|

|

市場調査レポート

商品コード

1507982

機内インターネットの世界市場:技術別、エンドユーザー別、サービスモデル別、接続速度別、地域別 - 予測(~2029年)In-flight Internet Market by Technology (Air-2-Ground, Satellite, Hybrid), End User (Commercial Aviation and Business Aviation), Service Model (Free, Paid, Freemium), Connectivity Speed and Regions - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 機内インターネットの世界市場:技術別、エンドユーザー別、サービスモデル別、接続速度別、地域別 - 予測(~2029年) |

|

出版日: 2024年06月06日

発行: MarketsandMarkets

ページ情報: 英文 218 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の機内インターネットの市場規模は、2024年の16億米ドルから2029年までに21億米ドルに達すると推定され、2024年~2029年にCAGRで5.7%の成長が見込まれます。

航空旅行のグローバリゼーションが進み、飛行時間が延びるにつれて、長距離飛行中も接続性を維持したいという乗客の要求が強まっています。機内Wi-Fiは、国際路線での中断のない接続性を確保するソリューションとして浮上しています。さらに、衛星通信インフラの拡大は、この接続性革命を推進する上で重大です。より多くの地上局と多様な地域にわたる衛星通信範囲の改善により、航空企業は機内Wi-Fiサービスの提供がますます容易かつコスト効率的になり、世界中で現代の旅行者の進化するニーズに応えています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 10億米ドル |

| セグメント | 技術別、エンドユーザー別、サービスモデル別、接続速度別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「エンドユーザー別では、民間航空セグメントが2024年にもっとも高い市場シェアを占めると予測されます。」

プラットフォームに基づくと、民間航空セグメントが2024年にもっとも高い市場シェアを占めると予測されます。機内Wi-Fiは民間航空企業にとってかなりの付帯収入源であり、企業は段階的価格設定、サブスクリプションサービス、広告などの多様な収益化モデルを通じて接続性を活用しています。この追加収入の潜在性は、乗客の接続性ニーズを満たすことによる経済的利益を認識し、航空企業が強力なWi-Fiインフラに投資する強力な動機となっています。

「接続速度別では、高速接続セグメントが予測期間にもっとも高いCAGRで成長すると推定されます。」

接続速度別では、電気GSEセグメントが予測期間にもっとも高い成長が見込まれます。大容量衛星ネットワークの進歩と導入は、機内Wi-Fiシステムの強化とともに、航空企業に高速インターネットサービスを提供する力を与えています。これらのネットワークは、より多くのユーザーを効率的に受け入れ、より高速な接続を提供することで、高速サービスの拡大を促進しています。さらに、高速Wi-Fiを備えた航空企業は、特に、航空企業を選択する際に接続品質を優先する、技術に精通し、目の肥えた乗客の間で、競合優位性を獲得しています。

「北米が2024年にもっとも高い市場シェアを占めると予測されます。」

北米には、American Airlines、Delta Air Lines、United Airlinesのような主要航空企業があり、最先端の機内接続性技術で機体を常に近代化しています。同地域では、頻繁に長距離便が運航されているため、機内接続の価値が強く示されており、乗客がWi-Fiサービスを利用し、評価する機会が十分に提供されています。さらに、北米の航空産業における競合情勢から、航空企業はWi-Fiを含む優れた機内サービスを優先し、顧客の獲得と維持に努めています。このような競合は、進化する乗客の期待に応えるための、機内接続性の継続的な強化と投資を促進します。

当レポートでは、世界の機内インターネット市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 機内インターネット市場における企業にとって魅力的な機会(2024年~2029年)

- 機内インターネット市場:技術別

- 機内インターネット市場:サービスモデル別

- 機内インターネット市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向と混乱

- エコシステム分析

- 著名企業

- 民間企業、中小企業

- エンドユーザー

- バリューチェーン分析

- ユースケース分析

- Panasonic Avionics、LEO衛星とGEO衛星を統合し遅延を削減

- Starlinkを使用した高速インターネット

- Wi-FiベースのIFEシステムを使用することで、乗客は自分のデバイスを使用できる

- 貿易分析

- 輸入データ統計

- 輸出データ統計

- 規制情勢

- 主なステークホルダーと購入基準

- 主な会議とイベント

- ビジネスモデル

- 参考価格分析

- 運用データ

第6章 産業動向

- イントロダクション

- 技術動向

- 低軌道衛星

- 5Gオンボード

- マルチリンクシステム

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- メガトレンドの影響

- AI・機械学習

- ビッグデータ・アナリティクス

- 接続性

- デジタル化

- サプライチェーン分析

- 特許分析

第7章 機内インターネット市場:技術別

- イントロダクション

- 空対地(セルラーベース)

- 衛星ベース

- ハイブリッド

第8章 機内インターネット市場:サービスモデル別

- イントロダクション

- 無料Wi-Fi

- 有料Wi-Fi

- フリーミアムWi-Fi

第9章 機内インターネット市場:接続速度別

- イントロダクション

- 高速接続

- 標準接続

- 低帯域幅接続

第10章 機内インターネット市場:エンドユーザー別

- イントロダクション

- 民間航空

- ビジネス航空

第11章 機内インターネット市場:地域別

- イントロダクション

- 北米

- イントロダクション

- 景気後退の影響の分析

- PESTLE分析

- 米国

- カナダ

- 欧州

- イントロダクション

- 景気後退の影響の分析

- PESTLE分析

- 英国

- ドイツ

- フランス

- スペイン

- イタリア

- その他の欧州

- アジア太平洋

- イントロダクション

- 景気後退の影響の分析

- PESTLE分析

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- その他のアジア太平洋

- 中東

- イントロダクション

- 景気後退の影響の分析

- PESTLE分析

- GCC

- トルコ

- その他の地域

- イントロダクション

- 景気後退の影響の分析

- PESTLE分析

- ブラジル

- メキシコ

- 南アフリカ

- その他の国々

第12章 競合情勢

- イントロダクション

- 主要企業戦略/有力企業

- 市場ランキング分析

- 収益分析

- 市場シェア分析

- ブランド/製品の比較

- 企業の評価マトリクス(2023年)

- スタートアップ/中小企業の評価マトリクス(2023年)

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- VIASAT, INC.

- GOGO BUSINESS AVIATION LLC

- PANASONIC AVIONICS CORPORATION

- THALES

- COLLINS AEROSPACE

- ANUVU

- SAFRAN

- INTELSAT

- IRIDIUM COMMUNICATIONS INC.

- STARLINK

- HUGHES NETWORK SYSTEMS, LLC

- EUTELSAT COMMUNICATIONS S.A.

- AEROMOBILE COMMUNICATIONS LTD.

- ASIA SATELLITE TELECOMMUNICATIONS CO., LTD.

- SITA

- その他の企業

- DEUTSCHE TELEKOM

- T-MOBILE US INC.

- THAICOM PLC

- AIRFI

- G-CONNECT

- JSAT MOBILE COMMUNICATIONS

- SKYFIVE

- SES SA

- TELESAT

- AVANTI HYLAS 2 LIMITED

第14章 付録

The In-flight Internet market is estimated to grow from USD 2.1 billion by 2029, from USD 1.6 billion in 2024, at a CAGR of 5.7% from 2024 to 2029. As air travel globalization progresses and flight durations extend, passengers' demand to remain connected during long-haul flights intensifies. In-flight Wi-Fi emerges as the solution, ensuring uninterrupted connectivity over international routes. Furthermore, expanding satellite communication infrastructure is pivotal in facilitating this connectivity revolution. With more ground stations and improved satellite coverage across diverse regions, airlines find it increasingly easier and cost-effective to offer in-flight Wi-Fi services, meeting the evolving needs of modern travelers worldwide.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Technology, End User, Service Model, Connectivity Speed and Regions |

| Regions covered | North America, Europe, APAC, RoW |

"Commercial aviation segment by end user is expected to hold the highest market share in 2024."

Based on platforms, the commercial aviation segment is expected to have the highest market share in 2024. In-flight Wi-Fi is a substantial ancillary revenue source for commercial airlines, who capitalize on connectivity through diverse monetization models like tiered pricing, subscription services, and advertising. This additional revenue potential is a strong incentive for airlines to invest in robust Wi-Fi infrastructure, recognizing the financial benefits of meeting passengers' connectivity needs.

"High-Speed Connectivity segment by connectivity speed is estimated to grow at highest CAGR in the forecast period."

Based on Connectivity Speed, the Electric GSE segment is expected to grow highest during the forecast period. The advancement and implementation of high-capacity satellite networks, alongside enhanced onboard Wi-Fi systems, have empowered airlines to provide high-speed internet services. These networks efficiently accommodate more users and deliver faster connections, facilitating the expansion of high-speed offerings. Moreover, airlines equipped with high-speed Wi-Fi gain a competitive advantage, particularly among tech-savvy and discerning passengers who prioritize connectivity quality when selecting an airline.

"North America is expected to hold the highest market share in 2024."

North America boasts major airlines like American Airlines, Delta Air Lines, and United Airlines, which continually modernize their fleets with cutting-edge in-flight connectivity technologies. The region's numerous frequent and long-haul flights emphasize the value of in-flight connectivity, providing ample opportunities for passengers to utilize and appreciate Wi-Fi services. Furthermore, the competitive landscape in North America's airline industry compels carriers to prioritize superior in-flight services, including Wi-Fi, to attract and retain customers. This competition fosters ongoing enhancements and investments in in-flight connectivity to meet evolving passenger expectations.

The break-up of the profile of primary participants in the In-flight Internet market:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C Level - 35%, Director Level - 25%, Others - 40%

- By Region: North America - 20%, Europe - 25%, Asia Pacific - 35%, Middle East - 10% & Africa - 5%, Latin America - 5%,

Viasat, Inc. (US), Gogo Business Aviation LLC (US), Panasonic Avionics Corporation (US), Thales (France), and Collins Aerospace (US) are key players offering connectivity applicable to various sectors and have well-equipped and strong distribution networks across North America, Europe, Asia Pacific, the Middle East, and the Rest of the World.

Research Coverage:

In terms of end user, the In-flight Internet market is divided into commercial and Business aviation. The technology segment of the In-flight Internet market is air-to-ground, Satellite-Based, and Hybrid.

The Connectivity speed segment includes high-speed, standard, and low-bandwidth connectivity.

Based on the service model, the In-flight Internet market is further segmented into free, paid, and freemium.

This report segments the In-flight Internet market across six key regions: North America, Europe, Asia Pacific, the Middle East, and the Rest of the World, along with their respective key countries. The report's scope includes in-depth information on significant factors, such as drivers, restraints, challenges, and opportunities that influence the growth of the In-flight Internet market.

A comprehensive analysis of major industry players has been conducted to provide insights into their business profiles, solutions, and services. This analysis also covers key aspects like agreements, collaborations, new product launches, contracts, expansions, acquisitions, and partnerships in the In-flight Internet market.

Reasons to buy this report:

This report is a valuable resource for market leaders and newcomers in the In-flight Internet market, offering data that closely approximates revenue figures for both the overall market and its subsegments. It equips stakeholders with a comprehensive understanding of the competitive landscape, facilitating informed decisions to enhance their market positioning and formulating effective go-to-market strategies. The report imparts valuable insights into the market dynamics, offering information on crucial factors such as drivers, restraints, challenges, and opportunities, enabling stakeholders to gauge the market's pulse.

The report provides insights on the following pointers:

- Analysis of the key driver (Increasing demand for connectivity), restraint (High initial installation and maintenance costs), opportunities (Expansion of in-flight internet services into emerging markets), and challenges (Complex installation) there are several factors that could contribute to an increase in the In-flight Internet market.

- Market Penetration: Comprehensive information on In-flight Internet solutions offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the In-flight Internet market

- Market Development: Comprehensive information about lucrative markets - the report analyses the In-flight Internet market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the In-flight Internet market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the In-flight Internet market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 IN-FLIGHT INTERNET MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATES

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primary interviews

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.3 KEY PRIMARY SOURCES

- TABLE 3 KEY PRIMARY SOURCES

- FIGURE 5 PARAMETERS AND KEY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.3 DEMAND-SIDE ANALYSIS

- 2.3.1 INTRODUCTION

- 2.3.2 DEMAND-SIDE INDICATORS

- 2.3.2.1 Passenger traffic

- FIGURE 6 GLOBAL PASSENGER TRAFFIC, 2015-2030

- 2.3.2.2 Emerging economies (by GDP)

- FIGURE 7 SHARE OF G7 AND BRIC OF GLOBAL GDP AT PURCHASING PARITY (1997 TO 2023)

- 2.4 SUPPLY-SIDE ANALYSIS

- 2.4.1 SUPPLY-SIDE INDICATORS

- 2.5 MARKET SIZE ESTIMATION

- 2.5.1 BOTTOM-UP APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (DEMAND SIDE)

- 2.5.2 TOP-DOWN APPROACH

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.6 DATA TRIANGULATION

- FIGURE 10 DATA TRIANGULATION

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RISK ASSESSMENT

- 2.9 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 11 COMMERCIAL AVIATION SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 12 HIGH-SPEED CONNECTIVITY SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN IN-FLIGHT INTERNET MARKET, 2024-2029

- FIGURE 14 INCREASING DEMAND FOR INTERNET SERVICES FOR ENHANCING PASSENGER EXPERIENCE TO DRIVE MARKET

- 4.2 IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY

- FIGURE 15 SATELLITE-BASED SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.3 IN-FLIGHT INTERNET MARKET, BY SERVICE MODEL

- FIGURE 16 PAID WI-FI SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.4 IN-FLIGHT INTERNET MARKET, BY COUNTRY

- FIGURE 17 UAE TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 IN-FLIGHT INTERNET MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for connectivity

- FIGURE 19 PASSENGER TRAFFIC VOLUME IN BILLION (2015-2023)

- 5.2.1.2 Airlines leveraging superior in-flight internet services

- 5.2.1.3 Long-haul flights

- 5.2.1.4 Deployment of advanced Ku-band and Ka-band satellites

- TABLE 4 TECHNOLOGY COMPARISON OF KU-BAND AND KA-BAND SATELLITES

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial installation and maintenance costs

- 5.2.2.2 Bandwidth limitations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of in-flight internet services into emerging markets

- 5.2.3.2 New revenue streams for airlines and service providers

- 5.2.3.3 Development of LEO satellite technology

- 5.2.4 CHALLENGES

- 5.2.4.1 Complex installation

- 5.2.4.2 Service quality viability

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR IN-FLIGHT INTERNET SERVICE PROVIDERS

- FIGURE 20 REVENUE SHIFT IN IN-FLIGHT INTERNET MARKET

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 PROMINENT COMPANIES

- 5.4.2 PRIVATE AND SMALL ENTERPRISES

- 5.4.3 END USERS

- FIGURE 21 IN-FLIGHT INTERNET MARKET ECOSYSTEM

- TABLE 5 ROLE OF COMPANIES IN ECOSYSTEM

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 22 VALUE CHAIN ANALYSIS

- 5.6 USE CASE ANALYSIS

- 5.6.1 PANASONIC AVIONICS INTEGRATES LEO SATELLITES WITH GEO SATELLITES TO REDUCE LATENCY

- 5.6.2 HIGH-SPEED INTERNET USING STARLINK

- 5.6.3 USE OF WI-FI-BASED IFE SYSTEMS ALLOWS PASSENGERS TO USE THEIR DEVICES

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT DATA STATISTICS

- 5.7.1.1 Top five importing countries of parts of aircraft and spacecraft (HS Code: 8903): Taiwan, Malaysia, Philippines, Brazil, and Brunei Darussalam

- FIGURE 23 TOP 10 IMPORTING COUNTRIES, 2019-2022 (USD THOUSAND)

- 5.7.2 EXPORT DATA STATISTICS

- 5.7.2.1 Top five exporting countries of parts of aircraft and spacecraft (HS Code: 8903): Philippines, Malaysia, Taiwan, Tunisia, and Brazil

- FIGURE 24 TOP 10 EXPORTING COUNTRIES, 2019-2022 (USD THOUSAND)

- 5.7.1 IMPORT DATA STATISTICS

- 5.8 REGULATORY LANDSCAPE

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS (%)

- 5.9.2 BUYING CRITERIA

- FIGURE 26 KEY BUYING CRITERIA FOR END USERS

- TABLE 11 KEY BUYING CRITERIA FOR END USERS

- 5.10 KEY CONFERENCES AND EVENTS

- TABLE 12 IN-FLIGHT INTERNET MARKET: KEY CONFERENCES AND EVENTS, 2024-2025

- 5.11 BUSINESS MODEL

- TABLE 13 BUSINESS MODEL

- 5.12 INDICATIVE PRICING ANALYSIS

- 5.12.1 INDICATIVE PRICING ANALYSIS, BY KEY PLAYERS

- TABLE 14 SUBSCRIPTION COST OF KEY PLAYERS, BY END USER

- 5.13 OPERATIONAL DATA

- FIGURE 27 NEW AIRCRAFT ORDERS BY AIRCRAFT OEM

- TABLE 15 NEW AIRCRAFT ORDERS BY AIRCRAFT OEM 2022-2024 (UNITS)

- FIGURE 28 NEW AIRCRAFT ORDERS BY AIRCRAFT TYPE

- TABLE 16 NEW AIRCRAFT ORDERS BY AIRCRAFT TYPE 2022-2024 (UNITS)

- TABLE 17 YOY PENETRATION OF IN-FLIGHT CONNECTIVITY INTO ACTIVE FLEET

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- FIGURE 29 TECHNOLOGY TRENDS IN IN-FLIGHT INTERNET MARKET

- 6.2.1 LOW EARTH ORBIT SATELLITES

- 6.2.2 5G ONBOARD

- 6.2.3 MULTI-LINK SYSTEMS

- 6.3 TECHNOLOGY ANALYSIS

- 6.3.1 KEY TECHNOLOGIES

- 6.3.1.1 Satellite Communications Systems

- TABLE 18 TECHNOLOGY ANALYSIS OF SATELLITE COMMUNICATIONS SYSTEMS

- 6.3.1.2 Air-to-Ground Networks

- TABLE 19 TECHNOLOGY ANALYSIS OF AIR-TO-GROUND NETWORKS

- 6.3.1.3 Antenna Technologies

- TABLE 20 TECHNOLOGY ANALYSIS OF ANTENNA TECHNOLOGIES

- 6.3.2 COMPLEMENTARY TECHNOLOGIES

- 6.3.2.1 Bandwidth Optimization and Management

- TABLE 21 TECHNOLOGY ANALYSIS OF BANDWIDTH OPTIMIZATION AND MANAGEMENT

- 6.3.2.2 Cybersecurity Solutions

- TABLE 22 TECHNOLOGY ANALYSIS OF CYBERSECURITY SOLUTIONS

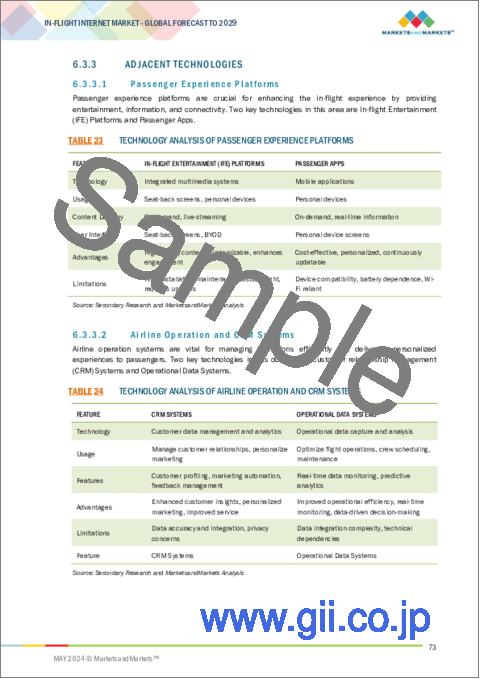

- 6.3.3 ADJACENT TECHNOLOGIES

- 6.3.3.1 Passenger Experience Platforms

- TABLE 23 TECHNOLOGY ANALYSIS OF PASSENGER EXPERIENCE PLATFORMS

- 6.3.3.2 Airline Operation and CRM Systems

- TABLE 24 TECHNOLOGY ANALYSIS OF AIRLINE OPERATION AND CRM SYSTEMS

- 6.3.1 KEY TECHNOLOGIES

- 6.4 IMPACT OF MEGATRENDS

- 6.4.1 ARTIFICIAL INTELLIGENCE & MACHINE LEARNING

- 6.4.2 BIG DATA & ANALYTICS

- 6.4.3 CONNECTIVITY

- 6.4.4 DIGITALIZATION

- 6.5 SUPPLY CHAIN ANALYSIS

- FIGURE 30 SUPPLY CHAIN ANALYSIS

- 6.6 PATENT ANALYSIS

- FIGURE 31 PATENT ANALYSIS

- TABLE 25 KEY PATENTS, 2020-2024

7 IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- FIGURE 32 SATELLITE-BASED SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 26 IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 27 IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- 7.2 AIR-TO-GROUND (CELLULAR-BASED)

- 7.2.1 EXPANSION OF CELLULAR NETWORK INFRASTRUCTURE TO DRIVE MARKET

- 7.3 SATELLITE-BASED

- 7.3.1 ADVANCEMENTS IN HIGH-THROUGHPUT SATELLITES TO DRIVE MARKET

- TABLE 28 IN-FLIGHT INTERNET MARKET, BY SATELLITE-BASED, 2020-2023 (USD MILLION)

- TABLE 29 IN-FLIGHT INTERNET MARKET, BY SATELLITE-BASED, 2024-2029 (USD MILLION)

- 7.3.2 KU-BAND

- 7.3.3 KA-BAND

- 7.3.4 SWIFT BROADBAND

- 7.4 HYBRID

- 7.4.1 INCREASING PASSENGER DEMAND FOR UNINTERRUPTED INTERNET ACCESS TO DRIVE MARKET

8 IN-FLIGHT INTERNET MARKET, BY SERVICE MODEL

- 8.1 INTRODUCTION

- FIGURE 33 FREE WI-FI SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 30 IN-FLIGHT INTERNET MARKET, BY SERVICE MODEL, 2020-2023 (USD MILLION)

- TABLE 31 IN-FLIGHT INTERNET MARKET, BY SERVICE MODEL, 2024-2029 (USD MILLION)

- 8.2 FREE WI-FI

- 8.2.1 ENHANCED PASSENGER EXPERIENCE TO DRIVE MARKET

- 8.3 PAID WI-FI

- 8.3.1 ADVANCEMENT IN TECHNOLOGY TO ENHANCE QUALITY AND SPEED OF IN-FLIGHT CONNECTIVITY

- 8.4 FREEMIUM WIFI

- 8.4.1 INCREASE IN CONNECTIVITY OPTIONS TO CATER DIFFERENT USER NEEDS TO DRIVE MARKET

9 IN-FLIGHT INTERNET MARKET, BY CONNECTIVITY SPEED

- 9.1 INTRODUCTION

- FIGURE 34 HIGH-SPEED CONNECTIVITY SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 32 IN-FLIGHT INTERNET MARKET, BY CONNECTIVITY SPEED, 2020-2023 (USD MILLION)

- TABLE 33 IN-FLIGHT INTERNET MARKET, BY CONNECTIVITY SPEED, 2024-2029 (USD MILLION)

- 9.2 HIGH-SPEED CONNECTIVITY

- 9.2.1 DEMAND FOR HIGH-QUALITY INTERNET TO DRIVE MARKET

- 9.3 STANDARD CONNECTIVITY

- 9.3.1 AIRLINES FOCUSING ON OFFERING ESSENTIAL CONNECTIVITY OPTIONS TO DRIVE MARKET

- 9.4 LOW-BANDWIDTH CONNECTIVITY

- 9.4.1 DEMAND FROM BUDGET-CONSCIOUS TRAVELERS FOR ESSENTIAL ONLINE CONNECTIVITY DURING FLIGHTS TO DRIVE MARKET

10 IN-FLIGHT INTERNET MARKET, BY END USER

- 10.1 INTRODUCTION

- FIGURE 35 COMMERCIAL AVIATION TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 34 IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 35 IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- 10.2 COMMERCIAL AVIATION

- 10.2.1 INCREASING PASSENGER EXPECTATIONS FOR SEAMLESS CONNECTIVITY TO DRIVE MARKET

- 10.3 BUSINESS AVIATION

- 10.3.1 TECHNOLOGICAL ADVANCEMENTS RESULTING IN SECURE AIRBORNE INTERNET TO DRIVE MARKET

11 IN-FLIGHT INTERNET MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 INTRODUCTION

- 11.2.2 RECESSION IMPACT ANALYSIS

- 11.2.3 PESTLE ANALYSIS

- FIGURE 36 NORTH AMERICA: IN-FLIGHT INTERNET MARKET REGIONAL SNAPSHOT

- TABLE 36 NORTH AMERICA: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 37 NORTH AMERICA: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 38 NORTH AMERICA: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 39 NORTH AMERICA: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 40 NORTH AMERICA: IN-FLIGHT INTERNET MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 41 NORTH AMERICA: IN-FLIGHT INTERNET MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.2.4 US

- 11.2.4.1 Strategic partnerships between airlines and technology providers to drive market

- TABLE 42 US: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 43 US: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 44 US: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 45 US: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- 11.2.5 CANADA

- 11.2.5.1 Innovations in LEO satellite constellation to drive market

- TABLE 46 CANADA: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 47 CANADA: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 48 CANADA: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 49 CANADA: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 INTRODUCTION

- 11.3.2 RECESSION IMPACT ANALYSIS

- 11.3.3 PESTLE ANALYSIS

- FIGURE 37 EUROPE: IN-FLIGHT INTERNET MARKET REGIONAL SNAPSHOT

- TABLE 50 EUROPE: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 51 EUROPE: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 52 EUROPE: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 53 EUROPE: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 54 EUROPE: IN-FLIGHT INTERNET MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 55 EUROPE: IN-FLIGHT INTERNET MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.3.4 UK

- 11.3.5 STRATEGIC COLLABORATIONS FOR INNOVATIVE SOLUTIONS TO DRIVE MARKET

- TABLE 56 UK: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 57 UK: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 58 UK: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 59 UK: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- 11.3.6 GERMANY

- 11.3.6.1 Regulatory support for advanced in-flight connectivity to drive market

- TABLE 60 GERMANY: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 61 GERMANY: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 62 GERMANY: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 63 GERMANY: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- 11.3.7 FRANCE

- 11.3.7.1 Strategic location of French airports as major international hubs to drive market

- TABLE 64 FRANCE: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 65 FRANCE: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 66 FRANCE: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 67 FRANCE: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- 11.3.8 SPAIN

- 11.3.8.1 Partnerships with leading telecommunications providers to drive market

- TABLE 68 SPAIN: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 69 SPAIN: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 70 SPAIN: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 71 SPAIN: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- 11.3.9 ITALY

- 11.3.9.1 Partnerships between telecom providers and airlines to drive market

- TABLE 72 ITALY: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 73 ITALY: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 74 ITALY: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 75 ITALY: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- 11.3.10 REST OF EUROPE

- TABLE 76 REST OF EUROPE: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 77 REST OF EUROPE: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 78 REST OF EUROPE: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 79 REST OF EUROPE: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- 11.4 ASIA PACIFIC

- 11.4.1 INTRODUCTION

- 11.4.2 RECESSION IMPACT ANALYSIS

- 11.4.3 PESTLE ANALYSIS

- FIGURE 38 ASIA PACIFIC: IN-FLIGHT INTERNET MARKET REGIONAL SNAPSHOT

- TABLE 80 ASIA PACIFIC: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 81 ASIA PACIFIC: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 82 ASIA PACIFIC: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 83 ASIA PACIFIC: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 84 ASIA PACIFIC: IN-FLIGHT INTERNET MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 85 ASIA PACIFIC: IN-FLIGHT INTERNET MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.4.4 CHINA

- 11.4.4.1 Partnerships between airlines and established technology providers to drive market

- TABLE 86 CHINA: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 87 CHINA: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 88 CHINA: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 89 CHINA: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- 11.4.5 INDIA

- 11.4.5.1 Indigenous development of in-flight connectivity to drive market

- TABLE 90 INDIA: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 91 INDIA: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 92 INDIA: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 93 INDIA: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- 11.4.6 JAPAN

- 11.4.6.1 Strategic focus on enhancing air travel experience of passengers to drive market

- TABLE 94 JAPAN: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 95 JAPAN: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 96 JAPAN: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 97 JAPAN: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- 11.4.7 SOUTH KOREA

- 11.4.7.1 Emphasis on high-quality in-flight connectivity services to drive growth

- TABLE 98 SOUTH KOREA: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 99 SOUTH KOREA: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 100 SOUTH KOREA: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 101 SOUTH KOREA: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- 11.4.8 AUSTRALIA

- 11.4.8.1 Expansive geographic area necessitating long domestic flights to drive market

- TABLE 102 AUSTRALIA: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 103 AUSTRALIA: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 104 AUSTRALIA: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 105 AUSTRALIA: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- 11.4.9 REST OF ASIA PACIFIC

- TABLE 106 REST OF ASIA PACIFIC: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 107 REST OF ASIA PACIFIC: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- 11.5 MIDDLE EAST

- 11.5.1 INTRODUCTION

- 11.5.2 RECESSION IMPACT ANALYSIS

- 11.5.3 PESTLE ANALYSIS

- FIGURE 39 MIDDLE EAST: IN-FLIGHT INTERNET MARKET REGIONAL SNAPSHOT

- TABLE 110 MIDDLE EAST: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 111 MIDDLE EAST: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 112 MIDDLE EAST: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 113 MIDDLE EAST: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 114 MIDDLE EAST: IN-FLIGHT INTERNET MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 115 MIDDLE EAST: IN-FLIGHT INTERNET MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.5.4 GULF COOPERATION COUNCIL (GCC)

- 11.5.4.1 UAE

- 11.5.4.1.1 Expectations of passengers for seamless digital experiences to drive market

- 11.5.4.1 UAE

- TABLE 116 UAE: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 117 UAE: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 118 UAE: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 119 UAE: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- 11.5.4.2 Saudi Arabia

- 11.5.4.2.1 Vision 2030 program to drive market

- 11.5.4.2 Saudi Arabia

- TABLE 120 SAUDI ARABIA: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 121 SAUDI ARABIA: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 122 SAUDI ARABIA: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 123 SAUDI ARABIA: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- 11.5.4.3 Qatar

- 11.5.4.3.1 Commitment to providing enhanced connectivity options to drive market

- 11.5.4.3 Qatar

- TABLE 124 QATAR: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 125 QATAR: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 126 QATAR: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 127 QATAR: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- 11.5.5 TURKEY

- 11.5.5.1 Emphasis on aviation technology and infrastructure developments to drive market

- TABLE 128 TURKEY: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 129 TURKEY: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 130 TURKEY: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 131 TURKEY: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- 11.6 REST OF THE WORLD

- 11.6.1 INTRODUCTION

- 11.6.2 RECESSION IMPACT ANALYSIS

- 11.6.3 PESTLE ANALYSIS

- TABLE 132 REST OF THE WORLD: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 133 REST OF THE WORLD: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 134 REST OF THE WORLD: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 135 REST OF THE WORLD: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 136 REST OF THE WORLD: IN-FLIGHT INTERNET MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 137 REST OF THE WORLD: IN-FLIGHT INTERNET MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.6.4 BRAZIL

- 11.6.4.1 Complimentary Wi-Fi on domestic flights to drive market

- TABLE 138 BRAZIL: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 139 BRAZIL: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 140 BRAZIL: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 141 BRAZIL: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- 11.6.5 MEXICO

- 11.6.5.1 Collaboration of airlines with key market players to drive market

- TABLE 142 MEXICO: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 143 MEXICO: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 144 MEXICO: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 145 MEXICO: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- 11.6.6 SOUTH AFRICA

- 11.6.6.1 Technological advancements in satellite communications to drive market

- TABLE 146 SOUTH AFRICA: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 147 SOUTH AFRICA: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 148 SOUTH AFRICA: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 149 SOUTH AFRICA: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

- 11.6.7 OTHER COUNTRIES

- TABLE 150 OTHER COUNTRIES: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 151 OTHER COUNTRIES: IN-FLIGHT INTERNET MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 152 OTHER COUNTRIES: IN-FLIGHT INTERNET MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 153 OTHER COUNTRIES: IN-FLIGHT INTERNET MARKET, BY END USER, 2024-2029 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 154 KEY STRATEGIES ADOPTED BY LEADING PLAYERS IN IN-FLIGHT INTERNET MARKET, 2023

- 12.3 MARKET RANKING ANALYSIS

- FIGURE 40 RANKING OF KEY PLAYERS IN IN-FLIGHT INTERNET MARKET, 2023

- 12.4 REVENUE ANALYSIS

- FIGURE 41 IN IN-FLIGHT INTERNET MARKET: REVENUE ANALYSIS FOR TOP 5 PLAYERS, 2019-2023

- 12.5 MARKET SHARE ANALYSIS

- FIGURE 42 IN IN-FLIGHT INTERNET MARKET: MARKET SHARE ANALYSIS FOR TOP 5 PLAYERS, 2023

- TABLE 155 IN-FLIGHT INTERNET: DEGREE OF COMPETITION

- 12.6 BRAND/PRODUCT COMPARISON

- FIGURE 43 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX, 2023

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- FIGURE 44 IN-FLIGHT INTERNET MARKET: COMPANY EVALUATION MATRIX, 2023

- 12.7.5 COMPANY FOOTPRINT

- FIGURE 45 IN-FLIGHT INTERNET MARKET: COMPANY FOOTPRINT

- TABLE 156 IN-FLIGHT INTERNET MARKET: TECHNOLOGY FOOTPRINT

- TABLE 157 IN-FLIGHT INTERNET MARKET: END USER FOOTPRINT

- TABLE 158 IN-FLIGHT INTERNET MARKET: REGION FOOTPRINT

- 12.8 STARTUP/SME EVALUATION MATRIX, 2023

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- FIGURE 46 IN-FLIGHT INTERNET MARKET: STARTUP/SME EVALUATION MATRIX, 2023

- 12.8.5 COMPETITIVE BENCHMARKING

- TABLE 159 IN-FLIGHT INTERNET MARKET: COMPETITIVE BENCHMARKING

- TABLE 160 IN FLIGHT INTERNET MARKET: COMPETITIVE BENCHMARKING

- TABLE 161 IN FLIGHT INTERNET MARKET: REGION FOOTPRINT

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 MARKET EVALUATION FRAMEWORK

- 12.9.2 PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 162 IN-FLIGHT INTERNET MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2021-DECEMBER 2022

- 12.9.3 DEALS

- TABLE 163 IN-FLIGHT INTERNET MARKET: DEALS, JANUARY 2021-MARCH 2024

- 12.9.4 OTHER DEVELOPMENTS

- TABLE 164 IN-FLIGHT INTERNET MARKET: OTHER DEVELOPMENTS, JANUARY 2020-MAY 2024

13 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 13.1 KEY PLAYERS

- 13.1.1 VIASAT, INC.

- TABLE 165 VIASAT, INC.: COMPANY OVERVIEW

- FIGURE 47 VIASAT, INC.: COMPANY SNAPSHOT

- TABLE 166 VIASAT, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 167 VIASAT, INC.: DEALS

- TABLE 168 VIASAT, INC.: OTHER DEVELOPMENTS

- 13.1.2 GOGO BUSINESS AVIATION LLC

- TABLE 169 GOGO BUSINESS AVIATION LLC: COMPANY OVERVIEW

- FIGURE 48 GOGO BUSINESS AVIATION LLC: COMPANY SNAPSHOT

- TABLE 170 GOGO BUSINESS AVIATION LLC: PRODUCTS/SOLUTIONS OFFERED

- TABLE 171 GOGO BUSINESS AVIATION LLC: DEALS

- TABLE 172 GOGO BUSINESS AVIATION LLC: OTHER DEVELOPMENTS

- 13.1.3 PANASONIC AVIONICS CORPORATION

- TABLE 173 PANASONIC AVIONICS CORPORATION: COMPANY OVERVIEW

- FIGURE 49 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- TABLE 174 PANASONIC AVIONICS CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 175 PANASONIC AVIONICS CORPORATION: PRODUCT LAUNCHES

- TABLE 176 PANASONIC AVIONICS CORPORATION: DEALS

- TABLE 177 PANASONIC AVIONICS CORPORATION: OTHER DEVELOPMENTS

- 13.1.4 THALES

- TABLE 178 THALES: COMPANY OVERVIEW

- FIGURE 50 THALES: COMPANY SNAPSHOT

- TABLE 179 THALES: PRODUCTS/SOLUTIONS OFFERED

- TABLE 180 THALES: DEALS

- 13.1.5 COLLINS AEROSPACE

- TABLE 181 COLLINS AEROSPACE: COMPANY OVERVIEW

- FIGURE 51 COLLINS AEROSPACE: COMPANY SNAPSHOT

- TABLE 182 COLLINS AEROSPACE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 183 COLLINS AEROSPACE: DEALS

- 13.1.6 ANUVU

- TABLE 184 ANUVU: COMPANY OVERVIEW

- TABLE 185 ANUVU: PRODUCTS/SOLUTIONS OFFERED

- TABLE 186 ANUVU: OTHER DEVELOPMENTS

- 13.1.7 SAFRAN

- TABLE 187 SAFRAN: COMPANY OVERVIEW

- FIGURE 52 SAFRAN: COMPANY SNAPSHOT

- TABLE 188 SAFRAN: PRODUCTS/SOLUTIONS OFFERED

- TABLE 189 SAFRAN: DEALS

- 13.1.8 INTELSAT

- TABLE 190 INTELSAT: COMPANY OVERVIEW

- TABLE 191 INTELSAT: PRODUCTS/SOLUTIONS OFFERED

- TABLE 192 INTELSAT: DEALS

- TABLE 193 INTELSAT: OTHER DEVELOPMENTS

- 13.1.9 IRIDIUM COMMUNICATIONS INC.

- TABLE 194 IRIDIUM COMMUNICATIONS INC.: COMPANY OVERVIEW

- FIGURE 53 IRIDIUM: COMPANY SNAPSHOT

- TABLE 195 IRIDIUM COMMUNICATIONS INC.: PRODUCTS/SOLUTIONS OFFERED

- 13.1.10 STARLINK

- TABLE 196 STARLINK: COMPANY OVERVIEW

- TABLE 197 STARLINK: PRODUCTS/SOLUTIONS OFFERED

- TABLE 198 STARLINK: PRODUCT LAUNCHES

- TABLE 199 STARLINK: DEALS

- 13.1.11 HUGHES NETWORK SYSTEMS, LLC

- TABLE 200 HUGHES NETWORK SYSTEMS, LLC: COMPANY OVERVIEW

- TABLE 201 HUGHES NETWORK SYSTEMS LLC: PRODUCTS/SOLUTIONS OFFERED

- 13.1.12 EUTELSAT COMMUNICATIONS S.A.

- TABLE 202 EUTELSAT COMMUNICATIONS S.A.: COMPANY OVERVIEW

- FIGURE 54 EUTELSAT COMMUNICATIONS S.A.: COMPANY SNAPSHOT

- TABLE 203 EUTELSAT COMMUNICATIONS S.A.: PRODUCTS/SOLUTIONS OFFERED

- 13.1.13 AEROMOBILE COMMUNICATIONS LTD.

- TABLE 204 AEROMOBILE COMMUNICATIONS LTD.: COMPANY OVERVIEW

- TABLE 205 AEROMOBILE COMMUNICATIONS LTD.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 206 AEROMOBILE COMMUNICATIONS LTD.: DEALS

- 13.1.14 ASIA SATELLITE TELECOMMUNICATIONS CO., LTD.

- TABLE 207 ASIA SATELLITE TELECOMMUNICATIONS CO., LTD.: COMPANY OVERVIEW

- TABLE 208 ASIA SATELLITE TELECOMMUNICATIONS CO., LTD.: PRODUCTS/SOLUTIONS OFFERED

- 13.1.15 SITA

- TABLE 209 SITA: COMPANY OVERVIEW

- TABLE 210 SITA: PRODUCTS/SOLUTIONS OFFERED

- TABLE 211 SITA: DEALS

- TABLE 212 SITA: OTHER DEVELOPMENTS

- 13.2 OTHER PLAYERS

- 13.2.1 DEUTSCHE TELEKOM

- TABLE 213 DEUTSCHE TELEKOM: COMPANY OVERVIEW

- 13.2.2 T-MOBILE US INC.

- TABLE 214 T-MOBILE US INC.: COMPANY OVERVIEW

- 13.2.3 THAICOM PLC

- TABLE 215 THAICOM PLC: COMPANY OVERVIEW

- 13.2.4 AIRFI

- TABLE 216 AIRFI: COMPANY OVERVIEW

- 13.2.5 G-CONNECT

- TABLE 217 G-CONNECT: COMPANY OVERVIEW

- 13.2.6 JSAT MOBILE COMMUNICATIONS

- TABLE 218 JSAT MOBILE COMMUNICATIONS: COMPANY OVERVIEW

- 13.2.7 SKYFIVE

- TABLE 219 SKYFIVE: COMPANY OVERVIEW

- 13.2.8 SES SA

- TABLE 220 SES SA: COMPANY OVERVIEW

- 13.2.9 TELESAT

- TABLE 221 TELESAT: COMPANY OVERVIEW

- 13.2.10 AVANTI HYLAS 2 LIMITED

- TABLE 222 AVANTI HYLAS 2 LIMITED: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 COMPANY LONG LIST

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS