|

|

市場調査レポート

商品コード

1537097

オフサイトデータセンター電力インフラの世界市場:コンポーネント別、業界別、地域別 - 予測(~2030年)Offsite Data Center Power Infrastructure Market by Component (Solutions and Services), Vertical (BFSI, Media & Entertainment, Government & Defence, Healthcare, Manufacturing, IT & Telecom, Retail) and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| オフサイトデータセンター電力インフラの世界市場:コンポーネント別、業界別、地域別 - 予測(~2030年) |

|

出版日: 2024年08月07日

発行: MarketsandMarkets

ページ情報: 英文 286 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

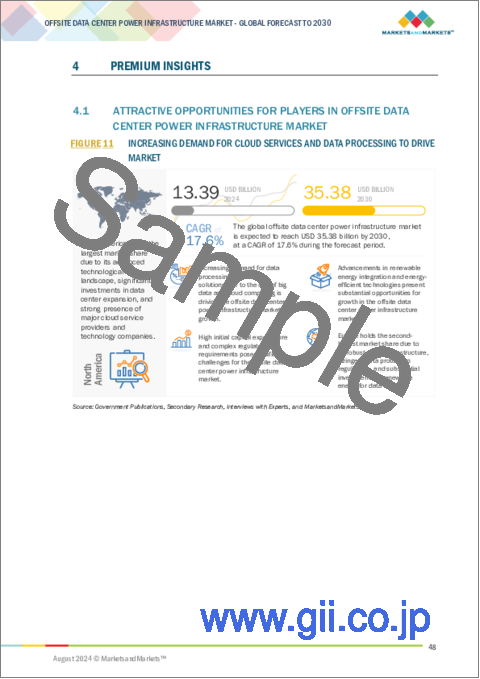

世界のオフサイトデータセンター電力インフラの市場規模は、2024年の推定134億米ドルから2030年までに354億米ドルに達する見通しで、2024年~2030年にCAGRで17.6%の安定した成長が見込まれます。

市場は、今後予測される数多くの動向による大きな拡大が見込まれます。環境と規制に対する懸念が高まる中、主な動向の1つはグリーン技術の受け入れの拡大です。二酸化炭素排出を減らすため、データセンターは現在、先進の冷却システムや再生可能エネルギーを含むグリーンエネルギーシステムといったグリーン技術に注力しています。また、信頼性の高いバックアップ電力オプションや効率性の向上として、電池貯蔵や燃料電池ソリューションに向けた新たな動向も見られます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 10億米ドル |

| セグメント | 業界別、提供別 |

| 対象地域 | アジア太平洋、北米、欧州、その他の地域 |

もう1つの主要動向は、エッジコンピューティングと5G技術への依存度の高まりです。IoT技術の普及とデータサービスの需要の増加に伴い、エッジオフサイトデータセンターは遅延のないアプリケーションをサポートする必要があります。そのため、市場の成長を促進する投資が増加しています。さらに、大手クラウドサービスプロバイダーによるハイパースケールデータセンターの拡張が加速し、市場が成長するにつれて、大規模な運用をサポートする堅牢な処理能力を持つインフラと高密度化が必要とされます。また、戦略的パートナーシップの締結が予測され、中核企業の統合により、技術的限界と市場リーチが拡大します。この分野のその他の競合もそれに寄与します。

「業界別では、政府・防衛セグメントが2024年~2030年に第3位の市場シェアを占めます。」

「北米のオフサイトデータセンター電力インフラ市場が予測期間を通じて最大の市場シェアを占める見込みです。」

北米は、確立された技術インフラ、データセンター開発への大規模な投資、強力なデジタルインフラと技術により、世界のオフサイトデータセンター電力インフラ市場で最大の市場シェアを占めています。同地域は、金融や医療などの先進の産業によるデータ処理とストレージの高い需要、良好な経営条件、安定した経済状況、大規模なデータセンター事業者と技術専門家の利用可能性により、成熟した市場の恩恵を受けています。また、企業はオフサイトデータセンター電力インフラの大幅な改良に引き続き注力しています。

当レポートでは、世界のオフサイトデータセンター電力インフラ市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- オフサイトデータセンター電力インフラ市場の企業にとって魅力的な機会

- オフサイトデータセンター電力インフラ市場:地域別

- 北米のオフサイトデータセンター電力インフラ市場:提供別、業界別

- オフサイトデータセンター電力インフラ市場:提供別

- オフサイトデータセンター電力インフラ市場:業界別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- 投資と資金調達のシナリオ

- サプライチェーン分析

- オフサイトデータセンター電力インフラ市場に対するAI/生成AIの影響

- 技術分析

- 主要技術

- 補完技術

- 価格分析

- 主要企業の平均販売価格の動向:提供別

- モジュラーデータセンターソリューションの参考価格の動向

- 主な会議とイベント(2024年~2025年)

- 関税と規制情勢

- 関税分析

- 規制機関、政府機関、その他の組織

- オフサイトデータセンター電力インフラ市場に関連する法と規制

- オフサイトデータセンター電力インフラ市場に関連する標準

- 貿易分析

- 輸入データ(HSコード8544)

- 輸出データ(HSコード8544)

- 特許分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

第6章 オフサイトデータセンター電力インフラ市場:提供別

- イントロダクション

- ソリューション

- サービス

- 設計・コンサルティング

- 設置・実装

- サポート・メンテナンス

第7章 オフサイトデータセンター電力インフラ市場:業界別

- イントロダクション

- BFSI

- IT・通信

- メディア・エンターテインメント

- 医療

- 政府・防衛

- 小売

- 製造

- その他

第8章 オフサイトデータセンター電力インフラ市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- ロシア

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他のアジア太平洋

- 中東・アフリカ

- GCC

- 南アフリカ

- その他の中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

第9章 競合情勢

- 概要

- 主要企業戦略/有力企業(2020年~2024年)

- 市場シェア分析(2023年)

- 市場ランキング(2023年)

- 収益分析(2019年~2023年)

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 企業の評価と財務指標

- ブランド/製品の比較

- 競合シナリオ

第10章 企業プロファイル

- 主要企業

- ABB

- SCHNEIDER ELECTRIC

- VERTIV GROUP CORP.

- EATON

- HUAWEI DIGITAL POWER TECHNOLOGIES CO., LTD.

- COMFORT SYSTEMS USA

- JOHNSON CONTROLS INC.

- YONDR

- HUBBELL

- MODUBUILD

- ALTRON A.S.

- INNOVIT AG

- MAVAB

- RITTAL GMBH & CO. KG

- INVT POWER SYSTEM (SHENZHEN) CO., LTD.

- DELTA ELECTRONICS, INC.

- DATA SPECIALTIES, INC.

- PRASA INFOCOM AND POWER SOLUTIONS PVT. LTD.

- BLADEROOM GROUP LIMITED

- CUPERTINO ELECTRIC, INC.

- その他の企業

- DATAXENTER

- ICT FACILITIES GMBH

- MASCO GROUP

- INTEGRA MISSION CRITICAL, LLC.

- BOX MODUL

第11章 付録

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS: BY OFFERING

- TABLE 2 INCLUSIONS AND EXCLUSIONS: BY VERTICAL

- TABLE 3 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET SNAPSHOT

- TABLE 4 GLOBAL TRENDS IN DIGITAL AND ENERGY INDICATORS, 2015-2022

- TABLE 5 ROLES OF COMPANIES IN OFFSITE DATA CENTER POWER INFRASTRUCTURE ECOSYSTEM

- TABLE 6 INDICATIVE PRICING ANALYSIS OF MODULAR DATA CENTER SOLUTIONS OFFERED BY KEY PLAYERS

- TABLE 7 INDICATIVE PRICING ANALYSIS OF MODULAR DATA CENTER SOLUTIONS

- TABLE 8 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET: LIST OF CONFERENCES AND EVENTS, 2024-2025

- TABLE 9 TARIFF DATA FOR HS 8544-COMPLIANT PRODUCTS

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 CODES AND REGULATIONS RELATED TO OFFSITE DATA CENTER POWER INFRASTRUCTURE

- TABLE 16 STANDARDS RELATED TO OFFSITE DATA CENTER POWER INFRASTRUCTURE

- TABLE 17 LIST OF APPLIED/GRANTED PATENTS RELATED TO OFFSITE DATA CENTER POWER INFRASTRUCTURE, 2018-2023

- TABLE 18 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 19 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY VERTICAL (%)

- TABLE 20 KEY BUYING CRITERIA FOR TOP FOUR VERTICALS

- TABLE 21 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 22 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 23 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 24 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 25 SOLUTIONS: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION 2021-2023 (USD MILLION)

- TABLE 26 SOLUTIONS: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 27 SERVICES: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 28 SERVICES: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 29 DESIGN & CONSULTING: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 30 DESIGN & CONSULTING: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 31 INSTALLATION & IMPLEMENTATION: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 32 INSTALLATION & IMPLEMENTATION: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 33 SUPPORT & MAINTENANCE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 34 SUPPORT & MAINTENANCE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 35 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY VERTICAL, 2021-2023 (USD MILLION)

- TABLE 36 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 37 BFSI: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 38 BFSI: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 39 IT & TELECOM: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 40 IT & TELECOM: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 41 MEDIA & ENTERTAINMENT: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 42 MEDIA & ENTERTAINMENT: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 43 HEALTHCARE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 44 HEALTHCARE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 45 GOVERNMENT & DEFENSE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 46 GOVERNMENT & DEFENSE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 47 RETAIL: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 48 RETAIL: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 49 MANUFACTURING: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 50 MANUFACTURING: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 51 OTHERS: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 52 OTHERS: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 53 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 54 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 55 NORTH AMERICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 56 NORTH AMERICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 57 NORTH AMERICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 58 NORTH AMERICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 59 NORTH AMERICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY VERTICAL, 2021-2023 (USD MILLION)

- TABLE 60 NORTH AMERICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 62 NORTH AMERICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 63 US: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 64 US: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 65 US: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 66 US: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 67 CANADA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 68 CANADA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 69 CANADA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 70 CANADA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 71 MEXICO: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 72 MEXICO: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 73 MEXICO: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 74 MEXICO: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 75 EUROPE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 76 EUROPE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 77 EUROPE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 78 EUROPE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 79 EUROPE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY VERTICAL, 2021-2023 (USD MILLION)

- TABLE 80 EUROPE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 81 EUROPE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 82 EUROPE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 83 UK: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 84 UK: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 85 UK: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 86 UK: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 87 GERMANY: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 88 GERMANY: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 89 GERMANY: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 90 GERMANY: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 91 FRANCE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 92 FRANCE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 93 FRANCE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 94 FRANCE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 95 ITALY: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 96 ITALY: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 97 ITALY: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 98 ITALY: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 99 RUSSIA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 100 RUSSIA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 101 RUSSIA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 102 RUSSIA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 103 REST OF EUROPE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 104 REST OF EUROPE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 105 REST OF EUROPE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 106 REST OF EUROPE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 107 ASIA PACIFIC: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 108 ASIA PACIFIC: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 109 ASIA PACIFIC: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 110 ASIA PACIFIC: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 111 ASIA PACIFIC: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY VERTICAL, 2021-2023 (USD MILLION)

- TABLE 112 ASIA PACIFIC: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 113 ASIA PACIFIC: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 114 ASIA PACIFIC: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 115 CHINA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 116 CHINA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 117 CHINA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 118 CHINA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 119 INDIA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 120 INDIA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 121 INDIA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 122 INDIA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 123 JAPAN: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 124 JAPAN: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 125 JAPAN: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 126 JAPAN: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 127 AUSTRALIA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 128 AUSTRALIA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 129 AUSTRALIA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 130 AUSTRALIA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 131 REST OF ASIA PACIFIC: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 132 REST OF ASIA PACIFIC: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 133 REST OF ASIA PACIFIC: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 134 REST OF ASIA PACIFIC: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY VERTICAL, 2021-2023 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 143 GCC: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 144 GCC: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 145 GCC: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 146 GCC: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 147 SAUDI ARABIA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 148 SAUDI ARABIA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 149 SAUDI ARABIA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 150 SAUDI ARABIA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 151 UAE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 152 UAE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 153 UAE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 154 UAE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 155 REST OF GCC: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 156 REST OF GCC: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 157 REST OF GCC: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 158 REST OF GCC: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 159 SOUTH AFRICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 160 SOUTH AFRICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 161 SOUTH AFRICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 162 SOUTH AFRICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 163 REST OF MIDDLE EAST & AFRICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 164 REST OF MIDDLE EAST & AFRICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 165 REST OF MIDDLE EAST & AFRICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 166 REST OF MIDDLE EAST & AFRICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 167 SOUTH AMERICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 168 SOUTH AMERICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 169 SOUTH AMERICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 170 SOUTH AMERICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 171 SOUTH AMERICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY VERTICAL, 2021-2023 (USD MILLION)

- TABLE 172 SOUTH AMERICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 173 SOUTH AMERICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 174 SOUTH AMERICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 175 BRAZIL: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 176 BRAZIL: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 177 BRAZIL: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 178 BRAZIL: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 179 ARGENTINA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 180 ARGENTINA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 181 ARGENTINA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 182 ARGENTINA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 183 REST OF SOUTH AMERICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2021-2023 (USD MILLION)

- TABLE 184 REST OF SOUTH AMERICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 185 REST OF SOUTH AMERICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2021-2023 (USD MILLION)

- TABLE 186 REST OF SOUTH AMERICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 187 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 188 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET: DEGREE OF COMPETITION, 2023

- TABLE 189 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET: OFFERING FOOTPRINT, 2023

- TABLE 190 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET: VERTICAL FOOTPRINT, 2023

- TABLE 191 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET: REGION FOOTPRINT, 2023

- TABLE 192 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET: LIST OF KEY STARTUPS/SMES, 2023

- TABLE 193 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 194 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET: PRODUCT LAUNCHES, APRIL 2020-JUNE 2024

- TABLE 195 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET: DEALS, APRIL 2020-JUNE 2024

- TABLE 196 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET: EXPANSIONS, APRIL 2020-JUNE 2024

- TABLE 197 ABB: COMPANY OVERVIEW

- TABLE 198 ABB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 199 ABB: PRODUCT LAUNCHES

- TABLE 200 ABB: DEALS

- TABLE 201 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 202 SCHNEIDER ELECTRIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 203 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 204 SCHNEIDER ELECTRIC: DEALS

- TABLE 205 VERTIV GROUP CORP.: COMPANY OVERVIEW

- TABLE 206 VERTIV GROUP CORP.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 207 VERTIV GROUP CORP.: PRODUCT LAUNCHES

- TABLE 208 VERTIV GROUP CORP.: DEALS

- TABLE 209 EATON: COMPANY OVERVIEW

- TABLE 210 EATON: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 211 EATON: PRODUCT LAUNCHES

- TABLE 212 EATON: DEALS

- TABLE 213 EATON: EXPANSIONS

- TABLE 214 HUAWEI DIGITAL POWER TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 215 HUAWEI DIGITAL POWER TECHNOLOGIES CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 216 HUAWEI DIGITAL POWER TECHNOLOGIES CO., LTD.: PRODUCT LAUNCHES

- TABLE 217 HUAWEI DIGITAL POWER TECHNOLOGIES CO., LTD.: DEALS

- TABLE 218 COMFORT SYSTEMS USA: COMPANY OVERVIEW

- TABLE 219 COMFORT SYSTEMS USA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 220 COMFORT SYSTEMS USA: DEALS

- TABLE 221 JOHNSON CONTROLS INC.: COMPANY OVERVIEW

- TABLE 222 JOHNSON CONTROLS INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 223 JOHNSON CONTROLS INC.: PRODUCT LAUNCHES

- TABLE 224 JOHNSON CONTROLS INC.: DEALS

- TABLE 225 YONDR: COMPANY OVERVIEW

- TABLE 226 YONDR: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 227 YONDR: DEALS

- TABLE 228 YONDR: EXPANSIONS

- TABLE 229 HUBBELL: COMPANY OVERVIEW

- TABLE 230 HUBBELL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 231 HUBBELL: DEALS

- TABLE 232 MODUBUILD: COMPANY OVERVIEW

- TABLE 233 MODUBUILD: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 234 ALTRON A.S.: COMPANY OVERVIEW

- TABLE 235 ALTRON A.S.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 236 ALTRON A.S.: PRODUCT LAUNCHES

- TABLE 237 INNOVIT AG: COMPANY OVERVIEW

- TABLE 238 INNOVIT AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 239 MAVAB: COMPANY OVERVIEW

- TABLE 240 MAVAB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 241 RITTAL GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 242 RITTAL GMBH & CO. KG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 243 RITTAL GMBH & CO. KG: PRODUCT LAUNCHES

- TABLE 244 RITTAL GMBH & CO. KG: DEALS

- TABLE 245 INVT POWER SYSTEM(SHENZHEN) CO., LTD.: COMPANY OVERVIEW

- TABLE 246 INVT POWER SYSTEM(SHENZHEN) CO., LTD.: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 247 DELTA ELECTRONICS, INC.: COMPANY OVERVIEW

- TABLE 248 DELTA ELECTRONICS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 249 DATA SPECIALTIES, INC.: COMPANY OVERVIEW

- TABLE 250 DATA SPECIALTIES, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 251 PRASA INFOCOM AND POWER SOLUTIONS PVT. LTD.: COMPANY OVERVIEW

- TABLE 252 PRASA INFOCOM AND POWER SOLUTIONS PVT. LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 253 BLADEROOM GROUP LIMITED: COMPANY OVERVIEW

- TABLE 254 BLADEROOM GROUP LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 255 CUPERTINO ELECTRIC, INC.: COMPANY OVERVIEW

- TABLE 256 CUPERTINO ELECTRIC, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

List of Figures

- FIGURE 1 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET: RESEARCH DESIGN

- FIGURE 3 DATA TRIANGULATION

- FIGURE 4 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET: BOTTOM-UP APPROACH

- FIGURE 5 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET: TOP-DOWN APPROACH

- FIGURE 6 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF OFFSITE DATA CENTER POWER INFRASTRUCTURE

- FIGURE 7 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 8 NORTH AMERICA DOMINATED OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET IN 2023

- FIGURE 9 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2024

- FIGURE 10 BFSI SEGMENT TO LEAD MARKET IN 2030

- FIGURE 11 INCREASING DEMAND FOR CLOUD SERVICES AND DATA PROCESSING TO DRIVE MARKET

- FIGURE 12 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 SOLUTIONS AND BFSI SEGMENTS HELD LARGEST MARKET SHARE IN 2023

- FIGURE 14 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2030

- FIGURE 15 BFSI SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 16 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 GLOBAL DATA ON ENERGY DEMAND, BY DATA CENTER TYPE, 2010-2022

- FIGURE 18 BREAKDOWN OF POWER USAGE IN DATA CENTERS

- FIGURE 19 GLOBAL POWER INVESTMENT, 2019-2023

- FIGURE 20 GLOBAL CLEAN ENERGY INVESTMENT, 2017-2023

- FIGURE 21 GLOBAL ENERGY INVESTMENT, 2019-2023

- FIGURE 22 GLOBAL RENEWABLE ENERGY CAPACITY EXPANSION, BY GEOGRAPHY, 2005-2028

- FIGURE 23 TOTAL CLEAN ENERGY EXPENDITURE IN DIFFERENT ECONOMIES, 2023

- FIGURE 24 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO

- FIGURE 27 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 28 IMPACT OF AI/GENERATIVE AI ON OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET SUPPLY CHAIN

- FIGURE 29 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING

- FIGURE 30 IMPORT DATA FOR HS CODE 8544-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 31 EXPORT DATA FOR HS CODE 8544-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 32 NUMBER OF PATENTS APPLIED AND GRANTED FOR OFFSITE DATA CENTER POWER INFRASTRUCTURE, 2013-2023

- FIGURE 33 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VERTICAL

- FIGURE 35 KEY BUYING CRITERIA, BY VERTICAL

- FIGURE 36 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET SHARE, BY OFFERING, 2023

- FIGURE 37 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET SHARE, BY VERTICAL, 2023

- FIGURE 38 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET SHARE, BY REGION

- FIGURE 39 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 NORTH AMERICA: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET SNAPSHOT

- FIGURE 41 EUROPE: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET SNAPSHOT

- FIGURE 43 MARKET SHARE ANALYSIS OF TOP COMPANIES IN OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, 2023

- FIGURE 44 RANKING OF TOP FIVE COMPANIES IN OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, 2023

- FIGURE 45 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2019-2023

- FIGURE 46 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 47 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET: COMPANY FOOTPRINT

- FIGURE 48 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 49 FINANCIAL METRICS, 2024 (EV/EBITDA)

- FIGURE 50 COMPANY VALUATION, 2024 (USD BILLION)

- FIGURE 51 BRAND/PRODUCT COMPARISON

- FIGURE 52 ABB: COMPANY SNAPSHOT

- FIGURE 53 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 54 VERTIV GROUP CORP.: COMPANY SNAPSHOT

- FIGURE 55 EATON: COMPANY SNAPSHOT

- FIGURE 56 HUAWEI DIGITAL POWER TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

- FIGURE 57 COMFORT SYSTEMS USA: COMPANY SNAPSHOT

- FIGURE 58 JOHNSON CONTROLS INC.: COMPANY SNAPSHOT

- FIGURE 59 HUBBELL: COMPANY SNAPSHOT

- FIGURE 60 DELTA ELECTRONICS, INC.: COMPANY SNAPSHOT

The global offsite data center power infrastructure market is on a trajectory to reach USD 35.4 billion by 2030, a notable increase from the estimated USD 13.4 billion in 2024, with a steady CAGR of 17.6% spanning the period from 2024 to 2030. The worldwide offsite data center power infrastructure market is anticipated to encounter major expansion driven by a number of forthcoming trends. With the mounting apprehensions about the environment and regulations, one of the key trends is the escalating acceptance of green technologies. To lessen the quantity of carbon emissions, data centers are now focusing on green technologies like advanced cooling systems and green energy systems containing renewable energy. There is also a new trend towards battery storage and fuel cell solutions forward as a reliable backup power option and efficiency advancement.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Vertical, By Offering |

| Regions covered | Asia Pacific, North America, Europe, and Rest of World |

Another key trend is the increased reliance on edge computing and 5G technologies. With the increase in proliferation of IoT technologies and the rising demand for data services, edge offsite data centers need to support latency-free applications. Therefore, there is an increase in the investments which is driving the market growth. In addition, hyper-scale data center expansion by large cloud service providers is set to accelerate, requiring robust capacity infrastructure to support their large operations and greater density as the market grows and strategic partnerships are expected and integration between core businesses will increase technical capacity and market reach. It is fed by other competitors in the field.

"Government & Defence segment, by Vertical, to hold third-largest market share from 2024 to 2030."

Government and Defense agencies hold the third largest market share in the global on-premises data center power infrastructure market due to the increasing need for secure, accessible data storage and access to and convenience therefore Government and security agencies sensitive and confidential Handle multiple demands robust infrastructure to ensure data integrity and protect from cyber threats Furthermore, thanks to advanced technologies such as AI, big data analytics and Due to the use of IoT, increasingly digitized government services and security operations require appropriate power systems This segment of uninterrupted power supply, disaster recovery solutions , requirement of regulatory standards a intensity and compliance are driving the adoption of advanced offsite data center and power infrastructure solutions.

"The North American offsite data center power infrastructure market is poised to hold the largest market share throughout the forecast period"

North America holds the largest market share in the global offsite data center power infrastructure market, owing to its well-established technology infrastructure, large investments in data center development, and strong digital infrastructure and technology Region benefits from a mature market driven by high demand for data processing and storage by advanced industries including finance and healthcare, as well as favorable operating conditions, stable economic conditions and availability of large data center operators and technology professionals there And the company's focus continues to make significant improvements to offsite data center power infrastructure .

Breakdown of Primaries:

In-depth interviews with key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, were conducted to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The primary interviews were distributed as follows:

By Company Type: Tier 1-30%, Tier 2-55%, and Tier 3-15%

By Designation: C-Level-30%, D-Level-20%, and Others-50%

By Region: North America-18%, Europe-8%, Asia Pacific-60%, South America-4% and

Middle East & Africa-10%.

Note: "Others" include sales managers, engineers, and regional managers

The tiers of the companies are defined based on their total revenue as of 2021: Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: <USD 500 million.

The offsite data center power infrastructure market is predominantly governed by well-established global leaders. Notable players in the offsite data center power infrastructure market include ABB (Switzerland), Schneider Electric (France), Eaton (Ireland), Vertiv (US), Huawei Digital Power Technologies Co., Ltd. (China), Comfort Systems USA (UK), Johnson Controls (US), Yondr (Netherlands), Hubbell (US), Modubuild (Ireland), Altron A.S. (Czech Republic), InnovIT AG (Germany), MAVAB (Sweden), Rittal (Germany)and Delta Electronics, Inc. (Norway).

Research Coverage:

The report provides a comprehensive definition, description, and forecast of the offsite data center power infrastructure market based on various parameters, including offerings (Solutions, Services), Vertical (BFSI, IT & Telecom, Media & Entertainment, Healthcare, Government & Defense, Retail, Manufacturing, Others), and region (Asia Pacific, North America, Europe, Middle East & Africa, South America). The report also offers a thorough qualitative and quantitative analysis of the offsite data center power infrastructure, encompassing a comprehensive examination of the key market drivers, limitations, opportunities, and challenges. Additionally, it covers critical facets of the market, such as an assessment of the competitive landscape, an analysis of market dynamics, value-based market estimates, and future trends in the offsite data center power infrastructure market. The report provides investment and funding information of key players in the offsite data center power infrastructure market.

Key Benefits of Buying the Report

The report is thoughtfully designed to benefit both established industry leaders and newcomers in the offsite data center power infrastructure market. It provides reliable revenue forecasts for the entire market as well as its individual sub-segments. This data is a valuable resource for stakeholders, enabling them to gain a comprehensive understanding of the competitive landscape and formulate effective market strategies for their businesses. Furthermore, the report serves as a channel for stakeholders to grasp the current state of the market, providing essential insights into market drivers, limitations, challenges, and growth opportunities. By incorporating these insights, stakeholders can make well-informed decisions and stay informed about the constantly evolving dynamics of the offsite data center power infrastructure industry.

- Analysis of key drivers: (Rising demand for data storage and processing, Expansion of cloud services, Growth of Colocation Services), restraints (High initial capital expenditure, Energy consumption and operational costs, Security concerns related to offsite data centers), opportunities (Adoption of renewable energy solutions, Technological advancements in energy efficiency, Emerging markets in developing nations), and challenges (Regulatory and compliance challenges, Environmental concerns related to offsite data centers) influencing the growth of the offsite data center power infrastructure market.

- Product Development/ Innovation: The offsite data center power infrastructure is in a constant state of evolution, with a primary focus on acquisitions, partnerships, and collaborations. Leading industry players like ABB, Schneider Electric, Eaton, and Vertiv are at the forefront of advancing their product offerings to address shifting demands and environmental considerations.

- Market Development: Market growth in the offsite data center power infrastructure sector is characterized by significant growth in modular power solutions, greater focus on energy efficiency, integration of renewable energy sources , driven by big data and analytics increasing demand for scalable and flexible power infrastructure to support data center proliferation drives market expansion Strategic collaborations, mergers and acquisitions further facilitate the growth and development of this market. There is a growing emphasis on sustainability and technological advancements pertaining to the offerings in the offsite data center power infrastructure market.

- Market Diversification: The Offsite Data Center Power Infrastructure market has a wide range of power solutions and specific services to suit the needs of various industries such as BFSI, IT & Telecommunication, and Healthcare Key players in this market are new -age power modules, Renewable Energy -In addition to focusing on diversifying their manufacturing processes by adopting integration strategies, and improving capacity utilization through data analytics and automation technologies, companies focus on developing their geographic footprint on various types. They focus on market expansion through strategies such as collaborations, partnerships and acquisitions.

- Competitive Assessment: A comprehensive evaluation has been conducted to scrutinize the market presence, growth strategies, and service offerings of key players in the offsite data center power infrastructure market. These prominent companies include ABB (Switzerland), Schneider Electric (France), Eaton (Ireland), Vertiv (US), Huawei Digital Power Technologies Co., Ltd. (China), Comfort Systems USA (UK), Johnson Controls (US), Yondr (Netherlands), Hubbell (US), Modubuild (Ireland), Altron A.S. (Czech Republic), InnovIT AG (Germany), MAVAB (Sweden), Rittal (Germany), and Delta Electronics, Inc. (Norway). This analysis provides in-depth insights into the competitive positions of these major players, their approaches to driving market growth, and the range of services they offer within the offsite data center power infrastructure market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 LIMITATIONS

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 PRIMARY AND SECONDARY RESEARCH

- 2.2 DATA TRIANGULATION

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.1.2 Key secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Intended participants and key opinion leaders in primary interviews

- 2.2.2.2 Key data from primary sources

- 2.2.2.3 Key industry insights

- 2.2.2.4 Breakdown of primaries

- 2.2.1 SECONDARY DATA

- 2.3 MARKET SCOPE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.4.3 DEMAND-SIDE ANALYSIS

- 2.4.3.1 Demand-side assumptions

- 2.4.3.2 Demand-side calculations

- 2.4.4 SUPPLY-SIDE ANALYSIS

- 2.4.4.1 Supply-side assumptions

- 2.4.4.2 Supply-side calculations

- 2.4.5 GROWTH FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET

- 4.2 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION

- 4.3 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET IN NORTH AMERICA, BY OFFERING AND VERTICAL

- 4.4 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING

- 4.5 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY VERTICAL

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand to store expanding digital data

- 5.2.1.2 Increasing adoption of cloud computing services

- 5.2.1.3 Growing demand for data center colocation services

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of establishing data center infrastructure

- 5.2.2.2 Energy-intensive data storage infrastructure

- 5.2.2.3 Susceptibility to cyberattacks

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Government-led initiatives to encourage adoption of environment-friendly technologies

- 5.2.3.2 Energy optimization with innovative technologies

- 5.2.3.3 Integration of smart grid and microgrid technologies into data center operations

- 5.2.3.4 Incorporating renewable energy sources in data center operations

- 5.2.3.5 Economic growth and urbanization in emerging markets

- 5.2.4 CHALLENGES

- 5.2.4.1 Regulatory and compliance-related challenges

- 5.2.4.2 High carbon emissions

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 IMPACT OF AI/GENERATIVE AI ON OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET

- 5.7.1 RATIONALE FOR IMPACT LEVELS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 AI and ML

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Edge computing

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PRICING ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING

- 5.9.2 INDICATIVE PRICING TREND OF MODULAR DATA CENTER SOLUTIONS

- 5.10 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.11.1 TARIFFS ANALYSIS

- 5.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.3 CODES AND REGULATIONS RELATED TO OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET

- 5.11.4 STANDARDS RELATED TO OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA (HS CODE 8544)

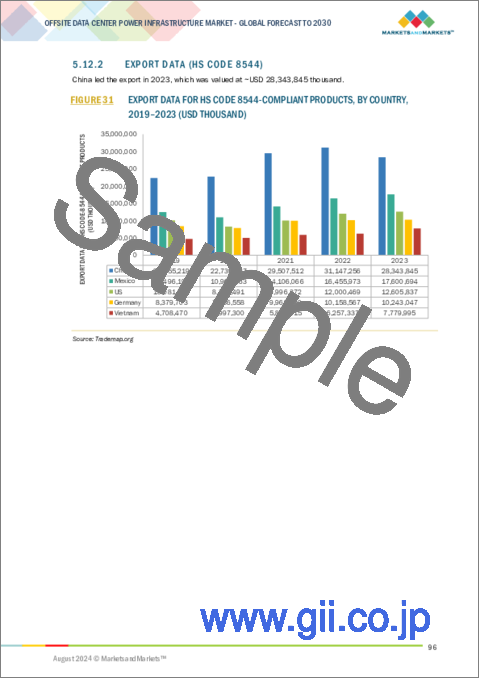

- 5.12.2 EXPORT DATA (HS CODE 8544)

- 5.13 PATENT ANALYSIS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF SUBSTITUTES

- 5.14.2 BARGAINING POWER OF SUPPLIERS

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 THREAT OF NEW ENTRANTS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 CASE STUDY ANALYSIS

- 5.16.1 AMDOCS COLLABORATED WITH EATON TO TRANSFORM DATA CENTER IN LONDON

- 5.16.2 POWER & TEL COLLABORATED WITH VERTIV TO MEET DEMANDS OF EXPANDING CUSTOMER BASE

- 5.16.3 DIGITAL REALTY HELPED IBM DEPLOY SECURED PRIVATE CLOUD SOLUTIONS DELIVERING LOW LATENCY AND HIGH THROUGHPUT TO CUSTOMERS

- 5.16.4 SCHNEIDER ELECTRIC LEVERAGED SMART GRID TECHNOLOGIES TO ENABLE PROACTIVE MANAGEMENT OF ELECTRICAL NETWORKS

6 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 SOLUTIONS

- 6.2.1 INCREASING EMPHASIS ON BOOSTING ENERGY EFFICIENCY WITH REDUCED OPERATIONAL COSTS TO DRIVE MARKET

- 6.3 SERVICES

- 6.3.1 DESIGN & CONSULTING

- 6.3.1.1 Rising demand for robust and efficient power infrastructure to foster segmental growth

- 6.3.2 INSTALLATION & IMPLEMENTATION

- 6.3.2.1 Ability to reduce downtime and mitigate operational inefficiencies to boost demand

- 6.3.3 SUPPORT & MAINTENANCE

- 6.3.3.1 Rising need to ensure optimum functioning of systems to drive market

- 6.3.1 DESIGN & CONSULTING

7 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY VERTICAL

- 7.1 INTRODUCTION

- 7.2 BFSI

- 7.2.1 GROWING SHIFT TOWARD ONLINE AND MOBILE BANKING TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 7.3 IT & TELECOM

- 7.3.1 EXPANSION OF 5G NETWORK TO FOSTER SEGMENTAL GROWTH

- 7.4 MEDIA & ENTERTAINMENT

- 7.4.1 RISING POPULARITY OF DIGITAL CONTENT AND STREAMING SERVICES TO ACCELERATE DEMAND

- 7.5 HEALTHCARE

- 7.5.1 INCREASING RELIANCE ON DIGITAL TECHNOLOGIES AND DATA-DRIVEN SOLUTIONS TO EXPEDITE SEGMENTAL GROWTH

- 7.6 GOVERNMENT & DEFENSE

- 7.6.1 PRESSING NEED TO ENSURE NATIONAL SECURITY AND EFFICIENT PUBLIC ADMINISTRATION TO DRIVE MARKET

- 7.7 RETAIL

- 7.7.1 SURGING DEPLOYMENT OF ADVANCED TECHNOLOGIES TO OPTIMIZE SUPPLY CHAIN OPERATIONS TO FUEL SEGMENTAL GROWTH

- 7.8 MANUFACTURING

- 7.8.1 RISING FOCUS ON PREDICTIVE MAINTENANCE AND ADVANCED ANALYTICS TO SPUR DEMAND

- 7.9 OTHERS

8 OFFSITE DATA CENTER POWER INFRASTRUCTURE MARKET, BY REGION

- 8.1 INTRODUCTION

- 8.2 NORTH AMERICA

- 8.2.1 US

- 8.2.1.1 Rising number of energy-efficient data centers to spike demand

- 8.2.2 CANADA

- 8.2.2.1 Growing focus on boosting cybersecurity and technological advancements to fuel market growth

- 8.2.3 MEXICO

- 8.2.3.1 Increasing foreign investments in technology sector to offer lucrative growth opportunities

- 8.2.1 US

- 8.3 EUROPE

- 8.3.1 UK

- 8.3.1.1 Escalating deployment of AI, ML, and IoT in data center infrastructure to foster segmental growth

- 8.3.2 GERMANY

- 8.3.2.1 Government-led initiatives to boost digital transformation to drive market

- 8.3.3 FRANCE

- 8.3.3.1 Increasing electricity generation using renewable resources to drive market

- 8.3.4 ITALY

- 8.3.4.1 Growing focus on boosting digital infrastructure and promoting technological developments to foster segmental growth

- 8.3.5 RUSSIA

- 8.3.5.1 Abundance of natural resources to offer lucrative growth opportunities

- 8.3.6 REST OF EUROPE

- 8.3.1 UK

- 8.4 ASIA PACIFIC

- 8.4.1 CHINA

- 8.4.1.1 Growing adoption of cloud-based solutions due to exponential increase in data volumes to drive demand

- 8.4.2 INDIA

- 8.4.2.1 Government-led initiatives to boost digital infrastructure to accelerate demand

- 8.4.3 JAPAN

- 8.4.3.1 Increasing FDI from tech giants to foster market growth

- 8.4.4 AUSTRALIA

- 8.4.4.1 Rising integration of renewable energy into data centers to offer lucrative growth opportunities

- 8.4.5 REST OF ASIA PACIFIC

- 8.4.1 CHINA

- 8.5 MIDDLE EAST & AFRICA

- 8.5.1 GCC

- 8.5.1.1 Saudi Arabia

- 8.5.1.1.1 Rising focus on improving energy infrastructure to boost demand

- 8.5.1.2 UAE

- 8.5.1.2.1 Growing demand for digital services to fuel market growth

- 8.5.1.3 Rest of GCC

- 8.5.1.1 Saudi Arabia

- 8.5.2 SOUTH AFRICA

- 8.5.2.1 Government-led initiatives to boost data center infrastructure development to drive market

- 8.5.3 REST OF MIDDLE EAST & AFRICA

- 8.5.1 GCC

- 8.6 SOUTH AMERICA

- 8.6.1 BRAZIL

- 8.6.1.1 Increasing emphasis on promoting digital economy to fuel market growth

- 8.6.2 ARGENTINA

- 8.6.2.1 Rising emphasis on technology exports to drive market

- 8.6.3 REST OF SOUTH AMERICA

- 8.6.1 BRAZIL

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- 9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 9.3 MARKET SHARE ANALYSIS, 2023

- 9.4 MARKET RANKING, 2023

- 9.5 REVENUE ANALYSIS, 2019-2023

- 9.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 9.6.1 STARS

- 9.6.2 EMERGING LEADERS

- 9.6.3 PERVASIVE PLAYERS

- 9.6.4 PARTICIPANTS

- 9.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 9.6.5.1 Company footprint

- 9.6.5.2 Offering footprint

- 9.6.5.3 Vertical footprint

- 9.6.5.4 Region footprint

- 9.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 9.7.1 PROGRESSIVE COMPANIES

- 9.7.2 RESPONSIVE COMPANIES

- 9.7.3 DYNAMIC COMPANIES

- 9.7.4 STARTING BLOCKS

- 9.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 9.7.5.1 Detailed list of key startups/SMEs

- 9.7.5.2 Competitive benchmarking of key startups/SMEs

- 9.8 COMPANY VALUATION AND FINANCIAL METRICS

- 9.9 BRAND/PRODUCT COMPARISON

- 9.10 COMPETITIVE SCENARIO

- 9.10.1 PRODUCT LAUNCHES

- 9.10.2 DEALS

- 9.10.3 EXPANSIONS

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- 10.1.1 ABB

- 10.1.1.1 Business overview

- 10.1.1.2 Products/Services/Solutions offered

- 10.1.1.3 Recent developments

- 10.1.1.3.1 Product launches

- 10.1.1.3.2 Deals

- 10.1.1.4 MnM view

- 10.1.1.4.1 Key strengths/Right to win

- 10.1.1.4.2 Strategic choices

- 10.1.1.4.3 Weaknesses/Competitive threats

- 10.1.2 SCHNEIDER ELECTRIC

- 10.1.2.1 Business overview

- 10.1.2.2 Products/Services/Solutions offered

- 10.1.2.3 Recent developments

- 10.1.2.3.1 Product launches

- 10.1.2.3.2 Deals

- 10.1.2.4 MnM view

- 10.1.2.4.1 Key strengths/Right to win

- 10.1.2.4.2 Strategic choices

- 10.1.2.4.3 Weaknesses/Competitive strengths

- 10.1.3 VERTIV GROUP CORP.

- 10.1.3.1 Business overview

- 10.1.3.2 Products/Services/Solutions offered

- 10.1.3.3 Recent developments

- 10.1.3.3.1 Product launches

- 10.1.3.3.2 Deals

- 10.1.3.4 MnM view

- 10.1.3.4.1 Key strengths/Right to win

- 10.1.3.4.2 Strategic choices

- 10.1.3.4.3 Weaknesses/Competitive strengths

- 10.1.4 EATON

- 10.1.4.1 Business overview

- 10.1.4.2 Products/Services/Solutions offered

- 10.1.4.3 Recent developments

- 10.1.4.3.1 Product launches

- 10.1.4.3.2 Deals

- 10.1.4.3.3 Expansions

- 10.1.4.4 MnM view

- 10.1.4.4.1 Key strengths/Right to win

- 10.1.4.4.2 Strategic choices

- 10.1.4.4.3 Weaknesses/Competitive strengths

- 10.1.5 HUAWEI DIGITAL POWER TECHNOLOGIES CO., LTD.

- 10.1.5.1 Business overview

- 10.1.5.2 Products/Services/Solutions offered

- 10.1.5.3 Recent developments

- 10.1.5.3.1 Product launches

- 10.1.5.3.2 Deals

- 10.1.5.4 MnM view

- 10.1.5.4.1 Key strengths/Right to win

- 10.1.5.4.2 Strategic choices

- 10.1.5.4.3 Weaknesses/Competitive strengths

- 10.1.6 COMFORT SYSTEMS USA

- 10.1.6.1 Business overview

- 10.1.6.2 Products/Services/Solutions offered

- 10.1.6.3 Recent developments

- 10.1.6.3.1 Deals

- 10.1.7 JOHNSON CONTROLS INC.

- 10.1.7.1 Business overview

- 10.1.7.2 Products/Services/Solutions offered

- 10.1.7.3 Recent developments

- 10.1.7.3.1 Product launches

- 10.1.7.3.2 Deals

- 10.1.8 YONDR

- 10.1.8.1 Business overview

- 10.1.8.2 Products/Services/Solutions offered

- 10.1.8.3 Recent developments

- 10.1.8.3.1 Deals

- 10.1.8.3.2 Expansions

- 10.1.9 HUBBELL

- 10.1.9.1 Business overview

- 10.1.9.2 Products/Services/Solutions offered

- 10.1.9.3 Recent developments

- 10.1.9.3.1 Deals

- 10.1.10 MODUBUILD

- 10.1.10.1 Business overview

- 10.1.10.2 Products/Services/Solutions offered

- 10.1.11 ALTRON A.S.

- 10.1.11.1 Business overview

- 10.1.11.2 Products/Services/Solutions offered

- 10.1.11.3 Recent developments

- 10.1.11.3.1 Product launches

- 10.1.12 INNOVIT AG

- 10.1.12.1 Business overview

- 10.1.12.2 Products/Services/Solutions offered

- 10.1.13 MAVAB

- 10.1.13.1 Business overview

- 10.1.13.2 Products/Services/Solutions offered

- 10.1.14 RITTAL GMBH & CO. KG

- 10.1.14.1 Business overview

- 10.1.14.2 Products/Services/Solutions offered

- 10.1.14.3 Recent developments

- 10.1.14.3.1 Product launches

- 10.1.14.3.2 Deals

- 10.1.15 INVT POWER SYSTEM(SHENZHEN) CO., LTD.

- 10.1.15.1 Business overview

- 10.1.15.2 Products/Services/Solutions offered

- 10.1.16 DELTA ELECTRONICS, INC.

- 10.1.16.1 Business overview

- 10.1.16.2 Products/Services/Solutions offered

- 10.1.17 DATA SPECIALTIES, INC.

- 10.1.17.1 Business overview

- 10.1.17.2 Products/Services/Solutions offered

- 10.1.18 PRASA INFOCOM AND POWER SOLUTIONS PVT. LTD.

- 10.1.18.1 Business overview

- 10.1.18.2 Products/Services/Solutions offered

- 10.1.19 BLADEROOM GROUP LIMITED

- 10.1.19.1 Business overview

- 10.1.19.2 Products/Services/Solutions offered

- 10.1.20 CUPERTINO ELECTRIC, INC.

- 10.1.20.1 Business overview

- 10.1.20.2 Products/Services/Solutions offered

- 10.1.1 ABB

- 10.2 OTHER PLAYERS

- 10.2.1 DATAXENTER

- 10.2.2 ICT FACILITIES GMBH

- 10.2.3 MASCO GROUP

- 10.2.4 INTEGRA MISSION CRITICAL, LLC.

- 10.2.5 BOX MODUL

11 APPENDIX

- 11.1 INSIGHTS FROM INDUSTRY EXPERTS

- 11.2 DISCUSSION GUIDE

- 11.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.4 CUSTOMIZATION OPTIONS

- 11.5 RELATED REPORTS

- 11.6 AUTHOR DETAILS