|

|

市場調査レポート

商品コード

1516919

炭化炉の世界市場:タイプ別、原料別、処理能力別、用途別、地域別 - 予測(~2029年)Carbonization Furnace Market by Type (Countinous carbonization furnace), Feed Stock (Agricultural waste, Forestry Waste, Nutshell waste), Capacity (<1000 kg/h, 1000-2000 kg/h) Application (Charcoal, Wood Vinegar, Tar), Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 炭化炉の世界市場:タイプ別、原料別、処理能力別、用途別、地域別 - 予測(~2029年) |

|

出版日: 2024年07月15日

発行: MarketsandMarkets

ページ情報: 英文 243 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の炭化炉の市場規模は、2024年の2億6,300万米ドルから2029年までに4億2,500万米ドルに達すると予測され、予測期間にCAGRで10.1%の成長が見込まれます。

市場の成長と進化にはさまざまな変数が寄与しています。主な促進要因の1つは、世界的な持続可能性と環境保護への注目の高まりです。気候変動と炭素排出への懸念が高まる中、産業と政府は環境フットプリントを削減しながら炭素隔離を増加させるソリューションを積極的に模索しています。炭化炉、特にバイオ炭や木炭の生成に使われる炭化炉は、こうした取り組みに不可欠です。これらの炉は、バイオマスを安定した炭素形態に変えることで炭素の回収と貯留に寄与し、温室効果ガスの影響を低減します。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 10億/100万米ドル |

| セグメント | タイプ、原料、用途、処理能力、地域 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

「林業廃棄物が市場の原料セグメントにおいて金額ベースで最大のシェアを占めました。」

林業廃棄物原料は、その量、費用対効果、環境上の利点から炭化炉市場を独占しています。伐採や森林管理のような林業活動は、枝、樹皮、おがくず、木材チップを含む大量の残留バイオマスを生産します。一般に廃棄物に分類されるこのバイオマスは、炭化炉の原料として広く入手可能で安価です。林業廃棄物を利用することで、本来であれば環境負荷となるはずのものを、バイオ炭や木炭の製造に用いる収益性の高い資源に変換することで、ゴミ処理問題を解決することができます。

林業廃棄物を利用することによる環境上の利点は非常に大きいです。このバイオマスをバイオ炭や木炭に変換することで、温室効果ガスの排出や気候変動の原因となる、分解や燃焼の際に排出される炭素が隔離されます。林業廃棄物から生産されるバイオ炭は、炭素の隔離に役立ち、世界の炭素削減目標をサポートし、土壌改良材として利用されると土壌の健全性を高めます。この2つの環境上の利点により、林業廃棄物は非常に魅力的な原料となっています。

「市場の用途セグメントでは、木炭が金額ベースで最大シェアを占めました。」

さまざまな説得力のある理由により、木炭用途が市場を独占しています。第一に、木炭は世界の多くの地域、特に近代的なエネルギー源へのアクセスが限られている発展途上国において、依然として重要かつ頻繁に利用される燃料源です。木炭は調理、暖房、産業活動に広く利用され、何百万もの家庭や企業に信頼できるコスト効率の高いエネルギー源を提供しています。このようなエネルギー源としての木炭に対する継続的な需要が、木炭生産専用の炭化炉市場を牽引しています。さらに、木炭の適応性と幅広い用途が、その世界的な優位性を高めています。燃料としての使用以外に、木炭が金属製錬の還元剤として使用される冶金や、水質浄化、空気ろ過、化学処理に多くの用途がある活性炭の生産など、複数の産業で使用されています。農業部門も土壌改良剤としての木炭の恩恵を受けており、土壌の肥沃度を高め、作物の収穫高を増やしています。こうした多様な用途により、木炭の安定した需要が確保され、効率的な先進の炭化炉へのニーズが高まっています。

「連続式炭化炉が市場の用途セグメントにおいて、金額ベースでもっとも大きなシェアを占めました。」

連続式炭化炉は連続で稼働するように作られており、原料の安定供給とバイオ炭の安定生産が可能です。バッチ式に比べ、生産効率が最大化され、ダウンタイムが最小化されるため、処理能力が向上します。連続運転は、安定した炭化環境を保証し、一定で均質なバイオ炭を生産します。特定用途向けに高級バイオ炭を必要とする産業にとって、これは不可欠です。最新の熱回収システムは連続炉に頻繁に搭載され、プロセス熱を再利用して原料を予熱します。これにより、燃料使用を削減し、エネルギー効率を向上させることができます。連続式炭化システムは、排出を最小限に抑え、環境性能を向上させるよう設計されています。先進の排出制御技術をより効果的にこれらのシステムに統合することで、厳しい環境規制へのコンプライアンスを確保することができます。

当レポートでは、世界の炭化炉市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 炭化炉市場の企業にとって魅力的な機会

- 炭化炉市場:用途別

- 炭化炉市場:タイプ別

- 炭化炉市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 産業動向

- イントロダクション

- 顧客ビジネスに影響を与える動向/混乱

- サプライチェーン分析

- 価格分析

- 平均販売価格の動向:地域別

- 平均販売価格の推移:炭化炉タイプ別

- 主要企業の平均販売価格の動向:タイプ別

- エコシステム分析

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 貿易分析

- 輸入シナリオ(HSコード841780)

- 輸出シナリオ(HSコード841780)

- 主な会議とイベント(2024年~2025年)

- 関税と規制情勢

- 関税分析

- 規制機関、政府機関、その他の組織

- 規制と基準

- ポーターのファイブフォース分析

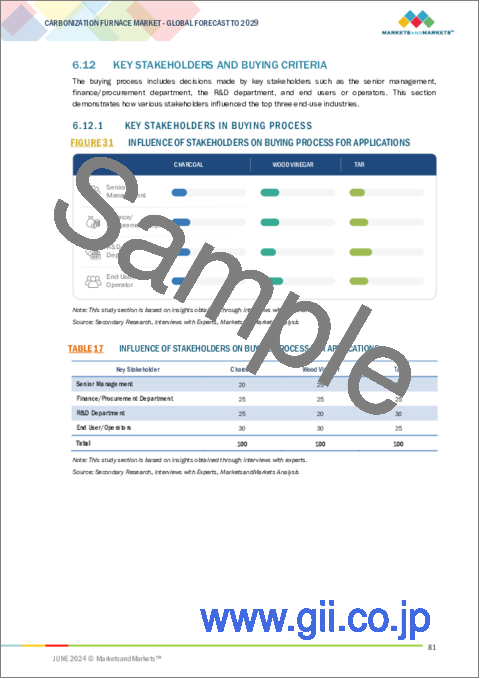

- 主なステークホルダーと購入基準

- マクロ経済指標

- ケーススタディ分析

第7章 炭化炉市場:原料別

- イントロダクション

- 農業廃棄物

- 林業廃棄物

- ナッツの殻

- その他の原料

第8章 炭化炉市場:用途別

- イントロダクション

- 木炭

- ウッドビネガー

- タール

第9章 炭化炉市場:処理能力別

- イントロダクション

- 1,000 kg/時未満

- 1,000~2,000kg/時

- 2,000~3,000kg/時

- 3,000kg/時超

第10章 炭化炉市場:タイプ別

- イントロダクション

- 連続式炭化炉

- 水平木炭炉

- スキッドマウント炭化炉

- その他のタイプ

第11章 炭化炉市場:地域別

- イントロダクション

- アジア太平洋

- アジア太平洋に対する不況の影響

- 中国

- 日本

- インド

- 韓国

- その他のアジア太平洋

- 北米

- 北米に対する不況の影響

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州に対する不況の影響

- ドイツ

- イタリア

- フランス

- 英国

- スペイン

- ロシア

- その他の欧州

- 中東・アフリカ

- 中東・アフリカに対する不況の影響

- GCC

- 南アフリカ

- その他の中東・アフリカ

- 南米

第12章 競合情勢

- イントロダクション

- 主要企業戦略/有力企業(2020年~2023年)

- 市場シェア分析(2023年)

- 収益分析(2020年~2023年)

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 評価と財務指標:炭化炉ベンダー

- 競合シナリオと動向

第13章 企業プロファイル

- 主要企業

- GREENPOWER LTD

- BESTON GROUP CO., LTD.

- ZHENGZHOU BELONG MACHINERY CO., LTD

- TIANJIN MIKIM TECHNIQUE CO., LTD.

- ZHENGZHOU SHULIY MACHINERY CO. LTD

- HENAN CHENGJINLAI MACHINERY CO., LTD.

- GONGYI XIAOYI MINGYANG MACHINERY PLANT

- GONGYI SANJIN CHARCOAL MACHINERY FACTORY

- ZHENGZHOU JIUTIAN MACHINERY EQUIPMENT CO., LTD.

- HENAN SUNRISE BIOCHAR MACHINE CO., LTD

- その他の企業

- ZHENGZHOU FUSMAR MACHINERY CO., LTD

- ZHENGZHOU DINGLI NEW ENERGY TECHNOLOGY CO., LTD

- OLTEN MACHINERY

- AGICO CEMENT MACHINERY CO., LTD.

- HUNAN JINGTAN AUTOMATION EQUIPMENT CO., LTD.

- ZHENGZHOU E.P MACHINERY CO., LTD.

- ABC MACHINERY

- KINGTIGER (SHANGHAI) ENVIRONMENTAL TECHNOLOGY CO., LTD.

- CXINDUCTION

- ZHENGZHOU LEABON MACHINERY EQUIPMENT CO., LTD.

- ZHENGZHOU HENGJU MACHINERY EQUIPMENT CO., LTD

- HENAN LANTIAN MACHINERY MANUFACTURING CO., LTD.

- GOMINE INDUSTRIAL TECHNOLOGY CO., LTD

- DOING HOLDINGS CO., LTD

第14章 付録

List of Tables

- TABLE 1 AVERAGE SELLING PRICE OF CARBONIZATION FURNACES, BY REGION, 2020-2029 (USD/UNIT)

- TABLE 2 AVERAGE SELLING PRICE TREND OF CARBONIZATION FURNACES, BY TYPE, 2020-2023 (USD/UNIT)

- TABLE 3 AVERAGE SELLING PRICE TREND OF CARBONIZATION FURNACES OFFERED BY KEY PLAYERS, BY TYPE (USD/UNIT)

- TABLE 4 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 TOTAL NUMBER OF PATENTS

- TABLE 6 TOP 10 OWNERS OF PATENTS RELATED TO CARBONIZATION FURNACE TECHNOLOGY

- TABLE 7 CARBONIZATION FURNACE TECHNOLOGY-RELATED KEY PATENTS

- TABLE 8 IMPORTANT CONFERENCES AND EVENTS, 2024-2025

- TABLE 9 TARIFF FOR HS CODE 841780-COMPLIANT PRODUCTS, BY COUNTRY (2023)

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REGULATIONS AND STANDARDS FOR PLAYERS IN CARBONIZATION FURNACE MARKET

- TABLE 16 IMPACT OF PORTER'S FIVE FORCES ON CARBONIZATION FURNACE MARKET

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATIONS

- TABLE 18 KEY BUYING CRITERIA FOR APPLICATIONS

- TABLE 19 GDP TRENDS AND FORECASTS, BY COUNTRY, 2020-2029 (USD MILLION)

- TABLE 20 CARBONIZATION FURNACE MARKET, BY FEEDSTOCK, 2020-2023 (USD MILLION)

- TABLE 21 CARBONIZATION FURNACE MARKET, BY FEEDSTOCK, 2024-2029 (USD MILLION)

- TABLE 22 CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 23 CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 24 CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 25 CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 26 CARBONIZATION FURNACE MARKET, BY CAPACITY, 2020-2023 (USD MILLION)

- TABLE 27 CARBONIZATION FURNACE MARKET, BY CAPACITY, 2024-2029 (USD MILLION)

- TABLE 28 CARBONIZATION FURNACE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 29 CARBONIZATION FURNACE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 30 CARBONIZATION FURNACE MARKET, BY TYPE, 2020-2023 (UNITS)

- TABLE 31 CARBONIZATION FURNACE MARKET, BY TYPE, 2024-2029 (UNITS)

- TABLE 32 CARBONIZATION FURNACE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 33 CARBONIZATION FURNACE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 34 CARBONIZATION FURNACE MARKET, BY REGION, 2020-2023 (UNITS)

- TABLE 35 CARBONIZATION FURNACE MARKET, BY REGION, 2024-2029 (UNITS)

- TABLE 36 ASIA PACIFIC: CARBONIZATION FURNACE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 37 ASIA PACIFIC: CARBONIZATION FURNACE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 38 ASIA PACIFIC: CARBONIZATION FURNACE MARKET, BY COUNTRY, 2020-2023 (UNITS)

- TABLE 39 ASIA PACIFIC: CARBONIZATION FURNACE MARKET, BY COUNTRY, 2024-2029 (UNITS)

- TABLE 40 ASIA PACIFIC: CARBONIZATION FURNACE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 41 ASIA PACIFIC: CARBONIZATION FURNACE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 42 ASIA PACIFIC: CARBONIZATION FURNACE MARKET, BY TYPE, 2020-2023 (UNITS)

- TABLE 43 ASIA PACIFIC: CARBONIZATION FURNACE MARKET, BY TYPE, 2024-2029 (UNITS)

- TABLE 44 ASIA PACIFIC: CARBONIZATION FURNACE MARKET, FEEDSTOCK, 2020-2023 (USD MILLION)

- TABLE 45 ASIA PACIFIC: CARBONIZATION FURNACE MARKET, BY FEEDSTOCK, 2024-2029 (USD MILLION)

- TABLE 46 ASIA PACIFIC: CARBONIZATION FURNACE MARKET, BY CAPACITY, 2020-2023 (USD MILLION)

- TABLE 47 ASIA PACIFIC: CARBONIZATION FURNACE MARKET, BY CAPACITY, 2024-2029 (USD MILLION)

- TABLE 48 ASIA PACIFIC: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 49 ASIA PACIFIC: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 50 ASIA PACIFIC: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 51 ASIA PACIFIC: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 52 CHINA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 53 CHINA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 54 CHINA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 55 CHINA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 56 JAPAN: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 57 JAPAN: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 58 JAPAN: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 59 JAPAN: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 60 INDIA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 61 INDIA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 62 INDIA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 63 INDIA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 64 SOUTH KOREA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 65 SOUTH KOREA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 66 SOUTH KOREA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 67 SOUTH KOREA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 68 REST OF ASIA PACIFIC: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 69 REST OF ASIA PACIFIC: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 70 REST OF ASIA PACIFIC: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 71 REST OF ASIA PACIFIC: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 72 NORTH AMERICA: CARBONIZATION FURNACE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 73 NORTH AMERICA: CARBONIZATION FURNACE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 74 NORTH AMERICA: CARBONIZATION FURNACE MARKET, BY COUNTRY, 2020-2023 (UNITS)

- TABLE 75 NORTH AMERICA: CARBONIZATION FURNACE MARKET, BY COUNTRY, 2024-2029 (UNITS)

- TABLE 76 NORTH AMERICA: CARBONIZATION FURNACE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 77 NORTH AMERICA: CARBONIZATION FURNACE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 78 NORTH AMERICA: CARBONIZATION FURNACE MARKET, BY TYPE, 2020-2023 (UNITS)

- TABLE 79 NORTH AMERICA: CARBONIZATION FURNACE MARKET, BY TYPE, 2024-2029 (UNITS)

- TABLE 80 NORTH AMERICA: CARBONIZATION FURNACE MARKET, BY FEEDSTOCK, 2020-2023 (USD MILLION)

- TABLE 81 NORTH AMERICA: CARBONIZATION FURNACE MARKET, BY FEEDSTOCK, 2024-2029 (USD MILLION)

- TABLE 82 NORTH AMERICA: CARBONIZATION FURNACE MARKET, BY CAPACITY, 2020-2023 (USD MILLION)

- TABLE 83 NORTH AMERICA: CARBONIZATION FURNACE MARKET, BY CAPACITY, 2024-2029 (USD MILLION)

- TABLE 84 NORTH AMERICA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 85 NORTH AMERICA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 86 NORTH AMERICA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 87 NORTH AMERICA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 88 US: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 89 US: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 90 US: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 91 US: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 92 CANADA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 93 CANADA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 94 CANADA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 95 CANADA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 96 MEXICO: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 97 MEXICO: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 98 MEXICO: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 99 MEXICO: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 100 EUROPE: CARBONIZATION FURNACE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 101 EUROPE: CARBONIZATION FURNACE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 102 EUROPE: CARBONIZATION FURNACE MARKET, BY COUNTRY, 2020-2023 (UNITS)

- TABLE 103 EUROPE: CARBONIZATION FURNACE MARKET, BY COUNTRY, 2024-2029 (UNITS)

- TABLE 104 EUROPE: CARBONIZATION FURNACE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 105 EUROPE: CARBONIZATION FURNACE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 106 EUROPE: CARBONIZATION FURNACE MARKET, BY TYPE, 2020-2023 (UNITS)

- TABLE 107 EUROPE: CARBONIZATION FURNACE MARKET, BY TYPE, 2024-2029 (UNITS)

- TABLE 108 EUROPE: CARBONIZATION FURNACE MARKET, BY FEEDSTOCK, 2020-2023 (USD MILLION)

- TABLE 109 EUROPE: CARBONIZATION FURNACE MARKET, BY FEEDSTOCK, 2024-2029 (USD MILLION)

- TABLE 110 EUROPE: CARBONIZATION FURNACE MARKET, BY CAPACITY, 2020-2023 (USD MILLION)

- TABLE 111 EUROPE: CARBONIZATION FURNACE MARKET, BY CAPACITY, 2024-2029 (USD MILLION)

- TABLE 112 EUROPE: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 113 EUROPE: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 114 EUROPE: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 115 EUROPE: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 116 GERMANY: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 117 GERMANY: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 118 GERMANY: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 119 GERMANY: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 120 ITALY: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 121 ITALY: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 122 ITALY: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 123 ITALY: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 124 FRANCE: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 125 FRANCE: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 126 FRANCE: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 127 FRANCE: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 128 UK: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 129 UK: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 130 UK: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 131 UK: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 132 SPAIN: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 133 SPAIN: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 134 SPAIN: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 135 SPAIN: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 136 RUSSIA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 137 RUSSIA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 138 RUSSIA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 139 RUSSIA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 140 REST OF EUROPE: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 141 REST OF EUROPE: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 142 REST OF EUROPE: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 143 REST OF EUROPE: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 144 MIDDLE EAST & AFRICA: CARBONIZATION FURNACE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: CARBONIZATION FURNACE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: CARBONIZATION FURNACE MARKET, BY COUNTRY, 2020-2023 (UNITS)

- TABLE 147 MIDDLE EAST & AFRICA: CARBONIZATION FURNACE MARKET, BY COUNTRY, 2024-2029 (UNITS)

- TABLE 148 MIDDLE EAST & AFRICA: CARBONIZATION FURNACE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: CARBONIZATION FURNACE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: CARBONIZATION FURNACE MARKET, BY TYPE, 2020-2023 (UNITS)

- TABLE 151 MIDDLE EAST & AFRICA: CARBONIZATION FURNACE MARKET, BY TYPE, 2024-2029 (UNITS)

- TABLE 152 MIDDLE EAST & AFRICA: CARBONIZATION FURNACE MARKET, BY FEEDSTOCK, 2020-2023 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: CARBONIZATION FURNACE MARKET, BY FEEDSTOCK, 2024-2029 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: CARBONIZATION FURNACE MARKET, BY CAPACITY, 2020-2023 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: CARBONIZATION FURNACE MARKET, BY CAPACITY, 2024-2029 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 159 MIDDLE EAST & AFRICA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 160 SAUDI ARABIA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 161 SAUDI ARABIA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 162 SAUDI ARABIA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 163 SAUDI ARABIA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 164 UAE: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 165 UAE: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 166 UAE: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 167 UAE: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 168 REST OF GCC: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 169 REST OF GCC: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 170 REST OF GCC: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 171 REST OF GCC: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 172 SOUTH AFRICA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 173 SOUTH AFRICA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 174 SOUTH AFRICA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 175 SOUTH AFRICA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 176 REST OF MIDDLE EAST & AFRICA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 177 REST OF MIDDLE EAST & AFRICA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 178 REST OF MIDDLE EAST & AFRICA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 179 REST OF MIDDLE EAST & AFRICA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 180 SOUTH AMERICA: CARBONIZATION FURNACE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 181 SOUTH AMERICA: CARBONIZATION FURNACE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 182 SOUTH AMERICA: CARBONIZATION FURNACE MARKET, BY COUNTRY, 2020-2023 (UNITS)

- TABLE 183 SOUTH AMERICA: CARBONIZATION FURNACE MARKET, BY COUNTRY, 2024-2029 (UNITS)

- TABLE 184 SOUTH AMERICA: CARBONIZATION FURNACE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 185 SOUTH AMERICA: CARBONIZATION FURNACE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 186 SOUTH AMERICA: CARBONIZATION FURNACE MARKET, BY TYPE, 2020-2023 (UNITS)

- TABLE 187 SOUTH AMERICA: CARBONIZATION FURNACE MARKET, BY TYPE, 2024-2029 (UNITS)

- TABLE 188 SOUTH AMERICA: CARBONIZATION FURNACE MARKET, BY FEEDSTOCK, 2020-2023 (USD MILLION)

- TABLE 189 SOUTH AMERICA: CARBONIZATION FURNACE MARKET, BY FEEDSTOCK, 2024-2029 (USD MILLION)

- TABLE 190 SOUTH AMERICA: CARBONIZATION FURNACE MARKET, BY CAPACITY, 2020-2023 (USD MILLION)

- TABLE 191 SOUTH AMERICA: CARBONIZATION FURNACE MARKET, BY CAPACITY, 2024-2029 (USD MILLION)

- TABLE 192 SOUTH AMERICA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 193 SOUTH AMERICA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 194 SOUTH AMERICA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 195 SOUTH AMERICA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 196 ARGENTINA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 197 ARGENTINA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 198 ARGENTINA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 199 ARGENTINA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 200 BRAZIL: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 201 BRAZIL: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 202 BRAZIL: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 203 BRAZIL: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 204 REST OF SOUTH AMERICA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 205 REST OF SOUTH AMERICA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 206 REST OF SOUTH AMERICA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2020-2023 (UNITS)

- TABLE 207 REST OF SOUTH AMERICA: CARBONIZATION FURNACE MARKET, BY APPLICATION, 2024-2029 (UNITS)

- TABLE 208 OVERVIEW OF STRATEGIES ADOPTED BY KEY CARBONIZATION FURNACE MANUFACTURERS

- TABLE 209 CARBONIZATION FURNACE MARKET: DEGREE OF COMPETITION, 2023

- TABLE 210 CARBONIZATION FURNACE MARKET: TYPE FOOTPRINT

- TABLE 211 CARBONIZATION FURNACE MARKET: APPLICATION FOOTPRINT

- TABLE 212 CARBONIZATION FURNACE MARKET: FEEDSTOCK FOOTPRINT

- TABLE 213 CARBONIZATION FURNACE MARKET: REGION FOOTPRINT

- TABLE 214 CARBONIZATION FURNACE MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 215 CARBONIZATION FURNACE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 216 CARBONIZATION FURNACE MARKET: EXPANSIONS, JANUARY 2020- FEBRUARY 2024

- TABLE 217 CARBONIZATION FURNACE MARKET: OTHERS, JANUARY 2020-FEBRUARY 2024

- TABLE 218 GREENPOWER LTD: COMPANY OVERVIEW

- TABLE 219 GREENPOWER LTD: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 220 GREENPOWER LTD: OTHER DEVELOPMENTS

- TABLE 221 BESTON GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 222 BESTON GROUP CO., LTD.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 223 ZHENGZHOU BELONG MACHINERY CO., LTD: COMPANY OVERVIEW

- TABLE 224 ZHENGZHOU BELONG MACHINERY CO., LTD: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 225 TIANJIN MIKIM TECHNIQUE CO., LTD.: COMPANY OVERVIEW

- TABLE 226 TIANJIN MIKIM TECHNIQUE CO., LTD.: PRODUCT OFFERINGS

- TABLE 227 ZHENGZHOU SHULIY MACHINERY CO. LTD: COMPANY OVERVIEW

- TABLE 228 ZHENGZHOU SHULIY MACHINERY CO. LTD: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 229 ZHENGZHOU SHULIY MACHINERY CO. LTD: EXPANSIONS

- TABLE 230 HENAN CHENGJINLAI MACHINERY CO., LTD.: COMPANY OVERVIEW

- TABLE 231 HENAN CHENGJINLAI MACHINERY CO., LTD.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 232 GONGYI XIAOYI MINGYANG MACHINERY PLANT: COMPANY OVERVIEW

- TABLE 233 GONGYI XIAOYI MINGYANG MACHINERY PLANT: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 234 GONGYI SANJIN CHARCOAL MACHINERY FACTORY: COMPANY OVERVIEW

- TABLE 235 GONGYI SANJIN CHARCOAL MACHINERY FACTORY: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 236 ZHENGZHOU JIUTIAN MACHINERY EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 237 ZHENGZHOU JIUTIAN MACHINERY EQUIPMENT CO., LTD.: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 238 HENAN SUNRISE BIOCHAR MACHINE CO., LTD: COMPANY OVERVIEW

- TABLE 239 HENAN SUNRISE BIOCHAR MACHINE CO., LTD: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 240 ZHENGZHOU FUSMAR MACHINERY CO., LTD: COMPANY OVERVIEW

- TABLE 241 ZHENGZHOU DINGLI NEW ENERGY TECHNOLOGY CO., LTD: COMPANY OVERVIEW

- TABLE 242 OLTEN MACHINERY: COMPANY OVERVIEW

- TABLE 243 AGICO CEMENT MACHINERY CO., LTD.: COMPANY OVERVIEW

- TABLE 244 HUNAN JINGTAN AUTOMATION EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 245 ZHENGZHOU E.P MACHINERY CO., LTD.: COMPANY OVERVIEW

- TABLE 246 ABC MACHINERY: COMPANY OVERVIEW

- TABLE 247 KINGTIGER (SHANGHAI) ENVIRONMENTAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 248 CXINDUCTION: COMPANY OVERVIEW

- TABLE 249 ZHENGZHOU LEABON MACHINERY EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 250 ZHENGZHOU HENGJU MACHINERY EQUIPMENT CO., LTD: COMPANY OVERVIEW

- TABLE 251 HENAN LANTIAN MACHINERY MANUFACTURING CO., LTD.: COMPANY OVERVIEW

- TABLE 252 GOMINE INDUSTRIAL TECHNOLOGY CO., LTD: COMPANY OVERVIEW

- TABLE 253 DOING HOLDINGS CO., LTD: COMPANY OVERVIEW

List of Figures

- FIGURE 1 CARBONIZATION FURNACE MARKET SEGMENTATION

- FIGURE 2 CARBONIZATION FURNACE MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 CARBONIZATION FURNACE MARKET: DATA TRIANGULATION

- FIGURE 9 COUNTINOUS CARBONIZATION FURNACE SEGMENT TO LEAD MARKET, BY TYPE, FROM 2024 TO 2029

- FIGURE 10 CHARCOAL SEGMENT TO COMMAND CARBONIZATION FURNACE MARKET, BY APPLICATION, THROUGHOUT FORECAST PERIOD

- FIGURE 11 FORESTRY WASTE SEGMENT TO DOMINATE MARKET, BY FEEDSTOCK, BETWEEN 2024 AND 2029

- FIGURE 12 <1,000 KG/H SEGMENT TO LEAD CARBONIZATION FURNACE MARKET, BY CAPACITY, THROUGHOUT FORECAST PERIOD

- FIGURE 13 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF CARBONIZATION FURNACE MARKET IN 2023

- FIGURE 14 GROWING USE OF CARBONIZATION FURNACES TO PRODUCE CHARCOAL AND TAR TO DRIVE MARKET

- FIGURE 15 CHARCOAL TO BE FASTEST-GROWING SEGMENT IN CARBONIZATION FURNACE MARKET DURING FORECAST PERIOD

- FIGURE 16 CONTINUOUS CARBONIZATION FURNACE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 17 MEXICO TO BE FASTEST-GROWING MARKET GLOBALLY DURING FORECAST PERIOD

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: CARBONIZATION FURNACE MARKET

- FIGURE 19 TRENDS INFLUENCING CUSTOMER BUSINESS

- FIGURE 20 CARBONIZATION FURNACE MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 21 CARBONIZATION FURNACE MARKET: AVERAGE SELLING PRICE TREND, BY REGION, 2020-2029 (USD/UNIT)

- FIGURE 22 AVERAGE SELLING PRICE TREND OF CARBONIZATION FURNACE TYPES PROVIDED BY KEY PLAYERS

- FIGURE 23 CARBONIZATION FURNACE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 PATENTS GRANTED OVER LAST 10 YEARS

- FIGURE 25 PATENT ANALYSIS, BY LEGAL STATUS

- FIGURE 26 REGIONAL ANALYSIS OF PATENTS GRANTED FOR CARBONIZATION FURNACE TECHNOLOGY, 2023

- FIGURE 27 TOP 10 COMPANIES WITH SUBSTANTIAL NUMBER OF PATENTS, 2013-2023

- FIGURE 28 IMPORT DATA FOR HS CODE 841780-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 29 EXPORT DATA FOR HS CODE 841780-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 30 PORTER'S FIVE FORCES ANALYSIS: CARBONIZATION FURNACE MARKET

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATIONS

- FIGURE 32 KEY BUYING CRITERIA FOR APPLICATIONS

- FIGURE 33 FORESTRY WASTE SEGMENT TO COMMAND CARBONIZATION FURNACE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 34 CHARCOAL TO LEAD CARBONIZATION FURNACE MARKET DURING FORECAST PERIOD

- FIGURE 35 <1,000 KG/H SEGMENT TO DOMINATE CARBONIZATION FURNACE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 36 CONTINUOUS CARBONIZATION FURNACE SEGMENT TO LEAD MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 37 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC: CARBONIZATION FURNACE MARKET SNAPSHOT

- FIGURE 39 NORTH AMERICA: CARBONIZATION FURNACE MARKET SNAPSHOT

- FIGURE 40 EUROPE: CARBONIZATION FURNACE MARKET SNAPSHOT

- FIGURE 41 RANKING OF TOP 5 PLAYERS IN CARBONIZATION FURNACE MARKET, 2023

- FIGURE 42 CARBONIZATION FURNACE MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- FIGURE 43 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 44 BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 45 CARBONIZATION FURNACE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 46 CARBONIZATION FURNACE MARKET: COMPANY FOOTPRINT

- FIGURE 47 CARBONIZATION FURNACE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 48 EV/EBITDA OF KEY VENDORS

- FIGURE 49 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

The Carbonization furnace market size is projected to grow from USD 263 million in 2024 to USD 425 million by 2029, registering a CAGR of 10.1% during the forecast period. A variety of variables contribute to the carbonization furnace market's growth and evolution. One of the key motivators is the growing global emphasis on sustainability and environmental protection. As concerns about climate change and carbon emissions grow, industry and governments are actively looking for solutions that increase carbon sequestration while reducing environmental footprint. Carbonization furnaces, particularly those used to generate biochar and charcoal, are critical to these efforts. These furnaces contribute to carbon capture and storage by turning biomass into stable carbon forms, reducing the influence of greenhouse gases.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion/ Million) |

| Segments | Type, Feedstock, Application, Capacity, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

" Forestry waste accounted for the largest share in feedstock segment of Carbonization furnace market in terms of value."

Forestry waste feedstock dominates the carbonization furnace market due to its quantity, cost-effectiveness, and environmental benefits. Forestry activities such as logging and forest management produce massive volumes of residual biomass, which includes branches, bark, sawdust, and wood chips. This biomass, which is commonly classified as waste, is a widely available and inexpensive feedstock for carbonization furnaces. Using forestry waste solves trash disposal problems by converting what would otherwise be an environmental burden into a profitable resource for biochar and charcoal manufacturing.

The environmental benefits of utilizing forestry waste are enormous. Converting this biomass into biochar or charcoal sequesters carbon that would otherwise be released during decomposition or combustion, which contributes to greenhouse gas emissions and climate change. Biochar produced from forestry waste helps sequester carbon supports global carbon reduction goals and enhances soil health when applied as a soil amendment. This dual environmental benefit makes forestry waste a highly attractive feedstock.

"Charcoal accounted for the largest share in application segment of Carbonization furnace market in terms of value."

Charcoal applications dominate the carbonization furnace market for a variety of compelling reasons. Primarily, charcoal remains an important and frequently utilised source of fuel in many parts of the world, particularly in developing countries with limited access to modern energy sources. It is widely used for cooking, heating, and industrial activities, offering a dependable and cost-effective energy source for millions of homes and companies. This ongoing demand for charcoal as an energy source is driving the market for carbonization furnaces specifically built for charcoal production. Furthermore, charcoal's adaptability and broad range of applications add to its global dominance. Aside from its usage as a fuel, charcoal is employed in several industries, including metallurgy, where it is used as a reducing agent in the smelting of metals, and in the production of activated carbon, which has numerous applications in water purification, air filtration, and chemical processing. The agricultural sector also benefits from charcoal as a soil amendment, enhancing soil fertility and crop yields. These diverse applications ensure a steady and robust demand for charcoal, thereby fueling the need for efficient and advanced carbonization furnaces.

" Countinous Carbonization Furnace accounted for the largest share in application segment of Carbonization furnace market in terms of value."

Continuous carbonization furnaces are made to run continuously, enabling a steady supply of raw materials and a steady output of biochar. In comparison to batch procedures, this maximizes production efficiency and minimize downtime, resulting in better throughput. Constant operation guarantees a steady and regulated carbonization environment, producing biochar of a constant and homogeneous grade. For industries that need premium biochar for certain uses, this is essential. Modern heat recovery systems are frequently installed in continuous furnaces, which reuse process heat to pre-heat incoming material. This lowers fuel use and improves energy efficiency. Continuous carbonization systems are designed to minimize emissions and improve environmental performance. Advanced emission control technologies can be more effectively integrated into these systems, ensuring compliance with stringent environmental regulations.

"North America is the largest market for Carbonization furnace."

North America has the biggest market share in the carbonization furnace industry, because to a combination of strong industrial infrastructure, technical breakthroughs, and stringent environmental laws. The region has a strong industrial foundation, with significant expertise and investment in innovative manufacturing technology such as carbonization furnaces. This industrial competency enables the development, production, and deployment of high-efficiency carbonization technologies, ensuring North America's market leadership. Technological innovation is a key aspect driving the North American market. Companies in the region are at the forefront of R&D, constantly refining furnace designs for increased efficiency, automation, and scalability. These advancements include updated control systems, improved heat distribution mechanisms, and the integration of emission control technologies, all of which increase the performance and environmental compliance of carbonization furnaces.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the Carbonization furnace market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C Level Executives- 20%, Directors - 10%, and Others - 70%

- By Region: North America - 20%, Europe - 30%, APAC - 30%, the Middle East & Africa -10%, and South America- 10%

The Carbonization furnace market comprises major players such GreenPower LTD (Europe), Beston Group Co., Ltd. (China), Zhengzhou Belong Machinery Co., Ltd (China), Zhengzhou Shuliy Machinery Co. Ltd (China), Tianjin Mikim Technique Co., Ltd. (China), Henan Chengjinlai Machinery Co., Ltd. (China), Gongyi Xiaoyi Mingyang Machinery Plant (China), Gongyi Sanjin Charcoal Machinery Factory (China), Zhengzhou Jiutian Machinery Equipment Co., Ltd. (China), and Henan Sunrise Biochar Machine Co.,Ltd (China). The study includes in-depth competitive analysis of these key players in the Carbonization furnace market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the market for Carbonization furnace market on the basis of grade, function, application, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, and expansions associated with the market for Carbonization furnace market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the Carbonization furnace market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of drivers: (Increasing demand for sustainable agriculture and soil improvement, Carbon sequestration and climate change mitigation, Renewable energy production ), restraints (Market Disparities and Socioeconomic Factors can affect the equitable distribution), opportunities (By valorizing waste streams and closing the loop in the circular economy, Soil Remediation and Environmental Restoration), and challenges (Limited awareness about benefits of carbonization hampers market growth) influencing the growth of Carbonization furnace market.

- Market Penetration: Comprehensive information on the Carbonization furnace market offered by top players in the global Carbonization furnace market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, in the Carbonization furnace market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for Carbonization furnace market across regions.

- Market Capacity: Production capacities of companies producing Carbonization furnace are provided wherever available with upcoming capacities for the Carbonization furnace market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the Carbonization furnace market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 MARKETS COVERED

- 1.3.3 REGIONAL SCOPE

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of major secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants/Key opinion leaders

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 SUPPLY-SIDE APPROACH

- 2.2.2 DEMAND-SIDE APPROACH

- 2.3 FORECAST

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RECESSION IMPACT ANALYSIS

- 2.8 HISTORICAL TREND AND GROWTH FORECAST

- 2.9 RISK ASSESSMENT

- 2.10 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CARBONIZATION FURNACE MARKET

- 4.2 CARBONIZATION FURNACE MARKET, BY APPLICATION

- 4.3 CARBONIZATION FURNACE MARKET, BY TYPE

- 4.4 CARBONIZATION FURNACE MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing focus of farmers on sustainable agriculture and soil improvement

- 5.2.1.2 Rising efforts toward climate change mitigation through carbon sequestration

- 5.2.1.3 Growing emphasis on renewable energy production

- 5.2.2 RESTRAINTS

- 5.2.2.1 Market disparities and socioeconomic factors

- 5.2.2.2 High dependence on fossil fuel in biochar production

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Harnessing carbonization technology to transform waste into wealth

- 5.2.3.2 Soil remediation, sustainable land management, and environmental restoration efforts

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited awareness about benefits of carbonization technology

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.4 PRICING ANALYSIS

- 6.4.1 AVERAGE SELLING PRICE TREND, BY REGION

- 6.4.2 AVERAGE SELLING PRICE TREND OF CARBONIZATION FURNACE, BY TYPE

- 6.4.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE

- 6.5 ECOSYSTEM ANALYSIS

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 KEY TECHNOLOGIES

- 6.6.1.1 Pyrolysis

- 6.6.2 COMPLEMENTARY TECHNOLOGIES

- 6.6.2.1 Gasification

- 6.6.2.2 Emission control

- 6.6.3 ADJACENT TECHNOLOGIES

- 6.6.3.1 Biomass pretreatment

- 6.6.3.2 Bio-oil upgrading

- 6.6.3.3 Syngas utilization

- 6.6.1 KEY TECHNOLOGIES

- 6.7 PATENT ANALYSIS

- 6.7.1 METHODOLOGY

- 6.7.2 TOTAL PATENTS, 2013-2023

- 6.7.2.1 Patent publication trends, 2013-2023

- 6.7.3 INSIGHTS

- 6.7.4 LEGAL STATUS

- 6.7.5 JURISDICTION ANALYSIS

- 6.7.6 TOP APPLICANTS

- 6.7.7 KEY PATENTS RELATED TO CARBONIZATION FURNACE TECHNOLOGY

- 6.8 TRADE ANALYSIS

- 6.8.1 IMPORT SCENARIO (HS CODE 841780)

- 6.8.2 EXPORT SCENARIO (HS CODE 841780)

- 6.9 KEY CONFERENCES AND EVENTS, 2024-2025

- 6.10 TARIFF AND REGULATORY LANDSCAPE

- 6.10.1 TARIFF ANALYSIS

- 6.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10.3 REGULATIONS AND STANDARDS

- 6.11 PORTER'S FIVE FORCES ANALYSIS

- 6.11.1 THREAT OF NEW ENTRANTS

- 6.11.2 THREAT OF SUBSTITUTES

- 6.11.3 BARGAINING POWER OF SUPPLIERS

- 6.11.4 BARGAINING POWER OF BUYERS

- 6.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.12.2 BUYING CRITERIA

- 6.13 MACROECONOMIC INDICATORS

- 6.13.1 GDP TRENDS AND FORECASTS, BY COUNTRY

- 6.14 CASE STUDY ANALYSIS

- 6.14.1 JAPAN-BASED STEEL PRODUCER DEPLOYED CARBONIZATION FURNACES TO CONVERT BIOMASS INTO BIO-COKE

- 6.14.2 UNIVERSITY OF WASHINGTON EXAMINED NEWLY DESIGNED CARBONIZATION FURNACES TO ENSURE SUSTAINABLE BIOCHAR PRODUCTION

- 6.14.3 THYSSENKRUPP ROTHE ERDE INSTALLED CARBONIZATION PLANT IN LIPPSTADT TO REDUCE OPERATIONAL COST AND C02 EMISSIONS

7 CARBONIZATION FURNACE MARKET, BY FEEDSTOCK

- 7.1 INTRODUCTION

- 7.2 AGRICULTURAL WASTE

- 7.2.1 ENVIRONMENTAL AND ECONOMIC ADVANTAGES TO BOOST UTILIZATION OF AGRICULTURAL WASTE IN BIOCHAR PRODUCTION

- 7.2.2 CORN STALKS

- 7.2.3 WHEAT STRAW

- 7.2.4 RICE HUSKS

- 7.2.5 SUGARCANE BAGASSE

- 7.3 FORESTRY WASTE

- 7.3.1 HIGH ADOPTION OF RENEWABLE ENERGY SOURCES TO FUEL SEGMENTAL GROWTH

- 7.3.2 SAWDUST AND WOOD CHIPS

- 7.3.3 BAMBOO

- 7.3.4 TRUNKS AND BRANCHES

- 7.4 NUTSHELLS

- 7.4.1 SIGNIFICANT DEMAND FOR HIGH-QUALITY CHARCOAL TO FOSTER SEGMENTAL GROWTH

- 7.4.2 COCONUT SHELLS

- 7.4.3 PALM SHELLS

- 7.4.4 OLIVE SHELLS

- 7.4.5 HAZELNUT SHELLS

- 7.5 OTHER FEEDSTOCKS

8 CARBONIZATION FURNACE MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 CHARCOAL

- 8.2.1 CEMENT, BRICK, AND BOILER FACTORIES TO CONTRIBUTE TO MARKET GROWTH

- 8.2.1.1 Charcoal applications

- 8.2.1.1.1 Smelter

- 8.2.1.1.2 Fuel

- 8.2.1.1.3 Purifier

- 8.2.1.1.4 Fertilizer

- 8.2.1.1.5 Insulating material

- 8.2.1.1 Charcoal applications

- 8.2.1 CEMENT, BRICK, AND BOILER FACTORIES TO CONTRIBUTE TO MARKET GROWTH

- 8.3 WOOD VINEGAR

- 8.3.1 RISING DEMAND FROM AGRICULTURAL, INDUSTRIAL, WASTE TREATMENT, AND LIVESTOCK APPLICATIONS TO SUPPORT SEGMENTAL GROWTH

- 8.3.1.1 Wood vinegar applications

- 8.3.1.1.1 Soil enhancer

- 8.3.1.1.2 Deodorizer

- 8.3.1.1.3 Fertilizer

- 8.3.1.1.4 Additive

- 8.3.1.1.5 Food preservative

- 8.3.1.1 Wood vinegar applications

- 8.3.1 RISING DEMAND FROM AGRICULTURAL, INDUSTRIAL, WASTE TREATMENT, AND LIVESTOCK APPLICATIONS TO SUPPORT SEGMENTAL GROWTH

- 8.4 TAR

- 8.4.1 VERSATILE APPLICATIONS IN CONSTRUCTION, FUEL GENERATION, AND WOOD PRESERVATION TO BOOST DEMAND

- 8.4.1.1 Tar applications

- 8.4.1.1.1 Fuel

- 8.4.1.1.2 Waterproof feedstock

- 8.4.1.1.3 Carbon black

- 8.4.1.1 Tar applications

- 8.4.1 VERSATILE APPLICATIONS IN CONSTRUCTION, FUEL GENERATION, AND WOOD PRESERVATION TO BOOST DEMAND

9 CARBONIZATION FURNACE MARKET, BY CAPACITY

- 9.1 INTRODUCTION

- 9.2 <1,000 KG/H

- 9.2.1 FARMERS, SMALL-SCALE COOPERATIVES, AND RESEARCH FACILITIES TO CONTRIBUTE TO SEGMENTAL GROWTH

- 9.3 1,000-2,000 KG/H

- 9.3.1 SEMI-CONTINUOUS OPERATIONAL MODE AND ABILITY TO ACCOMMODATE DIVERSE BIOMASS MATERIALS TO BOOST DEMAND

- 9.4 2,000-3,000 KG/H

- 9.4.1 SIGNIFICANT DEMAND FROM FORESTRY AND WASTE MANAGEMENT INDUSTRIES TO SUPPORT MARKET GROWTH

- 9.5 >3,000 KG/H

- 9.5.1 HIGH CAPACITY AND ADVANCED AUTOMATION AND EMISSION CONTROL FEATURES TO DRIVE ADOPTION

10 CARBONIZATION FURNACE MARKET, BY TYPE

- 10.1 INTRODUCTION

- 10.2 CONTINUOUS CARBONIZATION FURNACE

- 10.2.1 NEED TO PRODUCE LARGE-SCALE BIOCHAR WITH CONSISTENT QUALITY TO FOSTER SEGMENTAL GROWTH

- 10.3 HORIZONTAL CHARCOAL FURNACE

- 10.3.1 UNIFORM HEAT DISTRIBUTION AND ABILITY TO HANDLE DIFFERENT BIOMASS TYPES TO BOOST SEGMENTAL GROWTH

- 10.4 SKID-MOUNTED CARBONIZATION FURNACE

- 10.4.1 INCREASING ADOPTION IN FORESTRY OPERATIONS DUE TO PORTABILITY AND USER-FRIENDLY INTERFACE TO SUPPORT SEGMENTAL GROWTH

- 10.5 OTHER TYPES

11 CARBONIZATION FURNACE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 ASIA PACIFIC: RECESSION IMPACT

- 11.2.2 CHINA

- 11.2.2.1 Climate change mitigation and waste management initiatives to drive market

- 11.2.3 JAPAN

- 11.2.3.1 Focus on developing innovative carbonization solutions to fuel market growth

- 11.2.4 INDIA

- 11.2.4.1 Increasing adoption of sustainable farming techniques to accelerate market growth

- 11.2.5 SOUTH KOREA

- 11.2.5.1 Government subsidies for biomass utilization, soil improvement projects, and sustainable agricultural practices to promote market growth

- 11.2.6 REST OF ASIA PACIFIC

- 11.3 NORTH AMERICA

- 11.3.1 NORTH AMERICA: RECESSION IMPACT

- 11.3.2 US

- 11.3.2.1 Growing use of precision farming techniques to augment market growth

- 11.3.3 CANADA

- 11.3.3.1 Robust agricultural and forestry sectors to support market growth

- 11.3.4 MEXICO

- 11.3.4.1 Commitment to sustainability and environmental responsibility to create market growth opportunities

- 11.4 EUROPE

- 11.4.1 EUROPE: RECESSION IMPACT

- 11.4.2 GERMANY

- 11.4.2.1 Strong emphasis on recycling and waste reduction to stimulate demand

- 11.4.3 ITALY

- 11.4.3.1 Renewable energy projects and waste-to-energy initiatives to create lucrative opportunities

- 11.4.4 FRANCE

- 11.4.4.1 Stringent regulations to protect water quality and reduce pollution from agricultural runoff to drive market

- 11.4.5 UK

- 11.4.5.1 Advanced research and innovation in biochar technology to support market growth

- 11.4.6 SPAIN

- 11.4.6.1 Adoption of circular economy model to spur demand for carbonization furnaces

- 11.4.7 RUSSIA

- 11.4.7.1 Decarbonization efforts to contribute to market growth

- 11.4.8 REST OF EUROPE

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 11.5.2 GCC

- 11.5.2.1 Saudi Arabia

- 11.5.2.1.1 Urgent need for effective waste utilization and water conservation technologies to create opportunities

- 11.5.2.2 UAE

- 11.5.2.2.1 Increasing investment in sustainable agricultural practices to contribute to market growth

- 11.5.2.3 Rest of GCC

- 11.5.2.1 Saudi Arabia

- 11.5.3 SOUTH AFRICA

- 11.5.3.1 Government programs promoting use of biochar to fuel market growth

- 11.5.4 REST OF MIDDLE EAST & AFRICA

- 11.6 SOUTH AMERICA

- 11.6.1 SOUTH AMERICA: RECESSION IMPACT

- 11.6.1.1 Argentina

- 11.6.1.1.1 Growing demand for biochar from metallurgy industry to facilitate market growth

- 11.6.1.2 Brazil

- 11.6.1.2.1 Significant focus on agroecological practices and bioenergy production to drive market

- 11.6.1.3 Rest of South America

- 11.6.1.1 Argentina

- 11.6.1 SOUTH AMERICA: RECESSION IMPACT

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2023

- 12.3 MARKET SHARE ANALYSIS, 2023

- 12.3.1 RANKING OF KEY MARKET PLAYERS, 2023

- 12.3.2 MARKET SHARE OF KEY PLAYERS, 2023

- 12.4 REVENUE ANALYSIS, 2020-2023

- 12.5 BRAND/PRODUCT COMPARISON

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.6.5.1 Company footprint

- 12.6.5.2 Type footprint

- 12.6.5.3 Application footprint

- 12.6.5.4 Feedstock footprint

- 12.6.5.5 Region footprint

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 12.7.5.1 Detailed list of key startups/SMEs

- 12.7.5.2 Competitive benchmarking of key startups/SMEs

- 12.8 VALUATION AND FINANCIAL METRICS: CARBONIZATION FURNACE VENDORS

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 EXPANSIONS

- 12.9.2 OTHERS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 GREENPOWER LTD

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 BESTON GROUP CO., LTD.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 MnM view

- 13.1.2.3.1 Key strengths

- 13.1.2.3.2 Strategic choices

- 13.1.2.3.3 Weaknesses/Competitive threats

- 13.1.3 ZHENGZHOU BELONG MACHINERY CO., LTD

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 MnM view

- 13.1.3.3.1 Key strengths

- 13.1.3.3.2 Strategic choices

- 13.1.3.3.3 Weaknesses/Competitive threats

- 13.1.4 TIANJIN MIKIM TECHNIQUE CO., LTD.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Key strengths

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses/Competitive threats

- 13.1.5 ZHENGZHOU SHULIY MACHINERY CO. LTD

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Expansions

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 HENAN CHENGJINLAI MACHINERY CO., LTD.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 MnM view

- 13.1.6.3.1 Key strengths

- 13.1.6.3.2 Strategic choices

- 13.1.6.3.3 Weaknesses/Competitive threats

- 13.1.7 GONGYI XIAOYI MINGYANG MACHINERY PLANT

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 MnM view

- 13.1.7.3.1 Key strengths

- 13.1.7.3.2 Strategic choices

- 13.1.7.3.3 Weaknesses/Competitive threats

- 13.1.8 GONGYI SANJIN CHARCOAL MACHINERY FACTORY

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 MnM view

- 13.1.8.3.1 Key strengths

- 13.1.8.3.2 Strategic choices

- 13.1.8.3.3 Weaknesses/Competitive threats

- 13.1.9 ZHENGZHOU JIUTIAN MACHINERY EQUIPMENT CO., LTD.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Services/Solutions offered

- 13.1.9.3 MnM view

- 13.1.9.3.1 Key strengths

- 13.1.9.3.2 Strategic choices

- 13.1.9.3.3 Weaknesses/Competitive threats

- 13.1.10 HENAN SUNRISE BIOCHAR MACHINE CO., LTD

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 MnM view

- 13.1.10.3.1 Key strengths

- 13.1.10.3.2 Strategic choices

- 13.1.10.3.3 Weaknesses/Competitive threats

- 13.1.1 GREENPOWER LTD

- 13.2 OTHER PLAYERS

- 13.2.1 ZHENGZHOU FUSMAR MACHINERY CO., LTD

- 13.2.2 ZHENGZHOU DINGLI NEW ENERGY TECHNOLOGY CO., LTD

- 13.2.3 OLTEN MACHINERY

- 13.2.4 AGICO CEMENT MACHINERY CO., LTD.

- 13.2.5 HUNAN JINGTAN AUTOMATION EQUIPMENT CO., LTD.

- 13.2.6 ZHENGZHOU E.P MACHINERY CO., LTD.

- 13.2.7 ABC MACHINERY

- 13.2.8 KINGTIGER (SHANGHAI) ENVIRONMENTAL TECHNOLOGY CO., LTD.

- 13.2.9 CXINDUCTION

- 13.2.10 ZHENGZHOU LEABON MACHINERY EQUIPMENT CO., LTD.

- 13.2.11 ZHENGZHOU HENGJU MACHINERY EQUIPMENT CO., LTD

- 13.2.12 HENAN LANTIAN MACHINERY MANUFACTURING CO., LTD.

- 13.2.13 GOMINE INDUSTRIAL TECHNOLOGY CO., LTD

- 13.2.14 DOING HOLDINGS CO., LTD

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS