|

|

市場調査レポート

商品コード

1509566

排気システムの世界市場:後処理装置別、コンポーネント別、車両タイプ別、燃料タイプ別、販売チャネル別、装置タイプ別、地域別 - 2030年までの予測Exhaust System Market by After-Treatment Device (DOC, DPF, LNT, SCR, GPF), Vehicle Type (LCV, Trucks, Buses, Tractor, Construction & Mining Equipment), Aftermarket, Component, Application, Fuel Type, Sales Channel and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 排気システムの世界市場:後処理装置別、コンポーネント別、車両タイプ別、燃料タイプ別、販売チャネル別、装置タイプ別、地域別 - 2030年までの予測 |

|

出版日: 2024年07月04日

発行: MarketsandMarkets

ページ情報: 英文 326 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

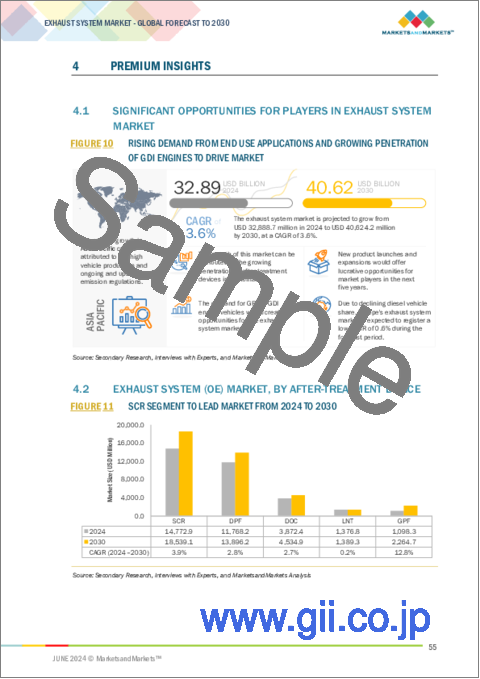

自動車排気システムの市場規模は、2024年の329億米ドルから2030年には406億米ドルへと3.6%の成長が予測されています。

アジア太平洋とラテンアメリカ市場では自動車需要が増加しています。これは新興経済諸国が急速に発展し、可処分所得が増加しているためです。また、各国政府は排ガスを規制するために厳しい規則や規制を導入しています。選択的触媒還元(SCR)、ディーゼル・パティキュレート・フィルター(DPF)、ガソリン・パティキュレート・フィルター(GPF)といった技術は、こうした要件を満たすための標準となりつつあります。メーカー各社は、continental AGによる排ガスセンサーの開発や、Tennecoによるコールドスタートサーマルユニットの開発など、研究開発への投資を通じてさまざまな取り組みを行っています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 後処理装置別、コンポーネント別、車両タイプ別、燃料タイプ別、販売チャネル別、装置タイプ別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州、その他の地域 |

選択触媒コンバーター(SCR)は、排気システム市場で最大のアフターマーケットセグメントを占めました。選択的触媒還元(SCR)装置のアフターマーケットにおける最近の進歩は、性能と効率の改善が中心となっています。2023年、Cumminsは、実績のあるディーゼル微粒子フィルター(DPF)とSCR技術を柔軟なモジュール式ソリューションに統合したモジュール式後処理システムを拡大しました。このシステムは、エンジンの信頼性と効率を高めながら、世界で最も厳しい排出ガス規制を満たすように設計されています。SCR技術は、実質的にメンテナンスフリーでありながら、窒素酸化物(NOx)の排出量を削減し、燃費を向上させる効果的なソリューションであり続けています。Cumminsの電子制御およびソフトウェアは、フロースルー触媒、DPF、SCRシステム、噴射システム制御など、あらゆる後処理オプションをサポートするように設計されています。これらの制御システムは、エンジン制御を強化する独立モジュールとして機能することも、エンジン制御モジュールに直接統合することもできます。NOx排出に特化した排出規制が厳しくなっており、SCRシステムはNOx排出を削減するための効果的な技術です。さらに、SCR触媒の設計、尿素噴射システム、エンジン制御技術の進歩により、SCRシステムの性能と費用対効果が向上し、排ガス制御用SCRシステムの採用を促進しています。

乗用車セグメントは、すべての車種において自動車生産台数シェアが最大であることから、排気システムの最大市場であると推定されます。米国と欧州諸国を中心に乗用車の排ガス規制が厳しくなっていることが、乗用車セグメントの成長をさらに後押ししています。ACEAによると、2023年第1~3四半期の世界の乗用車販売台数は9%増加しました。同期間にEUでは900万台以上の自動車が生産されました。米国の生産台数は約600万台で、2022年比で11%増加しました。中国の生産台数は1,750万台、日本の生産台数は600万台で、2022年比で18.5%増加しました。米国の乗用車市場は、消費者がSUVやピックアップトラックに乗り換えているため、安定した成長を続けています。同様に、コンパクト、ミドル、フルサイズのSUVやクーペの需要は、中国、インド、日本、欧州など他の国々でも増加しています。これらのSUVには、より優れた性能と牽引力を発揮するディーゼルエンジンもあります。多くのSUVは、特に悪天候やオフロードの状況下で、強化されたトラクションと安定性を提供するために、AWDまたは4WDシステムを提供しています。また、ガソリン直噴(GDI)エンジンの成長も、新興経済諸国や先進国でのGPF技術の搭載に拍車をかけ続けると思われます。このように、さまざまなSUVカテゴリの生産・販売台数の増加とGDIエンジンの受容率の上昇に伴い、乗用車のさまざまな後処理技術の市場は、今後数年間で大きな規模になると予想されます。

当レポートでは、世界の排気システム市場について調査し、後処理装置別、コンポーネント別、車両タイプ別、燃料タイプ別、販売チャネル別、装置タイプ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- サプライチェーン分析

- エコシステム分析

- ケーススタディ分析

- 特許分析

- 規制状況

- 燃費基準

- 主な利害関係者と購入基準

- 主な会議とイベント

- 貿易分析

- 投資と資金調達のシナリオ

- サプライヤー分析

- 価格分析

- 電気自動車が排気システム市場に与える影響

第6章 排気システム(OE)市場、後処理装置別

- イントロダクション

- ディーゼル酸化触媒(DOC)

- ディーゼル微粒子フィルター(DPF)

- リーンNOXトラップ(LNT)

- 選択触媒還元(SCR)

- ガソリン微粒子フィルター(GPF)

第7章 排気システム(OE)市場、コンポーネント別

- イントロダクション

- センサー

- 触媒コンバーター

- ダウンパイプ

- マニホールド

- マフラー

- テールパイプ

- ハンガー

第8章 排気システム(OE)市場、車両タイプ別

- イントロダクション

- 乗用車

- 小型商用車

- トラック

- バス

第9章 排気システム(OE)市場、燃料タイプ別

- イントロダクション

- ガソリン

- ディーゼル

第10章 排気システムアフターマーケット、後処理装置別

- イントロダクション

- ディーゼル酸化触媒(DOC)

- ディーゼル微粒子フィルター(DPF)

- 選択触媒還元(SCR)

第11章 排気システム市場、販売チャネル別

- イントロダクション

- アフターマーケット

- メーカー

第12章 オフハイウェイ車両用排気システム(OE)市場、装置タイプ別

- イントロダクション

- 農業用トラクター

- 建設機械

- 採掘設備

第13章 オフハイウェイ車両用排気システム(OE)市場、後処理装置別

- イントロダクション

- ディーゼル微粒子フィルター(DPF)

- ディーゼル酸化触媒(DOC)

- 選択触媒還元(SCR)

第14章 排気システム(OE)市場、地域別

- イントロダクション

- アジア太平洋

- 欧州

- 北米

- その他の地域

第15章 競合情勢

- 概要

- 市場シェア分析、2023年

- 排気システム市場:競合度、2023年

- 収益分析

- 主要参入企業の戦略/強み、2022年~2024年

- 企業評価マトリックス:排気システムおよび後処理装置メーカー、2024年

- 企業評価マトリックス:排気システム部品メーカー、2024年

- 競合シナリオと動向

- 企業価値評価と財務指標

- 製品比較

第16章 企業プロファイル

- 主要参入企業

- FORVIA FAURECIA

- TENNECO INC.

- CONTINENTAL AG

- EBERSPACHER

- FUTABA INDUSTRIAL CO., LTD.

- SANGO CO., LTD.

- FRIEDRICH BOYSEN GMBH & CO. KG

- YUTAKA GIKEN COMPANY LIMITED

- SEJONG INDUSTRIAL CO., LTD.

- BOSAL

- その他の企業

- MARELLI HOLDINGS CO., LTD.

- HIROTEC CORPORATION

- BENTELER INTERNATIONAL AG

- KATCON GLOBAL

- VIBRACOUSTIC SE

- ASMET

- DINEX A/S

- MAGNAFLOW

- GRAND ROCK CO., INC.

- EMINOX

- EUROPEAN EXHAUST AND CATALYST LTD.

- CREFACT CORPORATION

- SHARDA MOTOR INDUSTRIES LTD.

- EISENMANN EXHAUST SYSTEMS

- DENSO

- HARBIN AIRUI EMISSIONS CONTROL TECHNOLOGY CO., LTD.

- CHONGQING HEIGHT AUTOMOBILE EXHAUST SYSTEM CO., LTD.

- BOSCH MOBILITY

- JOHNSON MATTHEY

第17章 MARKETSANDMARKETSによる推奨事項

第18章 付録

The automotive exhaust systems market is projected to grow from USD 32.9 billion in 2024 to USD 40.6 billion by 2030, at 3.6%. There's a rise in demand for automotive vehicles in the APAC and the Latin America market; this is happening as the economies are developing rapidly and the disposable incomes are rising. The governments have also introduced stringent rules and regulations to control the emissions. Technologies such as selective catalytic reduction (SCR), diesel particulate filters (DPF), and gasoline particulate filters (GPF) are becoming standard in meeting these requirements. The manufacturers make various efforts by investing in R&D such as developing exhaust gas sensors by continental AG and developing Cold start thermal unit by Tenneco.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Segments | OE by after-treatment device, OE by component, OE by vehicle type, aftermarket by after-treatment device, OE by off-highway vehicle, off-highway by after-treatment device, OE by fuel type, By sales channel and by region |

| Regions covered | Asia Pacific, North America, Europe, and the Rest of the World [RoW] |

"The SCR segment accounted for the largest and fastest aftermarket segment in the exhaust systems market during the forecast period."

Selective catalytic converters (SCR) accounted for the largest aftermarket segment in the exhaust system market. Recent advancements in the aftermarket for Selective Catalytic Reduction (SCR) devices have centered on improving performance and efficiency. In 2023, Cummins expanded its Modular Aftertreatment System, which integrates proven diesel particulate filter (DPF) and SCR technologies into a flexible, modular solution. This system is designed to meet some of the world's most stringent emission regulations while enhancing engine reliability and efficiency. SCR technology continues to be an effective solution for reducing nitrogen oxide (NOx) emissions and improving fuel economy while being virtually maintenance-free. Cummins' electronic controls and software are designed to support a full range of after-treatment options, including flow-through catalysts, DPF, SCR systems, and injection system controls. These control systems can function as standalone modules to enhance engine control or be integrated directly into the engine control module. Growing stringent emission norms specifically for NOx emissions and SCR systems is an effective technology for reducing NOx emissions. Further, advancements in SCR catalyst design, urea injection systems, and engine control technologies have enhanced the performance and cost-effectiveness of SCR systems, driving the adoption of SCR systems for emission control.

"The passenger car segment is expected to be the largest and fastest vehicle type segment during the forecast period."

The passenger car segment is estimated to be the largest market for exhaust systems because of its largest share in vehicle production across all vehicle types. The stringency in emission norms for passenger cars, primarily in the US and European countries, further drives the passenger car segment's growth. According to ACEA, global passenger car sales increased by 9% in the first three quarters of 2023. Over 9 million cars were produced in the EU during the same period. The US manufactured around 6 million cars, marking an 11% rise compared to 2022. China manufactured 17.5 million cars, while Japan produced around 6 million cars, representing an 18.5% rise compared to 2022. The passenger car market in the US is growing at a steady rate as consumers are switching to SUVs and pickup trucks. Similarly, the demand for compact, mid and full-sized SUVs and coupes is increasing in other countries such as China, India, Japan, and Europe. These SUVs also offer diesel engines that deliver better performance and towing capacity. Many SUVs are offered with AWD or 4WD systems to provide enhanced traction and stability, particularly in adverse weather conditions or off-road situations. Also, the growth of Gasoline Direct Injection (GDI) engines will continue to fuel the installation of GPF technology in developed and emerging economies. Thus, with the rise in the production and sales of different SUV categories and the rising acceptance of GDI engines, the market for different after-treatment technologies in passenger cars is expected to be significant in the coming years.

"Europe is the second largest market in exhaust systems market."

Europe holds the 2nd largest market share in the exhaust system industry market during the forecast period. Stringent emission regulations and the demand for smaller, more efficient engines without compromising performance are driving the growth. Developed economies such as Germany, the UK, France, and Spain account for a considerable share of the European automotive industry, which is dominated by established OEMs such as BMW (Germany), Daimler (Germany), Fiat (Italy), PSA/Peugeot-Citroen (France), and Volkswagen (Germany). Further, Europe is known for the early adoption of emission norms for all vehicle types. Europe was a diesel-driven region, but for the last 5 years, the trend has been shifting toward gasoline cars. The penetration of diesel vehicles in Europe has declined from 16.4% in 2022 to 13.6% in 2023, affecting the demand for diesel after-treatment devices like DOC, DPF, SCR, and LNT. With the Euro 7 proposal for light-duty vehicles expected to come into force from July 1, 2025, OEMs must adopt the highly effective three-way catalyst to meet the emission regulations.

Furthermore, According to an AECA publication from 2023, light commercial vehicles and buses still dominate the EU market, with over 90% of the fleet running on diesel. This underscores the significant presence of diesel-powered vehicles in the commercial segment, which will drive the growth of diesel exhaust systems in the region.

"Asia-Pacific region is projected to be the fastest growing exhaust systems market by 2030."

China and India are pivotal in the global automotive industry, being major producers and home to vast populations. As vehicle demand rises, the exhaust system market is expected to grow correspondingly. Another significant factor driving this growth is the continuous evolution of government emission regulations and standards, such as China 7 and BS 7. These regulatory updates, alongside increasing vehicle demand, are anticipated to support consistent expansion in the exhaust system market.

The break-up of the profile of primary participants in the automotive exhaust systems market:

- By Company Type: Tier1 - 50%,Tier2-30%, and OEMs - 20%

- By Designation: C-Level Executives - 30%, Director Level- 40%, and Others - 30%

- By Region: North America -30%, Europe - 25%, Asia Pacific - 45%

Tenneco Inc.(US), Faurecia (France), Eberspacher (Germany), Continental AG (Germany), and Futaba Industrial Co.Ltd. (Japan) are the leading providers of an exhaust system in the global market.

Research Coverage:

This research report categorizes the Automotive exhaust systems market size based on OE Market, by the after-treatment device (DOC, DPF, SCR, LNT, and GPF), OE Market, by component (sensors, exhaust manifold, downpipe, catalytic converter, muffler, tailpipe, and hangers), aftermarket by the after-treatment device (DOC, DPF, SCR, and GPF), by vehicle type (passenger car, LCV, trucks, buses), OE Market, by off-highway vehicle (agricultural tractor and construction equipment), off-highway (OE) market, by the after-treatment device (DOC, DPF, and SCR), by Fuel Type (Diesel, Gasoline) Sales Channel (OEM and aftermarket), and Region (Asia Pacific, North America, Europe, and the Rest of the World).

The report comprehensively discusses key factors impacting the growth of the automotive exhaust systems market, including drivers, constraints, challenges, and opportunities. It provides detailed analyses of major industry players, offering insights into their business profiles, solutions, services, key strategies, contracts, partnerships, agreements, new product and service launches, mergers and acquisitions, recession impacts, and recent developments. Additionally, the report includes a competitive analysis of emerging startups within the automotive exhaust systems market ecosystem.

Reasons to buy this report:

This report offers comprehensive analyses of market share and supply chains and detailed information on component manufacturers. It is designed to aid market leaders and new entrants by providing precise revenue estimates for the overall automotive exhaust systems market. Additionally, the report helps stakeholders understand the market dynamics, highlighting key drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Vehicle pollution leading to stringent emission and fuel economy rules and regulations, growing penetration of after-treatment devices in combination), restraints (Increasing sales of clean vehicles), opportunities (Lightweight and efficient emission system supplementing the vehicle weight reduction, Growing demand for gasoline particulate filter in GDI engine), and challenges (Different emission regulations in different regulations) are fueling the demand of the exhaust systems.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the automotive exhaust systems market, such as the use of various kinds of metals in exhaust systems such as Titanium, stainless steel, etc.

- Market Development: Comprehensive information about lucrative markets - the report analyses the automotive exhaust systems market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the automotive exhaust systems market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the automotive exhaust systems market, such as Tenneco Inc.(US), Faurecia (France), Eberspacher (Germany), Continental AG (Germany), and Futaba Industrial Co.Ltd. (Japan).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 CURRENCY EXCHANGE RATES

- 1.5 SUMMARY OF CHANGES

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 RESEARCH METHODOLOGY MODEL

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources to estimate exhaust system market

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.1 List of primary participants

- 2.1.2.2 Sampling techniques and data collection methods

- 2.2 MARKET ESTIMATION METHODOLOGY

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 5 EXHAUST SYSTEM MARKET SIZE: BOTTOM-UP APPROACH (AFTER-TREATMENT DEVICE AND REGION)

- FIGURE 6 EXHAUST SYSTEM MARKET SIZE: BOTTOM-UP APPROACH (AFTERMARKET, BY VEHICLE TYPE)

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 7 EXHAUST SYSTEM MARKET SIZE: TOP-DOWN APPROACH (COMPONENT)

- 2.2.3 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 2.3 FACTOR ANALYSIS

- 2.4 RECESSION IMPACT ANALYSIS

- 2.5 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- 2.6 RESEARCH ASSUMPTIONS

- TABLE 2 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 REPORT SUMMARY

- FIGURE 9 EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2024 VS. 2030

4 PREMIUM INSIGHTS

- 4.1 SIGNIFICANT OPPORTUNITIES FOR PLAYERS IN EXHAUST SYSTEM MARKET

- FIGURE 10 RISING DEMAND FROM END USE APPLICATIONS AND GROWING PENETRATION OF GDI ENGINES TO DRIVE MARKET

- 4.2 EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE

- FIGURE 11 SCR SEGMENT TO LEAD MARKET FROM 2024 TO 2030

- 4.3 EXHAUST SYSTEM (OE) MARKET, BY COMPONENT

- FIGURE 12 SENSORS SEGMENT TO SECURE LEADING MARKET POSITION DURING FORECAST PERIOD

- 4.4 EXHAUST SYSTEM (OE) MARKET, BY VEHICLE TYPE

- FIGURE 13 PASSENGER CARS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.5 EXHAUST SYSTEM MARKET (OE), BY FUEL TYPE

- FIGURE 14 GASOLINE SEGMENT TO WITNESS HIGHER CAGR THAN DIESEL SEGMENT DURING FORECAST PERIOD

- 4.6 EXHAUST SYSTEM AFTERMARKET, BY AFTER-TREATMENT DEVICE

- FIGURE 15 SCR SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.7 OFF-HIGHWAY VEHICLES EXHAUST SYSTEM (OE) MARKET, BY EQUIPMENT TYPE

- FIGURE 16 AGRICULTURAL TRACTORS SEGMENT TO DOMINATE MARKET IN 2024

- 4.8 OFF-HIGHWAY VEHICLES EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE

- FIGURE 17 SCR SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- 4.9 EXHAUST SYSTEM MARKET, BY SALES CHANNEL

- FIGURE 18 AFTERMARKET SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.10 EXHAUST SYSTEM (OE) MARKET, BY REGION

- FIGURE 19 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 EXHAUST SYSTEM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising vehicle emissions and growing awareness of environmental sustainability

- 5.2.1.1.1 Stringent emission regulations for on-highway vehicles

- 5.2.1.1 Rising vehicle emissions and growing awareness of environmental sustainability

- TABLE 3 HISTORICAL OVERVIEW OF ON-ROAD VEHICLE EMISSION REGULATIONS FOR PASSENGER VEHICLES, 2016-2024

- 5.2.1.1.2 Stringency of emission norms for off-highway vehicles

- 5.2.1.1.3 Growing emphasis on fuel performance and efficiency

- 5.2.1.2 Increasing use of after-treatment device combinations

- 5.2.2 RESTRAINTS

- 5.2.2.1 Increasing sales of cleaner vehicles

- FIGURE 21 GLOBAL ELECTRIC VEHICLE SALES, 2018-2030

- FIGURE 22 GLOBAL CNG AND LPG VEHICLE SALES, 2018-2030

- TABLE 4 FINANCIAL INCENTIVES FOR ELECTRIC VEHICLES, BY COUNTRY

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand for lightweight and efficient exhaust systems to reduce vehicle weight

- 5.2.3.2 Growing demand for gasoline particulate filters (GPFs) in gasoline direct injection (GDI) engines

- FIGURE 23 GASOLINE-POWERED PASSENGER CAR TRENDS IN EUROPE, 2023-2030 (VOLUME SHARE)

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of uniformity in emission regulations across different regions

- TABLE 5 OVERVIEW OF EMISSION REGULATION SPECIFICATIONS FOR PASSENGER CARS, 2016-2023

- TABLE 6 EMISSION NORMS FOR PASSENGER CARS, BY COUNTRY

- FIGURE 24 EUROPE: CHANGE IN EMISSION LIMITS

- FIGURE 25 INDIA: CHANGE IN EMISSION LIMITS

- FIGURE 26 CHINA: CHANGE IN EMISSION LIMIT

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 REVENUE SHIFT IMPACTING CONSUMER BUSINESS

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 Use of ammonia slip catalyst (ASC) and selective catalytic reduction (SCR)

- 5.4.1.2 Use of ultra-high filtration diesel particulate filters

- 5.4.2 COMPLEMENTARY TECHNOLOGIES

- 5.4.2.1 Use of vanadium-based catalysts

- 5.4.2.2 Electric catalyst heating

- 5.4.3 ADJACENT TECHNOLOGIES

- 5.4.3.1 Development of sensor-based exhaust systems

- 5.4.1 KEY TECHNOLOGIES

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 28 EXHAUST SYSTEM MARKET: SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- FIGURE 29 EXHAUST SYSTEM MARKET: ECOSYSTEM ANALYSIS

- 5.6.1 EXHAUST COMPONENT MANUFACTURERS

- 5.6.2 EXHAUST SYSTEM AND AFTER-TREATMENT MANUFACTURERS

- 5.6.3 OEMS

- TABLE 7 EXHAUST SYSTEM MARKET: ECOSYSTEM

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 ANALYSIS OF EMISSIONS FROM GERMAN GASOLINE VEHICLES

- 5.7.2 LEVERAGING CONNECTIVITY AND AUTONOMY FOR IMPROVED DIESEL PARTICULATE FILTER (DPF) MANAGEMENT

- 5.7.3 EXPERIMENTAL STUDY ON RECIPROCATING FLOW REGENERATION OF DIESEL PARTICULATE FILTER (DPF) SYSTEMS

- 5.7.4 ASSESSMENT OF GASOLINE DIRECT INJECTION VEHICLE EMISSIONS WITH AND WITHOUT CATALYZED GASOLINE PARTICULATE FILTERS

- 5.7.5 OPTIMIZATION OF THERMOELECTRIC GENERATOR PLACEMENT IN EXHAUST SYSTEMS FOR WASTE HEAT RECOVERY

- 5.8 PATENT ANALYSIS

- 5.8.1 INTRODUCTION

- FIGURE 30 PATENT PUBLICATION TRENDS, 2014-2024

- 5.8.2 LEGAL STATUS OF PATENTS

- FIGURE 31 LEGAL STATUS OF PATENTS FILED FOR EXHAUST SYSTEMS, 2014-2023

- 5.8.3 TOP PATENT APPLICANTS

- FIGURE 32 EXHAUST SYSTEM PATENTS, BY OEM (2020-2024)

- TABLE 8 EXHAUST SYSTEM MARKET: KEY PATENTS, 2020-2024

- 5.9 REGULATORY LANDSCAPE

- TABLE 9 EURO-5 VS. EURO-6 VEHICLE EMISSION STANDARDS ON NEW EUROPEAN DRIVING CYCLE

- TABLE 10 ON-ROAD VEHICLE EMISSION REGULATION OUTLOOK FOR PASSENGER CARS, 2016-2024

- 5.9.1 ON-ROAD VEHICLES

- FIGURE 33 ON-ROAD VEHICLE EMISSION REGULATION OUTLOOK, 2014-2025

- 5.9.2 OFF-ROAD VEHICLES

- FIGURE 34 OFF-ROAD VEHICLE EMISSION REGULATION OUTLOOK, 2019-2025

- 5.9.3 REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

- 5.9.3.1 North America

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.3.2 Europe

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.3.3 Asia Pacific

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.3.4 Rest of the World

- TABLE 14 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10 FUEL ECONOMY NORMS

- 5.10.1 US

- TABLE 15 US: CAFE STANDARDS FOR EACH MODEL YEAR IN MILES PER GALLON, 2019-2025

- 5.10.2 EUROPE

- 5.10.3 CHINA

- TABLE 16 CHINA: CHINA 6A AND 6B STANDARDS, 2021 ONWARDS

- 5.10.4 INDIA

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR AFTER-TREATMENT DEVICES

- 5.11.2 BUYING CRITERIA

- FIGURE 35 KEY BUYING CRITERIA FOR AFTER-TREATMENT DEVICES

- TABLE 18 KEY BUYING CRITERIA FOR AFTER-TREATMENT DEVICES

- 5.12 KEY CONFERENCES AND EVENTS

- TABLE 19 EXHAUST SYSTEM MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT DATA

- TABLE 20 US: IMPORT SHARE, BY COUNTRY (VALUE USD)

- TABLE 21 CHINA: IMPORT SHARE, BY COUNTRY (VALUE USD)

- TABLE 22 JAPAN: IMPORT SHARE, BY COUNTRY (VALUE USD)

- TABLE 23 INDIA: IMPORT SHARE, BY COUNTRY (VALUE USD)

- 5.13.2 EXPORT DATA

- TABLE 24 US: EXPORT SHARE, BY COUNTRY (VALUE USD)

- TABLE 25 CHINA: EXPORT SHARE, BY COUNTRY (VALUE USD)

- TABLE 26 JAPAN: EXPORT SHARE, BY COUNTRY (VALUE USD)

- TABLE 27 INDIA: EXPORT SHARE, BY COUNTRY (VALUE USD)

- 5.14 INVESTMENT AND FUNDING SCENARIO

- FIGURE 36 INVESTMENT SCENARIO

- TABLE 28 LIST OF FUNDING, 2023-2024

- 5.15 SUPPLIER ANALYSIS

- 5.16 PRICING ANALYSIS

- 5.16.1 BY AFTER-TREATMENT DEVICE

- TABLE 29 AVERAGE SELLING PRICE (ASP), BY AFTER-TREATMENT DEVICE

- 5.16.2 BY REGION

- TABLE 30 AVERAGE SELLING PRICE (ASP), BY REGION

- 5.17 IMPACT OF ELECTRIC VEHICLES ON EXHAUST SYSTEM MARKET

6 EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE

- 6.1 INTRODUCTION

- 6.1.1 INDUSTRY INSIGHTS

- FIGURE 37 EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024 VS. 2030 (USD MILLION)

- TABLE 31 EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (THOUSAND UNITS)

- TABLE 32 EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (THOUSAND UNITS)

- TABLE 33 EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (USD MILLION)

- TABLE 34 EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (USD MILLION)

- 6.2 DIESEL OXIDATION CATALYST (DOC)

- 6.2.1 STRINGENT EMISSION REGULATIONS FOR DIESEL VEHICLES TO DRIVE MARKET

- TABLE 35 DIESEL OXIDATION CATALYST (OE) MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 36 DIESEL OXIDATION CATALYST (OE) MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 37 DIESEL OXIDATION CATALYST (OE) MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 38 DIESEL OXIDATION CATALYST (OE) MARKET, BY REGION, 2024-2030 (USD MILLION)

- 6.3 DIESEL PARTICULATE FILTER (DPF)

- 6.3.1 RISING EMISSION REGULATIONS FOR DIESEL VEHICLES TO DRIVE MARKET

- TABLE 39 DIESEL PARTICULATE FILTER (OE) MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 40 DIESEL PARTICULATE FILTER (OE) MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 41 DIESEL PARTICULATE FILTER (OE) MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 42 DIESEL PARTICULATE FILTER (OE) MARKET, BY REGION, 2024-2030 (USD MILLION)

- 6.4 LEAN NOX TRAP (LNT)

- 6.4.1 STRINGENT REGULATION TO CONTAIN NOX EMISSIONS TO DRIVE MARKET

- TABLE 43 LEAN NOX TRAP (OE) MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 44 LEAN NOX TRAP (OE) MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 45 LEAN NOX TRAP (OE) MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 46 LEAN NOX TRAP (OE) MARKET, BY REGION, 2024-2030 (USD MILLION)

- 6.5 SELECTIVE CATALYTIC REDUCTION (SCR)

- 6.5.1 ONGOING AND UPCOMING STRINGENT EMISSION NORMS IN EMERGING ECONOMIES TO DRIVE MARKET

- TABLE 47 SELECTIVE CATALYTIC REDUCTION (OE) MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 48 SELECTIVE CATALYTIC REDUCTION (OE) MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 49 SELECTIVE CATALYTIC REDUCTION (OE) MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 50 SELECTIVE CATALYTIC REDUCTION (OE) MARKET, BY REGION, 2024-2030 (USD MILLION)

- 6.6 GASOLINE PARTICULATE FILTER (GPF)

- 6.6.1 RISING PRODUCTION OF GASOLINE VEHICLES TO DRIVE MARKET

- TABLE 51 GASOLINE PARTICULATE FILTER (OE) MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 52 GASOLINE PARTICULATE FILTER (OE) MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 53 GASOLINE PARTICULATE FILTER (OE) MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 54 GASOLINE PARTICULATE FILTER (OE) MARKET, BY REGION, 2024-2030 (USD MILLION)

7 EXHAUST SYSTEM (OE) MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- 7.1.1 INDUSTRY INSIGHTS

- FIGURE 38 EXHAUST SYSTEM (OE) MARKET, BY COMPONENT, 2024 VS. 2030 (USD MILLION)

- TABLE 55 EXHAUST SYSTEM (OE) MARKET, BY COMPONENT, 2019-2023 (THOUSAND UNITS)

- TABLE 56 EXHAUST SYSTEM (OE) MARKET, BY COMPONENT, 2024-2030 (THOUSAND UNITS)

- TABLE 57 EXHAUST SYSTEM (OE) MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 58 EXHAUST SYSTEM (OE) MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- 7.2 SENSORS

- TABLE 59 SENSORS (OE) MARKET, BY TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 60 SENSORS (OE) MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 61 SENSORS (OE) MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 62 SENSORS (OE) MARKET, BY TYPE, 2024-2030 (USD MILLION)

- 7.2.1 NOX SENSORS

- 7.2.1.1 Rising installation of SCR after-treatment devices to drive market

- TABLE 63 NOX SENSORS (OE) MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 64 NOX SENSORS (OE) MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 65 NOX SENSORS (OE) MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 66 NOX SENSORS (OE) MARKET, BY REGION, 2024-2030 (USD MILLION)

- 7.2.2 OXYGEN SENSORS

- 7.2.2.1 Increasing adoption of oxygen sensors to curb emissions to drive market

- TABLE 67 OXYGEN SENSORS (OE) MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 68 OXYGEN SENSORS (OE) MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 69 OXYGEN SENSORS (OE) MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 70 OXYGEN SENSORS (OE) MARKET, BY REGION, 2024-2030 (USD MILLION)

- 7.2.3 TEMPERATURE SENSORS

- 7.2.3.1 Adoption of temperature sensors for effective temperature management to drive market

- TABLE 71 TEMPERATURE SENSORS (OE) MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 72 TEMPERATURE SENSORS (OE) MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 73 TEMPERATURE SENSORS (OE) MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 74 TEMPERATURE SENSORS (OE) MARKET, BY REGION, 2024-2030 (USD MILLION)

- 7.2.4 PM SENSORS

- 7.2.4.1 increasing implementation of after-treatment devices to drive market

- TABLE 75 PM SENSORS (OE) MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 76 PM SENSORS (OE) MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 77 PM SENSORS (OE) MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 78 PM SENSORS (OE) MARKET, BY REGION, 2024-2030 (USD MILLION)

- 7.3 CATALYTIC CONVERTERS

- 7.3.1 STRINGENT EMISSION NORMS TO DRIVE MARKET

- TABLE 79 CATALYTIC CONVERTERS (OE) MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 80 CATALYTIC CONVERTERS (OE) MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 81 CATALYTIC CONVERTERS (OE) MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 82 CATALYTIC CONVERTERS (OE) MARKET, BY REGION, 2024-2030 (USD MILLION)

- 7.4 DOWNPIPES

- 7.4.1 RISING DEMAND FOR AFTER-TREATMENT DEVICES TO DRIVE MARKET

- TABLE 83 DOWNPIPES (OE) MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 84 DOWNPIPES (OE) MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 85 DOWNPIPES (OE) MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 86 DOWNPIPES (OE) MARKET, BY REGION, 2024-2030 (USD MILLION)

- 7.5 MANIFOLDS

- 7.5.1 RISING ADOPTION OF AFTER-TREATMENT DEVICES AND INCREASING SALES OF VEHICLES TO DRIVE MARKET

- TABLE 87 MANIFOLDS (OE) MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 88 MANIFOLDS (OE) MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 89 MANIFOLDS (OE) MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 90 MANIFOLDS (OE) MARKET, BY REGION, 2024-2030 (USD MILLION)

- 7.6 MUFFLERS

- 7.6.1 GROWING ACCEPTANCE OF AFTER-TREATMENT DEVICES TO DRIVE MARKET

- TABLE 91 MUFFLERS (OE) MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 92 MUFFLERS (OE) MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 93 MUFFLERS (OE) MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 94 MUFFLERS (OE) MARKET, BY REGION, 2024-2030 (USD MILLION)

- 7.7 TAILPIPES

- 7.7.1 GROWING FOCUS ON IMPROVED ENGINE ACOUSTICS AND PERFORMANCE TO DRIVE MARKET

- TABLE 95 TAILPIPES (OE) MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 96 TAILPIPES (OE) MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 97 TAILPIPES (OE) MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 98 TAILPIPES (OE) MARKET, BY REGION, 2024-2030 (USD MILLION)

- 7.8 HANGERS

- 7.8.1 IMPLEMENTATION OF ADVANCED EXHAUST SYSTEMS TO DRIVE DEMAND

- TABLE 99 HANGERS (OE) MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 100 HANGERS (OE) MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 101 HANGERS (OE) MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 102 HANGERS (OE) MARKET, BY REGION, 2024-2030 (USD MILLION)

8 EXHAUST SYSTEM (OE) MARKET, BY VEHICLE TYPE

- 8.1 INTRODUCTION

- 8.1.1 INDUSTRY INSIGHTS

- FIGURE 39 EXHAUST SYSTEM (OE) MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 103 EXHAUST SYSTEM (OE) MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 104 EXHAUST SYSTEM (OE) MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 105 EXHAUST SYSTEM (OE) MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 106 EXHAUST SYSTEM (OE) MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 8.2 PASSENGER CARS

- 8.2.1 RISING PRODUCTION AND SALES OF PASSENGER CARS TO DRIVE MARKET

- TABLE 107 PASSENGER CARS: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 108 PASSENGER CARS: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 109 PASSENGER CARS: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 110 PASSENGER CARS: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2024-2030 (USD MILLION)

- 8.3 LIGHT COMMERCIAL VEHICLES

- 8.3.1 RISING PRODUCTION AND SALES OF LIGHT COMMERCIAL VEHICLES TO DRIVE MARKET

- TABLE 111 LIGHT COMMERCIAL VEHICLES: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 112 LIGHT COMMERCIAL VEHICLES: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 113 LIGHT COMMERCIAL VEHICLES: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 114 LIGHT COMMERCIAL VEHICLES: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2024-2030 (USD MILLION)

- 8.4 TRUCKS

- 8.4.1 RISING ADOPTION OF TRUCKS FOR COMMERCIAL TRANSPORTATION TO DRIVE MARKET

- TABLE 115 TRUCKS: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 116 TRUCKS: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 117 TRUCKS: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 118 TRUCKS: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2024-2030 (USD MILLION)

- 8.5 BUSES

- 8.5.1 INCREASING DEMAND FOR PUBLIC TRANSPORT TO DRIVE MARKET

- TABLE 119 BUSES: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 120 BUSES: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 121 BUSES: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 122 BUSES: EXHAUST SYSTEM (OE) MARKET, BY REGION, 2024-2030 (USD MILLION)

9 EXHAUST SYSTEM (OE) MARKET, BY FUEL TYPE

- 9.1 INTRODUCTION

- 9.1.1 INDUSTRY INSIGHTS

- FIGURE 40 EXHAUST SYSTEM MARKET, BY FUEL TYPE, 2024 VS. 2030 (USD MILLION)

- TABLE 123 EXHAUST SYSTEM MARKET, BY FUEL TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 124 EXHAUST SYSTEM MARKET, BY FUEL, 2024-2030 (THOUSAND UNITS)

- TABLE 125 EXHAUST SYSTEM MARKET, BY FUEL TYPE, 2019-2023 (USD MILLION)

- TABLE 126 EXHAUST SYSTEM MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- 9.2 GASOLINE

- 9.2.1 RISE IN GASOLINE-POWERED PASSENGER CARS TO DRIVE MARKET

- TABLE 127 GASOLINE: EXHAUST SYSTEM MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 128 GASOLINE: EXHAUST SYSTEM MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 129 GASOLINE: EXHAUST SYSTEM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 130 GASOLINE: EXHAUST SYSTEM MARKET, BY REGION, 2024-2030 (USD MILLION)

- 9.3 DIESEL

- 9.3.1 INCREASING EFFICIENCY OF DIESEL EXHAUST SYSTEMS TO DRIVE MARKET

- TABLE 131 DIESEL: EXHAUST SYSTEM MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 132 DIESEL: EXHAUST SYSTEM MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 133 DIESEL: EXHAUST SYSTEM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 134 DIESEL: EXHAUST SYSTEM MARKET, BY REGION, 2024-2030 (USD MILLION)

10 EXHAUST SYSTEM AFTERMARKET, BY AFTER-TREATMENT DEVICE

- 10.1 INTRODUCTION

- 10.1.1 INDUSTRY INSIGHTS

- FIGURE 41 EXHAUST SYSTEM AFTERMARKET, BY AFTER-TREATMENT DEVICE, 2024 VS. 2030 (USD MILLION)

- TABLE 135 EXHAUST SYSTEM AFTERMARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (THOUSAND UNITS)

- TABLE 136 EXHAUST SYSTEM (OE) AFTERMARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (THOUSAND UNITS)

- TABLE 137 EXHAUST SYSTEM (OE) AFTERMARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (USD MILLION)

- TABLE 138 EXHAUST SYSTEM (OE) AFTERMARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (USD MILLION)

- 10.2 DIESEL OXIDATION CATALYST (DOC)

- 10.2.1 INCREASING DEMAND FOR DIESEL VEHICLES TO DRIVE MARKET

- TABLE 139 DIESEL OXIDATION CATALYST AFTERMARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 140 DIESEL OXIDATION CATALYST AFTERMARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 141 DIESEL OXIDATION CATALYST AFTERMARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 142 DIESEL OXIDATION CATALYST AFTERMARKET, BY REGION, 2024-2030 (USD MILLION)

- 10.3 DIESEL PARTICULATE FILTER (DPF)

- 10.3.1 RISING DEMAND FOR DIESEL HEAVY-DUTY VEHICLES TO DRIVE MARKET

- TABLE 143 DIESEL PARTICULATE FILTER AFTERMARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 144 DIESEL PARTICULATE FILTER AFTERMARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 145 DIESEL PARTICULATE FILTER AFTERMARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 146 DIESEL PARTICULATE FILTER AFTERMARKET, BY REGION, 2024-2030 (USD MILLION)

- 10.4 SELECTIVE CATALYTIC REDUCTION (SCR)

- 10.4.1 STRINGENT EMISSION REGULATIONS TO DRIVE MARKET

- TABLE 147 SELECTIVE CATALYTIC REDUCTION AFTERMARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 148 SELECTIVE CATALYTIC REDUCTION AFTERMARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 149 SELECTIVE CATALYTIC REDUCTION AFTERMARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 150 SELECTIVE CATALYTIC REDUCTION AFTERMARKET, BY REGION, 2024-2030 (USD MILLION)

11 EXHAUST SYSTEM MARKET, BY SALES CHANNEL

- 11.1 INTRODUCTION

- 11.1.1 INDUSTRY INSIGHTS

- FIGURE 42 EXHAUST SYSTEM MARKET, BY SALES CHANNEL, 2024 VS. 2030 (USD MILLION)

- TABLE 151 EXHAUST SYSTEM MARKET, BY SALES CHANNEL, 2019-2023 (THOUSAND UNITS)

- TABLE 152 EXHAUST SYSTEM MARKET, BY SALES CHANNEL, 2024-2030 (THOUSAND UNITS)

- TABLE 153 EXHAUST SYSTEM MARKET, BY SALES CHANNEL, 2019-2023 (USD MILLION)

- TABLE 154 EXHAUST SYSTEM MARKET, BY SALES CHANNEL, 2024-2030 (USD MILLION)

- 11.2 AFTERMARKET

- 11.2.1 INCREASING VEHICLE OWNERSHIP AND TECHNOLOGICAL IMPROVEMENTS TO DRIVE DEMAND FOR AFTERMARKET COMPONENTS

- TABLE 155 EXHAUST SYSTEM AFTERMARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 156 EXHAUST SYSTEM AFTERMARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 157 EXHAUST SYSTEM AFTERMARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 158 EXHAUST SYSTEM AFTERMARKET, BY REGION, 2024-2030 (USD MILLION)

- 11.3 OEM

- 11.3.1 RISE IS GLOBAL VEHICLE PRODUCTION TO DRIVE MARKET

- TABLE 159 EXHAUST SYSTEM OEM MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 160 EXHAUST SYSTEM OEM MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 161 EXHAUST SYSTEM OEM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 162 EXHAUST SYSTEM OEM MARKET, BY REGION, 2024-2030 (USD MILLION)

12 OFF-HIGHWAY VEHICLES EXHAUST SYSTEM (OE) MARKET, BY EQUIPMENT TYPE

- 12.1 INTRODUCTION

- 12.1.1 INDUSTRY INSIGHTS

- FIGURE 43 OFF-HIGHWAY VEHICLES EXHAUST SYSTEM (OE) MARKET, BY EQUIPMENT TYPE, 2024 VS. 2030 (USD MILLION)

- TABLE 163 OFF-HIGHWAY VEHICLES EXHAUST SYSTEM (OE) MARKET, BY EQUIPMENT TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 164 OFF-HIGHWAY VEHICLES EXHAUST SYSTEM (OE) MARKET, BY EQUIPMENT TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 165 OFF-HIGHWAY VEHICLES EXHAUST SYSTEM (OE) MARKET, BY EQUIPMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 166 OFF-HIGHWAY VEHICLES EXHAUST SYSTEM (OE) MARKET, BY EQUIPMENT TYPE, 2024-2030 (USD MILLION)

- 12.2 AGRICULTURAL TRACTORS

- 12.2.1 INCREASING ADOPTION OF AFTER-TREATMENT DEVICES IN AGRICULTURE INDUSTRY TO DRIVE MARKET

- TABLE 167 EXHAUST SYSTEM MARKET FOR AGRICULTURAL TRACTORS, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 168 EXHAUST SYSTEM MARKET FOR AGRICULTURAL TRACTORS, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 169 EXHAUST SYSTEM MARKET FOR AGRICULTURAL TRACTORS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 170 EXHAUST SYSTEM MARKET FOR AGRICULTURAL TRACTORS, BY REGION, 2024-2030 (USD MILLION)

- 12.3 CONSTRUCTION EQUIPMENT

- 12.3.1 INCREASING USE OF AFTER-TREATMENT DEVICES IN CONSTRUCTION EQUIPMENT TO DRIVE MARKET

- TABLE 171 EXHAUST SYSTEM MARKET FOR CONSTRUCTION EQUIPMENT, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 172 EXHAUST SYSTEM MARKET FOR CONSTRUCTION EQUIPMENT, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 173 EXHAUST SYSTEM MARKET FOR CONSTRUCTION EQUIPMENT, BY REGION, 2019-2023 (USD MILLION)

- TABLE 174 EXHAUST SYSTEM MARKET FOR CONSTRUCTION EQUIPMENT, BY REGION, 2024-2030 (USD MILLION)

- 12.4 MINING EQUIPMENT

- 12.4.1 RISING DEMAND FOR MINERALS AND METALS ACROSS VARIOUS INDUSTRIES TO DRIVE MARKET

- TABLE 175 EXHAUST SYSTEM MARKET FOR MINING EQUIPMENT, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 176 EXHAUST SYSTEM MARKET FOR MINING EQUIPMENT, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 177 EXHAUST SYSTEM MARKET FOR MINING EQUIPMENT, BY REGION, 2019-2023 (USD MILLION)

- TABLE 178 EXHAUST SYSTEM MARKET FOR MINING EQUIPMENT, BY REGION, 2024-2030 (USD MILLION)

13 OFF-HIGHWAY VEHICLES EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE

- 13.1 INTRODUCTION

- 13.1.1 INDUSTRY INSIGHTS

- FIGURE 44 OFF-HIGHWAY VEHICLES EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (USD MILLION)

- TABLE 179 OFF-HIGHWAY VEHICLES EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (THOUSAND UNITS)

- TABLE 180 OFF-HIGHWAY VEHICLES EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (THOUSAND UNITS)

- TABLE 181 OFF-HIGHWAY VEHICLES EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (USD MILLION)

- TABLE 182 OFF-HIGHWAY VEHICLES EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (USD MILLION)

- 13.2 DIESEL PARTICULATE FILTER (DPF)

- 13.2.1 STRINGENT EMISSION NORMS FOR DIESEL VEHICLES TO DRIVE MARKET

- TABLE 183 DPF MARKET FOR OFF-HIGHWAY VEHICLES (OE), BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 184 DPF MARKET FOR OFF-HIGHWAY VEHICLES (OE), BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 185 DPF MARKET FOR OFF-HIGHWAY VEHICLES (OE), BY REGION, 2019-2023 (USD MILLION)

- TABLE 186 DPF MARKET FOR OFF-HIGHWAY VEHICLES (OE), BY REGION, 2024-2030 (USD MILLION)

- 13.3 DIESEL OXIDATION CATALYST (DOC)

- 13.3.1 STRINGENT NORMS TO CURB EMISSIONS TO DRIVE MARKET

- TABLE 187 DOC MARKET FOR OFF-HIGHWAY VEHICLES (OE), BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 188 DOC MARKET FOR OFF-HIGHWAY VEHICLES (OE), BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 189 DOC MARKET FOR OFF-HIGHWAY VEHICLES (OE), BY REGION, 2019-2023 (USD MILLION)

- TABLE 190 DOC MARKET FOR OFF-HIGHWAY VEHICLES (OE), BY REGION, 2024-2030 (USD MILLION)

- 13.4 SELECTIVE CATALYTIC REDUCTION (SCR)

- 13.4.1 ONGOING AND UPCOMING STRINGENT EMISSION NORMS IN EMERGING ECONOMIES TO DRIVE MARKET

- TABLE 191 SCR MARKET FOR OFF-HIGHWAY VEHICLES (OE), BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 192 SCR MARKET FOR OFF-HIGHWAY VEHICLES (OE), BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 193 SCR MARKET FOR OFF-HIGHWAY VEHICLES (OE), BY REGION, 2019-2023 (USD MILLION)

- TABLE 194 SCR MARKET FOR OFF-HIGHWAY VEHICLES (OE), BY REGION, 2024-2030 (USD MILLION)

14 EXHAUST SYSTEM (OE) MARKET, BY REGION

- 14.1 INTRODUCTION

- FIGURE 45 INDUSTRY INSIGHTS

- FIGURE 46 EXHAUST SYSTEM MARKET, BY REGION, 2024 VS. 2030 (USD MILLION)

- TABLE 195 EXHAUST SYSTEM MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 196 EXHAUST SYSTEM MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 197 EXHAUST SYSTEM MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 198 EXHAUST SYSTEM MARKET, BY REGION, 2024-2030 (USD MILLION)

- 14.2 ASIA PACIFIC

- 14.2.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 47 ASIA PACIFIC: EXHAUST SYSTEM MARKET SNAPSHOT

- TABLE 199 ASIA PACIFIC: EXHAUST SYSTEM MARKET, BY COUNTRY, 2019-2023 (THOUSAND UNITS)

- TABLE 200 ASIA PACIFIC: EXHAUST SYSTEM MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 201 ASIA PACIFIC: EXHAUST SYSTEM MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 202 ASIA PACIFIC: EXHAUST SYSTEM MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- 14.2.2 CHINA

- 14.2.2.1 Rising vehicle production and emission norms to drive market

- TABLE 203 CHINA: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (THOUSAND UNITS)

- TABLE 204 CHINA: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (THOUSAND UNITS)

- TABLE 205 CHINA: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (USD MILLION)

- TABLE 206 CHINA: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (USD MILLION)

- 14.2.3 INDIA

- 14.2.3.1 Growing focus on efficiency and sustainability to drive market

- TABLE 207 INDIA: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (THOUSAND UNITS)

- TABLE 208 INDIA: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (THOUSAND UNITS)

- TABLE 209 INDIA: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (USD MILLION)

- TABLE 210 INDIA: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (USD MILLION)

- 14.2.4 JAPAN

- 14.2.4.1 Stricter emission regulations to drive market

- TABLE 211 JAPAN: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (THOUSAND UNITS)

- TABLE 212 JAPAN: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (THOUSAND UNITS)

- TABLE 213 JAPAN: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (USD MILLION)

- TABLE 214 JAPAN: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (USD MILLION)

- 14.2.5 SOUTH KOREA

- 14.2.5.1 Sustainability and innovation to drive market

- TABLE 215 SOUTH KOREA: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (THOUSAND UNITS)

- TABLE 216 SOUTH KOREA: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (THOUSAND UNITS)

- TABLE 217 SOUTH KOREA: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (USD MILLION)

- TABLE 218 SOUTH KOREA: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (USD MILLION)

- 14.2.6 THAILAND

- 14.2.6.1 Rising number of vehicles to drive market

- TABLE 219 THAILAND: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (THOUSAND UNITS)

- TABLE 220 THAILAND: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (THOUSAND UNITS)

- TABLE 221 THAILAND: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (USD MILLION)

- TABLE 222 THAILAND: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (USD MILLION)

- 14.2.7 REST OF ASIA PACIFIC

- TABLE 223 REST OF ASIA PACIFIC: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (THOUSAND UNITS)

- TABLE 224 REST OF ASIA PACIFIC: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (THOUSAND UNITS)

- TABLE 225 REST OF ASIA PACIFIC: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (USD MILLION)

- TABLE 226 REST OF ASIA PACIFIC: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (USD MILLION)

- 14.3 EUROPE

- 14.3.1 EUROPE: RECESSION IMPACT

- FIGURE 48 EUROPE: EXHAUST SYSTEM MARKET SNAPSHOT

- TABLE 227 EUROPE: EXHAUST SYSTEM MARKET, BY COUNTRY, 2019-2023 (THOUSAND UNITS)

- TABLE 228 EUROPE: EXHAUST SYSTEM (OE) MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 229 EUROPE: EXHAUST SYSTEM (OE) MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 230 EUROPE: EXHAUST SYSTEM (OE) MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- 14.3.2 GERMANY

- 14.3.2.1 Increased demand for premium cars to drive market

- TABLE 231 GERMANY: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (THOUSAND UNITS)

- TABLE 232 GERMANY: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (THOUSAND UNITS)

- TABLE 233 GERMANY: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (USD MILLION)

- TABLE 234 GERMANY: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (USD MILLION)

- 14.3.3 FRANCE

- 14.3.3.1 Stringent environmental laws and shift toward carbon neutrality to reduce demand

- TABLE 235 FRANCE: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (THOUSAND UNITS)

- TABLE 236 FRANCE: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (THOUSAND UNITS)

- TABLE 237 FRANCE: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (USD MILLION)

- TABLE 238 FRANCE: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (USD MILLION)

- 14.3.4 UK

- 14.3.4.1 Rising sales of premium cars to drive market

- TABLE 239 UK: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (THOUSAND UNITS)

- TABLE 240 UK: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (THOUSAND UNITS)

- TABLE 241 UK: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (USD MILLION)

- TABLE 242 UK: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (USD MILLION)

- 14.3.5 SPAIN

- 14.3.5.1 Growing production of passenger cars to drive market

- TABLE 243 SPAIN: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (THOUSAND UNITS)

- TABLE 244 SPAIN: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (THOUSAND UNITS)

- TABLE 245 SPAIN: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (USD MILLION)

- TABLE 246 SPAIN: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (USD MILLION)

- 14.3.6 TURKEY

- 14.3.6.1 Growing demand for fuel-efficient vehicles to drive market

- TABLE 247 TURKEY: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (THOUSAND UNITS)

- TABLE 248 TURKEY: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (THOUSAND UNITS)

- TABLE 249 TURKEY: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (USD MILLION)

- TABLE 250 TURKEY: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (USD MILLION)

- 14.3.7 RUSSIA

- 14.3.7.1 Increasing sales of passenger cars to drive market

- TABLE 251 RUSSIA: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (THOUSAND UNITS)

- TABLE 252 RUSSIA: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (THOUSAND UNITS)

- TABLE 253 RUSSIA: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (USD MILLION)

- TABLE 254 RUSSIA: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (USD MILLION)

- 14.3.8 REST OF EUROPE

- TABLE 255 REST OF EUROPE: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (THOUSAND UNITS)

- TABLE 256 REST OF EUROPE: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (THOUSAND UNITS)

- TABLE 257 REST OF EUROPE: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (USD MILLION)

- TABLE 258 REST OF EUROPE: EXHAUST SYSTEM (OE) MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (USD MILLION)

- 14.4 NORTH AMERICA

- 14.4.1 NORTH AMERICA: RECESSION IMPACT

- FIGURE 49 NORTH AMERICA: EXHAUST SYSTEM MARKET SNAPSHOT

- TABLE 259 NORTH AMERICA: EXHAUST SYSTEM MARKET, BY COUNTRY, 2019-2023 (THOUSAND UNITS)

- TABLE 260 NORTH AMERICA: EXHAUST SYSTEM MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 261 NORTH AMERICA: EXHAUST SYSTEM MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 262 NORTH AMERICA: EXHAUST SYSTEM MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- 14.4.2 US

- 14.4.2.1 Advancements in after-treatment technologies and stringency in emission regulations to drive market

- TABLE 263 US: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (THOUSAND UNITS)

- TABLE 264 US: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (THOUSAND UNITS)

- TABLE 265 US: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (USD MILLION)

- TABLE 266 US: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (USD MILLION)

- 14.4.3 MEXICO

- 14.4.3.1 Implementation of emission regulations to drive market

- TABLE 267 MEXICO: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (THOUSAND UNITS)

- TABLE 268 MEXICO: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (THOUSAND UNITS)

- TABLE 269 MEXICO: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (USD MILLION)

- TABLE 270 MEXICO: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (USD MILLION)

- 14.4.4 CANADA

- 14.4.4.1 Increasing vehicle production and stringent emission regulations to drive market

- TABLE 271 CANADA: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (THOUSAND UNITS)

- TABLE 272 CANADA: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (THOUSAND UNITS)

- TABLE 273 CANADA: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (USD MILLION)

- TABLE 274 CANADA: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (USD MILLION)

- 14.5 REST OF THE WORLD

- 14.5.1 REST OF THE WORLD: RECESSION IMPACT

- FIGURE 50 REST OF THE WORLD: EXHAUST SYSTEM MARKET, BY COUNTRY, 2024 VS. 2030 (USD MILLION)

- TABLE 275 REST OF THE WORLD: EXHAUST SYSTEM MARKET, BY COUNTRY, 2019-2023 (THOUSAND UNITS)

- TABLE 276 REST OF THE WORLD: EXHAUST SYSTEM MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 277 REST OF THE WORLD: EXHAUST SYSTEM MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 278 REST OF THE WORLD: EXHAUST SYSTEM MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- 14.5.2 BRAZIL

- 14.5.2.1 Rise in vehicle production and emission regulations to drive market

- TABLE 279 BRAZIL: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (THOUSAND UNITS)

- TABLE 280 BRAZIL: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (THOUSAND UNITS)

- TABLE 281 BRAZIL: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (USD MILLION)

- TABLE 282 BRAZIL: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (USD MILLION)

- 14.5.3 IRAN

- 14.5.3.1 Growing vehicle production and adoption of Euro 6 standards to drive market

- TABLE 283 IRAN: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (THOUSAND UNITS)

- TABLE 284 IRAN: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (THOUSAND UNITS)

- TABLE 285 IRAN: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (USD MILLION)

- TABLE 286 IRAN: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (USD MILLION)

- 14.5.4 OTHERS

- TABLE 287 OTHERS: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (THOUSAND UNITS)

- TABLE 288 OTHERS: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (THOUSAND UNITS)

- TABLE 289 OTHERS: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2019-2023 (USD MILLION)

- TABLE 290 OTHERS: EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICE, 2024-2030 (USD MILLION)

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 MARKET SHARE ANALYSIS, 2023

- FIGURE 51 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- 15.3 EXHAUST SYSTEM MARKET: DEGREE OF COMPETITION, 2023

- 15.4 REVENUE ANALYSIS

- FIGURE 52 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2019-2022

- 15.5 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2024

- TABLE 291 KEY GROWTH STRATEGIES, 2022-2024

- 15.6 COMPANY EVALUATION MATRIX: EXHAUST SYSTEM AND AFTER-TREATMENT DEVICE MANUFACTURERS, 2024

- 15.6.1 STARS

- 15.6.2 EMERGING LEADERS

- 15.6.3 PERVASIVE PLAYERS

- 15.6.4 PARTICIPANTS

- 15.6.5 COMPANY FOOTPRINT

- FIGURE 53 EXHAUST SYSTEM MARKET: COMPANY FOOTPRINT

- 15.6.6 APPLICATION FOOTPRINT

- TABLE 292 EXHAUST SYSTEM MARKET: APPLICATION FOOTPRINT

- 15.6.7 REGION FOOTPRINT

- TABLE 293 EXHAUST SYSTEM MARKET: REGION FOOTPRINT

- 15.6.7.1 Propulsion footprint

- TABLE 294 EXHAUST SYSTEM MARKET: PROPULSION FOOTPRINT

- FIGURE 54 EXHAUST SYSTEM MARKET: COMPANY EVALUATION MATRIX FOR EXHAUST SYSTEM AND AFTER-TREATMENT DEVICE MANUFACTURERS, 2023

- 15.7 COMPANY EVALUATION MATRIX: EXHAUST SYSTEM COMPONENT MANUFACTURERS, 2024

- 15.7.1 STARS

- 15.7.2 EMERGING LEADERS

- 15.7.3 PERVASIVE PLAYERS

- 15.7.4 PARTICIPANTS

- 15.7.5 COMPANY FOOTPRINT

- FIGURE 55 EXHAUST SYSTEM COMPONENT MANUFACTURERS: COMPANY FOOTPRINT

- 15.7.5.1 After-treatment device footprint

- TABLE 295 EXHAUST SYSTEM COMPONENT MANUFACTURERS: AFTER-TREATMENT DEVICE FOOTPRINT

- 15.7.5.2 Application footprint

- TABLE 296 EXHAUST SYSTEM COMPONENT MANUFACTURERS: APPLICATION FOOTPRINT

- 15.7.5.3 Region footprint

- TABLE 297 EXHAUST SYSTEM COMPONENT MANUFACTURERS: REGION FOOTPRINT

- FIGURE 56 EXHAUST SYSTEM MARKET: COMPANY EVALUATION MATRIX FOR EXHAUST SYSTEM COMPONENT MANUFACTURERS, 2023

- 15.8 COMPETITIVE SCENARIO AND TRENDS

- 15.8.1 PRODUCT LAUNCHES

- TABLE 298 EXHAUST SYSTEM MARKET: PRODUCT LAUNCHES, JANUARY 2019-JANUARY 2024

- 15.8.2 DEALS

- TABLE 299 EXHAUST SYSTEM MARKET: DEALS, JANUARY 2019-JANUARY 2024

- 15.8.3 EXPANSIONS

- TABLE 300 EXHAUST SYSTEM MARKET: EXPANSIONS, JANUARY 2019-JANUARY 2024

- 15.9 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 57 COMPANY VALUATION

- FIGURE 58 FINANCIAL METRICS

- 15.10 PRODUCT COMPARISON

16 COMPANY PROFILES

- (Business overview, Products offered, Recent Developments, MNM view)**

- 16.1 KEY PLAYERS

- 16.1.1 FORVIA FAURECIA

- TABLE 301 FORVIA FAURECIA: COMPANY OVERVIEW

- FIGURE 59 FORVIA FAURECIA: COMPANY SNAPSHOT

- TABLE 302 FORVIA FAURECIA: PRODUCTS OFFERED

- TABLE 303 FORVIA FAURECIA: DEALS

- TABLE 304 FORVIA FAURECIA: EXPANSIONS

- 16.1.2 TENNECO INC.

- TABLE 305 TENNECO INC.: COMPANY OVERVIEW

- FIGURE 60 TENNECO INC.: COMPANY SNAPSHOT

- TABLE 306 TENNECO INC.: PRODUCTS OFFERED

- TABLE 307 TENNECO INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 308 TENNECO INC.: DEALS

- 16.1.3 CONTINENTAL AG

- TABLE 309 CONTINENTAL AG: COMPANY OVERVIEW

- FIGURE 61 CONTINENTAL AG: COMPANY SNAPSHOT

- TABLE 310 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 311 CONTINENTAL AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 312 CONTINENTAL AG: EXPANSIONS

- 16.1.4 EBERSPACHER

- TABLE 313 EBERSPACHER: COMPANY OVERVIEW

- FIGURE 62 EBERSPACHER: COMPANY SNAPSHOT

- TABLE 314 EBERSPACHER: PRODUCTS OFFERED

- TABLE 315 EBERSPACHER: NEW PRODUCT DEVELOPMENTS

- TABLE 316 EBERSPACHER: DEALS

- TABLE 317 EBERSPACHER: EXPANSIONS

- 16.1.5 FUTABA INDUSTRIAL CO., LTD.

- TABLE 318 FUTABA INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

- FIGURE 63 FUTABA INDUSTRIAL CO., LTD.: COMPANY SNAPSHOT

- TABLE 319 FUTABA INDUSTRIAL CO., LTD.: PRODUCTS OFFERED

- TABLE 320 FUTABA INDUSTRIAL CO., LTD.: EXPANSIONS

- TABLE 321 FUTABA INDUSTRIAL CO., LTD.: OTHER DEVELOPMENTS

- 16.1.6 SANGO CO., LTD.

- TABLE 322 SANGO CO., LTD.: COMPANY OVERVIEW

- FIGURE 64 SANGO CO., LTD.: COMPANY SNAPSHOT

- TABLE 323 SANGO CO., LTD.: PRODUCTS OFFERED

- TABLE 324 SANGO CO., LTD.: DEALS

- 16.1.7 FRIEDRICH BOYSEN GMBH & CO. KG

- TABLE 325 FRIEDRICH BOYSEN GMBH & CO. KG: COMPANY OVERVIEW

- FIGURE 65 FRIEDRICH BOYSEN GMBH & CO. KG: COMPANY SNAPSHOT

- TABLE 326 FRIEDRICH BOYSEN GMBH & CO. KG: PRODUCTS OFFERED

- 16.1.8 YUTAKA GIKEN COMPANY LIMITED

- TABLE 327 YUTAKA GIKEN COMPANY LIMITED: COMPANY OVERVIEW

- FIGURE 66 YUTAKA GIKEN COMPANY LIMITED: COMPANY SNAPSHOT

- TABLE 328 YUTAKA GIKEN COMPANY LIMITED: PRODUCTS OFFERED

- TABLE 329 YUTAKA GIKEN COMPANY LIMITED: DEALS

- TABLE 330 YUTAKA GIKEN COMPANY LIMITED: OTHER DEVELOPMENTS

- 16.1.9 SEJONG INDUSTRIAL CO., LTD.

- TABLE 331 SEJONG INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 332 SEJONG INDUSTRIAL CO., LTD.: PRODUCTS OFFERED

- TABLE 333 SEJONG INDUSTRIAL CO., LTD.: OTHER DEVELOPMENTS

- 16.1.10 BOSAL

- TABLE 334 BOSAL: COMPANY OVERVIEW

- TABLE 335 BOSAL: PRODUCTS OFFERED

- TABLE 336 BOSAL: EXPANSIONS

- 16.2 OTHER PLAYERS

- 16.2.1 MARELLI HOLDINGS CO., LTD.

- TABLE 337 MARELLI HOLDINGS CO., LTD.: COMPANY OVERVIEW

- 16.2.2 HIROTEC CORPORATION

- TABLE 338 HIROTEC CORPORATION: COMPANY OVERVIEW

- 16.2.3 BENTELER INTERNATIONAL AG

- TABLE 339 BENTELER INTERNATIONAL AG: COMPANY OVERVIEW

- 16.2.4 KATCON GLOBAL

- TABLE 340 KATCON GLOBAL: COMPANY OVERVIEW

- 16.2.5 VIBRACOUSTIC SE

- TABLE 341 VIBRACOUSTIC SE: COMPANY OVERVIEW

- 16.2.6 ASMET

- TABLE 342 ASMET: COMPANY OVERVIEW

- 16.2.7 DINEX A/S

- TABLE 343 DINEX A/S: COMPANY OVERVIEW

- 16.2.8 MAGNAFLOW

- TABLE 344 MAGNAFLOW: COMPANY OVERVIEW

- 16.2.9 GRAND ROCK CO., INC.

- TABLE 345 GRAND ROCK CO., INC.: COMPANY OVERVIEW

- 16.2.10 EMINOX

- TABLE 346 EMINOX: COMPANY OVERVIEW

- 16.2.11 EUROPEAN EXHAUST AND CATALYST LTD.

- TABLE 347 EUROPEAN EXHAUST AND CATALYST LTD.: COMPANY OVERVIEW

- 16.2.12 CREFACT CORPORATION

- TABLE 348 CREFACT CORPORATION: COMPANY OVERVIEW

- 16.2.13 SHARDA MOTOR INDUSTRIES LTD.

- TABLE 349 SHARDA MOTOR INDUSTRIES LTD.: COMPANY OVERVIEW

- 16.2.14 EISENMANN EXHAUST SYSTEMS

- TABLE 350 EISENMANN EXHAUST SYSTEMS: COMPANY OVERVIEW

- 16.2.15 DENSO

- TABLE 351 DENSO: COMPANY OVERVIEW

- 16.2.16 HARBIN AIRUI EMISSIONS CONTROL TECHNOLOGY CO., LTD.

- TABLE 352 HARBIN AIRUI EMISSIONS CONTROL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- 16.2.17 CHONGQING HEIGHT AUTOMOBILE EXHAUST SYSTEM CO., LTD.

- TABLE 353 CHONGQING HEIGHT AUTOMOBILE EXHAUST SYSTEM CO., LTD.: COMPANY OVERVIEW

- 16.2.18 BOSCH MOBILITY

- TABLE 354 BOSCH: COMPANY OVERVIEW

- 16.2.19 JOHNSON MATTHEY

- TABLE 355 JOHNSON MATTHEY: COMPANY OVERVIEW

- *Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

17 RECOMMENDATIONS BY MARKETSANDMARKETS

- 17.1 ASIA PACIFIC TO LEAD EXHAUST SYSTEM MARKET

- 17.2 KEY FOCUS AREAS: GROWING DEMAND FOR GDI ENGINES

- 17.3 CONCLUSION

18 APPENDIX

- 18.1 INSIGHTS FROM INDUSTRY EXPERTS

- 18.2 DISCUSSION GUIDE

- 18.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.4 CUSTOMIZATION OPTIONS

- 18.4.1 EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICES & VEHICLE TYPE

- 18.4.1.1 DOC

- 18.4.1.2 DPF

- 18.4.1.3 SCR

- 18.4.1.4 GPF

- 18.4.2 EXHAUST SYSTEM COMPONENTS OE MARKET, BY VEHICLE TYPE

- 18.4.2.1 Passenger Cars

- 18.4.2.2 LCVs

- 18.4.2.3 Trucks

- 18.4.2.4 Buses

- 18.4.3 HYBRID VEHICLE EXHAUST SYSTEM OE MARKET, BY AFTER-TREATMENT DEVICE

- 18.4.3.1 LNT

- 18.4.3.2 GPF

- 18.4.4 TWO & THREE-WHEELER VEHICLE EXHAUST SYSTEM OE MARKET, BY REGION

- 18.4.4.1 Asia Pacific

- 18.4.4.2 Europe

- 18.4.4.3 North America

- 18.4.4.4 Rest of the World

- 18.4.5 DETAILED ANALYSIS AND PROFILING OF ADDITIONAL MARKET PLAYERS (UP TO 3)

- 18.4.1 EXHAUST SYSTEM MARKET, BY AFTER-TREATMENT DEVICES & VEHICLE TYPE

- 18.5 RELATED REPORTS

- 18.6 AUTHOR DETAILS