|

|

市場調査レポート

商品コード

1756517

ソーラーパネルリサイクルの世界市場:タイプ別、耐用年数別、プロセス別、材質別、地域別 - 2030年までの予測Solar Panel Recycling Market by Type (Monocrystalline, Polycrystalline), Shelf Life (Early Loss, Normal Loss), Process (Mechanical, Hybrid), Material (Silicon, Metal, Plastic, Glass) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ソーラーパネルリサイクルの世界市場:タイプ別、耐用年数別、プロセス別、材質別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月19日

発行: MarketsandMarkets

ページ情報: 英文 256 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

ソーラーパネルリサイクルの市場規模は、2025年の4億6,000万米ドルから2030年には11億2,000万米ドルに成長し、予測期間中のCAGRは19.5%を記録すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル/10億米ドル) |

| セグメント | タイプ別、耐用年数別、プロセス別、材質別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、南米 |

ソーラーパネル・リサイクルの需要は、世界中で太陽光発電の設置率が高いため、環境に配慮した廃棄が必要な使用済みソーラーパネルが大量に発生するなど、さまざまな要因によって拍車がかかっています。電子廃棄物に対する懸念や、有害な廃棄による悪影響が、リサイクルへの取り組みをさらに後押ししています。さらに、欧州、北米、アジアでは、政府の厳しい規制と政策により、環境に配慮したソーラーパネルの廃棄物管理が求められており、これがリサイクルを後押ししています。シリコン、銀、アルミニウム、ガラスといった回収可能な材料を再利用・リサイクルすることで、原材料の採取を制限できるため、経済的なメリットも重要です。

多結晶ソーラーパネルは、主に単結晶ソーラーパネルと比較して最も一般的に使用され、稼働寿命が短いため、ソーラーパネルリサイクル市場で最も急成長するタイプになると予測されています。多結晶パネルは伝統的に安価で製造の難易度が低いため、新興経済諸国や先進経済諸国の商業用太陽光発電設備に大規模に導入されてきました。その結果、世界の太陽光発電設備容量の大部分を占めています。しかし、多結晶パネルは一般に単結晶パネルよりも効率が低く、寿命が短いため、交換サイクルが早まり、使用済み段階での廃棄物量が増加します。効果的なリサイクル・ソリューションへの需要を後押ししているのは、このような多結晶パネルの廃棄数の増加です。欧州、北米、アジアなどの経済圏における規制政策は、特に多結晶シリコンで作られた古いパネルのリサイクルをさらに奨励しています。

早期廃棄されるソーラーパネルが増加しているため、ソーラーパネルリサイクル業界では早期ロス分野が最も急成長しています。早期廃棄の原因には、製造段階での欠陥、低品質のマテリアル、誤った設置、異常気象、マテリアルハンドリングやメンテナンス中の偶発的な損傷などがあります。世界的に太陽光発電の普及が加速するにつれ、特に野心的な導入目標を掲げている市場では、設置量が膨大になるため、初期不良が発生する可能性が高まっています。パネルは、性能の低下や安全上の理由、あるいはより効率的な技術が利用できるようになったため、運転開始から5年未満で交換される傾向にあります。このため、予想よりも早く大量の太陽光発電廃棄物が発生し、適切なリサイクル方法が急務となっています。さらに、公益事業規模の太陽光発電プロジェクトでは、部分的な故障が発生する傾向があり、不良パネルが一括交換されるため、早期の廃棄物量に拍車がかかります。

機械的リサイクルは、費用対効果が高く、拡張性があり、操作が簡単であるため、ソーラーパネルリサイクル業界で最も急成長している分野です。これは、シュレッダー、破砕、選別などの方法でソーラーパネルを物理的に解体し、アルミフレーム、ガラス、銅配線、ジャンクションボックスなどの材料を回収することで行われます。化学処理や熱処理とは対照的に、メカニカル・リサイクルはコストのかかる機械や有毒な化学薬品を使用しないため、大量に使用する場合、経済的にも環境的にも優しいです。さらに、メカニカル・リサイクルによって再生された材料、特にアルミニウムとガラスは、循環型経済のように他の産業で直接使用することができます。欧州や北米などの地域では、政府による規制やリサイクル要件も、機械選別のような標準化された低コストのリサイクル技術の使用を促進しています。さらに、自動化と材料選別技術の向上も、機械的リサイクルの回収率と収益性を高めています。

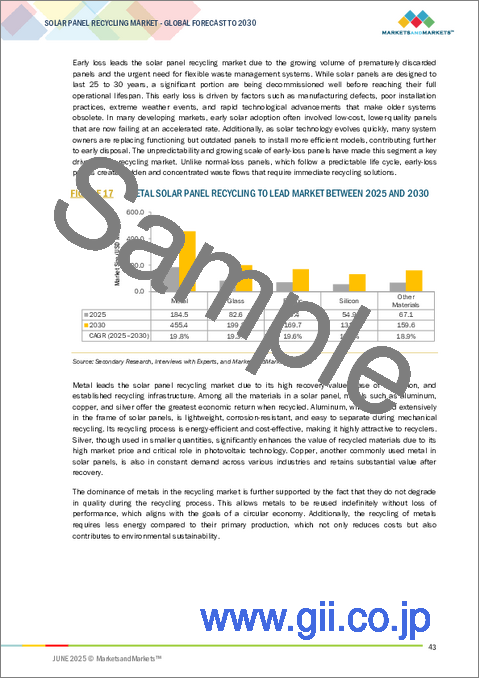

金属は、経済的価値が高く、産業需要が旺盛で、他の元素に比べて回収が容易であるため、ソーラーパネルリサイクル産業において最も急成長している材料セグメントです。ソーラーパネルは、アルミニウム、銅、銀などの貴金属で構成されています。アルミはパネルのフレームに、銅は電気配線や接続に、銀は送電用の太陽電池によく使われています。廃棄されるソーラーパネルの数が増えるにつれ、金属を再生できる可能性はメーカーやリサイクル業者にとってますます魅力的になっています。特に銅と銀の市場価格は割高であるため、回収量が少なくても経済的に回収が可能であり、利益を生みます。これらの金属はまた、エレクトロニクス、自動車、再生可能エネルギーといった様々な産業にとって極めて重要であり、一定の需要が保証されています。リサイクル技術における技術革新は、金属回収の有効性と精度を高めており、この分野の成長にさらに貢献しています。さらに、資源保護と循環経済の原則に対する世界の関心の高まりは、採掘への依存を避け、環境悪化を最小限に抑えるために、金属の回収と再利用を促進しています。

北米、特に米国は、太陽光発電設備の非常に高い成長率、規制状況の開拓、環境意識の高まりの相乗効果により、ソーラーパネルリサイクル市場において最も急速に拡大しています。米国では、政府の優遇措置、太陽光発電技術のコスト削減、クリーンエネルギーに対する企業や消費者の旺盛な需要を背景に、過去10年間に太陽光発電容量が飛躍的に増加しました。その結果、相当数のソーラーパネルが寿命を迎え、効果的なリサイクル・メカニズムが急務となっています。さらに、米国連邦政府と一部の州は、環境への悪影響を減らし、資源の持続可能な利用を確保するため、ソーラーパネルを含む電子廃棄物の処理について、ますます厳しい規制と政策を課し始めています。カリフォルニア州やワシントン州などでは、拡大生産者責任(EPR)制度やソーラーパネル廃棄物の埋め立て禁止が、メーカーや設置業者にリサイクル制度の利用を促し、市場のさらなる発展を促しています。最先端のリサイクル技術に対する官民の投資も増加傾向にあり、シリコン、ガラス、金属などの貴重な材料の回収率を高めています。さらに、循環経済や持続可能性の原則に対する企業や消費者の関心の高まりが、ソーラー製品の責任ある使用済み製品管理に対する需要に拍車をかけています。

当レポートでは、世界のソーラーパネルリサイクル市場について調査し、タイプ別、耐用年数別、プロセス別、材質別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 生成AI

第6章 業界動向

- イントロダクション

- 顧客ビジネスに影響を与える動向/混乱

- バリューチェーン分析

- 2025年の米国関税の影響

- 投資情勢と資金調達シナリオ

- 価格分析

- エコシステム分析

- 技術分析

- 特許分析

- 貿易分析

- 主要な会議とイベント

- 関税と規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- マクロ経済見通し

- ケーススタディ分析

第7章 ソーラーパネルリサイクル市場(タイプ別)

- イントロダクション

- 多結晶

- 単結晶

- その他

第8章 ソーラーパネルリサイクル市場(耐用年数別)

- イントロダクション

- 早期損失

- 通常損失

第9章 ソーラーパネルリサイクル市場(プロセス別)

- イントロダクション

- 機械

- ハイブリッド

第10章 ソーラーパネルリサイクル市場(材質別)

- イントロダクション

- シリコン

- 金属

- プラスチック

- ガラス

- その他

第11章 ソーラーパネルリサイクル市場(地域別)

- イントロダクション

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- イタリア

- フランス

- 英国

- スペイン

- ロシア

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 市場シェア分析、2024年

- 収益分析、2021年~2025年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- ブランド/製品比較

- 企業評価と財務指標

- 競合シナリオと動向

第13章 企業プロファイル

- 主要参入企業

- FIRST SOLAR

- REILING GMBH & CO. KG

- THE RETROFIT COMPANIES, INC.

- RINOVASOL GLOBAL SERVICES B. V.

- ROSI

- WE RECYCLE SOLAR

- SILCONTEL LTD

- ETAVOLT PTE. LTD.

- PV INDUSTRIES

- SOLARCYCLE, INC.

- その他の企業

- VEOLIA

- CLEANLITES RECYCLING

- AERISOUL METAL & ENERGY CORPORATION

- ENVARIS GMBH

- ELECSOME

- FABTECH

- H&H PRO LIMITED

- INTERCO TRADING, INC.

- SOLUCCIONA ENERGIA

- RECYCLE SOLAR

- IMMARK AG

- COMMERCIAL SOLAR PANEL RECYCLING

- RECYCLE1234.COM

- SUNR

- YOUSOLAR SRL

第14章 付録

List of Tables

- TABLE 1 INCLUSIONS & EXCLUSIONS

- TABLE 2 KEY PRIMARY SOURCES

- TABLE 3 KEY PARTICIPANTS FROM PRIMARY INTERVIEWS

- TABLE 4 GROWTH FORECAST MODEL WITH FACTORS

- TABLE 5 RISK ASSESSMENT

- TABLE 6 AVERAGE SELLING PRICE TREND OF SOLAR PANEL RECYCLING MARKET, BY REGION, 2021-2024 (USD/PANEL)

- TABLE 7 AVERAGE SELLING PRICE TREND OF SOLAR PANEL RECYCLING MARKET, BY TYPE, 2021-2024 (USD/PANEL)

- TABLE 8 AVERAGE SELLING PRICE OF SOLAR PANEL RECYCLING MARKET AMONG KEY PLAYERS, BY TYPE, 2024 (USD/PANEL)

- TABLE 9 SOLAR PANEL RECYCLING MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 10 SOLAR PANEL RECYCLING MARKET: KEY TECHNOLOGIES

- TABLE 11 SOLAR PANEL RECYCLING MARKET: COMPLEMENTARY TECHNOLOGIES

- TABLE 12 SOLAR PANEL RECYCLING MARKET: ADJACENT TECHNOLOGIES

- TABLE 13 SOLAR PANEL RECYCLING MARKET: TOTAL NUMBER OF PATENTS, 2015-2024

- TABLE 14 SOLAR PANEL RECYCLING: LIST OF KEY PATENT OWNERS

- TABLE 15 SOLAR PANEL RECYCLING: LIST OF KEY PATENTS, 2015-2024

- TABLE 16 SOLAR PANEL RECYCLING MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2025-2026

- TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 LIST OF REGULATIONS FOR SOLAR PANEL RECYCLING MARKET

- TABLE 23 SOLAR PANEL RECYCLING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 24 INFLUENCE OF INSTITUTIONAL BUYERS ON BUYING PROCESS FOR TOP SOLAR PANEL RECYCLING PROCESSES

- TABLE 25 KEY BUYING CRITERIA FOR PANELS RECYCLED BY KEY PROCESSES

- TABLE 26 GDP TRENDS AND FORECASTS, BY KEY COUNTRY, 2023-2025 (USD MILLION)

- TABLE 27 SOLAR PANEL RECYCLING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 28 SOLAR PANEL RECYCLING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 29 SOLAR PANEL RECYCLING MARKET, BY TYPE, 2021-2024 (MILLION PANELS)

- TABLE 30 SOLAR PANEL RECYCLING MARKET, BY TYPE, 2025-2030 (MILLION PANELS)

- TABLE 31 SOLAR PANEL RECYCLING MARKET, BY SHELF LIFE, 2021-2024 (USD MILLION)

- TABLE 32 SOLAR PANEL RECYCLING MARKET, BY SHELF LIFE, 2025-2030 (USD MILLION)

- TABLE 33 SOLAR PANEL RECYCLING MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 34 SOLAR PANEL RECYCLING MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 35 SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 36 SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 37 SOLAR PANEL RECYCLING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 SOLAR PANEL RECYCLING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 SOLAR PANEL RECYCLING MARKET, BY REGION, 2021-2024 (MILLION PANELS)

- TABLE 40 SOLAR PANEL RECYCLING MARKET, BY REGION, 2025-2030 (MILLION PANELS)

- TABLE 41 ASIA PACIFIC: SOLAR PANEL RECYCLING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 42 ASIA PACIFIC: SOLAR PANEL RECYCLING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 43 ASIA PACIFIC: SOLAR PANEL RECYCLING MARKET, BY COUNTRY, 2021-2024 (MILLION PANELS)

- TABLE 44 ASIA PACIFIC: SOLAR PANEL RECYCLING MARKET, BY COUNTRY, 2025-2030 (MILLION PANELS)

- TABLE 45 ASIA PACIFIC: SOLAR PANEL RECYCLING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 46 ASIA PACIFIC: SOLAR PANEL RECYCLING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 47 ASIA PACIFIC: SOLAR PANEL RECYCLING MARKET, BY TYPE, 2021-2024 (MILLION PANELS)

- TABLE 48 ASIA PACIFIC: SOLAR PANEL RECYCLING MARKET, BY TYPE, 2025-2030 (MILLION PANELS)

- TABLE 49 ASIA PACIFIC: SOLAR PANEL RECYCLING MARKET, BY SHELF LIFE, 2021-2024 (USD MILLION)

- TABLE 50 ASIA PACIFIC: SOLAR PANEL RECYCLING MARKET, BY SHELF LIFE, 2025-2030 (USD MILLION)

- TABLE 51 ASIA PACIFIC: SOLAR PANEL RECYCLING MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 52 ASIA PACIFIC: SOLAR PANEL RECYCLING MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 53 ASIA PACIFIC: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 54 ASIA PACIFIC: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 55 CHINA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 56 CHINA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 57 JAPAN: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 58 JAPAN: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 59 SOUTH KOREA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 60 SOUTH KOREA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 61 INDIA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 62 INDIA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 63 AUSTRALIA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 64 AUSTRALIA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 65 REST OF ASIA PACIFIC: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 66 REST OF ASIA PACIFIC: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 68 NORTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY COUNTRY, 2021-2024 (MILLION PANELS)

- TABLE 70 NORTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY COUNTRY, 2025-2030 (MILLION PANELS)

- TABLE 71 NORTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 72 NORTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 73 NORTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY TYPE, 2021-2024 (MILLION PANELS)

- TABLE 74 NORTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY TYPE, 2025-2030 (MILLION PANELS)

- TABLE 75 NORTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY SHELF LIFE, 2021-2024 (USD MILLION)

- TABLE 76 NORTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY SHELF LIFE, 2025-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 78 NORTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 80 NORTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 81 US: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 82 US: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 83 CANADA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 84 CANADA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 85 MEXICO: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 86 MEXICO: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 87 EUROPE: SOLAR PANEL RECYCLING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 88 EUROPE: SOLAR PANEL RECYCLING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 89 EUROPE: SOLAR PANEL RECYCLING MARKET, BY COUNTRY, 2021-2024 (MILLION PANELS)

- TABLE 90 EUROPE: SOLAR PANEL RECYCLING MARKET, BY COUNTRY, 2025-2030 (MILLION PANELS)

- TABLE 91 EUROPE: SOLAR PANEL RECYCLING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 92 EUROPE: SOLAR PANEL RECYCLING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 93 EUROPE: SOLAR PANEL RECYCLING MARKET, BY TYPE, 2021-2024 (MILLION PANELS)

- TABLE 94 EUROPE: SOLAR PANEL RECYCLING MARKET, BY TYPE, 2025-2030 (MILLION PANELS)

- TABLE 95 EUROPE: SOLAR PANEL RECYCLING MARKET, BY SHELF LIFE, 2021-2024 (USD MILLION)

- TABLE 96 EUROPE: SOLAR PANEL RECYCLING MARKET, BY SHELF LIFE, 2025-2030 (USD MILLION)

- TABLE 97 EUROPE: SOLAR PANEL RECYCLING MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 98 EUROPE: SOLAR PANEL RECYCLING MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 99 EUROPE: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 100 EUROPE: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 101 GERMANY: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 102 GERMANY: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 103 ITALY: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 104 ITALY: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 105 FRANCE: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 106 FRANCE: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 107 UK: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 108 UK: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 109 SPAIN: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 110 SPAIN: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 111 RUSSIA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 112 RUSSIA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 113 REST OF EUROPE: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 114 REST OF EUROPE: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: SOLAR PANEL RECYCLING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: SOLAR PANEL RECYCLING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: SOLAR PANEL RECYCLING MARKET, BY COUNTRY, 2021-2024 (MILLION PANELS)

- TABLE 118 MIDDLE EAST & AFRICA: SOLAR PANEL RECYCLING MARKET, BY COUNTRY, 2025-2030 (MILLION PANELS)

- TABLE 119 MIDDLE EAST & AFRICA: SOLAR PANEL RECYCLING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: SOLAR PANEL RECYCLING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: SOLAR PANEL RECYCLING MARKET, BY TYPE, 2021-2024 (MILLION PANELS)

- TABLE 122 MIDDLE EAST & AFRICA: SOLAR PANEL RECYCLING MARKET, BY TYPE, 2025-2030 (MILLION PANELS)

- TABLE 123 MIDDLE EAST & AFRICA: SOLAR PANEL RECYCLING MARKET, BY SHELF LIFE, 2021-2024 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: SOLAR PANEL RECYCLING MARKET, BY SHELF LIFE, 2025-2030 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: SOLAR PANEL RECYCLING MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: SOLAR PANEL RECYCLING MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 129 UAE: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 130 UAE: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 131 SAUDI ARABIA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 132 SAUDI ARABIA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 133 REST OF GCC COUNTRIES: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 134 REST OF GCC COUNTRIES: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 135 SOUTH AFRICA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 136 SOUTH AFRICA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 137 REST OF MIDDLE EAST & AFRICA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 138 REST OF MIDDLE EAST & AFRICA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 139 SOUTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 140 SOUTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 141 SOUTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY COUNTRY, 2021-2024 (MILLION PANELS)

- TABLE 142 SOUTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY COUNTRY, 2025-2030 (MILLION PANELS)

- TABLE 143 SOUTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 144 SOUTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 145 SOUTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY TYPE, 2021-2024 (MILLION PANELS)

- TABLE 146 SOUTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY TYPE, 2025-2030 (MILLION PANELS)

- TABLE 147 SOUTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY SHELF LIFE, 2021-2024 (USD MILLION)

- TABLE 148 SOUTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY SHELF LIFE, 2025-2030 (USD MILLION)

- TABLE 149 SOUTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 150 SOUTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 151 SOUTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 152 SOUTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 153 BRAZIL: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 154 BRAZIL: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 155 ARGENTINA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 156 ARGENTINA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 157 REST OF SOUTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 158 REST OF SOUTH AMERICA: SOLAR PANEL RECYCLING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 159 OVERVIEW OF STRATEGIES ADOPTED BY SOLAR PANEL RECYCLERS

- TABLE 160 SOLAR PANEL RECYCLING MARKET: DEGREE OF COMPETITION, 2024

- TABLE 161 SOLAR PANEL RECYCLING MARKET: TYPE FOOTPRINT, 2024

- TABLE 162 SOLAR PANEL RECYCLING MARKET: PROCESS FOOTPRINT, 2024

- TABLE 163 SOLAR PANEL RECYCLING MARKET: MATERIAL FOOTPRINT, 2024

- TABLE 164 SOLAR PANEL RECYCLING MARKET: REGIONAL FOOTPRINT, 2024

- TABLE 165 SOLAR PANEL RECYCLING MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2024

- TABLE 166 SOLAR PANEL RECYCLING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 167 SOLAR PANEL RECYCLING MARKET: PRODUCT LAUNCHES, JANUARY 2021-APRIL 2025

- TABLE 168 SOLAR PANEL RECYCLING MARKET: DEALS, JANUARY 2021-APRIL 2025

- TABLE 169 SOLAR PANEL RECYCLING MARKET: EXPANSIONS, JANUARY 2021-APRIL 2025

- TABLE 170 SOLAR PANEL RECYCLING MARKET: OTHER DEVELOPMENTS, JANUARY 2021-APRIL 2025

- TABLE 171 FIRST SOLAR: COMPANY OVERVIEW

- TABLE 172 FIRST SOLAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 FIRST SOLAR: DEALS

- TABLE 174 FIRST SOLAR: OTHER DEVELOPMENTS

- TABLE 175 REILING GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 176 REILING GMBH & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 REILING GMBH & CO. KG: PRODUCT LAUNCHES

- TABLE 178 REILING GMBH & CO. KG: DEALS

- TABLE 179 REILING GMBH & CO. KG: EXPANSIONS

- TABLE 180 REILING GMBH & CO. KG: OTHER DEVELOPMENTS

- TABLE 181 THE RETROFIT COMPANIES, INC.: COMPANY OVERVIEW

- TABLE 182 THE RETROFIT COMPANIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 RINOVASOL GLOBAL SERVICES B. V.: COMPANY OVERVIEW

- TABLE 184 RINOVASOL GLOBAL SERVICES B. V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 RINOVASOL GLOBAL SERVICES B. V.: DEALS

- TABLE 186 RINOVASOL GLOBAL SERVICES B. V.: EXPANSIONS

- TABLE 187 ROSI: COMPANY OVERVIEW

- TABLE 188 ROSI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 ROSI: DEALS

- TABLE 190 ROSI: EXPANSIONS

- TABLE 191 ROSI: OTHER DEVELOPMENTS

- TABLE 192 WE RECYCLE SOLAR: COMPANY OVERVIEW

- TABLE 193 WE RECYCLE SOLAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 WE RECYCLE SOLAR: DEALS

- TABLE 195 WE RECYCLE SOLAR: EXPANSIONS

- TABLE 196 WE RECYCLE SOLAR: OTHER DEVELOPMENTS

- TABLE 197 SILCONTEL LTD: COMPANY OVERVIEW

- TABLE 198 SILCONTEL LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 ETAVOLT PTE. LTD.: COMPANY OVERVIEW

- TABLE 200 ETAVOLT PTE. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 ETAVOLT PTE. LTD.: DEVELOPMENTS

- TABLE 202 PV INDUSTRIES: COMPANY OVERVIEW

- TABLE 203 PV INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 PV INDUSTRIES: DEALS

- TABLE 205 PV INDUSTRIES: OTHER DEVELOPMENTS

- TABLE 206 SOLARCYCLE, INC.: COMPANY OVERVIEW

- TABLE 207 SOLARCYCLE, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 SOLARCYCLE, INC.: DEALS

- TABLE 209 SOLARCYCLE, INC.: EXPANSIONS

- TABLE 210 SOLARCYCLE, INC.: OTHER DEVELOPMENTS

- TABLE 211 VEOLIA: COMPANY OVERVIEW

- TABLE 212 CLEANLITES RECYCLING: COMPANY OVERVIEW

- TABLE 213 AERISOUL METAL & ENERGY CORPORATION: COMPANY OVERVIEW

- TABLE 214 ENVARIS GMBH: COMPANY OVERVIEW

- TABLE 215 ELECSOME: COMPANY OVERVIEW

- TABLE 216 FABTECH: COMPANY OVERVIEW

- TABLE 217 H&H PRO LIMITED: COMPANY OVERVIEW

- TABLE 218 INTERCO TRADING INC.: COMPANY OVERVIEW

- TABLE 219 SOLUCCIONA ENERGIA: COMPANY OVERVIEW

- TABLE 220 RECYCLE SOLAR: COMPANY OVERVIEW

- TABLE 221 IMMARK AG: COMPANY OVERVIEW

- TABLE 222 COMMERCIAL SOLAR PANEL RECYCLING: COMPANY OVERVIEW

- TABLE 223 RECYCLE1234.COM: COMPANY OVERVIEW

- TABLE 224 SUNR: COMPANY OVERVIEW

- TABLE 225 YOUSOLAR SRL: COMPANY OVERVIEW

List of Figures

- FIGURE 1 SOLAR PANEL RECYCLING MARKET SEGMENTATION AND REGIONAL SNAPSHOT

- FIGURE 2 STUDY YEARS CONSIDERED

- FIGURE 3 SOLAR PANEL RECYCLING MARKET: RESEARCH DESIGN

- FIGURE 4 KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 KEY DATA FROM PRIMARY SOURCES

- FIGURE 6 BREAKDOWN OF INTERVIEWS WITH EXPERTS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 8 SUPPLY-SIDE ANALYSIS

- FIGURE 9 DEMAND-SIDE ANALYSIS

- FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS

- FIGURE 11 SOLAR PANEL RECYCLING MARKET: DATA TRIANGULATION

- FIGURE 12 RESEARCH ASSUMPTIONS

- FIGURE 13 FACTOR ANALYSIS

- FIGURE 14 POLYCRYSTALLINE TYPE TO LEAD MARKET BETWEEN 2025 AND 2030

- FIGURE 15 SOLAR PANELS RECYCLED USING HYBRID PROCESS TO LEAD MARKET BETWEEN 2025 AND 2030

- FIGURE 16 SOLAR PANELS RECYCLED DUE TO EARLY LOSS TO LEAD MARKET BETWEEN 2025 AND 2030

- FIGURE 17 METAL SOLAR PANEL RECYCLING TO LEAD MARKET BETWEEN 2025 AND 2030

- FIGURE 18 NORTH AMERICA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 19 GROWING DEMAND FROM WASTE MANAGEMENT AND RECYCLING SECTORS TO DRIVE MARKET

- FIGURE 20 POLYCRYSTALLINE SOLAR PANEL RECYCLING TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 21 GERMANY TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SOLAR PANEL RECYCLING MARKET

- FIGURE 23 USE OF GENERATIVE AI IN SOLAR PANEL RECYCLING MARKET

- FIGURE 24 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 OVERVIEW OF SOLAR PANEL RECYCLING MARKET VALUE CHAIN

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO IN SOLAR PANEL RECYCLING MARKET, 2022-2024 (USD MILLION)

- FIGURE 27 AVERAGE SELLING PRICE TREND OF SOLAR PANEL RECYCLING MARKET, BY REGION, 2021-2024 (USD/PANEL)

- FIGURE 28 AVERAGE SELLING PRICE TREND OF SOLAR PANEL RECYCLING MARKET AMONG KEY PLAYERS, BY TYPE, 2024 (USD/PANEL)

- FIGURE 29 SOLAR PANEL RECYCLING MARKET: ECOSYSTEM

- FIGURE 30 PATENTS GRANTED OVER LAST 10 YEARS, 2015-2024

- FIGURE 31 SOLAR PANEL RECYCLING MARKET: LEGAL STATUS OF PATENTS, 2015-2024

- FIGURE 32 PATENTS ANALYSIS FOR SOLAR PANEL RECYCLING MARKET, BY JURISDICTION, 2015-2024

- FIGURE 33 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENTS IN LAST 10 YEARS

- FIGURE 34 IMPORTS OF SOLAR PANEL RECYCLING, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 35 EXPORTS OF SOLAR PANEL RECYCLING, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 36 PORTER'S FIVE FORCES ANALYSIS: SOLAR PANEL RECYCLING MARKET

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON TOP RECYCLING PROCESSES

- FIGURE 38 KEY BUYING CRITERIA FOR PANELS RECYCLED BY KEY PROCESSES

- FIGURE 39 POLYCRYSTALLINE TO LEAD SOLAR PANEL RECYCLING MARKET IN 2025

- FIGURE 40 EARLY LOSS TO LEAD THE SOLAR PANEL RECYCLING MARKET IN 2025

- FIGURE 41 HYBRID PROCESS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 42 METAL TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 43 NORTH AMERICA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 44 ASIA PACIFIC: SOLAR PANEL RECYCLING MARKET SNAPSHOT

- FIGURE 45 NORTH AMERICA: SOLAR PANEL RECYCLING MARKET SNAPSHOT

- FIGURE 46 EUROPE: SOLAR PANEL RECYCLING MARKET SNAPSHOT

- FIGURE 47 SOLAR PANEL RECYCLING MARKET SHARE ANALYSIS, 2024

- FIGURE 48 REVENUE ANALYSIS OF KEY PLAYERS, 2021-2025 (USD BILLION)

- FIGURE 49 SOLAR PANEL RECYCLING MARKET: COMPANY EVALUATION MATRIX, KEY PLAYERS, 2024

- FIGURE 50 SOLAR PANEL RECYCLING MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 51 SOLAR PANEL RECYCLING MARKET: COMPANY EVALUATION MATRIX, STARTUPS/SMES, 2024

- FIGURE 52 BRAND/PRODUCT COMPARATIVE ANALYSIS, BY SOLAR PANEL RECYCLING

- FIGURE 53 SOLAR PANEL RECYCLING MARKET: EV/ EBITDA, 5-YEAR STOCK BETA, AND YEAR-TO-DATE (YTD) PRICE TOTAL RETURN

- FIGURE 54 FIRST SOLAR: COMPANY SNAPSHOT

The solar panel recycling market size is projected to grow from USD 0.46 billion in 2025 to USD 1.12 billion by 2030, registering a CAGR of 19.5% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Type, Shelf life, Process, Material, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and South America |

Demand for solar panel recycling is spurred by various drivers, such as the high rate of solar energy installation across the globe, which leads to the generation of high quantities of end-of-life solar panels in need of environmentally friendly disposal. Concerns over electronic waste and the negative effects of harmful disposal further drive recycling efforts. Moreover, the strict government policies and regulations in Europe, North America, and Asia require the environmentally responsible waste management of solar panels, which supports recycling. Economic benefits are also important, as recoverable materials such as silicon, silver, aluminum, and glass can be reused and recycled, limiting raw material extraction.

" Polycrystalline segment to be the fastest-growing type of the solar panel recycling market in terms of value during the forecast period, (2025-2030)"

Polycrystalline solar panels is projected to be the fastest-growing type of the solar panel recycling market mainly because they are most commonly used and have a lower operational life compared to monocrystalline solar panels. Polycrystalline panels have traditionally been cheaper and less difficult to manufacture, resulting in their large-scale implementation in commercial solar installations in emerging and developed economies. Consequently, they capture a large portion of the world's installed solar capacity. However, polycrystalline panels generally have reduced efficiency and shorter lifespans than monocrystalline panels and result in earlier replacement cycles and increased volumes of waste at the end-of-life stage. It is this increasing number of retired polycrystalline panels that is driving demand for effective recycling solutions. Regulatory policies in economies such as Europe, North America, and Asia are further encouraging the recycling of older panels, especially those made from polycrystalline silicon.

"Early loss is projected to be the fastest-growing shelf life segment of the solar panel recycling market in terms of value, during the forecast period, (2025-2030)"

The early loss segment is the most rapidly growing in the solar panel recycling industry because of the increasing number of solar panels decommissioned early. The causes of early loss include defects at the manufacturing stages, low-quality materials, faulty installation, extreme weather conditions, and accidental damage during handling or maintenance. As global solar uptake gains pace, particularly in markets with ambitious deployment targets, the sheer volume of installations increases the likelihood of early failures. Panels tend to be replaced in fewer than five years of operation due to performance degradation, safety reasons, or because more efficient technology is available. This creates large quantities of solar waste earlier than expected, prompting the urgent need for proper recycling methods. Additionally, utility-scale solar projects tend to undergo partial failures wherein the defective panels are replaced in batches, adding to the early loss volume.

"Mechanical to be fastest-growing process segment of solar panel recycling market in terms of value, during the forecast period, (2025-2030)"

Mechanical recycling is the most rapidly growing segment in the solar panel recycling industry because it is cost-effective, scalable, and easy to operate. This is done through the physical dismantling of the solar panels via shredding, crushing, and sorting methods to retrieve materials like aluminum frames, glass, copper wiring, and junction boxes. In contrast to chemical or heat processes, mechanical recycling does not involve costly machinery or toxic chemicals, thus, is more economically and environmentally friendly for mass application. In addition, materials recycled through mechanical recycling, particularly aluminum and glass, can be used directly in other industries as in a circular economy. Regulations by governments and recycling requirements in regions such as Europe and North America are also driving the use of standardized, low-cost recycling technologies, such as mechanical separation. Further, improvements in automation and material sorting technologies are also increasing the recovery rates and profitability of mechanical recycling.

"Metal to be the fastest-growing material segment of the solar panel recycling market in terms of value, during the forecast period, (2025-2030)"

Metals represent the most rapidly expanding material segment of the solar panel recycling industry because they hold high economic value, strong industrial demand, and ease of recovery in comparison to other elements. Solar panels are composed of several precious metals, including aluminum, copper, and silver. Aluminum is commonly used for panel frames, copper is utilized in electrical wiring and connections, and silver is utilized in photovoltaic cells for the transmission of electricity. As the numbers of retired solar panels rise, the potential to reclaim the metals has become increasingly appealing to manufacturers and recyclers. The premium market prices for copper and silver, in particular, make their recovery economically feasible and lucrative even from the smaller amounts recovered. These metals are also crucial to various industries, such as electronics, automotive, and renewable energy, which guarantee constant demand. Technological innovations in the recycling technology are enhancing the effectiveness and accuracy of metal recovery, thus further contributing to the growth of this sector. Moreover, increasing worldwide focus on the conservation of resources and principles of circular economy are promoting the recovery and reuse of metals to avoid dependence on mining and minimize environmental deterioration.

"North America is projected to be the fastest-growing region in the solar panel recycling market in terms of value, during the forecast period, (2025-2030)"

North America, and specifically the US, is the most rapidly expanding market in solar panel recycling as a result of the synergy of very high growth rates in solar installations, developing regulatory landscapes, and increased environmental consciousness. The US has experienced exponential growth in solar capacity during the last decade on the basis of government incentives, reducing costs of photovoltaic technology, and robust corporate and consumer demand for clean energy. Consequently, considerable numbers of solar panels are reaching the end of their lifespan, leading to the urgent requirement for effective recycling mechanisms. Furthermore, the US federal government and some states have started imposing increasingly stringent regulations and policies for dealing with electronic waste, including solar panels, to reduce the negative impacts on the environment and ensure the sustainable use of resources. Extended Producer Responsibility (EPR) programs and solar panel waste landfill bans in states such as California and Washington are prompting manufacturers and installers to use recycling programs, driving further market development. Public and private investments in state-of-the-art recycling technologies are also on the rise, enhancing recovery rates of valuable materials, including silicon, glass, and metals. In addition, increased corporate and consumer focus on the circular economy and sustainability principles is spurring demand for responsible end-of-life management of solar products.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the solar panel recycling market, and information was gathered through secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 35%, Tier 2 - 35%, and Tier 3 - 30%

- By Designation: Managers- 30%, Directors - 10%, and Others - 60%

- By Region: Europe - 30%, North America - 25%, Asia-Pacific - 25%, Middle East & Africa - 10%, South America - 10%

The solar panel recycling market comprises major players, such as First Solar (US), Reiling GmbH & Co. KG (Germany), The Retrofit Companies, Inc. (US), Rinovasol Global Services B. V. (Netherlands), ROSI (France), We Recycle Solar (US), SILCONTEL LTD (Israel), Etavolt Pte. Ltd. (Singapore), PV Industries (Australia), and SOLARCYCLE, Inc. (US). The study includes an in-depth competitive analysis of these key players in the solar panel recycling market, along with their company profiles, recent developments, and key market strategies adopted.

Research Coverage

This report segments the market for solar panel recycling on the basis of type, shelf life, process, material, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, and expansions associated with the market for solar panel recycling.

Key Benefits of Buying this Report

This research report focuses on various levels of analyses - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the solar panel recycling market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of Drivers: (Increasing value of recycled materials), restraints (Technological limitations in material extraction), opportunities (Supportive government initiatives), and challenges (High cost of recycling than landfilling) influencing the growth of the solar panel recycling market.

- Market Penetration: Comprehensive information on solar panel recycling offered by the top players in the global solar panel recycling market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, expansions, joint ventures, collaborations, and partnerships in the solar panel recycling market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for solar panel recycling across regions.

- Market Capacity: Production capacities of solar panel recycling companies are provided wherever available with upcoming capacities for the solar panel recycling market.

- Competitive Assessment: In-depth assessment of shares, strategies, products, and manufacturing capabilities of leading players in the solar panel recycling market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SNAPSHOTS

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 STUDY UNITS CONSIDERED

- 1.4.1 CURRENCY/VALUE UNIT

- 1.4.2 VOLUME UNIT

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.1.2.3 Key participants from primary interviews

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.2.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 2.3 GROWTH FORECAST

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 GROWTH FORECAST

- 2.8 RISK ASSESSMENT

- 2.9 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SOLAR PANEL RECYCLING MARKET

- 4.2 SOLAR PANEL RECYCLING MARKET, BY TYPE

- 4.3 SOLAR PANEL RECYCLING MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increase in value of recycled materials

- 5.2.1.2 Need to reduce electronic waste and landfills

- 5.2.1.3 Growth in volume of recyclable material

- 5.2.2 RESTRAINTS

- 5.2.2.1 Technological limitations in material extraction

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Supportive government initiatives

- 5.2.3.2 AI and robotics integration to improve solar panel recycling accuracy

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of accessible, dedicated solar panel recycling plants in most regions

- 5.2.4.2 Higher cost of recycling than landfilling

- 5.2.1 DRIVERS

- 5.3 GENERATIVE AI

- 5.3.1 INTRODUCTION

- 5.3.2 IMPACT ON SOLAR PANEL RECYCLING MARKET

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 COLLECTION OF END-OF-LIFE SOLAR PANELS

- 6.3.2 MATERIAL RECOVERY AND SEPARATION

- 6.3.3 MANUFACTURING OF RECYCLED MATERIALS

- 6.3.4 END CONSUMERS

- 6.4 IMPACT OF 2025 US TARIFFS

- 6.4.1 INTRODUCTION

- 6.4.2 KEY TARIFF RATES

- 6.4.3 PRICE IMPACT ANALYSIS

- 6.4.4 IMPACT ON REGION

- 6.4.4.1 North America

- 6.4.4.2 Europe

- 6.4.4.3 Asia Pacific

- 6.4.5 IMPACT ON MATERIALS

- 6.5 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE TREND OF SOLAR PANEL RECYCLING MARKET, BY REGION

- 6.6.2 AVERAGE SELLING PRICE TREND OF SOLAR PANEL RECYCLING MARKET, BY TYPE

- 6.6.3 AVERAGE SELLING PRICE TREND OF SOLAR PANEL RECYCLING MARKET AMONG KEY PLAYERS, BY TYPE

- 6.7 ECOSYSTEM ANALYSIS

- 6.8 TECHNOLOGY ANALYSIS

- 6.8.1 KEY TECHNOLOGIES

- 6.8.2 COMPLEMENTARY TECHNOLOGIES

- 6.8.3 ADJACENT TECHNOLOGIES

- 6.9 PATENT ANALYSIS

- 6.9.1 METHODOLOGY

- 6.9.2 PATENTS GRANTED WORLDWIDE

- 6.9.2.1 Patent publication trends

- 6.9.3 INSIGHTS

- 6.9.4 LEGAL STATUS OF PATENTS

- 6.9.5 JURISDICTION ANALYSIS

- 6.9.6 TOP APPLICANTS

- 6.9.7 LIST OF KEY PATENTS

- 6.10 TRADE ANALYSIS

- 6.10.1 IMPORT SCENARIO (HS CODE 854140)

- 6.10.2 EXPORT SCENARIO (HS CODE 854140)

- 6.11 KEY CONFERENCES & EVENTS

- 6.12 TARIFF AND REGULATORY LANDSCAPE

- 6.12.1 TARIFF DATA RELATED TO SOLAR PANEL RECYCLING MARKET

- 6.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12.3 REGULATIONS RELATED TO SOLAR PANEL RECYCLING MARKET

- 6.13 PORTER'S FIVE FORCES ANALYSIS

- 6.13.1 THREAT OF SUBSTITUTES

- 6.13.2 THREAT OF NEW ENTRANTS

- 6.13.3 BARGAINING POWER OF SUPPLIERS

- 6.13.4 BARGAINING POWER OF BUYERS

- 6.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

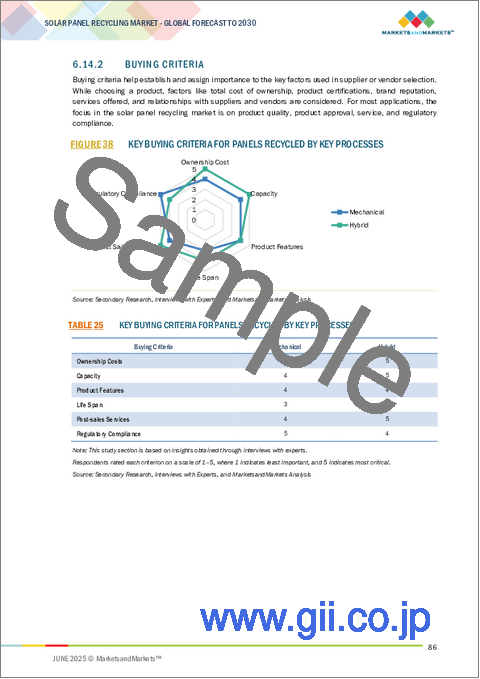

- 6.14.2 BUYING CRITERIA

- 6.15 MACROECONOMIC OUTLOOK

- 6.15.1 GDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

- 6.16 CASE STUDY ANALYSIS

- 6.16.1 RECYCLING END-OF-LIFE SOLAR PHOTOVOLTAIC (PV) PANELS: CHALLENGES, OPPORTUNITIES, AND CURRENT STATE OF RECYCLING TECHNOLOGIES

- 6.16.2 DOE'S ACTION PLAN FOR SAFE AND RESPONSIBLE HANDLING OF PHOTOVOLTAIC END-OF-LIFE MATERIALS TO SUPPORT SOLAR ENERGY DEPLOYMENT AND DECARBONIZATION

7 SOLAR PANEL RECYCLING MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 POLYCRYSTALLINE

- 7.2.1 ENVIRONMENTALLY AND ECONOMICALLY EFFICIENT OPTIONS TO DRIVE MARKET

- 7.3 MONOCRYSTALLINE

- 7.3.1 SUPERIOR SILICON QUALITY AND LONG-TERM ECONOMIC RETURNS TO FUEL GROWTH

- 7.4 OTHER TYPES

- 7.4.1 CADMIUM TELLURIDE (CDTE)

- 7.4.2 COPPER INDIUM GALLIUM SELENIDE (CIGS)

8 SOLAR PANEL RECYCLING MARKET, BY SHELF LIFE

- 8.1 INTRODUCTION

- 8.2 EARLY LOSS

- 8.2.1 ACCELERATED WEAR NECESSITATES EARLY SOLAR WASTE RECOVERY AND RECYCLING SOLUTIONS

- 8.3 NORMAL LOSS

- 8.3.1 AGING PANELS CREATE OPPORTUNITIES FOR SCALABLE AND COST-EFFECTIVE RECYCLING

9 SOLAR PANEL RECYCLING MARKET, BY PROCESS

- 9.1 INTRODUCTION

- 9.2 MECHANICAL

- 9.2.1 WIDE USE AND COST-EFFECTIVE NATURE TO DRIVE MARKET

- 9.3 HYBRID

- 9.3.1 COMPLEX PANEL DESIGNS TO PUSH DEMAND FOR MULTISTEP RECYCLING APPROACHES

- 9.3.1.1 Mechanical + Chemical

- 9.3.1.2 Mechanical + Thermal

- 9.3.1.3 Mechanical + Chemical + Thermal

- 9.3.1 COMPLEX PANEL DESIGNS TO PUSH DEMAND FOR MULTISTEP RECYCLING APPROACHES

10 SOLAR PANEL RECYCLING MARKET, BY MATERIAL

- 10.1 INTRODUCTION

- 10.2 SILICON

- 10.2.1 NEED FOR EFFICIENCY IN ENERGY CONVERSION TO DRIVE MARKET

- 10.3 METAL

- 10.3.1 REDUCTION IN DEMAND FOR VIRGIN MATERIALS TO FOSTER SEGMENTAL GROWTH

- 10.3.2 ALUMINUM

- 10.3.2.1 Widespread use in panel construction to drive market

- 10.4 PLASTIC

- 10.4.1 ADVANCEMENTS IN RECYCLING TECHNOLOGIES TO PROPEL MARKET

- 10.5 GLASS

- 10.5.1 REGULATORY SUPPORT AND CONSUMER AWARENESS TO DRIVE MARKET

- 10.6 OTHER MATERIALS

- 10.6.1 LEAD

- 10.6.2 CADMIUM AND TELLURIUM

- 10.6.3 INDIUM AND GALLIUM

11 SOLAR PANEL RECYCLING MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Heavy capital investment to drive market

- 11.2.2 JAPAN

- 11.2.2.1 Strong manufacturing sector and government incentives to support growth

- 11.2.3 SOUTH KOREA

- 11.2.3.1 Waste management initiatives to fuel market

- 11.2.4 INDIA

- 11.2.4.1 Government investment and policies to drive adoption

- 11.2.5 AUSTRALIA

- 11.2.5.1 Waste management practices to foster growth

- 11.2.6 REST OF ASIA PACIFIC

- 11.2.1 CHINA

- 11.3 NORTH AMERICA

- 11.3.1 US

- 11.3.1.1 Increasing investment in sustainability and green projects to support adoption

- 11.3.2 CANADA

- 11.3.2.1 Increasing need to manage associated waste to drive market

- 11.3.3 MEXICO

- 11.3.3.1 Increasing demand from residential and commercial sectors to augment market scope

- 11.3.1 US

- 11.4 EUROPE

- 11.4.1 GERMANY

- 11.4.1.1 Increased solar waste to fuel market

- 11.4.2 ITALY

- 11.4.2.1 Stringent policies implemented by government for recycling to drive market

- 11.4.3 FRANCE

- 11.4.3.1 Increasing waste and investment in new recycling facilities and stringent recycling laws to support market growth

- 11.4.4 UK

- 11.4.4.1 Growing need for recycling sector to expand its capabilities to propel market

- 11.4.5 SPAIN

- 11.4.5.1 Investments by government and private organizations to drive market

- 11.4.6 RUSSIA

- 11.4.6.1 Increasing deployment of solar panels and growing environment consciousness to foster market

- 11.4.7 REST OF EUROPE

- 11.4.1 GERMANY

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 UAE

- 11.5.1.1.1 Policy support and renewable energy targets to fuel UAE solar recycling growth

- 11.5.1.2 Saudi Arabia

- 11.5.1.2.1 Economic diversification and solar energy growth to propel demand

- 11.5.1.3 Rest of GCC countries

- 11.5.1.1 UAE

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Heightened awareness of electronic waste concerns to support market growth

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Emergence of innovative technologies and growing focus on recycling to drive market

- 11.6.2 ARGENTINA

- 11.6.2.1 Increasing awareness and incentives to drive adoption

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.3.1 FIRST SOLAR (US)

- 12.3.2 REILING GMBH & CO. KG (GERMANY)

- 12.3.3 WE RECYCLE SOLAR (US)

- 12.3.4 THE RETROFIT COMPANIES, INC. (US)

- 12.3.5 SOLARCYCLE, INC. (US)

- 12.4 REVENUE ANALYSIS, 2021-2025

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Type Footprint

- 12.5.5.3 Process footprint

- 12.5.5.4 Material footprint

- 12.5.5.5 Regional footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 BRAND/PRODUCT COMPARISON

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 FIRST SOLAR

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.3.2 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strategies

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 REILING GMBH & CO. KG

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.3.3 Expansions

- 13.1.2.3.4 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strategies

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 THE RETROFIT COMPANIES, INC.

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 MnM view

- 13.1.3.3.1 Key strategies

- 13.1.3.3.2 Strategic choices

- 13.1.3.3.3 Weaknesses and competitive threats

- 13.1.4 RINOVASOL GLOBAL SERVICES B. V.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.3.2 Expansions

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strategies

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 ROSI

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.3.2 Expansions

- 13.1.5.4 Other developments

- 13.1.5.5 MnM view

- 13.1.5.5.1 Key strategies

- 13.1.5.5.2 Strategic choices

- 13.1.5.5.3 Weaknesses and competitive threats

- 13.1.6 WE RECYCLE SOLAR

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.6.3.2 Expansions

- 13.1.6.3.3 Other developments

- 13.1.6.4 MnM view

- 13.1.6.4.1 Key strategies

- 13.1.6.4.2 Strategic choices

- 13.1.6.4.3 Weaknesses and competitive threats

- 13.1.7 SILCONTEL LTD

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 MnM view

- 13.1.7.3.1 Key strategies

- 13.1.7.3.2 Strategic choices

- 13.1.7.3.3 Weaknesses and competitive threats

- 13.1.8 ETAVOLT PTE. LTD.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Developments

- 13.1.8.4 MnM view

- 13.1.8.4.1 Key strategies

- 13.1.8.4.2 Strategic choices

- 13.1.8.4.3 Weaknesses and competitive threats

- 13.1.9 PV INDUSTRIES

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.9.3.2 Other developments

- 13.1.9.4 MnM view

- 13.1.9.4.1 Key strategies

- 13.1.9.4.2 Strategic choices

- 13.1.9.4.3 Weaknesses and competitive threats

- 13.1.10 SOLARCYCLE, INC.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.10.3.2 Expansions

- 13.1.10.3.3 Other developments

- 13.1.10.4 MnM view

- 13.1.10.4.1 Key strategies

- 13.1.10.4.2 Strategic choices

- 13.1.10.4.3 Weaknesses and competitive threats

- 13.1.1 FIRST SOLAR

- 13.2 OTHER PLAYERS

- 13.2.1 VEOLIA

- 13.2.2 CLEANLITES RECYCLING

- 13.2.3 AERISOUL METAL & ENERGY CORPORATION

- 13.2.4 ENVARIS GMBH

- 13.2.5 ELECSOME

- 13.2.6 FABTECH

- 13.2.7 H&H PRO LIMITED

- 13.2.8 INTERCO TRADING, INC.

- 13.2.9 SOLUCCIONA ENERGIA

- 13.2.10 RECYCLE SOLAR

- 13.2.11 IMMARK AG

- 13.2.12 COMMERCIAL SOLAR PANEL RECYCLING

- 13.2.13 RECYCLE1234.COM

- 13.2.14 SUNR

- 13.2.15 YOUSOLAR SRL

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS