|

|

市場調査レポート

商品コード

1504306

自動車産業の未来:OEMメーカーの情勢、コネクテッドカー、自律走行技術、電気自動車、バッテリー技術の革新、パワートレイン、シェアードモビリティ - 2030年までの予測Future of Automotive Industry, Covers Original Equipment Manufacturer Landscape, Connected Vehicles, Autonomous Driving Technologies, Electric Vehicles, Innovations In Battery Technology, Powertrains And Shared Mobility - Global Forecast 2030 |

||||||

カスタマイズ可能

|

|||||||

| 自動車産業の未来:OEMメーカーの情勢、コネクテッドカー、自律走行技術、電気自動車、バッテリー技術の革新、パワートレイン、シェアードモビリティ - 2030年までの予測 |

|

出版日: 2024年06月27日

発行: MarketsandMarkets

ページ情報: 英文 101 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

PV、LCV、MHCVを含む自動車産業の市場規模は、2024年の8,800万台から2030年には1億400万台に達すると予測され、CAGRは2.4%になると見込まれています。

自動車市場は、さまざまな要因によって成長が見込まれています。自動車産業は現在、技術の進歩やエンドユーザーの嗜好による新たな変化への適応を常に迫られています。電気自動車の採用は、自動車業界の急速な変化を目の当たりにした重要な要因です。EV分野では、長距離バッテリーの開発と製造、顧客向けの高速・超高速充電ポイントの設置が、OEMやEVソリューション提供企業の最重要課題となっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(台) |

| セグメント | OEMメーカー、バッテリー技術革新、パワートレイン、シェアードモビリティ |

| 対象地域 | アジア太平洋、欧州、北米、その他の地域 |

さらに、強化された安全機能と高度な自動化を備えた自律走行車の導入が、自動車市場の動向を変化させています。さらに、OEMは、ギガキャスティング技術や、部品の設計・製造時に自動化やロボット工学を採用するスマートマニュファクチャリングを利用することで、自動車の生産コストを削減することに注力しています。

運転体験の向上、車両管理、スマートシティ、クラウドコンピューティングを実現する5Gコネクテッドカーが急速に普及しています。2024年末までに、コネクテッドカーの約5分の1が5Gコネクティビティに統合されると推定されています。この技術は急速に発展し、2030年までに高い割合で市場に浸透すると予想されます。

シェアードモビリティは、個人で所有するのではなく、複数のユーザーによって利用されるさまざまな交通サービスや交通資源を包含します。この概念には、カーシェアリング、バイクシェアリング、ライドヘイリング、公共交通機関が含まれます。個人所有よりも共同利用を促進することで、シェアードモビリティは、輸送コストの削減、環境への影響の最小化、都市のモビリティとアクセシビリティの向上を目指します。車両とインフラの利用を最適化することで、交通渋滞や公害など、都市化で深刻化する課題に対する持続可能な解決策を提供します。最終的に、シェアードモビリティは、世界中の都市において、より効率的で公平、かつ環境に優しい交通システムを構築することを目指しています。

当レポートでは、世界の自動車産業の未来について調査し、自動車メーカーの業界情勢、コネクテッドカー、自律走行技術、電気自動車、バッテリー技術革新、パワートレイン、シェアードモビリティの動向などをまとめています。

目次

- 調査目的と調査手法

- 調査範囲

- 自動車産業の未来:全体的な動向

- 世界の自動車販売台数(PV+LCV+MHCV)とGDP成長率:1980年~2030年

- 自動車保有台数と平均車齢の伸び

- 中流階級とZ世代の人口増加が将来の売上を牽引

- コネクテッド、自律、シェアリング、電動化(事例):普及の拡大

- ベビーブーム経済:新興国が先進国を追い抜く

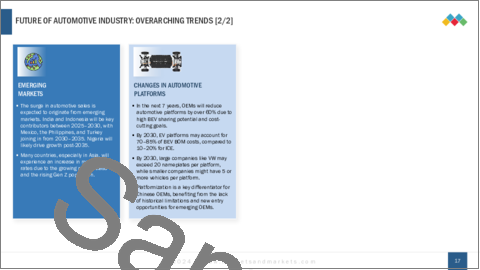

- 自動車販売:新興国からの次の成長の波

- 自動車OEMグループ上位20社

- 自動車プラットフォームの変化

- サマリー

- 電気自動車:BEV軽自動車販売の転換点

- 内燃機関車の段階的廃止

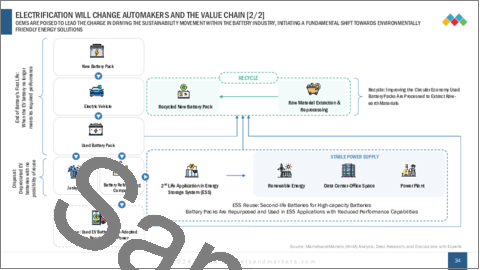

- 電動化は自動車メーカーとバリューチェーンを変える

- 製造プロセスを変える電動化

- 「プラットフォーム」の変化がEV製造の変化を牽引

- バッテリー容量分析

- 充電性能

- バッテリー技術:バッテリー技術の成熟曲線とタイムライン

- バッテリー技術:バッテリー熱管理技術とSSB

- バッテリー技術:EVバッテリーパッケージングソリューション

- バッテリー技術:電気自動車のバッテリー価格

- パワーエレクトロニクス:業界はSIC+GANへ移行しているが、応用要件に特化している

- 電気モーター

- EVバッテリー4Rエコシステム

- サマリー

- デジタルコネクテッドリビングの未来

- 自動車を背景としたコネクテッドリビングエコシステム

- デジタルコネクテッドリビングサービス:モビリティ業界向けTAM

- 未来の自動車のコネクテッド機能

- 車内体験とカスタマイズされたデジタル体験

- ソフトウェア定義フレームワーク

- OEMデジタルコックピットプログラムの概要

- SDVをサポートするためのハードウェア/EEアーキテクチャの進化

- ソフトウェア定義車両(SDV)

- データ収益化の手段

- 自動車業界における5G:使用事例

- ジェネレーティブAIが自動車業界に多面的な影響を及ぼす

- サマリー

- 自律運転

- 自動運転レベル

- センサーフォーカス

- 乗用車向けテクノロジースタック

- OEM自動運転サービス、地域別

- OEMフォーカス

- 自動運転:機能マッピング

- L4概要

- 自動運転市場予測

- 自動運転:重要なポイント

- サマリー

- 将来のパワートレインミックス

- 持続可能なモビリティロードマップ- ユースケースとアプリケーションに基づくソリューションのポートフォリオ

- E-モビリティパワートレイン開発ロードマップ- アセットライトモデルの導入の加速

- 未来のパワートレインプラットフォーム-OEM向け効率改善オプション

- OEM 2030 パワートレイン戦略

- サマリー

- マルチモーダルモビリティと15分都市

- 貨物車だけでなく専用車両も増加

- デジタルによる事前購入体験と自動車販売のアマゾニフィケーション

The automotive industry, encompassing PV, LCV, and MHCV, size is projected to grow from 88 million units in 2024 and is projected to hit 104 million units by 2030, at a CAGR of 2.4%. The automotive market is expected to experience growth driven by various factors. The automotive industry is currently under constant pressure to adapt to new changes due to technological advancements and end-user preferences. Adoption of electric vehicles is the key factor that has witnessed a rapid change in the automotive industry. In line with the EV sector, development and manufacturing of long-range batteries along with installation of fast and ultra-fast charging points for customers is the foremost agenda of the OEMs and EV solution providing companies.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (Units) |

| Segments | Covers Original Equipment Manufacturer, Innovations In Battery Technology, Powertrains And Shared Mobility |

| Regions covered | Asia Pacific, Europe, Row and North America |

Further, the introduction of autonomous cars with enhanced safety features and higher level of automation is shifting the trends in the automotive market. Moreover, OEMs are focused on reducing the production cost of the vehicle by using gigacasting technology and smart manufacturing by adopting automation and robotics while designing and manufacturing the components.

Furthermore, 5G connected cars to enhance driving experience, manage cars fleet, smart cities and cloud computing is catching on rapidly. It is estimated that around one-fifth of the connected cars will be integrated with 5G connectivity by the end of 2024. This technology is expected to develop quickly can penetrate the market at a high rate by 2030.

Shared mobility encompasses a range of transportation services and resources that are utilized by multiple users, rather than owned individually. This concept includes car-sharing, bike-sharing, ride-hailing, and public transit. By promoting shared access over individual ownership, shared mobility seeks to reduce transportation costs, minimize environmental impact, and enhance urban mobility and accessibility. It offers a sustainable solution to the growing challenges of urbanization, such as traffic congestion and pollution, by optimizing the use of vehicles and infrastructure. Ultimately, shared mobility aims to create more efficient, equitable, and environmentally friendly transportation systems in cities worldwide.

"Autonomous vehicles are anticipated to witness significant growth."

Autonomous vehicles are projected to grow significantly by 2030 due to the rising demand for safety, comfort, and driving convenience features. The launch of autonomous and semi-autonomous vehicles is another factor contributing to the market's expansion. Numerous OEMs are introducing Level 2, Level 3 and Level 4 autonomous vehicles, including Nissan, Honda, Audi, BMW, and Mercedes-Benz. For Instance, in July 2023, BMW announced to launch a 7 Series, Level 3 autonomous driving car by early 2024. Similarly, in February 2022, Benteler EV Systems, Beep and Mobileye announced a collaboration to develop a fully electric and autonomous (SAE Level 4) vehicle that can be used for commuters on public and private roads by early 2024.

"Asia Pacific holds the largest market share in the forecast period"

Asia Pacific has emerged as a promising market for the global automobile industry. The principal driver of this trend is the Chinese market, which has grown to become the world's largest producer and buyer of automobiles. India, Japan, and South Korea are also important country-level markets in the region. While India is gradually becoming a major contributor in the automotive sector, Japan and South Korea are already well-established. According to OICA, China and India produce over 30 million vehicles each year. Despite the worldwide market slowdown, the Asia region has seen growth in automobile production in 2022 and 2023. Continuing this trend, the Asia region will dominate the market in the forecast period.

Further, China is the most dominant nation in automotive industry with respect to supplying raw materials, manufacturing as well as its sales. China has the most powerful supply chain of EV batteries. Over 50% of the EV batteries are manufactured in China. Moreover, around 75% of the components of EV batteries are manufactured in China. These Chinese manufacturers are looking to expand their services and acquire additional market share around the world. For instance, in September 2023, a leading Chinese EV battery manufacturer, Gotion, has announced to invest $2 billion to setup EV lithium battery plant in Illinois, US. In addition, western automakers are adopting strategies in collaboration with Chinese players to manufacture batteries. For instance, in May 2023, Ford announced a collaboration with CATL to set up a EV battery plant in Michigan, US by investing $3.5 billion, which will be operational by 2026.

Furthermore, the market growth in Asia Pacific can be attributed to the high vehicle production and increased use of advanced electronics in Japan, South Korea, and China. The governments of these countries have recognized the growth potential of the automotive sector and have consequently undertaken various initiatives to encourage major OEMs to enter their domestic markets. Several global automobile manufacturers, such as Volkswagen (Germany), Mercedes Benz (Germany), and General Motors (US), have shifted their production plants to emerging economies in the region.

Research Coverage:

The market analysis encompasses the Future of Automotive Industry, focusing on the sales volume of both passenger vehicles and commercial vehicles. Additionally, it examines the developments that occurred in the automotive industry till 2030. The report delves into the trends propelling the automotive sector, analyzing factors that influence the industry till 2030. The study encompasses a broad range, including Internal Combustion Engine (ICE) vehicles and Electric Vehicles (EVs), autonomous vehicles, 5G connectivity in cars, smart manufacturing, shared mobility, online sales of vehicles, powertrains, manufacturing platforms and others automotive related future technologies. Geographically, the report covers North America, Europe, Asia Pacific, and the Rest of the World.

Report Scope

The report will help the market leaders/new entrants in this market with information on the technologies that are predected to drive the automotive industry in future. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key Trends in 2023 till 2030 (Electrification, Rise of 5G, Connected Cars, Smart Manufacturing etc).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the automotive market

- Market Development: Comprehensive information about lucrative markets - the report analyses the automotive market across varied regions

- Market Diversification: Exhaustive information about diversification of supply chains, untapped geographies, recent developments, and investments in the automotive market

- Competitive Assessment: Assessment of market shares, growth strategies and service offerings of leading players like across passenger and commercial vehicle segments which are then dirther divided into ICE and electric among others in the automotive market strategies. The report also helps stakeholders understand the pulse of the autonomous vehicle market and provides them information on key market drivers, challenges, and opportunities.

TABLE OF CONTENTS

1. EXECUTIVE SUMMARY

2. RESEARCH SCOPE, OBJECTIVES & METHODOLOGY

- 2.1 STUDY OBJECTIVES & METHODOLOGY

- 2.2 STUDY SCOPE

3. OVERARCHING TRENDS

- 3.1 FUTURE OF AUTOMOTIVE INDUSTRY: OVERARCHING TRENDS

- 3.2 GLOBAL AUTOMOTIVE SALES (PV + LCV + MHCV) AND GDP GROWTH: 1980 TO 2030

- 3.3 AUTOMOTIVE VEHICLE PARC AND GROWTH IN AVERAGE AGE OF VEHICLES

- 3.4 GROWING MIDDLE CLASS AND GEN Z POPULATION TO DRIVE FUTURE SALES

- 3.5 CONNECTED, AUTONOMOUS, SHARED AND ELECTRIC (CASE): GROWTH IN PENETRATION

- 3.6 BABY BUST ECONOMIES: EMERGING ECONOMIES TAKING OVER ADVANCED ECONOMIES

- 3.7 AUTOMOTIVE SALES: NEXT WAVE OF GROWTH FROM EMERGING ECONOMIES

- 3.8 TOP 20 AUTOMOTIVE OEM GROUPS

- 3.9 CHANGES IN AUTOMOTIVE PLATFORMS

4. FUTURE OF ELECTRIC VEHICLES AND BATTERY TECHNOLOGY

- 4.1 SUMMARY

- 4.2 ELECTRIC VEHICLES: BEV LIGHT VEHICLE SALES TIPPING POINT

- 4.3 PHASING OUT OF ICE VEHICLES

- 4.4 ELECTRIFICATION WILL CHANGE AUTOMAKERS AND THE VALUE CHAIN

- 4.5 ELECTRIFICATION TO CHANGE THE MANUFACTURING PROCESSES

- 4.6 SHIFT IN 'PLATFORM' DRIVING EV MANUFACTURING SHIFTS

- 4.7 BATTERY CAPACITY ANALYSIS

- 4.8 CHARGING PERFORMANCE

- 4.9 BATTERY TECHNOLOGY: BATTERY TECHNOLOGY MATURITY CURVE AND TIMELINES

- 4.10 BATTERY TECHNOLOGY: BATTERY THERMAL MANAGEMENT TECHNOLOGIES AND SSB

- 4.11 BATTERY TECHNOLOGY: EV BATTERY PACKAGING SOLUTIONS

- 4.12 BATTERY TECHNOLOGY: ELECTRIC VEHICLE BATTERY PRICES

- 4.13 POWER ELECTRONICS: INDUSTRY SHIFTING TOWARDS SIC + GAN BUT SPECIFIC TO APPLICATION REQUIREMENTS

- 4.14 ELECTRIC MOTORS

- 4.15 EV BATTERY 4R ECOSYSTEM

5. FUTURE OF CONNECTED VEHICLES

- 5.1 SUMMARY

- 5.2 FUTURE OF DIGITAL CONNECTED LIVING

- 5.3 CONNECTED LIVING ECOSYSTEM IN CONTEXT OF A CAR

- 5.4 DIGITAL CONNECTED LIVING SERVICES: TAM FOR MOBILITY INDUSTRY

- 5.5 CONNECTED FEATURES IN FUTURE CARS

- 5.1 IN-VEHICLE EXPERIENCE AND TAILOR-MADE DIGITAL EXPERIENCE

- 5.6 SOFTWARE-DEFINED FRAMEWORK

- 5.7 OEM DIGITAL COCKPIT PROGRAM OVERVIEW

- 5.8 HARDWARE/EE ARCHITECTURE EVOLUTION TO SUPPORT SDV

- 5.9 SOFTWARE DEFINED VEHICLES (SDV)

- 5.10 DATA MONETIZATION AVENUES

- 5.11 5G IN AUTOMOTIVE INDUSTRY: USE CASES

- 5.12 GENERATIVE AI TO HAVE MULTIFACETED IMPACT ON THE AUTOMOTIVE INDUSTRY

6. FUTURE OF AUTONOMOUS VEHICLES

- 6.1 SUMMARY

- 6.2 AUTONOMOUS WORLD

- 6.3 AUTOMATED DRIVING LEVELS

- 6.4 SENSOR FOCUS

- 6.5 TECHNOLOGY STACK FOR PASSENGER CARS

- 6.6 OEM AUTOMATED DRIVING OFFERING BY REGION

- 6.7 OEM FOCUS

- 6.8 AUTONOMOUS DRIVING: FEATURES MAPPING

- 6.9 L4 OVERVIEW

- 6.10 AUTOMATED DRIVING MARKET FORECASTS

- 6.11 AUTONOMOUS DRIVING: KEY TAKEAWAYS

7. FUTURE OF POWERTRAIN

- 7.1 SUMMARY

- 7.2 FUTURE POWERTRAIN MIX

- 7.3 SUSTAINABLE MOBILITY ROADMAP - PORTFOLIO OF SOLUTIONS BASED ON USE CASES AND APPLICATIONS

- 7.4 E-MOBILITY POWERTRAIN DEVELOPMENT ROADMAP - ACCELERATED ADOPTION OF ASSET-LIGHT MODELS

- 7.5 POWERTRAIN PLATFORM OF THE FUTURE - EFFICIENCY IMPROVEMENT OPTIONS FOR OEMS

- 7.6 OEM 2030 POWERTRAIN STRATEGIES

8. FUTURE OF SHARED MOBILITY AND AUTOMOTIVE CHANNELS

- 8.1 SUMMARY

- 8.2 MULTI-MODAL MOBILITY AND 15-MINUTE CITIES

- 8.3 RISE IN PURPOSE-BUILT VEHICLES AS WELL AS CARGO VEHICLES

- 8.4 DIGITAL PRE-BUYING EXPERIENCE AND AMAZONIFICATION OF CAR SALES

9. ABOUT MARKETSANDMARKETS

10. LEGAL DISCLAIMER