|

|

市場調査レポート

商品コード

1516923

EV用複合材料の世界市場:繊維タイプ別、樹脂タイプ別、タイプ別、製造プロセス別、用途別、地域別 - 予測(~2029年)EV Composites Market by Fiber Type (Glass Fiber, Carbon Fiber), Resin Type (Thermoplastics, Thermoset), Type (Ultra-Premium, Premium and Non-Premium), Manufacturing Process, Application, and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| EV用複合材料の世界市場:繊維タイプ別、樹脂タイプ別、タイプ別、製造プロセス別、用途別、地域別 - 予測(~2029年) |

|

出版日: 2024年07月17日

発行: MarketsandMarkets

ページ情報: 英文 258 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のEV用複合材料の市場規模は、2024年に23億米ドルであり、2029年までに51億米ドルに達すると予測され、2024年~2029年にCAGRで17.1%の成長が見込まれます。

ガラス繊維複合材料は、複数の主な要因により、電気自動車(EV)での使用が増加しています。ガラス繊維複合材料は大幅な軽量化に寄与し、効率と航続距離を向上させると同時に、炭素繊維のような他の複合材料に比べてコスト効率が高いです。ガラス繊維は高い引張強度と耐久性を持ち、さまざまな構造部品や非構造部品に適しています。その優れた熱的特性や電気絶縁特性は、電動パワートレインから発生する熱を管理し、電気システムの安全な作動を確保するのに役立ちます。ガラス繊維の設計の柔軟性は、複雑な形状や空力設計を可能にし、その生産は多くの場合、低いエネルギー要件とリサイクル可能性により、環境にやさしいです。さらに、ガラス繊維複合材料は騒音・振動・ハーシュネス(NVH)レベルの低減に役立ち、より静かな車内環境を提供することで、EVの全体的な運転体験をさらに向上させます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 金額(100万/10億米ドル)、数量(キロトン) |

| セグメント | 繊維タイプ別、樹脂タイプ別、タイプ別、製造プロセス別、用途別、地域別 |

| 対象地域 | 北米、アジア太平洋、ラテンアメリカ、中東・アフリカ |

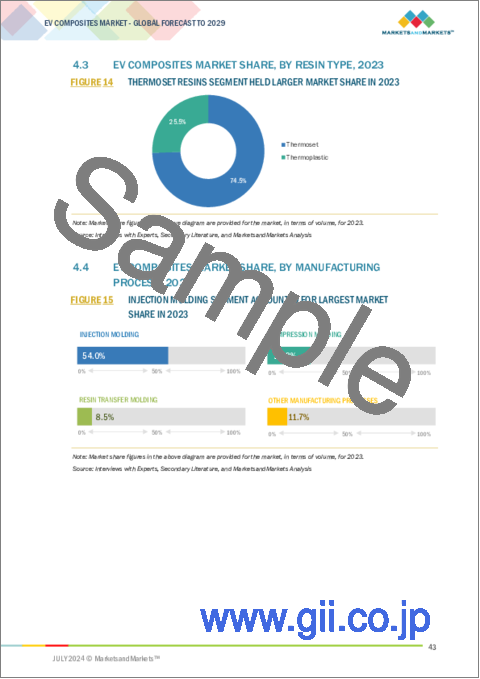

「熱硬化性樹脂セグメントが金額ベースで市場全体の最大のシェアを占めました。」

熱硬化性複合材料では、熱硬化性樹脂が炭素繊維、ガラス繊維、天然繊維、アラミド繊維などの繊維とともにマトリクスとして使用されます。現在、熱硬化性樹脂は硬化すると室温で液体状態になることから、EV用複合材料の製造に広く使用されています。樹脂のこのユニークな特性により、強化繊維を容易に含浸させることができます。熱硬化性複合材料は、剛性の高い相互連結分子構造、不活性な化学組成、紫外線や化学的攻撃に対する耐性により、非常に耐久性に優れています。また、熱硬化性複合材料で作られた構造物は、メンテナンスの手間も少ないです。EV用複合材料向け熱硬化性樹脂は、EV製造における軽量かつ高性能な材料への需要の高まりにより、大きく成長すると予測されます。

「RTM製造プロセスセグメントが金額ベースで市場全体の第3位のシェアを占めました。」

2023年、RTM製造プロセスセグメントが金額ベースで市場の第3位のシェアを占めました。RTMは、高品質なEV用複合材料部品を生産するコスト効率に優れた効率的な方法であり、EV産業における需要拡大に不可欠です。効率と航続距離の向上を目的とした自動車の軽量化の動向は、RTMが強度と軽量の両方を兼ね備えたコンポーネントを生産することから、重要な促進要因となっています。さらに、RTMは高いレベルの設計の柔軟性と精度を可能にするため、複雑な形状や一体化したコンポーネントを作ることができ、これは最新のEVに見られる革新的な設計に不可欠です。また、このプロセスは大量生産にも対応しており、EV市場の拡大ニーズに対応しています。さらに、RTMは高い熱絶縁性や電気絶縁性を持つ樹脂などのさまざまな樹脂系を使用できるため、EVにおける高い性能と安全基準が求められるコンポーネントの製造に適しています。全体として、RTMの効率性、汎用性、持続可能性は、EV用複合材料市場におけるRTMの成長を促進する主な要因です。

当レポートでは、世界のEV用複合材料市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- EV用複合材料市場の企業にとって魅力的な機会

- EV用複合材料の市場シェア:繊維タイプ別(2023年)

- EV用複合材料の市場シェア:樹脂タイプ別(2023年)

- EV用複合材料の市場シェア:製造プロセス別(2023年)

- EV用複合材料の市場シェア:タイプ別(2023年)

- EV用複合材料市場:用途別、地域別(2023年)

- EV用複合材料市場:主要国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- サプライチェーン分析

- 原材料

- 製造プロセス

- 最終製品

- エコシステム

- 価格分析

- 主要企業の平均販売価格の動向:繊維タイプ別

- 平均販売価格の動向:樹脂タイプ別

- 平均販売価格の動向:用途タイプ別

- 平均販売価格の動向:製造工程別

- 平均販売価格の動向:タイプ別

- 平均販売価格の動向:地域別

- バリューチェーン分析

- 貿易分析

- HSコード7019の輸出シナリオ

- HSコード7019の輸入シナリオ

- HSコード681511の輸出シナリオ

- HSコード681511の輸入シナリオ

- 技術分析

- ガラス繊維複合材料の技術分析

- 炭素繊維複合材料の技術分析

- 炭素繊維の最新製造プロセス向けの補完技術

- 炭素繊維の最新製造プロセスに関連する技術

- EV用複合材料市場に対するAI/生成AIの影響

- 主なユースケースと市場の将来性

- EV用複合材料市場におけるベストプラクティス

- EV用複合材料市場におけるAI導入の事例

- 相互接続された隣接エコシステムと市場企業に対する影響

- EV用複合材料市場における生成AI導入に対する顧客の準備状況

- 主なステークホルダーと購入基準

- 特許分析

- 規制情勢

- 主な会議とイベント(2024年~2025年)

- ケーススタディ分析

- 顧客ビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

第6章 EV用複合材料市場:繊維タイプ別

- イントロダクション

- 炭素

- ガラス

- その他の繊維

第7章 EV用複合材料市場:樹脂タイプ別

- イントロダクション

- 熱硬化性複合材料

- 熱可塑性複合材料

第8章 EV用複合材料市場:タイプ別

- イントロダクション

第9章 EV用複合材料市場:用途別

- イントロダクション

- 外装

- 内装

- パワートレイン、シャーシ

- バッテリーエンクロージャ

第10章 EV用複合材料市場:製造プロセス別

- イントロダクション

- 射出成形

- 圧縮成形

- 樹脂トランスファー成形

- その他の製造プロセス

第11章 EV用複合材料市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他のアジア太平洋

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- ベルギー

- その他の欧州

- 北米

- 米国

- カナダ

- ラテンアメリカ

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他の中東・アフリカ

第12章 競合情勢

- 概要

- 主要企業戦略/有力企業

- 収益分析

- 市場シェア分析

- ブランド/製品の比較分析

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- EV複合ベンダーの評価と財務指標

- 競合シナリオと動向

第13章 企業プロファイル

- 主要企業

- SYENSQO

- TORAY INDUSTRIES, INC.

- POLYTEC HOLDING AG

- OPMOBILITY

- FORVIA

- ELRINGKLINGER AG

- HENGRUI CORPORATION (HRC)

- EXEL COMPOSITES

- SGL CARBON

- TEIJIN LIMITED

- MITSUBISHI CHEMICAL GROUP CORPORATION

- OWENS CORNING

- PIRAN ADVANCED COMPOSITES

- MAR-BAL, INC.

- ROCHLING SE & CO. KG

- その他の企業

- HANKUK CARBON CO., LTD.

- CIE AUTOMOTIVE INDIA

- UFP TECHNOLOGIES, INC.

- ZHONGAO CARBON

- ATLAS FIBRE

- KAUTEX

- ENVALIOR

- TRB LIGHTWEIGHT STRUCTURES

- THE GUND COMPANY

- IDI COMPOSITES INTERNATIONAL

第14章 付録

List of Tables

- TABLE 1 EV COMPOSITES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 EV COMPOSITES MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 3 AVERAGE SELLING PRICE TREND, BY REGION

- TABLE 4 TOP 10 EXPORTING COUNTRIES OF GLASS FIBERS IN 2023

- TABLE 5 TOP 10 IMPORTING COUNTRIES OF GLASS FIBERS IN 2023

- TABLE 6 TOP 10 EXPORTING COUNTRIES OF CARBON FIBERS IN 2023

- TABLE 7 TOP 10 IMPORTING COUNTRIES OF CARBON FIBERS IN 2023

- TABLE 8 COMPARATIVE STUDY OF EV COMPOSITE MANUFACTURING PROCESSES

- TABLE 9 TOP USE CASES AND MARKET POTENTIAL

- TABLE 10 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

- TABLE 11 CASE STUDIES OF GEN AI IMPLEMENTATION IN EV COMPOSITES MARKET

- TABLE 12 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS IN EV COMPOSITES MARKET

- TABLE 14 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS IN EV COMPOSITES MARKET

- TABLE 15 EV COMPOSITES MARKET: TOTAL NUMBER OF PATENTS

- TABLE 16 LIST OF PATENTS BY BYD CO., LTD.

- TABLE 17 LIST OF PATENTS BY BEIJING INSTITUTE OF TECHNOLOGY

- TABLE 18 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- TABLE 19 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 EV COMPOSITES MARKET: KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 24 EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

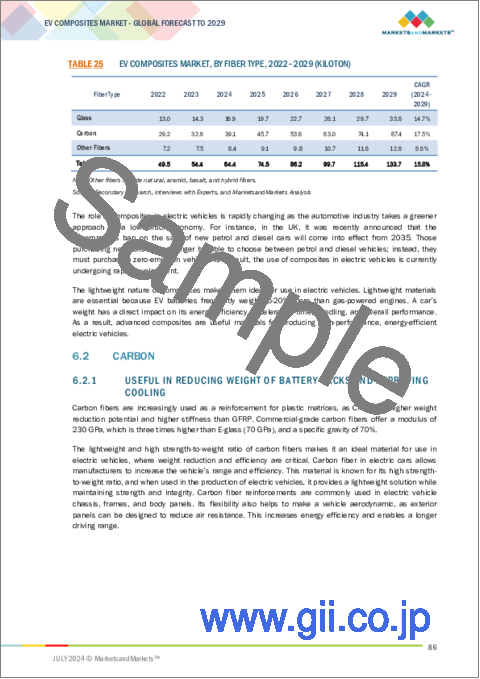

- TABLE 25 EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 26 EV CARBON FIBER COMPOSITES MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 27 EV CARBON FIBER COMPOSITES MARKET, BY REGION, 2022-2029 (KILOTON)

- TABLE 28 EV GLASS FIBER COMPOSITES MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 29 EV GLASS FIBER COMPOSITES MARKET, BY REGION, 2022-2029 (KILOTON)

- TABLE 30 OTHER EV FIBER COMPOSITES MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 31 OTHER EV FIBER COMPOSITES MARKET, BY REGION, 2022-2029 (KILOTON)

- TABLE 32 EV COMPOSITES MARKET, BY RESIN TYPE, 2022-2029 (USD MILLION)

- TABLE 33 EV COMPOSITES MARKET, BY RESIN TYPE, 2022-2029 (KILOTON)

- TABLE 34 EV THERMOSET COMPOSITES MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 35 EV THERMOSET COMPOSITES MARKET, BY REGION, 2022-2029 (KILOTON)

- TABLE 36 EV THERMOSET COMPOSITES MARKET, BY RESIN TYPE, 2022-2029 (USD MILLION)

- TABLE 37 EV THERMOSET COMPOSITES MARKET, BY RESIN TYPE, 2022-2029 (KILOTON)

- TABLE 38 EV THERMOPLASTIC COMPOSITES MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 39 EV THERMOPLASTIC COMPOSITES MARKET, BY REGION, 2022-2029 (KILOTON)

- TABLE 40 EV THERMOPLASTIC COMPOSITES MARKET, BY RESIN TYPE, 2022-2029 (USD MILLION)

- TABLE 41 EV THERMOPLASTIC COMPOSITES MARKET, BY RESIN TYPE, 2022-2029 (KILOTON)

- TABLE 42 EV COMPOSITES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 43 EV COMPOSITES MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 44 EV COMPOSITES MARKET IN BATTERY ENCLOSURE APPLICATIONS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 45 EV COMPOSITES MARKET IN BATTERY ENCLOSURE APPLICATIONS, BY TYPE, 2022-2029 (KILOTON)

- TABLE 46 EV COMPOSITES MARKET IN INTERIOR APPLICATIONS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 47 EV COMPOSITES MARKET IN INTERIOR APPLICATIONS, BY TYPE, 2022-2029 (KILOTON)

- TABLE 48 EV COMPOSITES MARKET IN EXTERIOR APPLICATIONS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 49 EV COMPOSITES MARKET IN EXTERIOR APPLICATIONS, BY TYPE, 2022-2029 (KILOTON)

- TABLE 50 EV COMPOSITES MARKET IN POWERTRAIN & CHASSIS APPLICATIONS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 51 EV COMPOSITES MARKET IN POWERTRAIN & CHASSIS APPLICATIONS, BY TYPE, 2022-2029 (KILOTON)

- TABLE 52 EV COMPOSITES MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 53 EV COMPOSITES MARKET, BY APPLICATION, 2022-2029 (KILOTON)

- TABLE 54 EV COMPOSITES MARKET IN EXTERIOR APPLICATIONS, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 55 EV COMPOSITES MARKET IN EXTERIOR APPLICATIONS, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 56 EV COMPOSITES MARKET IN INTERIOR APPLICATIONS, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 57 EV COMPOSITES MARKET IN INTERIOR APPLICATIONS, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 58 EV COMPOSITES MARKET IN POWERTRAIN & CHASSIS APPLICATIONS, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 59 EV COMPOSITES MARKET IN POWERTRAIN & CHASSIS APPLICATIONS, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 60 EV COMPOSITES MARKET IN BATTERY ENCLOSURE APPLICATIONS, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 61 EV COMPOSITES MARKET IN BATTERY ENCLOSURE APPLICATIONS, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 62 COMPARATIVE STUDY OF MAJOR EV COMPOSITE MANUFACTURING PROCESSES

- TABLE 63 EV COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2022-2029 (USD MILLION)

- TABLE 64 EV COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2022-2029 (KILOTON)

- TABLE 65 INJECTION MOLDING: EV COMPOSITES MARKET, 2022-2029 (USD MILLION)

- TABLE 66 INJECTION MOLDING: EV COMPOSITES MARKET, 2022-2029 (KILOTON)

- TABLE 67 COMPRESSION MOLDING: EV COMPOSITES MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 68 COMPRESSION MOLDING: EV COMPOSITES MARKET, BY REGION, 2022-2029 (KILOTON)

- TABLE 69 RESIN TRANSFER MOLDING: EV COMPOSITES MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 70 RESIN TRANSFER MOLDING: EV COMPOSITES MARKET, BY REGION, 2022-2029 (KILOTON)

- TABLE 71 OTHER MANUFACTURING PROCESSES: EV COMPOSITES MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 72 OTHER MANUFACTURING PROCESSES: EV COMPOSITES MARKET, BY REGION, 2022-2029 (KILOTON)

- TABLE 73 EV COMPOSITES MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 74 EV COMPOSITES MARKET, BY REGION, 2022-2029 (KILOTON)

- TABLE 75 ASIA PACIFIC: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 76 ASIA PACIFIC: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 77 ASIA PACIFIC: EV COMPOSITES MARKET, BY RESIN TYPE, 2022-2029 (USD MILLION)

- TABLE 78 ASIA PACIFIC: EV COMPOSITES MARKET, BY RESIN TYPE, 2022-2029 (KILOTON)

- TABLE 79 ASIA PACIFIC: EV COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2022-2029 (USD MILLION)

- TABLE 80 ASIA PACIFIC: EV COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2022-2029 (KILOTON)

- TABLE 81 ASIA PACIFIC: EV COMPOSITES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 82 ASIA PACIFIC: EV COMPOSITES MARKET, BY COUNTRY, 2022-2029 (KILOTON)

- TABLE 83 CHINA: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 84 CHINA: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 85 JAPAN: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 86 JAPAN: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 87 INDIA: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 88 INDIA: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 89 SOUTH KOREA: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 90 SOUTH KOREA: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 91 AUSTRALIA: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 92 AUSTRALIA: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 93 REST OF ASIA PACIFIC: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 94 REST OF ASIA PACIFIC: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 95 EUROPE: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 96 EUROPE: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 97 EUROPE: EV COMPOSITES MARKET, BY RESIN TYPE, 2022-2029 (USD MILLION)

- TABLE 98 EUROPE: EV COMPOSITES MARKET, BY RESIN TYPE, 2022-2029 (KILOTON)

- TABLE 99 EUROPE: EV COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2022-2029 (USD MILLION)

- TABLE 100 EUROPE: EV COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2022-2029 (KILOTON)

- TABLE 101 EUROPE: EV COMPOSITES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 102 EUROPE: EV COMPOSITES MARKET, BY COUNTRY, 2022-2029 (KILOTON)

- TABLE 103 GERMANY: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 104 GERMANY: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 105 FRANCE: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 106 FRANCE: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 107 UK: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 108 UK: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 109 ITALY: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 110 ITALY: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 111 SPAIN: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 112 SPAIN: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 113 RUSSIA: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 114 RUSSIA: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 115 BELGIUM: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 116 BELGIUM: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 117 REST OF EUROPE: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 118 REST OF EUROPE: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 119 NORTH AMERICA: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 120 NORTH AMERICA: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 121 NORTH AMERICA: EV COMPOSITES MARKET, BY RESIN TYPE, 2022-2029 (USD MILLION)

- TABLE 122 NORTH AMERICA: EV COMPOSITES MARKET, BY RESIN TYPE, 2022-2029 (KILOTON)

- TABLE 123 NORTH AMERICA: EV COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2022-2029 (USD MILLION)

- TABLE 124 NORTH AMERICA: EV COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2022-2029 (KILOTON)

- TABLE 125 NORTH AMERICA: EV COMPOSITES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 126 NORTH AMERICA: EV COMPOSITES MARKET, BY COUNTRY, 2022-2029 (KILOTON)

- TABLE 127 US: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 128 US: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 129 CANADA: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 130 CANADA: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 131 LATIN AMERICA: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 132 LATIN AMERICA: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 133 LATIN AMERICA: EV COMPOSITES MARKET, BY RESIN TYPE, 2022-2029 (USD MILLION)

- TABLE 134 LATIN AMERICA: EV COMPOSITES MARKET, BY RESIN TYPE, 2022-2029 (KILOTON)

- TABLE 135 LATIN AMERICA: EV COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2022-2029 (USD MILLION)

- TABLE 136 LATIN AMERICA: EV COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2022-2029 (KILOTON)

- TABLE 137 LATIN AMERICA: EV COMPOSITES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 138 LATIN AMERICA: EV COMPOSITES MARKET, BY COUNTRY, 2022-2029 (KILOTON)

- TABLE 139 BRAZIL: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 140 BRAZIL: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 141 MEXICO: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 142 MEXICO: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 143 REST OF LATIN AMERICA: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 144 REST OF LATIN AMERICA: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 145 MIDDLE EAST & AFRICA: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 147 MIDDLE EAST & AFRICA: EV COMPOSITES MARKET, BY RESIN TYPE, 2022-2029 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: EV COMPOSITES MARKET, BY RESIN TYPE, 2022-2029 (KILOTON)

- TABLE 149 MIDDLE EAST & AFRICA: EV COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2022-2029 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: EV COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2022-2029 (KILOTON)

- TABLE 151 MIDDLE EAST & AFRICA: EV COMPOSITES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: EV COMPOSITES MARKET, BY COUNTRY, 2022-2029 (KILOTON)

- TABLE 153 UAE: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 154 UAE: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 155 REST OF GCC COUNTRIES: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 156 REST OF GCC COUNTRIES: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 157 SOUTH AFRICA: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 158 SOUTH AFRICA: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 159 REST OF MIDDLE EAST & AFRICA: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (USD MILLION)

- TABLE 160 REST OF MIDDLE EAST & AFRICA: EV COMPOSITES MARKET, BY FIBER TYPE, 2022-2029 (KILOTON)

- TABLE 161 STRATEGIES ADOPTED BY EV COMPOSITE MANUFACTURERS

- TABLE 162 DEGREE OF COMPETITION: EV COMPOSITES MARKET

- TABLE 163 EV COMPOSITES MARKET: FIBER TYPE FOOTPRINT

- TABLE 164 EV COMPOSITES MARKET: TYPE FOOTPRINT

- TABLE 165 EV COMPOSITES MARKET: RESIN TYPE FOOTPRINT

- TABLE 166 EV COMPOSITES MARKET: APPLICATION FOOTPRINT

- TABLE 167 EV COMPOSITES MARKET: REGION FOOTPRINT

- TABLE 168 EV COMPOSITES MARKET: KEY STARTUPS/SMES

- TABLE 169 EV COMPOSITES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 170 EV COMPOSITES MARKET: PRODUCT LAUNCHES, JANUARY 2018-JUNE 2024

- TABLE 171 EV COMPOSITES MARKET: DEALS, JANUARY 2018-JUNE 2024

- TABLE 172 EV COMPOSITES MARKET: EXPANSIONS, JANUARY 2018-JUNE 2024

- TABLE 173 SYENSQO: COMPANY OVERVIEW

- TABLE 174 SYENSQO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 SYENSQO: PRODUCT LAUNCHES, JANUARY 2018-JUNE 2024

- TABLE 176 SYENSQO: OTHER DEVELOPMENTS, JANUARY 2018-JUNE 2024

- TABLE 177 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 178 TORAY INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 TORAY INDUSTRIES, INC.: PRODUCT LAUNCHES, JANUARY 2018-JUNE 2024

- TABLE 180 TORAY INDUSTRIES, INC.: DEALS, JANUARY 2018-JUNE 2024

- TABLE 181 TORAY INDUSTRIES, INC.: EXPANSIONS, JANUARY 2018-JUNE 2024

- TABLE 182 POLYTEC HOLDING AG: COMPANY OVERVIEW

- TABLE 183 POLYTEC HOLDING AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 POLYTEC HOLDING AG: DEALS, JANUARY 2018-JUNE 2024

- TABLE 185 OPMOBILITY: COMPANY OVERVIEW

- TABLE 186 OPMOBILITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 OPMOBILITY: DEALS, JANUARY 2018-JUNE 2024

- TABLE 188 OPMOBILITY: EXPANSIONS, JANUARY 2018-JUNE 2024

- TABLE 189 FORVIA: COMPANY OVERVIEW

- TABLE 190 FORVIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 FORVIA: DEALS, JANUARY 2018-JUNE 2024

- TABLE 192 ELRINGKLINGER AG: COMPANY OVERVIEW

- TABLE 193 ELRINGKLINGER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 HENGRUI CORPORATION (HRC): COMPANY OVERVIEW

- TABLE 195 HENGRUI CORPORATION (HRC): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 HRC (HENGRUI CORPORATION): DEALS, JANUARY 2018-JUNE 2024

- TABLE 197 EXEL COMPOSITES: COMPANY OVERVIEW

- TABLE 198 EXEL COMPOSITES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 SGL CARBON: COMPANY OVERVIEW

- TABLE 200 SGL CARBON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 SGL CARBON: DEALS, JANUARY 2018-JUNE 2024

- TABLE 202 SGL CARBON: EXPANSIONS, JANUARY 2018-JUNE 2024

- TABLE 203 TEIJIN LIMITED: COMPANY OVERVIEW

- TABLE 204 TEIJIN LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 TEIJIN LIMITED: DEALS, JANUARY 2018-JUNE 2024

- TABLE 206 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 207 MITSUBISHI CHEMICAL GROUP CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 208 MITSUBISHI CHEMICAL GROUP CORPORATION: DEALS, JANUARY 2018-JUNE 2024

- TABLE 209 MITSUBISHI CHEMICAL GROUP CORPORATION: EXPANSIONS, JANUARY 2018-JUNE 2024

- TABLE 210 OWENS CORNING: COMPANY OVERVIEW

- TABLE 211 OWENS CORNING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 PIRAN ADVANCED COMPOSITES: COMPANY OVERVIEW

- TABLE 213 PIRAN ADVANCED COMPOSITES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 MAR-BAL, INC.: COMPANY OVERVIEW

- TABLE 215 MAR-BAL, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 ROCHLING SE & CO. KG: COMPANY OVERVIEW

- TABLE 217 ROCHLING SE & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 HANKUK CARBON CO., LTD.: COMPANY OVERVIEW

- TABLE 219 CIE AUTOMOTIVE INDIA: COMPANY OVERVIEW

- TABLE 220 UFP TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 221 ZHONGAO CARBON: COMPANY OVERVIEW

- TABLE 222 ATLAS FIBRE: COMPANY OVERVIEW

- TABLE 223 KAUTEX: COMPANY OVERVIEW

- TABLE 224 ENVALIOR: COMPANY OVERVIEW

- TABLE 225 TRB LIGHTWEIGHT STRUCTURES: COMPANY OVERVIEW

- TABLE 226 THE GUND COMPANY: COMPANY OVERVIEW

- TABLE 227 IDI COMPOSITES INTERNATIONAL: COMPANY OVERVIEW

List of Figures

- FIGURE 1 EV COMPOSITES MARKET SEGMENTATION

- FIGURE 2 EV COMPOSITES MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 EV COMPOSITES MARKET: DATA TRIANGULATION

- FIGURE 6 CARBON FIBER-BASED EV COMPOSITES ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- FIGURE 7 THERMOSET SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- FIGURE 8 INJECTION MOLDING SEGMENT TO DOMINATE EV COMPOSITES MARKET IN 2023

- FIGURE 9 ULTRA-PREMIUM SEGMENT DOMINATED MARKET, BY TYPE, IN 2023

- FIGURE 10 EXTERIOR APPLICATIONS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- FIGURE 11 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 12 HIGH DEMAND FOR LIGHTWEIGHT MATERIALS IN EV INDUSTRY TO DRIVE MARKET

- FIGURE 13 CARBON FIBERS SEGMENT HELD LARGEST MARKET SHARE IN 2023

- FIGURE 14 THERMOSET RESINS SEGMENT HELD LARGER MARKET SHARE IN 2023

- FIGURE 15 INJECTION MOLDING SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- FIGURE 16 NON-PREMIUM SEGMENT HELD LARGEST MARKET SHARE IN 2023

- FIGURE 17 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE IN 2023

- FIGURE 18 INDIA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 19 EV COMPOSITES MARKET: MARKET DYNAMICS

- FIGURE 20 EV SALES BY MAJOR MARKETS (REGION/COUNTRY), 2023

- FIGURE 21 EV SALES FORECAST

- FIGURE 22 PUBLICLY AVAILABLE EV CHARGING INFRASTRUCTURE, 2015-2021

- FIGURE 23 EV SALES BY ORIGIN OF CARMAKER IN 2023

- FIGURE 24 EV COMPOSITES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 EV COMPOSITES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 EV COMPOSITES MARKET: KEY STAKEHOLDERS IN ECOSYSTEM

- FIGURE 27 EV COMPOSITES MARKET: ECOSYSTEM

- FIGURE 28 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY FIBER TYPE

- FIGURE 29 AVERAGE SELLING PRICE OF EV COMPOSITES, BY RESIN TYPE (USD/KG)

- FIGURE 30 AVERAGE SELLING PRICE OF EV COMPOSITES, BY APPLICATION TYPE (USD/KG)

- FIGURE 31 AVERAGE SELLING PRICE OF EV COMPOSITES, BY MANUFACTURING PROCESS (USD/KG)

- FIGURE 32 AVERAGE SELLING PRICE OF EV COMPOSITES, BY TYPE (USD/KG)

- FIGURE 33 EV COMPOSITES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 34 EXPORT OF GLASS FIBERS, BY KEY COUNTRY, 2018-2022 (USD THOUSAND)

- FIGURE 35 IMPORT OF GLASS FIBERS, BY KEY COUNTRY, 2018-2022 (USD THOUSAND)

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 37 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 38 PATENT ANALYSIS, BY PATENT TYPE

- FIGURE 39 PATENT PUBLICATION TREND, 2014-2024

- FIGURE 40 EV COMPOSITES MARKET: LEGAL STATUS OF PATENTS

- FIGURE 41 CHINESE JURISDICTION REGISTERED HIGHEST NUMBER OF PATENTS

- FIGURE 42 JIANGSU UNIVERSITY REGISTERED HIGHEST NUMBER OF PATENTS

- FIGURE 43 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS IN EV COMPOSITES MARKET

- FIGURE 44 DEALS AND FUNDING IN EV COMPOSITES MARKET SOARED IN 2022

- FIGURE 45 PROMINENT EV COMPOSITE MANUFACTURING FIRMS IN 2024 (USD BILLION)

- FIGURE 46 CARBON FIBER SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 47 THERMOPLASTIC COMPOSITES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 48 NON-PREMIUM SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 49 EXTERIOR APPLICATIONS TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 50 RESIN TRANSFER MOLDING PROCESS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 51 INDIA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 52 ASIA PACIFIC: EV COMPOSITES MARKET SNAPSHOT

- FIGURE 53 EUROPE: EV COMPOSITES MARKET SNAPSHOT

- FIGURE 54 NORTH AMERICA: EV COMPOSITES MARKET SNAPSHOT

- FIGURE 55 EV COMPOSITES MARKET: REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

- FIGURE 56 SHARES OF KEY PLAYERS IN EV COMPOSITES MARKET

- FIGURE 57 EV COMPOSITES MARKET: TOP TRENDING BRAND/PRODUCT

- FIGURE 58 BRAND/PRODUCT COMPARATIVE ANALYSIS, BY EV COMPOSITE PRODUCT

- FIGURE 59 EV COMPOSITES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 60 EV COMPOSITES MARKET: COMPANY FOOTPRINT

- FIGURE 61 EV COMPOSITES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 62 EV COMPOSITES MARKET: EV/EBITDA OF KEY VENDORS

- FIGURE 63 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 64 SYENSQO: COMPANY SNAPSHOT

- FIGURE 65 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 66 POLYTEC HOLDING AG: COMPANY SNAPSHOT

- FIGURE 67 OPMOBILITY: COMPANY SNAPSHOT

- FIGURE 68 FORVIA: COMPANY SNAPSHOT

- FIGURE 69 ELRINGKLINGER AG: COMPANY SNAPSHOT

- FIGURE 70 EXEL COMPOSITES: COMPANY SNAPSHOT

- FIGURE 71 SGL CARBON: COMPANY SNAPSHOT

- FIGURE 72 TEIJIN LIMITED: COMPANY SNAPSHOT

- FIGURE 73 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY SNAPSHOT

- FIGURE 74 OWENS CORNING: COMPANY SNAPSHOT

The EV Composites market is estimated at USD 2.3 billion in 2024 and is projected to reach USD 5.1 billion by 2029, at a CAGR of 17.1% from 2024 to 2029. Glass fiber composites are increasingly used in electric vehicles (EVs) due to several key factors. They contribute to significant weight reduction, enhancing efficiency and range, while being more cost-effective compared to other composites like carbon fiber. Glass fiber offers high tensile strength and durability, making it suitable for various structural and non-structural parts. Its excellent thermal and electrical insulation properties help manage heat generated by electric powertrains and ensure safe operation of electrical systems. The design flexibility of glass fiber allows for complex shapes and aerodynamic designs, and its production is often more environmentally friendly with lower energy requirements and recycling potential. Additionally, fiberglass composites help reduce noise, vibration, and harshness (NVH) levels, providing a quieter cabin environment, further enhancing the overall driving experience in EVs.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Segments | By Fiber Type, By Resin Type, By Type, By Manufacturing Process, Application, and Region |

| Regions covered | Europe, North America, Asia Pacific, Latin America, Middle East, and Africa |

''In terms of value, thermoset resin segment accounted for the largest share of the overall EV Composites market.''

In thermoset composites, thermoset resins are used as the matrix with fibers such as carbon fiber, fiberglass, natural fiber, and aramid fiber. Currently, thermoset resins are widely used for manufacturing EV composites as, when cured, they are in the liquid state at room temperature. This unique property of the resin allows for the convenient impregnation of reinforcing fiber. On account of their rigid interlinking molecular structure, inert chemical composition, and resistance to ultraviolet and chemical attack, thermoset composites are very durable. Structures made of thermoset composites are also low on maintenance. The thermoset resin for EV composites is expected to grow significantly due to the increasing demand for lightweight and high-performance materials in EV production.

''In terms of value, RTM manufacturing process segment accounted for the third largest share of the overall EV Composites market.''

In 2023, RTM manufacturing process segment accounted for the third largest share of the EV Composites market, in terms of value. RTM is a cost-effective and efficient method for producing high-quality EV composite parts, which is crucial for the growing demand in the EV industry. The trend towards lightweight vehicles for improved efficiency and range is a significant driver, as RTM produces components that are both strong and lightweight. Additionally, RTM allows for high levels of design flexibility and precision, enabling complex shapes and integrated components, which is essential for the innovative designs seen in modern EVs. The process also supports high-volume production, aligning with the scaling needs of the EV market. Moreover, RTM's capability to use various resin systems, including those with high thermal and electrical insulation properties, makes it suitable for manufacturing components that require high performance and safety standards in EVs. Overall, the efficiency, versatility, and sustainability of RTM are key factors driving its growth in the EV composites market.

"During the forecast period, the EV Composites market in Europe region is projected to be the second largest region."

The growth of EV composites in Europe is fuelled by regulatory pressures, government incentives, automotive innovation, infrastructure development, and sustainability goals. Trends such as the adoption of carbon fiber composites, advanced manufacturing techniques, and the focus on battery enclosures highlight the dynamic nature of this market. As Europe continues to lead in the transition to electric mobility, the demand for high-performance composites is set to increase, driving further advancements and adoption in the EV industry. Leading companies like Rochling SE & Co. KG and ElringKlinger AG are ramping up their R&D efforts to develop new products, aligning with market trends and meeting the growing demand for EV Composites.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type- Tier 1- 40%, Tier 2- 33%, and Tier 3- 27%

- By Designation- C Level- 50%, Director Level- 30%, and Others- 20%

- By Region- North America- 15%, Europe- 50%, Asia Pacific- 20%, Latin America- 10%, Middle East & Africa (MEA)-5%.

The report provides a comprehensive analysis of company profiles:

Prominent companies include Toray Industries, Inc. (Japan), Teijin Limited (Japan), Syensqo (Belgium), Piran Advanced Composites (UK), HRC (Hengrui Corporation) (China), Envalior (Germany), Exel Composites (Finland), Kautex Textron GmbH & Co. KG (Germany), SGL Carbon (Germany), POLYTEC HOLDING AG (Austria), Plastic Omnium (France), Rochling SE & Co. KG (Germany), Mar-Bal, Inc. (US), ElringKlinger AG (Germany), and Faurecia (France).

Research Coverage

This research report categorizes the EV Composites Market By Fiber Type (Glass Fiber, Carbon Fiber, Other Fibers), By Resin Type (Thermoplastics, Thermoset), By Type (Ultra-Premium, Premium and Non-Premium), By Manufacturing Process (Compression Molding, Injection Molding, RTM), Application (Interior, Exterior, Battery Enclosure, Powertrain & Chassis), Region (North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America). The scope of the report includes detailed information about the major factors influencing the growth of the EV Composites market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted in order to provide insights into their business overview, solutions, and services, key strategies, contracts, partnerships, and agreements. New product and service launches, mergers and acquisitions, and recent developments in the EV Composites market are all covered. This report includes a competitive analysis of upcoming startups in the EV Composites market ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall EV Composites market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing adoption of EV composites, Technological advancements), restraints (Competition with low-cost mature products, Limited market penetration), opportunities (Reduction in cost of carbon fiber, Expansion of EV Infrastructure), and challenges (Maintaining uninterrupted supply chain and operating at full production capacity, liquidity crunch) influencing the growth of the EV Composites market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the EV Composites market

- Market Development: Comprehensive information about lucrative markets - the report analyses the EV Composites market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the EV Composites market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Toray Industries, Inc. (Japan), Teijin Limited (Japan), Syensqo (Belgium), Piran Advanced Composites (UK), HRC (Hengrui Corporation) (China), Envalior (Germany), Exel Composites (Finland), Kautex Textron GmbH & Co. KG (Germany), SGL Carbon (Germany), POLYTEC HOLDING AG (Austria), Plastic Omnium (France), Rochling SE & Co. KG (Germany), Mar-Bal, Inc. (US), ElringKlinger AG (Germany), and Faurecia (France), The Gund Company (US), IDI Composites International (US), TRB Lightweight Structures (US), CIE Automotive India (India), ZhongAo Carbon (China), Atlas Fibre (US), Jiangsu Kangde Xin Composite Material (China), Euro Advanced Carbon Fiber Composites GmbH (US), Owens Corning (US) among others in the EV Composites market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 APPROACH 1: DEMAND-SIDE ANALYSIS

- 2.2.2 APPROACH 2: SUPPLY-SIDE ANALYSIS

- 2.3 FORECAST NUMBER CALCULATION

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 ASSUMPTIONS

- 2.8 GROWTH FORECAST

- 2.9 RESEARCH LIMITATIONS

- 2.10 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EV COMPOSITES MARKET

- 4.2 EV COMPOSITES MARKET SHARE, BY FIBER TYPE, 2023

- 4.3 EV COMPOSITES MARKET SHARE, BY RESIN TYPE, 2023

- 4.4 EV COMPOSITES MARKET SHARE, BY MANUFACTURING PROCESS, 2023

- 4.5 EV COMPOSITES MARKET SHARE, BY TYPE, 2023

- 4.6 EV COMPOSITES MARKET, BY APPLICATION AND REGION, 2023

- 4.7 EV COMPOSITES MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Stringent standards on emission control

- 5.2.1.2 Increasing adoption of composite materials by premium EV manufacturers

- 5.2.1.3 Government policies and incentives driving EV adoption

- 5.2.2 RESTRAINTS

- 5.2.2.1 High processing and manufacturing cost of composites

- 5.2.2.2 Lack of EV infrastructure

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Reduction in cost of carbon fibers

- 5.2.3.2 Growing demand for EVs from emerging economies

- 5.2.3.3 Growing application of composites in EV batteries

- 5.2.4 CHALLENGES

- 5.2.4.1 Recycling of composite materials

- 5.2.4.2 Developing low-cost technologies

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.4.1 RAW MATERIAL

- 5.4.2 MANUFACTURING PROCESS

- 5.4.3 FINAL PRODUCT

- 5.5 ECOSYSTEM

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY FIBER TYPE

- 5.6.2 AVERAGE SELLING PRICE TREND, BY RESIN TYPE

- 5.6.3 AVERAGE SELLING PRICE TREND, BY APPLICATION TYPE

- 5.6.4 AVERAGE SELLING PRICE TREND, BY MANUFACTURING PROCESS

- 5.6.5 AVERAGE SELLING PRICE TREND, BY TYPE

- 5.6.6 AVERAGE SELLING PRICE TREND, BY REGION

- 5.7 VALUE CHAIN ANALYSIS

- 5.8 TRADE ANALYSIS

- 5.8.1 EXPORT SCENARIO FOR HS CODE 7019

- 5.8.2 IMPORT SCENARIO FOR HS CODE 7019

- 5.8.3 EXPORT SCENARIO FOR HS CODE 681511

- 5.8.4 IMPORT SCENARIO FOR HS CODE 681511

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 TECHNOLOGY ANALYSIS FOR GLASS FIBER COMPOSITES

- 5.9.2 TECHNOLOGY ANALYSIS FOR CARBON FIBER COMPOSITES

- 5.9.3 COMPLEMENTARY TECHNOLOGIES FOR LATEST MANUFACTURING PROCESS OF CARBON FIBERS

- 5.9.4 ADJACENT TECHNOLOGIES FOR LATEST MANUFACTURING PROCESS OF CARBON FIBERS

- 5.10 IMPACT OF AI/GEN AI ON EV COMPOSITES MARKET

- 5.10.1 TOP USE CASES AND MARKET POTENTIAL

- 5.10.2 BEST PRACTICES IN EV COMPOSITES MARKET

- 5.10.3 CASE STUDIES OF AI IMPLEMENTATION IN EV COMPOSITES MARKET

- 5.10.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 5.10.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN EV COMPOSITES MARKET

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 PATENT ANALYSIS

- 5.12.1 INTRODUCTION

- 5.12.2 METHODOLOGY

- 5.12.3 PATENT TYPES

- 5.12.4 INSIGHTS

- 5.12.5 LEGAL STATUS

- 5.12.6 JURISDICTION ANALYSIS

- 5.12.7 TOP APPLICANTS

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 KEY CONFERENCES AND EVENTS IN 2024-2025

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 CASE STUDY 1: WATT ELECTRIC VEHICLES AND THE NATIONAL COMPOSITES CENTRE PARTNERSHIP TO MANUFACTURE COMPOSITE BATTERY

- 5.15.2 CASE STUDY 2: TEIJIN'S DEVELOPMENT OF CARBON FIBER BATTERY ENCLOSURE

- 5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.17 INVESTMENT AND FUNDING SCENARIO

6 EV COMPOSITES MARKET, BY FIBER TYPE

- 6.1 INTRODUCTION

- 6.2 CARBON

- 6.2.1 USEFUL IN REDUCING WEIGHT OF BATTERY PACKS AND IMPROVING COOLING

- 6.2.2 EV CARBON FIBER COMPOSITES MARKET, BY REGION

- 6.3 GLASS

- 6.3.1 WIDELY UTILIZED AS REINFORCEMENTS IN EV COMPOSITE, OFFERING BALANCE OF STRENGTH, AFFORDABILITY, AND CORROSION RESISTANCE

- 6.3.2 EV GLASS FIBER COMPOSITES MARKET, BY REGION

- 6.4 OTHER FIBERS

- 6.4.1 OTHER EV FIBER COMPOSITES MARKET, BY REGION

7 EV COMPOSITES MARKET, BY RESIN TYPE

- 7.1 INTRODUCTION

- 7.2 THERMOSET COMPOSITES

- 7.2.1 LOW ON MAINTENANCE-KEY FACTOR PROPELLING MARKET GROWTH

- 7.2.2 POLYESTER

- 7.2.3 VINYL ESTER

- 7.2.4 EPOXY

- 7.2.5 OTHER THERMOSET RESINS

- 7.2.6 EV THERMOSET COMPOSITES MARKET, BY REGION

- 7.3 THERMOPLASTIC COMPOSITES

- 7.3.1 HIGH COST TO RESTRAIN ADOPTION

- 7.3.2 POLYPROPYLENE

- 7.3.3 POLYAMIDE

- 7.3.4 POLYPHENYLENE SULFIDE

- 7.3.5 OTHER THERMOPLASTIC RESINS

- 7.3.5.1 Polyetheretherketone

- 7.3.5.2 Polyetherimide

- 7.3.6 EV THERMOPLASTIC COMPOSITES MARKET, BY REGION

8 EV COMPOSITES MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.1.1 EV COMPOSITES MARKET IN BATTERY ENCLOSURE APPLICATIONS

- 8.1.2 EV COMPOSITES MARKET IN INTERIOR APPLICATIONS

- 8.1.3 EV COMPOSITES MARKET IN EXTERIOR APPLICATIONS

- 8.1.4 EV COMPOSITES MARKET IN POWERTRAIN & CHASSIS APPLICATIONS

9 EV COMPOSITES MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 EXTERIOR

- 9.2.1 EXTERIOR PARTS MANUFACTURED WITH COMPOSITES IMPART RIGIDITY

- 9.2.2 EV COMPOSITES MARKET IN EXTERIOR APPLICATIONS, BY FIBER TYPE

- 9.3 INTERIOR

- 9.3.1 GLASS FIBER COMPOSITES WIDELY USED IN INTERIOR APPLICATIONS

- 9.3.2 EV COMPOSITES MARKET IN INTERIOR APPLICATIONS, BY FIBER TYPE

- 9.4 POWERTRAIN & CHASSIS

- 9.4.1 STRINGENT GOVERNMENT REGULATIONS TO REDUCE OVERALL WEIGHT OF VEHICLES

- 9.4.2 EV COMPOSITES MARKET IN POWERTRAIN & CHASSIS APPLICATIONS, BY FIBER TYPE

- 9.5 BATTERY ENCLOSURES

- 9.5.1 DESIGNED TO ENSURE SAFETY OF BATTERY AND PASSENGERS IN EVENT OF COLLISION

- 9.5.2 EV COMPOSITES MARKET IN BATTERY ENCLOSURE APPLICATIONS, BY FIBER TYPE

10 EV COMPOSITES MARKET, BY MANUFACTURING PROCESS

- 10.1 INTRODUCTION

- 10.2 INJECTION MOLDING

- 10.2.1 OFFERS LOW-COST TOOLING FOR PRODUCTION OF LOW VOLUME OF LARGE PARTS

- 10.2.2 INJECTION MOLDING: EV COMPOSITES MARKET, BY REGION

- 10.3 COMPRESSION MOLDING

- 10.3.1 PRODUCE HIGH-STRENGTH COMPLEX PARTS IN A VARIETY OF SIZES

- 10.3.2 COMPRESSION MOLDING: EV COMPOSITES MARKET, BY REGION

- 10.4 RESIN TRANSFER MOLDING

- 10.4.1 SUITABLE FOR MEDIUM-VOLUME PRODUCTION OF LARGE COMPONENTS

- 10.4.2 RESIN TRANSFER MOLDING: EV COMPOSITES MARKET, BY REGION

- 10.5 OTHER MANUFACTURING PROCESSES

- 10.5.1 FILAMENT WINDING PROCESS

- 10.5.2 CONTINUOUS PROCESS

- 10.5.3 LAY-UP PROCESS

- 10.5.4 OTHER MANUFACTURING PROCESSES: EV COMPOSITES MARKET, BY REGION

11 EV COMPOSITES MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Rising efforts by domestic automakers to support market growth

- 11.2.2 JAPAN

- 11.2.2.1 High demand from OEMs to drive market

- 11.2.3 INDIA

- 11.2.3.1 Government support to favor market growth

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Government incentives to promote EV demand to drive market

- 11.2.5 AUSTRALIA

- 11.2.5.1 Growing sales of electric cars to drive market

- 11.2.6 REST OF ASIA PACIFIC

- 11.2.1 CHINA

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Government and OEM plans for rapid EV shift to drive market

- 11.3.2 FRANCE

- 11.3.2.1 Plans for rapid electrification to support market growth

- 11.3.3 UK

- 11.3.3.1 Heavy investments in EV ecosystem to propel market

- 11.3.4 ITALY

- 11.3.4.1 Advanced manufacturing and innovation to drive market

- 11.3.5 SPAIN

- 11.3.5.1 Increasing investments in EV space to drive market

- 11.3.6 RUSSIA

- 11.3.6.1 Government support for EV adoption to propel market

- 11.3.7 BELGIUM

- 11.3.7.1 Increasing investments in EV space to drive market

- 11.3.8 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 NORTH AMERICA

- 11.4.1 US

- 11.4.1.1 High investments and government focus on cleaner mobility to drive market

- 11.4.2 CANADA

- 11.4.2.1 Increasing development of EV infrastructure to drive market

- 11.4.1 US

- 11.5 LATIN AMERICA

- 11.5.1 BRAZIL

- 11.5.1.1 Growth of electric vehicles industry to propel market

- 11.5.2 MEXICO

- 11.5.2.1 Lower manufacturing cost and proximity to OEMs in US to drive market

- 11.5.3 REST OF LATIN AMERICA

- 11.5.1 BRAZIL

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 GCC COUNTRIES

- 11.6.1.1 UAE

- 11.6.1.1.1 Supportive government policies to boost market growth

- 11.6.1.2 Rest of GCC countries

- 11.6.1.1 UAE

- 11.6.2 SOUTH AFRICA

- 11.6.2.1 Local and international investments to boost market

- 11.6.3 REST OF MIDDLE EAST & AFRICA

- 11.6.1 GCC COUNTRIES

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 12.5.1 BRAND/PRODUCT COMPARATIVE ANALYSIS, BY EV COMPOSITE PRODUCT

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.6.5.1 Company footprint

- 12.6.5.2 Fiber type footprint

- 12.6.5.3 Type footprint

- 12.6.5.4 Resin type footprint

- 12.6.5.5 Application footprint

- 12.6.5.6 Region footprint

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 12.8 VALUATION AND FINANCIAL METRICS OF EV COMPOSITE VENDORS

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 SYENSQO

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 TORAY INDUSTRIES, INC.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.3.3 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 POLYTEC HOLDING AG

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 OPMOBILITY

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 FORVIA

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 ELRINGKLINGER AG

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 MnM view

- 13.1.6.3.1 Right to win

- 13.1.6.3.2 Strategic choices

- 13.1.6.3.3 Weaknesses and competitive threats

- 13.1.7 HENGRUI CORPORATION (HRC)

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.4 MnM view

- 13.1.7.4.1 Right to win

- 13.1.7.4.2 Strategic choices

- 13.1.7.4.3 Weaknesses and competitive threats

- 13.1.8 EXEL COMPOSITES

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 MnM view

- 13.1.8.3.1 Right to win

- 13.1.8.3.2 Strategic choices

- 13.1.8.3.3 Weaknesses and competitive threats

- 13.1.9 SGL CARBON

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.9.3.2 Expansions

- 13.1.9.4 MnM view

- 13.1.9.4.1 Right to win

- 13.1.9.4.2 Strategic choices

- 13.1.9.4.3 Weaknesses and competitive threats

- 13.1.10 TEIJIN LIMITED

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.10.4 MnM view

- 13.1.10.4.1 Right to win

- 13.1.10.4.2 Strategic choices

- 13.1.10.4.3 Weaknesses and competitive threats

- 13.1.11 MITSUBISHI CHEMICAL GROUP CORPORATION

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.11.3.2 Expansions

- 13.1.11.4 MnM view

- 13.1.11.4.1 Right to win

- 13.1.11.4.2 Strategic choices

- 13.1.11.4.3 Weaknesses and competitive threats

- 13.1.12 OWENS CORNING

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 MnM view

- 13.1.12.3.1 Right to win

- 13.1.12.3.2 Strategic choices

- 13.1.12.3.3 Weaknesses and competitive threats

- 13.1.13 PIRAN ADVANCED COMPOSITES

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.13.3 MnM view

- 13.1.13.3.1 Right to win

- 13.1.13.3.2 Strategic choices

- 13.1.13.3.3 Weaknesses and competitive threats

- 13.1.14 MAR-BAL, INC.

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 MnM view

- 13.1.14.3.1 Right to win

- 13.1.14.3.2 Strategic choices

- 13.1.14.3.3 Weaknesses and competitive threats

- 13.1.15 ROCHLING SE & CO. KG

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.15.3 MnM view

- 13.1.15.3.1 Right to win

- 13.1.15.3.2 Strategic choices

- 13.1.15.3.3 Weaknesses and competitive threats

- 13.1.1 SYENSQO

- 13.2 OTHER PLAYERS

- 13.2.1 HANKUK CARBON CO., LTD.

- 13.2.2 CIE AUTOMOTIVE INDIA

- 13.2.3 UFP TECHNOLOGIES, INC.

- 13.2.4 ZHONGAO CARBON

- 13.2.5 ATLAS FIBRE

- 13.2.6 KAUTEX

- 13.2.7 ENVALIOR

- 13.2.8 TRB LIGHTWEIGHT STRUCTURES

- 13.2.9 THE GUND COMPANY

- 13.2.10 IDI COMPOSITES INTERNATIONAL

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS