|

|

市場調査レポート

商品コード

1537098

坐薬包装の世界市場:素材別、用途別、地域別 - 2029年までの予測Suppository Packaging Market by Material (Aluminum/Pe, Pvc/Pe), Application (Nasal, Ear, Rectal, Vaginal, Urethral), And Region (North America, Europe, Apac, South America, Mea) - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 坐薬包装の世界市場:素材別、用途別、地域別 - 2029年までの予測 |

|

出版日: 2024年08月07日

発行: MarketsandMarkets

ページ情報: 英文 223 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

坐薬包装の市場規模は、2024年の3億1,200万米ドルから6.5%のCAGRで拡大し、2029年には4億2,800万米ドルに達すると予測されています。

坐薬包装の需要は、様々な産業における汎用性の高い用途と有利な特性から生じています。乳化重合によって製造されるこれらのポリマーは、水中に分散したポリマー粒子で構成されています。さらに、坐薬包装は繊維製品の強度、柔軟性、耐洗濯性を高めるために幅広く使用されています。製紙業界では、コーティング特性、印刷適性、表面仕上げを向上させます。さらに、座薬包装はカーペットの裏地、不織布、特殊ラテックス製品にも利用され、その応用範囲はさらに広がっています。産業界が費用対効果に優れ、環境に優しい解決策を求め続けているため、坐薬包装の需要は伸びると予想されます。揮発性有機化合物(VOC)排出量が少なく、厳しい環境規制に準拠しているため、その魅力はますます高まっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 対象単位 | 数量(キロトン)、金額(100万米ドル) |

| セグメント | 材料用途、地域 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

アルミニウム/PEは、そのユニークな特性の組み合わせと多様な用途により、坐薬包装市場で最も急成長しているセグメントです。アルミニウム部分は、湿気、光、酸素に対して顕著な障害を与え、坐薬の固体性と生存性を保護するのに役立ちます。温度に敏感な医薬品の品質と性能を長期にわたって維持することは非常に重要であり、アルミニウム層は製品の保存期間を延ばす上で重要な役割を果たします。ポリエチレンとテーラードアルミフィルムを組み合わせることで、快適な柔軟性と耐久性を兼ね備えた包装材が生まれます。坐薬そのものを傷つけることなく包装を破ることができるため、製品が完全に保たれ、意図したとおりに使用できるようになります。

尿道用途は、坐薬包装市場で最も急成長している分野です。特に、勃起不全や尿路感染症など、局所治療が迅速な救済と患者の予後改善に役立つ疾患に対する尿道ドラッグデリバリーに関連する利点が、ますます認識されるようになっています。この投与様式は、粘膜を介した直接吸収を可能にし、消化管と初回通過代謝を回避し、薬効を高めます。さらに、尿路感染症の治療を必要とする病態の増加や人口の増加が、このような特殊医薬品の需要を促進しています。医療従事者は、経口薬では困難な患者に対してより効果的な治療法を求めており、液状錠剤は有効な選択肢として支持を集めています。

当レポートでは、世界の坐薬包装市場について調査し、素材別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

第6章 業界の動向

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- バリューチェーン分析

- エコシステム分析

- 貿易分析

- 技術分析

- 生成AIが坐薬包装市場に与える影響

- 規制状況

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- 特許分析

- 2024年~2025年の主な会議とイベント

- マクロ経済分析

第7章 坐薬包装市場(素材別)

- イントロダクション

- アルミニウム/PE

- PVC/PE

- その他

第8章 坐薬包装市場(用途別)

- イントロダクション

- 医薬品

- その他

第9章 坐薬包装市場(地域別)

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

第10章 競合情勢

- 概要

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- CONSTANTIA FLEXIBLES

- DELPHARM

- CORDENPHARMA

- AENOVA GROUP

- UNITHER PHARMACEUTICAL

- ACG

- HYSUM EUROPE GMBH

- CAPRIHANS INDIA LIMITED.

- FENGCHEN GROUP CO., LTD

- KAA TIMEX LR

- その他の企業

- ALUBERG S.P.A.

- FAMAR HEALTH CARE SERVICES

- LGM PHARMA.

- SARONG S.P.A.

- ADRAGOS PHARMA.

- VALMATIC S.R.L.

- HUDI PHARMA

- NEXTPHARMA TECHNOLOGIES

- TREFOIL PACKAGING PVT LTD

- SGM INDIA

- GREEN PACK FOILS PVT. LTD.

- BERKO PHARMACEUTICALS

第12章 隣接市場と関連市場

第13章 付録

List of Tables

- TABLE 1 SUPPOSITORY PACKAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- TABLE 3 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 4 ROLE OF COMPANIES IN SUPPOSITORY PACKAGING ECOSYSTEM

- TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 INDICATIVE PRICING TREND OF SUPPOSITORY PACKAGING OFFERED BY KEY PLAYERS, BY MATERIAL, 2023 (USD/KG)

- TABLE 11 AVERAGE SELLING PRICE TREND OF SUPPOSITORY PACKAGING, BY REGION, 2021-2029 (USD/KG)

- TABLE 12 SUPPOSITORY PACKAGING MARKET: LIST OF PATENTS, 2023

- TABLE 13 SUPPOSITORY PACKAGING MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 14 WORLD GDP GROWTH PROJECTION, 2021-2028 (USD TRILLION)

- TABLE 15 SUPPOSITORY PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 16 SUPPOSITORY PACKAGING MARKET, BY MATERIAL, 2024-2029 (KILOTON)

- TABLE 17 SUPPOSITORY PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 18 SUPPOSITORY PACKAGING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 19 SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 20 SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 21 SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 22 SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 23 NORTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 24 NORTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 25 NORTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 26 NORTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 27 NORTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 28 NORTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 29 NORTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 30 NORTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY MATERIAL, 2024-2029 (KILOTON)

- TABLE 31 NORTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 32 NORTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 33 NORTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 34 NORTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 35 US: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 36 US: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 37 US: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 38 US: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 39 CANADA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 40 CANADA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 41 CANADA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 42 CANADA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 43 MEXICO: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 44 MEXICO: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 45 MEXICO: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 46 MEXICO: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 47 EUROPE: SUPPOSITORY PACKAGING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 48 EUROPE: SUPPOSITORY PACKAGING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 49 EUROPE: SUPPOSITORY PACKAGING MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 50 EUROPE: SUPPOSITORY PACKAGING MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 51 EUROPE: SUPPOSITORY PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 52 EUROPE: SUPPOSITORY PACKAGING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 53 EUROPE: SUPPOSITORY PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 54 EUROPE: SUPPOSITORY PACKAGING MARKET, BY MATERIAL, 2024-2029 (KILOTON)

- TABLE 55 EUROPE: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 56 EUROPE: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 57 EUROPE: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 58 EUROPE: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 59 GERMANY: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 60 GERMANY: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 61 GERMANY: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 62 GERMANY: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 63 FRANCE: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 64 FRANCE: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 65 FRANCE: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 66 FRANCE: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 67 UK: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 68 UK: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 69 UK: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 70 UK: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 71 ITALY: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 72 ITALY: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 73 ITALY: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 74 ITALY: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 75 SPAIN: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 76 SPAIN: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 77 SPAIN: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 78 SPAIN: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 79 REST OF EUROPE: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 80 REST OF EUROPE: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 81 REST OF EUROPE: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 82 REST OF EUROPE: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 83 ASIA PACIFIC: SUPPOSITORY PACKAGING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 84 ASIA PACIFIC: SUPPOSITORY PACKAGING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 85 ASIA PACIFIC: SUPPOSITORY PACKAGING MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 86 ASIA PACIFIC: SUPPOSITORY PACKAGING MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 87 ASIA PACIFIC: SUPPOSITORY PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 88 ASIA PACIFIC: SUPPOSITORY PACKAGING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 89 ASIA PACIFIC: SUPPOSITORY PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 90 ASIA PACIFIC: SUPPOSITORY PACKAGING MARKET, BY MATERIAL, 2024-2029 (KILOTON)

- TABLE 91 ASIA PACIFIC: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 92 ASIA PACIFIC: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 93 ASIA PACIFIC: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 94 ASIA PACIFIC: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 95 CHINA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 96 CHINA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 97 CHINA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 98 CHINA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 99 INDIA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 100 INDIA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 101 INDIA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 102 INDIA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 103 JAPAN: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 104 JAPAN: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 105 JAPAN: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 106 JAPAN: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 107 AUSTRALIA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 108 AUSTRALIA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 109 AUSTRALIA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 110 AUSTRALIA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 111 REST OF ASIA PACIFIC: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 112 REST OF ASIA PACIFIC: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 113 REST OF ASIA PACIFIC: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 114 REST OF ASIA PACIFIC: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 115 SOUTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 116 SOUTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 117 SOUTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 118 SOUTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 119 SOUTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 120 SOUTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 121 SOUTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 122 SOUTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY MATERIAL, 2024-2029 (KILOTON)

- TABLE 123 SOUTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 124 SOUTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 125 SOUTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 126 SOUTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 127 BRAZIL: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 128 BRAZIL: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 129 BRAZIL: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 130 BRAZIL: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 131 ARGENTINA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 132 ARGENTINA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 133 ARGENTINA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 134 ARGENTINA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 135 REST OF SOUTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 136 REST OF SOUTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 137 REST OF SOUTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 138 REST OF SOUTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 139 MIDDLE EAST & AFRICA: SUPPOSITORY PACKAGING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: SUPPOSITORY PACKAGING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: SUPPOSITORY PACKAGING MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 142 MIDDLE EAST & AFRICA: SUPPOSITORY PACKAGING MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 143 MIDDLE EAST & AFRICA: SUPPOSITORY PACKAGING MARKET, BY MATERIAL, 2021-2023 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: SUPPOSITORY PACKAGING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: SUPPOSITORY PACKAGING MARKET, BY MATERIAL, 2021-2023 (KILOTON)

- TABLE 146 MIDDLE EAST & AFRICA: SUPPOSITORY PACKAGING MARKET, BY MATERIAL, 2024-2029 (KILOTON)

- TABLE 147 MIDDLE EAST & AFRICA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 150 MIDDLE EAST & AFRICA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 151 GCC COUNTRIES: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 152 GCC COUNTRIES: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 153 GCC COUNTRIES: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 154 GCC COUNTRIES: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 155 SAUDI ARABIA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 156 SAUDI ARABIA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 157 SAUDI ARABIA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 158 SAUDI ARABIA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 159 UAE: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 160 UAE: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 161 UAE: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 162 UAE: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 163 REST OF GCC COUNTRIES: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 164 REST OF GCC COUNTRIES: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 165 REST OF GCC COUNTRIES: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 166 REST OF GCC COUNTRIES: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 167 TURKEY: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 168 TURKEY: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 169 TURKEY: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 170 TURKEY: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 171 REST OF MIDDLE EAST & AFRICA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 172 REST OF MIDDLE EAST & AFRICA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 173 REST OF MIDDLE EAST & AFRICA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 174 REST OF MIDDLE EAST & AFRICA: SUPPOSITORY PACKAGING MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 175 SUPPOSITORY PACKAGING MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2022-2024

- TABLE 176 SUPPOSITORY PACKAGING MARKET: DEGREE OF COMPETITION, 2023

- TABLE 177 SUPPOSITORY PACKAGING MARKET: MATERIAL FOOTPRINT

- TABLE 178 SUPPOSITORY PACKAGING MARKET: APPLICATION FOOTPRINT

- TABLE 179 SUPPOSITORY PACKAGING MARKET: REGION FOOTPRINT

- TABLE 180 SUPPOSITORY PACKAGING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 181 SUPPOSITORY PACKAGING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 182 SUPPOSITORY PACKAGING MARKET: DEALS, JANUARY 2022-JUNE 2024

- TABLE 183 SUPPOSITORY PACKAGING MARKET: EXPANSIONS, JANUARY 2022-JUNE 2024

- TABLE 184 CONSTANTIA FLEXIBLES: COMPANY OVERVIEW

- TABLE 185 CONSTANTIA FLEXIBLES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 CONSTANTIA FLEXIBLES: DEALS

- TABLE 187 CONSTANTIA FLEXIBLES: EXPANSIONS

- TABLE 188 DELPHARM: COMPANY OVERVIEW

- TABLE 189 DELPHARM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 DELPHARM: DEALS

- TABLE 191 CORDENPHARMA: COMPANY OVERVIEW

- TABLE 192 CORDENPHARMA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 CORDENPHARMA: DEALS

- TABLE 194 AENOVA GROUP: COMPANY OVERVIEW

- TABLE 195 AENOVA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 AENOVA GROUP: DEALS

- TABLE 197 UNITHER PHARMACEUTICALS: COMPANY OVERVIEW

- TABLE 198 UNITHER PHARMACEUTICALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 ACG: COMPANY OVERVIEW

- TABLE 200 ACG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 ACG: DEALS

- TABLE 202 HYSUM EUROPE GMBH: COMPANY OVERVIEW

- TABLE 203 HYSUM EUROPE GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 CAPRIHANS INDIA LIMITED.: COMPANY OVERVIEW

- TABLE 205 CAPRIHANS INDIA LIMITED.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 FENGCHEN GROUP CO., LTD: COMPANY OVERVIEW

- TABLE 207 FENGCHEN GROUP CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 KAA TIMEX LR: COMPANY OVERVIEW

- TABLE 209 KAA TIMEX LR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 PHARMACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2020-2022 (USD MILLION)

- TABLE 211 PHARMACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2023-2028 (USD MILLION)

- TABLE 212 PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2020-2022 (KILOTON)

- TABLE 213 PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2023-2028 (KILOTON)

- TABLE 214 PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2020-2022 (USD MILLION)

- TABLE 215 PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2023-2028 (USD MILLION)

- TABLE 216 PHARMACEUTICAL PACKAGING MARKET, BY DRUG DELIVERY, 2020-2022 (USD MILLION)

- TABLE 217 PHARMACEUTICAL PACKAGING MARKET, BY DRUG DELIVERY, 2023-2028 (USD MILLION)

- TABLE 218 PHARMACEUTICAL PACKAGING MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 219 PHARMACEUTICAL PACKAGING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 220 PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 221 PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 222 HEALTH & HYGIENE PACKAGING MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 223 HEALTH & HYGIENE PACKAGING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 224 HEALTH & HYGIENE PACKAGING MARKET, BY TYPE, 2020-2022 (KILOTON)

- TABLE 225 HEALTH & HYGIENE PACKAGING MARKET, BY TYPE, 2023-2028 (KILOTON)

- TABLE 226 HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020-2022 (USD MILLION)

- TABLE 227 HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023-2028 (USD MILLION)

- TABLE 228 HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2020-2022 (KILOTON)

- TABLE 229 HEALTH & HYGIENE PACKAGING MARKET, BY FORM, 2023-2028 (KILOTON)

- TABLE 230 HEALTH & HYGIENE PACKAGING MARKET, BY SHIPPING FORM, 2020-2022 (USD MILLION)

- TABLE 231 HEALTH & HYGIENE PACKAGING MARKET, BY SHIPPING FORM, 2023-2028 (USD MILLION)

- TABLE 232 HEALTH & HYGIENE PACKAGING MARKET, BY SHIPPING FORM, 2020-2022 (KILOTON)

- TABLE 233 HEALTH & HYGIENE PACKAGING MARKET, BY SHIPPING FORM, 2023-2028 (KILOTON)

- TABLE 234 HEALTH & HYGIENE PACKAGING MARKET, BY STRUCTURE, 2020-2022 (USD MILLION)

- TABLE 235 HEALTH & HYGIENE PACKAGING MARKET, BY STRUCTURE, 2023-2028 (USD MILLION)

- TABLE 236 HEALTH & HYGIENE PACKAGING MARKET, BY STRUCTURE, 2020-2022 (KILOTON)

- TABLE 237 HEALTH & HYGIENE PACKAGING MARKET, BY STRUCTURE, 2023-2028 (KILOTON)

- TABLE 238 HEALTH & HYGIENE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2022 (USD MILLION)

- TABLE 239 HEALTH & HYGIENE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2023-2028 (USD MILLION)

- TABLE 240 HEALTH & HYGIENE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2022 (KILOTON)

- TABLE 241 HEALTH & HYGIENE PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2023-2028 (KILOTON)

- TABLE 242 HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 243 HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 244 HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 245 HEALTH & HYGIENE PACKAGING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 246 HEALTH & HYGIENE PACKAGING MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 247 HEALTH & HYGIENE PACKAGING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 248 HEALTH & HYGIENE PACKAGING MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 249 HEALTH & HYGIENE PACKAGING MARKET, BY REGION, 2023-2028 (KILOTON)

List of Figures

- FIGURE 1 SUPPOSITORY PACKAGING MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 4 DATA TRIANGULATION

- FIGURE 5 PVC/PE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF SUPPOSITORY PACKAGING MARKET IN 2024

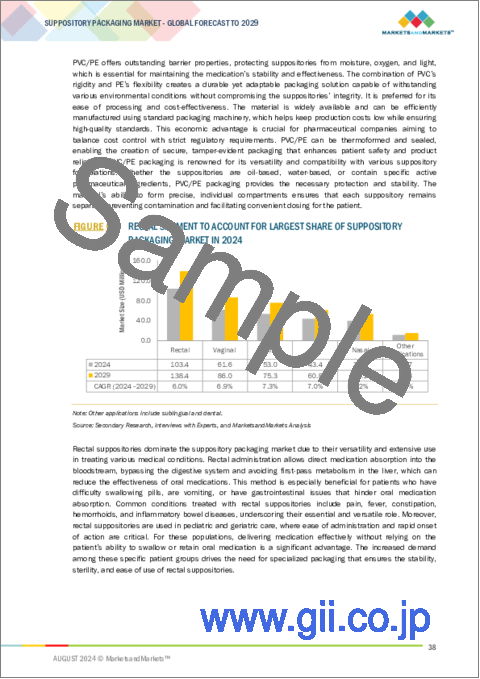

- FIGURE 6 RECTAL SEGMENT TO ACCOUNT FOR LARGEST SHARE OF SUPPOSITORY PACKAGING MARKET IN 2024

- FIGURE 7 NORTH AMERICA HELD LARGEST SHARE OF SUPPOSITORY PACKAGING MARKET IN 2023

- FIGURE 8 GROWING AGING POPULATION AND RISE IN PREVALENCE OF CHRONIC DISEASES TO DRIVE DEMAND

- FIGURE 9 PVC/PE SEGMENT TO HOLD LARGEST SHARE OF SUPPOSITORY PACKAGING MARKET IN 2029

- FIGURE 10 RECTAL SEGMENT TO HOLD LARGEST SHARE OF SUPPOSITORY PACKAGING MARKET IN 2029

- FIGURE 11 PVC/PE SEGMENT AND US ACCOUNTED FOR LARGEST SHARES OF NORTH AMERICAN SUPPOSITORY PACKAGING MARKET IN 2023

- FIGURE 12 CHINA TO REGISTER HIGHEST CAGR IN SUPPOSITORY PACKAGING MARKET DURING FORECAST PERIOD

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SUPPOSITORY PACKAGING MARKET

- FIGURE 14 GLOBAL POPULATION AGED 65 AND ABOVE, 2019-2023 (MILLION)

- FIGURE 15 PERCENTAGE OF POPULATION AGED 65 YEARS AND ABOVE, 2022 & 2030

- FIGURE 16 OECD HEALTH SPENDING AS SHARE OF GDP, 2005-2022

- FIGURE 17 HEALTH SPENDING IN CHINA AND INDIA, 2011-2020 (USD/CAPITA)

- FIGURE 18 SUPPOSITORY PACKAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 20 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 21 SUPPOSITORY PACKAGING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 SUPPOSITORY PACKAGING MARKET: ECOSYSTEM ANALYSIS

- FIGURE 23 EXPORT DATA RELATED TO SUPPOSITORY PACKAGING, BY KEY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 24 IMPORT DATA RELATED TO SUPPOSITORY PACKAGING, BY KEY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 25 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 26 AVERAGE SELLING PRICE TREND OF SUPPOSITORY PACKAGING OFFERED BY KEY PLAYERS, BY MATERIAL, 2023 (USD/KG)

- FIGURE 27 AVERAGE SELLING PRICE TREND OF SUPPOSITORY PACKAGING, BY REGION, 2021-2029 (USD/KG)

- FIGURE 28 MAJOR PATENTS RELATED TO SUPPOSITORY PACKAGING, 2013-2023

- FIGURE 29 CHINA TO RECORD HIGHEST CAGR IN SUPPOSITORY PACKAGING MARKET DURING FORECAST PERIOD

- FIGURE 30 NORTH AMERICA: SUPPOSITORY PACKAGING MARKET SNAPSHOT

- FIGURE 31 EUROPE: SUPPOSITORY PACKAGING MARKET SNAPSHOT

- FIGURE 32 SUPPOSITORY PACKAGING MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2018-2023 (USD MILLION)

- FIGURE 33 SUPPOSITORY PACKAGING MARKET SHARE ANALYSIS, 2023

- FIGURE 34 SUPPOSITORY PACKAGING MARKET: COMPANY VALUATION (USD MILLION)

- FIGURE 35 SUPPOSITORY PACKAGING MARKET: FINANCIAL MATRIX (EV/EBITDA RATIO)

- FIGURE 36 SUPPOSITORY PACKAGING MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 37 SUPPOSITORY PACKAGING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 38 SUPPOSITORY PACKAGING MARKET: COMPANY FOOTPRINT

- FIGURE 39 SUPPOSITORY PACKAGING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 40 AENOVA GROUP: COMPANY SNAPSHOT

- FIGURE 41 CAPRIHANS INDIA LIMITED.: COMPANY SNAPSHOT

The suppository packaging market is projected to reach USD 428 million by 2029, at a CAGR of 6.5% from USD 312 million in 2024. The demand for suppository packaging arises from their versatile applications and advantageous properties across various industries. These polymers, produced through emulsion polymerization, consist of polymer particles dispersed in water. Additionally, suppository packaging find extensive use in textiles for enhancing fabric strength, flexibility, and resistance to washing. In the paper industry, they improve coating properties, printability, and surface finish. Moreover, suppository packaging are utilized in carpet backing, nonwoven fabrics, and specialty latex products, further expanding their application scope. As industries continue to seek cost-effective and environmentally friendly solutions, the demand for suppository packaging is expected to grow. Their low volatile organic compound (VOC) emissions and compliance with stringent environmental regulations make them increasingly attractive.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Volume (Kilotons); Value (USD Million) |

| Segments | Material Application, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

"Based on material, aluminum/PE is expected to be the fastest growing market during the forecast period, in terms of value."

Aluminum/PE is the fastest growing segments in the suppository packaging market due to their unique combination of properties and diverse applications. The aluminum part gives a remarkable obstruction to dampness, light, and oxygen, which assists with safeguarding the solidarity and viability of the suppository substance. Maintaining the quality and performance of temperature-sensitive medicines over time is crucial, and the aluminum layer plays a key role in extending product shelf life. A packing material that is both pleasantly flexible and durable is created when polyethylene and tailored aluminum film are combined. It ensures that the product remains whole and ready for use as intended by allowing customers to tear open the packaging without damaging the suppository itself.

"Based on application, urethral is the fastest growing market during the forecast period, in terms of value."

The urethral application is the fastest-growing segment in the suppository packaging market. In particular, the benefits associated with urethral drug delivery for diseases like erectile dysfunction and urinary tract infection, in which local treatment could help rapidly to offer relief and improve patient outcome, have been realized more and more. This mode of administration allows for a direct absorption via the mucous membranes and avoids the gastrointestinal tract and first-pass metabolism, which enhances the drug effectiveness. Moreover, the increasing number of conditions requiring the treatment of urinary tract infections, as well as the growing population, is driving demand for these specialty medications as healthcare providers seek more effective treatments for patients who may find it difficult for oral medications, liquid tablets are gaining traction as viable options.

"Based on region, Asia Pacific is the fastest growing market for suppository packaging in 2023, in terms of value."

The demand for suppository packaging in Asia-Pacific is driven by several key factors. With the expansion of healthcare in this sector, hospitals, clinics and pharmaceuticals, the need for specialized drug delivery systems including suppositories increases. The increasing incidence of cancer, diabetes and gastrointestinal disorders requires new methods of drug delivery to the elderly population. As older adults typically implants are preferred or needed because of difficulty in swallowing implants or the need for local treatment. Furthermore, increased health literacy and implants acknowledging the efficacy of treatment drives the growth of the suppository packaging market in the region.

In the process of determining and verifying the market size for several segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees are as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-Level - 35%, Director Level - 25%, and Others - 40%

- By Region: North America - 30%, Europe - 20%, Asia Pacific - 40%, Middle East & Africa-5%, and Latin America-5%

The key players in this market are NextPharma Technologies (UK), CordenPharma (Switzerland), Recipharm AB (Sweden), Valmatic S.R.L. (Italy), Sarong S.p.A. (Italy), Key International (US), HySum Europe GmbH (Germany), FAMAR Health Care Services (Greece), Hudi Pharma HQ (Italy), Adragos Pharma (Germany), LGM Pharma (US), Aluberg s.p.a. (Italy), Delpharm (France), Unither (France), and Trefoil Packaging Pvt Ltd (India).

Research Coverage

This report segments the suppository packaging market based on material, application, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products and services, key strategies, new product launches, expansions, and mergers and acquisitions associated with the suppository packaging market.

Key benefits of buying this report

This research report focuses on various levels of analysis, including industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the suppository packaging market, high-growth regions, and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (growing geriatric population, increasing demand for child-resistant packaging, increased focus on patient convenience, rising prevalence of chronic diseases), restraints (adhering to regulatory standards, growing development in technologies), opportunities (growing demand for sustainable and environmentally friendly packaging solutions, rising awareness of health and safety) and challenges (storage and handling requirements).

- Market Penetration: Comprehensive information on the suppository packaging market offered by top players in the global suppository packaging market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the suppository packaging market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for suppository packaging market across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global suppository packaging market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the suppository packaging market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SUPPOSITORY PACKAGING MARKET

- 4.2 SUPPOSITORY PACKAGING MARKET, BY MATERIAL

- 4.3 SUPPOSITORY PACKAGING MARKET, BY APPLICATION

- 4.4 NORTH AMERICA: SUPPOSITORY PACKAGING MARKET, BY MATERIAL AND COUNTRY

- 4.5 SUPPOSITORY PACKAGING MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Global increase in aging population and incidence of chronic diseases

- 5.2.1.2 Rise in healthcare expenditure

- 5.2.1.3 Rising recognition of suppository benefits

- 5.2.2 RESTRAINTS

- 5.2.2.1 Rigorous regulatory compliance

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Ongoing technological developments

- 5.2.3.2 Increasing demand from emerging markets

- 5.2.4 CHALLENGES

- 5.2.4.1 High cost of advanced packaging solutions

- 5.2.4.2 Limited shelf life

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 BARGAINING POWER OF SUPPLIERS

- 6.1.2 BARGAINING POWER OF BUYERS

- 6.1.3 INTENSITY OF COMPETITIVE RIVALRY

- 6.1.4 THREAT OF NEW ENTRANTS

- 6.1.5 THREAT OF SUBSTITUTES

- 6.2 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.2.2 BUYING CRITERIA

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TRADE ANALYSIS

- 6.5.1 EXPORT SCENARIO OF SUPPOSITORY PACKAGING

- 6.5.2 IMPORT SCENARIO OF SUPPOSITORY PACKAGING

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 KEY TECHNOLOGIES

- 6.6.1.1 Blister packaging technology

- 6.6.1.2 Strip packaging technology

- 6.6.1.3 Form-Fill-Seal (FFS) machine technology

- 6.6.1.4 Injection molding technology

- 6.6.2 COMPLEMENTARY TECHNOLOGIES

- 6.6.2.1 Smart packaging technology

- 6.6.2.2 Cold chain management technology

- 6.6.1 KEY TECHNOLOGIES

- 6.7 IMPACT OF GEN AI ON SUPPOSITORY PACKAGING MARKET

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.10 PRICING ANALYSIS

- 6.10.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY MATERIAL

- 6.10.2 AVERAGE SELLING PRICE TREND OF SUPPOSITORY PACKAGING, BY REGION

- 6.11 PATENT ANALYSIS

- 6.11.1 METHODOLOGY

- 6.11.2 MAJOR PATENTS

- 6.12 KEY CONFERENCES AND EVENTS, 2024-2025

- 6.13 MACROECONOMIC ANALYSIS

- 6.13.1 INTRODUCTION

7 SUPPOSITORY PACKAGING MARKET, BY MATERIAL

- 7.1 INTRODUCTION

- 7.2 ALUMINUM/PE

- 7.2.1 EXCELLENT MOISTURE RESISTANCE AND LIGHT-BLOCKING PROPERTIES TO DRIVE DEMAND

- 7.3 PVC/PE

- 7.3.1 THERMOFORMABLE PROPERTIES AND ABILITY TO PREVENT LEAKAGE OR CONTAMINATION OF SUPPOSITORIES TO FUEL DEMAND

- 7.4 OTHER MATERIALS

8 SUPPOSITORY PACKAGING MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 PHARMACEUTICALS

- 8.2.1 GROWING USE TO ENSURE SAFE, EFFECTIVE, AND INFORMED DELIVERY OF SUPPOSITORY MEDICATIONS TO PATIENTS TO DRIVE MARKET

- 8.2.2 NASAL SUPPOSITORY PACKAGING

- 8.2.3 EAR SUPPOSITORY PACKAGING

- 8.2.4 RECTAL SUPPOSITORY PACKAGING

- 8.2.5 URETHRAL SUPPOSITORY PACKAGING

- 8.2.6 VAGINAL SUPPOSITORY PACKAGING

- 8.2.7 OTHER APPLICATIONS

9 SUPPOSITORY PACKAGING MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 US

- 9.2.1.1 Increasing number of pediatric patients to drive market

- 9.2.2 CANADA

- 9.2.2.1 Government-led initiatives to promote safe drug packaging to fuel demand

- 9.2.3 MEXICO

- 9.2.3.1 Strategic shift of global pharmaceutical companies toward Mexico to drive market

- 9.2.1 US

- 9.3 EUROPE

- 9.3.1 GERMANY

- 9.3.1.1 Rising emphasis on prevention and self-medication to drive market

- 9.3.2 FRANCE

- 9.3.2.1 Increasing healthcare expenditure and health consciousness to drive market

- 9.3.3 UK

- 9.3.3.1 Rising focus on patient-centric care to drive market

- 9.3.4 ITALY

- 9.3.4.1 Technological advancements in pharmaceutical manufacturing processes to drive market

- 9.3.5 SPAIN

- 9.3.5.1 Increasing demand for minimally invasive drug delivery systems to drive market

- 9.3.6 REST OF EUROPE

- 9.3.1 GERMANY

- 9.4 ASIA PACIFIC

- 9.4.1 CHINA

- 9.4.1.1 Rapidly aging population and increasing healthcare expenditures to drive market

- 9.4.2 INDIA

- 9.4.2.1 Expanding pharmaceutical industry to drive market

- 9.4.3 JAPAN

- 9.4.3.1 Need for convenient and reliable pharmaceutical packaging solutions to drive market

- 9.4.4 AUSTRALIA

- 9.4.4.1 Government-led initiative for safe pharmaceutical drugs production and consumption to drive market

- 9.4.5 REST OF ASIA PACIFIC

- 9.4.1 CHINA

- 9.5 SOUTH AMERICA

- 9.5.1 BRAZIL

- 9.5.1.1 High adoption in pharmaceutical industry to drive market

- 9.5.2 ARGENTINA

- 9.5.2.1 Trend of enhancing packaging technologies to fuel market growth

- 9.5.3 REST OF SOUTH AMERICA

- 9.5.1 BRAZIL

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 GCC COUNTRIES

- 9.6.1.1 Saudi Arabia

- 9.6.1.1.1 Rapidly expanding population and increased investments by foreign companies in pharmaceutical industry to drive market

- 9.6.1.2 UAE

- 9.6.1.2.1 Increasing demand for high-value pharmaceutical products to drive market

- 9.6.1.1 Saudi Arabia

- 9.6.2 REST OF GCC COUNTRIES

- 9.6.3 TURKEY

- 9.6.3.1 Advantages of suppository packaging over traditional oral medications to drive demand

- 9.6.4 REST OF MIDDLE EAST & AFRICA

- 9.6.1 GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.1.1 KEY STRATEGIES/RIGHT TO WIN, 2022-2024

- 10.1.2 REVENUE ANALYSIS, 2018-2023

- 10.1.3 MARKET SHARE ANALYSIS, 2023

- 10.1.4 INDUSTRY STRUCTURE

- 10.1.4.1 CordenPharma

- 10.1.4.2 HySum Europe GmbH

- 10.1.4.3 ACG

- 10.1.4.4 KAA Timex LR

- 10.1.4.5 Aluberg S.P.A.

- 10.1.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.1.6 BRAND/PRODUCT COMPARISON

- 10.2 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.2.1 STARS

- 10.2.2 EMERGING LEADERS

- 10.2.3 PERVASIVE PLAYERS

- 10.2.4 PARTICIPANTS

- 10.2.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 10.2.5.1 Company footprint

- 10.2.5.2 Material footprint

- 10.2.5.3 Application footprint

- 10.2.5.4 Region footprint

- 10.3 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 10.3.1 PROGRESSIVE COMPANIES

- 10.3.2 RESPONSIVE COMPANIES

- 10.3.3 DYNAMIC COMPANIES

- 10.3.4 STARTING BLOCKS

- 10.3.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 10.3.5.1 List of key startups/SMEs

- 10.3.5.2 Competitive benchmarking of key startups/SMEs

- 10.4 COMPETITIVE SCENARIO

- 10.4.1 DEALS

- 10.4.2 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 CONSTANTIA FLEXIBLES

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Deals

- 11.1.1.3.2 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths/Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses/Competitive threats

- 11.1.2 DELPHARM

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths/Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses/Competitive threats

- 11.1.3 CORDENPHARMA

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths/Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses/Competitive threats

- 11.1.4 AENOVA GROUP

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths/Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses/Competitive threats

- 11.1.5 UNITHER PHARMACEUTICAL

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Key strengths/Right to win

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses/Competitive threats

- 11.1.6 ACG

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.6.4 MnM view

- 11.1.7 HYSUM EUROPE GMBH

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 MnM view

- 11.1.8 CAPRIHANS INDIA LIMITED.

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 MnM view

- 11.1.9 FENGCHEN GROUP CO., LTD

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 MnM view

- 11.1.10 KAA TIMEX LR

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 MnM view

- 11.1.1 CONSTANTIA FLEXIBLES

- 11.2 OTHER PLAYERS

- 11.2.1 ALUBERG S.P.A.

- 11.2.2 FAMAR HEALTH CARE SERVICES

- 11.2.3 LGM PHARMA.

- 11.2.4 SARONG S.P.A.

- 11.2.5 ADRAGOS PHARMA.

- 11.2.6 VALMATIC S.R.L.

- 11.2.7 HUDI PHARMA

- 11.2.8 NEXTPHARMA TECHNOLOGIES

- 11.2.9 TREFOIL PACKAGING PVT LTD

- 11.2.10 SGM INDIA

- 11.2.11 GREEN PACK FOILS PVT. LTD.

- 11.2.12 BERKO PHARMACEUTICALS

12 ADJACENT AND RELATED MARKET

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.2.1 PHARMACEUTICAL PACKAGING MARKET

- 12.2.1.1 Market definition

- 12.2.1.2 Pharmaceutical packaging market, by packaging type

- 12.2.1.3 Pharmaceutical packaging market, by raw material

- 12.2.1.4 Pharmaceutical packaging market, by drug delivery

- 12.2.1.5 Pharmaceutical packaging market, by type

- 12.2.1.6 Pharmaceutical packaging market, by region

- 12.2.2 HEALTH AND HYGIENE PACKAGING MARKET

- 12.2.2.1 Market definition

- 12.2.2.2 Health and hygiene packaging market, by type

- 12.2.2.3 Health and hygiene packaging market, by form

- 12.2.2.4 Health and hygiene packaging market, by shipping form

- 12.2.2.5 Health and hygiene packaging market, by structure

- 12.2.2.6 Health and hygiene packaging market, by distribution channel

- 12.2.2.7 Health and hygiene packaging market, by end-use industry

- 12.2.2.8 Health and hygiene packaging market, by region

- 12.2.1 PHARMACEUTICAL PACKAGING MARKET

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS