|

|

市場調査レポート

商品コード

1487475

腫瘍アブレーションの世界市場:規模、シェア、動向:技術別、製品タイプ別、治療法別、用途別、エンドユーザー別、地域別 - 2029年までの予測Tumor Ablation Market Size, Share & Trends by Technology, Product, Mode, Cancer, End User & Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 腫瘍アブレーションの世界市場:規模、シェア、動向:技術別、製品タイプ別、治療法別、用途別、エンドユーザー別、地域別 - 2029年までの予測 |

|

出版日: 2024年05月28日

発行: MarketsandMarkets

ページ情報: 英文 192 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の腫瘍アブレーションの市場規模は、2024年の8億米ドルから2029年には14億米ドルに達し、2024年から2029年までのCAGRは10.0%になると予測されています。

人口の高齢化と骨様骨腫などの腫瘍症例の増加が相まって、これらの製品に対する需要が増加しています。さらに、従来の手技よりもアブレーション手技の認知度が高まっていることも、腫瘍アブレーションシステムの需要を押し上げています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 技術別、製品タイプ別、治療法別、用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

腫瘍アブレーション市場は、技術別では高周波アブレーション、マイクロ波アブレーション、レーザーアブレーション、高強度集束超音波(HIFU)、冷凍アブレーション、不可逆的エレクトロポレーション(IRE)に区分されます。世界人口の高齢化に伴い、主要臓器に影響を及ぼす疾患はより一般的になり、支持療法やリハビリテーション療法の需要に寄与しています。加えて、技術の進歩がアブレーションシステムの開発と組み込みにつながり、市場をさらに拡大しています。

製品タイプ別では、ジェネレーターとプローブ/電極に区分されます。ジェネレータセグメントは2023年に最大の市場シェアを占めました。プローブ/電極市場は、アブレーションシステムの最近の規制承認と有利な償還政策により成長を示しています。プローブ/電極は、正確なアブレーション手技をサポートする一定の技術的進歩を遂げています。早期発見の重要性に対する意識の高まりや、価値観に基づくヘルスケアへのシフトも、軟性・弾性装具の需要増加や市場拡大に寄与しています。

治療法別では、腫瘍アブレーション市場は外科的アブレーション、腹腔鏡アブレーション、経皮的アブレーションにセグメント化されます。2023年には外科的アブレーションセグメントが最大の市場シェアを占めました。研究開発への投資の増加と、より低侵襲な代替療法への需要の高まりが、このセグメントの成長を牽引しています。

腫瘍アブレーション市場は、用途別では、肝臓がん、肺がん、骨がん、腎臓がん、その他の用途に区分されます。肝臓がんは主要セグメントであり、2023年に腫瘍アブレーション市場の最大シェアを占めました。がん罹患率の上昇は、高齢化人口の増加によって支えられています。これが最終的に腫瘍アブレーションシステムの採用を後押ししています。症状の早期発見を目的としたキャンペーンの増加も、エンドユーザー施設におけるアブレーション治療の利用拡大に寄与しています。

当レポートでは、世界の腫瘍アブレーション市場について調査し、技術別、製品タイプ別、治療法別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 規制分析

- 払い戻しシナリオ

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 価格分析

- 貿易分析

- 特許分析

- ポーターのファイブフォース分析

- 2024年~2025年の主な会議とイベント

- ケーススタディ分析

- 技術分析

- 顧客のビジネスに影響を与える動向/混乱

- 主な利害関係者と購入基準

- アンメットニーズと主な問題点

第6章 腫瘍アブレーション市場(技術別)

- イントロダクション

- 高周波アブレーション

- マイクロ波アブレーション

- 冷凍アブレーション

- 高強度焦点式超音波(HIFU)

- その他

第7章 腫瘍アブレーション市場(製品タイプ別)

- イントロダクション

- ジェネレータ

- プローブ/電極

第8章 腫瘍アブレーション市場(治療法別)

- イントロダクション

- 外科的アブレーション

- 腹腔鏡下アブレーション

- 経皮的アブレーション

第9章 腫瘍アブレーション市場(用途別)

- イントロダクション

- 肝臓がん

- 肺がん

- 腎臓がん

- 骨がん

- その他

第10章 腫瘍アブレーション市場(エンドユーザー別)

- イントロダクション

- 病院とクリニック

- がん治療センター

- その他

第11章 腫瘍アブレーション市場(地域別)

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- MEDTRONIC PLC

- JOHNSON & JOHNSON MEDTECH(ETHICON)

- STRYKER CORPORATION

- VARIAN MEDICAL SYSTEMS, INC.

- ANGIODYNAMICS, INC.

- BOSTON SCIENTIFIC CORPORATION

- EDAP TMS S.A.

- MERMAID MEDICAL

- CANYON MEDICAL INC.

- OLYMPUS CORPORATION

- CHONGQING HAIFU MEDICAL TECHNOLOGY CO., LTD.

- MERIT MEDICAL SYSTEMS, INC.

- BIOVENTUS INC.

- ICECURE MEDICAL LTD.

- CONMED CORPORATION

- その他の企業

- MONTERIS MEDICAL

- MIANYANG SONIC ELECTRONIC

- RF MEDICAL

- MINIMAX MEDICAL HOLDING GROUP

- SONABLATE

- ECO MEDICAL TECHNOLOGY(NANJING)CO., LTD.

- STARMED CO., LTD.

- SURGNOVA

- CREO MEDICAL

- MEDSPHERE SHANGHAI

第14章 付録

The global tumor ablation market is projected to reach USD 1.4 billion by 2029 from USD 0.8 billion in 2024, at a CAGR of 10.0% from 2024 to 2029. Aging population, coupled with a rise in tumor cases such as osteoid osteoma, has increased the demand for these products. Moreover, increased awareness of ablation procedures over conventional procedures has driven demand for tumor ablation systems.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD) Billion |

| Segments | Technology, Product type, mode of treatment, application, end user, and region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

"The radiofrequency ablation segment of technology segment held the largest share of the market in 2023"

The tumor ablation market is segmented based on technology into radiofrequency ablation, microwave ablation, laser ablation, high-intensity focused ultrasound (HIFU), cryoablation, and irreversible electroporation (IRE). As the global population ages, conditions affecting the major organs are more prevalent, contributing to the demand for supportive and rehabilitative solutions. Additionally, advancements in technology have led to the development and incorporation of ablation systems, expanding the market further.

"The generators segment is projected to register the highest CAGR during the forecast period."

Based on product type, the tumor ablation market is segmented into generators and probes/electrodes. The generators segment accounted for the largest market share in 2023. The probes/electrodes market is witnessing growth due to recent regulatory approvals of ablation systems and favourable reimbursement policies. The probes/electrodes have undergone certain technological advancements supporting the precise ablation procedure. The growing awareness of the importance of early detection and the shift towards value-based healthcare has also contributed to the increasing demand for soft and elastic braces and its growing market.

"The laparoscopic ablation segment for mode of treatment segment is projected to register a significant CAGR during the forecast period."

Based on mode of treatment, the tumor ablation market is segmented into surgical ablation, laparoscopic ablation, and percutaneous ablation . The surgical ablation segment accounted for the largest market share in 2023. Growing investments in R&D and rising demand for less invasive alternative is driving the growth of this segment.

"The liver cancer segment for application segment held held the largest share of the market in 2022".

Based on application, the tumor ablation market is segmented into liver cancer, lung cancer, bone cancer, kidney cancer, and other applications. The liver cancer was the major segment, accounted for the largest share of the tumor ablation market in 2023. Rising cancer incidence is supported by the increasing aging population. This ultimately drives the adoption of tumor ablation systems. A rising number of campaigns for the early detection of symptoms is also contributing to the increasing utilization of ablation treatment in end-user facilities.

"The cancer care center segment for the end user segment is projected to register a significant CAGR during the forecast period."

The tumor ablation market is segmented by end user into hospitals and clinics, cancer care centers, and ambulatory surgery centers. The hospitals and clinics segment accounted for a significant market share in 2023. The emphasis on non- and minimally invasive treatment among the geriatric population helps the growing preference for ablation treatment solutions, driving the integration of tumor ablation systems into hospital settings.

"The market in the North America region is expected to witness the highest growth during the forecast period."

The North America tumor ablation market is expected to hold a major share during the forecast period. The US market holds a dominating position in the North American market, primarily due to the region's high healthcare spending, rising prevalence of target diseases, a growing number of non-invasive treatments, and technological advancements in ablation systems.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1-30%, Tier 2-42%, and Tier 3- 28%

- By Designation: Director-level-10%, C-level-14%, and Others-76%

- By Region: North America-40%, Europe-30%, Asia Pacific-22%, Latin America-6%, and the Middle East & Africa-2%

The prominent players in the tumor ablation market are Medtronic Plc (Ireland), Johnson & Johnson MedTech (US), Stryker Corporation (US), Varian Medical Systems, Inc. (US), AngioDynamics, Inc. (US), Boston Scientific Corporation (US) among others.

Research Coverage

This report studies the tumor ablation market based on technology, product type, mode of treatment, application, end user, and region. It also covers the factors affecting market growth, analyzes the various opportunities and challenges in the market, and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets with respect to their growth trends and forecasts the revenue of the market segments with respect to five main regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall tumor ablation market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

This report provides insights on the following pointers:

- Analysis of key drivers (increasing cancer incidence and rising geriatric population, rising focus on minimally invasive procedures, technological advancements in the field of tumor ablation, rising number of awareness campaigns and early detection), restraints (high cost of tumor ablation systems, unfavorable reimbursement scenario), opportunities (rising healthcare expenditure across emerging countries, increasing number of hospitals), and challenges (rising adoption of refurbished tumor ablation systems, hospital budget cuts) influencing the growth of the tumor ablation market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the tumor ablation market

- Market Development: Comprehensive information about lucrative markets-the report analyses the tumor ablation market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the tumor ablation market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players - such as Johnson & Johnson (US), Medtronic Plc (Ireland), Stryker Corporation (US), Varian Medical Systems, Inc. (US), Olympus (Japan), AngioDynamics, Inc. (US), Boston Scientific Corporation (US) among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.3.3 CURRENCY CONSIDERED

- 1.4 RESEARCH LIMITATIONS

- 1.5 KEY STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.7 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY RESEARCH

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach 1: Company revenue estimation approach

- FIGURE 5 TUMOR ABLATION MARKET SIZE ESTIMATION: APPROACH 1 (COMPANY REVENUE ESTIMATION)

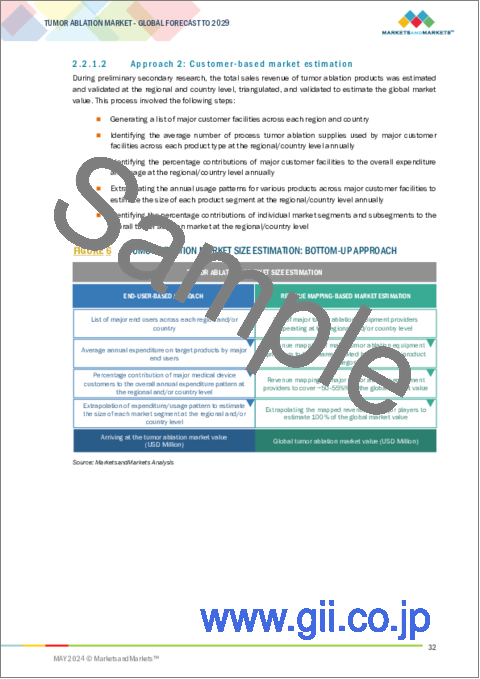

- 2.2.1.2 Approach 2: Customer-based market estimation

- FIGURE 6 TUMOR ABLATION MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.1.3 Growth forecast

- 2.2.1.4 CAGR projections

- FIGURE 7 CAGR PROJECTION: SUPPLY-SIDE ANALYSIS

- 2.3 DATA VALIDATION APPROACH

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET SHARE ASSESSMENT

- 2.5 STUDY ASSUMPTIONS

- 2.6 GROWTH RATE ASSUMPTIONS

- 2.7 RISK ASSESSMENT

- 2.8 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 9 TUMOR ABLATION MARKET, TECHNOLOGY, 2024 VS. 2029 (USD MILLION)

- FIGURE 10 TUMOR ABLATION MARKET, BY PRODUCT TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 11 TUMOR ABLATION MARKET, BY MODE OF TREATMENT, 2024 VS. 2029 (USD MILLION)

- FIGURE 12 TUMOR ABLATION MARKET, BY APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 13 TUMOR ABLATION MARKET, BY END USER, 2024 VS. 2029 (USD MILLION)

- FIGURE 14 TUMOR ABLATION MARKET: GEOGRAPHIC SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 TUMOR ABLATION MARKET OVERVIEW

- FIGURE 15 RISING PREVALENCE OF CANCER TO DRIVE MARKET GROWTH

- 4.2 NORTH AMERICA: TUMOR ABLATION MARKET, BY TECHNOLOGY

- FIGURE 16 MICROWAVE ABLATION SEGMENT TO REGISTER SIGNIFICANT GROWTH IN NORTH AMERICA DURING FORECAST PERIOD

- 4.3 EUROPE: TUMOR ABLATION MARKET, BY APPLICATION

- FIGURE 17 LIVER CANCER SEGMENT TO DOMINATE MARKET IN EUROPE DURING FORECAST PERIOD

- 4.4 ASIA PACIFIC: TUMOR ABLATION MARKET, BY END USER

- FIGURE 18 HOSPITALS & CLINICS SEGMENT TO CONTINUE TO HOLD LARGEST SHARE IN ASIA PACIFIC MARKET

- 4.5 GEOGRAPHIC SNAPSHOT OF TUMOR ABLATION MARKET

- FIGURE 19 CHINA TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 TUMOR ABLATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing cancer incidence and rising geriatric population

- 5.2.1.2 Rising focus on minimally invasive procedures

- 5.2.1.3 Technological advancements in field of tumor ablation

- 5.2.1.4 Rising number of awareness campaigns and early detection

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of tumor ablation systems

- 5.2.2.2 Unfavorable regulatory scenario

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising healthcare expenditure across emerging economies

- 5.2.3.2 Increasing number of hospitals

- 5.2.4 CHALLENGES

- 5.2.4.1 Rising adoption of refurbished tumor ablation systems

- 5.2.4.2 Hospital budget cuts

- 5.3 REGULATORY ANALYSIS

- 5.3.1 KEY REGULATORY BODIES AND GOVERNMENT AGENCIES

- TABLE 1 NORTH AMERICA: LIST OF REGULATORY BODIES AND GOVERNMENT AGENCIES

- TABLE 2 EUROPE: LIST OF REGULATORY BODIES AND GOVERNMENT AGENCIES

- TABLE 3 ASIA PACIFIC: LIST OF REGULATORY BODIES AND GOVERNMENT AGENCIES

- TABLE 4 LATIN AMERICA: LIST OF REGULATORY BODIES AND GOVERNMENT AGENCIES

- TABLE 5 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES AND GOVERNMENT AGENCIES

- 5.3.2 KEY REGULATORY GUIDELINES

- 5.3.2.1 US

- TABLE 6 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 7 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- FIGURE 21 PREMARKET NOTIFICATION: 510(K) APPROVALS FOR MEDICAL DEVICES

- 5.3.2.2 Canada

- TABLE 8 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- FIGURE 22 CANADA: REGULATORY APPROVAL PROCESS FOR MEDICAL DEVICES

- 5.3.2.3 Europe

- FIGURE 23 EUROPE: CE APPROVAL PROCESS FOR MEDICAL DEVICES

- 5.3.2.4 Asia Pacific

- 5.3.2.4.1 Japan

- 5.3.2.4 Asia Pacific

- TABLE 9 JAPAN: PMDA CLASSIFICATION OF ABLATION DEVICES

- TABLE 10 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PHARMACEUTICAL AND MEDICAL DEVICE AGENCY (PMDA)

- 5.3.2.4.2 China

- TABLE 11 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- 5.3.2.4.3 India

- TABLE 12 INDIA: CDSCO CLASSIFICATION OF ABLATION DEVICES

- 5.3.2.5 Latin America

- 5.3.2.5.1 Brazil

- 5.3.2.5 Latin America

- 5.4 REIMBURSEMENT SCENARIO

- TABLE 13 MEDICAL REIMBURSEMENT CPT CODES FOR MICROWAVE AND RADIOFREQUENCY ABLATION PROCEDURES IN US (EFFECTIVE JANUARY 1, 2022)

- 5.5 VALUE CHAIN ANALYSIS

- 5.5.1 RESEARCH & DEVELOPMENT

- 5.5.2 MANUFACTURING & ASSEMBLY

- 5.5.3 DISTRIBUTION, MARKETING & SALES, AND POST-SALES SERVICES

- FIGURE 24 TUMOR ABLATION MARKET: VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.6.1 PROMINENT COMPANIES

- 5.6.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 5.6.3 END USERS

- FIGURE 25 TUMOR ABLATION MARKET: SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- FIGURE 26 TUMOR ABLATION MARKET: ECOSYSTEM ANALYSIS

- TABLE 14 TUMOR ABLATION MARKET: ROLE IN ECOSYSTEM

- 5.8 INVESTMENT & FUNDING SCENARIO

- FIGURE 27 NUMBER OF INVESTOR DEALS IN TUMOR ABLATION MARKET, BY KEY PLAYER, 2018-2022

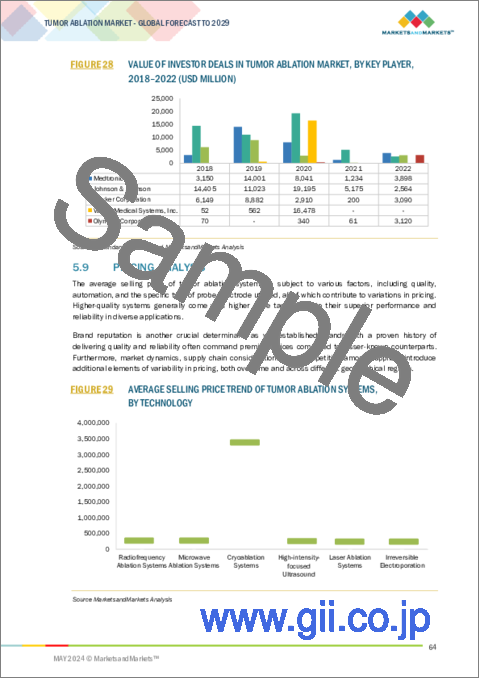

- FIGURE 28 VALUE OF INVESTOR DEALS IN TUMOR ABLATION MARKET, BY KEY PLAYER, 2018-2022 (USD MILLION)

- 5.9 PRICING ANALYSIS

- FIGURE 29 AVERAGE SELLING PRICE TREND OF TUMOR ABLATION SYSTEMS, BY TECHNOLOGY

- FIGURE 30 AVERAGE SELLING PRICE TREND OF TUMOR ABLATION SYSTEMS, BY REGION

- TABLE 15 AVERAGE SELLING PRICE OF TUMOR ABLATION SYSTEMS, BY REGION, 2021-2023

- 5.10 TRADE ANALYSIS

- TABLE 16 IMPORT DATA FOR TUMOR ABLATION SYSTEMS (HS CODE 9018), BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 17 EXPORT DATA FOR TUMOR ABLATION SYSTEMS (HS CODE 9018), BY COUNTRY, 2018-2022 (USD THOUSAND)

- 5.11 PATENT ANALYSIS

- FIGURE 31 PATENT DETAILS FOR TUMOR ABLATION MARKET (JANUARY 2013- DECEMBER 2023)

- 5.12 PORTER'S FIVE FORCE ANALYSIS

- TABLE 18 PORTER'S FIVE FORCES ANALYSIS: TUMOR ABLATION MARKET

- 5.12.1 THREAT OF NEW ENTRANTS

- 5.12.2 THREAT OF SUBSTITUTES

- 5.12.3 BARGAINING POWER OF SUPPLIERS

- 5.12.4 BARGAINING POWER OF BUYERS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY CONFERENCES & EVENTS IN 2024-2025

- TABLE 19 LIST OF MAJOR CONFERENCES & EVENTS IN TUMOR ABLATION MARKET, 2024-2025

- 5.14 CASE STUDY ANALYSIS

- TABLE 20 CASE STUDY 1: RADIOFREQUENCY ABLATION ANALYSIS CASE STUDY

- TABLE 21 CASE STUDY 2: ABLATION OF LOCALIZED RENAL TUMOR

- 5.15 TECHNOLOGY ANALYSIS

- 5.15.1 KEY TECHNOLOGIES

- 5.15.1.1 Radiofrequency ablation and microwave ablation

- 5.15.1.2 Cryoablation

- 5.15.2 COMPLEMENTARY TECHNOLOGIES

- 5.15.2.1 Laparoscopy

- 5.15.2.2 Diagnostic imaging

- 5.15.3 ADJACENT TECHNOLOGIES

- 5.15.3.1 Electrosurgery

- 5.15.1 KEY TECHNOLOGIES

- 5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 32 REVENUE SHIFT IN TUMOR ABLATION MARKET

- 5.17 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE CATEGORIES

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- 5.17.2 BUYING CRITERIA

- FIGURE 34 KEY BUYING CRITERIA FOR PROCESS TUMOR ABLATION SYSTEMS

- TABLE 23 KEY BUYING CRITERIA FOR TUMOR ABLATION SYSTEMS

- 5.18 UNMET NEEDS & KEY PAIN POINTS

- TABLE 24 TUMOR ABLATION MARKET: CURRENT UNMET NEEDS

6 TUMOR ABLATION MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- TABLE 25 TUMOR ABLATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- 6.2 RADIOFREQUENCY ABLATION

- 6.2.1 LOW COST OF RADIOFREQUENCY ABLATION TO CONTRIBUTE TO MARKET GROWTH

- TABLE 26 RADIOFREQUENCY ABLATION MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.3 MICROWAVE ABLATION

- 6.3.1 ADVANTAGES OF MICROWAVE ABLATION TO BOOST MARKET GROWTH

- TABLE 27 MICROWAVE ABLATION MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.4 CRYOABLATION

- 6.4.1 HIGH SAFETY AND EFFICACY OF CRYOABLATION TO BOOST MARKET

- TABLE 28 CRYOABLATION MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.5 HIGH-INTENSITY-FOCUSED ULTRASOUND (HIFU)

- 6.5.1 TECHNOLOGICAL ADVANCEMENTS IN ULTRASOUND ABLATION TO FAVOR MARKET GROWTH

- TABLE 29 HIGH-INTENSITY-FOCUSED ULTRASOUND MARKET, BY REGION, 2022-2029 (USD MILLION)

- 6.6 OTHER TECHNOLOGIES

- TABLE 30 OTHER TUMOR ABLATION TECHNOLOGIES MARKET, BY REGION, 2022-2029 (USD MILLION)

7 TUMOR ABLATION MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- TABLE 31 TUMOR ABLATION MARKET, BY PRODUCT TYPE, 2022-2029 (USD MILLION)

- TABLE 32 TUMOR ABLATION MARKET, BY TECHNOLOGY, 2022-2029 (UNITS)

- 7.2 GENERATORS

- 7.2.1 RISING ADOPTION OF TUMOR ABLATION SYSTEMS TO PROPEL MARKET GROWTH

- TABLE 33 TUMOR ABLATION GENERATORS MARKET, BY REGION, 2022-2029 (USD MILLION)

- 7.3 PROBES/ELECTRODES

- 7.3.1 RADIOFREQUENCY ABLATION PROBES

- 7.3.1.1 Rising adoption of radiofrequency ablation systems for multiple applications to propel market growth

- TABLE 34 RADIOFREQUENCY ABLATION PROBES MARKET, BY REGION, 2022-2029 (USD MILLION)

- 7.3.2 MICROWAVE ABLATION PROBES

- 7.3.2.1 Increasing cancer prevalence and precise ablation to boost adoption

- TABLE 35 MICROWAVE ABLATION PROBES MARKET, BY REGION, 2022-2029 (USD MILLION)

- 7.3.3 OTHER PROBES/ELECTRODES

- TABLE 36 OTHER TUMOR ABLATION PROBES/ELECTRODES MARKET, BY REGION, 2022-2029 (USD MILLION)

- 7.3.1 RADIOFREQUENCY ABLATION PROBES

8 TUMOR ABLATION MARKET, BY MODE OF TREATMENT

- 8.1 INTRODUCTION

- TABLE 37 TUMOR ABLATION MARKET, BY MODE OF TREATMENT, 2022-2029 (USD MILLION)

- 8.2 SURGICAL ABLATION

- 8.2.1 RISING UTILIZATION OF SURGICAL ABLATION IN END-USER FACILITIES TO PROPEL MARKET

- TABLE 38 TUMOR ABLATION MARKET FOR SURGICAL ABLATION, BY REGION, 2022-2029 (USD MILLION)

- 8.3 LAPAROSCOPIC ABLATION

- 8.3.1 IMPROVED SUCCESS RATE AND REAL-TIME VISUALIZATION TO BOOST DEMAND

- TABLE 39 TUMOR ABLATION MARKET FOR LAPAROSCOPIC ABLATION, BY REGION, 2022-2029 (USD MILLION)

- 8.4 PERCUTANEOUS ABLATION

- 8.4.1 SHORTER RECOVERY TIME AND COST-EFFECTIVENESS OF PROCEDURE TO DRIVE SEGMENT

- TABLE 40 TUMOR ABLATION MARKET FOR PERCUTANEOUS ABLATION, BY REGION, 2022-2029 (USD MILLION)

9 TUMOR ABLATION MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- TABLE 41 TUMOR ABLATION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- 9.2 LIVER CANCER

- 9.2.1 PROMISING OUTCOMES OF ABLATION IN TREATING HCC TO DRIVE MARKET

- TABLE 42 TUMOR ABLATION MARKET FOR LIVER CANCER, BY REGION, 2022-2029 (USD MILLION)

- 9.3 LUNG CANCER

- 9.3.1 RISING INCIDENCE OF LUNG CANCER TO FUEL MARKET

- TABLE 43 TUMOR ABLATION MARKET FOR LUNG CANCER, BY REGION, 2022-2029 (USD MILLION)

- 9.4 KIDNEY CANCER

- 9.4.1 RISING PREVALENCE OF KIDNEY CANCER AND MINIMAL DAMAGE OF HEALTHY TISSUE TO DRIVE ADOPTION

- TABLE 44 TUMOR ABLATION MARKET FOR KIDNEY CANCER, BY REGION, 2022-2029 (USD MILLION)

- 9.5 BONE CANCER

- 9.5.1 RISING USE OF ABLATION TECHNIQUES TO TREAT OSTEOID OSTEOMA TO BOOST GROWTH

- TABLE 45 TUMOR ABLATION MARKET FOR BONE CANCER, BY REGION, 2022-2029 (USD MILLION)

- 9.6 OTHER APPLICATIONS

- TABLE 46 TUMOR ABLATION MARKET FOR OTHER APPLICATIONS, BY REGION, 2022-2029 (USD MILLION)

10 TUMOR ABLATION MARKET, BY END USER

- 10.1 INTRODUCTION

- TABLE 47 TUMOR ABLATION MARKET, BY END USER, 2022-2029 (USD MILLION)

- 10.2 HOSPITALS & CLINICS

- 10.2.1 INCREASING ADOPTION OF ADVANCED TUMOR ABLATION SYSTEMS TO PROPEL MARKET

- TABLE 48 TUMOR ABLATION MARKET FOR HOSPITALS & CLINICS, BY REGION, 2022-2029 (USD MILLION)

- 10.3 CANCER CARE CENTERS

- 10.3.1 GROWING ESTABLISHMENT OF CANCER CARE CENTERS TO FUEL MARKET

- TABLE 49 TUMOR ABLATION MARKET FOR CANCER CARE CENTERS, BY REGION, 2022-2029 (USD MILLION)

- 10.4 OTHER END USERS

- TABLE 50 TUMOR ABLATION MARKET FOR OTHER END USERS, BY REGION, 2022-2029 (USD MILLION)

11 TUMOR ABLATION MARKET, BY REGION

- 11.1 INTRODUCTION

- TABLE 51 TUMOR ABLATION MARKET, BY REGION, 2022-2029 (USD MILLION)

- 11.2 NORTH AMERICA

- FIGURE 35 NORTH AMERICA: TUMOR ABLATION MARKET SNAPSHOT

- TABLE 52 NORTH AMERICA: TUMOR ABLATION MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 53 NORTH AMERICA: TUMOR ABLATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 54 NORTH AMERICA: TUMOR ABLATION MARKET, BY PRODUCT TYPE, 2022-2029 (USD MILLION)

- TABLE 55 NORTH AMERICA: TUMOR ABLATION MARKET, BY MODE OF TREATMENT, 2022-2029 (USD MILLION)

- TABLE 56 NORTH AMERICA: TUMOR ABLATION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 57 NORTH AMERICA: TUMOR ABLATION MARKET, BY END USER, 2022-2029 (USD MILLION)

- 11.2.1 NORTH AMERICA: RECESSION IMPACT

- 11.2.2 US

- 11.2.2.1 Rising prevalence of cancer to propel market growth

- TABLE 58 US: TUMOR ABLATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- 11.2.3 CANADA

- 11.2.3.1 Growing burden of cancer to support market growth

- TABLE 59 CANADA: TUMOR ABLATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- 11.3 EUROPE

- TABLE 60 EUROPE: TUMOR ABLATION MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 61 EUROPE: TUMOR ABLATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 62 EUROPE: TUMOR ABLATION MARKET, BY PRODUCT TYPE, 2022-2029 (USD MILLION)

- TABLE 63 EUROPE: TUMOR ABLATION MARKET, BY MODE OF TREATMENT, 2022-2029 (USD MILLION)

- TABLE 64 EUROPE: TUMOR ABLATION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 65 EUROPE: TUMOR ABLATION MARKET, BY END USER, 2022-2029 (USD MILLION)

- 11.3.1 EUROPE: RECESSION IMPACT

- 11.3.2 GERMANY

- 11.3.2.1 Highly developed healthcare infrastructure and rising disease incidence to ensure strong growth prospects

- TABLE 66 GERMANY: TUMOR ABLATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- 11.3.3 FRANCE

- 11.3.3.1 Growing geriatric population to support market growth in France

- TABLE 67 FRANCE: TUMOR ABLATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- 11.3.4 UK

- 11.3.4.1 Growing target patient population to support market growth in UK

- TABLE 68 UK: TUMOR ABLATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- 11.3.5 ITALY

- 11.3.5.1 Rising awareness to support market growth

- TABLE 69 ITALY: TUMOR ABLATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- 11.3.6 SPAIN

- 11.3.6.1 Increasing government funding for research to support market growth

- TABLE 70 SPAIN: TUMOR ABLATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- 11.3.7 REST OF EUROPE

- TABLE 71 REST OF EUROPE: TUMOR ABLATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- 11.4 ASIA PACIFIC

- FIGURE 36 ASIA PACIFIC: TUMOR ABLATION MARKET SNAPSHOT

- TABLE 72 ASIA PACIFIC: TUMOR ABLATION MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 73 ASIA PACIFIC: TUMOR ABLATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 74 ASIA PACIFIC: TUMOR ABLATION MARKET, BY PRODUCT TYPE, 2022-2029 (USD MILLION)

- TABLE 75 ASIA PACIFIC: TUMOR ABLATION MARKET, BY MODE OF TREATMENT, 2022-2029 (USD MILLION)

- TABLE 76 ASIA PACIFIC: TUMOR ABLATION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 77 ASIA PACIFIC: TUMOR ABLATION MARKET, BY END USER, 2022-2029 (USD MILLION)

- 11.4.1 ASIA PACIFIC: RECESSION IMPACT

- 11.4.2 JAPAN

- 11.4.2.1 Presence of universal healthcare reimbursement scenario to drive market growth

- TABLE 78 JAPAN: TUMOR ABLATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- 11.4.3 CHINA

- 11.4.3.1 Increasing patient pool and government initiatives for healthcare development to fuel market growth

- TABLE 79 CHINA: TUMOR ABLATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- 11.4.4 INDIA

- 11.4.4.1 Ongoing modernization and infrastructure development in India to support market growth

- TABLE 80 INDIA: TUMOR ABLATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- 11.4.5 AUSTRALIA

- 11.4.5.1 Rising research investments and awareness campaigns to support market growth

- TABLE 81 AUSTRALIA: TUMOR ABLATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Rising R&D and promising clinical trials to positively impact market growth

- TABLE 82 SOUTH KOREA: TUMOR ABLATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- 11.4.7 REST OF ASIA PACIFIC

- TABLE 83 REST OF ASIA PACIFIC: TUMOR ABLATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- 11.5 LATIN AMERICA

- 11.5.1 LATIN AMERICA: RECESSION IMPACT

- TABLE 84 LATIN AMERICA: TUMOR ABLATION MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 85 LATIN AMERICA: TUMOR ABLATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 86 LATIN AMERICA: TUMOR ABLATION MARKET, BY PRODUCT TYPE, 2022-2029 (USD MILLION)

- TABLE 87 LATIN AMERICA: TUMOR ABLATION MARKET, BY MODE OF TREATMENT, 2022-2029 (USD MILLION)

- TABLE 88 LATIN AMERICA: TUMOR ABLATION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 89 LATIN AMERICA: TUMOR ABLATION MARKET, BY END USER, 2022-2029 (USD MILLION)

- 11.5.2 BRAZIL

- 11.5.2.1 Modernization of healthcare facilities in Brazil to boost market

- TABLE 90 BRAZIL: TUMOR ABLATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- 11.5.3 MEXICO

- 11.5.3.1 Availability of advanced care and increasing awareness programs to fuel market growth in Mexico

- TABLE 91 MEXICO: TUMOR ABLATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- 11.5.4 REST OF LATIN AMERICA

- TABLE 92 REST OF LATIN AMERICA: TUMOR ABLATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 IMPROVING HEALTHCARE INFRASTRUCTURE AND INCREASING PUBLIC-PRIVATE INVESTMENTS TO DRIVE MARKET GROWTH

- TABLE 93 MIDDLE EAST & AFRICA: TUMOR ABLATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 94 MIDDLE EAST & AFRICA: TUMOR ABLATION MARKET, BY PRODUCT TYPE, 2022-2029 (USD MILLION)

- TABLE 95 MIDDLE EAST & AFRICA: TUMOR ABLATION MARKET, BY MODE OF TREATMENT, 2022-2029 (USD MILLION)

- TABLE 96 MIDDLE EAST & AFRICA: TUMOR ABLATION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 97 MIDDLE EAST & AFRICA: TUMOR ABLATION MARKET, BY END USER, 2022-2029 (USD MILLION)

- 11.6.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN TUMOR ABLATION MARKET

- TABLE 98 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MANUFACTURING COMPANIES

- 12.3 REVENUE ANALYSIS

- FIGURE 37 REVENUE ANALYSIS OF TOP THREE PLAYERS IN TUMOR ABLATION MARKET (2021-2023)

- 12.4 MARKET SHARE ANALYSIS

- FIGURE 38 MARKET SHARE ANALYSIS OF KEY PLAYERS (2023)

- TABLE 99 TUMOR ABLATION TECHNOLOGY MARKET: DEGREE OF COMPETITION

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 39 TUMOR ABLATION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.5.5.1 Company footprint

- FIGURE 40 TUMOR ABLATION MARKET: COMPANY FOOTPRINT

- 12.5.5.2 Technology footprint

- TABLE 100 TUMOR ABLATION MARKET: TECHNOLOGY FOOTPRINT

- 12.5.5.3 Region footprint

- TABLE 101 TUMOR ABLATION MARKET: REGION FOOTPRINT

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- FIGURE 41 TUMOR ABLATION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- TABLE 102 TUMOR ABLATION MARKET: DETAILED LIST OF KEY STARTUP/SME PLAYERS

- TABLE 103 TUMOR ABLATION MARKET: COMPETITIVE BENCHMARKING OF KEY EMERGING PLAYERS/STARTUPS

- 12.7 COMPANY VALUATION & FINANCIAL METRICS

- 12.7.1 FINANCIAL METRICS

- FIGURE 42 EV/EBITDA OF KEY VENDORS

- 12.7.2 COMPANY VALUATION

- FIGURE 43 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- 12.8 BRAND/PRODUCT COMPARISON

- FIGURE 44 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES/APPROVALS

- TABLE 104 TUMOR ABLATION MARKET: PRODUCT LAUNCHES, JANUARY 2021-MARCH 2024

- 12.9.2 DEALS

- TABLE 105 TUMOR ABLATION MARKET: DEALS, JANUARY 2021-MARCH 2024

- 12.9.3 EXPANSIONS

- TABLE 106 TUMOR ABLATION MARKET: EXPANSIONS, JANUARY 2021-MARCH 2024

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- (Business overview, Products offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and Competitive threats)**

- 13.1.1 MEDTRONIC PLC

- TABLE 107 MEDTRONIC PLC: COMPANY OVERVIEW

- FIGURE 45 MEDTRONIC PLC: COMPANY SNAPSHOT (2023)

- TABLE 108 MEDTRONIC PLC: PRODUCTS OFFERED

- TABLE 109 MEDTRONIC PLC: PRODUCT APPROVALS

- 13.1.2 JOHNSON & JOHNSON MEDTECH (ETHICON)

- TABLE 110 JOHNSON & JOHNSON MEDTECH: COMPANY OVERVIEW

- FIGURE 46 JOHNSON & JOHNSON MEDTECH: COMPANY SNAPSHOT (2022)

- TABLE 111 JOHNSON & JOHNSON MEDTECH: PRODUCTS OFFERED

- 13.1.3 STRYKER CORPORATION

- TABLE 112 STRYKER CORPORATION: COMPANY OVERVIEW

- FIGURE 47 STRYKER CORPORATION: COMPANY SNAPSHOT (2023)

- TABLE 113 STRYKER CORPORATION: PRODUCTS OFFERED

- TABLE 114 STRYKER CORPORATION: PRODUCT APPROVALS

- TABLE 115 STRYKER CORPORATION: EXPANSIONS

- 13.1.4 VARIAN MEDICAL SYSTEMS, INC.

- TABLE 116 VARIAN MEDICAL SYSTEMS, INC.: COMPANY OVERVIEW

- FIGURE 48 VARIAN MEDICAL SYSTEMS, INC.: COMPANY SNAPSHOT (2023)

- TABLE 117 VARIAN MEDICAL SYSTEMS, INC.: PRODUCTS OFFERED

- TABLE 118 VARIAN MEDICAL SYSTEMS, INC.: PRODUCT LAUNCHES

- TABLE 119 VARIAN MEDICAL SYSTEMS, INC.: DEALS

- 13.1.5 ANGIODYNAMICS, INC.

- TABLE 120 ANGIODYNAMICS, INC.: COMPANY OVERVIEW

- FIGURE 49 ANGIODYNAMICS, INC.: COMPANY SNAPSHOT (2023)

- TABLE 121 ANGIODYNAMICS, INC.: PRODUCTS OFFERED

- TABLE 122 ANGIODYNAMICS, INC.: DEALS

- 13.1.6 BOSTON SCIENTIFIC CORPORATION

- TABLE 123 BOSTON SCIENTIFIC CORPORATION: COMPANY OVERVIEW

- FIGURE 50 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT (2023)

- TABLE 124 BOSTON SCIENTIFIC CORPORATION: PRODUCTS OFFERED

- 13.1.7 EDAP TMS S.A.

- TABLE 125 EDAP TMS S.A.: COMPANY OVERVIEW

- FIGURE 51 EDAP TMS S.A.: COMPANY SNAPSHOT (2023)

- TABLE 126 EDAP TMS S.A.: PRODUCTS OFFERED

- 13.1.8 MERMAID MEDICAL

- TABLE 127 MERMAID MEDICAL: COMPANY OVERVIEW

- TABLE 128 MERMAID MEDICAL: PRODUCTS OFFERED

- 13.1.9 CANYON MEDICAL INC.

- TABLE 129 CANYON MEDICAL INC.: COMPANY OVERVIEW

- TABLE 130 CANYON MEDICAL INC.: PRODUCTS OFFERED

- 13.1.10 OLYMPUS CORPORATION

- TABLE 131 OLYMPUS CORPORATION: COMPANY OVERVIEW

- FIGURE 52 OLYMPUS CORPORATION: COMPANY SNAPSHOT (2023)

- TABLE 132 OLYMPUS CORPORATION: PRODUCTS OFFERED

- TABLE 133 OLYMPUS CORPORATION: PRODUCT LAUNCHES

- 13.1.11 CHONGQING HAIFU MEDICAL TECHNOLOGY CO., LTD.

- TABLE 134 CHONGQING HAIFU MEDICAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 135 CHONGQING HAIFU MEDICAL TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- 13.1.12 MERIT MEDICAL SYSTEMS, INC.

- TABLE 136 MERIT MEDICAL SYSTEMS, INC.: COMPANY OVERVIEW

- FIGURE 53 MERIT MEDICAL SYSTEMS, INC.: COMPANY SNAPSHOT (2022)

- TABLE 137 MERIT MEDICAL SYSTEMS, INC.: PRODUCTS OFFERED

- 13.1.13 BIOVENTUS INC.

- TABLE 138 BIOVENTUS INC.: COMPANY OVERVIEW

- FIGURE 54 BIOVENTUS INC.: COMPANY SNAPSHOT (2023)

- TABLE 139 BIOVENTUS INC.: PRODUCTS OFFERED

- TABLE 140 BIOVENTUS INC.: DEALS

- 13.1.14 ICECURE MEDICAL LTD.

- TABLE 141 ICECURE MEDICAL LTD.: COMPANY OVERVIEW

- FIGURE 55 ICECURE MEDICAL LTD.: COMPANY SNAPSHOT (2023)

- TABLE 142 ICECURE MEDICAL LTD.: PRODUCTS OFFERED

- TABLE 143 ICECURE MEDICAL LTD.: PRODUCT APPROVALS

- TABLE 144 ICECURE MEDICAL LTD.: DEALS

- 13.1.15 CONMED CORPORATION

- TABLE 145 CONMED CORPORATION: COMPANY OVERVIEW

- FIGURE 56 CONMED CORPORATION: COMPANY SNAPSHOT (2023)

- TABLE 146 CONMED CORPORATION: PRODUCTS OFFERED

- 13.2 OTHER PLAYERS

- 13.2.1 MONTERIS MEDICAL

- 13.2.2 MIANYANG SONIC ELECTRONIC

- 13.2.3 RF MEDICAL

- 13.2.4 MINIMAX MEDICAL HOLDING GROUP

- 13.2.5 SONABLATE

- 13.2.6 ECO MEDICAL TECHNOLOGY (NANJING) CO., LTD.

- 13.2.7 STARMED CO., LTD.

- 13.2.8 SURGNOVA

- 13.2.9 CREO MEDICAL

- 13.2.10 MEDSPHERE SHANGHAI

- *Details on Business overview, Products offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and Competitive threats might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS