|

|

市場調査レポート

商品コード

1518216

テトラアセチルエチレンジアミン(TAED)の世界市場:用途別、最終用途産業別、形状別、グレード別、流通チャネル別、地域別 - 予測(~2029年)Tetraacetylethylenediamine Market by Application, End-use Industry, Form, Grade, Distribution Channel, and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| テトラアセチルエチレンジアミン(TAED)の世界市場:用途別、最終用途産業別、形状別、グレード別、流通チャネル別、地域別 - 予測(~2029年) |

|

出版日: 2024年07月18日

発行: MarketsandMarkets

ページ情報: 英文 221 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のテトラアセチルエチレンジアミン(TAED)の市場規模は、2024年の8億8,100万米ドルから2029年までに10億7,000万米ドルに達すると予測され、予測期間にCAGRで4.0%の成長が見込まれます。

ランドリーケア製品の利便性、有効性、持続可能性が重視されるようになり、メーカーはTAEDのような先進の漂白活性剤を配合するようになっています。さらに、都市化の進行、共働き世帯や中間層の増加といった人口統計学的要因も、洗濯用洗剤やクリーニング製品の世界市場の拡大に寄与しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 金額(100万米ドル)、数量(キロトン) |

| セグメント | 用途、最終用途産業、地域 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

「用途別では、界面活性剤が金額ベースで第4位のセグメントになると予測されます。」

TAEDの主な機能は漂白ですが、その作用は間接的に界面活性剤に基づく汚れの除去をサポートします。汚れを効果的に漂白することで、TAEDは表面から土粒子を分解して浮き上がらせ、界面活性剤による除去を容易にします。このTAEDと界面活性剤の相乗作用により、製剤の全体的な洗浄効率が向上します。汚れの除去に加え、TAEDの漂白作用は布地の明るさと白さを保つのに役立ち、界面活性剤の布地ケア特性を補完します。TAEDと界面活性剤を併用することで、洗濯物が清潔で明るく、柔らかい状態を維持し、高品質な洗浄と布地のケアに対する消費者の期待に応えることができます。

「消費財・洗浄が市場の最終用途産業セグメントにおいて金額ベースで第2位のシェアを占めました。」

TAEDは、消費財、特に洗濯用洗剤や洗浄製品の洗浄・漂白能力を高めることにより、その効果を著しく向上させます。TAEDは自動食器洗い洗剤に使用され、食器に付着した食物残渣や汚れを効果的に除去し、高い衛生水準を確保します。さらにTAEDは、義歯洗浄剤のような殺生物剤にも使用され、細菌の蓄積を防ぎ口腔衛生を維持します。メーカー各社は、持続可能な製品に対する消費者の需要の高まりに応えるため、毒性レベルが低く、生分解性を備えた環境にやさしいTAED製剤を開発しています。

「欧州はTAEDの第2位の市場です。」

欧州は複数の主な要因により、世界で第2位の市場シェアを占めています。第一に、この地域は確立されたインフラ、先進の研究開発能力、厳格な規制基準の恩恵を受けており、TAED製品の革新と品質が促進されています。欧州はTAEDの生産における重大な要素である原材料へのアクセスが容易です。このことが、この地域の強力な市場ポジションにつながっています。加えて、欧州の消費者は衛生の重要性を強く認識しており、これが消毒剤や漂白活性剤といったTAEDベースの製品に対する需要を促進しています。この地域の環境・衛生問題に関する厳しい規制も、TAED製品が高い基準を満たすことを保証しています。このため、同地域ではTAEDの使用が増加しています。

当レポートでは、世界のテトラアセチルエチレンジアミン(TAED)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- TAED市場の企業にとって魅力的な機会

- TAED市場:用途別

- TAED市場:最終用途産業別

- TAED市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- マクロ経済指標

- 世界のGDP動向

- テキスタイル・衣料品の輸出:国別

- 主なステークホルダーと購入基準

- バリューチェーン分析

- 原材料

- メーカー

- 販売業者

- エンドユーザー

- エコシステムマッピング

- ケーススタディ

- 規制情勢

- 規制

- 標準

- 規制機関、政府機関、その他の機関

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 顧客ビジネスに影響を与える動向/混乱

- 貿易分析

- 主な会議とイベント(2024年~2025年)

- 価格分析

- 平均販売価格:地域別

- 平均販売価格:用途別

- 平均販売価格:最終用途産業別

- 平均販売価格:企業別

- 投資と資金調達のシナリオ

- 特許分析

- 定性分析

第6章 TAED市場:形状別

- イントロダクション

- 粉末

- 結晶

- その他の形状

第7章 TAED市場:グレード別

- イントロダクション

- 家庭

- 産業

第8章 TAED市場:流通チャネル別

- イントロダクション

- オンライン

- オフライン

第9章 TAED市場:用途別

- イントロダクション

- 洗剤

- 漂白剤

- 洗浄剤

- 界面活性剤

- 帯電防止剤

- 電気めっき剤

- その他の用途

第10章 TAED市場:最終用途産業別

- イントロダクション

- テキスタイル

- 水処理

- 紙・パルプ

- 消費財・洗浄

- 製薬

- プラスチック

- 一般工業

- その他の最終用途産業

第11章 TAED市場:地域別

- イントロダクション

- 欧州

- 景気後退の影響

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 景気後退の影響

- 中国

- インド

- 韓国

- 日本

- インドネシア

- その他のアジア太平洋

- 北米

- 景気後退の影響

- 米国

- カナダ

- メキシコ

- 中東・アフリカ

- 景気後退の影響

- GCC

- 南アフリカ

- その他の中東・アフリカ

- 南米

- 景気後退の影響

- ブラジル

- アルゼンチン

- その他の南米

第12章 競合情勢

- 概要

- 主要企業戦略

- 収益分析

- 企業の評価と財務指標

- 市場シェア分析

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 市場の評価フレームワーク

- 競合シナリオと動向

第13章 企業プロファイル

- 主要企業

- THE LUBRIZOL CORPORATION

- STPP GROUP

- WEYLCHEM INTERNATIONAL GMBH (ACQUIRED BY INTERNATIONAL CHEMICAL INVESTORS GROUP)

- JINKE COMPANY LIMITED

- FENGCHEN GROUP CO., LTD.

- SHANGHAI DEBORN CO., LTD.

- ZEHAO INDUSTRY CO., LTD.

- OTTO CHEMIE PVT. LTD

- ACURO ORGANICS LIMITED

- HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.

- ATAMAN KIMYA

- その他の企業

- TOKYO CHEMICAL INDUSTRY CO., LTD.

- SDC ENTERPRISES LTD.

- MUBY CHEMICALS

- SHANDONG CHUANGYING CHEMICAL CO., LTD

- MERU CHEM PVT. LTD.

- HENAN GP CHEMICALS CO., LTD

- SOLECHEM S.R.L

- SPRINGCHEM INTERNATIONAL CO., LTD.

- AECOCHEM

- HONGYE HOLDING GROUP CORPORATION LTD.

- SPECTRUM CHEMICAL

- DUBICHEM

- JIANGXI UNIC OXYGEN BLEACH ACTIVATOR CO. LTD.

- HENAN HAOFEI CHEMICAL CO., LTD.

- WEGO CHEMICAL GROUP

第14章 付録

List of Tables

- TABLE 1 TAED MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 TAED MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) FOR KEY COUNTRIES, 2021-2029

- TABLE 4 EXPORTS OF TEXTILES AND CLOTHING FOR KEY COUNTRIES IN 2020

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR THREE KEY END-USE INDUSTRIES (%)

- TABLE 6 TAED: ECOSYSTEM

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT BODIES, AND OTHER AGENCIES

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT BODIES, AND OTHER AGENCIES

- TABLE 9 AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 11 EXPORT TRADE DATA OF TAED FOR TOP COUNTRIES, 2019-2023 (USD THOUSAND)

- TABLE 12 IMPORT TRADE DATA OF TAED FOR TOP COUNTRIES, 2019-2023 (USD THOUSAND)

- TABLE 13 DETAILED LIST OF CONFERENCES & EVENTS, 2024-2025

- TABLE 14 AVERAGE SELLING PRICE, BY APPLICATION (USD/KG)

- TABLE 15 AVERAGE SELLING PRICE, BY END-USE INDUSTRY (USD/KG)

- TABLE 16 AVERAGE SELLING PRICE, BY COMPANY (USD/KG)

- TABLE 17 TOTAL NUMBER OF PATENTS

- TABLE 18 PATENTS BY PROCTER & GAMBLE COMPANY

- TABLE 19 PATENTS BY DOW GLOBAL TECHNOLOGIES LLC

- TABLE 20 PATENTS BY AGA NANOTECH LTD.

- TABLE 21 TOP TEN PATENT OWNERS

- TABLE 22 TAED MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 23 TAED MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 24 TAED MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 25 TAED MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 26 TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 27 TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 28 TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 29 TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 30 TAED MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 31 TAED MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 32 TAED MARKET, BY REGION, 2020-2023 (KILOTON)

- TABLE 33 TAED MARKET, BY REGION, 2024-2029 (KILOTON)

- TABLE 34 EUROPE: TAED MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 35 EUROPE: TAED MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 36 EUROPE: TAED MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 37 EUROPE: TAED MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 38 EUROPE: TAED MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 39 EUROPE: TAED MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 40 EUROPE: TAED MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 41 EUROPE: TAED MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 42 EUROPE: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 43 EUROPE: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 44 EUROPE: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 45 EUROPE: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 46 GERMANY: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 47 GERMANY: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 48 GERMANY: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 49 GERMANY: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 50 UK: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 51 UK: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 52 UK: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 53 UK: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 54 FRANCE: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 55 FRANCE: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 56 FRANCE: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 57 FRANCE: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 58 ITALY: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 59 ITALY: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 60 ITALY: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 61 ITALY: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 62 SPAIN: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 63 SPAIN: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 64 SPAIN: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 65 SPAIN: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 66 REST OF EUROPE: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 67 REST OF EUROPE: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 68 REST OF EUROPE: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 69 REST OF EUROPE: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 70 ASIA PACIFIC: TAED MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 71 ASIA PACIFIC: TAED MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 72 ASIA PACIFIC: TAED MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 73 ASIA PACIFIC: TAED MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 74 ASIA PACIFIC: TAED MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 75 ASIA PACIFIC: TAED MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 76 ASIA PACIFIC: TAED MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 77 ASIA PACIFIC: TAED MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 78 ASIA PACIFIC: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 79 ASIA PACIFIC: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 80 ASIA PACIFIC: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 81 ASIA PACIFIC: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 82 CHINA: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 83 CHINA: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 84 CHINA: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 85 CHINA: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 86 INDIA: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 87 INDIA: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 88 INDIA: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 89 INDIA: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 90 SOUTH KOREA: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 91 SOUTH KOREA: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 92 SOUTH KOREA: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 93 SOUTH KOREA: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 94 JAPAN: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 95 JAPAN: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 96 JAPAN: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 97 JAPAN: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 98 INDONESIA: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 99 INDONESIA: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 100 INDONESIA: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 101 INDONESIA: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 102 REST OF ASIA PACIFIC: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 103 REST OF ASIA PACIFIC: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 104 REST OF ASIA PACIFIC: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 105 REST OF ASIA PACIFIC: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 106 NORTH AMERICA: TAED MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 107 NORTH AMERICA: TAED MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 108 NORTH AMERICA: TAED MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 109 NORTH AMERICA: TAED MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 110 NORTH AMERICA: TAED MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 111 NORTH AMERICA: TAED MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 112 NORTH AMERICA: TAED MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 113 NORTH AMERICA: TAED MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 114 NORTH AMERICA: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 115 NORTH AMERICA: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 116 NORTH AMERICA: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 117 NORTH AMERICA: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 118 US: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 119 US: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 120 US: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 121 US: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 122 CANADA: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 123 CANADA: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 124 CANADA: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 125 CANADA: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 126 MEXICO: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 127 MEXICO: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 128 MEXICO: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 129 MEXICO: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 130 MIDDLE EAST & AFRICA: TAED MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: TAED MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: TAED MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 133 MIDDLE EAST & AFRICA: TAED MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 134 MIDDLE EAST & AFRICA: TAED MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: TAED MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: TAED MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 137 MIDDLE EAST & AFRICA: TAED MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 138 MIDDLE EAST & AFRICA: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 141 MIDDLE EAST & AFRICA: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 142 GCC: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 143 GCC: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 144 GCC: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 145 GCC: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 146 SAUDI ARABIA: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 147 SAUDI ARABIA: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 148 SAUDI ARABIA: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 149 SAUDI ARABIA: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 150 UAE: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 151 UAE: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 152 UAE: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 153 UAE: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 154 REST OF GCC: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 155 REST OF GCC: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 156 REST OF GCC: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 157 REST OF GCC: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 158 SOUTH AFRICA: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 159 SOUTH AFRICA: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 160 SOUTH AFRICA: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 161 SOUTH AFRICA: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 162 REST OF MIDDLE EAST & AFRICA: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 163 REST OF MIDDLE EAST & AFRICA: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 164 REST OF MIDDLE EAST & AFRICA: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 165 REST OF MIDDLE EAST & AFRICA: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 166 SOUTH AMERICA: TAED MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 167 SOUTH AMERICA: TAED MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 168 SOUTH AMERICA: TAED MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 169 SOUTH AMERICA: TAED MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 170 SOUTH AMERICA: TAED MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 171 SOUTH AMERICA: TAED MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 172 SOUTH AMERICA: TAED MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 173 SOUTH AMERICA: TAED MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- TABLE 174 SOUTH AMERICA: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 175 SOUTH AMERICA: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 176 SOUTH AMERICA: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 177 SOUTH AMERICA: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 178 BRAZIL: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 179 BRAZIL: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 180 BRAZIL: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 181 BRAZIL: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 182 ARGENTINA: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 183 ARGENTINA: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 184 ARGENTINA: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 185 ARGENTINA: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 186 REST OF SOUTH AMERICA: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 187 REST OF SOUTH AMERICA: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 188 REST OF SOUTH AMERICA: TAED MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 189 REST OF SOUTH AMERICA: TAED MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 190 TAED MARKET: DEGREE OF COMPETITION

- TABLE 191 TAED MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 192 TAED MARKET: REGION FOOTPRINT

- TABLE 193 TAED MARKET: FORM FOOTPRINT

- TABLE 194 TAED MARKET: DISTRIBUTION CHANNEL FOOTPRINT

- TABLE 195 TAED MARKET: GRADE FOOTPRINT

- TABLE 196 TAED MARKET: APPLICATION FOOTPRINT

- TABLE 197 TAED: KEY STARTUPS/SMES

- TABLE 198 TAED MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 199 MARKET EVALUATION FRAMEWORK

- TABLE 200 TAED MARKET: EXPANSIONS, JANUARY 2019-APRIL 2024

- TABLE 201 TAED MARKET: DEALS, JANUARY 2019-APRIL 2024

- TABLE 202 THE LUBRIZOL CORPORATION: COMPANY OVERVIEW

- TABLE 203 THE LUBRIZOL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 STPP GROUP: COMPANY OVERVIEW

- TABLE 205 STPP GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 WEYLCHEM INTERNATIONAL GMBH (ACQUIRED BY INTERNATIONAL CHEMICAL INVESTORS GROUP): COMPANY OVERVIEW

- TABLE 207 WEYLCHEM INTERNATIONAL GMBH (ACQUIRED BY INTERNATIONAL CHEMICAL INVESTORS GROUP): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 TAED MARKET: DEALS, JANUARY 2020-MAY 2024

- TABLE 209 TAED MARKET: EXPANSIONS, JANUARY 2020-MAY 2024

- TABLE 210 JINKE COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 211 JINKE COMPANY LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 FENGCHEN GROUP CO., LTD: COMPANY OVERVIEW

- TABLE 213 FENGCHEN GROUP CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 SHANGHAI DEBORN CO., LTD.: COMPANY OVERVIEW

- TABLE 215 SHANGHAI DEBORN CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 ZEHAO INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 217 ZEHAO INDUSTRY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 OTTO CHEMIE PVT. LTD.: COMPANY OVERVIEW

- TABLE 219 OTTO CHEMIE PVT LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 ACURO ORGANICS LIMITED: COMPANY OVERVIEW

- TABLE 221 ACURO ORGANICS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 223 HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 ATAMAN KIMYA: COMPANY OVERVIEW

- TABLE 225 ATAMAN KIMYA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 TOKYO CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 227 SDC ENTERPRISES LTD.: COMPANY OVERVIEW

- TABLE 228 MUBY CHEMICALS: COMPANY OVERVIEW

- TABLE 229 SHANDONG CHUANGYING CHEMICAL CO., LTD: COMPANY OVERVIEW

- TABLE 230 MERU CHEM PVT. LTD.: COMPANY OVERVIEW

- TABLE 231 HENAN GP CHEMICALS CO., LTD: COMPANY OVERVIEW

- TABLE 232 SOLECHEM S.R.L: COMPANY OVERVIEW

- TABLE 233 SPRINGCHEM INTERNATIONAL CO., LTD.: COMPANY OVERVIEW

- TABLE 234 AECOCHEM: COMPANY OVERVIEW

- TABLE 235 HONGYE HOLDING GROUP CORPORATION LTD.: COMPANY OVERVIEW

- TABLE 236 SPECTRUM CHEMICAL: COMPANY OVERVIEW

- TABLE 237 DUBICHEM: COMPANY OVERVIEW

- TABLE 238 JIANGXI UNIC OXYGEN BLEACH ACTIVATOR CO. LTD.: COMPANY OVERVIEW

- TABLE 239 HENAN HAOFEI CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 240 WEGO CHEMICAL GROUP: COMPANY OVERVIEW

List of Figures

- FIGURE 1 TAED MARKET SEGMENTATION

- FIGURE 2 TAED MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION APPROACH: DEMAND SIDE

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 TAED MARKET: DATA TRIANGULATION

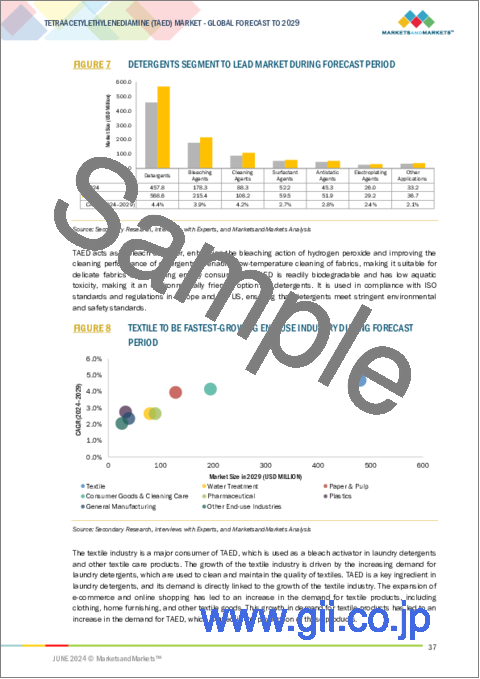

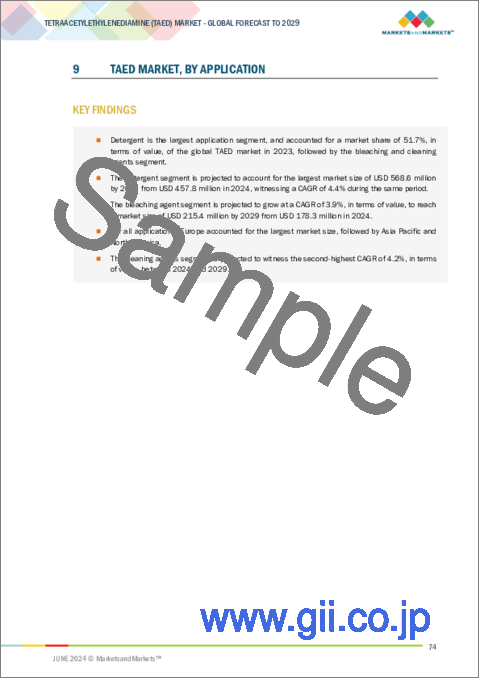

- FIGURE 7 DETERGENTS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 8 TEXTILE TO BE FASTEST-GROWING END-USE INDUSTRY DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 10 INCREASING DEMAND FROM DETERGENTS APPLICATION TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 11 DETERGENTS SEGMENT TO LEAD TAED MARKET DURING FORECAST PERIOD

- FIGURE 12 TEXTILE SEGMENT TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 13 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN TAED MARKET

- FIGURE 15 TAED MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF THREE KEY END-USE INDUSTRIES

- FIGURE 17 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 18 OVERVIEW OF TAED VALUE CHAIN

- FIGURE 19 TAED: ECOSYSTEM MAPPING

- FIGURE 20 RISING DEMAND FROM TEXTILE INDUSTRY LEADING TO MARKET GROWTH

- FIGURE 21 AVERAGE SELLING PRICE, BY REGION (USD/KG)

- FIGURE 22 TOTAL NUMBER OF PATENTS

- FIGURE 23 NUMBER OF PATENTS YEAR-WISE FROM 2013 TO 2023

- FIGURE 24 PATENT ANALYSIS, BY LEGAL STATUS

- FIGURE 25 TOP JURISDICTION - BY DOCUMENT

- FIGURE 26 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 27 DETERGENTS SEGMENT TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 28 TEXTILE INDUSTRY TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 29 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 30 TEXTILE END-USE INDUSTRY TO DOMINATE EUROPEAN MARKET DURING FORECAST PERIOD

- FIGURE 31 ASIA PACIFIC: TAED MARKET SNAPSHOT

- FIGURE 32 NORTH AMERICA: TAED MARKET SNAPSHOT

- FIGURE 33 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN TAED MARKET BETWEEN 2019 AND 2023

- FIGURE 34 REVENUE ANALYSIS OF KEY COMPANIES IN TAED MARKET, 2023

- FIGURE 35 COMPANY VALUATION OF COMPANIES IN TAED MARKET, 2023

- FIGURE 36 FINANCIAL METRICS OF COMPANIES IN TAED MARKET, 2023

- FIGURE 37 SHARES OF LEADING COMPANIES IN TAED MARKET, 2023

- FIGURE 38 RANKING OF TOP FIVE PLAYERS IN TAED MARKET, 2023

- FIGURE 39 TAED MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 40 TAED MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 41 TAED MARKET: COMPANY OVERALL FOOTPRINT

- FIGURE 42 TAED MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

The TAED market size is projected to grow from USD 881 million in 2024 to USD 1,070 million by 2029, registering a CAGR of 4.0% during the forecast period. The growing emphasis on convenience, efficacy, and sustainability in laundry care products encourages manufacturers to incorporate advanced bleach activators like TAED into their formulations. Additionally, demographic factors such as increasing urbanization, dual-income households, and a rising middle class contribute to the expanding market for laundry detergents and cleaning products globally.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Segments | Application, End-use Industry, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

"Surfactant is projected to be the fourth largest segment by application in terms of value."

While TAED's primary function is bleaching, its action indirectly supports surfactant-based stain removal. By effectively bleaching stains, TAED helps to break down and lift soil particles from surfaces, facilitating their removal by surfactants. This synergistic action between TAED and surfactants contributes to the overall cleaning efficiency of the formulation. In addition to stain removal, TAED's bleaching action can help maintain the brightness and whiteness of fabrics, complementing the fabric care properties of surfactants. Together, TAED and surfactants work to ensure that laundry remains clean, bright, and soft, meeting consumer expectations for high-quality cleaning and fabric care.

"Consumer goods & cleaning care accounted for the second largest share in the end-use industry segment of TAED market in terms of value."

TAED significantly improves the effectiveness of consumer goods, particularly in laundry detergents and cleaning products, by enhancing their cleaning and bleaching capabilities. TAED is used in automatic dishwashing detergents to effectively remove food residue and stains from dishes, ensuring a high standard of hygiene. Additionally, TAED is used in biocides, such as denture cleaners, to prevent bacterial buildup and maintain oral hygiene, and bleaching of paper products to improve their brightness and strength. Manufacturers are developing eco-friendly TAED formulations with low toxicity levels and biodegradable properties to meet growing consumer demand for sustainable products

"Europe is the second-largest market for TAED."

Europe holds the second-largest market share globally in the TAED market due to several key factors. Firstly, the region benefits from a well-established infrastructure, advanced research and development capabilities, and stringent regulatory standards, fostering innovation and quality in TAED products. Europe has easy access to raw materials, which is a crucial factor in the production of TAED. This has contributed to the region's strong market position. In addition, European consumers are highly aware of the importance of hygiene and sanitation, which has driven the demand for TAED-based products, such as disinfectants and bleach activators. The region's strict regulations on environmental and health issues also ensure that TAED products meet high standards. This has led to the increased usage of TAED in the region.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the TAED market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C Level Executives- 20%, Directors - 10%, and Others - 70%

- By Region: North America - 20%, Europe - 20%, APAC - 40%, South America- 10% , and

the Middle East & Africa -10%

The TAED market comprises major players such as WeylChem International GmbH (Germany), Zhejiang Jinke Peroxide Co., Ltd. (China), The Lubrizol Corporation (US), STPP Group (China), Fengchen Group Co., Ltd. (China), Shanghai Deborn Co., Ltd. (China), Zehao Industry Co., Ltd. (China), Otto Chemie Pvt. Ltd. (India), Acuro Organics Limited (India), and Hefei TNJ Chemical Industry Co., Ltd. (China). The study includes in-depth competitive analysis of these key players in the TAED market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the market for TAED on the basis of application, end-use industry, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, new product launches, expansions, and mergers & acquisition associated with the market for TAED market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the TAED market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on the TAED market offered by top players in the global TAED market.

- Analysis of drivers: (enhanced bleaching performance, temperature sensitivity, compatibility with enzymes, environmental benefits), restraints (higher cost, regulatory considerations), opportunities (growing demand for environmentally friendly products, expanding applications in emerging markets, technological advancements & product innovation), and challenges (cost competitiveness, limited market awareness) influencing the growth of TAED market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the TAED market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for TAED market across regions.

- Market Capacity: Production capacities of companies producing TAED are provided wherever available with upcoming capacities for the TAED market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the TAED market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.9 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary data sources: demand and supply sides

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.5.1 SUPPLY SIDE

- 2.5.2 DEMAND SIDE

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN TAED MARKET

- 4.2 TAED MARKET, BY APPLICATION

- 4.3 TAED MARKET, BY END-USE INDUSTRY

- 4.4 TAED MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Prioritization of hygiene and cleanliness

- 5.2.1.2 Optimizing energy use

- 5.2.1.3 Environmentally safe

- 5.2.2 RESTRAINTS

- 5.2.2.1 Rising preference for TAED substitutes

- 5.2.2.2 Health risks related to TAED

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising adoption in medical uses

- 5.2.3.2 Increasing demand for color-safe bleaching agents

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited application scope

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF BUYERS

- 5.3.2 BARGAINING POWER OF SUPPLIERS

- 5.3.3 THREAT OF NEW ENTRANTS

- 5.3.4 THREAT OF SUBSTITUTES

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 MACROECONOMIC INDICATORS

- 5.4.1 GLOBAL GDP TRENDS

- 5.4.2 EXPORTS OF TEXTILES AND CLOTHING, BY COUNTRY

- 5.5 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.5.2 BUYING CRITERIA

- 5.6 VALUE CHAIN ANALYSIS

- 5.6.1 RAW MATERIAL

- 5.6.2 MANUFACTURERS

- 5.6.3 DISTRIBUTORS

- 5.6.4 END USERS

- 5.7 ECOSYSTEM MAPPING

- 5.8 CASE STUDIES

- 5.8.1 ENHANCING DETERGENT POWER WITH TAED AND PHOSPHONIC ACIDS

- 5.8.2 BOOSTING HEALTH AND HYGIENE IN INDIA THROUGH LONG-LASTING DETERGENT BARS

- 5.8.3 BANANA FIBER AS SUSTAINABLE SOLUTION FOR TEXTILES

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATIONS

- 5.9.1.1 Europe

- 5.9.1.2 Asia Pacific

- 5.9.1.3 North America

- 5.9.2 STANDARDS

- 5.9.2.1 ISO/TC 61

- 5.9.2.2 ISO/TC 38

- 5.9.2.3 ISO 14001

- 5.9.3 REGULATORY BODIES, GOVERNMENT BODIES, AND OTHER AGENCIES

- 5.9.1 REGULATIONS

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGY

- 5.10.1.1 Production and application in detergent formulations

- 5.10.2 COMPLEMENTARY TECHNOLOGY

- 5.10.2.1 TAED's growing impact on health and hygiene applications

- 5.10.3 ADJACENT TECHNOLOGY

- 5.10.3.1 Maximizing bleaching efficiency with H2O2

- 5.10.1 KEY TECHNOLOGY

- 5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.12 TRADE ANALYSIS

- 5.13 KEY CONFERENCES & EVENTS, 2024-2025

- 5.14 PRICING ANALYSIS

- 5.14.1 AVERAGE SELLING PRICE, BY REGION

- 5.14.2 AVERAGE SELLING PRICE, BY APPLICATION

- 5.14.3 AVERAGE SELLING PRICE, BY END-USE INDUSTRY

- 5.14.4 AVERAGE SELLING PRICE, BY COMPANY

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 PATENT ANALYSIS

- 5.16.1 INTRODUCTION

- 5.16.2 APPROACH

- 5.16.3 DOCUMENT TYPE

- 5.16.4 PUBLICATION TRENDS, LAST 11 YEARS, 2013-2023

- 5.16.5 INSIGHTS

- 5.16.6 LEGAL STATUS OF PATENTS

- 5.16.7 JURISDICTION ANALYSIS

- 5.16.8 TOP COMPANIES/APPLICANTS

- 5.16.9 TOP 10 PATENT OWNERS (US) IN LAST 11 YEARS

- 5.17 QUALITATIVE ANALYSIS

- 5.17.1 GHG EMISSIONS

- 5.17.1.1 Production process

- 5.17.1.2 Transportation and storage

- 5.17.1.3 Use in detergents

- 5.17.1.4 Disposal and waste management

- 5.17.1 GHG EMISSIONS

6 TAED MARKET, BY FORM

- 6.1 INTRODUCTION

- 6.2 POWDER

- 6.3 CRYSTALLINE

- 6.4 OTHER FORMS

7 TAED MARKET, BY GRADE

- 7.1 INTRODUCTION

- 7.2 DOMESTIC

- 7.3 INDUSTRIAL

8 TAED MARKET, BY DISTRIBUTION CHANNEL

- 8.1 INTRODUCTION

- 8.2 ONLINE

- 8.3 OFFLINE

9 TAED MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 DETERGENTS

- 9.2.1 SUPERIOR BIOCIDAL QUALITIES TO DRIVE MARKET

- 9.3 BLEACHING AGENTS

- 9.3.1 INCREASE IN DEMAND FOR CLEANING PURPOSES TO DRIVE MARKET

- 9.4 CLEANING AGENTS

- 9.4.1 SUPERIOR STAIN REMOVAL EVEN AT LOWER TEMPERATURES TO DRIVE MARKET

- 9.5 SURFACTANT AGENTS

- 9.5.1 USE IN CLEANING PRODUCTS, PERSONAL CARE ITEMS, AND INDUSTRIAL APPLICATIONS TO DRIVE MARKET

- 9.6 ANTISTATIC AGENTS

- 9.6.1 APPLICATION TO FABRICS TO PREVENT STATIC CLING TO DRIVE MARKET

- 9.7 ELECTROPLATING AGENTS

- 9.7.1 USE IN PRODUCTION OF SMOOTH, UNIFORM, AND HIGH-QUALITY PLATED SURFACES TO DRIVE MARKET

- 9.8 OTHER APPLICATIONS

10 TAED MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 TEXTILE

- 10.2.1 PROTECTION OF DELICATE FABRICS FROM DAMAGE BY HIGH TEMPERATURES AND HARSH CHEMICALS TO DRIVE MARKET

- 10.3 WATER TREATMENT

- 10.3.1 ENHANCED EFFICIENCY AND SUSTAINABILITY OF CLEANING AND DISINFECTION PROCESSES TO DRIVE MARKET

- 10.4 PAPER & PULP

- 10.4.1 REDUCTION IN ENERGY CONSUMPTION BY MINIMIZING NEED FOR CHEMICALS AND ENERGY-INTENSIVE PROCESSES TO DRIVE MARKET

- 10.5 CONSUMER GOODS & CLEANING CARE

- 10.5.1 LOW RISK OF COLOR LOSS OR DAMAGE DUE TO HIGH TEMPERATURES TO DRIVE MARKET

- 10.6 PHARMACEUTICAL

- 10.6.1 BETTER SURFACE WETTING, FASTER EVAPORATION, AND MORE COMPLETE REMOVAL OF CONTAMINANTS TO DRIVE MARKET

- 10.7 PLASTICS

- 10.7.1 ENHANCED RESILIENCE AGAINST MOISTURE AND CHEMICAL EXPOSURE TO DRIVE MARKET

- 10.8 GENERAL MANUFACTURING

- 10.8.1 IMPROVED COLOR, SHINE, AND PROTECTIVE PROPERTIES TO DRIVE MARKET

- 10.9 OTHER END-USE INDUSTRIES

11 TAED MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 EUROPE

- 11.2.1 RECESSION IMPACT

- 11.2.2 GERMANY

- 11.2.2.1 Growing demand for cleaning products containing TAED to drive market

- 11.2.3 UK

- 11.2.3.1 Strategic investments and urbanization to drive market

- 11.2.4 FRANCE

- 11.2.4.1 Growth in textile industry to drive market

- 11.2.5 ITALY

- 11.2.5.1 Digital revolution in Italy's textile and clothing industry to drive market

- 11.2.6 SPAIN

- 11.2.6.1 Rise in chemical sector to drive market

- 11.2.7 REST OF EUROPE

- 11.3 ASIA PACIFIC

- 11.3.1 RECESSION IMPACT

- 11.3.2 CHINA

- 11.3.2.1 Increased manufacturing and export of textile to drive market

- 11.3.3 INDIA

- 11.3.3.1 Rapid economic growth and growing population to drive market growth

- 11.3.4 SOUTH KOREA

- 11.3.4.1 Large synthetic fiber industry to drive market

- 11.3.5 JAPAN

- 11.3.5.1 Increase in apparel segment to drive market

- 11.3.6 INDONESIA

- 11.3.6.1 Growth in textile & apparel industry to drive demand

- 11.3.7 REST OF ASIA PACIFIC

- 11.4 NORTH AMERICA

- 11.4.1 RECESSION IMPACT

- 11.4.2 US

- 11.4.2.1 Technological advancements in textile projects to drive market

- 11.4.3 CANADA

- 11.4.3.1 Growing demand for sterilization of products to drive market

- 11.4.4 MEXICO

- 11.4.4.1 Increased demand for paper and textile products to drive market

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 RECESSION IMPACT

- 11.5.2 GCC

- 11.5.2.1 Foreign investment and focus on non-oil exports to drive market

- 11.5.2.2 Saudi Arabia

- 11.5.2.2.1 Government initiatives to support economic growth to drive demand

- 11.5.2.3 UAE

- 11.5.2.3.1 Growth of non-oil sectors to drive market

- 11.5.2.4 Rest of GCC

- 11.5.3 SOUTH AFRICA

- 11.5.3.1 Imports from developed markets to drive demand

- 11.5.4 REST OF MIDDLE EAST & AFRICA

- 11.6 SOUTH AMERICA

- 11.6.1 RECESSION IMPACT

- 11.6.2 BRAZIL

- 11.6.2.1 Increase in industrial applications to drive market

- 11.6.3 ARGENTINA

- 11.6.3.1 Growth of textile industry to drive market

- 11.6.4 REST OF SOUTH AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES

- 12.3 REVENUE ANALYSIS

- 12.4 COMPANY VALUATION AND FINANCIAL METRICS

- 12.5 MARKET SHARE ANALYSIS

- 12.5.1 MARKET RANKING ANALYSIS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.7.5.1 End-use industry footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Form footprint

- 12.7.5.4 Distribution channel footprint

- 12.7.5.5 Grade footprint

- 12.7.5.6 Application footprint

- 12.7.5.7 Overall footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 12.9 MARKET EVALUATION FRAMEWORK

- 12.10 COMPETITIVE SCENARIO AND TRENDS

- 12.10.1 EXPANSIONS

- 12.10.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 THE LUBRIZOL CORPORATION

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 MnM view

- 13.1.1.3.1 Key strengths

- 13.1.1.3.2 Strategic choices

- 13.1.1.3.3 Weaknesses and competitive threats

- 13.1.2 STPP GROUP

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 MnM view

- 13.1.2.3.1 Key strengths

- 13.1.2.3.2 Strategic choices

- 13.1.2.3.3 Weaknesses and competitive threats

- 13.1.3 WEYLCHEM INTERNATIONAL GMBH (ACQUIRED BY INTERNATIONAL CHEMICAL INVESTORS GROUP)

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Expansions

- 13.1.3.4 MnM View

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 JINKE COMPANY LIMITED

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Key strengths

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses and competitive threats

- 13.1.5 FENGCHEN GROUP CO., LTD.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses and competitive threats

- 13.1.6 SHANGHAI DEBORN CO., LTD.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 MnM View

- 13.1.6.3.1 Key strengths

- 13.1.6.3.2 Strategic choices

- 13.1.6.3.3 Weaknesses and competitive threats

- 13.1.7 ZEHAO INDUSTRY CO., LTD.

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 MnM view

- 13.1.7.3.1 Key strengths

- 13.1.7.3.2 Strategic choices

- 13.1.7.3.3 Weaknesses and competitive threats

- 13.1.8 OTTO CHEMIE PVT. LTD

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 MnM view

- 13.1.8.3.1 Key strengths

- 13.1.8.3.2 Strategic choices

- 13.1.8.3.3 Weaknesses and competitive threats

- 13.1.9 ACURO ORGANICS LIMITED

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 MnM view

- 13.1.10 HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 MnM view

- 13.1.11 ATAMAN KIMYA

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 MnM view

- 13.1.1 THE LUBRIZOL CORPORATION

- 13.2 OTHER PLAYERS

- 13.2.1 TOKYO CHEMICAL INDUSTRY CO., LTD.

- 13.2.2 SDC ENTERPRISES LTD.

- 13.2.3 MUBY CHEMICALS

- 13.2.4 SHANDONG CHUANGYING CHEMICAL CO., LTD

- 13.2.5 MERU CHEM PVT. LTD.

- 13.2.6 HENAN GP CHEMICALS CO., LTD

- 13.2.7 SOLECHEM S.R.L

- 13.2.8 SPRINGCHEM INTERNATIONAL CO., LTD.

- 13.2.9 AECOCHEM

- 13.2.10 HONGYE HOLDING GROUP CORPORATION LTD.

- 13.2.11 SPECTRUM CHEMICAL

- 13.2.12 DUBICHEM

- 13.2.13 JIANGXI UNIC OXYGEN BLEACH ACTIVATOR CO. LTD.

- 13.2.14 HENAN HAOFEI CHEMICAL CO., LTD.

- 13.2.15 WEGO CHEMICAL GROUP

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS