.1.1 Pressing need for chemical-free clean water to boost demand

- 9.2.2 MUNICIPAL

- 9.2.2.1 Reclaiming groundwater in municipal settings to drive market

- 9.2.1 RESIDENTIAL & COMMERCIAL

- 9.3 INDUSTRIAL PROCESSING

- 9.3.1 ENERGY & POWER

- 9.3.1.1 Water treatment by RO membranes to boost plant operation efficiency

- 9.3.2 FOOD & BEVERAGE

- 9.3.2.1 Efficiency in reducing environmental impact and enabling water reuse to drive market

- 9.3.3 HEALTHCARE

- 9.3.3.1 Regulating manufacturing process of pharmaceutical ingredients to boost demand

- 9.3.4 CHEMICAL & PETROCHEMICAL

- 9.3.4.1 Selective separation properties of RO membranes to boost demand

- 9.3.5 OTHERS

- 9.3.1 ENERGY & POWER

10 REVERSE OSMOSIS MEMBRANE MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Growing industrialization and urbanization to drive market

- 10.2.2 JAPAN

- 10.2.2.1 Development of advanced technologies and industrial sector to drive market

- 10.2.3 INDIA

- 10.2.3.1 Rising environmental concerns for sustainable development to boost demand for wastewater

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Growth of food & beverage industry to drive market

- 10.2.5 AUSTRALIA

- 10.2.5.1 Rise in seawater desalination and recycling projects to drive market

- 10.2.6 REST OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Highest EU standards for wastewater treatment to drive market

- 10.3.2 SPAIN

- 10.3.2.1 Rising construction of desalinated plants to drive market

- 10.3.3 ITALY

- 10.3.3.1 Growth of food & beverage and pharmaceutical industries to drive market

- 10.3.4 UK

- 10.3.4.1 Established presence of oil & gas production fields in offshore and onshore platforms to drive market

- 10.3.5 FRANCE

- 10.3.5.1 Advancements in water treatment infrastructure to drive market

- 10.3.6 RUSSIA

- 10.3.6.1 Government focus on modernization and construction of water facilities to boost demand

- 10.3.7 TURKEY

- 10.3.7.1 Growth of industrial sector to drive market

- 10.3.8 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 NORTH AMERICA

- 10.4.1 US

- 10.4.1.1 Increase in oil production activities and rising demand for potable drinking water to drive market

- 10.4.2 CANADA

- 10.4.2.1 Expansion of food processing industries to drive market

- 10.4.3 MEXICO

- 10.4.3.1 Government initiatives and growth of manufacturing sector to drive market

- 10.4.1 US

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC

- 10.5.1.1 Saudi Arabia

- 10.5.1.1.1 Presence of tapped aquifers and network of large desalination projects to drive market

- 10.5.1.2 Rest of GCC

- 10.5.1.1 Saudi Arabia

- 10.5.2 EGYPT

- 10.5.2.1 Optimizing water usage and fostering a supportive environment to drive market

- 10.5.3 SOUTH AFRICA

- 10.5.3.1 Demand for advanced treatment technologies to boost market

- 10.5.4 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 High demand for potable and industrial processing water to drive market

- 10.6.2 ARGENTINA

- 10.6.2.1 Increase in treatment capacities and foreign investments to boost market

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 REVENUE ANALYSIS, 2021-2023

- 11.4 MARKET SHARE ANALYSIS

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

- 11.6.1 FILMTEC

- 11.6.2 TM700D

- 11.6.3 NANOH2O

- 11.6.4 PRO SERIES

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.8.1 RESPONSIVE COMPANIES

- 11.8.2 PROGRESSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 11.9 COMPETITIVE SCENARIO AND TRENDS

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.9.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 DUPONT

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and threats

- 12.1.2 TORAY INDUSTRIES, INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 LG CHEM

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Expansions

- 12.1.3.3.2 Other developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 HYDRANAUTICS (A NITTO DENKO GROUP COMPANY)

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 VEOLIA

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 TOYOBO, CO. LTD.

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 MnM view

- 12.1.7 ALFA LAVAL

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 MnM view

- 12.1.8 MANN + HUMMEL

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Services/Solutions offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.8.3.2 Expansions

- 12.1.8.4 MnM view

- 12.1.9 MERCK KGAA

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.10 KOVALUS SEPARATION SOLUTIONS

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.10.3.2 Deals

- 12.1.10.4 MnM view

- 12.1.11 MEMBRANIUM

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Services/Solutions offered

- 12.1.12 PENTAIR

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.13 THERMO FISHER SCIENTIFIC

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.14 PALL CORPORATION

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions/Services offered

- 12.1.15 BEST WATER TECHNOLOGY GROUP

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions/Services offered

- 12.1.1 DUPONT

- 12.2 OTHER PLAYERS

- 12.2.1 SYNDER FILTRATION, INC.

- 12.2.2 LENNTECH

- 12.2.3 AQUAPORIN A/S

- 12.2.4 KURITA WATER INDUSTRIES

- 12.2.5 APPLIED MEMBRANES, INC.

- 12.2.6 MEMBRACON

- 12.2.7 EUROWATER

- 12.2.8 AXEON WATER

- 12.2.9 PERMIONICS MEMBRANES PRIVATE LIMITED

- 12.2.10 VONTRON TECHNOLOGY

- 12.2.11 NEWATER

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 RELATED REPORTS

- 13.4 AUTHOR DETAILS