|

|

市場調査レポート

商品コード

1465229

ヒト個人識別の世界市場:市場規模、製品別、技術別、用途別、エンドユーザー別、地域別 - 2029年までの予測Human Identification Market Size by Product (Consumables, Instruments, Software), Technology, Application, End User & Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| ヒト個人識別の世界市場:市場規模、製品別、技術別、用途別、エンドユーザー別、地域別 - 2029年までの予測 |

|

出版日: 2024年04月16日

発行: MarketsandMarkets

ページ情報: 英文 232 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

ヒト個人識別の市場規模は2024年に8億米ドルになるとみられ、予測期間中に10.7%のCAGRで拡大すると予測されており、2029年には13億米ドルに達すると見込まれています。

ヒト個人識別は、法医学、親子鑑定、災害被害者識別、人類学などの用途で広く利用されており、DNA分析/プロファイリングはこの分野の重要なツールです。また、より良いヘルスケアの提供を保証し、組織化された一連の記録を作成する手段として、市民データベースの構築にも利用されています。アジア太平洋などの新興市場は、ヒト個人識別市場に有利な成長機会を提供しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 製品別、技術別、用途別、エンドユーザー別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ、GCC諸国 |

ヒト個人識別市場は消耗品、機器、ソフトウェアに二分されます。ヒト個人識別市場における消耗品セグメントは大幅な成長を遂げています。このセグメントの成長を促進する主な要因には、これらの消耗品が、ヒト個人識別に携わる機関や組織で大量に繰り返し購入されるなど、頻繁に使用されることが挙げられます。

ヒト個人識別市場は、法医学、父子鑑定、その他の用途(災害被害者識別、集団遺伝学、人身売買関連犯罪の識別、人類学)に二分されます。このような高い処理能力は、消耗品の定期的な調達やシステムの保守・交換につながり、法医学で利用されるヒト個人識別製品の大幅なシェアに拍車をかけています。

当レポートでは、世界のヒト個人識別市場について調査し、製品別、技術別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 価格分析

- バリューチェーン分析

- サプライチェーン分析

- ポーターのファイブフォース分析

- エコシステム分析

- 規制機関、政府機関、その他の組織

- 規制分析

- 特許分析

- 顧客のビジネスに影響を与える動向/混乱

- 2024年~2025年の主な会議とイベント

- 技術分析

- 主な利害関係者と購入基準

- 貿易分析

- 投資と資金調達のシナリオ

第6章 ヒト個人識別市場、製品別

- イントロダクション

- 消耗品

- 機器

- ソフトウェア

第7章 ヒト個人識別市場、技術別

- イントロダクション

- ポリメラーゼ連鎖反応

- キャピラリー電気泳動

- 次世代シーケンシング

- マイクロアレイ

- 迅速DNA分析

第8章 ヒト個人識別市場、用途別

- イントロダクション

- 法医学

- 父子鑑定

- その他

第9章 ヒト個人識別市場、エンドユーザー別

- イントロダクション

- 法医学研究所

- 研究センターおよび学術機関・政府機関

- その他

第10章 ヒト個人識別市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

- GCC諸国

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分配分析

- 市場シェア分析

- 企業評価マトリックス:主要参入企業

- 企業評価マトリックス:スタートアップ/中小企業

- ヒト個人識別ベンダーの評価と財務指標

- ブランド比較

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- THERMO FISHER SCIENTIFIC INC.

- QIAGEN N.V.

- PROMEGA CORPORATION

- HAMILTON COMPANY

- FUJIFILM WAKO PURE CHEMICAL CORPORATION

- ANDE

- AUTOGEN INC.

- INNOGENOMICS TECHNOLOGIES, LLC

- OXFORD NANOPORE TECHNOLOGIES PLC

- BODE CELLMARK FORENSICS, INC.

- その他の企業

- CAROLINA BIOLOGICAL SUPPLY COMPANY

- GENETEK BIOPHARMA GMBH

- STRMIX LIMITED

- NINGBO HEALTH GENE TECHNOLOGIES CO., LTD.

- SOFTGENETICS

- JUSTICETRAX

- GENO TECHNOLOGY INC.

- BIO-RAD LABORATORIES, INC.

- COMPLETE GENOMICS INCORPORATED

- BIONEER CORPORATION

- ABNOVA CORPORATION

- ZEISS

第13章 付録

The human identification market is valued at an estimated USD 0.8 billion in 2024 and is projected to reach USD 1.3 billion by 2029 at a CAGR of 10.7% during the forecast period. Human identification is widely used in forensics, paternity testing, disaster victim identification, and anthropology, among other applications, with DNA analysis/profiling being a key tool in this sector. It is also used in building citizen databases as a means of ensuring the provision of better healthcare and developing an organized set of records. Emeriging markets such as Asia Pacific region offer lucrative growth opportunities for human identification market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD) Billion |

| Segments | Product, technology, application and end user |

| Regions covered | North America, Europe, Asia Pacific, Latin America, the Middle East & Africa, and GCC countries |

"Consumables (Reagents & kits) segment accounted for the highest growth rate in the human identification market, by product, during the forecast period."

The human identification market is bifurcated into consumables, instruments, and software. Consumable segment in the human identification market is experiencing substantial growth. Major factors driving the growth of this segment include these consumables are frequently used in large amounts of repeat purchases by institutions and organizations that are involved in human identification.

"Forensics segment accounted for the highest growth rate in the human identification market, by application, during the forecast period."

The human identification market is bifurcated into into forensics, paternity testing, and other applications (disaster victim identification, population genetics, identification of crimes related to human trafficking, and anthropology applications). This high throughput leads to regular procurement of consumables and the maintenance or replacement of systems, adding to the substantial share of human identification products utilized in forensics.

"Asia Pacific: The fastest-growing region human identification market."

The worldwide market for human identification is categorized into North America, Europe, Asia Pacific, Latin America, the Middle East & Africa, and GCC countries. Notably, the Asia Pacific region market is expected to register the highest growth rate during the forecast period, mainly due to the increasing crime rates, rising number of forensic laboratories, and implementation of awareness campaigns and conferences on human identification and forensic sciences.

The break-up of the profile of primary participants in the human identification market:

- By Company Type: Tier 1 - 48%, Tier 2 - 36%, and Tier 3 - 16%

- By Designation: C-level - 14%, D-level - 10%, and Others - 76%

- By Region: North America - 40%, Europe - 32%, Asia Pacific - 20%, Rest of the World - 8%

The key players in this market are Thermo Fisher Scientific Inc. (US), QIAGEN N.V. (Netherlands), Promega Corporation (US), Hamilton Company (US), FUJIFILM Wako Pure Chemical Corporation (Japan), ANDE (US), AutoGen Inc. (US), InnoGenomics Technologies, LLC (US), Oxford Nanopore Technologies Plc (UK), Bode Cellmark Forensics Inc. (US), Carolina Biological Supply (US), Genetek Biopharma GmbH (Germany), STRmix Limited (New Zealand), Ningbo HEALTH Gene Technologies Co., Ltd. (China), SoftGenetics (US), JusticeTrax (US), Geno Technology, Inc.(US), Bio-Rad Laboratories, Inc. (US), Complete Genomics (US), Bioneer Corporation (Republic of Korea), Abnova Corporation (Taiwan), and ZEISS (Germany).

Research Coverage:

This research report categorizes the human identification market by product (Consumables (DNA Amplification Kits & Reagents, DNA Quantification Kits & Reagents, DNA Extraction Kits and Reagents, Rapid DNA Analysis Kits & Reagents), Instruments (Sample Preparation & Extraction Systems, DNA Quantification Systems, DNA Amplification Systems, DNA Analysis Systems), and Software), , by technology (Capillary Electrophoresis, Polymerase Chain Reaction, Microarrays, Next-generation Sequencing, Rapid DNA Analysis), by application (Forensics, Paternity Testing, Other Applications), by end user (Forensic Laboratories, Research Centers and Academic & Government Institutes, Other End Users) and region (North America, Europe, Asia Pacific, Latin America, the Middle East & Africa and GCC countries). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the human identification market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, key strategies, acquisitions, and agreements. New product & service launches and recent developments associated with the human identification market. Competitive analysis of upcoming startups in the human identification market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall human identification market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Government inititiatives for forensic programs, increasing demand for paternity testing, rise in crime rates, backlog in criminal cases, market expansion initiatives by key players, rising awareness among investigators about role of DNA profiling in criminology), restraints (high cost of forensic tools and services), opportunities (Emerging markets offer lucrative growth opportunities, increasing investments and funding for forensic research, use of rapid DNA technology in forensic science), and challenges (shortage of skilled professionals) influencing the growth of the human identification market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the human identification market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the human identification market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the human identification market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings of leading players like Thermo Fisher Scientific Inc. (US), QIAGEN N.V. (Netherlands), and Promega Corporation (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS OF STUDY

- TABLE 1 HUMAN IDENTIFICATION MARKET: INCLUSIONS & EXCLUSIONS OF STUDY

- 1.4 STUDY SCOPE

- 1.4.1 MARKET SEGMENTATION

- FIGURE 1 HUMAN IDENTIFICATION: MARKET SEGMENTATION

- 1.4.2 REGIONAL SEGMENTATION

- FIGURE 2 HUMAN IDENTIFICATION: REGIONAL SEGMENTATION

- 1.4.3 YEARS CONSIDERED

- 1.4.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.6.1 HUMAN IDENTIFICATION MARKET: RECESSION IMPACT

- 1.7 MARKET RECONCILIATION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 HUMAN IDENTIFICATION MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 4 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.3 KEY INDUSTRY INSIGHTS

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach 1: Company revenue estimation approach

- FIGURE 6 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

- 2.2.1.2 Approach 2: Presentations of companies and primary interviews

- 2.2.1.3 Approach 3: Number of instruments

- 2.2.1.4 Growth forecast

- 2.2.1.5 CAGR projections

- FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 8 HUMAN IDENTIFICATION MARKET: TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

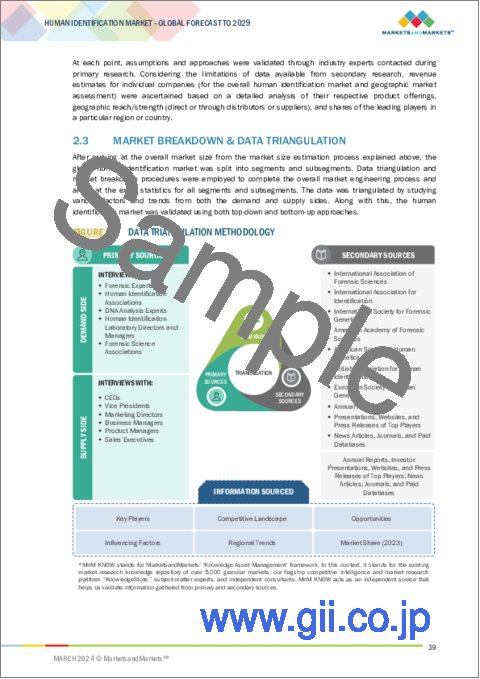

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET SHARE ANALYSIS

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

- TABLE 2 HUMAN IDENTIFICATION MARKET: RISK ASSESSMENT

- 2.8 IMPACT OF ECONOMIC RECESSION ON HUMAN IDENTIFICATION MARKET

3 EXECUTIVE SUMMARY

- FIGURE 10 HUMAN IDENTIFICATION MARKET, BY PRODUCT, 2024 VS. 2029 (USD MILLION)

- FIGURE 11 HUMAN IDENTIFICATION MARKET, BY TECHNOLOGY, 2024 VS. 2029 (USD MILLION)

- FIGURE 12 HUMAN IDENTIFICATION MARKET, BY APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 13 HUMAN IDENTIFICATION MARKET, BY END USER, 2024 VS. 2029 (USD MILLION)

- FIGURE 14 HUMAN IDENTIFICATION MARKET, BY REGION, 2024 VS. 2029 (USD MILLION)

4 PREMIUM INSIGHTS

- 4.1 HUMAN IDENTIFICATION MARKET OVERVIEW

- FIGURE 15 RISING CRIME RATE TO DRIVE MARKET

- 4.2 HUMAN IDENTIFICATION MARKET, BY PRODUCT (2024-2029)

- FIGURE 16 CONSUMABLES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 NORTH AMERICA: HUMAN IDENTIFICATION MARKET, BY PRODUCT AND COUNTRY (2023)

- FIGURE 17 CONSUMABLES ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN HUMAN IDENTIFICATION MARKET IN 2023

- 4.4 HUMAN IDENTIFICATION MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 18 ASIA PACIFIC COUNTRIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 HUMAN IDENTIFICATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Government initiatives for forensic programs

- 5.2.1.2 Increasing demand for paternity testing

- 5.2.1.3 Rise in crime rates

- 5.2.1.4 Backlog in criminal cases

- 5.2.1.5 Market expansion initiatives by key players

- 5.2.1.6 Rising awareness among investigators about role of DNA profiling in criminology

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of forensic tools and services

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging markets offer lucrative growth opportunities

- 5.2.3.2 Increasing investments and funding for forensic research

- 5.2.3.3 Use of rapid DNA technology in forensic science

- 5.2.4 CHALLENGES

- 5.2.4.1 Shortage of skilled professionals

- 5.3 PRICING ANALYSIS

- 5.3.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PRODUCT

- 5.3.2 AVERAGE SELLING PRICE TREND, BY PRODUCT

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 20 HUMAN IDENTIFICATION MARKET: VALUE CHAIN ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 21 HUMAN IDENTIFICATION MARKET: SUPPLY CHAIN ANALYSIS

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 HUMAN IDENTIFICATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.6.2 BARGAINING POWER OF SUPPLIERS

- 5.6.3 BARGAINING POWER OF BUYERS

- 5.6.4 THREAT OF NEW ENTRANTS

- 5.6.5 THREAT OF SUBSTITUTES

- 5.7 ECOSYSTEM ANALYSIS

- FIGURE 22 HUMAN IDENTIFICATION MARKET: ECOSYSTEM ANALYSIS

- 5.7.1 HUMAN IDENTIFICATION MARKET: ROLE IN ECOSYSTEM

- 5.8 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9 REGULATORY ANALYSIS

- 5.9.1 NORTH AMERICA

- 5.9.1.1 US

- TABLE 5 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 6 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- 5.9.1.2 Canada

- FIGURE 23 CANADA: REGULATORY PROCESS FOR IVD DEVICES

- 5.9.2 EUROPE

- TABLE 7 EUROPE: CLASSIFICATION OF IVD DEVICES

- 5.9.3 ASIA PACIFIC

- 5.9.3.1 Japan

- TABLE 8 JAPAN: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- 5.9.3.2 China

- TABLE 9 CHINA: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- 5.9.3.3 India

- 5.9.4 SOUTH KOREA

- TABLE 10 SOUTH KOREA: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- 5.9.1 NORTH AMERICA

- 5.10 PATENT ANALYSIS

- FIGURE 24 TOP APPLICANTS, OWNERS (COMPANIES/INSTITUTES), AND PATENT TRENDS FOR HUMAN IDENTIFICATION PRODUCTS, JANUARY 2014-DECEMBER 2023

- 5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 5.11.1 REVENUE SHIFT IN HUMAN IDENTIFICATION MARKET

- FIGURE 25 REVENUE SHIFT IN HUMAN IDENTIFICATION MARKET

- 5.12 KEY CONFERENCES & EVENTS IN 2024-2025

- TABLE 11 HUMAN IDENTIFICATION MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.13 TECHNOLOGY ANALYSIS

- 5.13.1 KEY TECHNOLOGIES

- 5.13.2 COMPLIMENTARY TECHNOLOGIES

- 5.13.3 ADJACENT TECHNOLOGIES

- 5.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF HUMAN IDENTIFICATION PRODUCTS

- TABLE 12 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF HUMAN IDENTIFICATION PRODUCTS (%)

- 5.14.2 BUYING CRITERIA

- FIGURE 27 KEY BUYING CRITERIA FOR HUMAN IDENTIFICATION PRODUCTS

- TABLE 13 KEY BUYING CRITERIA FOR HUMAN IDENTIFICATION PRODUCTS

- 5.15 TRADE ANALYSIS

- TABLE 14 IMPORT DATA FOR HS CODE 382200, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 15 EXPORT DATA FOR HS CODE 382200, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.16 INVESTMENT AND FUNDING SCENARIO

- FIGURE 28 INVESTMENT AND FUNDING SCENARIO FOR PLAYERS IN HUMAN IDENTIFICATION MARKET

6 HUMAN IDENTIFICATION MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- TABLE 16 HUMAN IDENTIFICATION MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- 6.2 CONSUMABLES

- TABLE 17 HUMAN IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 18 HUMAN IDENTIFICATION CONSUMABLES MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 19 NORTH AMERICA: HUMAN IDENTIFICATION CONSUMABLES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 20 EUROPE: HUMAN IDENTIFICATION CONSUMABLES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 21 ASIA PACIFIC: HUMAN IDENTIFICATION CONSUMABLES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

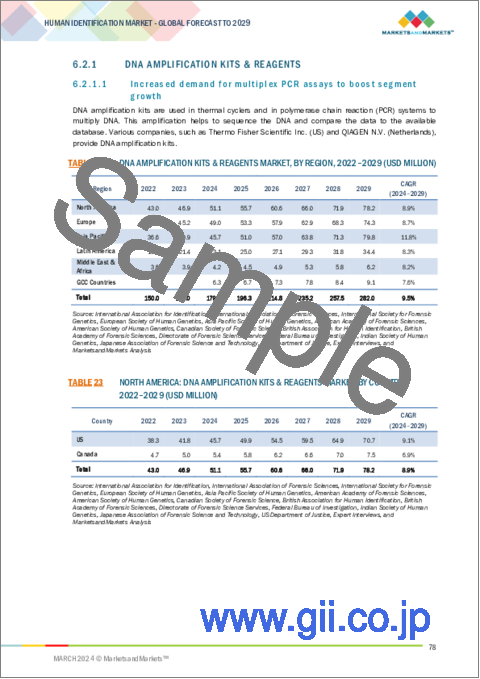

- 6.2.1 DNA AMPLIFICATION KITS & REAGENTS

- 6.2.1.1 Increased demand for multiplex PCR assays to boost segment growth

- TABLE 22 DNA AMPLIFICATION KITS & REAGENTS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 23 NORTH AMERICA: DNA AMPLIFICATION KITS & REAGENTS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 24 EUROPE: DNA AMPLIFICATION KITS & REAGENTS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 25 ASIA PACIFIC: DNA AMPLIFICATION KITS & REAGENTS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- 6.2.2 RAPID DNA ANALYSIS KITS & REAGENTS

- 6.2.2.1 Automated processing and reduced sample contamination to aid segment growth

- TABLE 26 RAPID DNA ANALYSIS KITS & REAGENTS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 27 NORTH AMERICA: RAPID DNA ANALYSIS KITS & REAGENTS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 28 EUROPE: RAPID DNA ANALYSIS KITS & REAGENTS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 29 ASIA PACIFIC: RAPID DNA ANALYSIS KITS & REAGENTS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- 6.2.3 DNA QUANTIFICATION KITS & REAGENTS

- 6.2.3.1 Advancements in qPCR technology and need for faster human identification results to drive market

- TABLE 30 DNA QUANTIFICATION KITS & REAGENTS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 31 NORTH AMERICA: DNA QUANTIFICATION KITS & REAGENTS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 32 EUROPE: DNA QUANTIFICATION KITS & REAGENTS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 33 ASIA PACIFIC: DNA QUANTIFICATION KITS & REAGENTS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- 6.2.4 DNA EXTRACTION KITS & REAGENTS

- 6.2.4.1 Advancements in DNA extraction and purification technologies to propel market growth

- TABLE 34 DNA EXTRACTION KITS & REAGENTS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 35 NORTH AMERICA: DNA EXTRACTION KITS & REAGENTS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 36 EUROPE: DNA EXTRACTION KITS & REAGENTS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 37 ASIA PACIFIC: DNA EXTRACTION KITS & REAGENTS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- 6.3 INSTRUMENTS

- TABLE 38 HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 39 HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 40 NORTH AMERICA: HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 41 EUROPE: HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 42 ASIA PACIFIC: HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- 6.3.1 SAMPLE PREPARATION & EXTRACTION SYSTEMS

- 6.3.1.1 Complete sample traceability and high process safety to drive market

- TABLE 43 SAMPLE PREPARATION & EXTRACTION SYSTEMS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 44 NORTH AMERICA: SAMPLE PREPARATION & EXTRACTION SYSTEMS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 45 EUROPE: SAMPLE PREPARATION & EXTRACTION SYSTEMS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 46 ASIA PACIFIC: SAMPLE PREPARATION & EXTRACTION SYSTEMS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- 6.3.2 DNA AMPLIFICATION SYSTEMS

- 6.3.2.1 Easy replication of specific DNA regions in forensic sciences to propel segment growth

- TABLE 47 DNA AMPLIFICATION SYSTEMS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 48 NORTH AMERICA: DNA AMPLIFICATION SYSTEMS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 49 EUROPE: DNA AMPLIFICATION SYSTEMS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 50 ASIA PACIFIC: DNA AMPLIFICATION SYSTEMS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- 6.3.3 DNA ANALYSIS SYSTEMS

- 6.3.3.1 Greater efficacy and lesser turnaround time to augment segment growth

- TABLE 51 DNA ANALYSIS SYSTEMS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 52 NORTH AMERICA: DNA ANALYSIS SYSTEMS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 53 EUROPE: DNA ANALYSIS SYSTEMS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 54 ASIA PACIFIC: DNA ANALYSIS SYSTEMS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- 6.3.4 DNA QUANTIFICATION SYSTEMS

- 6.3.4.1 Effective analysis of DNA integrity and detection of PCR inhibitors to boost market growth

- TABLE 55 DNA QUANTIFICATION SYSTEMS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 56 NORTH AMERICA: DNA QUANTIFICATION SYSTEMS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 57 EUROPE: DNA QUANTIFICATION SYSTEMS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 58 ASIA PACIFIC: DNA QUANTIFICATION SYSTEMS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- 6.4 SOFTWARE

- 6.4.1 RISING VOLUME OF PROCEDURES AND INCREASING COMPLEXITY OF GENETIC DATA TO DRIVE MARKET

- TABLE 59 HUMAN IDENTIFICATION SOFTWARE MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 60 NORTH AMERICA: HUMAN IDENTIFICATION SOFTWARE MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 61 EUROPE: HUMAN IDENTIFICATION SOFTWARE MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 62 ASIA PACIFIC: HUMAN IDENTIFICATION SOFTWARE MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

7 HUMAN IDENTIFICATION MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- TABLE 63 HUMAN IDENTIFICATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- 7.2 POLYMERASE CHAIN REACTION

- 7.2.1 HIGHER SENSITIVITY AND LOWER TURNAROUND TIME DURING FORENSIC INVESTIGATIONS TO PROPEL MARKET GROWTH

- TABLE 64 HUMAN IDENTIFICATION MARKET FOR POLYMERASE CHAIN REACTION, BY REGION, 2022-2029 (USD MILLION)

- TABLE 65 NORTH AMERICA: HUMAN IDENTIFICATION MARKET FOR POLYMERASE CHAIN REACTION, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 66 EUROPE: HUMAN IDENTIFICATION MARKET FOR POLYMERASE CHAIN REACTION, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 67 ASIA PACIFIC: HUMAN IDENTIFICATION MARKET FOR POLYMERASE CHAIN REACTION, BY COUNTRY, 2022-2029 (USD MILLION)

- 7.3 CAPILLARY ELECTROPHORESIS

- 7.3.1 ACCURATE EXAMINATION OF GENETIC MARKERS AND ESTABLISHMENT OF BIOLOGICAL LINKS TO DRIVE MARKET

- TABLE 68 HUMAN IDENTIFICATION MARKET FOR CAPILLARY ELECTROPHORESIS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 69 NORTH AMERICA: HUMAN IDENTIFICATION MARKET FOR CAPILLARY ELECTROPHORESIS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 70 EUROPE: HUMAN IDENTIFICATION MARKET FOR CAPILLARY ELECTROPHORESIS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 71 ASIA PACIFIC: HUMAN IDENTIFICATION MARKET FOR CAPILLARY ELECTROPHORESIS, BY COUNTRY, 2022-2029 (USD MILLION)

- 7.4 NEXT-GENERATION SEQUENCING

- 7.4.1 EASY IDENTIFICATION OF MIXED DNA SAMPLES AND ANALYSIS OF COMPLEX PATERNITY CASES TO AID MARKET GROWTH

- TABLE 72 HUMAN IDENTIFICATION MARKET FOR NEXT-GENERATION SEQUENCING, BY REGION, 2022-2029 (USD MILLION)

- TABLE 73 NORTH AMERICA: HUMAN IDENTIFICATION MARKET FOR NEXT-GENERATION SEQUENCING, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 74 EUROPE: HUMAN IDENTIFICATION MARKET FOR NEXT-GENERATION SEQUENCING, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 75 ASIA PACIFIC: HUMAN IDENTIFICATION MARKET FOR NEXT-GENERATION SEQUENCING, BY COUNTRY, 2022-2029 (USD MILLION)

- 7.5 MICROARRAYS

- 7.5.1 RAPID AND ACCURATE ANALYSIS OF LARGE SAMPLE SETS AT LOW COSTS TO AUGMENT MARKET GROWTH

- TABLE 76 HUMAN IDENTIFICATION MARKET FOR MICROARRAYS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 77 NORTH AMERICA: HUMAN IDENTIFICATION MARKET FOR MICROARRAYS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 78 EUROPE: HUMAN IDENTIFICATION MARKET FOR MICROARRAYS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 79 ASIA PACIFIC: HUMAN IDENTIFICATION MARKET FOR MICROARRAYS, BY COUNTRY, 2022-2029 (USD MILLION)

- 7.6 RAPID DNA ANALYSIS

- 7.6.1 EFFECTIVE REAL-TIME SAMPLE ANALYSIS FOR DNA PROFILE CREATION TO PROPEL MARKET GROWTH

- TABLE 80 HUMAN IDENTIFICATION MARKET FOR RAPID DNA ANALYSIS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 81 NORTH AMERICA: HUMAN IDENTIFICATION MARKET FOR RAPID DNA ANALYSIS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 82 EUROPE: HUMAN IDENTIFICATION MARKET FOR RAPID DNA ANALYSIS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 83 ASIA PACIFIC: HUMAN IDENTIFICATION MARKET FOR RAPID DNA ANALYSIS, BY COUNTRY, 2022-2029 (USD MILLION)

8 HUMAN IDENTIFICATION MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- TABLE 84 HUMAN IDENTIFICATION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- 8.2 FORENSICS

- 8.2.1 INCREASING CRIME RATE TO PROPEL GROWTH

- TABLE 85 US: CRIME RATES, BY REGION, 2022

- TABLE 86 HUMAN IDENTIFICATION MARKET FOR FORENSIC APPLICATIONS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 87 NORTH AMERICA: HUMAN IDENTIFICATION MARKET FOR FORENSIC APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 88 EUROPE: HUMAN IDENTIFICATION MARKET FOR FORENSIC APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 89 ASIA PACIFIC: HUMAN IDENTIFICATION MARKET FOR FORENSIC APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

- 8.3 PATERNITY TESTING

- 8.3.1 RISING NEED TO RESOLVE LEGAL AND PERSONAL DISPUTES TO SUPPORT MARKET GROWTH

- TABLE 90 HUMAN IDENTIFICATION MARKET FOR PATERNITY TESTING, BY REGION, 2022-2029 (USD MILLION)

- TABLE 91 NORTH AMERICA: HUMAN IDENTIFICATION MARKET FOR PATERNITY TESTING, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 92 EUROPE: HUMAN IDENTIFICATION MARKET FOR PATERNITY TESTING, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 93 ASIA PACIFIC: HUMAN IDENTIFICATION MARKET FOR PATERNITY TESTING, BY COUNTRY, 2022-2029 (USD MILLION)

- 8.4 OTHER APPLICATIONS

- TABLE 94 HUMAN IDENTIFICATION MARKET FOR OTHER APPLICATIONS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 95 NORTH AMERICA: HUMAN IDENTIFICATION MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 96 EUROPE: HUMAN IDENTIFICATION MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 97 ASIA PACIFIC: HUMAN IDENTIFICATION MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

9 HUMAN IDENTIFICATION MARKET, BY END USER

- 9.1 INTRODUCTION

- TABLE 98 HUMAN IDENTIFICATION MARKET, BY END USER, 2022-2029 (USD MILLION)

- 9.2 FORENSIC LABORATORIES

- 9.2.1 RISING CRIME RATE TO DRIVE DEMAND FOR HUMAN IDENTIFICATION SERVICES

- TABLE 99 HUMAN IDENTIFICATION MARKET FOR FORENSIC LABORATORIES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 100 NORTH AMERICA: HUMAN IDENTIFICATION MARKET FOR FORENSIC LABORATORIES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 101 EUROPE: HUMAN IDENTIFICATION MARKET FOR FORENSIC LABORATORIES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 102 ASIA PACIFIC: HUMAN IDENTIFICATION MARKET FOR FORENSIC LABORATORIES, BY COUNTRY, 2022-2029 (USD MILLION)

- 9.3 RESEARCH CENTERS AND ACADEMIC & GOVERNMENT INSTITUTES

- 9.3.1 ADVANCEMENTS IN GENOMICS RESEARCH TO DRIVE MARKET

- TABLE 103 HUMAN IDENTIFICATION MARKET FOR RESEARCH CENTERS AND ACADEMIC & GOVERNMENT INSTITUTES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 104 NORTH AMERICA: HUMAN IDENTIFICATION MARKET FOR RESEARCH CENTERS AND ACADEMIC & GOVERNMENT INSTITUTES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 105 EUROPE: HUMAN IDENTIFICATION MARKET FOR RESEARCH CENTERS AND ACADEMIC & GOVERNMENT INSTITUTES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 106 ASIA PACIFIC: HUMAN IDENTIFICATION MARKET FOR RESEARCH CENTERS AND ACADEMIC & GOVERNMENT INSTITUTES, BY COUNTRY, 2022-2029 (USD MILLION)

- 9.4 OTHER END USERS

- TABLE 107 HUMAN IDENTIFICATION MARKET FOR OTHER END USERS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 108 NORTH AMERICA: HUMAN IDENTIFICATION MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 109 EUROPE: HUMAN IDENTIFICATION MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 110 ASIA PACIFIC: HUMAN IDENTIFICATION MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2029 (USD MILLION)

10 HUMAN IDENTIFICATION MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 111 HUMAN IDENTIFICATION MARKET, BY REGION, 2022-2029 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: RECESSION IMPACT

- FIGURE 29 NORTH AMERICA: HUMAN IDENTIFICATION MARKET SNAPSHOT

- TABLE 112 NORTH AMERICA: HUMAN IDENTIFICATION MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 113 NORTH AMERICA: HUMAN IDENTIFICATION MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 114 NORTH AMERICA: HUMAN IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 115 NORTH AMERICA: HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 116 NORTH AMERICA: HUMAN IDENTIFICATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 117 NORTH AMERICA: HUMAN IDENTIFICATION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 118 NORTH AMERICA: HUMAN IDENTIFICATION MARKET, BY END USER, 2022-2029 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 Rising crime rates and increasing government-funded initiatives for forensic programs to boost demand

- TABLE 119 US: HUMAN IDENTIFICATION MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 120 US: HUMAN IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 121 US: HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 122 US: HUMAN IDENTIFICATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 123 US: HUMAN IDENTIFICATION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 124 US: HUMAN IDENTIFICATION MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 125 US: HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY END USER, 2022-2029 (UNITS)

- 10.2.3 CANADA

- 10.2.3.1 Improvements in forensic laboratory infrastructure to drive market

- TABLE 126 CANADA: HUMAN IDENTIFICATION MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 127 CANADA: HUMAN IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 128 CANADA: HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 129 CANADA: HUMAN IDENTIFICATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 130 CANADA: HUMAN IDENTIFICATION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 131 CANADA: HUMAN IDENTIFICATION MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 132 CANADA: HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY END USER, 2022-2029 (UNITS)

- 10.3 EUROPE

- 10.3.1 EUROPE: RECESSION IMPACT

- TABLE 133 EUROPE: HUMAN IDENTIFICATION MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 134 EUROPE: HUMAN IDENTIFICATION MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 135 EUROPE: HUMAN IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 136 EUROPE: HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 137 EUROPE: HUMAN IDENTIFICATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 138 EUROPE: HUMAN IDENTIFICATION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 139 EUROPE: HUMAN IDENTIFICATION MARKET, BY END USER, 2022-2029 (USD MILLION)

- 10.3.2 GERMANY

- 10.3.2.1 Stringent regulatory guidelines for forensic investigations to boost demand

- TABLE 140 GERMANY: HUMAN IDENTIFICATION MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 141 GERMANY: HUMAN IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 142 GERMANY: HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 143 GERMANY: HUMAN IDENTIFICATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 144 GERMANY: HUMAN IDENTIFICATION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 145 GERMANY: HUMAN IDENTIFICATION MARKET, BY END USER, 2022-2029 (USD MILLION)

- 10.3.3 FRANCE

- 10.3.3.1 Rising demand for paternity tests to support market growth

- TABLE 146 FRANCE: HUMAN IDENTIFICATION MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 147 FRANCE: HUMAN IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 148 FRANCE: HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 149 FRANCE: HUMAN IDENTIFICATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 150 FRANCE: HUMAN IDENTIFICATION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 151 FRANCE: HUMAN IDENTIFICATION MARKET, BY END USER, 2022-2029 (USD MILLION)

- 10.3.4 UK

- 10.3.4.1 Growing availability of forensic equipment to propel market

- TABLE 152 UK: HUMAN IDENTIFICATION MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 153 UK: HUMAN IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 154 UK: HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 155 UK: HUMAN IDENTIFICATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 156 UK: HUMAN IDENTIFICATION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 157 UK: HUMAN IDENTIFICATION MARKET, BY END USER, 2022-2029 (USD MILLION)

- 10.3.5 ITALY

- 10.3.5.1 Advancements in DNA analysis to fuel market

- TABLE 158 ITALY: HUMAN IDENTIFICATION MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 159 ITALY: HUMAN IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 160 ITALY: HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 161 ITALY: HUMAN IDENTIFICATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 162 ITALY: HUMAN IDENTIFICATION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 163 ITALY: HUMAN IDENTIFICATION MARKET, BY END USER, 2022-2029 (USD MILLION)

- 10.3.6 SPAIN

- 10.3.6.1 Growing demand for gene expression analysis services to propel market

- TABLE 164 SPAIN: HUMAN IDENTIFICATION MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 165 SPAIN: HUMAN IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 166 SPAIN: HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 167 SPAIN: HUMAN IDENTIFICATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 168 SPAIN: HUMAN IDENTIFICATION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 169 SPAIN: HUMAN IDENTIFICATION MARKET, BY END USER, 2022-2029 (USD MILLION)

- 10.3.7 REST OF EUROPE

- TABLE 170 REST OF EUROPE: HUMAN IDENTIFICATION MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 171 REST OF EUROPE: HUMAN IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 172 REST OF EUROPE: HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 173 REST OF EUROPE: HUMAN IDENTIFICATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 174 REST OF EUROPE: HUMAN IDENTIFICATION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 175 REST OF EUROPE: HUMAN IDENTIFICATION MARKET, BY END USER, 2022-2029 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 30 ASIA PACIFIC: HUMAN IDENTIFICATION MARKET SNAPSHOT

- TABLE 176 ASIA PACIFIC: HUMAN IDENTIFICATION MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 177 ASIA PACIFIC: HUMAN IDENTIFICATION MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 178 ASIA PACIFIC: HUMAN IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 179 ASIA PACIFIC: HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 180 ASIA PACIFIC: HUMAN IDENTIFICATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 181 ASIA PACIFIC: HUMAN IDENTIFICATION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 182 ASIA PACIFIC: HUMAN IDENTIFICATION MARKET, BY END USER, 2022-2029 (USD MILLION)

- 10.4.2 JAPAN

- 10.4.2.1 High demand for DNA analysis kits to drive market

- TABLE 183 JAPAN: HUMAN IDENTIFICATION MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 184 JAPAN: HUMAN IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 185 JAPAN: HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 186 JAPAN: HUMAN IDENTIFICATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 187 JAPAN: HUMAN IDENTIFICATION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 188 JAPAN: HUMAN IDENTIFICATION MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 189 JAPAN: HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY END USER, 2022-2029 (UNITS)

- 10.4.3 CHINA

- 10.4.3.1 Rising establishment of forensic laboratories to drive market

- TABLE 190 CHINA: HUMAN IDENTIFICATION MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 191 CHINA: HUMAN IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 192 CHINA: HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 193 CHINA: HUMAN IDENTIFICATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 194 CHINA: HUMAN IDENTIFICATION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 195 CHINA: HUMAN IDENTIFICATION MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 196 CHINA: HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY END USER, 2022-2029 (UNITS)

- 10.4.4 INDIA

- 10.4.4.1 Rising crime level rates to boost demand

- TABLE 197 INDIA: HUMAN IDENTIFICATION MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 198 INDIA: HUMAN IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 199 INDIA: HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 200 INDIA: HUMAN IDENTIFICATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 201 INDIA: HUMAN IDENTIFICATION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 202 INDIA: HUMAN IDENTIFICATION MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 203 INDIA: HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY END USER, 2022-2029 (UNITS)

- 10.4.5 REST OF ASIA PACIFIC

- TABLE 204 REST OF ASIA PACIFIC: HUMAN IDENTIFICATION MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 205 REST OF ASIA PACIFIC: HUMAN IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 206 REST OF ASIA PACIFIC: HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 207 REST OF ASIA PACIFIC: HUMAN IDENTIFICATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 208 REST OF ASIA PACIFIC: HUMAN IDENTIFICATION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 209 REST OF ASIA PACIFIC: HUMAN IDENTIFICATION MARKET, BY END USER, 2022-2029 (USD MILLION)

- 10.5 LATIN AMERICA

- 10.5.1 RISING LEVELS OF HOMICIDES TO DRIVE MARKET

- 10.5.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 210 LATIN AMERICA: HUMAN IDENTIFICATION MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 211 LATIN AMERICA: HUMAN IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 212 LATIN AMERICA: HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 213 LATIN AMERICA: HUMAN IDENTIFICATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 214 LATIN AMERICA: HUMAN IDENTIFICATION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 215 LATIN AMERICA: HUMAN IDENTIFICATION MARKET, BY END USER, 2022-2029 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 IMPROVEMENTS IN HEALTHCARE INFRASTRUCTURE TO SUPPORT MARKET GROWTH

- 10.6.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 216 MIDDLE EAST & AFRICA: HUMAN IDENTIFICATION MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: HUMAN IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: HUMAN IDENTIFICATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: HUMAN IDENTIFICATION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: HUMAN IDENTIFICATION MARKET, BY END USER, 2022-2029 (USD MILLION)

- 10.7 GCC COUNTRIES

- 10.7.1 RISING INVESTMENTS IN RESEARCH PROGRAMS TO SUPPORT MARKET GROWTH

- 10.7.2 GCC COUNTRIES: RECESSION IMPACT

- TABLE 222 GCC COUNTRIES: HUMAN IDENTIFICATION MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 223 GCC COUNTRIES: HUMAN IDENTIFICATION CONSUMABLES MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 224 GCC COUNTRIES: HUMAN IDENTIFICATION INSTRUMENTS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 225 GCC COUNTRIES: HUMAN IDENTIFICATION MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 226 GCC COUNTRIES: HUMAN IDENTIFICATION MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 227 GCC COUNTRIES: HUMAN IDENTIFICATION MARKET, BY END USER, 2022-2029 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY HUMAN IDENTIFICATION MANUFACTURERS

- 11.3 REVENUE SHARE ANALYSIS

- FIGURE 31 REVENUE ANALYSIS OF KEY PLAYERS

- 11.4 MARKET SHARE ANALYSIS

- FIGURE 32 HUMAN IDENTIFICATION MARKET SHARE ANALYSIS, 2023

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 33 HUMAN IDENTIFICATION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 11.5.5 COMPANY FOOTPRINT ANALYSIS

- TABLE 228 COMPANY FOOTPRINT

- TABLE 229 PRODUCT FOOTPRINT

- TABLE 230 APPLICATION FOOTPRINT

- TABLE 231 REGIONAL FOOTPRINT

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 STARTING BLOCKS

- 11.6.3 RESPONSIVE COMPANIES

- 11.6.4 DYNAMIC COMPANIES

- FIGURE 34 HUMAN IDENTIFICATION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- 11.6.5 COMPETITIVE BENCHMARKING

- TABLE 232 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 233 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.7 VALUATION AND FINANCIAL METRICS OF HUMAN IDENTIFICATION VENDORS

- FIGURE 35 EV/EBITDA OF KEY VENDORS

- FIGURE 36 EV/REVENUE OF KEY VENDORS

- FIGURE 37 BETA (5 YEARS) OF KEY VENDORS

- 11.8 BRAND COMPARISON

- FIGURE 38 PRODUCT/BRAND COMPARISON: HUMAN IDENTIFICATION INSTRUMENTS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES & APPROVALS

- TABLE 234 HUMAN IDENTIFICATION MARKET: PRODUCT LAUNCHES & APPROVALS, JANUARY 2020-DECEMBER 2023

- 11.9.2 DEALS

- TABLE 235 HUMAN IDENTIFICATION MARKET: DEALS, JANUARY 2020-DECEMBER 2023

- 11.9.3 OTHER DEVELOPMENTS

- TABLE 236 HUMAN IDENTIFICATION MARKET: OTHER DEVELOPMENTS, JANUARY 2020-DECEMBER 2023

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 12.1.1 THERMO FISHER SCIENTIFIC INC.

- TABLE 237 THERMO FISHER SCIENTIFIC INC.: BUSINESS OVERVIEW

- FIGURE 39 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2023)

- TABLE 238 THERMO FISHER SCIENTIFIC INC.: PRODUCTS OFFERED

- TABLE 239 THERMO FISHER SCIENTIFIC INC.: PRODUCT APPROVALS (JANUARY 2020-DECEMBER 2023)

- TABLE 240 THERMO FISHER SCIENTIFIC INC.: OTHER DEVELOPMENTS (JANUARY 2020-DECEMBER 2023)

- 12.1.2 QIAGEN N.V.

- TABLE 241 QIAGEN N.V.: BUSINESS OVERVIEW

- FIGURE 40 QIAGEN N.V.: COMPANY SNAPSHOT (2023)

- TABLE 242 QIAGEN N.V.: PRODUCTS OFFERED

- TABLE 243 QIAGEN N.V.: PRODUCT APPROVALS (JANUARY 2020-DECEMBER 2023)

- TABLE 244 QIAGEN N.V.: DEALS (JANUARY 2020-DECEMBER 2023)

- 12.1.3 PROMEGA CORPORATION

- TABLE 245 PROMEGA CORPORATION: BUSINESS OVERVIEW

- TABLE 246 PROMEGA CORPORATION: PRODUCTS OFFERED

- TABLE 247 PROMEGA CORPORATION: PRODUCT LAUNCHES (JANUARY 2020-DECEMBER 2023)

- 12.1.4 HAMILTON COMPANY

- TABLE 248 HAMILTON COMPANY: BUSINESS OVERVIEW

- TABLE 249 HAMILTON COMPANY: PRODUCTS OFFERED

- TABLE 250 HAMILTON COMPANY: PRODUCT LAUNCHES (JANUARY 2020-DECEMBER 2023)

- 12.1.5 FUJIFILM WAKO PURE CHEMICAL CORPORATION

- TABLE 251 FUJIFILM WAKO PURE CHEMICAL CORPORATION: BUSINESS OVERVIEW

- TABLE 252 FUJIFILM WAKO PURE CHEMICAL CORPORATION: PRODUCTS OFFERED

- 12.1.6 ANDE

- TABLE 253 ANDE: BUSINESS OVERVIEW

- 12.1.7 AUTOGEN INC.

- TABLE 254 AUTOGEN INC.: BUSINESS OVERVIEW

- TABLE 255 AUTOGEN INC.: PRODUCTS OFFERED

- 12.1.8 INNOGENOMICS TECHNOLOGIES, LLC

- TABLE 256 INNOGENOMICS TECHNOLOGIES, LLC: BUSINESS OVERVIEW

- TABLE 257 INNOGENOMICS TECHNOLOGIES, LLC: PRODUCTS OFFERED

- TABLE 258 INNOGENOMICS TECHNOLOGIES, LLC: PRODUCT LAUNCHES (JANUARY 2020-DECEMBER 2023)

- 12.1.9 OXFORD NANOPORE TECHNOLOGIES PLC

- TABLE 259 OXFORD NANOPORE TECHNOLOGIES PLC: BUSINESS OVERVIEW

- FIGURE 41 OXFORD NANOPORE TECHNOLOGIES PLC: COMPANY SNAPSHOT (2023)

- TABLE 260 OXFORD NANOPORE TECHNOLOGIES PLC: PRODUCTS OFFERED

- 12.1.10 BODE CELLMARK FORENSICS, INC.

- TABLE 261 BODE CELLMARK FORENSICS, INC.: BUSINESS OVERVIEW

- TABLE 262 BODE CELLMARK FORENSICS, INC.: PRODUCTS OFFERED

- 12.2 OTHER PLAYERS

- 12.2.1 CAROLINA BIOLOGICAL SUPPLY COMPANY

- 12.2.2 GENETEK BIOPHARMA GMBH

- 12.2.3 STRMIX LIMITED

- 12.2.4 NINGBO HEALTH GENE TECHNOLOGIES CO., LTD.

- 12.2.5 SOFTGENETICS

- 12.2.6 JUSTICETRAX

- 12.2.7 GENO TECHNOLOGY INC.

- 12.2.8 BIO-RAD LABORATORIES, INC.

- 12.2.9 COMPLETE GENOMICS INCORPORATED

- 12.2.10 BIONEER CORPORATION

- 12.2.11 ABNOVA CORPORATION

- 12.2.12 ZEISS

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS