|

|

市場調査レポート

商品コード

1501237

産業用IoTの世界市場:展開別、オファリング別、業界別、接続技術別、地域別 - 2029年までの予測Industrial IoT Market by Offering (Hardware (Processors, Connectivity ICs, Sensors, Memory Devices, Logic Devices), Software (PLM, MES, SCADA, OMS), Platforms), Connectivity Technology, Deployment, Vertical and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 産業用IoTの世界市場:展開別、オファリング別、業界別、接続技術別、地域別 - 2029年までの予測 |

|

出版日: 2024年06月24日

発行: MarketsandMarkets

ページ情報: 英文 239 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

産業用IoTの市場規模は、2024年の1,944億米ドルから2029年には2,863億米ドルに達すると予測されており、2024年から2029年までのCAGRは8.1%になる見込みです。

機械の予知保全、5G技術の出現は、産業用IoT市場に有利な機会を提供します。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | 展開別、オファリング別、業界別、接続技術別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

クラウドベースは現在最大の市場シェアを占めており、予測期間中に最も高い成長率を記録すると予測されています。クラウドプラットフォームは、データ量やデバイス数の増加に対応できる容易な拡張性を備えており、あらゆる規模の企業にとって魅力的な選択肢となっています。クラウドの導入により、オンプレミスのハードウェアやITインフラへの多額の投資が不要となり、コスト効率の高い選択肢となります。クラウドサービスプロバイダー(CSP)は、データのプライバシーやコンプライアンスに関する懸念に対応するため、セキュリティ対策を継続的に強化しています。クラウド技術は常に進化しており、産業用IoTの用途に新しい特徴や機能、強化された機能を提供しています。産業用IoT市場が拡大するにつれて、スケーラブルで費用対効果の高いクラウドプラットフォームへの需要が高まるとみられています。

ワイヤレス接続技術は、産業用IoT分野の中で、より大きな市場シェアを占めており、最も高いCAGRで成長すると予想されています。ワイヤレスソリューションは、有線接続と比較して、より容易な展開と拡張性を提供します。新しいデバイスの追加やレイアウトの変更はワイヤレスの方が簡単で、複雑な産業環境に最適です。ワイヤレスソリューションは、有線ネットワークよりも設置が簡単で安価であるため、特に電線の設置が邪魔になったり、コストが高くつく可能性のある既存の設備に適しています。無線センサーやデバイスの導入が容易なため、IIoTプロジェクトの実装が加速し、価値実現までの時間が短縮されます。

ドイツは、2023年に欧州の産業用IoT市場で最大のシェアを占め、研究開発への莫大な政府投資により、予測期間中もその地位を維持すると予想されます。欧州では、ドイツが特に製造業と自動車産業におけるIoTソリューションの導入でリードしています。また、省エネルギーを改善するためにエネルギー部門にIoT技術を取り入れる最前線にあります。ドイツの工業生産は欧州最大の経済にとって不可欠です。機械、自動車、化学、製薬、エレクトロニクス、航空宇宙といったハイテク産業の企業が、先端技術の導入の先頭に立っています。

当レポートでは、世界の産業用IoT市場について調査し、展開別、オファリング別、業界別、接続技術別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術動向

- ケーススタディ分析

- 特許分析

- 貿易分析

- 関税と規制状況

- 主な会議とイベント

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

第6章 産業用IoT市場(展開別)

- イントロダクション

- オンプレミス

- クラウドベース

第7章 産業用IoT市場(オファリング別)

- イントロダクション

- ソフトウェア

- プラットフォーム

第8章 産業用IoT市場(業界別)

- イントロダクション

- 製造

- エネルギー

- 石油ガス

- 金属・鉱業

- ヘルスケア

- 小売

- 輸送

- 農業

第9章 産業用IoT市場(接続技術別)

- イントロダクション

- 有線

- 無線

第10章 産業用IoT市場(地域別)

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第11章 競合情勢

- 主要参入企業が採用した戦略/強み

- 上位5社の収益分析

- 市場シェア分析

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス

- スタートアップ/中小企業評価マトリックス

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- HUAWEI TECHNOLOGIES CO., LTD.

- CISCO SYSTEMS, INC.

- ABB

- SIEMENS

- INTEL CORPORATION

- GENERAL ELECTRIC

- EMERSON ELECTRIC CO.

- SAP SE

- HONEYWELL INTERNATIONAL INC.

- ROCKWELL AUTOMATION

- その他の企業

- ARM LIMITED

- PTC

- DASSAULT SYSTEMES

- IBM

- ROBERT BOSCH GMBH

- NEC CORPORATION

- ANSYS, INC

- WORLDSENSING

- ARUNDO

- SOFTWARE AG

- TEXAS INSTRUMENTS INCORPORATED

- KUKA AG

- DRAGOS, INC.

- GOOGLE LLC

- MICROSOFT CORPORATION

第13章 付録

The industrial IoT market is valued at USD 194.4 billion in 2024 and is projected to reach USD 286.3 billion by 2029; it is expected to grow at a CAGR of 8.1% from 2024 to 2029. Predictive maintenance of machinery, and emergence of 5G technology provide lucrative opportunities to the industrial IoT market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Software, Connectivity Technology, Deployment, Vertical and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Cloud-based deployment segment to register highest growth rate during the forecast period."

The cloud-based deployment type currently has the largest market share and is expected to grow at the highest rate during the forecast period. Cloud platforms provide easy scalability to accommodate increasing data volumes and device numbers, making them an attractive option for businesses of all sizes. Cloud deployment eliminates the need for significant investments in on-premise hardware and IT infrastructure, making it a cost-effective option. Cloud service providers (CSPs) are continuously enhancing security measures to address concerns about data privacy and compliance. Cloud technology is constantly evolving, offering new features, functionalities, and enhanced capabilities for industrial IoT applications. As the industrial IoT market expands, the demand for scalable and cost-effective cloud platforms will increase.

"Wireless connectivity technology segment is expected to register highest growth rate during the forecast period."

Wireless connectivity technology holds the larger market share and is expected to grow with the highest CAGR within the Industrial IoT space. Wireless solutions offer greater ease of deployment and scalability compared to wired connections. Adding new devices or changing layouts is simpler with wireless, making them ideal for complex industrial environments. Wireless solutions can be easier and cheaper to install than wired networks, especially in existing facilities where installing wires might be disruptive or expensive. The ease of deploying wireless sensors and devices can accelerate the implementation of IIoT projects, reducing time to value.

"Germany is expected to hold the largest market share during the forecast period."

Germany held the largest share of the industrial IoT market in Europe in 2023 and is expected to retain its position during the forecast period due to huge government investments in R&D. In Europe, Germany leads in the implementation of IoT solutions, particularly in the manufacturing and automotive industries. It is also at the forefront of incorporating IoT technology in the energy sector to improve energy conservation. German industrial production is vital to Europe's largest economy. Companies in high-tech industries like machinery, automotive, chemicals, pharmaceuticals, electronics, and aerospace are spearheading the adoption of advanced technologies. Siemens, Bosch, and other companies have already integrated the Internet of Things and web-based manufacturing processes in their factories. Wittenstein and Bosch, electric motor manufacturers, have implemented smart technology in their hydraulic equipment assembly lines to enhance production efficiency.

Following is the breakup of the profiles of the primary participants for the report.

- By Company Type: Tier 1 - 45 %, Tier 2 - 35%, and Tier 3 - 20%

- By Designation: C-Level Executives -32%, Directors- 40%, and Others - 28%

- By Region: North America- 37%, Europe- 15%, Asia Pacific - 40%, and RoW - 8%

The report profiles key industrial IoT market players and analyzes their market shares. Players profiled in this report are ABB (Switzerland), General Electric (US), Emerson Electric Co. (US), Intel Corporation (US), Cisco Systems, Inc. (US), SAP SE (Germany), Honeywell International Inc. (US), Siemens (Germany), Huawei Technologies Co., Ltd. (China), etc.

Research Coverage

The report defines, describes, and forecasts the industrial IoT market based on Offering, Connectivity Technology, Deployment, Vertical, and Region. It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the industrial IoT market. It also analyses competitive developments such as product launches, acquisitions, expansions, contracts, partnerships, and actions conducted by the key players to grow in the market.

Reasons to Buy This Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall industrial IoT and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Global rise in internet penetration, growing adoption of cloud platforms, increasing adoption of IPv6, increased IoT-related government initiatives and R&D activities worldwide, and rise in demand for automation in industries), restraints (Incompatibility of legacy equipment with communication networks, and lack of standardization in IoT protocols), opportunities (Emergence of 5G technology, rise in demand for IoT-enabled digital transformation in businesses across verticals, and predictive maintenance of machinery), and challenges (Susceptibility of IoT technologies to cyber attacks, maintenance and updates of IIoT systems, and lack of skilled professionals) influencing the growth of the industrial IoT market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the industrial IoT market

- Market Development: Comprehensive information about lucrative markets - the report analyses the industrial IoT market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the industrial IoT market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like ABB (Switzerland), General Electric (US), Emerson Electric Co. (US), Intel Corporation (US), Cisco Systems, Inc. (US), SAP SE (Germany), Honeywell International Inc. (US), Siemens (Germany), Huawei Technologies Co., Ltd. (China), Rockwell Automation (US), Arm Limited (UK), PTC (US), Dassault Systemes (France), IBM (US), Robert Bosch GmbH (Germany), NEC Corporation (Japan), Software AG (Germany), Texas Instruments Incorporated (US), KUKA AG (Germany), Dragos, Inc. (US), Google LLC (US), and Microsoft Corporation (US), among others in the industrial IoT market strategies. The report also helps stakeholders understand the pulse of the industrial IoT market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 MARKETS COVERED

- FIGURE 1 INDUSTRIAL IOT: MARKET SEGMENTATION

- 1.3.3 REGIONAL SCOPE

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.8 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 INDUSTRIAL IOT MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key participants in primary interviews

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 RESEARCH FLOW OF MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach for estimating market size by bottom-up analysis (demand side)

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach for estimating market size by top-down analysis (supply side)

- FIGURE 5 APPROACH USED TO CAPTURE MARKET SIZE FROM SUPPLY SIDE

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION: INDUSTRIAL IOT MARKET

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 PARAMETERS CONSIDERED TO ANALYZE RECESSION IMPACT ON INDUSTRIAL IOT MARKET

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 8 HARDWARE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF INDUSTRIAL IOT MARKET DURING FORECAST PERIOD

- FIGURE 9 WIRELESS CONNECTIVITY SEGMENT TO RECORD HIGHER CAGR IN INDUSTRIAL IOT MARKET DURING FORECAST PERIOD

- FIGURE 10 CLOUD-BASED DEPLOYMENT SEGMENT TO HOLD LARGER SHARE OF INDUSTRIAL IOT MARKET DURING FORECAST PERIOD

- FIGURE 11 MANUFACTURING INDUSTRY TO DOMINATE INDUSTRIAL IOT MARKET DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC INDUSTRIAL IOT MARKET TO EXHIBIT HIGHEST GROWTH RATE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN INDUSTRIAL IOT MARKET

- FIGURE 13 GROWING DEMAND FROM MANUFACTURING SECTOR TO DRIVE GROWTH OF INDUSTRIAL IOT MARKET DURING FORECAST PERIOD

- 4.2 INDUSTRIAL IOT MARKET, BY OFFERING

- FIGURE 14 HARDWARE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF INDUSTRIAL IOT MARKET DURING FORECAST PERIOD

- 4.3 INDUSTRIAL IOT MARKET IN ASIA PACIFIC, BY VERTICAL AND COUNTRY

- FIGURE 15 CHINA TO ACCOUNT FOR LARGEST SHARE OF INDUSTRIAL IOT MARKET IN ASIA PACIFIC

- 4.4 INDUSTRIAL IOT MARKET, BY VERTICAL

- FIGURE 16 MANUFACTURING SEGMENT TO DOMINATE INDUSTRIAL IOT MARKET

- 4.5 INDUSTRIAL IOT MARKET, BY COUNTRY

- FIGURE 17 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 INDUSTRIAL IOT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Global rise in internet penetration

- FIGURE 19 GLOBAL INTERNET PENETRATION RATE TILL JANUARY 2024, BY REGION

- 5.2.1.2 Growing adoption of cloud platforms

- 5.2.1.3 Increasing adoption of IPv6

- FIGURE 20 ADOPTION RATE OF IPV6, BY COUNTRY, 2023

- 5.2.1.4 Increased IoT-related government initiatives and R&D activities worldwide

- 5.2.1.5 Rise in demand for automation in industries

- FIGURE 21 IMPACT OF DRIVERS ON INDUSTRIAL IOT MARKET

- 5.2.2 RESTRAINTS

- 5.2.2.1 Incompatibility of legacy equipment with communication networks

- 5.2.2.2 Lack of standardization in IoT protocols

- FIGURE 22 IMPACT OF RESTRAINTS ON INDUSTRIAL IOT MARKET

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emergence of 5G technology

- 5.2.3.2 Rise in demand for IoT-enabled digital transformation in businesses across verticals

- 5.2.3.3 Predictive maintenance of machinery

- FIGURE 23 IMPACT OF OPPORTUNITIES ON INDUSTRIAL IOT MARKET

- 5.2.4 CHALLENGES

- 5.2.4.1 Susceptibility of IoT technologies to cyberattacks

- 5.2.4.2 Maintenance and updates of IIoT systems

- 5.2.4.3 Lack of skilled professionals

- FIGURE 24 IMPACT OF CHALLENGES ON INDUSTRIAL IOT MARKET

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 TRENDS INFLUENCING INDUSTRIAL IOT BUSINESS OWNERS

- 5.4 PRICING ANALYSIS

- TABLE 1 AVERAGE SELLING PRICE OF HARDWARE

- FIGURE 26 AVERAGE SELLING PRICE TREND OF IOT NODE COMPONENTS, 2020-2029

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 27 INDUSTRIAL IOT MARKET: VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- TABLE 2 INDUSTRIAL IOT MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- 5.7 INVESTMENT AND FUNDING SCENARIO

- FIGURE 28 FUNDS ACQUIRED BY COMPANIES IN INDUSTRIAL IOT MARKET

- 5.8 TECHNOLOGY TRENDS

- 5.8.1 DIGITAL TWIN

- 5.8.2 CLOUD COMPUTING

- 5.8.3 5G

- 5.8.4 EDGE COMPUTING TECHNOLOGY

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 BOSCH.IO HELPED HOLMER UTILIZE BOSCH IOT SUITE GAIN VALUABLE INSIGHTS INTO AGRICULTURE IOT DATA

- 5.9.2 PTC HELPED QUANT TRANSFORM ITS BUSINESS OF FACTORY SERVICES

- 5.9.3 MICROSOFT HELPED LEGRAND ACHIEVE SMART BUILDING INNOVATIONS WITH OPEN IOT

- 5.10 PATENT ANALYSIS

- FIGURE 29 LG ELECTRONICS REGISTERED MAXIMUM PATENT APPLICATIONS IN LAST 10 YEARS

- TABLE 3 TOP 20 PATENT OWNERS IN LAST 10 YEARS (US)

- FIGURE 30 NUMBER OF PATENTS GRANTED, 2013-2023

- 5.10.1 KEY PATENTS

- TABLE 4 MAJOR PATENTS IN INDUSTRIAL IOT MARKET

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO

- FIGURE 31 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 903190, BY COUNTRY, 2019-2023 (USD THOUSAND)

- 5.11.2 EXPORT SCENARIO

- FIGURE 32 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 903190, BY COUNTRY, 2019-2023 (USD THOUSAND)

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 TARIFF ANALYSIS

- TABLE 5 MFN TARIFFS FOR HS CODE 903190-COMPLIANT PRODUCTS EXPORTED BY US

- TABLE 6 MFN TARIFFS FOR HS CODE 903190-COMPLIANT PRODUCTS EXPORTED BY JAPAN

- TABLE 7 MFN TARIFFS FOR HS CODE 903190-COMPLIANT PRODUCTS EXPORTED BY GERMANY

- TABLE 8 MFN TARIFFS FOR HS CODE 903190-COMPLIANT PRODUCTS EXPORTED BY CHINA

- 5.12.2 REGULATORY LANDSCAPE

- 5.12.2.1 Regulatory bodies, government agencies, and other organizations

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 KEY CONFERENCES AND EVENTS

- TABLE 13 INDUSTRIAL IOT MARKET: CONFERENCES AND EVENTS, 2024-2025

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 IMPACT OF PORTER'S FIVE FORCES ON INDUSTRIAL IOT MARKET

- FIGURE 33 INDUSTRIAL IOT MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.14.2 BARGAINING POWER OF SUPPLIERS

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 THREAT OF NEW ENTRANTS

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

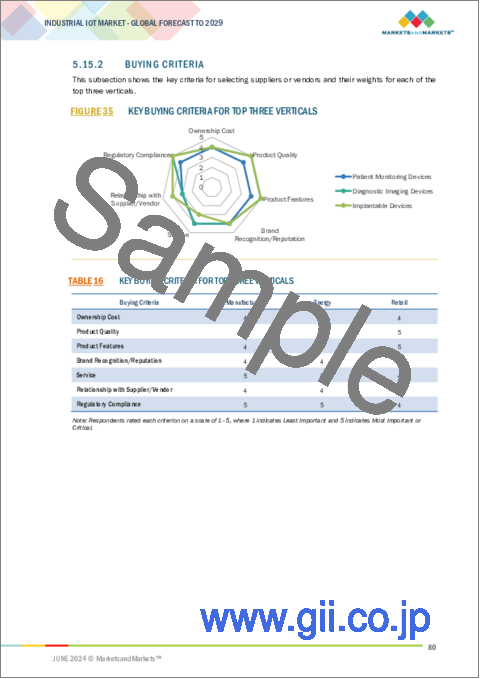

- 5.15.2 BUYING CRITERIA

- FIGURE 35 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 16 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

6 INDUSTRIAL IOT MARKET, BY DEPLOYMENT

- 6.1 INTRODUCTION

- FIGURE 36 INDUSTRIAL IOT MARKET, BY DEPLOYMENT

- FIGURE 37 CLOUD-BASED SEGMENT TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

- TABLE 17 INDUSTRIAL IOT MARKET, BY DEPLOYMENT, 2020-2023 (USD BILLION)

- TABLE 18 INDUSTRIAL IOT MARKET, BY DEPLOYMENT, 2024-2029 (USD BILLION)

- 6.2 ON-PREMISE

- 6.2.1 OFFERS HIGH DEGREE OF CONTROL AND CUSTOMIZATION

- 6.3 CLOUD-BASED

- 6.3.1 OFFERS SCALABILITY AND AGILITY FOR MODERN ENTERPRISES

7 INDUSTRIAL IOT MARKET, BY OFFERING

- 7.1 INTRODUCTION

- FIGURE 38 INDUSTRIAL IOT MARKET, BY OFFERING

- FIGURE 39 INDUSTRIAL IOT MARKET FOR HARDWARE TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- TABLE 19 INDUSTRIAL IOT MARKET, BY OFFERING, 2020-2023 (USD BILLION)

- TABLE 20 INDUSTRIAL IOT MARKET, BY OFFERING, 2024-2029 (USD BILLION)

- 7.2 HARDWARE

- TABLE 21 INDUSTRIAL IOT MARKET, BY HARDWARE, 2020-2023 (USD BILLION)

- TABLE 22 INDUSTRIAL IOT MARKET, BY HARDWARE, 2024-2029 (USD BILLION)

- TABLE 23 INDUSTRIAL IOT MARKET, BY HARDWARE, 2020-2023 (MILLION UNITS)

- TABLE 24 INDUSTRIAL IOT MARKET, BY HARDWARE, 2024-2029 (MILLION UNITS)

- 7.2.1 PROCESSORS

- 7.2.1.1 Companies' efforts to develop low-power processing hardware for IoT devices to drive market

- 7.2.2 SENSORS

- 7.2.2.1 Software-defined sensors leading next wave of IIoT innovations to drive market

- 7.2.3 CONNECTIVITY IC

- 7.2.3.1 Increase in companies providing low-power wireless network connectivity designed for IIoT applications to drive market

- 7.2.4 MEMORY DEVICES

- 7.2.4.1 Increase in number of connected devices to drive market

- 7.2.5 LOGIC DEVICES

- 7.2.5.1 Faster experimentation and iteration during development phase to drive market

- 7.3 SOFTWARE

- TABLE 25 INDUSTRIAL IOT MARKET, BY SOFTWARE, 2020-2023 (USD BILLION)

- TABLE 26 INDUSTRIAL IOT MARKET, BY SOFTWARE, 2024-2029 (USD BILLION)

- 7.3.1 PRODUCT LIFECYCLE MANAGEMENT (PLM)

- 7.3.1.1 Effective development and installation of products to drive market

- 7.3.2 MANUFACTURING EXECUTION SYSTEMS (MES)

- 7.3.2.1 Reduction in operational costs and improved efficiency to drive market

- 7.3.3 SCADA

- 7.3.3.1 Maintenance and effective control of different industrial operations to drive market

- 7.3.4 OUTAGE MANAGEMENT SYSTEMS (OMS)

- 7.3.4.1 Effective management of power outages and improved response time to drive market

- 7.3.5 DISTRIBUTION MANAGEMENT SYSTEMS (DMS)

- 7.3.5.1 Effective management of electricity distribution networks to drive market

- 7.3.6 REMOTE PATIENT MONITORING

- 7.3.6.1 Reduced instances of hospitalizations, readmissions, and hospital stays to drive market

- 7.3.7 RETAIL MANAGEMENT SOFTWARE

- 7.3.7.1 Planning and redesigning of business strategies according to prevailing market scenario to drive market

- 7.3.8 VISUALIZATION SOFTWARE

- 7.3.8.1 Use in engineering, architecture, manufacturing, and other complex domains to drive market

- 7.3.9 TRANSIT MANAGEMENT SYSTEMS

- 7.3.9.1 Use for tracking, controlling, and monitoring location of in-transit goods to drive market

- 7.3.10 FARM MANAGEMENT SYSTEMS

- 7.3.10.1 Increased use for precision farming to drive market

- 7.4 PLATFORMS

- TABLE 27 INDUSTRIAL IOT MARKET, BY PLATFORMS, 2020-2023 (USD BILLION)

- TABLE 28 INDUSTRIAL IOT MARKET, BY PLATFORMS, 2024-2029 (USD BILLION)

- 7.4.1 DEVICE MANAGEMENT PLATFORM

- 7.4.1.1 Rise in number of connected devices to drive growth

- 7.4.2 APPLICATION ENABLEMENT PLATFORM

- 7.4.2.1 Need to drive innovation and achieve operational excellence to propel market

- 7.4.3 CONNECTIVITY MANAGEMENT PLATFORM

- 7.4.3.1 Increased requirement for common platform to manage entire network to drive growth

- 7.4.4 SERVICES

- 7.4.4.1 Increased integration of third-party service providers across verticals to drive market

8 INDUSTRIAL IOT MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- FIGURE 40 INDUSTRIAL IOT MARKET, BY VERTICAL

- FIGURE 41 INDUSTRIAL IOT MARKET FOR MANUFACTURING TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- TABLE 29 INDUSTRIAL IOT MARKET, BY VERTICAL, 2020-2023 (USD BILLION)

- TABLE 30 INDUSTRIAL IOT MARKET, BY VERTICAL, 2024-2029 (USD BILLION)

- 8.2 MANUFACTURING

- TABLE 31 INDUSTRIAL IOT MARKET FOR MANUFACTURING, BY REGION, 2020-2023 (USD BILLION)

- TABLE 32 INDUSTRIAL IOT MARKET FOR MANUFACTURING, BY REGION, 2024-2029 (USD BILLION)

- 8.3 ENERGY

- 8.3.1 REMOTE MONITORING OF PLANTS TO DRIVE GROWTH

- TABLE 33 INDUSTRIAL IOT MARKET FOR ENERGY, BY REGION, 2020-2023 (USD BILLION)

- TABLE 34 INDUSTRIAL IOT MARKET FOR ENERGY, BY REGION, 2024-2029 (USD BILLION)

- 8.3.2 SMART GRIDS

- 8.4 OIL & GAS

- 8.4.1 INCREASING OPERATIONAL EFFICIENCY TO DRIVE GROWTH

- TABLE 35 INDUSTRIAL IOT MARKET FOR OIL & GAS, BY REGION, 2020-2023 (USD BILLION)

- TABLE 36 INDUSTRIAL IOT MARKET FOR OIL & GAS, BY REGION, 2024-2029 (USD BILLION)

- 8.5 METALS & MINING

- 8.5.1 INCREASING WORKPLACE SAFETY TO DRIVE GROWTH

- TABLE 37 INDUSTRIAL IOT MARKET FOR METALS & MINING, BY REGION, 2020-2023 (USD BILLION)

- TABLE 38 INDUSTRIAL IOT MARKET FOR METALS & MINING, BY REGION, 2024-2029 (USD BILLION)

- 8.6 HEALTHCARE

- 8.6.1 REMOTE PATIENT MONITORING TO DRIVE GROWTH

- TABLE 39 INDUSTRIAL IOT MARKET FOR HEALTHCARE, BY REGION, 2020-2023 (USD MILLION)

- TABLE 40 INDUSTRIAL IOT MARKET FOR HEALTHCARE, BY REGION, 2024-2029 (USD MILLION)

- 8.7 RETAIL

- 8.7.1 CHANGING CUSTOMER REQUIREMENTS TO DRIVE DEMAND

- 8.7.2 POINT-OF-SALES (POS)

- 8.7.3 INTERACTIVE KIOSKS

- 8.7.4 SELF-CHECKOUT SYSTEMS

- TABLE 41 INDUSTRIAL IOT MARKET FOR RETAIL, BY REGION, 2020-2023 (USD BILLION)

- TABLE 42 INDUSTRIAL IOT MARKET FOR RETAIL, BY REGION, 2024-2029 (USD BILLION)

- 8.8 TRANSPORTATION

- 8.8.1 INCREASING DEMAND FOR SMART SURVEILLANCE, INTELLIGENT SIGNALING SYSTEMS, AND REAL-TIME TRAFFIC ANALYTICS TO DRIVE GROWTH

- 8.8.2 INTELLIGENT SIGNALING SYSTEMS

- 8.8.3 VIDEO ANALYTICS

- 8.8.4 INCIDENT DETECTION SYSTEMS

- 8.8.5 ROUTE SCHEDULING GUIDANCE SYSTEMS

- TABLE 43 INDUSTRIAL IOT MARKET FOR TRANSPORTATION, BY REGION, 2020-2023 (USD MILLION)

- TABLE 44 INDUSTRIAL IOT MARKET FOR TRANSPORTATION, BY REGION, 2024-2029 (USD MILLION)

- 8.9 AGRICULTURE

- 8.9.1 GROWING ADOPTION OF PRECISION FARMING TO DRIVE MARKET

- 8.9.2 PRECISION FARMING

- 8.9.3 LIVESTOCK MONITORING

- 8.9.4 SMART GREENHOUSES

- 8.9.5 FISH FARMING

- TABLE 45 INDUSTRIAL IOT MARKET FOR AGRICULTURE, BY REGION, 2020-2023 (USD MILLION)

- TABLE 46 INDUSTRIAL IOT MARKET FOR AGRICULTURE, BY REGION, 2024-2029 (USD MILLION)

9 INDUSTRIAL IOT MARKET, BY CONNECTIVITY TECHNOLOGY

- 9.1 INTRODUCTION

- FIGURE 42 INDUSTRIAL IOT MARKET, BY CONNECTIVITY TECHNOLOGY

- FIGURE 43 WIRELESS CONNECTIVITY TECHNOLOGY TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

- TABLE 47 INDUSTRIAL IOT MARKET, BY CONNECTIVITY TECHNOLOGY, 2020-2023 (USD BILLION)

- TABLE 48 INDUSTRIAL IOT MARKET, BY CONNECTIVITY TECHNOLOGY, 2024-2029 (USD BILLION)

- 9.2 WIRED

- 9.2.1 ETHERNET

- 9.2.1.1 Increasing adoption of industrial ethernet to drive market

- 9.2.1.2 Modbus

- 9.2.1.3 PROFINET

- 9.2.1.4 CC-Link

- 9.2.2 FOUNDATION FIELDBUS

- 9.2.2.1 Enhanced communication and integration to drive market

- 9.2.1 ETHERNET

- 9.3 WIRELESS TECHNOLOGIES

- 9.3.1 WI-FI

- 9.3.1.1 Growing consumption of high-bandwidth content and services to drive market

- 9.3.2 BLUETOOTH

- 9.3.2.1 Used for exchanging data on smartphones, laptops, and tablets

- 9.3.3 CELLULAR TECHNOLOGIES

- 9.3.3.1 Low energy consumption to drive market

- 9.3.3.2 4G/LTE

- 9.3.3.3 5G

- 9.3.4 SATELLITE TECHNOLOGIES

- 9.3.4.1 Cost-effective maritime communication to drive market

- 9.3.1 WI-FI

10 INDUSTRIAL IOT MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 44 INDUSTRIAL IOT MARKET, BY REGION

- FIGURE 45 ASIA PACIFIC MARKET TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 49 INDUSTRIAL IOT MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 50 INDUSTRIAL IOT MARKET, BY REGION, 2024-2029 (USD BILLION)

- 10.2 NORTH AMERICA

- FIGURE 46 NORTH AMERICA: INDUSTRIAL IOT MARKET SNAPSHOT

- TABLE 51 NORTH AMERICA: INDUSTRIAL IOT MARKET, BY VERTICAL, 2020-2023 (USD BILLION)

- TABLE 52 NORTH AMERICA: INDUSTRIAL IOT MARKET, BY VERTICAL, 2024-2029 (USD BILLION)

- TABLE 53 NORTH AMERICA: INDUSTRIAL IOT MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 54 NORTH AMERICA: INDUSTRIAL IOT MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- 10.2.1 RECESSION IMPACT

- FIGURE 47 ANALYSIS OF INDUSTRIAL IOT MARKET IN NORTH AMERICA: PRE- AND POST-RECESSION SCENARIOS

- 10.2.2 US

- 10.2.2.1 Presence of major IoT solution providers and significant government support to drive market

- 10.2.3 CANADA

- 10.2.3.1 Increasing investments in development and adoption of IoT technologies to drive market

- 10.2.4 MEXICO

- 10.2.4.1 Rising preference for new technologies in manufacturing sector to drive market

- 10.3 EUROPE

- FIGURE 48 EUROPE: INDUSTRIAL IOT MARKET SNAPSHOT

- TABLE 55 EUROPE: INDUSTRIAL IOT MARKET, BY VERTICAL, 2020-2023 (USD BILLION)

- TABLE 56 EUROPE: INDUSTRIAL IOT MARKET, BY VERTICAL, 2024-2029 (USD BILLION)

- TABLE 57 EUROPE: INDUSTRIAL IOT MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 58 EUROPE: INDUSTRIAL IOT MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- 10.3.1 RECESSION IMPACT

- FIGURE 49 ANALYSIS OF INDUSTRIAL IOT MARKET IN EUROPE: PRE- AND POST-RECESSION SCENARIOS

- 10.3.2 UK

- 10.3.2.1 Increasing adoption of IoT solutions in energy vertical to drive market

- 10.3.3 GERMANY

- 10.3.3.1 Surge in deployment of IoT technology in automotive sector to drive market

- 10.3.4 FRANCE

- 10.3.4.1 Growing adoption of smart manufacturing to drive market

- 10.3.5 REST OF EUROPE

- 10.4 ASIA PACIFIC

- FIGURE 50 ASIA PACIFIC: INDUSTRIAL IOT MARKET SNAPSHOT

- TABLE 59 ASIA PACIFIC: INDUSTRIAL IOT MARKET, BY VERTICAL, 2020-2023 (USD BILLION)

- TABLE 60 ASIA PACIFIC: INDUSTRIAL IOT MARKET, BY VERTICAL, 2024-2029 (USD BILLION)

- TABLE 61 ASIA PACIFIC: INDUSTRIAL IOT MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 62 ASIA PACIFIC: INDUSTRIAL IOT MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- 10.4.1 RECESSION IMPACT

- FIGURE 51 ANALYSIS OF INDUSTRIAL IOT MARKET IN ASIA PACIFIC: PRE- AND POST-RECESSION SCENARIOS

- 10.4.2 CHINA

- 10.4.2.1 Government's robust financial and strategic involvement in R&D to drive market

- 10.4.3 JAPAN

- 10.4.3.1 Increased productivity and optimization to drive market

- 10.4.4 INDIA

- 10.4.4.1 Large-scale industrial development to drive market

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Growing R&D in IoT technologies to drive market

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 ROW

- TABLE 63 ROW: INDUSTRIAL IOT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 64 ROW: INDUSTRIAL IOT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 65 ROW: INDUSTRIAL IOT MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 66 ROW: INDUSTRIAL IOT MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- 10.5.1 RECESSION IMPACT

- FIGURE 52 ANALYSIS OF INDUSTRIAL IOT MARKET IN ROW: PRE- AND POST-RECESSION SCENARIOS

- 10.5.2 SOUTH AMERICA

- 10.5.2.1 Increasing focus on connectivity and networking technologies to drive market

- 10.5.3 GCC COUNTRIES

- 10.5.3.1 Rising collaborations between GCC and semiconductor companies to drive market

- 10.5.4 AFRICA & REST OF MIDDLE EAST

- 10.5.4.1 Rising demand for industrial IoT solutions from oil & gas vertical to drive market

11 COMPETITIVE LANDSCAPE

- 11.1 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

- TABLE 67 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN INDUSTRIAL IOT MARKET

- 11.2 REVENUE ANALYSIS OF TOP FIVE PLAYERS

- FIGURE 53 REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2021-2023

- 11.3 MARKET SHARE ANALYSIS

- TABLE 68 INDUSTRIAL IOT MARKET: DEGREE OF COMPETITION

- TABLE 69 INDUSTRIAL IOT MARKET: RANKING ANALYSIS

- FIGURE 54 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- 11.4 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 55 VALUATION AND FINANCIAL MATRIX OF KEY PLAYERS IN INDUSTRIAL IOT MARKET

- FIGURE 56 ENTERPRISE VALUE/EBITDA OF KEY PLAYERS

- 11.5 BRAND/PRODUCT COMPARISON

- 11.5.1 INDUSTRIAL IOT MARKET: TOP TRENDING BRANDS/PRODUCTS

- 11.6 COMPANY EVALUATION MATRIX

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- FIGURE 57 INDUSTRIAL IOT MARKET: COMPANY EVALUATION MATRIX, 2023

- 11.6.5 COMPANY FOOTPRINT

- 11.6.5.1 Offering footprint

- TABLE 70 INDUSTRIAL IOT MARKET: OFFERING FOOTPRINT

- 11.6.5.2 Connectivity technology footprint

- TABLE 71 INDUSTRIAL IOT MARKET: COMPANY CONNECTIVITY TECHNOLOGY FOOTPRINT

- 11.6.5.3 Deployment footprint

- TABLE 72 INDUSTRIAL IOT MARKET: COMPANY DEPLOYMENT FOOTPRINT

- 11.6.5.4 Vertical footprint

- TABLE 73 INDUSTRIAL IOT MARKET: VERTICAL FOOTPRINT

- 11.6.5.5 Region footprint

- TABLE 74 INDUSTRIAL IOT MARKET: REGION FOOTPRINT

- 11.6.5.6 Overall footprint

- FIGURE 58 INDUSTRIAL IOT MARKET: OVERALL FOOTPRINT

- 11.7 STARTUP/SME EVALUATION MATRIX

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- FIGURE 59 INDUSTRIAL IOT MARKET: STARTUP/SME EVALUATION MATRIX, 2023

- 11.7.5 COMPETITIVE BENCHMARKING

- TABLE 75 INDUSTRIAL IOT MARKET: KEY STARTUPS/SMES

- TABLE 76 INDUSTRIAL IOT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.8 COMPETITIVE SCENARIO

- 11.8.1 PRODUCT LAUNCHES

- TABLE 77 INDUSTRIAL IOT MARKET: PRODUCT LAUNCHES, JULY 2022-MARCH 2024

- 11.8.2 DEALS

- TABLE 78 INDUSTRIAL IOT MARKET: DEALS, JULY 2022-MARCH 2024

12 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- 12.2.1 HUAWEI TECHNOLOGIES CO., LTD.

- TABLE 79 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- FIGURE 60 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

- TABLE 80 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 81 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCT LAUNCHES, JULY 2022-MARCH 2024

- TABLE 82 HUAWEI TECHNOLOGIES CO., LTD.: DEALS, JULY 2022-MARCH 2024

- 12.2.2 CISCO SYSTEMS, INC.

- TABLE 83 CISCO SYSTEMS, INC.: COMPANY OVERVIEW

- FIGURE 61 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

- TABLE 84 CISCO SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 85 CISCO SYSTEMS, INC.: PRODUCT LAUNCHES, JULY 2022-MARCH 2024

- TABLE 86 CISCO SYSTEMS, INC.: DEALS, JULY 2022-MARCH 2024

- TABLE 87 CISCO SYSTEMS, INC.: OTHER DEVELOPMENTS, JULY 2022-MARCH 2024

- 12.2.3 ABB

- TABLE 88 ABB: COMPANY OVERVIEW

- FIGURE 62 ABB: COMPANY SNAPSHOT

- TABLE 89 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 90 ABB: DEALS, JULY 2022-MARCH 2024

- 12.2.4 SIEMENS

- TABLE 91 SIEMENS: COMPANY OVERVIEW

- FIGURE 63 SIEMENS: COMPANY SNAPSHOT

- TABLE 92 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 93 SIEMENS: PRODUCT LAUNCHES, JULY 2022-MARCH 2024

- TABLE 94 SIEMENS: DEALS, JULY 2022-MARCH 2024

- TABLE 95 SIEMENS: EXPANSIONS, JULY 2022-MARCH 2024

- 12.2.5 INTEL CORPORATION

- TABLE 96 INTEL CORPORATION: COMPANY OVERVIEW

- FIGURE 64 INTEL CORPORATION: COMPANY SNAPSHOT

- TABLE 97 INTEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 98 INTEL CORPORATION: EXPANSIONS, JULY 2022-MARCH 2024

- 12.2.6 GENERAL ELECTRIC

- TABLE 99 GENERAL ELECTRIC: COMPANY OVERVIEW

- FIGURE 65 GENERAL ELECTRIC: COMPANY SNAPSHOT

- TABLE 100 GENERAL ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 101 GENERAL ELECTRIC: PRODUCT LAUNCHES, JULY 2022-MARCH 2024

- TABLE 102 GENERAL ELECTRIC: OTHER DEVELOPMENTS, JULY 2022-MARCH 2024

- 12.2.7 EMERSON ELECTRIC CO.

- TABLE 103 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- FIGURE 66 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- TABLE 104 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 105 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES, JULY 2022-MARCH 2024

- TABLE 106 EMERSON ELECTRIC CO.: DEALS, JULY 2022-MARCH 2024

- TABLE 107 EMERSON ELECTRIC CO.: OTHER DEVELOPMENTS, JULY 2022-MARCH 2024

- 12.2.8 SAP SE

- TABLE 108 SAP SE: COMPANY OVERVIEW

- FIGURE 67 SAP SE: COMPANY SNAPSHOT

- TABLE 109 SAP SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.9 HONEYWELL INTERNATIONAL INC.

- TABLE 110 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- FIGURE 68 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 111 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 112 HONEYWELL INTERNATIONAL INC.: DEALS, JULY 2022-MARCH 2024

- 12.2.10 ROCKWELL AUTOMATION

- TABLE 113 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- FIGURE 69 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- TABLE 114 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 115 ROCKWELL AUTOMATION: PRODUCT LAUNCHES, JULY 2022-MARCH 2024

- TABLE 116 ROCKWELL AUTOMATION: DEALS, JULY 2022-MARCH 2024

- TABLE 117 ROCKWELL AUTOMATION: EXPANSIONS, JULY 2022-MARCH 2024

- 12.3 OTHER PLAYERS

- 12.3.1 ARM LIMITED

- TABLE 118 ARM LIMITED: COMPANY OVERVIEW

- 12.3.2 PTC

- TABLE 119 PTC: COMPANY OVERVIEW

- 12.3.3 DASSAULT SYSTEMES

- TABLE 120 DASSAULT SYSTEMES: COMPANY OVERVIEW

- 12.3.4 IBM

- TABLE 121 IBM: COMPANY OVERVIEW

- 12.3.5 ROBERT BOSCH GMBH

- TABLE 122 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- 12.3.6 NEC CORPORATION

- TABLE 123 NEC CORPORATION: COMPANY OVERVIEW

- 12.3.7 ANSYS, INC

- TABLE 124 ANSYS, INC: COMPANY OVERVIEW

- 12.3.8 WORLDSENSING

- TABLE 125 WORLDSENSING: COMPANY OVERVIEW

- 12.3.9 ARUNDO

- TABLE 126 ARUNDO: COMPANY OVERVIEW

- 12.3.10 SOFTWARE AG

- TABLE 127 SOFTWARE AG: COMPANY OVERVIEW

- 12.3.11 TEXAS INSTRUMENTS INCORPORATED

- TABLE 128 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- 12.3.12 KUKA AG

- TABLE 129 KUKA AG: COMPANY OVERVIEW

- 12.3.13 DRAGOS, INC.

- TABLE 130 DRAGOS, INC.: COMPANY OVERVIEW

- 12.3.14 GOOGLE LLC

- TABLE 131 GOOGLE LLC: COMPANY OVERVIEW

- 12.3.15 MICROSOFT CORPORATION

- TABLE 132 MICROSOFT CORPORATION: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS