|

|

市場調査レポート

商品コード

1537740

Open RANの世界市場、市場規模、シェア、成長分析:提供別、ネットワーク展開別、周波数帯域別、展開フェーズ別、地域別 - 産業予測(~2030年)Open Radio Access Network (Open RAN) Market Size, Share, Growth Analysis, By Offering (Hardware, Software, Services), Network Deployment (Public and Private), Frequency Band, Deployment Phase, & Region - Global Industry Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| Open RANの世界市場、市場規模、シェア、成長分析:提供別、ネットワーク展開別、周波数帯域別、展開フェーズ別、地域別 - 産業予測(~2030年) |

|

出版日: 2024年08月14日

発行: MarketsandMarkets

ページ情報: 英文 211 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のOpen RANの市場規模は、2024年に28億米ドル、2030年までに209億米ドルに達すると推定され、CAGRで39.4%の成長が見込まれます。

通信事業者によるOpen RAN技術の利用により、ネットワークの柔軟性と互換性の需要が高まっており、単一のベンダーへの依存を減らし、マルチベンダー環境を採用するのに役立っています。新興の5G技術は、コスト効率と拡張性に優れたネットワークインフラソリューションの必要性を高めています。Open RANの採用は、オープンスタンダードの受け入れを促進する規制活動にも影響されます。さらに、業界各社は、コスト削減と性能強化を通じて、Open RAN技術の革新とその展開を加速したいと考えています。さらに、仮想化やクラウドネイティブ技術への注目の高まりも、Open RANの原則に合致しており、Open RANの勢いをさらに加速させています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 10億米ドル |

| セグメント | 提供別、ネットワーク展開別、周波数帯域別、展開フェーズ別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

サービス別では、サービスセグメントが予測期間にもっとも高いCAGRを記録する見込みです。

サービスセグメントは、複数の有力な要因により、Open RAN市場で高い成長率を維持すると予測されます。Open RANソリューションを採用する企業では、ネットワークプランニング・最適化、展開・統合、サポート・メンテナンスサービスに対する需要が増加しています。通信業界では、仮想化やクラウドネイティブアーキテクチャが重視されるようになっており、仮想化ネットワーク機能やクラウド統合に関連するサービスへの需要が高まると予測されます。

グリーンフィールドが予測期間に最大の市場シェアを占める見込みです。Open RAN市場では、グリーンフィールドの展開により、事業者に比類ない柔軟性、技術革新の可能性、コスト削減がもたらされます。このような展開では、無線ユニット(RU)、分散ユニット(DU)、集中ユニット(CU)などの多様なネットワークコンポーネントについて、多数のサプライヤーからクラス最高のベンダーを選択できるため、単一ベンダーの独自システムによる制約を回避できます。オープンベンダーのセットアップは技術革新を加速させ、新しい機能や技術を迅速に提供するため、新しいベンダーの参入を可能にします。このような障害にもかかわらず、グリーンフィールドの展開は、事業者にとって、Open RAN市場の競争力のある革新的な利益を活用した、適応性のある未来志向のネットワークを構築する大きな機会となります。

北米が予測期間に2番目に大きい市場規模を持つと推定されます。

北米の高速接続性、範囲、最新の通信エコシステムは、Open RANシステムの採用と統合をサポートしています。政府のプログラムは、通信産業の技術革新と競合を促進しています。さらに、多くの主要企業が北米で研究開発に積極的に資金を提供し、Open RANシステムの機能と拡張性を強化しています。さらに、高速データサービスや新用途に対する消費者需要の高まりに後押しされ、5Gネットワークがこの地域で展開されることで、採用がさらに促進されます。

当レポートでは、世界のOpen RAN市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- Open RAN市場の企業にとって魅力的な機会

- Open RAN市場:もっとも成長しているセグメント

- Open RAN市場

- Open RAN市場:ネットワーク展開別

- Open RAN市場:サービス別

- Open RAN市場:周波数帯域別

- Open RAN市場:展開段階別

- 北米のOpen RAN市場:提供別、展開フェーズ別

第5章 市場の概要と産業動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- サプライチェーン分析

- エコシステム

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 貿易分析

- HSコード8517の輸出シナリオ

- HSコード8517の輸入シナリオ

- 主な会議とイベント(2024年)

- 関税と規制情勢

- Open RANデバイスに関する関税(851769)

- 規制機関、政府機関、その他の組織

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- Open RAN市場の技術ロードマップ

- 短期ロードマップ(2023年~2025年)

- 中期ロードマップ(2026年~2028年)

- 長期ロードマップ(2029年~2030年)

- Open RAN市場におけるベストプラクティス

- 標準化と提携を受け入れる

- DevOpsと自動化を活用する

- 設計によるセキュリティ

- オープン性と透明性

- 現在のビジネスモデルと新たなビジネスモデル

- サブスクリプションモデル

- 従来の販売モデル

- 政府所有

- オープンソースRAN(OSRAN)

- Open RAN市場:ツール、フレームワーク、技術

- Open RANフロントホールインターフェース標準

- CAT-A

- CAT-B

- Open RANの略歴

- 投資と資金調達のシナリオ

- ケーススタディ分析

第6章 Open RAN市場:提供別

- イントロダクション

- ハードウェア

- 無線ユニット

- 集中ユニット/分散ユニット

- その他のハードウェア

- ソフトウェア

- ネットワークオーケストレーション・管理ソフトウェア

- RANインテリジェントコントローラー

- その他のソフトウェア

- サービス

- ネットワークプランニング・最適化

- 展開・統合

- サポート・メンテナンス

第7章 Open RAN市場:ネットワーク展開別

- イントロダクション

- パブリックネットワーク

- プライベートネットワーク

第8章 Open RAN市場:周波数帯別

- イントロダクション

- サブ6GHz

- ミリ波

- その他の周波数帯域

第9章 Open RAN市場:展開フェーズ別

- イントロダクション

- グリーンフィールド

- ブラウンフィールド

第10章 Open RAN市場:地域別

- イントロダクション

- 北米

- 北米のOpen RAN市場の促進要因

- 北米のOpen RANの発展:国別

- 北米に対する不況の影響

- 欧州

- 欧州のOpen RAN市場の促進要因

- 欧州のOpen RANの発展:国別

- 欧州に対する不況の影響

- アジア太平洋

- アジア太平洋のOpen RAN市場の促進要因

- アジア太平洋のOpen RANの発展:国別

- アジア太平洋に対する不況の影響

- 中東・アフリカ

- 中東・アフリカのOpen RAN市場の促進要因

- 中東・アフリカのOpen RANの発展:国別

- 中東・アフリカに対する不況の影響

- ラテンアメリカ

- ラテンアメリカのOpen RAN市場の促進要因

- ラテンアメリカのOpen RANの発展:国別

- ラテンアメリカに対する不況の影響

第11章 競合情勢

- イントロダクション

- 主要企業戦略/有力企業

- 収益分析

- 市場シェア分析

- 企業評価マトリクス:主要企業(2023年)

- 企業評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオと動向

- ブランド/製品の比較

- 主要Open RANプロバイダーの企業評価と財務指標

第12章 企業プロファイル

- 主要企業

- ERICSSON

- NOKIA

- SAMSUNG

- NEC CORPORATION

- MAVENIR

- HUAWEI TECHNOLOGIES CO., LTD.

- HEWLETT PACKARD ENTERPRISE (HPE)

- BROADCOM

- FUJITSU

- VIAVI SOLUTIONS

- JUNIPER NETWORKS

- AMDOCS

- WIND RIVER SYSTEMS

- RAKUTEN GROUP

- COMBA TELECOM

- INTEL

- RADISYS (JIO)

- KEYSIGHT TECHNOLOGIES

- MAXLINEAR

- スタートアップ/中小企業

- AIRSPAN NETWORKS

- PICOCOM

- SIVERS SEMICONDUCTORS AB

- CELONA

- GLOBALSTAR

- DEEPSIG

- COHERE TECHNOLOGIES

- VERANA NETWORKS

- DIGIS SQUARED

- PARALLEL WIRELESS

- BAICELLS TECHNOLOGIES

- GIGATERA

第13章 隣接/関連市場

- イントロダクション

- クラウドRAN市場

- 市場の概要

- クラウドRAN市場:コンポーネント別

- クラウドRAN市場:ネットワークタイプ別

- クラウドRAN市場:展開別

- クラウドRAN市場:エンドユーザー別

- ミリ波5G市場

- 市場の定義

- 市場の概要

- ミリ波5G市場:コンポーネント別

- ミリ波5G市場:ユースケース別

- ミリ波5G市場:帯域幅別

- ミリ波5G市場:用途別

- ミリ波5G市場:エンドユーザー別

- ミリ波5G市場:地域別

第14章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2019-2023

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 AVERAGE SELLING PRICE TRENDS OF KEY PLAYERS, BY HARDWARE (USD)

- TABLE 4 OPEN RADIO ACCESS NETWORK MARKET: ECOSYSTEM

- TABLE 5 OPEN RADIO ACCESS NETWORK MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2024

- TABLE 6 TARIFF RELATED TO MACHINES FOR RECEPTION, CONVERSION, AND TRANSMISSION OR REGENERATION OF VOICE, IMAGES, OR OTHER DATA (851769)

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 PORTER'S FIVE FORCES IMPACT ON OPEN RADIO ACCESS NETWORK MARKET

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR NETWORK OPERATORS

- TABLE 13 KEY BUYING CRITERIA FOR NETWORK OPERATORS

- TABLE 14 OPEN RADIO ACCESS NETWORK MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 15 HARDWARE: OPEN RADIO ACCESS NETWORK MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 16 HARDWARE: OPEN RADIO ACCESS NETWORK MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 17 RADIO UNITS: OPEN RADIO ACCESS NETWORK MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 18 CENTRALIZED UNITS/DISTRIBUTED UNITS: OPEN RADIO ACCESS NETWORK MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 19 OTHER HARDWARE: OPEN RADIO ACCESS NETWORK MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 20 SOFTWARE: OPEN RADIO ACCESS NETWORK MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 21 SOFTWARE: OPEN RADIO ACCESS NETWORK MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 22 NETWORK ORCHESTRATION & MANAGEMENT SOFTWARE: OPEN RADIO ACCESS NETWORK MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 23 RAN INTELLIGENT CONTROLLER: OPEN RADIO ACCESS NETWORK MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 24 OTHER SOFTWARE: OPEN RADIO ACCESS NETWORK MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 25 SERVICES: OPEN RADIO ACCESS NETWORK MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 26 SERVICES: OPEN RADIO ACCESS NETWORK MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 27 NETWORK PLANNING & OPTIMIZATION: OPEN RADIO ACCESS NETWORK MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 28 DEPLOYMENT & INTEGRATION: OPEN RADIO ACCESS NETWORK MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 29 SUPPORT & MAINTENANCE: OPEN RADIO ACCESS NETWORK MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 30 OPEN RADIO ACCESS NETWORK MARKET, BY NETWORK DEPLOYMENT, 2024-2030 (USD MILLION)

- TABLE 31 PUBLIC NETWORKS: OPEN RADIO ACCESS NETWORK MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 32 PRIVATE NETWORKS: OPEN RADIO ACCESS NETWORK MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 33 OPEN RADIO ACCESS NETWORK MARKET, BY FREQUENCY BAND, 2024-2030 (USD MILLION)

- TABLE 34 SUB-6GHZ: OPEN RADIO ACCESS NETWORK MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 35 MMWAVE: OPEN RADIO ACCESS NETWORK MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 36 OTHER FREQUENCY BANDS: OPEN RADIO ACCESS NETWORK MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 37 OPEN RADIO ACCESS NETWORK MARKET, BY DEPLOYMENT PHASE, 2024-2030 (USD MILLION)

- TABLE 38 GREENFIELD: OPEN RADIO ACCESS NETWORK MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 39 BROWNFIELD: OPEN RADIO ACCESS NETWORK MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 40 OPEN RADIO ACCESS NETWORK MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 41 NORTH AMERICA: OPEN RADIO ACCESS NETWORK MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 42 NORTH AMERICA: OPEN RADIO ACCESS NETWORK MARKET, BY HARDWARE, 2024-2030 (USD MILLION)

- TABLE 43 NORTH AMERICA: OPEN RADIO ACCESS NETWORK MARKET, BY SOFTWARE, 2024-2030 (USD MILLION)

- TABLE 44 NORTH AMERICA: OPEN RADIO ACCESS NETWORK MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 45 NORTH AMERICA: OPEN RADIO ACCESS NETWORK MARKET, BY NETWORK DEPLOYMENT, 2024-2030 (USD MILLION)

- TABLE 46 NORTH AMERICA: OPEN RADIO ACCESS NETWORK MARKET, BY FREQUENCY BAND, 2024-2030 (USD MILLION)

- TABLE 47 NORTH AMERICA: OPEN RADIO ACCESS NETWORK MARKET, BY DEPLOYMENT PHASE, 2024-2030 (USD MILLION)

- TABLE 48 EUROPE: OPEN RADIO ACCESS NETWORK MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 49 EUROPE: OPEN RADIO ACCESS NETWORK MARKET, BY HARDWARE, 2024-2030 (USD MILLION)

- TABLE 50 EUROPE: OPEN RADIO ACCESS NETWORK MARKET, BY SOFTWARE, 2024-2030 (USD MILLION)

- TABLE 51 EUROPE: OPEN RADIO ACCESS NETWORK MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 52 EUROPE: OPEN RADIO ACCESS NETWORK MARKET, BY NETWORK DEPLOYMENT, 2024-2030 (USD MILLION)

- TABLE 53 EUROPE: OPEN RADIO ACCESS NETWORK MARKET, BY FREQUENCY BAND, 2024-2030 (USD MILLION)

- TABLE 54 EUROPE: OPEN RADIO ACCESS NETWORK MARKET, BY DEPLOYMENT PHASE, 2024-2030 (USD MILLION)

- TABLE 55 ASIA PACIFIC: OPEN RADIO ACCESS NETWORK MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 56 ASIA PACIFIC: OPEN RADIO ACCESS NETWORK MARKET, BY HARDWARE, 2024-2030 (USD MILLION)

- TABLE 57 ASIA PACIFIC: OPEN RADIO ACCESS NETWORK MARKET, BY SOFTWARE, 2024-2030 (USD MILLION)

- TABLE 58 ASIA PACIFIC: OPEN RADIO ACCESS NETWORK MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 59 ASIA PACIFIC: OPEN RADIO ACCESS NETWORK MARKET, BY NETWORK DEPLOYMENT, 2024-2030 (USD MILLION)

- TABLE 60 ASIA PACIFIC: OPEN RADIO ACCESS NETWORK MARKET, BY FREQUENCY BAND, 2024-2030 (USD MILLION)

- TABLE 61 ASIA PACIFIC: OPEN RADIO ACCESS NETWORK MARKET, BY DEPLOYMENT PHASE, 2024-2030 (USD MILLION)

- TABLE 62 MIDDLE EAST & AFRICA: OPEN RADIO ACCESS NETWORK MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 63 MIDDLE EAST & AFRICA: OPEN RADIO ACCESS NETWORK MARKET, BY HARDWARE, 2024-2030 (USD MILLION)

- TABLE 64 MIDDLE EAST & AFRICA: OPEN RADIO ACCESS NETWORK MARKET, BY SOFTWARE, 2024-2030 (USD MILLION)

- TABLE 65 MIDDLE EAST & AFRICA: OPEN RADIO ACCESS NETWORK MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 66 MIDDLE EAST & AFRICA: OPEN RADIO ACCESS NETWORK MARKET, BY NETWORK DEPLOYMENT, 2024-2030 (USD MILLION)

- TABLE 67 MIDDLE EAST & AFRICA: OPEN RADIO ACCESS NETWORK MARKET, BY FREQUENCY BAND, 2024-2030 (USD MILLION)

- TABLE 68 MIDDLE EAST & AFRICA: OPEN RADIO ACCESS NETWORK MARKET, BY DEPLOYMENT PHASE, 2024-2030 (USD MILLION)

- TABLE 69 LATIN AMERICA: OPEN RADIO ACCESS NETWORK MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 70 LATIN AMERICA: OPEN RADIO ACCESS NETWORK MARKET, BY HARDWARE, 2024-2030 (USD MILLION)

- TABLE 71 LATIN AMERICA: OPEN RADIO ACCESS NETWORK MARKET, BY SOFTWARE, 2024-2030 (USD MILLION)

- TABLE 72 LATIN AMERICA: OPEN RADIO ACCESS NETWORK MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 73 LATIN AMERICA: OPEN RADIO ACCESS NETWORK MARKET, BY NETWORK DEPLOYMENT, 2024-2030 (USD MILLION)

- TABLE 74 LATIN AMERICA: OPEN RADIO ACCESS NETWORK MARKET, BY FREQUENCY BAND, 2024-2030 (USD MILLION)

- TABLE 75 LATIN AMERICA: OPEN RADIO ACCESS NETWORK MARKET, BY DEPLOYMENT PHASE, 2024-2030 (USD MILLION)

- TABLE 76 OPEN RADIO ACCESS NETWORK MARKET: DEGREE OF COMPETITION

- TABLE 77 OFFERING FOOTPRINT

- TABLE 78 NETWORK DEPLOYMENT FOOTPRINT

- TABLE 79 REGIONAL FOOTPRINT

- TABLE 80 OPEN RADIO ACCESS NETWORK MARKET: KEY START-UPS/SMES

- TABLE 81 OPEN RADIO ACCESS NETWORK MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 82 OPEN RADIO ACCESS NETWORK MARKET: PRODUCT LAUNCHES, JANUARY 2021-JANUARY 2024

- TABLE 83 OPEN RADIO ACCESS NETWORK MARKET: DEALS, JANUARY 2021-MARCH 2024

- TABLE 84 ERICSSON: COMPANY OVERVIEW

- TABLE 85 ERICSSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 86 ERICSSON: PRODUCT LAUNCHES

- TABLE 87 ERICSSON: DEALS

- TABLE 88 NOKIA: COMPANY OVERVIEW

- TABLE 89 NOKIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 90 NOKIA: DEALS

- TABLE 91 SAMSUNG: COMPANY OVERVIEW

- TABLE 92 SAMSUNG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 93 SAMSUNG: DEALS

- TABLE 94 NEC CORPORATION: COMPANY OVERVIEW

- TABLE 95 NEC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 96 NEC CORPORATION: PRODUCT LAUNCHES

- TABLE 97 NEC CORPORATION: DEALS

- TABLE 98 MAVENIR: COMPANY OVERVIEW

- TABLE 99 MAVENIR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 100 MAVENIR: DEALS

- TABLE 101 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 102 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 103 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCT LAUNCHES

- TABLE 104 HPE: COMPANY OVERVIEW

- TABLE 105 HPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 106 HPE: DEALS

- TABLE 107 BROADCOM: COMPANY OVERVIEW

- TABLE 108 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 109 BROADCOM: DEALS

- TABLE 110 FUJITSU: COMPANY OVERVIEW

- TABLE 111 FUJITSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 112 FUJITSU: DEALS

- TABLE 113 VIAVI SOLUTIONS: COMPANY OVERVIEW

- TABLE 114 VIAVI SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 115 VIAVI SOLUTIONS: DEALS

- TABLE 116 JUNIPER NETWORKS: COMPANY OVERVIEW

- TABLE 117 JUNIPER NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 118 JUNIPER NETWORKS: DEALS

- TABLE 119 CLOUD-RADIO ACCESS NETWORK MARKET, BY COMPONENT, 2016-2019 (USD MILLION)

- TABLE 120 CLOUD-RADIO ACCESS NETWORK MARKET, BY COMPONENT, 2019-2025 (USD MILLION)

- TABLE 121 SOLUTIONS: CLOUD-RADIO ACCESS NETWORK MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 122 SOLUTIONS: CLOUD-RADIO ACCESS NETWORK MARKET, BY REGION, 2019-2025 (USD MILLION)

- TABLE 123 SERVICES: CLOUD-RADIO ACCESS NETWORK MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 124 SERVICES: CLOUD-RADIO ACCESS NETWORK MARKET, BY REGION, 2019-2025 (USD MILLION)

- TABLE 125 SERVICES: CLOUD-RADIO ACCESS NETWORK MARKET, BY TYPE, 2016-2019 (USD MILLION)

- TABLE 126 SERVICES: CLOUD-RADIO ACCESS NETWORK MARKET, BY TYPE, 2019-2025 (USD MILLION)

- TABLE 127 CLOUD-RADIO ACCESS NETWORK MARKET, BY NETWORK TYPE, 2016-2019 (USD MILLION)

- TABLE 128 CLOUD-RADIO ACCESS NETWORK MARKET, BY NETWORK TYPE, 2019-2025 (USD MILLION)

- TABLE 129 CLOUD-RADIO ACCESS NETWORK MARKET, BY DEPLOYMENT, 2016-2019 (USD MILLION)

- TABLE 130 CLOUD-RADIO ACCESS NETWORK MARKET, BY DEPLOYMENT, 2019-2025 (USD MILLION)

- TABLE 131 CLOUD-RADIO ACCESS NETWORK MARKET, BY END USER, 2016-2019 (USD MILLION)

- TABLE 132 CLOUD-RADIO ACCESS NETWORK MARKET, BY END USER, 2019-2025 (USD MILLION)

- TABLE 133 MMWAVE 5G MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 134 MMWAVE 5G MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 135 SERVICES: MMWAVE 5G MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 136 SERVICES: MMWAVE 5G MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 137 MMWAVE 5G MARKET, BY USE CASE, 2018-2021 (USD MILLION)

- TABLE 138 MMWAVE 5G MARKET, BY USE CASE, 2022-2027 (USD MILLION)

- TABLE 139 MMWAVE 5G MARKET, BY BANDWIDTH, 2018-2021 (USD MILLION)

- TABLE 140 MMWAVE 5G MARKET, BY BANDWIDTH, 2022-2027 (USD MILLION)

- TABLE 141 MMWAVE 5G MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 142 MMWAVE 5G MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 143 MMWAVE 5G MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 144 MMWAVE 5G MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 145 MMWAVE 5G MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 146 MMWAVE 5G MARKET, BY REGION, 2022-2027 (USD MILLION)

List of Figures

- FIGURE 1 OPEN RADIO ACCESS NETWORK MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 OPEN RADIO ACCESS NETWORK MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE OF VENDORS IN OPEN RADIO ACCESS NETWORK MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): OPEN RADIO ACCESS NETWORK MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION USING BOTTOM-UP APPROACH

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 OPEN RADIO ACCESS NETWORK MARKET TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 10 OPEN RADIO ACCESS NETWORK MARKET: REGIONAL SNAPSHOT

- FIGURE 11 RISING INVESTMENT IN 5G NETWORKS CONTRIBUTING TO ADOPTION OF OPEN RADIO ACCESS NETWORK SOLUTIONS

- FIGURE 12 OPEN RADIO ACCESS NETWORK MARKET: TOP GROWING SEGMENTS, 2024

- FIGURE 13 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 PUBLIC NETWORKS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2024

- FIGURE 15 DEPLOYMENT & INTEGRATION SEGMENT TO ACCOUNT FOR HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 16 SUB-6GHZ SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 GREENFIELD SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 SOFTWARE AND GREENFIELD SEGMENTS TO HOLD LARGEST MARKET SHARES IN 2024

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: OPEN RADIO ACCESS NETWORK MARKET

- FIGURE 20 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 21 AVERAGE SELLING PRICE TRENDS OF KEY PLAYERS, BY HARDWARE

- FIGURE 22 OPEN RADIO ACCESS NETWORK MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 KEY PLAYERS IN OPEN RADIO ACCESS NETWORK MARKET ECOSYSTEM

- FIGURE 24 LIST OF MAJOR PATENTS FOR OPEN RADIO ACCESS NETWORK

- FIGURE 25 MACHINES FOR RECEPTION, CONVERSION, AND TRANSMISSION OR REGENERATION OF VOICE, IMAGES, OR OTHER DATA, INCLUDING SWITCHING AND ROUTING APPARATUS, BY KEY COUNTRY, 2015-2022 (USD BILLION)

- FIGURE 26 MACHINES FOR RECEPTION, CONVERSION, AND TRANSMISSION OR REGENERATION OF VOICE, IMAGES, OR OTHER DATA, INCLUDING SWITCHING AND ROUTING APPARATUS, BY KEY COUNTRY, 2015-2022 (USD BILLION)

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR NETWORK OPERATORS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP NETWORK OPERATORS

- FIGURE 29 EVOLUTION OF OPEN RADIO ACCESS NETWORK

- FIGURE 30 LEADING GLOBAL OPEN RADIO ACCESS NETWORK MARKET VENDORS BY NUMBER OF INVESTORS AND FUNDING ROUNDS, 2023

- FIGURE 31 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 PRIVATE NETWORKS SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 33 MMWAVE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 BROWNFIELD SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 37 REVENUE ANALYSIS FOR KEY COMPANIES, 2018-2023 (USD MILLION)

- FIGURE 38 SHARE OF LEADING COMPANIES IN OPEN RADIO ACCESS NETWORK MARKET, 2023

- FIGURE 39 MARKET RANKING ANALYSIS OF TOP FIVE PLAYERS

- FIGURE 40 OPEN RADIO ACCESS NETWORK MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 41 OVERALL COMPANY FOOTPRINT

- FIGURE 42 OPEN RADIO ACCESS NETWORK MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- FIGURE 43 BRAND/PRODUCT COMPARISON

- FIGURE 44 FINANCIAL METRICS OF KEY OPEN RADIO ACCESS NETWORK VENDORS

- FIGURE 45 COMPANY VALUATION OF KEY OPEN RADIO ACCESS NETWORK VENDORS

- FIGURE 46 ERICSSON: COMPANY SNAPSHOT

- FIGURE 47 NOKIA: COMPANY SNAPSHOT

- FIGURE 48 SAMSUNG: COMPANY SNAPSHOT

- FIGURE 49 NEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

- FIGURE 51 HPE: COMPANY SNAPSHOT

- FIGURE 52 BROADCOM: COMPANY SNAPSHOT

- FIGURE 53 FUJITSU: COMPANY SNAPSHOT

- FIGURE 54 VIAVI SOLUTIONS: COMPANY SNAPSHOT

- FIGURE 55 JUNIPER NETWORKS: COMPANY SNAPSHOT

The open RAN market is estimated at USD 2.8 billion in 2024 to USD 20.9 billion by 2030, at a Compound Annual Growth Rate (CAGR) of 39.4%. Rising network flexibility and compatibility demand owing to the usage of Open RAN technology by telecom operators helps to reduce single vendors dependency and embrace multi-vendor environments. Emerging 5G technology fuels the need for more cost-effective and scalable network infrastructure solutions. The open RAN adoption is also affected by regulatory initiatives that promote the acceptance of open standards. Additionally, industry players want to speed up innovation in open RAN technology and its deployment through cost savings and performance enhancements. Furthermore, the increasing focus on virtualization and cloud-native technologies aligns well with the principles of open RAN, further driving its momentum.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | USD (Billion) |

| Segments | By offering, network deployment, frequency band, and deployment phase (brownfield, greenfield) |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. |

By offering, the services segment is expected to register the highest CAGR during the forecast period.

The services segment is expected to hold a higher growth rate in the open RAN market due to several compelling factors. There has been an increase in demand for network planning & optimization, deployment and integration, support and maintenance services by companies adopting open RAN solutions as these services assist them in facilitating deployment and optimization of these solutions. The growing emphasis on virtualization and cloud-native architectures within the telecom industry is expected to fuel demand for services related to virtualized network functions and cloud integration.

Greenfield is expected to hold the largest market share during the forecast period. In the open RAN market, greenfield deployments provide unmatched flexibility, the potential for innovation, and cost savings to operators. Such deployments enable the selection of best-in-class vendors for diverse network components such as the Radio Unit (RU), Distributed Unit (DU), and Central Unit (CU) from an array of suppliers, avoiding the limitations imposed by single vendor proprietary systems. The open vendor setup boosts innovation and quickly brings new features and technologies allowing new vendors to join. Despite these obstacles, greenfield deployments represent a substantial opportunity for operators to construct adaptable, future-oriented networks that leverage the competitive and innovative advantages of the open RAN market.

North America is estimated to have the second-largest market size during the forecast period.

North America's high-speed connectivity, coverage, and modern telecom ecosystem support the adoption and integration of Open RAN systems. Government programs foster innovation and competitiveness in the telecom industry. Furthermore, a number of top companies are actively funding R&D in North America to enhance the functionality and scalability of Open RAN systems. The adoption is further boosted by the rollout of 5G networks across the area which is motivated by growing consumer demand for high-speed data services and emerging applications.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the open RAN market.

- By Company Type: Tier 1 - 62%, Tier 2 - 23%, and Tier 3 - 15%

- By Designation: C-level -38%, D-level - 30%, and Others - 22%

- By Region: North America - 40%, Europe - 15%, Asia Pacific - 35%, and Rest of the World - 10%.

The major players in the open RAN market are Ericsson (Sweden), Nokia (Finland), Samsung (South Korea), NEC Corporation (Japan), Mavenir (US), Huawei Technologies (China), HPE (US), Broadcom (US), Fujitsu (Japan), Viavi Solutions (US), Juniper Networks (US), Amdocs (US), Wind River Systems (US), Rakuten (Japan), Comba Telecom (China), Intel (US), Radisys (US), Keysight Technologies (US), MaxLinear (US), Airspan Networks (US), Picocom (England), Sivers Semiconductors (Sweden), Celona (US), Globalstar (US), DeepSig (US), Cohere Technologies (US), Verana Networks (US), Digis Squared (UK), Parallel Wireless (US), Baicells Technologies (China), Gigatera (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, enhancements, and acquisitions to expand their open RAN market footprint.

Research Coverage

The market study covers the open RAN market size across different segments. It aims at estimating the market size and the growth potential across different segments, including offering (hardware, software, service), network deployment (public network and private network), frequency band (Sub-6GHz, mmWave, other frequency bands), deployment phase (brownfield and greenfield) and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the global open RAN market's revenue numbers and subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

1. Analysis of key drivers (demand for enhanced network flexibility and accelerated innovation, significant reduction in TCO, and implementation of beamforming technology resolving bitrate problem in fronthaul networks), restraints (high integration cost and complexity), opportunities (commercialization of 5G services, rising demand for open RAN from mobile operators, and acceptance of open fronthaul standard boosting commercial network deployment of Open RAN), and challenges (carrier-grade scalability and complicated systems due to multi-vendor environment) influencing the growth of the open RAN market.

2. Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the open RAN market.

3. Market Development: Comprehensive information about lucrative markets - the report analyses the open RAN market across various regions.

4. Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the open RAN market.

5. Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading companies including Ericsson (Sweden), Nokia (Finland), Samsung (South Korea), NEC Corporation (Japan), Mavenir (US), Huawei Technologies (China), HPE (US), Broadcom (US), Fujitsu (Japan), Viavi Solutions (US), Juniper Networks (US), Amdocs (US), Wind River Systems (US), Rakuten (Japan), Comba Telecom (China), Intel (US), Radisys (US), Keysight Technologies (US), MaxLinear (US), Airspan Networks (US), Picocom (England), Sivers Semiconductors (Sweden), Celona (US), Globalstar (US), DeepSig (US), Cohere Technologies (US), Verana Networks (US), Digis Squared (UK), Parallel Wireless (US), Baicells Technologies (China), Gigatera (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakdown of primary profiles

- 2.1.2.3 Key insights from industry experts

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.3 OPEN RADIO ACCESS NETWORK MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

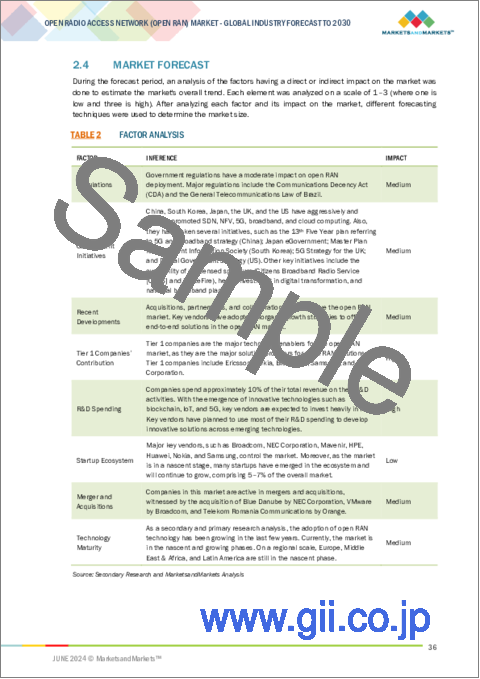

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.7 IMPACT OF RECESSION ON OPEN RADIO ACCESS NETWORK MARKET

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN OPEN RADIO ACCESS NETWORK MARKET

- 4.2 OPEN RADIO ACCESS NETWORK MARKET: TOP GROWING SEGMENTS

- 4.3 OPEN RADIO ACCESS NETWORK MARKET, BY OFFERING

- 4.4 OPEN RADIO ACCESS NETWORK MARKET, BY NETWORK DEPLOYMENT

- 4.5 OPEN RADIO ACCESS NETWORK MARKET, BY SERVICE

- 4.6 OPEN RADIO ACCESS NETWORK MARKET, BY FREQUENCY BAND

- 4.7 OPEN RADIO ACCESS NETWORK MARKET, BY DEPLOYMENT PHASE

- 4.8 NORTH AMERICAN OPEN RADIO ACCESS NETWORK MARKET, BY OFFERING AND DEPLOYMENT PHASE

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Demand for enhanced network flexibility and accelerated innovation

- 5.2.1.2 Significant reductions in TCO

- 5.2.1.3 Implementation of beamforming technology resolving bitrate problem in fronthaul networks

- 5.2.2 RESTRAINTS

- 5.2.2.1 High integration cost and complexity

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Commercialization of 5G services

- 5.2.3.2 Rising demand for open RAN from mobile operators

- 5.2.3.3 Acceptance of open fronthaul standard boosting commercial network deployment of open RAN

- 5.2.4 CHALLENGES

- 5.2.4.1 Carrier-grade scalability

- 5.2.4.2 Complicated systems due to multi-vendor environment

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY HARDWARE

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Cellular networks

- 5.7.1.2 Network Function Virtualization (NFV)

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Cloud computing

- 5.7.2.2 AI and ML

- 5.7.2.3 Software-Defined Networking (SDN)

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Beamforming

- 5.7.3.2 Network orchestration

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.8.1 LIST OF MAJOR PATENTS

- 5.9 TRADE ANALYSIS

- 5.9.1 EXPORT SCENARIO FOR HS CODE: 8517

- 5.9.2 IMPORT SCENARIO FOR HS CODE: 8517

- 5.10 KEY CONFERENCES AND EVENTS, 2024

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.11.1 TARIFF RELATED TO OPEN RADIO ACCESS NETWORK DEVICES (851769)

- 5.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2.1 North America

- 5.11.2.1.1 US

- 5.11.2.1.2 Canada

- 5.11.2.2 Europe

- 5.11.2.3 Asia Pacific

- 5.11.2.3.1 South Korea

- 5.11.2.3.2 China

- 5.11.2.3.3 India

- 5.11.2.4 Middle East & Africa

- 5.11.2.4.1 UAE

- 5.11.2.4.2 KSA

- 5.11.2.5 Latin America

- 5.11.2.5.1 Brazil

- 5.11.2.5.2 Mexico

- 5.11.2.1 North America

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF NEW ENTRANTS

- 5.12.2 THREAT OF SUBSTITUTES

- 5.12.3 BARGAINING POWER OF SUPPLIERS

- 5.12.4 BARGAINING POWER OF BUYERS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 TECHNOLOGY ROADMAP FOR OPEN RADIO ACCESS NETWORK MARKET

- 5.14.1 SHORT-TERM ROADMAP (2023-2025)

- 5.14.2 MID-TERM ROADMAP (2026-2028)

- 5.14.3 LONG-TERM ROADMAP (2029-2030)

- 5.15 BEST PRACTICES IN OPEN RADIO ACCESS NETWORK MARKET

- 5.15.1 EMBRACE STANDARDIZATION AND COLLABORATION

- 5.15.2 LEVERAGE DEVOPS AND AUTOMATION

- 5.15.3 SECURITY BY DESIGN

- 5.15.4 OPENNESS AND TRANSPARENCY

- 5.16 CURRENT AND EMERGING BUSINESS MODELS

- 5.16.1 SUBSCRIPTION MODEL

- 5.16.2 TRADITIONAL SALES MODEL

- 5.16.3 GOVERNMENT-OWNED

- 5.16.4 OPEN-SOURCE RAN (OSRAN)

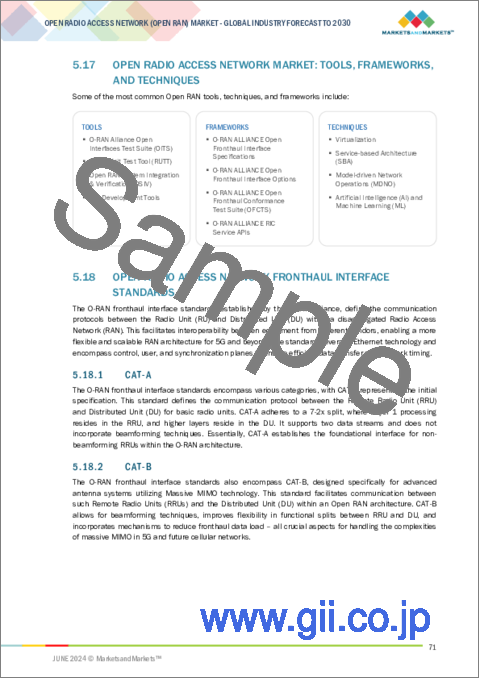

- 5.17 OPEN RADIO ACCESS NETWORK MARKET: TOOLS, FRAMEWORKS, AND TECHNIQUES

- 5.18 OPEN RADIO ACCESS NETWORK FRONTHAUL INTERFACE STANDARDS

- 5.18.1 CAT-A

- 5.18.2 CAT-B

- 5.18.2.1 CAT-B ULPI-A

- 5.18.2.2 CAT-B ULPI-B

- 5.19 BRIEF HISTORY OF OPEN RADIO ACCESS NETWORK

- 5.20 INVESTMENT & FUNDING SCENARIO

- 5.21 CASE STUDY ANALYSIS

- 5.21.1 DISH WIRELESS LAUNCHED WORLD'S FIRST 5G SA NETWORK USING MAVENIR OPEN VRAN ON PUBLIC CLOUD

- 5.21.2 ELISA IMPLEMENTED ERICSSON RAN ENERGY EFFICIENCY SOFTWARE TO BOOST ENERGY EFFICIENCY

- 5.21.3 A1 GROUP LEVERAGED NOKIA'S ANYRAN AND 5G STANDALONE APPROACH TO VALIDATE CENTRALIZED AND DISTRIBUTED OPTIONS WITH FRONTHAUL AND MID-HAUL DISTANCES

- 5.21.4 AMDOCS HELPED INDONESIAN UNIVERSITY IMPLEMENT OPEN RADIO ACCESS NETWORK TO SIMULATE REAL-WORLD ENVIRONMENTS AND RESOLVE ISSUES BETWEEN HARDWARE AND SOFTWARE VENDORS

6 OPEN RADIO ACCESS NETWORK MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERINGS: OPEN RADIO ACCESS NETWORK MARKET DRIVERS

- 6.2 HARDWARE

- 6.2.1 RADIO UNITS

- 6.2.1.1 Radio units to offer flexibility in choosing equipment from different vendors

- 6.2.2 CENTRALIZED UNITS/DISTRIBUTED UNITS

- 6.2.2.1 CUs/DUs to enable easier upgrades and optimizations and help networks adapt to evolving technologies

- 6.2.3 OTHER HARDWARE

- 6.2.1 RADIO UNITS

- 6.3 SOFTWARE

- 6.3.1 NETWORK ORCHESTRATION & MANAGEMENT SOFTWARE

- 6.3.1.1 Advanced orchestration & management software to simplify network management tasks and enhance operational efficiency

- 6.3.2 RAN INTELLIGENT CONTROLLER

- 6.3.2.1 RICs to deliver high-quality mobile services while maximizing use of network resources and minimizing operational overhead

- 6.3.3 OTHER SOFTWARE

- 6.3.1 NETWORK ORCHESTRATION & MANAGEMENT SOFTWARE

- 6.4 SERVICES

- 6.4.1 NETWORK PLANNING & OPTIMIZATION

- 6.4.1.1 Operators to deploy open RAN networks to deliver robust connectivity and meet escalating demand for mobile broadband services

- 6.4.2 DEPLOYMENT & INTEGRATION

- 6.4.2.1 Deployment & integration services to ensure all components work harmoniously and optimize network performance and reliability

- 6.4.3 SUPPORT & MAINTENANCE

- 6.4.3.1 Support & maintenance services to minimize downtime, enhance network reliability, and deliver superior customer service

- 6.4.1 NETWORK PLANNING & OPTIMIZATION

7 OPEN RADIO ACCESS NETWORK MARKET, BY NETWORK DEPLOYMENT

- 7.1 INTRODUCTION

- 7.1.1 NETWORK DEPLOYMENTS: OPEN RADIO ACCESS NETWORK MARKET DRIVERS

- 7.2 PUBLIC NETWORKS

- 7.2.1 PUBLIC NETWORKS TO DRIVE DEMAND FOR THEIR COMPATIBILITY AND VALID SUBSCRIPTION PLAN

- 7.3 PRIVATE NETWORKS

- 7.3.1 PRIVATE NETWORKS TO PROVIDE SECURE AND DEDICATED ENVIRONMENT FOR AUTHORIZED DEVICES AND APPLICATIONS USED WITHIN SPECIFIC ORGANIZATION

8 OPEN RADIO ACCESS NETWORK MARKET, BY FREQUENCY BAND

- 8.1 INTRODUCTION

- 8.1.1 FREQUENCY BANDS: OPEN RADIO ACCESS NETWORK MARKET DRIVERS

- 8.2 SUB-6GHZ

- 8.2.1 NEED FOR COMPREHENSIVE COVERAGE AND ROBUST SIGNAL PROPAGATION TO FUEL DEMAND FOR SUB-6GHZ

- 8.3 MMWAVE

- 8.3.1 MMWAVE TO ENHANCE DATA TRANSMISSION SPEEDS AND ACCOMMODATE EXTENSIVE USER BASE THAN TRADITIONAL SUB-6 GHZ BANDS

- 8.4 OTHER FREQUENCY BANDS

9 OPEN RADIO ACCESS NETWORK MARKET, BY DEPLOYMENT PHASE

- 9.1 INTRODUCTION

- 9.1.1 DEPLOYMENT PHASES: OPEN RADIO ACCESS NETWORK MARKET DRIVERS

- 9.2 GREENFIELD

- 9.2.1 GREENFIELD DEPLOYMENTS TO ENABLE OPERATORS TO BUILD NEW, FLEXIBLE, AND COST-EFFICIENT MOBILE NETWORKS FROM SCRATCH

- 9.3 BROWNFIELD

- 9.3.1 BROWNFIELD DEPLOYMENTS TO UPDATE EXISTING NETWORKS WITH NEW TECHNOLOGIES AND REDUCE DISRUPTIONS AND COSTS

10 OPEN RADIO ACCESS NETWORK MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: OPEN RADIO ACCESS NETWORK MARKET DRIVERS

- 10.2.2 NORTH AMERICA: OPEN RADIO ACCESS NETWORK DEVELOPMENTS, BY COUNTRY

- 10.2.2.1 US

- 10.2.2.2 Canada

- 10.2.3 NORTH AMERICA: RECESSION IMPACT

- 10.3 EUROPE

- 10.3.1 EUROPE: OPEN RADIO ACCESS NETWORK MARKET DRIVERS

- 10.3.2 EUROPE: OPEN RADIO ACCESS NETWORK DEVELOPMENTS, BY COUNTRY

- 10.3.2.1 US

- 10.3.2.2 Germany

- 10.3.2.3 France

- 10.3.2.4 Italy, Romania, and Spain

- 10.3.2.5 Ireland

- 10.3.2.6 Netherlands

- 10.3.3 EUROPE: RECESSION IMPACT

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: OPEN RADIO ACCESS NETWORK MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: OPEN RADIO ACCESS NETWORK DEVELOPMENTS, BY COUNTRY

- 10.4.2.1 Japan

- 10.4.2.2 India

- 10.4.2.3 Thailand

- 10.4.2.4 Indonesia

- 10.4.2.5 Malaysia

- 10.4.2.6 South Korea

- 10.4.3 ASIA PACIFIC: RECESSION IMPACT

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: OPEN RADIO ACCESS NETWORK MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: OPEN RADIO ACCESS NETWORK DEVELOPMENTS, BY COUNTRY

- 10.5.2.1 UAE

- 10.5.2.2 KSA

- 10.5.2.3 Kuwait

- 10.5.2.4 Bahrain

- 10.5.2.5 Qatar

- 10.5.2.6 Africa

- 10.5.3 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: OPEN RADIO ACCESS NETWORK MARKET DRIVERS

- 10.6.2 LATIN AMERICA: OPEN RADIO ACCESS NETWORK DEVELOPMENTS, BY COUNTRY

- 10.6.2.1 Brazil

- 10.6.2.2 Argentina

- 10.6.2.3 Peru

- 10.6.3 LATIN AMERICA: RECESSION IMPACT

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY OPEN RADIO ACCESS NETWORK VENDORS

- 11.3 REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

- 11.4.1 MARKET RANKING ANALYSIS

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.5.5.1 Company footprint

- 11.5.5.2 Offering footprint

- 11.5.5.3 Network deployment footprint

- 11.5.5.4 Regional footprint

- 11.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2023

- 11.6.5.1 Key start-ups/SMEs

- 11.6.5.2 Competitive benchmarking of key start-ups/SMEs

- 11.7 COMPETITIVE SCENARIO AND TRENDS

- 11.7.1 PRODUCT LAUNCHES

- 11.7.2 DEALS

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPANY VALUATION AND FINANCIAL METRICS OF KEY OPEN RADIO ACCESS NETWORK PROVIDERS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 ERICSSON

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices made

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 NOKIA

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices made

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 SAMSUNG

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices made

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 NEC CORPORATION

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.4 MNM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 MAVENIR

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices made

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 HUAWEI TECHNOLOGIES CO., LTD.

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.7 HEWLETT PACKARD ENTERPRISE (HPE)

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.8 BROADCOM

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.9 FUJITSU

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.10 VIAVI SOLUTIONS

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.11 JUNIPER NETWORKS

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.12 AMDOCS

- 12.1.13 WIND RIVER SYSTEMS

- 12.1.14 RAKUTEN GROUP

- 12.1.15 COMBA TELECOM

- 12.1.16 INTEL

- 12.1.17 RADISYS (JIO)

- 12.1.18 KEYSIGHT TECHNOLOGIES

- 12.1.19 MAXLINEAR

- 12.1.1 ERICSSON

- 12.2 START-UPS/SMES

- 12.2.1 AIRSPAN NETWORKS

- 12.2.2 PICOCOM

- 12.2.3 SIVERS SEMICONDUCTORS AB

- 12.2.4 CELONA

- 12.2.5 GLOBALSTAR

- 12.2.6 DEEPSIG

- 12.2.7 COHERE TECHNOLOGIES

- 12.2.8 VERANA NETWORKS

- 12.2.9 DIGIS SQUARED

- 12.2.10 PARALLEL WIRELESS

- 12.2.11 BAICELLS TECHNOLOGIES

- 12.2.12 GIGATERA

13 ADJACENT/RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 CLOUD-RADIO ACCESS NETWORK MARKET

- 13.2.1 MARKET OVERVIEW

- 13.2.2 CLOUD-RADIO ACCESS NETWORK MARKET, BY COMPONENT

- 13.2.2.1 Solutions

- 13.2.2.2 Services

- 13.2.3 CLOUD-RADIO ACCESS NETWORK MARKET, BY NETWORK TYPE

- 13.2.4 CLOUD-RADIO ACCESS NETWORK MARKET, BY DEPLOYMENT

- 13.2.5 CLOUD-RADIO ACCESS NETWORK MARKET, BY END USER

- 13.3 MMWAVE 5G MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.3 MMWAVE 5G MARKET, BY COMPONENT

- 13.3.4 MMWAVE 5G MARKET, BY USE CASE

- 13.3.5 MMWAVE 5G MARKET, BY BANDWIDTH

- 13.3.6 MMWAVE 5G MARKET, BY APPLICATION

- 13.3.7 MMWAVE 5G MARKET, BY END USER

- 13.3.8 MMWAVE 5G MARKET, BY REGION

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS