|

|

市場調査レポート

商品コード

1552974

顕微鏡カメラの世界市場 - 市場規模、シェア、動向:タイプ別、センサータイプ別、解像度別、用途別、エンドユーザー別、地域別 - 2029年までの予測Microscope Camera Market Size, Share & Trends by Type, Sensor, Resolution, Application, End User - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 顕微鏡カメラの世界市場 - 市場規模、シェア、動向:タイプ別、センサータイプ別、解像度別、用途別、エンドユーザー別、地域別 - 2029年までの予測 |

|

出版日: 2024年09月06日

発行: MarketsandMarkets

ページ情報: 英文 236 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の顕微鏡カメラの市場規模は、予測期間中に7.8%のCAGRで拡大し、2024年の1億9,100万米ドルから2029年には2億7,800万米ドルに成長すると予測されています。

顕微鏡カメラ市場は、慢性疾患の罹患率の上昇や顕微鏡カメラの技術の進歩など、様々な要因によって発展が見込まれています。アジア太平洋の成長見通しも、顕微鏡カメラ産業で事業を展開する企業にとって有利な条件を活用する必要があります。しかし、顕微鏡カメラの価格が高いため、市場の拡大はある程度制限されると予想されます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | タイプ別、センサータイプ別、解像度別、用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ、GCC諸国 |

顕微鏡カメラ市場のモノクロカメラセグメントとカラーカメラセグメントは、カメラのタイプに基づいて分けられています。モノクロカメラに比べカラーカメラは、はるかに迅速かつ効果的にカラー画像を生成することができます。対照的に、モノクロカメラはカラー画像を生成するために余分な技術と多数の画像取得を必要とします。その結果、2023年にはカラーカメラ・セグメントの市場シェアが拡大するとみられています。

顕微鏡カメラ市場は、センサーのタイプによって相補型金属酸化膜半導体(CMOS)センサーと電荷結合素子(CCD)センサーに分けられます。CMOSは集積化が容易で、低消費電力で動作し、フレームレートが高く、製造コストが比較的低いため、市場シェアが大きいです。また、CMOSセンサーでは、より優れた感度、低ノイズなどのハイテク機能が存在し、信頼性が高く解像度の高い画像の生成に貢献しています。これらの促進要因が、2023年にCMOSがより大きな市場を持つ理由です。

顕微鏡カメラ市場は、解像度によって標準画質と高画質の2つに分けられます。2023年、市場は高精細カメラカテゴリーが牽引し、この動向は予測期間中も続くと予測されます。今後5年間で、このセグメントはSDカメラセグメントよりも速い速度で成長すると予測されています。このセグメントの規模と急拡大の主な理由は、一般的にHDカメラへの需要が高まっていることと、それに関連して医療専門分野での高画質画像の必要性が高まっていることです。

当レポートでは、世界の顕微鏡カメラ市場について調査し、タイプ別、センサータイプ別、解像度別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- エコシステム分析

- 価格分析

- 特許分析

- バリューチェーン分析

- サプライチェーン分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 規制分析

- 貿易分析

- 技術分析

- 2024年~2025年の主な会議とイベント

- 顧客のビジネスに影響を与える動向/混乱

- ケーススタディ分析

- 生成AIが顕微鏡カメラ市場に与える影響

第6章 顕微鏡カメラ市場(タイプ別)

- イントロダクション

- モノクロカメラ

- カラーカメラ

第7章 顕微鏡カメラ市場(センサータイプ別)

- イントロダクション

- CMOSセンサー

- CCDセンサー

第8章 顕微鏡カメラ市場(解像度別)

- イントロダクション

- 高解像度(HD)カメラ

- 標準解像度(SD)カメラ

第9章 顕微鏡カメラ市場(用途別)

- イントロダクション

- 医薬品およびバイオ医薬品調査

- ライブセルイメージング

- 病理学

- その他

第10章 顕微鏡カメラ市場(エンドユーザー別)

- イントロダクション

- 製薬・バイオ医薬品企業

- 病院・診断検査室

- 学術研究機関

- その他

第11章 顕微鏡カメラ市場(地域別)

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

- GCC諸国

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要参入企業、2023年

- 競争評価マトリックス:スタートアップ/中小企業、2023年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- LEICA MICROSYSTEMS(DANAHER CORPORATION)

- NIKON CORPORATION

- CARL ZEISS AG

- EVIDENT

- TELEDYNE TECHNOLOGIES

- JENOPTIK AG

- HAMAMATSU PHOTONICS KK

- BASLER AG

- EXCELITAS TECHNOLOGIES CORP.

- THORLABS, INC.

- その他の企業

- KEYENCE CORPORATION

- ANDOR TECHNOLOGY(OXFORD INSTRUMENTS)

- SPOT IMAGING

- EUROMEX MICROSCOPEN BV

- MOTIC

- DINO-LITE DIGITAL MICROSCOPE(ANMO ELECTRONICS CORPORATION)

- MEIJI TECHNO CO.

- LABOMED, INC.

- DELTAPIX

- ADIMEC ADVANCED IMAGE SYSTEMS BV

- XIMEA GMBH

- DAGE-MTI

- GT VISION LTD.

- TUCSEN PHOTONICS CO.

- RAPTOR PHOTONICS

第14章 付録

List of Tables

- TABLE 1 MICROSCOPE CAMERA MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 MICROSCOPE CAMERA MARKET: KEY DATA FROM PRIMARY SOURCES

- TABLE 3 MICROSCOPE CAMERA MARKET: RISK ASSESSMENT ANALYSIS

- TABLE 4 MICROSCOPE CAMERA MARKET: ROLE IN ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE TREND FOR MICROSCOPE CAMERA PRODUCTS, 2021-2023

- TABLE 6 INDICATIVE LIST OF PATENTS IN MICROSCOPE CAMERA MARKET

- TABLE 7 MICROSCOPE CAMERA MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS

- TABLE 9 KEY BUYING CRITERIA FOR MICROSCOPE CAMERAS

- TABLE 10 INDICATIVE LIST OF REGULATORY AUTHORITIES IN MICROSCOPE CAMERA MARKET

- TABLE 11 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 12 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 13 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 14 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PHARMACEUTICAL AND MEDICAL DEVICE AGENCY (PMDA)

- TABLE 15 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 16 IMPORT DATA FOR MICROSCOPE CAMERAS (HS CODE 901190), BY COUNTRY, 2019-2023 (USD)

- TABLE 17 EXPORT DATA FOR MICROSCOPE CAMERAS (HS CODE 901190), BY COUNTRY, 2019-2023 (USD)

- TABLE 18 MICROSCOPE CAMERA MARKET: DETAILED LIST OF KEY CONFERENCES & EVENTS, JANUARY 2024-DECEMBER 2025

- TABLE 19 MONOCHROME CAMERAS VS. COLOR CAMERAS

- TABLE 20 MICROSCOPE CAMERA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 21 MAJOR MONOCHROME MICROSCOPE CAMERAS AVAILABLE IN MARKET

- TABLE 22 MONOCHROME CAMERA MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 23 NORTH AMERICA: MONOCHROME CAMERA MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 24 EUROPE: MONOCHROME CAMERA MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 25 ASIA PACIFIC: MONOCHROME CAMERA MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 26 LATIN AMERICA: MONOCHROME CAMERA MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 27 MAJOR COLOR CAMERAS AVAILABLE IN MARKET

- TABLE 28 COLOR CAMERA MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 29 NORTH AMERICA: COLOR CAMERA MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 30 EUROPE: COLOR CAMERA MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 31 ASIA PACIFIC: COLOR CAMERA MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 32 LATIN AMERICA: COLOR CAMERA MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 33 CMOS SENSORS VS. CCD SENSORS IN MEDICAL CAMERAS

- TABLE 34 MICROSCOPE CAMERA MARKET, BY SENSOR TYPE, 2022-2029 (USD MILLION)

- TABLE 35 MAJOR CMOS SENSOR-BASED MICROSCOPE CAMERAS AVAILABLE IN MARKET

- TABLE 36 MICROSCOPE CAMERA MARKET FOR CMOS SENSORS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 37 NORTH AMERICA: MICROSCOPE CAMERA MARKET FOR CMOS SENSORS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 38 EUROPE: MICROSCOPE CAMERA MARKET FOR CMOS SENSORS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 39 ASIA PACIFIC: MICROSCOPE CAMERA MARKET FOR CMOS SENSORS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 40 LATIN AMERICA: MICROSCOPE CAMERA MARKET FOR CMOS SENSORS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 41 MAJOR CCD SENSOR-BASED MICROSCOPE CAMERAS AVAILABLE IN MARKET

- TABLE 42 MICROSCOPE CAMERA MARKET FOR CCD SENSORS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 43 NORTH AMERICA: MICROSCOPE CAMERA MARKET FOR CCD SENSORS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 44 EUROPE: MICROSCOPE CAMERA MARKET FOR CCD SENSORS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 45 ASIA PACIFIC: MICROSCOPE CAMERA MARKET FOR CCD SENSORS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 46 LATIN AMERICA: MICROSCOPE CAMERA MARKET FOR CCD SENSORS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 47 MICROSCOPE CAMERA MARKET, BY RESOLUTION, 2022-2029 (USD MILLION)

- TABLE 48 HIGH-DEFINITION (HD) MICROSCOPE CAMERA MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 49 NORTH AMERICA: HIGH-DEFINITION (HD) MICROSCOPE CAMERA MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 50 EUROPE: HIGH-DEFINITION (HD) MICROSCOPE CAMERA MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 51 ASIA PACIFIC: HIGH-DEFINITION (HD) MICROSCOPE CAMERA MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 52 LATIN AMERICA: HIGH-DEFINITION (HD) MICROSCOPE CAMERA MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 53 STANDARD-DEFINITION (SD) MICROSCOPE CAMERA MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 54 NORTH AMERICA: STANDARD-DEFINITION (SD) MICROSCOPE CAMERA MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 55 EUROPE: STANDARD-DEFINITION (SD) MICROSCOPE CAMERA MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 56 ASIA PACIFIC: STANDARD-DEFINITION (SD) MICROSCOPE CAMERA MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 57 LATIN AMERICA: STANDARD-DEFINITION (SD) MICROSCOPE CAMERA MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 58 MICROSCOPE CAMERA MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 59 MICROSCOPE CAMERA MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL RESEARCH APPLICATIONS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 60 NORTH AMERICA: MICROSCOPE CAMERA MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL RESEARCH APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 61 EUROPE: MICROSCOPE CAMERA MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL RESEARCH APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 62 ASIA PACIFIC: MICROSCOPE CAMERA MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL RESEARCH APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 63 LATIN AMERICA: MICROSCOPE CAMERA MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL RESEARCH APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 64 MICROSCOPE CAMERA MARKET FOR LIVE CELL IMAGING APPLICATIONS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 65 NORTH AMERICA: MICROSCOPE CAMERA MARKET FOR LIVE CELL IMAGING APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 66 EUROPE: MICROSCOPE CAMERA MARKET FOR LIVE CELL IMAGING APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 67 ASIA PACIFIC: MICROSCOPE CAMERA MARKET FOR LIVE CELL IMAGING APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 68 LATIN AMERICA: MICROSCOPE CAMERA MARKET FOR LIVE CELL IMAGING APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 69 MICROSCOPE CAMERA MARKET FOR PATHOLOGY APPLICATIONS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 70 NORTH AMERICA: MICROSCOPE CAMERA MARKET FOR PATHOLOGY APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 71 EUROPE: MICROSCOPE CAMERA MARKET FOR PATHOLOGY APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 72 ASIA PACIFIC: MICROSCOPE CAMERA MARKET FOR PATHOLOGY APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 73 LATIN AMERICA: MICROSCOPE CAMERA MARKET FOR PATHOLOGY APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 74 MICROSCOPE CAMERA MARKET FOR OTHER APPLICATIONS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 75 NORTH AMERICA: MICROSCOPE CAMERA MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 76 EUROPE: MICROSCOPE CAMERA MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 77 ASIA PACIFIC: MICROSCOPE CAMERA MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 78 LATIN AMERICA: MICROSCOPE CAMERA MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 79 MICROSCOPE CAMERA MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 80 MICROSCOPE CAMERA MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 81 NORTH AMERICA: MICROSCOPE CAMERA MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 82 EUROPE: MICROSCOPE CAMERA MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 83 ASIA PACIFIC: MICROSCOPE CAMERA MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 84 LATIN AMERICA: MICROSCOPE CAMERA MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 85 MICROSCOPE CAMERA MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 86 NORTH AMERICA: MICROSCOPE CAMERA MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 87 EUROPE: MICROSCOPE CAMERA MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 88 ASIA PACIFIC: MICROSCOPE CAMERA MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 89 LATIN AMERICA: MICROSCOPE CAMERA MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 90 MICROSCOPE CAMERA MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 91 NORTH AMERICA: MICROSCOPE CAMERA MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 92 EUROPE: MICROSCOPE CAMERA MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 93 ASIA PACIFIC: MICROSCOPE CAMERA MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 94 LATIN AMERICA: MICROSCOPE CAMERA MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 95 MICROSCOPE CAMERA MARKET FOR OTHER END USERS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 96 NORTH AMERICA: MICROSCOPE CAMERA MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 97 EUROPE: MICROSCOPE CAMERA MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 98 ASIA PACIFIC: MICROSCOPE CAMERA MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 99 LATIN AMERICA: MICROSCOPE CAMERA MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 100 MICROSCOPE CAMERA MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 101 NORTH AMERICA: MICROSCOPE CAMERA MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 102 NORTH AMERICA: MICROSCOPE CAMERA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 103 NORTH AMERICA: MICROSCOPE CAMERA MARKET, BY SENSOR TYPE, 2022-2029 (USD MILLION)

- TABLE 104 NORTH AMERICA: MICROSCOPE CAMERA MARKET, BY RESOLUTION, 2022-2029 (USD MILLION)

- TABLE 105 NORTH AMERICA: MICROSCOPE CAMERA MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 106 NORTH AMERICA: MICROSCOPE CAMERA MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 107 US: MICROSCOPE CAMERA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 108 US: MICROSCOPE CAMERA MARKET, BY SENSOR TYPE, 2022-2029 (USD MILLION)

- TABLE 109 US: MICROSCOPE CAMERA MARKET, BY RESOLUTION, 2022-2029 (USD MILLION)

- TABLE 110 US: MICROSCOPE CAMERA MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 111 US: MICROSCOPE CAMERA MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 112 CANADA: MICROSCOPE CAMERA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 113 CANADA: MICROSCOPE CAMERA MARKET, BY SENSOR TYPE, 2022-2029 (USD MILLION)

- TABLE 114 CANADA: MICROSCOPE CAMERA MARKET, BY RESOLUTION, 2022-2029 (USD MILLION)

- TABLE 115 CANADA: MICROSCOPE CAMERA MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 116 CANADA: MICROSCOPE CAMERA MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 117 EUROPE: MICROSCOPE CAMERA MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 118 EUROPE: MICROSCOPE CAMERA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 119 EUROPE: MICROSCOPE CAMERA MARKET, BY SENSOR TYPE, 2022-2029 (USD MILLION)

- TABLE 120 EUROPE: MICROSCOPE CAMERA MARKET, BY RESOLUTION, 2022-2029 (USD MILLION)

- TABLE 121 EUROPE: MICROSCOPE CAMERA MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 122 EUROPE: MICROSCOPE CAMERA MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 123 GERMANY: MICROSCOPE CAMERA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 124 GERMANY: MICROSCOPE CAMERA MARKET, BY SENSOR TYPE, 2022-2029 (USD MILLION)

- TABLE 125 GERMANY: MICROSCOPE CAMERA MARKET, BY RESOLUTION, 2022-2029 (USD MILLION)

- TABLE 126 GERMANY: MICROSCOPE CAMERA MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 127 GERMANY: MICROSCOPE CAMERA MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 128 UK: MICROSCOPE CAMERA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 129 UK: MICROSCOPE CAMERA MARKET, BY SENSOR TYPE, 2022-2029 (USD MILLION)

- TABLE 130 UK: MICROSCOPE CAMERA MARKET, BY RESOLUTION, 2022-2029 (USD MILLION)

- TABLE 131 UK: MICROSCOPE CAMERA MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 132 UK: MICROSCOPE CAMERA MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 133 FRANCE: MICROSCOPE CAMERA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 134 FRANCE: MICROSCOPE CAMERA MARKET, BY SENSOR TYPE, 2022-2029 (USD MILLION)

- TABLE 135 FRANCE: MICROSCOPE CAMERA MARKET, BY RESOLUTION 2022-2029 (USD MILLION)

- TABLE 136 FRANCE: MICROSCOPE CAMERA MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 137 FRANCE: MICROSCOPE CAMERA MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 138 ITALY: MICROSCOPE CAMERA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 139 ITALY: MICROSCOPE CAMERA MARKET, BY SENSOR TYPE, 2022-2029 (USD MILLION)

- TABLE 140 ITALY: MICROSCOPE CAMERA MARKET, BY RESOLUTION, 2022-2029 (USD MILLION)

- TABLE 141 ITALY: MICROSCOPE CAMERA MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 142 ITALY: MICROSCOPE CAMERA MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 143 SPAIN: MICROSCOPE CAMERA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 144 SPAIN: MICROSCOPE CAMERA MARKET, BY SENSOR TYPE, 2022-2029 (USD MILLION)

- TABLE 145 SPAIN: MICROSCOPE CAMERA MARKET, BY RESOLUTION, 2022-2029 (USD MILLION)

- TABLE 146 SPAIN: MICROSCOPE CAMERA MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 147 SPAIN: MICROSCOPE CAMERA MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 148 REST OF EUROPE: MICROSCOPE CAMERA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 149 REST OF EUROPE: MICROSCOPE CAMERA MARKET, BY SENSOR TYPE, 2022-2029 (USD MILLION)

- TABLE 150 REST OF EUROPE: MICROSCOPE CAMERA MARKET, BY RESOLUTION, 2022-2029 (USD MILLION)

- TABLE 151 REST OF EUROPE: MICROSCOPE CAMERA MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 152 REST OF EUROPE: MICROSCOPE CAMERA MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 153 ASIA PACIFIC: MICROSCOPE CAMERA MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 154 ASIA PACIFIC: MICROSCOPE CAMERA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 155 ASIA PACIFIC: MICROSCOPE CAMERA MARKET, BY SENSOR TYPE, 2022-2029 (USD MILLION)

- TABLE 156 ASIA PACIFIC: MICROSCOPE CAMERA MARKET, BY RESOLUTION, 2022-2029 (USD MILLION)

- TABLE 157 ASIA PACIFIC: MICROSCOPE CAMERA MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 158 ASIA PACIFIC: MICROSCOPE CAMERA MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 159 JAPAN: MICROSCOPE CAMERA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 160 JAPAN: MICROSCOPE CAMERA MARKET, BY SENSOR TYPE, 2022-2029 (USD MILLION)

- TABLE 161 JAPAN: MICROSCOPE CAMERA MARKET, BY RESOLUTION, 2022-2029 (USD MILLION)

- TABLE 162 JAPAN: MICROSCOPE CAMERA MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 163 JAPAN: MICROSCOPE CAMERA MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 164 CHINA: MICROSCOPE CAMERA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 165 CHINA: MICROSCOPE CAMERA MARKET, BY SENSOR TYPE, 2022-2029 (USD MILLION)

- TABLE 166 CHINA: MICROSCOPE CAMERA MARKET, BY RESOLUTION, 2022-2029 (USD MILLION)

- TABLE 167 CHINA: MICROSCOPE CAMERA MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 168 CHINA: MICROSCOPE CAMERA MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 169 INDIA: MICROSCOPE CAMERA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 170 INDIA: MICROSCOPE CAMERA MARKET, BY SENSOR TYPE, 2022-2029 (USD MILLION)

- TABLE 171 INDIA: MICROSCOPE CAMERA MARKET, BY RESOLUTION, 2022-2029 (USD MILLION)

- TABLE 172 INDIA: MICROSCOPE CAMERA MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 173 INDIA: MICROSCOPE CAMERA MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 174 REST OF ASIA PACIFIC: MICROSCOPE CAMERA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 175 REST OF ASIA PACIFIC: MICROSCOPE CAMERA MARKET, BY SENSOR TYPE, 2022-2029 (USD MILLION)

- TABLE 176 REST OF ASIA PACIFIC: MICROSCOPE CAMERA MARKET, BY RESOLUTION, 2022-2029 (USD MILLION)

- TABLE 177 REST OF ASIA PACIFIC: MICROSCOPE CAMERA MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 178 REST OF ASIA PACIFIC: MICROSCOPE CAMERA MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 179 LATIN AMERICA: MICROSCOPE CAMERA MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 180 LATIN AMERICA: MICROSCOPE CAMERA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 181 LATIN AMERICA: MICROSCOPE CAMERA MARKET, BY SENSOR TYPE, 2022-2029 (USD MILLION)

- TABLE 182 LATIN AMERICA: MICROSCOPE CAMERA MARKET, BY RESOLUTION, 2022-2029 (USD MILLION)

- TABLE 183 LATIN AMERICA: MICROSCOPE CAMERA MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 184 LATIN AMERICA: MICROSCOPE CAMERA MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 185 BRAZIL: MICROSCOPE CAMERA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 186 BRAZIL: MICROSCOPE CAMERA MARKET, BY SENSOR TYPE, 2022-2029 (USD MILLION)

- TABLE 187 BRAZIL: MICROSCOPE CAMERA MARKET, BY RESOLUTION, 2022-2029 (USD MILLION)

- TABLE 188 BRAZIL: MICROSCOPE CAMERA MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 189 BRAZIL: MICROSCOPE CAMERA MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 190 MEXICO: MICROSCOPE CAMERA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 191 MEXICO: MICROSCOPE CAMERA MARKET, BY SENSOR TYPE, 2022-2029 (USD MILLION)

- TABLE 192 MEXICO: MICROSCOPE CAMERA MARKET, BY RESOLUTION, 2022-2029 (USD MILLION)

- TABLE 193 MEXICO: MICROSCOPE CAMERA MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 194 MEXICO: MICROSCOPE CAMERA MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 195 REST OF LATIN AMERICA MICROSCOPE CAMERA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 196 REST OF LATIN AMERICA: MICROSCOPE CAMERA MARKET, BY SENSOR TYPE, 2022-2029 (USD MILLION)

- TABLE 197 REST OF LATIN AMERICA: MICROSCOPE CAMERA MARKET, BY RESOLUTION, 2022-2029 (USD MILLION)

- TABLE 198 REST OF LATIN AMERICA: MICROSCOPE CAMERA MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 199 REST OF LATIN AMERICA: MICROSCOPE CAMERA MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: MICROSCOPE CAMERA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: MICROSCOPE CAMERA MARKET, BY SENSOR TYPE, 2022-2029 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: MICROSCOPE CAMERA MARKET, BY RESOLUTION, 2022-2029 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: MICROSCOPE CAMERA MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: MICROSCOPE CAMERA MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 205 GCC COUNTRIES: MICROSCOPE CAMERA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 206 GCC COUNTRIES: MICROSCOPE CAMERA MARKET, BY SENSOR TYPE, 2022-2029 (USD MILLION)

- TABLE 207 GCC COUNTRIES: MICROSCOPE CAMERA MARKET, BY RESOLUTION, 2022-2029 (USD MILLION)

- TABLE 208 GCC COUNTRIES: MICROSCOPE CAMERA MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 209 GCC COUNTRIES: MICROSCOPE CAMERA MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 210 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN MICROSCOPE CAMERA MARKET

- TABLE 211 MICROSCOPE CAMERA MARKET: DEGREE OF COMPETITION

- TABLE 212 MICROSCOPE CAMERA MARKET: TYPE FOOTPRINT

- TABLE 213 MICROSCOPE CAMERA MARKET: SENSOR TYPE FOOTPRINT

- TABLE 214 MICROSCOPE CAMERA MARKET: APPLICATION FOOTPRINT

- TABLE 215 MICROSCOPE CAMERA MARKET: REGION FOOTPRINT

- TABLE 216 MICROSCOPE CAMERA MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 217 MICROSCOPE CAMERA MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 218 MICROSCOPE CAMERA MARKET: PRODUCT LAUNCHES, JANUARY 2021-JULY 2024

- TABLE 219 MICROSCOPE CAMERA MARKET: DEALS, JANUARY 2021-JULY 2024

- TABLE 220 LEICA MICROSYSTEMS (DANAHER CORPORATION): COMPANY OVERVIEW

- TABLE 221 LEICA MICROSYSTEMS (DANAHER CORPORATION): PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 222 NIKON CORPORATION: COMPANY OVERVIEW

- TABLE 223 NIKON CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 224 NIKON CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-JULY 2024

- TABLE 225 CARL ZEISS AG: COMPANY OVERVIEW

- TABLE 226 CARL ZEISS AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 227 CARL ZEISS AG: DEALS, JANUARY 2021-JULY 2024

- TABLE 228 EVIDENT: COMPANY OVERVIEW

- TABLE 229 EVIDENT: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 230 EVIDENT: PRODUCT LAUNCHES, JANUARY 2021-JULY 2024

- TABLE 231 EVIDENT: DEALS, JANUARY 2021-JULY 2024

- TABLE 232 TELEDYNE TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 233 TELEDYNE TECHNOLOGIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 234 JENOPTIK AG: COMPANY OVERVIEW

- TABLE 235 JENOPTIK AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 236 JENOPTIK AG: EXPANSIONS, JANUARY 2021-JULY 2024

- TABLE 237 HAMAMATSU PHOTONICS KK: COMPANY OVERVIEW

- TABLE 238 HAMAMATSU PHOTONICS KK: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 239 BASLER AG: COMPANY OVERVIEW

- TABLE 240 BASLER AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 241 EXCELITAS TECHNOLOGIES CORP.: COMPANY OVERVIEW

- TABLE 242 EXCELITAS TECHNOLOGIES CORP.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 243 THORLABS, INC.: COMPANY OVERVIEW

- TABLE 244 THORLABS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 245 KEYENCE CORPORATION: COMPANY OVERVIEW

- TABLE 246 ANDOR TECHNOLOGY: COMPANY OVERVIEW

- TABLE 247 SPOT IMAGING: COMPANY OVERVIEW

- TABLE 248 EUROMEX MICROSCOPEN BV: COMPANY OVERVIEW

- TABLE 249 MOTIC: COMPANY OVERVIEW

- TABLE 250 DINO-LITE DIGITAL MICROSCOPE: COMPANY OVERVIEW

- TABLE 251 MEIJI TECHNO CO.: COMPANY OVERVIEW

- TABLE 252 LABOMED, INC.: COMPANY OVERVIEW

- TABLE 253 DELTAPIX: COMPANY OVERVIEW

- TABLE 254 ADIMEC ADVANCED IMAGE SYSTEMS BV: COMPANY OVERVIEW

- TABLE 255 XIMEA GMBH: COMPANY OVERVIEW

- TABLE 256 DAGE-MTI: COMPANY OVERVIEW

- TABLE 257 GT VISION LTD.: COMPANY OVERVIEW

- TABLE 258 TUCSEN PHOTONICS CO.: COMPANY OVERVIEW

- TABLE 259 RAPTOR PHOTONICS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MICROSCOPE CAMERA MARKET SEGMENTATION

- FIGURE 2 MICROSCOPE CAMERA MARKET: YEARS CONSIDERED

- FIGURE 3 MICROSCOPE CAMERA MARKET: RESEARCH DESIGN

- FIGURE 4 KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 KEY PRIMARY SOURCES: DEMAND AND SUPPLY SIDES

- FIGURE 6 MICROSCOPE CAMERA MARKET: KEY INSIGHTS FROM PRIMARY EXPERTS

- FIGURE 7 BREAKDOWN OF PRIMARIES: SUPPLY- AND DEMAND-SIDE PARTICIPANTS

- FIGURE 8 BREAKDOWN OF PRIMARIES: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 9 COMPANY REVENUE ESTIMATION APPROACH

- FIGURE 10 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 11 MICROSCOPE CAMERA MARKET: TOP-DOWN APPROACH

- FIGURE 12 MICROSCOPE CAMERA MARKET: DATA TRIANGULATION METHODOLOGY

- FIGURE 13 MICROSCOPE CAMERA MARKET, BY CAMERA TYPE, 2024 VS. 2029(USD MILLION)

- FIGURE 14 MICROSCOPE CAMERA MARKET, BY SENSOR TYPE, 2024 VS. 2029(USD MILLION)

- FIGURE 15 MICROSCOPE CAMERA MARKET, BY RESOLUTION, 2024 VS. 2029(USD MILLION)

- FIGURE 16 MICROSCOPE CAMERA MARKET, BY APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 17 MICROSCOPE CAMERA MARKET, BY END USER, 2024 VS. 2029 (USD MILLION)

- FIGURE 18 MICROSCOPE CAMERA MARKET: GEOGRAPHICAL SNAPSHOT

- FIGURE 19 TECHNOLOGICAL ADVANCEMENTS IN MICROSCOPE CAMERAS AND INCREASING CHRONIC DISEASE PREVALENCE TO DRIVE MARKET

- FIGURE 20 COLOR CAMERA SEGMENT TO DOMINATE MARKET TILL 2029

- FIGURE 21 CMOS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 22 HD SEGMENT TO ACCOUNT FOR LARGER SHARE

- FIGURE 23 PHARMACEUTICAL & BIOPHARMACEUTICAL RESEARCH TO RETAIN DOMINANCE IN APPLICATIONS MARKET

- FIGURE 24 PHARMA & BIOTECH COMPANIES AND HOSPITAL & DIAGNOSTIC LABS TO HOLD LARGEST SHARES

- FIGURE 25 APAC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 26 MICROSCOPE CAMERA MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 27 MICROSCOPE CAMERA MARKET: ECOSYSTEM MAP

- FIGURE 28 PATENT APPLICATIONS FOR MICROSCOPE CAMERA MARKET, JANUARY 2013-DECEMBER 2023

- FIGURE 29 MICROSCOPE CAMERA MARKET: VALUE CHAIN ANALYSIS

- FIGURE 30 MICROSCOPE CAMERA MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 31 MICROSCOPE CAMERA MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS

- FIGURE 33 KEY BUYING CRITERIA FOR MICROSCOPE CAMERA

- FIGURE 34 PREMARKET NOTIFICATION: 510(K) APPROVALS FOR MEDICAL DEVICES

- FIGURE 35 CANADA: REGULATORY APPROVAL PROCESS FOR MEDICAL DEVICES

- FIGURE 36 EUROPE: CE APPROVAL PROCESS FOR MEDICAL DEVICES

- FIGURE 37 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 38 NORTH AMERICA: MICROSCOPE CAMERA MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: MICROSCOPE CAMERA MARKET SNAPSHOT

- FIGURE 40 REVENUE ANALYSIS OF KEY PLAYERS IN MICROSCOPE CAMERA MARKET (2021-2023)

- FIGURE 41 MARKET SHARE ANALYSIS OF KEY PLAYERS IN MICROSCOPE CAMERA MARKET (2023)

- FIGURE 42 MICROSCOPE CAMERA MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 43 MICROSCOPE CAMERA MARKET: COMPANY FOOTPRINT

- FIGURE 44 MICROSCOPE CAMERA MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 45 EV/EBITDA OF KEY VENDORS

- FIGURE 46 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 47 MICROSCOPE CAMERA MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 48 LEICA MICROSYSTEMS (DANAHER CORPORATION): COMPANY SNAPSHOT (2023)

- FIGURE 49 NIKON CORPORATION: COMPANY SNAPSHOT (2023)

- FIGURE 50 CARL ZEISS AG: COMPANY SNAPSHOT (2023)

- FIGURE 51 TELEDYNE TECHNOLOGIES: COMPANY SNAPSHOT (2023)

- FIGURE 52 JENOPTIK AG: COMPANY SNAPSHOT (2023)

- FIGURE 53 HAMAMATSU PHOTONICS KK: COMPANY SNAPSHOT (2023)

- FIGURE 54 BASLER AG: COMPANY SNAPSHOT (2023)

At a CAGR of 7.8% over the course of the forecast period, the global market for microscope cameras is expected to grow from an estimated USD 191 million in 2024 to USD 278 million by 2029. The market for microscope cameras is expected to develop due to various factors, including the rising incidence of chronic illnesses and the advancement of technology in these cameras. Growth prospects in the Asia-Pacific area should also take advantage of favorable conditions for companies operating in the microscope camera industry. However, it is anticipated that the high price of microscope cameras will limit market expansion to some degree.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, sensor type, resolution, application, end user, and region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, the Middle East & Africa, and GCC Countries |

"Color Cameras segment accounted for the higher market share."

The monochrome and color camera segments of the microscope camera market are separated based on the type of camera. Compared to monochrome cameras, color cameras can produce color images far more swiftly and effectively. In contrast, monochrome cameras require extra technology and the acquisition of numerous images in order to generate a color image. As a result, in 2023 the color camera segment will have a greater market share.

"The CMOS segment accounted for the market share in the microscope camera market, by sensor type, during the forecast period."

The market for microscope cameras is divided into complementary metal oxide semiconductor (CMOS) and charge-coupled device (CCD) sensors based on the type of sensor. Because CMOS is easier to integrate, operates at a lower power consumption, has a higher frame rate, and has relatively low manufacturing costs, it holds a larger market share. Also, in CMOS sensors, presence of high-tech features such as better sensitivity, low-noise are prsesnt which contribute in generating reliable and good resolution images. These drivers are reason to CMOS having more market in 2023..

"HD segment accounted for the highest share."

The market for microscope cameras is divided into two categories based on resolution: standard definition and high definition. In 2023, the market was led by the high-definition camera category, and this trend is anticipated to hold true for the duration of the forecast. Over the next five years, this segment is anticipated to grow at a faster rate than the SD cameras segment. The primary reasons for this segment's size and rapid expansion are the increasing demand for HD cameras generally and the related necessity for high-quality images in medical specialties.

"Biopharmaceutical & pharmaceutical research segment accounted for the highest share."

Live cell imaging, pathology, pharmaceutical and biopharmaceutical research, and other applications are the segments of the microscope camera market based on their applications. In 2023, the pharmaceutical and biopharmaceutical research segment held the most market share, with live cell imaging coming in second. The majority can be attributed to the growing use of microscope cameras in protein structures, biomarker research, and mechanical characterization.

"Biopharmaceutical & pharmaceutical companies segment accounted for the highest share."

The market for microscope cameras can be divided into academic and research institutions, pharmaceutical and biopharmaceutical firms, hospital and diagnostic labs, and other end users, which include CROs, diagnostic centers, blood banks, and forensic laboratories. The segment including biopharmaceutical and pharmaceutical firms held the largest market due to the fact that microscope cameras are an essential tool for research, formulation, and production when using microscopes in various stages of pharmaceutical drug development.

"Asia Pacific: The fastest-growing region in cancer biomarkers market."

The global cancer biomarkers market is segmented into North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa and GCC Countries. The Asia Pacific region is projected to register the highest CAGR during the forecast period, primarily due to a number of factors including the rise in R&D funding for microscope camera-based research, the expansion of correlative microscope applications in life science and nanotechnology research, the creation of collaboration centers for microscope research, the low cost of materials and the availability of skilled labor at a low cost for OEMS. However, the primary factors impeding the growth of this industry are the lack of infrastructure, the slowdown in the Chinese economy, the uncertainty surrounding the macroeconomic climate, and the scarcity of skilled labor.

Breakdown of supply-side primary interviews, by company type, designation, and region:

- By Company Type: Tier 1 (40%), Tier 2 (30%), and Tier 3 (30%)

- By Designation: C-level (27%), Director-level (18%), and Others (55%)

- By Region: North America (51%), Europe (21%), Asia- Pacific (18%), Latin America (6%), and Middle East & Africa(4%)

Lists of Companies Profiled in the Report:

- Leica Microsystems, Inc. (Danaher Corporation) (US)

- Nikon Corporation (Japan)

- Carl Zeiss AG (Germany)

- Teledyne Technologies (US)

- EVIDENT (Japan)

- Jenoptik AG (Germany)

- Hamamatsu Photonics KK (Japan)

- Basler AG (Germany)

- Excelitas Technologies Corp. (US)

- Thorlabs, Inc. (US)

- Keyence Corporation (Japan)

- Andor Technology (Oxford Instruments) (Ireland)

- Spot Imaging (US)

- Euromex Microscopen BV (Netherlands)

- Motic (China)

- Dino-Lite Microscope (AnMo Electronics Corporation) (Taiwan)

- Meiji Techno Co. (Japan)

- Labomed Inc. (US), DeltaPix (Denmark)

- Adimec Advanced Image Systems BV (Netherlands)

- XIMEA Gmbh (Germany), Dage-MTI (US)

- GT Vision Ltd. (UK)

- Tucsen Photonics Co. (China)

- Raptor Photonics (Ireland).

Research Coverage

This research report categorizes the microscope camera market by type, sensor type, resolution, application, end-user and region. The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the microscope camera market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements, new product & service launches, mergers and acquisitions; and recent developments associated with the microscope camera market. Competitive analysis of upcoming startups in the optometry equipment market ecosystem is covered in this report.

Reasons to buy this report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall microscope camera market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Technological advancements and reduced prices of DNA sequencing, Growing importance and use of genotyping in drug discovery and development), restraints (High manufacturing, installation, and maintenance costs of genotyping instruments), opportunities (Increasing application areas in genomics and genotyping analysis for animal genetics and agricultural biotechnology), and challenges (lack of adequate data management in genomics research) influencing the growth of the microscope camera market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the microscope camera market

- Market Development: Comprehensive information about lucrative markets - the report analyses the microscope camera market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the microscope camera market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Leica Microsystems, Inc. (Danaher Corporation) (US), Nikon Corporation (Japan), Carl Zeiss AG (Germany), Teledyne Technologies (US), and EVIDENT (Japan), among others in the microscope camera market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.3.3 CURRENCY CONSIDERED

- 1.4 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.1.3 Objectives of secondary research

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources: Demand and supply sides

- 2.1.2.2 Objectives of primary research

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Insights from primary experts

- 2.1.2.5 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Company revenue estimation approach

- 2.2.1.2 Company presentations and primary interviews

- 2.2.1.3 Growth forecasts

- 2.2.1.4 CAGR projections

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.4 STUDY ASSUMPTIONS

- 2.5 GROWTH RATE ASSUMPTIONS

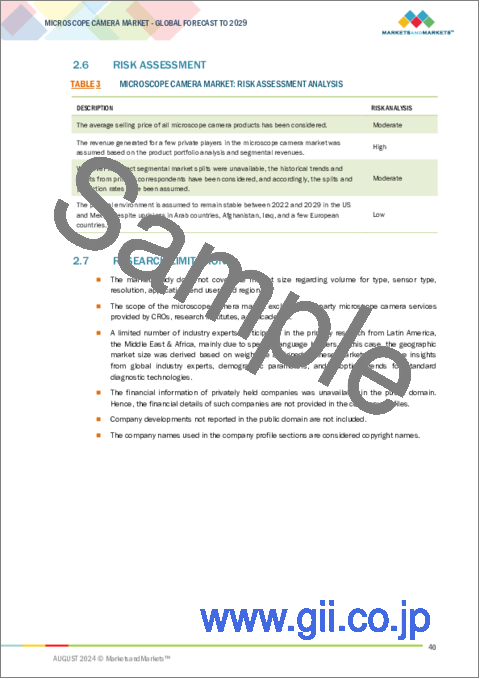

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 MICROSCOPE CAMERA MARKET OVERVIEW

- 4.2 MICROSCOPE CAMERA MARKET SHARE, BY TYPE, 2024 VS. 2029

- 4.3 MICROSCOPE CAMERA MARKET SHARE, BY SENSOR TYPE, 2024 VS. 2029

- 4.4 MICROSCOPE CAMERA MARKET SHARE, BY RESOLUTION, 2024 VS. 2029

- 4.5 MICROSCOPE CAMERA MARKET SHARE, BY APPLICATION, 2024 VS. 2029

- 4.6 MICROSCOPE CAMERA MARKET SHARE, BY END USER, 2024 VS. 2029

- 4.7 MICROSCOPE CAMERA MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing incidence of cancer and chronic diseases

- 5.2.1.2 Technological advancements in microscope cameras

- 5.2.2 RESTRAINTS

- 5.2.2.1 High installation and maintenance cost of microscope cameras

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth prospects in developing APAC and MEA countries

- 5.2.4 CHALLENGES

- 5.2.4.1 Dearth of trained personnel

- 5.2.4.2 Availability of refurbished products

- 5.2.1 DRIVERS

- 5.3 ECOSYSTEM ANALYSIS

- 5.3.1 ROLE IN ECOSYSTEM

- 5.4 PRICING ANALYSIS

- 5.4.1 PRICING ANALYSIS FOR MICROSCOPE CAMERA PRODUCTS, 2021-2023

- 5.5 PATENT ANALYSIS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.7.1 PROMINENT COMPANIES

- 5.7.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 5.7.3 END USERS

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 KEY BUYING CRITERIA

- 5.10 REGULATORY ANALYSIS

- 5.10.1 REGULATORY LANDSCAPE

- 5.10.1.1 North America

- 5.10.1.1.1 US

- 5.10.1.1.2 Canada

- 5.10.1.2 Europe

- 5.10.1.3 Asia Pacific

- 5.10.1.3.1 Japan

- 5.10.1.3.2 China

- 5.10.1.3.3 India

- 5.10.1.4 Latin America

- 5.10.1.5 Middle East

- 5.10.1.1 North America

- 5.10.1 REGULATORY LANDSCAPE

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA FOR MICROSCOPE CAMERAS

- 5.11.2 EXPORT DATA FOR MICROSCOPE CAMERAS

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 KEY TECHNOLOGIES

- 5.12.1.1 Teledyne EMCCD technology

- 5.12.2 COMPLEMENTARY TECHNOLOGIES

- 5.12.2.1 Olympus' color profiling technology

- 5.12.1 KEY TECHNOLOGIES

- 5.13 KEY CONFERENCES & EVENTS, 2024-2025

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 USE OF MICROSCOPE CAMERAS IN MARINE RESEARCH HELP IN ANALYZING MARINE MICROFOSSILS

- 5.16 IMPACT OF GENERATIVE AI ON MICROSCOPE CAMERA MARKET

6 MICROSCOPE CAMERA MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 MONOCHROME CAMERAS

- 6.2.1 HIGH SENSITIVITY OF MONOCHROME CAMERAS TO BOOST ADOPTION

- 6.3 COLOR CAMERAS

- 6.3.1 GROWING PREFERENCE FOR COLORED IMAGES IN MEDICAL APPLICATIONS TO FAVOR MARKET GROWTH

7 MICROSCOPE CAMERA MARKET, BY SENSOR TYPE

- 7.1 INTRODUCTION

- 7.2 CMOS SENSORS

- 7.2.1 CMOS SENSORS TO DOMINATE MICROSCOPE CAMERA MARKET DURING FORECAST PERIOD

- 7.3 CCD SENSORS

- 7.3.1 DISCONTINUATION OF CCD SENSORS BY PLAYERS IN MARKET TO HAMPER MARKET GROWTH

8 MICROSCOPE CAMERA MARKET, BY RESOLUTION

- 8.1 INTRODUCTION

- 8.2 HIGH-DEFINITION (HD) CAMERAS

- 8.2.1 TECHNOLOGICAL ADVANCEMENTS IN HIGH-DEFINITION CAMERAS TO SUPPORT MARKET GROWTH

- 8.3 STANDARD-DEFINITION (SD) CAMERAS

- 8.3.1 AVAILABILITY OF BETTER-RESOLUTION CAMERAS TO CHALLENGE MARKET GROWTH IN COMING YEARS

9 MICROSCOPE CAMERA MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 PHARMACEUTICAL & BIOPHARMACEUTICAL RESEARCH

- 9.2.1 GREATER ADOPTION OF MICROSCOPES AND NEED FOR MICROSCOPE CAMERAS IN MICROSCALE ANALYSIS TO DRIVE SEGMENT

- 9.3 LIVE CELL IMAGING

- 9.3.1 CONTINUOUS ADVANCEMENTS IN MICROSCOPE CAMERAS TO PLAY PIVOTAL ROLE IN GROWTH OF LIVE CELL IMAGING MARKET

- 9.4 PATHOLOGY

- 9.4.1 NEED FOR TIME-EFFICIENT AND QUICK IDENTIFICATION OF INFECTION-CAUSING AGENTS TO BOOST DEMAND

- 9.5 OTHER APPLICATIONS

10 MICROSCOPE CAMERA MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES

- 10.2.1 GROWING DEMAND FOR ADVANCED TECHNIQUES FOR DRUG DEVELOPMENT TO AUGMENT MARKET GROWTH

- 10.3 HOSPITALS & DIAGNOSTIC LABORATORIES

- 10.3.1 RISING DEMAND FOR TECHNOLOGICALLY ADVANCED MICROSCOPE CAMERA PRODUCTS TO AID MARKET GROWTH

- 10.4 ACADEMIC & RESEARCH INSTITUTES

- 10.4.1 SUPPORTIVE GOVERNMENT AND COMMERCIAL SECTORS TO DRIVE MARKET GROWTH

- 10.5 OTHER END USERS

11 MICROSCOPE CAMERA MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Rise in chronic disease prevalence to drive market

- 11.2.2 CANADA

- 11.2.2.1 Surge in cancer cases to boost market

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Favorable funding in microscope cameras, illumination, and laser technology fields to propel market

- 11.3.2 UK

- 11.3.2.1 Rising geriatric population to stimulate growth

- 11.3.3 FRANCE

- 11.3.3.1 Robust research financing to foster growth

- 11.3.4 ITALY

- 11.3.4.1 Advanced healthcare system to support growth

- 11.3.5 SPAIN

- 11.3.5.1 Increased R&D funding to boost market

- 11.3.6 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 JAPAN

- 11.4.1.1 Presence of major market players to propel market

- 11.4.2 CHINA

- 11.4.2.1 Surge in microbiology and molecular science research to aid growth

- 11.4.3 INDIA

- 11.4.3.1 Growing focus on biotechnology industry to augment growth

- 11.4.4 REST OF ASIA PACIFIC

- 11.4.1 JAPAN

- 11.5 LATIN AMERICA

- 11.5.1 BRAZIL

- 11.5.1.1 Booming nanotechnology field to boost market

- 11.5.2 MEXICO

- 11.5.2.1 Growing prevalence of chronic diseases to favor market growth

- 11.5.3 REST OF LATIN AMERICA

- 11.5.1 BRAZIL

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 GOVERNMENT INITIATIVES TO IMPROVE HEALTHCARE INFRASTRUCTURE TO FAVOR MARKET GROWTH

- 11.7 GCC COUNTRIES

- 11.7.1 RISING GOVERNMENT EXPENDITURE TO DRIVE MARKET

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MICROSCOPE CAMERA MARKET

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.5.5.1 Company footprint

- 12.5.5.2 Type footprint

- 12.5.5.3 Sensor type footprint

- 12.5.5.4 Application footprint

- 12.5.5.5 Region footprint

- 12.6 COMPETITIVE EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 12.7 COMPANY VALUATION & FINANCIAL METRICS

- 12.8 BRAND/PRODUCT COMPARISON

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 LEICA MICROSYSTEMS (DANAHER CORPORATION)

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Services/Solutions offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM View

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 NIKON CORPORATION

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Services/Solutions offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.4 MnM View

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 CARL ZEISS AG

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Services/Solutions offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 EVIDENT

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Services/Solutions offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 TELEDYNE TECHNOLOGIES

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Services/Solutions offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses and competitive threats

- 13.1.6 JENOPTIK AG

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Services/Solutions offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Expansions

- 13.1.7 HAMAMATSU PHOTONICS KK

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Services/Solutions offered

- 13.1.8 BASLER AG

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Services/Solutions offered

- 13.1.9 EXCELITAS TECHNOLOGIES CORP.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Services/Solutions offered

- 13.1.10 THORLABS, INC.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Services/Solutions offered

- 13.1.1 LEICA MICROSYSTEMS (DANAHER CORPORATION)

- 13.2 OTHER PLAYERS

- 13.2.1 KEYENCE CORPORATION

- 13.2.2 ANDOR TECHNOLOGY (OXFORD INSTRUMENTS)

- 13.2.3 SPOT IMAGING

- 13.2.4 EUROMEX MICROSCOPEN BV

- 13.2.5 MOTIC

- 13.2.6 DINO-LITE DIGITAL MICROSCOPE (ANMO ELECTRONICS CORPORATION)

- 13.2.7 MEIJI TECHNO CO.

- 13.2.8 LABOMED, INC.

- 13.2.9 DELTAPIX

- 13.2.10 ADIMEC ADVANCED IMAGE SYSTEMS BV

- 13.2.11 XIMEA GMBH

- 13.2.12 DAGE-MTI

- 13.2.13 GT VISION LTD.

- 13.2.14 TUCSEN PHOTONICS CO.

- 13.2.15 RAPTOR PHOTONICS

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS