|

|

市場調査レポート

商品コード

1780344

高級ビニルタイル(LVT)の世界市場:タイプ別、製品タイプ別、流通チャネル別、最終用途部門別、地域別 - 予測(~2030年)Luxury Vinyl Tiles Market by Type (Rigid, Flexible), Product Type (Click LVT, Glue-down LVT), Distribution Channel (Retail Stores, Online Retail), End-use Sector (Residential, Commercial), & Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 高級ビニルタイル(LVT)の世界市場:タイプ別、製品タイプ別、流通チャネル別、最終用途部門別、地域別 - 予測(~2030年) |

|

出版日: 2025年07月23日

発行: MarketsandMarkets

ページ情報: 英文 240 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

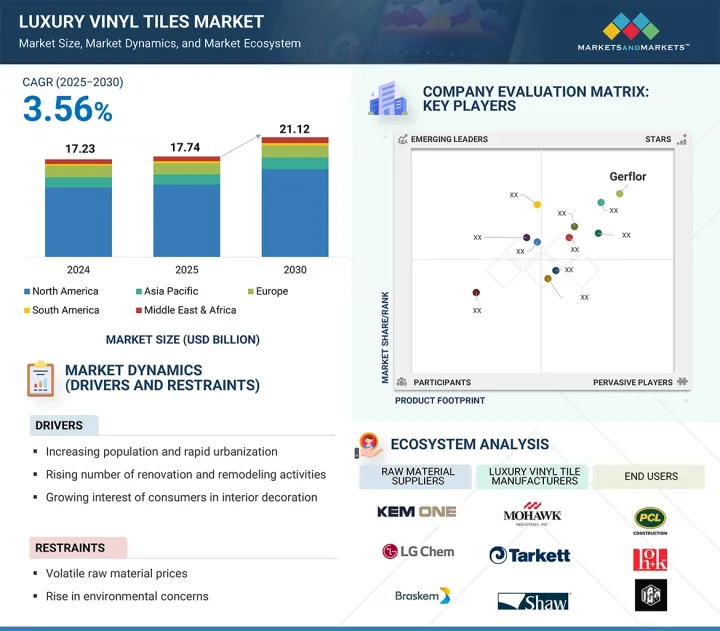

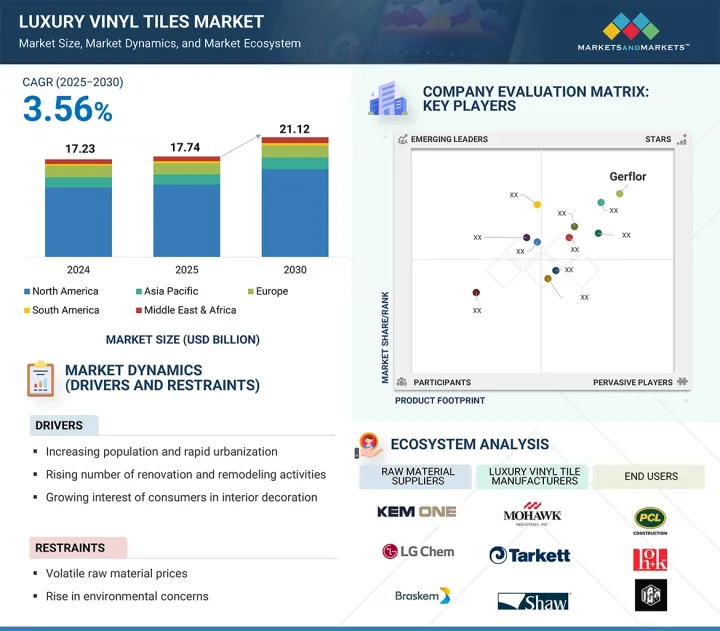

高級ビニルタイル(LVT)の市場規模は、2025年の177億4,000万米ドルから2030年までに211億2,000万米ドルに達すると予測され、予測期間にCAGRで3.56%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 金額(100万米ドル/10億米ドル)、数量(100万平方メートル) |

| セグメント | 製品タイプ、流通チャネル、最終用途部門、地域 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

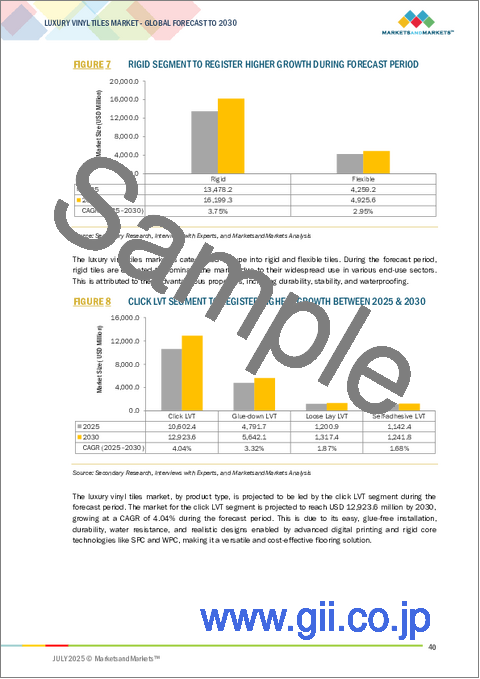

「硬質タイプが予測期間に市場でもっとも急成長するセグメントとなります。」

硬質タイプは、へこみや傷、温度変化に対する耐久性に優れているため、人通りの多い場所や湿気の多い環境に最適です。リジッドコアLVTは、コンクリート、合板、さらに以前のフローリングなどのさまざまな既存の床下地の上に、簡単なクリックロックまたはグルーダウン工法で施工できます。この簡単な施工プロセスは、人件費と時間を削減し、専門家にもDIY愛好家にも人気の選択肢となっています。

「グルーダウンLVTセグメントが第2位の市場シェアを占めます。」

グルーダウンLVTが2番目に大きなセグメントになると予測されます。この施工法は、安定性、耐久性に優れ、人通りの多い場所に適していることから支持されています。グルーダウンLVTは、感圧接着剤またはハードセット接着剤を使用してタイルや板を床下に直接接着するため、強力で長持ちします。そのため、オフィス、病院、小売店、学校など、人の往来が激しい場所に適しています。さらに、グルーダウンLVTは、経年変化による動きやずれを最小化し、より滑らかで安全な仕上がりを実現するため、広い空間や開放的な空間で特に効果を発揮します。

「卸売業者が第2位の市場シェアを占めると推定されます。」

LVTは、卸売業者を通じて大きな成長を示しています。その理由は、卸売業者が幅広い製品を提供し、競争力のある価格を設定し、効率的なサプライチェーンを構築しているからです。卸売業者は、さまざまなLVTを仕入れ、低価格で大量に提供することで、メーカーと小売業者、請負業者、大口バイヤーをつなぐ重要な役割を果たしています。このような大量供給は、短期間に大量の床材を必要とする商業プロジェクト、不動産開発業者、請負業者にとって特に魅力的です。

「商業部門が2番目に急成長する市場になると推定されます。」

LVTは、耐久性、デザインの柔軟性、費用対効果というユニークな組み合わせにより、商業部門で急速に人気を集めています。オフィス、小売店、ホテル、病院、教育機関などの商業空間では、激しい人の往来や頻繁な清掃、長期間の摩耗に耐える床材が求められますが、LVTはこれらすべての分野で優れています。傷、汚れ、湿気、へこみに対する高い耐性は、このような厳しい環境に理想的な選択肢となります。さらに、LVTの迅速で簡単な施工方法は、ダウンタイムを最小化することができるため、稼働を維持したり、厳しい納期を守ったりする必要のある商業プロジェクトでは特に重要です。

「北米が予測期間に最大の市場となります。」

北米は主要地域であり、数量、金額ともに最大の市場シェアを占めています。近年、米国とカナダでは住宅と商業施設の建設活動が継続的に伸びています。この成長により、床材や壁材に使用される材料の需要が高まっています。特に高級ビニルタイル(LVT)は、その耐久性、汎用性、費用対効果の高さから人気を博しています。さらに、北米全域でリフォームやリノベーションプロジェクトが増加していることも、高級ビニルタイル(LVT)の需要拡大に寄与しています。

当レポートでは、世界の高級ビニルタイル(LVT)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- 高級ビニルタイル(LVT)市場における魅力的な機会

- 北米の高級ビニルタイル(LVT)市場:最終用途部門別、国別

- 高級ビニルタイル(LVT)市場:タイプ別

- 高級ビニルタイル(LVT)市場:製品タイプ別

- 高級ビニルタイル(LVT)市場:流通チャネル別

- 高級ビニルタイル(LVT)市場:最終用途別

- 高級ビニルタイル(LVT)市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 産業動向

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- 高級ビニルタイル(LVT)の平均販売価格:主要企業別

- 高級ビニルタイル(LVT)の平均販売価格:地域別

- バリューチェーン分析

- エコシステム分析

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 高級ビニルタイル(LVT)市場に対する生成AIの影響

- 特許分析

- イントロダクション

- 調査手法

- 貿易分析

- 輸出シナリオ(HSコード391810)

- 輸入シナリオ(HSコード391810)

- 主な会議とイベント(2025年~2026年)

- 規制情勢と枠組み

- 規制情勢

- 規制枠組み

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

- マクロ経済分析

- イントロダクション

- GDPの動向と予測

- 投資と資金調達のシナリオ

- 高級ビニルタイル(LVT)市場に対する2025年の米国関税の影響

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 最終用途産業に対する影響

第7章 高級ビニルタイル(LVT)市場:タイプ別

- イントロダクション

- 硬質

- 軟質

第8章 高級ビニルタイル(LVT)市場:製品タイプ別

- イントロダクション

- グルーダウンLVT

- クリックLVT

- ルーズレイLVT

- 自己粘着LVT

第9章 高級ビニルタイル(LVT)市場:流通チャネル別

- イントロダクション

- 小売店

- オンライン小売

- 卸売業者

第10章 高級ビニルタイル(LVT)市場:最終用途別

- イントロダクション

- 住宅

- 商業

第11章 高級ビニルタイル(LVT)市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- イタリア

- 英国

- フランス

- ロシア

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他のアジア太平洋

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他の中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 市場ランキング分析

- 企業の評価と財務指標

- 製品/ブランドの比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- MOHAWK INDUSTRIES INC.

- TARKETT

- SHAW INDUSTRIES GROUP, INC.

- INTERFACE, INC.

- GERFLOR

- FORBO GROUP

- ARMSTRONG FLOORING

- MANNINGTON MILLS, INC.

- RESPONSIVE INDUSTRIES LTD.

- LX HAUSYS

- その他の企業

- AMERICAN BILTRITE

- MILLIKEN

- RASKIN

- WELLMADE PERFORMANCE FLOORS

- VINYLASA

- CONGOLEUM

- ADORE FLOORS, INC.

- EARTHWERKS

- FLOORFOLIO

- DAEJIN CO., LTD.

- JIANGSU TAIDE DECORATION MATERIALS CO., LTD

- ZHANGJIAGANG YIHUA RUNDONG NEW MATERIAL CO., LTD.

- TAIZHOU HUALI NEW MATERIALS CO., LTD.

- NOVALIS

- BEAULIEU INTERNATIONAL GROUP

第14章 隣接市場

- イントロダクション

- フローリング市場

第15章 付録

List of Tables

- TABLE 1 AVERAGE SELLING PRICE OF LUXURY VINYL TILES, BY KEY PLAYER, 2024 (USD/SQM)

- TABLE 2 AVERAGE SELLING PRICE OF LUXURY VINYL TILES, BY REGION, 2024-2030 (USD/SQM)

- TABLE 3 LUXURY VINYL TILES MARKET: ECOSYSTEM

- TABLE 4 LIST OF KEY PATENTS, 2022-2024

- TABLE 5 EXPORT DATA FOR HS CODE 391810-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 6 IMPORT DATA FOR HS CODE 391810-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 7 LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 LUXURY VINYL TILES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR LUXURY VINYL TILES MARKET

- TABLE 14 KEY BUYING CRITERIA FOR END-USE SECTORS

- TABLE 15 SEAMLESS KITCHEN TRANSFORMATION WITH INVICTUS FRENCH OAK POLAR AND VISUALIZATION TECHNOLOGY

- TABLE 16 GROUND FLOOR REVAMP WITH INVICTUS HERRINGBONE TILES AND END-TO-END INSTALLATION BY MAZON FLOORING

- TABLE 17 KAHRS KOMI FARMHOUSE LUXURY VINYL TILES PROJECT

- TABLE 18 GLOBAL GDP GROWTH PROJECTIONS, BY REGION, 2021-2028 (USD TRILLION)

- TABLE 19 KEY TARIFF RATES IMPOSED ON VARIOUS COUNTRIES AFFECTING FLOORING INDUSTRY (2025)

- TABLE 20 LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 21 LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 22 LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 23 LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 24 LUXURY VINYL TILES MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 25 LUXURY VINYL TILES MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 26 LUXURY VINYL TILES MARKET, BY PRODUCT TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 27 LUXURY VINYL TILES MARKET, BY PRODUCT TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 28 LUXURY VINYL TILES MARKET, BY DISTRIBUTION CHANNEL, 2020-2023 (USD MILLION)

- TABLE 29 LUXURY VINYL TILES MARKET, BY DISTRIBUTION CHANNEL, 2024-2030 (USD MILLION)

- TABLE 30 LUXURY VINYL TILES MARKET, BY DISTRIBUTION CHANNEL, 2020-2023 (MILLION SQUARE METER)

- TABLE 31 LUXURY VINYL TILES MARKET, BY DISTRIBUTION CHANNEL, 2024-2030 (MILLION SQUARE METER)

- TABLE 32 LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 33 LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 34 LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 35 LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 36 LUXURY VINYL TILES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 37 LUXURY VINYL TILES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 38 LUXURY VINYL TILES MARKET, BY REGION, 2020-2023 (MILLION SQUARE METER)

- TABLE 39 LUXURY VINYL TILES MARKET, BY REGION 2024-2030 (MILLION SQUARE METER)

- TABLE 40 NORTH AMERICA: LUXURY VINYL TILES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 41 NORTH AMERICA: LUXURY VINYL TILES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 42 NORTH AMERICA: LUXURY VINYL TILES MARKET, BY COUNTRY, 2020-2023 (MILLION SQUARE METER)

- TABLE 43 NORTH AMERICA: LUXURY VINYL TILES MARKET, BY COUNTRY, 2024-2030 (MILLION SQUARE METER)

- TABLE 44 NORTH AMERICA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 45 NORTH AMERICA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 46 NORTH AMERICA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 47 NORTH AMERICA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 48 NORTH AMERICA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 49 NORTH AMERICA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 51 NORTH AMERICA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 52 NORTH AMERICA: LUXURY VINYL TILES MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 53 NORTH AMERICA: LUXURY VINYL TILES MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 54 NORTH AMERICA: LUXURY VINYL TILES MARKET, BY PRODUCT TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 55 NORTH AMERICA: LUXURY VINYL TILES MARKET, BY PRODUCT TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 56 US: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 57 US: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 58 US: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 59 US: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 60 US: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 61 US: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 62 US: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 63 US: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 64 CANADA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 65 CANADA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 66 CANADA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 67 CANADA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 68 CANADA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 69 CANADA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 70 CANADA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 71 CANADA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 72 MEXICO: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 73 MEXICO: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 74 MEXICO: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 75 MEXICO: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 76 MEXICO: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 77 MEXICO: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 78 MEXICO: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 79 MEXICO: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 80 EUROPE: LUXURY VINYL TILES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 81 EUROPE: LUXURY VINYL TILES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 82 EUROPE: LUXURY VINYL TILES MARKET, BY COUNTRY, 2020-2023 (MILLION SQUARE METER)

- TABLE 83 EUROPE: LUXURY VINYL TILES MARKET, BY COUNTRY, 2024-2030 (MILLION SQUARE METER)

- TABLE 84 EUROPE: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 85 EUROPE: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 86 EUROPE: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 87 EUROPE: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 88 EUROPE: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 89 EUROPE: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 90 EUROPE: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 91 EUROPE: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 92 EUROPE: LUXURY VINYL TILES MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 93 EUROPE: LUXURY VINYL TILES MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 94 EUROPE: LUXURY VINYL TILES MARKET, BY PRODUCT TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 95 EUROPE: LUXURY VINYL TILES MARKET, BY PRODUCT TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 96 GERMANY LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 97 GERMANY: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 98 GERMANY: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 99 GERMANY: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 100 GERMANY: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 101 GERMANY: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 102 GERMANY: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 103 GERMANY: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 104 ITALY: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 105 ITALY: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 106 ITALY: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 107 ITALY: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 108 ITALY: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 109 ITALY: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 110 ITALY: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 111 ITALY: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 112 UK: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 113 UK: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 114 UK: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 115 UK: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 116 UK: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 117 UK: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 118 UK: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 119 UK: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 120 FRANCE: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 121 FRANCE: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 122 FRANCE: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 123 FRANCE: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 124 FRANCE: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 125 FRANCE: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 126 FRANCE: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 127 FRANCE: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 128 RUSSIA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 129 RUSSIA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 130 RUSSIA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 131 RUSSIA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 132 RUSSIA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 133 RUSSIA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 134 RUSSIA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 135 RUSSIA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 136 SPAIN: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 137 SPAIN: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 138 SPAIN: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 139 SPAIN: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 140 SPAIN: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 141 SPAIN: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 142 SPAIN: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 143 SPAIN: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 144 REST OF EUROPE: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 145 REST OF EUROPE: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 146 REST OF EUROPE: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 147 REST OF EUROPE: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 148 REST OF EUROPE: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 149 REST OF EUROPE: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 150 REST OF EUROPE: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 151 REST OF EUROPE: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 152 ASIA PACIFIC: LUXURY VINYL TILES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 153 ASIA PACIFIC: LUXURY VINYL TILES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 154 ASIA PACIFIC: LUXURY VINYL TILES MARKET, BY COUNTRY, 2020-2023 (MILLION SQUARE METER)

- TABLE 155 ASIA PACIFIC: LUXURY VINYL TILES MARKET, BY COUNTRY, 2024-2030 (MILLION SQUARE METER)

- TABLE 156 ASIA PACIFIC: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 157 ASIA PACIFIC: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 158 ASIA PACIFIC: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 159 ASIA PACIFIC: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 160 ASIA PACIFIC: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 161 ASIA PACIFIC: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 162 ASIA PACIFIC: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 163 ASIA PACIFIC: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 164 ASIA PACIFIC: LUXURY VINYL TILES MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 165 ASIA PACIFIC: LUXURY VINYL TILES MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 166 ASIA PACIFIC: LUXURY VINYL TILES MARKET, BY PRODUCT TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 167 ASIA PACIFIC: LUXURY VINYL TILES MARKET, BY PRODUCT TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 168 CHINA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 169 CHINA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 170 CHINA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 171 CHINA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 172 CHINA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 173 CHINA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 174 CHINA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 175 CHINA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 176 JAPAN: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 177 JAPAN: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 178 JAPAN: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 179 JAPAN: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 180 JAPAN: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 181 JAPAN: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 182 JAPAN: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 183 JAPAN: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 184 INDIA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 185 INDIA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 186 INDIA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 187 INDIA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 188 INDIA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 189 INDIA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 190 INDIA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 191 INDIA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 192 SOUTH KOREA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 193 SOUTH KOREA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 194 SOUTH KOREA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 195 SOUTH KOREA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 196 SOUTH KOREA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 197 SOUTH KOREA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 198 SOUTH KOREA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 199 SOUTH KOREA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 200 AUSTRALIA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 201 AUSTRALIA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 202 AUSTRALIA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 203 AUSTRALIA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 204 AUSTRALIA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 205 AUSTRALIA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 206 AUSTRALIA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 207 AUSTRALIA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 208 REST OF ASIA PACIFIC: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 209 REST OF ASIA PACIFIC: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 210 REST OF ASIA PACIFIC: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 211 REST OF ASIA PACIFIC: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 212 REST OF ASIA PACIFIC: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 213 REST OF ASIA PACIFIC: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 214 REST OF ASIA PACIFIC: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 215 REST OF ASIA PACIFIC: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 216 MIDDLE EAST & AFRICA: LUXURY VINYL TILES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: LUXURY VINYL TILES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: LUXURY VINYL TILES MARKET, BY COUNTRY, 2020-2023 (MILLION SQUARE METER)

- TABLE 219 MIDDLE EAST & AFRICA: LUXURY VINYL TILES MARKET, BY COUNTRY, 2024-2030 (MILLION SQUARE METER)

- TABLE 220 MIDDLE EAST & AFRICA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 223 MIDDLE EAST & AFRICA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 224 MIDDLE EAST & AFRICA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 227 MIDDLE EAST & AFRICA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 228 MIDDLE EAST & AFRICA: LUXURY VINYL TILES MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: LUXURY VINYL TILES MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: LUXURY VINYL TILES MARKET, BY PRODUCT TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 231 MIDDLE EAST & AFRICA: LUXURY VINYL TILES MARKET, BY PRODUCT TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 232 GCC COUNTRIES: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 233 GCC COUNTRIES: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 234 GCC COUNTRIES: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 235 GCC COUNTRIES: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 236 GCC COUNTRIES: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 237 GCC COUNTRIES: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 238 GCC COUNTRIES: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 239 GCC COUNTRIES: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 240 SAUDI ARABIA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 241 SAUDI ARABIA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 242 SAUDI ARABIA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 243 SAUDI ARABIA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 244 SAUDI ARABIA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 245 SAUDI ARABIA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 246 SAUDI ARABIA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 247 SAUDI ARABIA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 248 UAE: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 249 UAE: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 250 UAE: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 251 UAE: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 252 UAE: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 253 UAE: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 254 UAE: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 255 UAE: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 256 REST OF GCC COUNTRIES: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 257 REST OF GCC COUNTRIES: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 258 REST OF GCC COUNTRIES: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 259 REST OF GCC COUNTRIES: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 260 REST OF GCC COUNTRIES: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 261 REST OF GCC COUNTRIES: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 262 REST OF GCC COUNTRIES: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 263 REST OF GCC COUNTRIES: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 264 SOUTH AFRICA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 265 SOUTH AFRICA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 266 SOUTH AFRICA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 267 SOUTH AFRICA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 268 SOUTH AFRICA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 269 SOUTH AFRICA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 270 SOUTH AFRICA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 271 SOUTH AFRICA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 272 REST OF MIDDLE EAST & AFRICA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 273 REST OF MIDDLE EAST & AFRICA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 274 REST OF MIDDLE EAST & AFRICA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 275 REST OF MIDDLE EAST & AFRICA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 276 REST OF MIDDLE EAST & AFRICA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 277 REST OF MIDDLE EAST & AFRICA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 278 REST OF MIDDLE EAST & AFRICA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 279 REST OF MIDDLE EAST & AFRICA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 280 SOUTH AMERICA: LUXURY VINYL TILES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 281 SOUTH AMERICA: LUXURY VINYL TILES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 282 SOUTH AMERICA: LUXURY VINYL TILES MARKET, BY COUNTRY, 2020-2023 (MILLION SQUARE METER)

- TABLE 283 SOUTH AMERICA: LUXURY VINYL TILES MARKET, BY COUNTRY, 2024-2030 (MILLION SQUARE METER)

- TABLE 284 SOUTH AMERICA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 285 SOUTH AMERICA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 286 SOUTH AMERICA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 287 SOUTH AMERICA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 288 SOUTH AMERICA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 289 SOUTH AMERICA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 290 SOUTH AMERICA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 291 SOUTH AMERICA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 292 BRAZIL: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 293 BRAZIL: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 294 BRAZIL: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 295 BRAZIL: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 296 BRAZIL: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 297 BRAZIL: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 298 BRAZIL: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 299 BRAZIL: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 300 ARGENTINA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 301 ARGENTINA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 302 ARGENTINA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 303 ARGENTINA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 304 ARGENTINA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 305 ARGENTINA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 306 ARGENTINA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 307 ARGENTINA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 308 REST OF SOUTH AMERICA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 309 REST OF SOUTH AMERICA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 310 REST OF SOUTH AMERICA: LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 311 REST OF SOUTH AMERICA: LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 312 REST OF SOUTH AMERICA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 313 REST OF SOUTH AMERICA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 314 REST OF SOUTH AMERICA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 315 REST OF SOUTH AMERICA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 316 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 317 DEGREE OF COMPETITION

- TABLE 318 LUXURY VINYL TILES MARKET: REGION FOOTPRINT

- TABLE 319 LUXURY VINYL TILES MARKET: END-USE SECTOR FOOTPRINT

- TABLE 320 LUXURY VINYL TILES MARKET: TYPE FOOTPRINT

- TABLE 321 LUXURY VINYL TILES MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 322 LUXURY VINYL TILES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 323 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 324 LUXURY VINYL TILES MARKET: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 325 LUXURY VINYL TILES MARKET: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 326 LUXURY VINYL TILES MARKET: OTHER DEVELOPMENTS, JANUARY 2021-MAY 2025

- TABLE 327 MOHAWK INDUSTRIES INC.: COMPANY OVERVIEW

- TABLE 328 MOHAWK INDUSTRIES INC.: PRODUCTS OFFERED

- TABLE 329 MOHAWK INDUSTRIES INC.: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 330 TARKETT: COMPANY OVERVIEW

- TABLE 331 TARKETT: PRODUCTS OFFERED

- TABLE 332 TARKETT: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 333 SHAW INDUSTRIES GROUP, INC.: COMPANY OVERVIEW

- TABLE 334 SHAW INDUSTRIES GROUP, INC.: PRODUCTS OFFERED

- TABLE 335 SHAW INDUSTRIES GROUP, INC.: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 336 INTERFACE, INC.: COMPANY OVERVIEW

- TABLE 337 INTERFACE, INC.: PRODUCTS OFFERED

- TABLE 338 INTERFACE, INC.: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 339 GERFLOR: COMPANY OVERVIEW

- TABLE 340 GERFLOR: PRODUCTS OFFERED

- TABLE 341 GERFLOR: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 342 FORBO GROUP: COMPANY OVERVIEW

- TABLE 343 FORBO GROUP: PRODUCTS OFFERED

- TABLE 344 ARMSTRONG FLOORING: COMPANY OVERVIEW

- TABLE 345 ARMSTRONG FLOORING: PRODUCTS OFFERED

- TABLE 346 ARMSTRONG FLOORING: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 347 MANNINGTON MILLS, INC.: COMPANY OVERVIEW

- TABLE 348 MANNINGTON MILLS, INC.: PRODUCTS OFFERED

- TABLE 349 MANNINGTON MILLS, INC.: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 350 RESPONSIVE INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 351 RESPONSIVE INDUSTRIES LTD.: PRODUCTS OFFERED

- TABLE 352 LX HAUSYS: COMPANY OVERVIEW

- TABLE 353 LX HAUSYS: PRODUCTS OFFERED

- TABLE 354 LX HAUSYS: OTHER DEVELOPMENTS, JANUARY 2021-MAY 2025

- TABLE 355 FLOORING MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 356 FLOORING MARKET, BY REGION 2021-2028 (MILLION SQUARE METER)

List of Figures

- FIGURE 1 LUXURY VINYL TILES MARKET: RESEARCH DESIGN

- FIGURE 2 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF INTERVIEWS WITH EXPERTS

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: SUPPLY SIDE

- FIGURE 6 LUXURY VINYL TILES MARKET: DATA TRIANGULATION

- FIGURE 7 RIGID SEGMENT TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 8 CLICK LVT SEGMENT TO REGISTER HIGHEST GROWTH BETWEEN 2025 & 2030

- FIGURE 9 RETAIL STORES SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 10 RESIDENTIAL SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 12 GROWING CONSTRUCTION INDUSTRY TO OFFER GROWTH OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 13 RESIDENTIAL SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 14 RIGID SEGMENT TO REGISTER HIGHER GROWTH IN TERMS OF VOLUME BETWEEN 2025 & 2030

- FIGURE 15 CLICK LVT SEGMENT TO WITNESS HIGHEST MARKET GROWTH BY VOLUME

- FIGURE 16 ONLINE RETAIL SEGMENT TO REGISTER HIGHEST GROWTH IN TERMS OF VOLUME DURING FORECAST PERIOD

- FIGURE 17 COMMERCIAL SEGMENT TO REGISTER HIGHER GROWTH IN TERMS OF VOLUME DURING FORECAST PERIOD

- FIGURE 18 MEXICO TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 LUXURY VINYL TILES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 POPULATION GROWTH PROJECTION, 1998-2060 (MILLION)

- FIGURE 21 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 22 AVERAGE SELLING PRICE OF LUXURY VINYL TILES, BY KEY PLAYER, 2024

- FIGURE 23 AVERAGE SELLING PRICE OF LUXURY VINYL TILES, BY REGION, 2024-2030 (USD/SQM)

- FIGURE 24 LUXURY VINYL TILES: VALUE CHAIN ANALYSIS

- FIGURE 25 ECOSYSTEM MAP

- FIGURE 26 LIST OF MAJOR PATENTS, 2014-2024

- FIGURE 27 MAJOR PATENTS, BY REGION, 2014-2024

- FIGURE 28 EXPORT DATA FOR HS CODE 391810-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 29 IMPORT DATA FOR HS CODE 391810-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 30 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USE SECTOR

- FIGURE 32 KEY BUYING CRITERIA FOR END-USE SECTORS

- FIGURE 33 INVESTOR DEALS AND FUNDING FOR LUXURY VINYL TILES SOARED IN 2021

- FIGURE 34 RIGID SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 35 CLICK LVT SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 36 RETAIL STORES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 37 RESIDENTIAL SEGMENT TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

- FIGURE 38 LUXURY VINYL TILES MARKET: GROWTH RATE, BY COUNTRY

- FIGURE 39 NORTH AMERICA: LUXURY VINYL TILES MARKET SNAPSHOT

- FIGURE 40 EUROPE: LUXURY VINYL TILES MARKET SNAPSHOT

- FIGURE 41 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 42 MARKET SHARE ANALYSIS, 2024

- FIGURE 43 RANKING OF TOP 5 PLAYERS IN LUXURY VINYL TILES MARKET

- FIGURE 44 COMPANY VALUATION (USD BILLION)

- FIGURE 45 FINANCIAL MATRIX: EV/EBITDA RATIO

- FIGURE 46 YEAR-TO-DATE PRICE AND FIVE-YEAR STOCK BETA

- FIGURE 47 LUXURY VINYL TILES MARKET: PRODUCT/BRAND COMPARISON

- FIGURE 48 LUXURY VINYL TILES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 49 LUXURY VINYL TILES MARKET: COMPANY FOOTPRINT

- FIGURE 50 LUXURY VINYL TILES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 51 MOHAWK INDUSTRIES INC.: COMPANY SNAPSHOT

- FIGURE 52 TARKETT: COMPANY SNAPSHOT

- FIGURE 53 INTERFACE, INC.: COMPANY SNAPSHOT

- FIGURE 54 FORBO GROUP: COMPANY SNAPSHOT

- FIGURE 55 RESPONSIVE INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 56 LX HAUSYS: COMPANY SNAPSHOT

The luxury vinyl tiles market is expected to reach USD 21.12 billion by 2030 from USD 17.74 billion in 2025, at a CAGR of 3.56% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/USD Billion) and Volume (Million Square Meter) |

| Segments | Type, Product type, Distribution Channel, End-use Sector, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

"Rigid type to be the fastest-growing segment in the market during the forecast period."

The rigid type offers excellent durability against dents, scratches, and temperature fluctuations, making it ideal for high-traffic areas and damp environments. Rigid-core LVT can be installed over various existing subfloors, including concrete, plywood, and even previous flooring, using an easy click-lock or glue-down method. This straightforward installation process reduces both labor costs and time, making it a popular choice for professionals and DIY enthusiasts alike.

"Glue-down LVT segment to account for the second-largest market share."

Glue-down LVT is anticipated to be the second-largest segment. This installation method is favored for its superior stability, durability, and suitability for high-traffic areas. Glue-down LVT involves adhering tiles or planks directly to the subfloor using either pressure-sensitive or hard-set adhesives, which creates a strong, long-lasting bond. Consequently, it is particularly well-suited for commercial environments such as offices, hospitals, retail stores, and schools, where flooring must endure heavy foot traffic. Additionally, glue-down LVT provides a smoother, more secure finish with minimal movement or shifting over time, making it especially effective in large or open spaces.

"Wholesale distributors are estimated to account for the second-largest market share."

LVT is experiencing significant growth through wholesale distributors, due to their ability to offer a wide range of products, competitive pricing, and efficient supply chains. These distributors serve as a vital link between manufacturers and retailers, contractors, or large buyers by stocking a variety of LVT options and providing them in bulk at lower prices. This bulk availability is particularly attractive to commercial projects, real estate developers, and contractors who need large quantities of flooring materials on short notice.

"The commercial sector is estimated to be the second-fastest-growing market."

LVT is rapidly gaining popularity in the commercial sector due to its unique combination of durability, design flexibility, and cost-effectiveness. Commercial spaces such as offices, retail stores, hotels, hospitals, and educational institutes require flooring that can withstand heavy foot traffic, frequent cleaning, and long-term wear, and LVT excels in all these areas. Its high resistance to scratches, stains, moisture, and dents makes it an ideal choice for such demanding environments. Additionally, the quick and easy installation method of LVT minimizes downtime, which is especially important for commercial projects that need to remain operational or meet tight deadlines.

"North America to be the largest market during the forecast period."

North America is the leading region, holding the largest market share in terms of both volume and value. In recent years, there has been continuous growth in residential and commercial construction activities in the US and Canada. This growth has resulted in a heightened demand for materials used in floor and wall coverings. Luxury vinyl tiles, in particular, have gained popularity due to their durability, versatility, and cost-effectiveness. Furthermore, the increasing number of renovation and remodeling projects across North America is also contributing to the rising demand for luxury vinyl tiles.

By Company Type: Tier 1: 25%, Tier 2: 42%, and Tier 3: 33%

By Designation: C-level Executives: 20%, Directors: 30%, and Other Designations: 50%

By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America: 10%, and the Middle East & Africa 20%

Companies Covered: Mohawk Industries, Inc. (US), Tarkett (France), Shaw Industries Group, Inc. (US), Interface, Inc. (US), Gerflor (France), Forbo Group (Switzerland), Armstrong Flooring (US), Mannington Mills, Inc. (US), Responsive Industries Ltd. (India), and LX Hausys (South Korea), among others, are covered in the report.

The study includes an in-depth competitive analysis of these key players in the luxury vinyl tiles market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the luxury vinyl tiles market based on type (rigid and flexible), product type (glue-down LVT, click LVT, loose lay LVT, and self-adhesive LVT), distribution channel (retail stores, online retail, and wholesale distributors), end-use sector (residential and commercial), and region (Asia Pacific, North America, Europe, South America, and the Middle East & Africa). The report's scope covers detailed information regarding the drivers, restraints, challenges, and opportunities influencing the growth of the luxury vinyl tiles market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products offered, and key strategies, such as partnerships, agreements, product launches, expansions, and acquisitions, associated with the luxury vinyl tiles market. This report covers a competitive analysis of upcoming startups in the luxury vinyl tiles market ecosystem.

Reasons to Buy the Report

The report will offer the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall luxury vinyl tiles market and the subsegments. This report will help stakeholders understand the competitive landscape, gain more insights into positioning their businesses better, and plan suitable go-to-market strategies. The report will help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (increasing population and rapid urbanization, rising number of renovation and remodeling activities, and growing interest of consumers toward interior decoration), restraints (volatile raw material prices and rise in environmental concerns), opportunities (rising demand from emerging economies and growing investment in the construction industry), and challenges (disposal of waste).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the luxury vinyl tiles market.

- Market Development: Comprehensive information about profitable markets - the report analyzes the luxury vinyl tiles market across varied regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the luxury vinyl tiles market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Mohawk Industries, Inc. (US), Tarkett (France), Shaw Industries Group, Inc. (US), Interface, Inc. (US), Gerflor (France), Forbo Group (Switzerland), Armstrong Flooring (US), Mannington Mills, Inc. (US), Responsive Industries Ltd. (India), and LX Hausys (South Korea).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS OF STUDY

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LUXURY VINYL TILES MARKET

- 4.2 NORTH AMERICA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR & COUNTRY

- 4.3 LUXURY VINYL TILES MARKET, BY TYPE

- 4.4 LUXURY VINYL TILES MARKET, BY PRODUCT TYPE

- 4.5 LUXURY VINYL TILES MARKET, BY DISTRIBUTION CHANNEL

- 4.6 LUXURY VINYL TILES MARKET, BY END-USE SECTOR

- 4.7 LUXURY VINYL TILES MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing population and rapid urbanization

- 5.2.1.2 Rising number of renovation and remodeling activities

- 5.2.1.3 Growing interest of consumers in interior decoration

- 5.2.2 RESTRAINTS

- 5.2.2.1 Volatile raw material prices

- 5.2.2.2 Rising environmental concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand from emerging economies

- 5.2.3.2 Growing investments in construction industry

- 5.2.4 CHALLENGES

- 5.2.4.1 Disposal of waste

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE OF LUXURY VINYL TILES, BY KEY PLAYER

- 6.2.2 AVERAGE SELLING PRICE OF LUXURY VINYL TILES, BY REGION

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Digital Printing

- 6.5.1.2 Glueless Click Systems

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Noise Reduction Technology

- 6.5.2.2 Internet of Things (IoT) Technology

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 Quantum Guard Elite

- 6.5.3.2 Waterproof Core Technologies

- 6.5.1 KEY TECHNOLOGIES

- 6.6 IMPACT OF GEN AI ON LUXURY VINYL TILES MARKET

- 6.7 PATENT ANALYSIS

- 6.7.1 INTRODUCTION

- 6.7.2 METHODOLOGY

- 6.8 TRADE ANALYSIS

- 6.8.1 EXPORT SCENARIO (HS CODE 391810)

- 6.8.2 IMPORT SCENARIO (HS CODE 391810)

- 6.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.10 REGULATORY LANDSCAPE & FRAMEWORK

- 6.10.1 REGULATORY LANDSCAPE

- 6.10.1.1 Regulatory bodies, government agencies, and other organizations

- 6.10.2 REGULATORY FRAMEWORK

- 6.10.2.1 Floorscore Certification

- 6.10.2.2 ASTM F1700

- 6.10.2.3 EN 14041

- 6.10.1 REGULATORY LANDSCAPE

- 6.11 PORTER'S FIVE FORCES ANALYSIS

- 6.11.1 THREAT OF NEW ENTRANTS

- 6.11.2 THREAT OF SUBSTITUTES

- 6.11.3 BARGAINING POWER OF SUPPLIERS

- 6.11.4 BARGAINING POWER OF BUYERS

- 6.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.12.2 BUYING CRITERIA

- 6.13 CASE STUDY ANALYSIS

- 6.14 MACROECONOMIC ANALYSIS

- 6.14.1 INTRODUCTION

- 6.14.2 GDP TRENDS AND FORECASTS

- 6.15 INVESTMENT AND FUNDING SCENARIO

- 6.16 IMPACT OF 2025 US TARIFF ON LUXURY VINYL TILES MARKET

- 6.16.1 INTRODUCTION

- 6.16.2 KEY TARIFF RATES

- 6.16.3 PRICE IMPACT ANALYSIS

- 6.16.4 IMPACT ON COUNTRY/REGION

- 6.16.5 END-USE INDUSTRY IMPACT

7 LUXURY VINYL TILES MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 RIGID

- 7.2.1 EXCEPTIONAL WATER RESISTANCE, DURABILITY, AND TEMPERATURE SUITABILITY TO DRIVE MARKET

- 7.3 FLEXIBLE

- 7.3.1 COST-EFFECTIVENESS AND EASE OF INSTALLATION TO AUGMENT DEMAND

8 LUXURY VINYL TILES MARKET, BY PRODUCT TYPE

- 8.1 INTRODUCTION

- 8.2 GLUE-DOWN LVT

- 8.2.1 EXCEPTIONAL ADHESION, DURABILITY, AND TEMPERATURE SUITABILITY TO DRIVE DEMAND

- 8.3 CLICK LVT

- 8.3.1 EASE OF INSTALLATION AND RESIDENTIAL REMODELING ACTIVITIES TO BOOST GROWTH

- 8.4 LOOSE LAY LVT

- 8.4.1 EASE OF INSTALLATION AND RESIDENTIAL REMODELING ACTIVITIES TO BOOST GROWTH

- 8.5 SELF-ADHESIVE LVT

- 8.5.1 IMPROVING ADHESIVE TECHNOLOGIES AND NEED FOR TEMPORARY FLOORING SOLUTIONS TO DRIVE DEMAND

9 LUXURY VINYL TILES MARKET, BY DISTRIBUTION CHANNEL

- 9.1 INTRODUCTION

- 9.2 RETAIL STORES

- 9.2.1 ENHANCED CUSTOMER CONFIDENCE TO DRIVE MARKET

- 9.3 ONLINE RETAIL

- 9.3.1 COMPETITIVE PRICING AND ADVANCEMENTS IN AUGMENTED REALITY FOR VIRTUAL ROOM PREVIEWS TO DRIVE MARKET

- 9.4 WHOLESALE DISTRIBUTORS

- 9.4.1 COST-EFFECTIVE SOLUTIONS AND FLEXIBLE ORDER SIZES TO PROPEL MARKET

10 LUXURY VINYL TILES MARKET, BY END USE SECTOR

- 10.1 INTRODUCTION

- 10.2 RESIDENTIAL

- 10.2.1 POPULATION EXPANSION, EVOLVING LIVING PREFERENCES, AND ECONOMIC DEVELOPMENT TO AUGMENT DEMAND

- 10.3 COMMERCIAL

- 10.3.1 DURABILITY, LOW MAINTENANCE, AND AESTHETIC APPEAL TO DRIVE MARKET

11 LUXURY VINYL TILES MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Growth in construction industry to augment demand

- 11.2.2 CANADA

- 11.2.2.1 Growth in construction sector to drive market

- 11.2.3 MEXICO

- 11.2.3.1 High application in industrial construction to drive market

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Government initiatives to fuel demand

- 11.3.2 ITALY

- 11.3.2.1 Growing government investments to propel market

- 11.3.3 UK

- 11.3.3.1 Growing construction industry and housing programs to provide growth opportunities

- 11.3.4 FRANCE

- 11.3.4.1 Government initiatives to build housing units and growing renovation activities to boost demand

- 11.3.5 RUSSIA

- 11.3.5.1 Infrastructural projects by government to support market growth

- 11.3.6 SPAIN

- 11.3.6.1 Government investments in construction projects to boost market

- 11.3.7 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Government investments in infrastructure to drive market growth

- 11.4.2 JAPAN

- 11.4.2.1 High urban population to boost market

- 11.4.3 INDIA

- 11.4.3.1 Greater investment in housing and infrastructure projects to drive market

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Enhanced investor and consumer confidence to drive market

- 11.4.5 AUSTRALIA

- 11.4.5.1 Growing population and stable economic conditions to drive market

- 11.4.6 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Saudi Vision 2030 to play pivotal role in driving market

- 11.5.1.2 UAE

- 11.5.1.2.1 Rapid urbanization and infrastructure projects to drive growth

- 11.5.1.3 Rest of GCC countries

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Government initiatives and urbanization trends to support market growth

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Increase in construction and housing programs to fuel market

- 11.6.2 ARGENTINA

- 11.6.2.1 Growing investment for enhancing housing conditions to boost market

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 MARKET RANKING ANALYSIS

- 12.6 COMPANY VALUATION AND FINANCIAL METRICS

- 12.7 PRODUCT/BRAND COMPARISON

- 12.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.8.1 STARS

- 12.8.2 EMERGING LEADERS

- 12.8.3 PERVASIVE PLAYERS

- 12.8.4 PARTICIPANTS

- 12.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.8.5.1 Company footprint

- 12.8.5.2 Region footprint

- 12.8.5.3 End-use sector footprint

- 12.8.5.4 Type footprint

- 12.8.5.5 Product type footprint

- 12.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.9.1 PROGRESSIVE COMPANIES

- 12.9.2 RESPONSIVE COMPANIES

- 12.9.3 DYNAMIC COMPANIES

- 12.9.4 STARTING BLOCKS

- 12.9.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.9.5.1 Detailed list of key startups/SMEs

- 12.9.5.2 Competitive benchmarking of key startups/SMEs

- 12.10 COMPETITIVE SCENARIO

- 12.10.1 PRODUCT LAUNCHES

- 12.10.2 EXPANSIONS

- 12.10.3 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 MOHAWK INDUSTRIES INC.

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 TARKETT

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 SHAW INDUSTRIES GROUP, INC.

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 INTERFACE, INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 GERFLOR

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses & competitive threats

- 13.1.6 FORBO GROUP

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 MnM view

- 13.1.7 ARMSTRONG FLOORING

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.7.4 MnM view

- 13.1.8 MANNINGTON MILLS, INC.

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.4 MnM view

- 13.1.9 RESPONSIVE INDUSTRIES LTD.

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 MnM view

- 13.1.10 LX HAUSYS

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.10.3 MnM view

- 13.1.1 MOHAWK INDUSTRIES INC.

- 13.2 OTHER PLAYERS

- 13.2.1 AMERICAN BILTRITE

- 13.2.2 MILLIKEN

- 13.2.3 RASKIN

- 13.2.4 WELLMADE PERFORMANCE FLOORS

- 13.2.5 VINYLASA

- 13.2.6 CONGOLEUM

- 13.2.7 ADORE FLOORS, INC.

- 13.2.8 EARTHWERKS

- 13.2.9 FLOORFOLIO

- 13.2.10 DAEJIN CO., LTD.

- 13.2.11 JIANGSU TAIDE DECORATION MATERIALS CO., LTD

- 13.2.12 ZHANGJIAGANG YIHUA RUNDONG NEW MATERIAL CO., LTD.

- 13.2.13 TAIZHOU HUALI NEW MATERIALS CO., LTD.

- 13.2.14 NOVALIS

- 13.2.15 BEAULIEU INTERNATIONAL GROUP

14 ADJACENT MARKET

- 14.1 INTRODUCTION

- 14.2 FLOORING MARKET

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS