|

|

市場調査レポート

商品コード

1516917

小口径弾薬の世界市場:用途別、弾丸タイプ別、口径別、殺傷力別、地域別 - 2029年までの予測Small Caliber Ammunition Market by Application (Military, Homeland Security), Caliber Type (9MM Parabellum, 5.56MM, 7.62MM, 12.7MM, 14.5MM, .338 LAPUA Magnum, .338 Norma Magnum), Bullet Type, Lethality and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 小口径弾薬の世界市場:用途別、弾丸タイプ別、口径別、殺傷力別、地域別 - 2029年までの予測 |

|

出版日: 2024年07月12日

発行: MarketsandMarkets

ページ情報: 英文 304 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

小口径弾薬の市場規模は、2024年に57億米ドルになるとみられ、2024年から2029年までのCAGRは4.3%と見込まれており、2029年には70億米ドルに達すると予測されています。

市場成長の主因は、来るべきテロの脅威に対抗するための世界の軍備近代化です。小口径弾薬の需要は、世界の地政学的紛争のために増加しています。世界の安全保障上の懸念の高まり、小口径弾薬の調達や国防費への政府投資が市場成長を後押ししています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | 用途別、弾丸タイプ別、口径別、殺傷力別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

小口径弾薬市場の用途別軍事セグメントは、台頭する脅威に対抗するための軍事力強化のための国防予算と弾薬調達の増加によって牽引されています。軍隊の近代化、継続的な軍事訓練プログラム、平和維持任務、世界の歩兵部隊の拡大により、小口径弾薬の大規模調達に重点を置く需要が増加していることが、このセグメントの市場成長に拍車をかけています。

口径タイプ別の小口径弾薬市場は、9mmパラベラム、5.56mm、7.62mm、12.7mm、14.5mm、.338ラプアマグナム、.338ノルママグナム、その他に区分されます。7.62mmセグメントは予測期間中に最も高いCAGRで成長すると予測されています。7.62mm口径のライフル銃や機関銃への採用が多数の軍や国土安全保障で増加していることが市場成長の原動力となっています。7.62mm口径は、信頼性、長距離での有効性、貫通力を高め、戦闘シナリオや戦術作戦に適しています。現在進行中の世界の軍事近代化と防衛予算の増加が、このセグメントの市場成長を後押ししています。

当レポートでは、世界の小口径弾薬市場について調査し、用途別、弾丸タイプ別、口径別、殺傷力別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- 顧客ビジネスに影響を与える動向と混乱

- ケーススタディ分析

- 価格分析

- エコシステム分析

- 貿易データ分析

- 主な会議とイベント

- 規制状況

- 主な利害関係者と購入基準

- 技術分析

- ビジネスモデル

- 技術ロードマップ

- 部品表(BOM)

- 総所有コスト

- 運用データ

- 防衛プログラム

- 投資と資金調達のシナリオ

- 生成AIとAIが小口径弾薬市場に与える影響

第6章 業界の動向

- イントロダクション

- 技術動向

- メガトレンドの影響

- 特許分析

第7章 小口径弾薬市場、用途別

- イントロダクション

- 軍隊

- 国土安全保障

第8章 小口径弾薬市場、弾丸タイプ別

- イントロダクション

- 真鍮

- 銅

- 鋼鉄

- その他

第9章 小口径弾薬市場、口径別

- イントロダクション

- 5.56mm

- 9MMパラベラム

- 7.62mm

- 12.7mm

- 14.5mm

- 338ラプアマグナム

- 338ノーママグナム

- その他

第10章 小口径弾薬市場、殺傷力別

- イントロダクション

- 低

- 高

第11章 小口径弾薬市場、地域別

- イントロダクション

- 地域別景気後退影響分析

- 北米

- 欧州

- アジア太平洋

- 中東

- ラテンアメリカ

- アフリカ

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 市場シェア分析

- 収益分析

- ブランド比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業フットプリント:主要参入企業、2023年

- 企業価値評価と財務指標

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競争シナリオと動向

第13章 企業プロファイル

- イントロダクション

- 主要参入企業

- ELBIT SYSTEMS LTD.

- THALES

- OLIN CORPORATION

- GENERAL DYNAMICS CORPORATION

- NAMMO AS

- BAE SYSTEMS

- AMMO, INC.

- DENEL SOC LTD

- POONGSAN CORPORATION

- ADANI DEFENCE AND AEROSPACE

- ST ENGINEERING

- VISTA OUTDOOR OPERATIONS LLC

- FIOCCHI MUNIZIONI S.P.A.

- FN HERSTAL

- CBC GLOBAL AMMUNITION

- その他の企業

- NORINCO

- REMINGTON AMMUNITION

- SIERRA BULLETS

- SIG SAUER

- YUGOIMPORT SDPR J.P.

- ARSENAL

- WOLF PERFORMANCE AMMUNITION

- RIO OUTDOORS CORP

- ARMSCOR INTERNATIONAL, INC.

- TULA CARTRIDGE WORKS

第14章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES

- TABLE 2 INCLUSIONS AND EXCLUSIONS

- TABLE 3 GLOBAL TERRORISM INDEX, BY COUNTRY, 2023

- TABLE 4 RECENT DEVELOPMENTS IN AMMUNITION

- TABLE 5 SMALL CALIBER AMMUNITION MARKET: INDICATIVE PRICING ANALYSIS, BY CALIBER TYPE (USD), 2023

- TABLE 6 SMALL CALIBER AMMUNITION MARKET: ECOSYSTEM

- TABLE 7 SMALL CALIBER AMMUNITION MARKET: DETAILED LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO APPLICATIONS (%)

- TABLE 14 KEY BUYING CRITERIA FOR TOP TWO APPLICATIONS

- TABLE 15 COMPARISON OF BILL OF MATERIALS

- TABLE 16 TOTAL COST OF OWNERSHIP

- TABLE 17 KEY CALIBER TYPES, BY COUNTRY, 2023

- TABLE 18 KEY FIREARMS, BY COUNTRY, 2023

- TABLE 19 SMALL CALIBER AMMUNITION MARKET: LIST OF DEFENSE PROGRAMS

- TABLE 20 CONVENTIONAL BRASS-CASED AMMUNITION VS. EMERGENT CARTRIDGE CASE TECHNOLOGIES

- TABLE 21 WEIGHT DISTRIBUTION: 7.62X51 MM CARTRIDGE

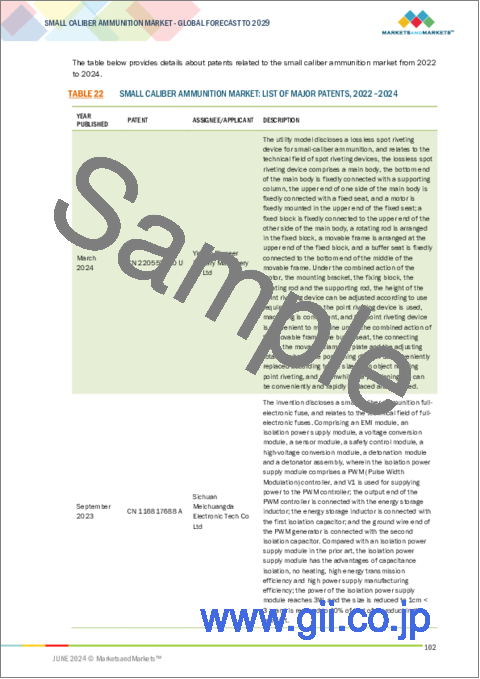

- TABLE 22 SMALL CALIBER AMMUNITION MARKET: LIST OF MAJOR PATENTS, 2022-2024

- TABLE 23 SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 24 SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 25 SMALL CALIBER AMMUNITION MARKET, BY BULLET TYPE, 2021-2023 (USD MILLION)

- TABLE 26 SMALL CALIBER AMMUNITION MARKET, BY BULLET TYPE, 2024-2029 (USD MILLION)

- TABLE 27 SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 28 SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 29 SMALL CALIBER AMMUNITION MARKET, BY LETHALITY, 2021-2023 (USD MILLION)

- TABLE 30 SMALL CALIBER AMMUNITION MARKET, BY LETHALITY, 2024-2029 (USD MILLION)

- TABLE 31 SMALL CALIBER AMMUNITION MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 32 SMALL CALIBER AMMUNITION MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 33 NORTH AMERICA: SMALL CALIBER AMMUNITION MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 34 NORTH AMERICA: SMALL CALIBER AMMUNITION MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 35 NORTH AMERICA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 36 NORTH AMERICA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 37 NORTH AMERICA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 38 NORTH AMERICA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 39 NORTH AMERICA: SMALL CALIBER AMMUNITION MARKET, BY BULLET TYPE, 2021-2023 (USD MILLION)

- TABLE 40 NORTH AMERICA: SMALL CALIBER AMMUNITION MARKET, BY BULLET TYPE, 2024-2029 (USD MILLION)

- TABLE 41 NORTH AMERICA: SMALL CALIBER AMMUNITION MARKET, BY LETHALITY, 2021-2023 (USD MILLION)

- TABLE 42 NORTH AMERICA: SMALL CALIBER AMMUNITION MARKET, BY LETHALITY, 2024-2029 (USD MILLION)

- TABLE 43 US: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 44 US: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 45 US: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 46 US: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 47 CANADA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 48 CANADA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 49 CANADA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 50 CANADA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 51 EUROPE: SMALL CALIBER AMMUNITION MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 52 EUROPE: SMALL CALIBER AMMUNITION MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 53 EUROPE: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 54 EUROPE: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 55 EUROPE: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 56 EUROPE: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 57 EUROPE: SMALL CALIBER AMMUNITION MARKET, BY BULLET TYPE, 2021-2023 (USD MILLION)

- TABLE 58 EUROPE: SMALL CALIBER AMMUNITION MARKET, BY BULLET TYPE, 2024-2029 (USD MILLION)

- TABLE 59 EUROPE: SMALL CALIBER AMMUNITION MARKET, BY LETHALITY, 2021-2023 (USD MILLION)

- TABLE 60 EUROPE: SMALL CALIBER AMMUNITION MARKET, BY LETHALITY, 2024-2029 (USD MILLION)

- TABLE 61 UK: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 62 UK: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 63 UK: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 64 UK: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 65 FRANCE: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 66 FRANCE: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 67 FRANCE: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 68 FRANCE: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 69 ITALY: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 70 ITALY: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 71 ITALY: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 72 ITALY: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 73 SPAIN: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 74 SPAIN: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 75 SPAIN: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 76 SPAIN: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 77 GERMANY: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 78 GERMANY: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 79 GERMANY: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 80 GERMANY: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 81 RUSSIA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 82 RUSSIA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 83 RUSSIA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 84 RUSSIA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 85 POLAND: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 86 POLAND: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 87 POLAND: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 88 POLAND: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 89 DENMARK: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 90 DENMARK: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 91 DENMARK: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 92 DENMARK: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 93 NORWAY: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 94 NORWAY: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 95 NORWAY: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 96 NORWAY: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 97 SWEDEN: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 98 SWEDEN: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 99 SWEDEN: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 100 SWEDEN: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 101 ASIA PACIFIC: SMALL CALIBER AMMUNITION MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 102 ASIA PACIFIC: SMALL CALIBER AMMUNITION MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 103 ASIA PACIFIC: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 104 ASIA PACIFIC: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 105 ASIA PACIFIC: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 106 ASIA PACIFIC: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 107 ASIA PACIFIC: SMALL CALIBER AMMUNITION MARKET, BY BULLET TYPE, 2021-2023 (USD MILLION)

- TABLE 108 ASIA PACIFIC: SMALL CALIBER AMMUNITION MARKET, BY BULLET TYPE, 2024-2029 (USD MILLION)

- TABLE 109 ASIA PACIFIC: SMALL CALIBER AMMUNITION MARKET, BY LETHALITY, 2021-2023 (USD MILLION)

- TABLE 110 ASIA PACIFIC: SMALL CALIBER AMMUNITION MARKET, BY LETHALITY, 2024-2029 (USD MILLION)

- TABLE 111 INDIA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 112 INDIA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 113 INDIA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 114 INDIA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 115 CHINA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 116 CHINA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 117 CHINA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 118 CHINA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 119 SOUTH KOREA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 120 SOUTH KOREA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 121 SOUTH KOREA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 122 SOUTH KOREA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 123 JAPAN: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 124 JAPAN: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 125 JAPAN: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 126 JAPAN: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 127 SINGAPORE: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 128 SINGAPORE: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 129 SINGAPORE: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 130 SINGAPORE: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 131 AUSTRALIA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 132 AUSTRALIA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 133 AUSTRALIA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 134 AUSTRALIA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 135 INDONESIA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 136 INDONESIA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 137 INDONESIA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 138 INDONESIA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 139 MALAYSIA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 140 MALAYSIA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 141 MALAYSIA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 142 MALAYSIA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 143 NEW ZEALAND: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 144 NEW ZEALAND: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 145 NEW ZEALAND: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 146 NEW ZEALAND: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 147 PHILIPPINES: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 148 PHILIPPINES: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 149 PHILIPPINES: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 150 PHILIPPINES: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 151 TAIWAN: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 152 TAIWAN: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 153 TAIWAN: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 154 TAIWAN: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 155 MIDDLE EAST: SMALL CALIBER AMMUNITION MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 156 MIDDLE EAST: SMALL CALIBER AMMUNITION MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 157 MIDDLE EAST: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 158 MIDDLE EAST: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 159 MIDDLE EAST: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 160 MIDDLE EAST: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 161 MIDDLE EAST: SMALL CALIBER AMMUNITION MARKET, BY BULLET TYPE, 2021-2023 (USD MILLION)

- TABLE 162 MIDDLE EAST: SMALL CALIBER AMMUNITION MARKET, BY BULLET TYPE, 2024-2029 (USD MILLION)

- TABLE 163 MIDDLE EAST: SMALL CALIBER AMMUNITION MARKET, BY LETHALITY, 2021-2023 (USD MILLION)

- TABLE 164 MIDDLE EAST: SMALL CALIBER AMMUNITION MARKET, BY LETHALITY, 2024-2029 (USD MILLION)

- TABLE 165 SAUDI ARABIA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 166 SAUDI ARABIA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 167 SAUDI ARABIA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 168 SAUDI ARABIA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 169 UAE: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 170 UAE: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 171 UAE: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 172 UAE: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 173 KUWAIT: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 174 KUWAIT: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 175 KUWAIT: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 176 KUWAIT: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 177 ISRAEL: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 178 ISRAEL: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 179 ISRAEL: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 180 ISRAEL: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 181 TURKEY: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 182 TURKEY: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 183 TURKEY: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 184 TURKEY: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 185 JORDAN: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 186 JORDAN: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 187 JORDAN: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 188 JORDAN: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 189 LATIN AMERICA: SMALL CALIBER AMMUNITION MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 190 LATIN AMERICA: SMALL CALIBER AMMUNITION MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 191 LATIN AMERICA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 192 LATIN AMERICA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 193 LATIN AMERICA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 194 LATIN AMERICA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 195 LATIN AMERICA: SMALL CALIBER AMMUNITION MARKET, BY BULLET TYPE, 2021-2023 (USD MILLION)

- TABLE 196 LATIN AMERICA: SMALL CALIBER AMMUNITION MARKET, BY BULLET TYPE, 2024-2029 (USD MILLION)

- TABLE 197 LATIN AMERICA: SMALL CALIBER AMMUNITION MARKET, BY LETHALITY, 2021-2023 (USD MILLION)

- TABLE 198 LATIN AMERICA: SMALL CALIBER AMMUNITION MARKET, BY LETHALITY, 2024-2029 (USD MILLION)

- TABLE 199 BRAZIL: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 200 BRAZIL: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 201 BRAZIL: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 202 BRAZIL: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 203 MEXICO: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 204 MEXICO: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 205 MEXICO: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 206 MEXICO: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 207 ARGENTINA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 208 ARGENTINA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 209 ARGENTINA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 210 ARGENTINA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 211 AFRICA: SMALL CALIBER AMMUNITION MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 212 AFRICA: SMALL CALIBER AMMUNITION MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 213 AFRICA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 214 AFRICA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 215 AFRICA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 216 AFRICA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 217 AFRICA: SMALL CALIBER AMMUNITION MARKET, BY BULLET TYPE, 2021-2023 (USD MILLION)

- TABLE 218 AFRICA: SMALL CALIBER AMMUNITION MARKET, BY BULLET TYPE, 2024-2029 (USD MILLION)

- TABLE 219 AFRICA: SMALL CALIBER AMMUNITION MARKET, BY LETHALITY, 2021-2023 (USD MILLION)

- TABLE 220 AFRICA: SMALL CALIBER AMMUNITION MARKET, BY LETHALITY, 2024-2029 (USD MILLION)

- TABLE 221 SOUTH AFRICA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 222 SOUTH AFRICA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 223 SOUTH AFRICA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 224 SOUTH AFRICA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 225 EGYPT: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 226 EGYPT: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 227 EGYPT: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 228 EGYPT: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 229 ALGERIA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 230 ALGERIA: SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 231 ALGERIA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 232 ALGERIA: SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- TABLE 233 KEY STRATEGIES ADOPTED BY LEADING MARKET PLAYERS, 2023

- TABLE 234 SMALL CALIBER AMMUNITION MARKET: DEGREE OF COMPETITION

- TABLE 235 SMALL CALIBER AMMUNITION MARKET: REGION FOOTPRINT

- TABLE 236 SMALL CALIBER AMMUNITION MARKET: CALIBER TYPE FOOTPRINT

- TABLE 237 SMALL CALIBER AMMUNITION MARKET: LETHALITY FOOTPRINT

- TABLE 238 SMALL CALIBER AMMUNITION MARKET: APPLICATION FOOTPRINT

- TABLE 239 SMALL CALIBER AMMUNITION MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 240 SMALL CALIBER AMMUNITION MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES, 2023

- TABLE 241 SMALL CALIBER AMMUNITION MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2020-MAY 2024

- TABLE 242 SMALL CALIBER AMMUNITION MARKET: DEALS, JANUARY 2020-MAY 2024

- TABLE 243 SMALL CALIBER AMMUNITION MARKET: OTHER DEVELOPMENTS, JANUARY 2020- MAY 2024

- TABLE 244 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 245 ELBIT SYSTEMS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 ELBIT SYSTEMS LTD.: OTHER DEVELOPMENTS

- TABLE 247 THALES: COMPANY OVERVIEW

- TABLE 248 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 THALES: DEALS

- TABLE 250 OLIN CORPORATION: COMPANY OVERVIEW

- TABLE 251 OLIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 OLIN CORPORATION: OTHER DEVELOPMENTS

- TABLE 253 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- TABLE 254 GENERAL DYNAMICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 NAMMO AS: COMPANY OVERVIEW

- TABLE 256 NAMMO AS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 NAMMO AS: OTHER DEVELOPMENTS

- TABLE 258 BAE SYSTEMS: COMPANY OVERVIEW

- TABLE 259 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 BAE SYSTEMS: OTHER DEVELOPMENTS

- TABLE 261 AMMO, INC.: COMPANY OVERVIEW

- TABLE 262 AMMO, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 AMMO, INC.: DEALS

- TABLE 264 AMMO, INC.: OTHER DEVELOPMENTS

- TABLE 265 DENEL SOC LTD: COMPANY OVERVIEW

- TABLE 266 DENEL SOC LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 267 POONGSAN CORPORATION: COMPANY OVERVIEW

- TABLE 268 POONGSAN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 ADANI DEFENCE AND AEROSPACE: COMPANY OVERVIEW

- TABLE 270 ADANI DEFENCE AND AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 ST ENGINEERING: COMPANY OVERVIEW

- TABLE 272 ST ENGINEERING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 ST ENGINEERING: PRODUCT LAUNCHES

- TABLE 274 VISTA OUTDOOR OPERATIONS LLC: COMPANY OVERVIEW

- TABLE 275 VISTA OUTDOOR OPERATIONS LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 276 VISTA OUTDOOR OPERATIONS LLC: DEALS

- TABLE 277 VISTA OUTDOOR OPERATIONS LLC: OTHER DEVELOPMENTS

- TABLE 278 FIOCCHI MUNIZIONI S.P.A.: COMPANY OVERVIEW

- TABLE 279 FIOCCHI MUNIZIONI S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 FN HERSTAL: COMPANY OVERVIEW

- TABLE 281 FN HERSTAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 282 FN HERSTAL: DEALS

- TABLE 283 CBC GLOBAL AMMUNITION: COMPANY OVERVIEW

- TABLE 284 CBC GLOBAL AMMUNITION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 NORINCO: COMPANY OVERVIEW

- TABLE 286 REMINGTON AMMUNITION: COMPANY OVERVIEW

- TABLE 287 SIERRA BULLETS: COMPANY OVERVIEW

- TABLE 288 SIG SAUER: COMPANY OVERVIEW

- TABLE 289 YUGOIMPORT SDPR J.P.: COMPANY OVERVIEW

- TABLE 290 ARSENAL: COMPANY OVERVIEW

- TABLE 291 WOLF PERFORMANCE AMMUNITION: COMPANY OVERVIEW

- TABLE 292 RIO OUTDOORS CORP: COMPANY OVERVIEW

- TABLE 293 ARMSCOR INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 294 TULA CARTRIDGE WORKS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 SMALL CALIBER AMMUNITION MARKET SEGMENTATION

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 SMALL CALIBER AMMUNITION MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 IMPACT OF RUSSIA-UKRAINE WAR ON MACRO FACTORS OF DEFENSE INDUSTRY

- FIGURE 8 IMPACT OF RUSSIA-UKRAINE WAR ON MICRO FACTORS OF SMALL CALIBER AMMUNITION MARKET

- FIGURE 9 MILITARY SEGMENT TO HAVE LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 7.62 MM SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 BRASS SEGMENT TO HAVE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 12 LETHAL SEGMENT TO HOLD LARGER MARKET SHARE THAN LESS LETHAL DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 14 INCREASING GEOPOLITICAL TENSIONS GLOBALLY TO DRIVE MARKET

- FIGURE 15 MILITARY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 OTHER CALIBER TYPES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 BRASS SEGMENT TO GAIN LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 LETHAL SEGMENT TO HOLD HIGHER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 19 RUSSIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 SMALL CALIBER AMMUNITION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 MILITARY EXPENDITURE OF TOP COUNTRIES, 2022

- FIGURE 22 SMALL CALIBER AMMUNITION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 AVERAGE SELLING PRICE BY TOP 5 CALIBER TYPE, 2023

- FIGURE 25 SMALL CALIBER AMMUNITION MARKET: ECOSYSTEM

- FIGURE 26 IMPORT DATA, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 27 EXPORT DATA, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO APPLICATIONS

- FIGURE 29 KEY BUYING CRITERIA FOR TOP TWO APPLICATIONS

- FIGURE 30 SMALL CALIBER AMMUNITION MARKET: BUSINESS MODELS

- FIGURE 31 SMALL CALIBER AMMUNITION MARKET: COMPARISON OF BUSINESS MODELS

- FIGURE 32 EVOLUTION OF KEY TECHNOLOGY

- FIGURE 33 EMERGING TRENDS RELATED TO SMALL CALIBER AMMUNITION MARKET

- FIGURE 34 BILL OF MATERIALS FOR 5.56 MM SMALL CALIBER AMMUNITION

- FIGURE 35 BILL OF MATERIALS FOR 7.62 MM SMALL CALIBER AMMUNITION

- FIGURE 36 TOTAL COST OF OWNERSHIP OF SMALL CALIBER AMMUNITION

- FIGURE 37 SMALL CALIBER AMMUNITION MARKET: INVESTMENT AND FUNDING

- FIGURE 38 GENERATIVE AI ADOPTION IN MILITARY FOR TOP COUNTRIES

- FIGURE 39 IMPACT OF AI IN SMALL CALIBER AMMUNITION

- FIGURE 40 TECHNOLOGY TRENDS RELATED TO SMALL CALIBER AMMUNITION

- FIGURE 41 LIST OF MAJOR PATENTS FOR SMALL CALIBER AMMUNITION

- FIGURE 42 SMALL CALIBER AMMUNITION MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- FIGURE 43 SMALL CALIBER AMMUNITION MARKET, BY BULLET TYPE, 2024-2029 (USD MILLION

- FIGURE 44 SMALL CALIBER AMMUNITION MARKET, BY CALIBER TYPE, 2024-2029 (USD MILLION)

- FIGURE 45 SMALL CALIBER AMMUNITION MARKET, 2024-2029 (USD MILLION)

- FIGURE 46 EUROPE TO REGISTER HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 47 NORTH AMERICA: SMALL CALIBER AMMUNITION MARKET SNAPSHOT

- FIGURE 48 EUROPE: SMALL CALIBER AMMUNITION MARKET SNAPSHOT

- FIGURE 49 ASIA PACIFIC: SMALL CALIBER AMMUNITION MARKET SNAPSHOT

- FIGURE 50 MIDDLE EAST: SMALL CALIBER AMMUNITION MARKET SNAPSHOT

- FIGURE 51 LATIN AMERICA: SMALL CALIBER AMMUNITION MARKET SNAPSHOT

- FIGURE 52 AFRICA: SMALL CALIBER AMMUNITION MARKET SNAPSHOT

- FIGURE 53 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS, 2023

- FIGURE 54 MARKET RANKING ANALYSIS OF KEY PLAYERS, 2023

- FIGURE 55 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2021-2023

- FIGURE 56 SMALL CALIBER AMMUNITION MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2023

- FIGURE 57 SMALL CALIBER AMMUNITION MARKET: PRODUCT FOOTPRINT

- FIGURE 58 FINANCIAL METRICS OF PROMINENT MARKET PLAYERS

- FIGURE 59 VALUATION OF PROMINENT MARKET PLAYERS

- FIGURE 60 SMALL CALIBER AMMUNITION MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES, 2023

- FIGURE 61 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 62 THALES: COMPANY SNAPSHOT

- FIGURE 63 OLIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 NAMMO AS: COMPANY SNAPSHOT

- FIGURE 66 BAE SYSTEMS: COMPANY SNAPSHOT

- FIGURE 67 AMMO, INC.: COMPANY SNAPSHOT

- FIGURE 68 POONGSAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 69 ST ENGINEERING: COMPANY SNAPSHOT

- FIGURE 70 VISTA OUTDOOR OPERATIONS LLC: COMPANY SNAPSHOT

The Small Caliber Ammunition market is valued at USD 5.7 billion in 2024 and is projected to reach USD 7.0 billion by 2029, at a CAGR of 4.3% from 2024 to 2029. The growth of market is primarily driven by modernization of military globally to counter upcoming terror threats. The demand for small caliber ammunition is increasing due to the geopolitical conflicts globally. The rising global security concerns ,government investments in procurement of small arms ammunition and defense expenditures propels the market growth.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Application, Caliber Type, Bullet Type, Lethality and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Based on Application, the Military segment is estimated to show highest CAGR during the forecast period."

The Military segment by Application in the Small Caliber Ammunition market is being driven by the increasing defense budgets and procurements of ammunitions to enhance the military forces to counter risng threats. The increasing demand for large-scale procurement of small caliber ammunition focus on due to modernizing armed forces, continuous military training programs, peacekeeping missions and expanding infantry units globally is fueling the market growth of the segment.

"Based on Caliber type, the 7.62 mm segment is estimated to show highest CAGR during the forecast period."

The small caliber ammunition market by Caliber type is segmented into 9 mm Parabellum, 5.56 mm, 7.62 mm, 12.7 mm, 14.5 mm, .338 Lapua Magnum, .338 Norma Magnum, and Others. The 7.62 mm segment is expected to grow at highest CAGR during the forecast period. The increasing adoption of 7.62 mm caliber in rifles and machine guns across numerous military and homeland security drives the market growth. The 7.62 mm offers enhance reliability, effectiveness at long ranges, and penetrating power, which is suitable for combat scenarios and tactical operations. The ongoing global military modernizations and increasing defense budgets fuels the market growth of the segment.

"Based on regions, the Europe region is estimated to grow at highest CAGR during the forecast period."

The Europe region is witnessing robust growth in the Small Caliber Ammunition market, driven by the ongoing disputes in the region. The growth of the region is attributed to the increasing defense budgets, driven by rising security concerns and NATO obligations. The countries in this region are modernizing their military and law enforcement arsenals in response to rising geopolitical tensions and the need for enhanced national and regional security. The heavy investments in advanced ammunition technologies by the countries to ensure readiness and operational advantage drives the market growth for Small Caliber Ammunition market.

The break-up of the profile of primary participants in the Small Caliber Ammunition market:

- By Company Type: Tier 1 - 49%, Tier 2 - 37%, and Tier 3 - 14%

- By Designation: C Level - 55%, Director Level - 27%, and Others - 18%

- By Region: North America - 32%, Europe - 32%, Asia Pacific - 16%, Latin America - 7%, Middle East - 10%, Africa - 3%

Major companies profiled in the report include Elbit Systems Ltd. (Israel), Thales (France), Olin Corporation (US), General Dynamics Corporation (US), Nammo AS (Norway) among others.

Research Coverage:

This market study covers the Small Caliber Ammunition market across various segments and subsegments. It aims to estimate this market's size and growth potential across different parts based on application, caliber type, bullet type, lethality and region. This study also includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to their product and business offerings, recent developments, and key market strategies they adopted.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall Small Caliber Ammunition market. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities. The Small Caliber Ammunition market is experiencing substantial growth, primarily driven by the increasing war scenarios across the world. The rising geopolitical tensions, terrorism activities and cross-border conflicts demands for Small Caliber Ammunition, contributing to regional and global stability. The report provides insights on the following pointers:

- Market Drivers (Increasing terrorism incidents and rising geopolitical tensions, Rising military expenditure, Changing nature of warfare), restraints (Regulatory Restrictions), Opportunities (Advancements in small caliber ammunition due to increased r&d expenditure, Stockpiling of ammunition, Increasing use of lightweight materials in small caliber ammunition) challenges (Proliferation of illicit ammunition manufacturers, Proliferation of illicit ammunition manufacturers) there are several factors that could contribute to an increase in the Small Caliber Ammunition market.

- Market Penetration: Comprehensive information on Small Caliber Ammunition offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the Small Caliber Ammunition market

- Market Development: Comprehensive information about lucrative markets - the report analyses the Small Caliber Ammunition market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the Small Caliber Ammunition market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and service providing capabilities of leading players in the Small Caliber Ammunition market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 INCLUSIONS AND EXCLUSIONS

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.4 RESEARCH APPROACH AND METHODOLOGY

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.1.1 Military: small caliber ammunition market

- 2.4.1.2 Law enforcement: small caliber ammunition market

- 2.4.1.3 Small caliber ammunition market size, by segment

- 2.4.2 TOP-DOWN APPROACH

- 2.4.1 BOTTOM-UP APPROACH

- 2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RECESSION IMPACT ANALYSIS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RUSSIA-UKRAINE WAR IMPACT ANALYSIS

- 2.9.1 IMPACT OF RUSSIA-UKRAINE WAR ON MACRO FACTORS OF DEFENSE INDUSTRY

- 2.9.1.1 Impact of Russia-Ukraine war on micro factors of defense market

- 2.9.1.2 Impact of Russia-Ukraine war on micro factors of ammunition market

- 2.9.1 IMPACT OF RUSSIA-UKRAINE WAR ON MACRO FACTORS OF DEFENSE INDUSTRY

- 2.10 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SMALL CALIBER AMMUNITION MARKET

- 4.2 SMALL CALIBER AMMUNITION MARKET, BY APPLICATION

- 4.3 SMALL CALIBER AMMUNITION MARKET, BY CALIBER

- 4.4 SMALL CALIBER AMMUNITION MARKET, BY BULLET TYPE

- 4.5 SMALL CALIBER AMMUNITION MARKET, BY LETHALITY

- 4.6 SMALL CALIBER AMMUNITION MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing terrorism incidents and geopolitical tensions

- 5.2.1.2 Rising military expenditure

- 5.2.1.3 Changing nature of warfare

- 5.2.2 RESTRAINTS

- 5.2.2.1 Regulatory restrictions

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advancements in small caliber ammunition due to increased R&D expenditure

- 5.2.3.2 Stockpiling of ammunition

- 5.2.3.3 Increasing use of lightweight materials in small-caliber ammunition

- 5.2.4 CHALLENGES

- 5.2.4.1 Proliferation of illicit ammunition manufacturers

- 5.2.4.2 International ammunition control measures

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 HIGH PRECISION SMALL CALIBER AMMUNITION

- 5.5.2 DEVELOPMENT OF LOW RECOIL AMMUNITION

- 5.5.3 DEVELOPMENT OF GREEN AMMUNITION

- 5.6 PRICING ANALYSIS

- 5.6.1 INDICATIVE PRICING ANALYSIS, BY CALIBER TYPE

- 5.6.2 INDICATIVE PRICING ANALYSIS, BY APPLICATION

- 5.7 ECOSYSTEM ANALYSIS

- 5.7.1 PROMINENT COMPANIES

- 5.7.2 PRIVATE AND SMALL ENTERPRISES

- 5.7.3 END USERS

- 5.8 TRADE DATA ANALYSIS

- 5.8.1 IMPORT DATA

- 5.8.1.1 Import value of (Product Harmonized System Code: 93) arms and ammunition; parts and accessories thereof.

- 5.8.2 EXPORT DATA

- 5.8.2.1 Export value of (Product Harmonized System Code: 93) arms and ammunition; parts and accessories thereof.

- 5.8.1 IMPORT DATA

- 5.9 KEY CONFERENCES AND EVENTS

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 KEY TECHNOLOGIES

- 5.12.1.1 Self-steering bullets

- 5.12.1.2 Advanced propellants

- 5.12.2 COMPLEMENTARY TECHNOLOGIES

- 5.12.2.1 Precision-guided munitions

- 5.12.2.2 Multipurpose munitions

- 5.12.1 KEY TECHNOLOGIES

- 5.13 BUSINESS MODELS

- 5.13.1 DIRECT SALES TO GOVERNMENTS

- 5.13.2 SUPPLY THROUGH DISTRIBUTORS

- 5.13.3 PUBLIC-PRIVATE PARTNERSHIPS

- 5.13.4 FOREIGN MILITARY SALES (FMS)

- 5.14 TECHNOLOGY ROADMAP

- 5.15 BILL OF MATERIALS (BOM)

- 5.16 TOTAL COST OF OWNERSHIP

- 5.17 OPERATIONAL DATA

- 5.17.1 KEY CALIBER TYPES USED BY MAJOR COUNTRIES, 2023

- 5.17.2 KEY FIREARMS USED BY MAJOR COUNTRIES, 2023

- 5.18 DEFENSE PROGRAMS

- 5.19 INVESTMENT AND FUNDING SCENARIO

- 5.20 IMPACT OF GENERATIVE AI AND AI ON SMALL CALIBER AMMUNITION MARKET

- 5.20.1 GENERATIVE AI ADOPTION IN MILITARY FOR TOP COUNTRIES

- 5.20.2 IMPACT OF AI IN SMALL CALIBER AMMUNITION

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 CASELESS TELESCOPED AMMUNITION (CTA)

- 6.2.2 POLYMER-CASED AMMUNITION

- 6.2.3 LIGHTWEIGHT AMMUNITION

- 6.2.4 ADVANCED BALLISTIC COATINGS

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 ADVANCEMENTS IN MATERIAL SCIENCE

- 6.3.2 ECO-FRIENDLY SMALL CALIBER AMMUNITION

- 6.4 PATENT ANALYSIS

7 SMALL CALIBER AMMUNITION MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 MILITARY

- 7.2.1 SURGE IN GEOPOLITICAL CONFLICTS AND WAR SCENARIOS TO DRIVE MARKET

- 7.3 HOMELAND SECURITY

- 7.3.1 GROWING FOCUS ON BORDER SECURITY, TRAINING, AND PUBLIC SAFETY TO DRIVE MARKET

8 SMALL CALIBER AMMUNITION MARKET, BY BULLET TYPE

- 8.1 INTRODUCTION

- 8.2 BRASS

- 8.2.1 RISING UTILIZATION IN ADVERSE WEATHER CONDITIONS AND HARSH ENVIRONMENTS TO DRIVE MARKET

- 8.3 COPPER

- 8.3.1 GROWING FOCUS ON ENVIRONMENTAL REGULATIONS TO DRIVE MARKET

- 8.4 STEEL

- 8.4.1 INCREASING USE IN MANUFACTURING CASING AND JACKETS TO DRIVE MARKET

- 8.5 OTHER BULLET TYPES

9 SMALL CALIBER AMMUNITION MARKET, BY CALIBER

- 9.1 INTRODUCTION

- 9.2 5.56 MM

- 9.2.1 EASE OF USE AND LIGHTWEIGHT DESIGN TO DRIVE MARKET

- 9.3 9 MM PARABELLUM

- 9.3.1 GROWING ADOPTION BY NATO FORCES TO DRIVE MARKET

- 9.4 7.62 MM

- 9.4.1 NEED FOR IMPROVED FRONTLINE ASSAULT AND FIRE SUPPORT CAPABILITIES TO DRIVE MARKET

- 9.5 12.7 MM

- 9.5.1 NEED FOR MILITARY FIREARMS TO DRIVE MARKET

- 9.6 14.5 MM

- 9.6.1 INCREASING USE OF HEAVY MACHINE AND NAVAL PEDESTAL MACHINE GUNS TO DRIVE MARKET

- 9.7 338 LAPUA MAGNUM

- 9.7.1 GROWING ROLE AS ANTI-PERSONNEL AND ANTI-MATERIAL AMMUNITION TO DRIVE MARKET

- 9.8 338 NORMA MAGNUM

- 9.8.1 SURGE IN DEMAND FOR HIGHER RANGE AND LIGHTWEIGHT CARTRIDGES TO DRIVE MARKET

- 9.9 OTHER CALIBER TYPES

10 SMALL CALIBER AMMUNITION MARKET, BY LETHALITY

- 10.1 INTRODUCTION

- 10.2 LESS LETHAL

- 10.2.1 RISING ADOPTION AMONG LAW ENFORCEMENT AGENCIES TO DRIVE MARKET

- 10.3 LETHAL

- 10.3.1 GROWING USE BY MILITARY FORCES WORLDWIDE TO DRIVE MARKET

11 SMALL CALIBER AMMUNITION MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 REGIONAL RECESSION IMPACT ANALYSIS

- 11.3 NORTH AMERICA

- 11.3.1 PESTLE ANALYSIS

- 11.3.2 RECESSION IMPACT ANALYSIS

- 11.3.3 US

- 11.3.3.1 Increased investments in defense sector modernization to drive market

- 11.3.4 CANADA

- 11.3.4.1 Growing focus on enhancing and modernizing defense capabilities to drive market

- 11.4 EUROPE

- 11.4.1 PESTLE ANALYSIS

- 11.4.2 RECESSION IMPACT ANALYSIS

- 11.4.3 UK

- 11.4.3.1 Increasing military training and operations to drive market

- 11.4.4 FRANCE

- 11.4.4.1 Strategic defense manufacturing agreements with other nations to drive market

- 11.4.5 ITALY

- 11.4.5.1 Increasing focus on counter-terrorism activities to drive market

- 11.4.6 SPAIN

- 11.4.6.1 Increasing focus on strengthening military and homeland security to drive market

- 11.4.7 GERMANY

- 11.4.7.1 Presence of key players to drive market

- 11.4.8 RUSSIA

- 11.4.8.1 Ongoing dispute with border-sharing countries to drive market

- 11.4.9 POLAND

- 11.4.9.1 Presence of key small-caliber ammunition manufacturers to drive market

- 11.4.10 DENMARK

- 11.4.10.1 Increasing government initiatives for ammunition production to drive market

- 11.4.11 NORWAY

- 11.4.11.1 Increasing armed force modernization and geopolitical tensions to drive market

- 11.4.12 SWEDEN

- 11.4.12.1 Increasing focus on enhancing military capabilities to drive market

- 11.5 ASIA PACIFIC

- 11.5.1 PESTLE ANALYSIS

- 11.5.2 RECESSION IMPACT ANALYSIS

- 11.5.3 INDIA

- 11.5.3.1 "Make in India" initiative to increase manufacturing of small-caliber ammunition

- 11.5.4 CHINA

- 11.5.4.1 Increasing R&D and exports of small-caliber ammunition to drive market

- 11.5.5 SOUTH KOREA

- 11.5.5.1 Increasing focus on military modernization to drive market

- 11.5.6 JAPAN

- 11.5.6.1 Increasing budget for ammunition procurement to drive market

- 11.5.7 SINGAPORE

- 11.5.7.1 Regular military equipment updates to drive market

- 11.5.8 AUSTRALIA

- 11.5.8.1 Military modernization efforts to drive market

- 11.5.9 INDONESIA

- 11.5.9.1 Increasing defense budget for procurement of ammunition to drive market

- 11.5.10 MALAYSIA

- 11.5.10.1 Tensions in Southeast Asian region to drive market

- 11.5.11 NEW ZEALAND

- 11.5.11.1 Increasing focus on armed force modernization and upgrade to drive market

- 11.5.12 PHILIPPINES

- 11.5.12.1 Increasing modernization of armed forces to drive market

- 11.5.13 TAIWAN

- 11.5.13.1 Rising focus on maintaining strong defense posture to drive market

- 11.6 MIDDLE EAST

- 11.6.1 PESTLE ANALYSIS

- 11.6.2 RECESSION IMPACT ANALYSIS

- 11.6.3 GCC COUNTRIES

- 11.6.3.1 Saudi Arabia

- 11.6.3.1.1 Focus on strengthening military and security forces to drive market

- 11.6.3.2 UAE

- 11.6.3.2.1 National security, military modernization, and economic diversification to drive market

- 11.6.3.3 Kuwait

- 11.6.3.3.1 Investments in defense infrastructure and modernization programs to drive market

- 11.6.3.1 Saudi Arabia

- 11.6.4 REST OF THE MIDDLE EAST

- 11.6.4.1 Israel

- 11.6.4.1.1 Need to support national defense amid regional tensions to drive market

- 11.6.4.2 Turkey

- 11.6.4.2.1 Defense modernization and self-sufficiency initiatives to drive market

- 11.6.4.3 Jordan

- 11.6.4.3.1 Emphasis on defense modernization and readiness to drive market

- 11.6.4.1 Israel

- 11.7 LATIN AMERICA

- 11.7.1 PESTLE ANALYSIS

- 11.7.2 RECESSION IMPACT ANALYSIS

- 11.7.3 BRAZIL

- 11.7.3.1 Rise in territorial disputes to drive market

- 11.7.4 MEXICO

- 11.7.4.1 Increase in organized crime and drug trafficking to drive market

- 11.7.5 ARGENTINA

- 11.7.5.1 Increasing domestic production of small-caliber ammunition and modernization of armed forces to drive market

- 11.8 AFRICA

- 11.8.1 PESTLE ANALYSIS

- 11.8.2 RECESSION IMPACT ANALYSIS

- 11.8.3 SOUTH AFRICA

- 11.8.3.1 Rise in defense exports to drive market

- 11.8.4 EGYPT

- 11.8.4.1 Increasing defense collaborations with neighboring countries to boost market

- 11.8.5 ALGERIA

- 11.8.5.1 Growing terrorism threats to drive market

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 MARKET SHARE ANALYSIS

- 12.3.1 MARKET RANKING ANALYSIS

- 12.4 REVENUE ANALYSIS

- 12.5 BRAND COMPARISON

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.7 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- 12.9 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 12.9.1 PROGRESSIVE COMPANIES

- 12.9.2 RESPONSIVE COMPANIES

- 12.9.3 DYNAMIC COMPANIES

- 12.9.4 STARTING BLOCKS

- 12.9.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2023

- 12.10 COMPETITIVE SCENARIOS AND TRENDS

- 12.10.1 MARKET EVALUATION FRAMEWORK

- 12.10.2 PRODUCT LAUNCHES/DEVELOPMENTS

- 12.10.3 DEALS

- 12.10.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 ELBIT SYSTEMS LTD.

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Other developments

- 13.2.1.4 MnM view

- 13.2.1.4.1 Right to win

- 13.2.1.4.2 Strategic choices

- 13.2.1.4.3 Weaknesses and competitive threats

- 13.2.2 THALES

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.3.1 Deals

- 13.2.2.4 MnM view

- 13.2.2.4.1 Right to win

- 13.2.2.4.2 Strategic choices

- 13.2.2.4.3 Weaknesses and competitive threats

- 13.2.3 OLIN CORPORATION

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Other developments

- 13.2.3.4 MnM view

- 13.2.3.4.1 Right to win

- 13.2.3.4.2 Strategic choices

- 13.2.3.4.3 Weaknesses and competitive threats

- 13.2.4 GENERAL DYNAMICS CORPORATION

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 MnM view

- 13.2.4.3.1 Right to win

- 13.2.4.3.2 Strategic choices

- 13.2.4.3.3 Weaknesses and competitive threats

- 13.2.5 NAMMO AS

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Other developments

- 13.2.5.4 MnM view

- 13.2.5.4.1 Right to win

- 13.2.5.4.2 Strategic choices

- 13.2.5.4.3 Weaknesses and competitive threats

- 13.2.6 BAE SYSTEMS

- 13.2.6.1 Business overview

- 13.2.6.2 Products/Solutions/Services offered

- 13.2.6.3 Recent developments

- 13.2.6.3.1 Other developments

- 13.2.7 AMMO, INC.

- 13.2.7.1 Business overview

- 13.2.7.2 Products/Solutions/Services offered

- 13.2.7.3 Recent developments

- 13.2.7.3.1 Deals

- 13.2.7.3.2 Other developments

- 13.2.8 DENEL SOC LTD

- 13.2.8.1 Business overview

- 13.2.8.2 Products/Solutions/Services offered

- 13.2.9 POONGSAN CORPORATION

- 13.2.9.1 Business overview

- 13.2.9.2 Products/Solutions/Services offered

- 13.2.10 ADANI DEFENCE AND AEROSPACE

- 13.2.10.1 Business overview

- 13.2.10.2 Products/Solutions/Services offered

- 13.2.11 ST ENGINEERING

- 13.2.11.1 Business overview

- 13.2.11.2 Products/Solutions/Services offered

- 13.2.11.3 Recent developments

- 13.2.11.3.1 Product launches

- 13.2.12 VISTA OUTDOOR OPERATIONS LLC

- 13.2.12.1 Business overview

- 13.2.12.2 Products/Solutions/Services offered

- 13.2.12.3 Recent developments

- 13.2.12.3.1 Deals

- 13.2.12.3.2 Other developments

- 13.2.13 FIOCCHI MUNIZIONI S.P.A.

- 13.2.13.1 Business overview

- 13.2.13.2 Products/Solutions/Services offered

- 13.2.14 FN HERSTAL

- 13.2.14.1 Business overview

- 13.2.14.2 Products/Solutions/Services offered

- 13.2.14.3 Recent developments

- 13.2.14.3.1 Deals

- 13.2.15 CBC GLOBAL AMMUNITION

- 13.2.15.1 Business overview

- 13.2.15.2 Products/Solutions/Services offered

- 13.2.1 ELBIT SYSTEMS LTD.

- 13.3 OTHER PLAYERS

- 13.3.1 NORINCO

- 13.3.2 REMINGTON AMMUNITION

- 13.3.3 SIERRA BULLETS

- 13.3.4 SIG SAUER

- 13.3.5 YUGOIMPORT SDPR J.P.

- 13.3.6 ARSENAL

- 13.3.7 WOLF PERFORMANCE AMMUNITION

- 13.3.8 RIO OUTDOORS CORP

- 13.3.9 ARMSCOR INTERNATIONAL, INC.

- 13.3.10 TULA CARTRIDGE WORKS

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS