|

|

市場調査レポート

商品コード

1539261

排気システム市場 - 世界および地域別分析:車両タイプ別、販売チャネル別、燃料タイプ別、コンポーネント別、後処理装置別、地域別 - 分析と予測(2024年~2034年)Exhaust System Market - A Global and Regional Analysis: Focus on Vehicle Type, Sales Channel, Fuel Type, Component, After-treatment Device, Original Equipment, Aftermarket, and Region - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| 排気システム市場 - 世界および地域別分析:車両タイプ別、販売チャネル別、燃料タイプ別、コンポーネント別、後処理装置別、地域別 - 分析と予測(2024年~2034年) |

|

出版日: 2024年08月23日

発行: BIS Research

ページ情報: 英文 100 Pages

納期: 1~5営業日

|

全表示

- 概要

- 目次

排気システム市場は自動車産業の重要な分野であり、全体的な性能を高めながら、自動車の排出ガスを管理・削減するように設計された技術や部品に焦点を当てています。

この市場は、ますます厳しくなる環境規制への準拠を確保し、よりクリーンで効率的な自動車に対する消費者の要求に応える上で重要な役割を果たしています。楽観的シナリオでは、2024年の市場規模は342億2,000万米ドルになるとみられ、CAGR 3.28%で拡大し、2034年には472億6,000万米ドルに達すると予測されます。

市場の多様性は、乗用車、商用車、農業用トラクター、建設機械、鉱山機械など、幅広い応用分野に反映されています。これらの用途はそれぞれ、エンジンの種類、車両の大きさ、運転条件などの要因によって、排気システムに特定の要件があります。最大のセグメントである乗用車は、生産台数が多く、厳しい排ガス基準を満たす必要があるため、高度な排気技術に対する大きな需要を牽引しています。同様に、小型商用車(LCV)、バス、トラックなどの商用車には、より重い積載量と長時間の使用による独特の要求に対応するための特殊な排気ソリューションが必要です。さらに、農業機械や建設機械、鉱山機械用の排気システムは、厳しい環境下で効果的に機能するのに十分な堅牢性が求められます。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年の評価 | 342億2,000万米ドル |

| 2034年の予測 | 472億6,000万米ドル |

| CAGR | 3.28% |

排気システム市場はさらに、マニホールド、ダウンパイプ、触媒コンバーター、マフラー、テールパイプ、NOxセンサー、酸素センサー、温度センサー、粒子状物質センサーなどの各種センサーなど、製品タイプ別に分類されます。各コンポーネントは排気システムにおいて特定の役割を果たし、排気ガス制御の全体的な効果と車両性能に貢献します。市場はまた、OEM(相手先ブランド製造)製品とアフターマーケット・ソリューションを区別しており、OEM部品は車両の初期生産時に統合され、アフターマーケット部品は交換やアップグレードに対応しています。

燃料の種類も排気システム市場の重要な要素であり、ディーゼルエンジンとガソリンエンジンでは別の考慮事項があります。燃料の種類によって、排ガス規制に対する独自の課題と要件があり、排気部品と後処理装置の設計と機能に影響を与えます。

当レポートでは、世界の排気システム市場について調査し、市場の概要とともに、車両タイプ別、販売チャネル別、燃料タイプ別、コンポーネント別、後処理装置別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- R&Dレビュー

- 規制状況

- ステークホルダー分析

- 主要な世界的イベントの影響分析

- 市場力学の概要

第2章 排気システム市場(用途別)

- 用途のセグメンテーション

- 用途の概要

- 排気システム市場(車両タイプ別)

第3章 排気システム市場(製品別)

- 製品セグメンテーション

- 製品概要

- 排気システム市場(販売チャネル別)

- 排気システム市場(燃料タイプ別)

- 排気システム市場(コンポーネント別)

- 排気システム純正部品市場(後処理装置別)

- 排気システムアフターマーケット(後処理装置別)

第4章 排気システム市場(地域別)

- 排気システム市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル

- Forvia

- Tenneco Inc.

- Continental AG

- Eberspacher

- Futaba Industrial Co., Ltd.

- Sango Co., Ltd.

- Friedrich Boysen GmbH & Co. KG

- Yutaka Giken

- Sejong Industrial Co., Ltd

- BOSAL

- Johnson Matthey

- Klarius Products Ltd

- Benteler International AG

- MagnaFlow

- Borla Performance Industries Inc.

- その他

第6章 調査手法

Introduction to the Exhaust System Market

The exhaust system market is a critical segment of the automotive industry, focusing on technologies and components designed to manage and reduce vehicle emissions while enhancing overall performance. This market plays a vital role in ensuring compliance with increasingly stringent environmental regulations and meeting consumer demands for cleaner, more efficient vehicles. In an optimistic scenario, the market is evaluated at a valuation of $34.22 billion in 2024 and is projected to expand at a CAGR of 3.28% to reach $47.26 billion by 2034.

The market's diversity is reflected in its broad application areas, which include passenger vehicles, commercial vehicles, agricultural tractors, construction equipment, and mining equipment. Each of these applications has specific requirements for exhaust systems, driven by factors such as engine type, vehicle size, and operational conditions. Passenger vehicles, being the largest segment, drive substantial demand for advanced exhaust technologies due to their high production volumes and the need to meet rigorous emission standards. Similarly, commercial vehicles, including light commercial vehicles (LCVs), buses, and trucks, require specialized exhaust solutions to handle the unique demands of their heavier loads and extended usage. Additionally, exhaust systems for agricultural and construction machinery, as well as mining equipment, must be robust enough to perform effectively in challenging environments.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $34.22 Billion |

| 2034 Forecast | $47.26 Billion |

| CAGR | 3.28% |

The exhaust system market is further categorized by product types, including manifolds, downpipes, catalytic converters, mufflers, tailpipes, and various sensors such as NOx, oxygen, temperature, and particulate matter sensors. Each component plays a specific role in the exhaust system, contributing to the overall effectiveness of emission control and vehicle performance. The market also distinguishes between original equipment manufacturer (OEM) products and aftermarket solutions, with OEM components being integrated during the vehicle's initial production and aftermarket parts catering to replacements and upgrades.

Fuel type is another significant factor in the exhaust system market, with separate considerations for diesel and gasoline engines. Each fuel type presents unique challenges and requirements for emission control, influencing the design and functionality of exhaust components and after-treatment devices.

The market for after-treatment devices is segmented into original equipment and aftermarket categories. Original equipment includes advanced technologies such as diesel oxidation catalysts (DOCs), diesel particulate filters (DPFs), selective catalytic reduction (SCR), lean NOx traps (LNTs), and gasoline particulate filters (GPFs). These devices are critical for meeting emission standards and improving vehicle efficiency. The aftermarket segment mirrors these technologies, providing replacement and enhancement options to extend the lifespan and performance of existing exhaust systems.

The regional segmentation of the exhaust system market includes North America, Europe, Asia-Pacific, and Rest-of-the-World. Asia-Pacific stands out as the largest regional market, driven by its rapidly growing automotive industry, increasing vehicle production, and expanding infrastructure. This region's substantial market size is supported by major automotive manufacturing hubs in countries such as China, Japan, and South Korea. Europe and North America follow, with significant demand driven by stringent environmental regulations and high vehicle ownership rates.

Overall, the exhaust system market is characterized by its dynamic nature, driven by evolving regulatory standards, technological advancements, and shifting consumer preferences. As the industry continues to innovate and adapt, the market is expected to see ongoing development and growth, reflecting the broader trends toward cleaner and more efficient automotive solutions.

Market Segmentation:

Segmentation 1: by Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Light Commercial Vehicles (LCVs)

- Buses

- Trucks

- Agricultural Tractor

- Construction Equipment

- Mining Equipment

Segmentation 2: by Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

Segmentation 3: by Fuel Type

- Diesel

- Gasoline

- Others

Segmentation 4: by Component

- Manifolds

- Downpipes

- Catalytic Converter

- Muffler

- Tailpipes

- Sensors

- NOx Sensors

- Oxygen Sensors

- Temperature Sensors

- Particulate Matter (PM) Sensors

- Hangers

- Others

Segmentation 5: by After-Treatment Device (Exhaust System Original Equipment (OE) Market)

- Diesel Oxidation Catalyst (DOC)

- Diesel Particulate Filter (DPF)

- Selective Catalytic Reduction (SCR)

- Lean NOx Trap (LNT)

- Gasoline Particulate Filter (GPF)

Segmentation 6: by After-Treatment Device (Exhaust System Aftermarket)

- Diesel Oxidation Catalyst (DOC)

- Diesel Particulate Filter (DPF)

- Gasoline Particulate Filter (GPF)

- Selective Catalytic Reduction (SCR)

Segmentation 7: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

How can this report add value to an organization?

Product/Innovation Strategy: This report provides a comprehensive product/innovation strategy for the global exhaust system market, identifying opportunities for market entry, technology adoption, and sustainable growth. It offers actionable insights, helping organizations gain a competitive edge, and capitalize on the increasing demand.

Growth/Marketing Strategy: This report offers a comprehensive growth and marketing strategy designed specifically for the exhaust system market. It presents a targeted approach to identifying specialized market segments, establishing a competitive advantage, and implementing creative marketing initiatives aimed at optimizing market share and financial performance. By harnessing these strategic recommendations, organizations can elevate their market presence, seize emerging prospects, and efficiently propel revenue expansion.

Competitive Strategy: This report crafts a strong competitive strategy tailored to the exhaust system market. It evaluates market rivals, suggests methods to stand out, and offers guidance for maintaining a competitive edge. By adhering to these strategic directives, companies can position themselves effectively in the face of market competition, ensuring sustained prosperity and profitability.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

Some of the prominent companies in this market are:

- Tenneco Inc.

- Continental AG

- Eberspacher

- Futaba Industrial Co., Ltd.

- Sango Co., Ltd.

- BOSAL

- Benteler International AG

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Forecast

- 1.3 R&D Review

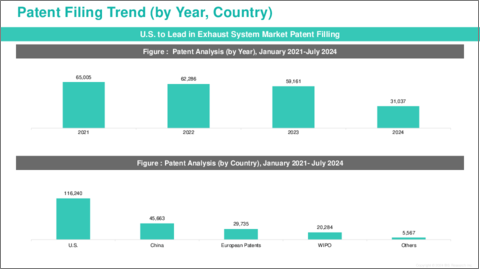

- 1.3.1 Patent Filing Trend by Country, by Company

- 1.4 Regulatory Landscape

- 1.5 Stakeholder Analysis

- 1.5.1 Use Case

- 1.5.2 End User and Buying Criteria

- 1.6 Impact Analysis for Key Global Events

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.2 Market Restraints

- 1.7.3 Market Opportunities

2. Exhaust System Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Exhaust System Market (by Vehicle Type)

- 2.3.1 Passenger Vehicles

- 2.3.2 Commercial Vehicles

- 2.3.2.1 Light Commercial Vehicles (LCVs)

- 2.3.2.2 Buses

- 2.3.2.3 Trucks

- 2.3.3 Agricultural tractor

- 2.3.4 Construction Equipment

- 2.3.5 Mining Equipment

3. Exhaust System Market (by Product)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Exhaust System Market (by Sales Channel)

- 3.3.1 Original Equipment Manufacturer (OEM)

- 3.3.2 Aftermarket

- 3.4 Exhaust System Market (by Fuel Type)

- 3.4.1 Diesel

- 3.4.2 Gasoline

- 3.4.3 Others

- 3.5 Exhaust System Market (by Component)

- 3.5.1 Manifolds

- 3.5.2 Downpipes

- 3.5.3 Catalytic Converter

- 3.5.4 Mufflers

- 3.5.5 Tailpipes

- 3.5.6 Sensors

- 3.5.6.1 NOx Sensors

- 3.5.6.2 Oxygen Sensors

- 3.5.6.3 Temperature Sensors

- 3.5.6.4 Particulate Matter (PM) Sensors

- 3.5.7 Hangers

- 3.5.8 Others

- 3.6 Exhaust System Original Equipment (OE) Market (by After-treatment Device)

- 3.6.1 Diesel Oxidation Catalyst (DOC)

- 3.6.2 Diesel Particulate Filter (DPF)

- 3.6.3 Selective Catalytic Reduction (SCR)

- 3.6.4 Lean NOx Trap (LNT)

- 3.6.5 Gasoline Particulate Filter (GPF)

- 3.7 Exhaust System Aftermarket (by After-treatment Device)

- 3.7.1 Diesel Oxidation Catalyst (DOC)

- 3.7.2 Diesel Particulate Filter (DPF)

- 3.7.3 Gasoline Particulate Filter (GPF)

- 3.7.4 Selective Catalytic Reduction (SCR)

4. Exhaust System Market (by Region)

- 4.1 Exhaust System Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.5.1 U.S.

- 4.2.5.1.1 Market by Application

- 4.2.5.1.2 Market by Product

- 4.2.5.2 Canada

- 4.2.5.2.1 Market by Application

- 4.2.5.2.2 Market by Product

- 4.2.5.3 Mexico

- 4.2.5.3.1 Market by Application

- 4.2.5.3.2 Market by Product

- 4.2.5.1 U.S.

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.5.1 Germany

- 4.3.5.1.1 Market by Application

- 4.3.5.1.2 Market by Product

- 4.3.5.2 France

- 4.3.5.2.1 Market by Application

- 4.3.5.2.2 Market by Product

- 4.3.5.3 U.K.

- 4.3.5.3.1 Market by Application

- 4.3.5.3.2 Market by Product

- 4.3.5.4 Italy

- 4.3.5.4.1 Market by Application

- 4.3.5.4.2 Market by Product

- 4.3.5.5 Rest-of-Europe

- 4.3.5.5.1 Market by Application

- 4.3.5.5.2 Market by Product

- 4.3.5.1 Germany

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.5.1 China

- 4.4.5.1.1 Market by Application

- 4.4.5.1.2 Market by Product

- 4.4.5.2 Japan

- 4.4.5.2.1 Market by Application

- 4.4.5.2.2 Market by Product

- 4.4.5.3 India

- 4.4.5.3.1 Market by Application

- 4.4.5.3.2 Market by Product

- 4.4.5.4 South Korea

- 4.4.5.4.1 Market by Application

- 4.4.5.4.2 Market by Product

- 4.4.5.5 Rest-of-Asia-Pacific

- 4.4.5.5.1 Market by Application

- 4.4.5.5.2 Market by Product

- 4.4.5.1 China

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.5.1 South America

- 4.5.5.1.1 Market by Application

- 4.5.5.1.2 Market by Product

- 4.5.5.2 Middle East and Africa

- 4.5.5.2.1 Market by Application

- 4.5.5.2.2 Market by Product

- 4.5.5.1 South America

5. Companies Profiled

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Company Profiles

- 5.3.1 Forvia

- 5.3.1.1 Overview

- 5.3.1.2 Top Products/Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.1.7 Market Share

- 5.3.2 Tenneco Inc.

- 5.3.2.1 Overview

- 5.3.2.2 Top Products/Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.2.7 Market Share

- 5.3.3 Continental AG

- 5.3.3.1 Overview

- 5.3.3.2 Top Products/Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.3.7 Market Share

- 5.3.4 Eberspacher

- 5.3.4.1 Overview

- 5.3.4.2 Top Products/Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.4.7 Market Share

- 5.3.5 Futaba Industrial Co., Ltd.

- 5.3.5.1 Overview

- 5.3.5.2 Top Products/Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers

- 5.3.5.5 Key Personnel

- 5.3.5.6 Analyst View

- 5.3.5.7 Market Share

- 5.3.6 Sango Co., Ltd.

- 5.3.6.1 Overview

- 5.3.6.2 Top Products/Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.6.7 Market Share

- 5.3.7 Friedrich Boysen GmbH & Co. KG

- 5.3.7.1 Overview

- 5.3.7.2 Top Products/Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.7.7 Market Share

- 5.3.8 Yutaka Giken

- 5.3.8.1 Overview

- 5.3.8.2 Top Products/Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.8.7 Market Share

- 5.3.9 Sejong Industrial Co., Ltd

- 5.3.9.1 Overview

- 5.3.9.2 Top Products/Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.9.7 Market Share

- 5.3.10 BOSAL

- 5.3.10.1 Overview

- 5.3.10.2 Top Products/Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.10.7 Market Share

- 5.3.11 Johnson Matthey

- 5.3.11.1 Overview

- 5.3.11.2 Top Products/Product Portfolio

- 5.3.11.3 Top Competitors

- 5.3.11.4 Target Customers

- 5.3.11.5 Key Personnel

- 5.3.11.6 Analyst View

- 5.3.11.7 Market Share

- 5.3.12 Klarius Products Ltd

- 5.3.12.1 Overview

- 5.3.12.2 Top Products/Product Portfolio

- 5.3.12.3 Top Competitors

- 5.3.12.4 Target Customers

- 5.3.12.5 Key Personnel

- 5.3.12.6 Analyst View

- 5.3.12.7 Market Share

- 5.3.13 Benteler International AG

- 5.3.13.1 Overview

- 5.3.13.2 Top Products/Product Portfolio

- 5.3.13.3 Top Competitors

- 5.3.13.4 Target Customers

- 5.3.13.5 Key Personnel

- 5.3.13.6 Analyst View

- 5.3.13.7 Market Share

- 5.3.14 MagnaFlow

- 5.3.14.1 Overview

- 5.3.14.2 Top Products/Product Portfolio

- 5.3.14.3 Top Competitors

- 5.3.14.4 Target Customers

- 5.3.14.5 Key Personnel

- 5.3.14.6 Analyst View

- 5.3.14.7 Market Share

- 5.3.15 Borla Performance Industries Inc.

- 5.3.15.1 Overview

- 5.3.15.2 Top Products/Product Portfolio

- 5.3.15.3 Top Competitors

- 5.3.15.4 Target Customers

- 5.3.15.5 Key Personnel

- 5.3.15.6 Analyst View

- 5.3.15.7 Market Share

- 5.3.16 Other Key Players

- 5.3.1 Forvia