|

|

市場調査レポート

商品コード

1525675

デジタルレーダーの世界市場:タイプ別、次元別、用途別、業界別、地域別 - 2029年までの予測Digital Radar Market by Type (Active and Passive), Dimension (2D, 3D and 4D), Application (Safety, Security and Surveillance), Vertical (Automotive, Aerospace, Military and Defense) and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| デジタルレーダーの世界市場:タイプ別、次元別、用途別、業界別、地域別 - 2029年までの予測 |

|

出版日: 2024年07月17日

発行: MarketsandMarkets

ページ情報: 英文 217 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

デジタルレーダーの市場規模は、2024年の59億米ドルから成長し、2024年から2029年までのCAGRは18.2%と見込まれ、2029年には137億米ドルに達すると予測されています。

自動車市場は、技術革新、安全性の向上、ADAS(先進運転支援システム)のような高度なシステムの統合によって大きく牽引されています。例えば、物体検出、追跡機能、一般的な状況把握は、4Dデジタルレーダー技術の使用により大幅にアップグレードされます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | タイプ別、次元別、用途別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東アフリカ、ラテンアメリカ |

デジタルレーダー市場における4Dセグメントは、その優れた機能と4Dレーダーセグメントの広範な用途により、高い成長率が見込まれます。4Dレーダーは、第4次元として時間を追加することで、レンジデータ、角度、速度しか持たない従来のレーダーシステムと比較して、より正確で、より優れた空間認識を提供します。高解像度で撮像する技術により、複雑な環境でも物体を検出、追跡、分類することが可能になり、自動運転車やスマート交通管理、ADAS(先進運転支援システム)にとって特に重要です。

セキュリティ・監視用途は、軍事・防衛戦略における重要な機能により、最大の市場シェアを占めています。現在の軍事作戦において、最新のデジタルレーダーシステムは、悪天候の影響を考慮した上で、遠距離からターゲットを探知、追跡、識別するため、必要不可欠です。重要な動向は、デジタルレーダーの品質と効率の両方を向上させるために、より多くの技術が使用されるようになったことです。デジタルビームフォーミング、GaN(窒化ガリウム)半導体、周波数変調連続波(FMCW)レーダーなどの先進技術を採用した新しいソリューションは、効果や効率の面で従来のレーダーを凌駕しています。

当レポートでは、世界のデジタルレーダー市場について調査し、タイプ別、次元別、用途別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- エコシステム分析

- 技術分析

- 顧客ビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ分析

- 価格分析

- 特許分析

- 貿易分析

- 規制状況

- 2024年~2025年の主な会議とイベント

第6章 デジタルレーダー市場、タイプ別

- イントロダクション

- アクティブ

- パッシブ

第7章 デジタルレーダー市場、次元別

- イントロダクション

- 2次元と3次元

- 4次元

第8章 デジタルレーダー市場、用途別

- イントロダクション

- 安全性

- セキュリティと監視

- その他

第9章 デジタルレーダー市場、業界別

- イントロダクション

- 自動車

- 航空宇宙

- 軍事・防衛

- その他

第10章 デジタルレーダー市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第11章 競合情勢

- 概要

- 収益分析、2021年~2023年

- 市場シェア分析、2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオと動向

第12章 企業プロファイル

- 主要参入企業

- LOCKHEED MARTIN CORPORATION

- THALES

- INDRA

- LEONARDO S.P.A.

- BHARAT ELECTRONICS LIMITED

- ADVANCED MICRO DEVICES, INC.

- MAGNA INTERNATIONAL INC

- NXP SEMICONDUCTORS

- SAAB AB

- UHNDER

- その他の企業

- ISRAEL AEROSPACE INDUSTRIES

- BAE SYSTEMS

- ELBIT SYSTEMS LTD.

- VAYYAR

- ARBE

- AINSTEIN RADAR SYSTEMS

- OCULII

- SPARTAN RADAR, INC.

- CUBTEK INC.

- ASELSAN A.S.

- TELEDYNE FLIR LLC

- ECHODYNE CORP

- BITSENSING

- RFISEE

- GAPWAVES AB

第13章 付録

List of Tables

- TABLE 1 DIGITAL RADAR MARKET: RISK ANALYSIS

- TABLE 2 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 3 DIGITAL RADAR MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- TABLE 5 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 6 INDICATIVE PRICING TREND OF DIGITAL RADAR FOR AUTOMOTIVE VERTICAL, BY DIMENSION (USD)

- TABLE 7 DIGITAL RADAR MARKET: PATENTS, 2023

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 DIGITAL RADAR MARKET: CONFERENCES AND EVENTS, 2024-2025

- TABLE 13 DIGITAL RADAR MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 14 DIGITAL RADAR MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 15 DIGITAL RADAR MARKET, BY DIMENSION, 2020-2023 (USD MILLION)

- TABLE 16 DIGITAL RADAR MARKET, BY DIMENSION, 2024-2029 (USD MILLION)

- TABLE 17 2D & 3D: DIGITAL RADAR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 18 2D & 3D: DIGITAL RADAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 19 4D: DIGITAL RADAR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 20 4D: DIGITAL RADAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 21 DIGITAL RADAR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 22 DIGITAL RADAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 23 SAFETY: DIGITAL RADAR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 24 SAFETY: DIGITAL RADAR MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 25 SECURITY & SURVEILLANCE: DIGITAL RADAR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 26 SECURITY & SURVEILLANCE: DIGITAL RADAR MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 27 OTHER APPLICATIONS: DIGITAL RADAR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 28 OTHER APPLICATIONS: DIGITAL RADAR MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 29 DIGITAL RADAR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 30 DIGITAL RADAR MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 31 AUTOMOTIVE: DIGITAL RADAR MARKET, IN TERMS OF VOLUME, 2020-2023 (MILLION UNITS)

- TABLE 32 AUTOMOTIVE: DIGITAL RADAR MARKET, IN TERMS OF VOLUME, 2024-2029 (MILLION UNITS)

- TABLE 33 AUTOMOTIVE: DIGITAL RADAR MARKET, BY DIMENSION, 2020-2023 (USD MILLION)

- TABLE 34 AUTOMOTIVE: DIGITAL RADAR MARKET, BY DIMENSION, 2024-2029 (USD MILLION)

- TABLE 35 AUTOMOTIVE: DIGITAL RADAR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 36 AUTOMOTIVE: DIGITAL RADAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 37 AUTOMOTIVE: DIGITAL RADAR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 38 AUTOMOTIVE: DIGITAL RADAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 39 AEROSPACE: DIGITAL RADAR MARKET, BY DIMENSION, 2020-2023 (USD MILLION)

- TABLE 40 AEROSPACE: DIGITAL RADAR MARKET, BY DIMENSION, 2024-2029 (USD MILLION)

- TABLE 41 AEROSPACE: DIGITAL RADAR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 42 AEROSPACE: DIGITAL RADAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 43 AEROSPACE: DIGITAL RADAR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 44 AEROSPACE: DIGITAL RADAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 45 MILITARY & DEFENSE: DIGITAL RADAR MARKET, BY DIMENSION, 2020-2023 (USD MILLION)

- TABLE 46 MILITARY & DEFENSE: DIGITAL RADAR MARKET, BY DIMENSION, 2024-2029 (USD MILLION)

- TABLE 47 MILITARY & DEFENSE: DIGITAL RADAR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 48 MILITARY & DEFENSE: DIGITAL RADAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 49 MILITARY & DEFENSE: DIGITAL RADAR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 50 MILITARY & DEFENSE: DIGITAL RADAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 51 OTHER VERTICALS: DIGITAL RADAR MARKET, BY DIMENSION, 2020-2023 (USD MILLION)

- TABLE 52 OTHER VERTICALS: DIGITAL RADAR MARKET, BY DIMENSION, 2024-2029 (USD MILLION)

- TABLE 53 OTHER VERTICALS: DIGITAL RADAR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 54 OTHER VERTICALS: DIGITAL RADAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 55 OTHER VERTICALS: DIGITAL RADAR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 56 OTHER VERTICALS: DIGITAL RADAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 57 DIGITAL RADAR MARKET: BY REGION, 2020-2023 (USD MILLION)

- TABLE 58 DIGITAL RADAR MARKET: BY REGION, 2024-2029 (USD MILLION)

- TABLE 59 NORTH AMERICA: DIGITAL RADAR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 60 NORTH AMERICA: DIGITAL RADAR MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 61 NORTH AMERICA: DIGITAL RADAR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 62 NORTH AMERICA: DIGITAL RADAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 63 NORTH AMERICA: DIGITAL RADAR MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 64 NORTH AMERICA: DIGITAL RADAR MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 65 US: DIGITAL RADAR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 66 US: DIGITAL RADAR MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 67 CANADA: DIGITAL RADAR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 68 CANADA: DIGITAL RADAR MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 69 MEXICO: DIGITAL RADAR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 70 MEXICO: DIGITAL RADAR MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 71 EUROPE: DIGITAL RADAR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 72 EUROPE: DIGITAL RADAR MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 73 EUROPE: DIGITAL RADAR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 74 EUROPE: DIGITAL RADAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 75 EUROPE: DIGITAL RADAR MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 76 EUROPE: DIGITAL RADAR MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 77 GERMANY: DIGITAL RADAR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 78 GERMANY: DIGITAL RADAR MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 79 UK: DIGITAL RADAR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 80 UK: DIGITAL RADAR MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 81 FRANCE: DIGITAL RADAR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 82 FRANCE: DIGITAL RADAR MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 83 REST OF EUROPE: DIGITAL RADAR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 84 REST OF EUROPE: DIGITAL RADAR MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 85 ASIA PACIFIC: DIGITAL RADAR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 86 ASIA PACIFIC: DIGITAL RADAR MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 87 ASIA PACIFIC: DIGITAL RADAR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 88 ASIA PACIFIC: DIGITAL RADAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 89 ASIA PACIFIC: DIGITAL RADAR MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 90 ASIA PACIFIC: DIGITAL RADAR MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 91 CHINA: DIGITAL RADAR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 92 CHINA: DIGITAL RADAR MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 93 JAPAN: DIGITAL RADAR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 94 JAPAN: DIGITAL RADAR MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 95 SOUTH KOREA: DIGITAL RADAR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 96 SOUTH KOREA: DIGITAL RADAR MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 97 REST OF ASIA PACIFIC: DIGITAL RADAR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 98 REST OF ROW: DIGITAL RADAR MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 99 ROW: DIGITAL RADAR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 100 ROW: DIGITAL RADAR MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 101 ROW: DIGITAL RADAR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 102 ROW: DIGITAL RADAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 103 ROW: DIGITAL RADAR MARKET, BY GEOGRAPHY, 2020-2023 (USD MILLION)

- TABLE 104 ROW: DIGITAL RADAR MARKET, BY GEOGRAPHY, 2024-2029 (USD MILLION)

- TABLE 105 GCC: DIGITAL RADAR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 106 GCC: DIGITAL RADAR MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 107 REST OF MIDDLE EAST & AFRICA: DIGITAL RADAR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 108 REST OF MIDDLE EAST & AFRICA: DIGITAL RADAR MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 109 SOUTH AMERICA: DIGITAL RADAR MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 110 SOUTH AMERICA: DIGITAL RADAR MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 111 DIGITAL RADAR MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 112 DIGITAL RADAR MARKET SHARE ANALYSIS FOR TOP FIVE PLAYERS, 2023

- TABLE 113 DIGITAL RADAR MARKET: VERTICAL FOOTPRINT

- TABLE 114 DIGITAL RADAR MARKET: TYPE FOOTPRINT

- TABLE 115 DIGITAL RADAR MARKET: DIMENSION FOOTPRINT

- TABLE 116 DIGITAL RADAR MARKET: APPLICATION FOOTPRINT

- TABLE 117 DIGITAL RADAR MARKET: REGION FOOTPRINT

- TABLE 118 DIGITAL RADAR MARKET: KEY STARTUPS

- TABLE 119 DIGITAL RADAR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 120 DIGITAL RADAR MARKET: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2024

- TABLE 121 DIGITAL RADAR MARKET: DEALS, JANUARY 2021-JUNE 2024

- TABLE 122 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 123 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 124 LOCKHEED MARTIN CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 125 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 126 LOCKHEED MARTIN CORPORATION: OTHER DEVELOPMENTS

- TABLE 127 THALES: COMPANY OVERVIEW

- TABLE 128 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 129 THALES: DEALS

- TABLE 130 THALES: OTHER DEVELOPMENTS

- TABLE 131 INDRA: COMPANY OVERVIEW

- TABLE 132 INDRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 INDRA: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 134 INDRA: DEALS

- TABLE 135 INDRA: OTHER DEVELOPMENTS

- TABLE 136 LEONARDO S.P.A.: COMPANY OVERVIEW

- TABLE 137 LEONARDO S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 138 LEONARDO S.P.A.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 139 BHARAT ELECTRONICS LIMITED: COMPANY OVERVIEW

- TABLE 140 BHARAT ELECTRONICS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 BHARAT ELECTRONICS LIMITED: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 142 BHARAT ELECTRONICS LIMITED: DEALS

- TABLE 143 ADVANCED MICRO DEVICES, INC.: COMPANY OVERVIEW

- TABLE 144 ADVANCED MICRO DEVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 145 ADVANCED MICRO DEVICES, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 146 ADVANCED MICRO DEVICES, INC.: DEALS

- TABLE 147 MAGNA INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 148 MAGNA INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 MAGNA INTERNATIONAL INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 150 MAGNA INTERNATIONAL INC.: DEALS

- TABLE 151 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- TABLE 152 NXP SEMICONDUCTORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 153 NXP SEMICONDUCTORS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 154 NXP SEMICONDUCTORS: DEALS

- TABLE 155 SAAB AB: COMPANY OVERVIEW

- TABLE 156 SAAB AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 157 SAAB AB: DEALS

- TABLE 158 SAAB AB: OTHER DEVELOPMENTS

- TABLE 159 UHNDER: COMPANY OVERVIEW

- TABLE 160 UHNDER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 UHNDER: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 162 UHNDER: DEALS

- TABLE 163 ISRAEL AEROSPACE INDUSTRIES: COMPANY OVERVIEW

- TABLE 164 BAE SYSTEMS: COMPANY OVERVIEW

- TABLE 165 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 166 VAYYAR: COMPANY OVERVIEW

- TABLE 167 ARBE: COMPANY OVERVIEW

- TABLE 168 AINSTEIN RADRA SYSTEMS: COMPANY OVERVIEW

- TABLE 169 OCULII: COMPANY OVERVIEW

- TABLE 170 SPARTAN RADAR, INC.: COMPANY OVERVIEW

- TABLE 171 CUBTEK INC.: COMPANY OVERVIEW

- TABLE 172 ASELSAN A.S.: COMPANY OVERVIEW

- TABLE 173 TELEDYNE FLIR LLC: COMPANY OVERVIEW

- TABLE 174 ECHODYNE CORP: COMPANY OVERVIEW

- TABLE 175 BITSENSING: COMPANY OVERVIEW

- TABLE 176 RFISEE: COMPANY OVERVIEW

- TABLE 177 GAPWAVES AB: COMPANY OVERVIEW

List of Figures

- FIGURE 1 DIGITAL RADAR MARKET: SEGMENTATION

- FIGURE 2 DIGITAL RADAR MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 DIGITAL RADAR MARKET: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY-SIDE): REVENUE GENERATED BY DIGITAL RADAR MANUFACTURERS

- FIGURE 6 DIGITAL RADAR MARKET: BOTTOM-UP APPROACH

- FIGURE 7 DIGITAL RADAR MARKET: TOP-DOWN APPROACH

- FIGURE 8 DIGITAL RADAR MARKET: DATA TRIANGULATION

- FIGURE 9 ACTIVE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 2D & 3D SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 11 SECURITY & SURVEILLANCE SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 12 MILITARY & DEFENSE SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 NORTH AMERICA DOMINATED GLOBAL DIGITAL RADAR MARKET IN 2023

- FIGURE 14 GROWING ADOPTION OF DIGITAL RADAR IN MILITARY & DEFENSE TO SURGE MARKET GROWTH DURING FORECAST PERIOD

- FIGURE 15 ACTIVE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 2D & 3D SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 17 SECURITY & SURVEILLANCE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 18 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 19 REST OF ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 IMPACT OF DRIVERS ON DIGITAL RADAR MARKET

- FIGURE 21 IMPACT OF RESTRAINTS ON DIGITAL RADAR MARKET

- FIGURE 22 IMPACT OF OPPORTUNITIES ON DIGITAL RADAR MARKET

- FIGURE 23 TEN HIGHEST TRAFFIC DELAY TIMES, BY CITY, 2022

- FIGURE 24 IMPACT OF CHALLENGES ON DIGITAL RADAR MARKET

- FIGURE 25 DIGITAL RADAR MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 DIGITAL RADAR ECOSYSTEM

- FIGURE 27 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 28 FUNDS RAISED BY UHNDER-STARTUP IN DIGITAL RADAR MARKET, 2020 - 2024 (USD MILLION)

- FIGURE 29 DIGITAL RADAR MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 31 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 32 AVERAGE SELLING PRICE TREND OF DIGITAL RADAR, BY DIMENSION

- FIGURE 33 AVERAGE SELLING PRICE TREND OF 2D & 3D DIMENSIONAL AUTOMOTIVE DIGITAL RADAR, BY REGION, 2020-2023 (USD)

- FIGURE 34 NUMBER OF PATENTS GRANTED AND APPLIED, 2013 -2023

- FIGURE 35 IMPORT DATA FOR HS CODE 8526, BY COUNTRY, 2019-2022

- FIGURE 36 EXPORT DATA FOR HS CODE 8526, BY COUNTRY, 2019-2022

- FIGURE 37 ACTIVE SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 38 2D & 3D SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 39 SECURITY & SURVEILLANCE SEGMENT TO HOLD LARGEST MARKET SHARE FROM 2024 T0 2029

- FIGURE 40 MILITARY & DEFENSE SEGMENT TO HOLD LARGEST MARKET FROM 2024 TO 2029

- FIGURE 41 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 NORTH AMERICA: DIGITAL RADAR MARKET SNAPSHOT

- FIGURE 43 US TO LEAD NORTH AMERICAN DIGITAL RADAR MARKET DURING FORECAST PERIOD

- FIGURE 44 EUROPE: DIGITAL RADAR MARKET SNAPSHOT

- FIGURE 45 GERMANY TO HOLD LARGEST SHARE OF EUROPEAN MARKET DURING FORECAST PERIOD

- FIGURE 46 ASIA PACIFIC: DIGITAL RADAR MARKET SNAPSHOT

- FIGURE 47 CHINA TO HOLD LARGEST SHARE OF MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 48 SOUTH AMERICA TO HOLD LARGEST SHARE OF MARKET IN ROW DURING FORECAST PERIOD

- FIGURE 49 DIGITAL RADAR MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2021-2023

- FIGURE 50 DIGITAL RADAR MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2023

- FIGURE 51 COMPANY VALUATION (USD BILLION), 2024

- FIGURE 52 FINANCIAL METRICS (ENTERPRISE VALUE/EBITDA), 2024

- FIGURE 53 DIGITAL RADAR MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 54 DIGITAL RADAR MARKET: COMPANY EVALUATION MATRIX, 2023

- FIGURE 55 DIGITAL RADAR MARKET: COMPANY FOOTPRINT

- FIGURE 56 DIGITAL RADAR MARKET: STARTUPS/SMES EVALUATION MATRIX, 2023

- FIGURE 57 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 THALES: COMPANY SNAPSHOT

- FIGURE 59 INDRA: COMPANY SNAPSHOT

- FIGURE 60 LEONARDO S.P.A.: COMPANY SNAPSHOT

- FIGURE 61 BHARAT ELECTRONICS LIMITED: COMPANY SNAPSHOT

- FIGURE 62 ADVANCED MICRO DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 63 MAGNA INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 64 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- FIGURE 65 SAAB AB: COMPANY SNAPSHOT

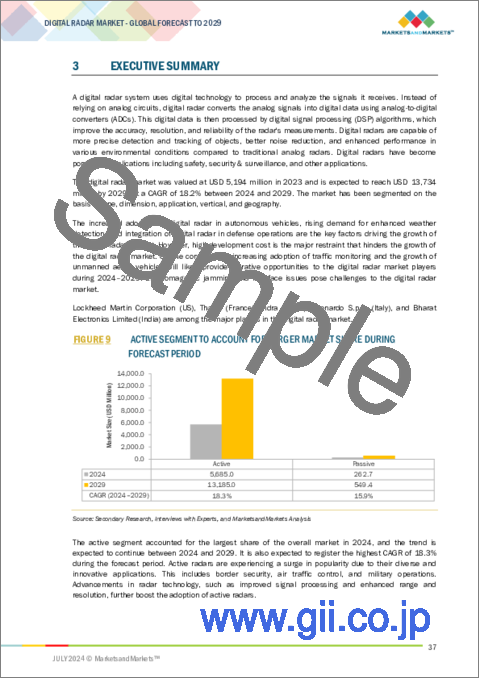

The digital radar market is projected to grow from USD 5.9 billion in 2024 and is expected to reach USD 13.7 billion by 2029, growing at a CAGR of 18.2% from 2024 to 2029. The automobile market is largely driven by innovation, safety improvements as well as integration of sophisticated systems such as Advanced Driver Assistance Systems. For instance, object detection, tracking features and general situational understanding are significantly upgraded through the use of 4D digital radar technology.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Dimension, Application, Vertical and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East Africa, and Latin America |

"The 4D segment in the digital radar market to witness higher growth rate during the forecast period."

The 4D segment to witness high growth rate in the digital radar market due to its superior capabilities and wide-ranging applications of the 4D radar segment. 4D radar adds time as the fourth dimension, which makes it more precise and gives a better spatial awareness when compared with traditional radar systems that only have range data, angles, and velocity. The technology of imaging at a high resolution makes it possible to detect, track, and classify objects in complex environments with greater success, which is especially important for self-driving cars, smart traffic management or advanced driver-assistance systems (ADAS).

"Market for security & surveillance in the digital radar market to hold the largest market share during the forecast period."

The security & surveillance application holds the largest market share due to its vital function in military & defense strategies. In current military operations, modern digital radar systems are essential since they detect, track and identify targets from far off with adverse weather effects taken into consideration. A significant trend is how more technology is now being used to improve both quality and efficiency within digital radars. New solutions employing advanced technologies like digital beamforming, the GaN (Gallium Nitride) Semiconductors, and Frequency Modulated Continuous Wave (FMCW) Radar surpass traditional radar in terms of effectiveness or efficiency.

"The US is expected to hold the largest market size in the North American region during the forecast period."

During the forecast period, the US is predicted to dominate in the North American region owing to the presence of major defense companies such as Lockheed Martin Corporation (US), and RTX (US). They have developed sophisticated radar technologies for a number of applications, such as military & defense, and aviation, among others. The US government makes large investments in the modernization and research of defense in order to increase the market for digital radar. Moreover, the US automotive industry is adding radar technology to boost safety features like accident avoidance systems and adaptive cruise control.

- By Company Type: Tier 1 - 20%, Tier 2 - 35%, and Tier 3 - 45%

- By Designation: C-level Executives - 20%, Directors -30%, and Others - 50%

- By Region: North America -40%, Europe - 20%, Asia Pacific- 30%, and RoW - 10%

Prominent players profiled in this report include Lockheed Martin Corporation (US), Thales (France), Indra (Spain), Leonardo S.p.A. (Italy), Bharat Electronics Limited (India), Advanced Micro Devices, Inc. (US), Magna International Inc. (Canada), NXP Semiconductors (Netherlands), Saab AB (Sweden), and Uhnder (US). Israel Aerospace Industries (Israel), BAE Systems (UK), Elbit Systems Ltd. (Israel), Vayyar (Israel), Arbe (Israel), Ainstein Radar Systems (US), Oculii (US), Spartan Radar, Inc. (US), Cubtek Inc. (Taiwan), ASELSAN A.S. (Turkiye), Teledyne FLIR LLC (US), Echodyne Corp (US) Bitsensing (South Korea), RFISee (Israel), Gapwaves AB (Sweden) are among a few other key companies in the digital radar market.

Report Coverage

The report defines, describes, and forecasts the digital radar market based on type, dimension, application, vertical, and region. It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the digital radar market. It also analyzes competitive developments such as acquisitions, product launches, expansions, and actions carried out by the key players to grow in the market.

Reasons to Buy This Report

The report will help the market leaders/new entrants in the market with information on the closest approximations of the revenue for the overall digital radar market and the subsegments. The report will help stakeholders understand the competitive landscape and gain more insight to position their business better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key drivers, restraints, opportunities, and challenges.

The report will provide insights into the following pointers:

- Analysis of key drivers (Increased adoption of digital radar in autonomous vehicles) restraints (High development cost)

opportunities (Increasing adoption of digital radar in traffic monitoring), and challenges (Electromagnetic jamming and interface issue) of the digital radar market.

- Product development /Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the digital radar market.

- Market Development: Comprehensive information about lucrative markets; the report analyses the digital radar market across various regions.

- Market Diversification: Exhaustive information about new products launched, untapped geographies, recent developments, and investments in the digital radar market.

- Competitive Assessment: In-depth assessment of market share, growth strategies, and offering of leading players like Lockheed Martin Corporation (US), Thales (France), Indra (Spain), Leonardo S.p.A. (Italy), Bharat Electronics Limited (India) among others in the digital radar market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of key interview participants

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (supply side)

- 2.2.1.2 Approach to estimate market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (demand side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ANALYSIS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DIGITAL RADAR MARKET

- 4.2 DIGITAL RADAR MARKET, BY TYPE

- 4.3 DIGITAL RADAR MARKET, BY DIMENSION

- 4.4 DIGITAL RADAR MARKET, BY APPLICATION

- 4.5 DIGITAL RADAR MARKET IN NORTH AMERICA, BY TYPE AND COUNTRY

- 4.6 DIGITAL RADAR MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing focus on improving safety and reliability of autonomous vehicles

- 5.2.1.2 Rising demand for reliable weather detection and monitoring solutions

- 5.2.1.3 Pressing need to identify potential threats and improve situational awareness in aerospace & defense sector

- 5.2.2 RESTRAINTS

- 5.2.2.1 High development cost

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Elevating requirement for sophisticated traffic management solutions

- 5.2.3.2 Increasing use of unmanned aerial vehicles (UAVs)

- 5.2.4 CHALLENGES

- 5.2.4.1 Electromagnetic jamming and interface issue

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 KEY TECHNOLOGIES

- 5.5.1.1 Beamforming

- 5.5.1.2 Radar-on-Chip (RoC)

- 5.5.2 COMPLEMENTARY TECHNOLOGIES

- 5.5.2.1 Sensor fusion

- 5.5.3 ADJACENT TECHNOLOGIES

- 5.5.3.1 Advanced antenna

- 5.5.1 KEY TECHNOLOGIES

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 BUYING CRITERIA

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 OKLAHOMA UNIVERSITY DEPLOYS ADVANCED RADAR TO PREDICT FORMATION OF SEVERE WEATHER

- 5.10.2 INDIAN ARMY AND NAVY ADOPTS BHARAT ELECTRONICS LIMITED'S RADAR SOLUTIONS FOR IMPROVED SITUATIONAL AWARENESS

- 5.10.3 INDRA MODERNIZES RADAR NETWORK IN NEW ZEALAND TO IMPROVE AIR SECURITY AND REDUCE CARBON EMISSIONS

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE TREND, BY DIMENSION

- 5.11.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.12 PATENT ANALYSIS

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT SCENARIO (HS CODE 8526)

- 5.13.2 EXPORT SCENARIO (HS CODE 8526)

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 REGULATORY STANDARDS

- 5.14.3 GOVERNMENT REGULATIONS

- 5.15 KEY CONFERENCES AND EVENTS, 2024-2025

6 DIGITAL RADAR MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 ACTIVE

- 6.2.1 RISING NEED FOR ENHANCED SECURITY AND SURVEILLANCE TO FUEL MARKET GROWTH

- 6.3 PASSIVE

- 6.3.1 INCREASING FOCUS ON STEALTH AND NON-INTERFERENCE TECHNOLOGIES IN MILITARY APPLICATIONS TO FUEL DEMAND

7 DIGITAL RADAR MARKET, BY DIMENSION

- 7.1 INTRODUCTION

- 7.2 2D & 3D

- 7.2.1 2D

- 7.2.1.1 Surging demand for defense equipment for improved target detection to accelerate market growth

- 7.2.2 3D

- 7.2.2.1 Rising demand from aerospace & defense industry to drive market

- 7.2.1 2D

- 7.3 4D

- 7.3.1 INCREASING AWARENESS OF PASSENGER AND VEHICLE SAFETY BENEFITS TO FUEL DEMAND

8 DIGITAL RADAR MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 SAFETY

- 8.2.1 EXCEPTIONAL RELIABILITY, UNPARALLELED PERFORMANCE, AND CUTTING-EDGE DIGITAL INNOVATIONS TO FUEL DEMAND

- 8.3 SECURITY & SURVEILLANCE

- 8.3.1 INCREASING GOVERNMENT AND PRIVATE SECTOR INVESTMENTS TO SUPPORT MARKET GROWTH

- 8.4 OTHER APPLICATIONS

9 DIGITAL RADAR MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.2 AUTOMOTIVE

- 9.2.1 CHANGING LIFESTYLES AND CONSUMER PREFERENCES TO FUEL DEMAND

- 9.3 AEROSPACE

- 9.3.1 RISING DEMAND FOR DIGITAL RADAR IN AEROSPACE APPLICATIONS TO PROPEL MARKET

- 9.4 MILITARY & DEFENSE

- 9.4.1 INCREASING DEMAND FOR HIGH-END RADAR SOLUTIONS TO FUEL MARKET GROWTH

- 9.5 OTHER VERTICALS

10 DIGITAL RADAR MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: RECESSION IMPACT

- 10.2.2 US

- 10.2.2.1 Growing investments by defense department in security applications to support market growth

- 10.2.3 CANADA

- 10.2.3.1 Rising focus on development of precision-guided defense systems to fuel market growth

- 10.2.4 MEXICO

- 10.2.4.1 Pressing need to improve national security measures to boost demand

- 10.3 EUROPE

- 10.3.1 EUROPE: RECESSION IMPACT

- 10.3.2 GERMANY

- 10.3.2.1 Growing focus on enhancing situational awareness and national security to create opportunities

- 10.3.3 UK

- 10.3.3.1 Increasing government funding in digitalizing military sector to boost demand

- 10.3.4 FRANCE

- 10.3.4.1 Elevating demand and spending on advanced surveillance systems to contribute to market growth

- 10.3.5 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: RECESSION IMPACT

- 10.4.2 CHINA

- 10.4.2.1 Collaboration with domestic and international players to modernize defense infrastructure to create opportunities

- 10.4.3 JAPAN

- 10.4.3.1 Strong research and development ecosystem to propel market growth

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Thriving aerospace industry to provide lucrative opportunities

- 10.4.5 REST OF ASIA PACIFIC

- 10.5 ROW

- 10.5.1 ROW: RECESSION IMPACT

- 10.5.2 GCC

- 10.5.3 REST OF MIDDLE EAST & AFRICA

- 10.5.4 SOUTH AMERICA

- 10.5.4.1 Increasing investment in modern military equipment to drive market growth

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 REVENUE ANALYSIS, 2021-2023

- 11.3 MARKET SHARE ANALYSIS, 2023

- 11.4 COMPANY VALUATION AND FINANCIAL METRICS

- 11.5 BRAND/PRODUCT COMPARISON

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.6.5.1 Company footprint

- 11.6.5.2 Vertical footprint

- 11.6.5.3 Type footprint

- 11.6.5.4 Dimension footprint

- 11.6.5.5 Application footprint

- 11.6.5.6 Region footprint

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING: SMES, 2023

- 11.7.5.1 Detailed list of startups/SMEs

- 11.7.5.2 Competitive benchmarking of key startups/SMEs

- 11.8 COMPETITIVE SCENARIO AND TRENDS

- 11.8.1 PRODUCT LAUNCHES

- 11.8.2 DEALS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 LOCKHEED MARTIN CORPORATION

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches/Developments

- 12.1.1.3.2 Deals

- 12.1.1.3.3 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 THALES

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Other developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 INDRA

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches/Developments

- 12.1.3.3.2 Deals

- 12.1.3.3.3 Other developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 LEONARDO S.P.A.

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches/Developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 BHARAT ELECTRONICS LIMITED

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches/Developments

- 12.1.5.3.2 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 ADVANCED MICRO DEVICES, INC.

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches/Developments

- 12.1.6.3.2 Deals

- 12.1.7 MAGNA INTERNATIONAL INC

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches/Developments

- 12.1.7.3.2 Deals

- 12.1.8 NXP SEMICONDUCTORS

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches/Developments

- 12.1.8.3.2 Deals

- 12.1.9 SAAB AB

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.9.3.2 Other developments

- 12.1.10 UHNDER

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches/Developments

- 12.1.10.3.2 Deals

- 12.1.1 LOCKHEED MARTIN CORPORATION

- 12.2 OTHER COMPANIES

- 12.2.1 ISRAEL AEROSPACE INDUSTRIES

- 12.2.2 BAE SYSTEMS

- 12.2.3 ELBIT SYSTEMS LTD.

- 12.2.4 VAYYAR

- 12.2.5 ARBE

- 12.2.6 AINSTEIN RADAR SYSTEMS

- 12.2.7 OCULII

- 12.2.8 SPARTAN RADAR, INC.

- 12.2.9 CUBTEK INC.

- 12.2.10 ASELSAN A.S.

- 12.2.11 TELEDYNE FLIR LLC

- 12.2.12 ECHODYNE CORP

- 12.2.13 BITSENSING

- 12.2.14 RFISEE

- 12.2.15 GAPWAVES AB

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS