|

|

市場調査レポート

商品コード

1546638

仮想データルームの世界市場:オファリング別、文書タイプ別、技術別、用途別、エンドユーザー別、地域別 - 2029年までの予測Virtual Data Room Market by Data Storage & Management (Database, Content), Security (Encryption, DRM, DLP), Document Type (Contracts & Agreements, IP), Application (M&A Due Diligence, Document Management, Audit, Compliance) - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 仮想データルームの世界市場:オファリング別、文書タイプ別、技術別、用途別、エンドユーザー別、地域別 - 2029年までの予測 |

|

出版日: 2024年08月29日

発行: MarketsandMarkets

ページ情報: 英文 337 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

仮想データルームの市場規模は、2024年の25億米ドルから2029年には56億米ドルへと、予測期間中のCAGR18.1%で拡大すると予測されています。

同市場は、ナビゲーションを容易にするための階層的な文書整理に対する需要の高まり、デジタル文書の評価と効率的な共有のための統一された集中アクセスポイントの提供機能、デューデリジェンスプロセスの合理化と利害関係者間のコラボレーション改善の必要性などから、成長が見込まれています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 米ドル(10億米ドル) |

| セグメント | オファリング別、文書タイプ別、技術別、用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、アジア太平洋、欧州、中東・アフリカ、ラテンアメリカ |

AIアシスト再編集ソフトウェアは、機密データ保護プロセスを自動化・合理化する能力により、バーチャルデータルームで最も高いCAGRを記録しています。企業が大量の機密情報を管理するようになるにつれ、手作業による再編集は非効率的でミスが発生しやすくなります。AIを活用したツールは、様々な種類の文書に含まれる機密データを迅速に特定し、再編集することができるため、人為的ミスのリスクを低減し、データ保護規制へのコンプライアンスを確保することができます。さらに、業界全体でAI技術の採用が進んでいることや、安全で効率的なデータ管理ソリューションの必要性が、AI支援型再編集ソフトウェアの需要を促進しており、バーチャル・データ・ルーム市場の主要成長分野となっています。

アジア太平洋は、急速なデジタル化、M&A活動の増加、中国、インド、東南アジアなどの新興国における安全なデータ管理のニーズの高まりにより、バーチャルデータルーム市場で最も高いCAGRを記録しています。同地域の技術インフラの拡大とデータプライバシー規制に対する意識の高まりが、バーチャル・データルームの需要を後押ししています。

当レポートでは、世界の仮想データルーム市場について調査し、オファリング別、文書タイプ別、技術別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 仮想データルーム市場の進化

- サプライチェーン分析

- エコシステム分析

- ケーススタディ分析

- 技術分析

- 主要な会議とイベント(2024年~2025年)

- 投資情勢と資金調達シナリオ

- 規制状況

- 特許分析

- 価格分析

- ポーターのファイブフォース分析

- 顧客のビジネスに影響を与える動向/混乱

- 主な利害関係者と購入基準

- 生成AIが仮想データルーム市場に与える影響

第6章 仮想データルーム市場、オファリング別

- イントロダクション

- ソフトウェアタイプ

- 展開モード別ソフトウェア

- サービス

第7章 仮想データルーム市場、文書タイプ別

- イントロダクション

- 財務諸表

- 契約と合意

- 法務およびコーポレートガバナンス

- 知的財産(IP)と従業員記録

- その他

第8章 仮想データルーム市場、技術別

- イントロダクション

- データの保存と管理

- セキュリティ

- 分類とコラボレーション

- インテリジェンスと検索

第9章 仮想データルーム市場、用途別

- イントロダクション

- M&Aデューデリジェンス

- 文書管理

- フランチャイズ管理

- 監査、リスク、コンプライアンス管理

- アクセス制御と権限管理

- 資産とワークフローの管理

- 資金調達とIP管理

- 自動転送とトピックマッピング

- その他

第10章 仮想データルーム市場、エンドユーザー別

- イントロダクション

- エンドユーザー、業種別

- 役割固有のユーザー

第11章 仮想データルーム市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 製品比較分析

- 主要ベンダーの企業評価と財務指標

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオと動向

第13章 企業プロファイル

- イントロダクション

- 主要参入企業

- SS&C INTRALINKS

- BOX

- DATASITE

- THOMSON REUTERS

- DONNELLEY FINANCIAL SOLUTIONS

- MICROSOFT

- ANSARADA

- PANDADOC

- EGNYTE

- IDEALS

- SMARTROOM

- VITRIUM SYSTEMS

- SHAREVAULT

- FORDATA

- ETHOSDATA

- CAPLINKED

- IMPRIMA

- MIDAXO

- FUSEBASE

- ONIT

- スタートアップ/中小企業

- FIRMSDATA

- CONFIEX DATA ROOM

- DROOMS

- BIT.AI

- DCIRRUS

- VIRTUAL VAULTS

- FIRMEX

- DEALLINK

- PACTCENTRAL

- DOCULLYVDR

第14章 隣接市場と関連市場

第15章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2019-2023

- TABLE 2 PRIMARY INTERVIEWS

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 GLOBAL VIRTUAL DATA ROOM MARKET SIZE AND GROWTH RATE, 2019-2023 (USD MILLION, Y-O-Y %)

- TABLE 5 GLOBAL VIRTUAL DATA ROOM MARKET SIZE AND GROWTH RATE, 2024-2029 (USD MILLION, Y-O-Y %)

- TABLE 6 VIRTUAL DATA ROOM MARKET: ECOSYSTEM

- TABLE 7 VIRTUAL DATA ROOM MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2024-2025

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 PATENTS FILED, 2014-2024

- TABLE 14 VIRTUAL DATA ROOM MARKET: TOP 20 PATENT OWNERS, 2014-2024

- TABLE 15 VIRTUAL DATA ROOM MARKET: LIST OF PATENTS GRANTED, 2023-2024

- TABLE 16 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP 3 APPLICATIONS

- TABLE 17 INDICATIVE PRICING OF VIRTUAL DATA ROOM MARKET, BY APPLICATION

- TABLE 18 VIRTUAL DATA ROOM MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 20 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 21 VIRTUAL DATA ROOM MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 22 VIRTUAL DATA ROOM MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 23 VIRTUAL DATA ROOM MARKET, BY SOFTWARE TYPE, 2019-2023 (USD MILLION)

- TABLE 24 VIRTUAL DATA ROOM MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 25 SOFTWARE BY TYPE: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 26 SOFTWARE BY TYPE: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 27 AI CONTRACT ANALYTICS: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 28 AI CONTRACT ANALYTICS: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 29 DOCUMENT SHARING SYSTEM: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 30 DOCUMENT SHARING SYSTEM: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 31 AI-ASSISTED REDACTION: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

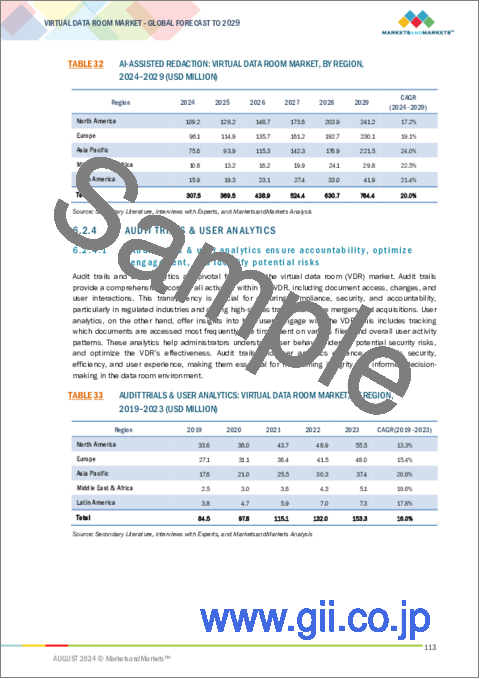

- TABLE 32 AI-ASSISTED REDACTION: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 33 AUDIT TRIALS & USER ANALYTICS: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 34 AUDIT TRIALS & USER ANALYTICS: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 35 COLLABORATION TOOLS: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 36 COLLABORATION TOOLS: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 37 AI TRANSLATION: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 38 AI TRANSLATION: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 39 VIRTUAL DATA ROOM MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 40 VIRTUAL DATA ROOM MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 41 CLOUD: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 42 CLOUD: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 43 ON-PREMISES: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 44 ON-PREMISES: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 45 VIRTUAL DATA ROOM MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 46 VIRTUAL DATA ROOM MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 47 SERVICES: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 48 SERVICES: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 49 VIRTUAL DATA ROOM MARKET, BY PROFESSIONAL SERVICE, 2019-2023 (USD MILLION)

- TABLE 50 VIRTUAL DATA ROOM MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 51 PROFESSIONAL SERVICES: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 52 PROFESSIONAL SERVICES: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 53 CONSULTING & ADVISORY: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 54 CONSULTING & ADVISORY: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 55 INTEGRATION & DEPLOYMENT: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 56 INTEGRATION & DEPLOYMENT: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 57 DATA ROOM TRAINING: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 58 DATA ROOM TRAINING: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 59 ASSET ONBOARDING & DATA MIGRATION: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 60 ASSET ONBOARDING & DATA MIGRATION: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 61 MANAGED SERVICES: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 62 MANAGED SERVICES: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 63 VIRTUAL DATA ROOM MARKET, BY DOCUMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 64 VIRTUAL DATA ROOM MARKET, BY DOCUMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 65 FINANCIAL STATEMENTS: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 66 FINANCIAL STATEMENTS: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 67 CONTRACTS & AGREEMENTS: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 68 CONTRACTS & AGREEMENTS: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 69 LEGAL & CORPORATE GOVERNANCE: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 70 LEGAL & CORPORATE GOVERNANCE: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 71 INTELLECTUAL PROPERTY (IP) & EMPLOYEE RECORDS: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 72 INTELLECTUAL PROPERTY (IP) & EMPLOYEE RECORDS: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 73 OTHER DOCUMENT TYPES: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 74 OTHER DOCUMENT TYPES: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 75 VIRTUAL DATA ROOM MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 76 VIRTUAL DATA ROOM MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 77 DATA STORAGE & MANAGEMENT: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 78 DATA STORAGE & MANAGEMENT: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 79 SECURITY: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 80 SECURITY: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 81 CLASSIFICATION & COLLABORATION: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 82 CLASSIFICATION & COLLABORATION: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 83 INTELLIGENCE & SEARCH: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 84 INTELLIGENCE & SEARCH: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 85 VIRTUAL DATA ROOM MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 86 VIRTUAL DATA ROOM MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 87 M&A DUE DILIGENCE: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 88 M&A DUE DILIGENCE: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 89 DOCUMENT MANAGEMENT: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 90 DOCUMENT MANAGEMENT: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 91 FRANCHISE MANAGEMENT: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 92 FRANCHISE MANAGEMENT: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 93 AUDIT, RISK & COMPLIANCE MANAGEMENT: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 94 AUDIT, RISK & COMPLIANCE MANAGEMENT: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 95 ACCESS CONTROL & PERMISSION MANAGEMENT: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 96 ACCESS CONTROL & PERMISSION MANAGEMENT: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 97 ASSET & WORKFLOW MANAGEMENT: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 98 ASSET & WORKFLOW MANAGEMENT: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 99 FUNDRAISING AND IP MANAGEMENT: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 100 FUNDRAISING AND IP MANAGEMENT: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 101 AUTO-FORWARDING & TOPIC MAPPING: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 102 AUTO-FORWARDING & TOPIC MAPPING: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 103 OTHER APPLICATIONS: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 104 OTHER APPLICATIONS: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 105 VIRTUAL DATA ROOM MARKET, BY BUSINESS SECTOR, 2019-2023 (USD MILLION)

- TABLE 106 VIRTUAL DATA ROOM MARKET, BY BUSINESS SECTOR, 2024-2029 (USD MILLION)

- TABLE 107 FINANCIAL SERVICES: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 108 FINANCIAL SERVICES: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 109 LEGAL & LAW FIRMS: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 110 LEGAL & LAW FIRMS: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 111 ACCOUNTING & AUDITING FIRMS: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 112 ACCOUNTING & AUDITING FIRMS: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 113 TECH FIRMS: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 114 TECH FIRMS: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 115 CORPORATE ENTERPRISES: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 116 CORPORATE ENTERPRISES: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 117 VIRTUAL DATA ROOM MARKET, BY ROLE-SPECIFIC USER, 2019-2023 (USD MILLION)

- TABLE 118 VIRTUAL DATA ROOM MARKET, BY ROLE-SPECIFIC USER, 2024-2029 (USD MILLION)

- TABLE 119 INVESTORS: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 120 INVESTORS: VIRTUAL DATA ROOM MARKET BY REGION, 2024-2029 (USD MILLION)

- TABLE 121 FINANCIAL ANALYSTS: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 122 FINANCIAL ANALYSTS: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 123 AUDITORS & ACCOUNTANTS: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 124 AUDITORS & ACCOUNTANTS: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 125 CONSULTING FIRMS: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 126 CONSULTING FIRMS: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 127 OTHERS: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 128 OTHERS: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 129 VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 130 VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 131 NORTH AMERICA: VIRTUAL DATA ROOM MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 132 NORTH AMERICA: VIRTUAL DATA ROOM MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 133 NORTH AMERICA: VIRTUAL DATA ROOM MARKET, BY SOFTWARE TYPE, 2019-2023 (USD MILLION)

- TABLE 134 NORTH AMERICA: VIRTUAL DATA ROOM MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 135 NORTH AMERICA: VIRTUAL DATA ROOM MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 136 NORTH AMERICA: VIRTUAL DATA ROOM MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 137 NORTH AMERICA: VIRTUAL DATA ROOM MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 138 NORTH AMERICA: VIRTUAL DATA ROOM MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 139 NORTH AMERICA: VIRTUAL DATA ROOM MARKET, BY PROFESSIONAL SERVICE, 2019-2023 (USD MILLION)

- TABLE 140 NORTH AMERICA: VIRTUAL DATA ROOM MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 141 NORTH AMERICA: VIRTUAL DATA ROOM MARKET, BY DOCUMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 142 NORTH AMERICA: VIRTUAL DATA ROOM MARKET, BY DOCUMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 143 NORTH AMERICA: VIRTUAL DATA ROOM MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 144 NORTH AMERICA: VIRTUAL DATA ROOM MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 145 NORTH AMERICA: VIRTUAL DATA ROOM MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 146 NORTH AMERICA: VIRTUAL DATA ROOM MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 147 NORTH AMERICA: VIRTUAL DATA ROOM MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 148 NORTH AMERICA: VIRTUAL DATA ROOM MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 149 NORTH AMERICA: VIRTUAL DATA ROOM MARKET, BY ROLE-SPECIFIC USER, 2019-2023 (USD MILLION)

- TABLE 150 NORTH AMERICA: VIRTUAL DATA ROOM MARKET, BY ROLE-SPECIFIC USER, 2024-2029 (USD MILLION)

- TABLE 151 NORTH AMERICA: VIRTUAL DATA ROOM MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 152 NORTH AMERICA: VIRTUAL DATA ROOM MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 153 US: VIRTUAL DATA ROOM MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 154 US: VIRTUAL DATA ROOM MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 155 CANADA: VIRTUAL DATA ROOM MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 156 CANADA: VIRTUAL DATA ROOM MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 157 EUROPE: VIRTUAL DATA ROOM MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 158 EUROPE: VIRTUAL DATA ROOM MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 159 EUROPE: VIRTUAL DATA ROOM MARKET, BY SOFTWARE TYPE, 2019-2023 (USD MILLION)

- TABLE 160 EUROPE: VIRTUAL DATA ROOM MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 161 EUROPE: VIRTUAL DATA ROOM MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 162 EUROPE: VIRTUAL DATA ROOM MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 163 EUROPE: VIRTUAL DATA ROOM MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 164 EUROPE: VIRTUAL DATA ROOM MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 165 EUROPE: VIRTUAL DATA ROOM MARKET, BY PROFESSIONAL SERVICE, 2019-2023 (USD MILLION)

- TABLE 166 EUROPE: VIRTUAL DATA ROOM MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 167 EUROPE: VIRTUAL DATA ROOM MARKET, BY DOCUMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 168 EUROPE: VIRTUAL DATA ROOM MARKET, BY DOCUMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 169 EUROPE: VIRTUAL DATA ROOM MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 170 EUROPE: VIRTUAL DATA ROOM MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 171 EUROPE: VIRTUAL DATA ROOM MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 172 EUROPE: VIRTUAL DATA ROOM MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 173 EUROPE: VIRTUAL DATA ROOM MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 174 EUROPE: VIRTUAL DATA ROOM MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 175 EUROPE: VIRTUAL DATA ROOM MARKET, BY ROLE-SPECIFIC USER, 2019-2023 (USD MILLION)

- TABLE 176 EUROPE: VIRTUAL DATA ROOM MARKET, BY ROLE-SPECIFIC USER, 2024-2029 (USD MILLION)

- TABLE 177 EUROPE: VIRTUAL DATA ROOM MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 178 EUROPE: VIRTUAL DATA ROOM MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 179 UK: VIRTUAL DATA ROOM MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 180 UK: VIRTUAL DATA ROOM MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 181 GERMANY: VIRTUAL DATA ROOM MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 182 GERMANY: VIRTUAL DATA ROOM MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 183 ASIA PACIFIC: VIRTUAL DATA ROOM MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 184 ASIA PACIFIC: VIRTUAL DATA ROOM MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 185 ASIA PACIFIC: VIRTUAL DATA ROOM MARKET, BY SOFTWARE TYPE, 2019-2023 (USD MILLION)

- TABLE 186 ASIA PACIFIC: VIRTUAL DATA ROOM MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 187 ASIA PACIFIC: VIRTUAL DATA ROOM MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 188 ASIA PACIFIC: VIRTUAL DATA ROOM MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 189 ASIA PACIFIC: VIRTUAL DATA ROOM MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 190 ASIA PACIFIC: VIRTUAL DATA ROOM MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 191 ASIA PACIFIC: VIRTUAL DATA ROOM MARKET, BY PROFESSIONAL SERVICE, 2019-2023 (USD MILLION)

- TABLE 192 ASIA PACIFIC: VIRTUAL DATA ROOM MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 193 ASIA PACIFIC: VIRTUAL DATA ROOM MARKET, BY DOCUMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 194 ASIA PACIFIC: VIRTUAL DATA ROOM MARKET, BY DOCUMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 195 ASIA PACIFIC: VIRTUAL DATA ROOM MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 196 ASIA PACIFIC: VIRTUAL DATA ROOM MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 197 ASIA PACIFIC: VIRTUAL DATA ROOM MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 198 ASIA PACIFIC: VIRTUAL DATA ROOM MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 199 ASIA PACIFIC: VIRTUAL DATA ROOM MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 200 ASIA PACIFIC: VIRTUAL DATA ROOM MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 201 ASIA PACIFIC: VIRTUAL DATA ROOM MARKET, BY ROLE-SPECIFIC USER, 2019-2023 (USD MILLION)

- TABLE 202 ASIA PACIFIC: VIRTUAL DATA ROOM MARKET, BY ROLE-SPECIFIC USER, 2024-2029 (USD MILLION)

- TABLE 203 ASIA PACIFIC: VIRTUAL DATA ROOM MARKET, BY COUNTRY/REGION, 2019-2023 (USD MILLION)

- TABLE 204 ASIA PACIFIC: VIRTUAL DATA ROOM MARKET, BY COUNTRY/REGION, 2024-2029 (USD MILLION)

- TABLE 205 ASEAN: VIRTUAL DATA ROOM MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 206 ASEAN: VIRTUAL DATA ROOM MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: VIRTUAL DATA ROOM MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: VIRTUAL DATA ROOM MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: VIRTUAL DATA ROOM MARKET, BY SOFTWARE TYPE, 2019-2023 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: VIRTUAL DATA ROOM MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: VIRTUAL DATA ROOM MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: VIRTUAL DATA ROOM MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: VIRTUAL DATA ROOM MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: VIRTUAL DATA ROOM MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: VIRTUAL DATA ROOM MARKET, BY PROFESSIONAL SERVICE, 2019-2023 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: VIRTUAL DATA ROOM MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: VIRTUAL DATA ROOM MARKET, BY DOCUMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: VIRTUAL DATA ROOM MARKET, BY DOCUMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: VIRTUAL DATA ROOM MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: VIRTUAL DATA ROOM MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: VIRTUAL DATA ROOM MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: VIRTUAL DATA ROOM MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: VIRTUAL DATA ROOM MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: VIRTUAL DATA ROOM MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: VIRTUAL DATA ROOM MARKET, BY ROLE-SPECIFIC USER, 2019-2023 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: VIRTUAL DATA ROOM MARKET, BY ROLE-SPECIFIC USER, 2024-2029 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: VIRTUAL DATA ROOM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: VIRTUAL DATA ROOM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 229 MIDDLE EAST: VIRTUAL DATA ROOM MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 230 MIDDLE EAST: VIRTUAL DATA ROOM MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 231 KSA: VIRTUAL DATA ROOM MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 232 KSA: VIRTUAL DATA ROOM MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 233 UAE: VIRTUAL DATA ROOM MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 234 UAE: VIRTUAL DATA ROOM MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 235 LATIN AMERICA: VIRTUAL DATA ROOM MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 236 LATIN AMERICA: VIRTUAL DATA ROOM MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 237 LATIN AMERICA: VIRTUAL DATA ROOM MARKET, BY SOFTWARE TYPE, 2019-2023 (USD MILLION)

- TABLE 238 LATIN AMERICA: AI VIRTUAL DATA ROOM MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 239 LATIN AMERICA: VIRTUAL DATA ROOM MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 240 LATIN AMERICA: VIRTUAL DATA ROOM MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 241 LATIN AMERICA: VIRTUAL DATA ROOM MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 242 LATIN AMERICA: VIRTUAL DATA ROOM MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 243 LATIN AMERICA: VIRTUAL DATA ROOM MARKET, BY PROFESSIONAL SERVICE, 2019-2023 (USD MILLION)

- TABLE 244 LATIN AMERICA: VIRTUAL DATA ROOM MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 245 LATIN AMERICA: VIRTUAL DATA ROOM MARKET, BY DOCUMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 246 LATIN AMERICA: VIRTUAL DATA ROOM MARKET, BY DOCUMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 247 LATIN AMERICA: VIRTUAL DATA ROOM MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 248 LATIN AMERICA: VIRTUAL DATA ROOM MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 249 LATIN AMERICA: VIRTUAL DATA ROOM MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 250 LATIN AMERICA: VIRTUAL DATA ROOM MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 251 LATIN AMERICA: VIRTUAL DATA ROOM MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 252 LATIN AMERICA: VIRTUAL DATA ROOM MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 253 LATIN AMERICA: VIRTUAL DATA ROOM MARKET, BY ROLE-SPECIFIC USER, 2019-2023 (USD MILLION)

- TABLE 254 LATIN AMERICA: VIRTUAL DATA ROOM MARKET, BY ROLE-SPECIFIC USER, 2024-2029 (USD MILLION)

- TABLE 255 LATIN AMERICA: VIRTUAL DATA ROOM MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 256 LATIN AMERICA: VIRTUAL DATA ROOM MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 257 BRAZIL: VIRTUAL DATA ROOM MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 258 BRAZIL: VIRTUAL DATA ROOM MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 259 MEXICO: VIRTUAL DATA ROOM MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 260 MEXICO: VIRTUAL DATA ROOM MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 261 OVERVIEW OF STRATEGIES ADOPTED BY KEY VIRTUAL DATA ROOM VENDORS

- TABLE 262 VIRTUAL DATA ROOM MARKET: DEGREE OF COMPETITION

- TABLE 263 VIRTUAL DATA ROOM MARKET: REGIONAL FOOTPRINT

- TABLE 264 VIRTUAL DATA ROOM MARKET: APPLICATION FOOTPRINT

- TABLE 265 VIRTUAL DATA ROOM MARKET: END USER FOOTPRINT

- TABLE 266 VIRTUAL DATA ROOM MARKET: PRODUCT FOOTPRINT

- TABLE 267 VIRTUAL DATA ROOM MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 268 VIRTUAL DATA ROOM MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 269 VIRTUAL DATA ROOM MARKET: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2021-JULY 2024

- TABLE 270 VIRTUAL DATA ROOM MARKET: DEALS, JANUARY 2021-JULY 2024

- TABLE 271 SS&C INTRALINKS: COMPANY OVERVIEW

- TABLE 272 SS&C INTRALINKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 SS&C INTRALINKS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 274 BOX: COMPANY OVERVIEW

- TABLE 275 BOX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 276 DATASITE: COMPANY OVERVIEW

- TABLE 277 DATASITE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 278 DATASITE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 279 DATASITE: DEALS

- TABLE 280 THOMSON REUTERS: COMPANY OVERVIEW

- TABLE 281 THOMSON REUTERS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 282 THOMSON REUTERS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 283 THOMSON REUTERS: DEALS

- TABLE 284 DONNELLEY FINANCIAL SOLUTIONS: COMPANY OVERVIEW

- TABLE 285 DONNELLEY FINANCIAL SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 286 DONNELLEY FINANCIAL SOLUTIONS: DEALS

- TABLE 287 MICROSOFT: COMPANY OVERVIEW

- TABLE 288 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 290 GOOGLE: COMPANY OVERVIEW

- TABLE 291 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 292 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 293 ANSARADA: COMPANY OVERVIEW

- TABLE 294 ANSARADA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 295 PANDADOC: COMPANY OVERVIEW

- TABLE 296 PANDADOC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 297 EGNYTE: COMPANY OVERVIEW

- TABLE 298 EGNYTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 299 EGNYTE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 300 BIG DATA MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 301 BIG DATA MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 302 BIG DATA SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 303 BIG DATA SOFTWARE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 304 BIG DATA MARKET, BY BUSINESS FUNCTION, 2018-2022 (USD MILLION)

- TABLE 305 BIG DATA MARKET, BY BUSINESS FUNCTION, 2023-2028 (USD MILLION)

- TABLE 306 BIG DATA MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 307 BIG DATA MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 308 BIG DATA MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 309 BIG DATA MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 310 CUSTOMER DATA PLATFORM MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 311 CUSTOMER DATA PLATFORM MARKET, BY OFFERING, 2024-2028 (USD MILLION)

- TABLE 312 CUSTOMER DATA PLATFORM MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 313 CUSTOMER DATA PLATFORM MARKET, BY DEPLOYMENT MODE, 2024-2028 (USD MILLION)

- TABLE 314 CUSTOMER DATA PLATFORM MARKET, BY DATA CHANNEL, 2018-2023 (USD MILLION)

- TABLE 315 CUSTOMER DATA PLATFORM MARKET, BY DATA CHANNEL, 2024-2028 (USD MILLION)

- TABLE 316 CUSTOMER DATA PLATFORM MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 317 CUSTOMER DATA PLATFORM MARKET, BY TYPE, 2024-2028 (USD MILLION)

- TABLE 318 CUSTOMER DATA PLATFORM MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 319 CUSTOMER DATA PLATFORM MARKET, BY VERTICAL, 2024-2028 (USD MILLION)

- TABLE 320 CUSTOMER DATA PLATFORM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 321 CUSTOMER DATA PLATFORM MARKET, BY REGION, 2024-2028 (USD MILLION)

List of Figures

- FIGURE 1 VIRTUAL DATA ROOM MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 VIRTUAL DATA ROOM MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 APPROACH 1, BOTTOM UP (SUPPLY SIDE): REVENUE FROM SOFTWARE/SERVICES OF VIRTUAL DATA ROOM MARKET

- FIGURE 5 APPROACH 2, BOTTOM UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOFTWARE/SERVICES OF VIRTUAL DATA ROOM MARKET

- FIGURE 6 APPROACH 3, BOTTOM UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOFTWARE/SERVICES OF VIRTUAL DATA ROOM MARKET

- FIGURE 7 APPROACH 4, BOTTOM UP (DEMAND SIDE): SHARE OF VIRTUAL DATA ROOM THROUGH OVERALL DIGITAL SOLUTIONS SPENDING

- FIGURE 8 SOFTWARE SEGMENT TO DOMINATE MARKET IN 2024

- FIGURE 9 AI CONTRACT ANALYTICS TO HOLD LARGEST MARKET SHARE IN 2024

- FIGURE 10 CLOUD SEGMENT TO DOMINATE MARKET IN 2024

- FIGURE 11 PROFESSIONAL SERVICES SEGMENT TO DOMINATE VIRTUAL DATA ROOM MARKET IN 2024

- FIGURE 12 INTEGRATION & DEPLOYMENT SERVICES TO HOLD LARGEST MARKET SHARE IN 2024

- FIGURE 13 FINANCIAL STATEMENTS SEGMENT TO DOMINATE MARKET IN 2024

- FIGURE 14 SECURITY SEGMENT TO HOLD LARGEST SHARE IN 2024

- FIGURE 15 M&A DUE DILIGENCE SEGMENT TO DOMINATE MARKET IN 2024

- FIGURE 16 FINANCIAL SERVICES TO HOLD LARGEST MARKET SIZE IN 2024

- FIGURE 17 INVESTORS TO HOLD LARGEST SHARE IN 2024

- FIGURE 18 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 CAPABILITY TO OFFER UNIFIED AND CENTRALIZED ACCESS POINTS TO ASSESS AND EFFICIENTLY SHARE DIGITAL DOCUMENTS TO DRIVE MARKET GROWTH

- FIGURE 20 AUDIT, RISK & COMPLIANCE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

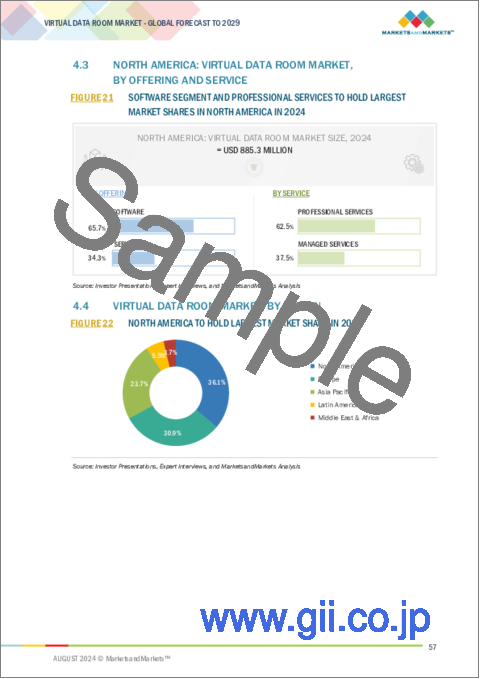

- FIGURE 21 SOFTWARE SEGMENT AND PROFESSIONAL SERVICES TO HOLD LARGEST MARKET SHARES IN NORTH AMERICA IN 2024

- FIGURE 22 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2024

- FIGURE 23 VIRTUAL DATA ROOM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 EVOLUTION OF VIRTUAL DATA ROOM MARKET

- FIGURE 25 VIRTUAL DATA ROOM MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 VIRTUAL DATA ROOM MARKET ECOSYSTEM: KEY PLAYERS

- FIGURE 27 VIRTUAL DATA ROOM MARKET: INVESTMENT LANDSCAPE AND FUNDING SCENARIO (USD MILLION AND NUMBER OF FUNDING ROUNDS)

- FIGURE 28 NUMBER OF PATENTS GRANTED TO VENDORS IN LAST 10 YEARS

- FIGURE 29 TOP 10 PATENT APPLICANTS IN LAST 10 YEARS

- FIGURE 30 REGIONAL ANALYSIS OF PATENTS GRANTED, 2013-2023

- FIGURE 31 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP 3 APPLICATIONS

- FIGURE 32 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 35 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 36 MARKET POTENTIAL OF GENERATIVE AI IN ENHANCING VIRTUAL DATA ROOMS ACROSS KEY END USERS

- FIGURE 37 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 38 AI-ASSISTED REDACTION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 ON-PREMISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 40 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 41 ASSET ONBOARDING & DATA MIGRATION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 CONTRACTS & AGREEMENTS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 INTELLIGENCE & SEARCH SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 44 AUDIT, RISK & COMPLIANCE MANAGEMENT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 TECH FIRMS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 46 AUDITORS & ACCOUNTANTS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 47 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 48 ASIA PACIFIC TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 49 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 50 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 51 REVENUE ANALYSIS OF KEY PLAYERS IN PAST FIVE YEARS

- FIGURE 52 SHARE OF LEADING COMPANIES IN VIRTUAL DATA ROOM MARKET, 2023

- FIGURE 53 PRODUCT COMPARATIVE ANALYSIS

- FIGURE 54 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- FIGURE 55 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 56 VIRTUAL DATA ROOM MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 57 VIRTUAL DATA ROOM MARKET: COMPANY FOOTPRINT

- FIGURE 58 VIRTUAL DATA ROOM MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 59 BOX: COMPANY SNAPSHOT

- FIGURE 60 THOMSON REUTERS: COMPANY SNAPSHOT

- FIGURE 61 DONNELLEY FINANCIAL SOLUTIONS: COMPANY SNAPSHOT

- FIGURE 62 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 63 GOOGLE: COMPANY SNAPSHOT

- FIGURE 64 ANSARADA: COMPANY SNAPSHOT

The virtual data room market is projected to grow from USD 2.5 billion in 2024 to USD 5.6 billion by 2029, at a compound annual growth rate (CAGR) of 18.1% during the forecast period. The market is anticipated to grow due to the increasing demand for hierarchical document organization for ease of navigation, the capability to offer unified and centralized access points to assess and efficiently share digital documents and need to streamline the due diligence process and improve collaboration among stakeholders.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | USD (Billion) |

| Segments | Offering, Document Type, Technology, Application, End User, and Region |

| Regions covered | North America, Asia Pacific, Europe, Middle East & Africa, and Latin America |

"By Software type, the AI-assisted Redaction segment registers for the fastest growing market during the forecast period."

AI-assisted redaction software is experiencing the highest CAGR in virtual data room due to its ability to automate and streamline the sensitive data protection process. As businesses increasingly manage large volumes of confidential information, manual redaction becomes inefficient and error prone. AI-driven tools can swiftly identify and redact sensitive data across various document types, reducing the risk of human error and ensuring compliance with data protection regulations. Additionally, the growing adoption of AI technologies across industries and the need for secure, efficient data management solutions drive demand for AI-assisted redaction software, making it a key growth area in the virtual data room market.

"By region, Asia Pacific to register the highest CAGR market during the forecast period." Asia Pacific is experiencing the highest CAGR in the virtual data room market due to rapid digitalization, increased M&A activities, and the rising need for secure data management in emerging economies like China, India, and Southeast Asia. The region's expanding tech infrastructure, coupled with growing awareness of data privacy regulations, drives demand for virtual data room. Additionally, a surge in cross-border transactions and investments in sectors such as technology, finance, and healthcare further fuel the market. Government initiatives promoting digital transformation and foreign investments also contribute to the region's accelerated growth in the virtual data room sector.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the virtual data room market.

- By Company: Tier I: 45%, Tier II: 35%, and Tier III: 20%

- By Designation: C-Level Executives: 40%, D-Level Executives: 35%, and Others: 25%

- By Region: North America: 30%, Europe: 20%, Asia Pacific: 35%, Latin America-10%, and

Middle East and Africa- 5%

The report includes the study of key players offering virtual data room solutions. It profiles major vendors in the virtual data room market. The major players in the virtual data room market include SS&C Intralinks (US), Box (US), Datasite (US), Thomson Reuters (Canada), Donnelley Financial Solutions (US), Microsoft (US), Google (US), Ansarada (Australia), PandaDoc (US), Egnyte (US), iDeals (UK), SmartRoom (US), Vitrium Security (US), ShareVault (US), ForData (Poland), EthosData (UK), CapLinked (US), Imprima (UK), Midaxo (US), FuseBase (US), Onit (US), FirmsData (India), Confiex Data Room (India), Drooms (Switzerland), Bit.ai (US), DCirrus (India), Virtual Vaults (Netherlands), Firmex (US), Deallink (Brazil), PactCentral (US), DocullyVDR (UAE).

Research Coverage

The virtual data room market research study involved extensive secondary sources, directories, journals, and paid databases. Primary sources were industry experts from the core and related industries, preferred virtual data room providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market's prospects.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall virtual data room market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing demand for hierarchical document organization for ease of navigation, need to streamline due diligence process and improve collaboration among stakeholders, and capability to offer centralized access points to assess and efficiently share digital documents), restraints (facilitating and accelerating restructuring process during bankruptcy and rising cybersecurity issues and data breaches due to hybrid environment), opportunities (Integration of AI and ML technology to automate redaction process and optimize document management, and advent of blockchain for integrity and authenticity of documents in regulatory and compliance scenarios across healthcare sector), and challenges (rise of cyber threats are susceptible to data threats, the rising need to efficiently manage access control and permissions, and increasing demand for securely storing and analyzing large volumes of data during M&A).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the virtual data room market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the virtual data room market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the virtual data room market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players including SS&C Intralinks (US), Box (US), Datasite (US), Thomson Reuters (Canada), Donnelley Financial Solutions (US), among others in the virtual data room market strategies. The report also helps stakeholders understand the pulse of the virtual data room market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN VIRTUAL DATA ROOM MARKET

- 4.2 VIRTUAL DATA ROOM MARKET: TOP THREE APPLICATIONS

- 4.3 NORTH AMERICA: VIRTUAL DATA ROOM MARKET, BY OFFERING AND SERVICE

- 4.4 VIRTUAL DATA ROOM MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Capability to offer unified and centralized access points to assess and efficiently share digital documents

- 5.2.1.2 Increasing demand for hierarchical document organization for ease of navigation

- 5.2.1.3 Need to streamline due diligence process and improve collaboration among stakeholders

- 5.2.2 RESTRAINTS

- 5.2.2.1 Facilitating and accelerating restructuring process during bankruptcy

- 5.2.2.2 Rising cybersecurity issues and data breaches due to hybrid environment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of AI and ML technology to automate redaction process and optimize document management

- 5.2.3.2 Advent of blockchain for authenticity of documents in regulatory and compliance scenarios across healthcare sector

- 5.2.4 CHALLENGES

- 5.2.4.1 Rising need to efficiently manage access control and permissions

- 5.2.4.2 Incompatibility with various integrated devices and browsers

- 5.2.4.3 Increasing demand for securely storing and analyzing large volumes of data during M&A

- 5.2.1 DRIVERS

- 5.3 EVOLUTION OF VIRTUAL DATA ROOM MARKET

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 VIRTUAL DATA ROOM MARKET SERVICE PROVIDERS

- 5.5.2 VIRTUAL DATA ROOM MARKET SOFTWARE PROVIDERS

- 5.5.3 VIRTUAL DATA ROOM MARKET END USERS

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 ACI'S USE OF VITRIUM SECURITY ENTERPRISE TO PREVENT UNAUTHORIZED ACCESS AND SHARING DOCUMENTATION

- 5.6.2 FASTEST LABS BOOSTED EFFICIENCY AND SAVED MONEY WITH PANDADOC AND HUBSPOT INTEGRATION

- 5.6.3 LEGALTECH STARTUP THOUGHTRIVER CONDUCTED DUE DILIGENCE AND EFFECTIVE INVESTOR FOLLOW-UPS USING DIGIFY

- 5.6.4 OAKNORTH BANK USED ETHOSDATA VIRTUAL DATAROOM FOR SECURE COMMUNICATION

- 5.6.5 TRANSFORMING HSH REAL ESTATE TRANSACTIONS WITH INTRALINKS VIRTUAL DATA ROOM

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 AI and ML

- 5.7.1.2 Cloud Computing

- 5.7.2 ADJACENT TECHNOLOGIES

- 5.7.2.1 BI

- 5.7.2.2 IoT

- 5.7.2.3 Cybersecurity

- 5.7.3 COMPLEMENTARY TECHNOLOGIES

- 5.7.3.1 Electronic Signature

- 5.7.3.2 Blockchain

- 5.7.1 KEY TECHNOLOGIES

- 5.8 KEY CONFERENCES AND EVENTS (2024-2025)

- 5.9 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 REGULATIONS: VIRTUAL DATA ROOM

- 5.10.2.1 North America

- 5.10.2.1.1 US

- 5.10.2.1.2 Canada

- 5.10.2.2 Europe

- 5.10.2.2.1 UK

- 5.10.2.3 Asia Pacific

- 5.10.2.3.1 China

- 5.10.2.3.2 Singapore

- 5.10.2.3.3 Australia

- 5.10.2.4 Middle East & Africa

- 5.10.2.4.1 UAE

- 5.10.2.4.2 South Africa

- 5.10.2.5 Latin America

- 5.10.2.5.1 Brazil

- 5.10.2.5.2 Mexico

- 5.10.2.5.3 Argentina

- 5.10.2.1 North America

- 5.11 PATENT ANALYSIS

- 5.11.1 METHODOLOGY

- 5.11.2 PATENTS FILED, BY DOCUMENT TYPE

- 5.11.3 INNOVATIONS AND PATENT APPLICATIONS

- 5.11.3.1 Top 10 patent applicants

- 5.12 PRICING ANALYSIS

- 5.12.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION

- 5.12.2 INDICATIVE PRICING ANALYSIS, BY APPLICATION

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 THREAT OF SUBSTITUTES

- 5.13.3 BARGAINING POWER OF SUPPLIERS

- 5.13.4 BARGAINING POWER OF BUYERS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF GENERATIVE AI ON VIRTUAL DATA ROOM MARKET

- 5.16.1 TOP USE CASES & MARKET POTENTIAL

- 5.16.1.1 Key Use Cases

- 5.16.2 AUTOMATED DOCUMENT CREATION & SUMMARIZATION

- 5.16.3 ENHANCED DATA ANALYSIS

- 5.16.4 INTELLIGENT DOCUMENT TAGGING & CATEGORIZATION

- 5.16.5 ADVANCED RISK DETECTION

- 5.16.6 ENRICHED COLLABORATION

- 5.16.7 SUPERIOR SECURITY MEASURES

- 5.16.1 TOP USE CASES & MARKET POTENTIAL

6 VIRTUAL DATA ROOM MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: VIRTUAL DATA ROOM MARKET DRIVERS

- 6.2 SOFTWARE BY TYPE

- 6.2.1 AI CONTRACT ANALYTICS

- 6.2.1.1 AI contract analytics enhances accuracy and accelerates decision-making in complex transactions

- 6.2.2 DOCUMENT SHARING SYSTEM

- 6.2.2.1 Document sharing system safeguards data integrity in high-stakes transactions

- 6.2.3 AI-ASSISTED REDACTION

- 6.2.3.1 Redaction automates compliance and efficiency with data security

- 6.2.4 AUDIT TRIALS & USER ANALYTICS

- 6.2.4.1 Audit trials & user analytics ensure accountability, optimize engagement, and identify potential risks

- 6.2.5 COLLABORATION TOOLS

- 6.2.5.1 Accelerated decision-making, ensuring real-time communication and coordination through collaboration tools in data rooms

- 6.2.6 AI TRANSLATION

- 6.2.6.1 Enhance global deal efficiency with real-time AI translation in virtual data rooms

- 6.2.1 AI CONTRACT ANALYTICS

- 6.3 SOFTWARE BY DEPLOYMENT MODE

- 6.3.1 CLOUD

- 6.3.1.1 Cloud deployment provides cost-effective solutions with remote access and reduced IT overhead

- 6.3.2 ON-PREMISES

- 6.3.2.1 On-premises provides tailored data protection and compliance

- 6.3.1 CLOUD

- 6.4 SERVICES

- 6.4.1 PROFESSIONAL SERVICES

- 6.4.1.1 Consulting & Advisory

- 6.4.1.1.1 Consulting & advisory to tailor solutions for optimal integration and compliance

- 6.4.1.2 Integration & Deployment

- 6.4.1.2.1 Seamless system integration and deployment ensure smooth transition and optimized VDR performance

- 6.4.1.3 Data Room Training

- 6.4.1.3.1 Empower users for optimal VDR utilization and secure document management

- 6.4.1.4 Asset Onboarding & Data Migration

- 6.4.1.4.1 Asset onboarding and data migration services ensure accurate integration and access to seamless transition

- 6.4.1.1 Consulting & Advisory

- 6.4.2 MANAGED SERVICES

- 6.4.1 PROFESSIONAL SERVICES

7 VIRTUAL DATA ROOM MARKET, BY DOCUMENT TYPE

- 7.1 INTRODUCTION

- 7.1.1 DOCUMENT TYPE: VIRTUAL DATA ROOM MARKET DRIVERS

- 7.2 FINANCIAL STATEMENTS

- 7.2.1 INTEGRATION OF FINANCIAL STATEMENTS ENHANCES TRANSPARENCY AND TRUST AND ALIGNS DECISION-MAKING PROCESS

- 7.3 CONTRACTS & AGREEMENTS

- 7.3.1 CONTRACTS IN VIRTUAL DATA ROOMS ENHANCE TRANSPARENCY, ENSURING TRANSACTION INTEGRITY WITH CONTRACTUAL CLARITY

- 7.4 LEGAL & CORPORATE GOVERNANCE

- 7.4.1 VDRS ENHANCE TRANSACTION EFFICIENCY AND COMPLIANCE WHILE SAFEGUARDING SENSITIVE INFORMATION WITH ADVANCED SECURITY FEATURES

- 7.5 INTELLECTUAL PROPERTY (IP) & EMPLOYEE RECORDS

- 7.5.1 IP & EMPLOYEE RECORDS ENHANCE PROTECTION AND COMPLIANCE THROUGH ADVANCED ENCRYPTION, ACCESS CONTROLS, AND AUDIT TRAILS

- 7.6 OTHER DOCUMENT TYPES

8 VIRTUAL DATA ROOM MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.1.1 TECHNOLOGY: VIRTUAL DATA ROOM MARKET DRIVERS

- 8.2 DATA STORAGE & MANAGEMENT

- 8.2.1 CLOUD COMPUTING

- 8.2.1.1 Enhancing data security and scalability in virtual data rooms through cloud computing

- 8.2.2 DATABASE MANAGEMENT

- 8.2.2.1 Database management in virtual data room market enhances data security and efficiency

- 8.2.3 CONTENT MANAGEMENT

- 8.2.3.1 Optimizing content management in virtual data rooms: Enhancing organization, access, and security

- 8.2.1 CLOUD COMPUTING

- 8.3 SECURITY

- 8.3.1 ENCRYPTION

- 8.3.1.1 Encryption strategies enhancing security in virtual data rooms

- 8.3.2 DIGITAL RIGHTS MANAGEMENT

- 8.3.2.1 Strengthening data protection with advanced digital rights management

- 8.3.3 FIREWALL AND INTRUSION DETECTION SYSTEMS (IDS)

- 8.3.3.1 Advanced firewalls and intrusion detection systems shield against unauthorized access

- 8.3.4 MULTI-FACTOR AUTHENTICATION

- 8.3.4.1 Strengthen security with multi-factor authentication: Ensuring robust access control and data protection

- 8.3.5 DATA LOSS PREVENTION

- 8.3.5.1 Advanced encryption and access controls ensure data security and minimize unauthorized access

- 8.3.1 ENCRYPTION

- 8.4 CLASSIFICATION & COLLABORATION

- 8.4.1 SECURE MESSAGING AND Q&A MODULES

- 8.4.1.1 Ensures confidential communication with end-to-end encryption and Q&A modules

- 8.4.2 VERSION CONTROL

- 8.4.2.1 Version control manages document changes which ensures every modification is recorded and traceable

- 8.4.3 METADATA TAGGING AND CATEGORIZATION

- 8.4.3.1 Efficient metadata tagging and categorization streamlines document retrieval and enhances security through organized access

- 8.4.4 AUTOMATED DOCUMENT CLASSIFICATION

- 8.4.4.1 Automated document classification enhances efficiency reducing errors and improving retrieval accuracy

- 8.4.1 SECURE MESSAGING AND Q&A MODULES

- 8.5 INTELLIGENCE & SEARCH

- 8.5.1 ARTIFICIAL INTELLIGENCE

- 8.5.1.1 AI-enhanced efficiency in virtual data rooms boosts productivity with automated data management and advanced security insights

- 8.5.2 NATURAL LANGUAGE PROCESSING

- 8.5.2.1 NLP helps in aligning document management and boosting accuracy by automating classification

- 8.5.3 OPTICAL CHARACTER RECOGNITION

- 8.5.3.1 OCR unlocks efficiency by converting scanned documents in searchable texts for data access

- 8.5.1 ARTIFICIAL INTELLIGENCE

9 VIRTUAL DATA ROOM MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.1.1 APPLICATION: VIRTUAL DATA ROOM MARKET DRIVERS

- 9.2 M&A DUE DILIGENCE

- 9.2.1 INNOVATIONS TO HELP STREAMLINE DUE DILIGENCE FOR M&A AND MITIGATE RISKS

- 9.3 DOCUMENT MANAGEMENT

- 9.3.1 SECURE DOCUMENT MANAGEMENT PROTECTS SENSITIVE INFORMATION WITH ENCRYPTION AND PRECISE ACCESS CONTROLS

- 9.4 FRANCHISE MANAGEMENT

- 9.4.1 CENTRALIZED DOCUMENT STORAGE AND SECURE, STREAMLINED COMMUNICATION WITH VIRTUAL DATA ROOMS

- 9.5 AUDIT, RISK & COMPLIANCE MANAGEMENT

- 9.5.1 IMPLEMENTING ROBUST AUDITING AND COMPLIANCE TOOLS IN VDR TO MITIGATE RISKS

- 9.6 ACCESS CONTROL & PERMISSION MANAGEMENT

- 9.6.1 ACCESS CONTROLS ENHANCE DATA SECURITY BY RESTRICTING ACCESS AND TRACKING USER ACTIVITIES

- 9.7 ASSET & WORKFLOW MANAGEMENT

- 9.7.1 INTEGRATED ASSET AND WORKFLOW MANAGEMENT STREAMLINES DATA ORGANIZATION AND COLLABORATION

- 9.8 FUNDRAISING & IP MANAGEMENT

- 9.8.1 VDRS STREAMLINE AND PROTECT SENSITIVE INFORMATION FOR EFFICIENT FUNDRAISING AND EFFECTIVE INTELLECTUAL PROPERTY MANAGEMENT

- 9.9 AUTO-FORWARDING & TOPIC MAPPING

- 9.9.1 AUTO-FORWARDING STREAMLINES WORKFLOWS AND TOPIC MAPPING ORGANIZES AND CATEGORIZES DOCUMENTS FOR EASY NAVIGATION AND ACCESS.

- 9.10 OTHER APPLICATIONS

10 VIRTUAL DATA ROOM MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.1.1 END USER: VIRTUAL DATA ROOM MARKET DRIVERS

- 10.2 END USER, BY BUSINESS SECTOR

- 10.2.1 FINANCIAL SERVICES

- 10.2.1.1 Data rooms secure and streamline financial transactions for investment banking, private equity, and lending

- 10.2.2 LEGAL & LAW FIRMS

- 10.2.2.1 Enhancing legal operations and secure document management with data rooms

- 10.2.3 ACCOUNTING & AUDITING FIRMS

- 10.2.3.1 Streamline financial audits and enhance transparency for accounting

- 10.2.4 TECH FIRMS

- 10.2.4.1 Secure IP and tech operations with secure intellectual property management

- 10.2.5 CORPORATE ENTERPRISES

- 10.2.5.1 Corporate enterprises and tech firms leverage VDRs for M&A and internal collaboration

- 10.2.5.1.1 Real Estate

- 10.2.5.1.2 Healthcare

- 10.2.5.1.3 Pharmaceutical and Life Sciences

- 10.2.5.1.4 Manufacturing

- 10.2.5.1.5 Others

- 10.2.5.1 Corporate enterprises and tech firms leverage VDRs for M&A and internal collaboration

- 10.2.1 FINANCIAL SERVICES

- 10.3 ROLE-SPECIFIC USERS

- 10.3.1 INVESTORS

- 10.3.1.1 Investors leverage virtual data rooms for enhanced due diligence and secure transactions

- 10.3.2 FINANCIAL ANALYSTS

- 10.3.2.1 Virtual data rooms used by financial analysts to enhance data management and analysis

- 10.3.3 AUDITORS & ACCOUNTANTS

- 10.3.3.1 Auditors and accountants leverage data rooms for financial integrity

- 10.3.4 CONSULTING FIRMS

- 10.3.4.1 Consulting firms optimize data management and ensure regulatory compliance through virtual data rooms

- 10.3.5 OTHERS

- 10.3.1 INVESTORS

11 VIRTUAL DATA ROOM MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: VIRTUAL DATA ROOM MARKET DRIVERS

- 11.2.2 NORTH AMERICA: MACROECONOMIC IMPACT

- 11.2.3 US

- 11.2.3.1 Navigating evolving landscape of US virtual data room market through growth opportunities and compliance

- 11.2.4 CANADA

- 11.2.4.1 Driving responsible AI in Canada: Evolving regulations and fostering innovation in virtual data room market

- 11.3 EUROPE

- 11.3.1 EUROPE: VIRTUAL DATA ROOM MARKET DRIVERS

- 11.3.2 EUROPE: MACROECONOMIC IMPACT

- 11.3.3 UK

- 11.3.3.1 Evolving landscape of virtual data room market in UK

- 11.3.4 GERMANY

- 11.3.4.1 Rise of virtual data rooms in Germany's corporate landscape providing secure data management

- 11.3.5 FRANCE

- 11.3.5.1 Advancing France's regulatory landscape and industry innovation in virtual data rooms

- 11.3.6 ITALY

- 11.3.6.1 Advancements in Italian market attributed to increase in data room solutions

- 11.3.7 SPAIN

- 11.3.7.1 Virtual data rooms to foster ethical, transparent, and trustworthy solutions in Spain

- 11.3.8 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: VIRTUAL DATA ROOM MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: MACROECONOMIC IMPACT

- 11.4.3 CHINA

- 11.4.3.1 China navigating regulatory landscape and technological advancements in virtual data room market

- 11.4.4 JAPAN

- 11.4.4.1 Balancing governmental initiatives and private sector while mitigating risks related to bias, data privacy, and decision-making

- 11.4.5 INDIA

- 11.4.5.1 India ultimately drives sustainable growth and innovation through effective use of data rooms

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Evolution of virtual data room to elevate business and secure collaboration in South Korea

- 11.4.7 AUSTRALIA & NEW ZEALAND

- 11.4.7.1 Leveraging advanced security and local innovation for growth in Australia & New Zealand

- 11.4.8 ASEAN

- 11.4.8.1 Empowering business growth by using advanced virtual data rooms for secure and efficient transactions in ASEAN region

- 11.4.9 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: VIRTUAL DATA ROOM MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC IMPACT

- 11.5.3 MIDDLE EAST

- 11.5.3.1 KSA

- 11.5.3.1.1 Enhanced security and innovation drive rapid growth in Saudi Arabia's virtual data room market

- 11.5.3.2 UAE

- 11.5.3.2.1 Advanced technology and robust security drive sector growth in UAE market

- 11.5.3.3 Bahrain

- 11.5.3.3.1 Enhanced security and local innovation fuel growth in Bahrain's virtual data room market

- 11.5.3.4 Kuwait

- 11.5.3.4.1 Rise of virtual data rooms in Kuwait for enhanced data protection to drive market growth

- 11.5.3.5 Rest of Middle East

- 11.5.3.1 KSA

- 11.5.4 AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: VIRTUAL DATA ROOM MARKET DRIVERS

- 11.6.2 LATIN AMERICA: MACROECONOMIC IMPACT

- 11.6.3 BRAZIL

- 11.6.3.1 Brazil to commit to balance technological growth with need for safety and ethical standards in virtual data room market

- 11.6.4 MEXICO

- 11.6.4.1 Offers advanced security to ensure compliance with local data protection in Mexico's data rooms

- 11.6.5 ARGENTINA

- 11.6.5.1 Argentina emphasizes on developing data room solutions that ensure secure and reliable systems across sectors

- 11.6.6 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.4.1 MARKET RANKING ANALYSIS

- 12.5 PRODUCT COMPARATIVE ANALYSIS

- 12.6 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS

- 12.7.5.1 Company footprint

- 12.7.5.2 Regional footprint

- 12.7.5.3 Application footprint

- 12.7.5.4 End User footprint

- 12.7.5.5 Product footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES & ENHANCEMENTS

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 SS&C INTRALINKS

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.4 MnM view

- 13.2.1.4.1 Key strengths

- 13.2.1.4.2 Strategic choices

- 13.2.1.4.3 Weaknesses and competitive threats

- 13.2.2 BOX

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 MnM view

- 13.2.2.3.1 Key strengths

- 13.2.2.3.2 Strategic choices

- 13.2.2.3.3 Weaknesses and competitive threats

- 13.2.3 DATASITE

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.4 MnM view

- 13.2.3.4.1 Key strengths

- 13.2.3.4.2 Strategic choices

- 13.2.3.4.3 Weaknesses and competitive threats

- 13.2.4 THOMSON REUTERS

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.4 MnM view

- 13.2.4.4.1 Key strengths

- 13.2.4.4.2 Strategic choices

- 13.2.4.4.3 Weaknesses and competitive threats

- 13.2.5 DONNELLEY FINANCIAL SOLUTIONS

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.6 MICROSOFT

- 13.2.6.1 Business overview

- 13.2.6.2 Products/Solutions/Services offered

- 13.2.6.3 Recent developments

- 13.2.7 GOOGLE

- 13.2.7.1 Business overview

- 13.2.7.2 Products/Solutions/Services offered

- 13.2.7.3 Recent developments

- 13.2.8 ANSARADA

- 13.2.8.1 Business overview

- 13.2.8.2 Products/Solutions/Services offered

- 13.2.9 PANDADOC

- 13.2.9.1 Business overview

- 13.2.9.2 Products/Solutions/Services offered

- 13.2.10 EGNYTE

- 13.2.10.1 Business overview

- 13.2.10.2 Products/Solutions/Services offered

- 13.2.10.3 Recent developments

- 13.2.11 IDEALS

- 13.2.12 SMARTROOM

- 13.2.13 VITRIUM SYSTEMS

- 13.2.14 SHAREVAULT

- 13.2.15 FORDATA

- 13.2.16 ETHOSDATA

- 13.2.17 CAPLINKED

- 13.2.18 IMPRIMA

- 13.2.19 MIDAXO

- 13.2.20 FUSEBASE

- 13.2.21 ONIT

- 13.2.1 SS&C INTRALINKS

- 13.3 STARTUPS/SMES

- 13.3.1 FIRMSDATA

- 13.3.2 CONFIEX DATA ROOM

- 13.3.3 DROOMS

- 13.3.4 BIT.AI

- 13.3.5 DCIRRUS

- 13.3.6 VIRTUAL VAULTS

- 13.3.7 FIRMEX

- 13.3.8 DEALLINK

- 13.3.9 PACTCENTRAL

- 13.3.10 DOCULLYVDR

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 BIG DATA MARKET - GLOBAL FORECAST TO 2028

- 14.2.1 MARKET DEFINITION

- 14.2.2 MARKET OVERVIEW

- 14.2.2.1 Big data market, by offering

- 14.2.2.2 Big data market, by deployment mode

- 14.2.2.3 Big data market, by business function

- 14.2.2.4 Big data market, by vertical

- 14.2.2.5 Big data market, by region

- 14.3 CUSTOMER DATA PLATFORM MARKET - GLOBAL FORECAST TO 2028

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.2.1 CDP market, by offering

- 14.3.2.2 CDP market, by deployment mode

- 14.3.2.3 CDP market, by data channel

- 14.3.2.4 CDP market, by type

- 14.3.2.5 CDP market, by vertical

- 14.3.2.6 CDP market, by region

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS