|

|

市場調査レポート

商品コード

1484373

自動車用HUDの世界市場:技術別、HUDタイプ別、車両クラス別、自律性レベル別、車両タイプ別、推進タイプ別、電気自動車タイプ別、オファリング別、地域別 - 2030年までの予測Automotive HUD Market by Technology (2D HUD, AR HUD, 3D HUD), HUD Type (Combiner, Windshield), Offering (Hardware, Software), Vehicle Class, Level of Autonomy, Vehicle Type, Propulsion Type, EV Type and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用HUDの世界市場:技術別、HUDタイプ別、車両クラス別、自律性レベル別、車両タイプ別、推進タイプ別、電気自動車タイプ別、オファリング別、地域別 - 2030年までの予測 |

|

出版日: 2024年05月23日

発行: MarketsandMarkets

ページ情報: 英文 290 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の自動車用HUDの市場規模は、2024年の12億米ドルから2030年には24億米ドルに成長し、CAGRは12.3%と予測されています。

自動車の安全性に対する意識の高まりと、特に新興市場における高級車やハイエンド車に対する需要の着実な増加が、予測期間中の自動車用HUD市場の収益成長を押し上げると予想されます。また、コネクテッドカーに対する需要の高まりや、より充実した車内体験を望む声も、市場成長を促進すると予測される主要因です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 技術別、HUDタイプ別、車両クラス別、自律性レベル別、車両タイプ別、推進タイプ別、電気自動車タイプ別、オファリング別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州 |

ウインドシールドHUDセグメントは注目すべきCAGRで発展すると予測されています。近い将来、フロントガラスHUDはコンバイナーHUDよりも多くの情報を提供するため、需要が増加する可能性が高いとみられています。さらに、予測期間中、フロントガラスHUDセグメントは、拡張現実技術の統合により上昇すると予測されています。最先端の車載安全システムを搭載したプレミアム車への需要の高まり、ミッドセグメント車へのフロントガラスHUDの高い搭載率、中国や日本のような先進市場での先進車載技術への需要の高まりにより、アジア太平洋は2030年までにフロントガラスHUDの最大市場になると予測されています。

自動車用HUD市場ではエコノミーカーセグメントが急成長していますが、予測期間中は高級車セグメントが最大になると予測されています。2023年、チェリー(中国)はAR HUDを搭載したExceed Stellarモデルを中国で発表しました。Mercedes-BenzとVolkswagenも自社の車種にAR HUDを搭載しており、曲がり角や出口ランプで 促進要因を誘導する矢印付きのナビゲーション機能を表示しています。Continental AG(ドイツ)もBMWと協力し、車両HUDシステムにAR機能を統合しています。HUDを標準装備するモデルには、Cadillac LYRIQ、Mazda Carol Hybrid、BMW 7シリーズ、Volvo XC90、Chevrolet Corvette Stingray、Mazda Mazda3、Lexus RX、Jaguar XF、Mercedes-Benz C-Class、MINI Cooper などがあります。

当レポートでは、世界の自動車用HUD市場について調査し、技術別、HUDタイプ別、車両クラス別、自律性レベル別、車両タイプ別、推進タイプ別、電気自動車タイプ別、オファリング別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向と混乱

- HUDタイプ別の主なOEMヘッドアップディスプレイ製品

- AR HUDプロバイダー(供給契約シェア別)

- 自動車用HUD市場:供給体系

- 価格分析

- エコシステム分析

- サプライチェーン分析

- 部品表

- ケーススタディ分析

- 特許分析

- 主な利害関係者と購入基準

- 技術分析

- 新たな動向

- 関税と規制状況

- 主な会議とイベント

- 投資と資金調達のシナリオ

第6章 自動車用HUD市場、HUDタイプ別

- イントロダクション

- フロントガラスHUD

- コンバイナーHUD

- 主要な業界洞察

第7章 自動車用HUD市場、技術別

- イントロダクション

- 2D HUD

- ARヘッドアップディスプレイ

- 3D HUD

- 主要な業界洞察

第8章 自動車用HUD市場、車両クラス別

- イントロダクション

- エコノミーカー

- ミッドセグメントカー

- 高級車

- 主要な業界洞察

第9章 自動車用HUD市場、車両タイプ別

- イントロダクション

- 乗用車

- 商用車

- 主要な業界洞察

第10章 自動車用HUD市場、電気自動車タイプ別

- イントロダクション

- バッテリー電気自動車

- 燃料電池電気自動車

- ハイブリッド電気自動車

- プラグインハイブリッド電気自動車

- 主要な業界洞察

第11章 自動車用HUD市場、自律性レベル別

- イントロダクション

- 非自動運転車

- 半自動運転車

- 自動運転車

第12章 自動車用HUD市場、推進タイプ別

- イントロダクション

- エンジン車

- 電気自動車

- 主要な業界洞察

第13章 自動車用HUD市場、オファリング別

- イントロダクション

- ハードウェア

- ソフトウェア

- 主要な業界洞察

第14章 自動車用HUD市場、地域別

- イントロダクション

- 北米

- アジア太平洋

- 欧州

第15章 競合情勢

- 概要

- 主要参入企業の戦略

- 市場シェア分析

- 収益分析

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス

- スタートアップ/中小企業評価マトリックス

- 競合シナリオと動向

第16章 企業プロファイル

- 主要参入企業

- NIPPON SEIKI CO., LTD.

- CONTINENTAL AG

- PANASONIC HOLDINGS CORPORATION

- DENSO CORPORATION

- FORYOU CORPORATION

- YAZAKI CORPORATION

- VISTEON CORPORATION

- HUAWEI TECHNOLOGIES CO., LTD.

- VALEO

- JIANGSU ZEJING AUTOMOTIVE ELECTRONICS CO., LTD.

- HYUNDAI MOBIS

- LG ELECTRONICS

- その他の企業

- HARMAN INTERNATIONAL

- WAYRAY AG

- FUTURUS

- HUDWAY, LLC

- HUDLY

- CY VISION

- ENVISICS

- ZHEJIANG CRYSTAL-OPTECH CO., LTD.

- YILI ELECTRONICS CO., LTD.

- MAXELL, LTD.

- NEUSOFT CORPORATION

第17章 MARKETSANDMARKETSによる推奨事項

第18章 付録

The global automotive HUD market size is projected to grow from USD 1.2 billion in 2024 to USD 2.4 billion by 2030, at a CAGR of 12.3%. Increasing awareness of vehicle safety and a steady increase in demand for luxury and high-end cars, particularly in emerging markets, is expected to boost the revenue growth of the automotive HUD market during the forecast period. The rising demand for connected vehicles and the desire for an enhanced in-vehicle experience are also key factors anticipated to drive market growth.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Segments | Technology, HUD Type, Offering, Vehicle Class, Level of Autonomy, Vehicle Type, Propulsion Type, EV Type and Region |

| Regions covered | Asia Pacific, North America, and Europe. |

"The windshield HUD segment is estimated to grow at a significant CAGR during the forecast period."

The windshield HUD segment is anticipated to develop at a notable CAGR. In near future, there will likely be a rise in demand for windshield HUDs since they provide more information than combiner HUDs. Furthermore, during the projection period, the windshield HUD segment is anticipated to rise due to the integration of augmented reality technology. Due to the rising demand for premium vehicles with cutting-edge in-vehicle safety systems, the high installation rate of windshield HUDs in mid-segment vehicles, and the growing demand for advanced in-vehicle technology in advanced markets like China and Japan, Asia Pacific is predicted to become the largest market for windshield HUDs by 2030.

"Economy Car segment is likely to be the fastest growing segment in the automotive HUD market during the forecast period."

The economy car segment is the fastest growing in the automotive HUD market, while the luxury car segment is projected to be the largest during the forecast period. In 2023, Cherry (China) introduced its Exceed Stellar models in China, featuring AR HUDs. Both Mercedes-Benz and Volkswagen also offer AR HUDs in their car models, which display navigation functions with arrows guiding drivers through turns and exit ramps. Continental AG (Germany) is also collaborating with BMW to integrate AR capabilities into a vehicle HUD system, which is expected to debut in premium cars. Models that offer HUDs as standard equipment include the Cadillac LYRIQ, Mazda Carol Hybrid, BMW 7 Series, Volvo XC90, Chevrolet Corvette Stingray, Mazda Mazda3, Lexus RX, Jaguar XF, Mercedes-Benz C-Class, and MINI Cooper.

"North America shows high growth potential for automotive HUD market."

In the US and Canada, the high disposable income of consumers has led to increased vehicle demand. There is a growing consumer preference for in-vehicle safety and comfort electronics. In response to this rising demand, numerous North American OEMs now include infotainment and navigation units as standard features in mid-range and premium passenger vehicles. Premium vehicles are equipped with advanced applications, such as HUDs integrated with ADAS functions. The escalating demand for these in-vehicle features propels the need for advanced display technologies in vehicles. As the prices of display applications decrease, these displays are becoming more affordable for mid-range vehicles. Increasingly, premium vehicles are expected to adopt augmented reality HUDs that integrate various ADAS functions. The region is anticipated to become the largest luxury car market, resulting in a high demand for advanced safety features and technologies such as augmented reality.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in the automotive HUD market. The break-up of the primaries is as follows:

- By Company Type: Automotive HUD Manufacturers - 60%, OEMs - 20%, and Tier 2 -20%,

- By Designation: CXOs- 23%, Manager - 43%, and Executives - 34%

- By Region: North America - 30%, Europe - 45%, and Asia Pacific - 25%

The automotive HUD market comprises major manufacturers such as Nippon Seiki Co. Ltd. (Japan), Continental AG (Germany), DENSO Corporation (Japan), Panasonic Holdings Corporation (Japan), Foryou Corporation (China), Yazaki Corporation (Japan), and Valeo (France), etc.

Research Coverage:

The study covers the automotive HUD market across various segments. It aims at estimating the market size and future growth potential of this market across different segments such as HUD type, technology, vehicle class, offering, vehicle type, EV type, propulsion type, level of autonomy, and region. The study also includes an in-depth competitive analysis of key market players, their company profiles, key observations related to product and business offerings, recent developments, and acquisitions.

This research report categorizes Automotive HUD Market by HUD Type (Windshield HUD, and Combiner HUD), Technology (2D HUD, 3D HUD, and AR HUD), Offering (Hardware, and Software), Vehicle Type (Passenger Cars, and Commercial Vehicles), Vehicle Class (Mid-Segment Cars, Luxury Cars, and Economy Cars), Level of Autonomy (Non-autonomous Cars, Semi-autonomous Cars, and Autonomous Cars), Propulsion Type (ICE vehicles and Electric Vehicles), EV Type (BEVs, PHEVs, HEVs and FCEVs), and Region (Asia Pacific, Europe, and North America ).

The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the automotive HUD market. A detailed analysis of the key industry players provides insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, mergers and acquisitions, and recent developments associated with the automotive HUD market. This report covers a competitive analysis of SMEs/startups in the automotive HUD market ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall automotive HUD market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing awareness about passenger and vehicle safety, demand for enhanced in-vehicle experience, rising demand for connected vehicles, steady growth in demand for luxury and high-end segment cars, mainly in emerging markets), restraints (Requirement for greater space in automotive cockpits, lack of luminance and high-power consumption), opportunities (Increasing demand for semi-autonomous vehicles, rising penetration of electric vehicles, introduction of portable HUDs at lower prices in low and middle-segment cars, increasing investment in automotive head-up displays), and challenges (Optical Challenges in head-up display systems, integration with existing infrastructure) influencing the growth of the automotive HUD market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the automotive HUD market

- Market Development: Comprehensive information about lucrative markets - the report analyses the automotive HUD market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the automotive HUD market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Nippon Seiki Co. Ltd. (Japan), Continental AG (Germany), DENSO Corporation (Japan), Panasonic Holdings Corporation (Japan), and Foryou Corporation (China), among others in the automotive HUD market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- TABLE 1 AUTOMOTIVE HUD MARKET DEFINITION, BY HUD TYPE

- TABLE 2 AUTOMOTIVE HUD MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 3 AUTOMOTIVE HUD MARKET DEFINITION, BY LEVEL OF AUTONOMY

- TABLE 4 AUTOMOTIVE HUD MARKET DEFINITION, BY TECHNOLOGY

- TABLE 5 AUTOMOTIVE HUD MARKET DEFINITION, BY VEHICLE CLASS

- TABLE 6 AUTOMOTIVE HUD MARKET DEFINITION, BY OFFERING

- TABLE 7 AUTOMOTIVE HUD MARKET DEFINITION, BY PROPULSION TYPE

- TABLE 8 AUTOMOTIVE HUD MARKET DEFINITION, BY ELECTRIC VEHICLE TYPE

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 AUTOMOTIVE HUD MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 INCLUSIONS AND EXCLUSIONS

- TABLE 9 INCLUSIONS AND EXCLUSIONS

- 1.5 CURRENCY CONSIDERED

- TABLE 10 USD EXCHANGE RATES

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH PROCESS FLOW

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interview participants

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.4 List of primary participants

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 RECESSION IMPACT ANALYSIS

- 2.2.2 BOTTOM-UP APPROACH

- FIGURE 6 BOTTOM-UP APPROACH

- 2.2.3 TOP-DOWN APPROACH

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 RESEARCH DESIGN AND METHODOLOGY

- 2.3 DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS

- 2.4 FACTOR ANALYSIS

- FIGURE 11 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 12 AUTOMOTIVE HUD MARKET OUTLOOK

- FIGURE 13 AUTOMOTIVE HUD MARKET, BY REGION, 2024-2030

- FIGURE 14 AUTOMOTIVE HUD MARKET, BY VEHICLE TYPE, 2024-2030

- FIGURE 15 AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030

- FIGURE 16 KEY PLAYERS IN AUTOMOTIVE HUD MARKET

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE HUD MARKET

- FIGURE 17 INCREASING DEMAND FOR ROAD SAFETY AND ENHANCED DRIVING EXPERIENCE TO DRIVE MARKET

- 4.2 AUTOMOTIVE HUD MARKET, BY REGION

- FIGURE 18 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- 4.3 AUTOMOTIVE HUD MARKET, BY HUD TYPE

- FIGURE 19 WINDSHIELD HUD TO BE DOMINANT SEGMENT DURING FORECAST PERIOD

- 4.4 AUTOMOTIVE HUD MARKET, BY TECHNOLOGY

- FIGURE 20 3D HUD TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- 4.5 AUTOMOTIVE HUD MARKET, BY ELECTRIC VEHICLE TYPE

- FIGURE 21 BEV SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.6 AUTOMOTIVE HUD MARKET, BY VEHICLE TYPE

- FIGURE 22 PASSENGER CAR SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.7 AUTOMOTIVE HUD MARKET, BY LEVEL OF AUTONOMY

- FIGURE 23 SEMI-AUTONOMOUS CAR SEGMENT TO HAVE LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.8 AUTOMOTIVE HUD MARKET, BY PROPULSION TYPE

- FIGURE 24 ELECTRIC VEHICLE SEGMENT TO GROW AT FASTER RATE THAN ICE VEHICLE SEGMENT DURING FORECAST PERIOD

- 4.9 AUTOMOTIVE HUD MARKET, BY VEHICLE CLASS

- FIGURE 25 ECONOMY CAR SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- 4.10 AUTOMOTIVE HUD MARKET, BY OFFERING

- FIGURE 26 SOFTWARE SEGMENT TO REGISTER HIGHER CAGR THAN HARDWARE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 27 AUTOMOTIVE HUD MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing awareness about passenger and vehicle safety

- FIGURE 28 GLOBAL STATUS REPORT ON ROAD SAFETY

- TABLE 11 ROAD ACCIDENTS IN EUROPE, 2020-2023

- 5.2.1.2 Growing inclination toward enhanced in-vehicle experience

- FIGURE 29 HUD BENEFITS FOR END USERS

- FIGURE 30 CATEGORIES OF HUD DESIGNS

- TABLE 12 HEAD-UP DISPLAY APPLICATIONS

- 5.2.1.3 Booming demand for connected vehicles

- 5.2.1.4 Surge in demand for luxury and high-end cars

- TABLE 13 VEHICLES EQUIPPED WITH HEAD-UP DISPLAYS, 2021-2024

- 5.2.2 RESTRAINTS

- 5.2.2.1 Space constraints in automotive cockpits

- 5.2.2.2 Lack of luminance and high-power consumption

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing adoption of self-driving technology

- TABLE 14 LEVEL OF AUTONOMY IN ELECTRIC VEHICLES, 2019-2024

- 5.2.3.2 Growing utilization of head-up displays in electric vehicles

- FIGURE 31 GLOBAL BEV AND PHEV SALES, 2020-2023

- TABLE 15 MONETARY INCENTIVES FOR ELECTRIC VEHICLES IN WESTERN EUROPE, 2023

- TABLE 16 MAJOR ANNOUNCEMENTS ON AUTOMOTIVE ELECTRIFICATION, 2021-2023

- 5.2.3.3 Thriving investments in automotive head-up displays

- 5.2.4 CHALLENGES

- 5.2.4.1 Optical challenges

- 5.2.4.2 Complex integration process

- TABLE 17 AUTOMOTIVE HUD MARKET: IMPACT OF MARKET DYNAMICS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 32 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 KEY OEM HEAD-UP DISPLAY OFFERINGS, BY HUD TYPE

- FIGURE 33 KEY OEM HEAD-UP DISPLAY OFFERINGS, BY HUD TYPE, 2023

- 5.5 AR HUD PROVIDERS, BY SHARE OF SUPPLY CONTRACTS

- FIGURE 34 AR HUD PROVIDERS, BY SHARE OF SUPPLY CONTRACTS, 2023

- 5.6 AUTOMOTIVE HUD MARKET: WHO SUPPLIES WHOM

- TABLE 18 AUTOMOTIVE HUD MARKET: WHO SUPPLIES WHOM

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND, BY TECHNOLOGY

- FIGURE 35 AVERAGE SELLING PRICE, BY TECHNOLOGY, 2020-2024 (USD)

- 5.7.2 AVERAGE SELLING PRICE TREND OF COMBINER HUD, BY KEY PLAYERS IN AFTERMARKET

- TABLE 19 AVERAGE SELLING PRICE OF COMBINER HUD, BY KEY PLAYERS IN AFTERMARKET, 2024 (USD)

- 5.7.3 AVERAGE SELLING PRICE TREND, BY REGION

- TABLE 20 AR HUD: AVERAGE SELLING PRICE TREND, BY REGION, 2020-2024

- TABLE 21 2D HUD: AVERAGE SELLING PRICE TREND, BY REGION, 2020-2024

- 5.8 ECOSYSTEM ANALYSIS

- FIGURE 36 ECOSYSTEM ANALYSIS

- 5.8.1 OEMS

- 5.8.2 HUD PROVIDERS

- 5.8.3 HUD COMPONENT PROVIDERS

- 5.8.4 HUD SOFTWARE PROVIDERS

- TABLE 22 ROLE OF COMPANIES IN ECOSYSTEM

- 5.9 SUPPLY CHAIN ANALYSIS

- FIGURE 37 SUPPLY CHAIN ANALYSIS

- 5.10 BILL OF MATERIALS

- FIGURE 38 COMPARISON OF BILL OF MATERIALS OF 2D HUD VS. AR HUD IN 2024

- FIGURE 39 COMPARISON OF BILL OF MATERIALS OF 2D HUD VS. AR HUD IN 2030

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 DEVELOPMENT OF EFFECTIVE THERMAL SOLUTION FOR AUTOMOTIVE HEAD-UP DISPLAYS

- 5.11.2 IMPROVED DATA MONITORING CAPABILITIES WITH HUD DEMONSTRATOR

- 5.11.3 ENHANCED PERFORMANCE AND DELIVERY TIME WITH HUDSON TEST SYSTEM

- 5.11.4 DRIVERLESS AUTOMATED VALET PARKING SYSTEM AND AR-HUD TECHNOLOGY FOR AUTOMOTIVE SAFETY AND COMFORT

- 5.11.5 BETTER HUD VISUAL QUALITY USING PROMETRIC IMAGING SYSTEMS AND TT-HUD SOFTWARE PLATFORM

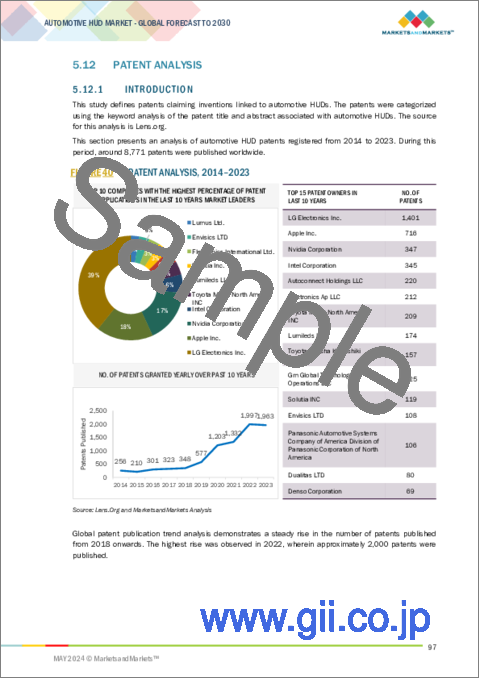

- 5.12 PATENT ANALYSIS

- 5.12.1 INTRODUCTION

- FIGURE 40 PATENT ANALYSIS, 2014-2023

- 5.12.2 LEGAL STATUS OF PATENTS

- FIGURE 41 LEGAL STATUS OF PATENTS FILED FOR AUTOMOTIVE HUDS, 2012-2024

- TABLE 23 INNOVATIONS AND PATENT REGISTRATIONS, 2020-2024

- 5.12.3 HS CODE

- 5.12.3.1 Import/Export Scenario (HS Code 870390)

- TABLE 24 IMPORT DATA FOR HS CODE 870390, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 25 EXPORT DATA FOR HS CODE 870390, BY COUNTRY, 2020-2023 (USD MILLION)

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 42 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY HUD TYPE

- TABLE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY HUD TYPE (%)

- 5.13.2 BUYING CRITERIA

- FIGURE 43 KEY BUYING CRITERIA, BY HUD TYPE

- TABLE 27 KEY BUYING CRITERIA, BY HUD TYPE

- 5.14 TECHNOLOGY ANALYSIS

- 5.14.1 INTRODUCTION

- FIGURE 44 TECHNOLOGICAL TRENDS

- FIGURE 45 EVOLUTION OF AUTOMOTIVE HUD

- FIGURE 46 TECHNOLOGY ROADMAP

- 5.14.2 KEY TECHNOLOGIES

- 5.14.2.1 3D HUD

- FIGURE 47 3D HUD

- 5.14.2.2 3D AR HUD

- FIGURE 48 3D AR HUD

- 5.14.3 COMPLEMENTARY TECHNOLOGIES

- 5.14.3.1 Advanced sensors

- 5.14.3.1.1 Radar

- 5.14.3.1.2 LiDAR

- 5.14.3.1.3 Image sensors

- 5.14.3.2 Light-emitting diode technology

- 5.14.3.1 Advanced sensors

- FIGURE 49 LIGHT EMITTING DIODE DISPLAY

- 5.14.3.3 Laser beam scanning

- FIGURE 50 LASER BEAM SCANNING

- 5.14.3.4 Biometric driver monitoring

- FIGURE 51 BIOMETRIC DRIVER MONITORING

- 5.14.4 ADJACENT TECHNOLOGIES

- 5.14.4.1 Connected vehicles

- FIGURE 52 CONNECTED VEHICLE

- 5.14.4.2 Advanced driver-assistance system

- FIGURE 53 DIFFERENT TYPES OF ADAS SENSORS

- 5.14.5 UPCOMING TECHNOLOGICAL TRENDS

- 5.15 EMERGING TRENDS

- 5.15.1 MOTORCYCLE WINDSHIELD HUDS

- 5.15.2 MOTORCYCLE HELMET HUDS

- 5.15.3 AR HUDS

- FIGURE 54 CONVENTIONAL AND AR HEAD-UP DISPLAY DEVELOPMENTS, 2017-2023

- 5.16 TARIFF AND REGULATORY LANDSCAPE

- 5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 28 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 29 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 30 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.17 KEY CONFERENCES AND EVENTS

- TABLE 31 AUTOMOTIVE HUD MARKET: KEY CONFERENCES AND EVENTS, 2024-2025

- 5.18 INVESTMENT AND FUNDING SCENARIO

- FIGURE 55 INVESTMENT AND FUNDING SCENARIO, 2020-2024

6 AUTOMOTIVE HUD MARKET, BY HUD TYPE

- 6.1 INTRODUCTION

- TABLE 32 COMBINER HUD VS. WINDSHIELD HUD

- FIGURE 56 AUTOMOTIVE HUD MARKET, BY HUD TYPE, 2024 VS. 2030 (USD MILLION)

- TABLE 33 AUTOMOTIVE HUD MARKET, BY HUD TYPE, 2020-2023 (USD MILLION)

- TABLE 34 AUTOMOTIVE HUD MARKET, BY HUD TYPE, 2024-2030 (USD MILLION)

- 6.1.1 OPERATIONAL DATA

- TABLE 35 PRODUCT OFFERINGS BY LEADING AUTOMOTIVE HUD MANUFACTURERS

- 6.2 WINDSHIELD HUD

- 6.2.1 INCREASED CONSUMER WILLINGNESS TO PAY FOR SAFETY FUNCTIONS TO DRIVE MARKET

- TABLE 36 MODELS EQUIPPED WITH WINDSHIELD HEAD-UP DISPLAYS, 2022-2024

- TABLE 37 WINDSHIELD: AUTOMOTIVE HUD MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 38 WINDSHIELD: AUTOMOTIVE HUD MARKET, BY REGION, 2024-2030 (USD MILLION)

- 6.3 COMBINER HUD

- 6.3.1 GROWING AFTERMARKET INSTALLATION TO DRIVE MARKET

- 6.4 KEY INDUSTRY INSIGHTS

7 AUTOMOTIVE HUD MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- FIGURE 57 AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024 VS. 2030 (USD MILLION)

- TABLE 39 AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2020-2023 (THOUSAND UNITS)

- TABLE 40 AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030 (THOUSAND UNITS)

- TABLE 41 AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 42 AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- 7.1.1 OPERATIONAL DATA

- TABLE 43 TECHNOLOGY OFFERINGS BY LEADING AUTOMOTIVE HUD MANUFACTURERS

- TABLE 44 2D VS. AR VS. 3D HEAD-UP DISPLAYS

- 7.2 2D HUD

- 7.2.1 INCREASING FOCUS ON CAR SAFETY TO DRIVE MARKET

- TABLE 45 MODELS EQUIPPED WITH 2D HEAD-UP DISPLAYS, 2022-2024

- TABLE 46 2D HUD: AUTOMOTIVE HUD MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 47 2D HUD: AUTOMOTIVE HUD MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 48 2D HUD: AUTOMOTIVE HUD MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 49 2D HUD: AUTOMOTIVE HUD MARKET, BY REGION, 2024-2030 (USD MILLION)

- 7.3 AR HUD

- 7.3.1 RISING ADOPTION OF ADAS TECHNOLOGY TO DRIVE MARKET

- TABLE 50 MODELS EQUIPPED WITH AR-HUDS, 2021-2024

- TABLE 51 AR HUD: AUTOMOTIVE HUD MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 52 AR HUD: AUTOMOTIVE HUD MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 53 AR HUD: AUTOMOTIVE HUD MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 54 AR HUD: AUTOMOTIVE HUD MARKET, BY REGION, 2024-2030 (USD MILLION)

- 7.4 3D HUD

- 7.4.1 NEED TO REDUCE ACCIDENT RATES TO DRIVE MARKET

- TABLE 55 3D HUD: AUTOMOTIVE HUD MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 56 3D HUD: AUTOMOTIVE HUD MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 57 3D HUD: AUTOMOTIVE HUD MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 58 3D HUD: AUTOMOTIVE HUD MARKET, BY REGION, 2024-2030 (USD MILLION)

- 7.5 KEY INDUSTRY INSIGHTS

8 AUTOMOTIVE HUD MARKET, BY VEHICLE CLASS

- 8.1 INTRODUCTION

- FIGURE 58 AUTOMOTIVE HUD MARKET, BY VEHICLE CLASS, 2024 VS. 2030 (USD MILLION)

- TABLE 59 AUTOMOTIVE HUD MARKET, BY VEHICLE CLASS, 2020-2023 (THOUSAND UNITS)

- TABLE 60 AUTOMOTIVE HUD MARKET, BY VEHICLE CLASS, 2024-2030 (THOUSAND UNITS)

- TABLE 61 AUTOMOTIVE HUD MARKET, BY VEHICLE CLASS, 2020-2023 (USD MILLION)

- TABLE 62 AUTOMOTIVE HUD MARKET, BY VEHICLE CLASS, 2024-2030 (USD MILLION)

- 8.2 ECONOMY CAR

- 8.2.1 INCREASING ADOPTION OF ADAS AND CONNECTED FEATURES TO DRIVE MARKET

- TABLE 63 ECONOMY CAR: AUTOMOTIVE HUD MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 64 ECONOMY CAR: AUTOMOTIVE HUD MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 65 ECONOMY CAR: AUTOMOTIVE HUD MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 66 ECONOMY CAR: AUTOMOTIVE HUD MARKET, BY REGION, 2024-2030 (USD MILLION)

- 8.3 MID-SEGMENT CAR

- 8.3.1 GROWING REQUIREMENT FOR COMPACT SPACE AND LIMITED COLOR DEFINITION TO DRIVE MARKET

- TABLE 67 MID-SEGMENT CAR: AUTOMOTIVE HUD MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 68 MID-SEGMENT CAR: AUTOMOTIVE HUD MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 69 MID-SEGMENT CAR: AUTOMOTIVE HUD MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 70 MID-SEGMENT CAR: AUTOMOTIVE HUD MARKET, BY REGION, 2024-2030 (USD MILLION)

- 8.4 LUXURY CAR

- 8.4.1 RISING DEMAND FOR ADVANCED SAFETY AND IN-VEHICLE FEATURES TO DRIVE MARKET

- TABLE 71 LUXURY CAR: AUTOMOTIVE HUD MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 72 LUXURY CAR: AUTOMOTIVE HUD MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 73 LUXURY CAR: AUTOMOTIVE HUD MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 74 LUXURY CAR: AUTOMOTIVE HUD MARKET, BY REGION, 2024-2030 (USD MILLION)

- 8.5 KEY INDUSTRY INSIGHTS

9 AUTOMOTIVE HUD MARKET, BY VEHICLE TYPE

- 9.1 INTRODUCTION

- TABLE 75 HUD-ENABLED VEHICLES, 2021-2024

- FIGURE 59 AUTOMOTIVE HUD MARKET, BY VEHICLE TYPE, 2024 VS. 2030 (USD MILLION)

- TABLE 76 AUTOMOTIVE HUD MARKET, BY VEHICLE TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 77 AUTOMOTIVE HUD MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 78 AUTOMOTIVE HUD MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 79 AUTOMOTIVE HUD MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- 9.2 PASSENGER CAR

- 9.2.1 BOOMING SALES OF HUD-EQUIPPED PASSENGER CARS TO DRIVE MARKET

- TABLE 80 PASSENGER CARS EQUIPPED WITH AUTOMOTIVE HUDS

- TABLE 81 PASSENGER CAR: AUTOMOTIVE HUD MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 82 PASSENGER CAR: AUTOMOTIVE HUD MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 83 PASSENGER CAR: AUTOMOTIVE HUD MARKE, BY REGION, 2020-2023 (USD MILLION)

- TABLE 84 PASSENGER CAR: AUTOMOTIVE HUD MARKET, BY REGION, 2024-2030 (USD MILLION)

- 9.3 COMMERCIAL VEHICLE

- 9.3.1 EXPANDING E-COMMERCE AND LAST-MILE DELIVERY SERVICES TO DRIVE MARKET

- TABLE 85 COMMERCIAL VEHICLE: AUTOMOTIVE HUD MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 86 COMMERCIAL VEHICLE: AUTOMOTIVE HUD MARKET, BY REGION, 2024-2030 (USD MILLION)

- 9.4 KEY INDUSTRY INSIGHTS

10 AUTOMOTIVE HUD MARKET, BY ELECTRIC VEHICLE TYPE

- 10.1 INTRODUCTION

- FIGURE 60 ELECTRIC VEHICLE COMPARISON, BY PROPULSION

- FIGURE 61 AUTOMOTIVE HUD MARKET, BY ELECTRIC VEHICLE TYPE, 2024 VS. 2030 (USD MILLION)

- TABLE 87 AUTOMOTIVE HUD MARKET, BY EV TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 88 AUTOMOTIVE HUD MARKET, BY EV TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 89 AUTOMOTIVE HUD MARKET, BY EV TYPE, 2020-2023 (USD MILLION)

- TABLE 90 AUTOMOTIVE HUD MARKET, BY EV TYPE, 2024-2030 (USD MILLION)

- 10.1.1 OPERATIONAL DATA

- TABLE 91 BEST-SELLING EVS AND ICE VEHICLES IN 2023

- TABLE 92 ELECTRIC VEHICLES EQUIPPED WITH AUTOMOTIVE HUDS

- 10.2 BATTERY ELECTRIC VEHICLE

- 10.2.1 GROWING FOCUS ON ADVANCED BATTERY TECHNOLOGY TO DRIVE MARKET

- 10.3 FUEL CELL ELECTRIC VEHICLE

- 10.3.1 INCREASING DEMAND FOR HYDROGEN PROPULSION TO DRIVE MARKET

- 10.4 HYBRID ELECTRIC VEHICLE

- 10.4.1 ENHANCED ENERGY-SAVING CAPABILITIES TO DRIVE MARKET

- 10.5 PLUG-IN HYBRID ELECTRIC VEHICLE

- 10.5.1 INCREASING NEED FOR LONGER ELECTRIC RANGE TO DRIVE MARKET

- 10.6 KEY INDUSTRY INSIGHTS

11 AUTOMOTIVE HUD MARKET, BY LEVEL OF AUTONOMY

- 11.1 INTRODUCTION

- FIGURE 62 LEVELS OF AUTONOMY IN CARS

- FIGURE 63 AUTOMOTIVE HUD MARKET, BY LEVEL OF AUTONOMY, 2024 VS. 2030 (THOUSAND UNITS)

- TABLE 93 AUTOMOTIVE HUD MARKET, BY LEVEL OF AUTONOMY, 2020-2023 (THOUSAND UNITS)

- TABLE 94 AUTOMOTIVE HUD MARKET, BY LEVEL OF AUTONOMY, 2024-2030 (THOUSAND UNITS)

- 11.2 NON-AUTONOMOUS CAR

- 11.2.1 L0

- 11.2.1.1 Rising production of cars in Asia Pacific to drive market

- 11.2.1 L0

- 11.3 SEMI-AUTONOMOUS CAR

- 11.3.1 L1

- 11.3.1.1 Increasing adoption of autonomous driving features to drive market

- 11.3.2 L2

- 11.3.2.1 Growing integration of automatic emergency braking, cross-traffic alert, and blind spot detection to drive market

- 11.3.3 L2+

- 11.3.3.1 Surge in adoption of driver support systems to drive market

- 11.3.4 L3

- 11.3.4.1 Growing shift to self-driving vehicles and driver support systems to drive market

- 11.3.1 L1

- 11.4 AUTONOMOUS CAR

- TABLE 95 POPULAR AUTONOMOUS VEHICLES WORLDWIDE

- 11.4.1 L4

- 11.4.1.1 Growing inclination toward autonomous mobility solutions to drive market

- 11.4.2 L5

- 11.4.2.1 Rising demand for reduced manual control to drive market

- 11.4.3 KEY INDUSTRY INSIGHTS

12 AUTOMOTIVE HUD MARKET, BY PROPULSION TYPE

- 12.1 INTRODUCTION

- 12.1.1 OPERATIONAL DATA

- TABLE 96 VEHICLE MODELS EQUIPPED WITH HEAD-UP DISPLAYS, BY PROPULSION TYPE

- FIGURE 64 AUTOMOTIVE HUD MARKET, BY PROPULSION TYPE, 2024 VS. 2030 (USD MILLION)

- TABLE 97 AUTOMOTIVE HUD MARKET, BY PROPULSION TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 98 AUTOMOTIVE HUD MARKET, BY PROPULSION TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 99 AUTOMOTIVE HUD MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 100 AUTOMOTIVE HUD MARKET, BY PROPULSION TYPE, 2024-2030 (USD MILLION)

- 12.2 ICE VEHICLE

- 12.2.1 RISING ADOPTION OF ADAS IN ICE VEHICLES TO DRIVE MARKET

- 12.3 ELECTRIC VEHICLE

- 12.3.1 GROWING FOCUS ON STRICT VEHICLE EMISSIONS TO DRIVE MARKET

- 12.4 KEY INDUSTRY INSIGHTS

13 AUTOMOTIVE HUD MARKET, BY OFFERING

- 13.1 INTRODUCTION

- TABLE 101 HARDWARE VS. SOFTWARE OFFERINGS

- FIGURE 65 AUTOMOTIVE HUD MARKET, BY OFFERING, 2024 VS. 2030 (USD MILLION)

- TABLE 102 AUTOMOTIVE HUD MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 103 AUTOMOTIVE HUD MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- 13.2 HARDWARE

- 13.2.1 INCREASING FOCUS ON ENHANCED DRIVING SAFETY AND CONVENIENCE TO DRIVE MARKET

- 13.3 SOFTWARE

- 13.3.1 RISING ADOPTION OF ADAS-EQUIPPED VEHICLES TO DRIVE MARKET

- 13.4 KEY INDUSTRY INSIGHTS

14 AUTOMOTIVE HUD MARKET, BY REGION

- 14.1 INTRODUCTION

- FIGURE 66 AUTOMOTIVE HUD MARKET, BY REGION, 2024 VS. 2030 (USD MILLION)

- TABLE 104 AUTOMOTIVE HUD MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 105 AUTOMOTIVE HUD MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 106 AUTOMOTIVE HUD MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 107 AUTOMOTIVE HUD MARKET, BY REGION, 2024-2030 (USD MILLION)

- 14.2 NORTH AMERICA

- 14.2.1 RECESSION IMPACT ANALYSIS

- FIGURE 67 NORTH AMERICA: AUTOMOTIVE HUD MARKET SNAPSHOT

- TABLE 108 NORTH AMERICA: AUTOMOTIVE HUD MARKET, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 109 NORTH AMERICA: AUTOMOTIVE HUD MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 110 NORTH AMERICA: AUTOMOTIVE HUD MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 111 NORTH AMERICA: AUTOMOTIVE HUD MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- 14.2.2 CANADA

- 14.2.2.1 Rising sales of connected cars to drive market

- TABLE 112 CANADA: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2020-2023 (THOUSAND UNITS)

- TABLE 113 CANADA: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030 (THOUSAND UNITS)

- TABLE 114 CANADA: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 115 CANADA: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- 14.2.3 MEXICO

- 14.2.3.1 Growing demand for premium in-vehicle experiences, safety, and comfort features to drive market

- TABLE 116 MEXICO: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2020-2023 (THOUSAND UNITS)

- TABLE 117 MEXICO: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030 (THOUSAND UNITS)

- TABLE 118 MEXICO: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 119 MEXICO: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- 14.2.4 US

- 14.2.4.1 Increasing demand for advanced features in vehicles to drive market

- TABLE 120 US: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2020-2023 (THOUSAND UNITS)

- TABLE 121 US: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030 (THOUSAND UNITS)

- TABLE 122 US: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 123 US: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- 14.3 ASIA PACIFIC

- 14.3.1 RECESSION IMPACT ANALYSIS

- FIGURE 68 ASIA PACIFIC: AUTOMOTIVE HUD MARKET SNAPSHOT

- TABLE 124 ASIA PACIFIC: AUTOMOTIVE HUD MARKET, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 125 ASIA PACIFIC: AUTOMOTIVE HUD MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 126 ASIA PACIFIC: AUTOMOTIVE HUD MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 127 ASIA PACIFIC: AUTOMOTIVE HUD MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- 14.3.2 CHINA

- 14.3.2.1 High investment by major OEMs in autonomous and semi-autonomous vehicles to drive market

- TABLE 128 CHINA: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2020-2023 (THOUSAND UNITS)

- TABLE 129 CHINA: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030 (THOUSAND UNITS)

- TABLE 130 CHINA: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 131 CHINA: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- 14.3.3 INDIA

- 14.3.3.1 Increasing population and smart city initiatives to drive market

- TABLE 132 INDIA: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2020-2023 (THOUSAND UNITS)

- TABLE 133 INDIA: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030 (THOUSAND UNITS)

- TABLE 134 INDIA: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 135 INDIA: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- 14.3.4 JAPAN

- 14.3.4.1 Growing demand for connected and semi-autonomous cars to drive market

- TABLE 136 JAPAN: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2020-2023 (THOUSAND UNITS)

- TABLE 137 JAPAN: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030 (THOUSAND UNITS)

- TABLE 138 JAPAN: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 139 JAPAN: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- 14.3.5 SOUTH KOREA

- 14.3.5.1 Increasing demand for vehicle electronics and safety features to drive market

- TABLE 140 SOUTH KOREA: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2020-2023 (THOUSAND UNITS)

- TABLE 141 SOUTH KOREA: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030 (THOUSAND UNITS)

- TABLE 142 SOUTH KOREA: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 143 SOUTH KOREA: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- 14.4 EUROPE

- 14.4.1 RECESSION IMPACT ANALYSIS

- FIGURE 69 EUROPE: AUTOMOTIVE HUD MARKET, BY COUNTRY, 2024-2030

- TABLE 144 EUROPE: AUTOMOTIVE HUD MARKET, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 145 EUROPE: AUTOMOTIVE HUD MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 146 EUROPE: AUTOMOTIVE HUD MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 147 EUROPE: AUTOMOTIVE HUD MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- 14.4.2 FRANCE

- 14.4.2.1 Growing installation of lane departure warning systems in heavy trucks to drive market

- TABLE 148 FRANCE: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2020-2023 (THOUSAND UNITS)

- TABLE 149 FRANCE: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030 (THOUSAND UNITS)

- TABLE 150 FRANCE: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 151 FRANCE: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- 14.4.3 GERMANY

- 14.4.3.1 Presence of domestic automotive sector players to drive market

- TABLE 152 GERMANY: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2020-2023 (THOUSAND UNITS)

- TABLE 153 GERMANY: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030 (THOUSAND UNITS)

- TABLE 154 GERMANY: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 155 GERMANY: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- 14.4.4 SPAIN

- 14.4.4.1 Increasing production and export from OEMs to drive market

- TABLE 156 SPAIN: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2020-2023 (THOUSAND UNITS)

- TABLE 157 SPAIN: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030 (THOUSAND UNITS)

- TABLE 158 SPAIN: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 159 SPAIN: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- 14.4.5 UK

- 14.4.5.1 Surging demand for advanced safety systems and driving convenience features to drive market

- TABLE 160 UK: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2020-2023 (THOUSAND UNITS)

- TABLE 161 UK: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030 (THOUSAND UNITS)

- TABLE 162 UK: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 163 UK: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- 14.4.6 ITALY

- 14.4.6.1 Growing demand for mid-segment and luxury cars to drive market

- TABLE 164 ITALY: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2020-2023 (THOUSAND UNITS)

- TABLE 165 ITALY: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030 (THOUSAND UNITS)

- TABLE 166 ITALY: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 167 ITALY: AUTOMOTIVE HUD MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER STRATEGIES

- TABLE 168 KEY PLAYER STRATEGIES, 2021-2024

- 15.3 MARKET SHARE ANALYSIS

- TABLE 169 AUTOMOTIVE HUD MARKET: DEGREE OF COMPETITION

- FIGURE 70 MARKET SHARE ANALYSIS, 2023

- 15.4 REVENUE ANALYSIS

- FIGURE 71 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2018-2022

- 15.5 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 72 COMPANY VALUATION OF KEY PLAYERS

- FIGURE 73 FINANCIAL METRICS OF KEY PLAYERS

- 15.6 BRAND/PRODUCT COMPARISON

- FIGURE 74 BRAND/PRODUCT COMPARISON

- 15.7 COMPANY EVALUATION MATRIX

- 15.7.1 STARS

- 15.7.2 EMERGING LEADERS

- 15.7.3 PERVASIVE PLAYERS

- 15.7.4 PARTICIPANTS

- FIGURE 75 AUTOMOTIVE HUD MARKET: COMPANY EVALUATION MATRIX, 2023

- 15.7.5 COMPANY FOOTPRINT

- TABLE 170 AUTOMOTIVE HUD MARKET: COMPANY FOOTPRINT, 2023

- TABLE 171 AUTOMOTIVE HUD MARKET: REGION FOOTPRINT, 2023

- TABLE 172 AUTOMOTIVE HUD MARKET: HUD TYPE FOOTPRINT, 2023

- 15.8 STARTUP/SME EVALUATION MATRIX

- 15.8.1 PROGRESSIVE COMPANIES

- 15.8.2 RESPONSIVE COMPANIES

- 15.8.3 DYNAMIC COMPANIES

- 15.8.4 STARTING BLOCKS

- FIGURE 76 AUTOMOTIVE HUD MARKET: STARTUP/SME EVALUATION MATRIX, 2023

- 15.8.5 COMPETITIVE BENCHMARKING

- TABLE 173 AUTOMOTIVE HUD MARKET: KEY STARTUPS/SMES

- TABLE 174 AUTOMOTIVE HUD MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 15.9 COMPETITIVE SCENARIOS AND TRENDS

- 15.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 175 AUTOMOTIVE HUD MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2021-MARCH 2024

- 15.9.2 DEALS

- TABLE 176 AUTOMOTIVE HUD MARKET: DEALS, JANUARY 2021-MARCH 2024

- 15.9.3 OTHER DEVELOPMENTS

- TABLE 177 AUTOMOTIVE HUD MARKET: OTHER DEVELOPMENTS, JANUARY 2021-MARCH 2024

16 COMPANY PROFILES

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 16.1 KEY PLAYERS

- 16.1.1 NIPPON SEIKI CO., LTD.

- TABLE 178 NIPPON SEIKI CO., LTD.: COMPANY OVERVIEW '

- FIGURE 77 NIPPON SEIKI CO., LTD.: COMPANY SNAPSHOT

- TABLE 179 NIPPON SEIKI CO., LTD.: SHAREHOLDERS (AS OF MARCH 2023)

- TABLE 180 NIPPON SEIKI CO., LTD.: SALES RATIO TO MAJOR CUSTOMERS (AS OF MARCH 2023)

- TABLE 181 NIPPON SEIKI CO., LTD.: MAJOR SUPPLY CONTRACTS

- TABLE 182 NIPPON SEIKI CO., LTD.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 183 NIPPON SEIKI CO., LTD.: DEALS

- TABLE 184 NIPPON SEIKI CO., LTD.: OTHER DEVELOPMENTS

- TABLE 185 NIPPON SEIKI CO., LTD.: EXPANSIONS

- 16.1.2 CONTINENTAL AG

- TABLE 186 CONTINENTAL AG: COMPANY OVERVIEW

- FIGURE 78 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 79 CONTINENTAL AG: BUSINESS LOCATIONS AND EMPLOYEES (AS OF JANUARY 2023)

- TABLE 187 CONTINENTAL AG: MAJOR SUPPLY AGREEMENTS

- TABLE 188 CONTINENTAL AG: KEY CUSTOMERS (AS OF MARCH 2023)

- TABLE 189 CONTINENTAL AG: PRODUCTS/SOLUTIONS OFFERED

- TABLE 190 CONTINENTAL AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 191 CONTINENTAL AG: EXPANSIONS

- 16.1.3 PANASONIC HOLDINGS CORPORATION

- TABLE 192 PANASONIC HOLDINGS CORPORATION: COMPANY OVERVIEW

- FIGURE 80 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- TABLE 193 PANASONIC HOLDINGS CORPORATION: KEY CUSTOMERS

- TABLE 194 PANASONIC HOLDINGS CORPORATION: SUPPLY CONTRACTS

- TABLE 195 PANASONIC HOLDINGS CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 196 PANASONIC HOLDINGS CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 197 PANASONIC HOLDINGS CORPORATION: DEALS

- TABLE 198 PANASONIC HOLDINGS CORPORATION: EXPANSIONS

- TABLE 199 PANASONIC HOLDINGS CORPORATION: OTHER DEVELOPMENTS

- 16.1.4 DENSO CORPORATION

- TABLE 200 DENSO CORPORATION: COMPANY OVERVIEW

- FIGURE 81 DENSO CORPORATION: COMPANY SNAPSHOT

- TABLE 201 DENSO CORPORATION: KEY CUSTOMERS

- TABLE 202 DENSO CORPORATION: SALES BREAKDOWN, BY OEMS (AS OF MARCH 2022)

- TABLE 203 DENSO CORPORATION: MAJOR SUBSIDIARIES AND AFFILIATES

- TABLE 204 DENSO CORPORATION: MAJOR SUPPLY AGREEMENTS

- TABLE 205 DENSO CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 206 DENSO CORPORATION: EXPANSIONS

- TABLE 207 DENSO CORPORATION: OTHER DEVELOPMENTS

- 16.1.5 FORYOU CORPORATION

- TABLE 208 FORYOU CORPORATION: COMPANY OVERVIEW

- FIGURE 82 FORYOU CORPORATION: COMPANY SNAPSHOT

- TABLE 209 FORYOU CORPORATION: KEY CUSTOMERS

- TABLE 210 FORYOU CORPORATION: MAJOR SUPPLY AGREEMENTS

- TABLE 211 FORYOU CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 212 FORYOU CORPORATION: DEALS

- TABLE 213 FORYOU CORPORATION: OTHER DEVELOPMENTS

- 16.1.6 YAZAKI CORPORATION

- TABLE 214 YAZAKI CORPORATION: COMPANY OVERVIEW

- FIGURE 83 YAZAKI CORPORATION: COMPANY SNAPSHOT

- TABLE 215 YAZAKI CORPORATION: KEY CUSTOMERS

- TABLE 216 YAZAKI CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 217 YAZAKI CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 218 YAZAKI CORPORATION: DEALS

- TABLE 219 YAZAKI CORPORATION: EXPANSIONS

- TABLE 220 YAZAKI CORPORATION: OTHER DEVELOPMENTS

- 16.1.7 VISTEON CORPORATION

- TABLE 221 VISTEON CORPORATION: COMPANY OVERVIEW

- FIGURE 84 VISTEON CORPORATION: COMPANY SNAPSHOT

- TABLE 222 VISTEON CORPORATION: KEY CUSTOMERS

- TABLE 223 VISTEON CORPORATION: SUPPLY CONTRACTS

- TABLE 224 VISTEON CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 225 VISTEON CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 226 VISTEON CORPORATION: EXPANSIONS

- 16.1.8 HUAWEI TECHNOLOGIES CO., LTD.

- TABLE 227 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- FIGURE 85 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

- TABLE 228 HUAWEI TECHNOLOGIES CO., LTD.: MAJOR SUPPLY AGREEMENTS

- TABLE 229 HUAWEI TECHNOLOGIES CO., LTD.: KEY CUSTOMERS

- TABLE 230 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 231 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 232 HUAWEI TECHNOLOGIES CO., LTD.: DEALS

- TABLE 233 HUAWEI TECHNOLOGIES CO., LTD.: OTHER DEVELOPMENTS

- 16.1.9 VALEO

- TABLE 234 VALEO: COMPANY OVERVIEW

- FIGURE 86 VALEO: COMPANY SNAPSHOT

- TABLE 235 VALEO: PRODUCTS/SOLUTIONS OFFERED

- TABLE 236 VALEO: KEY CUSTOMERS

- TABLE 237 VALEO: BUSINESS GROUPS WITH MAJOR COMPETITORS

- TABLE 238 VALEO.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 239 VALEO: EXPANSIONS

- 16.1.10 JIANGSU ZEJING AUTOMOTIVE ELECTRONICS CO., LTD.

- TABLE 240 JIANGSU ZEJING AUTOMOTIVE ELECTRONICS CO., LTD.: COMPANY OVERVIEW

- TABLE 241 JIANGSU ZEJING AUTOMOTIVE ELECTRONICS CO., LTD.: PRODUCTS/SOLUTIONS OFFERED

- 16.1.11 HYUNDAI MOBIS

- TABLE 242 HYUNDAI MOBIS: COMPANY OVERVIEW

- TABLE 243 HYUNDAI MOBIS: SUPPLY CONTRACTS

- TABLE 244 HYUNDAI MOBIS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 245 HYUNDAI MOBIS: OTHER DEVELOPMENTS

- 16.1.12 LG ELECTRONICS

- TABLE 246 LG ELECTRONICS: COMPANY OVERVIEW

- FIGURE 87 LG ELECTRONICS: COMPANY SNAPSHOT

- TABLE 247 LG ELECTRONICS: KEY CUSTOMERS

- TABLE 248 LG ELECTRONICS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 249 LG ELECTRONICS: PRODUCT LAUNCHES/DEVELOPMENTS

- 16.2 OTHER PLAYERS

- 16.2.1 HARMAN INTERNATIONAL

- TABLE 250 HARMAN INTERNATIONAL: COMPANY OVERVIEW

- 16.2.2 WAYRAY AG

- TABLE 251 WAYRAY AG: COMPANY OVERVIEW

- 16.2.3 FUTURUS

- TABLE 252 FUTURUS: COMPANY OVERVIEW

- 16.2.4 HUDWAY, LLC

- TABLE 253 HUDWAY, LLC: COMPANY OVERVIEW

- 16.2.5 HUDLY

- TABLE 254 HUDLY: COMPANY OVERVIEW

- 16.2.6 CY VISION

- TABLE 255 CY VISION: COMPANY OVERVIEW

- 16.2.7 ENVISICS

- TABLE 256 ENVISICS: COMPANY OVERVIEW

- 16.2.8 ZHEJIANG CRYSTAL-OPTECH CO., LTD.

- TABLE 257 ZHEJIANG CRYSTAL-OPTECH CO., LTD.: COMPANY OVERVIEW

- 16.2.9 YILI ELECTRONICS CO., LTD.

- TABLE 258 YILI ELECTRONICS CO., LTD.: COMPANY OVERVIEW

- 16.2.10 MAXELL, LTD.

- TABLE 259 MAXELL, LTD.: COMPANY OVERVIEW

- 16.2.11 NEUSOFT CORPORATION

- TABLE 260 NEUSOFT CORPORATION: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

17 RECOMMENDATIONS BY MARKETSANDMARKETS

- 17.1 ASIA PACIFIC TO BE LARGEST MARKET DURING FORECAST PERIOD

- 17.2 INCREASING FOCUS ON SEMI-AUTONOMOUS VEHICLES TO DRIVE DEMAND FOR AUTOMOTIVE HUD SOLUTIONS

- 17.3 AR AND 3D HUDS TO EMERGE AS KEY TECHNOLOGIES

- 17.4 CONCLUSION

18 APPENDIX

- 18.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 18.2 DISCUSSION GUIDE

- 18.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.4 CUSTOMIZATION OPTIONS

- 18.4.1 AUTOMOTIVE HUD MARKET, BY EV TYPE, AT A REGIONAL LEVEL

- 18.4.2 AUTOMOTIVE HUD MARKET, BY LEVEL OF AUTONOMY, AT A REGIONAL LEVEL

- 18.4.3 PROFILING OF ADDITIONAL MARKET PLAYERS (UP TO 5)

- 18.5 RELATED REPORTS

- 18.6 AUTHOR DETAILS